New Invoice Template for Streamlined Billing and Professional Invoicing

Efficient financial management is essential for any business, and having a well-structured billing system can streamline the entire process. A well-designed document can not only save time but also improve the perception of your professionalism. Adopting a structured format for payment requests ensures clarity and helps avoid misunderstandings with clients.

In this guide, we’ll explore the benefits of using pre-designed formats for creating payment requests. Whether you’re a freelancer, a small business owner, or part of a larger company, the right layout can make all the difference in how your financial documents are received. With a few simple adjustments, you can enhance accuracy, reduce errors, and make your billing process much more efficient.

From the basic layout to more advanced customization options, you’ll discover how to adapt these documents to meet the unique needs of your business. With a focus on ease of use and functionality, these solutions are designed to save you time and ensure that your requests for payment are both clear and professional.

New Invoice Template Benefits for Businesses

Adopting a structured, pre-designed format for billing can bring significant advantages to businesses of all sizes. By utilizing an efficient layout for payment requests, companies can streamline their financial operations, improve communication with clients, and ensure that all transactions are processed smoothly. Below are some key benefits of using such solutions in your business.

- Time-Saving – Pre-designed formats eliminate the need to manually create documents from scratch, allowing you to focus on other important tasks.

- Consistency – Standardized layouts ensure that all payment requests follow a uniform style, improving brand identity and client trust.

- Accuracy – Well-structured designs reduce the risk of errors by guiding users to include all necessary details, ensuring clear and complete information.

- Professionalism – A polished and neat presentation makes your financial documents look more credible and trustworthy, enhancing your business reputation.

- Customization – These systems offer flexibility, allowing you to adjust the layout to suit your specific needs and preferences.

Overall, adopting these solutions helps reduce administrative workload while improving your company’s financial efficiency. With fewer mistakes and clearer communication, businesses can maintain better client relationships and ensure timely payments.

How to Create a Custom Invoice

Designing a personalized billing document involves several key steps to ensure that all the necessary information is included and presented clearly. Tailoring your financial requests to reflect your business’s style and requirements can help streamline the process and foster better relationships with clients. Below, we’ll walk through how to craft a custom layout that suits your specific needs.

Step 1: Gather Essential Information

The first step in creating a custom document is to collect all the critical details that need to be included. These may vary depending on the nature of your business, but the following elements are typically required:

| Information | Description |

|---|---|

| Business Name | Your company’s name and contact information |

| Client Details | Name and contact information of the client or company receiving the request |

| Date | When the transaction is taking place or when the document is issued |

| Payment Terms | Details on the payment due date and any penalties for late payments |

| Services or Products | A detailed list of the services or products provided, including quantities and prices |

| Total Amount | The overall cost, including taxes and discounts if applicable |

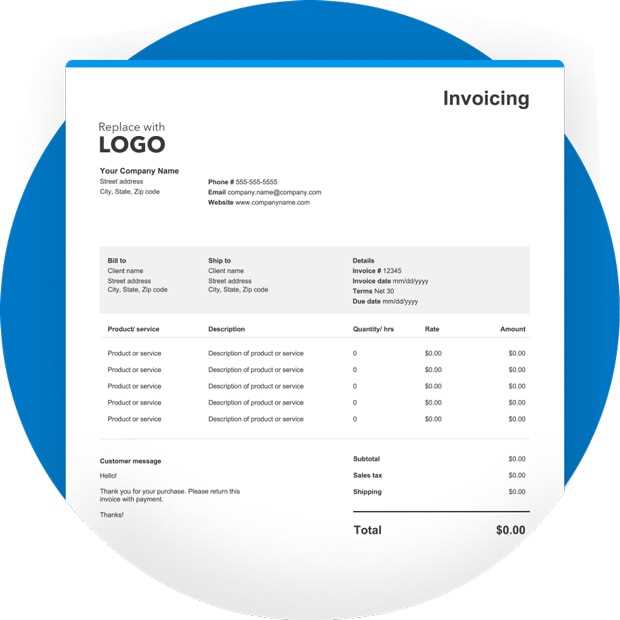

Step 2: Customize the Layout

Once all the necessary information is gathered, the next step is to arrange it in an organized and visually appealing format. You can adjust fonts, colors, and spacing to align with your brand’s style. A professional layout not only enhances clarity but also leaves a positive impression on your clients. Make sure the most important details, such as the total amount and payment terms, are easy to find.

With the basic structure and design in place, you can now save your custom billing document for future use or adjust it for different types of transactions. By maintaining consistency in your billing system, you ensure that clients receive clear and professional documents every time.

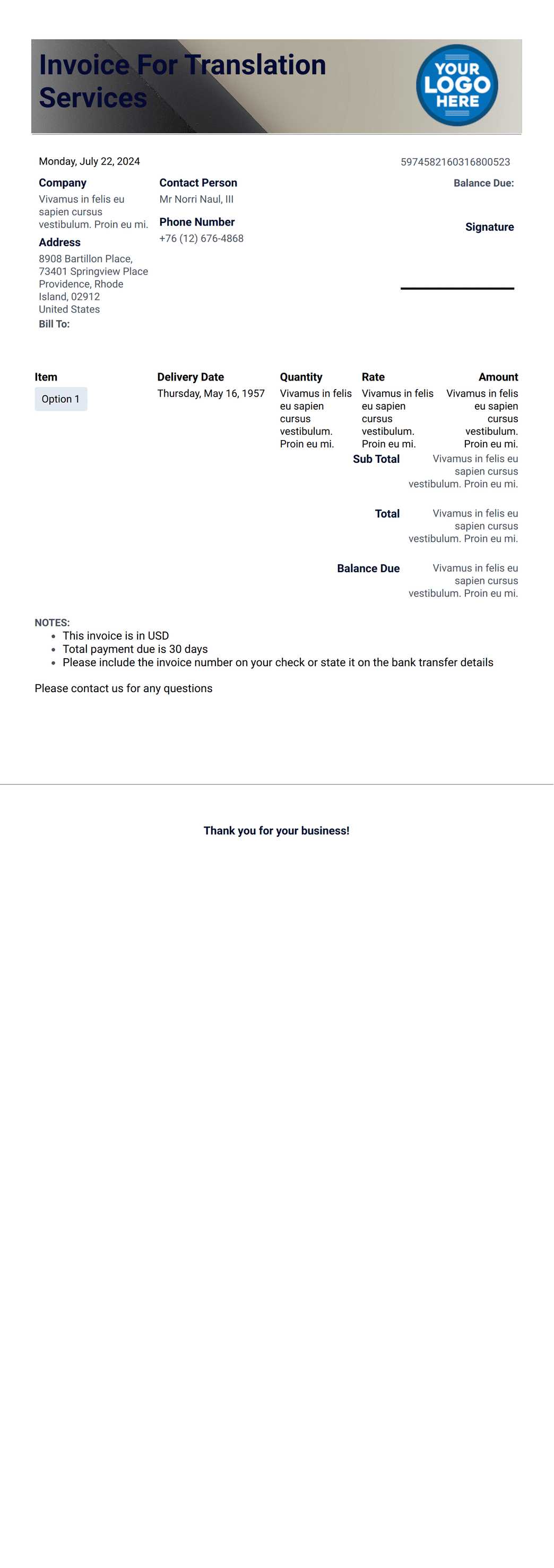

Essential Features of an Invoice Template

For any business, creating a clear and efficient billing document is crucial to ensure smooth financial transactions. A well-structured layout should include all necessary elements that make it easy for both the business and the client to understand the terms and details of the payment. Below are some of the essential components that should be present in every billing document to ensure its effectiveness and professionalism.

Clear Identification of Parties Involved

One of the most important aspects of any billing document is the identification of both the business and the client. This includes:

- Your Company Information – Include your company name, address, phone number, and email for easy contact.

- Client Information – Include the client’s name, address, and contact details to ensure the request reaches the right person.

Having this information prominently displayed at the top ensures both parties can quickly verify details and avoids confusion in the future.

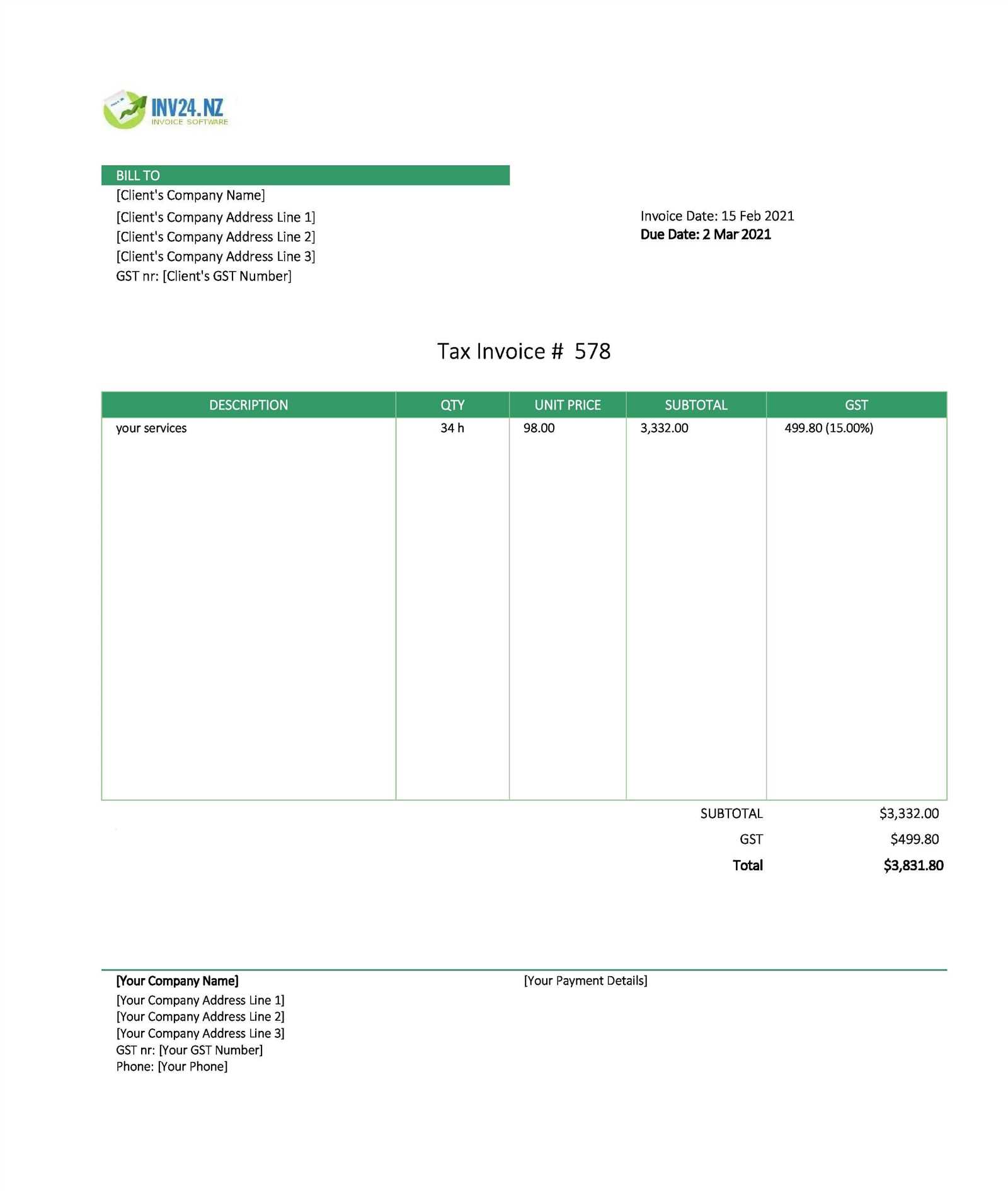

Clear Payment Breakdown

It is essential to clearly display all relevant financial information. This includes:

- Service or Product Description – Each service or product provided should be listed with clear descriptions and quantities.

- Unit Price and Total – Ensure the cost for each item is listed with a subtotal and the final total at the bottom.

- Taxes and Discounts – Any applicable taxes, discounts, or additional fees should be clearly itemized to avoid confusion.

Clearly itemizing charges ensures transparency and helps clients quickly understand what they are being billed for. This also minimizes the chances of disputes over payment details.

Additionally, a due date should be clearly stated, along with any payment terms or conditions, to guide clients in making timely payments. Providing these details helps ensure that the payment process goes smoothly for both sides.

Why Use a Digital Invoice Template

In today’s fast-paced business world, efficiency and accuracy are paramount, especially when it comes to financial transactions. Utilizing a digital billing document format offers several advantages over traditional methods, ensuring streamlined processes, better organization, and faster transactions. Below, we explore the key reasons why businesses should consider making the switch to digital solutions.

Time Efficiency and Convenience

Digital formats allow businesses to create and send requests for payment much faster than manual methods. Instead of filling out information on paper or creating documents from scratch, users can access pre-designed layouts and simply input the necessary details. This speeds up the entire billing process and reduces administrative work.

Improved Accuracy and Organization

Automating many of the billing steps reduces the chances of human error, such as miscalculating totals or omitting important information. Digital solutions also make it easier to store and retrieve records, improving organization. Companies can maintain an organized database of past transactions, simplifying tracking and reporting.

| Benefit | Description |

|---|---|

| Time-Saving | Quickly create and send documents without manually entering data each time. |

| Automation | Features like auto-calculating totals and adding taxes reduce manual effort. |

| Storage | Easy to store and organize documents electronically for quick access. |

| Accessibility | Access documents from any device, anywhere, without the need for physical storage. |

Adopting a digital solution makes managing payments more efficient and accurate, ultimately saving both time and resources for your business.

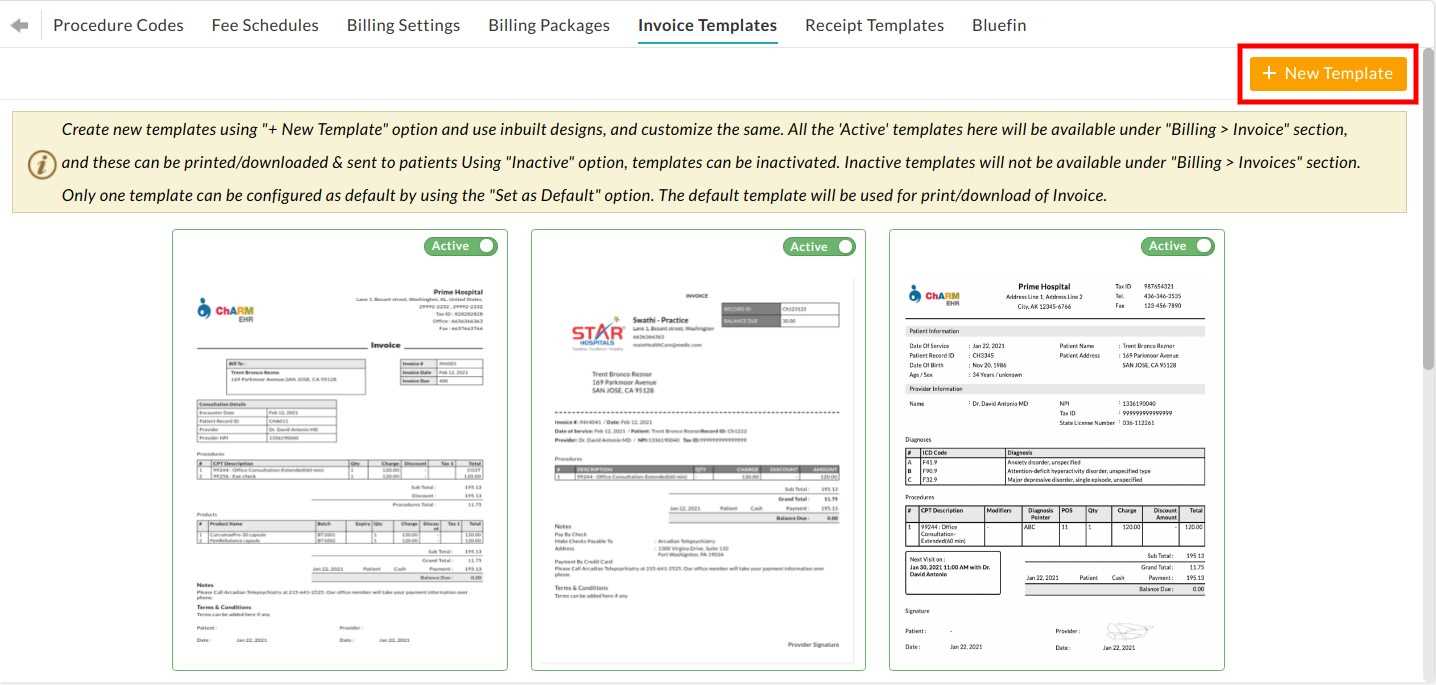

Steps to Customize Your Invoice

Personalizing your billing documents allows you to better reflect your business identity while ensuring that all the necessary details are clearly communicated. Customizing your financial documents is not only about design but also about making sure that the format aligns with your business needs. Below are the steps you can follow to create a customized and professional payment request.

Step 1: Choose a Layout

The first step is to decide on the overall layout of your document. You can choose from a variety of designs depending on your brand and style preferences. Many systems provide templates that offer flexibility, allowing you to adjust the structure based on your needs. Consider these factors when choosing a layout:

| Consideration | Details |

|---|---|

| Brand Consistency | Choose a design that reflects your business’s visual identity, including colors and logos. |

| Client Needs | Ensure that the design makes the document easy to read and that key details are highlighted. |

| Complexity | Opt for a layout that suits the complexity of your business transactions–simple or detailed. |

Step 2: Add Relevant Information

Once you’ve chosen the layout, the next step is to input all relevant information. This includes company details, client information, a breakdown of services or products, payment terms, and the total amount due. Ensure the following:

- Clear Contact Information – Both parties should have easily accessible contact details.

- Itemized List – Provide clear descriptions, quantities, and prices for each product or service.

- Due Date and Payment Instructions – Clearly state when the payment is due and how it should be made.

Customizing these elements makes your document not only personalized but also practical for both you and your client.

Design Tips for Professional Invoices

Creating a visually appealing and professional billing document is essential for any business. A well-designed payment request not only ensures that your information is easy to understand but also enhances your brand’s credibility. Below are some design tips that can help you create professional-looking documents that leave a positive impression on clients.

1. Keep It Clean and Simple

Simplicity is key when it comes to design. Avoid clutter and focus on clear, easy-to-read elements. Use ample white space to give your document a clean and organized look. Here are some tips to achieve a streamlined design:

- Limit Font Choices: Stick to one or two fonts to maintain consistency.

- Use Clear Headings: Make sure each section is clearly marked for easy navigation.

- Organize Information: Group related details together, such as contact information, product descriptions, and payment terms.

2. Prioritize Key Information

While design is important, functionality is just as crucial. The most important details, such as the total amount due and the payment due date, should stand out. Consider the following tips:

- Bold Key Figures: Highlight the total amount and any other important numbers to make them easy to find.

- Clear Call to Action: Include a section for payment instructions and deadlines, making sure it’s noticeable and easy to follow.

- Simple Color Scheme: Use colors that are part of your brand’s palette, but ensure they don’t overwhelm the reader. Contrasting colors can help important information stand out.

By focusing on clarity and simplicity, you can create a professional document that not only looks great but is also easy for your clients to navigate and understand.

How Templates Save Time and Effort

One of the biggest challenges for businesses is managing administrative tasks efficiently, and financial documentation is no exception. Using a pre-designed format to generate payment requests can drastically reduce the time and effort spent on creating and sending these documents. By leveraging ready-made layouts, you can simplify the entire process, ensuring accuracy and consistency without having to start from scratch each time.

Speeding Up Document Creation

When you use a pre-made structure, much of the work is already done for you. Instead of manually setting up each section of the document–such as headings, item descriptions, or payment details–you only need to input the relevant information. This eliminates repetitive tasks and allows you to generate professional documents in a fraction of the time.

- Faster Setup: Pre-configured fields mean you don’t have to format or adjust each document.

- Instant Access: Easily retrieve and use saved formats from your system, speeding up the entire process.

- Reduced Errors: With fixed fields and sections, there’s less room for missing or incorrect information.

Consistency and Professionalism

In addition to saving time, using a pre-designed layout ensures that every document you send follows the same professional format. This consistency helps build trust with clients and makes your business appear more organized and reliable. Maintaining the same style also reduces the time spent on design choices and layout adjustments.

- Uniform Design: Every document will have the same clean, organized appearance, boosting your brand image.

- Less Customization Needed: Once you’ve selected your layout, you can use it repeatedly without needing to make adjustments each time.

- Fewer Mistakes: With standardized structures, the likelihood of errors due to formatting or missing fields is minimized.

Overall, by using pre-designed systems, businesses can save both time and effort, allowing them to focus more on core tasks while ensuring their financial documents remain accurate and professional.

Invoice Templates for Different Industries

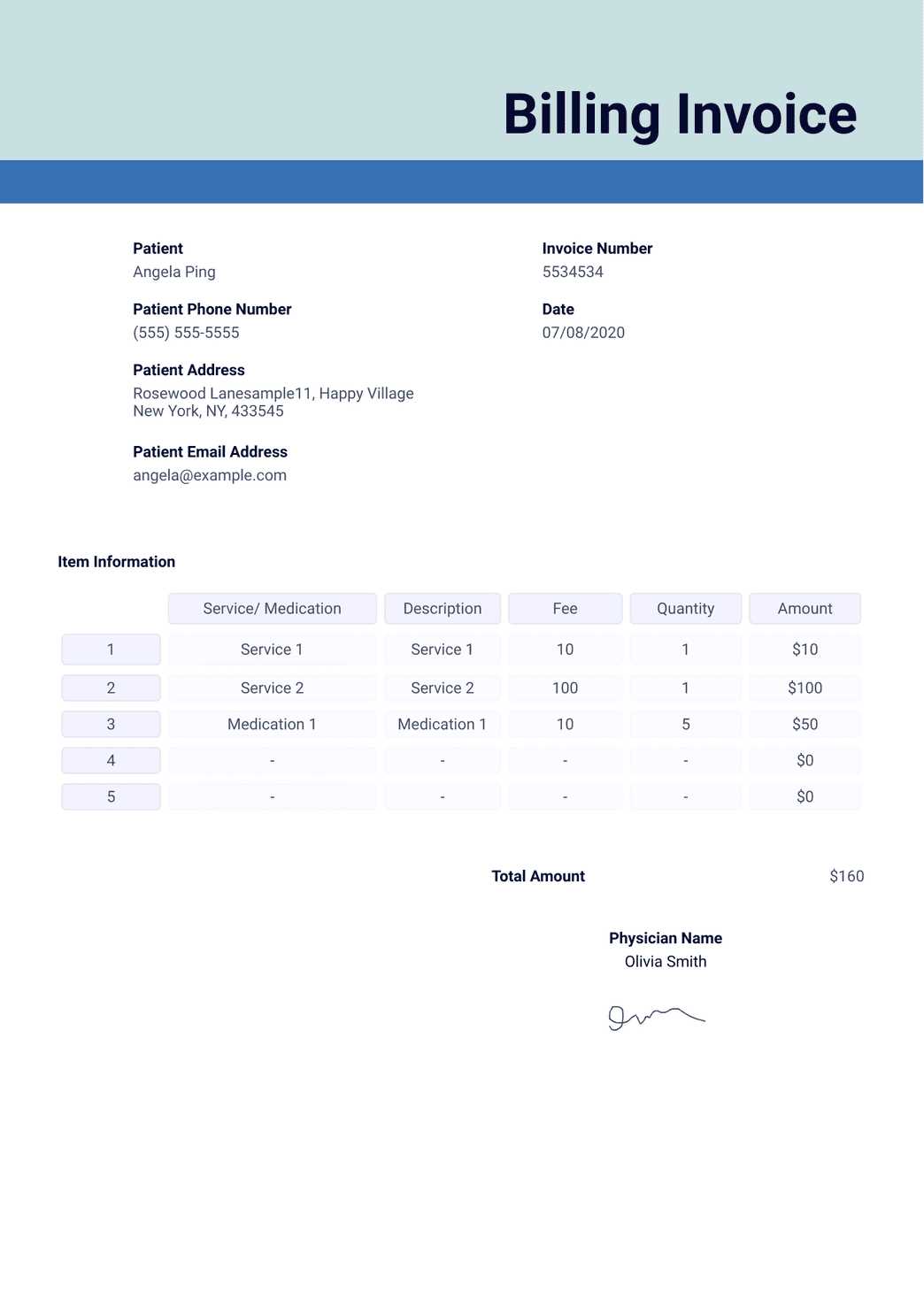

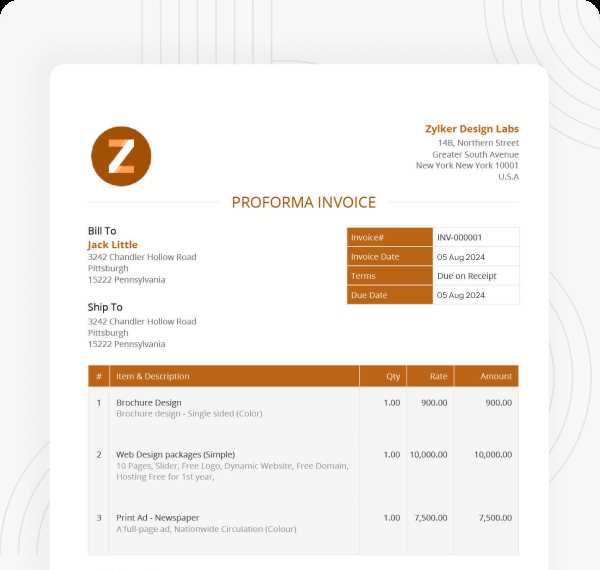

Each industry has its own unique requirements when it comes to billing and payment requests. Depending on the nature of your business, you may need to include specific details or follow particular formats to ensure that your documents meet industry standards and client expectations. Below, we’ll explore how different sectors can benefit from customized layouts to streamline their billing processes.

1. Service-Based Industries

For businesses providing services–such as consulting, marketing, or design–clarity and detail are key. A structured layout for service-based transactions should highlight the type of service, hours worked, and rate per hour. Essential components include:

- Service Description: Clear details about the work provided or tasks completed.

- Hourly or Fixed Rates: Include the rate of service or flat fees for specific projects.

- Work Time and Deliverables: Include the number of hours worked or project milestones completed.

Such documents should ensure that clients easily understand what they are paying for and the value they are receiving from the service provided.

2. Product-Based Industries

In product-based businesses, the layout needs to be oriented towards the details of goods sold, quantities, and unit prices. A typical structure for product transactions may include:

- Product Descriptions: A list of the items being sold with accurate descriptions.

- Unit Price and Quantity: The cost per item and the quantity purchased.

- Total Cost: A clear calculation of the total, including taxes or discounts applied.

These layouts help both the business and the client keep track of purchased items and ensure transparent, efficient transactions.

3. Freelancers and Contractors

Freelancers and independent contractors often have a mix of services and custom terms to account for. In these cases, a flexible layout is needed to accommodate a wide range of work types and payment schedules. Key features might include:

- Milestone Payments: Clear breakdowns of payments based on work completion or project phases.

- Project-Specific Terms: Space for outlining any special terms or custom agreements.

- Recurrent Billing: For contractors with long-term clients, options to include recurring payment details.

These types of documents allow freelancers and contractors to clearly communicate their terms and ensure timely payment for completed work.

4. Retailers and E-Co

Free vs Paid Invoice Templates

When it comes to creating professional billing documents, businesses have the option of using either free or paid formats. Both options offer their own advantages and disadvantages, depending on the needs of the company and the level of customization required. Below, we will explore the key differences between free and paid options to help you determine which is best for your business.

Free Formats

Free billing document designs are widely available online and can be a great starting point for small businesses or freelancers who need a simple solution without additional costs. However, they often come with some limitations. Here are some common features of free layouts:

- Basic Features: Free designs typically include only the essential elements such as payment details, business contact information, and simple formatting.

- Limited Customization: Customization options may be limited, with little flexibility for design adjustments or adding advanced features.

- Standard Designs: Many free layouts look generic and may not reflect your brand’s unique style or image.

- Potential for Ads: Some free options may include advertising or branding from the provider.

Free formats are ideal for businesses that need a quick, no-cost solution for basic billing but may not offer the level of professionalism or customization required for more complex needs.

Paid Formats

Paid billing documents, on the other hand, offer advanced features and enhanced design options that can make your financial documents stand out. These options typically come with a price tag, but the benefits can be significant for growing businesses. Key advantages of paid solutions include:

- More Customization: Paid options often allow for greater flexibility in design, enabling businesses to create documents that reflect their brand’s identity.

- Advanced Features: Many paid options include features such as automatic tax calculations, integration with accounting software, and recurring billing setups.

- No Ads or Branding: Paid layouts are typically ad-free and do not include any third-party branding, ensuring a professional appearance.

- Customer Support: With paid options, you often gain access to customer support if any issues arise during document creation or use.

For businesses that require more complex billing processes or want to create customized, polished documents, paid layouts offer a more professional and versatile solution.

Which Option is Right for You?

The choice between free and paid options largely depends on the specific needs of your business. If you’re just starting out or have a simple billing system, free solutions may be sufficient. However, as your business grows and your billing needs become more complex, investing in paid layouts may provide better value through enhanced features and customization.

Ultimately, both free and paid options can be effective, but businesses should consider their unique requirements, branding needs, and the level of functionality they need when choosing the best option for creating financial documents.

How to Use Invoice Templates in Excel

Using a pre-designed structure in Excel for creating billing documents is an efficient way to streamline your financial processes. Excel offers flexibility and powerful tools that allow you to create professional and accurate payment requests with minimal effort. Below, we’ll walk through the steps to effectively use Excel to generate well-organized and customizable financial documents.

Step 1: Download or Create a Layout

First, you need to either download an existing design or create your own in Excel. Many free and paid options are available online that offer pre-made structures with customizable fields. Alternatively, you can create a layout from scratch using Excel’s grid system and formatting tools. Here’s what to look for:

- Basic Fields: Ensure the layout includes essential details like business and client information, payment terms, and a description of goods or services provided.

- Space for Calculations: Make sure there are fields for adding unit prices, quantities, totals, taxes, and any applicable discounts.

- Customization Options: Choose a design that allows for easy editing to match your business’s branding and specific needs.

Step 2: Input Data and Make Adjustments

Once you have your chosen structure, you can begin entering your business and client information. Excel’s easy-to-use formulas and cell references allow you to automate calculations, reducing the chances of errors. Key steps include:

- Enter Basic Information: Fill in your company’s contact details, client name, address, and any other necessary information.

- Describe Products/Services: List all goods or services provided along with quantities, prices, and any applicable discounts.

- Use Formulas: Implement Excel’s built-in formulas to calculate totals, taxes, and apply any discounts automatically.

Once the data is entered, the layout will automatically update calculations, saving time and ensuring accuracy in your billing process.

Step 3: Save and Send the Document

After finalizing the document, save it in your desired format. Excel allows you to save your document as a standard .xlsx file, or you can export it as a PDF for easier sharing with clients. Make sure to name the file in a way that is easy to reference, such as including the client’s name or invoice number.

- Save Regularly: Ensure that you save your document frequently to avoid losing any data.

- Export as PDF: If you plan to send the document via email or print it, exporting it as a PDF will preserve the formatting and prevent unauthorized changes.

With these steps, you can quickly generate accurate, professional payment requests using Excel, making your billing process more efficient and reliable.

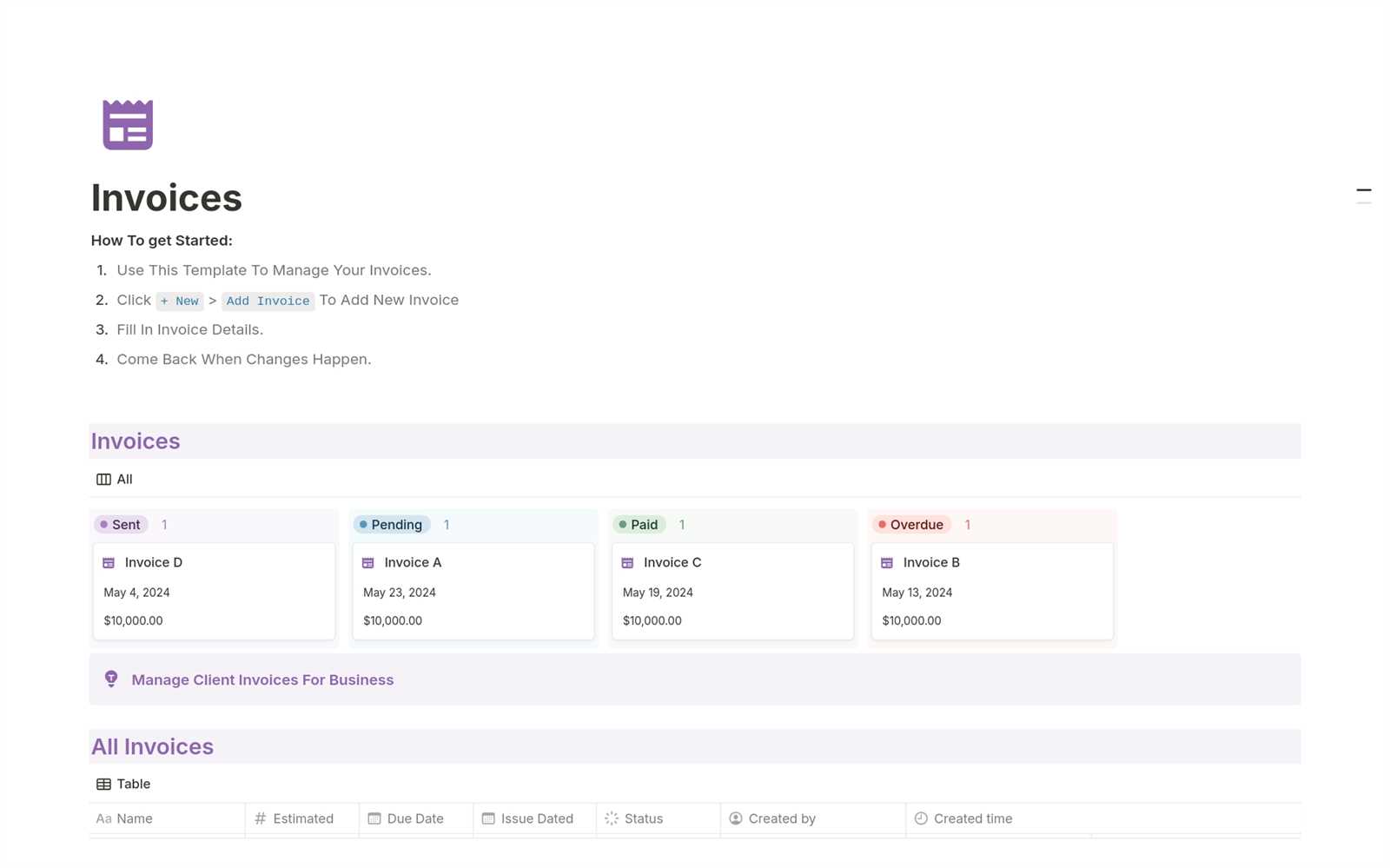

Automating Your Invoicing Process

Automating your billing workflow can significantly reduce the time spent on administrative tasks and help maintain consistent cash flow. By using automated systems to generate and send payment requests, businesses can streamline their operations, reduce human error, and ensure that clients are billed promptly. Below are some key strategies and tools that can help automate this process efficiently.

1. Use Software with Built-in Automation

One of the most effective ways to automate billing is by using accounting software or invoicing platforms that offer automation features. These tools can automatically generate documents based on preset criteria, such as client information, services provided, and payment terms. With this approach, businesses can:

- Save Time: Automatically generate documents without manually entering repetitive data.

- Ensure Accuracy: Avoid mistakes by reducing the need for manual input and calculations.

- Set Recurring Schedules: Automate recurring billing for long-term clients with fixed payment intervals.

2. Implement Payment Reminders

Automating reminders is another way to ensure timely payments. Many invoicing platforms allow businesses to schedule automatic payment reminders, reducing the need for follow-up emails and calls. These reminders can be sent:

- Before the Due Date: To prompt clients ahead of time about upcoming payments.

- On the Due Date: To remind clients that the payment is due today.

- After the Due Date: To gently nudge clients who may have missed the payment deadline.

Automated reminders help maintain professionalism while ensuring that payments are collected on time, improving cash flow and client relationships.

3. Integrate Payment Gateways

Integrating payment systems directly into your billing process can further streamline the process. By connecting payment gateways like PayPal, Stripe, or other online payment processors, businesses can enable clients to pay directly from their documents. This integration offers several benefits:

- Instant Payments: Clients can pay instantly with a few clicks, reducing delays in processing payments.

- Easy Tracking: Payments made via integrated gateways are automatically recorded, simplifying bookkeeping and reconciliation.

- Multiple Payment Options:Invoice Templates for Freelancers and Contractors

For freelancers and independent contractors, managing financial documents is crucial to ensure timely payments and maintain professionalism. Having a structured format to outline services, rates, and payment terms can help streamline the billing process. Below, we explore how customized layouts can benefit freelancers and contractors by making the payment request process more efficient and transparent.

Key Features for Freelancers

Freelancers typically work with a variety of clients, often under different terms. A flexible layout that can accommodate varying work types and payment schedules is essential. The following features are particularly important for freelancers:

- Service Descriptions: A clear breakdown of the services provided, including detailed descriptions of work completed.

- Hourly or Flat Rate: Fields to specify the agreed-upon rate, whether hourly or project-based.

- Project Milestones: For larger projects, it’s useful to show payment due for specific milestones or completed phases.

- Payment Terms: Include information about payment deadlines, methods, and late fees, if applicable.

Key Features for Contractors

Independent contractors often juggle multiple clients and longer-term projects. The format needs to be adaptable to different agreements and include essential details like ongoing work, payments, and timelines. Key features for contractors include:

- Recurring Billing: For long-term contracts, set up automatic billing cycles for monthly or periodic payments.

- Detailed Line Items: Include each specific task or service with corresponding costs to ensure transparency and avoid confusion.

- Tax Information: Contractors should include tax identification numbers and any applicable tax rates for each project or service rendered.

- Invoice Tracking: Use unique numbers or identifiers for each document to easily track payment statuses and avoid duplication.

By having a well-organized system in place, freelancers and contractors can reduce administrative stress, ensure consistent cash flow, and maintain clear communication with clients regarding payments.

Best Practices for Invoice Formatting

Creating clear and professional billing documents is crucial for maintaining positive client relationships and ensuring timely payments. Proper formatting can help prevent confusion, facilitate smoother transactions, and present your business as organized and trustworthy. In this section, we’ll cover the key best practices to ensure that your payment requests are both functional and polished.

1. Keep It Clear and Organized

Structure is key when designing a billing document. A well-organized format ensures that all relevant details are easy to find and understand. Here are some tips:

- Use Headers: Clearly label sections like business information, client details, services, and payment terms to make the document easy to navigate.

- Align Information Properly: Ensure all text, numbers, and columns are aligned for a clean and professional appearance.

- Provide Clear Payment Instructions: Specify how clients should submit payments, including methods (e.g., bank transfer, credit card), deadlines, and any late fees.

2. Include Essential Information

A comprehensive billing document should include all the necessary details to prevent confusion or delays. Make sure to include the following:

- Client and Business Information: Include the name, address, phone number, and email of both parties. This helps establish the legitimacy of the document.

- Itemized List of Services: Detail each service or product with clear descriptions, quantities, unit prices, and total amounts.

- Payment Terms and Due Dates: Specify when payment is due and any applicable terms like discounts or late fees.

3. Use Consistent and Professional Fonts

The fonts you choose can greatly impact the readability and professionalism of your document. Stick to clean, easily readable fonts such as Arial, Times New Roman, or Calibri. Additionally, use:

- Bold for Headings: Make headings stand out with bold tex

Common Mistakes in Invoice Design

Creating a billing document might seem straightforward, but poor design choices can lead to confusion, delays, and even missed payments. While having a structured format is important, there are several common pitfalls that can undermine the effectiveness and professionalism of these financial documents. Below are some frequent design mistakes to avoid when creating your payment requests.

1. Lack of Clear Organization

One of the most frequent mistakes is a cluttered or poorly organized layout. When information is hard to find, it can lead to misunderstandings or missed details. Key points to avoid include:

- Unclear Section Breaks: Failing to separate important sections, such as contact details, services, and payment terms, can cause confusion.

- Poor Alignment: Misaligned text or numbers make the document look unprofessional and difficult to read.

- Overcrowded Pages: Including too much information on one page without proper spacing can overwhelm the reader.

2. Missing or Incorrect Information

Accurate information is crucial in a billing document. Omitting or incorrectly entering any details can lead to delays in payments and even disputes. Common errors include:

- Wrong Contact Information: Ensure both your business and the client’s contact details are accurate and up to date.

- Inaccurate Payment Terms: Double-check that the payment deadlines, methods, and fees are clearly stated and correct.

- Incorrect Itemization: Ensure that all services or products are listed with correct descriptions, quantities, and prices.

3. Inconsistent Formatting

Inconsistent formatting can make a document look unprofessional and reduce its readability. To avoid this, make sure to:

- Use Uniform Fonts: Avoid using multiple font styles or sizes in a single document, as this can make it appear disorganized.

- Stick to One Color Scheme: Too many colors can distract from the content and create an amateurish appearance.

- Maintain Consistent Number Formatting: Ensure that all numbers, including prices and totals, are presented in a uniform format for clarity.

- Predefined Fields: Each section, such as contact details, quantities, and total costs, has a designated space, reducing the risk of forgetting or misplacing information.

- Auto-Fill Features: Many systems allow for automated population of recurring information, reducing the chances of input mistakes.

- Clear Structure: Having set fields for each piece of information ensures that no crucial details are left out, such as the due date or payment terms.

- Uniform Formatting: Every document follows the same format, making it easier for clients to understand and reference when needed.

- Standardized Information: Essential details, such as tax rates, service descriptions, and payment terms, remain the same across all documents, reducing confusion.

- Time-Saving: Once a format is set, there’s no need to redesign or reformat each document, streamlining the process and saving valuable time.

- Automated Data Transfer: Once a document is generated, key information such as amounts, client details, and dates can automatically sync with your accounting software, reducing manual entry.

- Real-Time Financial Tracking: Payments and outstanding amounts are updated in real time, helping you keep track of cash flow without manual reconciliation.

- Improved Accuracy: With automated entry, the risk of human error is significantly lowered, ensuring that financial records are accurate and consistent.

- Syncing Client Information: Integration with CRM (Customer Relationship Management) tools can automatically populate client details in your billing documents, ensuring that no information is missed.

- Tax Calculation Tools: Many accounting platforms have built-in tax calculators that can automatically apply the correct tax rate, reducing the likelihood of incorrect charges.

- Payment Gateway Integration: Linking your documents to payment gateways allows for instant updates on paid or overdue invoices, improving cash flow management.

- Financial Reporting: Integration ensures that your billing records are seamlessly incorporated into financial reports, saving time on manual data entry and improving the accuracy of financial statements.

- Freelancers and Contractors: A minimalistic, clear layout may be all that’s needed to list services, rates, and payment terms.

- Retail Businesses: For physical product sales, a more comprehensive structure with itemized product listings, quantities, and prices is essential.

- Consulting Firms: Detailed descriptions of the services provided, including hourly rates and project breakdowns, may be necessary to ensure transparency.

- Subscription-Based Services: A recurring billing format that includes subscription dates, terms, and payment frequencies would be the most effective.

- Customization: Look for a design that allows you to tailor fields such as client names, services, amounts, and payment details. Customization ensures that your documents remain unique and professional.

- Tax Calculations: If your business is subject to sales tax, select a structure that automatically includes tax rates and calculates the total amount due based on the products or services provided.

- Client-Specific Fields: If your clients have specific requirements, such as purchase order numbers or contract references, choose a structure that accommodates these additional fields.

- Payment Methods: Ensure the structure includes clear options for different payment methods–credit cards, bank transfers, or online payments–to suit your clients’ preferences.

Legal Requirements for Invoices

Creating a proper billing document is not just about design and functionality; it also involves ensuring compliance with legal standards. Depending on your location and industry, there are certain details that must be included to meet tax and regulatory requirements. These essential elements help both businesses and clients avoid legal issues and ensure transparency in financial transactions.

Essential Legal Elements to Include

Regardless of where your business operates, certain information must always be present in a billing document. These details provide legal protection for both parties and help ensure the document is recognized by tax authorities. Below are the key components that are typically required:

Required Information Purpose Business Name and Contact Details Identifies the service provider or seller, including full legal name, address, and contact information. Client Name and Contact Details Identifies the buyer or recipient of services, ensuring clarity regarding who the payment is being made to. Invoice Number Provides a unique identifier for each document, making it easier to track and reference in the future. Issue Date and Due Date Clearly indicates when the document was created and when payment is due. Detailed Description of Goods or Services Itemizes each product or service provided, including quantities and unit prices, to avoid disputes. Payment Terms Clarifies payment methods, deadlines, and any applicable late fees or discounts. Tax Identification Number (TIN) Required in many countries for tax reporting purposes, especially for businesses that are VAT-registered. Total Amount Due Summarizes the total charges, including any taxes, fees, and discounts. Tax-Specific Requirements

In addition to the basic information listed above, some jurisdictions may require specific details related to taxation. These requirements can vary widely depending on your count

Why Invoice Templates Improve Accuracy

Using pre-designed billing documents offers significant benefits in terms of precision and consistency. By following a structured format, businesses can minimize human errors and ensure that every important detail is captured correctly. This consistency not only streamlines the billing process but also improves overall reliability in financial transactions.

1. Reduces Data Entry Errors

Manual data entry is prone to mistakes, whether it’s misspelled client names, incorrect service descriptions, or missing amounts. With a standardized layout, many of these errors are avoided because:

2. Ensures Consistency Across Documents

Consistency in your billing documents is crucial for building a professional reputation and for tracking payments. Using the same layout for all transactions guarantees that:

By using a well-structured billing document format, businesses can improve the accuracy and efficiency of their financial processes, leading to better client relationships and smoother transactions.

Integrating Invoice Templates with Accounting Tools

Integrating your billing documents with accounting software can significantly streamline your financial management. This process not only saves time but also ensures that all transactions are automatically recorded and categorized. By linking your billing system to accounting tools, businesses can achieve greater accuracy, minimize errors, and improve overall efficiency.

1. Benefits of Integration

Connecting your billing documents with accounting software provides several advantages:

2. Key Integrations to Consider

When looking to integrate billing documents with accounting software, consider these common features and tools:

By integrating your billing system with accounting tools, you create a more streamlined workflow that enhances accuracy, saves time, and reduces the risk of financial errors. This approach also provides greater visibility into the health of your business and ensures that your financial processes remain efficient and organized.

Choosing the Right Billing Document for Your Business

Selecting the right structure for your billing process is crucial for maintaining professionalism and ensuring clarity in your transactions. The format you choose should reflect your business style, cater to your industry’s needs, and facilitate smooth communication with clients. A well-suited billing structure helps improve your cash flow, reduces errors, and enhances the overall client experience.

1. Consider Your Business Type

Your business type plays a significant role in determining which structure will work best for you. Some businesses require a simple, straightforward layout, while others need more detailed, customized formats. Consider the following:

2. Features to Look For

When choosing a structure, it’s important to select one with features that align with your business needs. Here are a few key elements to look for:

By selecting the right format for your business, you’ll not only enhance efficiency but also present a professional image that reflects the quality of your services or products. Customizing the structure to your specific needs will help you manage your financial processes more effectively and m