How to Use an Online Service Invoice Template for Professional Billing

Efficient billing is crucial for maintaining a smooth workflow and ensuring timely payments. With the right tools, creating and managing invoices can become a straightforward task, saving both time and effort. By using a well-structured document, businesses and freelancers can ensure that all necessary details are clearly outlined, minimizing errors and confusion.

One of the most effective ways to simplify this process is by adopting pre-designed billing documents that can be easily tailored to your specific needs. These ready-to-use formats offer a professional appearance, ensuring consistency across all transactions. Whether you are a small business owner or a freelancer, having a reliable billing structure can improve your credibility and efficiency.

With numerous options available, choosing the right kind of document to fit your needs is essential. It should reflect your brand while also adhering to legal standards. A proper billing structure doesn’t just help you keep track of payments, but also serves as a record of your professional interactions.

Online Service Invoice Template Benefits

Using a well-organized billing document offers numerous advantages, especially when it comes to efficiency, professionalism, and accuracy. With a pre-built structure, businesses can quickly generate customized records for their transactions, ensuring that all the required information is included without missing any important details. This streamlined approach can reduce manual errors, save time, and enhance communication between clients and service providers.

Moreover, these documents are easy to adjust to fit your specific needs, helping you maintain a consistent format across different projects. From freelancers to larger enterprises, everyone can benefit from a uniform and professional appearance in their financial records. Let’s take a closer look at the key benefits:

| Benefit | Description |

|---|---|

| Time-saving | Pre-built formats allow you to quickly create and send payment requests without starting from scratch. |

| Professional Appearance | Using a consistent layout adds credibility to your business communications and builds trust with clients. |

| Customization | These records can be easily tailored to your specific needs, ensuring they align with your branding and project details. |

| Accuracy | Predefined fields help eliminate common errors, ensuring all required information is included and properly formatted. |

| Record Keeping | Digital formats make it easy to store and retrieve past records, improving your financial organization. |

By adopting a structured document, you not only improve your internal workflow but also enhance your professional image in the eyes of your clients. The benefits go beyond simple convenience, contributing to better financial management and a more seamless business operation overall.

Why You Need an Invoice Template

Creating consistent, professional billing documents is essential for any business or freelance operation. A well-organized billing record ensures that all necessary information is captured, allowing for accurate tracking of payments and simplifying financial management. Without a standardized format, billing can quickly become disorganized, leading to confusion, delays, or even missed payments. Implementing a reliable structure for these records can save valuable time and reduce errors.

Ensure Accuracy and Consistency

One of the key advantages of using a pre-designed document is that it helps maintain consistency across all financial communications. A uniform layout guarantees that all the required fields are filled in every time, from client details to payment terms. This ensures that you never forget important information, reducing the risk of errors and improving the clarity of your transaction records.

Simplify the Billing Process

Having a predefined structure eliminates the need to create each record from scratch. With a template in place, you can easily input the necessary details and generate invoices in just a few minutes. This not only speeds up the billing process but also frees up time for other essential tasks, allowing you to focus more on delivering your services or products.

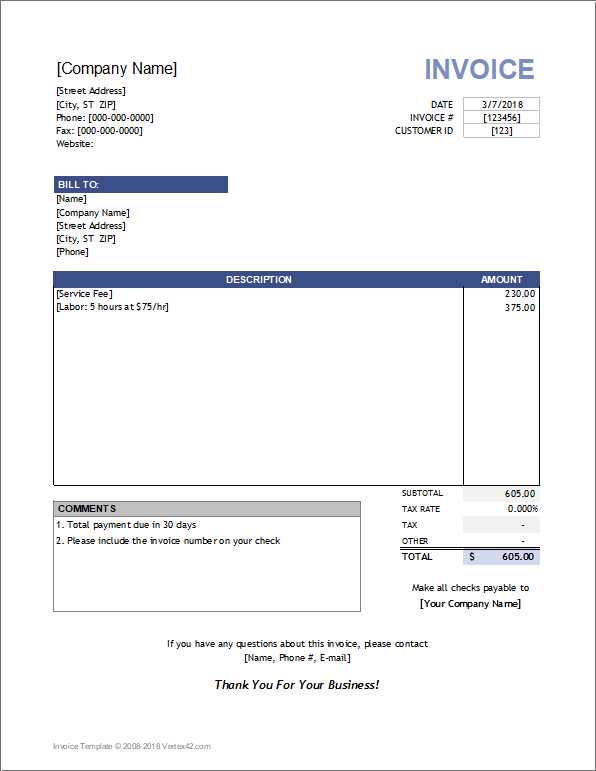

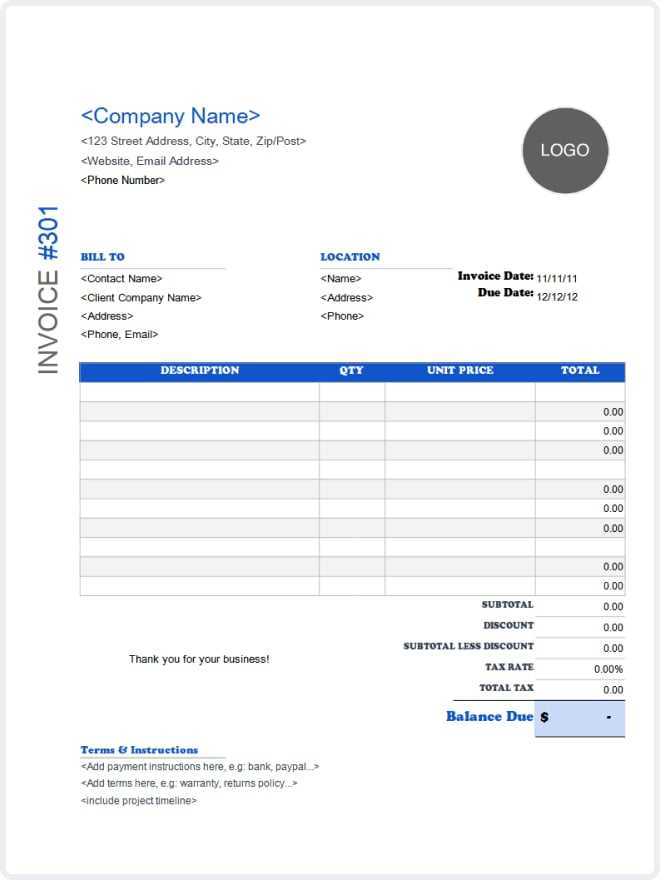

Customizing Your Service Invoice

Personalizing your billing documents is essential for creating a professional and cohesive experience for your clients. By customizing your financial records, you can align them with your business’s branding and specific needs, ensuring that every detail is tailored to reflect your unique style. Customization allows you to create a more impactful and memorable impression, while also ensuring that all relevant information is easily accessible and clear.

Here are some key elements to consider when customizing your billing documents:

- Branding Elements – Add your logo, brand colors, and contact information to make your documents instantly recognizable and consistent with your business’s visual identity.

- Payment Terms – Clearly specify your payment terms, such as due dates, late fees, or discounts for early payments, to avoid misunderstandings with clients.

- Service Descriptions – Customize the sections for detailing the services or products provided, ensuring that the descriptions are accurate and comprehensive.

- Client Details – Include client-specific information, such as their business name, address, and contact person, ensuring that all communication remains professional.

- Additional Notes – Include any important instructions or messages to the client, such as thank-you notes or reminders for future engagements.

Customizing these elements helps create a streamlined, consistent approach to managing transactions, giving you full control over how your business is presented to your clients.

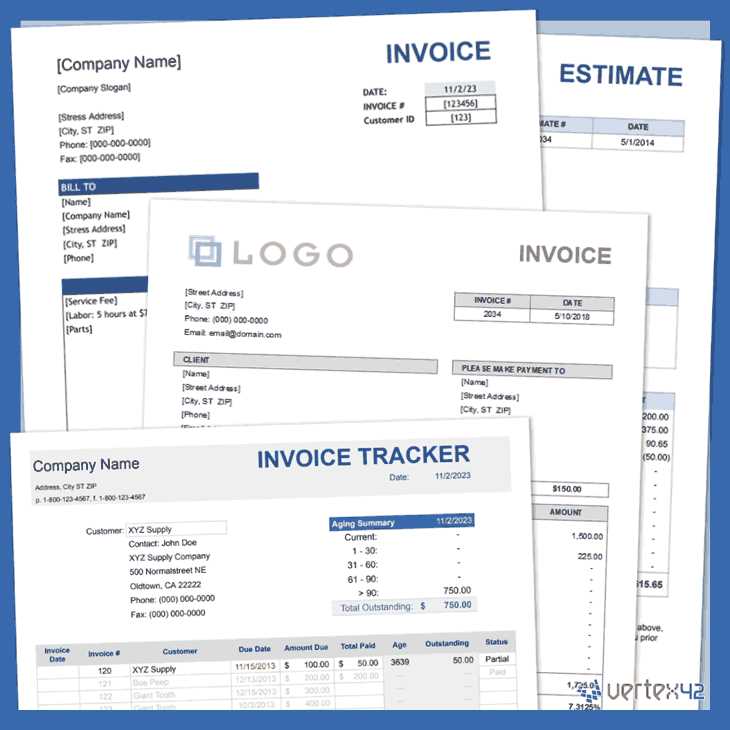

Choosing the Right Template for You

Selecting the appropriate billing document format is crucial for maintaining professionalism and meeting the specific needs of your business. The right layout not only ensures that all relevant information is included but also aligns with your branding and client expectations. With various options available, it’s important to assess your requirements before making a decision, as the wrong choice could complicate your process or leave out key details.

Factors to Consider

Before choosing a layout, consider the following factors to determine the best fit for your needs:

- Business Size and Type – A small freelancer may need a simpler format, while a larger company might require a more complex structure to track different services, multiple clients, or payment terms.

- Branding – Your layout should reflect your business’s identity. If your brand is modern and creative, opt for a visually appealing design; for more formal industries, a clean, simple layout might be better.

- Customization Needs – Some formats offer more flexibility than others, allowing you to add extra fields or adjust the structure according to your specific services or preferences.

- Client Preferences – If your clients expect detailed, itemized records, choose a format that allows for a comprehensive breakdown of services provided and costs incurred.

Comparison of Options

Here’s a quick comparison of some common layout types:

| Layout Type | Best For | Key Features |

|---|---|---|

| Simple Layout | Freelancers, small businesses | Clear, minimal design, easy to fill in, good for basic transactions |

| Detailed Layout | Medium to large businesses, contractors | Multiple sections, itemized billing, space for project details |

| Customizable Layout | Businesses with complex needs, long-term projects | Highly flexible, adjustable fields, tailored to specific business needs |

By evaluating these factors and options, you can choose the most suitable format that will help you efficiently manage transactions and present a professional image to your clients.

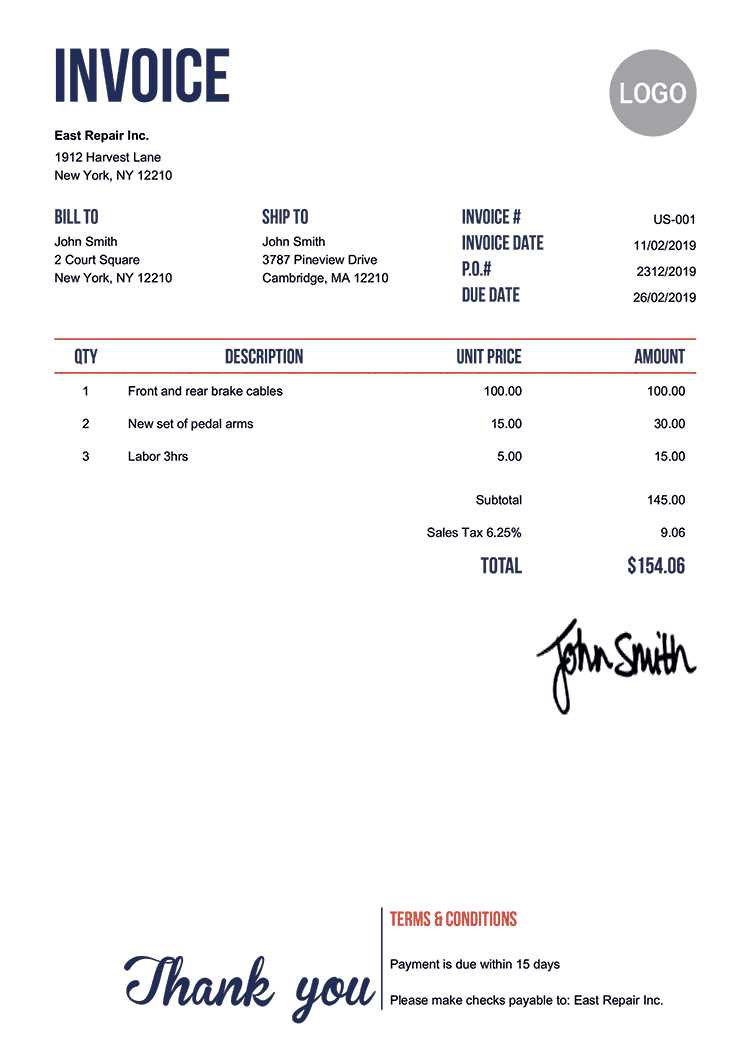

Essential Elements of an Invoice

For a financial document to be both effective and professional, it must contain all the necessary information to ensure clarity and facilitate timely payments. A well-structured record should be easy to read, accurately reflect the transaction, and be legally compliant. By including key components, you can ensure that both you and your client have a clear understanding of the agreement and payment terms.

Key Information to Include

There are several essential details that should be present in every financial document to ensure smooth processing and proper record-keeping:

- Business Information – Your company name, logo, and contact details should be clearly visible at the top of the document.

- Client Information – The client’s name, address, and contact information should also be included for proper identification and correspondence.

- Unique Reference Number – Every record should have a unique identifier to help both parties track and refer to the transaction easily.

- Details of Goods or Services – A clear description of what was provided, including the quantities, rates, and any other relevant information related to the work performed or products delivered.

- Payment Terms – Clear terms regarding due dates, late fees, and discounts for early payments should be specified.

- Total Amount Due – The total sum payable, including taxes, discounts, or any additional charges, should be clearly highlighted.

Additional Information for Clarity

In addition to the basics, there are a few optional elements that can enhance the clarity and professionalism of your billing records:

| Element | Purpose |

|---|---|

| Notes or Special Instructions | Provides space for any additional comments or instructions to the client, such as delivery details or follow-up actions. |

| Payment Methods | Specify the accepted payment methods, such as bank transfer, PayPal, or credit card, to simplify the process for your client. |

| Due Date | Indicates the final date by which payment should be received to avoid late fees or penalties. |

By including these essential elements, you can ensure that your financial documents are comprehensive, clear, and professional, making the payment process smoother for both parties involved.

How to Create a Service Invoice

Creating a billing document involves several key steps that ensure both clarity and professionalism. Whether you are a freelancer, a small business owner, or part of a larger enterprise, knowing how to effectively craft a financial record is essential. The process starts by gathering the necessary information, then inputting it into a structured format that is easy for your client to understand and process.

Step 1: Gather Required Information

Before you begin, make sure you have all the essential details for both yourself and the client. This includes:

- Your Contact Information – This includes your business name, address, phone number, email, and website (if applicable).

- Client’s Contact Information – Include the client’s name, address, and any relevant details, such as their business or department.

- Transaction Details – Record what was provided (services or products), the date of the transaction, and any relevant specifics, such as hourly rates, quantities, or project milestones.

- Payment Terms – Clarify when and how you expect to be paid, including any discounts or late fees.

Step 2: Organize the Document Structure

Once you have the necessary information, it’s time to organize it within the document. Follow these guidelines:

- Title – Clearly label the document as a “Billing Record” or “Payment Request” to avoid confusion.

- Unique Reference Number – Assign a unique number to each document for easy tracking and reference in future correspondence.

- Breakdown of Services – List each item or service provided, including the price for each, the quantity, and any applicable tax.

- Total Amount – Include a section at the bottom that clearly shows the total amount due, including taxes and any other adjustments.

After entering all the relevant information and ensuring the document is accurate, your billing record will be ready to send. The more organized and precise the document, the more professional it will appear, helping ensure prompt payment and smooth client relationships.

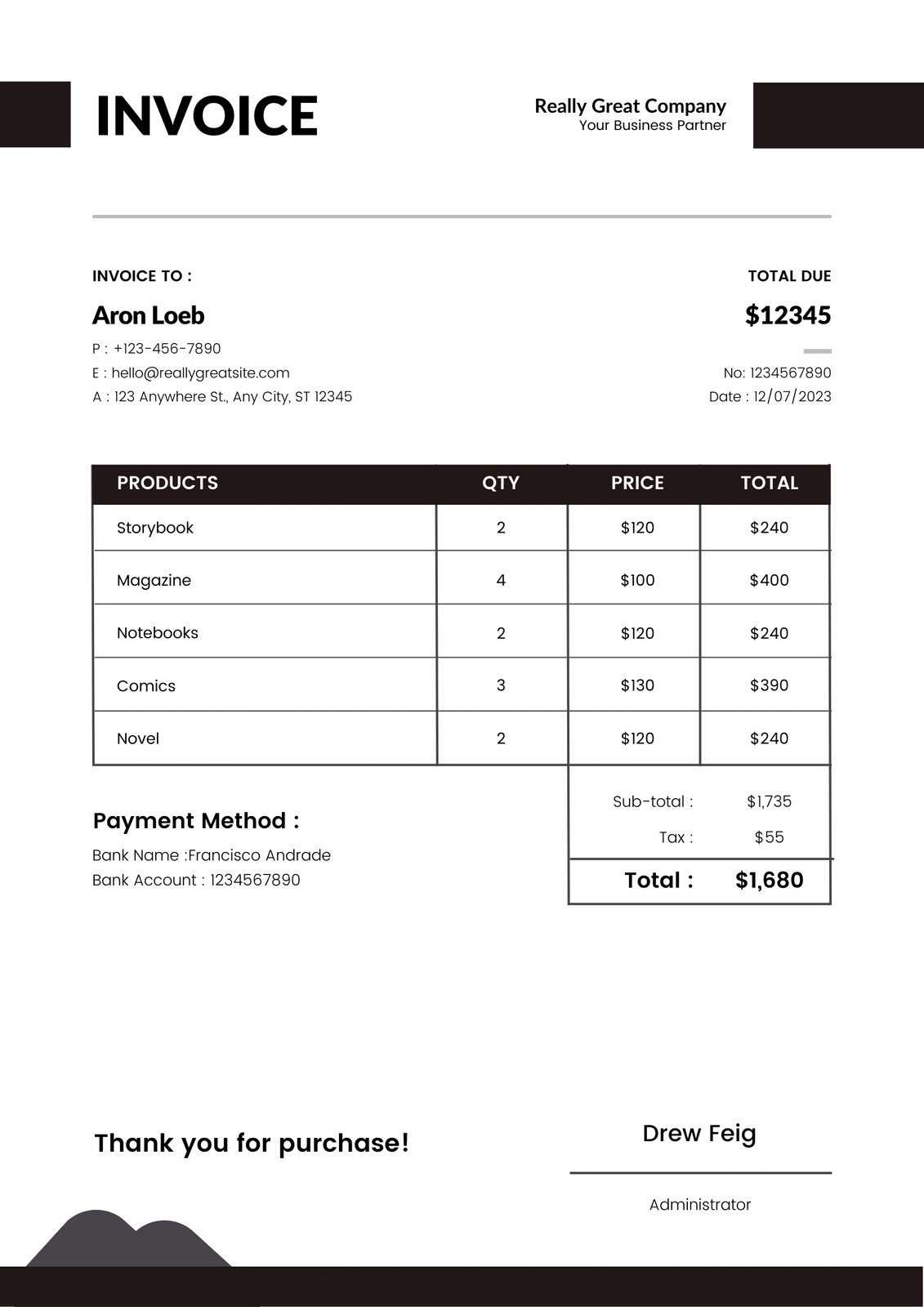

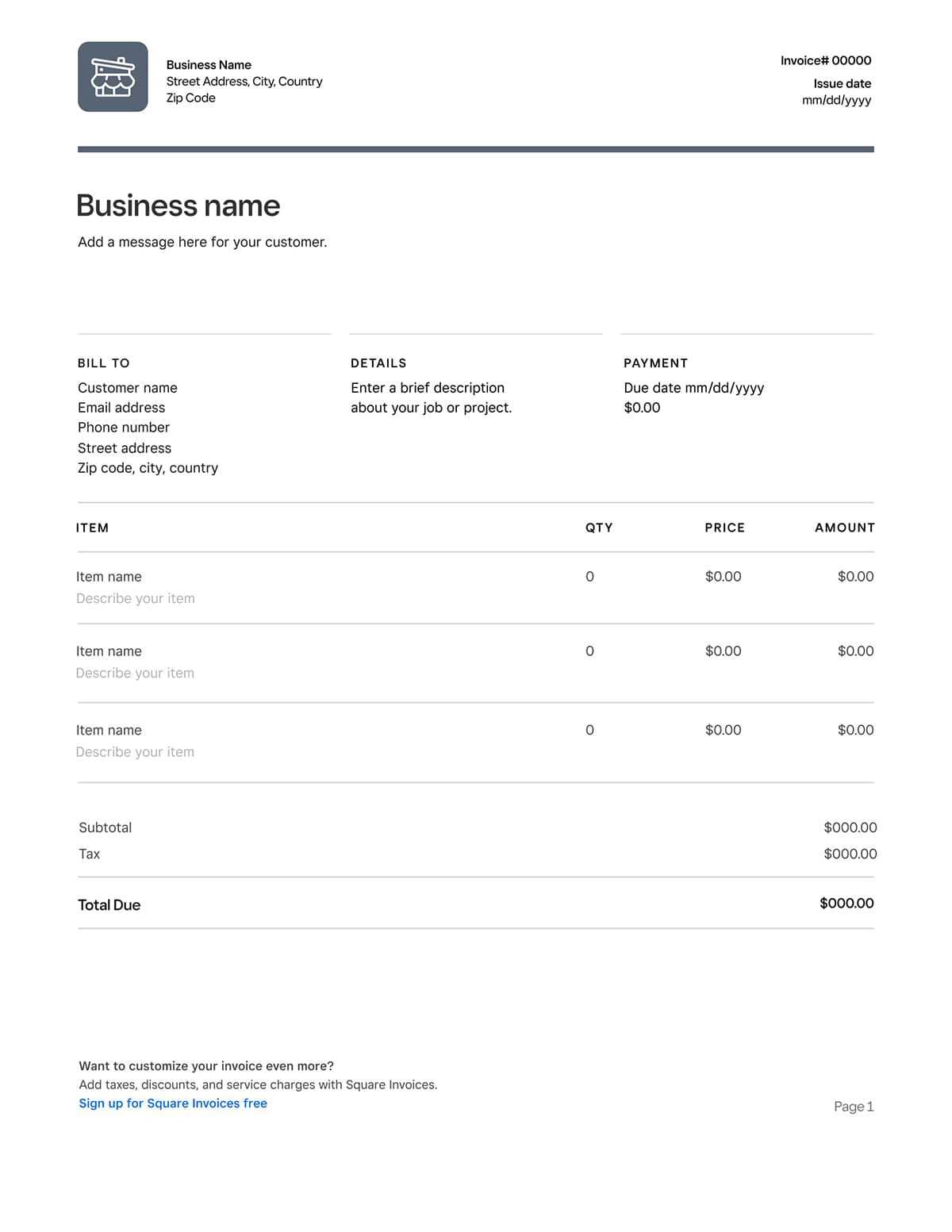

Invoice Templates for Freelancers

For freelancers, having a professional and efficient way to request payment is crucial to maintaining smooth business operations. A well-structured document allows freelancers to communicate billing details clearly and ensures that clients understand exactly what they are paying for. With customizable formats, freelancers can easily generate these records for different projects, ensuring consistency and professionalism in every transaction.

Why Freelancers Need Custom Billing Records

As a freelancer, your work often varies in scope and pricing. Having the ability to customize your billing document is essential to accurately reflect the services provided. A standard layout allows you to include all the relevant details for each project, such as:

- Hourly Rates – If you charge by the hour, you can specify the number of hours worked and the rate applied.

- Project Milestones – For larger projects, you may break the work into phases, listing each milestone and its corresponding payment.

- Flat Fees – If you offer fixed-price services, your document should clearly reflect the agreed-upon amount for the entire project.

Key Features for Freelancer Billing Documents

A good billing document for freelancers should include a few essential features to make the process seamless and professional:

- Simple and Clear Structure – A minimalist design that is easy to read and understand helps avoid confusion for both you and your clients.

- Payment Terms – Clearly outline when payments are due, any discounts for early payments, or penalties for delays to set proper expectations.

- Personalization – Add your branding, such as your logo or colors, to make the document feel more like a part of your professional identity.

By using a structured and customizable document, freelancers can save time, avoid mistakes, and present a polished, professional image to clients, helping to foster trust and secure timely payments.

Improving Billing Efficiency with Templates

Streamlining the billing process is essential for businesses and freelancers looking to save time and reduce errors. Using a pre-designed structure helps eliminate repetitive tasks, ensures consistency, and speeds up the creation of financial documents. With the right format, you can easily generate accurate records that meet client expectations and improve the overall efficiency of your workflow.

By adopting a structured approach, you minimize the chances of omitting crucial information and reduce the time spent on manual calculations. This allows you to focus more on delivering quality work and building strong client relationships. Here’s how you can improve your billing process:

| Benefit | Description |

|---|---|

| Faster Document Creation | Predefined formats allow you to quickly input necessary details without starting from scratch each time. |

| Consistency Across Records | Using the same layout for all transactions ensures your documents remain uniform and professional. |

| Reduced Errors | Automated fields reduce the chances of missing key details or making calculation mistakes, improving accuracy. |

| Better Time Management | Automated processes allow you to allocate more time to core business activities while reducing administrative work. |

| Easy Client Communication | Clear, well-organized billing records help clients understand charges and avoid confusion or disputes. |

By incorporating these benefits into your workflow, you can significantly increase your operational efficiency, allowing you to focus on growing your business while ensuring a smoother financial process for both you and your clients.

Common Invoice Mistakes to Avoid

While creating billing records may seem straightforward, there are several common pitfalls that can lead to confusion, delays in payment, or even disputes. Even small mistakes can have a significant impact on the efficiency of your payment process. Being aware of these common errors can help you create clear and accurate documents that improve communication with clients and ensure timely payments.

Here are some frequent mistakes to watch out for:

- Incorrect Client Information – Always double-check the client’s name, address, and contact details to ensure accuracy. Mistakes in client details can cause delays in processing and communication issues.

- Missing or Wrong Payment Terms – Make sure your payment terms are clearly stated, including the due date, any applicable late fees, and accepted payment methods. Failing to include these can lead to confusion and delayed payments.

- Unclear Descriptions of Work – It’s important to provide clear and concise descriptions of the work or products provided. Vague or ambiguous descriptions can lead to misunderstandings and disputes over the charges.

- Omitting Taxes and Additional Charges – Failing to include taxes or additional charges can result in unexpected financial issues. Be sure to list all relevant fees or taxes in a transparent way to avoid confusion.

- Not Using a Unique Reference Number – Each billing record should have a unique reference number to help both you and your clients track the transaction easily. This is especially important for future follow-ups or if there is any need to reference the document later.

- Failure to Proofread – Always review your document before sending it. Typos or calculation mistakes can make your business appear unprofessional and may delay payments as clients may question the accuracy of the record.

Avoiding these mistakes ensures that your billing records are accurate, professional, and effective, leading to smoother transactions and a better relationship with your clients.

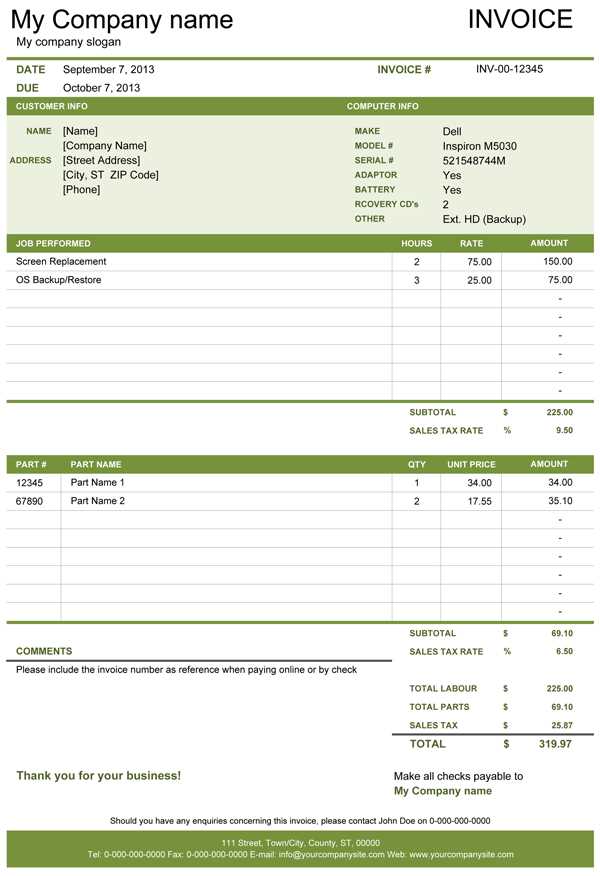

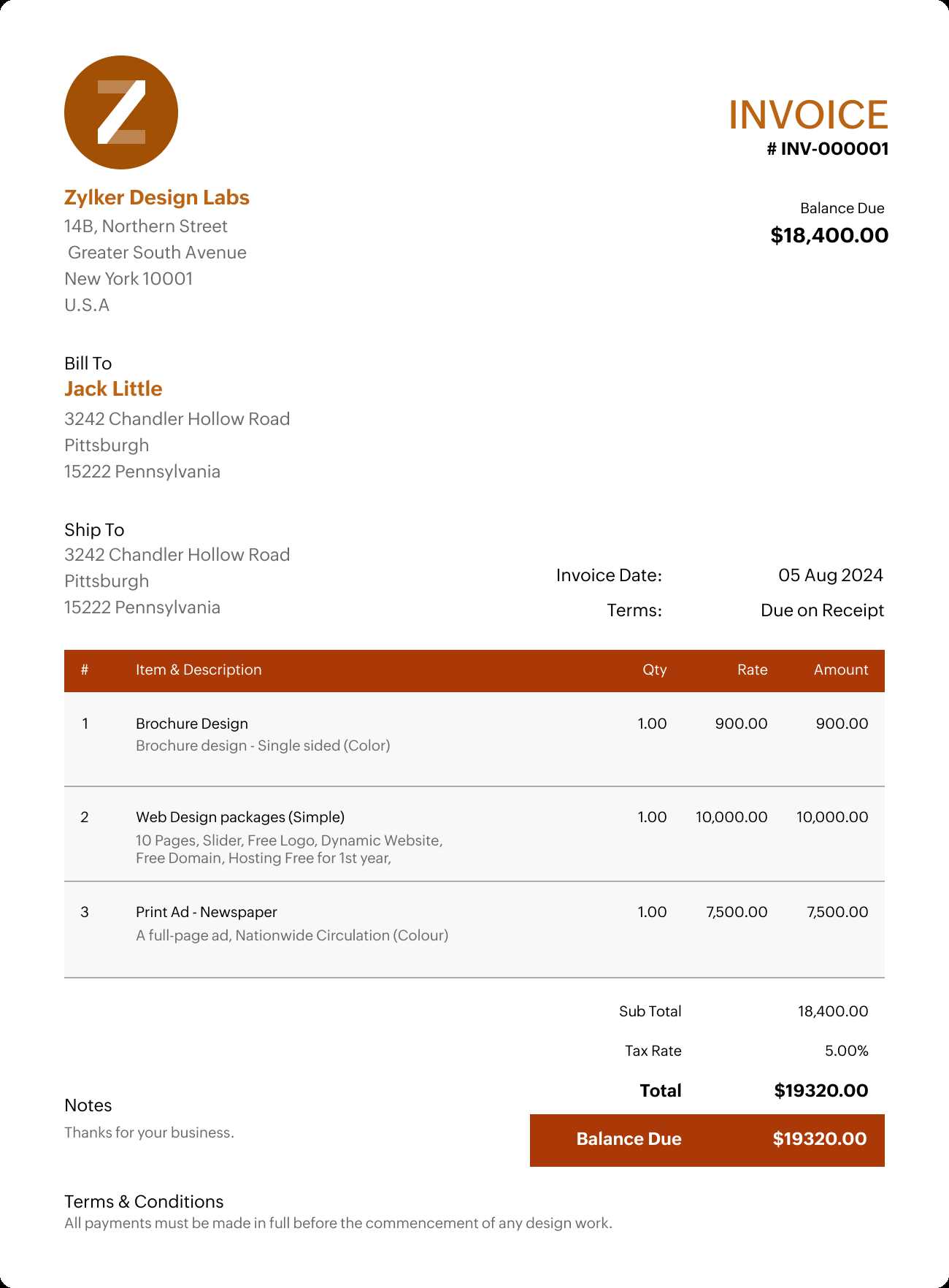

Incorporating Your Brand in Invoices

Incorporating your brand identity into financial records is an important way to maintain consistency and professionalism in all of your client interactions. A branded document not only reinforces your business’s image but also helps build trust with your clients. By using consistent colors, logos, and fonts, you ensure that your financial documents reflect the same quality and attention to detail as the services you provide.

Here are some key ways to integrate your branding into your billing records:

- Logo Placement – Your logo should be placed prominently at the top of the document, usually in the header, to ensure that it’s immediately recognizable. This helps reinforce your business identity and adds a personal touch.

- Consistent Color Scheme – Using your brand’s colors in headers, borders, and accents creates a cohesive look across all of your business materials, including your billing records.

- Font Choice – Stick to the fonts that are part of your brand guidelines. This ensures that the document matches your website, marketing materials, and any other communication your clients receive from you.

- Personalized Messaging – Including a thank-you note or a reminder of your next collaboration in your documents can add a personal touch. This not only reinforces your relationship with the client but also makes your document feel less transactional and more thoughtful.

- Header and Footer Design – Customize the header and footer with your business information, website link, and social media handles. This not only adds to the visual appeal but also keeps your contact information front and center.

By incorporating these elements, you ensure that your billing records align with your brand’s overall aesthetic, creating a cohesive and professional experience for your clients every time they receive a payment request.

Free vs Paid Invoice Templates

When it comes to choosing the right format for billing, you have two main options: free and paid solutions. Each option has its pros and cons, and the choice largely depends on your business needs, budget, and the level of customization you’re looking for. Free options often come with basic features, while paid versions may offer advanced functionality and more professional designs. Understanding the differences between these options can help you decide which is best for you.

Benefits of Free Billing Formats

Free formats are a great option for those just starting out or working with a tight budget. These solutions typically offer:

- No Cost – Free formats are completely cost-effective, making them an attractive option for small businesses or freelancers who need to minimize expenses.

- Basic Features – They usually cover the essential components needed for a billing document, such as payment details, services rendered, and total due.

- Simple to Use – Most free formats are straightforward and easy to use, with limited customization, meaning you can get your document ready quickly without much hassle.

Advantages of Paid Billing Formats

On the other hand, paid formats offer additional features that may benefit more established businesses or those looking for enhanced professionalism:

- Advanced Customization – Paid versions often provide greater flexibility, allowing you to add logos, adjust layout designs, and include additional fields specific to your business.

- Professional Designs – Many paid solutions offer sleek, polished layouts that reflect a higher level of professionalism and attention to detail.

- Additional Functionalities – Paid formats might include features like automated calculations, multi-currency support, or integrations with accounting software, helping to streamline your workflow.

- Customer Support – With a paid option, you often gain access to customer service or technical support in case you run into any issues or need assistance customizing your format.

Ultimately, the choice between free and paid solutions comes down to your specific needs. If you’re looking for something simple and budget-friendly, a free option might be sufficient. However, if you’re seeking more advanced features and a more polished, professional look, investing in a paid format could be worthwhile.

How to Download and Use Templates

Downloading and using pre-designed billing formats is a simple and effective way to speed up your payment process and ensure that your financial records are accurate and professional. Whether you’re a freelancer or a small business owner, these ready-made formats can help you create well-structured documents with minimal effort. Here’s a guide to help you download and make the most out of these formats.

Step 1: Find the Right Format

The first step is finding a suitable layout for your needs. There are a variety of options available, ranging from basic, free designs to more advanced, paid versions. Consider your requirements before choosing the right one:

- Simple Design – If you need just the basics, a free or simple layout may suffice.

- Customizable Layout – For more complex needs, look for a format that allows you to add your branding, adjust the structure, or include additional fields.

- Functionality – Make sure the format supports the necessary fields and features, such as payment terms, itemized charges, and totals.

Step 2: Download and Save the File

Once you’ve found the perfect design, the next step is to download the file. Most websites that offer billing formats will allow you to download them in a variety of file types, such as Word, Excel, or PDF. Here’s how to proceed:

- Click the Download Link – Find the download button on the website, and select the format you prefer.

- Save the File – Choose a location on your computer where you can easily find the file later. It’s a good idea to organize your files in folders for easy access.

- Ensure Compatibility – Verify that the format you download is compatible with your software. For example, if you download an Excel file, ensure that you have a spreadsheet program to open it.

Step 3: Customize and Use the Format

Now that you have the format, it’s time to personalize it. You can add your business details, modify the layout to fit your style, and input specific charges for your clients:

- Fill in Business Information – Add your business name, logo, address, and contact details.

- Customize Client Information – Input the client’s details, such as their name, company, and payment address.

- Enter Transaction Details – Provide a clear description of the services or goods provided, including rates, quantities, and any applicable taxes.

- Set Payment Terms – Include payment deadlines, late fees, and any other relevant terms that both parties have agreed upon.

After customizing the layout, save the file a

Managing Multiple Client Invoices

Handling multiple billing records at once can be a challenge, especially when dealing with numerous clients and varying terms. Organizing and tracking payments across different accounts requires a system that ensures nothing is overlooked and all payments are processed efficiently. A structured approach helps you manage multiple transactions seamlessly, ensuring both timely payment and accurate records for every client.

To effectively manage several client accounts, it’s important to implement organization strategies that streamline the billing process. Here are some tips for keeping track of multiple transactions:

| Strategy | Details |

|---|---|

| Use a Consistent Format | Ensure all billing records follow a consistent structure. This makes it easier to spot discrepancies and ensures uniformity in how information is presented. |

| Label and Track Records | Assign each record a unique reference number and categorize them by client, due date, or project to avoid confusion. |

| Set Clear Deadlines | Always include clear payment terms and due dates. This helps you stay on top of which clients owe payments and when they are due. |

| Automate Reminders | Use software or digital tools to automatically send reminders before and after payment due dates, reducing the need for manual follow-ups. |

| Centralized Tracking System | Consider using an accounting or project management tool to centralize all your billing records. This keeps everything organized in one place and reduces errors. |

By using these strategies, you can better manage multiple transactions and maintain control over your finances, allowing you to focus more on growing your business and less on administrative tasks. Consistent organization ensures that each client receives timely communication, reducing the likelihood of delayed payments and errors in billing.

How Invoice Templates Save Time

Managing financial records and creating billing documents from scratch can be time-consuming and repetitive. By using pre-structured formats, you can significantly reduce the time spent on creating and organizing these records. These ready-made solutions allow you to quickly input the necessary details and generate professional documents with minimal effort. This time-saving approach frees you up to focus on core business activities and client relationships.

Quick Document Generation

One of the biggest time-saving benefits of using a structured billing layout is the ability to create documents rapidly. Instead of starting from scratch, you can simply fill in the relevant details, such as client information, services provided, and payment terms. With everything else already set up, your document is ready to go in a fraction of the time it would take to build one manually.

Consistency and Accuracy

Another key advantage is the consistency and accuracy that comes with using a standardized format. Pre-designed structures ensure that all the necessary fields are included and that calculations are accurate. This reduces the likelihood of errors that would require time to correct, thus further streamlining the process.

With these time-saving benefits, adopting ready-made layouts can improve your workflow and reduce administrative tasks. Whether you’re working with a handful of clients or a large customer base, these tools help ensure a more efficient and organized approach to managing your business’s financial records.

Digital vs Printed Service Invoices

When it comes to billing, businesses often have to decide between sending documents digitally or using traditional printed methods. Both options come with their own advantages and disadvantages, depending on the needs of the business and its clients. Choosing the right method can impact efficiency, costs, and even client satisfaction. Understanding the differences between these two formats can help you make the best decision for your operations.

Advantages of Digital Billing

Digital records have become increasingly popular due to their convenience and environmental benefits. Here are some key advantages:

- Speed and Efficiency – Sending documents electronically allows for immediate delivery, meaning clients can receive their bills without any delays. This quick delivery can also speed up payment processing.

- Cost-Effective – Digital records eliminate the need for paper, ink, and postage costs. This makes it a more affordable option for businesses, especially those that manage a large volume of clients.

- Easy Storage and Organization – Digital files can be easily stored, categorized, and accessed at any time. This eliminates the need for physical filing and allows you to search and retrieve documents quickly.

- Environmentally Friendly – By opting for electronic records, businesses can reduce paper waste, contributing to a more sustainable approach to operations.

Advantages of Printed Billing Records

While digital formats are increasingly popular, there are still benefits to using printed documents, especially for businesses that prefer a more traditional approach:

- Physical Touchpoint – Printed documents provide a tangible product that some clients may prefer, especially in more formal or traditional industries. A physical copy can also serve as a reminder for clients to take action on payments.

- No Technical Barriers – Not all clients are comfortable with digital formats, or they may not have reliable internet access. Printed records ensure that everyone, regardless of their technical ability, receives their bill without any issues.

- Professional Appearance – In some cases, a printed document can appear more official and professional, which can enhance your business’s image and create a sense of trust with clients.

Ultimately, the choice between digital and printed records depends on your client base and business goals. While digital formats offer convenience and cost-saving benefits, printed records may still have a place in certain industries or with specific clients. Balancing both options may be the best approach for maximizing efficiency while meeting client expectations.

Legal Considerations for Service Invoices

When creating billing records, it’s essential to be aware of the legal requirements surrounding these documents. Ensuring that your records meet legal standards not only helps protect your business, but also ensures that transactions are transparent and enforceable. There are various legal aspects that need to be considered, from including the right information to understanding the rules around payment terms and tax obligations.

Here are some of the key legal factors to keep in mind when creating billing records:

- Correct Information – Ensure that the document includes essential details such as your business name, registration number, client information, and a clear description of goods or services provided. Failure to include this information may lead to confusion or disputes.

- Accurate Payment Terms – Clearly state the payment due date, accepted payment methods, and any penalties for late payment. This helps establish the legal framework for the transaction and prevents misunderstandings about when payment is expected.

- Tax Compliance – Depending on your location, you may be required to include tax information such as VAT or sales tax on your records. Ensure that the applicable tax rates are correct and that you comply with local tax laws.

- Unique Reference Numbers – Assigning a unique reference number or code to each document is a common legal requirement in many jurisdictions. This allows both you and your client to easily track payments and resolve disputes if necessary.

- Proper Record Keeping – It is important to store these documents in a way that complies with record-keeping regulations. Many countries have laws on how long businesses must retain financial records for tax purposes or audits.

By ensuring that these legal aspects are addressed in your billing documents, you protect your business from potential legal complications and create a clear, transparent relationship with your clients. Always consult with a legal professional or accountant to ensure full compliance with your local laws and regulations.