Top Online Invoice Templates for Effortless Billing

Managing financial transactions efficiently is a critical part of running any business. One of the most time-consuming tasks for entrepreneurs and freelancers alike is creating and sending bills to clients. Simplifying this process with pre-designed solutions can save valuable time and reduce the likelihood of errors. By using professional, customizable formats, businesses can ensure consistent and accurate documentation of payments.

Adopting ready-made structures for generating payment requests allows for quicker customization, ensuring that every detail is correct and personalized to suit the specific needs of each client. These systems not only improve workflow but also help businesses maintain a high level of professionalism when dealing with customers. With just a few modifications, it’s easy to create an effective and polished record of a transaction.

Whether you’re a freelancer, small business owner, or part of a larger corporation, having access to simple yet functional solutions can significantly improve the efficiency of your financial operations. With just a few clicks, you can create clear, error-free documents that reflect the exact services rendered, all while reducing the administrative burden.

Why Use Online Invoice Templates

Handling financial documents can be a complex and time-consuming task, especially for small business owners and freelancers. Manually creating these records often leads to inefficiencies and errors that can affect cash flow and customer satisfaction. By relying on pre-designed formats, you can automate much of the process, ensuring that everything is accurate and professional with minimal effort.

Save Time and Reduce Errors

Creating bills from scratch for every transaction is not only tedious but also increases the risk of mistakes. Pre-designed structures allow for quick entry of necessary information, reducing the chances of overlooking important details. With built-in fields for dates, amounts, and services provided, you can generate a correct document in just a few minutes. Speed and accuracy are crucial for maintaining smooth operations and keeping clients satisfied.

Professional Appearance and Branding

Presenting your business in a professional light is essential for building trust with clients. By using customizable formats, you ensure that every document sent out is not only accurate but also looks polished and consistent. You can incorporate your brand’s colors, logo, and contact details, creating a strong and cohesive identity. This level of consistency in your financial communications reflects positively on your overall business image.

Advantages of Digital Invoice Solutions

Switching to digital tools for managing payment requests offers a wide range of benefits for businesses of all sizes. Traditional methods of creating and sending bills can be slow, prone to errors, and difficult to track. By using modern, digital solutions, companies can streamline their entire billing process, saving time and resources while ensuring a higher level of accuracy and professionalism.

One of the primary advantages of digital systems is the speed with which documents can be generated. With just a few clicks, businesses can create customized records and send them instantly, eliminating the delays associated with manual creation and physical mailing. Additionally, digital formats allow for easy storage and retrieval, making it simple to maintain an organized archive of financial documents.

Another key benefit is the ability to track payments and outstanding amounts automatically. Most digital solutions offer integrated features that enable businesses to monitor when payments are due and send reminders to clients. This improves cash flow management and helps prevent overdue invoices from slipping through the cracks.

How Online Invoices Save Time

Generating payment documents manually can be a time-consuming process, especially when handling multiple transactions each day. Businesses that rely on traditional methods often find themselves spending valuable hours on repetitive tasks, such as filling out forms and correcting mistakes. However, using pre-designed solutions can significantly reduce the time spent on billing and increase overall efficiency.

Instant Customization and Creation

With ready-made structures, businesses can quickly customize each record without having to start from scratch. Fields for key information such as client name, service details, and amounts are already built in, allowing for rapid input. This eliminates the need for manually formatting each document and ensures a faster turnaround time for both the creator and the client.

Automated Tracking and Reminders

Digital billing systems often come with built-in features that automatically track payment status and send reminders to clients. This reduces the time spent manually following up on overdue bills and allows businesses to focus on more important tasks, such as serving clients or growing their operations. With automatic notifications, businesses can stay on top of their cash flow with minimal effort.

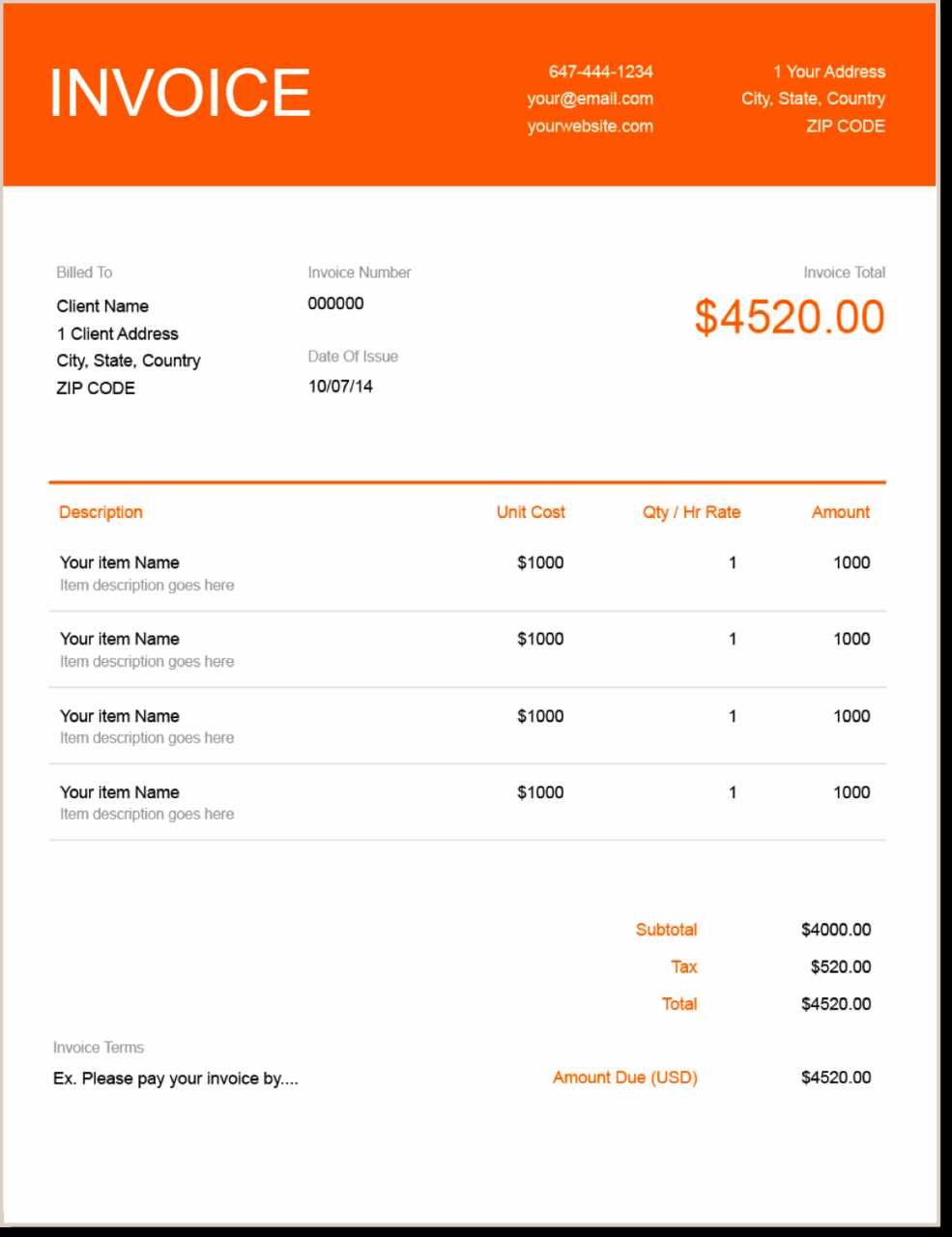

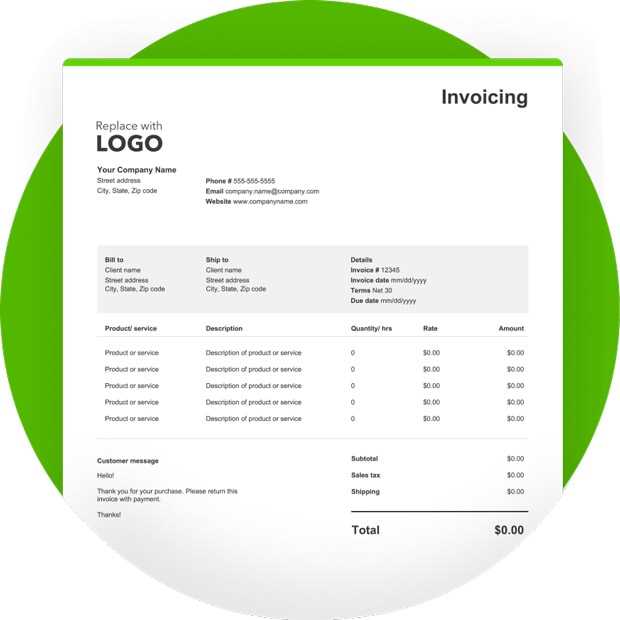

Creating Customizable Invoice Designs

Personalization plays a key role in making financial documents not only functional but also reflective of your brand. Customizing the design of your payment requests allows you to create a professional appearance that aligns with your business identity. By adjusting colors, fonts, logos, and layout, you can ensure that each document feels unique and polished, all while maintaining clarity and accuracy.

Adjusting Layout and Style

Customizing the layout of your billing documents helps to highlight important details, such as amounts due, services provided, and payment terms. Whether you prefer a simple, minimalist design or a more detailed structure, having the ability to tweak elements like headers, columns, and spacing makes it easy to create a layout that suits your needs. Flexible design options ensure that your documents stand out while remaining easy to read.

Incorporating Brand Elements

Adding brand-specific elements, such as your logo, business colors, and fonts, ensures consistency across all of your communications. By incorporating these visual elements into each financial record, you reinforce your brand identity and present a cohesive image to your clients. A well-designed document not only looks professional but also helps build trust and recognition.

Free Invoice Templates for Small Businesses

For small business owners, managing finances efficiently can be a challenge, especially when starting out. The good news is that there are free resources available that simplify the process of generating payment records. These tools allow businesses to quickly create professional documents without the need for expensive software or complex systems.

By using free solutions, small businesses can access a variety of customizable formats that are easy to use and require no prior experience with accounting or design. Below is an example of the key features that free tools often offer:

| Feature | Benefit |

|---|---|

| Customizable Fields | Easily adapt the document to your specific needs, adding company name, service details, or payment terms. |

| Pre-set Layouts | Save time with ready-made designs that only require minimal adjustments to suit your brand. |

| Export Options | Download or share documents in formats like PDF or Excel, making it simple to send them to clients. |

| No Cost | Access high-quality, professional documents without the need to invest in expensive software. |

Using these free solutions, small business owners can streamline their administrative tasks, save time, and present a professional image to clients–all at no cost.

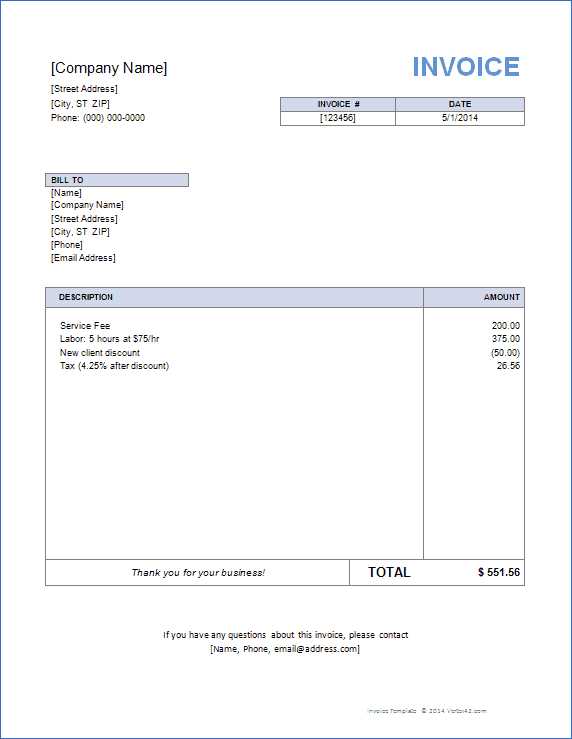

Choosing the Right Invoice Template

Selecting the right structure for your financial documents is crucial to ensure clarity, professionalism, and efficiency. With so many options available, it can be overwhelming to decide which one suits your business needs the best. The right design not only makes your billing process smoother but also creates a positive impression on your clients.

Factors to Consider When Choosing

When selecting a format for your payment records, it’s important to keep a few key factors in mind:

- Business Type: Different industries have unique requirements. A freelancer may need a simpler layout, while a service-based business may require more detailed breakdowns.

- Customization Needs: Choose a design that allows for easy adjustments, such as adding your logo, adjusting colors, or editing text.

- Ease of Use: The structure should be user-friendly, with clearly defined fields for all necessary information, such as amounts, services, and dates.

- Client Preferences: Consider what your clients prefer or need in a bill–some may require detailed descriptions, while others might need a simpler document.

Popular Design Features

When browsing available formats, look for features that will make the process easier for you:

- Pre-filled Fields: Having automatic fields for date, payment terms, and client details can save a lot of time.

- Clear Layout: Ensure the design is organized and easy to read, with enough space for important details like amounts due and services provided.

- Branding Options: If branding is important to you, select a design that allows you to easily add your company logo and colors.

By carefully considering these factors, you can choose a format that best fits your business operations, helping you save time and present a professional image to clients.

Top Features to Look for in Templates

When choosing a design for your financial documents, certain features can significantly improve both the ease of use and the professionalism of your bills. A well-crafted format ensures that the document is clear, organized, and easy to customize, making the entire billing process more efficient. Below are key features to consider when selecting the right structure for your needs:

| Feature | Benefit |

|---|---|

| Customizable Fields | Allows you to easily input your business information, client details, service descriptions, and amounts. |

| Professional Layout | Ensures the document is easy to read and presents a polished, clean look to clients. |

| Multiple Payment Methods | Gives clients options to pay through various channels, making it convenient for them and improving cash flow. |

| Automated Calculations | Reduces errors and saves time by automatically calculating totals, taxes, and discounts. |

| Branding Options | Allows you to add logos, colors, and fonts that match your business identity for consistency. |

| Mobile-Friendly Design | Ensures that the document is easily viewable and accessible on different devices, including smartphones and tablets. |

By selecting a design that includes these features, you can make the billing process smoother, more accurate, and more professional, while also enhancing your client’s experience with your business.

Integrating Invoices with Accounting Software

Efficient management of financial documents becomes significantly easier when integrated with accounting software. By connecting billing records directly to your accounting system, you can automate many aspects of the financial workflow, reducing manual entry and the risk of errors. This seamless connection ensures that all transactions are accurately recorded and up to date across your business systems.

Streamlining data transfer between your payment documents and financial tracking software eliminates the need for duplicate data entry. When you generate a new bill, the details can be automatically transferred to your accounts, updating income reports and balancing ledgers with no additional effort. This process enhances accuracy and ensures that your financial records are always aligned.

Another key benefit of integration is real-time tracking. As payments are made, your system can immediately reflect updates, providing you with an accurate overview of cash flow. You can also easily track overdue bills, outstanding payments, and even set automatic reminders, which improves overall financial management and client communication.

Integrating billing systems with accounting software not only saves time but also reduces administrative workload, allowing business owners to focus on growth and customer satisfaction.

How to Personalize Your Invoices

Personalizing your financial documents can help create a stronger connection with your clients, reinforce your brand identity, and enhance professionalism. Customization ensures that each document reflects your unique business style and makes your communications stand out. Fortunately, modern solutions make it easy to personalize billing records with just a few simple adjustments.

Adding Your Brand Identity

One of the most effective ways to personalize your records is by incorporating your company’s logo, colors, and font style. This helps maintain a consistent visual identity across all communications and fosters brand recognition. You can also add your business contact information, website, or social media links, ensuring that clients always know how to reach you.

Customizing Content and Layout

Along with visual branding, you can also tailor the content and layout to better suit your specific needs. Adding a personalized message or a thank-you note at the end of each document can leave a positive impression on clients. Additionally, adjusting the layout allows you to highlight important details, such as payment terms or special instructions, making the document clearer and more user-friendly.

By taking the time to customize your documents, you can create a lasting impression while ensuring that all the necessary details are clearly communicated.

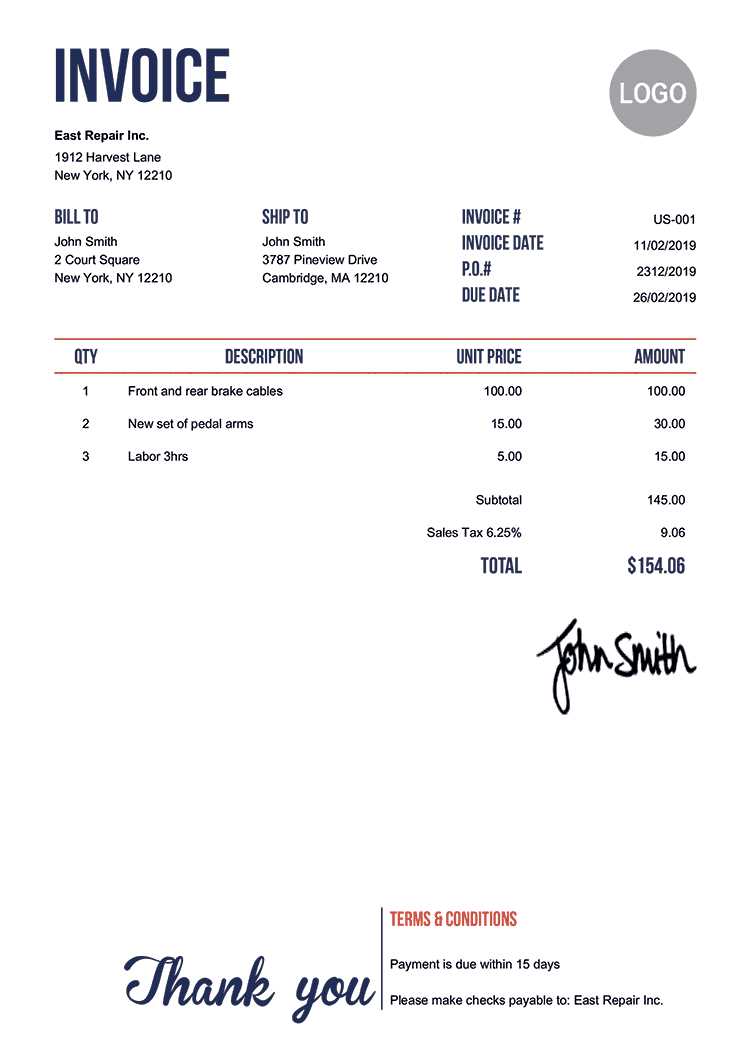

Legal Requirements for Online Invoices

When creating financial documents for business transactions, it’s important to ensure that they comply with local and international legal standards. Various regulations outline what must be included in these records to make them legally valid and enforceable. Failing to meet these requirements could lead to disputes, penalties, or challenges with tax authorities.

The essential elements typically required in these documents include accurate details of the transaction, such as the date of issue, a unique identification number, and a breakdown of the services or goods provided. Additionally, it’s important to include the full legal name and address of both the business and the client, as well as the payment terms and due dates. In some regions, tax identification numbers or VAT registration numbers may also be necessary, especially if the transaction involves cross-border business.

By ensuring that these key elements are present in every document, businesses can avoid legal complications and ensure compliance with applicable laws. This will help build trust with clients and protect the business from potential legal issues down the road.

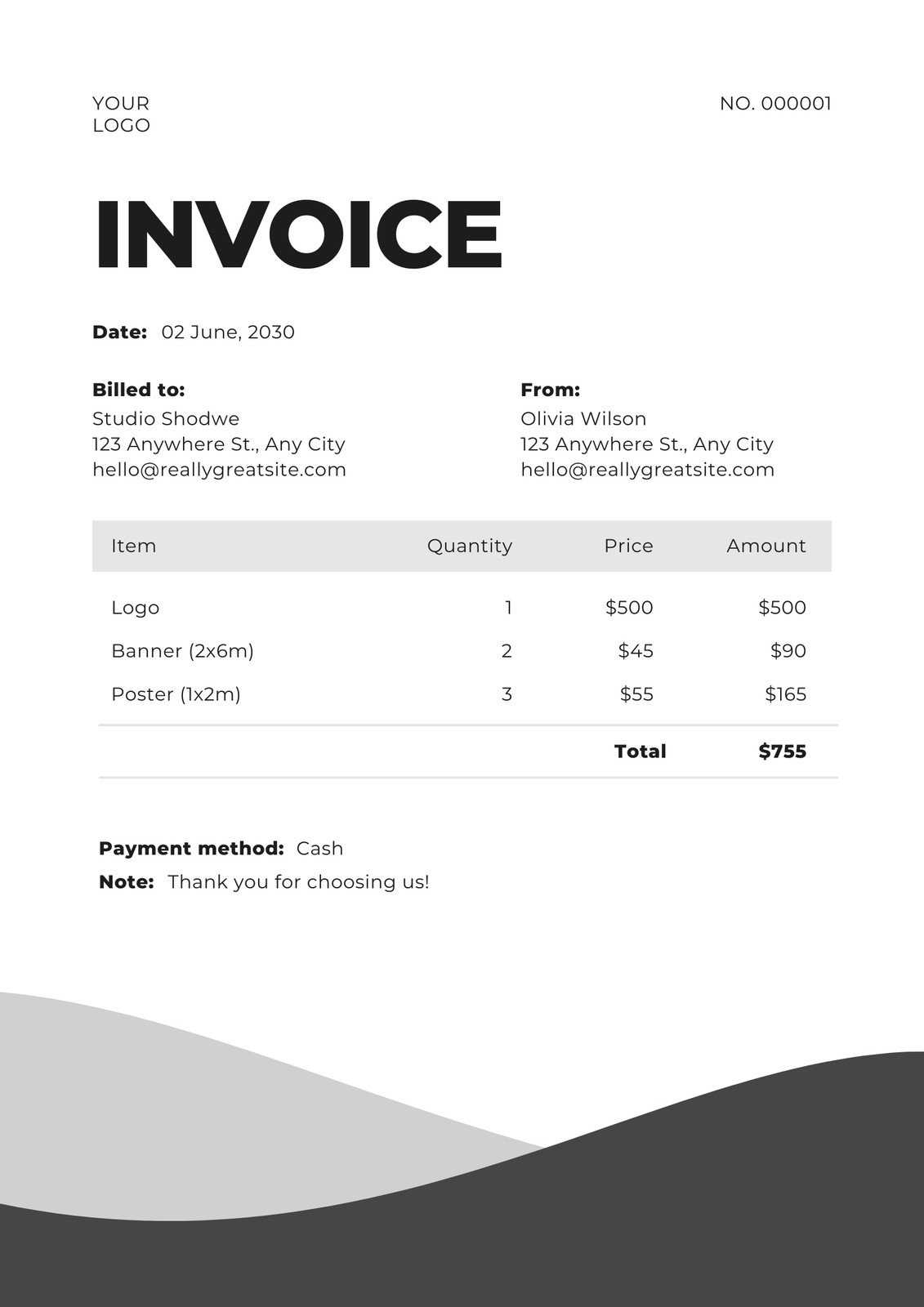

Tips for Professional Invoice Appearance

Creating a polished and professional look for your billing records can have a significant impact on how your business is perceived by clients. A well-designed document not only makes a strong impression but also enhances the clarity and readability of essential financial information. With the right design choices, you can make sure that your documents reflect the professionalism of your business.

Keep It Clean and Organized

One of the most important aspects of a professional document is its layout. Avoid cluttering the page with excessive text or design elements. Use clear headings, defined sections, and enough spacing to separate the different pieces of information. A clean, well-organized layout makes it easier for clients to understand the key details–such as payment amounts, services rendered, and due dates–at a glance.

Choose the Right Fonts and Colors

Fonts and colors play a crucial role in the overall look of your financial documents. Choose easy-to-read fonts such as Arial, Helvetica, or Times New Roman, and make sure the font size is large enough for comfortable reading. For colors, stick to a simple palette that matches your brand’s identity. Bold headers or section dividers can help important details stand out without overwhelming the reader. Using too many colors or decorative fonts can make the document look unprofessional and harder to follow.

By following these simple guidelines, you can ensure that your documents maintain a professional appearance, making them more likely to be taken seriously by clients and partners.

Tracking Payments with Invoice Templates

Keeping track of payments is essential for maintaining healthy cash flow and managing finances effectively. Having a well-organized system for recording and tracking paid and outstanding amounts helps prevent missed payments and ensures that all transactions are accounted for. Using pre-designed solutions can simplify this process, making it easier to stay on top of your financial obligations.

Most modern solutions include features that allow you to monitor the status of each payment. For example, you can easily mark bills as “paid” once the payment is received, and track the remaining balance for overdue transactions. Additionally, some systems automatically generate payment reminders, reducing the need for manual follow-ups and saving you time in the process. Automated tracking reduces errors and ensures that you’re always informed about the status of your outstanding amounts.

By implementing a streamlined tracking system, you can maintain a clearer picture of your financial situation, improving cash flow management and enabling you to act quickly if a payment is delayed or missed.

Invoice Templates for Different Industries

Different industries have unique billing needs, and having the right structure for your financial documents is crucial for maintaining professionalism and accuracy. Whether you’re a freelancer, a service provider, or running a retail business, the way you organize and present your payment records can vary based on the specific requirements of your industry.

For example, a creative professional may require a simple, easy-to-read layout with detailed descriptions of services provided, while a contractor might need a more complex document that includes labor rates, materials, and job-specific costs. Retail businesses, on the other hand, may focus more on itemized product lists with quantities, prices, and applicable taxes. Understanding the unique demands of your industry helps ensure that your billing records are both clear and legally compliant, while also making it easier for clients to process payments.

By using a suitable document format designed for your specific business type, you can streamline your billing process and make sure that all necessary information is included, leading to faster payments and a more efficient workflow.

Reducing Errors in Invoice Generation

Accurate billing is essential for maintaining trust and professionalism in any business. Errors in payment records can lead to misunderstandings, delayed payments, and even legal issues. By adopting the right tools and practices, you can minimize mistakes and ensure that every transaction is recorded correctly.

Automating Calculations and Fields

One of the most effective ways to reduce errors is through automation. By using systems that automatically calculate totals, taxes, discounts, and other variables, you eliminate the need for manual input, reducing the chance of human error. Additionally, pre-filled fields for client information, dates, and service details ensure consistency and prevent data entry mistakes.

Review and Quality Control

While automation is helpful, it’s still important to review each document before sending it. Double-checking key details–such as payment amounts, due dates, and client information–ensures that no critical elements are overlooked. Developing a habit of reviewing each bill before submission can prevent costly mistakes and maintain a high level of professionalism.

By combining automation with careful review, businesses can significantly reduce errors, leading to smoother transactions and better client relationships.

Best Platforms for Invoice Templates

Choosing the right platform to generate professional billing documents can significantly streamline your administrative tasks. Several platforms offer customizable solutions, each catering to different business needs and preferences. Whether you’re looking for ease of use, advanced features, or industry-specific designs, there are numerous options available to help you manage your payment records efficiently.

Here are some of the best platforms that offer excellent resources for creating and managing billing documents:

- FreshBooks: Ideal for small businesses and freelancers, this platform offers an easy-to-use interface with customizable fields, automated reminders, and integrated payment processing.

- Wave: A free accounting software with professional document generation features. Wave allows you to create detailed financial records with simple design options.

- Zoho Invoice: Known for its powerful customization options, Zoho offers both pre-designed and fully customizable layouts, making it perfect for businesses that need flexibility in their billing process.

- QuickBooks: A robust accounting platform that integrates billing solutions with accounting tools, making it ideal for companies that want an all-in-one financial management system.

- PayPal: For businesses that need simple and fast solutions, PayPal offers an easy way to generate basic billing documents while integrating payment options directly into the system.

These platforms provide a range of functionalities to fit different business needs, ensuring that you can create accurate, professional-looking documents with minimal effort.

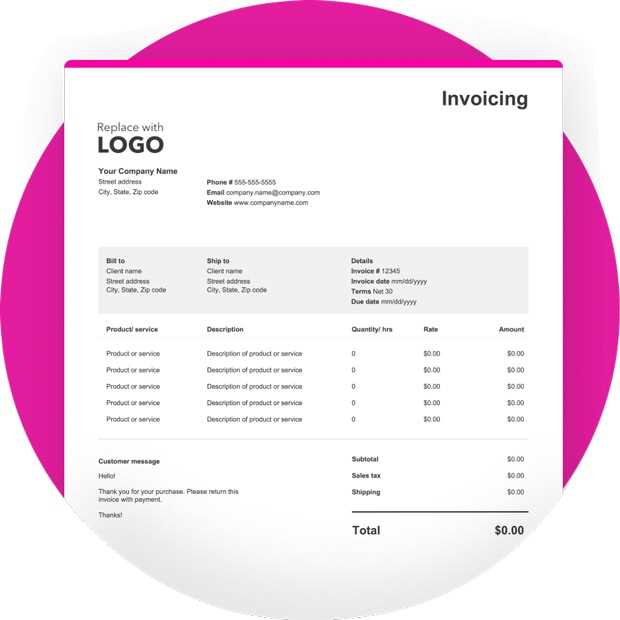

Mobile-Friendly Invoice Template Options

In today’s fast-paced business environment, being able to access and manage financial documents on-the-go is crucial. Mobile-friendly designs ensure that your payment records look professional and are easy to read, regardless of the device being used. With many clients and business owners accessing documents via smartphones and tablets, having a responsive, mobile-optimized format is more important than ever.

Responsive Design Features

Responsive designs automatically adjust to fit various screen sizes, ensuring that all content is displayed clearly on mobile devices. This means your clients won’t have to zoom in to read the details of their payment records. Important information such as amounts, payment terms, and contact details should remain easily readable and well-organized, no matter the device.

Ease of Use for Clients

Mobile-friendly options also enhance the experience for clients, allowing them to view and act on the document directly from their phones. Features like embedded payment links or integration with mobile payment systems streamline the process, enabling quicker responses and faster payments. Simple layouts and clear calls-to-action make it easy for clients to understand their obligations and take action, improving the overall client experience.

Adopting a mobile-friendly solution can increase efficiency, reduce errors, and improve client satisfaction by making it easier for everyone to access and manage essential financial information from any device.

How to Export and Share Invoices

Once your billing documents are created, it’s essential to know how to export and share them with clients quickly and securely. Whether you need to send a file by email, upload it to a client portal, or share it through a cloud storage service, understanding the different export options available can streamline the process and ensure timely payments.

Most systems allow you to export your documents in a variety of formats, such as PDF, Excel, or Word. The PDF format is one of the most common and widely accepted because it preserves the layout and ensures the recipient views the document exactly as intended. After exporting, you can easily email the file or use secure cloud storage links to share it directly with clients.

If you prefer more automated solutions, many platforms offer direct sharing capabilities that integrate with email or payment systems. This means that with a few clicks, you can generate and send your billing records without leaving the platform. Additionally, some systems offer features like payment links or reminders that can be included when sharing documents, speeding up the payment process.

Improving Cash Flow with Invoice Templates

Maintaining a steady cash flow is crucial for the financial health of any business. One of the key ways to improve cash flow is by ensuring timely and accurate billing. Having a streamlined and efficient process for creating and managing payment documents can help minimize delays and ensure that your business gets paid on time, every time. Using well-designed documents can make the billing process faster and more organized, which ultimately supports better cash flow management.

Key Strategies for Faster Payments

There are several strategies that businesses can adopt to improve cash flow through better billing practices:

- Clear Payment Terms: Ensure that all payment terms are clearly stated, including the due date and any late fees. Clients are more likely to pay on time when they know exactly when and how to make payments.

- Automated Reminders: Set up automated reminders for clients when payment deadlines are approaching. This reduces the need for manual follow-ups and encourages timely payments.

- Immediate Delivery: Send documents as soon as the service is completed or goods are delivered. The sooner clients receive their payment records, the sooner they can process the payment.

Tracking Payment Status

By tracking the status of your payment records, you can keep a close eye on which bills have been paid and which are still outstanding. Some platforms offer the ability to mark bills as paid once the payment is received, making it easier to track balances and follow up on overdue accounts.

| Payment Status | Action Required |

|---|---|

| Paid | No action needed |

| Pending | Send reminder or contact client |

| Overdue | Send overdue notice with possible penalty |

By implementing these strategies and leveraging efficient billing systems, businesses can ensure a smoother flow of cash, reduce the risk of overdue payments, and maintain financial stability.