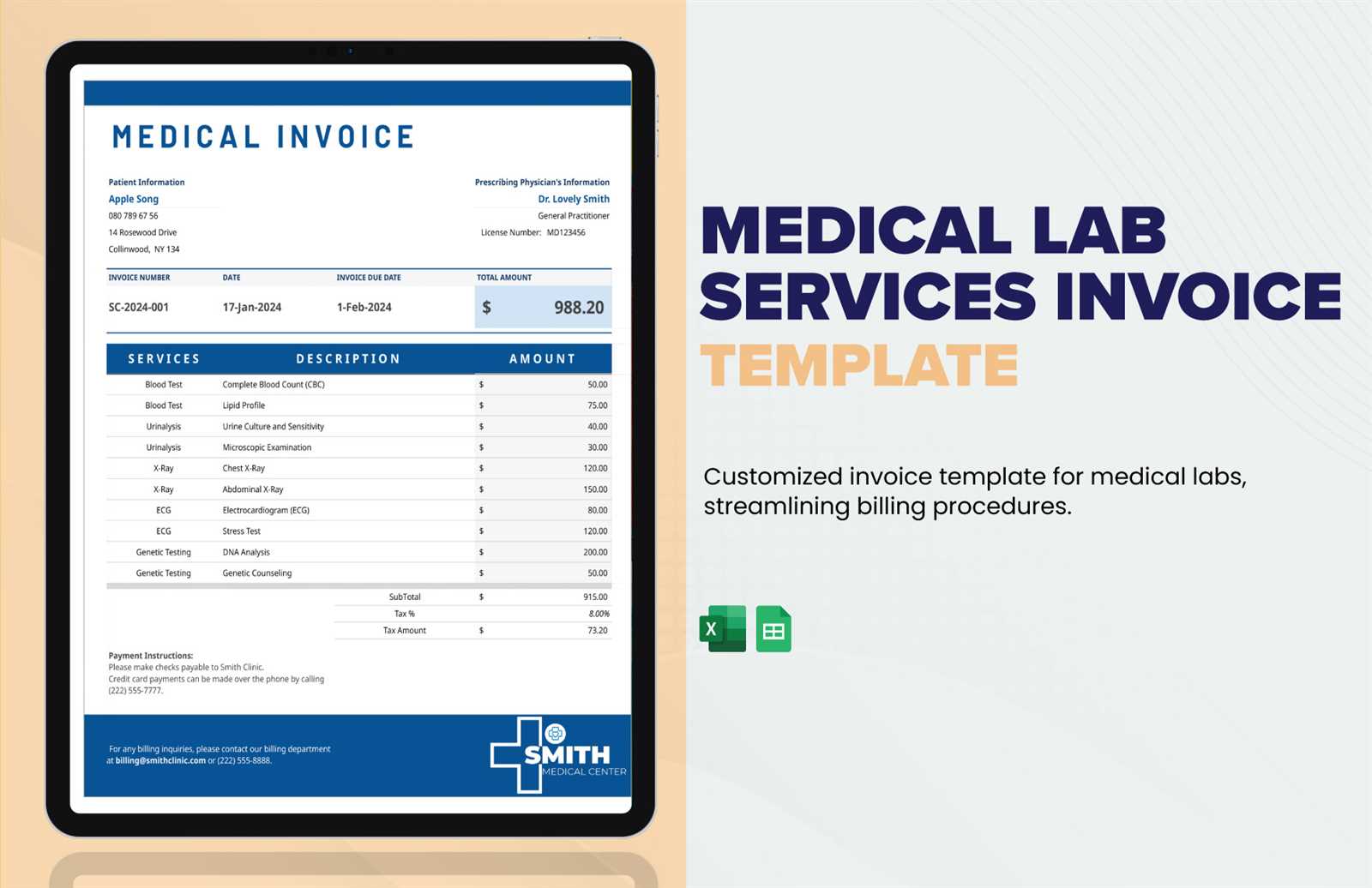

Customizable Optical Invoice Template for Professional Billing

Efficient billing is a crucial part of running any business. A well-organized and clear billing system not only ensures that payments are collected on time but also helps in maintaining professional relationships with clients. The right approach to creating billing documents can save time, reduce errors, and boost productivity. With the right tools, generating these documents becomes a streamlined and hassle-free process.

One of the most effective ways to simplify billing is by using ready-made, customizable forms designed for specific business needs. These forms allow you to create accurate and professional-looking documents in minutes, ensuring consistency across all your transactions. Whether you’re a freelancer or managing a larger team, this approach can make your financial processes more efficient and organized.

By choosing the right solution, businesses can avoid common mistakes such as incorrect details, missing information, or inconsistent formatting. Customizable forms give you full control over the design and structure, allowing you to align the output with your brand while keeping the necessary legal and financial components intact.

Understanding Optical Invoice Templates

In today’s fast-paced business environment, having the right tools to manage billing is essential for smooth operations. The creation of professional and consistent financial documents is a key component in maintaining accurate records and building trust with clients. A well-structured billing document helps prevent errors and ensures that all essential information is included, from payment terms to service descriptions. Using predefined structures for these documents can significantly improve efficiency and reduce the likelihood of mistakes.

The Importance of Structured Billing Documents

When businesses rely on customized forms for billing, they can focus more on their core operations rather than spending time manually formatting each document. These structured documents ensure that all relevant fields are included, such as business details, payment instructions, and itemized services. This reduces the risk of overlooking critical information, making financial interactions clearer and more transparent.

How Predefined Formats Enhance Efficiency

Predefined formats provide consistency across all your billing documents, ensuring that every form looks professional and contains all necessary details. These formats can be tailored to meet specific needs, whether you’re a small business owner or managing a large organization. By using such structures, businesses can generate accurate documents quickly, helping to streamline workflows and enhance productivity.

What Is an Optical Invoice Template?

At its core, this tool is designed to simplify the creation of professional billing documents. It provides a structured layout where business information, service details, payment terms, and other essential elements are pre-arranged. This makes generating accurate and consistent financial statements faster and more efficient. The main purpose is to help businesses streamline their accounting and ensure all necessary details are captured in each transaction.

Rather than creating a new document from scratch each time, a predefined structure offers several advantages:

- Consistency: Each document follows the same format, ensuring all details are included and organized in a standardized way.

- Time-saving: Predefined fields and sections allow for quick customization, reducing the time spent on formatting and data entry.

- Professional Appearance: The clean and organized layout enhances the credibility of your financial documents.

- Accuracy: Minimizes the risk of errors by ensuring the right information is always included in the correct sections.

Ultimately, this solution is a practical tool for any business that requires frequent billing, whether you’re a freelancer or part of a larger team. It allows you to focus on the content of the transaction rather than the layout and formatting, ensuring that your documents are both functional and professional.

Benefits of Using Optical Invoice Templates

Using predefined document structures for creating financial records brings numerous advantages to businesses of all sizes. These formats are designed to make the billing process faster, more accurate, and more consistent. By relying on ready-made solutions, businesses can minimize errors, improve professionalism, and save valuable time. Here are the key benefits of utilizing these structured forms:

Increased Efficiency and Time Savings

One of the biggest advantages of using a standardized format is the time it saves. Instead of manually creating each document from scratch, businesses can quickly populate pre-designed fields with necessary details. This reduces the time spent on repetitive tasks and allows you to focus on more important activities. With minimal adjustments, a complete and accurate document can be ready in a matter of minutes.

Improved Accuracy and Consistency

Structured formats ensure that all required information is included and formatted correctly. By using predefined sections, businesses reduce the likelihood of missing critical details such as tax rates, payment terms, or item descriptions. This leads to fewer errors and discrepancies, improving both internal processes and client relations. Accuracy is key to maintaining trust and avoiding disputes, and these documents provide a reliable framework for ensuring that no information is overlooked.

Additionally, the consistency of design across all your financial documents reinforces your company’s professional image. Clients receive a polished and cohesive experience, which can build credibility and enhance customer satisfaction.

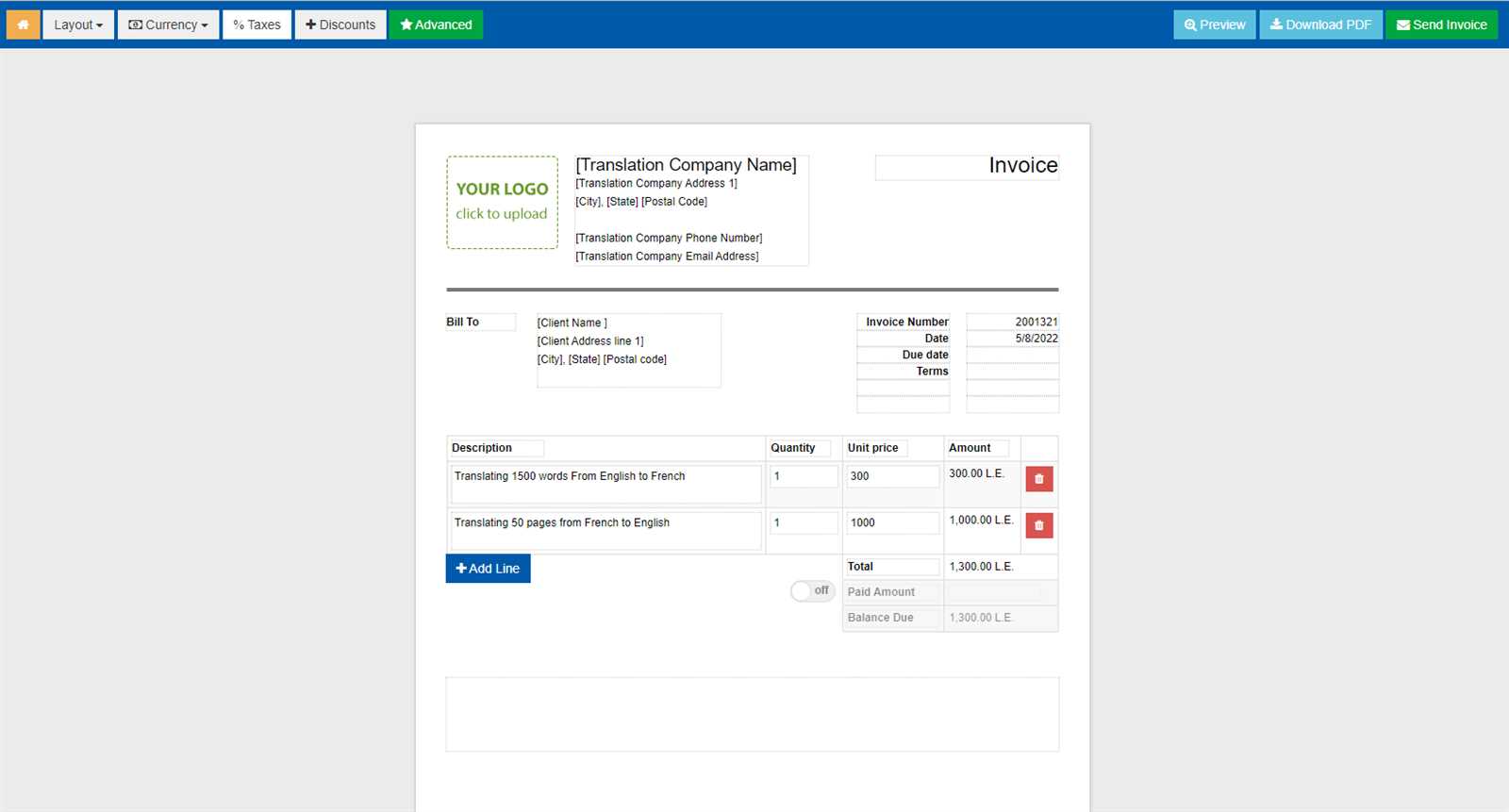

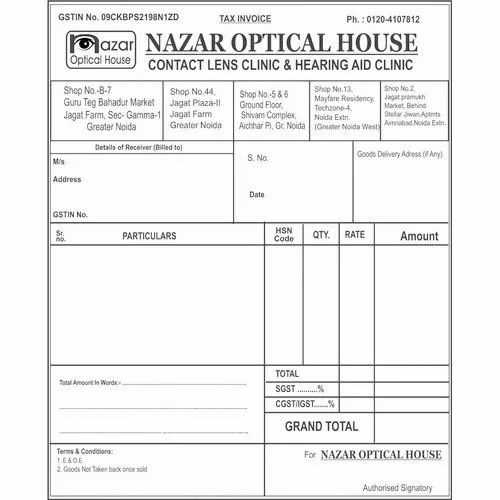

How to Customize Your Invoice Template

Personalizing your billing documents ensures that they reflect your business identity while maintaining the necessary structure for accuracy and professionalism. Customization allows you to tailor the document to your specific needs, whether it’s adding your company logo, adjusting the layout, or including specific payment instructions. Here are some practical steps to customize your billing forms effectively:

Adjusting the Layout and Design

One of the first aspects of customization is choosing the layout that best suits your business. Many billing forms come with a range of design options, from minimalist styles to more detailed, corporate designs. Consider the following when customizing the layout:

- Logo Placement: Adding your company logo at the top makes your document instantly recognizable and reinforces your branding.

- Font and Color Scheme: Choose fonts and colors that align with your company’s visual identity, ensuring a professional and cohesive look.

- Section Organization: Rearrange or remove sections that are unnecessary for your business to create a more streamlined document.

Including Specific Business Details

To make your documents more functional, you can also include personalized sections that cater to your business operations. This could include:

- Payment Terms: Specify your preferred payment methods, due dates, and late fees to avoid any misunderstandings with clients.

- Item Descriptions: Customize the layout for listing services or products, providing enough detail for the client to understand the charges.

- Tax and Discount Information: Ensure that tax rates, discounts, and total amounts are clearly calculated and displayed.

By adjusting these elements, you can create a tailored billing document that meets both your business needs and client expectations.

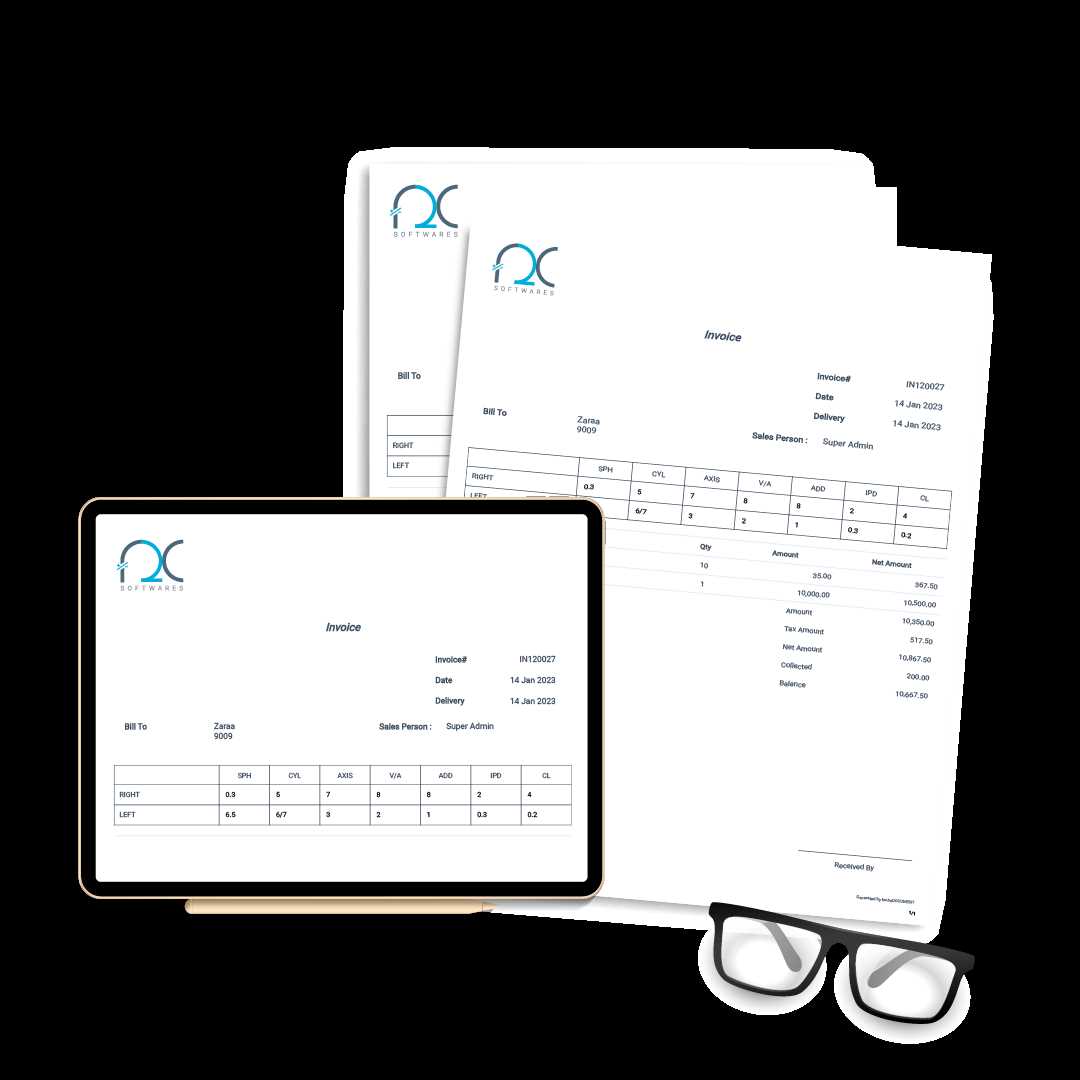

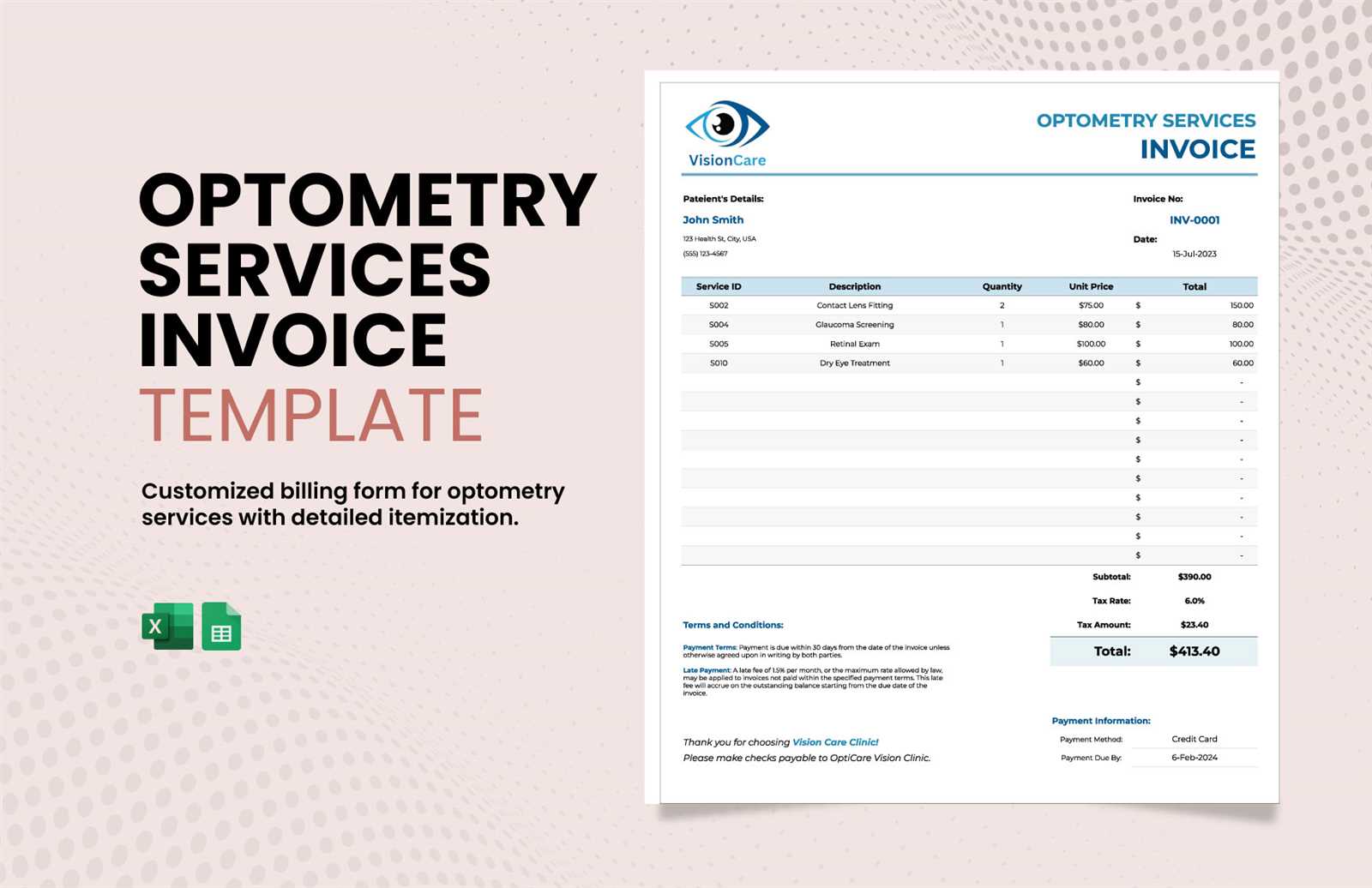

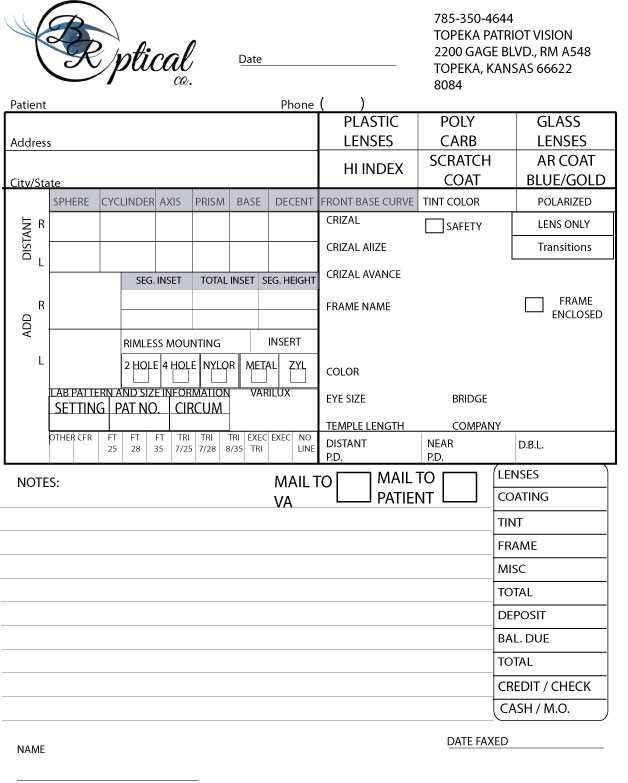

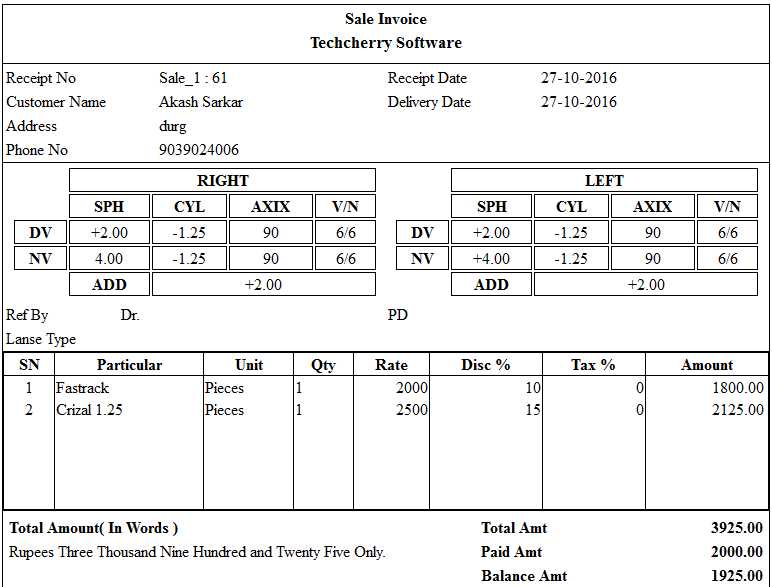

Key Features of an Optical Invoice

When it comes to creating effective billing documents, certain features are essential for clarity, accuracy, and professionalism. These features ensure that all necessary information is included, well-organized, and easy to understand by both the business and the client. A well-designed billing document goes beyond just presenting a payment request–it serves as a comprehensive record of the transaction. Here are the key elements that should be present in any billing document:

- Business Information: The document should clearly display the company’s name, address, contact details, and tax identification number. This helps establish the business’s identity and ensures legal compliance.

- Client Details: Include the client’s name, address, and contact information to confirm who the payment is being sent to. This reduces any potential confusion and adds to the document’s credibility.

- Unique Identifier: A unique reference number or invoice code is essential for tracking and organizing financial records. This feature makes it easier to reference past transactions when needed.

Additionally, there are several functional aspects that improve the utility of these forms:

- Itemized List: The document should break down services or products with clear descriptions, quantities, unit prices, and total costs. This transparency builds trust and ensures that both parties understand the charges.

- Payment Terms: Clearly state the payment due date, accepted payment methods, and any late fees. This helps manage expectations and avoids misunderstandings.

- Tax Information: Include applicable tax rates, discounts, and totals to ensure the document is accurate and complies with tax laws.

By incorporating these key features, a billing document becomes not only a request for payment but also an essential tool for tracking and managing business transactions.

Choosing the Right Template for Your Business

Selecting the right structure for your billing documents is crucial for ensuring that your business operations are efficient, professional, and aligned with your brand. The right document format not only streamlines the process of generating financial records but also enhances your business’s image. A well-chosen format can help maintain consistency across your documents, making them easier to read and ensuring that all important information is included.

When choosing the appropriate layout for your billing documents, consider the following factors:

- Industry Needs: Different industries have different requirements for financial records. For example, service-based businesses may need more detailed breakdowns of work performed, while product-based companies may require space for itemized lists of products sold. Understanding your industry’s specific needs will guide you in selecting a layout that works best.

- Customization Options: Your chosen structure should allow for easy customization, such as adding your logo, adjusting color schemes, or modifying section titles to suit your business model. A flexible design ensures your documents reflect your company’s branding and professional standards.

- Ease of Use: Opt for a layout that is simple to modify and update. If your billing system involves multiple team members, the format should be easy to navigate and fill out without requiring specialized knowledge. The more intuitive it is, the less time you’ll spend training employees or clients on how to use it.

By selecting the right layout, you can ensure that your financial documents are not only functional but also convey a sense of professionalism and trustworthiness to your clients.

Common Mistakes to Avoid with Invoices

When it comes to generating financial documents, accuracy and clarity are essential. Small errors in these records can lead to confusion, delayed payments, and potential disputes with clients. While these mistakes might seem insignificant, they can significantly affect your business’s cash flow and professionalism. Understanding and avoiding common pitfalls will help ensure that your documents are always accurate, transparent, and effective.

Here are some of the most common mistakes businesses make and how to avoid them:

- Missing or Incorrect Contact Information: Failing to include or incorrectly listing your business or client’s contact details can cause delays in payment or communication. Always double-check that the names, addresses, and contact information are accurate and up to date.

- Unclear Payment Terms: Not specifying payment due dates, late fees, or accepted payment methods can lead to misunderstandings. Make sure all payment terms are clearly outlined and easy to follow to avoid any confusion.

- Omitting Detailed Descriptions: Without a clear breakdown of services or products, clients may question the charges. Always include detailed descriptions, quantities, unit prices, and total amounts, as this builds trust and transparency.

Additionally, there are other critical issues to address:

- Incorrect Calculations: Errors in tax calculations, discounts, or totals can undermine the accuracy of the entire document. Double-check all figures, especially when dealing with taxes or multiple items, to ensure the total is correct.

- Failure to Use Unique Identifiers: Without a unique reference number or document code, tracking and referencing transactions becomes difficult. Always include a unique i

How Optical Invoices Improve Accuracy

Ensuring accuracy in financial records is critical for maintaining smooth operations and building trust with clients. Errors in billing documents can lead to payment disputes, delayed collections, and ultimately damage a business’s reputation. Using structured, pre-designed formats can significantly reduce the chance of mistakes by providing a clear, consistent framework for creating each document. These formats help businesses automate many parts of the process, ensuring that all necessary details are included and correctly formatted every time.

Here are a few ways in which using these well-structured documents improves accuracy:

- Standardized Format: When using a predefined structure, all documents are created using the same layout, which reduces the chance of missing or misplaced information. Fields for important details–such as payment terms, client information, and service descriptions–are clearly defined, ensuring consistency across all records.

- Automated Calculations: Many billing formats allow for automatic calculations of totals, taxes, discounts, and other variables. This reduces human error, ensuring that the correct amounts are always calculated and presented to the client.

- Required Fields: Pre-designed forms often come with built-in checks that require essential information to be entered. For example, fields for client details, dates, or payment instructions must be filled before generating the document. This ensures no important information is overlooked.

Additionally, these structures help eliminate inconsistencies in how documents are created. By following a fixed framework, businesses can be confident that each record adheres to the same high standards, whether it’s for internal use or client-facing. This reduces the likelihood of errors and strengthens the reliability of your financial processes.

Integrating Optical Invoice Templates with Software

Integrating predefined document structures with accounting and management software can significantly streamline the billing process. By connecting your financial records to software systems, you can automate much of the work involved in creating and managing these documents. This integration reduces manual data entry, minimizes errors, and speeds up the overall process of generating professional and accurate financial statements.

Here’s how integrating such formats with software can enhance your workflow:

- Automation of Data Entry: With integration, client information, product or service details, and pricing can be pulled directly from your database into the billing document. This automation eliminates the need for repetitive manual entry, saving time and reducing the risk of errors.

- Real-Time Updates: Software integration ensures that any changes in inventory, pricing, or tax rates are automatically reflected in your billing records. This makes it easier to stay up to date with any adjustments and ensures that your documents always contain the most accurate and current information.

- Seamless Record Keeping: Integrating your billing forms with accounting software allows for better tracking of payments and outstanding balances. You can automatically link your billing documents to payment records, making it easier to manage cash flow and financial reporting.

Moreover, these integrations can save your business time and resources. By reducing the amount of manual work involved in generating, sending, and tracking billing documents, you can focus more on growing your business. Whether you are using CRM systems, ERP platforms, or dedicated financial tools, this kind of integration can greatly improve both accuracy and efficiency in your billing processes.

Templates for Different Business Needs

Every business has unique requirements when it comes to managing financial transactions. Whether you are a freelancer, a small business owner, or part of a larger corporation, having the right structure for your financial documents is essential for smooth operations. The ability to tailor documents to meet specific business needs ensures that all necessary details are included and presented in a professional manner. Depending on the nature of your business, the format you choose should align with the type of services or products you offer, as well as your client interactions.

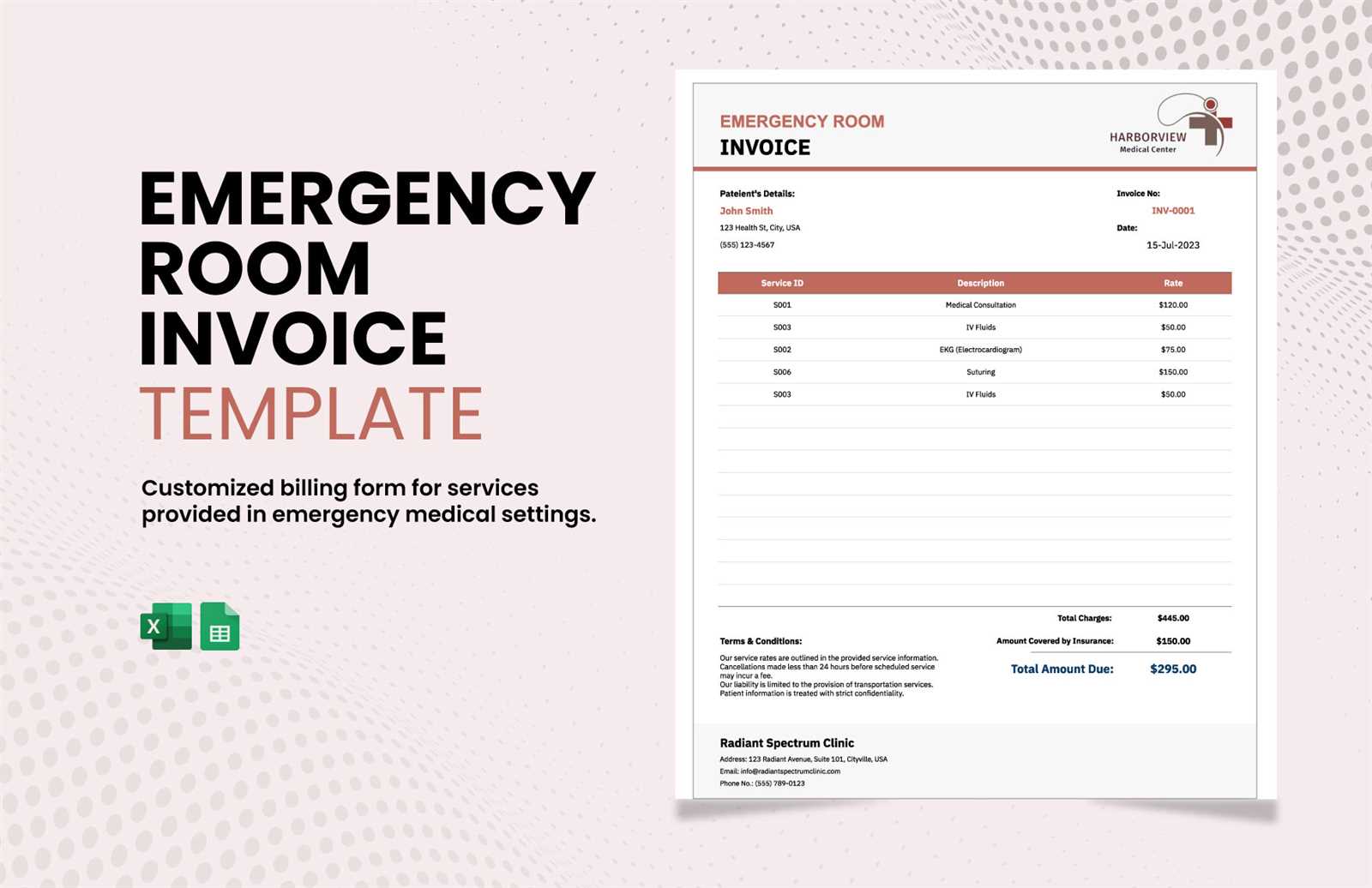

Here are some examples of how different types of businesses can benefit from customized billing forms:

- Freelancers and Consultants: Freelancers often provide one-time services or projects, and their billing documents should reflect clear breakdowns of services rendered, hours worked, or project milestones. Simple, minimalist designs with an emphasis on service descriptions and hourly rates are ideal.

- Product-Based Businesses: For businesses selling goods, a more detailed format may be necessary, with space for itemized lists of products, quantities, unit prices, and shipping details. This helps ensure that all items are accounted for and that clients have a transparent view of what they are being charged for.

- Service Providers: Companies offering ongoing services, such as cleaning, IT support, or consulting, may require recurring billing options. These structures should include the frequency of services, subscription fees, and payment cycles, making it easy to manage long-term client relationships.

- Retailers and E-Commerce Stores: Online stores or physical retailers may need more complex billing documents that integrate with inventory systems, showing stock availability, discounts, and taxes. A well-organized format ensures clients receive an accurate summary of their purchases.

By choosing a structure that is tailored to your business, you can ensure that your financial documents are efficient, clear, and aligned with your operational needs. A customizable solution not only improves the accuracy of your records but also helps maintain a professional image with your clients, no matter the size or type of your business.

How Optical Invoices Save Time

Time is a valuable resource, especially in business. The more efficiently you can manage administrative tasks like creating billing documents, the more time you have to focus on growing your business and serving your clients. Using structured billing formats significantly reduces the time spent on creating financial documents, allowing businesses to automate much of the process. These streamlined solutions eliminate the need for manual formatting and calculations, making it faster and easier to generate accurate and professional documents.

Here’s how using such formats helps save time in the billing process:

Action Time Without Template Time With Template Creating a New Document Manual formatting, adding company details, organizing sections, calculating totals Pre-designed structure with predefined sections, auto-calculation features Entering Client Information Re-entering details for each document Auto-fill from customer database or CRM integration Calculating Total Amount Manual calculation of taxes, discounts, and totals Automatic calculations for tax, discounts, and totals Sending and Tracking Manual emailing or printing, tracking payments Automated email delivery, easy tracking through software integration By automating many of the routine tasks associated with creating and managing these records, you can cut down the time it takes to complete each transaction. From auto-populating client i

Creating an Invoice from Scratch

When starting from scratch to create a financial document, the process may seem daunting. However, by following a structured approach, you can ensure that all necessary information is included, and the document is both accurate and professional. Creating your own billing record gives you complete control over the layout, content, and design, but it also requires careful attention to detail to avoid errors. Understanding the essential components of such a document is the first step in ensuring it serves its purpose effectively.

Key Elements to Include

The primary goal of any billing document is to clearly outline the transaction between you and the client. Here are the key components you need to include:

- Business Information: Include your company’s name, address, contact details, and tax identification number.

- Client Information: Ensure that the recipient’s name, address, and contact details are correctly listed.

- Document Number: Assign a unique reference number to the document for tracking purposes.

- Detailed Breakdown of Charges: List the services or products provided, including quantities, unit prices, and any additional details relevant to the charge.

- Payment Terms: Clearly state the payment due date, acceptable methods, and any penalties for late payments.

- Tax and Discounts: Include applicable taxes, discounts, and the final total after adjustments.

Step-by-Step Process

Follow these steps to create your billing document from scratch:

- Start by selecting a clean layout with enough space to organize the required information.

- Enter your company details at the top, followed by the client’s information directly beneath it.

- Assign a unique reference number to the document to ensure easy tracking.

- List the items or services provided, detailing each one with the corresponding prices and quantities.

- Clearly calculate taxes, discounts, and final amounts, ensuring no detail is missed.

- Finish by adding payment terms, ensuring the client understands when and how to pay.

By following these steps, you can create a professional billing document tailored to your business needs. While this process can take time, it ensures that all the important details are accurately reflected, giving you and your clients clear communication regarding the transaction.

Managing Payment Records with Templates

Effective management of payment records is vital for maintaining clear financial oversight and ensuring that your business remains organized. By using structured documents for recording transactions, you can easily track payments, monitor outstanding balances, and streamline the reconciliation process. Having a standardized format for payment records allows you to maintain consistency, reduces the risk of errors, and ensures that all necessary information is captured in one place.

Here are some ways structured forms can help in managing payment records:

- Centralized Tracking: By using a consistent structure, you can quickly reference past transactions and keep all payment details in one easily accessible place. This centralization reduces the risk of losing track of payments and ensures everything is documented accurately.

- Clear Payment Status: A well-organized format helps you easily distinguish between paid and outstanding invoices. You can highlight payment status or use color coding to quickly assess the state of each transaction without searching through individual records.

- Automatic Calculations: With the right format, you can automate calculations for tax, discounts, and totals, which reduces manual errors and saves time. This ensures that the amounts recorded are accurate and helps prevent discrepancies in your financial records.

Additionally, using such structured systems for managing payments enables easier reporting and reconciliation. You can generate financial statements quickly by pulling data from consistent forms, making month-end closings or audits simpler and more accurate. By integrating these formats with accounting software, you can automate many of these processes, further improving your business’s efficiency.

How to Add Tax and Discounts

Accurate tax calculations and proper application of discounts are crucial for maintaining transparency and fairness in financial transactions. When preparing a billing document, it is important to ensure that taxes are calculated correctly and that any discounts or promotional offers are applied appropriately. This not only ensures compliance with legal tax requirements but also builds trust with clients by providing clear and precise information about their charges.

Here’s how you can properly add taxes and discounts to your billing documents:

Adding Tax

Taxes vary depending on the location of your business and the type of goods or services provided. To add taxes correctly:

- Know the Applicable Tax Rate: Research the tax rate for your region or business sector. This may include sales tax, VAT, or other applicable taxes.

- Calculate the Tax Amount: Multiply the taxable amount (the total price of goods or services) by the tax rate. For example, if your total before tax is $100 and the tax rate is 10%, the tax would be $10, making the total $110.

- Clearly Display the Tax: Always show the tax separately on the document to maintain transparency. Clients should see the tax amount in a separate line, showing how it was calculated.

Applying Discounts

Discounts can be a great way to reward loyal customers or incentivize larger purchases. To apply discounts correctly:

- Specify Discount Type: Discounts can be either a fixed amount or a percentage. For example, you might offer a 10% discount on a $200 order or a $20 discount on a $100 purchase.

- Apply Discount Before or After Tax: Decide whether the discount will be applied before or after taxes are calculated. This decision should be consistent with your business’s pricing policies.

- Clearly List the Discount: The discount s

Legal Considerations in Invoice Design

When creating billing documents, it’s important to ensure that the design not only serves a functional purpose but also complies with legal requirements. Certain elements are legally required to be included in financial documents to ensure transparency, compliance with tax laws, and proper documentation for business transactions. Failing to include the necessary information could lead to legal disputes or difficulties in tax reporting. Understanding the legal considerations involved is essential for protecting both your business and your clients.

Essential Legal Information

Depending on your location and the type of business, there are several key details that must be included in any formal billing document:

- Bus

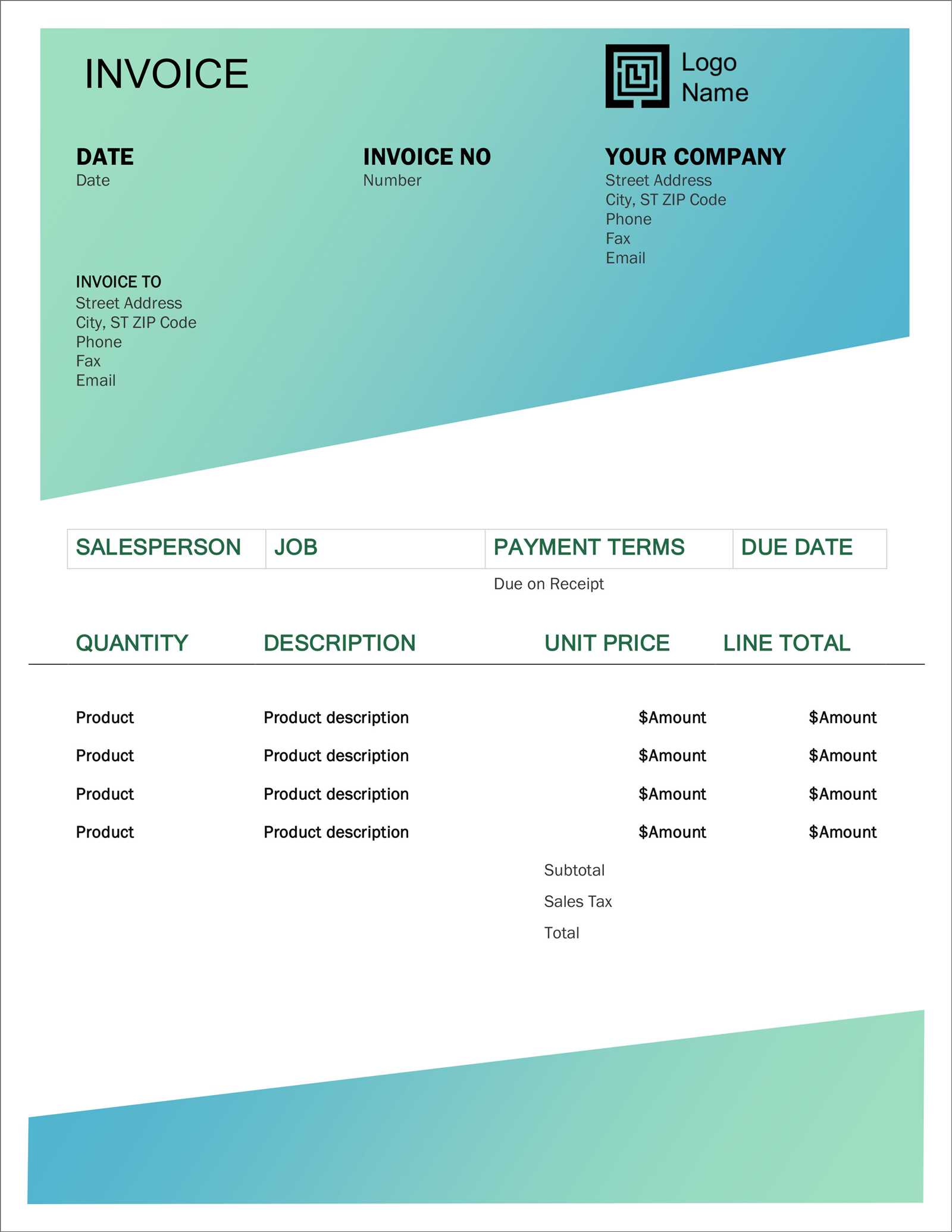

Best Practices for Invoice Formatting

Formatting your billing documents correctly is crucial for clarity, professionalism, and efficiency. A well-organized document ensures that clients can easily understand the charges, while also helping your business maintain consistency and accuracy in its financial records. By following some best practices in design and layout, you can create clear, readable documents that convey all necessary details while minimizing the risk of confusion or errors.

Key Formatting Tips

Here are some essential formatting tips to help ensure your billing documents are both functional and professional:

- Keep it Simple and Clean: Use a clear, legible font and avoid cluttering the document with excessive information or design elements. A simple layout with well-spaced sections makes the document easier to read and understand.

- Use Clear Headings and Labels: Ensure that each section of the document is clearly labeled, such as “Bill To,” “Itemized Charges,” and “Total Amount Due.” This makes it easy for both you and your client to quickly locate the necessary details.

- Organize Information Logically: Present details in a logical order, such as placing client information at the top, followed by the transaction date, a breakdown of charges, and then payment terms and totals at the bottom.

- Ensure Consistent Alignment: Keep the text aligned properly throughout the document. For instance, use left-alignment for text, right-alignment for numerical values (such as amounts), and center-alignment for titles or section headers.

- Use Tables for Breakdown: Use tables to present itemized lists of services or products. Each line should include a description, quantity, unit price, and total cost. This makes it easier to understand the details of the transaction at a glance.

- Include Enough Space: Provide adequate space between sections and lines. A crowded document can be difficult to read, and important details might get overlooked.

- Bus