Ultimate Online Shop Invoice Template for Efficient Billing

Managing financial transactions efficiently is crucial for any business. When you sell products or services, providing customers with clear and professional receipts is not just a necessity but also a reflection of your brand’s credibility. A well-structured document that outlines the details of each sale can make a significant difference in both customer trust and internal record-keeping.

Creating consistent and error-free payment statements ensures smooth operations. These documents can be customized to match your business style and legal requirements while simplifying the tracking of payments. With the right approach, generating these essential papers can be quick and straightforward, freeing up time for other aspects of your business.

In this guide, we’ll explore how to develop a reliable solution for issuing payment records that can be easily adapted to various business needs. Whether you’re looking to improve efficiency, maintain professionalism, or stay compliant with regulations, the right system will make a world of difference.

Why You Need an Invoice Template

In any business, clear communication with customers about payments is essential. When transactions occur, providing a professional and accurate record not only helps in maintaining trust but also ensures that both parties are on the same page regarding the exchange. Having a structured document ready for each sale allows you to manage your finances more efficiently and avoid errors in billing.

A standardized payment record offers consistency, making it easier to track sales, apply taxes, and manage outstanding amounts. It simplifies the process of organizing financial data, which is particularly important when managing multiple transactions. Additionally, using a pre-designed structure reduces the risk of overlooking important details and helps meet legal or regulatory requirements in some regions.

By using a ready-made solution, you can save time on formatting and ensure that each document reflects your brand’s professionalism. This can improve customer experience and streamline the entire payment process. In essence, having a reliable and customizable document ensures that you’re always prepared, regardless of the size or complexity of the transaction.

Key Features of Online Invoice Templates

When creating a document for payment requests, having the right structure can make all the difference. A well-designed form ensures that all necessary details are included, making the process quicker and reducing the likelihood of errors. The most effective solutions allow for customization while maintaining essential elements that keep the records clear and professional.

Customizability and Flexibility

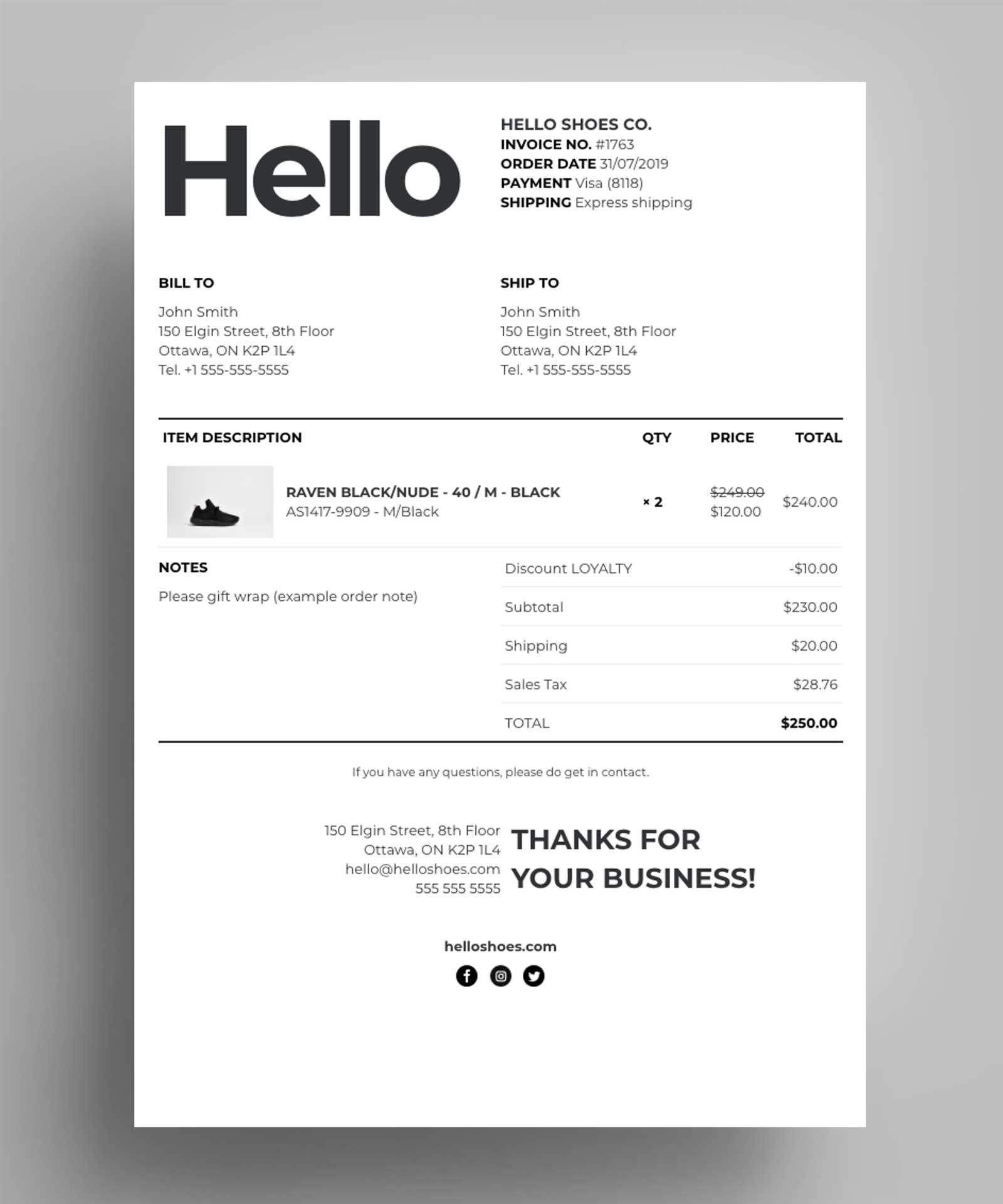

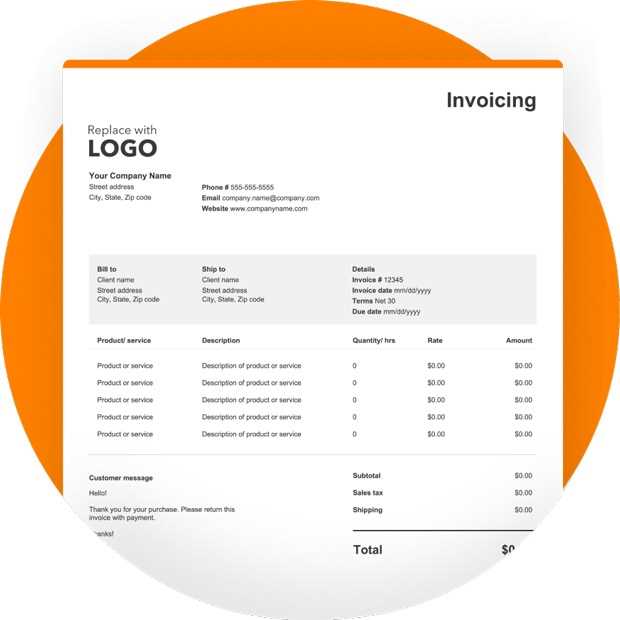

A key feature of any good document format is the ability to personalize it to match your brand and business needs. Custom fields for company logo, contact information, or specific payment terms allow for easy alignment with your business’s identity. These options give you full control over how your transactions are presented to clients while ensuring that all legal requirements are met.

Automated Calculations and Accuracy

Another essential feature is the automation of calculations, including tax rates, discounts, and totals. By integrating these elements, the document reduces human error and saves valuable time. Automatic updates for subtotals and final amounts ensure accuracy every time a new sale is recorded, preventing discrepancies that could lead to confusion or financial issues.

How to Create an Invoice for Your Business

Creating a detailed and accurate document for each transaction is crucial for maintaining clear financial records. Whether you’re selling goods or offering services, this document serves as both proof of purchase and a request for payment. The process should be straightforward and involve key details that protect both you and your customer.

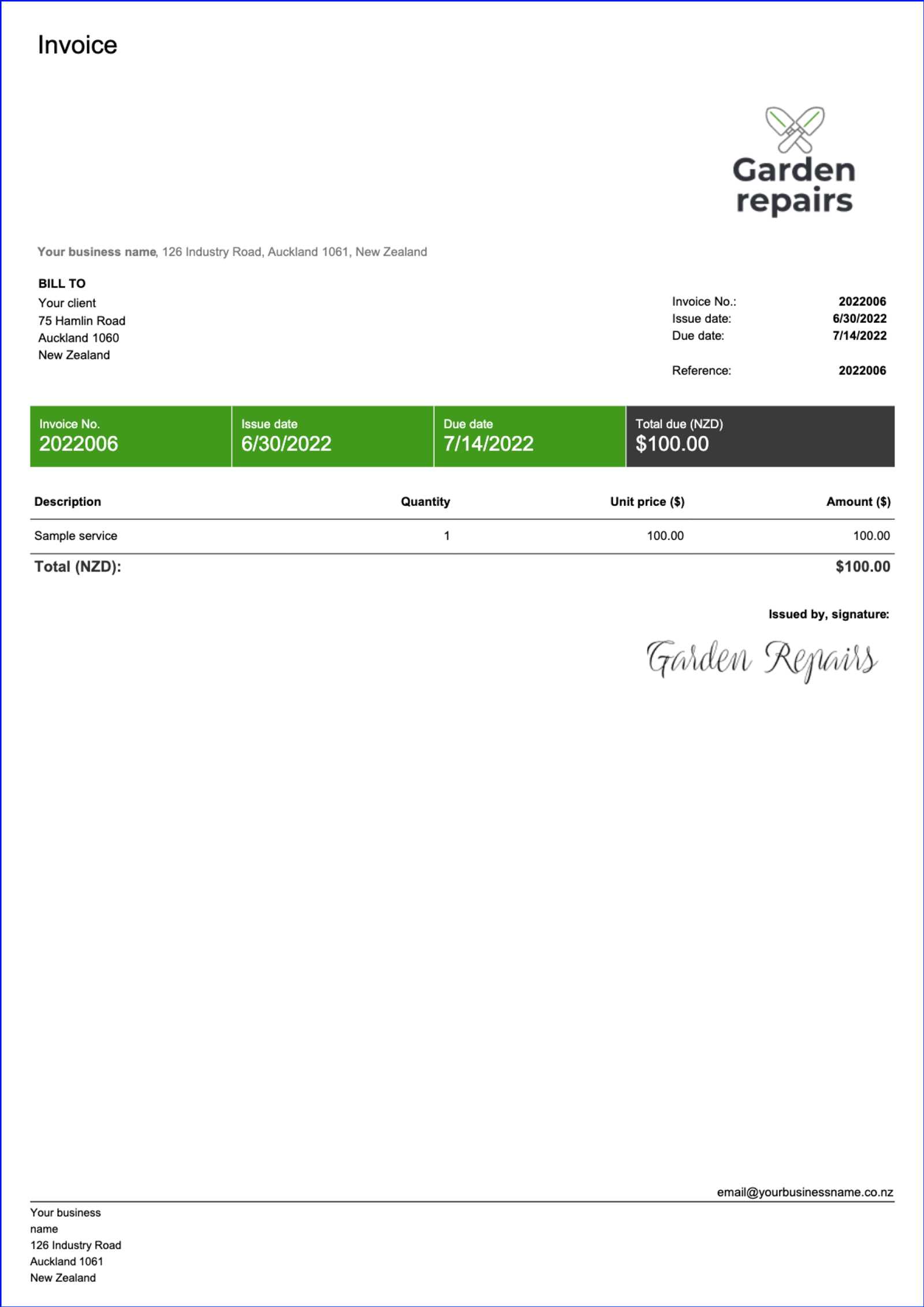

Start by including essential information such as your business name, address, and contact details. This ensures that your customer can easily reach you if needed. Next, list the items or services provided, along with their respective prices and any applicable taxes or discounts. The final total should be clearly stated, and you can also include payment instructions or terms to avoid confusion.

Additionally, a unique reference number should be assigned to each transaction for organizational purposes. This helps track payments and follow up on any outstanding balances. Finally, make sure to review the document for accuracy before sending it to the client to ensure that all details are correct and professionally presented.

Choosing the Right Template for Your Business

Selecting the right format for your payment documentation is essential to ensuring smooth transactions and maintaining professionalism. The right choice can help streamline your processes and present your business in a polished light. There are various options available, each suited to different business types and needs, so it’s important to understand what features you require before making a decision.

Consider the following factors when choosing the right format:

- Business Type: Different industries may require specific fields or details. For example, a service-based business may need space for hourly rates, while a product-based business will require itemized lists of goods.

- Customization Needs: If you want your document to reflect your brand, choose a format that allows customization of colors, logos, and contact information.

- Legal Compliance: Ensure the format you choose includes fields necessary for tax calculations and regulatory requirements specific to your region.

- Ease of Use: Look for formats that are user-friendly and minimize the time spent on each transaction. Automated calculations and easy-to-fill fields can save significant time.

Once you’ve considered these factors, you’ll be better equipped to find a solution that suits your business needs and enhances your overall workflow.

Customizing Your Invoice for Branding

Personalizing your payment documents is an excellent way to reinforce your brand identity and create a memorable experience for your customers. A well-branded document not only provides essential transaction details but also communicates professionalism and trustworthiness. Customizing the appearance of these records allows your business to stand out and align with your overall marketing strategy.

Start by incorporating your business logo, using brand colors, and selecting fonts that reflect your company’s style. This helps create a cohesive look across all customer-facing materials, from your website to physical packaging. You can also add a personalized message or tagline that aligns with your brand’s voice, making the document feel more personal and engaging.

In addition to aesthetics, make sure the structure of your payment document is clear and easy to follow. A clean, professional layout ensures that all critical information–such as the payment due date, total amount, and contact details–is easy to find. This combination of design and functionality helps strengthen your brand’s reputation for reliability and attention to detail.

Top Benefits of Digital Invoices

Switching to electronic records for transactions offers several advantages over traditional paper-based methods. With digital solutions, you can automate, streamline, and improve various aspects of your billing process. This approach not only saves time but also enhances the accuracy and security of financial documentation.

One of the primary benefits is efficiency. Digital records can be generated, sent, and tracked instantly, eliminating delays associated with printing and mailing. This rapid processing speeds up the entire workflow, from creation to payment, ensuring faster cash flow for your business.

Additionally, electronic formats help reduce the risk of human error. Automatic calculations for taxes, totals, and discounts ensure accuracy, preventing costly mistakes. Moreover, these digital records are easier to store and retrieve, providing a more organized system for record-keeping. You can quickly access past transactions, which simplifies audits, tax filings, and financial reporting.

Another significant benefit is environmental sustainability. Reducing the need for paper not only lowers your business’s environmental impact but also cuts down on the cost of printing and physical storage. Overall, adopting digital documents makes your processes more eco-friendly and cost-effective, while increasing both reliability and convenience.

How to Use Invoices for Record Keeping

Proper record-keeping is essential for every business, as it ensures you maintain accurate financial data for budgeting, tax filing, and overall business management. Transaction documents play a key role in organizing sales information, tracking payments, and keeping your books up to date. By systematically storing and reviewing these documents, you can easily monitor cash flow and stay compliant with legal regulations.

Organizing and Storing Transaction Records

To effectively use payment documents for record-keeping, it’s crucial to establish a clear organization system. One effective method is categorizing them by date or transaction type, making it easy to search and retrieve specific records when needed. Using digital files can simplify this process, allowing for easy backup and access on various devices.

Tracking Payment Status and Balances

Another important aspect is using these documents to track whether payments have been received or if any are still pending. By maintaining a detailed log of each transaction, you can easily identify outstanding amounts and follow up with clients promptly. A simple table or spreadsheet can help you stay on top of this process.

| Transaction Date | Customer Name | Amount | Status | Due Date |

|---|---|---|---|---|

| 01/10/2024 | John Doe | $250 | Paid | 01/15/2024 |

| 02/10/2024 | Jane Smith | $300 | Pending | 02/15/2024 |

By consistently updating this log and referencing your transaction documents, you can maintain accurate and easily accessible records that support sound financial management and decision-making.

Understanding Invoice Numbering and Organization

Maintaining a logical and systematic approach to numbering and organizing your transaction records is crucial for both internal tracking and external auditing. Properly structured numbering not only helps identify and locate documents quickly, but it also ensures compliance with tax regulations and financial reporting standards. An organized system can prevent confusion, reduce errors, and improve your overall business efficiency.

Why Numbering Matters

Numbering your documents in a clear and consistent way allows you to keep track of all transactions easily. A well-organized numbering system also facilitates a smoother workflow, helping you locate specific records quickly when needed. Here are some key reasons why numbering is important:

- Prevents Duplication: A unique reference number ensures that no two documents are the same, preventing mix-ups.

- Supports Record Integrity: Sequential numbering provides a clear audit trail that can be followed in case of disputes or audits.

- Improves Tracking: An organized system helps you monitor outstanding payments, refunds, and other financial activities efficiently.

Best Practices for Organizing Documents

Organizing your transaction records effectively can save you time and effort. Here are a few best practices for keeping your records well-organized:

- Use Sequential Numbers: Assign each document a unique, consecutive number, making it easier to track transactions and maintain order.

- Group by Time Period: Sort records by date, month, or quarter to streamline the retrieval of specific time frames.

- Maintain a Digital Log: If you’re using electronic records, ensure your system is searchable and backed up regularly for security.

By adhering to these best practices, you can ensure that your records are easy to manage, secure, and compliant with any necessary regulations. A clear numbering and organizational system provides both operational efficiency and peace of mind for your business.

How to Add Taxes and Discounts

Including taxes and discounts in your payment documents is an essential step in ensuring that your transactions are accurate and compliant with local regulations. These elements not only affect the final amount owed but also demonstrate transparency in your pricing structure. Knowing how to correctly apply taxes and discounts ensures that your business remains fair and professional while helping you maintain accurate financial records.

Adding Taxes to the Total

Tax calculation is a crucial aspect of pricing, and it varies depending on the location and type of product or service being sold. To add taxes correctly, you must first determine the applicable tax rate. Once you know the rate, you can apply it to the pre-tax total of the goods or services provided. It’s important to specify the tax amount separately so that customers understand exactly what they are paying for.

- Step 1: Identify the applicable tax rate based on your region and product type.

- Step 2: Calculate the tax by multiplying the subtotal by the tax rate (e.g., subtotal × tax rate = tax amount).

- Step 3: Add the tax amount to the subtotal to get the final total.

Applying Discounts to the Subtotal

Discounts can be applied in various forms, such as percentage-based or fixed amounts. You can offer discounts to attract customers or reward loyal clients. To apply a discount, you must first determine the discount type (e.g., 10% off or $20 off). Then, subtract the discount from the subtotal before calculating any taxes, as the discount is applied to the base amount.

- Step 1: Decide on the discount type and calculate the amount to be deducted.

- Step 2: Subtract the discount from the subtotal.

- Step 3: Calculate taxes on the discounted amount and add it to the final total.

Properly calculating taxes and discounts ensures that the transaction is clear, accurate, and fair for both your business and your customers. It also helps you comply with tax regulations and provides customers with transparent pricing.

Ensuring Legal Compliance with Invoices

For businesses, adhering to local and international regulations is a crucial aspect of managing transactions. Properly structured documents that detail each sale not only ensure smooth business operations but also help maintain compliance with tax laws and consumer protection rules. Failing to comply with legal standards can result in penalties, audits, or even the loss of credibility, so it’s essential to incorporate all required information in every document.

Key elements that must be included to ensure legal compliance include the business’s tax identification number, itemized descriptions of goods or services, and the correct application of taxes. Additionally, depending on the region, certain consumer rights and payment terms need to be clearly stated. Below is an example of how these key details should be structured in your transaction records:

| Field | Required Information |

|---|---|

| Tax Identification Number | Your business’s unique tax ID number or VAT registration number, if applicable. |

| Business Information | Legal name, address, and contact details of your business. |

| Itemized List of Products or Services | Clear descriptions of each item or service, including quantities and prices. |

| Taxes and Rates | Accurate tax rates applied to the sale, based on your location and type of product or service. |

| Terms and Payment Due Date | Clear payment terms, including deadlines for payment and accepted methods. |

By including these essential details, your transaction records not only provide transparency to your customers but also protect your business from potential legal issues. Regularly reviewing and updating your records to comply with changing regulations is vital to staying on top of your legal responsibilities.

Common Mistakes in Invoice Creation

Creating accurate transaction documents is crucial for maintaining smooth business operations, but mistakes are more common than one might think. Even small errors in these records can lead to confusion, delays in payment, or even legal issues. Understanding the most frequent mistakes can help you avoid them and ensure your records are always clear, professional, and compliant.

Some common mistakes include failing to include important details such as the transaction date, missing contact information, or inaccurate calculations. These omissions can result in disputes or payment delays, which ultimately affect your cash flow. Below are a few frequent errors to watch out for:

- Incorrect or Missing Contact Information: Not including your business’s correct name, address, and contact details can lead to confusion and make it harder for clients to reach you.

- Wrong Tax Rates: Applying an incorrect tax rate or failing to account for tax entirely can result in compliance issues or customers paying the wrong amount.

- Lack of Clear Payment Terms: Not specifying when payment is due or what methods are accepted can lead to delays or disputes.

- Inaccurate Item Descriptions: Vague or unclear descriptions of the goods or services provided can confuse customers and result in questions or dissatisfaction.

By carefully reviewing each document before sending it, you can avoid these common pitfalls and maintain professionalism in all of your transactions.

Improving Payment Collection with Invoices

Effective payment collection is critical for maintaining healthy cash flow in any business. By using well-structured transaction documents, you can streamline the payment process, reduce delays, and ensure timely settlement of accounts. A clear, professional payment request not only sets expectations but also acts as a reminder to customers about their financial obligations.

Here are a few strategies to improve payment collection by using detailed records:

- Clear Payment Terms: Always specify when payments are due, what methods are accepted, and any penalties for late payment. This helps avoid confusion and sets clear expectations upfront.

- Send Reminders: Include a due date and follow up promptly if payments are overdue. Automating reminders can help ensure timely payment without the need for manual tracking.

- Offer Multiple Payment Options: Make it easier for your customers to pay by offering various payment methods, such as credit cards, bank transfers, or digital wallets.

- Detailed Descriptions: Clearly list the products or services, along with their individual costs and any applicable taxes. Transparency ensures that customers understand exactly what they are paying for and can avoid disputes.

- Early Payment Incentives: Offering a small discount for early payment can encourage customers to pay sooner and help improve cash flow.

By incorporating these strategies into your business processes, you can improve the speed and reliability of your payment collections. Consistent communication and clear documentation are key to keeping everything organized and ensuring that payments are received on time.

Integrating Invoices with Your Online Store

Seamlessly linking your sales records to your e-commerce platform can greatly enhance operational efficiency, reduce manual errors, and provide a smoother experience for your customers. By automating the process of generating and sending transaction records directly from your store, you can save time, ensure accuracy, and keep track of all orders in real-time. Integration ensures that each sale is properly documented, and relevant information is updated automatically.

Here’s how you can integrate transaction records into your e-commerce system:

| Step | Action | Benefit |

|---|---|---|

| 1. Choose the Right Platform | Select an e-commerce platform or plugin that supports automated record generation. | Reduces manual work and ensures seamless integration. |

| 2. Enable Automatic Record Generation | Configure the system to generate transaction records after every sale. | Speeds up the process and ensures every sale is documented immediately. |

| 3. Sync Customer Information | Ensure that customer details, such as name and contact info, are automatically populated in each record. | Minimizes errors and ensures accurate documentation. |

| 4. Include Payment Details | Integrate payment gateway data to automatically display payment status and method. | Ensures that payment details are clearly outlined for both parties. |

| 5. Automate Delivery Confirmation | Link the shipping and delivery information to the record for accurate tracking. | Provides customers with detailed transaction and shipping information in one document. |

By integrating these systems, you ensure that every sale is properly documented and that both you and your customers have easy access to important transaction details. This not only boosts efficiency but also improves transparency and trust in your business.

Free vs Paid Invoice Templates for Shops

When choosing a structure for your transaction records, businesses often face the decision between using free or paid options. Both have their advantages, but understanding the differences can help you make an informed choice based on your needs, budget, and desired features. Free solutions may offer basic functionality, while paid options tend to provide more advanced features and customization capabilities.

Benefits of Free Templates

Free options are attractive because they come with no cost and can be a good starting point for small businesses or those just getting started. While they may have limitations, they still offer essential functions for generating simple transaction records.

- No Cost: The most obvious advantage is that they are free to use, making them a budget-friendly option for new businesses.

- Easy to Use: Many free solutions are simple and intuitive, making them easy to use even for beginners.

- Basic Features: Free options generally offer the fundamental features needed to create basic transaction records, such as item descriptions and amounts.

Advantages of Paid Templates

Paid options offer more advanced features and greater customization, allowing businesses to create professional, branded documents. These solutions typically come with additional tools to streamline the process and provide more control over the design and structure of the records.

- Customization: Paid solutions often allow for deeper customization, such as adding logos, choosing fonts, or adjusting layout and color schemes to align with your brand.

- Advanced Features: These may include automatic tax calculations, integration with accounting software, and features like recurring billing or multi-currency support.

- Professional Appearance: Paid options tend to offer more polished and professional designs, which can enhance your brand’s image and customer trust.

- Customer Support: Many paid services include customer support, making it easier to resolve issues or troubleshoot when needed.

Ultimately, the choice between free and paid options depends on your business’s specific needs. If you have a limited budget and only require basic functionality, free templates may be sufficient. However, if you need more customization, advanced features, or professional-level tools, investing in a paid solution might be worth the cost.

Best Tools for Generating Invoices

Choosing the right software or platform for creating transaction documents can significantly improve efficiency and accuracy in your business. Whether you need a simple solution for small-scale operations or a comprehensive system with advanced features for a larger enterprise, there are many tools available to help automate the process. Below, we explore some of the best tools for generating professional and error-free records, each offering unique features suited to different needs.

1. QuickBooks

QuickBooks is one of the most popular accounting platforms that offers a robust solution for creating detailed transaction records. It provides a user-friendly interface, allowing businesses to generate professional documents, track payments, and integrate seamlessly with accounting tools. Its features include automatic tax calculations, customizable layouts, and the ability to send invoices directly to customers via email.

- Pros: Easy to use, integrates with other accounting tools, supports multiple currencies.

- Cons: Monthly subscription required, may be overkill for small businesses with simple needs.

2. FreshBooks

FreshBooks is an intuitive invoicing and accounting software aimed at small businesses and freelancers. It provides an easy-to-navigate platform for creating professional-looking documents. FreshBooks also includes time tracking, expense management, and the ability to accept online payments directly from the document.

- Pros: Simple interface, time tracking integration, automated payment reminders.

- Cons: Limited customization options for more complex needs, higher pricing for additional features.

3. Zoho Invoice

Zoho Invoice offers a flexible, cloud-based solution designed to streamline the process of creating and managing transaction documents. With its customizable templates, automated reminders, and integration with other Zoho products, this tool is ideal for businesses looking for a cost-effective solution to handle invoicing and accounting needs.

- Pros: Free tier available, customizable templates, supports multi-currency invoicing.

- Cons: Limited functionality in the free version, requires integration with other Zoho tools for advanced features.

Each of these tools offers unique strengths depending on the size and complexity of your business. Whether you need a simple and cost-effective solution or an advanced, all-in-one platform, these tools provide reliable ways to generate professional transaction records and keep your business operations running smoothly.

How to Save Time with Automated Invoices

Automation has become a game-changer for businesses looking to streamline their administrative tasks. By automating the process of creating and sending transaction records, you can save valuable time that would otherwise be spent on manual entry, calculations, and follow-ups. This not only boosts efficiency but also reduces human error, ensuring that every transaction is recorded accurately and promptly.

Using automated systems, businesses can generate customized transaction documents instantly, without having to manually input data for each sale. The process can be set up to automatically include customer details, payment amounts, taxes, and even payment reminders, all based on predefined settings. This reduces the need for repetitive tasks and frees up time to focus on growing your business.

Automating these tasks can also help maintain consistency across all your records. With automation, you ensure that every document follows the same format and includes all necessary details, which improves professionalism and reliability. In addition, many automated systems integrate directly with your payment gateways and accounting software, further reducing the need for manual intervention and simplifying your financial reporting process.

Overall, adopting automated systems to manage your transaction records is a smart way to save time, reduce errors, and enhance your operational efficiency, allowing you to focus on more strategic aspects of your business.