Complete Online Store Invoice Template for Efficient Billing

Managing financial transactions in an e-commerce business can be a time-consuming task. Having the right tools to ensure accurate and professional records is essential for smooth operations. Whether you’re a small entrepreneur or running a large digital business, automating financial documents helps keep everything organized and error-free.

Customizable formats are available to suit different business needs, allowing easy adaptation to various sales models. By incorporating a standardized format, you can simplify the process of creating financial records, saving valuable time and reducing mistakes.

Adopting a reliable system for generating and managing these documents not only boosts efficiency but also enhances customer trust. Professional-looking records provide a sense of credibility, making transactions smoother and ensuring that both parties are clear on the details of each sale.

What is an Invoice Format for E-commerce Businesses

In any e-commerce venture, keeping track of financial transactions is crucial for maintaining organization and transparency. A financial document used to detail the sale, including product information, pricing, and payment terms, is an essential part of this process. This structured document serves as both a receipt for the buyer and a record for the seller.

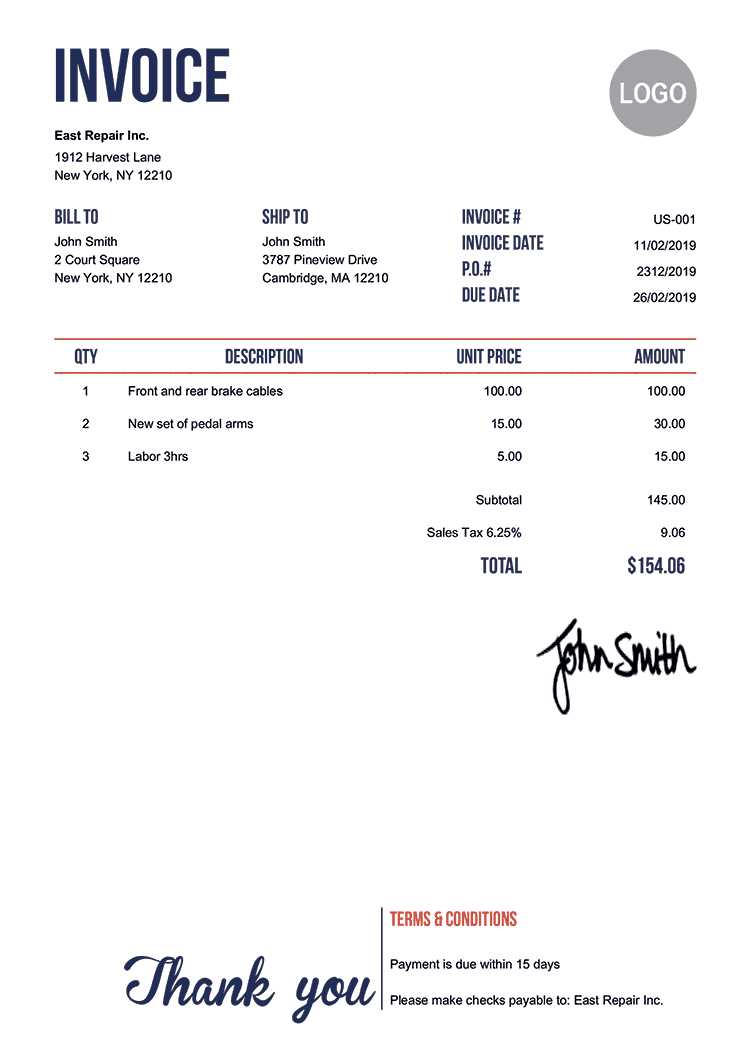

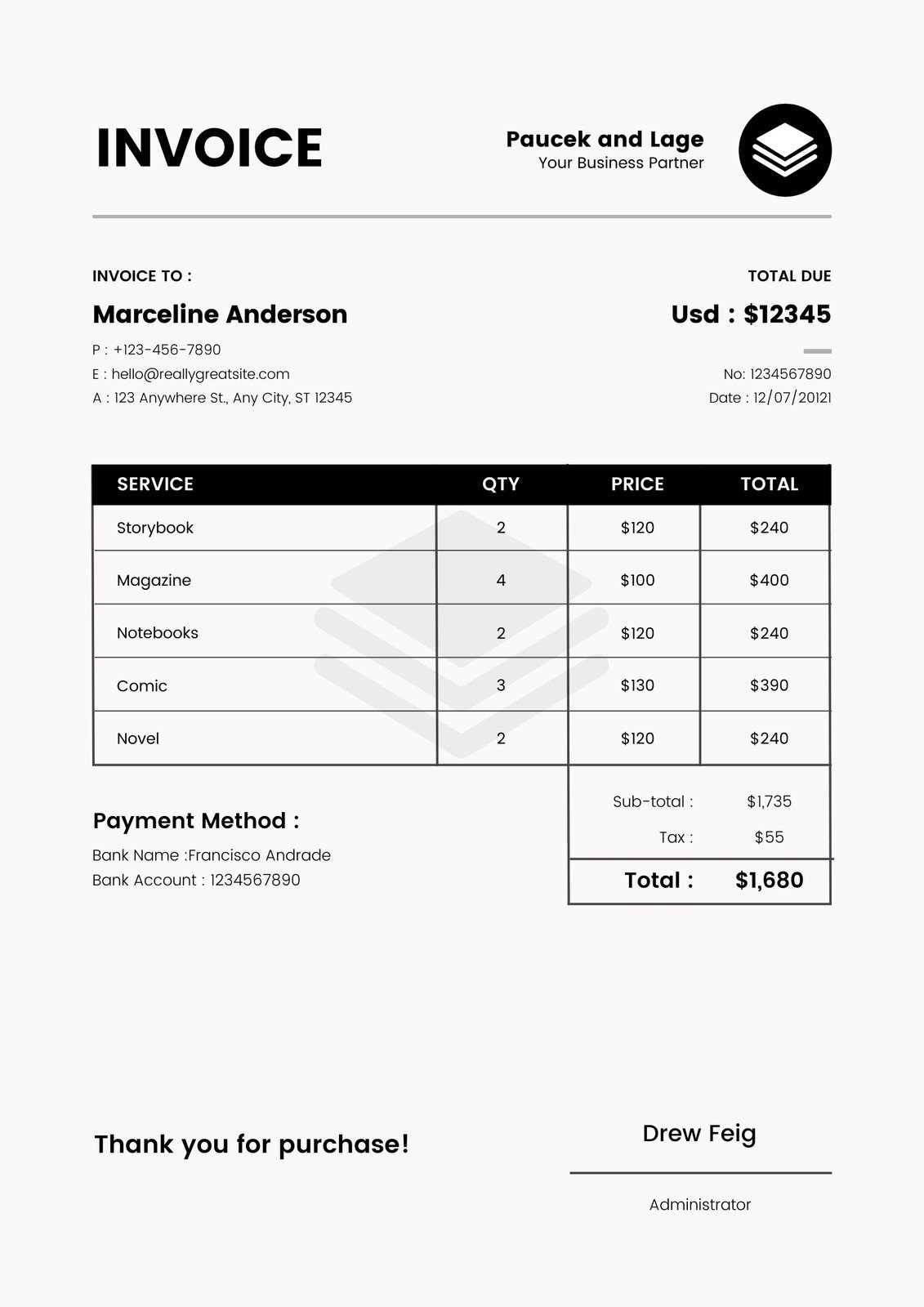

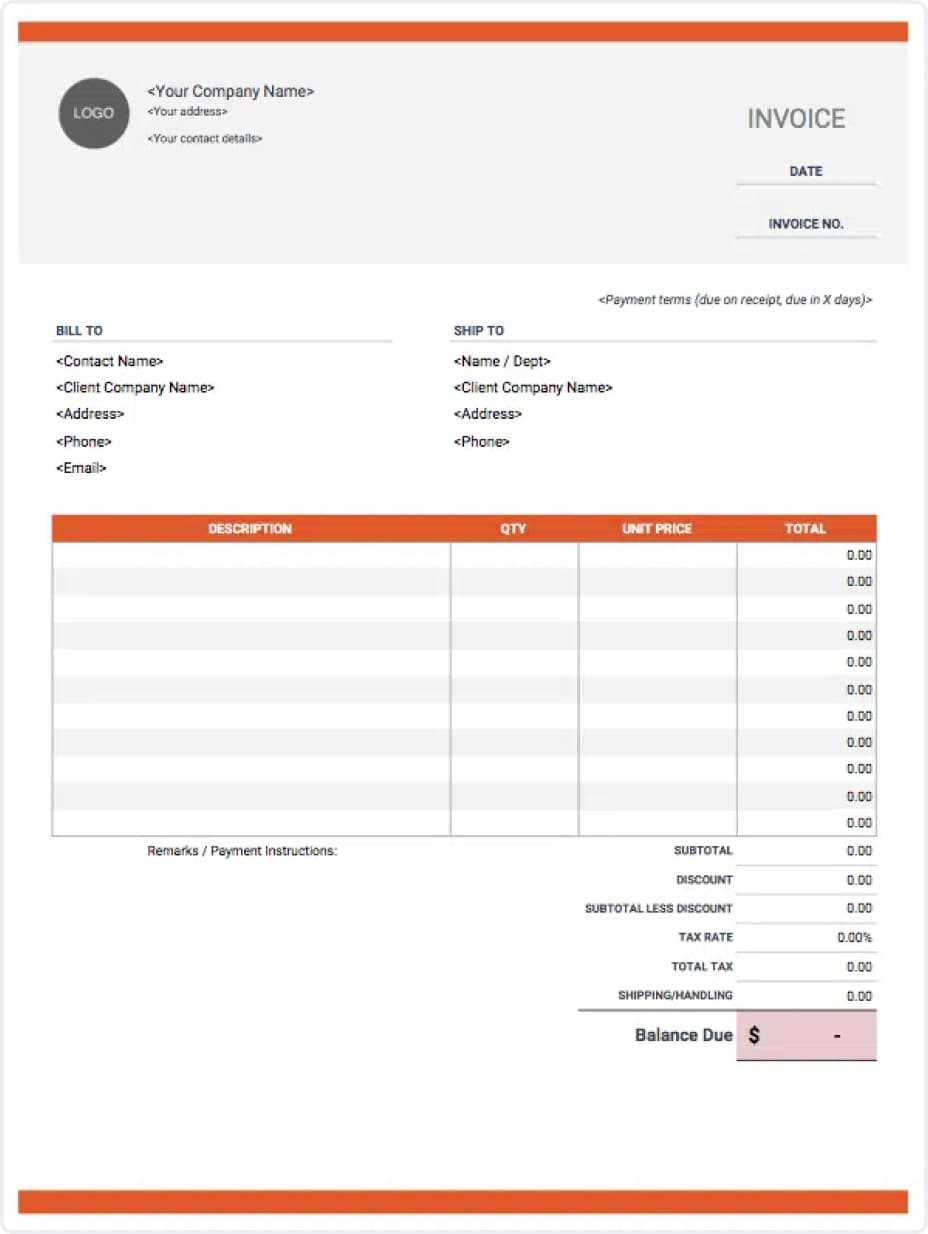

It typically includes several key details to ensure accuracy and prevent confusion. These documents can be customized to match the needs of different businesses, ensuring that all required information is clearly presented. Below is a breakdown of common components found in such a document:

| Component | Description |

|---|---|

| Business Details | Includes the name, address, and contact details of the seller. |

| Client Information | Lists the buyer’s name, address, and contact details for reference. |

| Transaction Date | Indicates the date the purchase was made or processed. |

| Itemized List | Details of the products or services sold, including quantity and individual price. |

| Total Amount | Shows the final sum, including any taxes or discounts applied. |

| Payment Terms | Specifies how and when payment is expected, including methods of payment. |

By using a well-structured document, businesses can ensure that both parties are clear about the details of the transaction, leading to fewer disputes and smoother operations.

Why You Need a Billing Document Format

Managing financial records in an e-commerce business can quickly become overwhelming without a consistent and organized system. Using a standardized format for sales documentation not only helps streamline the process but also ensures accuracy and professionalism in every transaction. Whether you’re selling a product or offering a service, having a structured document for each sale is essential for both your business and your customers.

Benefits of Using a Standardized Format

- Time Efficiency: Creating consistent financial records eliminates the need to start from scratch with each transaction, speeding up the process.

- Professionalism: A uniform document reflects well on your business, showing that you take your transactions seriously and are committed to clarity.

- Legal Protection: Accurate and properly formatted records can serve as legal proof of the transaction if disputes arise, helping avoid potential misunderstandings.

- Customer Trust: Clear and well-presented financial details build credibility and reassure customers that they are working with a reliable business.

How It Helps with Financial Organization

Using a set structure allows you to easily track and categorize all sales, simplifying the management of finances. It also makes it much easier to monitor unpaid amounts, manage taxes, and prepare financial statements. With proper records, you will never lose track of past transactions or have to search through disorganized files when you need information.

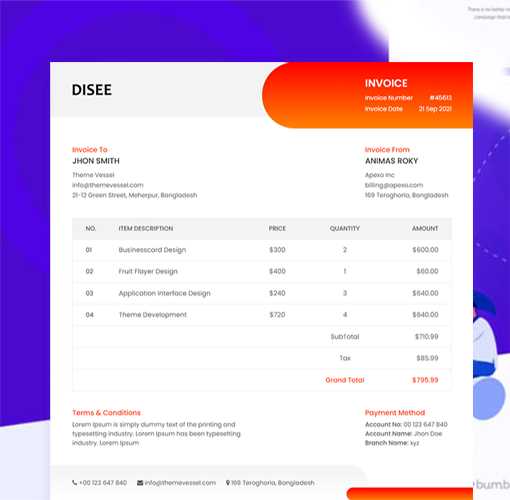

How to Customize Your Billing Document Format

Personalizing your sales documentation is a crucial step in creating a professional and seamless process for both you and your customers. Customization allows you to tailor the design, structure, and content to fit the specific needs of your business while ensuring clarity and consistency in every transaction. Whether you prefer a minimalistic layout or a more detailed approach, adjusting these elements can help streamline your financial records.

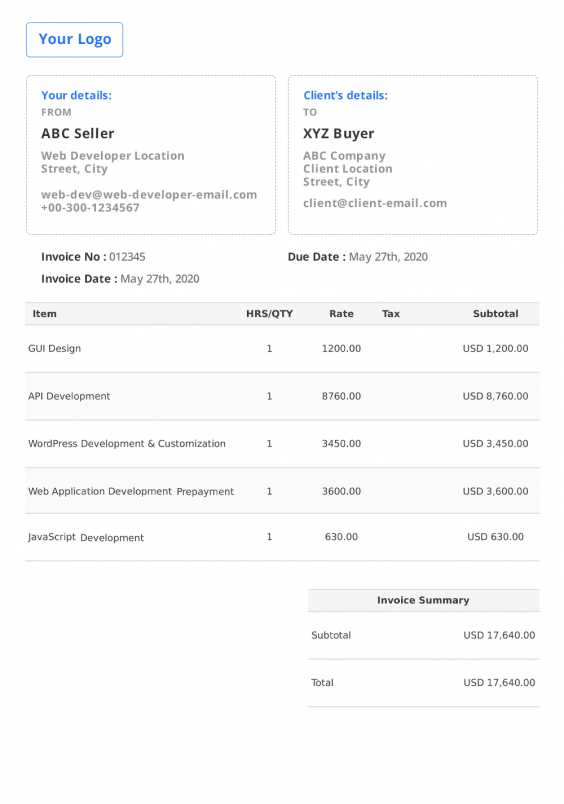

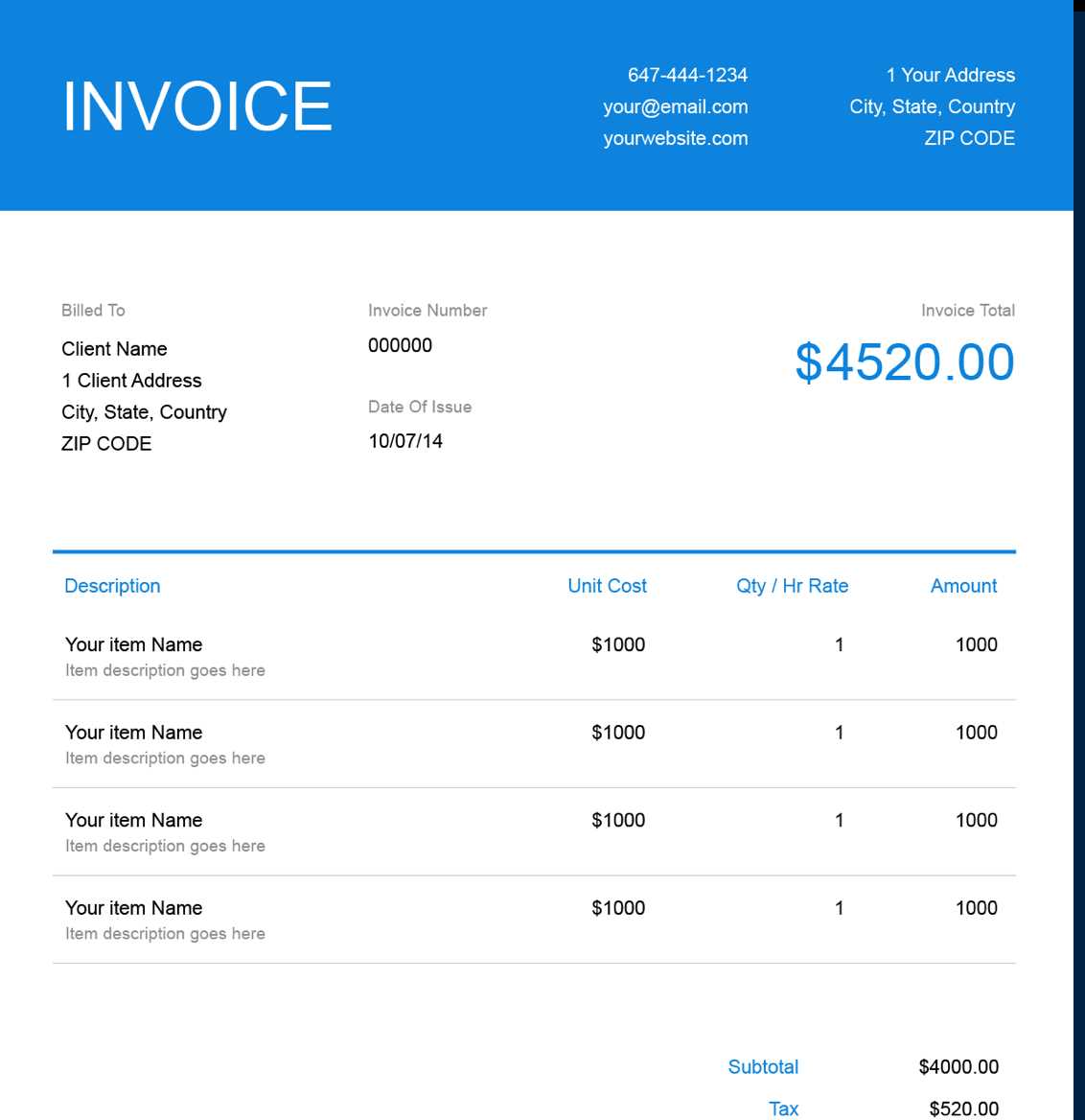

Choosing the Right Design

The design of your document should reflect your brand identity and make it easy to read. Here are some aspects to consider when adjusting the layout:

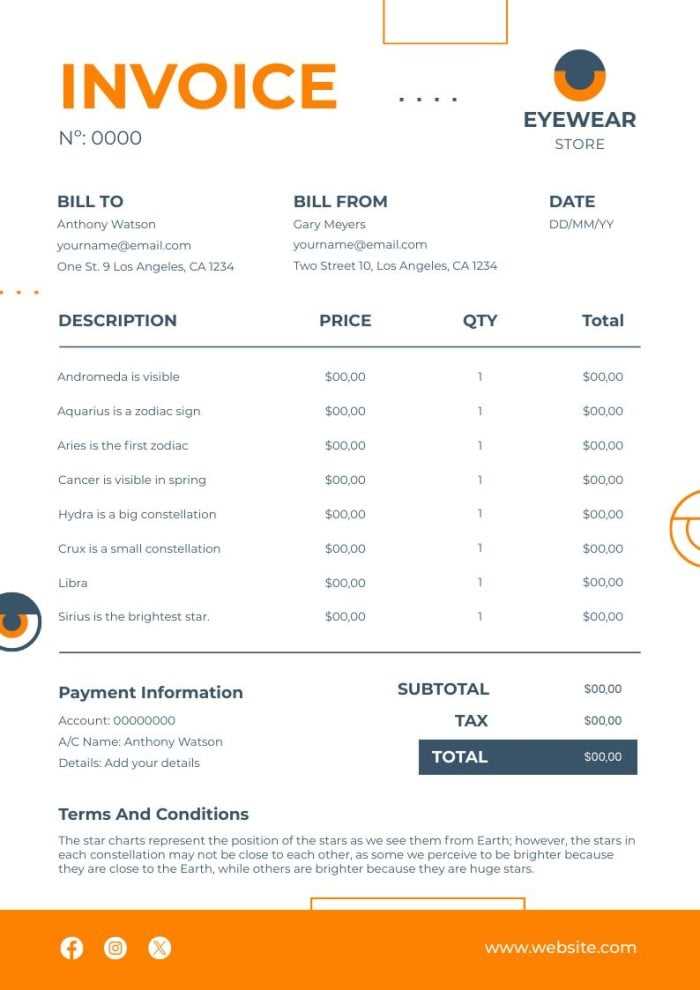

- Logo and Branding: Adding your logo at the top of the page helps establish brand recognition. Choose colors and fonts that align with your brand’s style.

- Readability: Ensure the text is legible by using clean fonts and a clear hierarchy. Use bold headings and bullet points to break up information.

- Section Layout: Organize the content logically, with sections for buyer and seller details, itemized purchases, totals, and payment terms clearly separated.

Adjusting Key Information

Tailoring the content is just as important as the design. Here’s how to customize essential details:

- Client Information: Include the necessary fields for your customer’s name, address, and contact details. You can add custom fields to capture specific data relevant to your business.

- Product or Service Descriptions: Make sure to include accurate descriptions, quantities, and prices for each item. This helps avoid confusion and ensures transparency.

- Payment Terms: Clearly state the payment method, due dates, and any penalties for late payment to ensure both parties understand the expectations.

By customizing these elements, you create a document that fits your business needs while maintaining professionalism in every transaction.

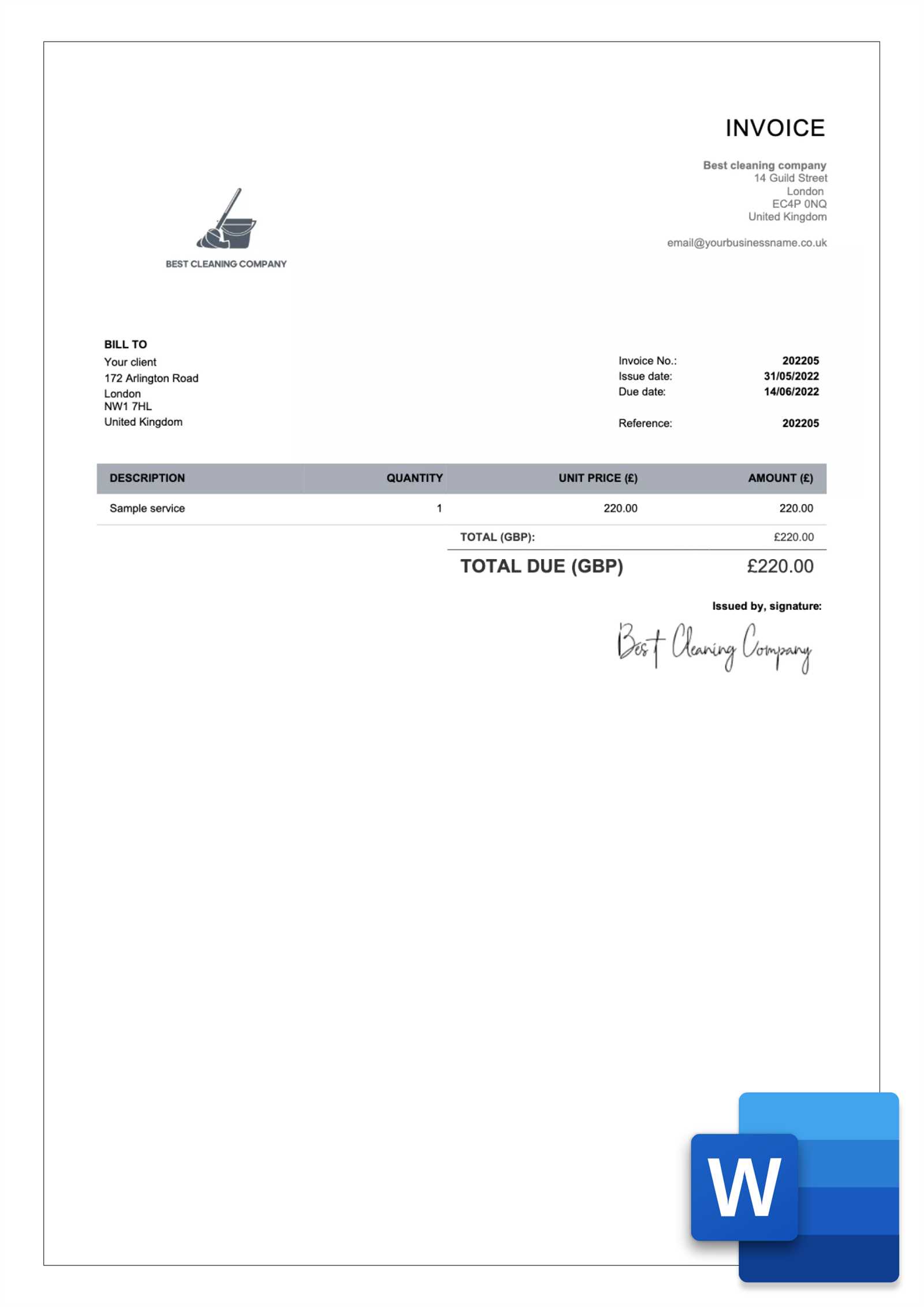

Key Elements of a Billing Document Format

For any business, a well-structured financial document is essential for ensuring clarity and transparency in transactions. A properly designed record should contain all the necessary details to avoid confusion and provide both the buyer and seller with a clear understanding of the sale. These details help to facilitate smooth communication, streamline payment processes, and keep accurate business records.

Here are the key elements that should be included in every document to ensure completeness and professionalism:

- Business Information: The name, address, phone number, and email address of the seller should be clearly stated at the top, allowing the customer to contact the business easily if needed.

- Client Details: The customer’s full name, address, and contact information should also be included, ensuring that both parties are properly identified.

- Unique Reference Number: A unique identifier for each transaction helps with record-keeping and makes it easier to track payments, refunds, or disputes.

- Transaction Date: Clearly state the date when the transaction was completed to avoid any confusion regarding payment due dates.

- Detailed Item List: Include a breakdown of each product or service purchased, with descriptions, quantities, unit prices, and the total amount for each item. This provides full transparency to the customer.

- Subtotal and Tax Information: Show the total amount for items purchased, followed by the applicable taxes and any discounts applied. This makes the final total clear.

- Payment Terms: Clearly state the payment method (e.g., credit card, bank transfer) and any deadlines for payment. Including payment instructions can help avoid delays.

- Additional Notes: This section can include any important information, such as return policies, warranties, or special instructions related to the transaction.

Including all these key elements in your financial documents ensures that your transactions are well-documented and transparent, reducing misunderstandings and helping to maintain professional relationships with your clients.

Benefits of Using a Billing Document Format

Having a pre-designed structure for financial records can significantly simplify the management of transactions. By using a consistent format, businesses can save time, ensure accuracy, and maintain professionalism with minimal effort. A well-structured document not only enhances business operations but also improves the customer experience, making transactions smoother and more transparent.

Time-Saving and Efficiency

Creating financial documents from scratch for every sale can be a tedious and time-consuming process. Using a standardized layout allows you to quickly generate accurate records without having to input the same information repeatedly. This saves valuable time and reduces the risk of errors.

- Faster Processing: With a ready-made structure, you can instantly create and send documents, speeding up your workflow.

- Less Manual Work: Pre-filled fields, such as business details or product descriptions, eliminate the need to manually enter repetitive information.

Improved Professionalism and Accuracy

Using a standardized approach ensures that each document looks professional and contains all necessary information, reducing the chances of confusion or disputes. By avoiding mistakes like missing data or incorrect calculations, businesses can present a trustworthy image and build stronger customer relationships.

- Consistent Presentation: A uniform look for every transaction boosts brand recognition and trustworthiness.

- Accuracy: Templates typically include built-in fields for calculations, reducing the chances of errors in totals, taxes, or itemized charges.

By adopting a structured approach, businesses not only improve efficiency but also enhance their credibility, leading to smoother operations and satisfied customers.

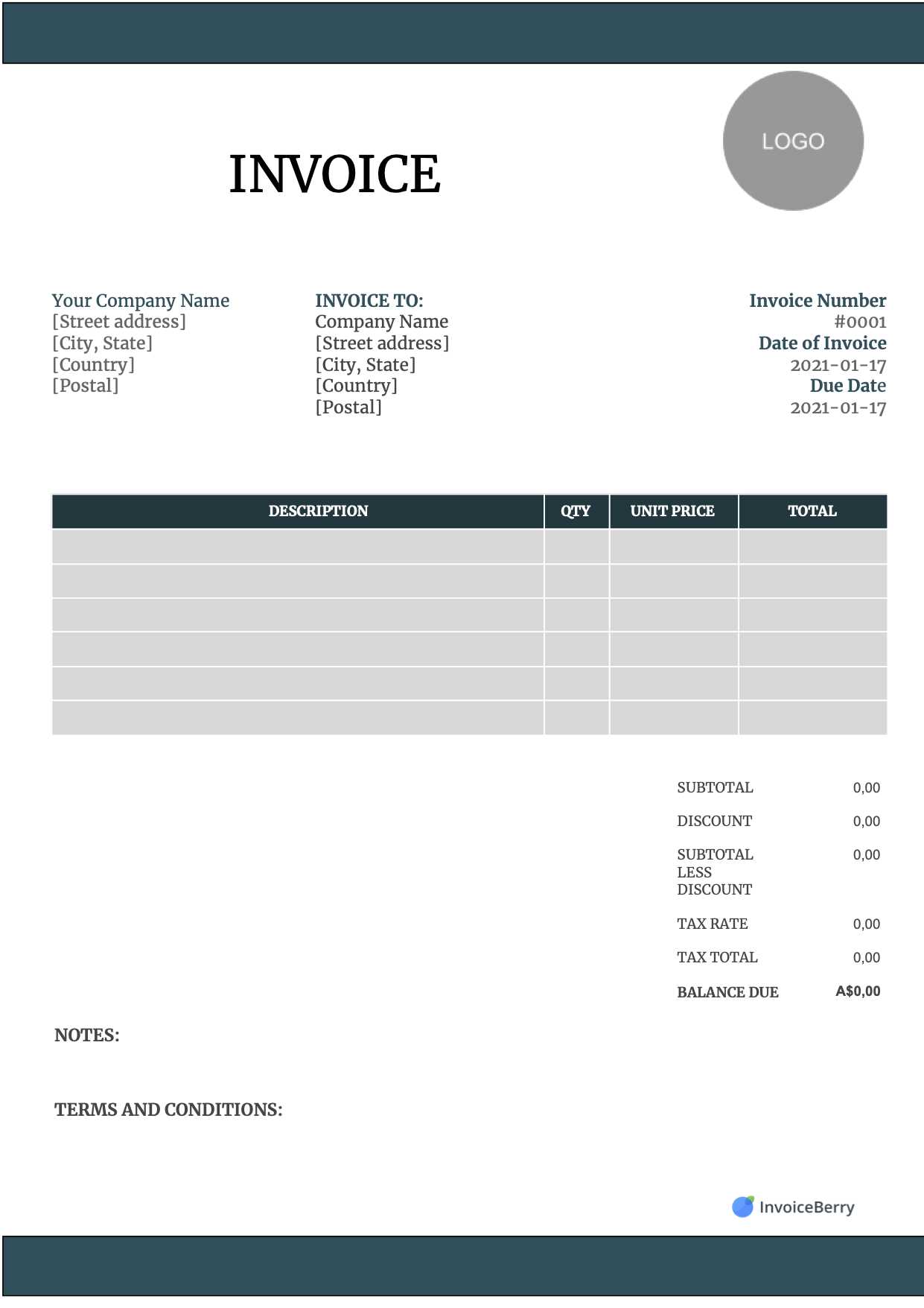

Choosing the Right Billing Document Format

Selecting the right structure for your financial records is essential for ensuring clarity and efficiency in your transactions. The format you choose will directly impact how easy it is to manage sales, process payments, and maintain accurate business records. A well-suited design should meet both functional and aesthetic needs, reflecting your business identity while offering practical benefits for both you and your customers.

Consider Your Business Needs

Not all businesses are the same, and neither are their requirements for sales documentation. When choosing a format, it’s important to consider factors such as the size of your business, the volume of transactions, and the complexity of the goods or services you offer. For example, if you’re selling a wide range of products with varying pricing, you might need a more detailed structure that includes item descriptions and custom pricing fields.

- Small Businesses: If you’re running a smaller operation, a simpler design might be sufficient, with fewer fields and a more straightforward layout.

- Larger Businesses: For larger companies with more complex transactions, a more detailed layout with additional sections for taxes, discounts, and shipping costs may be necessary.

Design and Customization Options

The appearance of your financial records also matters. A clean, professional look can go a long way in establishing trust with your clients. Choose a format that allows customization of key elements like your logo, business colors, and font styles, which can reinforce your branding.

- Simple Layout: A minimalist design can often be more effective, as it ensures that the essential details stand out clearly.

- Customizable Fields: Make sure the format you choose allows you to adjust fields to fit your specific needs, whether that’s adding additional lines for products or custom sections for notes or payment terms.

By carefully selecting the right structure, you can ensure that your documents are both functional and professional, streamlining your operations while keeping customers satisfied.

How to Create Professional Billing Records

Creating professional sales documentation is essential for establishing credibility and ensuring smooth transactions. A well-crafted document not only provides clear details for your customers but also reinforces your business’s professionalism. By paying attention to layout, content, and accuracy, you can produce documents that leave a positive impression and streamline your payment process.

Steps for Creating a Professional Document

Follow these key steps to ensure that your sales records are both accurate and visually appealing:

- Use a Clear Layout: Organize the content logically with distinct sections for each key element. Make sure the buyer’s details, product or service descriptions, and payment terms are easy to locate.

- Include Accurate Information: Ensure that all fields, such as pricing, tax rates, and quantities, are correct. Double-check for any errors before sending the document.

- Incorporate Your Branding: Customize the document with your logo, business colors, and fonts to create a consistent brand image. This adds a professional touch and makes your documents easily recognizable.

- Include Payment Instructions: Clearly specify how the client can make payment and the due date. Mention any late fees or early payment discounts to avoid misunderstandings.

Additional Tips for Enhancing Professionalism

- Use High-Quality Paper or Digital Format: If sending a physical copy, choose good-quality paper. For digital versions, ensure the document is formatted correctly and easy to read across devices.

- Check for Consistency: Maintain consistency in font, alignment, and spacing. A well-aligned and uniformly styled document reflects attention to detail.

- Proofread Before Sending: Ensure that there are no typos, grammatical errors, or incorrect details. Mistakes can undermine your business’s credibility.

By following these guidelines, you can create professional and polished sales documents that enhance your brand’s image, increase efficiency, and ensure clarity in every transaction.

Common Mistakes in Creating Sales Documents

Even the most experienced business owners can make mistakes when preparing sales records. These errors can lead to confusion, delayed payments, or even legal issues. By understanding and avoiding common pitfalls, you can ensure your transactions are smooth and professional. Below are some of the most frequent mistakes people make when creating financial documents.

Frequent Errors to Avoid

| Error | Consequence | How to Avoid |

|---|---|---|

| Missing or Incorrect Client Details | Leads to confusion about the recipient and can delay payments. | Double-check client information before finalizing the document. |

| Omitting Important Dates | Payment deadlines may be unclear, causing late payments. | Always include the transaction date, payment due date, and any grace periods. |

| Incorrect Pricing or Calculations | Results in disputes and loss of trust with clients. | Use a calculator or accounting software to verify pricing and totals. |

| Not Including Payment Instructions | Clients may be unsure how to complete the payment, leading to delays. | Clearly specify accepted payment methods, account numbers, and deadlines. |

| Overcomplicating the Design | Can confuse the reader and reduce clarity. | Keep the format clean and organized, with clear headings and sections. |

How to Ensure Accuracy

- Double-check all fields: Ensure that all numbers, dates, and names are correct before sending.

- Proofread for errors: Look over the document for any grammatical or typographical mistakes that could harm professionalism.

- Use automation tools: Accounting software or templates can help prevent errors and streamline the process.

By avoiding these common mistakes and implementing a more structured and attentive approach, you can create clear, accurate, and professional documents that help facilitate smooth business transactions.

Integrating Billing Formats with Your Business

Efficiently connecting your sales documentation process with your business system can drastically improve workflow and reduce errors. By integrating a standardized record creation system into your sales platform, you ensure that each transaction is automatically documented with the right details. This integration can save time, streamline your operations, and ensure consistency across all transactions.

Automation and Workflow Efficiency

Integrating a custom billing format with your sales platform allows for automatic generation of records once a purchase is completed. This eliminates the need for manual data entry and speeds up the process, helping you focus on other aspects of the business. Key details such as product descriptions, customer information, and transaction amounts are pulled directly from the system, ensuring accuracy every time.

- Real-Time Updates: As soon as a sale occurs, the billing document is generated in real time, keeping everything up-to-date.

- Data Accuracy: Integration reduces human errors by pulling data directly from your system, ensuring that pricing, quantities, and customer details are correct.

Seamless Integration with Payment Systems

Another benefit of integrating your billing format is the seamless connection with payment processors. Once the customer completes a purchase, the payment status can be automatically updated in the document, reducing the need for follow-up or confusion. This integration provides both you and your customers with a clear view of the transaction, improving communication and streamlining the payment process.

- Automatic Payment Tracking: Payment status is updated directly in the document, reducing manual tracking efforts.

- Faster Transactions: With integrated systems, the transaction flow becomes smoother, and clients are more likely to receive their records promptly.

By integrating your sales platform with a custom billing system, you streamline both the creation and management of financial documents, leading to improved efficiency and fewer errors in your day-to-day operations.

Automating Billing for Efficiency

Automation can significantly enhance the efficiency of managing financial records by reducing manual work, increasing accuracy, and saving time. When sales documentation is automatically generated, businesses can focus on growth and customer service, instead of spending hours preparing and processing transactions. By integrating automated solutions into your workflow, you ensure that each document is consistently created and delivered on time, with minimal human intervention.

Benefits of Automating the Process

Automating your financial record creation offers several key advantages that can transform your business operations:

- Time Savings: Once the automation system is set up, creating sales records is instantaneous, freeing up valuable time for other tasks.

- Reduced Human Error: Automated systems pull data directly from your sales platform, minimizing the chance of mistakes in calculations, client details, or item descriptions.

- Consistency and Accuracy: Every document is generated in the same format, ensuring a professional and consistent look across all transactions.

- Faster Payment Processing: Automating billing ensures that clients receive their records immediately after purchase, speeding up the payment cycle.

How to Set Up Automation

Implementing an automated system for financial documentation doesn’t have to be complicated. Many modern accounting software and e-commerce platforms offer built-in automation features that integrate seamlessly into your existing workflow. Here’s how you can set it up:

- Choose the Right Software: Select an accounting or sales management tool that offers automation features, such as automatic record generation and payment tracking.

- Integrate Your Sales System: Link your e-commerce platform with your billing software so that transaction data is automatically transferred when a sale is made.

- Customize Your Settings: Set up your preferred format, including fields like product names, prices, taxes, and payment terms, so that every document matches your business requirements.

With automation in place, your financial documentation process will become much more streamlined, accurate, and efficient, allowing you to focus on running your business instead of managing paperwork.

Free vs Paid Billing Formats

When it comes to managing financial records, businesses often face the decision between using free resources or opting for premium solutions. Each option offers distinct advantages and drawbacks, depending on your specific needs and goals. While free options can be a good starting point, paid solutions typically provide enhanced features and customization that can help streamline business operations.

Advantages of Free Billing Formats

Free solutions are a popular choice for businesses just starting out or those with limited budgets. These formats often provide basic functionality to get the job done without additional cost. Below are some of the benefits of using free formats:

- Cost-Effective: Free options allow businesses to manage sales records without any financial investment, which is particularly beneficial for startups or small businesses.

- Easy to Access: Free billing formats are readily available online and can be quickly downloaded or used without complex registration or setup processes.

- Basic Functionality: Many free formats offer essential fields, such as customer information, product descriptions, and pricing, making them suitable for businesses with simple invoicing needs.

Advantages of Paid Billing Formats

Paid billing formats typically offer more robust features and customization options, which can be particularly valuable for growing businesses with more complex needs. Here are some reasons why businesses may opt for a premium solution:

- Customization Options: Paid formats often allow for greater flexibility in design and layout, enabling businesses to create documents that match their brand identity.

- Advanced Features: Premium solutions often include features like automated calculations, payment tracking, and integration with accounting software, saving time and reducing errors.

- Customer Support: With a paid service, businesses typically have access to customer support for troubleshooting and assistance, ensuring smoother operations.

- Scalability: As your business grows, paid formats often offer additional features and customization options to meet evolving needs, such as multi-currency support or more detailed reporting.

In conclusion, the choice between free and paid formats depends on the specific needs of your business. If you’re just starting out or have simple requirements, free formats may be enough. However, for businesses looking to scale or improve their efficiency, investing in a paid solution could provide significant benefits in the long run.

Best Tools for Creating Billing Records

Having the right tools at your disposal is key to simplifying the process of creating financial records. Whether you are a small business owner or running a larger operation, using the right software can save time, reduce errors, and improve the professionalism of your documents. In this section, we’ll explore some of the top tools available to help you create clear, accurate, and well-designed records for your transactions.

Top Software Solutions for Managing Billing

Various tools cater to different business needs, from basic free options to advanced paid software with extensive features. Here are some of the most popular tools for creating professional billing records:

- QuickBooks: This widely-used accounting software offers an intuitive way to generate professional documents, track payments, and manage business finances in one place. It also integrates well with other financial tools, making it suitable for growing businesses.

- FreshBooks: Ideal for small businesses and freelancers, FreshBooks allows users to create personalized records quickly. It also provides features like automated payment reminders, time tracking, and reporting, all designed to save time and improve cash flow management.

- Zoho Invoice: Zoho offers a simple and user-friendly interface, making it a great option for businesses that need to create clean, professional documents without complexity. It also supports automated billing, multi-currency support, and customizable templates.

- Wave: Wave is a free option that’s ideal for small businesses and freelancers. It offers a range of accounting features, including invoice generation, expense tracking, and reporting. Though free, it provides robust functionality and scalability as your business grows.

Free vs Paid Solutions

When choosing the right tool for creating financial records, it’s important to consider the trade-offs between free and paid options:

- Free Tools: Great for those just starting out or with minimal needs. Free tools generally offer basic functionality, which is fine for businesses with straightforward billing processes.

- Paid Tools: Offer more advanced features such as automation, payment tracking, and integration with accounting systems. These tools are typically more scalable and suited for businesses with higher transaction volumes or more complex needs.

Ultimately, the best tool for creating billing records depends on your specific business requirements, including your budget, the complexity of your transactions, and your future growth plans.

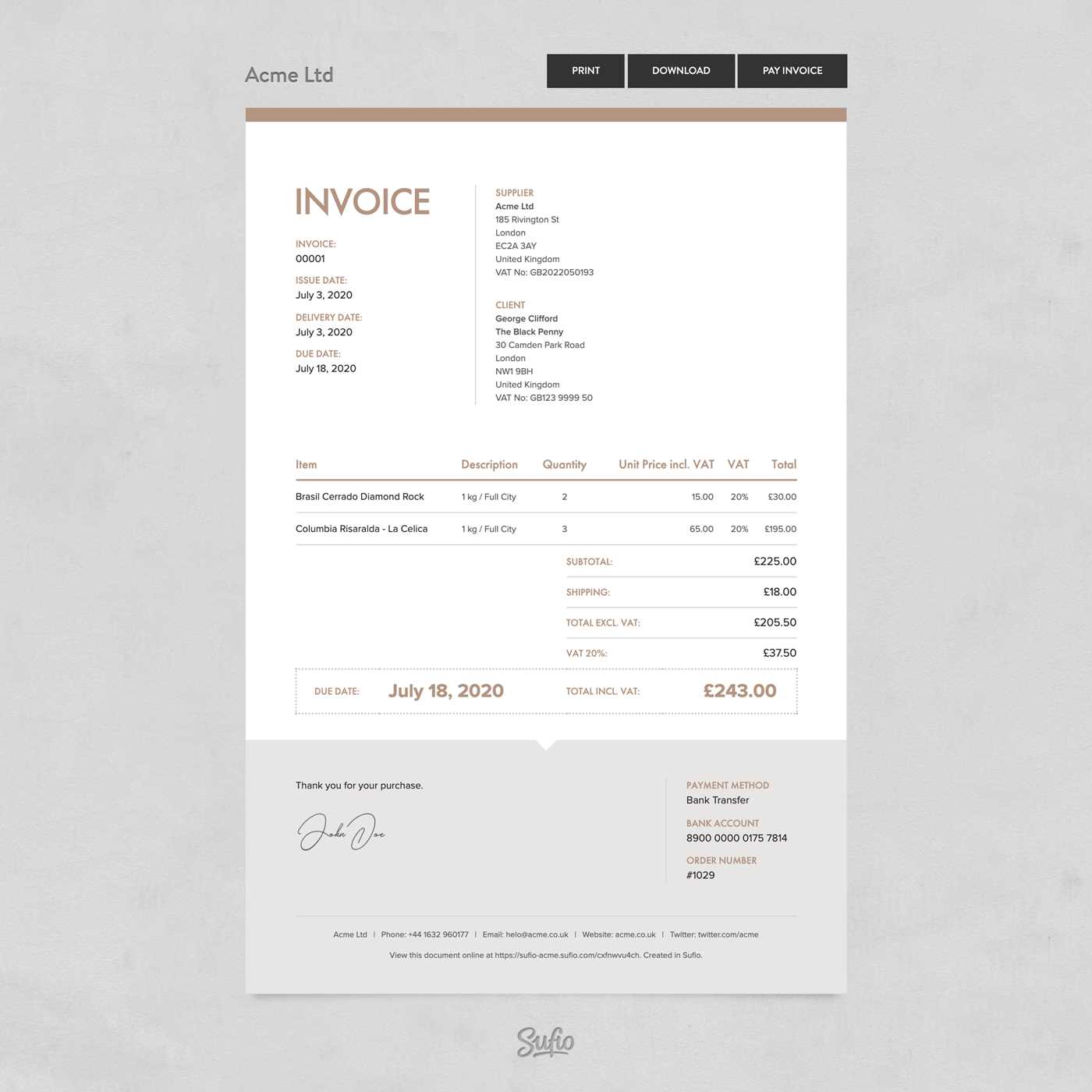

Legal Requirements for E-commerce Billing Records

When conducting business transactions, it’s crucial to ensure that all sales documentation complies with local laws and regulations. Failing to meet legal standards can result in penalties, disputes, and complications with tax authorities. Understanding the essential elements that must appear in your sales records will help ensure you remain compliant while maintaining transparency with your customers.

Key Legal Elements for Compliance

Different countries and regions may have specific requirements, but there are common elements that every billing document should include to avoid legal issues. Below are some of the critical components required for your sales records:

- Business Information: Your company’s legal name, registered address, and contact details should be clearly visible. In some jurisdictions, your business registration or VAT number may also be required.

- Customer Details: Depending on the region, customer information such as name, address, and contact details may need to be included to verify the transaction.

- Unique Document Number: Every billing record should have a unique identifier, which is often a serial number or a reference number, to track and differentiate each transaction.

- Date of Transaction: Both the date of sale and the due date for payment should be included to clarify the time frame of the transaction.

- Itemized List of Products/Services: A clear description of each product or service provided, along with the quantity and unit price, ensures transparency and helps with tax calculations.

- Tax Information: If applicable, tax rates and the total amount of tax charged must be included in the document, particularly if your business is VAT-registered or subject to similar tax regulations.

- Total Amount Due: The final amount to be paid by the customer, including any additional fees, taxes, or discounts, should be clearly displayed.

Specific Regional Requirements

While the above elements are generally applicable, certain countries may have additional legal requirements for sales documentation. For instance:

- European Union: Businesses must include their VAT number, along with the VAT breakdown for each item sold.

- United States: States may have varying requirements for sales tax, with some needing to specify the tax rate applied in each transaction.

- Australia: Tax invoices must show the GST amount separ

How to Track Payment for Sales Records

Efficiently tracking payments for your transactions is crucial for maintaining accurate financial records and ensuring cash flow. Whether you are dealing with one-time payments or recurring transactions, it’s important to have a system in place that allows you to easily monitor the status of each payment. This section will guide you through the essential steps to track payments effectively, ensuring you never lose track of a pending or completed payment.

Steps to Track Payment Status

To keep your financial records organized and ensure payments are received promptly, follow these steps:

- Assign Unique Identifiers: For each transaction, assign a unique reference number or code. This will help you easily track payments, link them to specific sales, and avoid confusion.

- Update Payment Status: As payments are made, update the status of each record to reflect whether it is paid, partially paid, or still outstanding. This provides you with a clear overview of all financial transactions.

- Set Payment Due Dates: Including a due date on your documents helps both you and your customers know when payments are expected. This also allows you to easily spot overdue payments.

- Track Payment Methods: Keep a record of how payments are made (e.g., bank transfer, credit card, check, etc.). This information will help you reconcile your financial statements and keep track of different payment sources.

Tools for Payment Tracking

There are several tools available that can automate the payment tracking process, making it easier and more accurate:

- Accounting Software: Many accounting platforms, such as QuickBooks and Xero, offer integrated features that automatically track and update the status of payments. These tools can also send reminders for overdue payments and generate reports on payment history.

- Spreadsheets: For smaller businesses, spreadsheets can serve as a simple but effective way to track payments. By maintaining a detailed log with columns for payment status, date, and amount, you can easily monitor your financial flow.

- Payment Gateways: Payment processors such as PayPal, Stripe, and Square often provide detailed reports on payments received. You can use these to track payments in real-time and reconcile them with your records.

Consistently tracking payment statuses helps maintai

Improving Your Customer Experience with Billing Records

Creating a seamless and positive experience for your customers goes beyond just offering great products or services; it also involves how you manage the transactional side of your business. By providing clear, professional, and easy-to-understand sales documentation, you can enhance your customers’ overall experience, build trust, and encourage repeat business. Well-structured billing records not only ensure accuracy but also serve as a touchpoint for customer communication and satisfaction.

How Professional Billing Can Enhance Customer Experience

A well-crafted sales document can significantly improve the relationship between you and your customers. Here are some ways in which an effective system for managing billing can benefit your customer interactions:

- Transparency: Clear breakdowns of products, services, taxes, and total costs help customers understand exactly what they are paying for, reducing confusion and potential disputes.

- Prompt Delivery: Timely delivery of accurate sales records allows customers to have immediate access to proof of purchase and payment details, which is particularly important for refunds, returns, and warranty claims.

- Customization: Personalizing your billing documents with your brand’s logo and contact information creates a professional image, strengthening your brand identity and fostering customer trust.

- Professionalism: A well-organized and properly formatted record instills confidence in your customers, showing them that you are a reliable and credible business.

Key Elements for Customer-Friendly Billing

To create a better experience for your customers, ensure your billing records include the following customer-focused features:

Element Description Clear Itemization Provide a detailed list of purchased items or services, including quantities, unit prices, and any applicable discounts. This helps customers understand the charges and ensures they are being billed accurately. Payment Information Include payment methods and confirmation of received payments. This reassures customers that their transactions have been processed successfully and securely.