New Zealand Tax Invoice Template for Businesses and Freelancers

For any business or freelancer, maintaining accurate financial records is crucial. One of the most essential components of these records is the document used to request payment from clients. This official record not only ensures that all transactions are properly tracked but also serves as proof of a sale or service rendered. Without the right structure and information, businesses may encounter issues with compliance or delayed payments.

Designing a well-structured billing document can simplify this process. By using an organized form, you make it easier for clients to understand the charges, payment terms, and legal requirements. A professionally created document can help enhance your business’s reputation and ensure smooth financial operations.

In this article, we will explore how to create, customize, and use billing documents that meet the necessary requirements in your region. Whether you’re just starting or refining your approach, learning how to properly structure these essential forms will help streamline your business’s financial transactions.

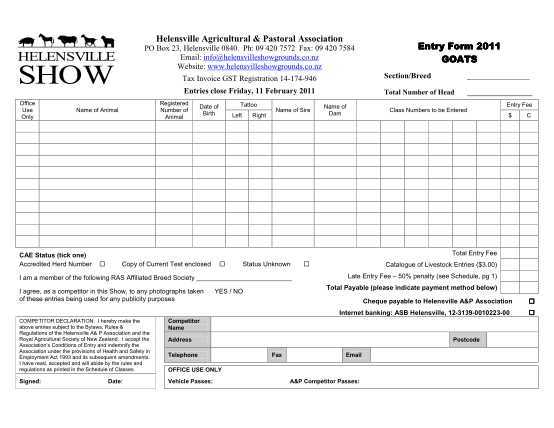

New Zealand Tax Invoice Template Overview

When running a business, it is important to have a well-organized document for requesting payments from clients. This document serves as a clear record of a transaction, outlining services or goods provided, the agreed price, and payment terms. Having a consistent and legally compliant format is crucial for ensuring smooth financial operations and maintaining good client relations.

Properly designed documents offer clarity to both the business and the customer. They contain key details such as transaction amounts, identification numbers, and contact information, helping to avoid misunderstandings and errors. Additionally, these records are often required for tax purposes, making it essential that the right information is included in a clear and structured format.

Essential Components of a Payment Request Form

The document should include specific elements to meet legal and business standards. These include the seller’s and buyer’s contact details, a unique identification number, a description of the products or services, and the total amount due. The document must also state applicable taxes and payment terms, ensuring both parties are aware of deadlines and obligations.

Benefits of Using a Pre-Formatted Document

Using a pre-designed format saves time and ensures accuracy. With the right structure, businesses can quickly generate documents for clients while ensuring compliance with regional laws. This also reduces the chance of missing crucial information, such as tax rates or payment conditions, which can cause delays or confusion.

Understanding Tax Invoices in New Zealand

In any business, proper documentation of financial transactions is essential. For businesses that deal with goods or services, an official document is required to outline the details of each sale. This document ensures that all parties involved are clear on the agreed terms, amounts, and payment expectations. Additionally, it plays a critical role in the management of financial records, especially for compliance with local regulations.

For businesses in New Zealand, this document must meet certain legal standards to be considered valid. It not only helps in establishing the legitimacy of a transaction but also provides a clear reference for tax reporting purposes. The document must contain specific details such as the seller’s and buyer’s information, a description of the transaction, and the amount due, along with any applicable charges or duties.

Understanding the key requirements is vital for ensuring that the document fulfills all necessary legal obligations and protects both the business and its customers. Whether you’re a freelancer or a large enterprise, knowing what to include will make the process of billing smoother and more efficient, while also reducing the risk of errors that could lead to delays or financial complications.

Key Elements of a Tax Invoice

For any official payment request document to be valid and effective, it must contain several important components. These elements not only ensure clarity between the business and the client but also guarantee that the document complies with relevant laws and regulations. Missing any of these details could lead to confusion or issues during payment processing, so it is essential to understand what needs to be included.

Essential Information

Each payment request must include specific details to be legally recognized and easy to understand. Below is a list of the core components that should be present:

- Seller’s Details: The name, address, and contact information of the business or service provider.

- Buyer’s Details: The name and contact information of the customer or company receiving the goods or services.

- Unique Identifier: A sequential number or code for tracking the document.

- Description of Goods or Services: A clear explanation of what was sold or provided, including quantities and pricing.

- Amount Due: The total price of the goods or services, including any applicable charges or fees.

- Payment Terms: The due date and method of payment (e.g., bank transfer, credit card).

- GST or Other Charges: Any applicable taxes or duties that need to be stated separately.

Optional but Helpful Information

In addition to the essential elements, there are some optional details that can enhance the clarity of the document:

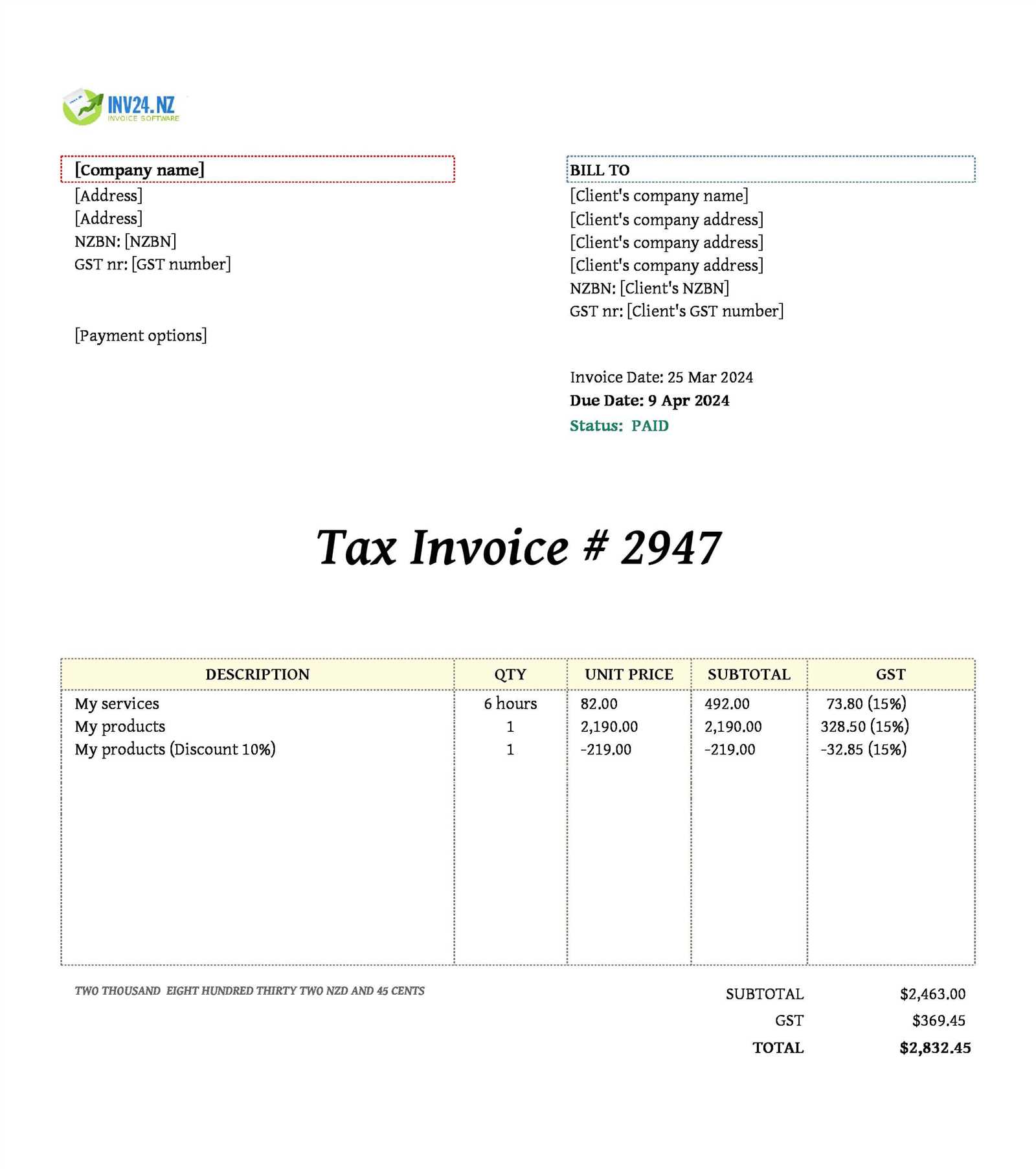

- Discounts or Promotions: If applicable, any discounts provided to the buyer should be noted.

- Shipping Costs: Additional fees for delivery or transport, if relevant to the transaction.

- Payment Instructions: Special instructions for how the customer can make a payment or any account details required.

By including these key components in a well-organized manner, businesses can ensure that their payment request documents are both professional and legally compliant.

Why Use a Template for Tax Invoices

Using a pre-designed format for your payment request documents can save both time and effort. By relying on a consistent structure, businesses can ensure that all necessary information is included, reducing the risk of errors and omissions. Additionally, templates help maintain a professional appearance and standardize the process, which is crucial for both client relationships and legal compliance.

Here are some key reasons why utilizing a ready-made form is beneficial:

| Advantage | Explanation |

|---|---|

| Time Efficiency | Templates allow businesses to quickly generate documents without having to start from scratch each time. |

| Consistency | Using a fixed structure ensures that each document follows the same format, making it easier to review and manage. |

| Legal Compliance | A well-designed form ensures that all required legal elements are included, preventing potential issues. |

| Professional Appearance | A standardized format presents your business as organized and trustworthy, enhancing client confidence. |

| Customization | Templates can be easily adapted to fit your business’s specific needs, from branding to special terms. |

Overall, using a pre-made structure for your billing documents simplifies the process and helps maintain professionalism in all transactions.

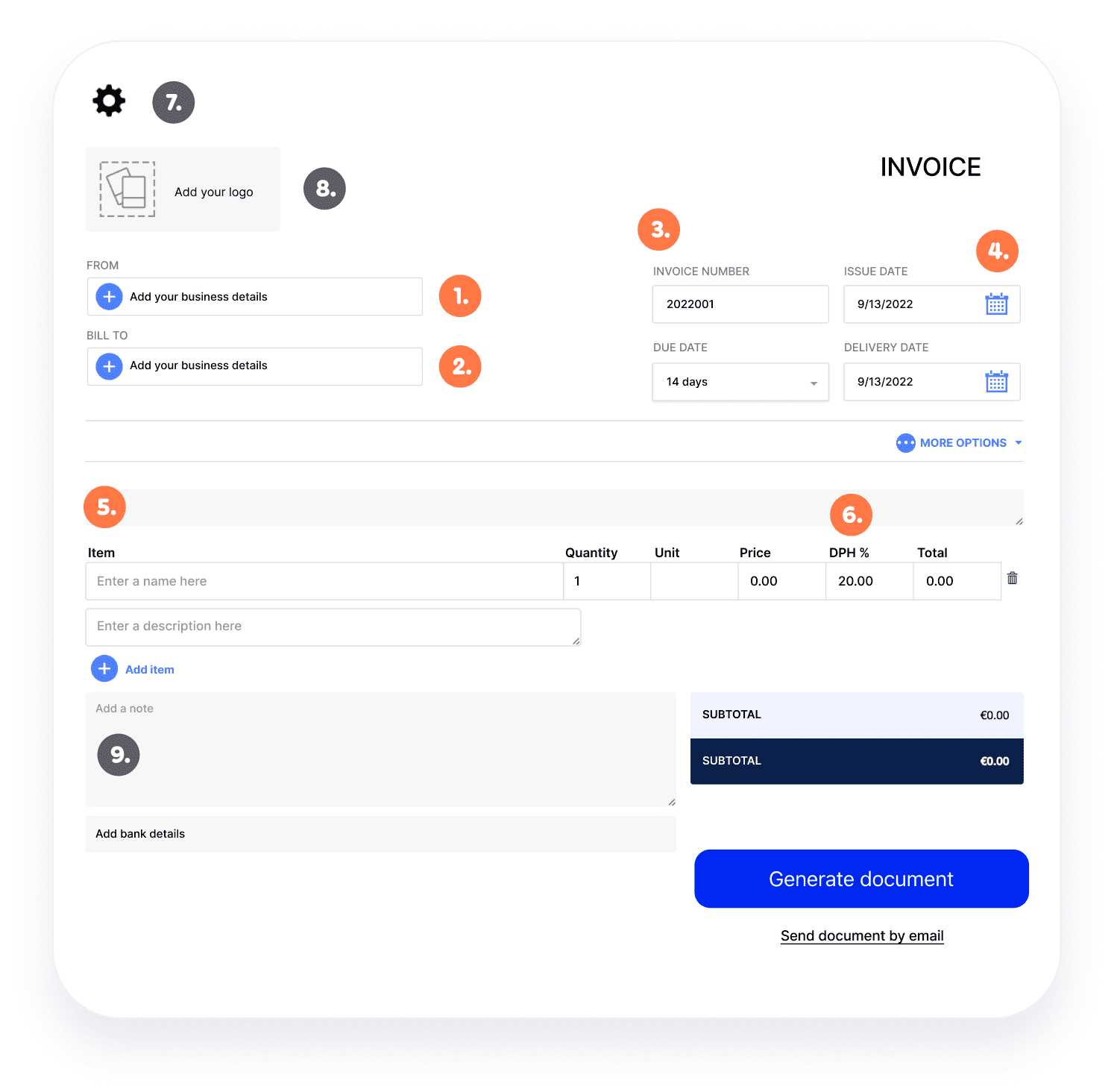

How to Customize Your Invoice Template

Customizing your billing document is essential to make it fit your business needs while maintaining a professional appearance. A well-tailored format ensures that all necessary details are included and aligns with your brand identity. With a few simple adjustments, you can create a document that not only meets legal requirements but also enhances your business’s image.

Begin by selecting a basic structure that includes all essential information. Once the core components are in place, focus on personalization to make the document reflect your unique style. Here are some key areas you can modify:

- Branding: Add your business logo, colors, and fonts to make the document consistent with your branding.

- Contact Information: Ensure your business address, phone number, and email are clearly visible at the top of the document for easy reference.

- Legal Requirements: Double-check that all necessary legal elements such as the transaction number, GST details, and payment terms are correctly included.

- Payment Methods: Provide a list of payment options available to your clients, such as bank transfer, credit card, or online payment platforms.

- Custom Notes: Include any additional instructions or information that may be relevant to the transaction, such as discounts or delivery terms.

By making these adjustments, you can create a polished and efficient billing document that meets both your functional and aesthetic needs, making it easier for clients to process payments and ensuring your transactions are recorded accurately.

Legal Requirements for New Zealand Invoices

For businesses operating in New Zealand, it is crucial that official payment documents meet certain legal standards. These documents must contain specific information to ensure they are valid and compliant with local tax laws. Failing to include all the required details could lead to complications, including issues with tax reporting and payments.

To ensure that your payment documents are legally compliant, here are the key elements that must be included:

Required Information

- Document Type: The document must clearly state that it is an official payment request.

- Business Details: The seller’s name, address, and GST registration number (if applicable) must be listed.

- Buyer’s Details: The name and contact information of the buyer should be clearly stated.

- Unique Identification Number: Each document must have a unique identifier to differentiate it from others.

- Description of Goods or Services: A detailed description of what was sold or provided, including quantities and prices.

- Amount Due: The total price of the transaction, including applicable taxes, must be clearly indicated.

- GST Information: If GST is applicable, it must be shown separately, with the rate and total amount calculated.

- Payment Terms: Specify the due date and any conditions related to the payment.

Additional Compliance Guidelines

- Tax Period: For businesses registered for GST, the tax period in which the transaction occurred must be mentioned.

- Payment Methods: If you offer multiple payment options, list them clearly along with any payment instructions.

- Notes or Special Conditions: Any additional terms related to discounts, refunds, or specific agreements should be included.

By ensuring that these legal requirements are met, businesses can avoid complications and ensure smooth financial operations while complying with New Zealand’s regulatory standards.

Free Resources for Downloading Templates

Finding the right document format for your business can be time-consuming and costly. However, there are many free resources available online that offer pre-designed forms to help businesses create professional and legally compliant records. These resources can save time, reduce errors, and ensure that all necessary information is included in your documents.

Here are some popular platforms where you can download free forms for your business:

| Resource | Details |

|---|---|

| Google Docs | Google Docs offers customizable document templates that can be easily edited and saved in various formats. You can access free templates and adjust them to suit your business needs. |

| Canva | Canva provides a wide range of free, user-friendly templates with professional designs. These can be downloaded and customized with your business logo and details. |

| Microsoft Office Templates | Microsoft Office offers a variety of free downloadable document formats for Word and Excel. These templates are fully editable and compatible with most software. |

| Template.net | Template.net provides a collection of free templates, including those specifically designed for financial documents, which can be downloaded and personalized. |

| Zoho Invoice | Zoho offers free, customizable invoice templates that meet legal standards and can be adapted for any business. Templates can be accessed online and customized to fit your brand. |

These platforms provide easy access to professionally designed documents, allowing businesses of all sizes to create accurate and well-organized records quickly. Whether you’re looking for a simple format or a more complex design, these resources can help streamline your billing and administrative processes.

Common Mistakes to Avoid on Invoices

Even the smallest mistake on an official payment request document can lead to confusion, delayed payments, or even legal issues. It’s important to be diligent when creating such documents, as missing or incorrect information can create unnecessary complications for both the business and the client. Below, we highlight some of the most common mistakes to avoid when preparing payment documents.

Key Mistakes to Watch Out For

| Mistake | Explanation |

|---|---|

| Missing Contact Information | Failure to include accurate contact details for both the seller and the buyer can lead to confusion and hinder communication regarding payments. |

| Incorrect or Missing Transaction Dates | Not specifying the correct date of the transaction or the payment due date can create discrepancies and delays in processing payments. |

| Inaccurate Amounts or Pricing | Listing incorrect prices or failing to include all necessary charges can lead to disputes or payment delays, as clients may challenge the amounts due. |

| Omitting Legal Details | Not including required information such as business registration numbers or tax rates can result in the document being deemed invalid for tax or legal purposes. |

| Unclear Payment Terms | Vague or missing payment instructions can confuse clients about when and how to settle the amount due, leading to delays in payment. |

Other Things to Avoid

- Incorrect Payment Methods: Always specify the accepted methods of payment clearly to avoid complications during the payment process.

- Not Numbering Documents: Failing to assign a unique identifier to each payment document can make it harder to track and manage records.

- Failing to Check for Errors: Typos or clerical errors can make the document appear unprofessional and could also lead to misunderstandings regarding payment amounts or terms.

By being mindful of these common mistakes and taking the time to carefully review each document, businesses can ensure smooth transactions and avoid unnecessary complications with clients.

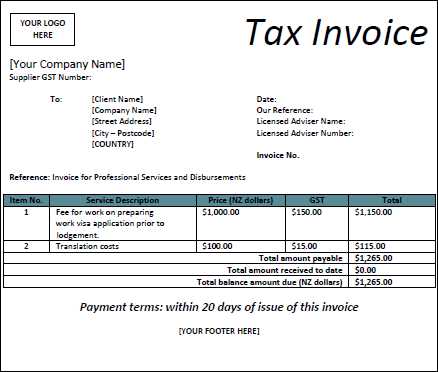

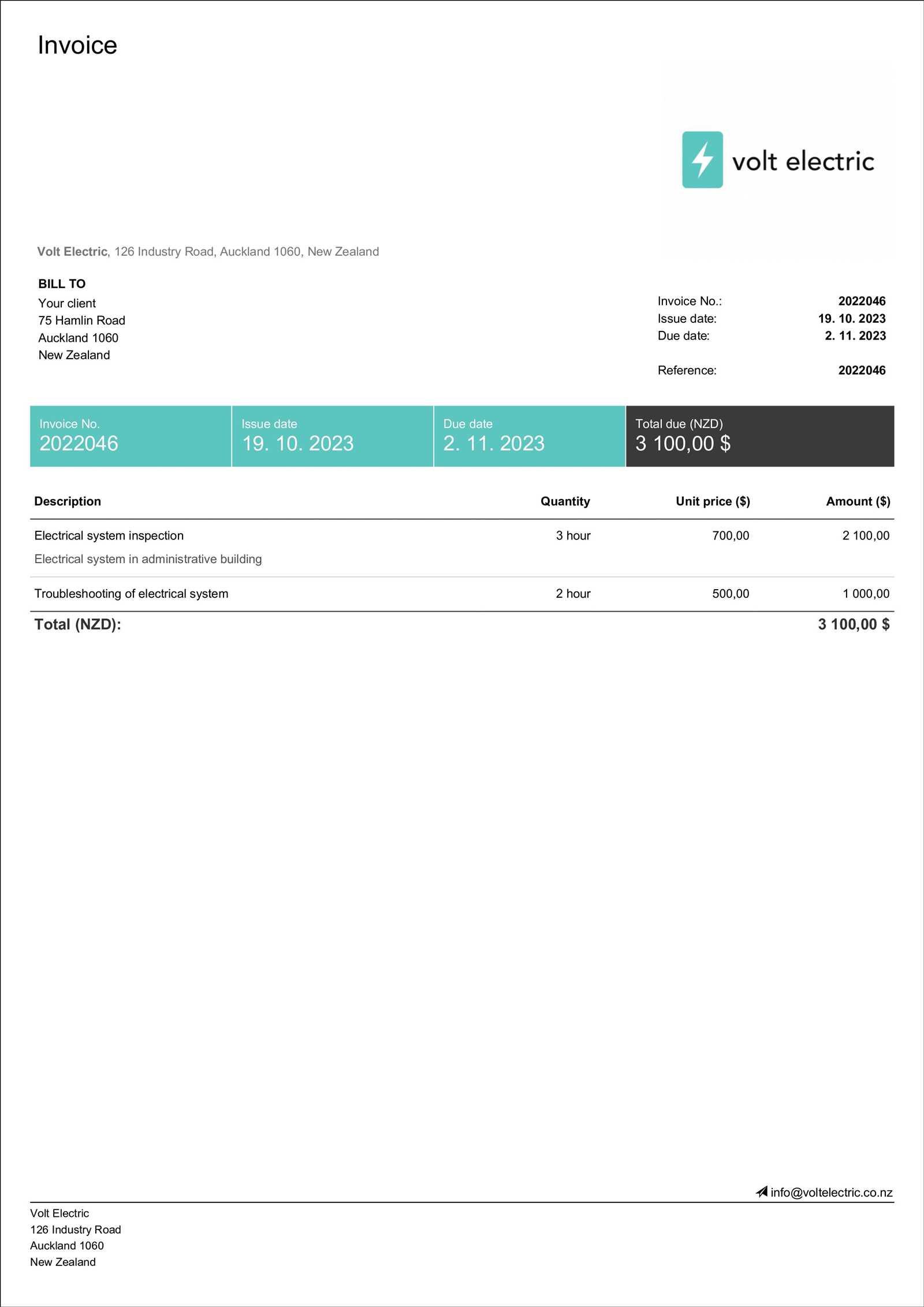

GST and Tax Invoice Compliance

In any business that deals with the sale of goods or services, ensuring compliance with local tax laws is essential. When providing official records for transactions, businesses must adhere to specific guidelines to remain compliant with tax authorities. This is especially important for businesses that charge goods and services tax (GST), as the correct documentation must be provided to ensure proper reporting and payment.

In order to meet these compliance requirements, businesses must include certain details in their payment documents when GST is applicable. The following points outline the key aspects of GST and how they affect the creation of payment documents:

Key Compliance Requirements

- GST Registration Number: Businesses must include their GST registration number on the payment document to validate that they are legally registered to charge GST.

- GST Rate: The specific GST rate charged on goods or services must be clearly indicated. In most cases, this will be 15%, but it’s important to check for any changes to the rate.

- Separate Tax Amount: The GST amount should be listed separately from the total price to ensure transparency and easy calculations for both the seller and the buyer.

- Clear Description of Goods or Services: A detailed description of what is being sold is crucial for determining which items are subject to GST. This also helps the buyer understand what they are being charged for.

- Tax Period: It is necessary to include the date or the period in which the transaction occurred, as this determines when the GST should be reported to tax authorities.

Best Practices for GST Compliance

- Review Regulations Regularly: Keep up-to-date with any changes to GST rules and ensure your payment documents reflect the latest requirements.

- Use Automated Tools: Consider using accounting software or online tools that can automatically calculate and include the GST, reducing the risk of errors.

- Retain Copies for Records: Always keep copies of all official documents, as they will be required for tax filings and potential audits.

- Double-Check Calculations: Ensure that the correct GST amount is applied, and that it is calculated based on the correct portion of the total price.

By following these compliance guidelines, businesses can avoid legal issues, maintain accurate financial records, and ensure they remain in good standing with local tax authorities.

How to Create an Invoice in Excel

Creating an official payment request document in Excel is a practical and efficient way to manage your billing process. Excel offers flexibility, allowing you to design a customized format that fits your business needs while also providing the necessary structure to ensure accuracy and compliance. By using Excel’s built-in features, you can quickly generate documents that are both professional and easy to update as your business grows.

Steps to Create a Basic Billing Document in Excel

- Open a New Spreadsheet: Start by opening a new blank worksheet in Excel. This will be your canvas for creating the document.

- Add Your Business Details: At the top of the document, include your business name, address, contact information, and any other relevant details. This will help your client easily identify your business.

- Include Client Information: Below your business details, add the client’s name, address, and contact information. This ensures that the document is clearly tied to the correct customer.

- Create a Table for the Items or Services: Use Excel’s table function to list the goods or services provided. Include columns for descriptions, quantities, unit prices, and total amounts.

- Apply Simple Formulas: Use Excel’s built-in formulas to automatically calculate totals, such as multiplying quantity by unit price. This ensures that calculations are accurate and saves you time.

- Add Payment Terms: Below the table, clearly outline payment instructions, including the due date, accepted payment methods, and any late payment fees or discounts.

Enhance Your Document’s Appearance

- Format the Table: Use Excel’s formatting options to make the table clear and visually appealing. Bold the headers, adjust column widths, and apply borders for readability.

- Add a Professional Touch: Customize the design by adding your company logo, using branded colors, or adjusting fonts to match your business identity.

- Double-Check for Accuracy: Before saving and sending the document, review it for any errors, especially in calculations, dates, or client details.

Once your payment request document is ready, you can save it as a PDF for easy sharing and printing. Excel makes it simple to create and manage these documents, providing you with a professional, cost-effective solution to track your transactions.

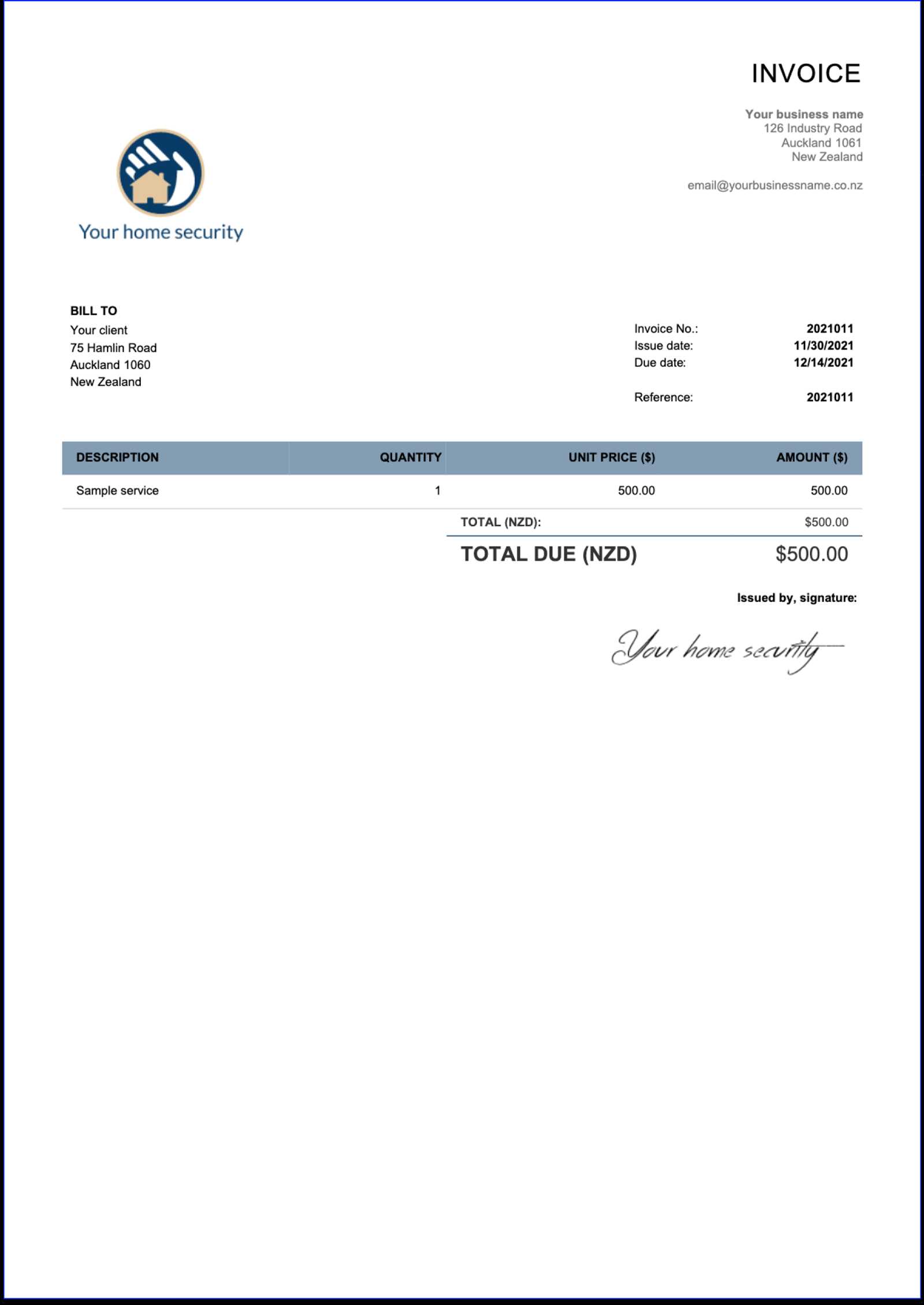

Designing a Professional Tax Invoice

Creating a polished and professional payment request document is essential for any business. A well-designed document not only ensures clarity for your clients but also strengthens your brand’s image. A professional format helps clients easily understand the transaction details and ensures that all necessary information is provided for accurate record-keeping and payment processing.

When designing a billing document, several elements should be carefully considered to maintain a clear, professional, and consistent layout. Below are key areas to focus on when creating an effective document:

Key Elements of a Professional Document

| Element | Importance |

|---|---|

| Header Section | The header should clearly display your business name, logo, and contact details. It sets the tone for the document and helps the client easily identify the source of the document. |

| Client Information | Include the client’s name, address, and contact details. This ensures that the document is tied to the correct customer and reduces confusion. |

| Itemized List | Break down the products or services provided with clear descriptions, quantities, unit prices, and totals. This transparency prevents misunderstandings and supports accurate payments. |

| Unique Reference Number | Assign a unique number to each document for easy tracking and reference. This helps maintain organized records and prevents duplication. |

| Clear Total Amount | Make sure the total due is prominently displayed, including any applicable taxes or discounts. This makes it easy for the client to see the final amount. |

| Payment Terms | Include payment due dates, accepted methods, and any late fees or discounts for early payment. This sets clear expectations for both parties. |

Best Practices for Layout and Design

- Keep it Simple: Use a clean and organized layout. Avoid cluttering the document with too much information, and keep the focus on the key transaction details.

- Consistent Branding: Use your company’s colors, logo, and fonts to make the document visually aligned with your brand. A cohesive design reflects professionalism.

- Readable Fonts: Choose clear, easy-to-read fonts. A document filled with hard-to-read text creates a negative impression and may lead to mistakes.

- Use Tables for Organization: Tables are ideal for organizing data, such as line items, quantities, and totals. They help keep the document tidy and facilitate easy reading.

By focusing on these elements and design principles, businesses can create documents that not only fulfill legal and financial requirements but also reflect their professionalism and attention to detail. A well-designed document can improve the client exper

Invoice Template for Freelancers in NZ

Freelancers often need customized billing documents to ensure they’re paid accurately and on time for their work. These documents serve as a professional record of services rendered and are crucial for tracking payments, managing finances, and staying compliant with local regulations. For freelancers working in the country, it’s essential that their records meet specific standards to ensure smooth transactions and avoid any legal complications.

When creating a billing document for freelance work, there are several key elements to include. This will not only help maintain professionalism but also guarantee that all necessary information is provided for tax purposes and client reference.

Essential Elements of a Freelancer’s Billing Document

- Freelancer’s Contact Information: Include your full name, address, email, and phone number. This ensures clients can reach you easily for any questions or issues related to payment.

- Client Details: Make sure to list the client’s name, business name (if applicable), and contact information, so it’s clear which client the document pertains to.

- Project or Service Description: Provide a detailed breakdown of the services or projects completed, including quantities and unit costs if applicable. This helps clarify the scope of work.

- Amount Due: Clearly list the total amount due for services rendered, ensuring that this includes any applicable charges, taxes, or discounts.

- Payment Terms: Indicate the due date for payment, as well as the preferred methods (e.g., bank transfer, PayPal). You may also specify penalties for late payments or discounts for early settlement.

- Unique Reference Number: Assign a unique identifier to each document, making it easy to reference and track for both you and your client.

Best Practices for Freelancers

- Provide Clear Payment Instructions: Be specific about how clients should pay. Include banking details or any online payment platform information to avoid confusion.

- Set a Clear Payment Deadline: Clearly state when payment is due to ensure timely payments. If there are penalties for late payment, mention them explicitly.

- Maintain Consistency: Use the same layout and format for each billing document to present a professional and organized appearance to clients.

- Track Payments: Keep a copy of each document sent and track payments. This will help you avoid any discrepancies and easily follow up with clients if necessary.

By ensuring that your billing document contains these elements and is clearly structured, you can foster good communicati

Best Practices for Sending Invoices

Sending payment request documents efficiently and professionally is crucial for businesses to maintain cash flow and build strong client relationships. Proper timing, clear communication, and the right tools can help ensure that payments are processed smoothly and without delay. Adhering to best practices when sending these documents not only streamlines your operations but also enhances your reputation as a reliable business partner.

Here are some of the most important guidelines to follow when dispatching payment documents to clients:

Key Steps to Follow

- Send Timely Documents: It’s important to send your payment request promptly after completing the service or delivering goods. Avoid unnecessary delays that can create confusion and push back the payment schedule.

- Choose the Right Method: Depending on your client, send the document via the most appropriate channel. Email is often the fastest, but in some cases, a physical copy or secure online platform might be preferred.

- Ensure Accuracy: Double-check the payment document for any errors before sending it. Mistakes in pricing, contact information, or payment terms can delay processing and cause unnecessary confusion.

- Use Clear and Professional Language: Be concise and formal in your wording. Avoid jargon and ensure the terms are easy to understand, including the total amount due, payment methods, and deadlines.

- Include Supporting Documents: If necessary, attach additional details such as contracts, service agreements, or delivery receipts that clarify the transaction.

Enhancing Client Communication

- Set Clear Expectations: Clearly state payment due dates and methods. Inform your client of any late fees or discounts for early payments, and ensure they are aware of how the payment should be made.

- Follow Up Regularly: If a payment has not been received by the agreed-upon date, send a polite reminder email or message. Keep communication friendly and professional to maintain a positive relationship.

- Keep Records: Always keep a copy of the payment document sent and the communication related to it. This helps you track payments and manage any discrepancies that may arise later.

By following these best practices, you’ll not only ensure smoother transactions but also build stronger, more professional relationships with your clients. Timely, clear, and accurate communication is key to getting paid on time and maintaining your business’s financial health.

Understanding Invoice Numbers and Dates

When managing payment requests, two critical elements–document numbers and dates–play a central role in organization and clarity. These identifiers help both businesses and clients keep track of transactions and provide a structured system for referencing documents. Properly managing numbers and dates ensures smooth bookkeeping, timely payments, and clear communication between parties.

Understanding the correct way to use these elements not only helps prevent confusion but also supports compliance with local regulations and industry standards. Let’s explore how invoice numbers and dates work together and why they are important for maintaining professional and organized records.

The Importance of Unique Numbers

- Systematic Tracking: Each document should have a unique number assigned to it. This unique identifier helps distinguish one document from another, making it easier to reference and follow up on specific transactions.

- Prevents Duplication: A consistent numbering system ensures that no two documents share the same number, avoiding any confusion about which transaction is being referred to.

- Improves Record Keeping: Using unique numbers allows businesses to keep their financial records in order. It also simplifies audits and financial reviews by creating a clear chronological record of transactions.

- Promotes Professionalism: A well-structured numbering system gives a professional impression and builds trust with clients, who may appreciate the organization and clarity.

Why Dates Matter

- Establishes Payment Deadlines: The issue date marks the beginning of the payment period and sets the expectation for when payment should be made. It’s essential for defining the timeline for any payment terms, whether it’s due immediately or within a set number of days.

- Aids in Legal Compliance: Dates ensure that businesses are following proper procedures and meeting any legal requirements related to payment terms and tax obligations. Some regions have specific regulations about how long invoices can remain open before requiring payment.

- Helps with Organization: Including both the issue and due dates on your documents ensures that payments are tracked efficiently. It also helps businesses understand when a document should be followed up on or considered overdue.

- Supports Clear Communication: Clients rely on the dates to know when to expect payment reminders or late fees. By clearly indicating when payments are due, misunderstandings can be minimized.

By adopting a clear and consistent system for both invoice numbers and dates, businesses can stay organized, avoid mistakes, and ensure that their clients understand the payment expectations. This level of organization is essential for maintaining smooth operations and promoting positive business relationships.

Using Invoices for Record-Keeping

Maintaining accurate records is essential for every business, both for internal organization and external compliance. Payment documents serve as a key part of this process, as they provide a detailed, chronological record of transactions. These documents not only help track payments but also assist in organizing financial data for tax purposes, budgeting, and auditing.

By using payment requests effectively, businesses can streamline their accounting processes, reduce errors, and stay organized. A well-kept record of these documents is essential for monitoring outstanding payments, managing cash flow, and ensuring timely financial reporting.

Here are some ways to use payment documents effectively for record-keeping:

- Track Financial Transactions: Each payment request serves as a record of a transaction, capturing details such as services rendered, amounts due, and payment terms. This information helps businesses track their revenue and monitor any outstanding balances.

- Monitor Cash Flow: By keeping track of issued documents, businesses can have a clear picture of incoming payments. This is essential for managing cash flow, planning for expenses, and ensuring the business remains financially healthy.

- Facilitate Tax Preparation: Organized records of payment requests make tax preparation easier. These documents provide proof of income and are essential for calculating tax obligations, deductions, and credits. They also ensure compliance with regulatory requirements.

- Support Audits and Financial Reviews: Well-maintained records can be invaluable during audits or financial reviews. Clear and accurate documentation provides transparency and helps businesses avoid discrepancies or errors in their financial reporting.

- Set Payment Reminders: Maintaining a system of records allows businesses to easily track due dates and send timely reminders for payments. This ensures that no payments are overlooked and reduces the risk of overdue accounts.

By integrating payment requests into the record-keeping process, businesses can improve organization, reduce stress around tax season, and have a clearer overview of their financial standing. A well-organized system of documents is vital for a smooth and efficient operation, helping businesses stay compliant and financially sound.

How to Track Payments with Invoices

Tracking payments is crucial for maintaining healthy cash flow and staying on top of financial obligations. Payment records serve as a detailed log of transactions between businesses and clients, helping to ensure that all payments are accounted for and that any outstanding balances are addressed in a timely manner. By effectively managing these documents, you can easily monitor incoming payments and follow up on overdue accounts, leading to smoother operations and better financial control.

Using a systematic approach to track payments is essential, especially for small businesses and freelancers who rely on accurate payment records for their financial management. Here’s how to efficiently track payments and keep everything organized:

Steps to Track Payments

- Assign Unique Reference Numbers: Each payment document should have a unique reference number. This helps identify and track individual transactions, making it easier to match payments to the corresponding documents.

- Record Payment Dates: Always note the date when payment is received. This allows you to track when a payment was made and whether it was received on time, or if any delays occurred.

- Monitor Outstanding Balances: Maintain a clear record of unpaid amounts. Set reminders for any outstanding balances to ensure that overdue payments are followed up on promptly.

- Update Payment Status: Once a payment has been received, update the status of the payment request to “paid” in your system or document. This helps keep track of which payments are complete and which still need attention.

- Use Digital Tools: Consider using accounting software or spreadsheets to track payments. These tools can help automate the process, making it easier to update records and generate reports as needed.

Organizing Payment Records

Effective organization of payment records is vital for ensuring that no payments are missed and that all accounts are kept up to date. Below is an example of a simple tracking table you can use to monitor your payments:

| Document Number | Client Name | Amount Due | Payment Date | Payment Status |

|---|---|---|---|---|

| 001 | ABC Ltd. | $500.00 | 2024-10-15 | Paid |

| 002 | XYZ Corp. | $750.00 | 2024-10-20 | Pending |

| 003 | LMN Enterprises | $320.00 | 2024-10-22 | Paid |

By maintaining a clear and up-to-date record of all payments, businesses can ensure that their cash flow remains consistent and that any issues with unpaid amounts are identified early. Tracking payments with these methods will help streamline financial management and keep operations running smoothly.