Download Free Online Invoice Templates for Easy Billing

Managing financial transactions efficiently is crucial for any business. With the right tools, you can streamline the process of creating, customizing, and sending bills to your clients. These solutions not only save time but also help maintain accuracy and professionalism in your business communications.

Customizable forms allow you to quickly adjust key details and ensure that your documents align with your company’s brand identity. Whether you are a freelancer or a small business owner, using a pre-designed structure can simplify your workload and reduce errors. With just a few tweaks, you can have a professional document ready to go.

In today’s fast-paced world, it’s important to adopt solutions that are both flexible and user-friendly. The ability to generate a professional document in minutes and send it instantly can significantly improve your workflow and ensure that payments are processed without unnecessary delays.

Efficient Document Creation for Billing

Accessing ready-made documents for creating bills can drastically reduce the time and effort required to manage financial transactions. With customizable formats, you can quickly generate professional paperwork that suits your business needs. These structures are designed to be flexible, allowing you to tailor them with the necessary information and send them to clients in a matter of minutes.

By using an accessible format, businesses can eliminate the need for designing documents from scratch. This ensures that all essential details are included in a consistent manner, helping you maintain a streamlined workflow and avoid common errors that can arise when manually crafting paperwork.

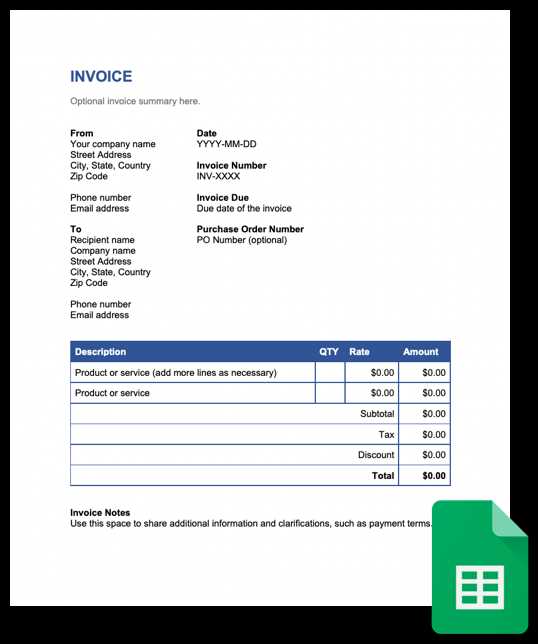

Here’s a quick overview of the most important elements to include when creating a professional document:

| Element | Description |

|---|---|

| Client Information | Ensure all client details are accurate, including name, address, and contact information. |

| Itemized List | Break down the products or services provided, including quantities, prices, and descriptions. |

| Payment Terms | Clearly outline payment due dates, methods, and any late fees if applicable. |

| Business Details | Include your company’s contact information, tax ID, and payment instructions. |

| Total Amount | Sum up the charges to be paid, including taxes and discounts if relevant. |

With the right tools, creating an effective bill is as simple as filling in these essential details. Once set up, you can quickly personalize and distribute them to clients for a smooth and professional transaction process.

Why Use Ready-Made Billing Formats

Using pre-designed structures for creating billing documents can save significant time and effort. These ready-made formats are designed to simplify the process of generating accurate and professional records, making it easier for businesses to manage their financial transactions effectively. Instead of creating each document from scratch, these options provide a streamlined solution that ensures consistency and reduces the chances of errors.

Key Advantages of Using Pre-Designed Formats

- Time Efficiency: Pre-built formats allow you to quickly fill in the necessary details, saving valuable time compared to creating documents from scratch.

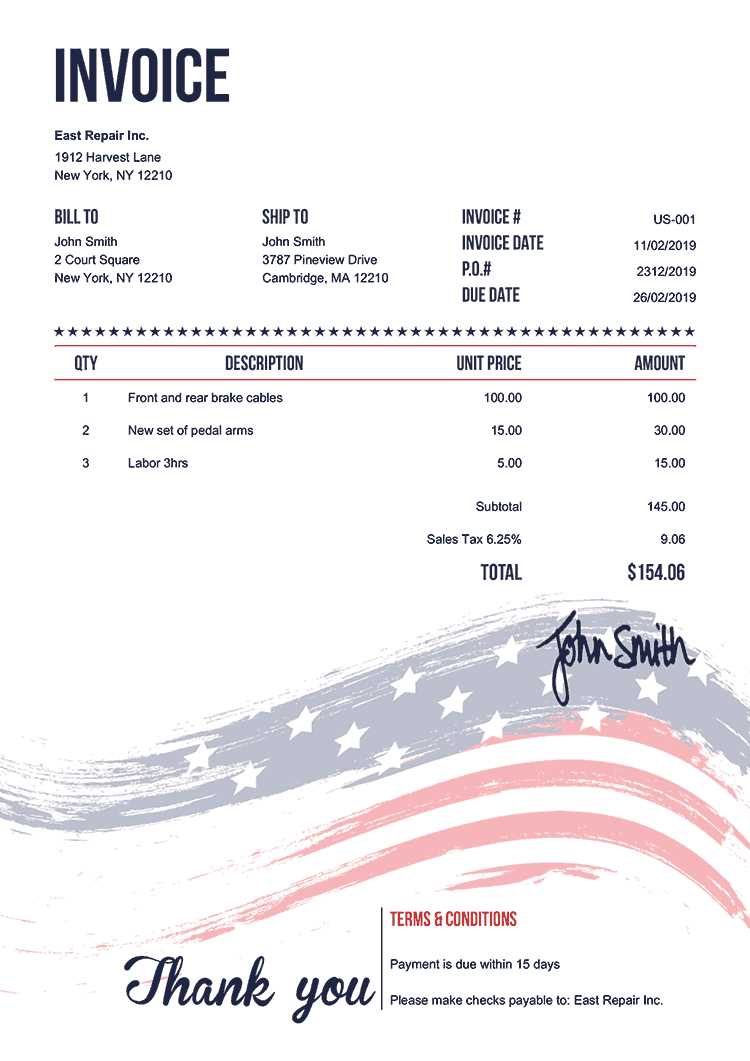

- Professional Appearance: These documents come with a polished design that adds credibility to your business and makes a good impression on clients.

- Customization Options: Even with a pre-made format, you can modify the fields and layout to suit your specific needs, ensuring the document aligns with your business style.

- Error Reduction: Ready-made formats include all the essential elements, helping to prevent omissions or mistakes in key areas like payment terms or client details.

- Consistency: Using the same layout for all your financial records ensures consistency across all your client interactions, which is important for maintaining professionalism.

Who Can Benefit the Most

- Freelancers: Quick and simple solutions for independent contractors who need to send accurate and professional bills to clients.

- Small Businesses: Streamlined processes for businesses that may not have dedicated accounting staff but still need reliable documents for billing.

- Startups: New companies can benefit from easy-to-use formats that allow them to focus on growing their business rather than on administrative tasks.

By using these ready-made formats, businesses of all sizes can ensure that their billing processes are efficient, professional, and error-free. This approach minimizes time spent on paperwork and allows more focus on what matters most: serving clients and growing your business.

Benefits of Customizable Billing Forms

Having the ability to modify the structure of your billing documents offers significant advantages, allowing you to tailor them to the unique needs of your business and clients. Customizable forms ensure flexibility, letting you adapt to different client preferences, industries, or legal requirements. With this adaptability, businesses can present their charges in a professional and personalized manner, fostering better relationships and smoother transactions.

Customizable formats provide an efficient way to create documents that are aligned with your company’s brand identity. From adjusting fonts and colors to adding specific fields, these forms allow for greater control over the final appearance and content of each record, making it easier to meet various business needs and client expectations.

| Benefit | Description |

|---|---|

| Brand Consistency | Adjust colors, logos, and fonts to reflect your business’s visual identity, reinforcing professionalism and trust. |

| Flexibility | Easily modify details such as payment terms, services offered, or additional fees based on each specific project or client. |

| Improved Client Communication | Personalize the format to include special instructions or discounts, improving transparency and communication with your clients. |

| Efficiency | Quickly adapt existing forms to suit new transactions, reducing the time spent on creating new paperwork from scratch. |

| Legal Compliance | Modify the format to ensure all required fields for tax or legal purposes are included, helping to avoid compliance issues. |

By using flexible billing structures, businesses can enhance the overall client experience while ensuring that all essential details are captured and presented in a clear, professional manner. Customizable forms simplify the process of managing payments and help maintain accuracy across different transactions and industries.

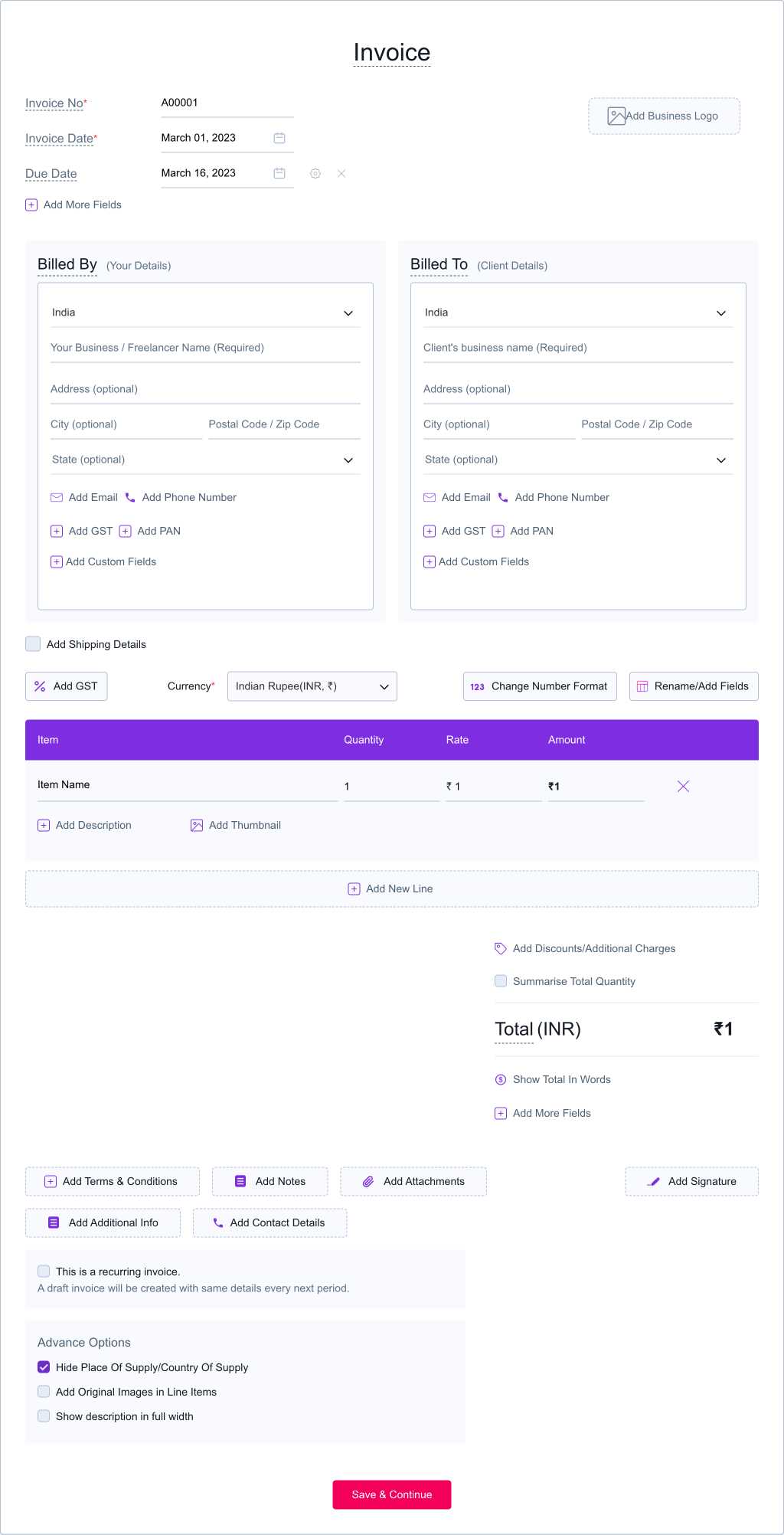

How to Create a Billing Document Structure

Designing a structured document for billing purposes is an essential step for businesses looking to streamline their financial operations. A well-organized form can help you clearly communicate payment details to clients while maintaining a professional appearance. The process involves selecting the right elements, customizing them to fit your business needs, and ensuring that all necessary information is easy to read and accurate.

Essential Steps to Create a Billing Document

Creating a billing document requires careful attention to detail and a clear layout. Follow these steps to ensure your document is both functional and professional:

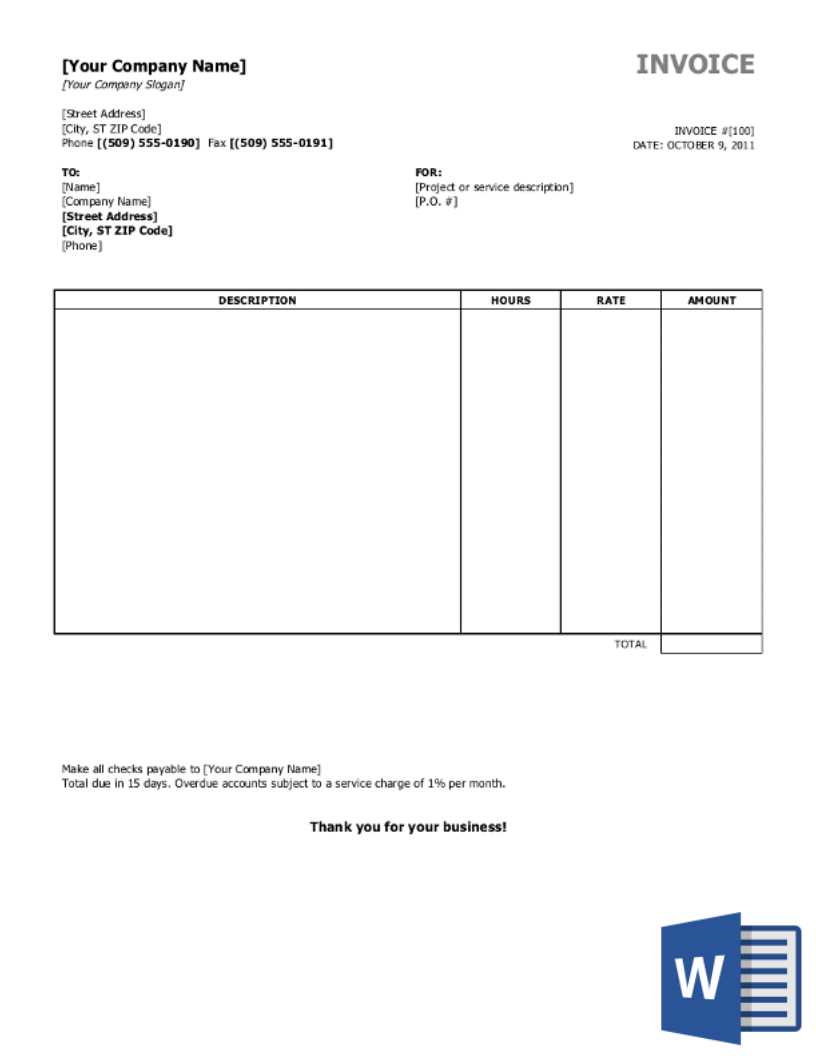

- Choose a Layout: Select a layout that fits your business style. Keep the design clean and straightforward, ensuring clients can easily read and understand the details.

- Add Business Information: Include your company’s name, address, contact details, and any legal information like tax identification numbers.

- Client Information: Include the client’s name, address, and contact information to ensure the document is correctly addressed.

- Itemized List: Break down the services or products provided with clear descriptions, quantities, and prices.

- Terms and Conditions: Specify payment terms, due dates, and any late fee policies if applicable.

Key Elements to Include in Your Document

For a clear and complete billing document, make sure to include the following elements:

| Element | Description |

|---|---|

| Header | Include your business name, logo, and contact information at the top for easy identification. |

| Client Information | Ensure you have the client’s name, address, and contact details for accurate record keeping. |

| Detailed List of Products or Services | Provide a clear breakdown of what was delivered, including prices and quantities, so the client can see the exact charges. |

| Total Amount | Summarize the total cost, including taxes, discounts, and any applicable fees. |

| Payment Terms | Specify when payment is due, preferred payment methods, and any additional instructions for payment processing. |

Once these elements are in place, you can customize the document further by adjusting the layout or adding additional sections based on your specific business needs. The goal is to create a document that is clear, concise, and professional, ensuring smooth financial transactions.

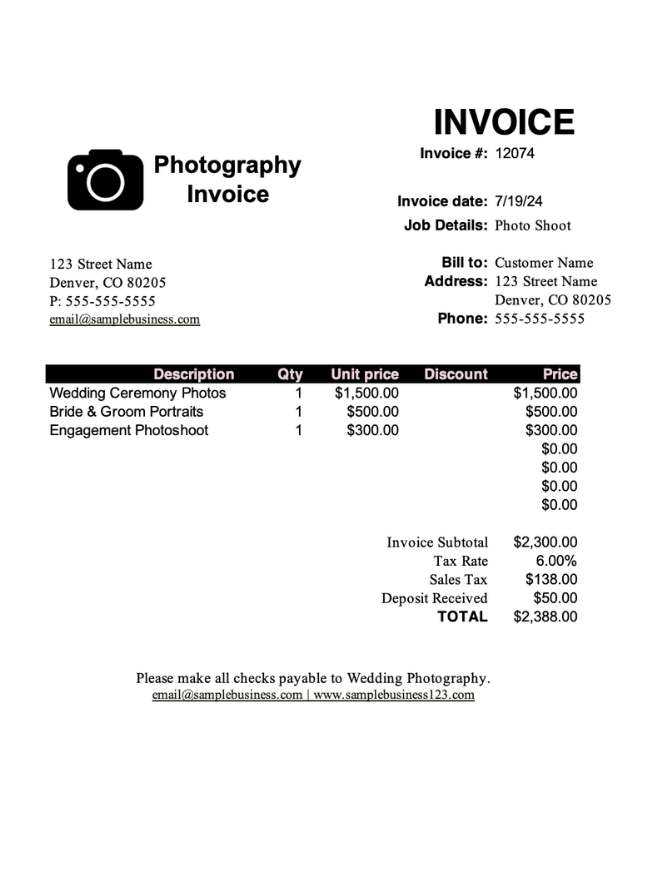

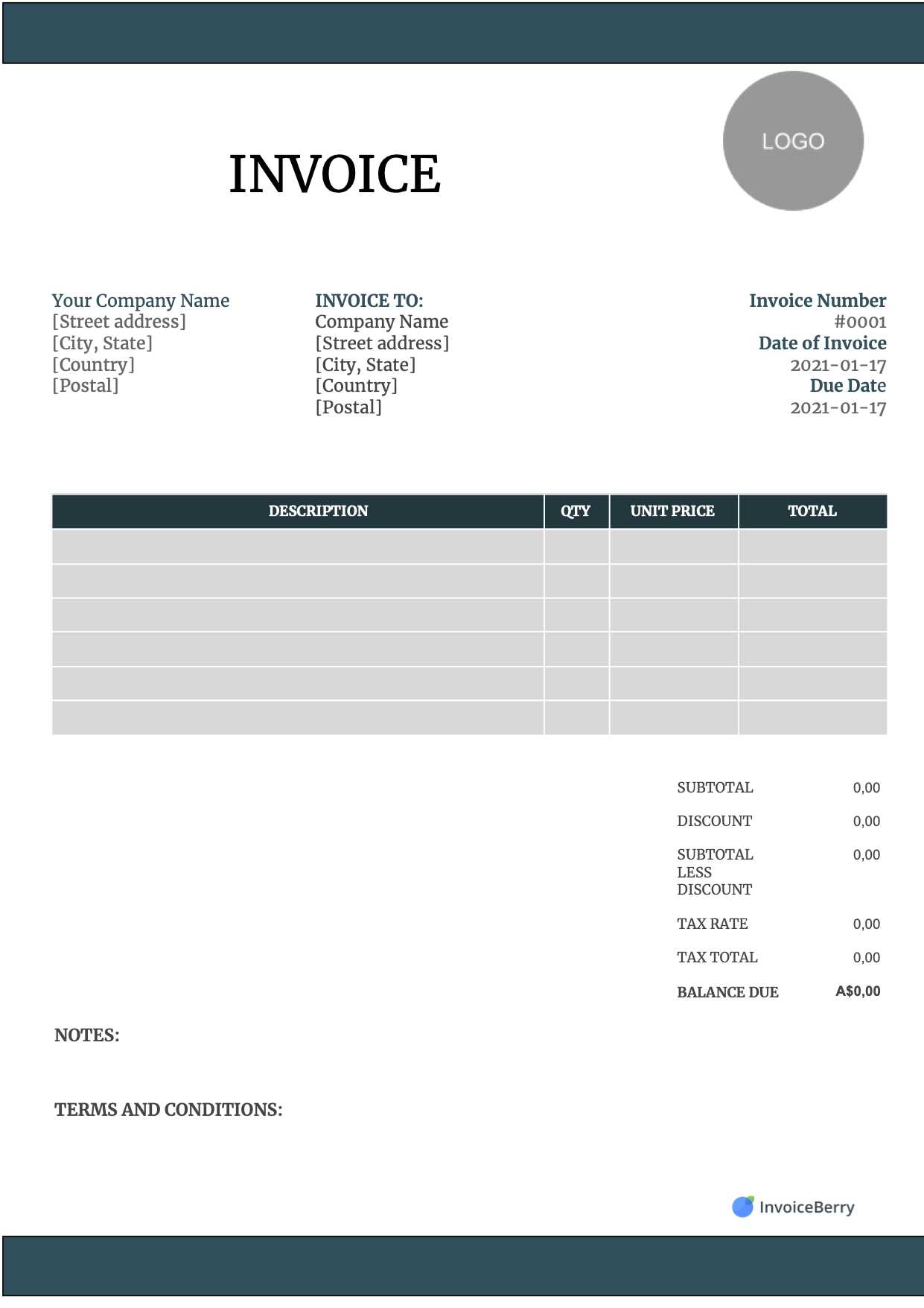

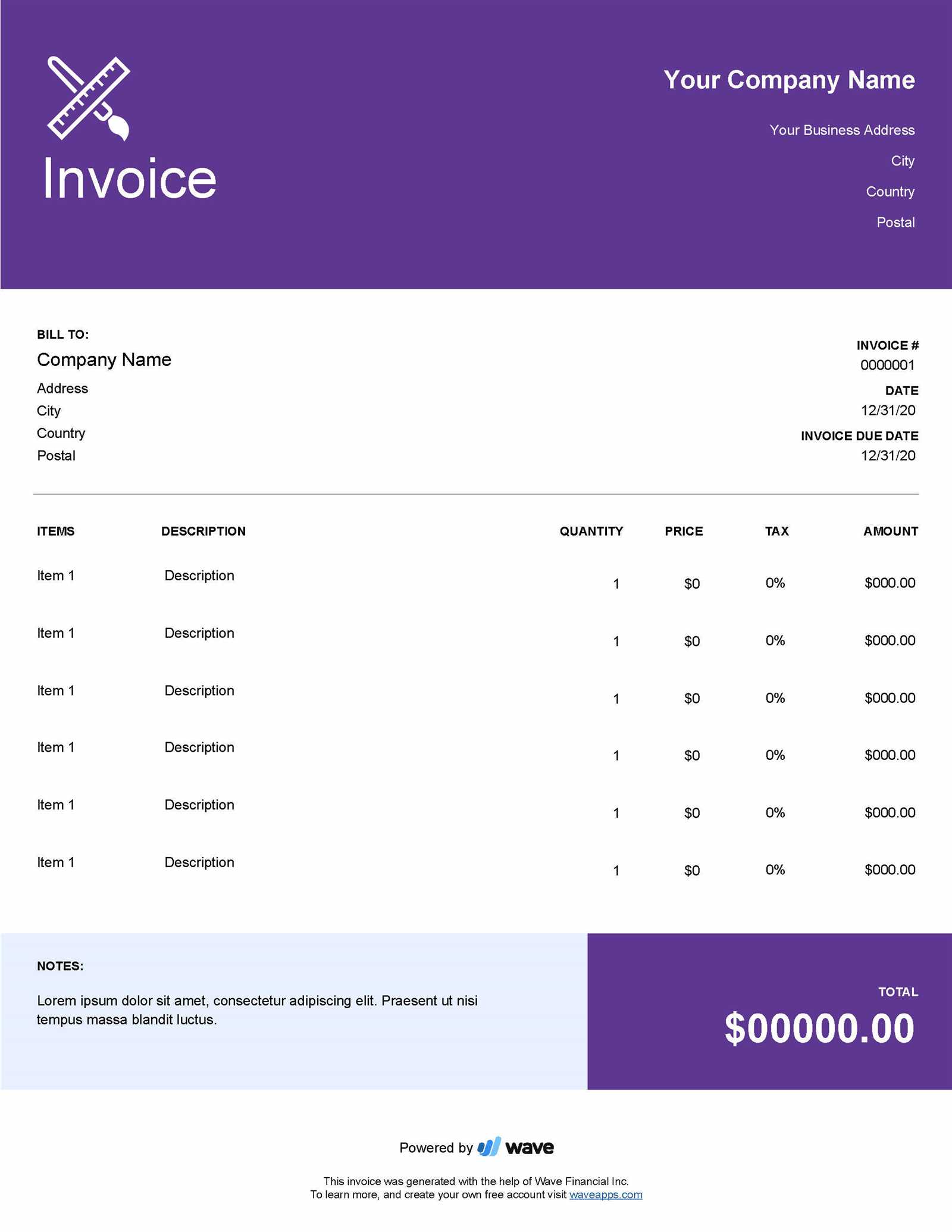

Top Free Billing Document Formats

Finding free, high-quality billing forms can be a game-changer for small businesses and freelancers. These ready-made structures are designed to make the process of creating financial records quicker and more efficient. Whether you need something simple or more detailed, there are numerous options available that can be customized to suit your specific needs.

Here are some of the best free formats that provide flexibility and functionality for businesses of all sizes:

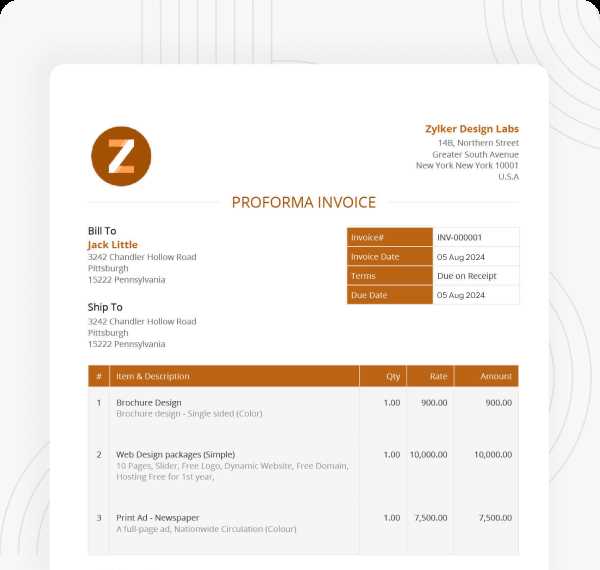

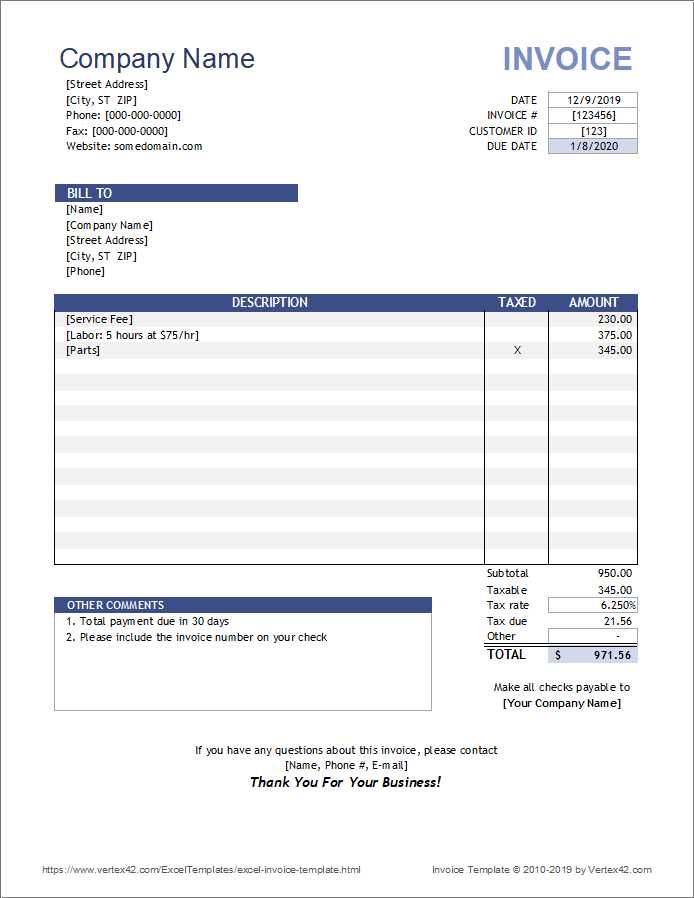

- Simple Billing Structure: Ideal for freelancers or businesses that need a straightforward, no-frills approach. This format includes the basic fields necessary for clear communication, like client info, services/products provided, and payment terms.

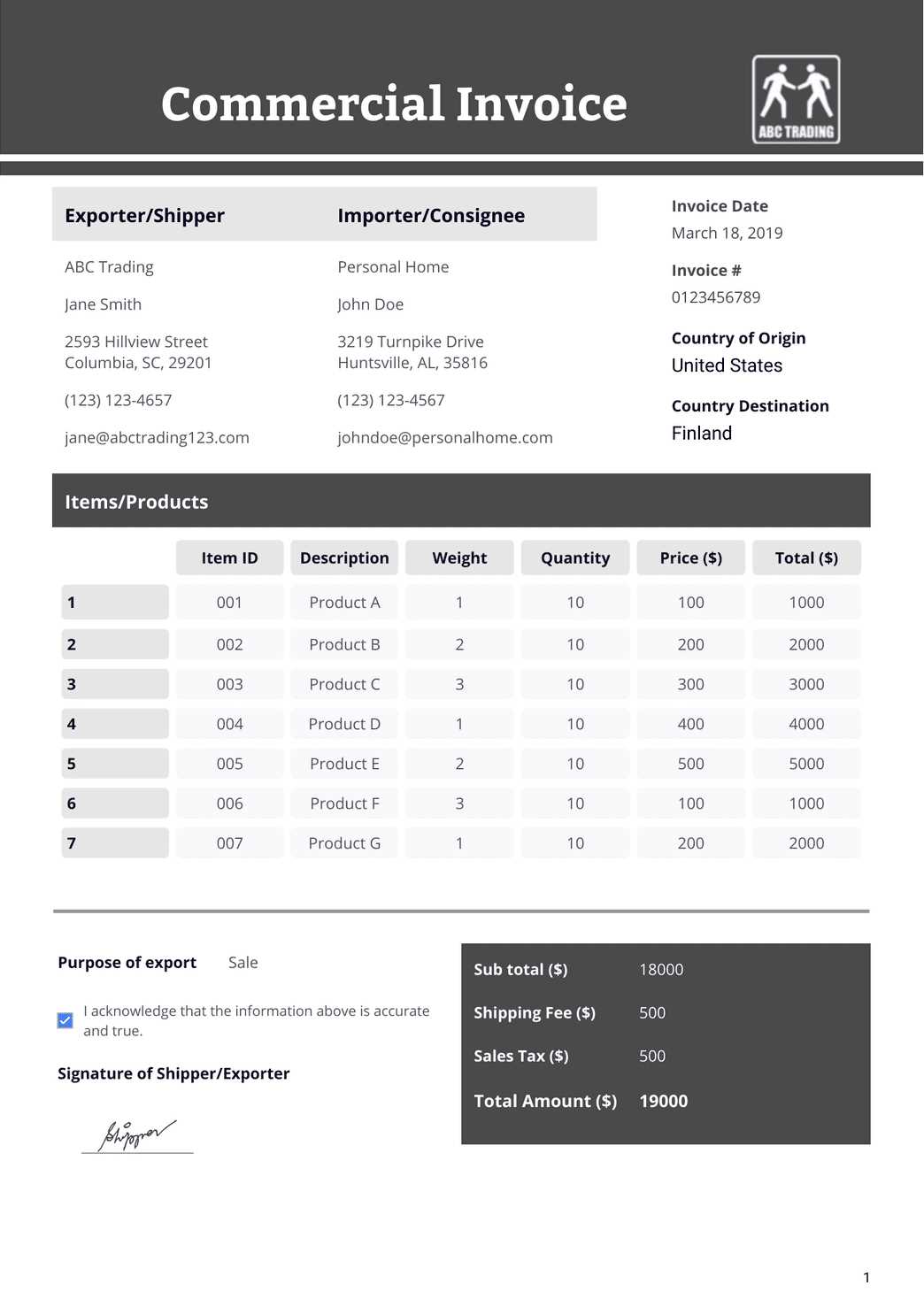

- Itemized Detailed Format: Perfect for businesses that need to break down products or services in detail. This format includes sections for multiple items, quantities, unit prices, and tax calculations.

- Modern Professional Layout: A sleek, contemporary design with a clean layout, suited for companies wanting a polished and branded look. It often includes space for logos and specific business details.

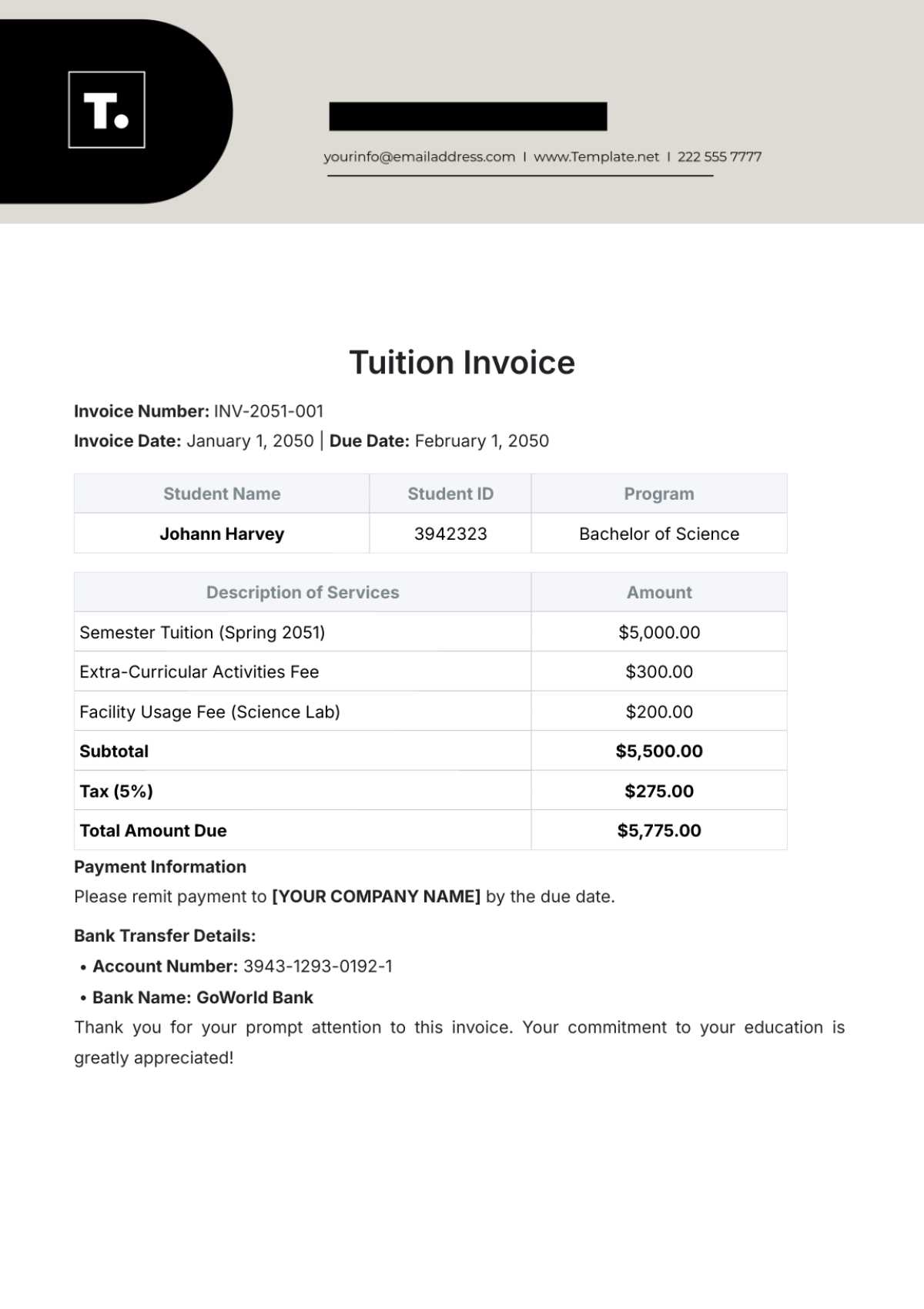

- Service-Based Billing Document: Great for service providers, this format includes sections for service descriptions, hours worked, hourly rates, and total charges, making it easy to invoice for time-based work.

- Recurring Payment Format: Designed for businesses that offer subscription services or ongoing contracts, this layout helps track multiple payments and billing cycles in one document.

Each of these options is free to use, providing an excellent starting point for businesses looking to streamline their payment processes without spending money on complex software. By choosing a format that fits your needs, you can save time and ensure your documents are both professional and accurate.

Choosing the Right Billing Format

Selecting the right structure for your billing documents is crucial for ensuring clarity, accuracy, and professionalism. The format you choose should align with the nature of your business, the type of services or products you offer, and the expectations of your clients. A well-organized billing record not only facilitates smooth transactions but also helps in maintaining a positive relationship with clients by providing them with clear and transparent information.

Factors to Consider When Choosing a Format

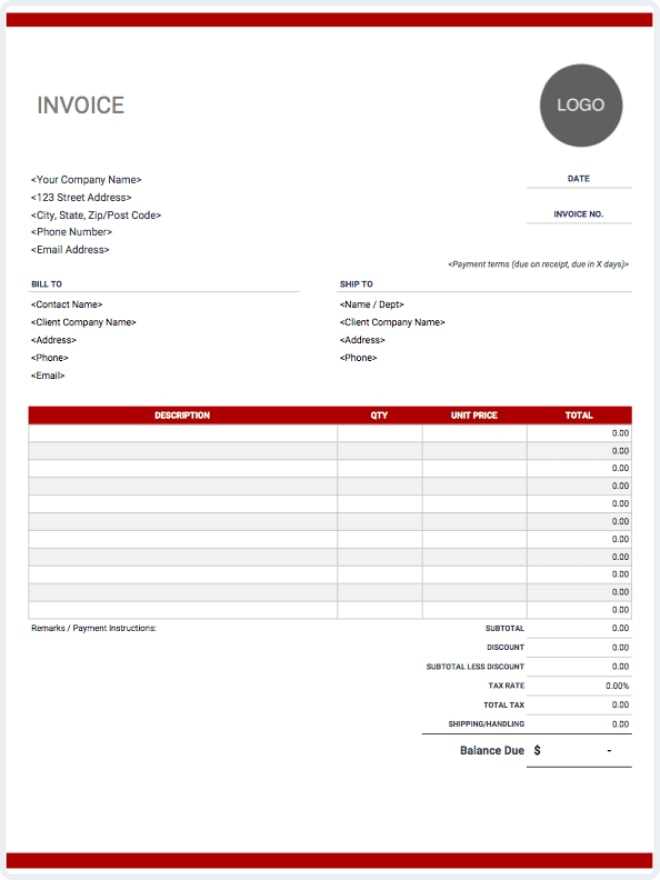

- Business Type: Different businesses require different levels of detail. A service-based company may need more space for time tracking, while a product-based company will need to list items, quantities, and prices clearly.

- Client Preferences: Some clients may prefer a detailed breakdown of charges, while others may be content with a more simplified record. Understanding your client’s needs will help you choose the best format.

- Legal or Tax Requirements: Make sure the format you choose includes all necessary fields for legal and tax purposes, such as tax identification numbers, payment terms, and relevant taxes.

- Frequency of Use: If you bill frequently, you may want a more streamlined format for quick editing, whereas, for occasional billing, a more detailed structure might be needed to capture all necessary information.

Different Billing Formats for Different Needs

Once you’ve considered the factors above, you can choose the most suitable format based on your specific needs. Below is a comparison of common options:

| Format Type | Best For | Key Features | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Simple Billing Record | Small businesses, freelancers | Quick and easy to create; includes basic details like client name, service, and total amount. | |||||||||

| Detailed Service Record | Service providers, consultants | Includes sections for hourly rates, time worked, and specific services provided. | |||||||||

| Product Billing Form | Retailers, wholesalers | Itemized list of products with descriptions, quantities, and unit prices. | |||||||||

| Recurring Payment Layout | Subscription services, memberships | Includes sections to track payment cycles, recurring charges, and payment dates. | |||||||||

| Professional Branded Design | Com

Essential Information in a Billing DocumentFor a billing document to be clear, effective, and legally compliant, it must contain certain key details. These elements not only ensure that the recipient understands the charges but also protect your business in case of disputes. The right information helps maintain transparency and facilitates timely payments, improving cash flow and client relations. Key Details to Include

When creating a billing record, make sure the following information is present:

Why Each Element MattersEach piece of information on the document serves a specific purpose. Business and client information help establish clear communication and ensure accountability. The unique identifier makes it easy to track and reference specific transactions. An itemized list helps clients understand exactly what they’re paying for, while the payment terms set clear expectations for when and how payment should be made. Lastly, displaying the total amount in a clear and concise manner avoids confusion and ensures both parties are aligned on the final figure. By including these essential details, you can create a professional, transparent, and legally compliant billing document that helps ensure smooth and efficient financial transactions. Billing Document Features You Need

When creating a billing record, having the right features in place can make the process much more efficient and effective. A well-designed structure should not only capture all necessary details but also make the document easy to read and understand. These features ensure that all relevant information is included, reducing the risk of errors and misunderstandings. They also contribute to a more professional presentation, helping you build trust with your clients. Must-Have Features for Your Billing DocumentHere are some essential features that every billing record should include to ensure smooth and efficient financial transactions:

Why These Features Matter

Each feature plays a key role in simplifying the billing process and making transactions as clear as possible for both parties. Customizable fields give you flexibility, while itemization ensures that every detail is transparent. The inclusion of tax and discount calculations prevents errors, and clearly stated payment terms help manage client expectations. Finally, a professional design helps establish your credibility and makes your documents stand out. By choosing a structure that includes these essential features, you ensure a smoother workflow, reduce confusion, and enhance your relationship with clients, all while maintaining a professional and polished image. How to Edit Downloaded Billing FormsEditing a pre-designed billing document is a straightforward process, but it requires attention to detail to ensure that all the necessary information is included and presented clearly. Whether you’re working with a simple or a more complex layout, knowing how to modify and personalize the document is crucial for maintaining consistency and professionalism. Here’s how you can easily edit your downloaded form to suit your specific needs. Steps to Edit Your Billing DocumentFollow these basic steps to customize your form and make it ready for use:

Common Editing Mistakes to AvoidWhile editing, there are a few mistakes you should be mindful of to ensure the document remains accurate and professional:

By following these editing steps and being mindful of common mistakes, you can easily customize any pre-designed billing document. This ensures that your records are professional, accurate, and tailored to your business and client needs. Digital Billing vs Paper BillingWhen it comes to managing payments, businesses have the option of using either digital or traditional paper-based billing methods. Both approaches have their advantages and disadvantages, but in today’s fast-paced world, more businesses are shifting towards digital solutions due to their speed, efficiency, and cost-effectiveness. However, some companies still rely on paper records for various reasons, such as a preference for physical documentation or the need to comply with specific industry regulations. Understanding the differences between these two methods can help you determine which one is the best fit for your business. Benefits of Digital BillingDigital billing has become increasingly popular due to its many advantages over traditional paper-based systems:

Challenges of Digital BillingWhile there are numerous benefits, there are also some challenges to consider with digital billing:

Advantages of Paper BillingDespite the rise of digital solutions, paper billing still offers certain benefits:

|