How to Use an Open Invoice Template for Efficient Billing

Managing financial transactions efficiently is a key part of running any business. The ability to create clear, professional documents for requesting payment is essential. With the right tools, creating these documents can be a quick and straightforward process, helping to save both time and effort.

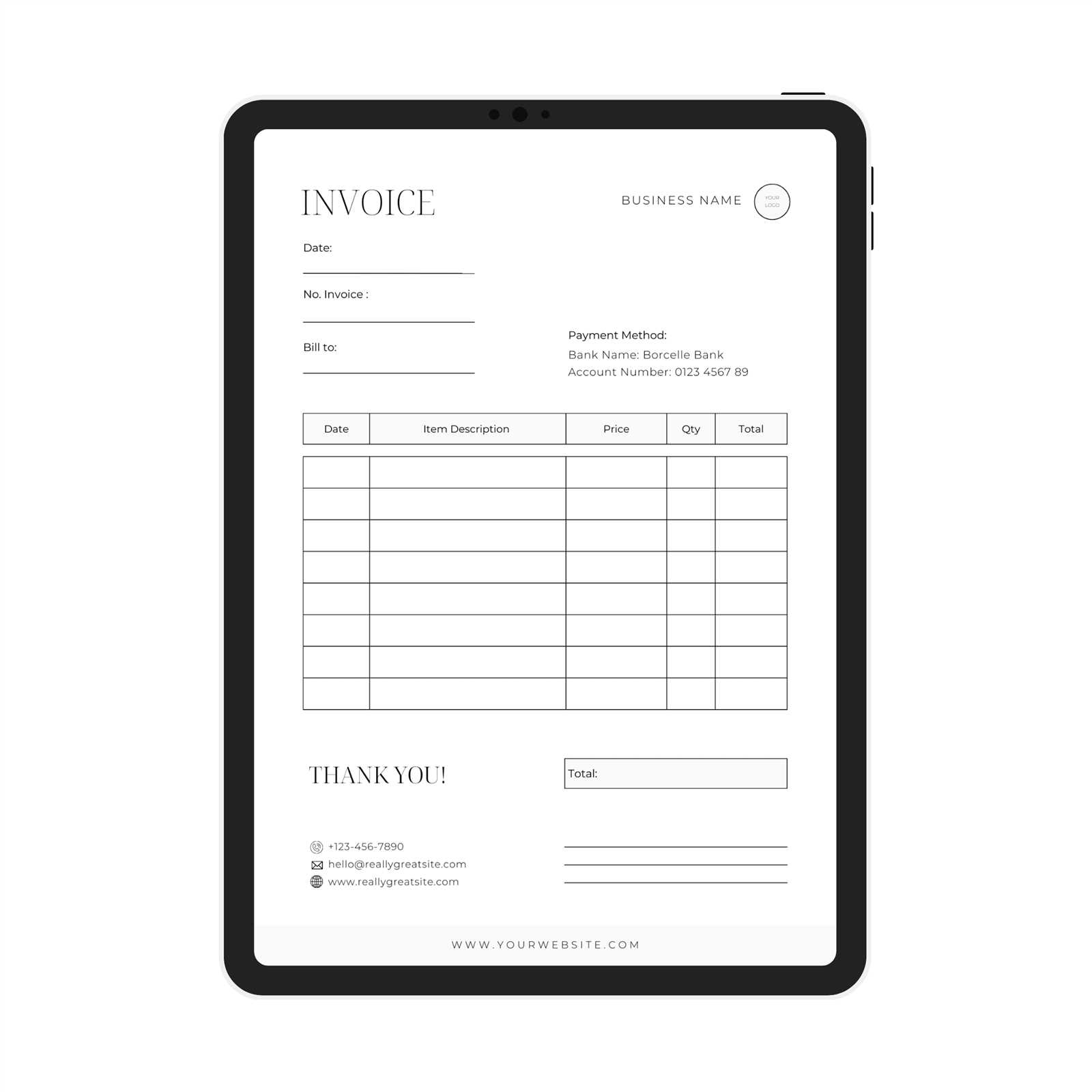

Customizable billing formats offer a simple solution for businesses of all sizes. These documents can be easily adjusted to suit various needs, whether you’re working with individual clients or handling multiple accounts. By using such resources, it’s possible to keep track of payments, ensure accuracy, and maintain a high level of professionalism.

Utilizing these documents can also enhance financial organization by providing consistent structures for all your transactions. The flexibility to modify details like payment terms, service descriptions, and client information allows you to tailor each document to the situation at hand, ensuring clarity and minimizing errors.

Open Invoice Template Overview

In the modern business world, having a streamlined way to request payment is essential for efficiency. A well-structured document can make a significant difference in the clarity and professionalism of financial transactions. Customizable forms that can be easily adjusted to different clients and services provide a versatile solution for businesses looking to simplify their billing processes.

These versatile billing documents can be tailored to meet various needs, from freelancers to large companies. They allow for quick changes to important fields such as amounts, dates, and service descriptions. Additionally, they provide a uniform structure that ensures consistency across all transactions, promoting both organization and clarity.

| Feature | Description |

|---|---|

| Customizable Fields | Ability to modify details like client names, services, and payment amounts. |

| Professional Layout | Clean, organized structure that promotes clear communication. |

| Efficiency | Save time by using pre-made formats that require minimal adjustment. |

| Flexibility | Adapt the document for different clients, services, or industries. |

Why Choose an Open Invoice Template

When managing financial transactions, having an easy-to-use, adaptable document is crucial for maintaining efficiency and professionalism. Instead of creating a new form for each client or project, using a pre-designed, customizable document can save valuable time while ensuring that all the necessary information is included. This flexibility allows businesses to focus on providing quality services rather than spending time on administrative tasks.

Time-Saving Solution

One of the primary reasons businesses opt for these ready-made formats is the time saved in document creation. Rather than starting from scratch, you can fill in the required fields, such as customer details, service descriptions, and payment amounts. This significantly speeds up the process, especially when dealing with multiple clients or projects.

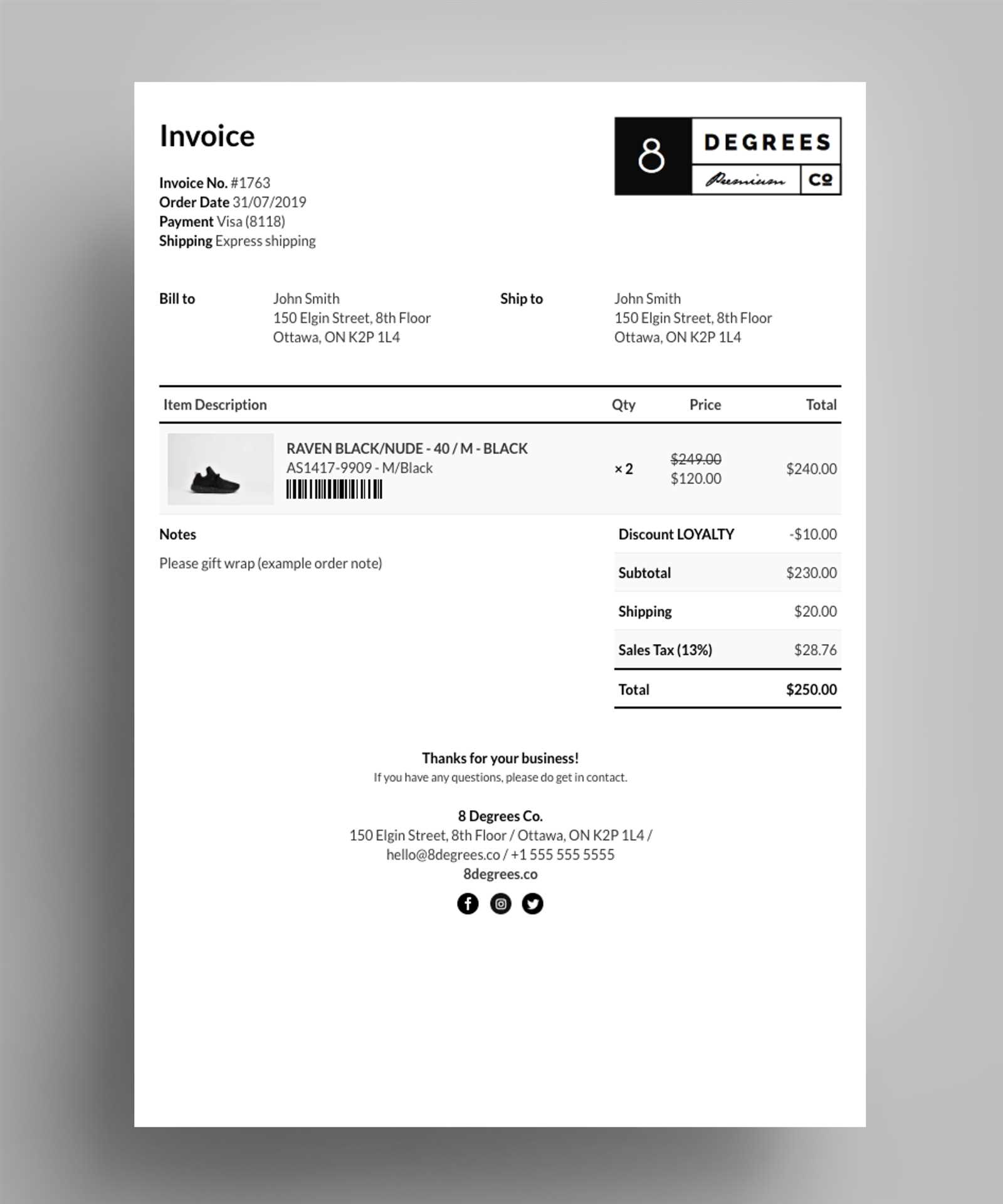

Professional and Consistent Presentation

Using a standardized structure promotes a polished and professional image. By maintaining a consistent format across all transactions, you ensure that clients receive clear and organized documentation, which can enhance their trust and confidence in your business. A well-crafted document reflects positively on your company’s reputation.

Customization is another significant advantage. These documents allow you to tailor them to suit different clients or industries, ensuring that each request for payment meets specific needs without compromising professionalism.

Overall, using a customizable document for payment requests is an efficient, professional, and flexible way to handle financial transactions with minimal hassle.

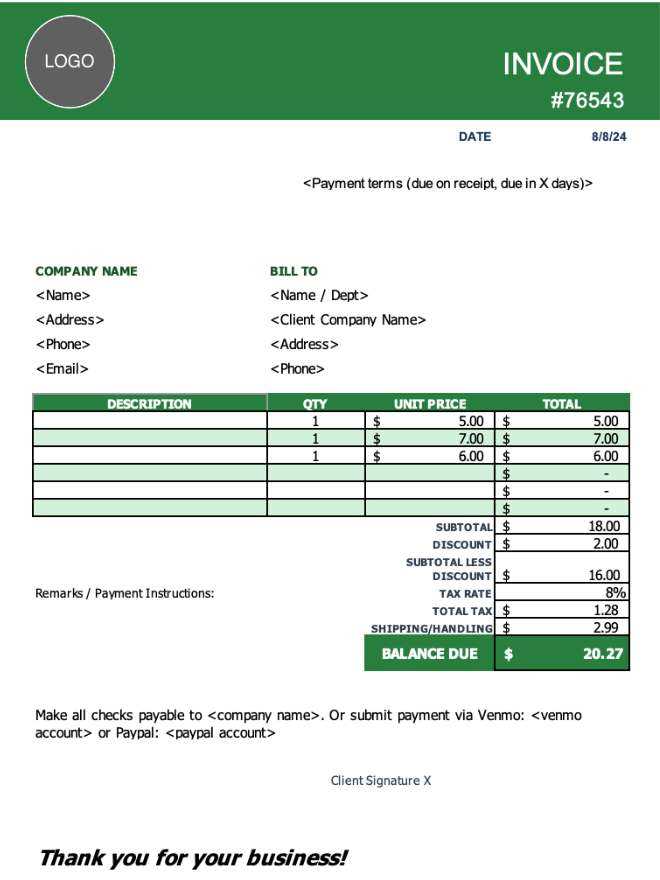

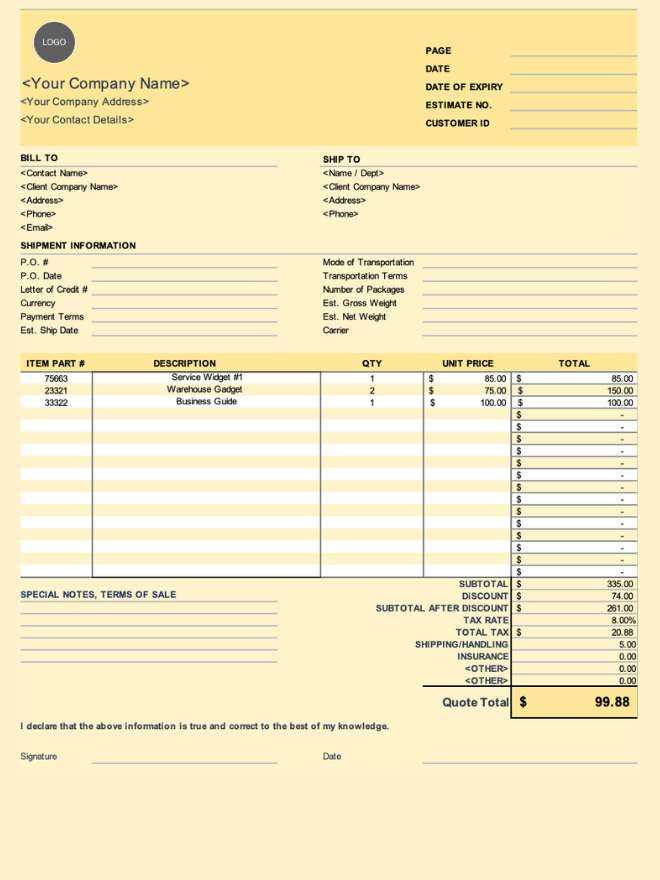

How to Customize an Invoice Template

Customizing a billing document allows you to tailor it to the specific needs of each client or project. With just a few adjustments, you can create a professional, personalized document that accurately reflects your services and payment terms. The ability to modify key fields ensures that each document meets the unique requirements of your business.

Key Elements to Modify

When adapting a billing document, focus on the most critical sections that will vary depending on the client or project. These include details such as client name, description of services rendered, amounts, and due dates. Ensuring these fields are correctly filled out is essential for accuracy and clarity.

| Field | Customization Tip |

|---|---|

| Client Information | Include full names, addresses, and contact details to personalize the document. |

| Service Description | Be clear and concise about the work provided to avoid misunderstandings. |

| Payment Amount | Ensure the total matches agreed-upon pricing or hourly rates. |

| Due Date | Set realistic due dates that align with your payment terms. |

Design and Layout Adjustments

Along with modifying the content, consider the visual layout of the document. Using clean fonts, consistent spacing, and a logical flow ensures the document is easy to read and looks professional. You may also want to add your company logo, payment instructions, or terms and conditions to further personalize the document.

By customizing these elements, you ensure that each document not only meets your specific needs but also maintains a high level of professionalism.

Benefits of Using Invoice Templates

Using pre-designed billing documents can offer numerous advantages for businesses of all sizes. These ready-to-use forms provide an easy way to ensure that every transaction is handled efficiently and professionally. By reducing the time spent on document creation, businesses can focus on their core operations while still maintaining accuracy in financial dealings.

Time Efficiency

One of the greatest benefits of using ready-made billing documents is the time saved. Instead of starting from scratch with every new client or project, you can quickly fill in the necessary details, making the process of creating financial documents much faster. This is especially valuable when handling large volumes of work or recurring billing.

Consistency and Professionalism

Maintaining a consistent format across all transactions helps ensure that your business is perceived as organized and professional. When clients receive clear, uniform documents, it fosters trust and improves the overall customer experience. Standardized forms make your billing process look polished and well-managed, reinforcing your brand’s reputation.

| Benefit | Details |

|---|---|

| Faster Document Creation | Quickly fill in key fields, saving time and effort on every transaction. |

| Reduced Errors | Standardized format helps reduce mistakes and ensures accuracy in billing. |

| Professional Appearance | Polished and consistent documents help maintain a professional image with clients. |

| Customization | Easily adapt the document to fit specific needs for different clients or projects. |

By leveraging these advantages, businesses can streamline their financial workflows, improve client satisfaction, and maintain a high level of professionalism in their billing practices.

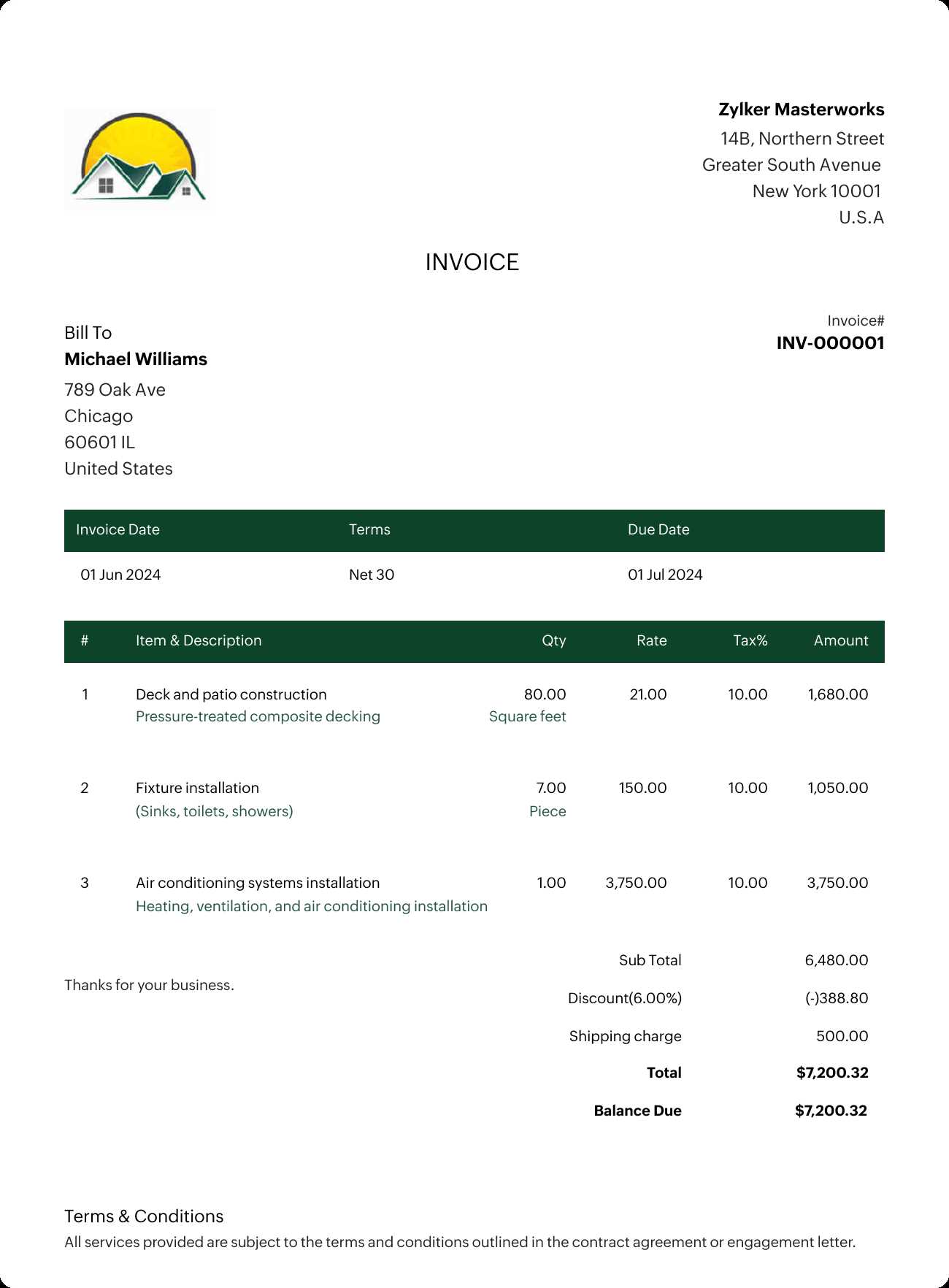

Essential Fields in an Invoice

When creating a financial document to request payment, certain key elements must always be included to ensure accuracy and clarity. These essential sections provide all the necessary information for both the business and the client, reducing the risk of confusion or missed payments. Including the right details helps maintain a professional image and ensures that transactions are processed smoothly.

Client Information is one of the most important sections to customize. This should include the full name, address, and contact details of the person or business being billed. Ensuring this information is correct will prevent delays and ensure proper communication.

Description of Services clearly outlines what products or services have been provided. This should be detailed enough to avoid any misunderstandings, yet concise enough to keep the document easy to read. Including dates of service or delivery is also helpful for both parties.

Payment Amount specifies the total amount due. This should be broken down if necessary, listing individual prices for services, products, taxes, and any applicable fees. Having this section clearly defined ensures transparency and avoids any confusion when the bill is paid.

| Field | Importance |

|---|---|

| Client Details | Ensures accurate identification of the recipient for payment processing. |

| Service or Product Description | Provides clarity on what is being billed for, avoiding confusion. |

| Total Due | Clearly outlines the amount to be paid, including any taxes or extra charges. |

| Due Date | Sets expectations for payment timelines and helps avoid overdue accounts. |

Due Date is equally important, as it establishes when the payment is expected. Providing a clear timeline can help ensure that both parties adhere to agreed-upon terms. These essential fields work together to make the payment process as smooth as possible for all parties involved.

How to Save Time with Templates

Using pre-designed billing forms can significantly reduce the time spent on administrative tasks. By starting with a ready-made structure, you avoid the need to recreate the document from scratch for each client or project. This allows you to quickly fill in the essential details and focus on other important aspects of your business.

Here are some ways you can save time when using ready-made billing documents:

- Quick Customization: Instead of formatting each document manually, you only need to input specific details like client information, service descriptions, and payment terms. This saves you from dealing with repetitive layout adjustments.

- Pre-Set Fields: Many of these documents come with pre-set sections for things like pricing, taxes, and payment terms. This ensures that nothing is missed and prevents you from having to add these elements every time.

- Consistency: Using the same format every time ensures consistency across all documents, which reduces the risk of errors or forgetting to include essential information.

- Automated Calculations: Some forms can automatically calculate totals, taxes, and discounts. This reduces manual work and minimizes errors in math or data entry.

By leveraging these time-saving features, you can handle your financial documentation more efficiently, allowing you to spend less time on administrative tasks and more on running your business.

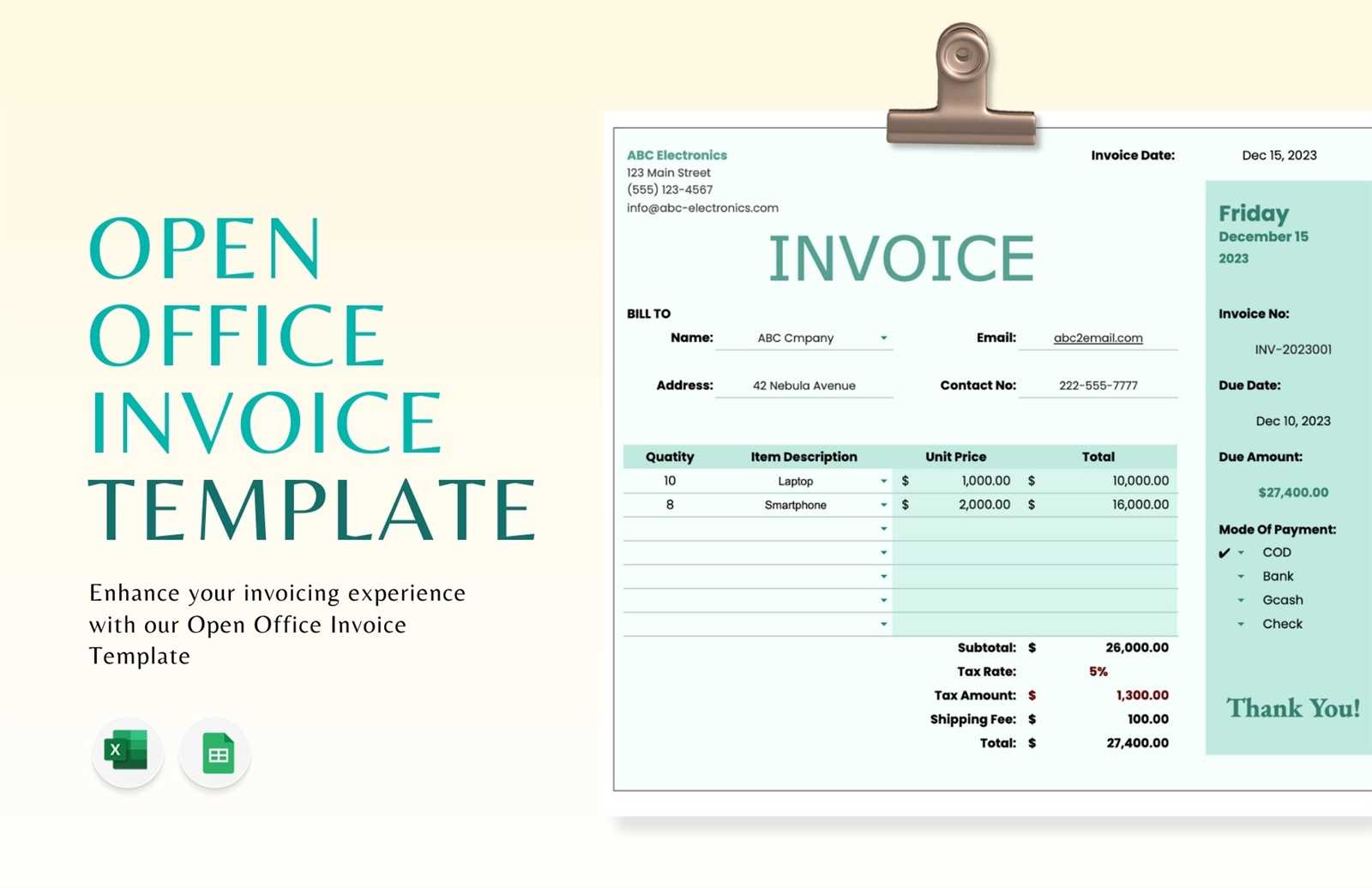

Common Invoice Template Formats

There are several document formats available for creating billing records, each offering unique features that cater to different business needs. These formats vary in layout, ease of customization, and functionality, allowing businesses to choose the one that best suits their operational requirements. Understanding the most common formats helps streamline the billing process and ensures that the final documents are both professional and efficient.

Popular Formats

When selecting a format for billing, consider the following common options:

- PDF Format: This format is ideal for sending finalized documents that should not be altered. It offers a clean, professional appearance and is widely accessible across all devices.

- Word Document: This format allows for easy editing and customization, making it ideal for businesses that need to adjust the document frequently.

- Excel Spreadsheet: Perfect for businesses that require detailed calculations or itemized breakdowns. It allows for easy updates and quick adjustments in pricing.

- Online Billing Software: Many businesses use cloud-based software to generate and manage billing documents, offering features such as automatic calculations, reminders, and direct email options.

Comparison of Formats

| Format | Key Features | Best For |

|---|---|---|

| Fixed format, widely accessible, professional presentation | Finalized billing records | |

| Word Document | Editable, flexible, easy to customize | Businesses needing frequent updates |

| Excel | Automatic calculations, easy to update data | Itemized billing or detailed calculations |

| Online Software | Automated features, cloud storage, real-time access | Businesses looking for automated and recurring billing |

Each format offers different strengths depending on the needs of the business. Understanding these formats helps in selecting the most efficient

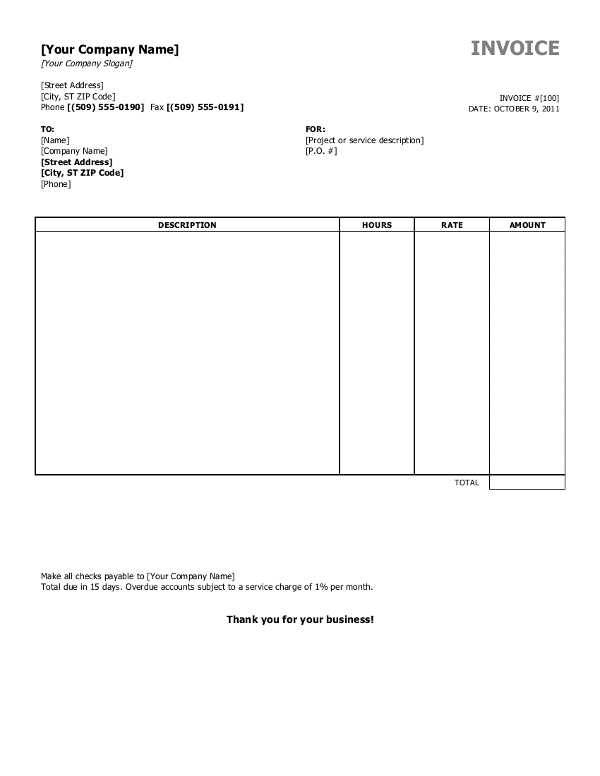

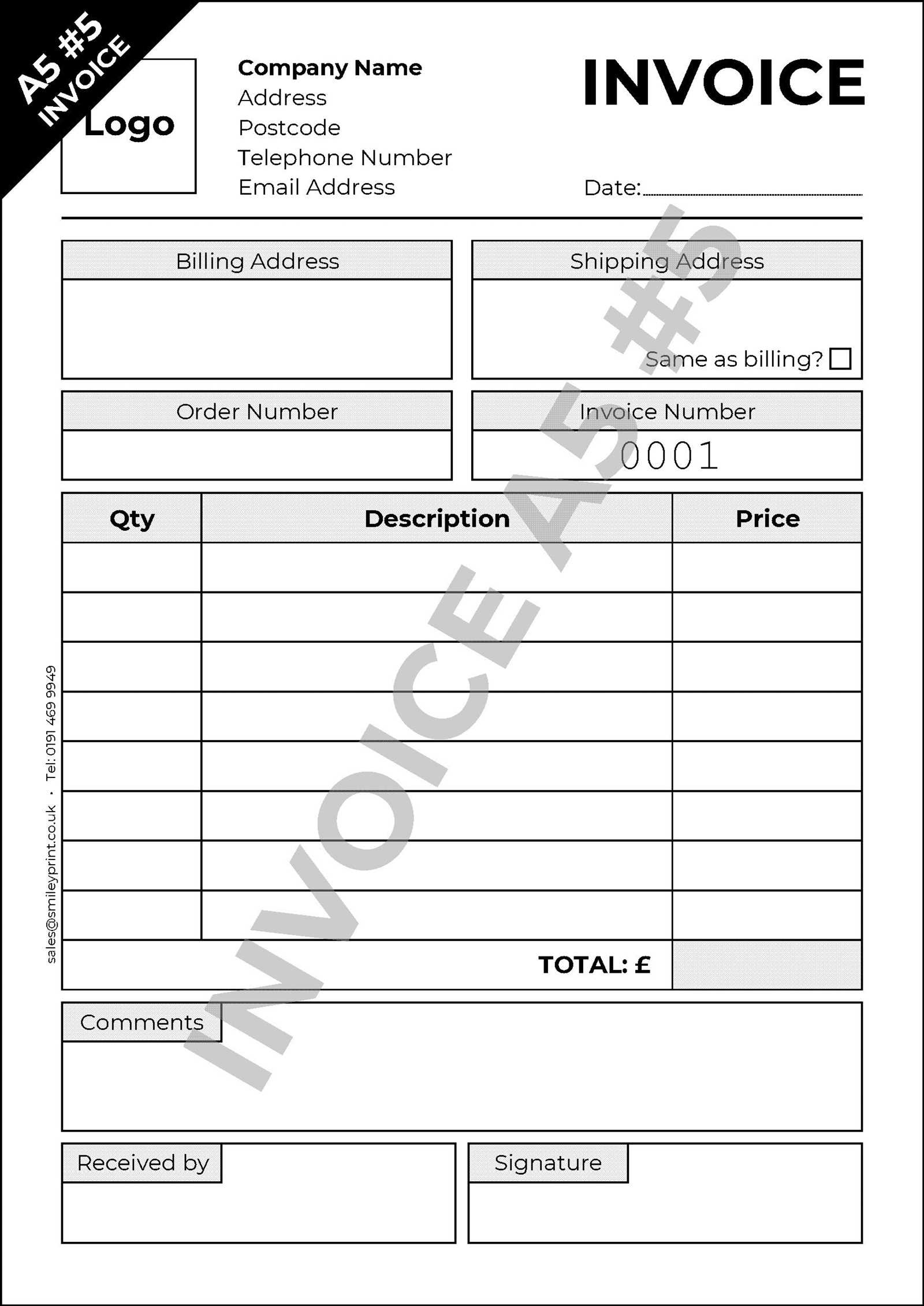

Steps to Create Your First Invoice

Creating a professional billing document for the first time may seem daunting, but the process can be straightforward with the right approach. Following a series of well-defined steps ensures that all necessary details are included, and the document is clear and easy to understand for both parties. Here’s a step-by-step guide to help you get started with your first billing record.

- Choose a Format: Decide on the format you will use for your billing document. Whether it’s a Word document, PDF, or an online software tool, ensure it’s a format that suits your business needs and can be easily customized.

- Include Your Business Information: At the top of the document, include your company’s name, address, phone number, email, and other contact details. This helps the recipient identify where the bill is coming from.

- Include Client Information: Make sure to add your client’s full name or business name, address, and contact details. This is essential for proper record-keeping and payment tracking.

- Describe the Products or Services: List the items or services provided, including a brief description of each. Be sure to include dates of service or delivery if applicable.

- Set the Payment Amount: Clearly indicate the amount due for each service or product. Include any additional charges, taxes, or discounts, and calculate the total amount due.

- Define Payment Terms: Specify the payment due date and any other important terms, such as accepted payment methods and late fees if applicable.

- Finalize the Document: Review the document for any errors or missing information. Once everything looks correct, finalize the billing document and save it in the desired format.

Following these steps ensures that your first billing record is clear, professional, and complete, helping you create a positive impression with your clients and streamline your payment process.

How to Include Payment Terms

Clearly defining the conditions for payment is crucial to ensure smooth transactions and avoid misunderstandings with clients. Including well-structured payment terms helps set expectations regarding when and how payments should be made. These terms should be concise, clear, and easy to follow for both you and the recipient.

Specify the Due Date: One of the most important elements is the payment due date. Clearly state when payment is expected, whether it’s within a specific number of days from the document date or on a particular date. Common time frames include 30, 60, or 90 days, but you can adjust this according to your business practices.

Define Accepted Payment Methods: Indicate the acceptable methods of payment, such as bank transfer, credit card, PayPal, or checks. Make sure to provide any necessary payment details, like bank account information or online payment links, to simplify the process for your client.

Late Fees and Penalties: It’s helpful to include a clause regarding late fees or penalties if the payment is not made by the agreed-upon date. This can be a fixed fee or a percentage of the outstanding amount. Clearly communicate the consequences of late payments to encourage timely settlements.

Discounts for Early Payment: If you offer discounts for early payments, make sure to specify the discount percentage and the period during which the discount applies. For example, a “2% discount for payments made within 10 days” is a common practice.

Installment Payment Option: In some cases, clients may request the ability to pay in installments. If you allow this, outline the installment amounts, due dates, and any associated interest rates or terms.

Including these details in your billing document ensures that both parties are on the same page and helps prevent confusion regarding payment expectations. Properly stated payment terms contribute to smoother cash flow and stronger business relationships.

Improving Professionalism with Templates

Utilizing pre-designed billing documents can significantly enhance the professional appearance of your business communications. A consistent, clean, and well-structured document helps create a strong impression with clients, showing that your business is organized and detail-oriented. When a client receives a clear and polished statement, it not only builds trust but also fosters a sense of credibility and reliability.

Consistency in Design: Using a uniform format for all your financial documents ensures that every transaction reflects the same high standard. This consistency conveys professionalism and makes it easier for clients to recognize your brand. A neat layout with clearly defined sections, like payment terms and item descriptions, presents the information in a way that is easy to read and understand.

Clear Communication: Pre-made billing forms help ensure that all essential details are included, such as business and client contact information, payment amounts, due dates, and any other critical clauses. This reduces the risk of miscommunication and ensures that nothing important is overlooked.

Enhanced Credibility: When you use polished, well-structured forms, clients are more likely to view your business as professional and trustworthy. The use of formal and consistent layouts establishes credibility, which can be crucial in competitive industries.

Time Efficiency: By using ready-made forms, you eliminate the need to create new documents from scratch each time. This allows you to focus on other aspects of your business wh

Integrating Templates with Accounting Software

Integrating pre-designed billing forms with accounting software can streamline your financial processes and improve efficiency. By linking your billing system directly to your accounting tools, you can automate tasks such as generating records, tracking payments, and updating financial reports. This integration minimizes manual entry and helps ensure that your financial data remains accurate and consistent across platforms.

Benefits of Integration

- Automation: Automating document generation saves valuable time and reduces the risk of human error. Instead of manually creating a new document for every transaction, the software can automatically populate necessary fields based on the data you input.

- Consistency: Integration ensures that all your financial documents follow the same layout and structure, maintaining consistency throughout your records.

- Real-Time Updates: Linking your billing forms to accounting software allows for real-time tracking of payments and adjustments, keeping your financial information up-to-date without manual intervention.

- Improved Reporting: When integrated, accounting software can generate detailed financial reports from the data in your billing forms, making it easier to track income, expenses, and profits.

How to Integrate Templates with Accounting Software

- Choose Compatible Software: Ensure that the accounting software you choose supports integration with customizable forms. Popular tools like QuickBooks, FreshBooks, or Xero offer seamless integration options.

- Set Up Document Customization: Once you’ve selected your software, customize the billing form according to your needs, including the details of your services, terms, and client information.

- Connect Your Accounting Software: Follow the software’s instructions to link the billing form with your accounting system. This may involve syncing your client database, payment gateway, and financial records.

- Test the Integration: Before fully relying on the integration, run tests to ensure the data flows correctly from the form to the software, and that all information is accurate and consistent.

By integrating your billing forms with accounting software, you create a more efficient, accurate, and professional financial management system, allowing you to focus on growing your business while automating tedious tasks.

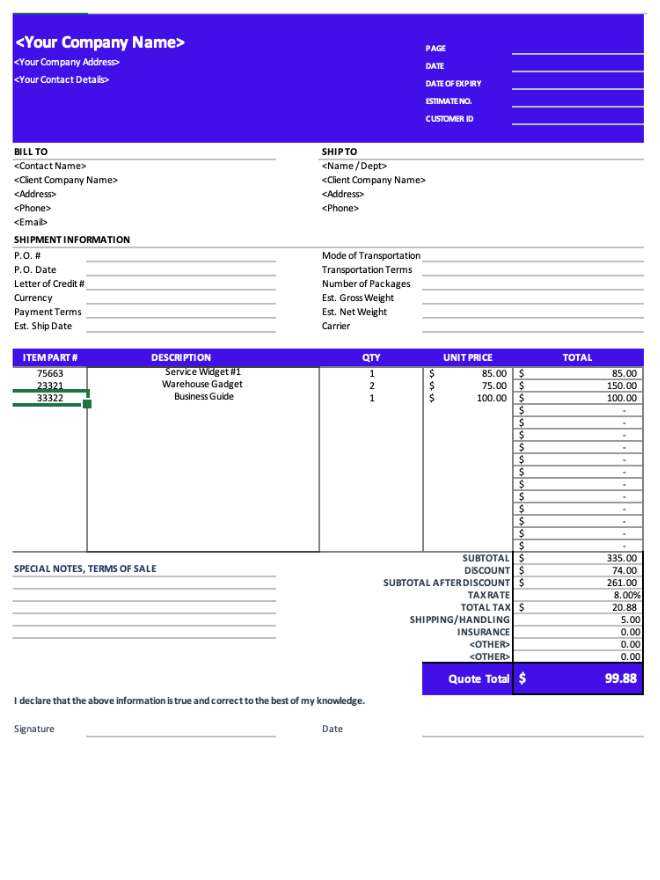

How to Add Taxes and Fees

Including taxes and additional charges in your billing documents is essential for ensuring compliance with tax laws and maintaining transparency with clients. Adding these amounts correctly helps avoid discrepancies and guarantees that both parties are clear on the total amount due. It’s important to understand the different types of taxes and fees that may apply to your transactions and how to accurately include them in your records.

Step-by-Step Process

- Identify Applicable Taxes: Depending on your location and the type of products or services you provide, various taxes such as sales tax, VAT, or service tax may apply. Make sure you are aware of the current rates and regulations in your jurisdiction.

- Include Tax Rate Information: In the appropriate section of your document, add the tax percentage or amount. Ensure that you calculate it based on the subtotal, not including the tax, unless specified otherwise.

- Account for Additional Fees: Beyond taxes, additional fees such as handling, delivery, or service charges may apply. Be sure to clearly list these fees with a brief description to avoid any confusion.

- Calculate Total Amount: After adding taxes and fees, calculate the final total. This should be the sum of the subtotal, taxes, and any additional charges. Double-check the math to ensure accuracy.

Formatting and Clarity

- Breakdown of Charges: Clearly break down each tax and fee, showing the individual amounts and the total for transparency. This makes it easier for clients to understand how the final amount was calculated.

- Use Clear Labels: Label each tax or fee with a specific name (e.g., “Sales Tax,” “Shipping Fee”) to avoid confusion. If applicable, state the percentage rate next to each charge.

Accurate tax and fee inclusion not only ensures that your transactions are compliant but also builds trust with your clients by keeping the financial information transparent and understandable.

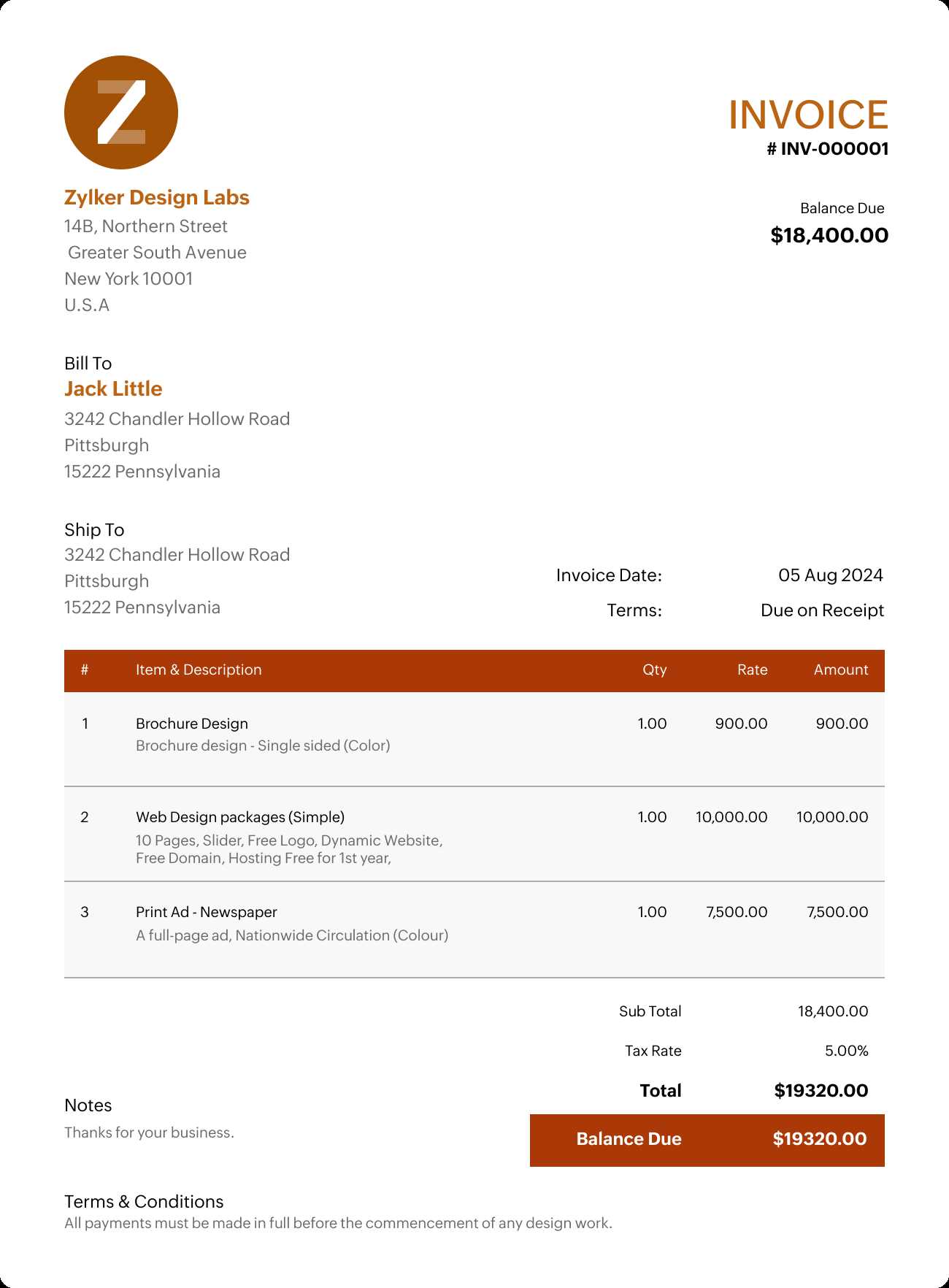

Customizing Templates for Different Clients

Personalizing your billing documents for individual clients not only enhances professionalism but also strengthens your relationship with them. Customization ensures that each document accurately reflects the specific needs and agreements of your clients. By tailoring details such as services provided, payment terms, and contact information, you make your communication more relevant and clear.

Key Areas for Customization

- Client Information: Include the client’s name, address, and contact details. Ensuring that this information is accurate avoids confusion and ensures proper communication.

- Service or Product Details: List specific services or items provided to the client, along with quantities and individual pricing. Customizing this section helps clients easily understand what they are being charged for.

- Payment Terms: Adjust the payment terms to suit the agreement with the client, such as specifying the payment due date, accepted payment methods, or installment options if applicable.

- Discounts and Special Conditions: If applicable, apply any agreed-upon discounts, promotions, or specific conditions related to the client’s purchase. This helps reinforce positive client relations.

Best Practices for Customization

- Use Client-Specific Branding: If your clients have a logo or brand guidelines, include these elements in the document to make the interaction more personalized.

- Maintain a Professional Tone: Even when customizing for individual clients, maintain a professional and respectful tone throughout the document.

- Save Custom Versions: Create custom versions for repeat clients, saving time in future transactions by adjusting only the necessary details.

Tailoring your billing documents ensures clarity and strengthens client relationships. A personalized approach not only reflects well on your business but also encourages timely payments and builds trust with your clients.

How to Protect Your Invoice Templates

Ensuring the security of your billing documents is crucial to prevent unauthorized access, alterations, or misuse. Protecting these files not only preserves the integrity of your business operations but also safeguards sensitive client and financial information. By implementing several strategies, you can effectively protect your documents from potential threats.

Effective Ways to Safeguard Your Documents

- Password Protection: Use strong passwords to protect editable versions of your documents. This ensures that only authorized individuals can make changes to important information.

- Watermarking: Add watermarks to your documents, especially when sharing them online. A watermark can help deter unauthorized distribution and indicate the document’s ownership.

- Digital Signatures: Apply a digital signature to your documents to confirm their authenticity and ensure they haven’t been altered after creation.

- Limit Access: Restrict access to the document by using secure storage solutions. This could include cloud services with encrypted files or local storage with limited user permissions.

Best Practices for Ongoing Protection

- Regular Backups: Perform regular backups of your documents to ensure you can recover them if lost or corrupted. Store backups in a secure, off-site location or encrypted cloud storage.

- Update Software: Ensure that your software, including security tools and antivirus programs, is up-to-date to protect against vulnerabilities that could compromise your files.

- Monitor Document Access: Keep track of who accesses or modifies your files. This can help identify potential issues or unauthorized activity quickly.

By taking these steps to protect your billing documents, you ensure that your business remains secure, professional, and trustworthy in the eyes of your clients.

Best Practices for Invoice Formatting

Properly structuring and formatting your billing documents is essential for clarity, professionalism, and efficiency. A well-organized document helps ensure that both you and your clients can easily understand the details, reducing the risk of errors or misunderstandings. Following best practices for layout, design, and content presentation will streamline the process and enhance the overall user experience.

Key Formatting Guidelines

- Clear Header Information: Include all necessary business and client details at the top of the document, such as your company name, logo, contact information, and the recipient’s details. This makes it easy for the client to verify and contact you if needed.

- Easy-to-Read Date and Reference Numbers: Clearly highlight the issue date and any reference numbers (such as a purchase order or transaction ID). This will help both parties keep track of the document and facilitate future reference.

- Itemized List of Services or Goods: Provide a detailed list of what is being billed, including descriptions, quantities, unit prices, and totals. A clean table format for this section allows clients to quickly identify what they are being charged for.

- Consistent and Simple Fonts: Use easy-to-read fonts, such as Arial or Times New Roman, in a uniform size for the entire document. Avoid using too many different font styles or sizes, as it can make the document appear cluttered.

Tips for Enhanced Professionalism

- Maintain Alignment: Ensure all columns, rows, and sections are aligned properly to create a clean and organized appearance. This includes aligning numerical data, such as totals and tax amounts, to the right for easy reading.

- Whitespace Usage: Utilize whitespace effectively to separate different sections of the document. This makes the layout less dense and easier to navigate.

- Accurate Totals and Calculations: Double-check all numbers, especially totals and taxes, to ensure accuracy. Incorrect calculations can lead to confusion and may harm your reputation.

By following these best practices for formatting, you ensure that your billing documents are professional, easy to read, and efficient for both you and your clients. A well-formatted document not only provides clarity but also enhances the overall business image and strengthens client trust.

Free vs Paid Invoice Templates

When it comes to creating billing documents, there are two main options available: free and paid solutions. Each has its pros and cons, and the choice between them depends on your specific business needs, budget, and desired features. Understanding the key differences can help you decide which option is best suited for your requirements.

Advantages of Free Options

- Cost-Effective: Free options come with no financial commitment, making them an ideal choice for small businesses, freelancers, or startups with a tight budget.

- Basic Features: Free tools typically offer the basic functionalities required for generating billing documents, such as customizable fields and simple design layouts.

- Accessibility: Many free solutions are easy to access and use, with no need for additional software or subscriptions. They can be found online or downloaded quickly for immediate use.

Drawbacks of Free Options

- Limited Customization: Free solutions often come with limited design flexibility or functionality. You may be restricted in terms of layout options, branding elements, or the ability to add advanced features.

- Basic Templates: Free tools may only provide simple designs, which might not be ideal for businesses looking to create a more professional or unique appearance.

- Support and Updates: Free solutions may not offer customer support or regular updates, which can be a challenge if you encounter issues or need improvements.

Advantages of Paid Options

- Advanced Features: Paid solutions often include more robust features, such as automatic calculations, integration with accounting software, advanced customization options, and more detailed reporting.

- Better Customization: With a paid service, you often have more flexibility in designing documents that reflect your brand’s identity, offering options like adding logos, adjusting fonts, and customizing colors.

- Dedicated Support: Many paid solutions come with customer support, ensuring that any technical issues can be resolved quickly and effectively. You also benefit from regular software updates and new features.

Drawbacks of Paid Options

- Cost: Paid solutions require a financial investment, which may not be feasible for all businesses, especially those just starting out or working with limited resources.

- Complexity: Some paid options may come with a steeper learning curve due to advanced features, which could require additional time and effort to master.

Ultimately, the decision between free and paid solutions depends on your business needs an

Automating Invoices with Templates

Automation has become a game changer in streamlining business processes, and generating billing documents is no exception. By using pre-designed forms, companies can save valuable time and reduce the risk of human error. Automating the creation and distribution of these documents allows businesses to focus on other crucial tasks while ensuring that all details are correctly filled in and sent on time.

Benefits of Automating Billing Documents

- Consistency: Automated solutions ensure that every document follows the same structure, eliminating variations that may occur with manual entry. This consistency is crucial for maintaining professionalism and accuracy.

- Time Savings: Once set up, automated systems can generate documents instantly without requiring additional effort. This allows businesses to focus on more strategic tasks, such as growth and client engagement.

- Reduced Errors: By eliminating manual data entry, automation minimizes the chances of mistakes, such as incorrect amounts, dates, or client information.

How Automation Works

Automating billing forms typically involves setting up a system that integrates with your client database or accounting software. Once configured, the system automatically populates the relevant fields, such as customer information, item descriptions, and totals. The document is then generated and can be sent directly to the client via email or saved for future reference. This seamless process significantly reduces the workload and ensures that everything is handled efficiently.

For businesses looking to implement this technology, many software options offer customizable features, such as automatic reminders for unpaid balances or recurring billing cycles. By leveraging these tools, businesses can achieve a higher level of efficiency while also improving customer experience.

Tips for Managing Invoice Records

Keeping track of billing documents and financial records is crucial for any business. Proper management not only helps with staying organized but also ensures compliance with tax regulations and facilitates smoother financial planning. Efficiently organizing these records allows you to maintain a clear overview of your cash flow and helps when it’s time for audits or tax filing.

Organize and Categorize Records

One of the first steps in managing financial records is to categorize them properly. Grouping documents by client, service type, or date can make it much easier to locate specific records when needed. Using a consistent naming convention for files, such as including the client name and the date, can help maintain order and prevent confusion. Storing the documents in digital formats allows for easier searching and retrieval.

Regularly Backup Your Data

Backing up your billing documents is an essential practice to ensure that they are never lost. Whether you store these records on a cloud platform or external hard drive, having regular backups will prevent the risk of losing vital information. Set a schedule to back up your data at least once a month, or more frequently if your business deals with high volumes of transactions.

Additionally, consider implementing a cloud-based accounting system that automatically saves and organizes your records. These systems offer secure storage and can sync data across multiple devices, ensuring that your information is always accessible and safe from potential hardware failures.