Owner Operator Invoice Template for Simple and Efficient Billing

Managing payments and ensuring timely transactions is a crucial aspect of running a successful business. For freelancers and small business owners, creating clear and professional documentation for each completed job is essential. The right billing structure helps maintain transparency with clients, streamlines payment processing, and reduces errors. By utilizing a well-organized document, you can ensure smooth financial operations and foster better client relationships.

In this guide, we will explore how to create an effective billing document that simplifies the payment process. We’ll discuss the key elements that should be included, tips for customization, and ways to enhance the document’s usability for different types of services. Whether you’re just starting or looking to improve your current system, having the right approach to your billing can save you time and effort, allowing you to focus on growing your business.

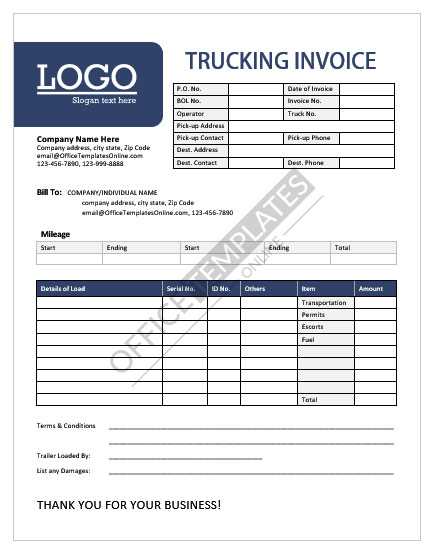

Owner Operator Invoice Template

For independent professionals, creating a comprehensive and clear document for billing is essential to ensure smooth transactions with clients. A well-designed billing structure not only saves time but also helps prevent misunderstandings and delays in payment. It acts as a formal record of services rendered, with all necessary details to make payment processing seamless.

To craft the perfect billing document, you need to include several key components that ensure clarity and professionalism. Here’s what to consider when designing your billing structure:

- Header Information: Include your business name, contact details, and any relevant business identification numbers.

- Client Details: Clearly state the client’s name, address, and contact information.

- Invoice Number: A unique reference number for each document to keep track of payments.

- Description of Services: List the services provided, including dates, quantities, and rates.

- Total Amount Due: Calculate the total payment required, including any applicable taxes or discounts.

- Payment Terms: Define the due date, payment methods, and any late fees if applicable.

When formatted correctly, this document not only serves as a tool for getting paid but also enhances your professional image. The consistency of the layout and the accuracy of the details will leave a positive impression on your clients, encouraging timely payments and fostering long-term business relationships.

Why You Need an Invoice Template

For any independent professional or small business, having a standardized billing document is essential to maintain a smooth workflow and ensure timely payments. A structured document provides clarity to both you and your clients, making transactions transparent and reducing the likelihood of misunderstandings. Without a consistent approach, managing payments can become disorganized, leading to confusion and delayed settlements.

Benefits of Using a Structured Billing Document

- Efficiency: A ready-made format speeds up the process of issuing bills, saving time that can be spent on other business tasks.

- Consistency: Using the same layout for every billing helps maintain professionalism and makes your documents instantly recognizable.

- Accuracy: A fixed structure ensures that all necessary details are included, preventing mistakes that could lead to payment delays.

- Legal Protection: A clear and precise document serves as a formal record of the transaction, protecting both parties in case of disputes.

How It Helps Your Business

- Improved Cash Flow: Consistently issued documents help set clear expectations about payment deadlines, improving the likelihood of receiving payments on time.

- Better Client Relationships: Clients appreciate a well-organized and professional approach, fostering trust and encouraging repeat business.

- Tracking Payments: With a standardized billing document, keeping track of pending payments and past transactions becomes much easier, streamlining your accounting processes.

How to Customize Your Billing Document

Customizing your billing structure ensures that it meets your specific business needs and reflects your professional identity. Personalizing the layout and content not only makes your documents more recognizable but also allows you to tailor the details according to the services you provide. The more specific and clear your document is, the better your clients will understand the charges and terms associated with your work.

Here are several ways to adjust the document for your business:

- Branding: Include your company logo, colors, and contact information to give the document a consistent professional appearance.

- Service Details: Adjust the description of services section to fit the nature of your work, whether it’s hourly rates, project-based fees, or other specialized services.

- Payment Terms: Specify your payment expectations clearly, including due dates, accepted payment methods, and any late fees or discounts.

- Additional Charges: If applicable, add sections for extra charges such as taxes, travel expenses, or materials to ensure complete transparency.

Customization also allows you to create different versions of the document for various clients, ensuring that each one receives the most relevant and accurate information. By personalizing your document, you can streamline your billing process while maintaining professionalism and consistency in your business operations.

Essential Details to Include in an Invoice

To ensure smooth payment processing and avoid misunderstandings, it’s essential to include all the necessary details in your billing document. Each section serves a specific purpose, whether it’s to provide clarity to your client or to keep your financial records organized. Properly documenting the transaction is key to ensuring that both you and your client are on the same page regarding the work completed and the agreed-upon payment terms.

Key Components of a Billing Document

| Detail | Description |

|---|---|

| Contact Information | Your name, business name, and contact details, along with the client’s information, are vital for identification and communication. |

| Document Number | A unique reference number for each document to keep track of payments and create an organized record of transactions. |

| Description of Work | A detailed list of services provided, including dates, rates, and quantities. This ensures transparency for both parties. |

| Total Due | The total amount the client owes, including taxes and any applicable discounts or fees. |

| Payment Terms | Include the payment due date, preferred payment methods, and any penalties for late payments. |

Additional Information to Include

- Tax Information: If applicable, be sure to include tax identification numbers or any relevant tax rates.

- Notes or Special Instructions: Any additional information or clarifications regarding the services provided or payment terms can be included here.

- Early Payment Discounts: If you offer discounts for early payments, clearly state the terms to encourage faster settlements.

By including these key details, you ensure that your billing documents are clear, professional, and legally sound, helping to avoid confusion and ensuring that payments are made on time.

Best Practices for Billing Document Design

Designing a well-structured billing document is not just about aesthetics; it’s about ensuring clarity, professionalism, and ease of use for both you and your clients. A clean, organized layout makes it easier for clients to quickly understand the details of the transaction, which can reduce the risk of errors or disputes. Whether you’re designing a document from scratch or customizing an existing layout, following best practices will help create a document that is both functional and visually appealing.

Here are some key design practices to follow when creating your billing structure:

- Clear Branding: Include your business logo, name, and contact information at the top. This not only gives the document a professional appearance but also ensures that clients can easily identify the source.

- Readable Fonts: Use clean, easy-to-read fonts. Avoid overly decorative fonts that may be hard to read. Stick to standard fonts like Arial, Helvetica, or Times New Roman to maintain legibility.

- Logical Layout: Organize the content into clearly defined sections: header, client information, service details, payment terms, and total amount due. This will help clients find the information they need quickly.

- Consistent Alignment: Ensure that text, numbers, and dates are aligned properly. Consistency in alignment, especially for columns of figures, improves readability and gives the document a polished look.

- Minimal Use of Colors: Stick to one or two colors for accents. Overuse of color can make the document look cluttered and distract from the essential information.

- White Space: Use adequate spacing between sections and around text. This makes the document easier to read and visually appealing, preventing it from feeling overcrowded.

By adhering to these design principles, you can ensure that your billing documents not only look professional but also function as an effective tool for communication and payment collection.

How to Avoid Common Billing Mistakes

When creating billing documents, small errors can lead to delays in payment or confusion with your clients. It’s important to ensure that each document is accurate, clear, and professional. Avoiding common mistakes can help improve your cash flow and maintain a strong relationship with clients. By paying attention to the details and following a structured approach, you can minimize the risk of mistakes and ensure smooth transactions.

Common Billing Mistakes and How to Fix Them

- Incorrect Contact Information: Double-check that both your details and the client’s contact information are accurate. Missing or incorrect information can delay payments or lead to miscommunication.

- Missing Invoice Number: Always include a unique reference number for each bill. This makes it easier to track payments and reduces confusion for both you and your client.

- Unclear Payment Terms: Clearly define the payment due date, acceptable payment methods, and any penalties for late payments. Ambiguity can cause confusion and delay the payment process.

- Not Listing All Services: Ensure that you include a detailed breakdown of the services or products provided. This helps your client understand what they’re being charged for and prevents disputes over what was delivered.

- Incorrect Totals: Always double-check the math! Small errors in calculations can lead to incorrect totals, which can cause delays and damage your reputation.

Best Practices to Minimize Mistakes

- Review Before Sending: Always review your billing documents before sending them out. A second look can often help catch errors you may have missed the first time.

- Use a Standardized Format: Stick to a consistent layout and structure for all your bills. This not only reduces the chance of forgetting important details but also presents a professional image.

- Automate Where Possible: Consider using accounting software or tools that automate certain aspects of billing, such as calculations, number tracking, and payment reminders.

By avoiding these common billing mistakes and following best practices, you can improve your billing process and ensure smoother transactions with your clients.

Choosing the Right Format for Your Billing Document

Selecting the right format for your billing document is crucial for maintaining organization and ensuring that the document is easily understood by both you and your client. The format should reflect your business needs and provide the necessary structure to communicate all important details clearly. Whether you choose a digital or paper version, having the right layout can save time and reduce the likelihood of errors.

When choosing a format, consider factors like ease of use, accessibility, and how your clients prefer to receive documents. Here’s a comparison of different format options:

| Format | Pros | Cons |

|---|---|---|

| Digital (PDF, Word) | Easy to send via email, professional appearance, can be easily stored and retrieved | Requires technology to view, potential compatibility issues |

| Printed (Paper) | Tangible, easier for clients who prefer physical copies | Cost of printing, environmental impact, slower delivery |

| Online Tools (Software) | Automates calculations, saves time, tracks payments | Requires an internet connection, may involve subscription fees |

Each format has its benefits depending on your business operations and the preferences of your clients. If you operate in a digital space and your clients are tech-savvy, digital formats are often the best choice. However, for clients who prefer hard copies, paper-based documents may still be necessary.

Choose the format that best suits your workflow, ensures clarity, and is easy for both you and your clients to manage effectively.

Understanding Payment Terms and Conditions

Clearly defined payment terms are essential for ensuring smooth financial transactions between you and your clients. These terms not only outline the expectations regarding the timing and method of payment but also help prevent misunderstandings or disputes. Setting clear terms from the beginning creates transparency and fosters trust, ensuring both parties are aware of their responsibilities throughout the payment process.

Key Components of Payment Terms

- Due Date: Clearly specify the date by which the payment is expected. Common options include “Net 30,” “Net 15,” or a fixed calendar date. This helps avoid any confusion about when the payment should be made.

- Accepted Payment Methods: Indicate which payment methods are acceptable, whether it be credit card, bank transfer, or online payment services. Providing multiple options can encourage quicker payment.

- Late Payment Fees: Set clear penalties for late payments, such as a percentage of the total due or a fixed fee. This serves as an incentive for clients to pay on time.

- Discounts for Early Payment: If you offer discounts for early settlement, make sure to specify the discount percentage and the timeline within which the payment must be made to qualify.

- Payment Schedule: For larger projects, outline whether payments are due in installments or upon completion of specific milestones. This helps ensure that you are paid as work progresses.

Best Practices for Setting Payment Terms

- Be Clear and Precise: Avoid ambiguity by using clear and concise language. The easier the terms are to understand, the fewer chances there are for confusion.

- Stay Consistent: Use the same payment terms across all your transactions to maintain uniformity and avoid creating exceptions that could lead to misunderstandings.

- Communicate Upfront: Discuss payment terms with your client before beginning work to ensure mutual understanding and agreement. This can be part of your initial contract or agreement.

By understanding and clearly outlining payment terms and conditions, you can set expectations for both yourself and your clients, ensuring timely payments and reducing the likelihood of disputes down the road.

How to Handle Late Payments

Late payments can disrupt your cash flow and create unnecessary stress, but addressing them properly can help you maintain a healthy business relationship while securing the payments owed to you. Handling delayed payments professionally and systematically ensures that your clients remain respectful of your terms while also safeguarding your financial interests.

Steps to Take When Payments Are Delayed

- Send a Friendly Reminder: Often, clients simply forget about a payment or need a gentle nudge. Sending a polite reminder as soon as a payment is overdue can help resolve the issue quickly without escalating it.

- Follow Up with Clear Communication: If a reminder doesn’t result in payment, follow up with a more formal communication. Specify the overdue amount, the original due date, and any penalties for late payment, if applicable.

- Review Your Payment Terms: Revisit the payment terms you set at the outset. Ensure that they are clear and that you have communicated them effectively. A late payment may indicate that the terms were not fully understood or agreed upon.

- Offer Payment Plans: If your client is facing financial difficulties, offer a payment plan. This can help ensure that you receive the amount owed over time while maintaining a positive relationship.

Dealing with Persistent Late Payments

- Implement Late Fees: If late payments are a recurring issue, consider implementing a penalty for overdue payments. Late fees serve as a deterrent and encourage timely payments.

- Cut Off Future Work: As a last resort, you may need to stop providing services or delivering goods until payment is made. This measure can be uncomfortable but may be necessary to protect your business.

- Seek Legal Action: If payments remain unpaid after all other efforts, you may need to take legal action. Small claims court or working with a collections agency can help recover funds, though this should be a last resort.

By having a clear process in place for handling late payments, you can protect your business from financial strain and maintain professional relationships with your clients.

Key Elements of Professional Billing Statements

A well-structured billing document plays a vital role in ensuring clarity and professionalism in financial transactions. Including the right elements not only enhances the look of the document but also helps clients understand the details of their payment obligations. These key components are essential for maintaining transparency and reducing the chances of confusion or disputes.

Essential Components for a Professional Statement

- Your Business Information: Always include your company name, address, phone number, and email. This allows clients to contact you easily if they have questions or need to discuss the payment.

- Client Information: Include the name and contact details of the person or business receiving the billing. This ensures that the correct party is being billed and that there is no confusion about payment responsibilities.

- Unique Reference Number: Assign a unique number to each statement. This helps track payments and simplifies your accounting process.

- Clear Description of Services or Products: Provide a detailed list of the services rendered or goods delivered, including dates, quantities, and individual pricing. This ensures transparency and prevents disputes about what is being charged.

- Amount Due: Clearly indicate the total amount owed, including any taxes, fees, or discounts. This allows the client to quickly understand the final payment amount.

- Payment Instructions: Outline the preferred payment methods, such as bank transfer, credit card, or online payment platforms. Make sure the process is clear and straightforward for your client.

- Due Date: Clearly specify the date by which the payment should be made. This helps set clear expectations and encourages timely payment.

Additional Professional Touches

- Terms and Conditions: Include any relevant terms such as late payment penalties, early payment discounts, or refund policies. This helps prevent misunderstandings.

- Branding: Adding your logo and using a consistent color scheme or layout creates a polished, professional appearance that reinforces your brand.

- Payment Tracking: Consider adding a section that allows clients to mark the payment as complete once paid. This makes it easier to track and reconcile payments.

Incorporating these key elements into your billing documents ensures professionalism and improves the chances of prompt, accurate payments. Clear, concise, and well-organized statements leave a positive impression on clients and strengthen your financial processes.

Tracking Payments with Billing Documents

Effectively monitoring payments is crucial to maintaining healthy cash flow and ensuring that all transactions are settled on time. Using a structured approach for tracking payments can make this process seamless and reduce the risk of missed or delayed payments. A well-designed billing document allows you to easily record and track the status of each payment, helping you stay organized and informed.

By including essential information such as due dates, payment methods, and payment status, you can easily monitor whether a payment has been received or if follow-up actions are required. Keeping a detailed record of all transactions ensures that both you and your clients have a clear understanding of outstanding amounts and the overall financial situation.

| Reference Number | Client Name | Amount Due | Payment Status | Due Date | Payment Date |

|---|---|---|---|---|---|

| #001 | John Doe | $500 | Paid | 2024-10-15 | 2024-10-14 |

| #002 | Jane Smith | $300 | Pending | 2024-10-20 | N/A |

| #003 | ABC Corp. | $1,000 | Overdue | 2024-10-10 | N/A |

By creating a system to track payment statuses–whether paid, pending, or overdue–you can quickly identify which payments need attention. This process not only enhances your organizational workflow but also improves client communication, reducing the chances of overdue accounts.

How to Send Billing Documents Efficiently

Efficiently sending financial documents is key to ensuring that payments are processed on time and that your administrative tasks are streamlined. A structured approach to delivering these documents can help save time, reduce errors, and create a professional experience for both you and your clients. Whether using physical mail or digital platforms, there are several methods to consider when sending your bills.

Methods for Sending Documents

- Email: Sending bills via email is one of the fastest and most convenient methods. It allows you to reach clients instantly, and you can include a PDF attachment of the document for easy viewing and downloading.

- Online Billing Software: Utilizing billing software or platforms like QuickBooks, FreshBooks, or Xero can help you send professional-looking documents directly to your clients with just a few clicks. These platforms also offer tracking features to monitor when a document is opened or paid.

- Physical Mail: For clients who prefer paper copies, mailing the document ensures that they receive it in a physical format. However, this method can take longer and may incur additional costs for postage.

- Cloud Storage Links: If you’re working with large documents or need to send multiple files, cloud storage services like Google Drive or Dropbox allow you to send links to your clients where they can download the files at their convenience.

Tips for Streamlining the Process

- Automate Regular Billings: If you have recurring clients, set up automatic billing reminders or scheduled sends to save time and reduce the risk of missing a payment cycle.

- Double-Check Contact Information: Before sending any bills, verify that the client’s contact information is accurate. Incorrect email addresses or mailing addresses can delay the payment process.

- Keep Records of Communication: Maintain a record of sent documents and confirmation receipts, especially when using digital platforms. This helps in case you need to follow up with the client.

By choosing the most efficient method for your business needs and streamlining your processes, you can ensure timely deliveries and foster positive relationships with your clients. A well-organized approach to sending bills not only saves time but also contributes to better financial management.

Benefits of Using Digital Billing Documents

Digital billing documents have revolutionized the way businesses manage their financial transactions. By using electronic formats instead of traditional paper-based methods, businesses can streamline their processes, reduce costs, and improve efficiency. These digital records offer several advantages that can enhance both the sender’s and the recipient’s experience.

Advantages of Digital Documents

- Time Efficiency: Sending digital documents allows for instantaneous delivery, eliminating delays associated with physical mail or manual processing.

- Cost Savings: Reducing the need for printing, postage, and paper cuts down operational costs, contributing to a more cost-effective approach to billing.

- Environmental Impact: Using digital formats reduces paper waste, promoting eco-friendly practices and helping businesses align with sustainability goals.

- Improved Accuracy: With digital tools, businesses can easily create, review, and edit documents, reducing the chances of errors compared to handwritten or manually generated bills.

- Access and Convenience: Clients can access digital records anytime, anywhere, making it more convenient for them to review their details, pay on time, and keep track of past transactions.

Key Features of Digital Billing Documents

| Feature | Description | Benefit |

|---|---|---|

| Automated Reminders | Set up automatic payment reminders for clients | Helps prevent overdue payments and improves cash flow |

| Customizable Layouts | Easily modify and personalize design for each client | Enhances branding and professionalism |

| Instant Payment Tracking | Monitor payment status in real time | Quickly identify outstanding amounts and reduce follow-ups |

Digital documents provide a faster, more efficient, and professional way to handle billing tasks. The ability to streamline workflows, reduce costs, and provide better service to clients makes this method an ideal choice for modern businesses. Whether using basic PDF files or integrated software solutions, the benefits of switching to digital formats are undeniable.

Integrating Billing Documents with Accounting Software

Connecting your billing documents with accounting software can greatly enhance the efficiency of financial management. By syncing the two, businesses can ensure that all transactions are automatically recorded, reducing the time spent on manual data entry and minimizing the risk of errors. This integration not only streamlines your operations but also provides real-time insights into your financial health.

Key Benefits of Integration

- Time Savings: Automating the transfer of data from billing records to accounting systems eliminates the need for duplicate entries, saving hours of manual work.

- Enhanced Accuracy: With automatic syncing, you reduce the risk of human error, ensuring that your financial records are always accurate and up-to-date.

- Real-Time Data: Integrated systems provide instant updates, so both the billing and accounting departments have access to the same information at all times.

- Improved Financial Insights: By linking billing records to your accounting software, you gain better visibility into your revenue streams, outstanding payments, and overall business performance.

- Reduced Paperwork: The integration significantly reduces the need for paper documentation, helping businesses adopt more eco-friendly practices.

How to Integrate Billing Systems

| Step | Description | Benefits |

|---|---|---|

| Step 1: Choose Compatible Software | Ensure the accounting software supports integration with your chosen billing tools. | Streamlines the integration process and prevents compatibility issues. |

| Step 2: Sync Data | Link your billing documents directly to the software and automate data import. | Reduces manual input, saving time and improving accuracy. |

| Step 3: Test Integration | Run a few tests to ensure data flows smoothly between systems. | Helps identify any issues early, minimizing disruptions. |

| Step 4: Monitor Performance |