How to Create and Customize Odoo Template Invoice

Creating clear, professional financial documents is essential for any business. Whether you’re issuing payments or requesting funds, well-designed records can improve communication and enhance your brand’s credibility. Customizing these documents allows companies to present their services in a more organized and appealing way.

With the right tools, businesses can automate and personalize these records to match their unique needs. From adding logos and custom fields to setting up recurring billing cycles, these features can save time while maintaining accuracy. Additionally, automating this process helps reduce errors and ensures consistency across all client interactions.

Effective management of your billing process not only simplifies administrative tasks but also improves cash flow. By adopting flexible solutions that support diverse payment terms and currencies, companies can better adapt to international markets and meet client expectations efficiently.

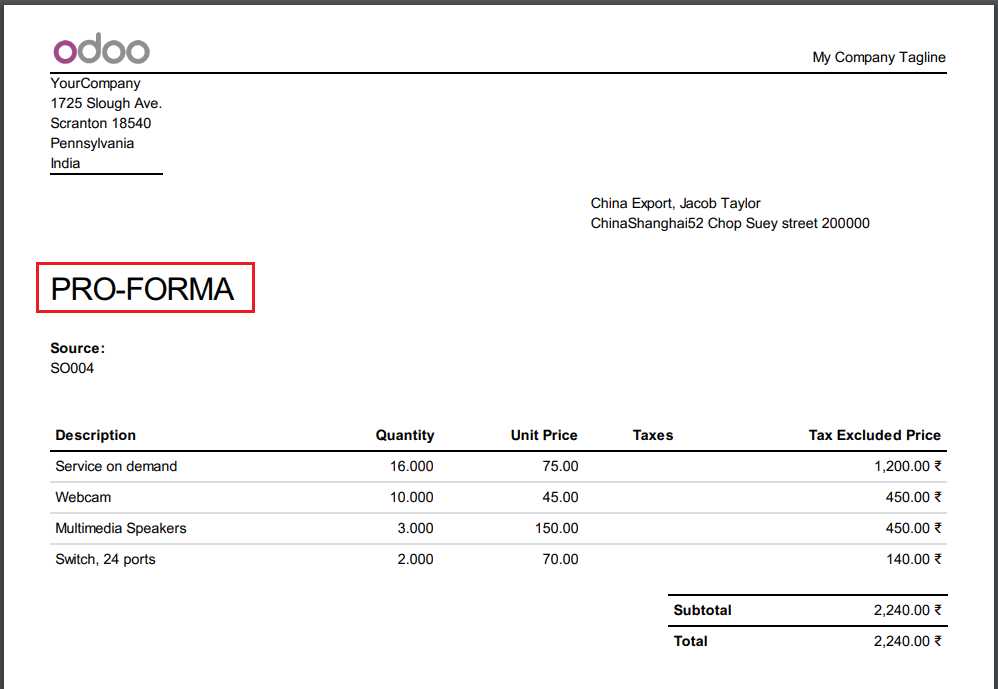

What is Odoo Template Invoice

In the world of business, efficiently generating and managing financial documents is key to smooth operations. These records serve as a formal request for payment and are used to track transactions between a company and its clients. Customization of these documents allows businesses to align them with their branding and operational requirements, providing both functionality and professionalism in every transaction.

One such solution is a feature that allows companies to create personalized billing documents with predefined layouts. These layouts can be modified to include company logos, payment terms, and other necessary details, ensuring that each document reflects the company’s identity and meets specific client needs. The flexibility of these solutions helps businesses save time and reduce errors by automating the document creation process while maintaining a high level of consistency.

With advanced tools, businesses can manage multiple document formats, adjust content dynamically, and ensure compliance with legal or tax requirements. The ability to generate recurring statements, track payments, and create reports further enhances the efficiency and accuracy of financial management. This system is designed to integrate seamlessly into broader business processes, offering a streamlined approach to managing payments and financial records.

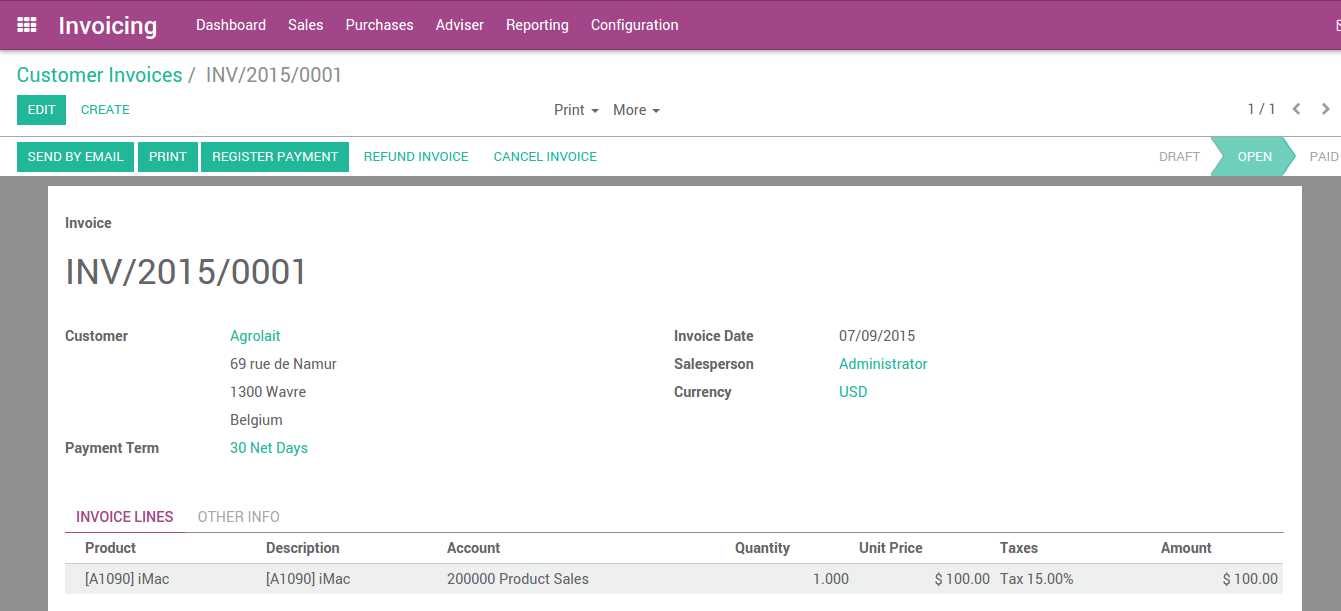

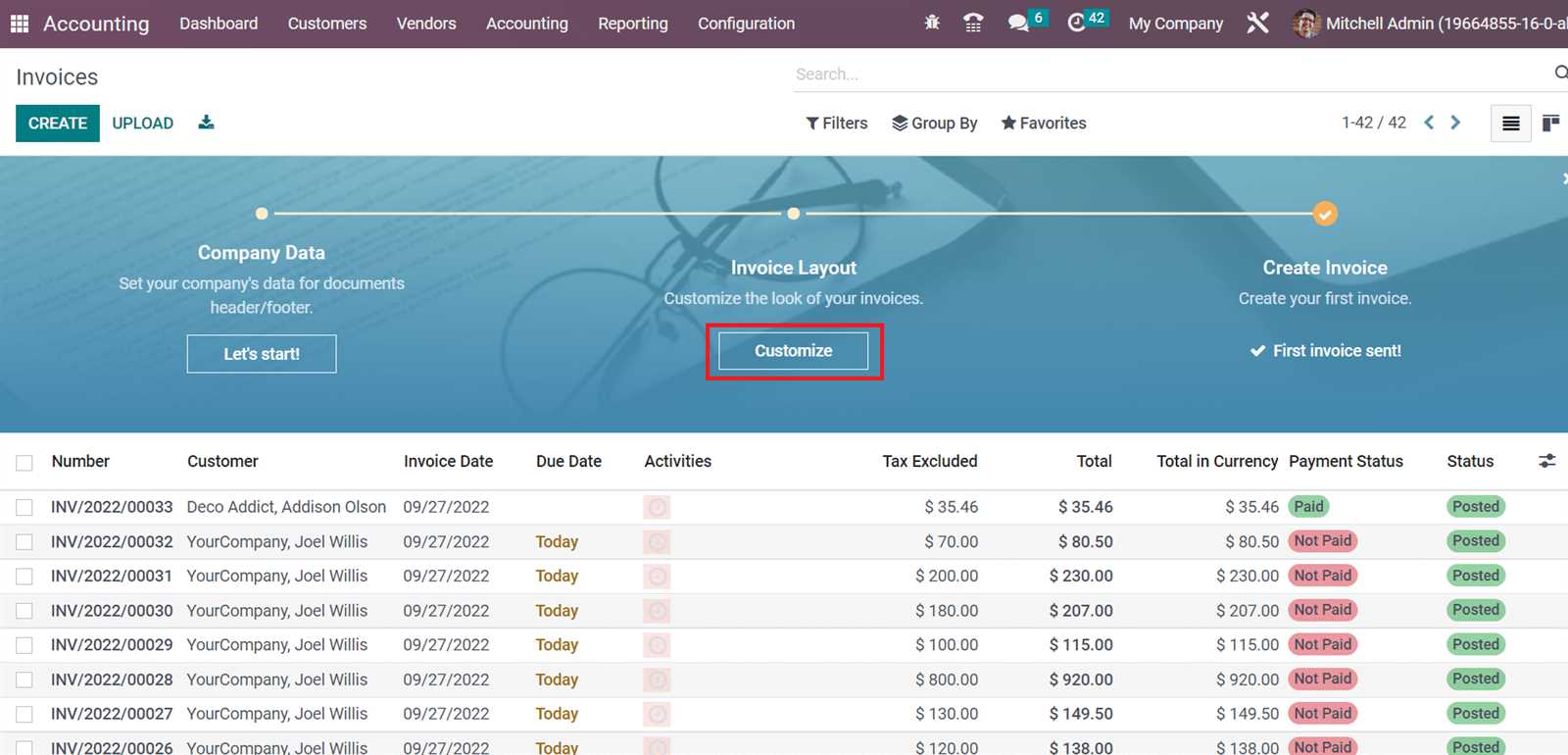

How to Set Up Odoo Invoices

Setting up a system for creating billing documents is a crucial step in streamlining your business’s financial processes. A well-organized setup ensures that the necessary details are included in every document, from customer information to payment terms. By following a few simple steps, you can customize and automate the creation of your billing documents, saving time and reducing errors.

To begin, you need to configure several key settings in your system to ensure that all your financial records are correctly generated. Here’s a general guide to help you set up your billing document creation process:

- Enable the Accounting Module – Make sure that the accounting features are enabled in your system to access all the tools required for managing financial documents.

- Create Your Company Profile – Input essential company information, such as name, logo, and contact details, so they automatically appear on all generated documents.

- Configure Payment Terms – Define payment terms, including deadlines, late fees, and discounts, to ensure these are included in every document generated.

- Set Up Tax Information – If applicable, configure tax settings for your products and services to automatically calculate taxes in your documents.

- Create Document Layouts – Design the layout of your financial records by choosing from available templates or creating your own custom designs to reflect your company’s brand.

- Define Numbering Series – Customize the numbering system to keep track of your documents efficiently and avoid conflicts with existing records.

- Automate Recurring Transactions – Set up recurring billing cycles for clients with ongoing contracts, ensuring consistent document generation without manual input.

By following these steps, you’ll have a customized and efficient system for managing your financial documents. The flexibility of this setup allows businesses to scale operations and adapt to changing requirements, ensuring that all your transactions are recorded accurately and professionally.

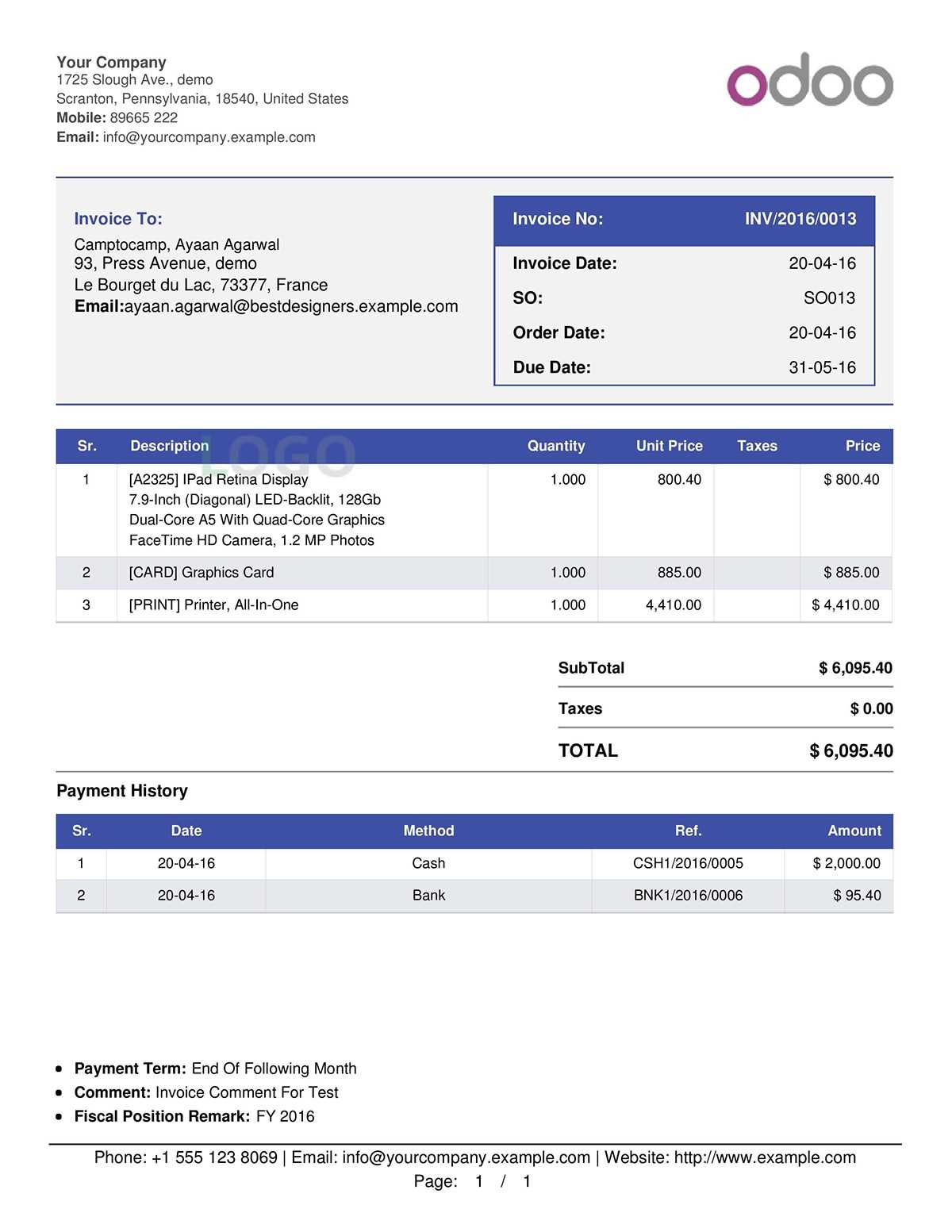

Customizing Invoice Templates in Odoo

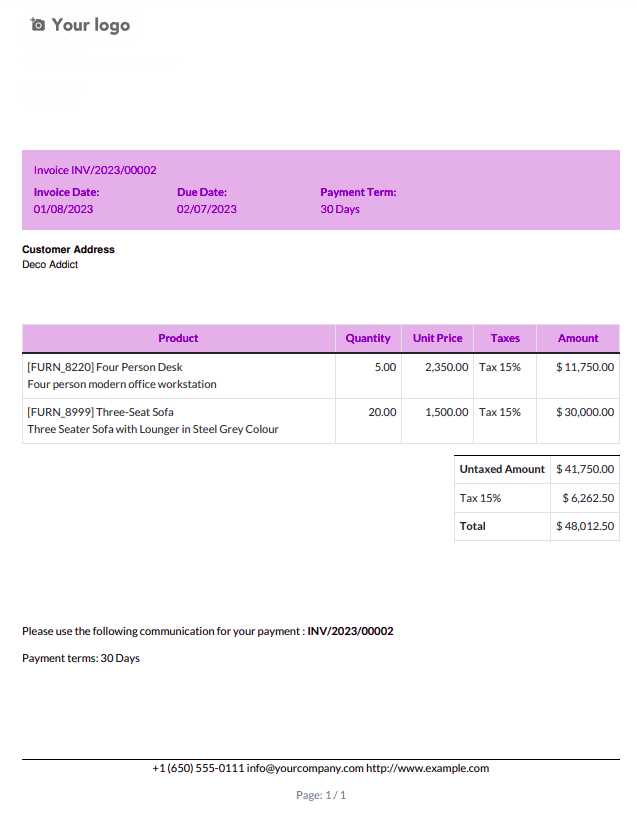

Customizing your financial documents is a powerful way to align them with your company’s branding and client requirements. Whether you need to add a logo, adjust the layout, or include specific fields, these modifications can help make your documents more professional and user-friendly. Personalizing these records ensures they reflect your company’s identity while meeting legal and business needs.

One of the key advantages of customizing these documents is the ability to streamline communication with your clients. For instance, you can include details like payment instructions, discounts, or a custom message to personalize each document. The more control you have over the design and content, the more it can align with your business processes.

Here are some common customization options available for financial records:

- Adding Company Branding – You can incorporate your company logo, color scheme, and other branding elements into the layout, ensuring that each document reflects your company’s identity.

- Modifying the Layout – Adjust the positioning of key information such as client details, item descriptions, and payment terms. You can also choose to hide or display certain sections depending on the type of transaction.

- Custom Fields – Add specific fields to include additional information such as project numbers, reference codes, or custom terms unique to your business.

- Dynamic Content – Enable automatic population of fields such as dates, customer details, and payment amounts to reduce manual input and errors.

- Multi-Currency Support – Customize the display of amounts in different currencies based on your clients’ locations and agreements.

Customizing your financial documents not only improves professionalism but also enhances the overall client experience. By tailoring them to fit your specific needs, you can ensure that each record is both functional and in line with your company’s values and branding.

Benefits of Using Odoo Invoice Templates

Utilizing customized document formats for generating financial records brings several advantages to businesses, particularly in terms of efficiency, consistency, and accuracy. By adopting ready-made or customizable formats, companies can ensure that all necessary information is presented clearly and professionally. These solutions simplify the entire process of document creation while saving valuable time and resources.

Here are some key benefits of using these automated tools for your billing process:

- Time Savings – Automating the creation of financial documents reduces the amount of manual input required, allowing employees to focus on more important tasks and improving overall workflow efficiency.

- Consistency and Accuracy – By using predefined formats, you ensure that each document is consistent in terms of layout, content, and calculations. This helps prevent errors and discrepancies that may arise from manual entries.

- Improved Professionalism – Customizable designs allow you to create polished, branded documents that enhance the perception of your business in the eyes of your clients and partners.

- Streamlined Client Interaction – Predefined fields like client details, payment terms, and tax information can be automatically filled in, leading to faster turnaround times and clearer communication with clients.

- Better Compliance – Built-in options to include essential legal information, such as tax rates and payment terms, ensure that your documents meet compliance standards in your region or industry.

- Cost Efficiency – Reducing the time spent on manual document creation lowers operational costs and allows businesses to allocate resources to other areas, such as sales or customer support.

By integrating such systems into your workflow, you gain greater control over your financial processes and improve the overall client experience. These solutions not only make the document creation process faster but also ensure that your records are accurate, professional, and aligned with business objectives.

How to Automate Invoice Creation in Odoo

Automating the process of generating financial documents can significantly improve efficiency and reduce the time spent on repetitive tasks. By setting up automatic document creation, businesses can ensure that their records are generated consistently and on time, with minimal manual effort. This not only streamlines the workflow but also helps reduce human errors, improving overall accuracy in financial reporting.

To automate the creation of these documents, there are several essential steps you can follow to configure the system to handle recurring tasks, billing cycles, and other regular transactions without manual intervention:

- Set Up Recurring Billing Cycles – For clients with subscription-based services or regular billing, configure recurring transactions. This will automatically generate new documents at set intervals, saving you from having to create each one manually.

- Enable Automatic Data Entry – Customize fields to auto-populate with customer details, product information, pricing, and payment terms based on predefined rules. This ensures that each document contains accurate and up-to-date information without needing to be manually filled in.

- Define Payment Schedules – Set up specific payment terms such as due dates, early payment discounts, or late fees to be automatically included in each document. This helps maintain consistency and prevents oversight.

- Integrate with Your Sales System – By connecting your financial document system with sales and inventory modules, you can ensure that each generated document reflects the most current transaction details, including products sold, quantities, and pricing.

- Automate Notifications – Set up automatic email alerts to be sent to clients when a new document is created or when payment is due. This helps keep clients informed and ensures that your billing process is more transparent.

By automating these processes, businesses can ensure a smoother and more efficient financial operation. Automation not only saves time but also helps ensure that documents are accurate, timely, and professional, which ultimately leads to improved customer relationships and better cash flow management.

Integrating Odoo with Your Accounting System

Integrating your financial document management system with accounting software is a powerful way to streamline business operations and improve accuracy. By connecting both systems, you can ensure that transaction data flows seamlessly between them, reducing the need for manual input and minimizing errors. This integration allows for real-time updates, enhanced reporting, and more efficient financial tracking across your organization.

When you link your document creation tools with an accounting platform, several benefits become immediately apparent:

- Automatic Data Synchronization – Transaction details, such as amounts, taxes, and client information, are automatically transferred between systems, ensuring that all records are accurate and up-to-date without manual data entry.

- Improved Financial Reporting – The integration allows for better reporting capabilities by combining data from both systems. You can generate comprehensive financial statements, balance sheets, and profit and loss reports with a single click.

- Efficient Payment Tracking – By connecting the two systems, payment statuses and balances are automatically updated in real-time, making it easier to track outstanding payments and overdue accounts.

- Streamlined Reconciliation – The integration simplifies the reconciliation process, allowing you to match payments and transactions automatically, reducing the time spent on manual checks.

- Compliance and Accuracy – By having all financial data in sync, you ensure that your documents meet legal and tax regulations, with accurate calculations for taxes, fees, and other financial elements.

With a seamless connection between your document management and accounting systems, you can greatly improve operational efficiency, reduce manual work, and ensure that your financial records are always accurate and up to date. This integration is a key step toward scaling your business while maintaining control over your financial processes.

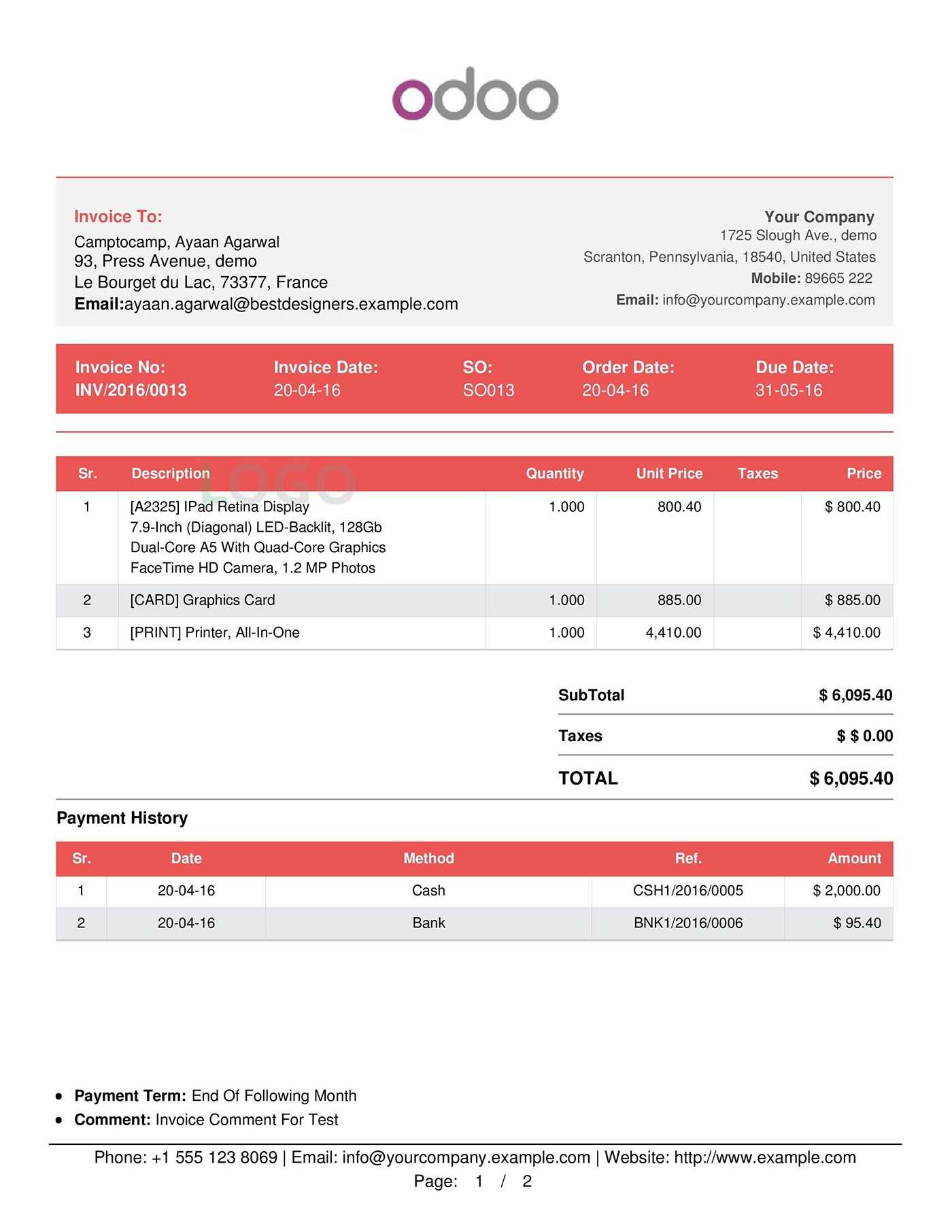

Designing Professional Invoices with Odoo

Creating polished and professional financial documents is crucial for maintaining a strong brand image and establishing trust with clients. A well-designed record not only communicates essential payment information but also reflects your company’s attention to detail and professionalism. By customizing your financial statements, you can create documents that are both functional and aligned with your business’s visual identity.

Key Elements of a Professional Design

When designing your financial documents, it’s important to consider the following elements to ensure that the layout is both visually appealing and easy to understand:

- Branding – Include your company’s logo, color scheme, and contact details to make the document instantly recognizable and consistent with your brand’s identity.

- Clear Layout – Organize the information in a logical flow, with clear sections for client details, item descriptions, payment terms, and totals. This ensures the document is easy to read and follow.

- Legibility – Use a clean, professional font and ensure that the text is large enough to be easily readable. Avoid cluttering the document with unnecessary information or excessive design elements.

- Legal and Tax Information – Include all required legal and tax details, such as tax rates, payment terms, and applicable fees, to ensure that the document complies with local regulations.

How to Customize and Enhance the Design

Once the essential elements are in place, you can enhance your documents with additional features to make them stand out and better serve your business needs:

- Custom Fields – Add fields for specific details that are unique to your business, such as project numbers, order references, or discount codes. This helps personalize the document for each client.

- Dynamic Content – Set up fields that automatically populate with transaction data, such as item descriptions, quantities, prices, and taxes, to save time and reduce manual errors.

- Recurring Billing Options – For clients with ongoing contracts, include the ability to automate recurring charges and adjust the layout accordingly for subscription-based services.

By following these steps and customizing the design of your financial records, you can create documents that not only look professional but also serve your business operations more effectively. A well-designed document is a valuable tool in building strong client relationships and improving the efficiency of your financial processes.

Managing Multiple Invoice Templates in Odoo

Businesses often deal with a variety of financial documents tailored to different types of transactions, clients, and services. Managing multiple document formats for various purposes–whether for recurring payments, one-time charges, or special offers–can become complex without an efficient system. Organizing these formats in a way that ensures quick access, consistency, and accuracy across all generated records is key to improving workflow and maintaining a professional image.

One of the main benefits of handling multiple formats is the ability to customize each document according to its specific purpose. Whether it’s for regular clients, new customers, or special projects, having the right format helps ensure that all necessary details are included while maintaining a consistent look and feel. Here’s how to effectively manage multiple document designs:

- Organize by Use Case – Create different layouts for different types of transactions, such as sales orders, service contracts, or recurring subscriptions. This way, you can select the appropriate format depending on the nature of the transaction.

- Label and Categorize – Clearly label each document format according to its use case. This will make it easy to differentiate between various formats when selecting one for a specific client or situation.

- Maintain Consistent Design Elements – Even though the content and layout may vary, ensure that key design elements like logos, fonts, and color schemes are consistent across all formats to reinforce your brand identity.

- Automate Format Selection – Set up rules or triggers that automatically select the correct format based on factors such as client type, service type, or payment frequency. This reduces the risk of human error and speeds up the document creation process.

- Centralized Management – Store all formats in one centralized location where they can be easily accessed and updated. This ensures that any changes made to a format (such as a logo update or tax rate change) are reflected across all relevant documents.

By adopting these strategies, you can efficiently manage and utilize multiple document formats, ensuring that each transaction is recorded in a professional and consistent manner. This approach not only saves time but also enhances your ability to scale your operations and maintain strong client relationships.

How to Add Company Logo to Odoo Invoices

Including your company’s logo in financial documents is an effective way to enhance brand recognition and present a more professional appearance. Adding a logo ensures that each document reflects your company’s identity, whether it’s sent to clients, suppliers, or partners. Fortunately, incorporating your logo into these records is a straightforward process that can be done quickly through the system’s customization options.

Step-by-Step Guide to Add Your Logo

Follow these steps to add your company logo to the financial documents created in the system:

- Step 1: Navigate to the Settings menu and ensure you have the appropriate permissions to make changes to document layouts.

- Step 2: Access the document design settings, usually found under the Accounting or Document Settings section, depending on the system configuration.

- Step 3: Locate the area where the company logo can be uploaded. This is typically found in the header section of the layout configuration.

- Step 4: Click the “Upload” or “Browse” button to select the logo file from your computer. Make sure the logo is in a supported image format, such as PNG or JPEG, and optimized for clear resolution at various sizes.

- Step 5: Adjust the size and positioning of the logo within the document header to ensure it appears properly aligned with the rest of the content. This may involve resizing the image or moving it within the layout to achieve the desired look.

- Step 6: Save your changes and preview the document to ensure the logo appears correctly on all generated files.

Additional Tips for Logo Customization

When adding your logo, consider the following tips to ensure it aligns with your business needs:

- File Size and Quality: Use a high-resolution logo that looks professional but avoid excessively large files that could affect loading times or document quality.

- Brand Consistency: Make sure the logo’s colors and design match your company’s overall branding for a cohesive look across all documents.

- Test Across Devices: Check how the document appears on different devices and screen sizes to ensure that the logo is properly displayed and maintains its clarity.

By following these steps, you can easily add your company’s logo to every generated document, ensuring that your brand is consistently represent

Invoice Template for Different Currencies

When dealing with international clients or conducting business in multiple regions, it’s essential to create financial documents that reflect various currencies. A versatile format allows businesses to present the correct currency value, including the appropriate symbols, exchange rates, and formatting. This ensures clarity for both your company and clients, making transactions smoother and reducing the risk of confusion.

How to Set Up Currency Formats

Setting up the system to handle different currencies involves configuring the relevant settings and ensuring that the document automatically adjusts according to the client’s location or transaction details. Below are some important steps to set up the system for handling multiple currencies:

- Enable Multiple Currency Support: Ensure that your system is configured to support various currencies by activating this feature in the currency settings.

- Select Currency per Client: When creating a new client or transaction, specify the currency in which they operate. This allows the system to automatically use the correct currency for the document.

- Automatic Conversion: The system can be configured to display the equivalent amount in different currencies using the latest exchange rates, which can be updated automatically.

Sample Layout for Currency Conversion

Here’s an example of how a document layout might look when handling multiple currencies. It shows how the amounts can be displayed in both the local currency and the foreign currency, with the exchange rate clearly stated for transparency.

| Item | Quantity | Unit Price (USD) | Total (USD) | Total (EUR) | Exchange Rate (1 USD = EUR) |

|---|---|---|---|---|---|

| Product A | 3 | $20.00 | $60.00 | €55.00 | 1.1 |

| Product B | 2 | $15.00 | $30.00 | €27.50 | 1.1 |

This format helps clients easily understand the value of the products or services they are being billed for in their local currency, reducing confusion and enhancing transparency in international transactions.

Additional Considerations

- Currency Symbols: Ensure that the correct currency symbol is displayed in the document for better clarity (e.g., “$” f

Creating Recurring Invoices with Odoo

For businesses that offer subscription-based services or long-term contracts, automating the creation of recurring financial records is essential for ensuring timely billing and reducing administrative workload. By setting up a system that automatically generates documents at regular intervals, businesses can streamline operations, maintain cash flow, and improve customer satisfaction through consistent and reliable billing.

How to Set Up Recurring Billing

To create a recurring payment schedule, it is important to first configure the system to recognize the frequency of charges, the amount, and the duration of the contract. Below are the steps to automate recurring charges:

- Define Subscription Parameters: When creating a new contract or agreement with a client, specify the terms, including the amount, billing frequency (monthly, quarterly, yearly), and any special conditions (such as discounts or one-time charges).

- Set Billing Cycle: Configure the system to generate new records automatically based on the agreed-upon billing cycle. This could include selecting the start date and determining whether the document should be created on a specific day each month or another custom schedule.

- Automate Recurring Charges: Once the contract is set up, the system will automatically calculate and apply any recurring charges, including taxes and discounts, for each billing period.

- Notifications and Reminders: Set up automatic email notifications to remind clients about upcoming charges or renewals. These reminders can also be sent out if payments are overdue.

Managing and Tracking Recurring Billing

Once recurring payments are set up, it is important to have an efficient way of managing and tracking them. Below are some key strategies for managing recurring billing:

- Automatic Renewal Tracking: Track renewal dates for each client’s subscription or service contract. The system can automatically renew the contract and generate new documents without manual intervention.

- Payment Status Updates: Automatically update the status of payments (paid, pending, overdue) to ensure accurate records and follow-up actions are taken promptly.

- Customizable Payment Terms: Allow flexibility in payment terms, such as setting up early payment discounts or late fees, which can be automatically applied each billing cycle.

- View Recurring Contracts: Easily view all ongoing contracts and their billing schedules. This allows you to keep track of active clients and ensure that no billing cycles are missed.

Setting up recurring payments through automation not only sav

How to Track Invoice Payments in Odoo

Monitoring and tracking payments for financial records is crucial for maintaining accurate cash flow and ensuring that no payments are missed or overlooked. By keeping track of the payment status for each record, businesses can identify overdue amounts, follow up with clients in a timely manner, and maintain financial transparency. Implementing a system that automatically updates payment statuses and generates reports makes the process more efficient and less error-prone.

Tracking payments involves not only marking when a payment is received but also ensuring that it is properly allocated to the correct records. Below are the steps and features that can help streamline the process of tracking payments:

- Automatic Payment Updates: Once a payment is processed, the system can automatically update the payment status for the relevant record, marking it as paid or partially paid based on the received amount.

- Payment Methods and References: Track various payment methods (such as credit card, bank transfer, or cash) and attach payment reference numbers to each transaction for easy identification and reconciliation.

- Payment Notifications: Set up notifications to alert the team when a payment is received, or when a payment is overdue, prompting timely follow-up actions.

- Partial Payments and Credit Notes: If a client makes a partial payment, the system can track the remaining balance, generate credit notes if needed, and send updated statements reflecting the remaining amount due.

Additionally, integrating payment tracking with accounting and financial reporting tools can significantly enhance the process, allowing businesses to generate accurate financial statements and reports. By doing so, businesses can stay on top of receivables and ensure smooth cash flow management.

Generating Payment Reports

Creating payment reports helps businesses quickly see outstanding payments, payment histories, and customer behaviors. These reports provide valuable insights for accounting teams and help manage future payments. Key reports include:

- Outstanding Payments Report: This report lists all unpaid or partially paid records, enabling businesses to prioritize collections and manage overdue accounts.

- Paid Transactions Report: A record of all fully settled payments, allowing you to track when and how payments were made, and verifying the accuracy of records.

- Customer Payment History: A detailed overview of a particular customer’s payment history, including dates, amounts, and payment methods, which helps in identifying payment trends or issues.

By setting up a robust payment tracking system and utilizing automated notifications and reports, businesses can improve cash flow management, reduce errors, and ensure a seamless billing and payment process for both the company a

Generating Reports from Financial Documents

Creating comprehensive reports from financial records is an essential part of business management. These reports provide insights into various aspects of the company’s financial health, such as outstanding payments, revenue, and customer activity. The ability to generate detailed, accurate reports not only aids in decision-making but also ensures transparency and accuracy in financial operations.

By using the right tools, businesses can automate the creation of reports, filter data based on specific criteria, and even track key metrics such as payment history or sales trends. Below are the steps and features for generating valuable reports from your financial records.

Types of Reports You Can Generate

Generating the right types of reports allows businesses to stay organized and maintain a clear view of their financial status. Here are some of the most useful reports:

- Outstanding Payments Report: This report shows all unpaid or partially paid records. It helps businesses track overdue amounts, prioritize collections, and follow up with clients efficiently.

- Revenue by Customer: A detailed breakdown of revenue generated from each customer over a given period. This report helps identify high-value clients and track changes in sales patterns.

- Sales by Product/Service: Provides insights into which products or services are generating the most revenue, enabling businesses to optimize their offerings or adjust pricing strategies.

- Payment History Report: Displays a complete history of payments made by each client, showing the dates, amounts, and payment methods. This is particularly useful for reconciling accounts and resolving any payment disputes.

- Tax Breakdown Report: This report outlines the total amount of tax collected during a specified period, helping businesses ensure they are compliant with tax regulations and prepare for tax filing.

Steps to Generate Reports

Generating reports from financial documents is a simple process if the right steps are followed. Below is a basic guide:

- Access the Reporting Section: Go to the reporting or analytics section of the system. Most platforms have a dedicated area for generating financial reports.

- Select the Report Type: Choose the type of report you want to generate, such as payment history, sales revenue, or outstanding balances.

- Apply Filters: Apply filters based on specific criteria like date range, customer name, or product type. This allows you to generate more tailored reports that meet your needs.

- Generate and Review: Once the filters are set, generate the report. Review it for accuracy and

Custom Fields and Their Use in Financial Documents

Custom fields are a powerful tool that allows businesses to tailor financial records according to their specific needs and requirements. These fields enable the inclusion of additional information that may not be standard, such as custom terms, project codes, or client-specific details. By leveraging custom fields, businesses can personalize their financial documents, streamline workflows, and ensure that all necessary data is captured for both internal use and client interactions.

Benefits of Using Custom Fields

Adding custom fields to financial documents offers several key benefits:

- Enhanced Flexibility: Custom fields allow businesses to capture information that is unique to their industry or operations, such as service codes, discount structures, or contract reference numbers.

- Better Data Organization: By including additional information in custom fields, companies can keep track of specific project details, terms, or other data that may be relevant for reporting or decision-making.

- Improved Communication: Including client-specific terms or notes in financial documents helps to avoid misunderstandings and ensures that all parties are aligned on the details of the agreement.

- Streamlined Operations: Custom fields can help automate and simplify many business processes by providing the exact information needed for billing, reporting, or compliance.

How to Implement Custom Fields

Custom fields can be added to financial documents by following a few simple steps. Depending on the platform or software, the steps may vary, but the general process remains the same:

- Define the Field: First, determine what type of information you want to capture. This could be a project code, discount type, or custom terms. The field should be relevant to your business needs.

- Add the Field to the Document: Using the customization options, add the new field to the document layout. This typically involves selecting a place for the field to appear (such as near the total amount or under customer details) and defining the field’s type (e.g., text, number, date).

- Populate the Field: Once the custom field is created, populate it with the necessary data for each document. This can be done manually or, in some cases, automatically by integrating with other systems such as CRM or inventory management.

- Utilize the Field for Reporting: Custom fields can be used in reports to analyze specific data trends or gather insights. For example, you can generate a report showin

Tips for Optimizing Financial Documents for Efficiency

Optimizing financial documents is essential for reducing manual work, minimizing errors, and ensuring smooth operations in any business. By streamlining the process of creating, sending, and tracking these records, businesses can save time, improve accuracy, and enhance customer satisfaction. Automation, customization, and integration with other systems are some of the most effective ways to optimize these processes for greater efficiency.

Automation to Save Time

One of the most powerful ways to optimize financial record management is through automation. By automating routine tasks, businesses can focus more on value-added activities while reducing the risk of human error. Here are a few tips to get started with automation:

- Set Up Recurring Billing: For customers with ongoing contracts or subscriptions, automate the creation of new records at regular intervals (weekly, monthly, annually). This eliminates the need for manual input and ensures timely billing.

- Use Payment Reminders: Automatically send reminders to clients when payments are due or overdue. This helps maintain cash flow without requiring constant manual follow-up.

- Automate Tax Calculations: Automatically apply the correct tax rates based on location, product/service, or customer type. This ensures consistency and reduces the chances of errors in tax calculations.

Customizing for Greater Accuracy

Customization allows businesses to tailor their financial documents to meet specific needs, which can significantly improve accuracy and streamline workflows. Here are some ways to use customization effectively:

- Pre-fill Customer Information: Use customer profiles to automatically fill in their details (name, address, payment terms) in each new document. This minimizes the need for manual entry and reduces errors.

- Use Custom Fields: Add custom fields to capture industry-specific data or client preferences. This can include project codes, specific service details, or special billing terms, all of which can be automatically populated when generating new records.

- Custom Layouts: Design document layouts that are easy to read and professional, including clear sections for products/services, taxes, discounts, and terms. Well-organized layouts reduce confusion for both clients and internal teams.

Integrating with Other Business Systems

Integrating financial record-keeping with other business systems, such as CRM or inventory management tools, can significantly enhance efficiency. These integrations allow for seamless data flow and reduce the need for duplicate entries. Key integration opportunities include:

- Link to Sales or Order Management: Automatically convert sales orders into financial documents without having to manually enter data. This saves time and ensures consisten