Free Pages Mac Invoice Template for Easy Billing

In the modern business world, presenting clear and professional financial documents is essential for smooth transactions. Whether you’re a freelancer, small business owner, or contractor, having the right tools to generate well-organized payment requests can save time and improve client relations.

Designing a customized billing form that reflects your brand’s identity is easier than ever with modern software. With the right approach, you can create a polished document that includes all the necessary details, ensuring accuracy and professionalism in every transaction.

Customization plays a key role in this process, as it allows you to adjust every section according to your specific needs. From adding your company’s logo to specifying payment terms, there are various ways to personalize the document. This not only improves functionality but also enhances your credibility as a business.

Whether you need a simple structure or a more detailed breakdown, a well-organized document helps your clients understand their financial obligations clearly. This guide will explore the best practices for creating and managing your personalized billing documents with ease.

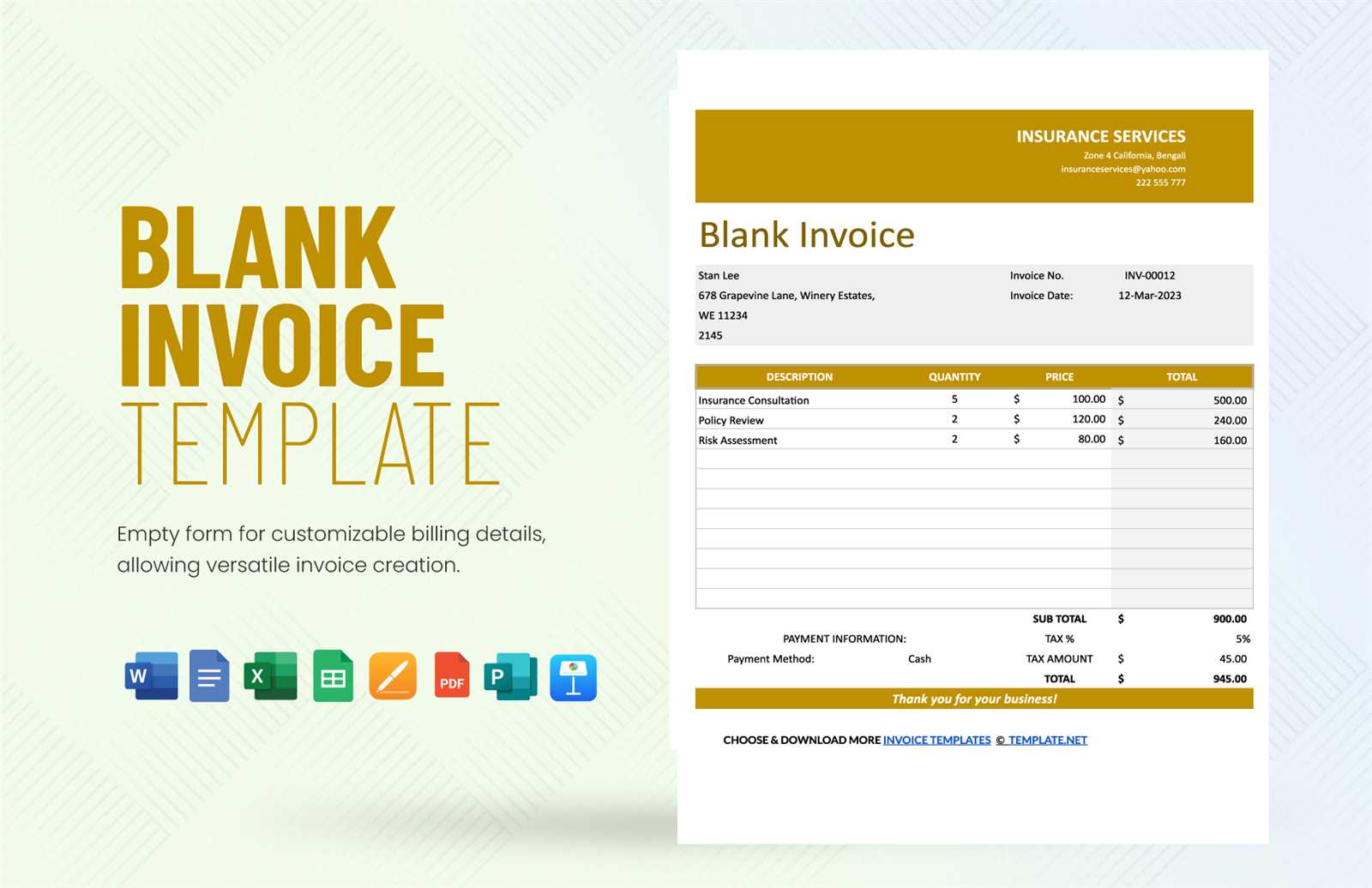

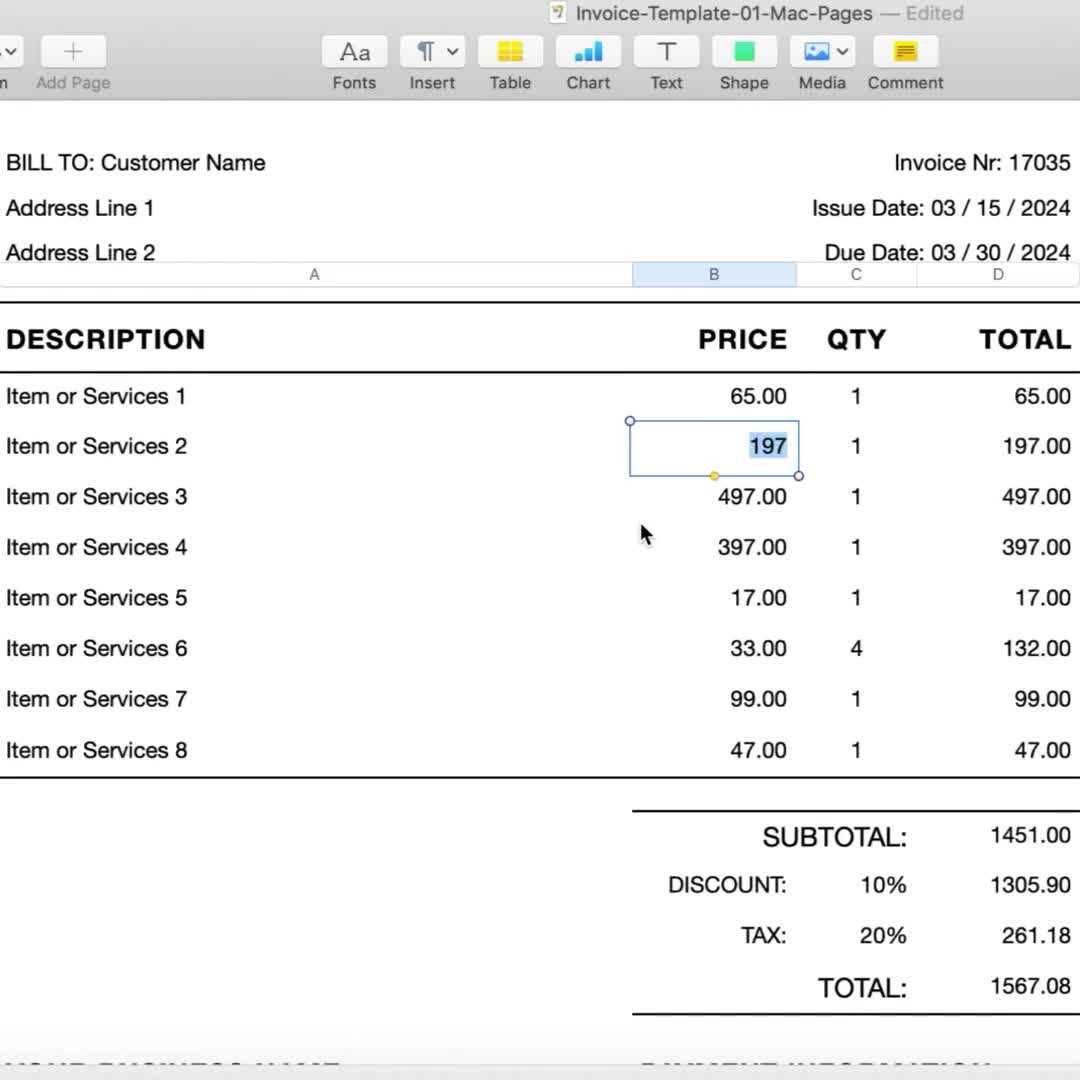

Pages Mac Invoice Template Overview

Creating professional financial documents on a personal computer has never been easier. With the right tool, you can quickly design customized billing forms that suit your business needs. These documents are essential for maintaining organized records and ensuring smooth transactions between you and your clients.

When using the built-in software on a personal computer, you gain access to a variety of flexible options to streamline the billing process. The user-friendly interface allows you to create tailored forms that can be saved and reused, making the process faster and more efficient for repeated use.

The software offers the following features:

- Pre-designed layouts for quick document creation

- Customization options for adding business logos and contact information

- Fields for specifying terms, dates, and payment methods

- Options for incorporating tax rates and itemized lists

These features allow you to produce high-quality financial documents without the need for advanced technical skills. Whether you’re handling a few transactions or managing a large volume of work, the tool ensures your documents are both clear and professional.

Why Use an Invoice Template

Having a pre-designed structure for your billing documents offers a range of benefits, from saving time to ensuring consistency. By using a ready-made format, you can focus on the key details of the transaction rather than worrying about layout or organization. This streamlines the process and guarantees a professional result every time.

One of the main advantages of using a ready-made structure is efficiency. Instead of manually creating a document from scratch for each new client or service, you can simply input the necessary information into a structured layout. This significantly reduces the time spent on administrative tasks, allowing you to focus on more important aspects of your business.

Key Benefits

| Benefit | Description |

|---|---|

| Time-saving | Quickly fill out pre-designed fields rather than starting from zero. |

| Consistency | Maintain uniformity in your documents, ensuring they always look professional. |

| Customization | Easily personalize documents to reflect your branding and specific business needs. |

| Accuracy | Reduce errors by following a predefined structure, ensuring all necessary details are included. |

How It Helps in Business

By utilizing a pre-designed form, businesses can ensure their financial records remain organized and professional. Additionally, these forms often come with features such as tax calculations, payment terms, and itemized lists, further reducing the chance of errors. Whether you are a freelancer, small business owner, or large enterprise, this tool can help enhance the clarity and efficiency of your billing process.

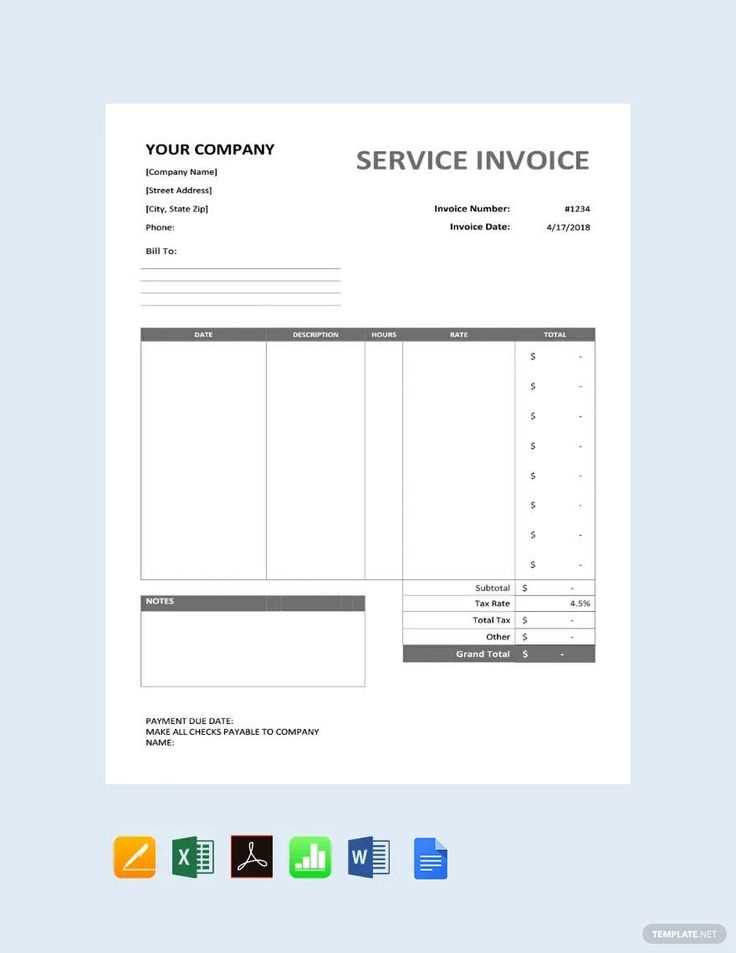

How to Download the Template

Downloading a pre-designed document layout for creating financial records is a simple and quick process. These customizable files are available through various platforms, making them accessible to users across different devices. Once downloaded, the file can be easily edited and tailored to suit specific business needs.

Steps to Download

Follow these straightforward steps to obtain a pre-built layout:

- Visit a trusted source or online marketplace offering customizable billing forms.

- Select the desired format and click on the download button.

- Save the file to your computer or cloud storage.

- Open the file using your preferred document editing software.

Important Considerations

File Format: Ensure the document is compatible with your software. Most formats are widely supported, but it’s always best to check.

Customization: After downloading, personalize the document by adding your business logo, terms, and other necessary details.

Tip: Some sources may offer free downloads, while others might require a small fee for premium layouts with more advanced features.

Customizing Your Document Layout

Personalizing your billing form allows you to tailor it to your business identity and ensure all necessary details are included. By customizing the layout, you can add elements such as your logo, adjust payment terms, and include specific product or service details. This ensures your document not only looks professional but also meets your unique business needs.

Here are some key areas you can adjust to make the document truly yours:

- Business Information: Add your company name, address, contact details, and any other relevant information.

- Logo: Insert your business logo for branding purposes.

- Payment Terms: Specify your payment methods, deadlines, and late fee policies.

- Line Items: List products or services provided with clear descriptions, quantities, and pricing.

- Tax Information: Adjust for local taxes or any other applicable charges.

To make these changes, simply open the document in your editing software, select the text or area you want to modify, and input the relevant details. This process is intuitive and allows for flexibility in how your document appears.

Additionally, consider using custom styles such as bold fonts or color to emphasize key sections, ensuring clarity and ease of use for your clients.

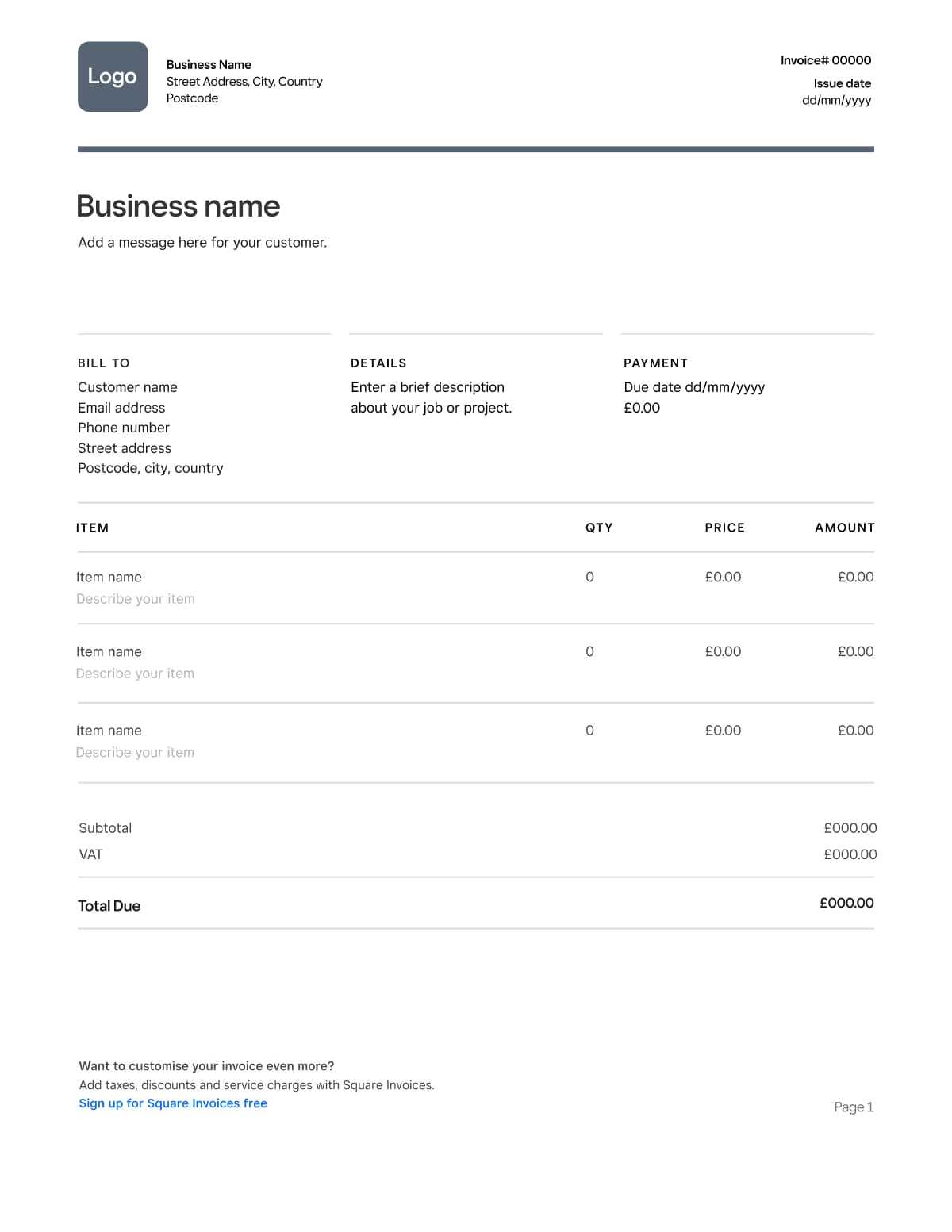

Essential Fields in a Billing Document

To create a well-organized and effective billing form, certain fields must be included to ensure clarity and prevent any confusion during the payment process. These fields help both you and your client understand the terms of the transaction and provide a clear breakdown of the charges. By ensuring all essential elements are present, you can maintain professionalism and accuracy in every document you issue.

Key Components to Include

The following fields are essential for a comprehensive financial document:

- Contact Information: Include both your business and the client’s name, address, and phone number to clearly identify both parties.

- Unique Reference Number: Assign a reference or document number to keep track of the transaction.

- Date: Specify the date the document was created, as well as the due date for payment.

- Service/Product Description: List the services or goods provided, along with quantities and prices.

- Total Amount: Clearly state the total amount due, including any applicable taxes or discounts.

- Payment Terms: Specify payment methods, deadlines, and any penalties for late payments.

Optional Fields for Better Clarity

While the fields listed above are necessary, you may also want to include the following to further clarify the details of the transaction:

- Tax Details: Specify the tax rate and amount if applicable.

- Notes or Terms: Add any additional comments or legal terms relevant to the transaction.

Including these fields ensures your document is not only complete but also clear and professional, helping to avoid any potential misunderstandings with clients.

Adding Your Business Logo

Incorporating your business logo into financial documents is a powerful way to enhance your brand identity and make your communications more professional. A well-placed logo not only helps distinguish your documents but also reinforces your business’s visual presence. By adding this element, you ensure that clients instantly recognize your brand, building trust and credibility.

Steps to Add Your Logo

Adding your logo to the document layout is a straightforward process. Follow these steps to ensure it appears correctly:

- Ensure you have a high-quality image of your logo in a supported file format (such as PNG, JPEG, or SVG).

- Open the document in your editing software and navigate to the header or top section of the page.

- Insert the logo image by using the image insertion tool or dragging the file directly into the document.

- Resize the logo to fit appropriately, ensuring it does not overcrowd the top section or interfere with important text.

- Position the logo to the left, center, or right, depending on your layout preference.

Tips for Effective Logo Placement

Size: The logo should be large enough to be easily recognizable but not so large that it distracts from the important content.

Position: Typically, placing the logo at the top left or center is most effective, as it is where the reader’s eyes naturally gravitate when first looking at the document.

Tip: If you use color in your logo, ensure that the background of your document complements the logo’s colors for maximum visibility.

Setting Payment Terms for Clients

Clearly defining payment terms is essential to ensure smooth financial transactions and avoid misunderstandings. By specifying the conditions under which payments are due, businesses can set clear expectations with clients, helping to prevent late payments and disputes. Whether you prefer to offer flexibility or enforce strict deadlines, outlining payment terms ensures both parties are aligned from the start.

Payment terms typically include details such as the due date, accepted methods of payment, and any penalties for late payments. These terms help clarify the timing of transactions and protect your business from delays that could disrupt cash flow.

Common Payment Terms Include:

- Net 30/60/90: This specifies the number of days after the transaction date within which the client must pay (e.g., “Payment due within 30 days”).

- Early Payment Discounts: Offering a small discount if the client pays early can encourage faster payments.

- Late Fees: Charging a percentage of the total due if payment is not made by the specified due date.

- Installment Payments: Allowing clients to pay in smaller, scheduled amounts over a set period.

Tip: Be sure to clearly communicate these terms to your clients before finalizing any agreement, either through email, a signed contract, or within the document itself. Clear communication minimizes the risk of late payments and misunderstandings.

Reminder: Always keep a copy of the agreed payment terms in writing, as they serve as a reference in case of disputes or delays.

Using Tax Rates in Billing Documents

Incorporating applicable tax rates into your financial documents is essential for maintaining compliance and transparency in business transactions. Taxes are a crucial part of the pricing structure, and clearly displaying them ensures that both you and your clients are on the same page regarding the total amount due. Understanding how to apply tax rates correctly can help prevent errors and ensure that your business adheres to local tax regulations.

How to Calculate and Add Taxes

When applying tax rates to a billing form, the following steps should be followed:

- Determine the applicable tax rate based on your region or industry standards.

- Calculate the tax by multiplying the subtotal (before tax) by the tax rate percentage.

- Ensure that the tax is clearly stated as a separate line item on the document, showing both the percentage and the amount being charged.

- Include the final total that reflects both the subtotal and the tax amount.

Example of Tax Calculation

Here’s an example of how tax is calculated and displayed:

| Item Description | Price |

|---|---|

| Product A | $100 |

| Tax (8%) | $8 |

| Total | $108 |

Tip: Ensure that tax rates are updated regularly to reflect any changes in local regulations or policies. You may also want to specify whether tax is included in the price or added separately to avoid confusion.

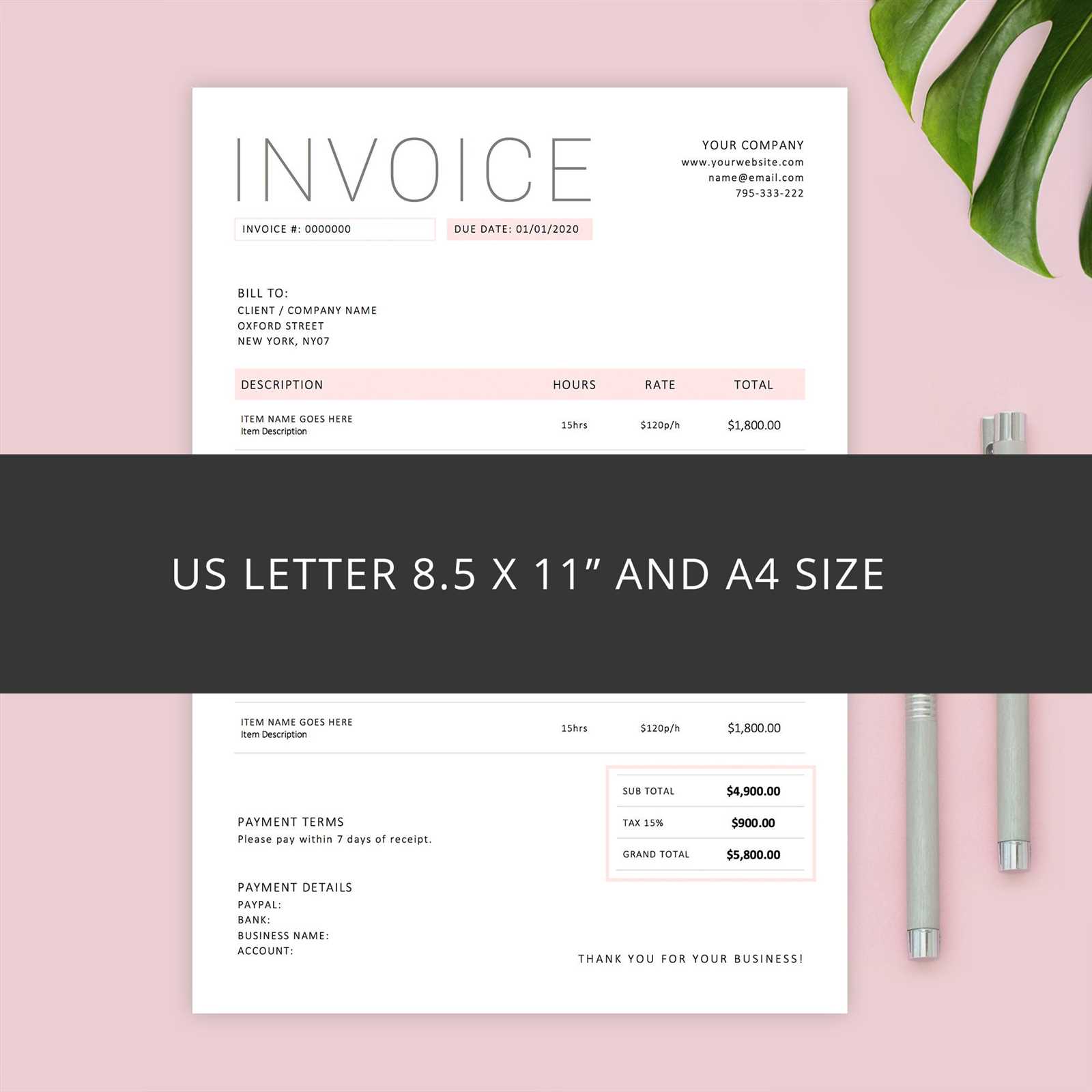

Incorporating Itemized Lists in Documents

Including a detailed breakdown of products or services within your financial documents enhances clarity and transparency. An itemized list helps clients quickly understand what they are being charged for, avoiding confusion and ensuring accuracy. This approach not only strengthens your professionalism but also makes it easier for clients to verify each component of their purchase or service.

Benefits of Itemized Lists

Using an itemized list in your documents offers several advantages:

- Clear Breakdown: Clients can easily see the cost for each item, service, or product.

- Transparency: It helps build trust by ensuring all charges are visible and understandable.

- Accuracy: Both parties can easily identify errors in pricing or quantities.

- Better Communication: Reduces the chance of misunderstandings about the final amount due.

How to Create an Itemized List

To create an itemized list in your document, follow these simple steps:

- Start with a heading like “Description” or “Items,” clearly identifying the section.

- For each item or service, include the following details:

- Item Name: Provide a clear name or description of the product or service.

- Quantity: Specify the number of units or services provided.

- Price: Include the price per unit or service.

- Total: Multiply the quantity by the unit price to give the total for that item.

- End the list with a subtotal or total amount reflecting all items listed.

Tip: Ensure that the list is easy to read, using sufficient spacing and alignment to avoid clutter. A well-organized itemized list will create a professional impression and help avoid disputes.

Saving and Organizing Your Documents

Properly storing and managing your financial documents is key to maintaining a well-structured business operation. Keeping accurate records not only helps with accounting and taxes but also ensures that you can quickly access past transactions when needed. A good organization system reduces clutter and increases efficiency, enabling you to focus on running your business smoothly.

Best Practices for Storing Your Files

To stay organized and ensure easy access to your records, consider these helpful strategies:

- Use Folders: Create separate folders for different categories such as “Paid,” “Unpaid,” or “Pending” to streamline your document retrieval process.

- Label Clearly: Name each document with a recognizable system, such as including the client name and the date of the transaction.

- Backup Files: Always maintain both digital and physical copies, especially for important documents. Regularly back up your files to cloud storage or an external hard drive.

- Track Payments: Maintain a payment log that tracks all transactions, including amounts and dates, to ensure nothing gets overlooked.

Efficient File Organization Systems

Consider the following file organization methods to keep your documents well-ordered:

- Digital Organization: Store your documents in cloud-based systems (such as Google Drive or Dropbox) where you can access them from any device and share with clients as needed.

- Physical Organization: If you prefer hard copies, use labeled binders or filing cabinets with a consistent structure for easy retrieval.

- Automated Systems: Utilize accounting software or apps to automatically store and categorize your documents, helping you save time and effort.

Reminder: Stay consistent with your organization method to make it easier to locate and manage files, especially during busy periods like tax season or when preparing for audits.

Sharing Documents with Clients

Sharing business documents with clients is a crucial part of maintaining clear communication and ensuring prompt payments. Whether you are sending a detailed account statement or a final bill, making sure the document is delivered securely and professionally will enhance client satisfaction. It is important to choose the right format and method of delivery to ensure that the information is easily accessible and well-received.

Methods for Sending Documents

There are several ways to send documents to your clients, each with its benefits:

- Email: Sending files via email is one of the most common methods, providing a quick and convenient way to deliver documents. Make sure to attach the file in a commonly used format, such as PDF, to ensure compatibility.

- Cloud Storage Links: For larger files, using cloud services like Google Drive or Dropbox allows you to share a secure link that clients can access anytime, from any device.

- Physical Mail: If your client prefers a hard copy or if required by law, sending a physical copy via postal mail is an option. Ensure the document is well-organized and professionally presented.

Key Points to Ensure Smooth Sharing

When sharing important documents, consider these best practices:

- Clear Communication: Always inform your client beforehand when you are sending a document, and follow up to confirm receipt.

- File Format: Use universally accepted formats like PDF to prevent issues with opening files.

- Security: For sensitive financial information, use encryption or password-protected files to ensure that only the intended recipient can access the document.

Sample Table of Details

Here is a basic example of a document containing detailed transaction information that can be shared:

| Item Description | Amount |

|---|---|

| Service 1 | $150.00 |

| Service 2 | $200.00 |

| Total | $350.00 |

Tip: Before sharing any document, double-check the details for accuracy and ensure that all necessary information is included to prevent confusion or delays in payment.

Printing Documents from Your Application

Printing business documents directly from your software allows for quick and efficient physical copies of your transactions, receipts, or billing statements. Whether you need a hard copy for client meetings, record-keeping, or tax purposes, the process should be seamless and easy to follow. This section will guide you through how to print documents while ensuring that your printouts maintain their professional appearance and readability.

Steps to Print Your Document

Follow these simple steps to ensure your document is printed correctly:

- Preview Before Printing: Always preview your document to check for any errors in formatting, margins, or missing information before printing.

- Select the Printer: Choose your printer from the available options in the print dialog box. Make sure the printer is connected and functioning properly.

- Set Print Settings: Adjust your print settings to choose the number of copies, page orientation, and paper size according to your needs.

- Print the Document: Once everything looks good in the preview, click the “Print” button to begin the printing process.

Tips for Best Printing Results

To ensure that your printouts come out clean, clear, and professional, consider these tips:

- Use High-Quality Paper: For a more polished look, use thicker paper or high-quality cardstock, especially for client-facing documents.

- Check Printer Ink: Ensure your printer has enough ink or toner to avoid faded text or smudges.

- Adjust for Margin Settings: Be sure that the margins are set appropriately to avoid cutting off any text or details on the document.

Tip: If you need multiple copies or specific page numbers, most printers allow you to customize the printing options in the settings for more efficient results.

Integrating Payment Methods on Documents

Including various payment options in your business documents allows your clients to choose the most convenient way to settle their accounts. Providing multiple payment methods ensures a smoother transaction process and improves the likelihood of timely payments. This section will guide you on how to seamlessly integrate these methods, making it easier for both you and your clients to complete the process efficiently.

Common Payment Options to Include

Here are the most common payment methods to incorporate into your documents:

- Bank Transfer: Including your bank account details allows clients to transfer funds directly from their bank to yours. Make sure to provide clear instructions, including the bank name, account number, and routing code.

- Credit or Debit Card: Many businesses offer the option to pay via credit or debit card. You can include a link to an online payment gateway or provide card payment instructions, depending on your setup.

- Online Payment Systems: Integrating popular payment platforms like PayPal, Venmo, or Stripe provides a quick and secure way for clients to pay online. Simply add your account details or a payment link to the document.

- Cash or Check: For clients who prefer traditional payment methods, offering the option to pay by cash or check remains relevant. Specify your mailing address or office location for check payments.

How to Format Payment Information

To avoid any confusion, it is crucial to clearly present payment details on your document:

- Make It Clear: List the payment methods in a clean, easy-to-read format, using bullet points or a dedicated payment section.

- Include Deadlines: Specify the due date for payment to avoid delays and confusion about when payments are expected.

- Provide Support: Add a customer service or support number/email in case clients face difficulties with payments.

Tip: Offering a range of payment methods can help build trust and reduce barriers to payment, resulting in faster and more reliable transactions.

Creating Recurring Billing Documents

Automating the creation of recurring billing documents saves time and ensures consistency in your invoicing process. For businesses that offer subscription-based services or ongoing contracts, having a reliable system for generating regular payments is essential. This section will guide you through the process of setting up documents that can be generated automatically at regular intervals, reducing manual effort while keeping clients informed.

Steps to Set Up Recurring Documents

Follow these simple steps to set up recurring billing documents for your clients:

- Define the Frequency: Decide how often the document should be created (e.g., weekly, monthly, quarterly). This is critical for businesses with long-term service agreements.

- Enter Client Information: Ensure that each recurring document includes all necessary details, such as the client’s name, billing address, and contract terms. This should remain consistent with each iteration.

- Set the Payment Amount: Specify the agreed-upon amount for each period, including any taxes or additional charges. This should be updated if there are any changes in the pricing structure.

- Choose the Delivery Method: Decide whether the document will be sent via email, printed, or uploaded to an online platform. Automated email systems can ensure timely delivery each cycle.

Automating the Process

To streamline the recurring billing process, many tools allow for automation. Here’s how to automate document creation:

- Use Automation Features: Set up automated reminders for generating and sending billing documents. This feature ensures the documents are created and delivered at the correct time without manual intervention.

- Track Payment Status: Keep track of payments by adding status fields in your documents. This will help you monitor which clients have paid and which are pending, ensuring you never miss a payment.

- Review and Adjust: Regularly review your recurring billing setup. Ensure that any updates to the pricing, terms, or client information are accurately reflected in each new document.

Tip: If you plan to offer discounts or promotions, make sure these adjustments are accounted for in your recurring documents to avoid confusion with clients.

Design Tips for Professional Billing Documents

Creating visually appealing and easy-to-read billing documents is essential for making a positive impression on your clients. A well-designed document not only reflects your business’s professionalism but also ensures that important information is clear and accessible. Below are some key tips for designing billing documents that are both functional and aesthetically pleasing.

Maintain a Clean and Simple Layout

The layout of your document should be straightforward and clutter-free. A clean design helps clients focus on the essential details without distraction. Consider the following:

- Use Plenty of White Space: Give your content room to breathe by including adequate spacing between sections and text. This makes the document easier to navigate.

- Limit Font Styles: Stick to one or two fonts for a professional look. Use bold or italics for emphasis, but avoid overusing them, which can clutter the design.

- Group Related Information: Place related details together in logical sections. For example, contact information should be grouped at the top, followed by the breakdown of charges and payment terms.

Ensure Brand Consistency

To enhance brand recognition, incorporate your company’s visual elements into the document design:

- Use Your Brand Colors: Choose colors that align with your brand identity. This consistency across all client-facing materials strengthens your business’s visual identity.

- Incorporate Your Logo: Place your logo at the top or footer of the document for a professional touch. Ensure that the logo is clear and visible without overwhelming the rest of the content.

- Maintain Consistent Typography: Select fonts that are aligned with your brand’s style guide. Choose legible fonts for body text and more distinct ones for headings.

Highlight Key Information

Certain details are crucial for clients to review, such as payment deadlines and amounts due. Ensure these elements stand out visually:

- Emphasize the Total Amount: Make the total payment amount more prominent by using a larger font size or bold formatting. This makes it easy for clients to identify what they owe at a glance.

- Include Clear Payment Instructions: If you accept multiple payment methods, clearly outline the instructions. Use icons or small images to represent payment options, such as credit cards or bank transfers.

- Specify Deadlines: Ensure that the payment due date is clearly marked. Using a larger or colored font can help it stand out from the rest of the document.

Consider Mobile Optimization

As more clients access documents on their smartphones and tablets, it’s important that your document is optimized for mobile viewing:

- Use a Responsive Layout: Ensure your document adapts well to smaller screens, with text and images scaling appropriately.

- Avoid Large Images: While logos and branding elements are important, large images can slow down the loading time and may not render well on smaller devices.

Tip: Before sending a document, test it on different devices to make sure it looks great on both desktop and mobile platforms.

Common Mistakes to Avoid in Billing Documents

When creating financial documents for your clients, accuracy and clarity are paramount. Even small errors can lead to confusion or delays in payment. Below are some of the most common mistakes to watch out for when preparing your billing documents, and how to avoid them to ensure smooth transactions.

Missing or Incorrect Contact Information: One of the simplest yet most crucial mistakes is neglecting to include or correctly list essential contact details. Always double-check that both your and your client’s contact information is correct. This includes phone numbers, addresses, and email addresses. Incorrect details can lead to miscommunications or delays in processing the payment.

Failure to Include Payment Terms: If payment terms are unclear, it can create confusion for both parties. Be sure to specify the payment due date, late fees, and any other terms (such as discounts for early payment). Clear payment instructions prevent misunderstandings and ensure timely payments.

Not Detailing Services or Products: A vague description of services or products can cause confusion for your clients. Make sure to provide a detailed list of what they are being charged for. This includes a breakdown of each item, unit prices, quantities, and any applicable taxes. The more specific the details, the less likely there will be disputes.

Incorrect or Missing Totals: Double-check your calculations to ensure accuracy. Missing totals or incorrect calculations can raise questions and create a negative experience for your client. It’s also important to clearly show the subtotal, taxes, and final amount due to make the document transparent and easy to understand.

Neglecting to Add a Unique Reference Number: A unique reference number, or bill ID, helps both you and your clients keep track of the document for future reference. It’s especially important for keeping organized records, managing multiple clients, or handling repeat transactions. Make sure to assign a unique identifier to each document.

Using Complex Language or Unnecessary Jargon: Keep the language simple and professional. Avoid using industry-specific jargon or complicated terms that might confuse your clients. Clear, straightforward language ensures that your client fully understands the charges, the payment terms, and the deadline.

Overlooking the Design: A cluttered or hard-to-read document can cause frustration for the recipient. Ensure your document has a clean layout, with properly aligned text, ample white space, and distinct sections. A well-organized document is not only professional but also makes it easier for your clients to find and process the relevant information.

How to Create Multiple Templates

Creating multiple versions of your billing or business documents can save time and provide flexibility when dealing with different clients or types of transactions. Customizing each version to suit the specific needs of the recipient ensures a more professional and tailored approach. Below are some steps on how to efficiently create various versions of your documents while maintaining consistency and accuracy.

1. Identify Different Document Types

Before starting, identify the different categories or types of documents you’ll need. This could include standard billing documents, service agreements, product orders, or statements. Understanding the specific requirements for each type will help you tailor the layout, content, and formatting appropriately.

2. Set Up Base Templates

Create a base document that includes all the necessary fields and sections, such as contact information, payment terms, and itemized lists. This base can be used as a foundation for all other variations. Once the core structure is in place, you can make adjustments as needed for each type of document.

Key Customization Tips:

- Change headers and footers: Adapt the title or introduction for each version, depending on its purpose.

- Adjust the layout: Some documents may need more detailed lists, while others may require additional sections like terms and conditions.

- Modify branding elements: Ensure each document reflects your business’s identity by including your logo, color scheme, and typography.

3. Save and Organize Different Versions

Once you have customized each version, save them as separate files. Naming them according to their purpose, such as “Client Statement” or “Service Agreement,” will make it easier to find the right version later. Organizing your documents in clearly labeled folders can streamline the process of accessing the appropriate template when needed.

Pro Tip: If you frequently need to create variations, consider setting up a document management system to keep all your templates neatly organized and easily accessible.

Benefits of Using Pages for Invoices

Creating professional business documents can be streamlined with the right tools, offering a combination of convenience, flexibility, and customization. When choosing software to craft these essential documents, certain platforms provide intuitive features that cater to various business needs. By leveraging these features, users can easily generate consistent, polished, and accurate records that reflect their professionalism.

One of the key advantages of using such tools is their ease of use. They offer pre-built structures that simplify the process of adding essential elements like client details, transaction summaries, and terms of service. This can significantly reduce the time spent on document creation, allowing you to focus on the core aspects of your work.

Another benefit is the ability to customize each document according to your brand’s style. With advanced formatting options, users can integrate logos, select colors, and personalize fonts, ensuring that each document is not only functional but also visually aligned with your business identity. This level of customization helps establish a consistent brand image across all client-facing materials.

Moreover, many platforms allow for easy document management and organization. Once documents are created, they can be saved and categorized for future use, making it simpler to maintain records and retrieve previous versions when necessary. This organizational capability aids in keeping your business operations running smoothly, ensuring that every transaction is documented properly.

Other advantages include:

- Cloud-based accessibility: Access your documents from anywhere, on any device, ensuring flexibility and convenience.

- Cost-effectiveness: Eliminate the need for costly third-party software or outsourcing by utilizing built-in tools.

- Increased accuracy: Automated fields and error-checking features help to minimize mistakes, ensuring that all information is correct.

Overall, utilizing such platforms provides an efficient and professional approach to managing your business documentation while enhancing productivity and brand consistency.