Best Outstanding Invoice Template for Efficient Payment Collection

When managing finances in any business, clear and professional documentation is crucial. Properly structured payment requests help maintain smooth operations and ensure that both parties understand the terms of agreement. A well-designed document can reduce misunderstandings, speed up payments, and keep clients satisfied with the transaction process.

Having a standardized format for these financial requests simplifies the process and saves time. By using a reliable format, you can focus on other important tasks while ensuring that every detail is accounted for. This consistency helps create trust and reliability in your client relationships, which ultimately benefits your business.

In this article, we will explore how to create the perfect document that can be used for requesting payments. From essential components to customization tips, you’ll find everything you need to improve your billing practices and enhance financial communication with clients.

Outstanding Invoice Template for Smooth Billing

Efficient financial communication is key to maintaining positive relationships with clients and ensuring timely payments. A structured approach to requesting payment can streamline your billing process, reduce errors, and minimize delays. By utilizing an organized format, you can make it easier for clients to understand the payment terms and fulfill their obligations without confusion.

Essential Elements of a Payment Request Document

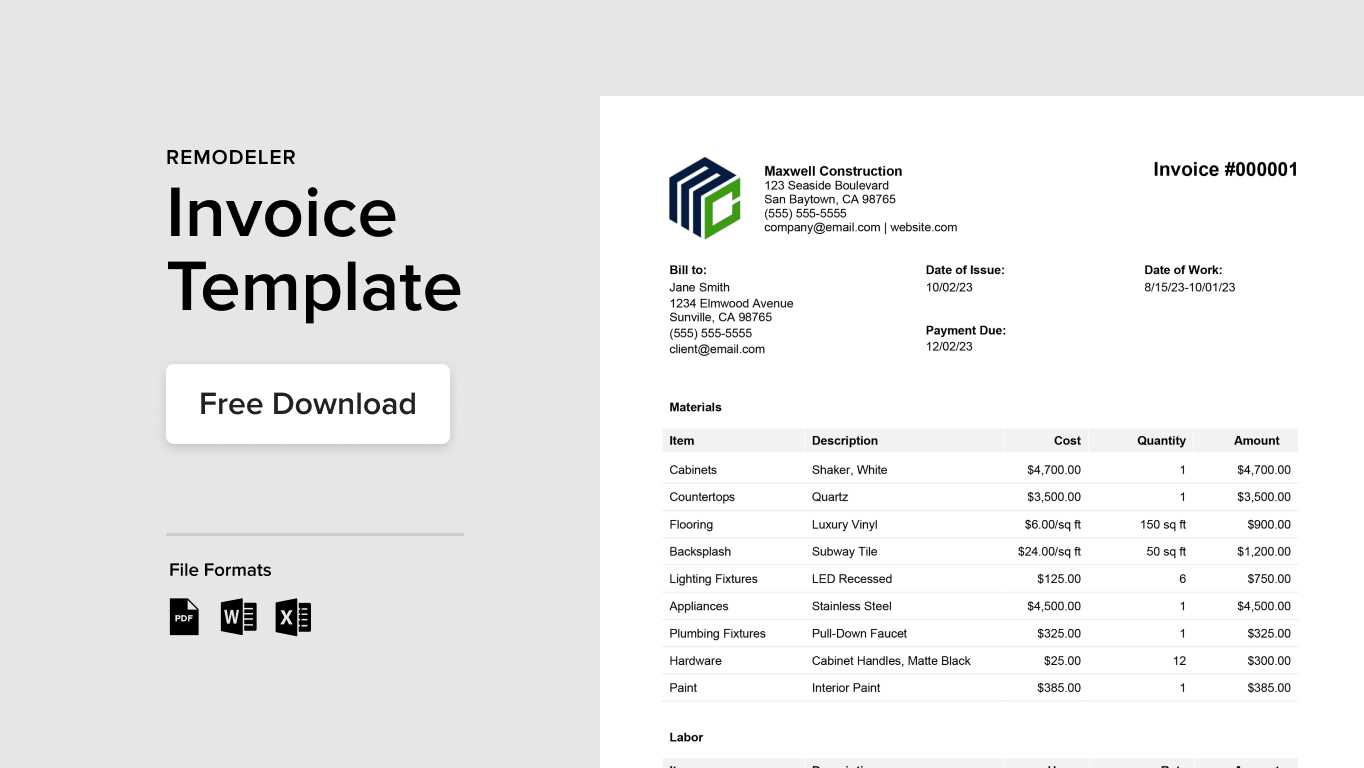

To create a seamless experience for both you and your clients, it’s important to include the right details in each document. A clear breakdown of the services or products provided, the agreed-upon amounts, and the due date should be easily visible. Additionally, adding payment instructions, such as available methods or bank account details, can further reduce friction in the payment process.

How a Well-Designed Document Enhances Professionalism

A polished and visually appealing payment request reflects your professionalism and attention to detail. By using consistent formatting, aligning text properly, and adding your business logo, you make the document not only functional but also aligned with your brand identity. This not only boosts credibility but also increases the likelihood of timely payments.

Why an Invoice Template is Essential

In any business, maintaining a clear and organized approach to financial transactions is crucial. Without a standardized method for documenting and requesting payments, the risk of mistakes, delays, and misunderstandings increases significantly. A well-structured form for billing can ensure consistency, professionalism, and efficiency in the payment process, both for your company and for your clients.

Benefits of Using a Structured Payment Document

Utilizing a pre-designed format for requesting payments offers numerous advantages that contribute to smooth financial operations:

- Consistency: Each request follows the same format, making it easier for clients to understand the terms and avoid confusion.

- Efficiency: With a ready-to-use structure, you can focus more on other tasks and send payment requests quickly.

- Professionalism: A polished and standardized document enhances your business image, building trust with clients.

- Accuracy: A clear format helps avoid errors by ensuring all necessary details are included.

Key Elements That Should Be Included

A reliable format should contain all the essential information to facilitate smooth transactions. The most important details to include are:

- Client’s contact information

- A breakdown of products or services provided

- Agreed-upon amounts and payment terms

- Due date and payment instructions

- Business details such as name, address, and payment method options

By incorporating these elements into each financial request, you ensure clarity and make it easier for clients to make timely payments. This practice reduces back-and-forth communication and fosters a smoother financial relationship.

Key Features of an Effective Invoice

Creating a payment request that is both clear and professional is essential for ensuring smooth financial transactions. The document used to request payment should provide all necessary details in an easy-to-understand format, preventing confusion and delays. By incorporating key features, you can streamline your billing process and improve communication with clients, making it easier for them to fulfill their obligations on time.

Essential Components to Include

An effective payment request includes several critical elements that help both the sender and recipient understand the terms of the transaction. Below is a breakdown of the most important features that should be part of any payment request document:

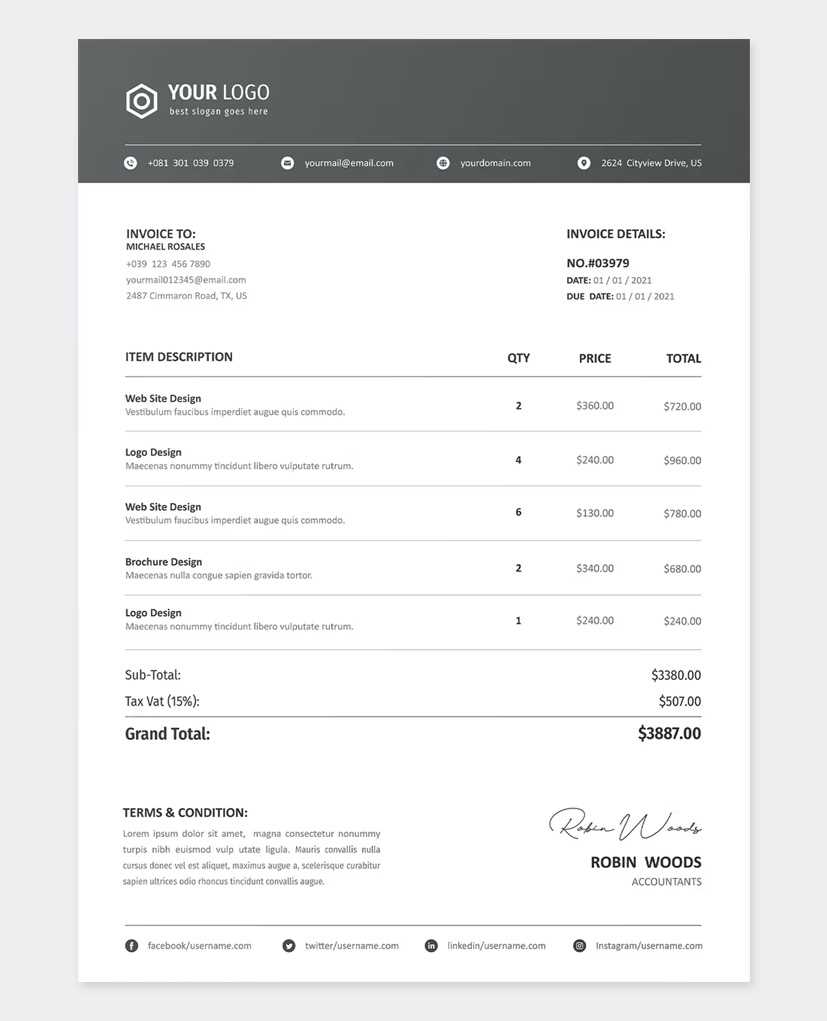

| Feature | Description |

|---|---|

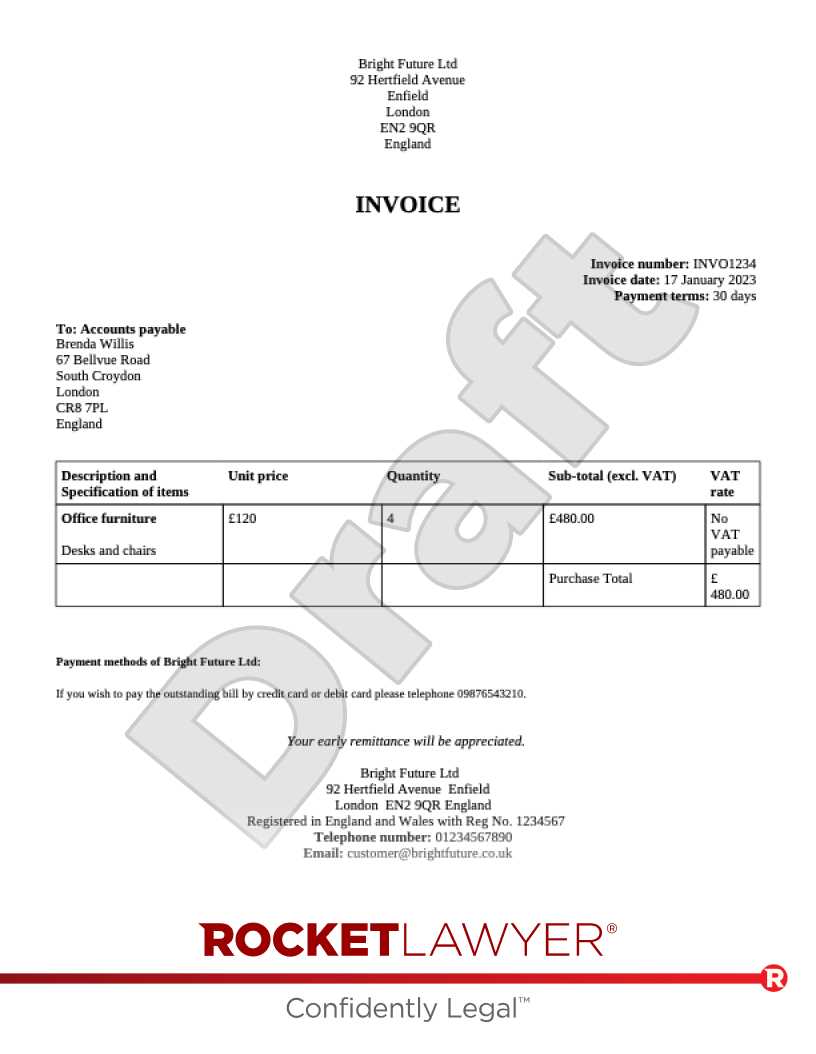

| Clear Header | Displays your business name, logo, and contact information at the top, establishing credibility and making it easy for clients to identify the source. |

| Client Information | Includes the client’s name, address, and contact details to ensure the document is addressed correctly. |

| Itemized List | A detailed breakdown of the services or products provided, including quantity, price, and total amounts. |

| Due Date | Clearly indicates the date by which payment is expected, ensuring that both parties are on the same page regarding deadlines. |

| Payment Terms | Describes the conditions for payment, such as accepted payment methods, any discounts for early payment, or penalties for late payment. |

| Subtotal and Total | Summarizes the charges, including any applicable taxes or fees, providing a clear total amount due. |

Formatting f

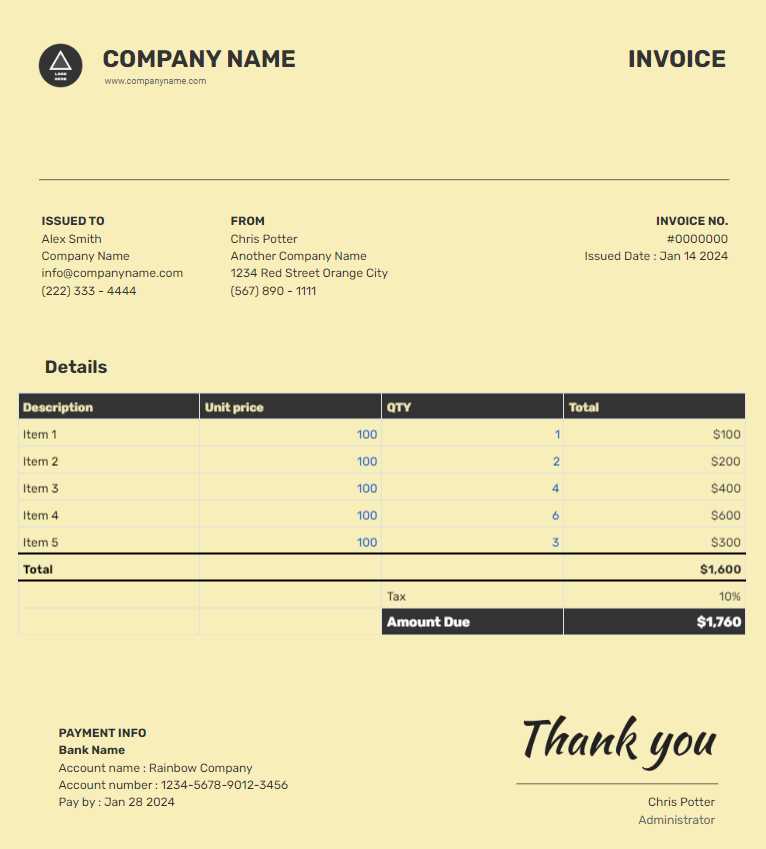

How to Customize Your Invoice Template

Customizing your billing document ensures that it aligns with your brand identity while maintaining clarity and professionalism. A personalized payment request can reflect your business values and make the process more efficient. By adjusting key sections and details, you can create a document that meets your specific needs and stands out to clients.

Steps to Personalize Your Payment Request Document

Follow these steps to modify your document for maximum effectiveness:

- Choose the Right Layout: Select a layout that suits your business type. Whether you’re a freelancer or a large corporation, choose a format that makes the information easy to digest.

- Incorporate Your Branding: Include your business logo, color scheme, and font choices. This will help reinforce your brand’s visual identity in every interaction.

- Adjust Itemized Details: Modify the sections for products or services to reflect what you offer. If necessary, include extra columns for discounts, taxes, or additional fees.

- Add Personal Notes: Adding a short thank-you note or specific payment instructions can make your document more personable and help avoid misunderstandings.

- Set Payment Terms: Clearly specify payment deadlines, acceptable methods, and any early payment discounts or late fees. Customize these terms to suit your business model.

- Review Legal Information: Include any necessary legal disclaimers, such as refund policies or compliance details, relevant to your industry or location.

Tools for Customizing Your Document

There are several tools available to assist with customization, depending on your preferences and technical skill level:

- Word Processors: Programs like Microsoft Word or Google Docs offer simple customization options for creating and editing documents.

- Online Platforms: Websites such as Canva, Zoho, or FreshBooks allow for easy drag-and-drop customization, with pre-made designs to speed up the process.

- Spreadsheet Software: Excel or Google Sheets can be used for more complex documents with calculations and automatic totals.

By following these steps and utilizing the right tools, you can create a well-tailored payment request that enhances your business’s professionalism and ensures that clients have all the information they need to complete transactions smoothly.

Best Invoice Formats for Freelancers

As a freelancer, having a professional and efficient way to request payment is essential for managing your finances. The format of your billing document plays a significant role in how clients perceive your professionalism and the clarity of your payment terms. Choosing the right structure ensures that all important details are communicated effectively, making it easier for clients to process payments promptly.

Essential Features for Freelance Billing Documents

For freelancers, the key to an effective payment request is simplicity, clarity, and organization. Here are the essential features that should be included:

- Your Contact Information: Clearly state your name, business name (if applicable), address, and preferred method of communication.

- Client Information: Include the client’s name, address, and any specific billing details relevant to them.

- Services or Products Rendered: Provide a detailed list of the services or work completed, along with the corresponding rates or fees.

- Payment Terms: Specify the due date, payment methods accepted, and any late fees or discounts for early payment.

- Subtotal and Total Amount: Break down the cost clearly, listing the individual amounts and any additional taxes or fees to provide a transparent total.

Best Formats for Freelancers

There are several formats that work particularly well for freelancers, depending on the type of work they do and the preferences of their clients. Some of the best formats to consider include:

- Simple One-Page Format: A clean, concise layout with all the necessary information on one page. Ideal for small projects or one-time services.

- Itemized Breakdown: Perfect for larger or ongoing projects, where you can list individual tasks and their associated costs, allowing clients to see exactly what they’re paying for.

- Professional Letterhead Format: Including your branding, logo, and professional layout can add a level of formality, particularly for high-end services or long-term clients.

- Online Billing Systems: Using platforms like PayPal, FreshBooks, or QuickBooks can automate the process, ensuring accuracy and faster processing times for both you and your client.

Choosing the best format depends on your type of freelance work and how you want to present your business. Regardless of the format, make sure your payment request is easy to read, free of errors, and professional to ensure timely payments and smooth client relations.

How to Avoid Common Billing Mistakes

Accurate and timely payment requests are essential to maintaining healthy business relationships and ensuring prompt payments. However, mistakes in the billing process can lead to confusion, delays, or even lost revenue. Understanding and addressing common billing errors can help you streamline your financial operations and avoid unnecessary complications.

Common Billing Mistakes to Avoid

Here are some of the most frequent billing mistakes and how to avoid them:

- Missing Client Information: Ensure that you always include the correct details for both yourself and your client, such as contact information and addresses. This prevents any confusion or delays.

- Incorrect Payment Terms: Clearly outline the payment deadlines, methods, and any late fees or discounts for early payment. Ambiguities in payment terms can cause misunderstandings.

- Failure to Itemize Services: Always provide a detailed breakdown of the services or products provided. An unclear or vague list may lead to disputes over what is being charged.

- Not Double-Checking Calculations: Ensure that all amounts, including taxes, discounts, and total costs, are calculated accurately. Double-checking numbers before sending the request is critical to avoid errors.

- Missing Due Dates: Leaving out the payment due date or failing to highlight it clearly can delay payments and create confusion about when the funds are expected.

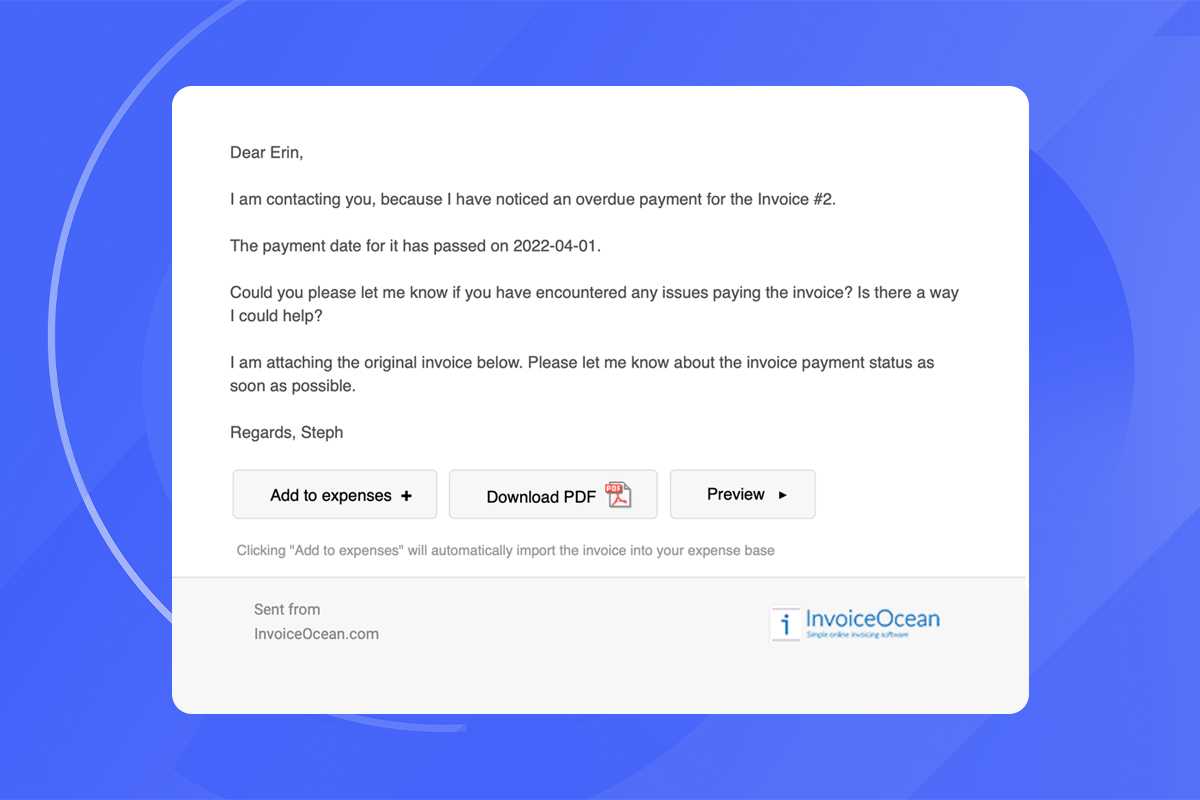

- Failure to Follow Up: Not following up on overdue payments can cause clients to forget or neglect their obligations. Regular reminders help keep payments on track.

Best Practices for Smooth Billing

To avoid these common errors, it’s important to implement a few simple best practices in your billing process:

- Double-check Details: Always verify that your client’s details and billing information are accurate before sending out any requests.

- Set Clear Expectations: Establish clear payment terms from the start, and communicate these terms consistently to your clients.

- Use Automated Tools: Billing software or online platforms can help eliminate human errors by automatically calculating totals and managing due dates.

- Stay Organized: Keep track of all outstanding payments and follow up in a timely manner to avoid unnecessary delays.

By being mindful of these common mistakes and following best practices, you can ensure a smoother billing process and create more professional, reliable payment requests for your clients.

Top Tools for Creating Invoices

Creating professional payment requests doesn’t have to be a complex task. With the right tools, you can streamline the entire process, save time, and ensure that every document is accurate and clear. There are a variety of software and online platforms designed to help businesses quickly generate payment documents, customize them to fit their needs, and track outstanding amounts efficiently.

Best Software for Customizing and Sending Payment Documents

Here are some of the top tools that can help you create and manage your billing documents:

- FreshBooks: A popular choice among freelancers and small businesses, FreshBooks offers a user-friendly interface for creating customized payment requests, tracking expenses, and managing client communications. It also includes automated reminders for overdue payments.

- QuickBooks: QuickBooks is widely used for its comprehensive financial management tools. It allows users to generate professional payment documents, handle taxes, and manage accounting all in one place. It’s especially useful for businesses looking for more than just a simple payment request generator.

- Zoho Invoice: Zoho Invoice is a great option for those seeking an easy-to-use platform with customizable layouts. It offers automatic invoice creation, time tracking, and detailed reporting. It also integrates with several payment gateways for easy transactions.

- Wave: Wave is a free tool perfect for small businesses and freelancers. It allows you to create and send customized billing requests, manage accounting, and track payments. Its simple interface and no-cost structure make it a great starting point for new entrepreneurs.

- PayPal Invoicing: For those who primarily use PayPal, their invoicing system is a quick and easy solution. You can create a payment document directly through PayPal, send it to clients, and even accept payments online, all within the same platform.

Key Features to Look for in Billing Tools

When selecting a tool to help you create payment requests, keep in mind the features that will make the process easier and more efficient:

- Customization Options: The ability to personalize the layout, branding, and content of your payment document is crucial for maintaining a professional appearance.

- Payment Integration: Look for tools that offer easy integration with payment gateways, so clients can pay directly from the document.

- Automated Reminders: Automated follow-up reminders for overdue payments can save you time and reduce the need for manual tracking.

- Multi-currency and Multi-language Support: If you have international clients, ensure that the tool can handle different currencies and languages.

- Mobile Accessibility: Many tools offer mobile apps, allowing you to manage your billing on-the-go, which is perfect for freelancers and remote workers.

By using the right tool, you can make the payment request process much smoother, ensuring that your clients receive clear, professional documents and that payments are processed promptly.

How to Maintain Professional Invoice Design

When creating payment documents, maintaining a polished and professional design is key to conveying reliability and trustworthiness. The design of your payment request not only reflects your brand but also ensures that all necessary information is easy to find and understand. A clean, well-organized layout can make a significant difference in how clients perceive your business and how smoothly the payment process goes.

Essential Elements of a Professional Payment Request

To ensure your payment document maintains a professional look, include these key elements:

- Branding: Use your company’s logo, color scheme, and fonts to create a cohesive look that aligns with your brand identity. This adds a personal touch and makes the document easily recognizable to clients.

- Clear Structure: Organize your document with distinct sections–client information, itemized list of services, payment terms, and totals. Use headings and spacing to keep everything neatly separated and easy to read.

- Legible Fonts: Use professional, easy-to-read fonts like Arial or Helvetica. Avoid overly decorative fonts that may make the document harder to read or appear unprofessional.

- Consistency: Maintain consistent formatting throughout, such as aligning text properly, using uniform margins, and applying consistent font sizes for similar sections.

Best Practices for Layout and Visual Appeal

While the content of your payment request is crucial, how you present that information is just as important. Follow these best practices to maintain visual appeal:

- Whitespace: Use sufficient white space around text and elements. This helps avoid a cluttered appearance and makes the document easier to digest.

- Bold for Emphasis: Use bold text for headings and important details, like the total amount due or due date, to draw attention to critical information without overwhelming the reader.

- Color Usage: Stick to a minimal color palette–typically two or three colors. Choose colors that complement your brand and are easy on the eyes.

- Professional Borders and Lines: Use subtle borders and lines to separate different sections and create a neat, organized structure.

By keeping your payment request design clean, organized, and aligned with your branding, you create a professional experience for your clients. A well-designed document not only ensures that all details are easy to understand, but it also refle

Ensuring Clear Payment Terms on Invoices

One of the most important aspects of any payment request is the clarity of the payment terms. Without clearly defined conditions, misunderstandings can arise, leading to delayed payments or disputes. Ensuring that your payment terms are easy to read, understand, and follow can help maintain healthy client relationships and guarantee timely payments.

Key Elements of Clear Payment Terms

When outlining the conditions for payment, make sure to include the following essential details:

- Due Date: Clearly state when payment is expected. This removes any ambiguity and gives your clients a specific deadline.

- Accepted Payment Methods: Specify how you want to be paid, whether through bank transfer, credit card, PayPal, or other options. Make sure clients are aware of all available choices.

- Late Fees: If applicable, include any penalties for late payments. This can help motivate clients to pay on time and set clear expectations for consequences.

- Discounts for Early Payment: If you offer any discounts for early payment, be sure to highlight this, along with the specific terms and conditions.

Best Practices for Communicating Payment Terms

To ensure your payment terms are understood, consider these best practices:

- Use Simple Language: Avoid complex jargon. Use straightforward language that anyone can understand, regardless of their familiarity with business terminology.

- Highlight Key Details: Make the payment terms stand out by using bold text or larger font sizes for critical details such as the due date, amount due, and accepted payment methods.

- Consistency: Keep your payment terms consistent across all documents. This reduces confusion and makes your billing process predictable for clients.

- Provide Contact Information: Offer a point of contact in case the client has any questions regarding the payment conditions. This helps address concerns before they lead to delays.

By following these guidelines and ensuring your payment terms are clear and straightforward, you set the foundation for smooth financial transactions and maintain positive business relationships with your clients.

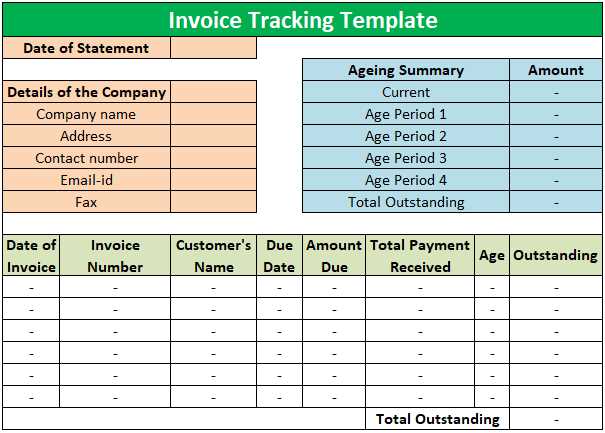

Tips for Tracking Outstanding Invoices

Tracking unpaid payment requests is crucial for maintaining steady cash flow and ensuring timely receipts. Without an organized system in place, it becomes easy to lose track of overdue balances, which can lead to financial setbacks. Implementing effective tracking practices helps you stay on top of what’s due, when it’s due, and follow up promptly with clients as necessary.

Effective Methods for Tracking Unpaid Payments

Here are some practical tips to help you track unpaid balances and ensure that you receive payments on time:

- Use Accounting Software: Platforms like QuickBooks, FreshBooks, or Xero offer automated tracking features, allowing you to monitor unpaid amounts and generate reports on overdue payments.

- Maintain a Payment Calendar: Set up a calendar or spreadsheet to record the due dates of all payments. This will give you a clear visual reference of upcoming deadlines and overdue amounts.

- Set Reminders: Utilize reminders in your digital calendar or invoicing software to alert you when a payment is due or when it’s overdue. Automated follow-ups can help you avoid manual tracking and ensure consistency.

- Create a Clear Payment History: Keep a detailed record of all payments, including dates, amounts, and client communications. This will make it easier to track which clients have paid and which ones still owe.

- Use Color Coding or Flags: Mark unpaid balances in red or use flags to indicate overdue accounts. This provides an easy way to spot overdue payments at a glance.

Best Practices for Following Up on Unpaid Balances

Once you’ve identified unpaid balances, it’s important to follow up promptly and professionally. Here are some tips for maintaining a professional approach:

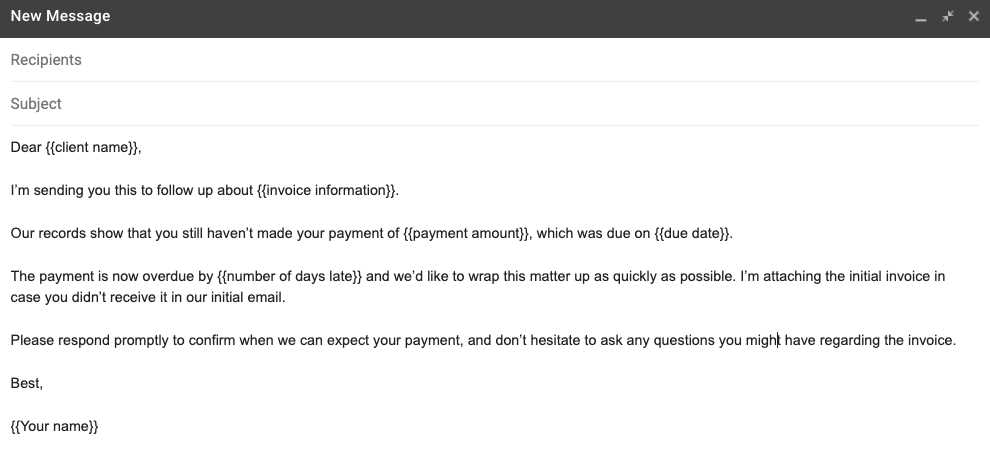

- Send Polite Reminders: Always start with a friendly reminder. Clients may have missed the due date, so a gentle nudge can often resolve the issue quickly.

- Follow a Set Timeline: Establish a routine for following up on overdue payments–such as sending a reminder 7 days after the due date, then sending a second reminder 14 days later, and so on.

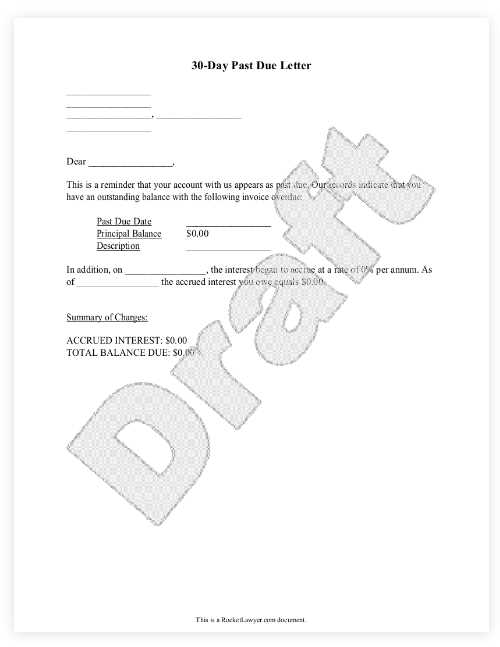

How to Handle Unpaid Invoices Professionally Dealing with unpaid balances can be a delicate situation for any business. It’s important to address these issues with professionalism and tact to ensure that relationships with clients remain intact while also securing the payments you are owed. A well-thought-out approach will help maintain respect between both parties while encouraging timely resolution of overdue amounts.

Steps to Handle Unpaid Balances

Here are several steps you can take to manage overdue payments in a professional manner:

- Send a Polite Reminder: The first step in addressing unpaid balances is often a simple reminder. Many clients may have forgotten or overlooked the payment, so sending a friendly note can resolve the issue without conflict.

- Provide a Clear Breakdown: If the client questions the payment, provide a detailed breakdown of the amounts owed, including the services or goods provided. Transparency ensures there’s no confusion regarding the charges.

- Set a Payment Deadline: Include a clear due date for when the payment should be made. Giving your client a new, specific deadline creates a sense of urgency and helps avoid further delays.

- Offer Flexible Payment Options: Sometimes, clients face financial challenges. Offering alternative payment methods or a payment plan can show empathy while still ensuring you get paid.

- Follow Up Consistently: If payment is still not received by the new deadline, follow up with another polite communication. Maintaining consistent, non-confrontational reminders can keep the issue at the forefront of your client’s mind.

Escalating the Situation If Necessary

If gentle reminders and follow-ups do not result in payment, it may be necessary to take a firmer approach. However, it’s important to remain professional throughout this process:

- Send a Formal Letter: If the payment remains unpaid after multiple reminders, send a formal letter outlining the overdue balance and your intent to take further action if necessary.

- Offer a Final Payment Warning: Before taking legal action, give the client a final warning that payment is due immediately or you will have to pursue collections or other legal remedies. This step should be used sparingly to avoid damaging relationships.

- Consider Using a Collection Agency: If all attempts to resolve the situation have failed, you may need to consider engaging a professional collections agency. This is a last resort and should be done only when other methods have been exhausted.

By handling unpaid balances with professionalism and patience, you can ensure that your business operations remain smooth and that your client relationships remain intact. Addressing payment issues promptly and respectfully increases the li

Legal Aspects of Invoice Templates

When creating billing documents for your business, it’s essential to ensure that they meet the legal requirements for both your country and industry. Having the proper legal elements in your payment requests can help protect your business, avoid disputes, and ensure that the payment process is smooth and compliant with relevant regulations. Understanding the key legal aspects involved in crafting these documents is crucial for maintaining professional and lawful business operations.

Key Legal Considerations for Billing Documents

Here are the critical legal elements that should be included in every payment document to ensure compliance and protect both you and your clients:

- Business Information: Always include your business’s legal name, address, and contact details. This helps establish your identity and provides a point of contact in case of disputes or questions.

- Client Details: Your client’s full name or business name, as well as their address, should be clearly stated. This helps ensure that there is no confusion about who the payment is coming from or who is responsible for it.

- Clear Payment Terms: Explicitly state the payment due date, any applicable late fees, and the payment methods you accept. Providing these details in advance helps avoid misunderstandings about the expectations for payment.

- Tax Information: If applicable, include information about the taxes you charge, such as VAT or sales tax. In many jurisdictions, it’s legally required to provide detailed tax breakdowns for the services or products sold.

- Unique Reference Number: Each payment request should have a unique identification number. This reference is essential for tracking purposes, both for your internal records and in case of any legal disputes.

- Terms and Conditions: Depending on the nature of your business, you may need to include specific legal clauses, such as return policies, service guarantees, or warranties. These should be clearly stated to avoid future conflicts.

Compliance with Local and International Laws

When creating billing documents, it’s important to ensure they comply with local regulations, as well as international standards if you have clients overseas. Keep in mind the following:

- Local Tax Laws: Ensure your documents reflect the tax laws of the country or region in which you operate. This may include the requirement to list your tax registration number or display tax rates on each payment request.

Automating the Invoice Process for Efficiency Streamlining the payment request process is crucial for any business looking to save time and reduce errors. Automating this process not only accelerates the creation and distribution of payment documents but also ensures consistency and accuracy. With the right tools and strategies, businesses can eliminate manual tasks, improve cash flow, and focus more on core activities, all while ensuring a smooth experience for clients.

Benefits of Automating Payment Requests

Here are some key benefits of automating your payment request process:

- Time Savings: Automating the creation and delivery of documents frees up valuable time that can be used for other important business tasks.

- Reduced Errors: Manual input increases the risk of mistakes. Automated systems minimize human error by generating consistent, accurate records.

- Faster Payments: Automated reminders and notifications can help encourage prompt payments by clients, reducing delays and improving cash flow.

- Better Organization: Automating the process allows for better tracking of outstanding balances and payment history, which helps you stay on top of overdue accounts.

Key Features of Automated Systems

When selecting tools for automation, make sure they offer the following key features to maximize efficiency:

Feature Description Customizable Templates Pre-designed, editable formats allow for consistent branding and easy adaptation to suit different clients or projects. Automatic Reminders Set up automatic follow-ups to remind clients of upcoming or overdue payments, helping to reduce delays without manual effort. Integration with Payment Gateways Linking to payment systems enables clients to pay directly from the payment document, streamlining the process and reducing friction. Tracking and Reporting Automated tools can generate reports that help track which payments are due, when they were sent, and the current status of each transaction. By integrating automated solutions, businesses can create a more efficient and error-free process for generating and managing payment requests. The result is a faster, more organized system that benefits both the business and its clients.

How to Send and Follow Up on Invoices

Sending payment requests to clients and following up on them is a crucial step in managing business finances. Ensuring that your documents are delivered promptly and professionally, followed by timely reminders, can help maintain a smooth cash flow and prevent unnecessary delays. A well-structured process for both sending and following up on these requests ensures that payments are received without compromising your relationship with the client.

Steps to Send Payment Requests

When sending a payment request, it’s important to follow a few key steps to ensure it’s received and processed smoothly:

Step Action 1. Ensure Accuracy Double-check the details on the payment document, including the client’s name, the amount due, the payment terms, and the deadline. Accuracy helps avoid confusion. 2. Choose the Right Delivery Method Send the payment request via the client’s preferred method, whether through email, a payment portal, or physical mail, to ensure it is received in a timely manner. 3. Add a Personal Touch Personalize the communication with a polite note thanking the client for their business. A professional tone can enhance client relations. 4. Keep a Copy Store a copy of the sent document for your records. This ensures you have a reference point should any issues arise later. How to Follow Up on Unpaid Balances

If a payment is overdue, a professional follow-up is necessary. Below are steps to follow up effectively and politely:

Step Action 1. Send a Reminder If payment hasn’t been received by the due date, send a courteous reminder email or message. Keep the tone friendly and professional. 2. Be Clear About Terms Importance of Itemizing Invoice Details

Clearly breaking down the components of a payment request is essential for fostering transparency and trust between businesses and their clients. By itemizing the services or products provided, clients can easily understand what they are being charged for, which helps avoid misunderstandings and disputes. A well-detailed breakdown also makes it easier to track transactions and ensures that all aspects of the business arrangement are accounted for.

Benefits of Itemizing Charges

Providing a detailed list of the charges in your payment request brings several advantages:

- Clarity and Transparency: Itemizing allows clients to see exactly what they’re paying for, which helps prevent confusion over pricing or services rendered.

- Professionalism: A well-organized breakdown demonstrates professionalism and attention to detail, which can enhance your business reputation.

- Dispute Prevention: When clients see an itemized list, it’s easier for them to agree on the amounts owed, reducing the likelihood of disputes over charges.

- Accurate Recordkeeping: Itemizing each service or product makes it easier to track your sales and revenue, aiding in accounting and tax preparation.

Key Elements to Include in Itemized Payment Requests

When itemizing your charges, make sure to include the following key elements:

Element Description Description of Services or Products Clearly describe each item or service provided to the client. Be specific so there’s no ambiguity about what the client is being charged for. Unit Price or Rate List the cost per unit or the rate for each service, so the client can see how the total amount is calculated. Quantity If applicable, include the quantity or number of hours worked. This helps clients see how their total is derived. Total Cost Show the total cost for each item or service, and include the overall total at the bottom of the list. This helps clients track their expenses clearly. Itemizing payment

How to Create an Invoice for International Clients

When working with international clients, crafting a payment request involves more than just detailing the products or services provided. It requires careful consideration of various factors such as currency, tax regulations, and cross-border payment methods. Ensuring these elements are clearly addressed can prevent confusion, delays, and ensure smooth transactions across different countries and jurisdictions.

Key Considerations for International Transactions

To create a payment request that meets the needs of international clients, consider the following points:

- Currency and Exchange Rates: Always specify the currency in which the payment is expected, especially when dealing with clients in different countries. If applicable, include the exchange rate or state whether it is the client’s responsibility to cover any currency conversion fees.

- International Payment Methods: Provide clear instructions on how clients can make payments, including bank transfer details, PayPal information, or other globally accepted methods. Make sure these options are accessible and convenient for international clients.

- Taxation and VAT: International transactions often require additional attention to tax regulations. Depending on the client’s location, you may need to include VAT, GST, or other country-specific taxes in your payment request. Research the tax obligations for both your country and your client’s jurisdiction.

- Language and Local Laws: Consider providing a translation of the payment request or including details in both your and your client’s primary language. It’s also essential to be aware of local business laws and regulations that may impact the content or delivery of the document.

Steps to Create a Payment Request for International Clients

Here is a simple guide to follow when preparing a payment request for clients outside your country:

- 1. Include All Relevant Contact Information: Provide both your business details and the client’s contact information, including international dialing codes and full address for proper identification.

- 2. Specify Clear Payment Terms: Clearly state the payment due date and any late fees. Mention whether payments should be made via a specific method, such as wire transfer or international payment platforms like PayPal or TransferWise.

- 3. State the Currency and Total Amount Due: Specify the currency (USD, EUR, etc.), ensuring that the client knows the exact amount they need to pay in their preferred c