Free Online Invoice Template for Simple and Professional Billing

In today’s fast-paced world, managing financial transactions has never been easier. With a variety of digital tools available, creating professional billing documents is more accessible than ever. Whether you’re a small business owner or a freelancer, having a well-organized method to send requests for payments can streamline your operations and improve your cash flow.

Ready-made documents can be a game-changer when it comes to generating accurate and professional statements. These ready-to-use forms allow you to customize details quickly, saving both time and effort while maintaining consistency in your business transactions.

With numerous platforms offering customizable solutions, getting the job done efficiently becomes simpler. By selecting the right tools, you can ensure all your invoicing needs are met without the hassle of creating complex documents from scratch.

Benefits of Using Free Invoice Templates

Using pre-designed billing documents offers several advantages for businesses of all sizes. These tools allow you to quickly generate accurate payment requests without spending excessive time on formatting or design. By eliminating the need for manual document creation, businesses can focus more on core operations and reduce administrative overhead.

Time Efficiency and Convenience

One of the main advantages of utilizing pre-made documents is the significant time savings. Instead of starting from scratch, you can choose a suitable format, input the necessary details, and generate a professional-looking document in minutes. This efficiency ensures that your workflow remains uninterrupted and allows for faster processing of payments.

Cost-Effective Solution

For small businesses and freelancers, the cost of professional billing software or hiring a designer can be a barrier. Pre-designed billing forms eliminate this expense, offering an affordable and accessible solution. With no subscription fees or one-time purchases, businesses can maintain a professional approach to transactions without straining their budgets.

How to Create an Invoice Online

Creating a professional payment request doesn’t have to be complicated. With the right tools, you can easily generate accurate documents by simply entering key details. Whether you’re handling payments for products or services, the process can be streamlined using simple online resources that automate most of the work for you.

Choose a Platform for Document Creation

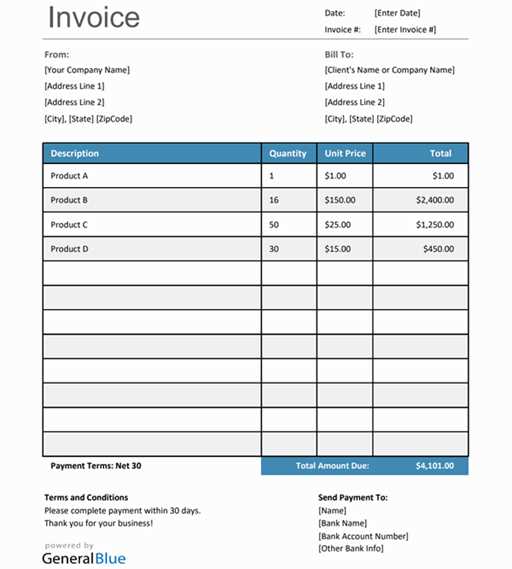

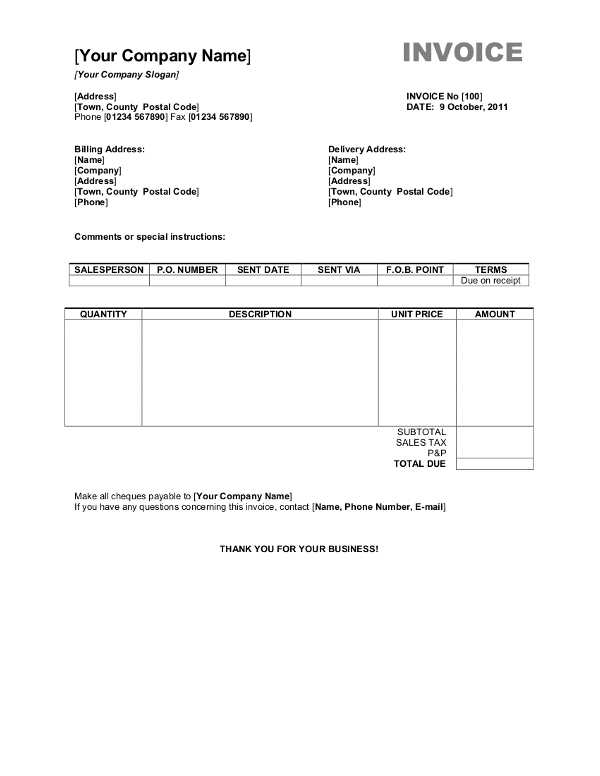

The first step is selecting a platform that offers customizable forms. These platforms typically provide pre-designed layouts where you can enter your business and client details, item descriptions, and payment terms. Many options are available, some of which are even accessible without any software installation, allowing you to get started right away.

Customize the Document and Add Details

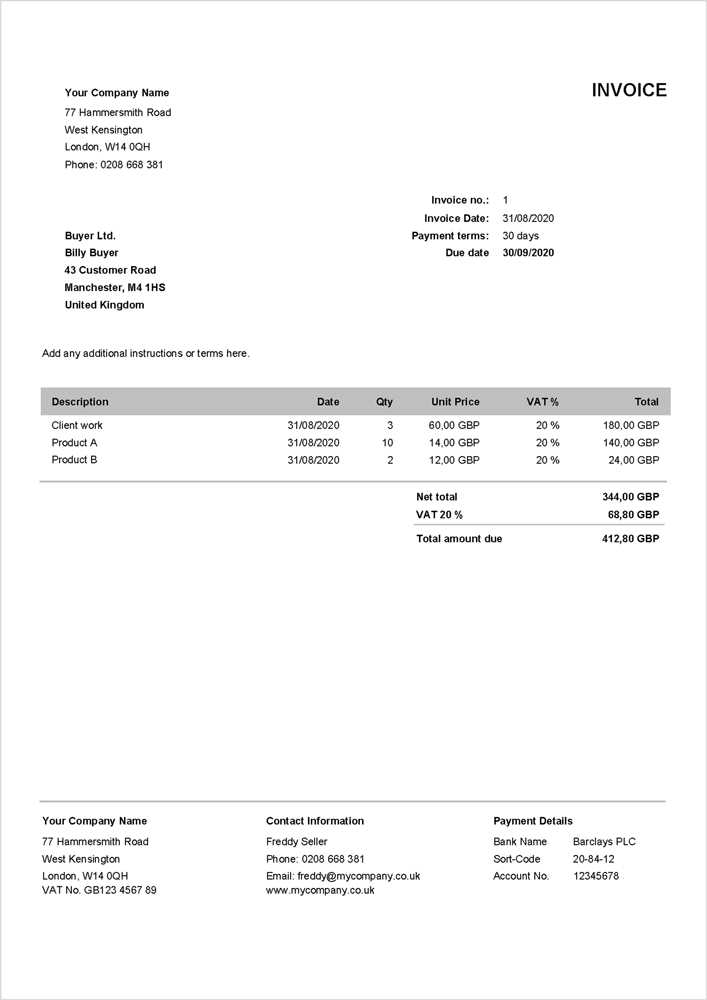

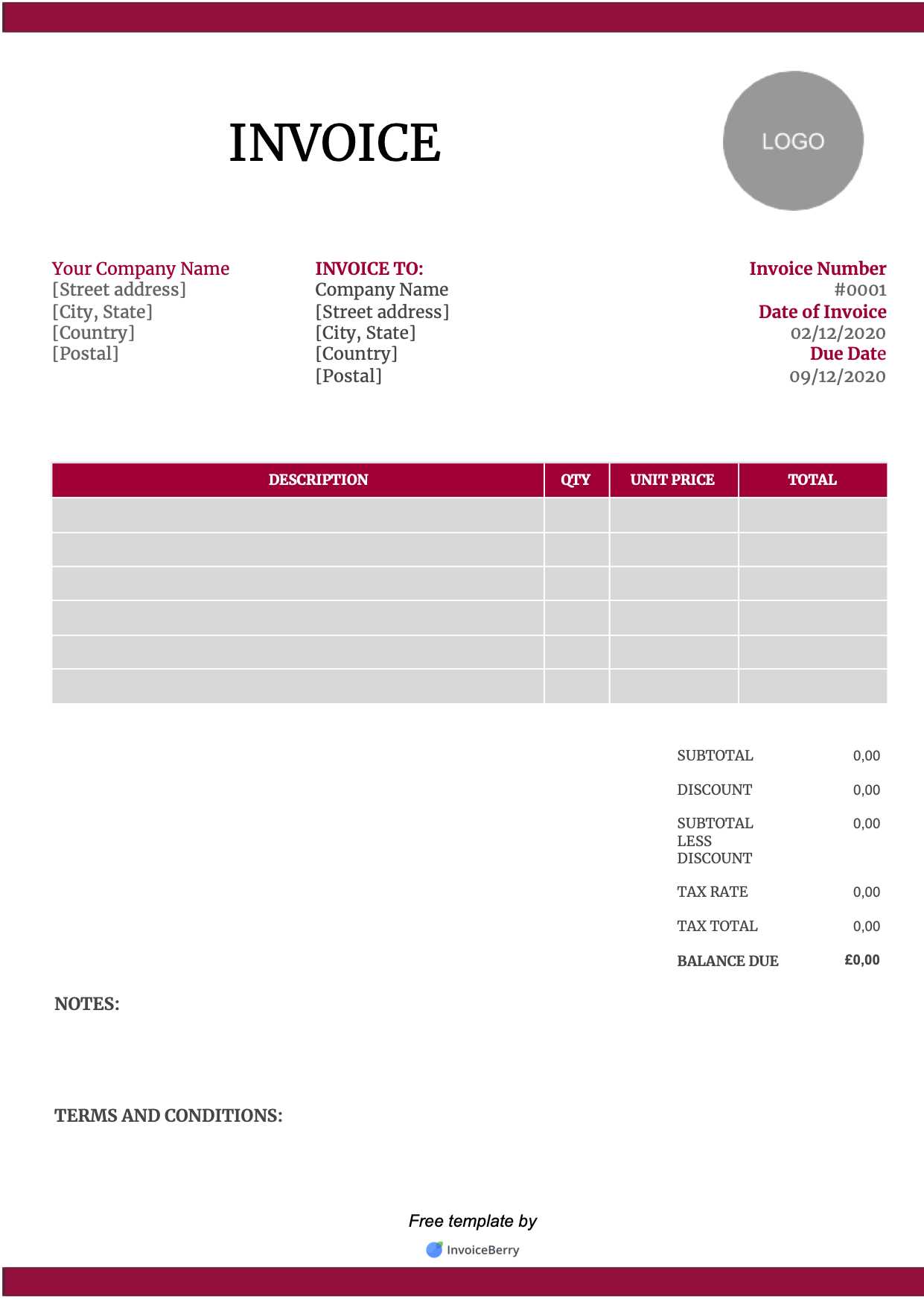

Once you’ve selected the right format, it’s time to fill in the necessary information. Be sure to include all relevant details, such as the date, client name, service or product description, and payment instructions. This will help ensure that the document is clear, accurate, and professional, reducing the risk of confusion and delays in payment.

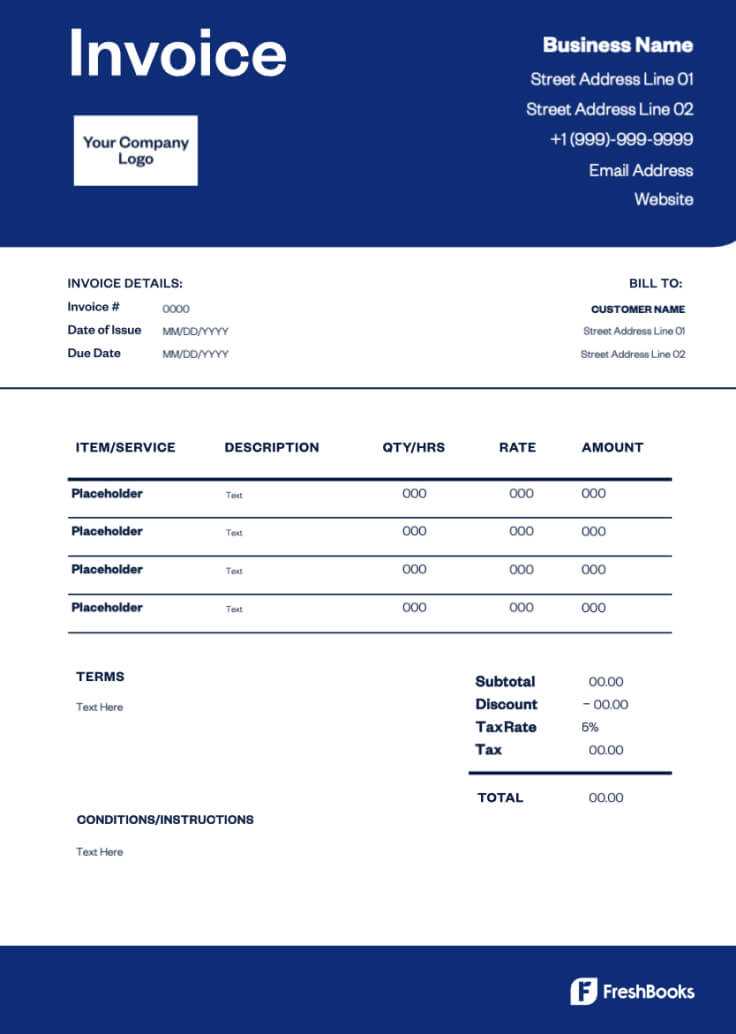

Top Features of Invoice Templates

When creating payment requests, having a well-structured and customizable document is essential for maintaining a professional image. The best tools for generating these documents come with a variety of helpful features that allow you to personalize each statement while ensuring accuracy and clarity. These features can make the process of billing smoother and more efficient for businesses of all sizes.

Key Elements for Customization

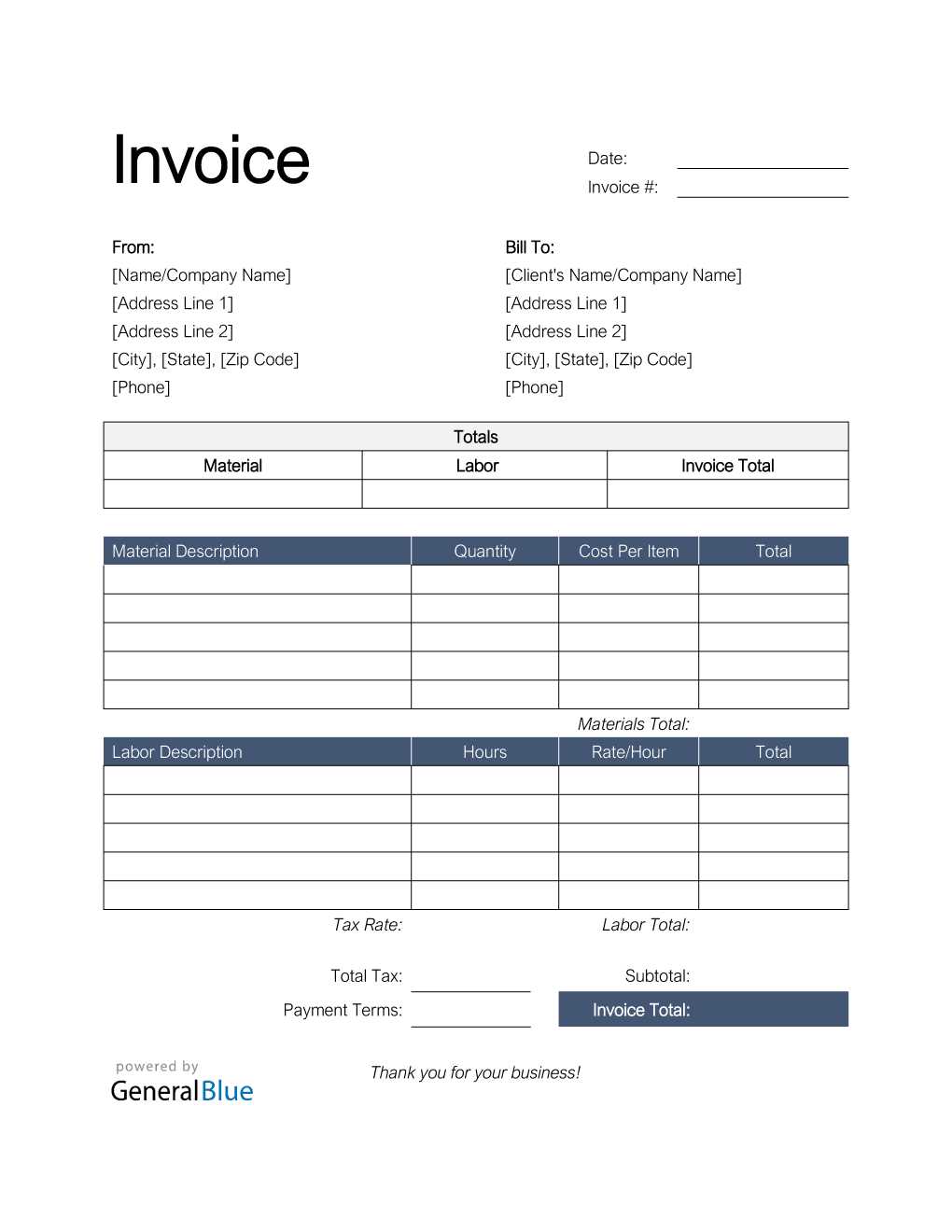

- Editable Fields: The ability to input and modify client information, product or service details, and pricing ensures each document is tailored to specific transactions.

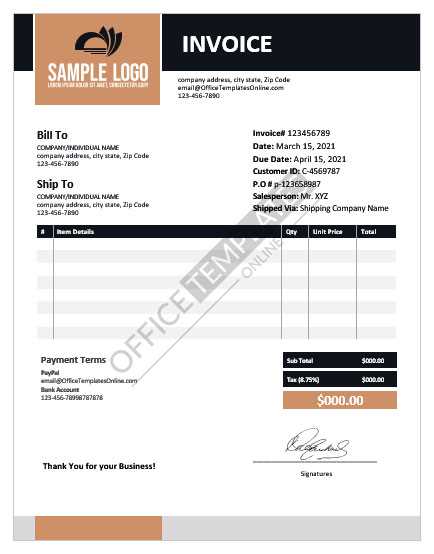

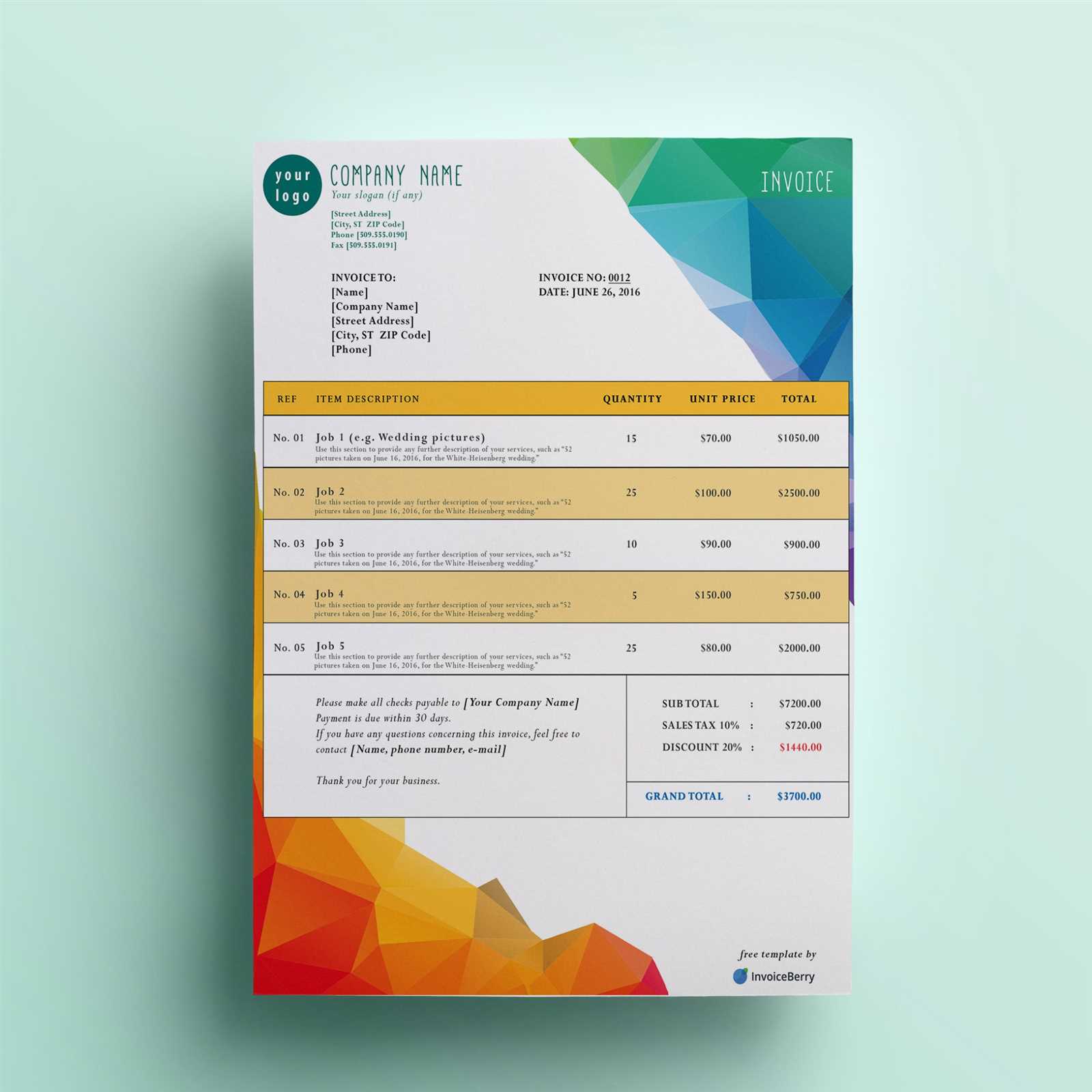

- Logo and Branding: Adding your company’s logo and color scheme helps maintain a consistent brand identity across all communications.

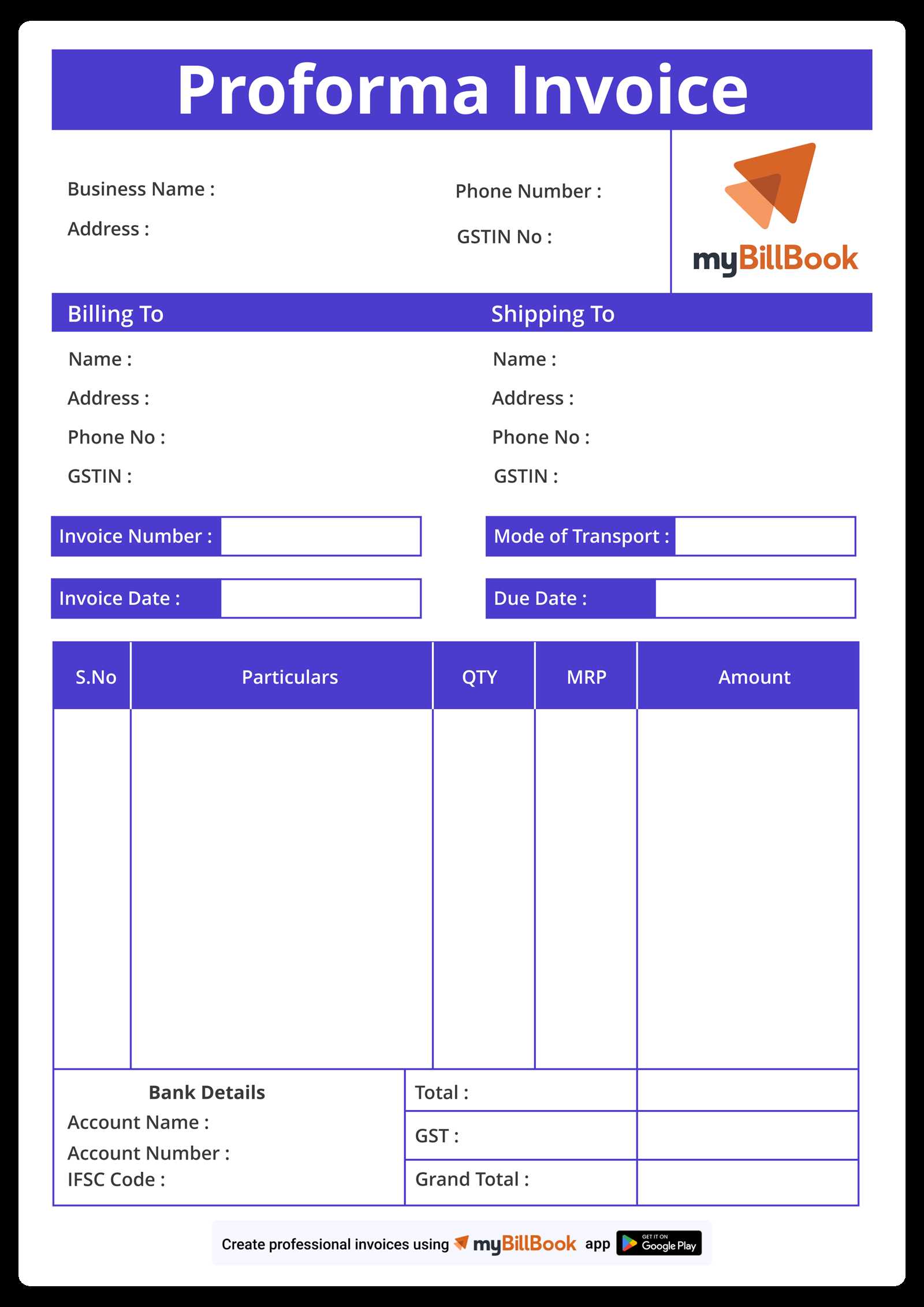

- Multiple Payment Methods: Including various payment options, such as bank transfer, credit card, or online payment links, provides clients with flexibility in how they pay.

Time-Saving Features

- Pre-Formatted Layouts: Ready-made designs ensure that all the necessary fields are in place, reducing the time spent on document creation.

- Automatic Calculations: Many tools include auto-calculation features for totals, taxes, and discounts, eliminating manual errors.

- Downloadable and Shareable: Once completed, these documents can easily be downloaded in various formats or shared directly with clients via email.

Why Choose Free Invoice Templates

For businesses and freelancers, keeping costs low while maintaining professionalism is a priority. Using no-cost resources for generating billing documents is an excellent way to achieve both. These tools not only help reduce overhead but also provide high-quality solutions that make the payment process smoother for both you and your clients.

Cost-Effective Solution

Saving money is one of the primary reasons to choose these resources. Instead of paying for expensive software or subscriptions, you can access and use customizable documents at no charge. This is especially beneficial for small businesses, startups, or independent contractors who need to keep their expenses in check.

Ease of Access and Convenience

Using these tools is simple and requires minimal effort. You can quickly generate a professional billing statement with just a few clicks. With no need to install software or sign up for services, you can immediately begin creating and sending documents without delay. This ease of access ensures that your billing process is never a bottleneck in your workflow.

Customizing Your Invoice Template

Personalizing your billing document is key to making a lasting impression on clients. Tailoring each form to reflect your business identity ensures professionalism and consistency across all communications. Whether it’s adjusting the layout or adding specific details, customization allows you to create a document that meets your exact needs while maintaining a polished appearance.

Personalizing Design Elements

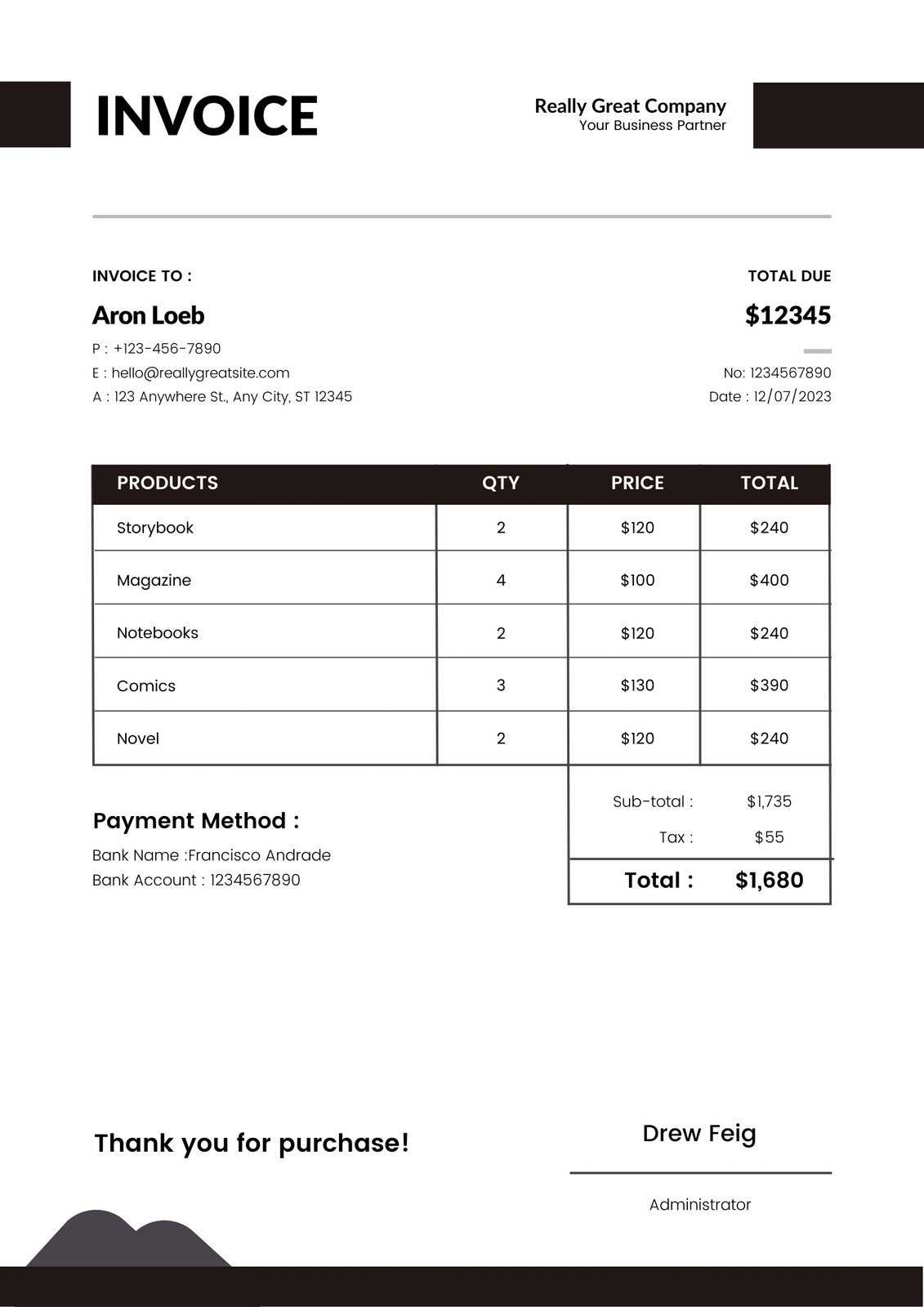

One of the first things to customize is the visual layout of the document. This includes incorporating your company logo, choosing colors that align with your branding, and adjusting the font style to match your business’s identity. A well-designed document not only looks more professional but also reinforces your brand image, making it easily recognizable to clients.

Adjusting Content and Fields

Another important aspect of customization is modifying the content and structure of the document. You can easily add or remove fields to include only the most relevant information. For example, you might want to include a section for discounts, payment terms, or specific product descriptions. This flexibility ensures that every transaction is accurately represented and that clients receive all necessary details clearly and concisely.

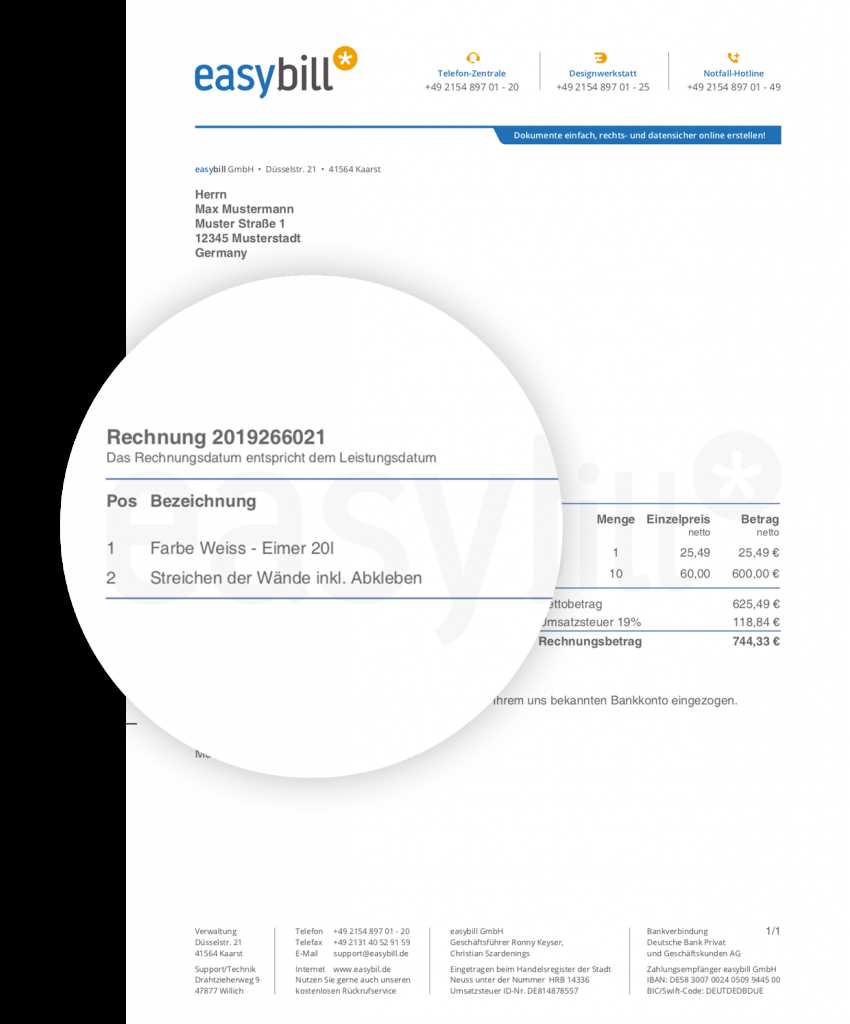

Best Free Invoice Template Resources

When it comes to creating professional billing documents, there are many accessible resources that offer high-quality options at no cost. These platforms provide ready-made designs that can be easily customized to suit your business needs. Whether you are looking for simple formats or more detailed layouts, these tools make it easy to produce professional documents without any software investment.

Top Platforms for Billing Forms

- Invoice Generator: A simple yet effective tool for creating quick billing statements, allowing easy customization of all fields with no sign-up required.

- Zoho Invoice: A popular choice offering both free and premium plans, Zoho provides customizable forms along with options for tracking payments and recurring billing.

- Wave: Ideal for small businesses, Wave’s free invoicing software includes helpful features such as auto-calculations and integration with accounting tools.

Resources for Specialized Forms

- Invoice Simple: This platform offers a variety of customizable options for different industries, making it easy to tailor forms to specific business needs.

- FreshBooks: While primarily a paid service, FreshBooks offers a limited free plan with basic tools for generating and sending professional payment requests.

Saving Time with Invoice Templates

Time is one of the most valuable resources for any business. By using pre-designed billing documents, you can significantly reduce the amount of time spent on creating and managing payment requests. These ready-made forms automate much of the process, allowing you to focus on more critical tasks while ensuring that each transaction is properly documented and sent without delay.

Quick Setup and Customization

With pre-structured formats, creating a billing document becomes a simple task. You no longer need to manually format each page, adjust column widths, or ensure that every detail is correctly aligned. By using customizable fields, you can quickly input client details, services provided, and payment terms, making the process faster and more efficient.

Streamlined Repetitive Tasks

Another significant time-saving feature is the ability to reuse and update existing forms. If you frequently send similar types of billing requests, you can simply copy a previous document and make necessary adjustments, eliminating the need to start from scratch each time. This reduces the overall effort required for each transaction, speeding up your workflow.

Free Invoice Templates for Small Businesses

For small business owners, managing cash flow and ensuring timely payments is crucial. Having the right tools to create professional billing documents can simplify this process and help establish a reliable system for tracking transactions. Many resources are available that allow small businesses to create custom, polished documents without additional expenses, ensuring smooth financial operations without the need for expensive software or services.

Using ready-made forms is especially beneficial for businesses with limited resources. These tools offer straightforward solutions for generating professional-looking billing statements, allowing small business owners to focus on growing their operations while handling payments efficiently. Whether you’re providing services or selling products, customizable formats can be easily tailored to reflect your unique business needs, ensuring accuracy and consistency in all financial transactions.

Invoice Templates for Freelancers and Contractors

For freelancers and independent contractors, managing billing can be a time-consuming task that takes away from the focus on delivering quality work. Having access to customizable, professional documents can streamline this process and ensure that payments are requested promptly and clearly. With the right tools, freelancers can create detailed payment requests that not only look professional but also contain all the necessary information to avoid confusion.

Customizing Payment Details

Freelancers and contractors often need to customize their payment requests to include specific job details, such as project milestones, hourly rates, or agreed-upon deliverables. Having an easy way to add these personalized sections ensures accuracy and helps both parties stay aligned on expectations. With simple, editable forms, it’s easy to update every document for each client while maintaining a consistent professional appearance.

Tracking and Managing Payments

Another advantage of using these tools is the ability to keep track of payments and outstanding balances. Many platforms offer features that allow you to organize your past billing records, helping you monitor overdue payments and follow up efficiently. This organizational aspect is crucial for independent workers, who often handle multiple projects at once and need a streamlined way to stay on top of their finances.

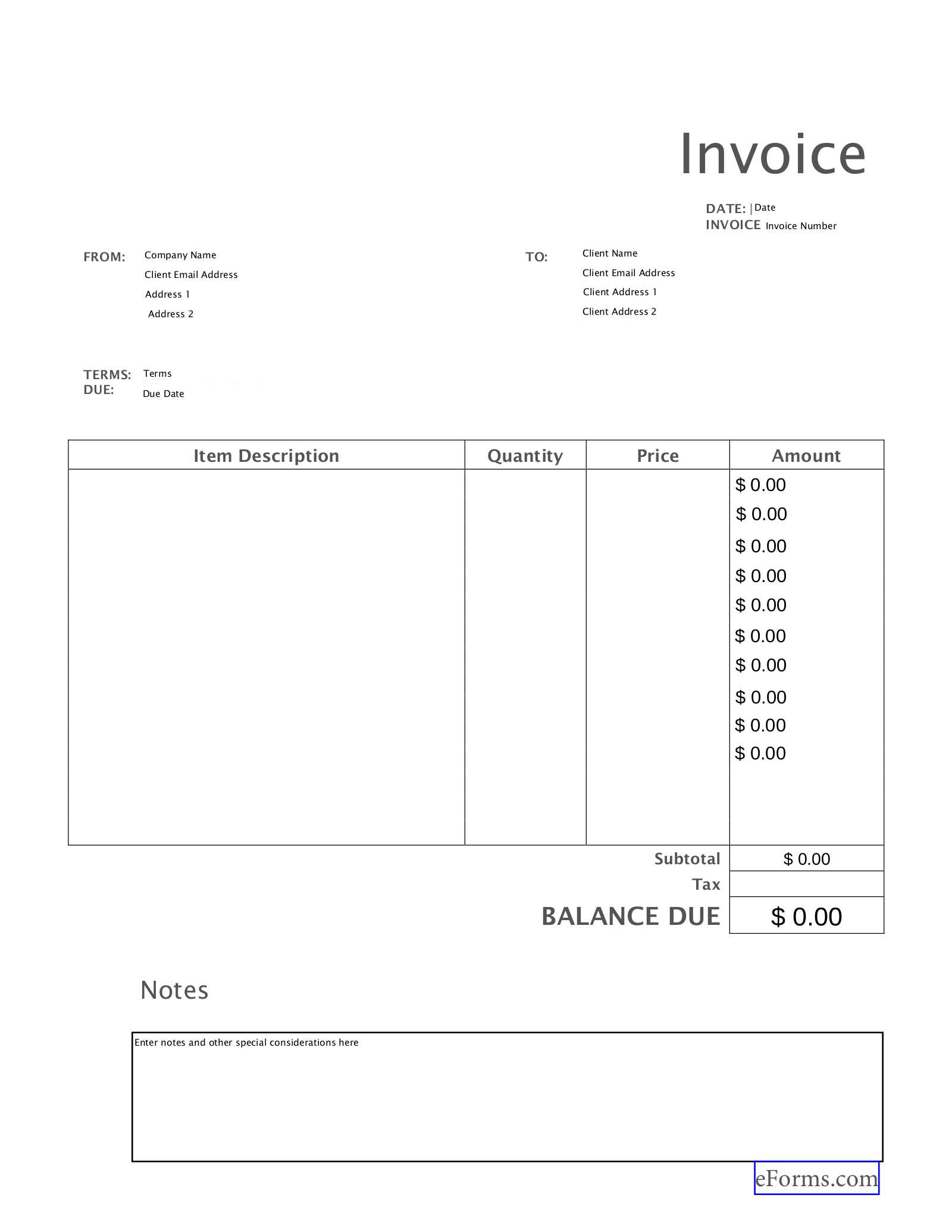

How to Download Free Invoice Templates

Accessing customizable billing forms is easy and can be done in just a few simple steps. Many websites offer these ready-made documents, which can be downloaded quickly and tailored to suit your business needs. Here’s a quick guide on how to find and download the best resources for your payment requests:

| Step | Action | Details |

|---|---|---|

| 1 | Visit a Trusted Resource | Search for platforms offering customizable forms. Many websites provide a range of styles for different business needs. |

| 2 | Select a Document Style | Browse through the available formats and choose one that fits your preferences. Look for easy-to-edit features. |

| 3 | Customize the Document | Input necessary information such as business name, client details, and services provided. Personalize as needed. |

| 4 | Download the Document | After customization, click on the download button to save the document to your computer or device in your preferred format. |

By following these steps, you can quickly generate a professional payment request, ready to be sent to clients, all without the need for costly software or complicated processes.

Choosing the Right Format for Invoices

When creating a payment request, selecting the right format is crucial to ensure clarity and professionalism. The right layout helps convey all necessary details in a simple, organized manner. Whether you’re sending a digital version or printing a hard copy, the format you choose should reflect the nature of your business and meet the needs of your clients.

Digital vs. Paper Versions

One of the first decisions to make is whether you want to send your billing statement digitally or in paper form. Digital documents, such as PDFs or editable Word files, are convenient for quick delivery via email and are often more environmentally friendly. On the other hand, paper versions may be required in specific industries or when dealing with clients who prefer traditional methods. Both formats can be customized, but it’s important to choose the one that best suits your workflow and client preferences.

Simple or Detailed Layout

The level of detail in your document will depend on the complexity of the service or product you are offering. A simple design might include only essential information such as the amount due and payment instructions. However, for more complex projects, such as consulting services or long-term contracts, a more detailed layout is necessary to outline specific terms, milestones, and additional fees. Always consider the type of service you’re providing and select a format that clearly conveys the necessary information without overwhelming the recipient.

Printable vs Digital Invoice Templates

When creating billing documents, businesses have the option to choose between printable or digital formats, each with its own set of advantages. Understanding the differences between these two approaches is important for determining which method best suits your workflow and client preferences. Both formats can serve their purpose effectively, but each offers unique benefits depending on the situation.

Advantages of Printable Formats

- Physical Copy: A printed document can be delivered in person or through traditional mail, which may be necessary for clients who prefer hard copies or for official records.

- Professional Presentation: For some clients, receiving a printed bill may appear more formal and professional, especially for large transactions or formal agreements.

- Record Keeping: Physical documents can be easier to store for long-term filing or if your business requires hard-copy retention for legal or accounting purposes.

Advantages of Digital Formats

- Instant Delivery: Digital billing allows you to send documents immediately via email, speeding up the payment process and reducing delays in communication.

- Environmentally Friendly: Digital formats eliminate the need for paper, contributing to environmentally conscious business practices.

- Easy Tracking and Updates: Digital records are easier to organize, track, and update. You can quickly edit and resend documents if changes are needed.

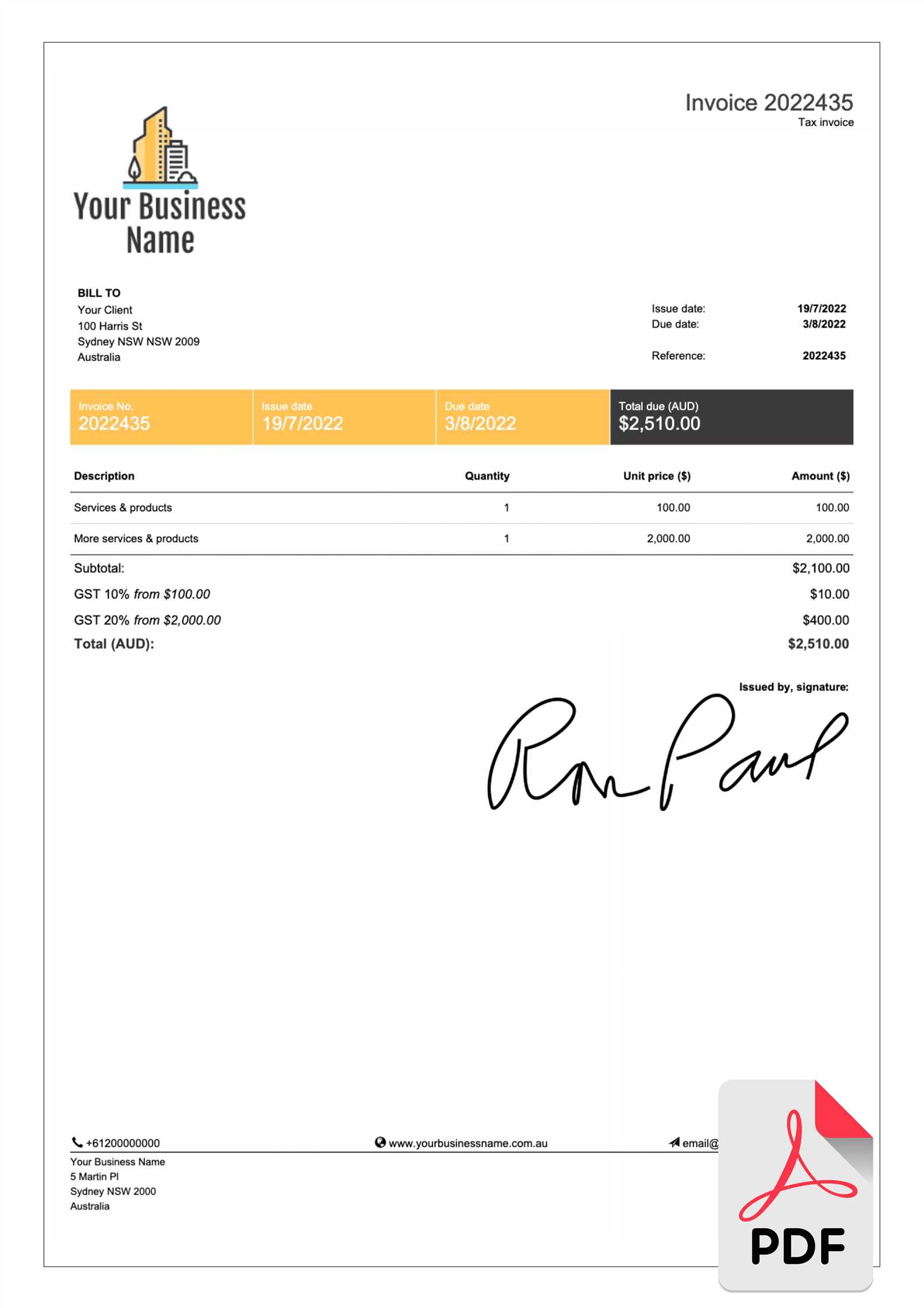

Understanding Invoice Template Legal Requirements

When creating payment documents, it is essential to ensure that they comply with the legal regulations set forth by local and international laws. These requirements vary by region and industry but generally include certain key details that must be included in any official billing statement. Understanding these legal necessities helps avoid disputes and ensures that your documents hold up in case of audits or legal proceedings.

For example, many countries require that the document includes specific information such as the seller’s and buyer’s full names and addresses, tax identification numbers, and a clear breakdown of the goods or services provided. Failure to include these details could lead to complications, including tax-related issues or delayed payments. Additionally, businesses must be mindful of local sales tax laws and whether they need to include tax amounts in their statements.

How to Send Invoices to Clients

Once you’ve created a professional payment document, the next step is delivering it to your client in a timely and effective manner. Properly sending these documents ensures that your clients understand the details clearly and that you receive timely payment. Whether you’re sending a digital file or a physical copy, there are key practices to follow for smooth delivery and receipt confirmation.

Emailing is one of the most common and efficient methods of sending a payment request. Ensure that the document is attached as a clear, easy-to-read file, such as a PDF. In your email, include a polite message that highlights important details, such as the total amount due, payment terms, and due date. For example, you could write, “Please find attached the payment request for the services rendered. The total amount is due by [date]. If you have any questions, feel free to reach out.”

Another option is to use an invoicing platform, which allows you to send the document directly through their system. Many platforms offer additional features like automated reminders, payment tracking, and even integration with payment gateways, making the process more seamless.

For clients who prefer physical copies, it’s essential to send the document via postal services. Be sure to use a reliable mailing service, such as certified mail or courier, to ensure that the payment request reaches your client in a timely manner and can be tracked if needed.

Free Invoice Template for Quick Payments

When it comes to getting paid on time, having a well-structured billing document can make all the difference. A clear, professional-looking form not only ensures that all the necessary details are provided but also encourages timely payment. By using pre-designed forms that can be quickly customized, you can streamline the payment process and improve cash flow for your business.

Simple and Clear Structure

A straightforward document with clear payment instructions helps reduce confusion and encourages your clients to settle their balances promptly. Ensure that your document includes essential details such as the total amount due, payment terms, and the due date. A clean and professional layout can also convey your commitment to professionalism, making clients more likely to pay on time.

Streamlined Process for Clients

Offering a simple payment process is another key factor in speeding up payments. Include multiple payment options, such as bank transfers, credit cards, or even online payment services, to make it as convenient as possible for clients to pay. The easier it is for them to make a payment, the quicker they’ll do it.

Common Mistakes in Invoice Creation

Creating payment requests may seem straightforward, but there are several common mistakes that businesses often make, which can lead to delays in payments or confusion with clients. Recognizing and avoiding these errors is essential for ensuring smooth transactions and maintaining a professional image. Below are some frequent issues to watch out for when preparing your billing documents.

Key Mistakes to Avoid

- Incorrect or Missing Contact Information: Always ensure that your business and client contact details are accurate and up-to-date. Missing or incorrect addresses or phone numbers can cause delays in payment processing or miscommunication.

- Failure to Include Payment Terms: Not specifying the payment due date or terms (such as late fees or discounts) can lead to misunderstandings. Always clearly outline when payment is expected and any penalties for delays.

- Inaccurate Item Descriptions: Be specific when listing the goods or services provided. Ambiguous descriptions can lead to disputes or confusion about what was delivered or completed.

- Not Including Tax Information: If applicable, be sure to include tax details such as tax rates and the total amount of tax charged. Omitting this information may result in compliance issues or confusion for your client.

- Errors in Amounts: Double-check the calculations for total amounts, including the sum of individual items, taxes, and discounts. A simple math error can lead to delays in payment and a lack of trust from clients.

How to Avoid These Errors

- Use Automated Tools: Many invoicing platforms offer tools that help you avoid common errors by automatically calculating totals and taxes.

- Review Before Sending: Always double-check the document before sending it to ensure all details are accurate and clear.

- Establish Clear Guidelines: Set up a standard format for your documents that includes all necessary sections, so you don’t forget important information.