Effective Overdue Invoice Template Email for Prompt Payments

In any business, ensuring timely payments is crucial to maintaining healthy cash flow and sustaining operations. Sometimes, clients may forget or delay their financial obligations, which can put unnecessary strain on your resources. One of the most efficient ways to address this issue is by sending well-crafted reminders that prompt action without damaging relationships.

Sending a polite and professional reminder is an art that requires a careful balance of tone and clarity. A well-composed message not only encourages prompt payment but also helps preserve strong business relationships for future collaborations. By using the right language and structure, you can effectively communicate your expectations and maintain a positive rapport with your clients.

In this guide, we will explore the essential components of a successful payment reminder. From choosing the right wording to knowing when to follow up, you will learn strategies that ensure your requests are clear, professional, and respectful. By applying these techniques, businesses can reduce delays, improve cash flow, and foster trust with their clients.

Why You Need an Overdue Invoice Email

When clients fail to meet payment deadlines, it can create significant challenges for businesses, particularly when cash flow is affected. Sending a professional reminder is essential to ensure payments are collected promptly, while maintaining a positive relationship with your customers. A timely and tactful payment reminder can make a world of difference in keeping your operations running smoothly.

Prompt Action for Improved Cash Flow

Delays in payment can quickly accumulate, impacting your ability to pay vendors, employees, or invest in new opportunities. By sending a friendly yet firm reminder, you increase the likelihood of getting paid faster. A well-written message can prevent further delays, helping to restore the financial balance your business relies on.

Maintain Professional Relationships

Not all late payments are intentional, and many clients simply forget about their obligations. By using a respectful tone in your reminder, you show understanding while still asserting your need for timely payment. This balance helps to strengthen your professional relationships, ensuring that clients feel valued but also reminded of their responsibilities.

Sending a professional payment request also reduces the need for more drastic actions, such as involving collection agencies or pursuing legal action. A clear, concise message often resolves the issue without escalating the situation.

Key Elements of an Effective Invoice Reminder

A well-crafted reminder is an essential tool for encouraging timely payments from clients. To ensure that your message is both professional and effective, certain elements must be included. A reminder should not only convey your request clearly but also reflect your business’s professionalism and consideration for the client’s situation.

- Clear Subject Line: Make sure the subject of your message is direct and leaves no ambiguity. Clients should immediately understand the purpose of your communication. For example, “Payment Reminder for Invoice #1234”.

- Polite and Professional Tone: Even though you’re reminding the client of a financial obligation, it’s important to maintain a respectful and courteous tone. This helps avoid any tension and keeps the relationship positive.

- Details of the Unpaid Balance: Include essential details like the amount due, the original due date, and any previous communication regarding payment. This ensures there is no confusion on the client’s part.

- Call to Action: Clearly state what you expect from the client, whether it’s payment or contacting you for a discussion. This guides the client on how to proceed.

- Grace Period or Payment Options: If applicable, offer a grace period or alternative payment methods to make it easier for the client to settle the amount. This flexibility can encourage faster resolution.

- Contact Information: Always provide a way for clients to reach you with any questions or concerns. This shows that you’re open to communication and can help resolve any issues promptly.

- Closing Remarks: End the message with a polite and friendly closing, reinforcing your willingness to work with the client and your expectation for prompt resolution.

By ensuring your reminder includes these key elements, you improve your chances of receiving payment on time while maintaining positive client relationships.

How to Structure Your Overdue Invoice Email

When requesting payment from a client, the way you structure your message can make a significant impact on the likelihood of prompt settlement. A well-organized message not only presents the necessary details clearly but also conveys professionalism and respect. By following a specific format, you can ensure that your request is both effective and polite.

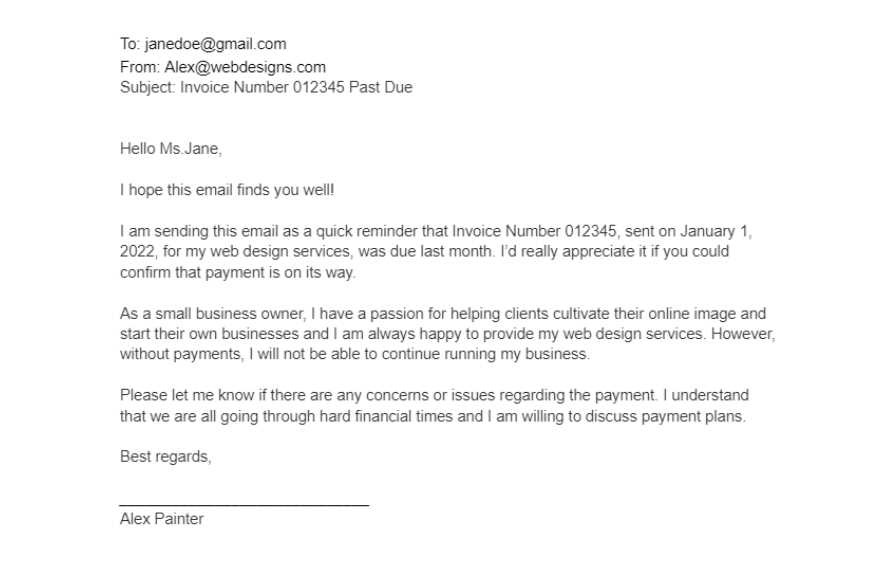

1. Start with a Professional Greeting

Always begin with a polite and respectful salutation. Address the recipient by their name, if possible, to make the message more personal and less generic. A courteous tone from the outset sets the stage for a positive exchange.

- Dear [Client Name],

- Hello [Client Name],

2. State the Purpose of the Message Early

Get straight to the point without being overly harsh. Briefly mention that this message serves as a reminder about an outstanding payment, and specify the amount due. This keeps the client focused on the matter at hand.

- We wanted to kindly remind you that payment for [service/product] is now due.

- This is a gentle reminder regarding the outstanding balance of [amount] for [service/product].

3. Provide Relevant Details

Include key information about the transaction, such as the invoice number, the original due date, and any previous communication regarding the payment. This helps eliminate confusion and gives the client all the information they need to settle the amount quickly.

- Invoice Number: [#12345]

- Original Due Date: [Date]

- Amount Due: [$Amount]

4. Offer Flexible Payment Options

If possible, provide different ways for the client to pay, such as bank transfer, credit card, or online payment platforms. Offering flexibility can lead to faster payments and demonstrates your willingness to accommodate the client’s preferences.

5. Close with a Polite and Clear Request

Politely encourage the client to take action. If appropriate, include a specific deadline or a gentle nudge, but avoid sounding confrontational. Offering to discuss any issues they may have can also be helpful.

- Please let us know if you need any assistance with the payment process.

- We would appreciate receiving payment by [date].

Conclude with a warm, friendly sign-off, reinforcing your desire to resolve the matter efficiently.

Tips for Writing a Polite Payment Reminder

When requesting payment from clients, maintaining a respectful and polite tone is crucial for preserving a positive relationship. A well-crafted reminder not only encourages prompt payment but also reflects your professionalism and consideration. Here are some tips for ensuring that your message remains courteous while still conveying the need for timely action.

- Use a Friendly Tone: Start with a warm greeting and avoid any harsh language. A tone that feels friendly and understanding encourages cooperation and minimizes the risk of conflict.

- Keep It Concise: Get to the point quickly without unnecessary details. Be clear about the payment due, but avoid making the message too long or complex.

- Be Understanding: Acknowledge that delays can happen for various reasons. Offering a bit of empathy shows that you understand the client’s situation while still reminding them of their responsibility.

- Reassure Your Client: Let the client know that you’re available to assist if there are any issues with the payment process. This helps create an atmosphere of open communication and reduces the likelihood of misunderstandings.

- Include Clear Details: Always mention the amount due, the due date, and the payment methods available. This ensures that the client knows exactly what is expected of them.

- Set a Friendly Deadline: If applicable, give a reasonable timeframe by which the payment should be made. Be polite but firm in your request, and avoid sounding too forceful.

- Close Positively: End your message on a positive note. Express appreciation for their business and reassure them that you look forward to continuing the relationship.

By following these tips, you can craft payment reminders that are both effective and considerate, helping you maintain good relations with clients while ensuring timely payments.

Common Mistakes in Payment Reminder Messages

When crafting payment reminder messages, it’s easy to make mistakes that can affect both the tone and effectiveness of your communication. Certain missteps can create confusion, damage relationships, or even delay payment further. Avoiding these common errors is essential for ensuring your message is clear, polite, and actionable.

- Being Too Aggressive: One of the most common mistakes is using a confrontational or harsh tone. While it’s important to express the need for payment, aggressive language can damage your relationship with the client and make them less likely to pay promptly. Keep the tone polite, respectful, and professional.

- Not Providing Clear Payment Information: Vague or incomplete details can confuse the client. Always include specific information, such as the exact amount due, the due date, and any payment methods available. This ensures that the client knows exactly what is expected of them.

- Failure to Personalize: Sending a generic or impersonal message can make the client feel as though they are just another number. Use the client’s name and mention specific details relevant to their situation to make the message feel more personal and thoughtful.

- Missing a Clear Call to Action: Without a clear request for payment or next steps, clients may not know how to proceed. Always include a straightforward call to action, such as requesting payment by a certain date or asking the client to get in touch with you if there are any issues.

- Overloading with Information: While it’s important to include key details, overwhelming the recipient with too much information can cause them to miss the main point. Stick to the essentials–payment amount, due date, and payment instructions–without unnecessary elaboration.

- Not Offering Assistance or Flexibility: Sometimes clients may have issues or need more time. A reminder that doesn’t leave room for discussion or assistance can alienate them. Offering to help with payment arrangements or answering questions can foster goodwill and encourage payment.

- Not Following Up: Sending just one reminder and leaving it at that is a missed opportunity. Follow-up reminders, spaced appropriately, can be a gentle nudge that keeps the matter at the top of the client’s mind. Neglecting to send a follow-up can result in further delays.

By avoiding these common mistakes, you can ensure that your payment reminder messages are clear, professional, and conducive to timely resolution, helping you maintain positive relationships with clients while securing the payments owed to you.

Best Practices for Professional Payment Requests

When requesting payment from clients, professionalism and clarity are key to achieving a timely response while preserving a positive relationship. Following best practices helps ensure your messages are effective, courteous, and clear. The way you approach payment requests can influence how clients perceive your business and how quickly they settle their debts.

Here are some best practices to consider when making payment requests:

| Best Practice | Description |

|---|---|

| Be Clear and Concise | Ensure that your message clearly states the amount due, the due date, and any relevant details to avoid confusion. Keep the message brief while including all necessary information. |

| Maintain a Professional Tone | Even if payments are delayed, always use polite language and maintain a respectful tone. Your communication should convey professionalism and empathy, not frustration. |

| Provide Multiple Payment Methods | Offering different ways for clients to make payments (bank transfer, online platforms, checks) can make the process more convenient and increase the likelihood of timely settlement. |

| Be Timely with Reminders | Send reminders promptly, without waiting too long after the payment due date. A timely reminder ensures the issue remains fresh and shows that you are on top of your accounts. |

| Set a Clear Deadline | Politely indicate a specific date by which you expect payment. Clear deadlines help the client understand when action is needed, minimizing ambiguity. |

| Offer Assistance if Necessary | Include a line offering assistance if the client is facing issues with payment. Showing willingness to work with the client can foster goodwill and expedite resolution. |

By implementing these best practices, you can ensure that your payment requests are professional, clear, and more likely to be acted upon promptly, leading to better cash flow and stronger client relationships.

When to Send a Payment Reminder

Timing is crucial when it comes to requesting payment from clients. Sending a reminder too soon can seem pushy, while waiting too long can lead to delayed payments and potential cash flow issues. Understanding the right moment to send a polite reminder is key to ensuring a positive and professional interaction while encouraging timely payment.

1. Immediately After the Due Date

The first reminder should be sent shortly after the payment due date has passed. It’s important to act quickly to ensure the matter remains a priority for the client. A gentle nudge at this stage can prevent further delays without causing friction. This reminder is typically soft in tone, simply informing the client that the payment is due and reminding them of the specifics.

2. After One Week or 10 Days

If the client hasn’t responded or made a payment after your initial reminder, it’s appropriate to follow up after about a week or ten days. This second reminder can be slightly firmer but should still be professional and respectful. At this stage, you can also offer assistance if there are any issues preventing the payment from being processed.

Sending reminders at these intervals keeps your business finances on track while maintaining a positive relationship with your clients. By choosing the right time to reach out, you increase the likelihood of prompt resolution without overstepping boundaries.

How to Address Late Payment Issues Politely

When a client fails to meet payment deadlines, it’s important to handle the situation with tact and professionalism. Addressing the issue politely not only helps you maintain a good relationship but also increases the chances of timely payment. By striking the right balance between firmness and courtesy, you can resolve the matter efficiently while keeping the client’s trust intact.

- Start with a Friendly Reminder: Begin by sending a gentle and friendly reminder as soon as the payment deadline passes. Use positive language, such as “I hope this message finds you well” or “Just a quick reminder,” to avoid sounding accusatory.

- Be Clear but Considerate: While it’s essential to state the amount due and the payment terms clearly, also express understanding. You might say, “We understand that sometimes delays happen” or “If there are any issues with processing the payment, please let us know.”

- Offer Payment Assistance: If there are difficulties or confusion surrounding the payment process, offer your help. This could include suggesting alternate payment methods or offering flexible terms. This gesture shows empathy while still expecting resolution.

- Avoid Threats or Ultimatums: Never use threatening language, such as mentioning legal action or cutting off services, unless absolutely necessary. Keeping the conversation professional and positive helps maintain goodwill for future business.

- Follow Up Professionally: If there is no response to the first polite reminder, send a follow-up message after a few days. Remind the client of the amount due and express your hope for a quick resolution, keeping the tone polite but firm.

By approaching late payments with understanding and respect, you can resolve the issue without damaging your relationship with the client. Maintaining professionalism ensures that you stay on good terms while securing the payment you’re owed.

Customizing Your Payment Reminder Message

When crafting a payment reminder, it’s important to personalize the message to fit both your brand and the specific client. Customization ensures that your communication feels professional, relevant, and respectful, which can improve the chances of prompt payment. A one-size-fits-all approach may come across as impersonal or ineffective, so tailoring your reminder is key to achieving the best results.

Key Aspects to Customize

When personalizing a payment reminder, consider the following elements to ensure the message aligns with your business needs and the client’s situation:

| Element | Customization Tips |

|---|---|

| Client’s Name | Always address the client by name. This adds a personal touch and makes the reminder feel more individualized. |

| Amount Due | Clearly specify the exact amount owed and include any applicable taxes or fees. Make it easy for the client to see what they’re being charged. |

| Due Date | Refer to the original due date and mention how many days have passed since the deadline. This helps the client understand the context of the reminder. |

| Services or Products Provided | List the services or products provided to the client, with dates if applicable. This helps avoid any confusion about the charges. |

| Payment Methods | Include information about how the client can pay, whether it’s via bank transfer, credit card, or an online payment system. Offering various payment options shows flexibility. |

Personalizing the Tone

The tone of your message is just as important as the content. Be sure to adjust the tone depending on the client’s history and your relationship. A friendly and warm tone is often best, but for clients who are consistently late, you may need to adopt a firmer, more professional approach. Regardless of the tone, always remain courteous and clear.

By customizi

How to Include Payment Terms Clearly

Clear payment terms are essential in any business transaction. By explicitly stating the conditions under which payment is expected, you eliminate confusion and ensure that both parties are on the same page. This clarity helps prevent delays, misunderstandings, and potential disputes. Here’s how you can effectively include payment terms in your communication.

1. Specify the Amount and Due Date

Clearly outline the total amount due and the exact date by which payment should be made. This is one of the most critical aspects of your request, as it tells the client exactly how much they owe and when payment is expected.

- Example: The total amount of $500 is due on or before [date].

2. Include Accepted Payment Methods

List all available payment methods so that the client knows how they can pay. This includes bank transfers, credit card payments, online platforms, or checks. By providing multiple options, you make it easier for the client to pay promptly.

- Example: Payments can be made via bank transfer, credit card, or PayPal.

3. Define Any Late Fees or Penalties

If applicable, outline any penalties or late fees that will be charged if payment is not received by the agreed-upon due date. Be sure to specify the rate and how it will be applied (e.g., a fixed fee or a percentage of the outstanding amount).

- Example: A late fee of 2% per month will be applied to all unpaid balances after [due date].

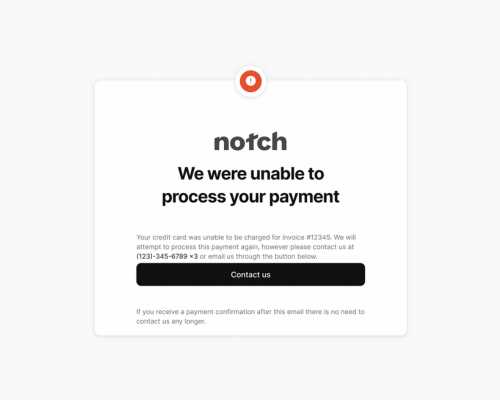

4. Include Contact Information for Issues

Provide contact details in case the client needs assistance or wishes to discuss any issues related to the payment. This ensures that any potential problems are addressed quickly and professionally.

- Example: If you have any questions or concerns, please contact us at [phone number] or [email address].

By including these key elements, you make your payment terms transparent and straightforward, which helps clients understand their obligations and avoid delays in settling their account.

Following Up After Sending a Payment Reminder

After sending a payment request, it’s important to follow up if the payment is still pending. A follow-up message helps reinforce the need for timely settlement and shows that you’re actively managing your accounts. However, it’s essential to approach the follow-up carefully–remaining polite, professional, and respectful ensures that you maintain good relations with your clients while encouraging them to fulfill their payment obligations.

Below are key steps to take when following up on a payment request:

| Step | Description |

|---|---|

| Wait for a Reasonable Time | Give your client sufficient time to process the payment after sending the first reminder. Typically, waiting 5-7 days after the initial request is appropriate before sending a follow-up. |

| Send a Polite Reminder | If the payment hasn’t been made, send a gentle follow-up message. Keep the tone friendly and understanding, while reminding the client of the payment terms and the amount due. |

| Provide Payment Details Again | Include the amount due, payment methods, and due date once more. Sometimes clients overlook the specifics, so reiterating this information can prevent confusion. |

| Express Willingness to Discuss Issues | If the client is facing difficulties, offer to discuss the matter further. Offering flexible solutions or payment options can help resolve the issue without further delay. |

| Keep It Professional | Avoid sounding accusatory or frustrated. Your goal is to maintain a positive relationship and encourage the client to pay, not to escalate the situation unnecessarily. |

| Follow Up Again if Necessary | If there’s still no response or payment after the first follow-up, send a second reminder. After multiple follow-ups, consider outlining potential consequences, but always remain professional. |

Following up on outstanding payments with professionalism and patience is crucial in maintaining good client relationships. A well-crafted follow-up can help ensure that payments are settled without damaging trust or rapport.

Legal Aspects of Payment Reminder Communication

When requesting payment for outstanding balances, it is essential to understand the legal implications of your communications. Not only do you want to ensure that your requests are professional and clear, but they must also comply with relevant laws and regulations. Proper handling of overdue payments can help prevent legal disputes, while improper communication can expose your business to potential legal risks.

Here are some key legal considerations to keep in mind when addressing delayed payments:

- Truth in Communication: Always provide accurate and truthful information when reminding clients of their outstanding balance. Misleading or incorrect information can lead to legal issues, including claims of fraud or misrepresentation.

- Debt Collection Laws: Depending on your jurisdiction, there are specific laws regarding how you can pursue payment. These laws may govern how and when you can contact the debtor, the language you can use, and the steps you must take before involving third-party debt collectors.

- Harassment and Threats: Be cautious not to use language that could be seen as harassment or intimidation. Legal standards often prohibit aggressive tactics, such as threatening legal action or taking extreme measures without cause.

- Confidentiality and Privacy: Be mindful of privacy laws, including data protection regulations, when sending payment reminders. Avoid sharing sensitive financial details with unauthorized parties and respect your client’s confidentiality at all times.

- Payment Terms Enforcement: If your original agreement includes specific terms for payment, such as interest on late payments or penalty fees, ensure that these terms are clearly communicated and legally enforceable. This will help protect your business and encourage timely payment.

- Third-Party Involvement: If you need to escalate the matter to a collection agency or initiate legal proceedings, ensure that you are following the legal procedures for involving third parties in the debt recovery process. This includes providing notice, obtaining permission if necessary, and adhering to collection guidelines.

Understanding the legal aspects of requesting payment helps you navigate potential challenges and ensures that your approach is compliant. By being aware of these regulations, you can handle overdue payments effectively without jeopardizing your business’s legal standing.

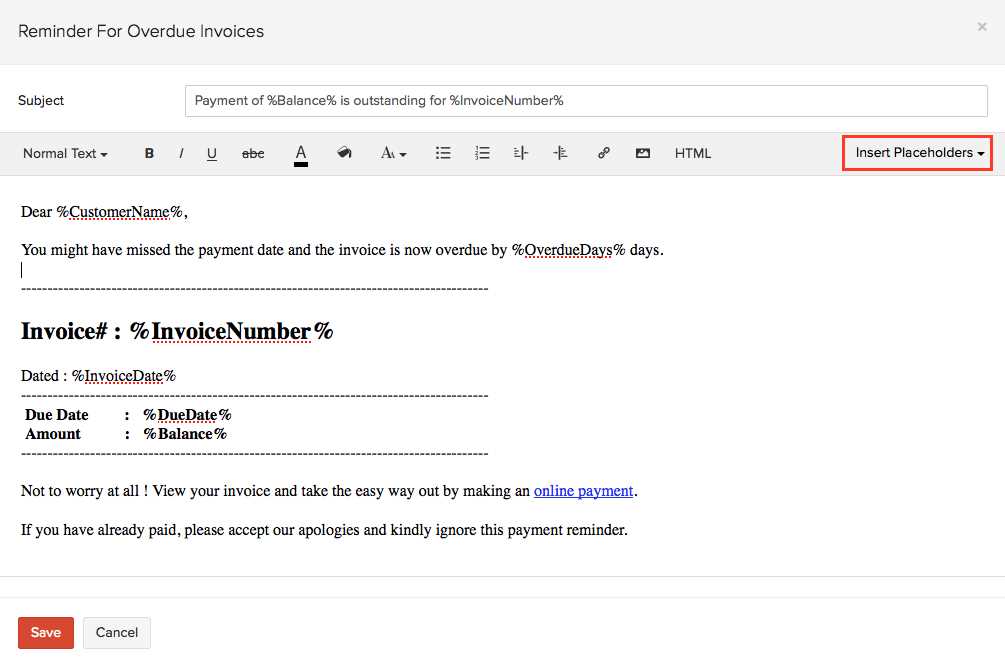

Automating Payment Reminders

Automating payment reminders is an effective way to streamline the process of managing outstanding balances, ensuring that clients are consistently reminded of their payment obligations without requiring manual effort. By setting up automated systems, you can save time, reduce human error, and maintain professionalism in your communications. Automation not only helps keep cash flow steady but also improves your ability to follow up on delayed payments consistently.

Here are some key steps to implement automation for payment reminders:

- Select the Right Tool: Choose a reliable software or platform that can handle automated reminders. There are numerous invoicing and accounting tools available that integrate with your payment systems, making it easier to automate the reminder process.

- Set Custom Triggers: Define when reminders should be sent. For example, set a reminder for a few days after the due date, another one a week later, and a final reminder before escalating to a more formal action.

- Personalize the Message: Even though the process is automated, ensure that each reminder is personalized with the client’s name, the amount due, and other relevant details. This helps maintain a professional tone and makes the message feel more individualized.

- Define Payment Terms: Clearly outline payment expectations in each automated reminder. Specify the amount due, available payment methods, and due dates to ensure that your clients have all the necessary information to act quickly.

- Set Up Multiple Follow-Ups: Program the system to send a series of follow-up reminders. For example, one gentle reminder 3 days after the due date, a firmer reminder 7 days later, and a final, more urgent message after 14 days.

- Monitor Responses: While the process is automated, it’s important to monitor any responses. Set up notifications for when clients respond, so you can address any issues promptly and adjust follow-up strategies as needed.

- Track Effectiveness: Regularly assess how well your automated reminders are working. Review metrics such as response time, payment speed, and the effectiveness of different message types to refine your approach.

By automating payment reminders, you free up valuable time and reduce the risk of missed payments. A well-organized system ensures that clients receive timely reminders while you maintain consistent follow-up without adding extra administrative burden.

How to Handle Unresponsive Clients

Dealing with clients who fail to respond to payment reminders can be challenging. While it’s important to maintain professionalism and patience, it’s equally crucial to take effective steps to resolve the situation. Unresponsive clients may ignore your requests for various reasons, such as financial difficulties, miscommunication, or simple oversight. Regardless of the cause, it’s essential to approach the issue with a balanced strategy to encourage payment while preserving the business relationship.

Here are some strategies for handling unresponsive clients:

- Send a Polite Follow-Up: If the client hasn’t responded to your first reminder, send a second, more assertive yet still polite message. Ensure that the tone remains respectful but firm, reiterating the details of the payment due and any consequences of non-payment.

- Verify Contact Information: Sometimes, the reason for non-response is a simple issue like incorrect contact details. Double-check the information you have for the client, including email addresses, phone numbers, and billing addresses, to ensure that your communications are reaching them.

- Offer Payment Solutions: If the client is facing financial difficulties, consider offering alternative payment options, such as a payment plan or extended terms. Showing flexibility can help maintain a positive relationship and encourage the client to settle their account.

- Be Persistent, but Not Aggressive: Continue following up periodically, but avoid becoming too aggressive or overwhelming the client with frequent messages. A balanced approach, where reminders are spaced out and polite, will increase the likelihood of a response.

- Escalate Gradually: If the client remains unresponsive, it may be time to escalate the situation. Begin by sending a final notice that outlines any penalties or legal actions that could occur if payment is not received. If the matter is not resolved, consider involving a collection agency or legal professional.

- Know When to Cut Ties: If repeated attempts to contact the client and resolve the situation have failed, it may be necessary to stop doing business with them. While this is a last resort, it protects your business from further financial risk.

By following these steps, you can increase the likelihood of receiving payment from unresponsive clients while ensuring that your approach remains professional and respectful. It’s important to strike a balance between persistence and courtesy, ultimately helping to preserve both your revenue and your client relationships.

Building a Payment Reminder Strategy

A well-thought-out payment reminder strategy is crucial for maintaining a steady cash flow and ensuring timely settlements from clients. An effective strategy helps to reduce the chances of missed payments while fostering positive client relationships. The key to building such a strategy is understanding when and how to follow up with clients, providing clear communication, and offering flexible solutions if necessary. By establishing a structured approach, businesses can handle late payments efficiently without damaging their reputation.

1. Define Clear Payment Terms

Before diving into reminders, it’s essential to set clear and agreed-upon payment terms from the start. This includes specifying due dates, payment methods, and any late fees. When your terms are clearly outlined, it minimizes confusion and provides a solid foundation for reminders if payments are delayed.

- Example: Payments are due within 30 days of receipt, with a 2% late fee applied for each month after the due date.

2. Create a Reminder Schedule

Deciding when to send reminders is a key part of your strategy. Timing is important; you want to remind clients before the due date, just after the due date, and periodically afterward if necessary. A well-planned schedule prevents unnecessary delays and ensures a consistent follow-up process.

- Initial Reminder: Send a reminder a few days before the due date.

- First Follow-Up: If payment hasn’t been received by the due date, send the first reminder immediately afterward.

- Second Follow-Up: If the client still hasn’t paid after a week or two, send a more assertive follow-up.

- Final Notice: A final reminder before taking more serious action, such as involving a collection agency or seeking legal counsel.

3. Personalize Your Approach

Personalizing payment reminders helps maintain a professional and respectful tone. Use the client’s name, mention the specific service or product they purchased, and include relevant details like the payment amount and due date. Personalization shows that you’re actively engaged in the relationship and helps prevent your communication from feeling like a generic message.

- Example: “Dear [Client Name], we noticed that payment for your [product/service] of [$ amount] was due on [due date]. Please make the payment as soon as possible to avoid any late fees.”

4. Be Flexible with Payment Options

Offering flexible payment options can encourage timely settlement. If a client is facing financial difficulty, consider offering payment plans or an extension on the due date. Being accommodating shows understanding, and it may lead to quicker payment instead of pushing the client further into default.

- Example: “If you are facing any difficulties making the payment, we would be happy to discuss an install

How to Improve Cash Flow with Timely Payments

Maintaining consistent cash flow is crucial for the growth and sustainability of any business. One of the most effective ways to ensure a steady flow of income is by receiving payments on time. When clients settle their bills promptly, it not only improves liquidity but also allows for more accurate financial planning. Implementing strategies to encourage timely payments can help prevent cash flow disruptions and reduce financial stress on the business.

Here are some key strategies to improve cash flow by encouraging clients to pay on time:

- Set Clear Payment Terms: Establishing transparent and well-defined payment terms upfront ensures that both parties are aligned. Clearly communicate due dates, payment methods, and any penalties for late payments. This creates a sense of urgency and accountability for your clients.

- Offer Early Payment Discounts: Incentivize clients to pay early by offering discounts. For example, you can provide a 2% discount for payments made within 10 days. This can encourage quicker payments and benefit your business in terms of improved cash flow.

- Automate Payment Reminders: Set up automated systems to send reminders to clients before and after the due date. Automated notifications ensure you don’t forget to follow up, and they help maintain consistent communication without additional manual effort. Timely reminders reduce the chances of delays.

- Use Recurring Billing for Regular Clients: For clients with ongoing or subscription-based services, set up a recurring billing system. Automating regular payments can improve predictability and reduce administrative burden, allowing you to focus on other aspects of your business.

- Offer Multiple Payment Options: The more convenient you make it for clients to pay, the more likely they are to do so on time. Offer various payment options such as credit cards, bank transfers, or online payment systems, giving your clients the flexibility to choose the method that works best for them.

- Set Payment Milestones for Large Projects: For large or long-term projects, break payments down into milestones. This approach not only makes it easier for clients to manage their cash flow but also ensures that you receive compensation at key points throughout the project. It helps protect your business against delayed payments for extended periods of work.

- Enforce Penalties for Late Payments: While it’s essential to offer flexibility, enforcing a late fee or interest for missed payments can deter clients from delaying. Make sure that any penalties are clearly stated in

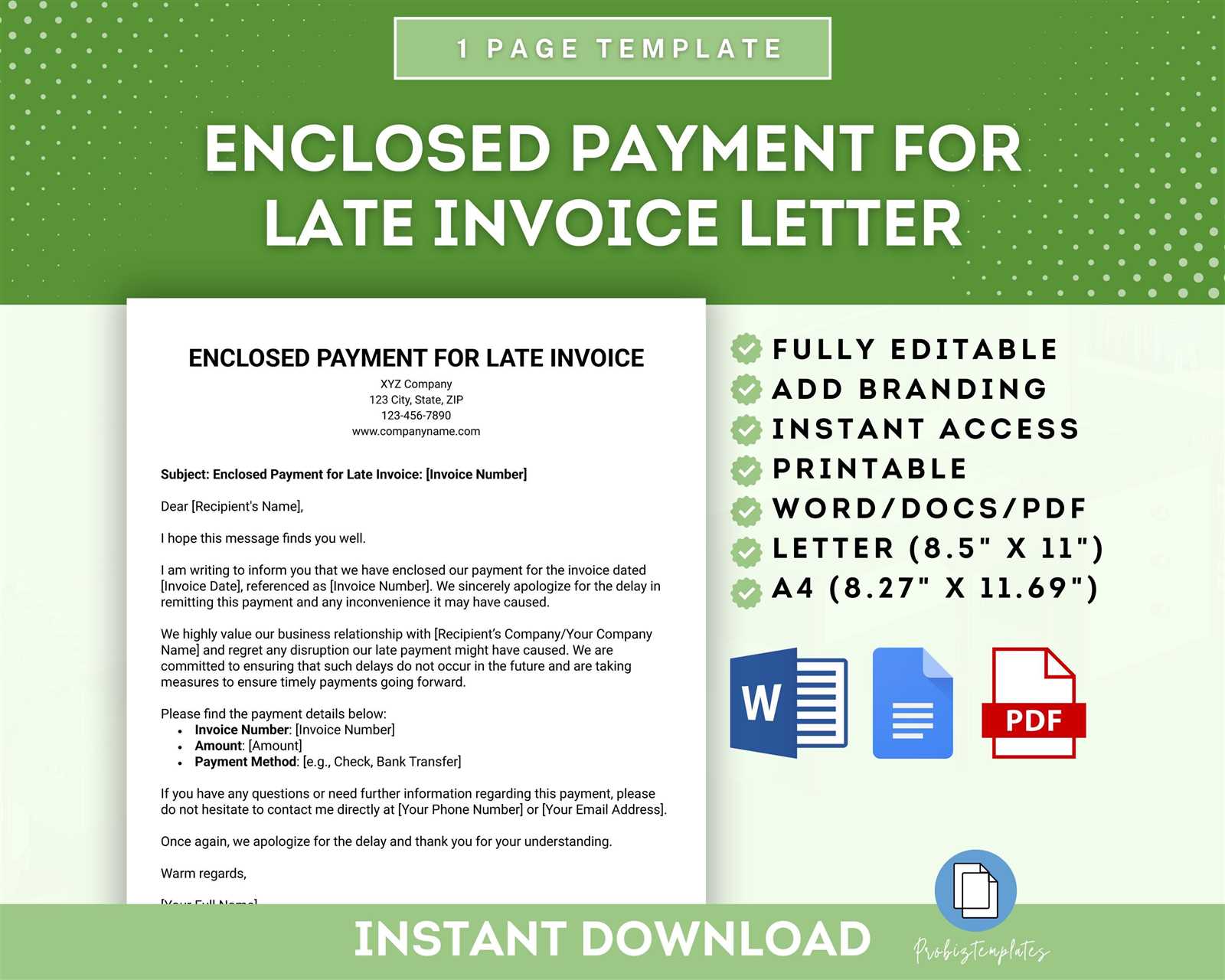

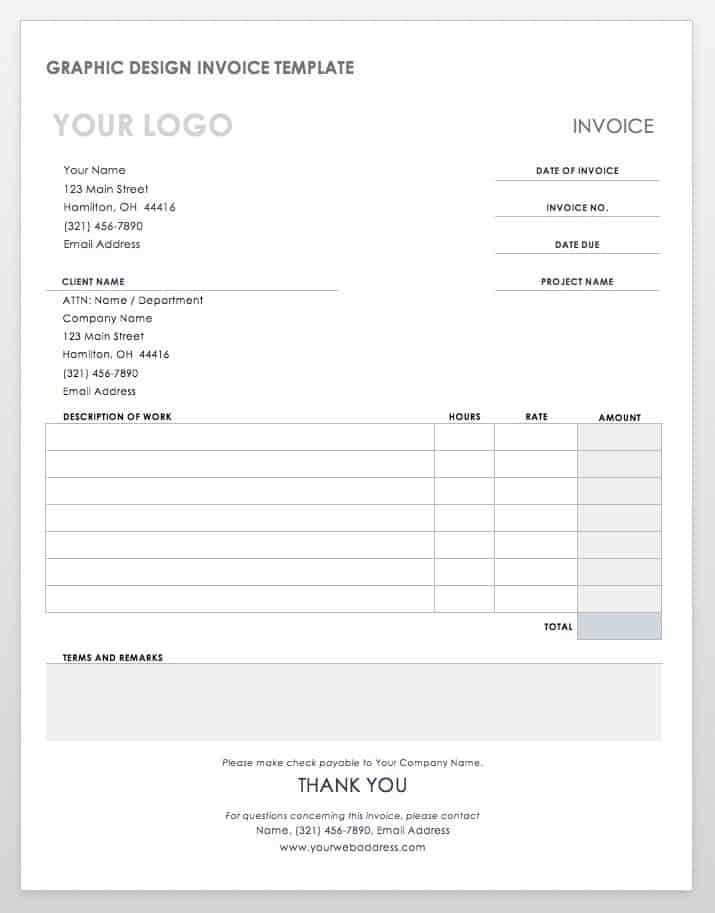

Free Tools for Creating Invoice Templates

When it comes to managing business finances, having an efficient way to create billing documents is essential. Many small business owners and freelancers rely on customizable tools to generate professional-looking statements for their clients. Fortunately, there are several free tools available that allow you to create and personalize these documents without the need for specialized software. These tools offer templates that streamline the process, ensuring accuracy and saving time on repetitive tasks.

1. Invoice Generator by Invoicely

Invoicely is a free, easy-to-use tool for creating and managing billing documents. This platform provides customizable templates that you can tailor to suit your needs. Whether you’re issuing a simple request for payment or a more detailed breakdown of services, Invoicely’s intuitive design makes the process simple and quick.

- Free plan allows you to create unlimited billing documents.

- Customizable fields for adding your business logo, payment terms, and service descriptions.

- Allows for PDF export for easy sharing and printing.

2. Wave Accounting

Wave Accounting is a comprehensive financial management tool that includes an invoicing feature. With its free plan, you can create and send unlimited billing statements, and track payments, all in one place. This is a great option for business owners who want an all-in-one solution for their financial needs.

- Fully customizable documents, including different templates and styles.

- Integrated with Wave’s accounting software for easy tracking of payments and expenses.

- Option to set up recurring payments for regular clients.

3. Zoho Invoice

Zoho Invoice offers a free plan suitable for small businesses or freelancers who need to create invoices and manage client payments. The tool is user-friendly and allows for extensive customization, such as adding discounts, taxes, and payment terms.

- Templates are fully customizable, allowing for a personalized look.

- Send invoices directly to clients via email and track payment status.

- Option to create automated reminders for pending payments.

4. PayPal Invoicing

For businesses already using PayPal for transactions, their invoicing feature is an excellent, no-cost option for creating professional billing documents. The tool integrates seamlessly with PayPal accounts, making it ideal for businesses that already accept online payments.

- Simple interface to create and send invoices quickly.

- Track paid and unpaid invoices directly in your PayPal account.

- Accept payments instantly via PayPal.

5. Invoice Simple

Invoice Simple is another free invoicing tool that is ideal for freelancers and small businesses. It features easy-to-use templates that allow you to customize your document with your business information and logo. The platform also supports tax calculations and payment tracking.

- Simple templates with