Professional Notary Public Invoice Template for Easy Billing

Professionals in legal services benefit greatly from organized and clear billing practices. Setting up a reliable format for transaction records helps to maintain a consistent process, saving both time and effort. An effective billing approach not only enhances efficiency but also ensures that all necessary details are documented accurately for future reference.

With a structured layout designed for accuracy, service providers can create records that are both professional and comprehensive. Adopting a clear framework reduces the chances of missed information, helping maintain a high level of trust with clients. Utilizing a well-organized format also assists in simplifying tracking, making it easier to monitor completed tasks and outstanding payments.

Professionally structured billing forms enhance transparency and organization, supporting smooth interactions with clients. By establishing a reliable system, service providers can focus more on their core tasks while ensuring that financial documentation remains straightforward and manageable.

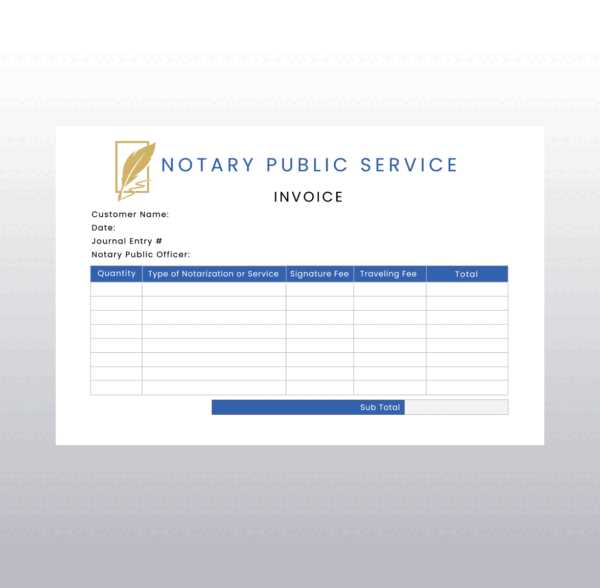

Notary Public Invoice Template Guide

Creating a structured billing document helps legal service providers ensure that their work is clearly outlined and professionally presented. A well-organized record layout includes essential elements that offer transparency and clarity, benefiting both the provider and the client. A thoughtfully designed system streamlines the process, making it easier to handle payments and maintain accurate records.

Key Components for Effective Billing

To achieve clarity and professionalism, certain core elements should be included in every billing document. These components not only help provide transparency but also ensure that all necessary details are easy to understand. Below is a list of key sections typically included:

| Component | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service Description | Detailed explanation of the specific services provided |

| Error | Consequences | Solution |

|---|---|---|

| Missing Service Details | Clients may be unclear about what is being charged, leading to disputes or delayed payments. | Always provide a detailed description of each service rendered, including dates and specific tasks. |

| Incorrect Payment Terms | Clients may miss the payment due date, causing delays and potential misunderstandings. | Clearly state the payment terms, including due date and accepted payment methods. |

| Unclear Contact Information | Failure to provide proper contact details can result in missed follow-ups or communication breakdowns. | Ensure both provider and client contact information are clearly displayed on each document. |

| Not Using Unique Identifiers | Without unique reference numbers, tracking and managing multiple transactions can become challenging. | Assign a unique number or code to each document for easier tracking and future reference. |

| Failure to Include Taxes or Fees | Omitting taxes or additional charges can cause confusion and lead to clients not paying the full amount. | Include all applicable taxes or additional charges clearly, with a breakdown of costs. |

By avoiding these common mistakes and paying attention to the finer details, service providers can ensure a more effective and professional billing process.

Making Your Invoice Legally Compliant

Ensuring that billing documents adhere to legal standards is crucial for avoiding disputes and ensuring smooth financial operations. Legal compliance helps protect both the service provider and the client by ensuring that all transactions are conducted transparently and in accordance with local regulations. A well-structured, legally compliant document not only builds trust but also reduces the risk of potential legal issues in the future.

Key Legal Elements to Include

To ensure that your billing records are compliant with the law, include all necessary legal elements such as the business’s registration details, applicable tax numbers, and any specific regulatory information required by your jurisdiction. Clearly stated payment terms, including the due date and payment method, help to avoid misunderstandings. Accurate record-keeping ensures that you are prepared in case of audits or legal inquiries.

Understanding Local Regulations

Different regions may have specific legal requirements for billing documents. This can include the inclusion of certain tax rates or additional fields that must be documented. Familiarizing yourself with local laws and regulations will ensure that your documents are fully compliant and that you avoid potential fines or legal complications.

Streamlining Billing for Notary Services

Efficient billing is crucial for any professional service provider. Simplifying the payment process can help improve cash flow, reduce administrative overhead, and ensure that clients have a seamless experience. Streamlining the method of charging for services involves adopting clear practices that allow for quick and accurate transactions, minimizing confusion for both the service provider and the client.

One key to streamlining is to standardize the information that needs to be included in each billing document. Ensuring consistency in the details provided, such as service descriptions, fees, and payment terms, helps make the process more predictable and easier to manage. Additionally, using digital tools or software to automate the creation and sending of documents can greatly reduce manual effort and speed up payment cycles.

Finally, offering multiple payment options can further simplify the process, making it more convenient for clients to settle their accounts. By embracing modern solutions for billing, service providers can save time, reduce errors, and focus on providing high-quality services rather than managing paperwork.

Tips for Accurate Invoice Details

Ensuring that your billing records are precise is essential for avoiding confusion and maintaining professionalism. Accuracy in the information provided not only speeds up the payment process but also helps to build trust with clients. Properly documenting all necessary details prevents delays and helps maintain transparency in financial transactions.

Double-Check Client Information

One of the simplest yet most important aspects of accuracy is ensuring that the client’s information is correct. Always verify the client’s name, address, and contact details before preparing any financial documentation. Incorrect information can lead to delays in payment and even cause legal issues if disputes arise. Double-checking client information ensures that all communications and records are aligned and accurate.

Clearly Define Service Details

Providing a detailed and clear description of the services rendered is essential. Break down the services into specific items, showing the duration or quantity, rates, and total cost for each. This transparency not only helps clients understand exactly what they are paying for but also reduces the chance of disputes. Clear itemization avoids ambiguity and helps ensure that both parties are on the same page regarding the charges.

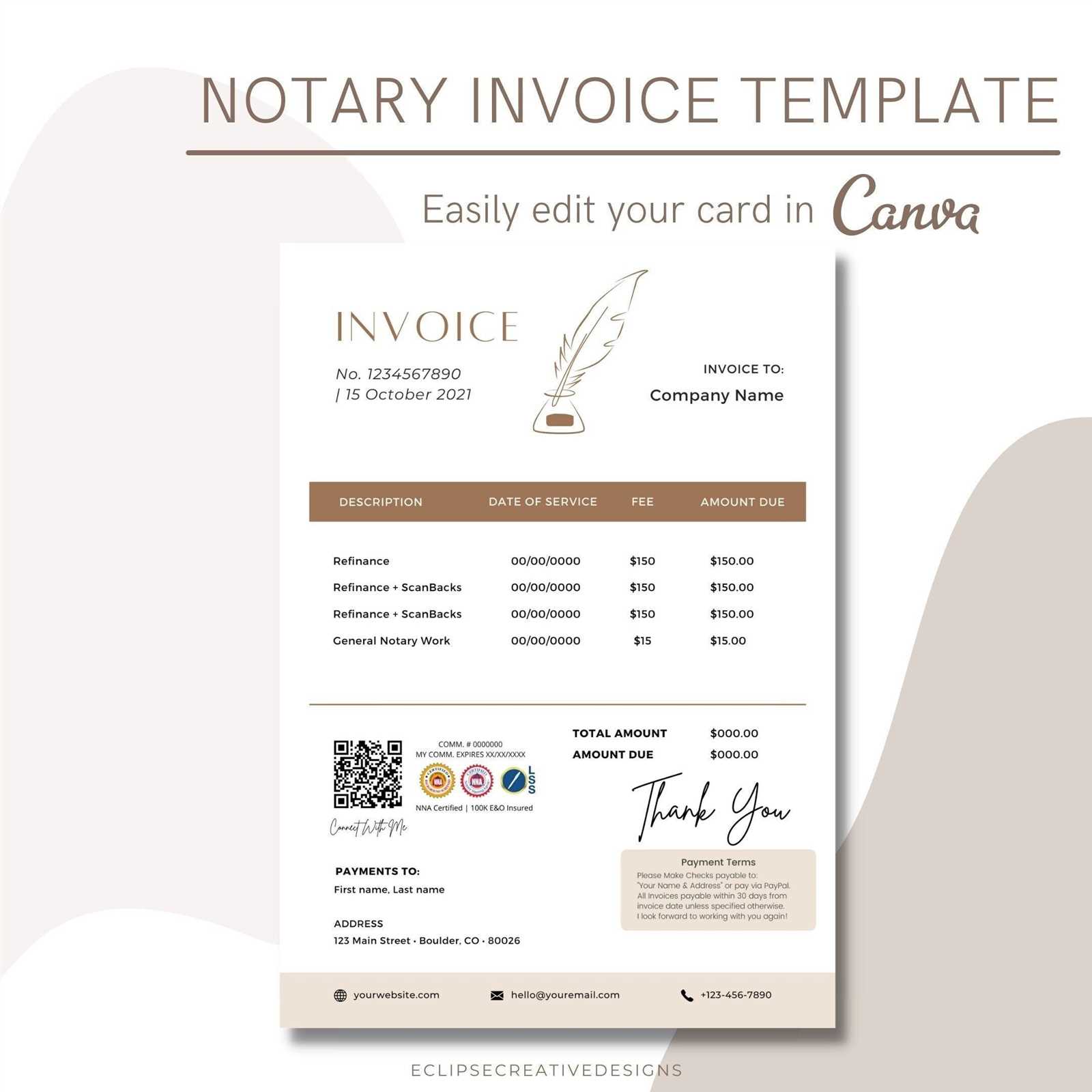

Using Templates to Save Time

Utilizing pre-designed documents can greatly enhance efficiency and reduce time spent on repetitive tasks. By setting up standardized forms for routine processes, professionals can focus on providing services instead of creating new paperwork from scratch each time. This method not only accelerates the workflow but also ensures consistency in the documents provided to clients.

Streamlining Documentation Creation

Having a structured framework ready for use allows for quick customization. Instead of re-entering the same information repeatedly, professionals can easily update specific sections while keeping the overall format intact. This efficiency results in faster document preparation and fewer errors, ultimately saving time and resources.

Consistency and Professionalism

By consistently using the same format, professionals ensure that all documents are uniform, making it easier for clients to understand and process. A polished and standardized appearance reflects positively on the service, reinforcing credibility and trust. This consistency also minimizes the chances of forgetting important details or introducing inconsistencies between different records.

Enhancing Client Trust with Clear Invoices

Transparency in documentation plays a crucial role in building strong, trust-based relationships with clients. When details are presented in a straightforward and easy-to-understand manner, clients are more likely to feel confident in the services they receive. Clear records help avoid misunderstandings and ensure that both parties are on the same page regarding the terms and conditions of the transaction.

Clear and Detailed Information

Providing a detailed breakdown of the services or charges on the document can eliminate confusion. When clients see exactly what they are being charged for, it fosters a sense of fairness and transparency. Including clear descriptions of services, payment terms, and any additional costs reinforces professionalism and clarity.

Building Long-Term Relationships

Clients appreciate consistency and transparency, which can contribute to the development of long-term professional relationships. When records are presented in a way that is easy to understand, clients are less likely to question charges, leading to smoother interactions and increased trust over time. This approach not only strengthens credibility but also helps maintain loyal clients.

Tracking Payments with Your Invoice System

Efficient tracking of payments is essential for maintaining a smooth cash flow and ensuring that financial records are up-to-date. A reliable system allows you to monitor which transactions have been completed, which are pending, and any outstanding balances. By keeping accurate records, you can reduce the risk of missing payments and avoid confusion with clients.

One of the key advantages of using a structured system is that it provides an organized method for tracking the status of each transaction. This includes noting payment due dates, amounts received, and any discrepancies. By updating this system regularly, you can easily identify any late payments or issues that require attention, ensuring timely follow-ups and better overall management of finances.

Integrating Digital Signatures in Invoices

Incorporating digital signatures into financial documents is becoming an essential practice for enhancing security and ensuring authenticity. A digital signature offers a secure way to validate the sender’s identity and confirm that the content of the document has not been altered. By using advanced encryption techniques, these signatures help prevent fraudulent activities and provide a legally recognized method of approval.

Adding a digital signature to your financial paperwork streamlines the process of authorization and helps eliminate the need for paper-based documents. This not only saves time but also reduces costs associated with printing and mailing. Additionally, it increases the efficiency of transactions, allowing for faster processing and quicker confirmation from clients or partners.

Organizing Your Notary Business Finances

Efficiently managing the financial aspects of your professional services is crucial for long-term success. By implementing sound financial practices, you can ensure your operations run smoothly, maintain proper cash flow, and track your earnings and expenses with accuracy. Proper organization not only helps with financial stability but also simplifies tax filings and reporting.

To maintain control over your financial records, consider using accounting software or tools that allow for easy tracking of payments, expenses, and income. Regularly reviewing financial statements will help identify trends and potential issues early on. Additionally, keeping detailed records of transactions ensures you can provide transparent and accurate documentation when needed, especially for legal or tax purposes.

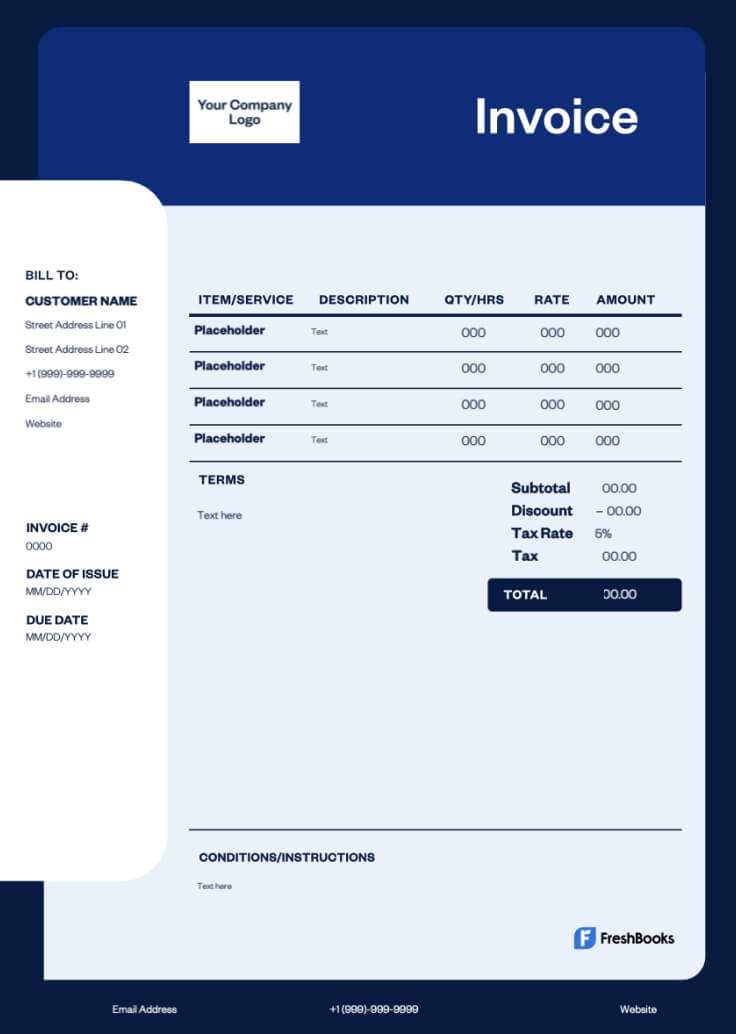

Templates for Different Notary Services

When providing various professional services, it’s essential to tailor the documentation to fit each type of task performed. Different situations require specific details, and having a consistent format helps in maintaining clarity, organization, and professionalism. Below are a few examples of common services and what should be included in each corresponding document.

- Document Authentication: This type of service often requires a clear statement of the document’s authenticity, the date it was verified, and the credentials of the individual verifying it.

- Affidavits: For affidavits, the document should include the statement of oath, the full legal name of the individual, and the specific declaration they are making under oath.

- Certified Copies: A certified copy requires a statement that the copy is true and accurate, along with a reference to the original document and the date of certification.

- Witnessing Signatures: Documents involving witnessed signatures should clearly indicate the names of the signers, their signatures, and the official witnessing statement.

Each service should be carefully documented, ensuring that all necessary details are recorded accurately. This consistency helps streamline workflows and ensures compliance with legal requirements, making the process more efficient and reliable for both service providers and clients.

How to Send Invoices Efficiently

Sending out payment requests quickly and accurately is crucial for maintaining smooth operations in any business. Efficiency in delivering these documents can save time, reduce errors, and ensure that payments are received on time. Here are a few tips to improve the process of sending out billing statements.

- Automate the Process: Using software that generates and sends documents automatically helps streamline the process. This eliminates manual errors and ensures consistency in every document sent.

- Choose the Right Delivery Method: Depending on your clients, choose between email, postal mail, or electronic platforms. Digital delivery is often the fastest and easiest method, especially for clients in different locations.

- Use Preformatted Documents: Having ready-made structures for various service types helps save time. Customizing a preformatted structure ensures accuracy while speeding up the process.

- Send Reminders: If payments are not made promptly, sending gentle reminders can help encourage timely payments. Set up automated reminders to stay organized without manual follow-ups.

By adopting these strategies, you can ensure that your payment requests are sent in a timely and professional manner, contributing to a smooth and efficient business operation.

Maintaining Professionalism in Your Documents

Ensuring that your payment requests maintain a professional tone is essential for building trust and credibility with clients. Professionalism in how you present financial documents reflects your business values and helps establish long-term relationships. Here are a few key aspects to focus on to keep your documents looking polished.

- Use Clear and Concise Language: Avoid using ambiguous or complicated terms. Ensure that your communication is straightforward and easy to understand to prevent confusion or delays in processing.

- Ensure Accuracy: Double-check all the details, such as dates, amounts, and contact information. Mistakes can make you appear careless and may lead to disputes or payment delays.

- Incorporate a Consistent Layout: A uniform design helps maintain consistency across your documents. Use the same font, structure, and color scheme each time to make your documents instantly recognizable.

- Personalize When Appropriate: Adding a personal touch, such as addressing clients by name or thanking them for their business, can go a long way in strengthening your professional image.

By keeping these elements in mind, you can ensure that your documents consistently represent your business in a polished, professional manner, helping foster positive interactions and efficient financial exchanges.