Office Cleaning Invoice Template for Professional Service Providers

When providing cleaning services, having a structured way to bill clients is essential for maintaining professionalism and ensuring smooth transactions. A well-organized bill not only clarifies the cost of services rendered but also builds trust with customers by showcasing transparency. To streamline the process, many service providers rely on pre-designed formats that simplify this task and reduce the risk of errors.

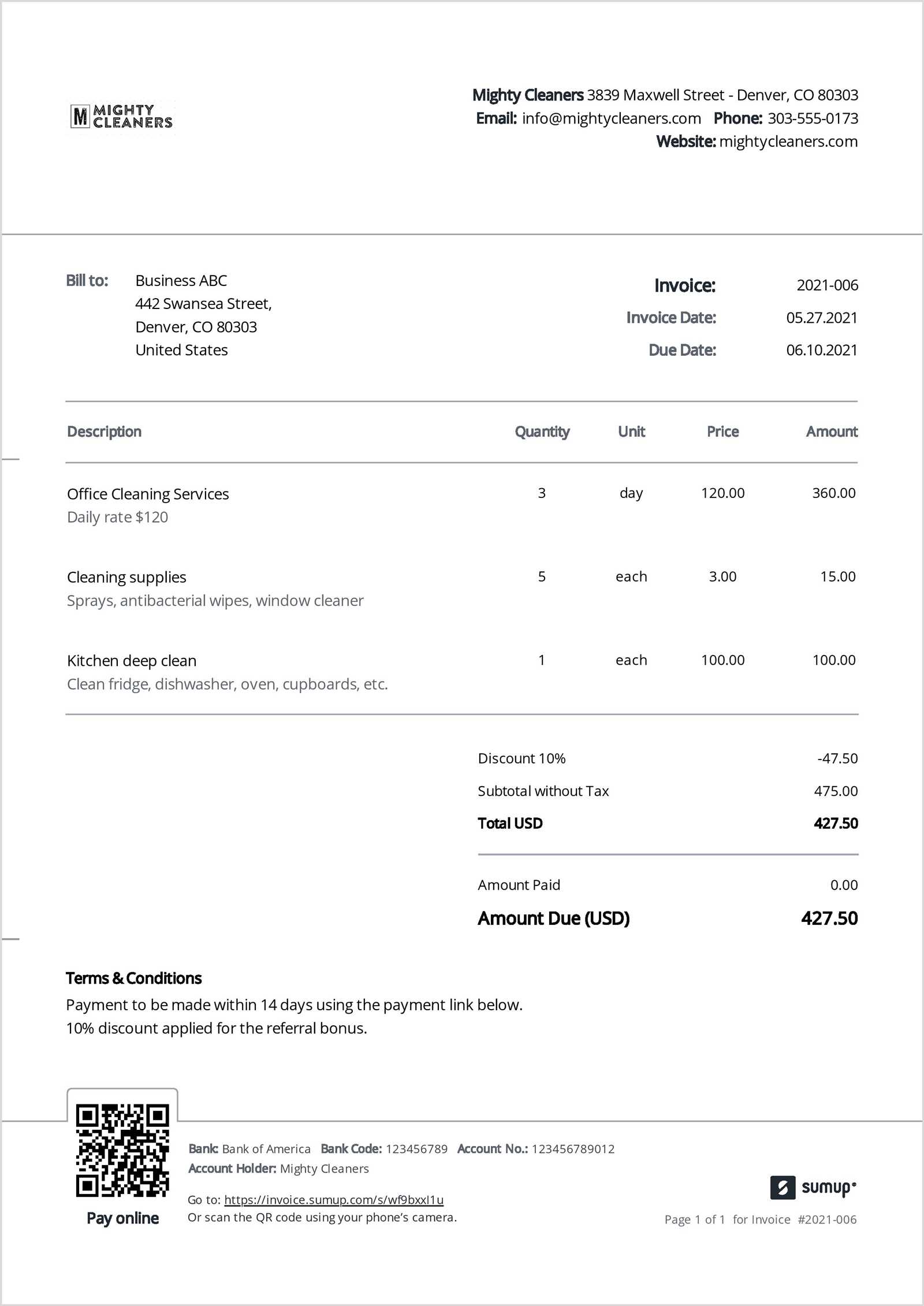

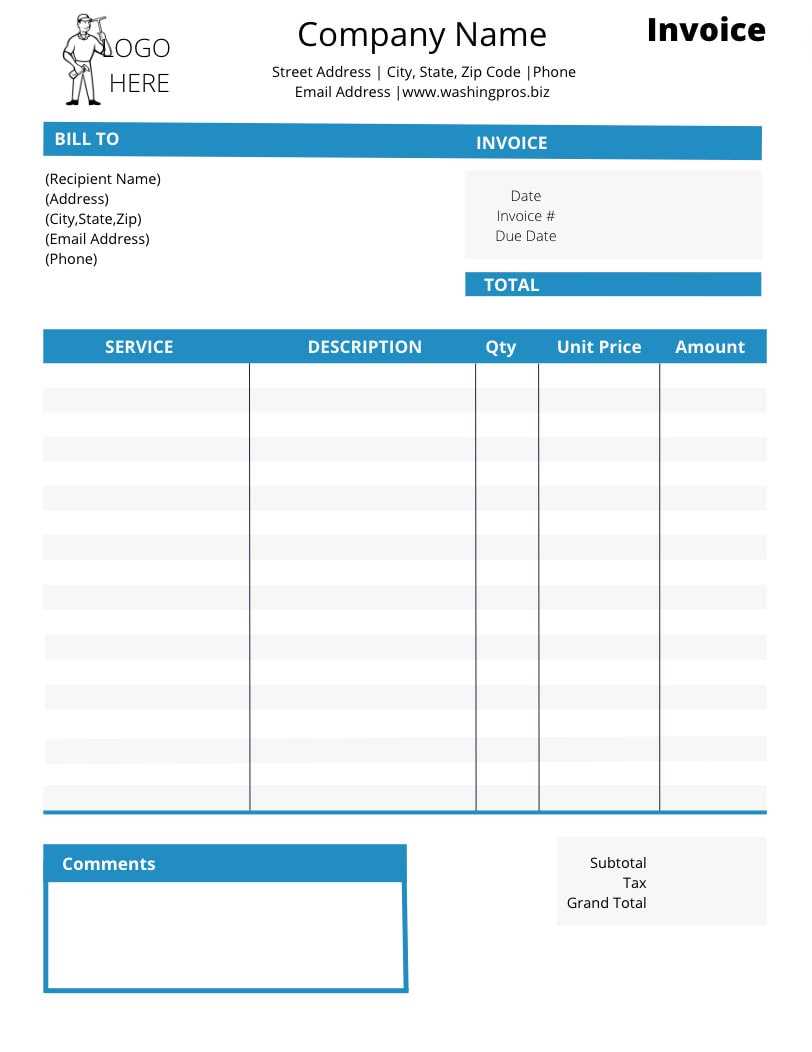

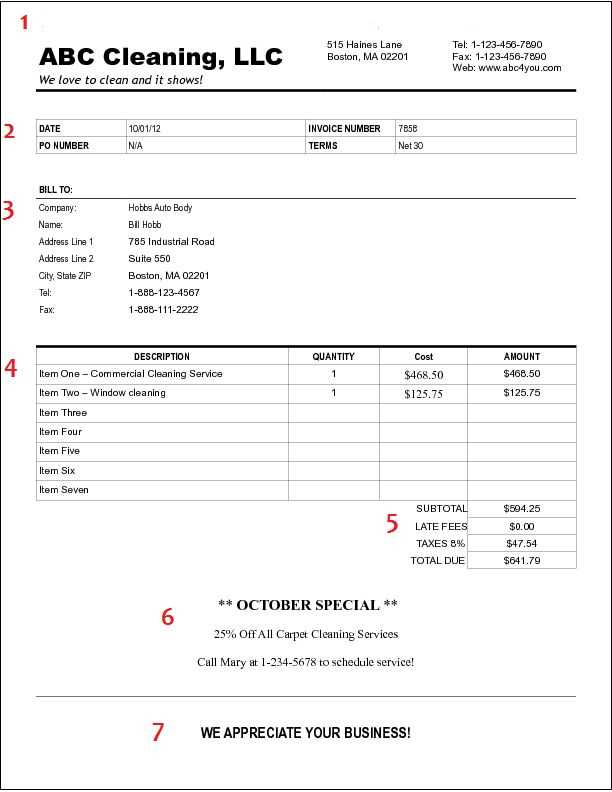

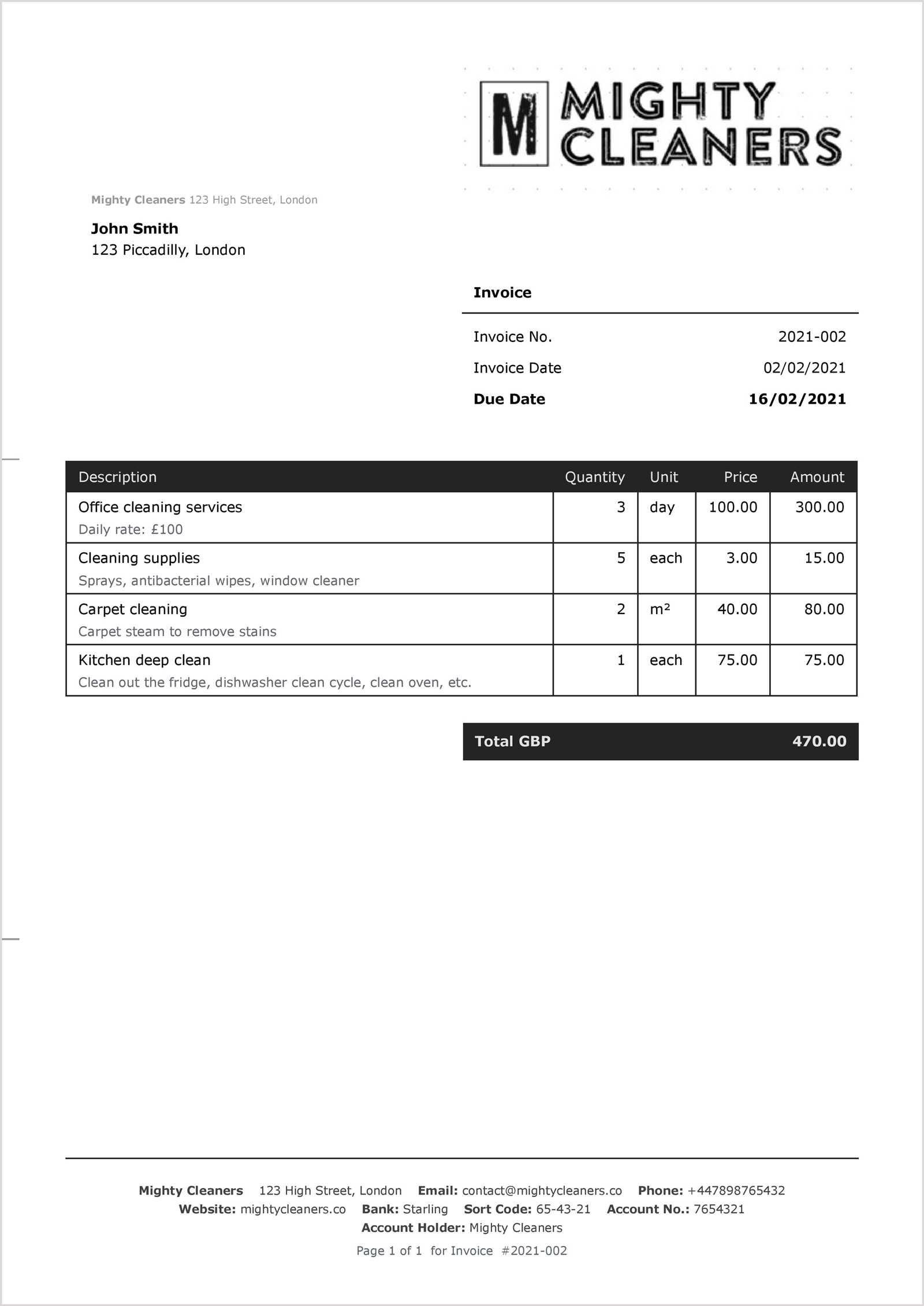

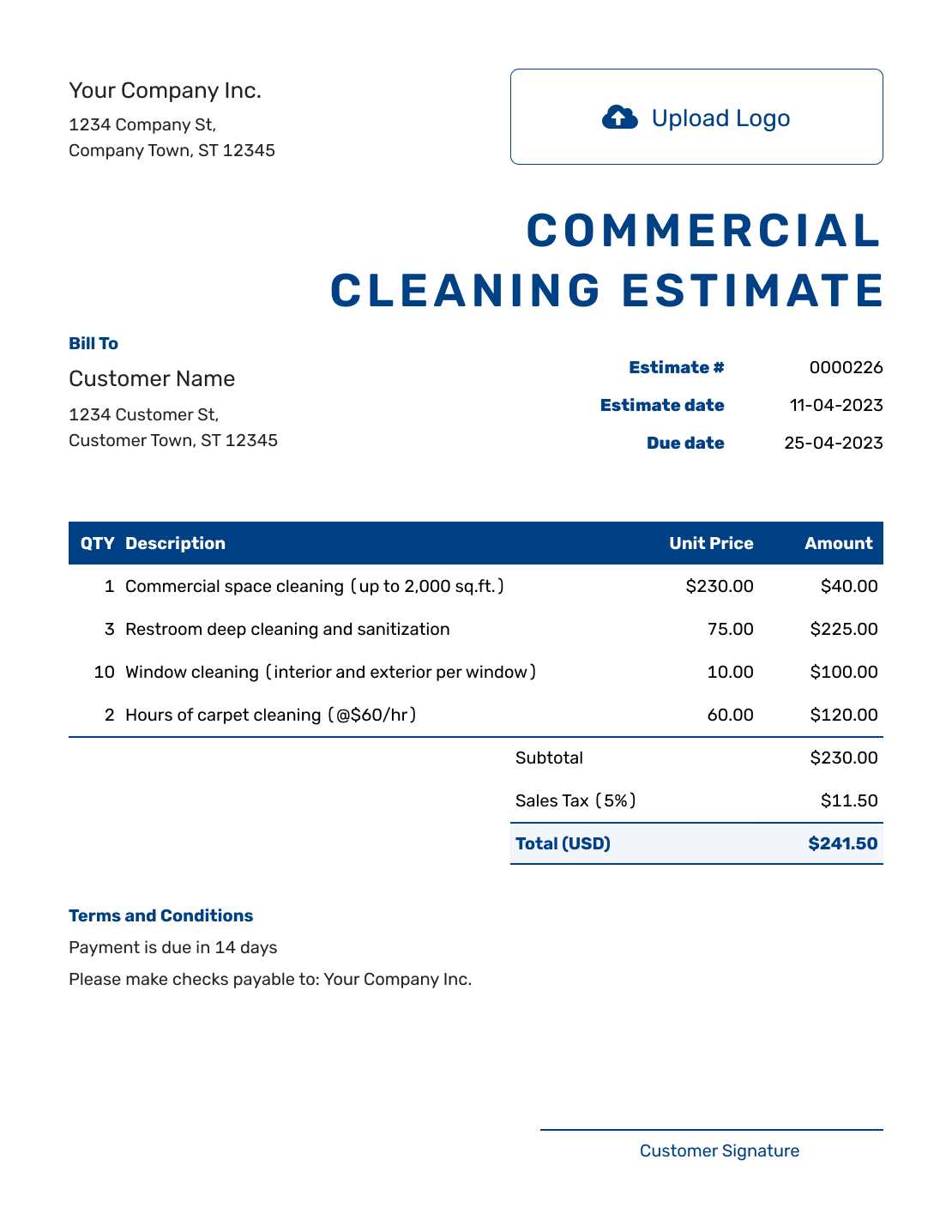

These billing documents should include all necessary details, such as the scope of work, hours spent, and agreed-upon rates, as well as contact information and payment instructions. By customizing a basic structure, providers can tailor it to suit their specific business needs, ensuring clarity and accuracy in every transaction.

Whether you’re a small business owner or part of a larger team, creating clear and consistent financial documents will help improve cash flow, minimize misunderstandings, and facilitate smooth client relationships. The right tools can make this process not only easier but also more professional and efficient.

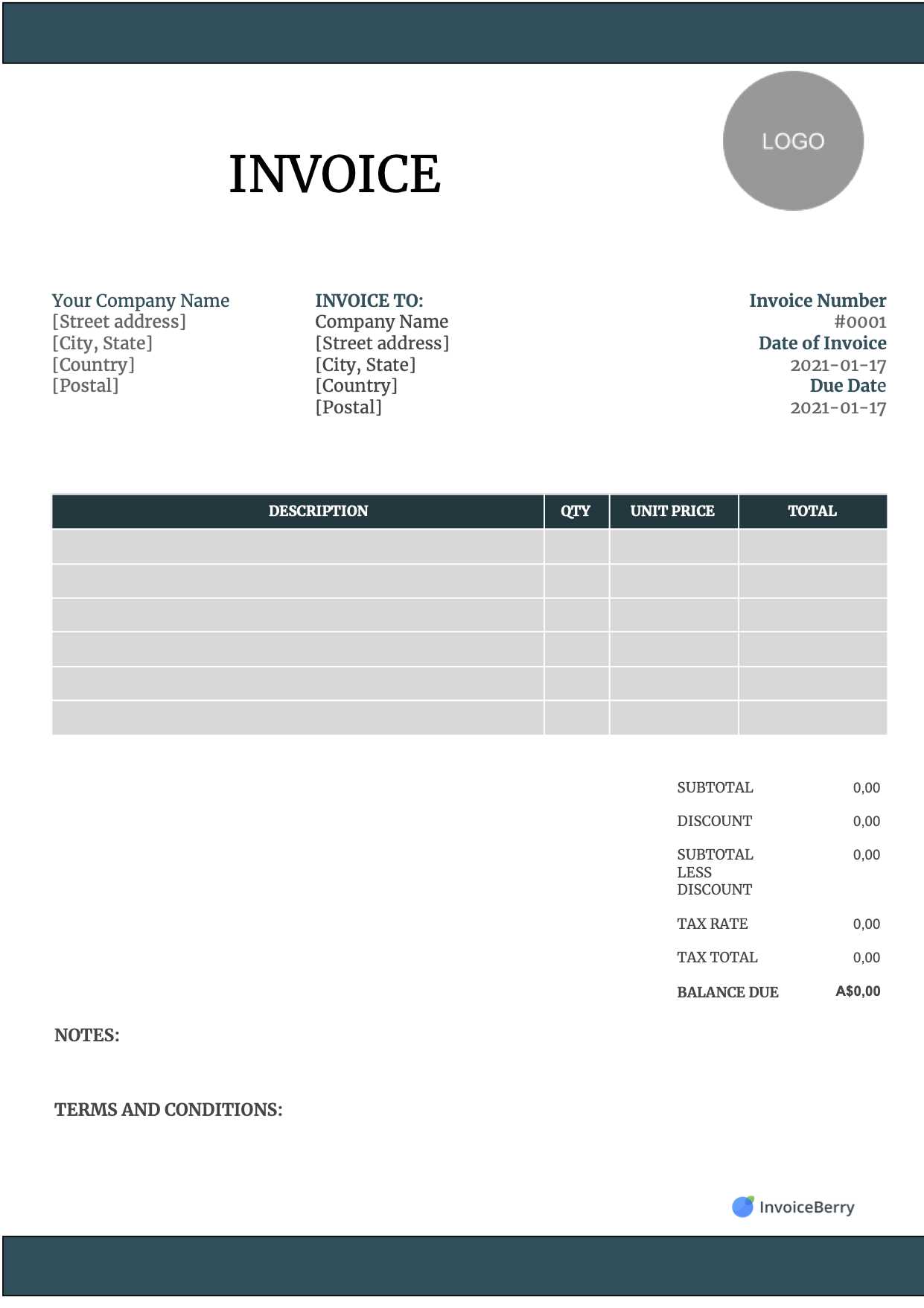

Office Cleaning Invoice Template Overview

When managing a service-based business, it’s crucial to have a standardized method of documenting payments for the work performed. A structured billing document serves as a formal record that outlines the services provided, the associated costs, and payment terms. By using a reliable format, business owners ensure they meet client expectations and maintain financial organization.

These documents are designed to be clear and concise, detailing all necessary information such as the date of service, the hours worked, and any additional fees. Customizable formats allow businesses to personalize the layout according to their specific needs while ensuring all relevant information is included. This helps reduce any potential confusion and fosters transparent communication with clients.

Having an efficient way to generate and send these records streamlines administrative tasks, allowing service providers to focus on their core business activities. A professional approach to billing can also enhance the overall customer experience, contributing to the long-term success of the business.

Why You Need an Invoice Template

Having a standardized document for billing is essential for businesses that provide services. A well-organized bill helps both parties–service provider and client–understand the cost breakdown, payment terms, and other essential details. Using a consistent structure minimizes errors and ensures professionalism, which can strengthen business relationships and improve cash flow.

Key Benefits of a Structured Billing Document

- Clarity: A well-structured document clearly lists the services provided, rates, and total cost, leaving no room for confusion.

- Professionalism: A consistent format demonstrates attention to detail and enhances the service provider’s credibility.

- Efficiency: Using a pre-designed format saves time and reduces administrative tasks, allowing for quicker processing.

- Accuracy: A standardized document reduces the chance of errors in calculations, ensuring correct amounts are billed.

- Legal Protection: Proper documentation of services and payment terms can protect both parties in case of disputes.

How a Pre-made Format Saves Time

Instead of creating a bill from scratch each time, using a pre-designed structure enables quicker and more consistent document creation. Customizable options allow businesses to adapt the format to their needs without reinventing the wheel. This saves both time and effort, making the administrative side of the business run more smoothly.

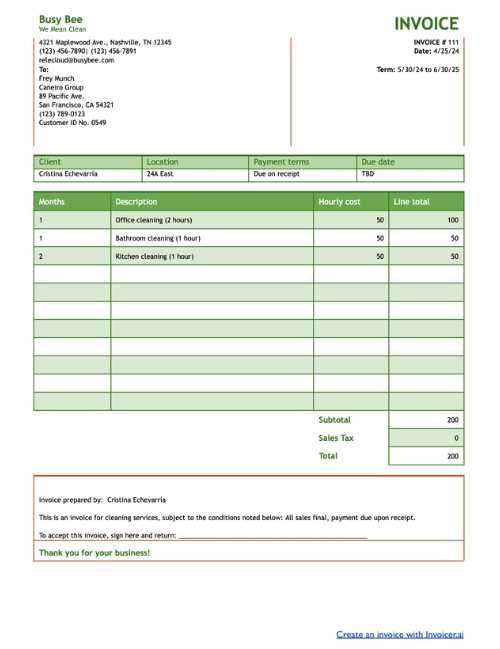

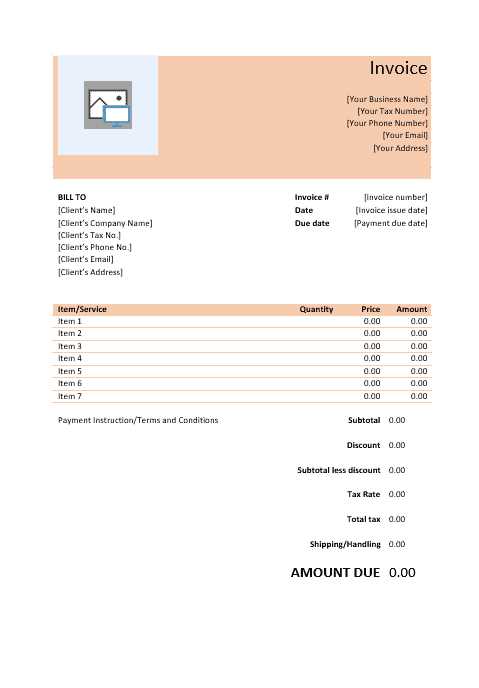

Key Elements of an Office Cleaning Invoice

For any business offering services, a billing document should include specific information to ensure transparency and avoid misunderstandings. Every key detail should be outlined clearly to facilitate smooth transactions and help both parties track services and payments. A well-crafted document not only lists the services provided but also establishes payment terms, deadlines, and other critical aspects that protect both the provider and the client.

Essential Information to Include

- Service Provider Details: Include the name, address, and contact information of the business or individual providing the service.

- Client Information: Clearly state the name, address, and contact details of the client receiving the service.

- Service Description: Outline each task or service performed in detail, including quantities and unit costs where applicable.

- Dates of Service: Specify the date when the service was provided to ensure clarity on the timeline of work.

- Payment Terms: Define the agreed-upon amount, payment deadlines, and any applicable taxes or fees.

- Unique Invoice Number: A unique reference number for each document helps in organizing records and avoiding confusion.

- Payment Instructions: Provide clear details on how the payment should be made, including accepted methods and relevant banking information.

Importance of Clear Breakdown

Breaking down the cost of each service allows the client to understand exactly what they are paying for. It also reduces the chances of disputes over pricing and ensures that all parties are aligned on the agreed-upon terms. Additionally, including a comprehensive breakdown can showcase the value of the services provided, making it easier for clients to justify the cost.

How to Customize Your Invoice Template

Personalizing your billing document is an important step in creating a professional and effective tool for your business. Customizing it allows you to tailor the layout, content, and design to better reflect your brand and meet the unique needs of your clients. With a few simple adjustments, you can make the document not only functional but also visually appealing and aligned with your business identity.

Steps to Personalize Your Billing Document

- Adjust Layout and Design: Choose a clean, easy-to-read layout that suits your brand. You can modify the font, color scheme, and logo placement to make it unique to your business.

- Include Your Branding: Add your company logo, business name, and tagline to help reinforce your brand’s identity.

- Set Terms and Conditions: Define your payment terms, late fees, or discounts in a clear section. Customize these terms according to your business needs.

- Include Client-Specific Details: Tailor the document for each client by adding relevant project information, such as specific tasks completed or personalized notes.

- Adjust Pricing Structure: Modify the pricing sections to reflect your specific rate, discounts, and additional charges that may apply to different clients.

- Customizable Footer: Use the footer space to add additional contact details, a call to action, or payment instructions for convenience.

Tools for Customization

There are various online tools and software programs available that can help you customize your billing records easily. Many of these tools offer drag-and-drop features, allowing you to create and personalize the layout without needing graphic design skills. Additionally, they often provide pre-made templates that you can quickly adapt, saving you time while still achieving a professional result.

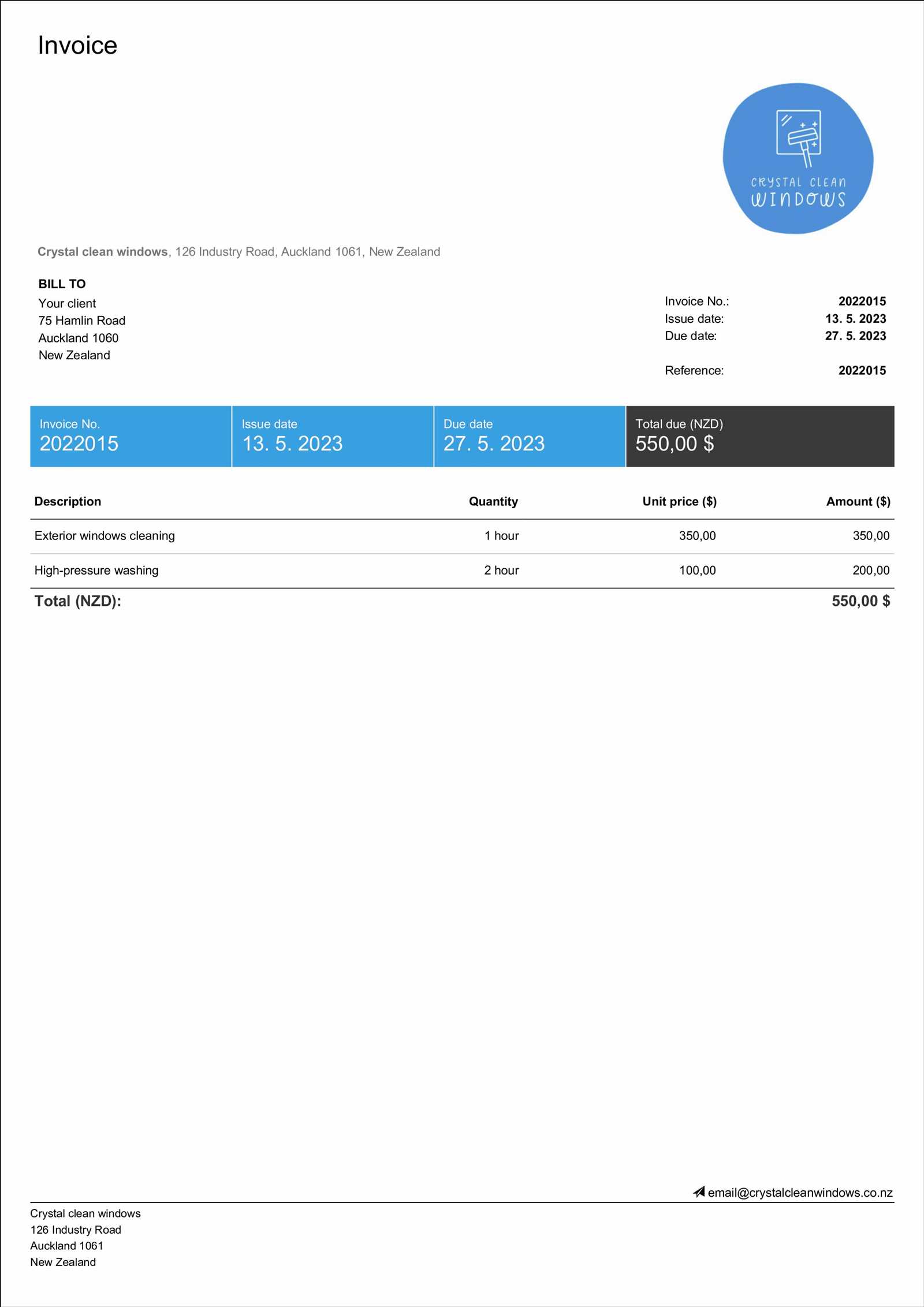

Best Formats for Office Cleaning Invoices

Choosing the right format for your billing document is essential to ensure clarity, ease of use, and professionalism. The format should be simple, structured, and easy for both you and your clients to read and understand. Different businesses might prefer different layouts, but the key is to select one that best suits the type of service provided and the preferences of the client.

Common Formats for Billing Documents

- Word Documents: Word processors are a popular choice due to their versatility. They allow for easy customization and offer a clean, straightforward layout. However, they may require manual calculations unless formulas are added.

- Excel Spreadsheets: Ideal for businesses that need to track multiple variables, such as hours worked or different rates for various tasks. Excel documents also allow for automatic calculations, making them a time-saving option for regular clients.

- PDF Files: PDF files are great for providing a professional, polished look. They can be shared easily with clients and remain unchanged once sent, ensuring the document’s integrity. They also allow for a uniform, high-quality appearance across devices.

- Online Invoicing Software: Many businesses use dedicated software for creating and managing their documents. These tools often offer templates, automated calculations, and the ability to track payments, making them efficient for both one-time and recurring jobs.

Factors to Consider When Choosing a Format

When selecting a format, consider your business needs, your clients’ preferences, and the level of detail required for each job. For example, if your services vary in complexity, a spreadsheet might be the most useful, while a simple word document may suffice for straightforward tasks. Ultimately, the goal is to provide a clear, professional document that is easy to customize and share with your clients.

Creating Clear Billing Terms for Clients

Establishing transparent and well-defined payment terms is essential for ensuring smooth transactions between service providers and clients. Clear billing terms help set expectations regarding costs, deadlines, and payment methods, reducing the likelihood of misunderstandings and disputes. By outlining these details in advance, both parties are aware of their obligations, which fosters trust and maintains a professional relationship.

Key Elements to Include in Billing Terms

- Payment Due Date: Clearly specify when the payment is expected, whether it is upon completion of the service or within a set number of days after the bill is issued.

- Accepted Payment Methods: List all the acceptable forms of payment, such as bank transfers, credit cards, or digital payment systems, to give clients flexibility.

- Late Fees and Penalties: Define any additional charges for overdue payments, ensuring that clients are aware of the consequences of missing a deadline.

- Discounts and Promotions: If applicable, outline any discounts for early payment or special offers that clients can take advantage of.

- Detailed Cost Breakdown: Include a clear description of the charges, ensuring clients understand exactly what they are paying for, whether it’s hourly rates, flat fees, or additional costs.

Communicating Billing Terms to Clients

To avoid confusion, it’s important to present the billing terms clearly, either as part of an agreement or within the initial quote provided to clients. Ensure that the terms are easy to read and highlight important details such as payment deadlines and fees. A written document, email, or digital agreement should include these terms so that clients can refer back to them as needed, ensuring transparency throughout the service period.

How to Include Service Details in Invoices

When preparing a billing document, it’s crucial to provide clear and accurate information about the services performed. Including detailed descriptions helps clients understand exactly what they are paying for and ensures transparency. Well-documented service details also reduce the chances of disputes and allow for smoother, more efficient transactions between both parties.

What to Include in Service Descriptions

- Task Breakdown: Specify each individual task or service provided, whether it’s a specific cleaning activity or a maintenance job. This ensures that clients see exactly what they are being charged for.

- Hours Worked: If applicable, list the amount of time spent on each task. This is especially important for businesses charging by the hour, as it helps justify the final cost.

- Materials Used: Include any materials, tools, or products used during the service. This is useful for clients who may wish to see a breakdown of all costs, including supplies.

- Frequency of Service: If the service is recurring, clearly state how often the work is performed, whether it’s weekly, bi-weekly, or monthly. This ensures the client understands the duration and frequency of services provided.

- Special Requests: If the client made specific requests, mention them in the service details. This helps reinforce the value of the customized services provided and avoids any confusion about expectations.

Why Clarity Matters

Including detailed descriptions not only helps clients understand the value of the services rendered but also prevents misunderstandings. When a client receives a clear breakdown, they can see exactly where their money is going, making them more likely to be satisfied with the transaction. Additionally, clear documentation makes it easier to track work completed, particularly for businesses that offer multiple services or perform frequent jobs for the same client.

Adding Taxes and Discounts to Invoices

In many service-based industries, including taxes and discounts is a crucial part of the billing process. Properly calculating and presenting these adjustments ensures that clients understand the full cost of the service and helps maintain transparency. Including taxes where required and applying discounts when appropriate can improve client satisfaction and ensure that your business remains compliant with legal and financial regulations.

How to Apply Taxes and Discounts

Taxes are usually applied as a percentage of the total cost, depending on local regulations. Discounts, on the other hand, can be offered as a fixed amount or a percentage of the total amount, often used as an incentive for early payment or as part of a promotional offer.

Example of Tax and Discount Calculations

| Description | Amount |

|---|---|

| Service Cost | $200.00 |

| Sales Tax (8%) | $16.00 |

| Discount (5%) | -$10.00 |

| Total Due | $206.00 |

In the example above, the original service cost is $200.00. A sales tax of 8% is added, bringing the total to $216.00. A 5% discount is then applied, reducing the total by $10.00, resulting in a final amount due of $206.00. By clearly showing these calculations on the document, clients can easily see how the final price was determined.

Ensure that your business complies with local tax regulations and clearly communicate any discounts or promotions in advance to avoid confusion. Properly including taxes and discounts in your billing records is an important step in maintaining transparency and trust with your clients.

Choosing the Right Invoice Design

Selecting the appropriate design for your billing documents is an essential aspect of presenting your business in a professional light. A well-organized and visually appealing format not only improves readability but also enhances your brand’s image. The right design should reflect the nature of your services while ensuring that all necessary details are easily accessible for your clients.

Factors to Consider When Choosing a Design

- Clarity and Simplicity: A clean and simple layout makes the document easy to read and navigate. Avoid clutter by ensuring there’s enough white space and logical organization of information.

- Brand Consistency: Your billing document should align with your business’s visual identity. Incorporate your logo, color scheme, and font choices to maintain consistency across all your materials.

- Legibility: Choose fonts that are easy to read. Clear headings, subheadings, and adequate font sizes ensure that clients can quickly locate the information they need.

- Professional Look: Avoid overly decorative or complex designs. A professional design conveys trust and competence, which can positively impact client relationships.

- Functionality: Ensure the design allows for easy customization. It should accommodate all necessary details like client information, services rendered, pricing, and payment terms.

Types of Designs to Consider

- Minimalist: A simple, clean design with only the essential elements makes the document straightforward and easy to understand. This style often uses a limited color palette and simple typography.

- Modern: Modern designs may incorporate bold colors, unique layouts, and contemporary fonts to give the document a more stylish look while maintaining clarity.

- Classic: A traditional design uses familiar layouts and a more formal font style, offering a timeless, professional appearance.

- Customizable: Many businesses prefer using flexible designs that can be adapted for different clients or services, allowing for easy changes to reflect specific needs.

Choosing the right design is key to making a strong first impression with clients. A polished, clear, and professional-looking billing document not only facilitates smooth transactions but also helps build trust with your customers.

Common Mistakes in Cleaning Invoices

Billing documents are an essential part of any service-based business, but even small errors in these records can lead to confusion, delays, and disputes. It’s important to be aware of common mistakes that can arise during the process of preparing these documents. By recognizing and avoiding these pitfalls, businesses can improve their professionalism and enhance customer satisfaction.

Common Errors to Avoid

- Incorrect Calculation of Charges: One of the most frequent mistakes is miscalculating the total cost. This can happen when hourly rates or unit prices are applied incorrectly, leading to incorrect totals.

- Omitting Key Information: Failing to include essential details such as client contact information, service description, or payment terms can make it difficult for clients to process the document properly.

- Unclear Descriptions: Vague or unclear service descriptions can lead to confusion about what exactly was provided. A lack of detail makes it harder for clients to understand the charges, which may lead to disputes later on.

- Not Including Taxes or Fees: Forgetting to apply applicable taxes or fees can result in an inaccurate total. This oversight can create issues, especially when tax laws require specific calculations for services.

- Using Inconsistent Formatting: Inconsistent fonts, layouts, or styles can make the document look unprofessional and harder to read, which can affect the client’s perception of your business.

Example of Common Mistakes in Billing Documents

| Error | Example |

|---|---|

| Incorrect Calculation | Hourly rate of $50 was applied for 3 hours but the total shows $150.00 instead of $150.00. |

| Omitted Details | No description of services provided, leaving the client unsure of what work was done. |

| Unclear Service Description | “Cleaning services provided” without specifying the specific tasks like dusting, vacuuming, etc. |

| Missing Tax Information | Failure to add state sales tax (8%) on the service amount, resulting in a lower total. |

| Inconsistent Formatting | Mixing fonts and colors, making it hard to follow and understand the content. |

By avoiding these common mistakes, businesses can ensure that their documents are accurate, professional, and clear. A well-structured and error-free billing document helps build trust with clients, r

How to Track Payments Using Invoices

Effectively managing payments is essential for any business to maintain cash flow and ensure financial stability. One of the best ways to keep track of payments is by utilizing billing documents that include clear, organized payment details. By recording each transaction in a structured manner, businesses can easily monitor outstanding balances, identify overdue payments, and maintain accurate financial records.

Steps to Track Payments Effectively

- Assign Unique Numbers: Each billing document should have a unique identifier, such as an invoice number. This makes it easy to track and refer to specific transactions in your accounting system.

- Record Payment Terms: Clearly state the payment due date and any terms regarding late fees or discounts for early payment. This helps both you and your clients stay on top of deadlines.

- Update Payment Status: Regularly update the payment status for each document–whether it’s marked as “Paid,” “Pending,” or “Overdue.” This provides a quick overview of outstanding balances.

- Include Payment Methods: Indicate the payment method used (e.g., credit card, bank transfer, cash) and any relevant transaction details. This helps you keep track of which payments have been processed and which are still pending.

- Maintain a Payment Log: Keep a log or digital record of all transactions associated with each billing document. This record should include the date of payment, the amount received, and any notes about the payment, such as partial payments or adjustments.

Tools for Payment Tracking

There are various tools and software that can help streamline payment tracking. Many accounting and invoicing software programs offer automated payment reminders, status updates, and reporting features. These tools can generate reports showing unpaid invoices and automatically send reminders to clients, helping to ensure timely payments and reducing administrative burden.

By following these steps and leveraging the right tools, businesses can stay organized and on top of their payment processes, which ultimately contributes to better cash flow and fewer payment-related issues.

Digital vs Printable Cleaning Invoices

When it comes to managing billing documents, businesses have the option to choose between digital and printable formats. Both methods have their advantages and limitations, and selecting the right one depends on your workflow, client preferences, and the level of convenience you require. Understanding the differences between digital and printed formats can help you make a more informed decision that best suits your business needs.

Advantages of Digital Billing Documents

- Faster Delivery: Digital documents can be sent instantly via email or online platforms, eliminating the time and cost associated with mailing physical copies.

- Convenience and Accessibility: Clients can easily access and store digital documents on their devices, allowing for quick reference and organization.

- Automated Tracking: Many online invoicing systems offer automated payment tracking and reminders, reducing manual effort and minimizing errors.

- Environmental Impact: Using digital documents reduces paper waste and is a more eco-friendly option, contributing to sustainability efforts.

- Security: Digital formats can be encrypted and backed up, making them more secure than physical copies that can be lost or damaged.

Advantages of Printable Billing Documents

- Physical Documentation: Some clients prefer receiving a hard copy for their records, which can be physically stored or filed for future reference.

- Personal Touch: Printed documents can feel more formal and personal, which may be important in certain business relationships.

- No Technical Barriers: Printable formats do not require internet access or digital tools, making them an accessible option for clients who may not be tech-savvy.

- Better for Certain Industries: Some industries or clients may still prefer physical records for legal or tax purposes, and printed copies can be signed more easily for official agreements.

Ultimately, the choice between digital and printable formats depends on your specific needs and client preferences. Many businesses today choose to offer both options, allowing flexibility for different types of clients and ensuring efficiency in their billing processes.

Automating Your Billing Documents

Automation is a powerful tool that can streamline business processes, particularly when it comes to managing payment records. By automating your billing tasks, you can save time, reduce human error, and ensure consistent delivery of accurate documents. This approach is especially beneficial for businesses that deal with frequent or recurring transactions, making it easier to maintain organization and stay on top of payment schedules.

Benefits of Automating Your Billing Process

- Time Savings: Automation eliminates the need to manually create and send each document. Once set up, it can generate and send records automatically, freeing up valuable time for other important tasks.

- Consistency and Accuracy: Automated systems reduce the risk of errors, ensuring that each document contains accurate details like service descriptions, costs, and payment terms.

- Faster Processing: Automated documents can be sent instantly via email or through online portals, speeding up the payment cycle and improving cash flow.

- Recurring Billing: If your services are billed on a regular basis, automation allows you to set up recurring charges, ensuring timely and reliable billing for both you and your clients.

- Customizable Reminders: Many automated systems offer the option to schedule reminders for unpaid amounts or upcoming payments, reducing the need for manual follow-ups and improving client compliance.

How to Set Up Automation for Billing

- Choose an Automation Tool: Select software that fits your business size and needs. There are many invoicing platforms that allow you to set up recurring invoices, payment reminders, and even integrate payment gateways.

- Set Up Payment Terms: Customize the payment terms, including due dates, tax rates, and discounts, to ensure that each document automatically calculates the correct amounts.

- Integrate with Your Accounting System: Link your automated system to your accounting software for seamless tracking of payments and balances.

- Personalize Your Documents: Even with automation, it’s important to maintain your brand identity. Ensure that your billing documents reflect your logo, color scheme, and other branding elements.

By automating your billing documents, you can improve operational efficiency, reduce administrative work, and provide a more professional experience for your clients. Automation is an investment that pays off in both time and accuracy, allowing you to focus on growing your business.

Legal Considerations for Cleaning Invoices

When preparing billing documents for services rendered, it’s essential to consider the legal aspects to ensure compliance and protect your business interests. Accurate and legally sound records are crucial not only for smooth business operations but also for avoiding disputes and ensuring timely payments. There are several key legal requirements that should be taken into account when creating and managing your billing documents.

Important Legal Elements to Include

| Legal Element | Explanation |

|---|---|

| Service Description | Provide clear and detailed descriptions of the services provided. This helps prevent misunderstandings and ensures that the client knows exactly what they are paying for. |

| Payment Terms | Clearly state the payment terms, including the due date, late fees (if applicable), and any discounts for early payment. This helps manage client expectations and provides a reference point in case of disputes. |

| Tax Compliance | Ensure that the correct tax rates are applied based on the location of the service and the nature of the transaction. Failure to apply taxes correctly can result in fines or legal issues with tax authorities. |

| Client Information | Always include accurate client details such as their legal name, address, and contact information. This ensures that your records are correct and can be used in any legal matters if necessary. |

| Contractual Agreement Reference | If the service is based on a signed contract or agreement, reference that agreement in the billing document. This helps establish that the service terms have been met as per the contract. |

Legal Considerations for Late Payments

In the event of a late payment, having clear terms regarding interest or penalties for overdue amounts is crucial. Many businesses include a specific interest rate or late fee percentage to encourage timely payments. Additionally, in some regions, businesses may be legally required to send formal reminders or issue a formal demand for payment before taking further action, such as involving collections or legal proceedings.

By ensuring that your billing documents are legally compliant, you not only protect your business from potential disputes but also establish trust with your clients. Proper documentation can help resolve conflicts quickly and efficiently, protecting both parties’ interests.

How to Send Billing Documents

Once your service has been provided and the billing document is ready, sending it to your client in a timely and professional manner is essential for smooth business transactions. The method of delivery can affect how quickly payments are processed, as well as the client’s perception of your business. Understanding the various ways to send these documents ensures efficiency and clarity.

Methods of Sending Billing Documents

- Email: Sending digital billing documents via email is one of the fastest and most common methods. It allows for quick delivery and easy record-keeping. Attach the document as a PDF to ensure that it is accessible and formatted correctly on all devices.

- Online Payment Platforms: If you use an online billing or payment system, such as PayPal or a specialized invoicing platform, you can send documents directly through these services. This allows the client to review the document and make a payment in one seamless process.

- Postal Mail: Although less common, some clients prefer receiving physical copies of billing documents. Mailing hard copies may be necessary for legal purposes or if your client specifically requests it. Be sure to send documents via tracked mail for security and confirmation of delivery.

- Client Portals: For businesses with repeat clients, using a secure client portal is an excellent way to share and track billing documents. Portals offer clients easy access to their payment history and current balances.

Best Practices for Sending Billing Documents

- Ensure Accuracy: Double-check that all the information in your document is accurate before sending. Incorrect details can delay payments and cause confusion.

- Include Payment Instructions: Always include clear instructions on how the client can make a payment, including accepted methods and payment due dates.

- Confirm Receipt: When sending documents via email or online platforms, request a confirmation of receipt. This ensures that your client has received the document and is aware of the payment terms.

- Follow Up: If no payment has been made within the agreed timeframe, send a polite reminder. Be consistent but respectful in your communication to maintain a good business relationship.

Example of Payment Methods and Deadlines

| Payment Method | Details |

|---|---|

| Bank Transfer | Provide the account details for direct transfer. Include the deadline for the payment. |

| Credit Card | Include a link to the online payment portal whe

Ensuring Timely Payment from ClientsReceiving payments on time is crucial for maintaining cash flow and ensuring the smooth operation of your business. However, clients sometimes delay payments, which can create financial strain. To avoid these issues, it’s important to establish clear payment expectations upfront and adopt strategies that encourage clients to pay on time. By implementing effective practices, you can significantly reduce payment delays and improve the efficiency of your billing process. Strategies to Encourage On-Time Payments

Handling Late Payments

By setting clear expectations, offering incentives for early payments, and maintaining open lines of communication, you can minimize late payments and create a more predictable cash flow. Taking proactive steps to ensure timely payments will ultimately help your business run more smoothly and avoid financial disruptions. Where to Find Free Billing Document Templates

Creating professional billing documents doesn’t always require expensive software or complicated designs. There are numerous free resources available online that provide customizable templates, allowing you to generate clear and well-organized records for your business. Whether you’re looking for simple layouts or more advanced features, these free tools can help you maintain an efficient billing process without additional costs. Top Resources for Free Billing Templates

Benefits of Using Free Billing Document Templates

By utilizing these free resources, you can create billing documents that are both functional and professional, helping you streamline your processes without unnecessary expenses. Take advantage of the many tools available to suit your business needs and improve your billing efficiency. |