No Commercial Value Invoice Template for Simple Transactions

In many business and personal scenarios, it’s necessary to document transactions that don’t involve the exchange of money or goods for profit. These records can serve as formal acknowledgments or confirmations for various activities, such as donations, gifts, or internal transfers. Creating these documents can be simple, but it’s important to ensure they follow the proper structure for clarity and legal purposes.

For individuals and businesses looking to maintain professional standards without complicating the process, a well-structured document is essential. Using an adaptable format that can be tailored to suit various situations helps streamline the process. It provides consistency, reducing errors and ensuring that the details are clear and easily understood by all parties involved.

Customizable forms can save time and effort, enabling quick adjustments based on specific needs. Whether it’s for personal record-keeping or internal business use, these forms are an essential tool for organizing non-financial exchanges in a clear and professional way.

What is a No Commercial Value Invoice?

A document used to record exchanges that do not involve any financial gain or profit is commonly referred to as a non-transactional billing record. These are typically issued in situations where goods or services are provided for reasons other than business transactions, such as for gifts, donations, or internal transfers. Such records are important for maintaining transparency and keeping accurate documentation for various purposes.

Unlike regular billing documents, these records do not reflect a monetary amount due or a transaction for which payment is expected. Instead, they serve as formal acknowledgments of an exchange, often for accounting or reporting reasons. These records help businesses and individuals track non-profit-related exchanges, ensuring that all actions are documented for legal, organizational, or tax purposes.

Legal and administrative requirements may necessitate the use of such forms in specific circumstances, especially when reporting to tax authorities or other regulatory bodies. The document itself is often customizable to fit a wide range of non-commercial exchanges, making it a versatile tool for many situations.

Importance of Non-Commercial Invoices

While typical business transactions involve the exchange of goods or services for payment, there are many instances where no financial exchange takes place. In such cases, keeping an accurate record of these non-profitable exchanges becomes crucial. These documents help ensure proper documentation for internal purposes, compliance with regulations, and clarity for all parties involved.

Ensuring Legal Compliance

For both individuals and organizations, it’s important to maintain transparent records even when no payment is involved. These documents serve as proof of the exchange, which may be required for legal or regulatory reasons. Whether it’s for tax reporting or internal record-keeping, having the correct documentation in place ensures compliance with local laws and business standards.

Streamlining Internal Processes

Using structured records for non-financial exchanges helps streamline operations within organizations. These documents provide consistency, reducing confusion and making it easier to track various transactions. Additionally, they help avoid misunderstandings between parties by clearly outlining the nature of the exchange, even when no payment is involved.

Professionalism is another key benefit of using properly structured records. Whether for personal or business purposes, having these well-prepared forms reinforces a sense of organization and care in all interactions.

How to Create a No Commercial Value Invoice

Creating a document to record non-financial exchanges is a simple yet important task. Whether it’s for internal use, personal record-keeping, or legal documentation, having a structured format makes the process more efficient and transparent. Here’s a step-by-step guide to creating a professional record for transactions that do not involve payment.

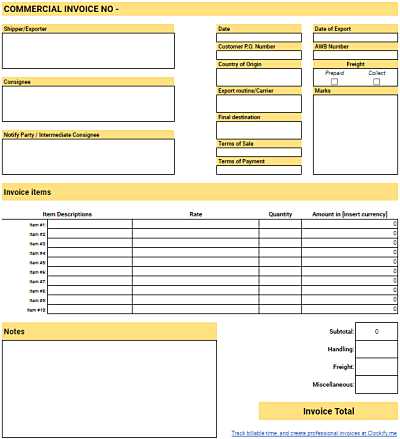

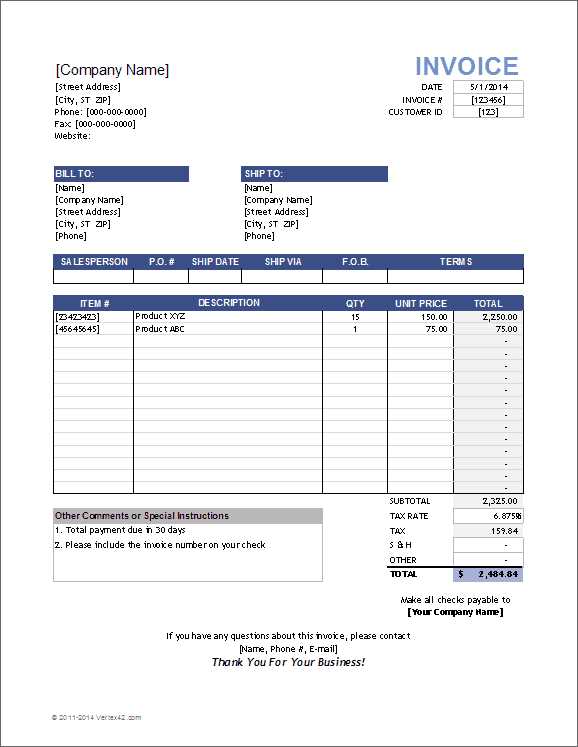

The first step is to choose a format that allows easy customization. A good layout will include essential details such as the parties involved, a description of the exchange, and the date. You don’t need to include payment information, as no money is being exchanged, but clarity is key. Below is an example of a basic structure:

| Field | Details |

|---|---|

| Document Title | Non-Payment Acknowledgment |

| Recipient | Full Name or Business Name |

| Sender | Full Name or Business Name |

| Description of Exchange | Details about goods or services exchanged |

| Date | Date of the transaction |

| Signature | Optional, for added formality |

This structure helps to clearly outline the exchange and ensures that both parties have a record of the transaction for future reference. You can adapt the document based on the specifics of the situation, such as including additional details or omitting certain fields that aren’t relevant.

Key Elements of an Invoice Template

When creating a document for non-financial exchanges, it’s important to include all necessary details to ensure clarity and professionalism. A well-structured form should have essential components that outline the transaction, even if no payment is involved. These elements help both parties understand the nature of the exchange and keep proper records.

Here are the key elements to include:

- Document Title – Clearly label the document to specify the purpose, such as “Non-Payment Record” or “Exchange Acknowledgment”.

- Parties Involved – List the names or business details of both the sender and the recipient of the goods or services.

- Description of Exchange – Provide a brief but detailed description of what is being exchanged, including any relevant specifics (e.g., item names, quantities, or services provided).

- Date of Exchange – Always include the date when the transaction took place for accurate record-keeping.

- Reference Number – If applicable, assign a reference number for easier tracking of the document within your records.

- Signatures – While optional, having both parties sign the document adds a layer of formality and acknowledgment.

- Additional Notes – Include any special instructions or context that may be important for the exchange, such as delivery methods or terms.

By ensuring these key elements are included, you can create a document that is clear, professional, and useful for both parties, even when no financial transaction is involved.

When to Use a No Commercial Value Invoice

There are several situations where a document for non-financial exchanges becomes necessary. These cases typically involve exchanges where no money changes hands, but a formal record is still required. Whether for personal, charitable, or business purposes, these records help clarify the details of the exchange and ensure that all parties involved have proper documentation.

Non-Profit or Charitable Donations

One common scenario for using a non-financial document is when making a donation or gift. Organizations or individuals may provide goods or services without expecting compensation, and a formal record is necessary for both the donor and recipient. This document serves as acknowledgment of the exchange and may be required for tax or legal purposes, especially when the exchange is significant.

Internal Business Transactions

In a business context, such documents are often used for internal transfers, such as when one department provides goods or services to another without the expectation of payment. This ensures that all exchanges within the company are documented for organizational clarity, even if no financial transaction occurs. Additionally, it can be useful for inventory management or internal auditing.

These records provide transparency and consistency, ensuring that all transactions, even without monetary exchange, are clearly documented and understood by all parties involved.

Differences Between Commercial and Non-Commercial Invoices

While both documents are used to record exchanges, there are distinct differences between those that involve a financial transaction and those that do not. The primary difference lies in the presence or absence of a monetary value and the purpose behind the exchange. Understanding these differences is key to selecting the correct format and ensuring proper documentation for any given situation.

Purpose and Intent

Documents used for transactions involving payment are typically issued as a formal request for compensation. They serve as proof of the transaction and often include a detailed breakdown of costs, taxes, and payment terms. In contrast, documents used for non-financial exchanges are intended to acknowledge the exchange itself rather than request payment. These are often used for gifts, donations, or internal transfers where no money is expected in return.

Key Information Included

In a typical transactional document, the key information includes the total amount due, payment instructions, and any applicable taxes or fees. The document will also specify the terms of payment, such as deadlines or installment plans. On the other hand, non-financial documents focus on the description of the exchange, the parties involved, and the date of the transaction, with no payment or pricing details included. The document may include a note clarifying that no compensation is required.

In summary, the key differences between these two types of documents are found in their purpose, content, and use. While both serve important roles in keeping accurate records, the presence or absence of a financial exchange significantly influences the structure and details of the document.

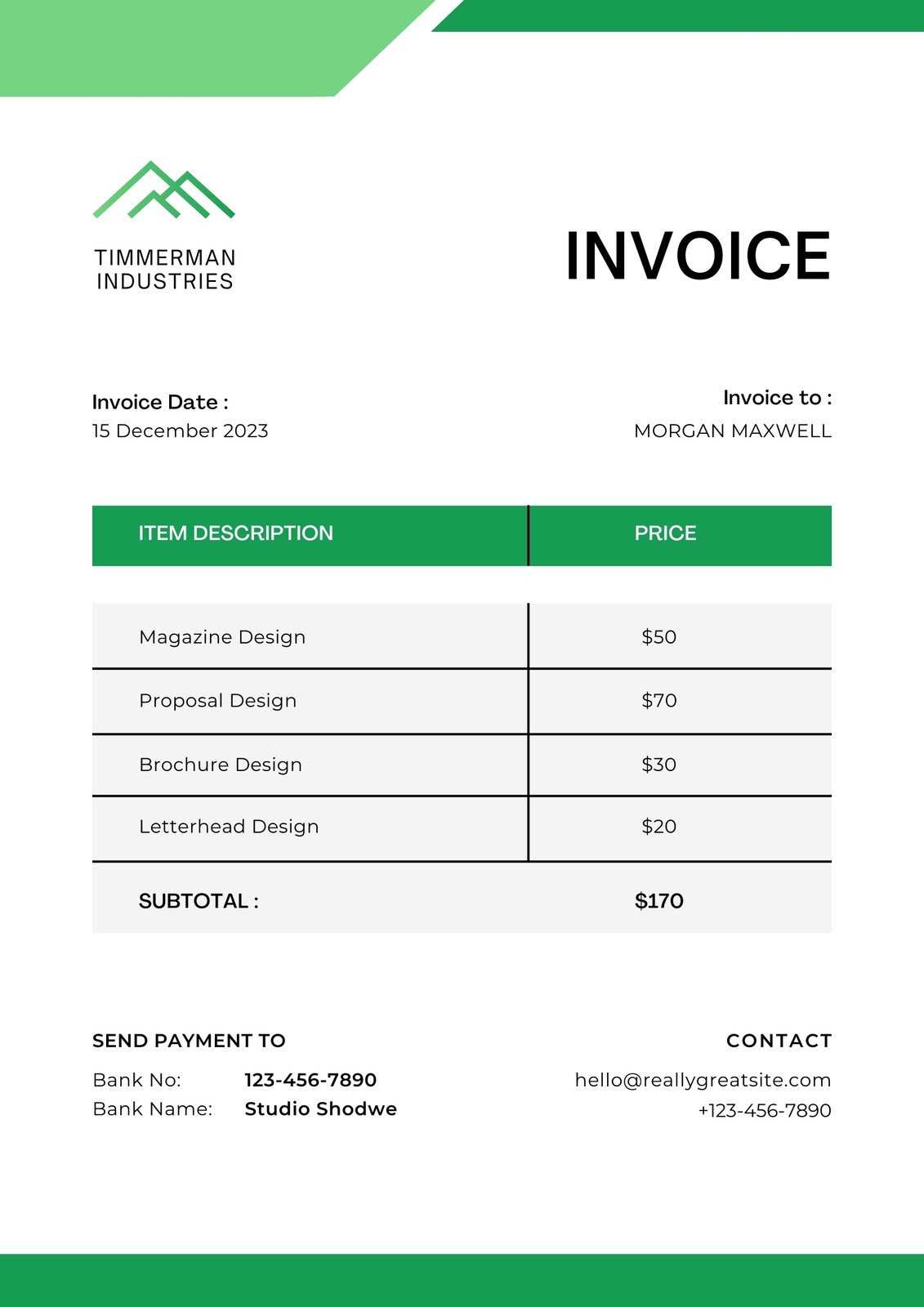

Benefits of Using a Free Invoice Template

Utilizing a pre-designed document format for non-financial exchanges can save significant time and effort. These ready-to-use forms help streamline the process of creating formal records without having to start from scratch. Whether for personal or business purposes, using a free format offers numerous advantages, ensuring clarity, accuracy, and professionalism in every exchange.

Time and Cost Savings

One of the main benefits of using a free document layout is the time saved in creating the form. Instead of designing a record from the ground up, you can simply customize an existing structure to fit your specific needs. Additionally, these free options eliminate the need to purchase expensive software or hire a professional to create a custom form, making them a cost-effective solution.

Ease of Customization

Pre-designed documents are often fully customizable, allowing you to easily modify details such as the names of the parties involved, the description of the exchange, and any other relevant information. This flexibility ensures that the document meets your unique requirements without the hassle of redesigning it each time. Plus, many free options come in editable formats, such as Word or PDF, so you can make adjustments as needed.

Overall, using a free format for recording non-financial exchanges not only simplifies the process but also ensures consistency and professionalism, making it an ideal choice for individuals and businesses alike.

How to Customize Your Invoice Template

Customizing a pre-designed document for non-financial exchanges is a straightforward process that allows you to tailor the form to suit your specific needs. Whether you’re using it for internal business records, donations, or personal transactions, adapting the layout ensures that all relevant information is clearly presented and accurate. Here’s how to make your document work for you.

The first step in customization is to adjust the header section, which typically includes the title of the document and your contact information. You should make sure that the document is clearly labeled for easy identification, such as “Non-Payment Acknowledgment” or “Transaction Record.” Include your full name or business details, as well as any other pertinent contact information.

Next, ensure that the description of the exchange is specific and clear. You’ll want to accurately describe what was exchanged, including any relevant quantities, items, or services. You can also add fields for additional notes or special instructions that may be necessary for the situation. Keep this section concise but detailed enough to avoid confusion.

Another important aspect of customization is adjusting the date and reference sections. Ensure that the date of the exchange is accurately recorded, and if applicable, add a reference or transaction number for easy tracking. This can be especially helpful if you plan on using these records in the future for auditing or reporting purposes.

Finally, you can tweak the design and layout to suit your preferences. Many editable formats allow you to adjust fonts, colors, and spacing to make the document more professional or personalized. Once customized, save the document in your desired format, ensuring that it’s easy to update and reuse as needed.

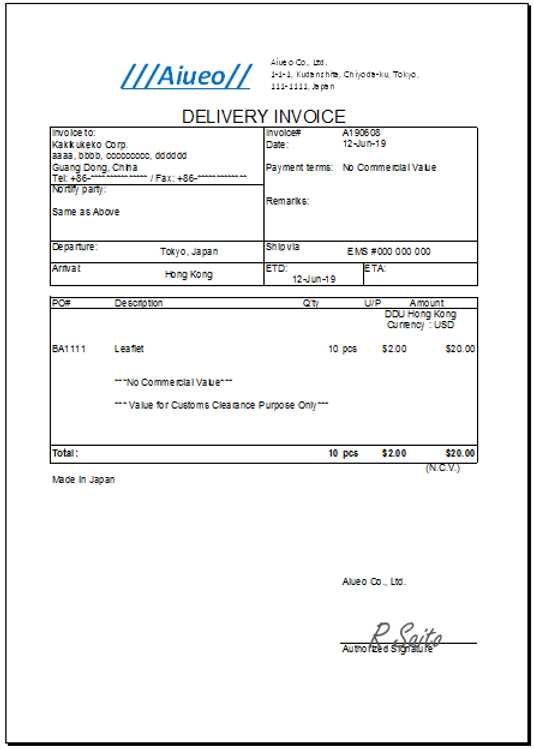

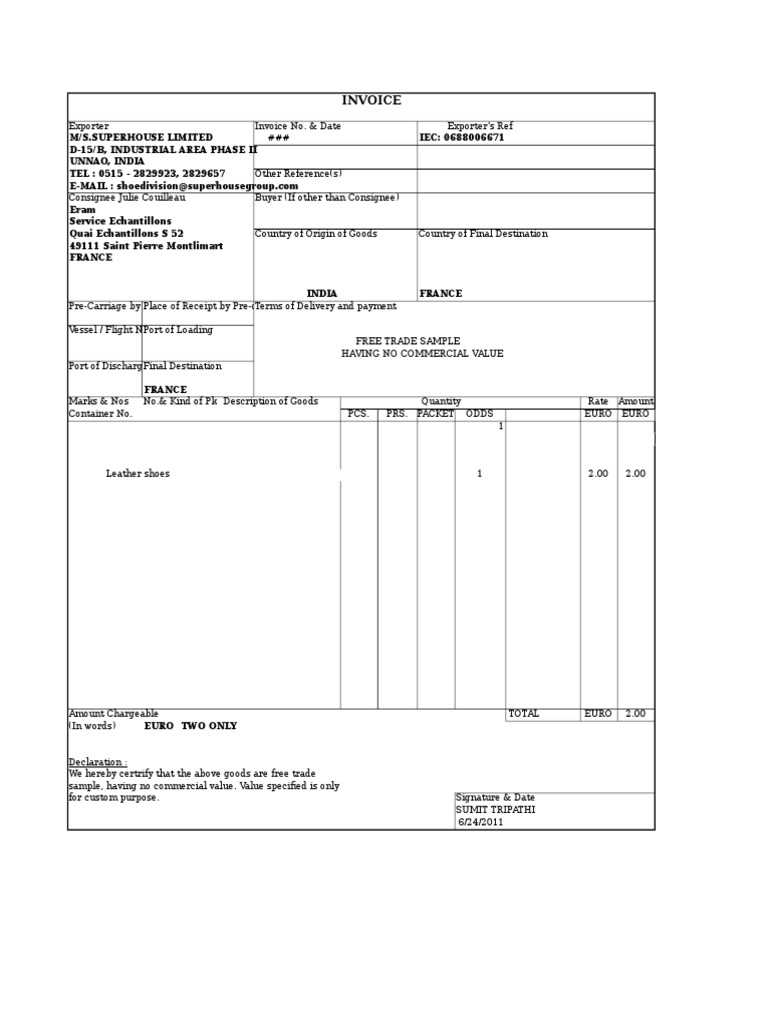

Examples of No Commercial Value Invoices

When documenting non-financial exchanges, it’s helpful to have clear examples to guide you in creating your own records. These forms are often used for situations like gifts, donations, or internal transfers within an organization. Below are some typical examples that can serve as models for different scenarios.

Example 1: Donation Acknowledgment

In the case of a charitable donation, the form might include details about the item or service being donated, along with the donor’s information and a description of the transaction. For example:

| Field | Details |

|---|---|

| Document Title | Donation Acknowledgment |

| Donor Name | John Doe |

| Recipient | XYZ Charity Organization |

| Description | One laptop, 15-inch screen |

| Date | January 5, 2024 |

| Signature | Optional |

Example 2: Internal Transfer Record

For an internal exchange within a business, such as transferring equipment from one department to another, the form might look like this:

| Field | Details | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Document Title | Internal Equipment Transfer | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sender Department | Marketing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Recipient Department | IT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Description | 1 laptop, 13-inch screen |

| Field | Details |

|---|---|

| Document Title | Non-Financial Transaction Record |

| Parties Involved | Full Name or Business Name of Sender and Recipient |

| Description of Exchange | Detailed Description of Goods or Services Transferred |

| Date | Transaction Date |

| Reference Number | If applicable, for tracking purposes |

| Signature | Optional, but recommended for legal acknowledgment |

By following these guidelines and ensuring that your record is clear and legally compliant, you can minimize risks and maintain proper documentation for all non-financial exchanges.

Common Mistakes to Avoid in Invoicing

Creating a record for non-financial exchanges may seem straightforward, but there are several common pitfalls that can lead to confusion or legal issues down the line. Ensuring that all the necessary details are properly included and formatted can save time and prevent misunderstandings. Here are some of the most frequent mistakes to watch out for.

1. Missing or Incorrect Information

One of the most common errors is leaving out essential information such as the names of the parties involved, the description of the exchange, or the date of the transaction. Inaccurate or incomplete details can lead to confusion and might make the record legally invalid. Always double-check that all fields are filled correctly before finalizing the document.

2. Not Using Clear Descriptions

Another mistake is failing to provide clear and specific descriptions of the goods or services being exchanged. Vague language can lead to misunderstandings between the involved parties, especially if the document is used as a reference in the future. Always ensure that the description is detailed enough to fully explain what was exchanged.

3. Failing to Include Dates

Omitting the date of the transaction is a serious mistake that can cause issues in the future, particularly if the exchange needs to be referenced later for legal or tax purposes. It’s important to always include the exact date when the transaction occurred to ensure accurate record-keeping.

4. Not Using a Reference Number

If you’re dealing with multiple transactions or need to track the exchange for business purposes, it’s helpful to include a unique reference number. Not using one can make it difficult to organize and search for specific records, leading to inefficiency in case you need to find that document later.

5. Overcomplicating the Format

While it’s important to include all necessary details, don’t make the document too complex or hard to follow. A clean, simple format that clearly presents all relevant information will be much easier to understand and refer back to in the future. Avoid unnecessary jargon or overly complex layouts.

By being aware of these common mistakes, you can ensure that your records for non-financial exchanges are clear, accurate, and legally sound.

How to Save Time with Invoice Templates

Using pre-designed forms for documenting non-financial exchanges can significantly reduce the time spent on creating records from scratch. These ready-to-use formats allow for quick customization, enabling you to focus on the essential details while maintaining accuracy and consistency. Here’s how leveraging these documents can save you time.

Quick Customization

One of the biggest time-saving benefits is the ability to quickly adapt a pre-made structure to fit your specific needs. Rather than starting from a blank page, you can simply update the names of the parties, the description of the exchange, and other essential details. This allows you to produce professional records in a fraction of the time it would take to design one yourself.

Consistency Across Documents

Using a standardized structure ensures consistency across all your records. Whether you’re documenting internal transfers, donations, or personal exchanges, having a consistent format means you won’t need to worry about formatting or missing information each time. This streamlined approach saves both time and effort in the long run.

Here’s an example of how a pre-designed form can speed up the process:

| Field | Details |

|---|---|

| Document Title | Transaction Record |

| Sender | John Doe |

| Recipient | XYZ Organization |

| Exchange Description | Donated 5 computers |

| Date | November 1, 2024 |

| Reference Number | TRX-1001 |

By filling in just the necessary details, you can complete the form quickly, without worrying about layout or structure. This helps you create a well-organized record that can be reused in future transactions.

Overall, using a pre-designed structure for your documentation not only streamlines the process but also ensures that all critical information is included, saving you time and ensuring consistency across all your records.

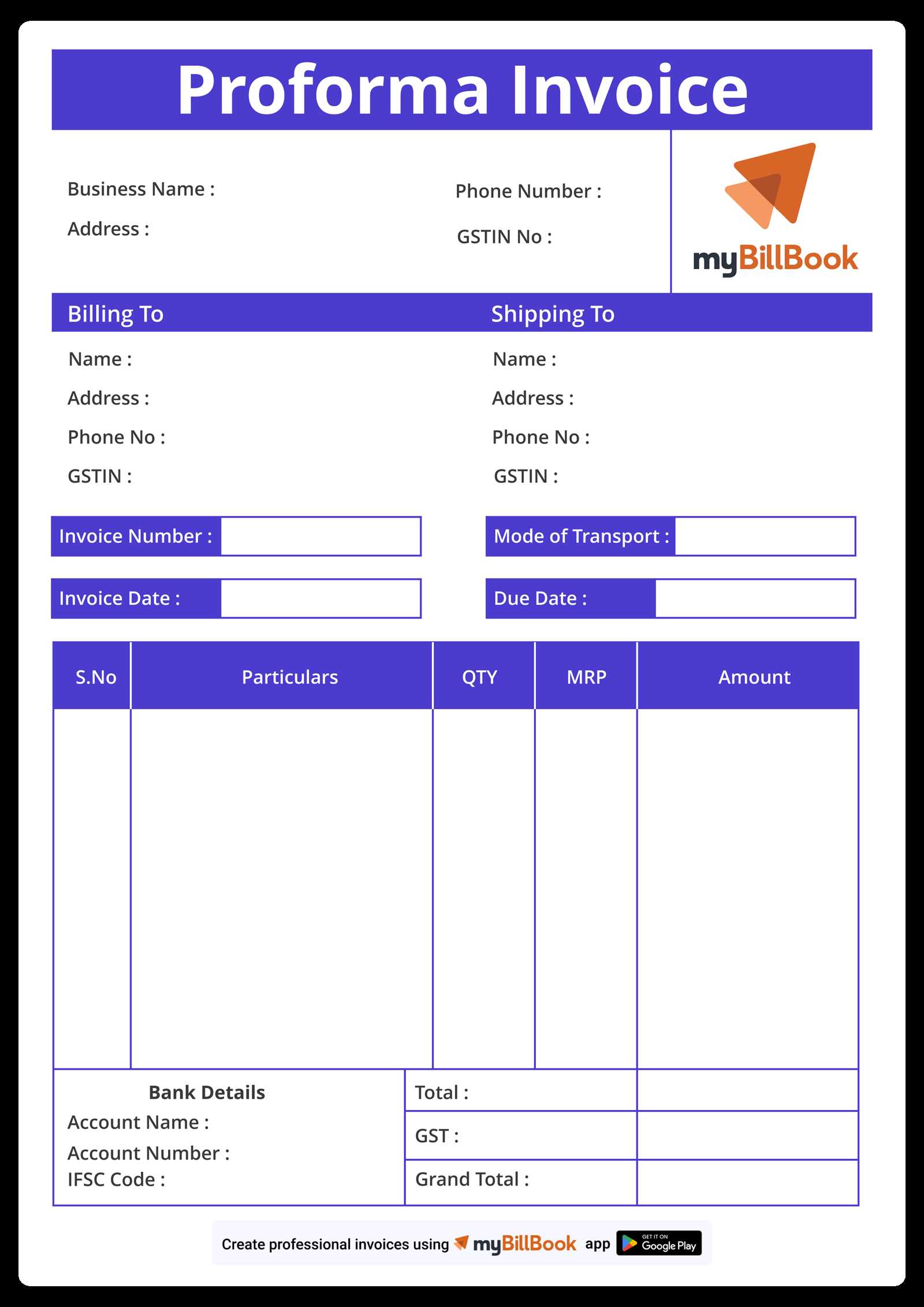

Downloadable Invoice Templates for Easy Use

For those looking to simplify the process of documenting non-financial exchanges, downloadable forms offer a convenient solution. These ready-made structures can be easily accessed, customized, and reused without the need to start from scratch each time. Whether you’re dealing with personal gifts, donations, or internal transfers, downloadable documents save time and ensure that all necessary information is included.

These forms are designed for quick download, and they often come in various formats such as Word, Excel, and PDF, allowing you to choose the one that best suits your needs. The flexibility and accessibility of downloadable options make them a great choice for individuals and businesses alike.

Here’s an example of the types of details typically included in a downloadable structure:

| Field | Details |

|---|---|

| Document Title | Non-Financial Exchange Record |

| Sender Name | Jane Smith |

| Recipient Name | XYZ Organization |

| Description of Exchange | 5 Used Laptops Donated |

| Date | October 15, 2024 |

| Reference Number | REC-1024 |

By downloading a pre-designed structure, you can ensure all critical fields are included and can quickly customize the document with relevant details. This eliminates the guesswork and ensures that you have a professional record each time you need it.

Downloading these forms not only saves you time but also provides the flexibility to handle various types of transactions efficiently. With just a few clicks, you can have a ready-to-use structure that suits your needs.

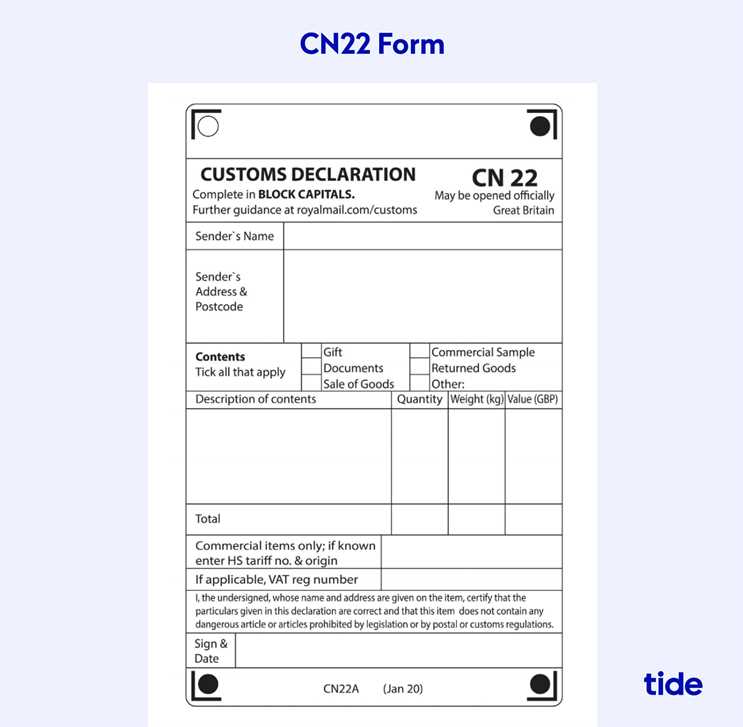

How to Handle Taxes on Non-Commercial Invoices

When dealing with non-financial transactions, many people are unsure about how to handle taxes, especially when no payment is involved. In these situations, it’s important to understand whether or not taxes need to be applied, and if so, how to properly manage them. While some exchanges are exempt from taxation, others may require documentation for tax reporting or regulatory purposes.

Tax Exemptions for Non-Financial Transactions

In many cases, non-financial exchanges, such as donations, gifts, or transfers between departments, may not require tax payment. However, some jurisdictions have specific rules about when taxes apply, even to non-commercial transactions. For example, certain types of donations or goods given to charitable organizations could be subject to tax reporting, while others are fully exempt. It’s important to consult local tax laws to determine whether your transaction falls under an exemption or requires tax reporting.

When to Report for Tax Purposes

Even if no money changes hands, some exchanges may still need to be reported for tax purposes. For example, if you donate goods to a registered charity, you may need to provide a document acknowledging the donation’s value for tax deduction purposes. In other cases, goods transferred within a business (such as inventory being moved between departments) may need to be recorded for internal accounting and tax purposes, even if there’s no monetary exchange.

Here’s an example of a basic form that can be used to track non-commercial exchanges for tax purposes:

| Field | Details |

|---|---|

| Document Title | Non-Financial Transaction Record |

| Sender | John Doe |

| Recipient | XYZ Charity |

| Description | Donation of 3 used computers |

| Date | November 10, 2024 |

| Tax Status | No tax applied (Exempt) |

Consulting a Tax Professional

When in doubt, it’s always a good idea to consult with a tax professional. They can guide you through the specific rules and regulations that apply to your region and the type of transaction you’re handling. A tax expert can help ensure that you comply with all necessary tax laws and that you’re not missing any important steps for reporting.

Handling taxes on non-financial transactions can be complex, but with the right information and careful attention to local laws, you can navigate these requirements efficiently. Be sure to always maintain accurate records of these transactions to s

Best Software for Creating No Commercial Value Invoices

When it comes to documenting non-financial transactions, using the right software can make the process much easier. Many tools are available that allow users to quickly create and customize documents for various purposes, such as donations, gifts, or internal transfers. These programs typically offer pre-designed formats, which can save time and help ensure that all necessary details are included. Here are some of the best software options for creating these types of records.

1. Microsoft Word

Microsoft Word is a versatile tool that allows users to create professional-looking documents easily. With customizable templates, you can quickly build a structure for your non-financial exchange records. Word also offers a wide range of formatting options, making it a good choice for those who want a simple yet flexible solution for generating documents.

2. Google Docs

Google Docs offers the advantage of being cloud-based, meaning you can access and edit your documents from any device with internet access. Like Microsoft Word, Google Docs allows users to create custom layouts and includes a variety of pre-built templates. It also allows for real-time collaboration if multiple people need to access or edit the document.

3. Canva

Canva is a user-friendly design tool that can be particularly useful for creating visually appealing documents. While it’s often associated with graphic design, Canva also offers a variety of templates for different types of records. You can easily customize fonts, colors, and layouts, making it an excellent choice for those who want to create more visually attractive documents.

4. Zoho Invoice

Zoho Invoice is a specialized tool for creating various types of records, including those for non-commercial transactions. It provides easy-to-use features like pre-built forms and customization options to fit different needs. While typically used for billing, Zoho can be adapted for non-financial exchanges by removing any monetary values and using the tool’s customizable fields.

5. Invoice Ninja

Invoice Ninja is another tool often used for business invoicing, but it also offers features that make it adaptable for non-financial records. You can create fully customizable documents, including the ability to exclude prices or modify fields for tracking purposes. Invoice Ninja offers both free and paid versions, depending on the level of features needed.

Here is a comparison of some of the features provided by these tools:

| Software | Features | Best For |

|---|---|---|

| Microsoft Word | Customizable templates, formatting options | General purpose, offline use |

| Google Docs | Cloud-based, collaboration, templates | Real-time collaboration, cloud access |

| Canva | Visual design tools, templates | Visually appealing documents |

| Zoho Invoice | Pre-built forms, customization, cloud-based | Small business use, customization |

| Invoice Ninja | Customizable fields, cloud-based, free options | Creating detailed non-financial records |

By using these tools, you can streamline the process of creating non-financial records and ensure that all necessary information is included in an easy-to-read format. Choose the software that best fits your needs and start creating professional

Integrating No Commercial Value Invoices into Your Workflow

Incorporating non-financial transaction records into your workflow can streamline your processes and ensure that all necessary documentation is in place. Whether for internal use, donations, or exchanges between organizations, creating consistent and easily accessible records can save time and avoid potential errors. Integrating this practice into your daily operations involves adopting tools, establishing best practices, and maintaining consistency across all documents.

Here are a few key steps to effectively integrate non-financial transaction documentation into your workflow:

- Choose the Right Tool: Select the software or platform that best fits your needs. Tools like Microsoft Word, Google Docs, or specialized record-keeping systems are perfect for simplifying the process.

- Create Standardized Templates: Develop a standard format for these records to ensure consistency. This can include predefined fields like date, sender, recipient, and transaction description.

- Automate Where Possible: If you frequently deal with similar transactions, consider automating the creation of these documents. Many tools offer automation features that can save time and reduce manual input.

- Assign Roles for Documentation: Designate individuals or departments responsible for managing these records. Clear responsibilities can help avoid confusion and ensure timely creation and filing of documents.

- Store and Organize Records Effectively: Whether digital or physical, organize your records in a way that makes them easy to access when needed. Digital systems with search functionalities or cloud storage solutions can be particularly helpful for fast retrieval.

- Monitor for Compliance: Ensure that your record-keeping complies with relevant legal or organizational requirements. Keep track of any updates to regulations that might affect the documentation process.

By following these steps, you can integrate non-financial transaction records into your workflow efficiently. The key is consistency and ensuring that all involved parties are aware of their responsibilities and tools available to them. Once integrated, you’ll be able to create and manage these documents quickly, minimizing the risk of errors and improving overall organization.

Tips for Professional-Looking Invoices

Creating professional-looking records, even for non-financial transactions, is essential for maintaining a polished and credible image. Whether you’re dealing with internal transfers, donations, or gifts, a well-organized document reflects your attention to detail and reinforces trust in your operations. Below are some useful tips for ensuring that your documents look polished and professional.

1. Use a Clean and Simple Layout

One of the most important aspects of a professional-looking document is a clear, easy-to-read layout. Avoid clutter by using white space effectively and organizing the content in a logical manner. Ensure that key details like the date, sender, recipient, and description of the exchange are prominently displayed.

2. Include Your Branding

Adding your company or personal branding–such as a logo and brand colors–helps create a consistent look across all your documentation. This can be particularly important for businesses or organizations aiming to maintain a professional image. A branded header and footer can add a polished touch to your documents.

3. Use Professional Fonts

Choose fonts that are easy to read and look professional. Stick to one or two font types, avoiding overly decorative or hard-to-read options. Common professional fonts like Arial, Helvetica, or Times New Roman are ideal. Ensure that text is legible both on screen and in print.

4. Organize Information Clearly

Structure your document logically. Use headings and subheadings to break up the information into digestible sections. Information should flow in a natural order–starting with the basic details, followed by the description of the exchange, and ending with any additional notes or references.

5. Include Clear Contact Information

Always include clear and up-to-date contact information, such as an email address, phone number, and website (if applicable). This makes it easy for recipients to reach out if they have any questions or need further details about the exchange.

6. Double-Check for Accuracy

Accuracy is critical in maintaining professionalism. Double-check all details for spelling mistakes, incorrect dates, or missing information. A document full of errors can undermine your credibility, even if the content itself is important.

7. Make Use of High-Quality Paper or PDF

If you are printing the document, use high-quality paper to give it a professional feel. For digital records, consider converting the document to a PDF format befo