Open Source Invoice Template for Easy Customization and Efficient Billing

Managing financial transactions efficiently is essential for any business, regardless of size. A well-organized approach to issuing documents that request payment ensures clarity, accuracy, and professionalism. This not only saves time but also strengthens the relationship between businesses and clients by reducing the chance of errors or misunderstandings.

Instead of relying on expensive software or complex systems, many entrepreneurs are turning to customizable solutions that are freely available and easy to modify. These tools enable businesses to create professional-looking documents that meet specific needs without requiring advanced technical skills or a large budget.

In this article, we explore how you can leverage these versatile tools to simplify your billing process. Whether you’re a freelancer, a small business owner, or part of a larger organization, these resources can help you maintain a smooth financial workflow while enhancing the experience for your clients.

Open Source Invoice Templates for Businesses

For any business, maintaining a professional and organized approach to billing is essential. Instead of relying on expensive software or complex systems, there are freely available solutions that allow businesses to generate payment requests with ease. These options provide businesses the flexibility to customize and adjust their documents to better suit specific needs, ensuring a personalized approach to client transactions.

Why Use Customizable Billing Solutions?

Customizable billing solutions offer several advantages for businesses of all sizes. They allow companies to tailor each document to reflect their unique branding and meet legal or financial requirements. Moreover, these resources can be adapted for different currencies, languages, and tax structures, making them ideal for companies operating in various regions or industries.

How These Tools Benefit Small Businesses

For small businesses and freelancers, the ability to create professional-looking payment requests without the need for complex software can be a significant cost-saving advantage. These accessible tools help streamline administrative tasks, freeing up more time for core business activities. Additionally, they help reduce the risk of errors, which could result in delayed payments or client dissatisfaction.

What is an Open Source Invoice Template

In today’s business environment, having a reliable, cost-effective way to create billing documents is essential. A flexible solution allows businesses to generate professional payment requests without relying on expensive software. Such a tool can be freely accessed, modified, and distributed, making it accessible for companies of all sizes.

These tools are designed to provide customizable formats that businesses can easily adapt to meet their specific needs. They usually include pre-built structures, but users can modify various elements like logos, fonts, and content to better reflect their brand or business requirements.

- Free to use and distribute

- Easy to modify for different needs

- Customizable to reflect brand identity

- Compatible with a variety of formats (Excel, PDF, Word)

- Ideal for businesses of all sizes

In essence, these solutions allow businesses to manage their financial documentation effectively, while also keeping costs low and maintaining flexibility. Their widespread use has made them an essential tool for small businesses, freelancers, and even larger companies looking for straightforward, budget-friendly options.

Benefits of Using Open Source Templates

Using a customizable billing document solution can bring significant advantages to businesses. By choosing a flexible and accessible tool, companies can streamline their administrative processes while maintaining control over their documents. These solutions are designed to be adaptable, helping businesses save both time and money while ensuring that the documents they produce meet their unique needs.

Cost-Effectiveness

One of the biggest advantages of using these tools is that they are completely free. This eliminates the need for costly software licenses, subscription fees, or additional purchases for premium features. Small businesses and freelancers especially benefit from this low-cost option, as they can create professional documents without spending extra resources on software solutions.

- No upfront costs

- No recurring fees

- Access to a wide range of free resources

Flexibility and Customization

Another major benefit is the level of customization available. Businesses can modify every aspect of the document, from its layout and structure to the fonts, colors, and logos used. This flexibility allows companies to create documents that match their branding or suit specific client requirements. Furthermore, users can make updates or adjust the format anytime, ensuring the document evolves with the business.

- Easy to modify for specific needs

- Customization options for branding consistency

- Compatible with various file formats

How to Customize Your Invoice Template

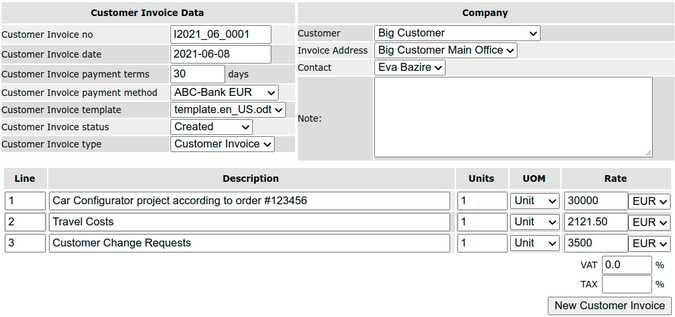

Customizing your billing document allows you to make it more aligned with your brand identity and specific business requirements. Whether you’re adjusting the layout, adding custom fields, or changing visual elements, personalization is key to creating a professional and effective document. Here’s a step-by-step guide to help you tailor your document to suit your needs.

Step 1: Modify the Layout

The first step in customization is adjusting the general layout. You can rearrange the sections, such as client details, itemized charges, and payment terms, to ensure the most important information stands out. Start by reviewing the existing structure and deciding if any elements need to be moved or removed.

| Section | Possible Modifications |

|---|---|

| Header | Change business logo, add contact information |

| Item List | Adjust column width, reorder items, add additional fields |

| Footer | Include payment methods, terms, or company disclaimer |

Step 2: Update Text and Currency Formatting

Next, customize the text elements to reflect your business language and style. Modify headers, payment instructions, and any terms and conditions. Additionally, ensure the formatting aligns with the currency and tax structure relevant to your business or region.

- Change currency symbols

- Adjust language for clarity or legal compliance

- Personalize payment instructions for clients

Once these adjustments are made, you’ll have a fully customized billing document that suits your business’s needs while maintaining a professional appearance.

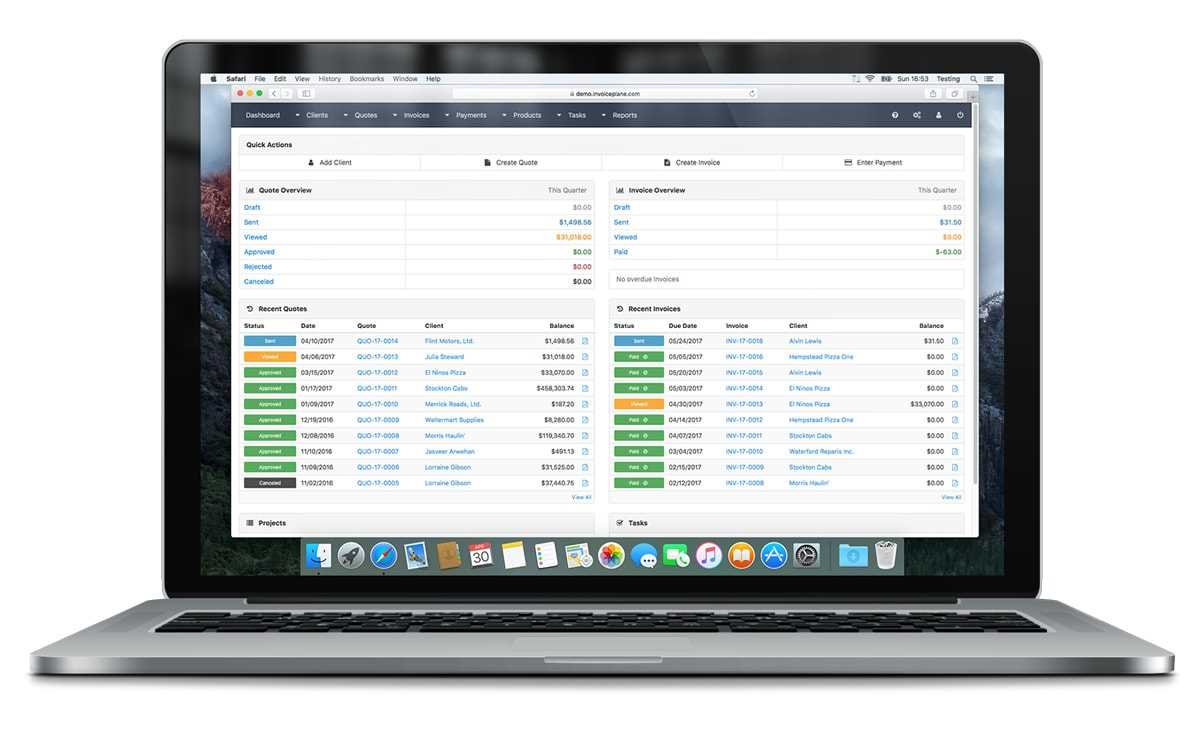

Popular Open Source Invoice Tools

There are several highly regarded tools available that can help businesses create customized billing documents without the need for expensive software. These tools offer a variety of features, from simple document generation to advanced customization options. Below are some of the most popular free tools that businesses can use to streamline their billing process.

| Tool | Key Features | Best For |

|---|---|---|

| Invoice Ninja | Invoice creation, time tracking, and payment integration | Freelancers and small businesses |

| Facture | Customizable billing templates and multi-language support | International businesses with multilingual clients |

| LibreOffice Calc | Spreadsheet-based billing documents, highly customizable | Users familiar with spreadsheet software |

| Simple Invoices | Easy setup, basic billing management | Startups and small businesses |

These tools can significantly reduce the time spent on generating billing documents while providing businesses with the flexibility to create professional and tailored payment requests. By using these resources, companies can avoid the costs associated with premium software, while still benefiting from features that streamline their invoicing process.

Free vs Paid Invoice Templates

When it comes to creating professional billing documents, businesses often face the choice between free and paid solutions. Both options have their advantages and potential drawbacks, depending on the specific needs of the company. While free tools offer accessibility and cost savings, paid solutions may provide additional features and support that can enhance functionality and user experience.

Benefits of Free Solutions

Free tools are an attractive option for small businesses or freelancers who need to minimize costs. These options are often straightforward, easy to use, and readily available. With no upfront costs or subscription fees, they provide a quick and affordable way to generate basic documents without additional financial commitment.

- No initial cost

- Quick to set up and use

- Good for simple, standard billing needs

Advantages of Paid Solutions

On the other hand, paid tools typically offer more advanced features, such as custom branding, better integrations with accounting software, and enhanced security. These options can be highly beneficial for businesses that require more complex invoicing capabilities or additional customer support. Paid platforms often come with regular updates and dedicated resources, which can be crucial for larger businesses or those with more intricate billing requirements.

- Advanced customization options

- More robust security and features

- Dedicated customer support

Ultimately, the decision between free and paid tools depends on the business’s scale, needs, and the level of complexity required for its billing processes.

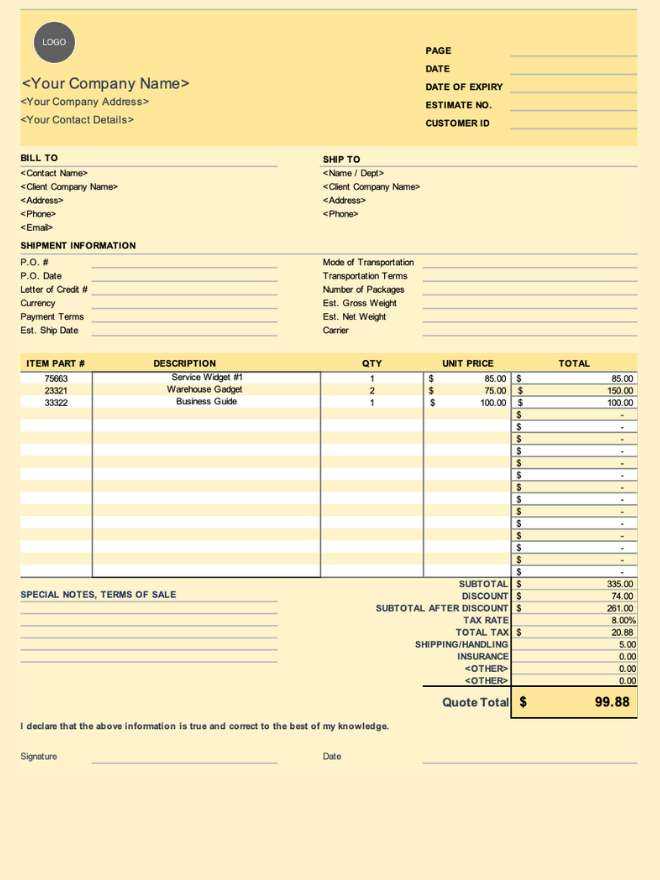

How to Choose the Right Template

Selecting the right document structure for billing can significantly impact the professionalism and efficiency of your business transactions. The right choice ensures that your payment requests are clear, organized, and tailored to your business needs. When evaluating different options, it’s essential to consider factors such as customization, ease of use, and compatibility with your workflow.

Consider Your Business Needs

Before choosing a format, it’s important to identify the specific requirements of your business. For example, if you’re a freelancer, a simple and straightforward layout may suffice. However, larger businesses may need more complex documents that include payment terms, multiple items, and tax breakdowns.

- Simple design for freelancers or small businesses

- Complex layouts with itemized charges for larger operations

- Customizable fields for special payment terms or discounts

Check Compatibility and Customization Options

Make sure the document is easy to customize and adjust as your business grows or changes. Look for solutions that allow you to update information such as your logo, contact details, or payment instructions without needing technical expertise. Also, check if the format supports various file types (PDF, Excel, Word) for easy sharing and printing.

- Ability to update contact details, branding, and terms

- Support for multiple file formats

- Easy-to-use customization interface

By carefully considering these factors, you can select the most effective solution that meets both your current needs and future growth. The right choice can help ensure consistency, reduce errors, and streamline your billing process.

Integration with Accounting Software

Integrating your billing system with accounting software can streamline your financial processes, ensuring that all payment records are accurately captured and automatically updated. This integration helps reduce manual data entry, minimize errors, and provide a unified view of your business’s financial health. With the right setup, your payment requests and accounting systems can work together seamlessly, saving you time and effort.

Key Benefits of Integration

Integrating billing solutions with accounting platforms offers several key advantages that can enhance both operational efficiency and accuracy. Below are some of the most significant benefits:

- Automated Data Transfer: Payment details are automatically transferred to your accounting software, reducing the need for manual input.

- Reduced Errors: By eliminating duplicate entries, integration minimizes the risk of human error, ensuring that records are consistent across systems.

- Time Savings: The automation of financial tasks allows you to focus on more important business activities, like growth and customer service.

- Real-Time Financial Tracking: With integrated systems, you can view up-to-date financial reports without waiting for manual reconciliation.

Popular Software for Integration

Many popular accounting platforms offer integration options with billing solutions. When choosing a system, make sure it supports the integration features you need. Below are some commonly used accounting platforms that work well with customizable billing tools:

- QuickBooks

- Xero

- FreshBooks

- Zoho Books

By connecting your payment requests with your accounting software, you can create a more efficient and organized workflow, helping your business stay on top of finances while minimizing administrative tasks.

Security Considerations with Open Source Templates

When using customizable billing documents, it’s important to consider the security of the tools and data involved. While these solutions are often free and accessible, they can come with certain risks, especially if sensitive client or financial information is being handled. Ensuring that your document management system is secure is critical for protecting both your business and your clients.

Potential Security Risks

There are several security concerns to keep in mind when using customizable billing solutions. These tools might not always come with robust security features out of the box, leaving businesses vulnerable to data breaches or unauthorized access. Below are some common risks:

| Risk | Description |

|---|---|

| Data Exposure | Improper handling of sensitive information could lead to unauthorized access to client or business data. |

| Malware or Viruses | Using third-party tools or downloading files from untrusted sources could introduce malicious software into your system. |

| Weak Authentication | Insecure or weak login systems can allow unauthorized users to gain access to sensitive billing records. |

Best Practices for Securing Your Documents

To mitigate these risks, there are several best practices businesses should follow to ensure the safety and confidentiality of their financial data:

- Use Secure Hosting: Make sure the tools and systems you use are hosted on secure, encrypted platforms.

- Regular Updates: Keep your software and systems updated to ensure vulnerabilities are patched and known security flaws are fixed.

- Limit Access: Restrict access to sensitive documents and information to only authorized personnel.

- Data Encryption: Always encrypt billing records and payment details to protect against unauthorized access.

By taking these precautions, businesses can greatly reduce the risk of data theft and ensure that their financial information remains secure. While customizable solutions can be highly beneficial, it’s important to implement security measures to safeguard both client and business data.

How to Edit and Update Your Invoice

As your business evolves, it’s important to ensure that your billing documents remain up to date. Editing and updating these documents is a straightforward process that allows you to keep your records accurate and aligned with your current business needs. Whether you need to modify the layout, adjust pricing, or update contact information, making changes to your payment requests should be quick and simple.

Step 1: Accessing Your Document

To begin editing, you first need to access the document you want to update. Depending on the tool you’re using, this could involve opening a saved file in a word processor or spreadsheet software, or logging into an online platform that houses your billing documents. If you’re working with an editable file, such as a Word or Excel document, you can easily open it and start making changes. If you’re using an online system, look for an “Edit” option next to your saved drafts.

- Locate the document file on your computer or in your online account

- Ensure you have the necessary permissions to make edits

- Open the document in the appropriate editing tool (e.g., Word, Excel, PDF editor)

Step 2: Making Changes

Once the document is open, you can begin making the necessary updates. These changes could include:

- Editing Contact Details: Update your business name, address, phone number, or email if any information has changed.

- Adjusting Prices: If your pricing structure has changed, ensure that itemized charges reflect the new rates.

- Adding New Fields: If additional information is required, such as taxes or discount codes, you can add new sections or rows to accommodate these changes.

After making the changes, be sure to review the document for accuracy before saving it. Double-check all the details to avoid errors that could cause confusion or delays in payment.

Step 3: Saving and Sharing Your Updated Document

Once you have updated the document, save it in your preferred format (e.g., PDF, Word, Excel) and ensure that it’s properly stored for future reference. Most tools allow you to save the document in multiple formats for easy sharing and printing. After saving, you can email the updated billing request to your client or store it in your business records.

- Save your document in the appropriate format for sharing or printing

- Store it securely in a file management system

- Send the updated request to your client with clear communication

By following these simple steps, you can ensure that your payment requests are always up to date, accurate, and ready for clients, helping to maintain a smooth financial workflow for your business.

Why Open Source Templates Are Cost-Effective

When managing business finances, the cost of essential tools can quickly add up. However, free and customizable billing document solutions offer an affordable alternative that doesn’t compromise on quality or functionality. These resources allow businesses, especially small ones, to access professional-grade tools without spending money on expensive software or subscriptions. By eliminating upfront and ongoing costs, these solutions provide a highly cost-effective way to manage financial documentation.

No Upfront Costs

One of the primary reasons these tools are so budget-friendly is that they come at no initial cost. Unlike paid software that requires an upfront payment or ongoing subscription fees, free billing solutions can be downloaded and used without any financial commitment. This is particularly valuable for startups and small businesses looking to keep expenses low while still maintaining a professional image.

- No subscription fees

- Free to download and use

- No hidden costs or licensing fees

Reduced Maintenance and Upgrade Costs

Paid tools often require additional expenses for updates, technical support, and new features. In contrast, free solutions are typically community-supported, meaning that updates and improvements are regularly provided at no additional charge. This removes the need for businesses to invest in costly upgrades or rely on customer service packages that can be expensive over time.

- Free updates and improvements

- No reliance on costly customer support services

- Community-driven support and development

By choosing free, customizable solutions, businesses can significantly cut costs while still benefiting from powerful tools that meet their billing needs. This cost-effectiveness allows companies to reinvest the savings into other areas of their operations, helping them grow and succeed without financial strain.

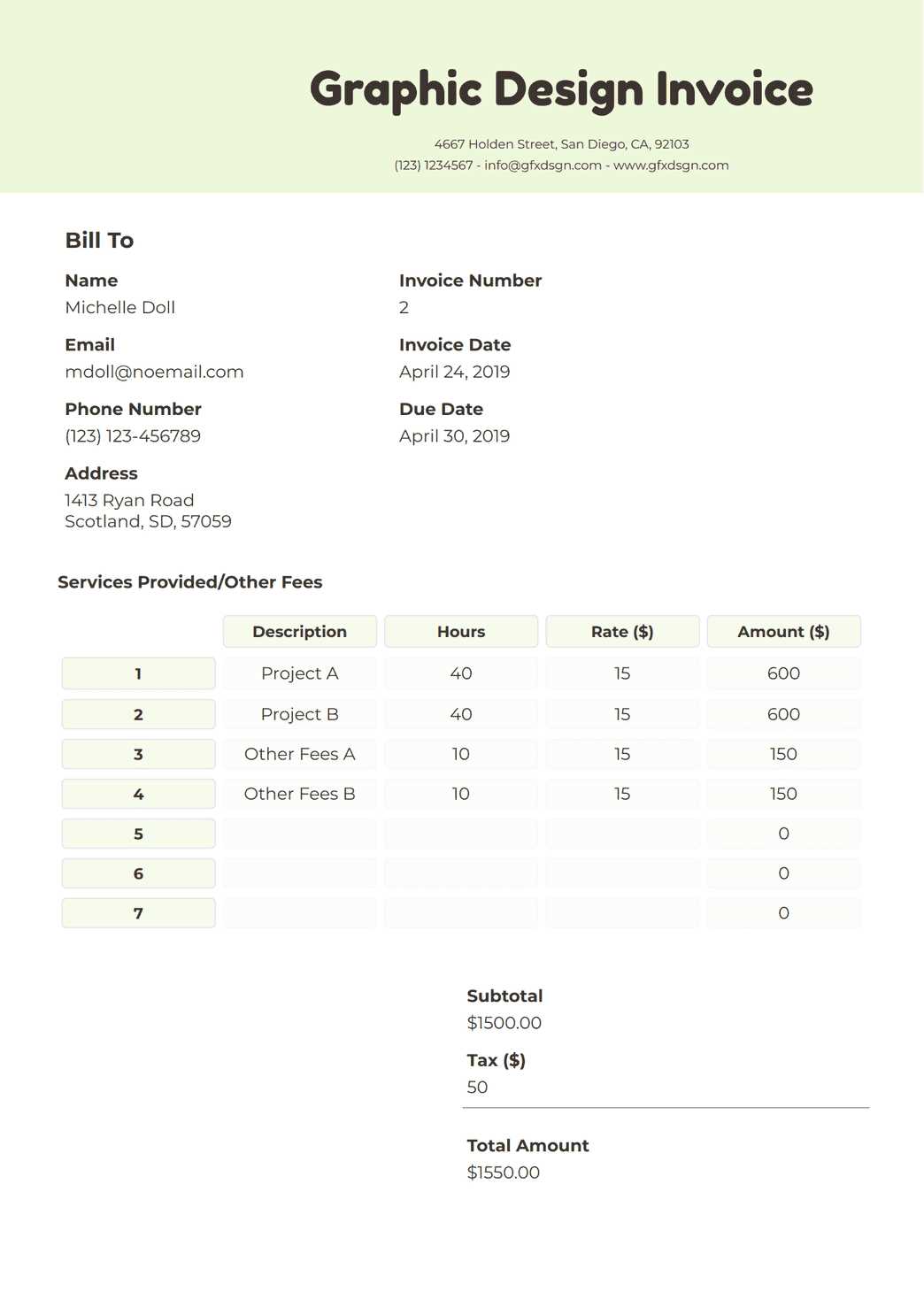

Creating Professional Invoices with Open Source

Generating high-quality billing documents is crucial for any business to maintain a professional image and ensure timely payments. With free, customizable solutions, businesses can create visually appealing and functional documents without needing to invest in costly software. These tools offer flexibility, allowing you to design documents that reflect your brand’s identity while meeting all necessary legal and business requirements.

Customization and Branding

One of the main advantages of using customizable resources is the ability to add personal branding to your documents. You can include your business logo, choose specific fonts and colors, and design the layout to suit your unique style. This adds a professional touch to every billing document you send, helping to reinforce your brand and make a lasting impression on clients.

- Add logos, company details, and contact information

- Choose custom fonts and colors to match your branding

- Design your document layout for a consistent professional look

Ensuring Accuracy and Completeness

Another benefit of free customizable tools is that they ensure your documents are accurate and complete. These solutions typically come with built-in fields for all necessary details, such as client information, itemized charges, payment terms, and due dates. By filling in these sections, you can create a clear and professional document that meets your business’s needs and reduces the chances of errors.

- Pre-set fields for easy entry of all necessary details

- Ensure payment terms, taxes, and totals are accurately calculated

- Reduce human error by using standardized formats

With these free, customizable tools, you can produce professional, well-organized documents that not only meet your clients’ expectations but also enhance your business’s reputation.

Design Tips for Open Source Invoices

Creating visually appealing and effective billing documents is key to leaving a positive impression on clients. A well-designed document not only reflects your business’s professionalism but also ensures that all important details are easy to understand. When using free, customizable solutions for your billing needs, it’s essential to focus on clean, user-friendly design that enhances clarity and improves readability.

Keep the Layout Clean and Simple

A cluttered document can confuse clients and cause delays in processing payments. To avoid this, prioritize simplicity and clarity. Make sure there is enough white space between sections, and use a layout that allows each piece of information to stand out. The goal is for your clients to quickly locate important details like the total amount, payment terms, and due date.

- Use clear headings and subheadings to organize sections

- Leave space between different sections for better readability

- Avoid overloading the document with unnecessary information

Choose Readable Fonts and Colors

The fonts and colors you choose for your billing documents should be easy to read while still aligning with your brand’s aesthetic. Avoid overly decorative fonts and ensure that the text contrasts well with the background. Stick to a simple, professional font like Arial, Helvetica, or Times New Roman, and use no more than two colors to maintain consistency.

- Opt for standard fonts that are easy to read on both screens and printed copies

- Use high-contrast colors for text and background to enhance legibility

- Limit color usage to emphasize key information, such as totals or deadlines

By focusing on these design principles, you can create billing documents that are both functional and visually appealing, improving the overall client experience and ensuring prompt payments.

Legal and Tax Compliance for Invoices

When creating billing documents for your business, it is essential to ensure that they comply with legal and tax regulations. These documents serve as an official record of transactions, and any missing or incorrect information can lead to legal issues, fines, or delays in payments. By following the appropriate rules and including the necessary details, you can protect both your business and your clients.

Key Legal Requirements

There are several legal requirements that must be met when generating a billing document. These can vary depending on your country or region, but the following elements are generally required:

- Business Information: Include your business name, address, and contact details.

- Client Information: Ensure that your client’s name, address, and contact information are clearly stated.

- Unique Identification Number: Each document should have a unique reference number for tracking purposes.

- Date of Issue: Clearly indicate the date the billing document was generated.

- Payment Terms: Include clear payment due dates, penalties for late payments, and accepted payment methods.

Tax Compliance

In addition to the legal requirements, ensuring that your billing documents are tax-compliant is crucial for avoiding potential issues with tax authorities. Some of the important tax-related details to include are:

- Tax Identification Number (TIN): Ensure that both your business and your client have proper tax identification numbers if required by law.

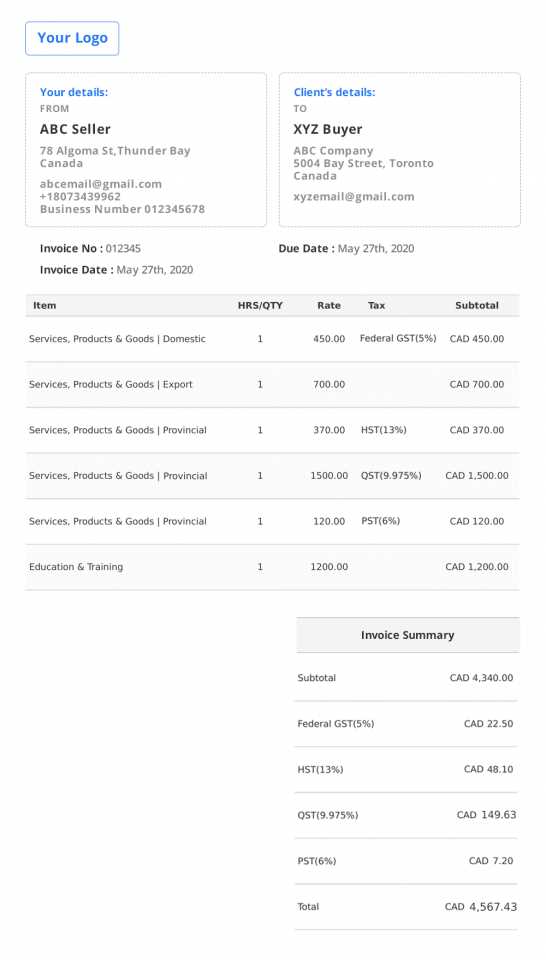

- Tax Rates: Include applicable tax rates (e.g., VAT, sales tax) and clearly specify the amount charged for each item or service.

- Tax Breakdown: Provide a detailed breakdown of the taxes on individual items or services, as well as the total tax amount applied.

By adhering to these legal and tax guidelines, you can ensure that your billing documents are compliant, reducing the risk of legal complications and ensuring smooth transactions with clients.

How to Automate Your Invoicing Process

Managing the billing process manually can be time-consuming and prone to errors, especially as your business grows. Automating this process allows you to streamline operations, reduce human error, and ensure timely and accurate payment requests. By integrating automation into your billing system, you can save time, improve efficiency, and focus more on your core business tasks.

Step 1: Choose the Right Automation Tool

The first step to automating your payment request process is selecting the right tool or software. There are various tools available that offer features such as automatic document generation, recurring billing, and integration with other business systems like accounting software. Be sure to choose a solution that fits your needs and budget.

- Look for tools that offer automatic generation of payment requests

- Ensure the tool integrates with your existing accounting or financial software

- Check for features like recurring billing, reminders, and payment tracking

Step 2: Set Up Templates and Customization

Once you’ve chosen the automation tool, set up your billing documents with all the necessary fields and information. Most tools allow you to customize the layout and content of your documents. Pre-fill standard information like your business details, tax rates, and payment terms to save time when generating new documents.

- Create and save reusable document layouts

- Automate client data population, such as name, address, and contact information

- Set up default payment terms, tax rates, and other recurring details

Step 3: Automate Recurring Payments

If your business involves subscriptions or repeat clients, automating recurring payments can be a game-changer. Many billing tools offer recurring payment options, allowing you to set up regular charges that are automatically billed to clients without needing to manually generate each document.

- Set up recurring billing for regular clients or subscription-based services

- Allow for automated reminders and overdue payment notifications

- Ensure secure payment processing through integrated payment gateways

By automating your billing processes, you can save time, reduce administrative overhead, and ensure that your clients always receive timely and accurate payment requests. The added efficiency will free up your resources, allowing you to focus on growing your business and improving customer satisfaction.

Common Mistakes When Using Invoice Templates

While using pre-designed billing documents can significantly speed up the process of creating payment requests, there are several common pitfalls that businesses often fall into. These mistakes can lead to confusion, payment delays, or even legal issues. It’s important to pay attention to the details and ensure that your documents are accurate, complete, and compliant with relevant regulations.

1. Missing Essential Information

One of the most common mistakes is forgetting to include key information on your billing documents. Without the necessary details, clients may be unable to process payments, or you may run into legal issues. Always ensure that your document includes all required fields, such as business and client details, a unique reference number, and payment terms.

| Missing Details | Potential Consequences |

|---|---|

| Client Information | Payment delays, confusion |

| Due Dates | Late payments, misunderstandings |

| Unique Reference Number | Difficulty tracking documents |

2. Incorrect Tax Calculation

Many billing documents require tax information, and errors in tax rates or calculations can lead to serious financial and legal issues. Double-check the applicable tax rates and ensure that you are calculating them correctly. This is especially important if you are serving clients in different tax jurisdictions.

- Ensure the correct tax rate for your location or client’s location is applied.

- Double-check totals after taxes are added to prevent errors.

- Include clear breakdowns of taxable and non-taxable items to avoid confusion.

3. Using Outdated Information

Another mistake is using outdated or incorrect business information on your billing documents. This includes old addresses, incorrect contact details, or outdated bank information. Always update your business details on your documents to avoid payment delays or missed communication with clients.

- Keep your business address, contact details, and payment methods up to date.

- Review documents before sending them to ensure all details are accurate.

- Regularly check that your payment terms and tax rates are current and reflect any changes in regulations.

By avoiding these common mistakes and paying close attention to detail, you can ensure that your billing documents are professional, accurate, and legally compliant, leading to smoother transactions and timely payments.

How to Share Invoices with Clients

Once your billing document is ready, sharing it with your clients in a timely and efficient manner is crucial for maintaining good relationships and ensuring prompt payments. There are several methods available for sending these documents, and each comes with its own benefits and considerations. Choosing the right method depends on your business needs and your client’s preferences.

One of the most common ways to share billing documents is through email. This is quick, easy, and allows you to send the document directly to your client’s inbox. Ensure the file is in a widely accessible format, such as PDF, to ensure that your client can open and view it without any issues.

Another option is using online payment platforms that allow you to create and send documents directly from their system. These platforms often have built-in tools to track payments, send reminders, and manage recurring transactions. This can simplify the process for both you and your clients, as everything is handled within a single platform.

For clients who prefer paper or need a hard copy for their records, sending a physical copy by mail is an option. However, this method can be slower and incur additional costs, so it’s best used for specific situations when electronic sharing isn’t feasible.

Finally, consider using cloud-based file-sharing services like Google Drive, Dropbox, or OneDrive. These services allow you to upload your document and share a secure link with your client. This is useful for clients who prefer to access documents from anywhere, at any time, and is also an easy way to store copies for your records.

No matter which method you choose, make sure to follow up with clients to confirm they received the document and to address any questions they may have. Clear communication is key to ensuring that the payment process goes smoothly and efficiently.

Future of Open Source Invoice Solutions

The landscape of billing solutions is constantly evolving, and open tools for generating payment requests are at the forefront of this transformation. As businesses look for cost-effective and flexible options, the future of these solutions lies in greater integration, automation, and customization. With increasing demand for user-friendly, secure, and scalable systems, open tools are poised to offer even more robust features to meet these needs.

Increased Integration with Other Business Systems

One of the key trends in the future of billing solutions is seamless integration with other business management tools. Many businesses use multiple systems for accounting, customer relationship management, and project management. As the demand for efficiency grows, billing tools will increasingly connect with these systems to automatically update and synchronize data. This integration will streamline workflows and reduce the time spent on manual data entry.

- Automatic syncing with accounting software

- Real-time updates on payment statuses

- Integration with customer management systems

Advanced Automation Features

Another significant development in the future of these tools is enhanced automation. With the ability to automate repetitive tasks like sending payment reminders, generating recurring payment requests, and tracking overdue amounts, businesses can reduce the manual effort required to manage their billing process. Future systems will likely incorporate even more sophisticated automation, such as AI-driven analysis to predict payment trends and optimize cash flow.

- Automated payment reminders and follow-ups

- AI-driven reporting for financial forecasting

- Recurring billing and subscription management

As these systems continue to evolve, we can expect even more features that improve efficiency, enhance user experience, and ensure compliance. The future of these solutions promises to be a seamless blend of advanced technology, greater flexibility, and enhanced customization, allowing businesses to manage their payment requests with ease.