Free Notion Invoice Template for Effortless Billing

Managing finances efficiently is essential for any business, whether you’re a freelancer or running a small company. With the right tools, creating and tracking payments can become a smooth and automated process. Having an organized approach to handling transactions helps save time and reduce errors, making your day-to-day operations more manageable.

One of the most effective ways to stay on top of billing is by using a digital solution that adapts to your specific needs. With a customizable system, you can easily structure your records, track amounts due, and maintain a professional appearance with minimal effort. A structured framework allows you to handle all the details quickly, ensuring everything is clear and well-documented.

In this guide, we’ll explore how to simplify your payment processes with the help of a robust and versatile system. Whether you’re managing multiple clients or just need a reliable way to handle your accounts, this tool offers a seamless solution for organizing and keeping track of your transactions without unnecessary complexity.

Why Choose a Notion Invoice Template

When it comes to managing financial records, efficiency and simplicity are key. Having an organized and easy-to-use system to handle transactions can save you valuable time and ensure accuracy. Whether you’re a freelancer, small business owner, or contractor, choosing the right tool can significantly improve your workflow and professionalism.

Streamlined Workflow and Flexibility

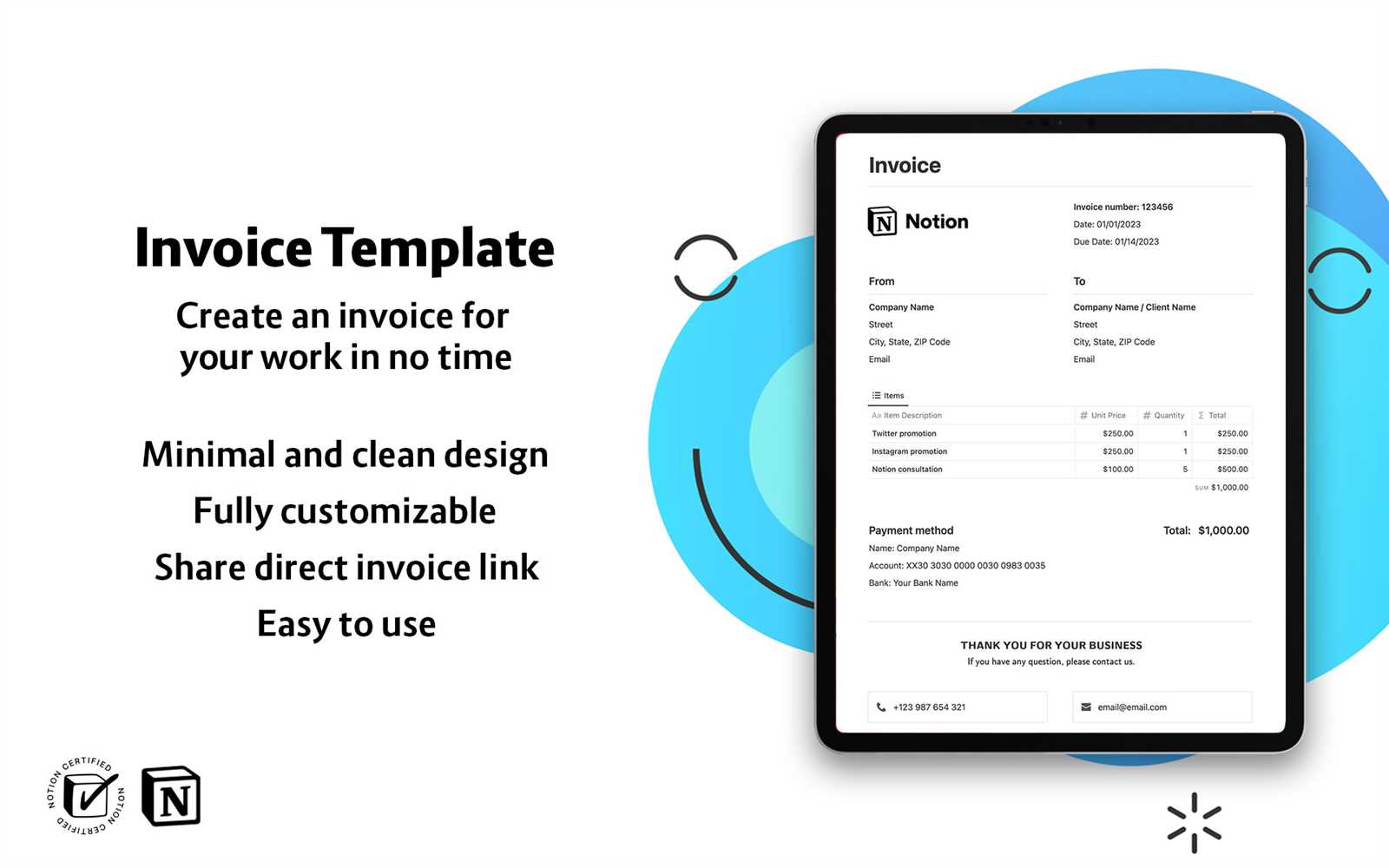

A flexible system allows you to quickly adapt to changing needs. With an intuitive layout, you can customize fields, categories, and even design elements, ensuring the final document reflects your branding and specific requirements. This adaptability makes it easy to manage client accounts, track payments, and store all relevant information in one place.

Cost-Effective and Accessible Solution

One of the major advantages of using such a system is that it offers an affordable alternative to costly software subscriptions or complex accounting tools. By opting for a simple yet powerful tool, you can eliminate extra expenses and still access professional-grade features. The best part is that these solutions are often easily accessible across various devices, so you can manage your records on the go.

With minimal setup required, you can start using the system immediately, allowing you to focus on what matters most–your work. The combination of simplicity, flexibility, and accessibility makes it a highly attractive choice for those seeking an efficient way to handle financial records without unnecessary complexity.

Benefits of Using Notion for Billing

Using a digital solution for managing your financial records brings numerous advantages. From better organization to enhanced efficiency, a well-designed platform helps streamline the entire billing process, reducing manual effort and minimizing the chance of errors. By utilizing such a system, you can handle all aspects of client transactions, payments, and records from a single interface, saving both time and resources.

Centralized Management

One of the main benefits is the ability to consolidate all your financial data in one place. Rather than juggling multiple tools, you can track both pending and completed payments, as well as client details, within a single framework. This centralization makes it much easier to stay on top of your accounts, ensuring that nothing slips through the cracks.

Customization and Personalization

Another significant advantage is the level of customization available. You can tailor the system to meet your specific needs, adjusting categories, fields, and even the design of your documents. Whether you need to add tax details, payment terms, or other unique information, this flexibility ensures that your records are always accurate and professional-looking.

By utilizing a platform designed for both flexibility and ease of use, you can eliminate unnecessary complexity while still maintaining control over your financial operations. This helps not only in keeping records organized but also in improving client communication and trust.

How to Create an Invoice in Notion

Creating a professional billing document from scratch doesn’t have to be a complex task. With the right tools, you can easily design and manage your financial records in a way that’s both functional and visually appealing. By following a few simple steps, you can set up a reliable system to generate and track payments with ease.

Step-by-Step Guide to Building Your Document

Follow these simple steps to create your billing document:

- Set Up a New Page: Start by creating a new page in your system. This will act as your main workspace for managing client details and transactions.

- Create a Table: Add a table to structure your record. Include key fields like “Client Name,” “Service Description,” “Amount Due,” and “Due Date.”

- Customize the Layout: Tailor the columns to include any specific information you need, such as tax rates, payment status, or client contact details. Make sure to design it for easy readability.

- Add Calculations: Use built-in formulas to automatically calculate totals, taxes, and discounts. This saves time and ensures accuracy.

- Save and Duplicate: Once your structure is complete, save it as a reusable template. You can duplicate it each time you need to create a new document for a client.

Making It Your Own

To ensure the document reflects your brand, you can personalize the layout further. Add your logo, adjust colors, and choose fonts that align with your style. This will give your document a polished and professional look, making a lasting impression on clients.

Once you’ve set up your system, creating and tracking payments becomes a seamless task. With everything organized in one place, you can focus more on your work and less on administrative duties.

Top Free Invoice Templates for Notion

If you’re looking to manage your billing and financial records more efficiently, there are several options available to help you get started. Many platforms offer pre-made structures that can be easily customized to suit your specific needs. These tools provide a quick way to organize transactions and save time on manual work, all while maintaining a professional appearance.

Here are some of the top options that allow for easy customization and efficient tracking:

| Template Name | Features | Best For |

|---|---|---|

| Simple Billing Structure | Easy-to-use table with basic client and payment info | Freelancers and small businesses |

| Advanced Payment Tracker | Includes tax calculations, due dates, and status tracking | Contractors and service providers |

| Client Payment Summary | Consolidated view of all client transactions with totals | Companies managing multiple clients |

| Customizable Billing System | Fully adaptable, with the option to add discounts and payments | Business owners who need flexibility |

Each of these options offers a unique set of features tailored to different needs. By choosing the one that fits your workflow, you can streamline your processes and reduce the time spent on administrative tasks. Whether you’re a freelancer handling one-off projects or a business managing ongoing services, there is a solution to help you stay organized and efficient.

Customizing Your Notion Invoice Template

Personalizing your billing structure is an essential step in making it both functional and aligned with your business needs. Customization allows you to add the specific fields, details, and design elements that best reflect your brand and streamline your accounting processes. Whether you need to include additional information or adjust the layout for clarity, modifying your document can make managing finances easier and more professional.

Adjusting Fields and Layout

One of the first customizations you’ll want to consider is adjusting the fields. Depending on your business, you may need different information, such as additional client details, payment terms, or specific service descriptions. The layout can also be modified to improve readability and usability. Below are some common elements you may want to customize:

| Element | Customization Options |

|---|---|

| Client Information | Add fields for contact details, company name, and billing address |

| Payment Terms | Customize payment due dates, late fees, and deposit requirements |

| Service Descriptions | Include detailed descriptions, hourly rates, or quantities of items |

| Tax Calculations | Add tax rates or customize discount fields for more precise billing |

Designing for Brand Consistency

Another key aspect of customization is ensuring the document aligns with your branding. You can adjust color schemes, fonts, and overall design to match your business identity. Adding your logo and using consistent visual elements helps create a cohesive experience for your clients and strengthens your brand’s professionalism. Below are some design adjustments to consider:

- Choose brand colors for headings and tables

- Upload your logo for easy recognition

- Use consistent fonts that align with your brand’s style guide

By tailoring your document in these w

How Notion Templates Save Time

Managing financial records and client details can often be time-consuming, especially when you’re starting from scratch each time. However, by using a well-structured framework, you can drastically reduce the amount of time spent on administrative tasks. Pre-built solutions that can be customized to your needs help streamline repetitive processes, allowing you to focus on what matters most–growing your business or completing projects.

Efficient Setup and Organization

Instead of designing a document from the ground up, a ready-made structure provides a solid foundation that you can adapt quickly. This eliminates the need to repeatedly set up basic fields, layouts, or calculations. Once you have your framework in place, you can simply duplicate it for new clients or projects, saving precious minutes or hours on every new task.

Automation and Formula Features

One of the key ways to save time is through automation. Many systems offer built-in formulas that handle calculations automatically, such as tax rates, totals, or discounts. This removes the need for manual calculations and reduces the chance of errors. Here are some ways this feature can improve efficiency:

- Automatic total calculation based on unit price and quantity

- Instant updates to totals when adding new line items or adjusting rates

- Real-time tracking of payment status and due dates

Reducing Repetitive Tasks

With everything organized in one centralized place, you no longer need to enter the same information repeatedly. Once your system is set up with key client details, payment terms, and project specifics, you can quickly duplicate and edit the data for new invoices. This reduces the amount of time spent on administrative overhead and ensures consistency across all records.

By automating these tasks and eliminating repetitive steps, you can significantly speed up your workflow. This results in more time for creative work, client communication, and business growth, rather than being bogged down by time-consuming paperwork.

Organizing Your Finances with Notion

Effectively managing your financial records is essential for keeping your business running smoothly. A well-organized system can help you track payments, expenses, and client interactions, making it easier to stay on top of your cash flow. By structuring your financial information in a clear and accessible way, you can save time, reduce errors, and ensure that all your transactions are properly documented.

Centralizing Your Financial Data

Instead of managing different financial aspects across multiple platforms or documents, consolidating everything in one place offers clear advantages. You can create a central hub where all relevant information–client details, payment history, and outstanding amounts–are stored and easily accessible. This centralized approach makes it simpler to manage, update, and retrieve any financial data at a moment’s notice.

Tracking Payments and Expenses

Tracking income and expenses is crucial for any business, whether you are a freelancer, a small business owner, or part of a larger organization. Setting up a well-organized ledger allows you to track both incoming and outgoing funds, so you can easily see which invoices are paid, which are overdue, and which clients still owe. You can also keep a record of all expenses related to your business, ensuring that you can quickly access financial reports when needed.

By organizing your finances in this way, you gain complete visibility over your business’s financial health. This level of control allows you to make informed decisions, plan ahead, and stay compliant with tax regulations.

Best Practices for Professional Invoices

Creating professional billing documents is essential for maintaining a positive relationship with clients and ensuring timely payments. A well-structured document not only reflects your attention to detail but also helps avoid misunderstandings. By following a few simple practices, you can improve the clarity, accuracy, and overall professionalism of your financial records, making it easier for clients to understand and process your payments.

Key Elements of a Professional Document

To ensure that your billing record meets professional standards, include the following essential details:

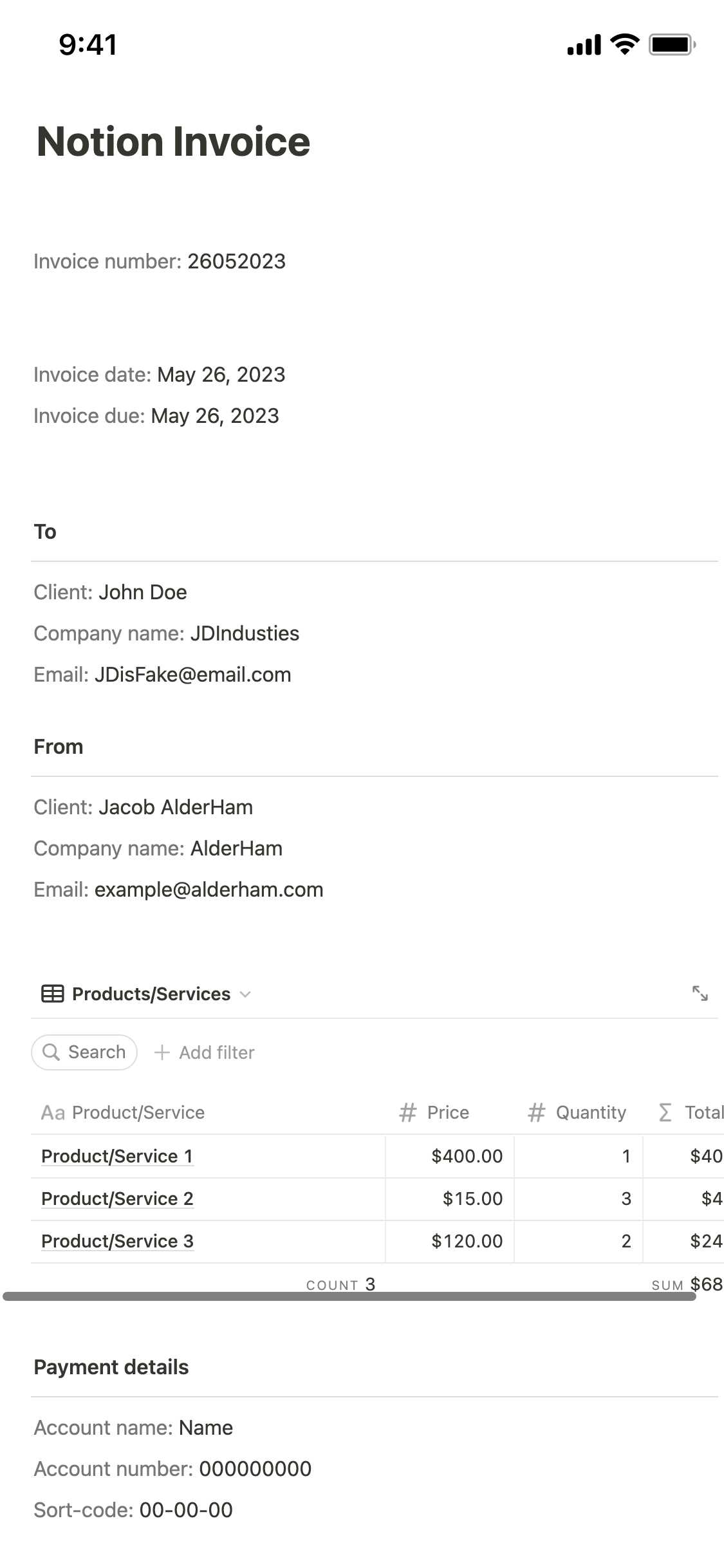

- Clear Identification: Always include your business name, logo, and contact information at the top of the document. This establishes credibility and makes it easy for clients to reach out if necessary.

- Client Information: Include the client’s full name, address, and contact details. This ensures that the document is personalized and that it’s clear who the payment is intended for.

- Itemized List of Services: Provide a detailed breakdown of the services or products provided, along with their corresponding prices. This clarity prevents any confusion and makes it easier for clients to see exactly what they are paying for.

- Payment Terms: Be explicit about the payment due date, accepted payment methods, and any late fees or discounts that apply. Setting clear terms helps manage expectations and prevents delays.

- Unique Invoice Number: Assigning a unique number to each document is important for tracking payments and keeping your records organized.

Designing for Clarity and Professionalism

A professional layout makes a big difference in how your document is received. Here are a few tips to ensure your record is both clear and polished:

- Use clean fonts and ample spacing to make the document easy to read.

- Highlight important information, such as the total amount due and the due date, by making it bold or using a larger font size.

- Organize your data into well-defined sections, such as “Services Provided,” “Payment

How to Manage Clients with Notion Templates

Efficient client management is crucial for maintaining strong relationships and ensuring timely payments. By using a structured system to track client details, project progress, and billing information, you can streamline your processes and stay organized. A well-organized platform allows you to store all client-related data in one place, helping you stay on top of important tasks and deadlines while improving communication.

Organizing Client Information

The first step to managing clients effectively is having a central location for storing key details. A simple, easy-to-navigate structure can help you keep track of important contact information, project status, and communication history. Below are some essential details to include in your client database:

- Client Contact Information: Name, phone number, email, and mailing address.

- Project Details: Description of the services or products you are providing, start date, and deadlines.

- Payment Information: Billing terms, payment history, and outstanding balances.

- Communication Log: Notes on meetings, calls, or email exchanges with the client.

Tracking Project Progress and Deadlines

Once your client data is organized, it’s important to track the progress of each project. Keeping an up-to-date record of milestones and due dates ensures that both you and your clients are on the same page. You can break down tasks into smaller, manageable actions and assign deadlines for each. Here are some ways to track your projects effectively:

- Milestone Tracking: Use a timeline or checklist to break the project down into phases and monitor progress at each stage.

- Due Date Reminders: Set reminders for upcoming deadlines to ensure that nothing slips through the cracks.

- Status Updates: Regularly update the status of tasks, indicating whether they are in progress, completed, or pending.

Improving Client Communication

Maintaining clear and open communication with your clients is key to a successful business relationship. By using an organized system, you can quickly reference previous conversations, follow up on action items, and ensure that you’re meeting client expectations. Some tips for improving communication include:

- Notes Section: Add a section for important notes or special requests from

Tracking Payments Using Notion Templates

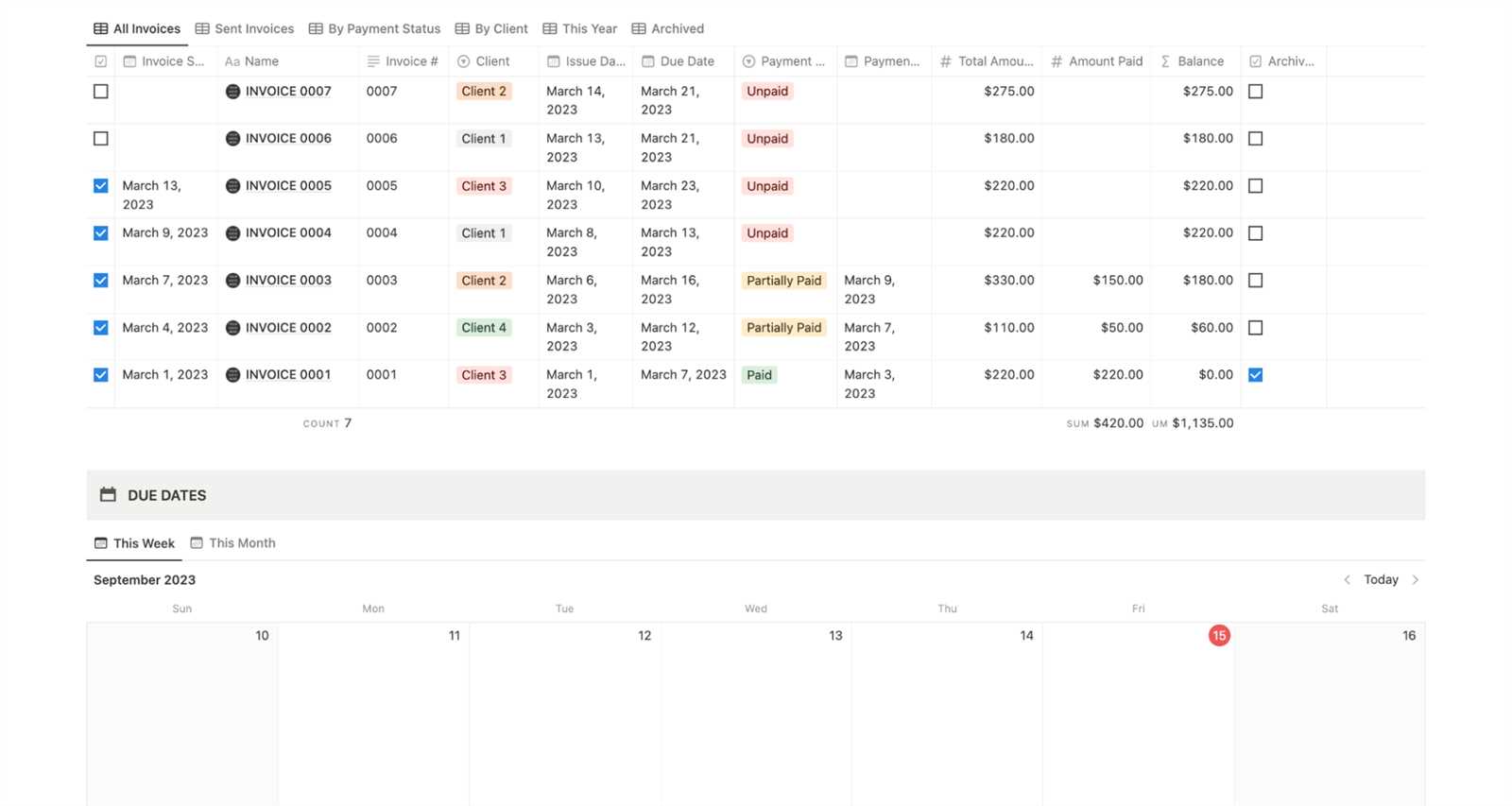

Keeping track of payments is essential for maintaining financial clarity and ensuring that all transactions are settled on time. A systematic approach to tracking payments helps you monitor outstanding balances, identify late payments, and stay on top of your cash flow. By using a well-organized structure, you can quickly access information about client payments and streamline the collection process, which reduces the chances of errors and delays.

Key Features for Tracking Payments

To effectively track payments, it’s important to include several key features that will give you a clear overview of each transaction. Here are some important aspects to include in your payment tracking system:

- Client Information: Record the client’s name, contact details, and any relevant account information for easy identification.

- Payment Status: Track whether the payment is “Pending,” “Paid,” or “Late” to get an immediate understanding of the payment situation.

- Amount Due: Always include the total amount owed, making it easy to see outstanding balances.

- Payment Method: Note how the payment was made (e.g., credit card, bank transfer, check), which helps when you need to reference transactions later.

- Due Date: Record the due date of the payment so that you can track whether it was paid on time or is overdue.

Efficient Ways to Monitor Payments

Once you’ve set up the necessary fields, it’s important to organize the information in a way that makes monitoring and following up easier. Below are a few methods to efficiently track payments:

- Create a Payment Dashboard: Use a centralized view where you can see the status of all transactions, including outstanding balances and due dates. This makes it easy to track everything at a glance.

- Set Up Reminders: Use reminder notifications to follow up on overdue payments or to check in when a payment is approaching its due date.

- Link Payments to Projects: If you’re working with multiple clients, you can link each payment record to the corresponding project or service, making it easier to identify the source of each transaction.

- Filter by Payment Status: Use filters to display only unpaid or overdue payments. This helps you focus on collecting outstanding balances without being distracted by paid ones.

Automating Payment Tracking

Automation can further streamline the payment tracking process. Many systems offer built-in features that automatically update payment status based on certain t

Streamlining Your Invoicing Workflow

Efficient billing is a crucial aspect of running any business. A streamlined process helps save time, reduce errors, and improve cash flow. By optimizing each step–from creating the billing document to sending it to the client and tracking payment–you can ensure that the process is quick and error-free. Organizing and automating repetitive tasks allows you to focus more on delivering your services or products and less on administrative work.

Automating Routine Tasks

One of the best ways to streamline your billing process is by automating repetitive tasks. Many systems allow you to set up templates and workflows that reduce the need for manual input. Here’s how automation can improve efficiency:

- Pre-filled Data: Automatically populate fields like client name, contact details, and service descriptions by linking to your existing client database.

- Recurring Billing: Set up recurring invoices for ongoing clients or subscriptions. This eliminates the need to manually generate new documents every billing cycle.

- Due Date Reminders: Use automated notifications to alert clients about upcoming or overdue payments, ensuring you don’t have to send reminders manually.

Organizing and Tracking Payments

A crucial part of streamlining your billing process is keeping a close eye on payments. Using a well-organized system to track which payments have been received and which are still outstanding can save you significant time. Consider the following steps to enhance payment tracking:

- Centralized Payment Dashboard: Keep track of all outstanding and completed payments in one place for easy monitoring.

- Real-Time Updates: Automatically update payment statuses when funds are received, ensuring you have accurate data at all times.

- Customizable Reminders: Set reminders for clients when payments are due or overdue, allowing you to send automatic follow-ups without having to remember each one.

By automating key steps and staying organized, you can greatly reduce the time spent on administrative tasks, allowing you to focus on growing your business. A well-organized billing workflow ensures that payments are tracked, documents are generated correctly, and clients are kept informed, all while

Notion vs Other Invoice Tools

When it comes to managing billing and financial records, there are a variety of tools available, each offering different features and workflows. Some systems are purpose-built for generating and tracking payments, while others provide more flexibility, allowing you to customize the process to fit your needs. Understanding the strengths and limitations of each option is essential for choosing the best solution for your business.

Comparison of Flexibility and Customization

One of the key advantages of some tools is the level of customization they offer. While dedicated billing software often comes with predefined fields and structures, other platforms allow for a more tailored approach. Here’s a comparison of the customization options:

- Specialized Software: These platforms are designed specifically for managing billing, offering pre-built templates, automated calculations, and predefined structures. They are easy to use but often offer less flexibility when it comes to adapting the format or adding unique fields.

- Customizable Platforms: More flexible solutions allow you to build your own workflows, documents, and reports. While this requires more setup, it enables you to tailor the system exactly to your business needs. You can add or remove fields, adjust layouts, and integrate with other business tools.

Ease of Use vs Advanced Features

Another major factor in choosing a system is ease of use versus the depth of features. Some tools are designed for simplicity and can be quickly adopted, while others are more complex but offer advanced functionalities. Here’s how the two compare:

- Ease of Use: Dedicated billing platforms usually come with user-friendly interfaces and preconfigured options, making it easy for businesses to start billing immediately. However, this simplicity may limit the ability to scale or adjust the system as your business grows.

- Advanced Features: More robust platforms provide advanced functionalities like automation, recurring billing, and detailed reporting. These features can significantly improve efficiency but may require more time to learn and set up.

- Centralized Client Database: Start by organizing all client data, such as names, contact details, and billing preferences, into a single database. This central repository will act as the foundation for generating documents and tracking payments.

- Custom Fields for Billing Information: Create custom fields to capture important details, such as payment terms, due dates, and service descriptions. These fields can be populated automatically based on the information you enter about the client or project.

- Set Up Automation Workflows: Use the built-in automation features of your platform to trigger actions. For example, you can set up a workflow that creates a new document every time a project is marked as completed or when a client’s billing cycle arrives.

- Pre-Filled Document Creation: Use formulas or linked databases to automatically populate your billing records with pre-set details, including services rendered, amounts, and payment terms. This eliminates manual data entry and speeds up the document creation process.

- Automatic Reminders: Set up reminders to alert clients when a new document is ready or when payment is approaching. These reminders can be customized and sent automatically, ensuring timely follow-up without extra effort.

- Choose Compatible Payment Systems: Start by selecting payment processors that can easily integrate with your platform. Popular payment gateways like PayPal, Stripe, or Square often offer API integrations that can automatically sync payment data with your records.

- Set Up API Connections: Use API keys to connect your platform with the payment system. This allows for data to flow seamlessly between the two platforms. Many payment processors provide step-by-step guides for setting up these integrations.

- Automate Payment Tracking: Once connected, set up rules to track payments automatically. For example, when a payment is made via a payment gateway, the system can update the client’s record with the payment amount, date, and status.

- Generate Payment Notifications: Set up automatic notifications to inform clients when payments are received, overdue, or approaching their due date. This can improve client communication and reduce the need for manual follow-ups.

- Time Efficiency: Automatically updating payment statuses reduce

Designing a Clean and Effective Invoice

Creating a professional and easy-to-read billing document is essential for maintaining clear communication with your clients. A well-designed document not only looks professional but also ensures that all the necessary details are presented in an organized and straightforward manner. By focusing on clean design and key elements, you can create a document that is both visually appealing and functional.

Key Elements of a Well-Designed Billing Document

When designing your billing records, it’s important to include the essential details while keeping the layout simple and uncluttered. Below are the key elements to focus on:

- Clear Header: Ensure that the document has a prominent header with your business name, logo, and contact details. This helps establish your brand and makes it easier for clients to get in touch with you if needed.

- Client Information: Include the client’s name, address, and contact information in a clearly visible section. This is essential for ensuring that the document is correctly attributed.

- Itemized Breakdown: Clearly list the services or products provided, along with the associated costs. Using a table format with columns for quantity, description, unit price, and total makes the breakdown easy to follow.

- Payment Terms: Include the payment due date, accepted payment methods, and any other relevant terms such as late fees or discounts for early payment.

- Total Amount Due: Highlight the total amount due at the bottom of the document. Make it bold or use a larger font size to make it stand out and ensure there is no confusion about the amount owed.

Design Tips for Visual Appeal

How to Automate Invoice Generation in Notion

Automating the creation of billing documents can significantly improve efficiency, reduce errors, and save time. By leveraging digital tools and setting up workflows, you can create a seamless process that generates documents automatically, ensuring consistency and accuracy. This approach allows you to focus more on providing services or managing projects while ensuring that financial documents are consistently generated when needed.

To automate the creation of your billing records, you’ll need to set up a system where key information such as client details, payment amounts, and due dates are automatically pulled from a centralized database. This system can be enhanced by integrating various tools to trigger actions such as creating new records or sending notifications when a new document is due for generation.

Steps to Automate the Billing Process

Follow these steps to automate the process of generating billing documents:

Integrating with Other

Integrating Notion with Payment Systems

Integrating your billing system with payment platforms can significantly streamline the process of tracking and receiving payments. By connecting your digital documents to payment processors, you can automate payment tracking, reduce manual entry errors, and ensure that payments are promptly recorded. This integration allows for a smoother workflow, ensuring that all client transactions are accurately tracked and up-to-date without the need for constant manual updates.

When integrating your record-keeping platform with payment systems, the goal is to automatically sync data between the two platforms. This can include updates on when payments are received, what method was used, and the balance status of each transaction. By linking these systems, you can quickly track which payments have been made, which are outstanding, and even send automatic payment reminders to clients.

Steps to Connect Payment Platforms

Here are the steps you can take to integrate payment systems with your digital document workflow:

Advantages of Integrating Payment Systems

Integrating payment systems with your billing platform offers several key advantages: