How to Use an Old Invoice Template for Efficient Billing

Managing finances and keeping track of payments is an essential part of any business. One of the most straightforward ways to ensure accuracy and professionalism in financial transactions is by using pre-designed documents that can be easily customized to suit individual needs. These forms not only simplify the process but also provide a clear structure for both parties involved, ensuring that all necessary details are included in every transaction.

By adopting a ready-made layout, companies can save valuable time, reduce human errors, and maintain consistency across all transactions. These layouts are easily adaptable to various business needs and allow for quick modifications without starting from scratch each time. This approach helps businesses focus on their core operations rather than getting caught up in administrative tasks.

Whether for small startups or large enterprises, using pre-designed documents offers an efficient solution for maintaining professional communication with clients and partners, while also enhancing the overall financial workflow.

Benefits of Using an Old Invoice Template

Using a pre-designed document for financial transactions can greatly simplify business operations. These forms provide a consistent structure that ensures all essential details are included every time, reducing the chances of missing important information. Relying on established formats streamlines the process, saving time and effort for both the issuer and the recipient.

Time Efficiency and Consistency

One of the primary advantages of utilizing a ready-made structure is the time it saves. Instead of creating a new document from scratch for each transaction, businesses can simply fill in the necessary fields. This consistency not only speeds up the process but also helps maintain a professional appearance across all documents, reflecting the reliability of the business.

Cost-Effective Solution

For small businesses and freelancers, using a customizable structure can be a cost-effective solution. Instead of investing in expensive software or hiring professionals for document creation, businesses can easily modify pre-existing forms to suit their needs. This reduces both upfront costs and ongoing expenses associated with custom document generation.

Incorporating these ready-to-use designs can bring measurable benefits in terms of efficiency and professionalism. They offer a simple yet effective way to manage finances without complicating the process.

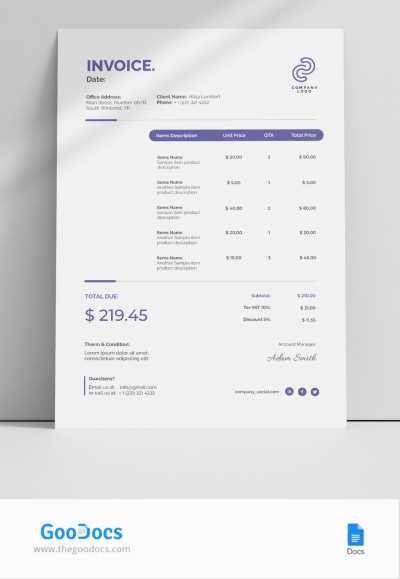

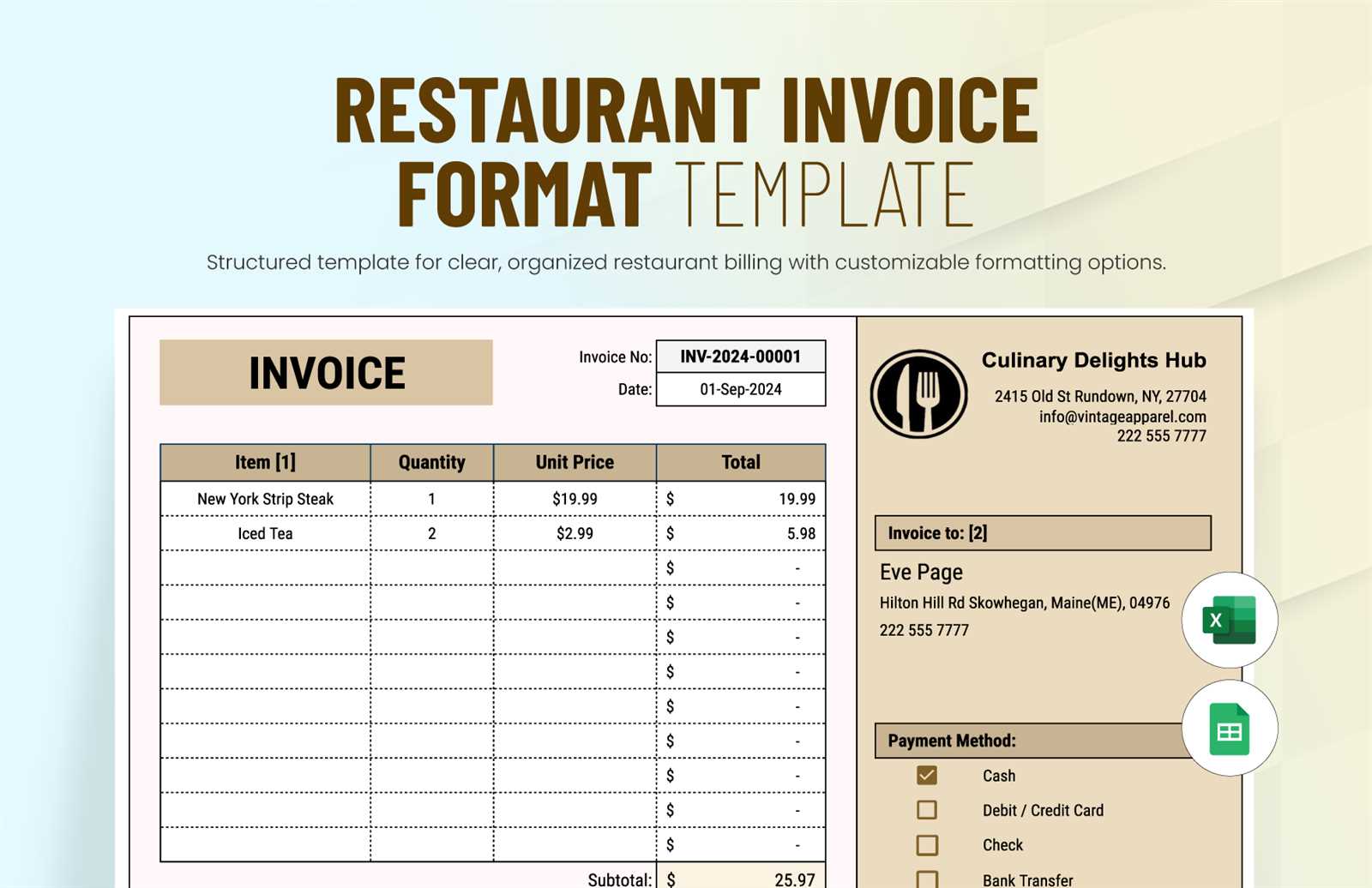

How to Customize Your Invoice Template

Customizing a pre-designed document for billing purposes allows businesses to tailor the layout to their specific needs, ensuring that all relevant details are clearly presented. Adjusting the content and design elements to match your brand’s identity can make a significant difference in the professionalism of your communications with clients and partners.

Adjusting Layout and Structure

The first step in customization is choosing a layout that works best for your business. Whether you prefer a simple and straightforward format or a more detailed one, the key is to make sure that the structure clearly showcases important information, such as transaction date, service/product details, and payment terms. Adjusting font sizes, line spacing, and the overall design can help achieve a clean, organized look.

Adding Personal Touches

Once the basic layout is set, the next step is to incorporate your branding. Adding your logo, changing the color scheme, or adjusting the font style can all help reinforce your business identity. It’s important to strike a balance between aesthetics and clarity to ensure the document remains easy to read and professional-looking.

Personalization not only enhances the customer experience but also helps establish trust and brand recognition. A well-customized document is more likely to leave a lasting impression on clients.

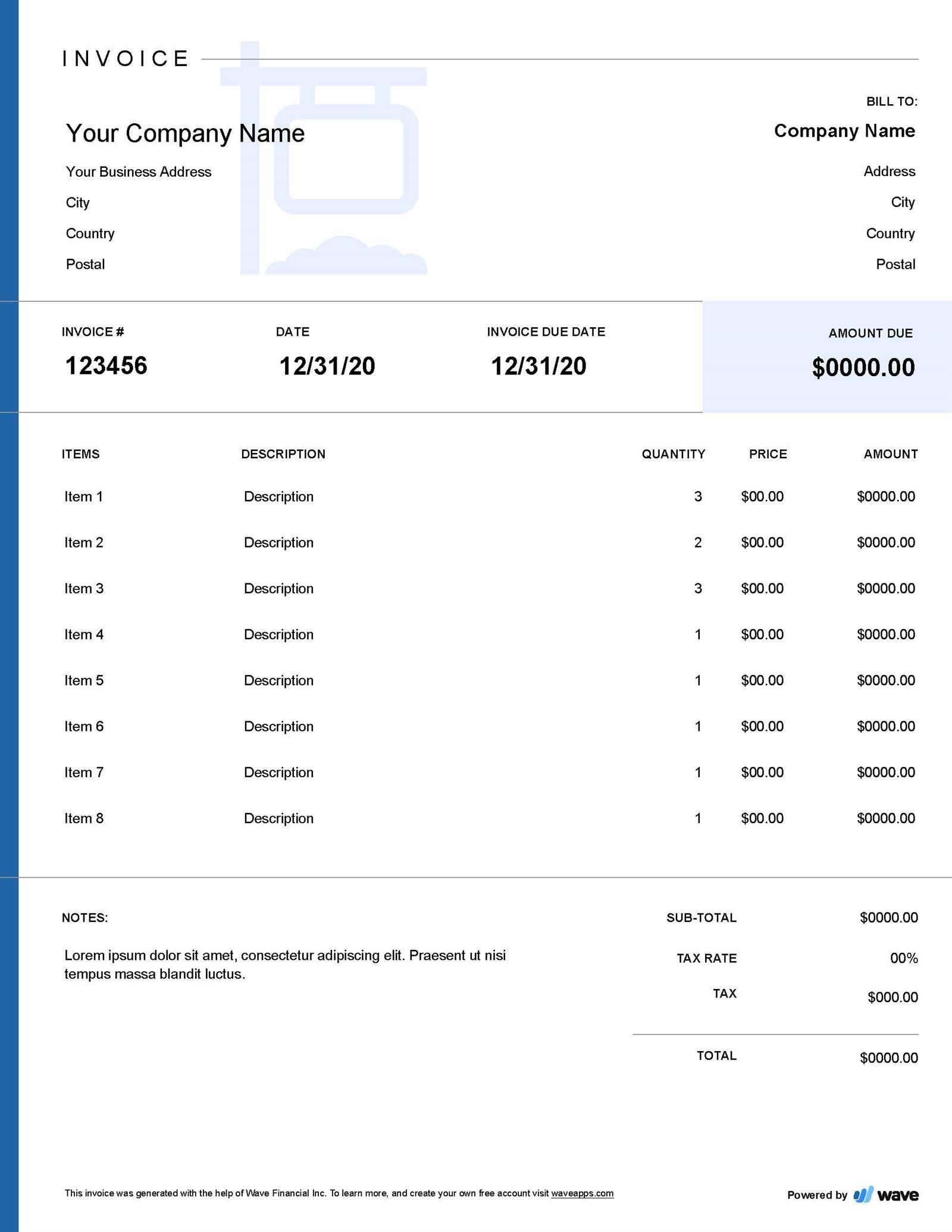

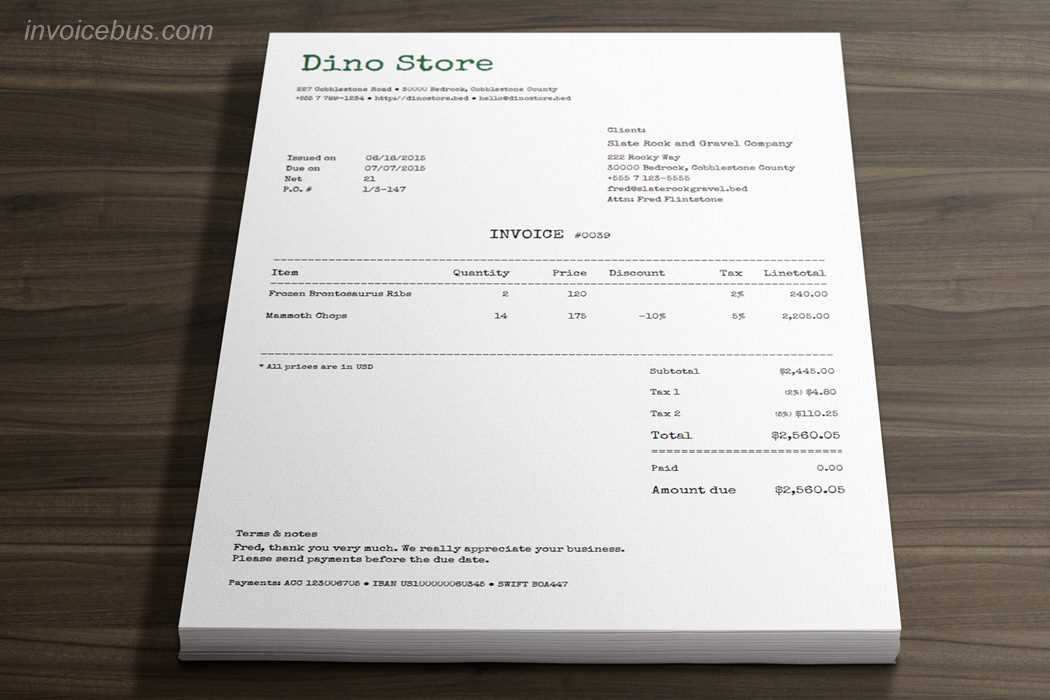

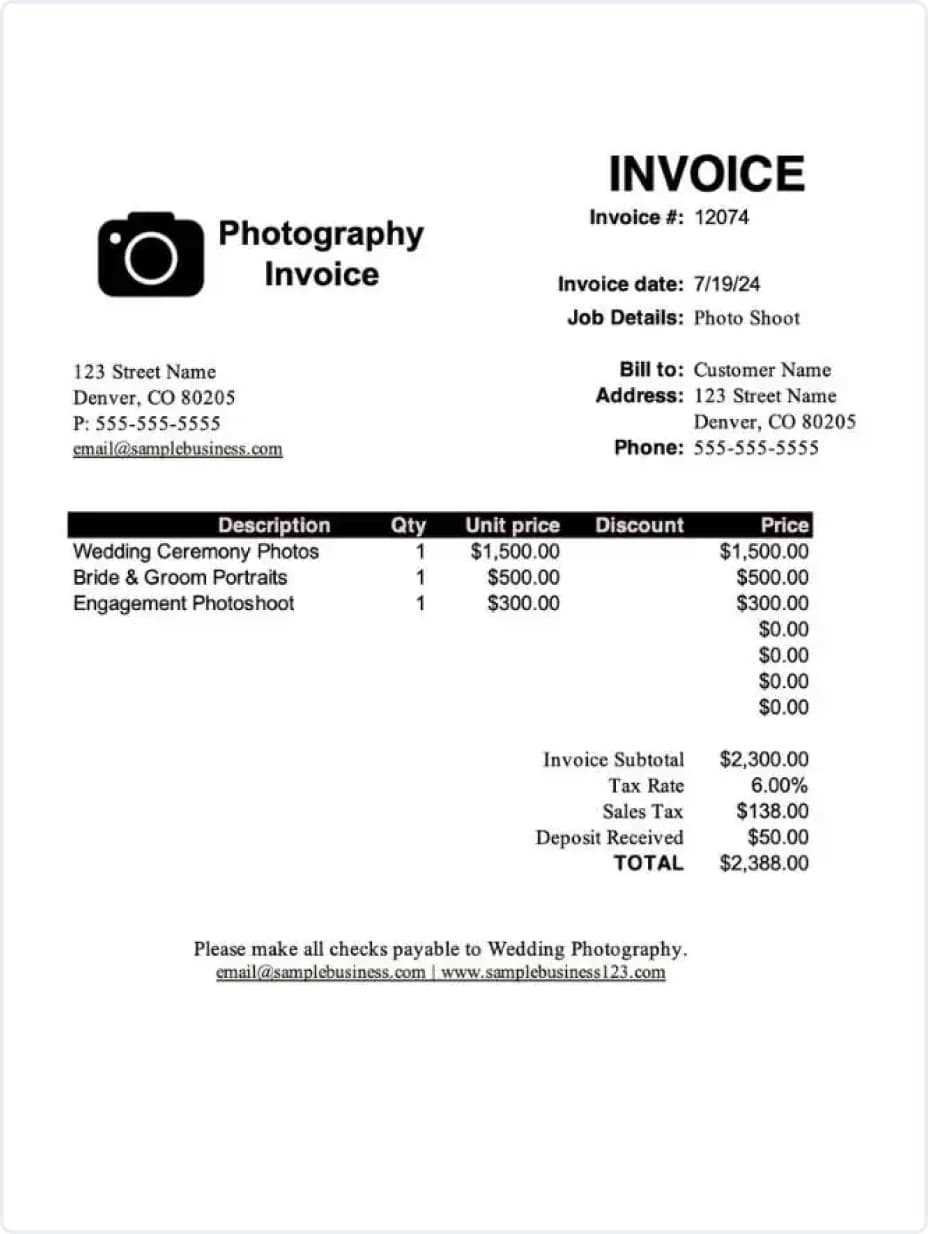

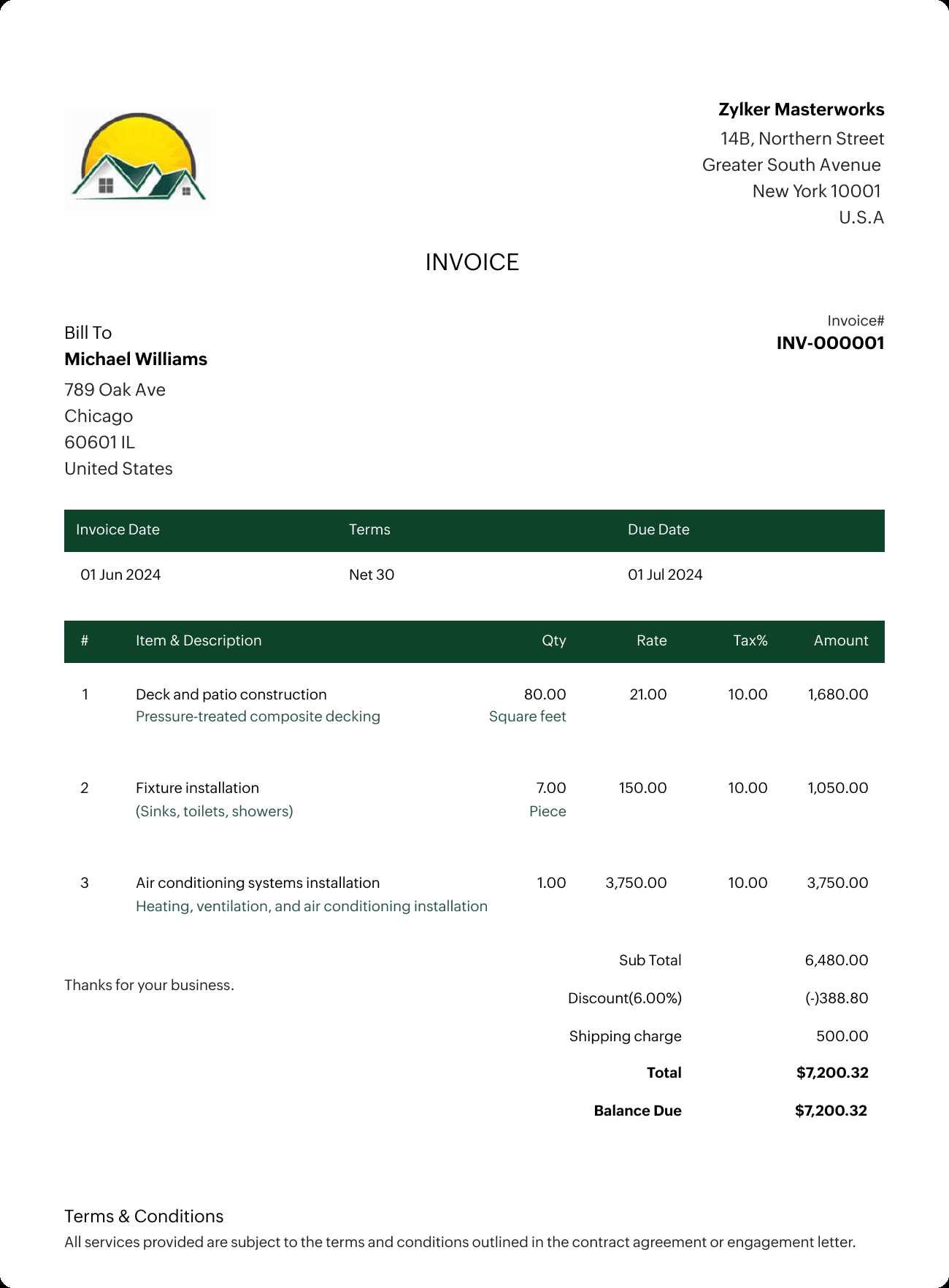

Essential Elements of an Invoice

Every financial document used for transactions must include certain key components to ensure clarity, accuracy, and professionalism. These elements not only help both parties understand the details of the transaction but also provide legal protection in case of disputes. The right structure ensures all necessary information is present and easily accessible.

Contact Information

At the top of the document, it is essential to include the names, addresses, and contact details of both the seller and the buyer. This information serves as a reference for future communication and ensures that both parties can easily follow up if needed. Having clear contact details establishes credibility and reliability.

Transaction Details

One of the most critical aspects of any financial document is the detailed breakdown of the products or services provided. Each item should be listed with its description, quantity, price, and any applicable taxes. This transparency is crucial for avoiding misunderstandings and ensuring both parties agree on the terms of the transaction.

Dates and payment terms are also key elements that must be included. The date of issue and the due date provide clear guidelines on when payment is expected. Establishing these details upfront prevents confusion and ensures timely payments.

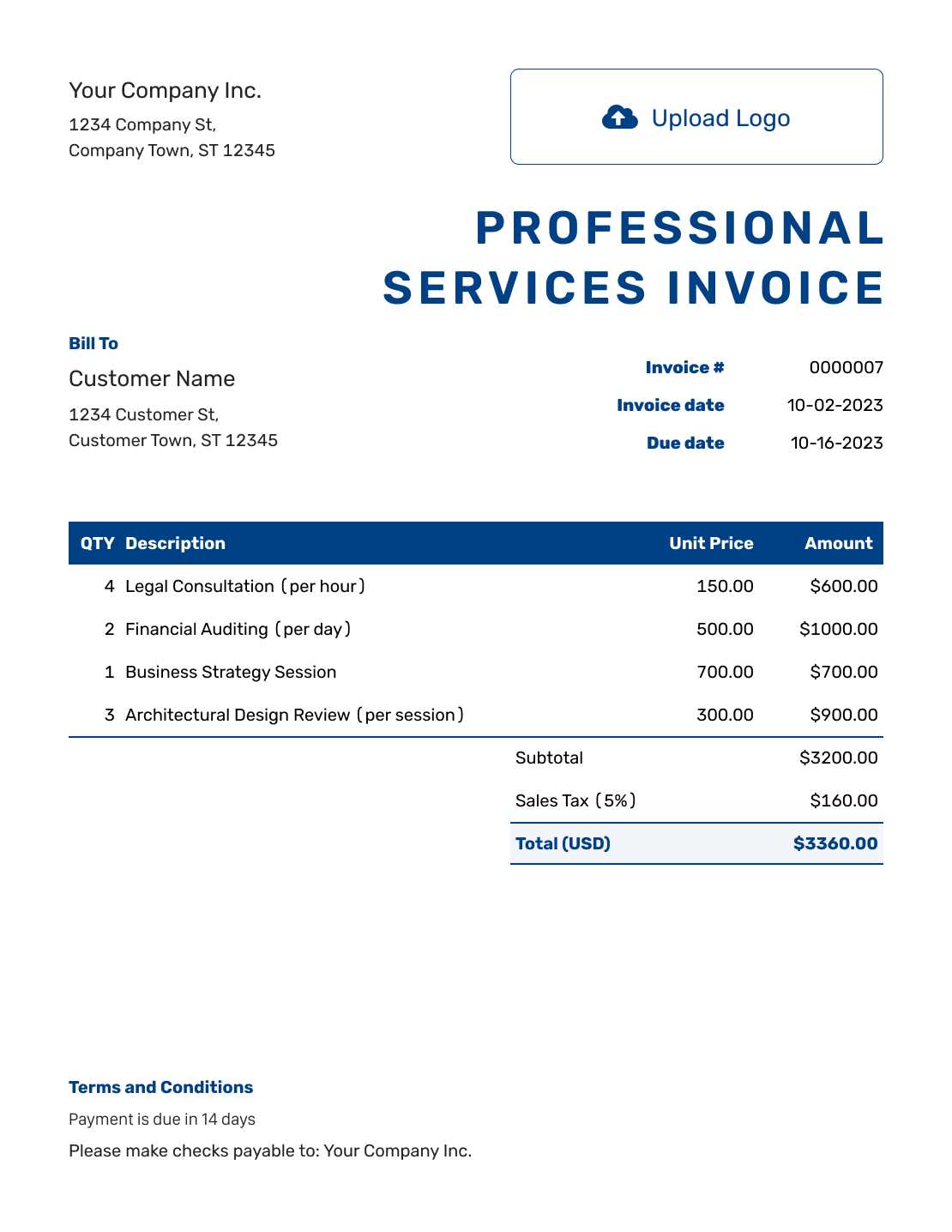

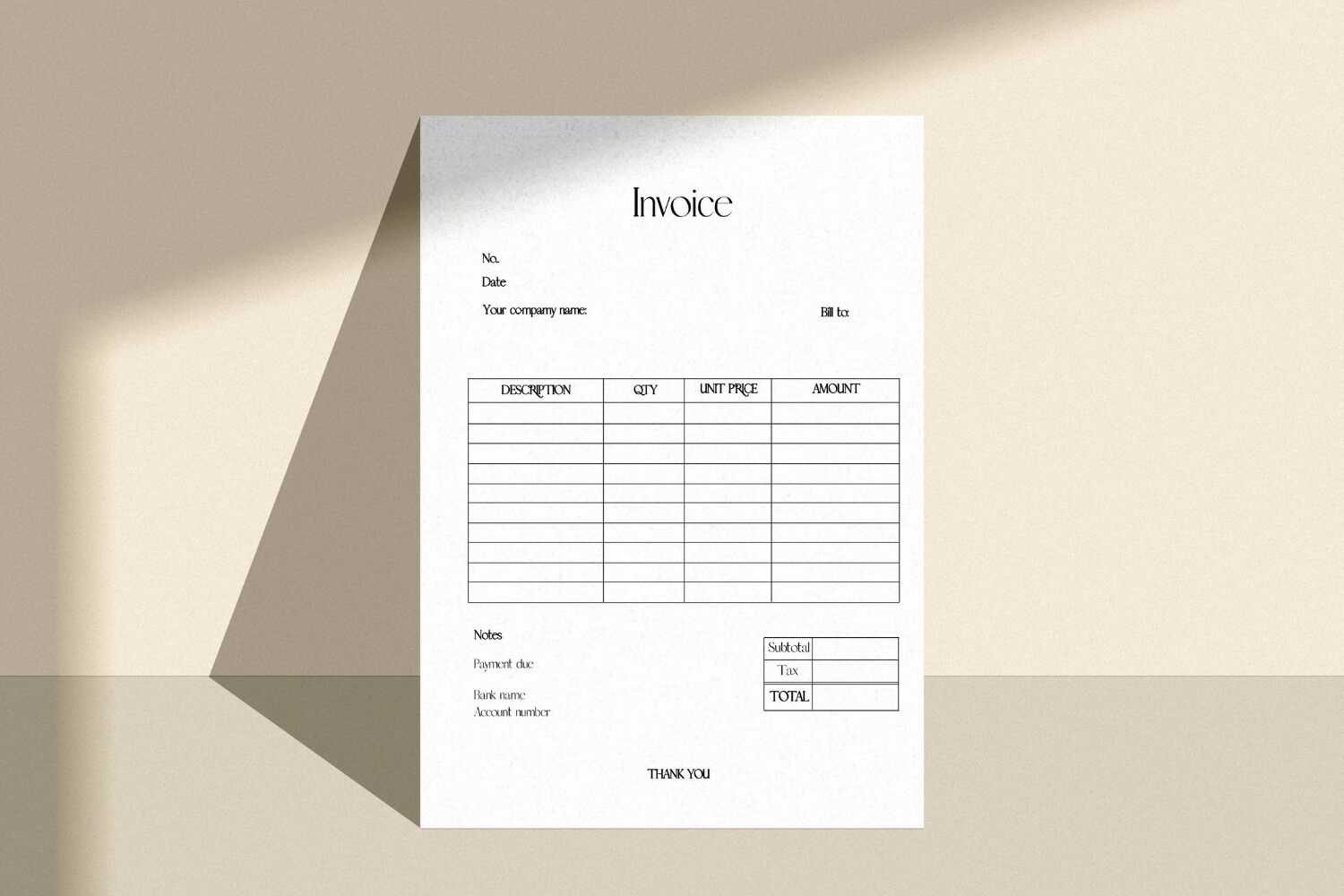

Choosing the Right Format for Invoices

Selecting the appropriate structure for financial documents is crucial to ensuring clear communication and efficiency. The format should suit both your business needs and the preferences of your clients, offering an easy-to-understand layout that promotes quick processing. The right structure ensures that all necessary details are presented in a professional and organized manner.

Digital vs. Paper Formats

One of the first decisions to make when choosing a structure is whether to go digital or print. Digital formats, such as PDF files, are widely preferred for their convenience, ease of sharing, and secure storage. On the other hand, some clients may still prefer physical copies, making printed formats necessary in certain cases. It’s important to offer both options when needed to accommodate all preferences.

Simple vs. Detailed Layouts

Another consideration is the level of detail in the layout. A simple structure may work well for small businesses or freelancers who need to quickly issue documents with minimal information. However, larger companies or more complex transactions may require a more detailed format that includes additional fields like purchase order numbers, discount details, and payment terms. Choosing the right level of detail ensures that the document serves its purpose without overwhelming the recipient.

Ultimately, the ideal format balances clarity, professionalism, and practicality, making the entire process easier for everyone involved.

Saving Time with Pre-Designed Templates

Utilizing ready-made documents for financial transactions can significantly reduce the time spent on administrative tasks. With an established structure in place, businesses can quickly input necessary details without needing to format or design the document from scratch. This streamlined process not only boosts efficiency but also ensures consistency across all issued forms.

Quick Customization for Frequent Use

Pre-designed forms allow for fast and easy customization, making it possible to issue new documents in a fraction of the time. By simply updating a few fields such as dates, amounts, or client information, businesses can create personalized versions tailored to each transaction. This saves hours that would otherwise be spent creating documents from the ground up.

Reducing Errors and Oversights

Using a pre-designed structure minimizes the chances of forgetting crucial details or making formatting errors. The design ensures that all required information is included, and the layout is consistent, reducing the risk of mistakes. With less time spent on manual entry, businesses can focus on other important tasks while maintaining a high level of professionalism.

By adopting these ready-to-use formats, companies can improve their workflow, speed up their billing processes, and enhance overall productivity.

Common Mistakes When Using Templates

Even though pre-designed documents simplify the billing process, they can lead to errors if not used carefully. Common mistakes often occur when users overlook important details or fail to adapt the structure to fit their specific needs. These oversights can result in inaccurate information, miscommunication, or delays in payments.

Forgetting to Update Key Details

One of the most frequent errors is forgetting to update crucial information, such as client names, dates, or amounts. These fields are easy to overlook when using an existing design, but failing to replace them can lead to confusion and disputes. Always double-check that all details are accurate before sending out any document.

Overlooking Formatting and Clarity

Another common issue is neglecting the overall presentation of the document. While the structure may be set, it’s important to ensure that the layout remains clear and professional. A cluttered or poorly formatted design can make the document difficult to read and may leave a negative impression. Ensure that the information is well-organized and visually appealing to maintain a high standard of communication.

Double-checking and adapting your document to meet specific requirements is essential to avoid these mistakes. A little attention to detail can ensure that the process remains efficient and professional.

How to Maintain Professionalism in Invoices

Maintaining a professional appearance in financial documents is essential for building trust and credibility with clients. The way you present billing information reflects your business’s values and attention to detail. A well-structured and clear document not only helps in securing payments but also strengthens client relationships.

Clear and Concise Content

Ensure that the information provided is straightforward and easy to understand. Avoid using jargon or ambiguous terms. A concise description of the products or services, along with transparent pricing, helps eliminate confusion and ensures that the client knows exactly what they are paying for. Clarity in all sections is key to maintaining a professional image.

Consistent Branding and Design

Incorporating consistent branding elements such as your logo, business colors, and fonts can enhance the professionalism of the document. This visual consistency reinforces your brand identity and gives a sense of cohesion across all communications. However, it’s important to strike a balance–while design is important, it should not distract from the main content.

By focusing on both the content and visual appeal, businesses can produce financial documents that are not only functional but also leave a positive, lasting impression on clients.

Legal Considerations for Invoice Templates

When creating financial documents for business transactions, it’s crucial to ensure that they comply with legal requirements. These documents are not just tools for requesting payment, but also legal records that can be used in case of disputes. Understanding the essential legal elements and ensuring they are correctly included can help protect both businesses and clients.

Key Legal Elements to Include

- Legal Names and Contact Information: Always include the full legal names and addresses of both parties involved in the transaction.

- Tax Identification Numbers: In many jurisdictions, including tax IDs (such as VAT or GST numbers) is mandatory for businesses to be compliant.

- Payment Terms: Clearly state payment terms, including the due date and any late fees for overdue payments, to avoid future misunderstandings.

- Applicable Taxes: Ensure that taxes are correctly calculated and listed in accordance with local tax laws.

Keeping Records for Legal Purposes

Beyond creating documents, businesses must also maintain accurate records for legal compliance and tax purposes. It’s important to store all issued documents for a specified period, as required by local regulations. Regularly updating and archiving your records can help avoid legal complications and ensure you are prepared for audits or disputes.

By ensuring that all legal aspects are covered, businesses can safeguard themselves from potential legal issues while maintaining professional and compliant billing practices.

Why You Should Keep Old Templates

Storing previous versions of financial documents can provide valuable benefits to businesses. While creating new versions is essential for keeping operations up to date, retaining older formats offers a sense of continuity and ensures that past records are easily accessible when needed. Maintaining these documents can also support business processes in unexpected situations.

Benefits of Retaining Previous Versions

- Consistency in Design: Keeping older versions helps ensure that any updates or changes made to the structure are aligned with past formats, maintaining a consistent look for your business communications.

- Reference for Customization: Archived documents can serve as a useful reference for customizing future documents, helping you track trends in your business needs or customer preferences.

- Legal Protection: In case of disputes or audits, having a record of past documents can be crucial. They can serve as evidence in resolving disagreements or verifying past transactions.

Preparing for Future Needs

Older versions may also serve as backups when transitioning to a new system or updating your processes. By preserving past formats, you ensure that your business has access to various styles and options to adapt to different clients or situations. This foresight can save time and reduce the stress of trying to recreate documents in the future.

Ultimately, keeping a collection of older documents is a proactive strategy that can enhance your business’s efficiency, legal compliance, and adaptability.

Integrating Old Invoice Templates with Software

Integrating established document formats with modern software systems can help streamline business operations, improve efficiency, and reduce human error. By connecting pre-designed forms with digital tools, businesses can automate the creation, editing, and distribution of key documents. This integration ensures a smoother workflow and saves time on repetitive tasks.

Advantages of Software Integration

Linking traditional forms with software offers several key benefits:

- Automation: Automatically fill in data from client records and previous transactions, reducing manual entry and minimizing errors.

- Faster Processing: Speed up the document creation process by eliminating the need to manually format or customize each new record.

- Data Storage: Store all documents securely in a digital format for easy access, retrieval, and archiving.

- Consistency: Ensure uniformity in the appearance and structure of documents, making them easier to read and process.

Example of Integration Workflow

Here is an example of how a typical software integration might work with an existing document format:

| Step | Description | Benefit |

|---|---|---|

| Step 1 | Import client data from CRM software. | Save time on data entry. |

| Step 2 | Automatically populate the document fields (e.g., client name, amount, due date). | Reduce errors and ensure consistency. |

| Step 3 | Send the completed document via email or generate a PDF for printing. | Speed up document distribution. |

Integrating these documents with software systems enables businesses to maintain accuracy, improve efficiency, and enhance the overall client experience.

Printable vs. Digital Invoice Templates

When choosing between physical and electronic formats for business documents, it’s important to consider the advantages and limitations of each. Both methods serve the same purpose, but the way they are used can significantly impact workflow, communication, and even legal compliance. Understanding the pros and cons of each option can help businesses make the right decision for their needs.

Benefits of Printable Versions

Physical documents remain an important tool for businesses that prefer traditional methods or operate in industries where hard copies are required. Some advantages include:

- Familiarity: Many clients still prefer receiving paper copies, especially for formal transactions.

- Legal Compliance: Certain industries or jurisdictions may require physical copies for record-keeping or audits.

- Personal Touch: A printed document may offer a more personal or formal presentation, which can be useful in some client relationships.

Benefits of Digital Versions

On the other hand, digital formats offer greater flexibility and convenience, making them ideal for businesses focused on efficiency and modernity. Some benefits include:

- Speed and Efficiency: Digital files can be generated, sent, and stored instantly, reducing delays in processing and delivery.

- Environmentally Friendly: Going paperless helps reduce the environmental impact by saving paper and ink.

- Easy Storage and Retrieval: Electronic documents can be easily archived, searched, and retrieved, minimizing the risk of losing records.

Ultimately, the choice between printable and digital formats depends on business needs, industry standards, and client preferences. Many businesses choose to use both, offering clients the option to select their preferred method of receipt.

How to Securely Store Invoice Templates

Protecting business documents is crucial to ensure both legal compliance and the privacy of sensitive data. Whether you’re storing pre-designed forms or finalized client records, maintaining secure storage practices can help prevent data loss, unauthorized access, or other potential threats. By implementing a few key strategies, businesses can safeguard their essential paperwork from various risks.

Best Practices for Secure Storage

To ensure the safety of your digital files, consider the following methods:

- Use Cloud Storage: Secure cloud services with encryption ensure that your documents are stored safely while being accessible from anywhere with proper authentication.

- Back Up Regularly: Always keep multiple backups of your files, both on cloud servers and physical external drives, to prevent data loss due to accidental deletion or system failures.

- Set Access Controls: Limit access to the stored files by setting permissions for specific users or teams, ensuring that only authorized individuals can view or modify the documents.

Physical Storage Options

If you still prefer paper-based storage, consider these physical security measures:

- Lockable Filing Cabinets: Store important documents in cabinets with strong locks to prevent unauthorized access.

- Fireproof Storage: Protect paper copies from fire damage by storing them in fireproof safes or cabinets.

- Organized Filing Systems: Keep files neatly organized and categorized to avoid misplacement and enhance retrieval efficiency when needed.

By taking these precautions, businesses can ensure that their financial records and documents remain secure and easily accessible whenever necessary.

Improving Accuracy with Template Use

Using pre-designed forms for business documentation can significantly enhance precision in data entry and reduce the likelihood of errors. By eliminating the need to create new records from scratch each time, these forms provide a consistent structure that ensures all necessary details are included and correctly formatted. This consistency helps businesses maintain high levels of accuracy while also saving time.

Benefits of Consistent Structure

One of the main advantages of using predefined structures is that they standardize the format for all documents, ensuring that important information is always included. Here’s how it improves accuracy:

- Predefined Fields: Key details such as contact information, payment terms, and item descriptions are automatically included, reducing the chance of missing critical data.

- Automated Calculations: Templates with built-in formulas can automatically calculate totals, taxes, and discounts, minimizing the risk of mathematical errors.

- Consistency: Using the same format for every document ensures uniformity, which is especially important for businesses with multiple team members creating similar documents.

Reducing Human Error

Templates help limit the potential for mistakes caused by manual input. With fewer opportunities for miscommunication or oversight, the process becomes more streamlined, leading to fewer corrections and discrepancies.

- Less Manual Input: Automated fields in forms reduce the need for retyping common data, which lowers the likelihood of typographical errors.

- Guided Entries: Templates often include helpful prompts or reminders that guide users through the document creation process, further reducing the chance of omissions or inaccuracies.

By adopting consistent and structured formats, businesses can ensure that their records are not only more accurate but also more efficient to create, improving overall operational effectiveness.

Adapting Old Templates for New Businesses

When starting a new business, it’s important to build a strong foundation, including setting up efficient document structures. Leveraging existing formats can save time and effort, allowing entrepreneurs to focus on other critical areas of their operations. However, these formats must be carefully adapted to fit the unique needs and branding of the new business while ensuring they remain functional and legally compliant.

Key Considerations for Adapting Existing Structures

While adapting older formats, businesses need to consider several factors to ensure the final product is aligned with their requirements:

- Brand Consistency: Modify the design elements, such as logos, colors, and fonts, to reflect the company’s identity, making the documents feel personal and professional.

- Legal Co

Frequently Asked Questions About Invoice Templates

As businesses rely on structured documents for financial transactions, many questions arise regarding their customization, usage, and effectiveness. The following section aims to address some of the most common inquiries that can help streamline the process and ensure that businesses use these documents efficiently and accurately.

What is the best format for financial documents?

The ideal format depends on your business needs. Most companies use formats such as PDFs or Word documents for their ease of use and accessibility. These formats are easily editable and can be shared with clients digitally or printed for physical records. It’s important to choose a format that aligns with how you intend to distribute or store these documents.

Can I modify existing layouts to suit my business needs?

Yes, customization is one of the key benefits of using structured documents. You can easily modify an existing layout to reflect your branding, specific payment terms, or the services your business offers. It’s essential to adjust the design elements like logo, colors, and field descriptions to match the unique aspects of your business.

How can I ensure my documents are legally compliant?

To maintain legal compliance, it’s important to regularly update your documents based on the current industry laws and tax regulations. Be sure to include necessary terms, such as payment deadlines, tax rates, and business registration numbers, to ensure you meet legal standards. If unsure, consulting with a legal advisor can be helpful.

Are these structures suitable for international transactions?

Many formats are adaptable for international use, but it’s crucial to ensure they include features that accommodate different currencies, tax systems, and legal requirements. International transactions often require additional information, such as VAT numbers or shipping terms, so adjusting the layout to meet these needs is key for smooth cross-border business operations.

How do I store my documents securely?

Secure storage is critical to protect sensitive financial data. Many businesses use encrypted cloud storage services or password-protected files to ensure confidentiality. Regular backups and secure access protocols also help maintain the integrity and safety of these important documents.

By addressing these common questions, businesses can optimize their use of structured documents, ensuring that they are both functional and compliant while saving time and reducing errors.