Net 30 Invoice Template for Easy and Timely Billing

Effective billing is a crucial part of maintaining healthy financial operations for any business. By establishing clear payment expectations, companies can ensure timely receipts for their services and products. One of the most common methods for managing payment timelines is setting a specific period, like 30 days, for clients to settle their balances. This approach helps streamline cash flow while offering a clear structure for both the service provider and the customer.

Designing an efficient billing document with a specified payment period is essential for clarity and professionalism. This simple yet powerful tool not only ensures prompt payments but also serves as a formal record for both parties. The format should include all necessary details such as due dates, amounts owed, and payment instructions to avoid confusion or delays.

By using a well-crafted document, businesses can avoid misunderstandings and enhance the client relationship, making it easier to follow up on outstanding balances. Whether you are a freelancer, contractor, or a small business owner, having a reliable and clear billing system can significantly impact your cash flow management and overall financial health.

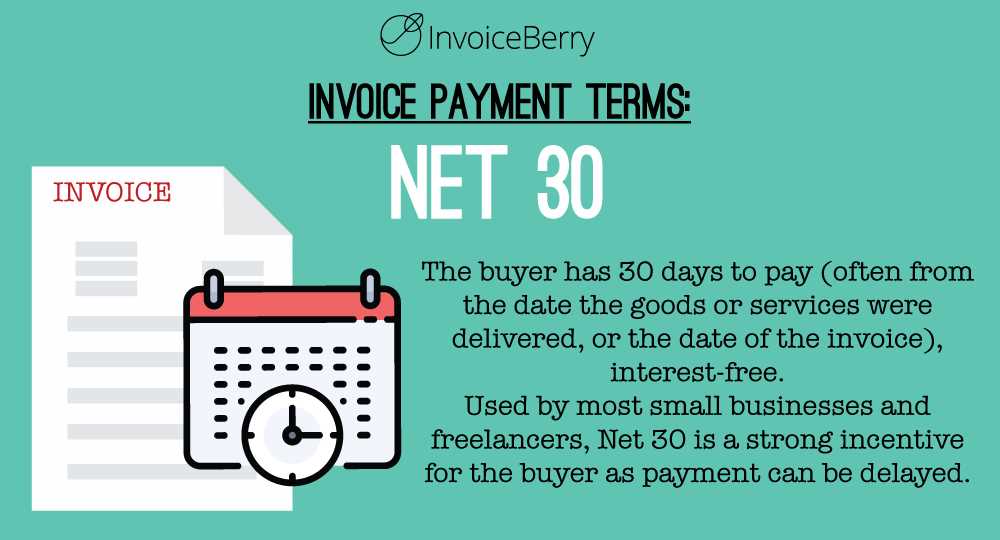

What is a Net 30 Invoice

A billing document that sets a 30-day period for payment after the transaction date is one of the most common methods businesses use to manage payments. This approach offers clients a clear window of time to settle their debts, ensuring companies can plan their cash flow more effectively. It serves as both a formal request for payment and a reminder of the terms agreed upon at the time of the sale.

The key feature of this type of billing arrangement is that it allows customers 30 days from the issue date to make a payment. The term “30 days” refers specifically to the time frame within which the amount owed must be paid in full. If the payment is not made within this period, the business may take steps to follow up or apply late fees, depending on the agreement.

| Details | Example |

|---|---|

| Transaction Date | January 1 |

| Payment Due Date | January 31 |

| Amount Owed | $500 |

| Late Fee (if applicable) | 5% after due date |

This payment arrangement provides a balance between flexibility for customers and security for businesses, as it sets clear expectations on when payments are due without being overly restrictive. The document itself typically includes all necessary details, including due dates, amounts, and payment instructions to help both parties stay organized and avoid misunderstandings.

Why Use a 30-Day Payment Term

Offering a 30-day period for clients to settle their outstanding balances provides a practical balance between customer convenience and business cash flow management. This approach is widely adopted across industries for its ability to support both flexibility and structure in financial transactions. There are several reasons why businesses choose to implement this payment timeline, all of which contribute to smoother operations and stronger client relationships.

- Improved Cash Flow Management: Having a clear 30-day period allows businesses to predict when they will receive payments, helping them better plan for expenses and avoid cash flow gaps.

- Increased Customer Satisfaction: Offering a reasonable window for payment gives customers more time to manage their finances, which can result in higher satisfaction and loyalty.

- Standard Industry Practice: Many industries use a 30-day term, making it a universally understood and accepted practice that simplifies the billing process for both parties.

- Less Administrative Hassle: A set payment term reduces the need for constant reminders or renegotiation of payment expectations, allowing businesses to focus on their core operations.

- Fostering Professionalism: By providing a clear structure, businesses can present themselves as professional and trustworthy, helping to build stronger long-term relationships with clients.

Implementing a 30-day payment period also reduces the likelihood of misunderstandings, as both parties are clear on when payment is due. This fosters a more transparent and efficient transactional process, ultimately benefiting both the business and the customer.

Benefits of Using 30-Day Payment Terms

Implementing a 30-day payment period offers several advantages for both businesses and their clients. By setting a fixed period for payment, companies create a predictable and structured process that benefits cash flow management, customer satisfaction, and professional reputation. This method ensures clarity in financial transactions and supports smoother operations.

Enhanced Financial Planning

With a consistent 30-day payment window, businesses can predict when payments will be received, which enables better cash flow forecasting. This predictability helps in planning for expenses, making it easier to cover operational costs and invest in growth initiatives. It also reduces the likelihood of running into cash flow shortages.

Improved Client Relationships

Offering a reasonable and widely accepted payment term, such as 30 days, can foster

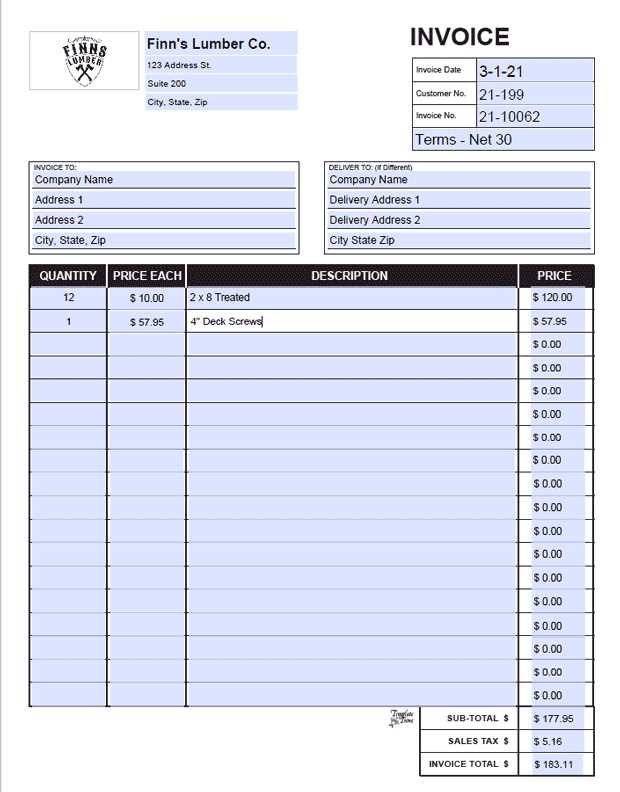

How to Create a 30-Day Payment Document

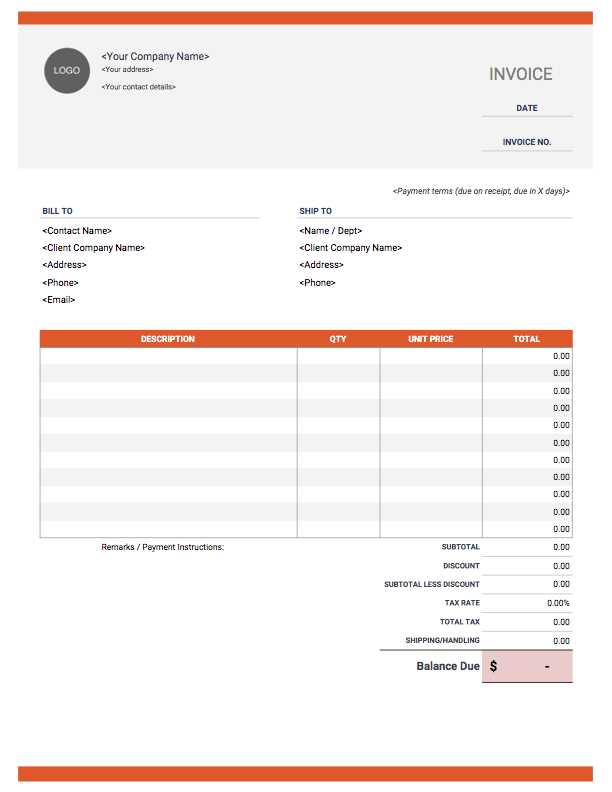

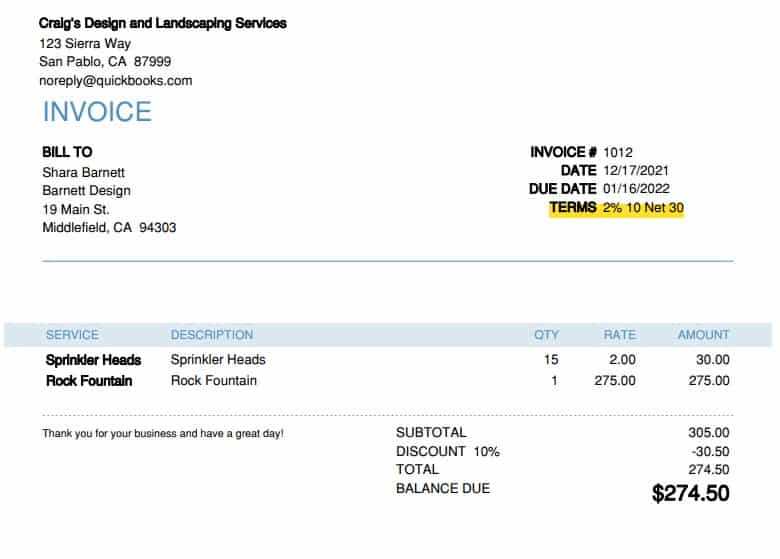

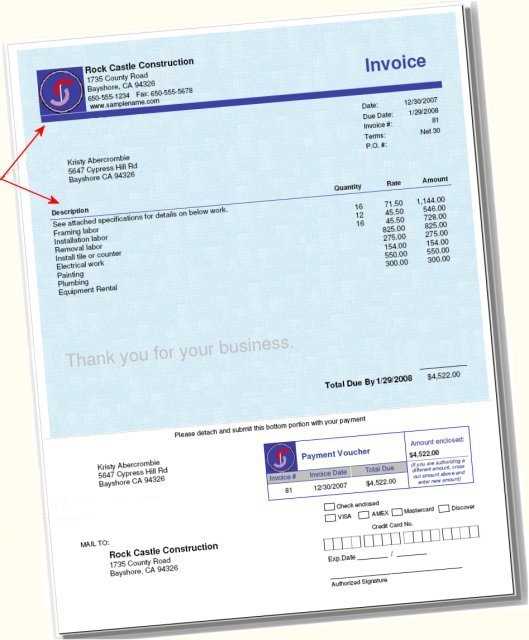

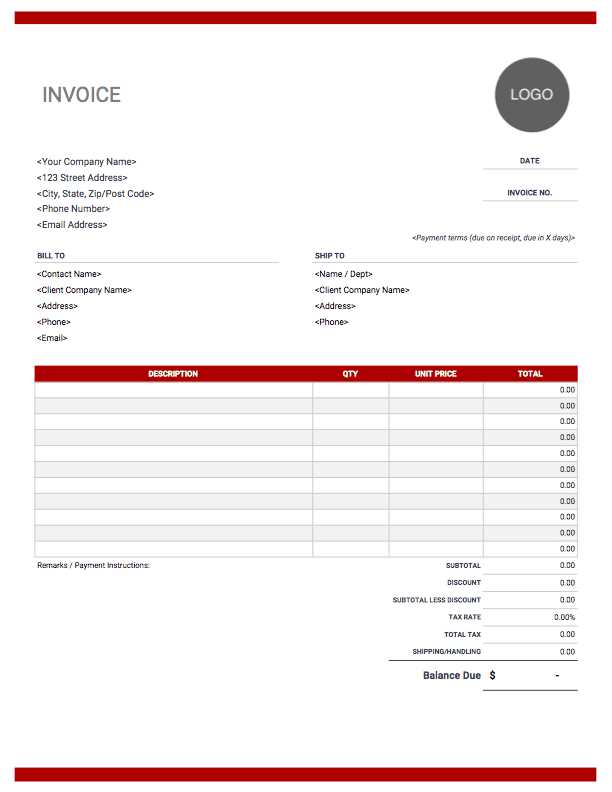

Creating a document that outlines a 30-day payment term is essential for maintaining clear expectations between businesses and their clients. This formal document serves as a reminder of the agreed-upon payment period and provides all the necessary details for a smooth transaction. By following a few simple steps, businesses can craft an effective and professional billing statement.

1. Include Your Business Information

Start by adding your company’s name, address, phone number, and email. This ensures that the recipient can easily identify the source of the document and contact you if needed.

2. Add Client Information

Include the client’s name or business name, address, and contact information. This clarifies who the document is intended for and avoids confusion.

3. List Products or Services Provided

Provide a detailed list of the products or services delivered, including quantities, unit prices, and any applicable taxes or discounts. This helps the client understand exactly what they are being charged for.

4. Specify the Amount Due and Due Date

Clearly state the total amount owed and highlight the due date. For a 30-day payment term, make sure the due date is exactly 30 days after the transaction date. This gives the client a clear timeline for when the payment is expected.

5. Include Payment Instructions

Provide the methods of payment you accept, such as bank transfer, credit card, or other payment platforms. Also, include any necessary account details or payment references to help the client process the payment.

6. Add a Professional Message

End the document with a courteous note thanking the client for their business and encouraging timely payment. This can help maintain a positive relationship and encourage future transactions.

Once you’ve included all the necessary information, you can format it neatly and send it to the client. A well-structured document not only ensures timely payments but also enhances your company’s professional image.

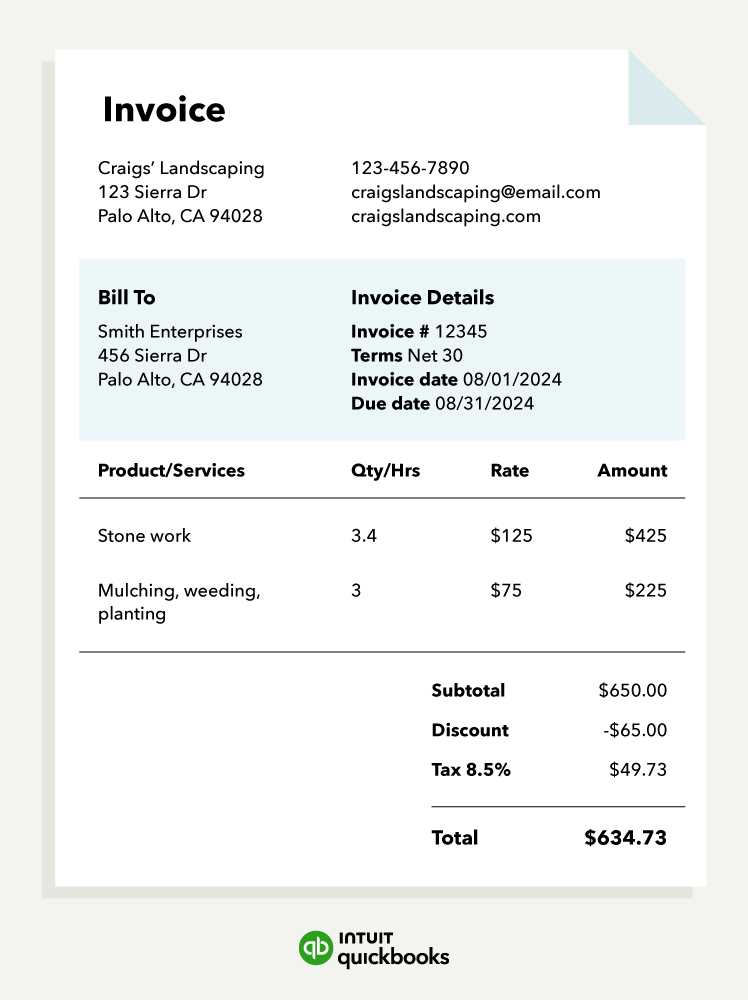

Key Elements of a 30-Day Payment Document

To ensure clarity and professionalism, a well-structured document outlining a 30-day payment term should include several essential components. These elements not only make the transaction process smoother but also help avoid confusion or misunderstandings between the business and the client. Below are the key elements that every billing statement should contain.

Essential Information for Clarity

- Business Contact Details: Include the full name, address, phone number, and email address of your business. This ensures that the client can easily reach out if needed.

- Client Information: The client’s name or business name, along with their contact details, should be clearly stated to avoid any confusion.

- Transaction Date: The date when the service was provided or the goods were delivered should be clearly mentioned. This is the reference date for calculating the payment due date.

- Unique Invoice Number: Each document should have a unique identification number to make tracking and future references easier.

Payment Terms and Instructions

- Total Amount Due: Clearly state the total sum the client owes, including any taxes, discounts, or additional charges.

- Due Date: Specify the exact due date, which should be 30 days after the transaction date. This helps avoid any confusion about when payment is expected.

- Accepted Payment Methods: Indicate the payment options available, such as bank transfer, credit card, or online payment platforms, along with any relevant account details.

- Late Payment Penalties: If applicable, include information about any fees or interest charges that will apply if the payment is not made by the due date.

Including these key elements in your document not only ensures that your client understands their obligations but also reinforces your business’s professionalism and

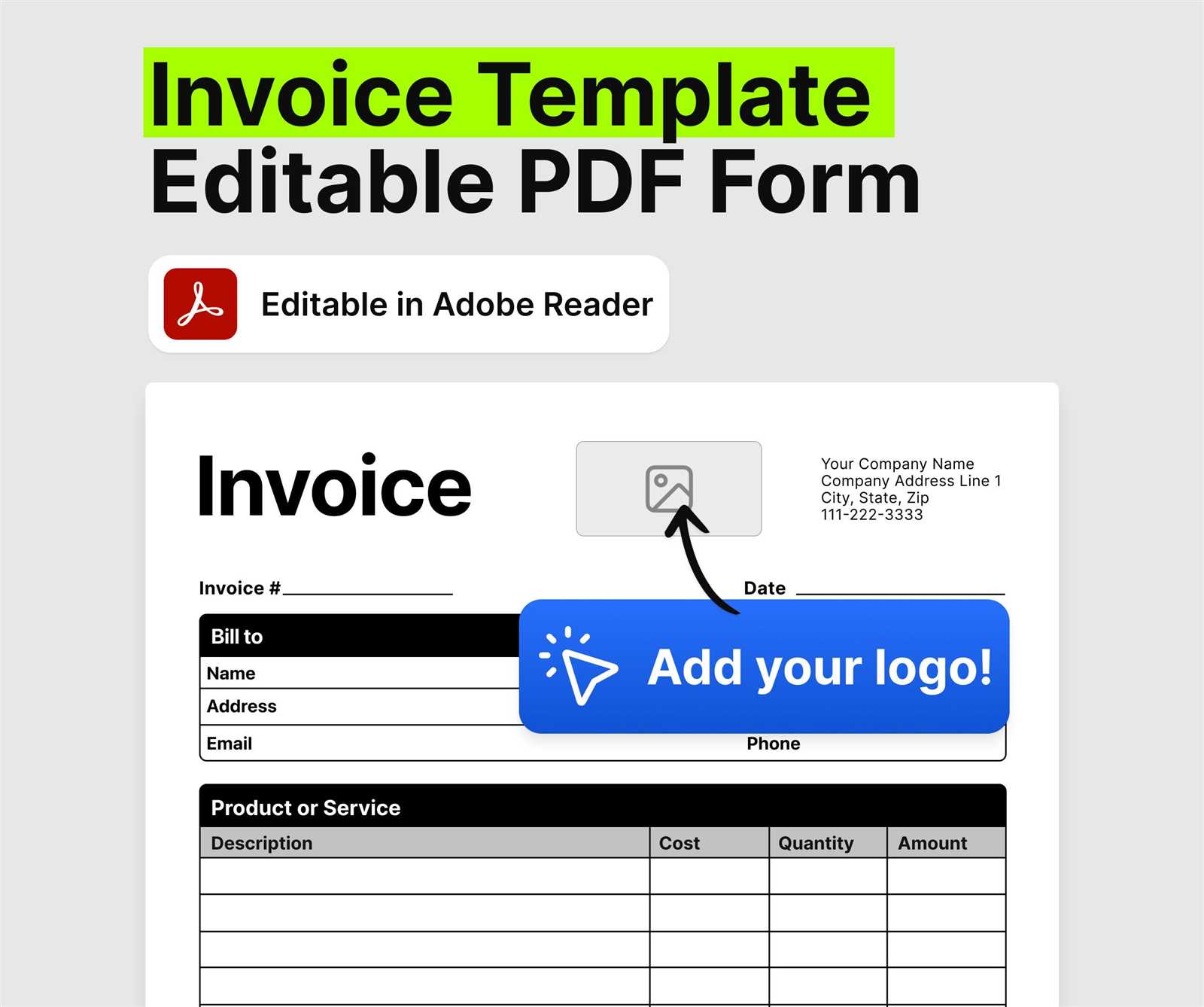

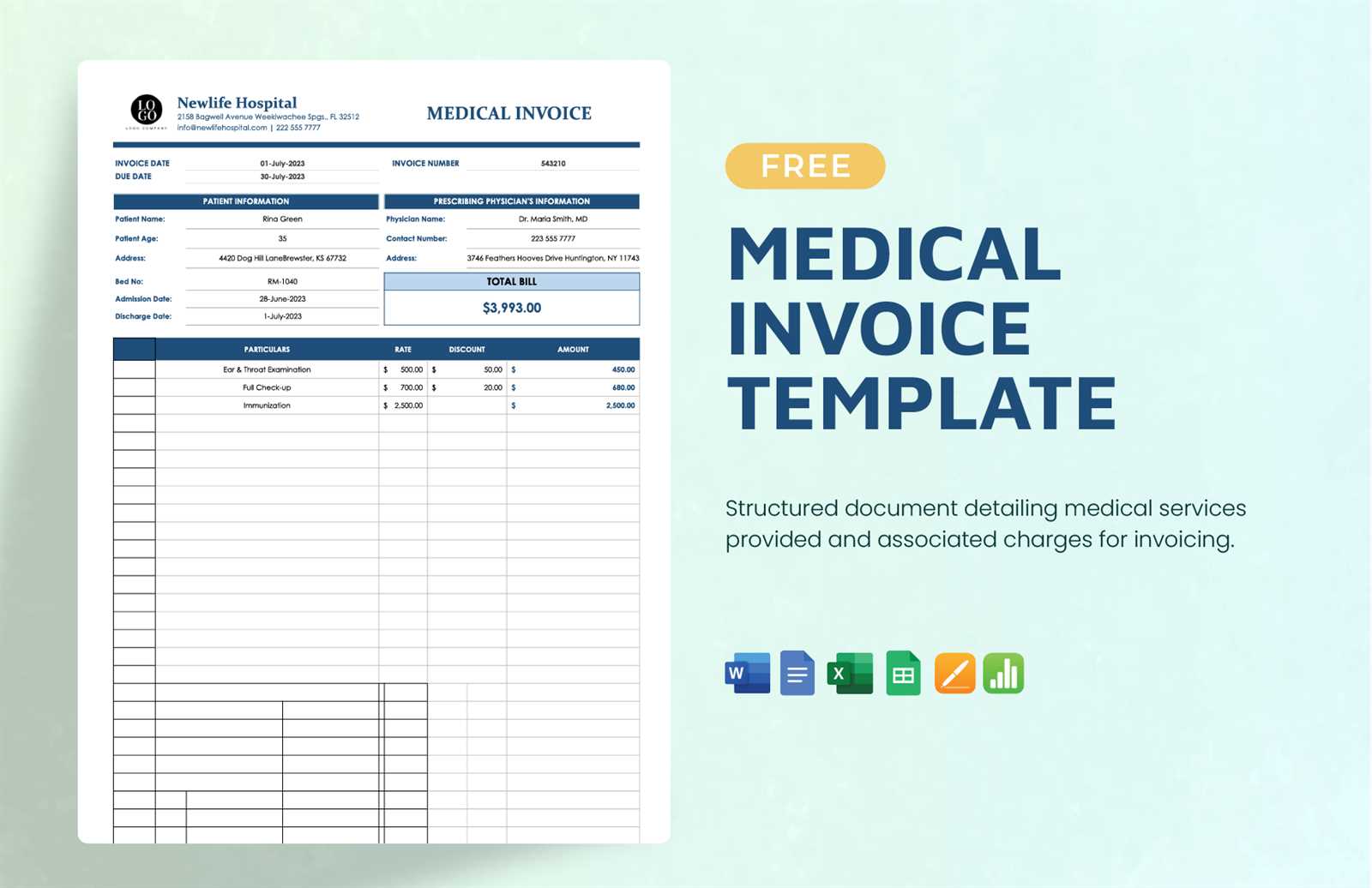

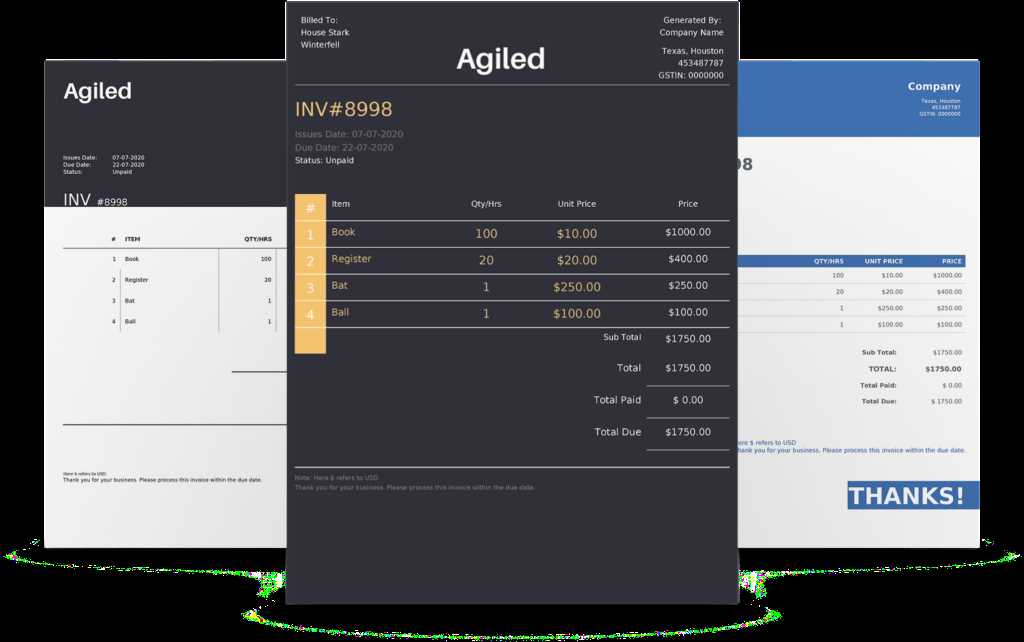

Free 30-Day Payment Document Templates

For businesses looking to streamline their billing process, using a pre-designed 30-day payment document can save time and reduce errors. These ready-made forms are especially useful for small businesses and freelancers who want a professional, organized way to request payments while maintaining clear terms for clients. The best part is that many of these forms are available for free, providing a convenient and cost-effective solution for businesses.

Benefits of Using Free Templates

- Time Savings: Free forms are designed to be quick and easy to use, allowing businesses to generate billing documents in minutes without needing to create them from scratch.

- Professional Appearance: These ready-made documents are professionally designed to ensure your business looks polished and trustworthy to clients.

- Customization Options: Many free templates offer customization features, allowing you to adjust the details such as logos, payment terms, and client information to fit your specific needs.

- Cost-Effective: Free templates eliminate the need to hire a designer or purchase expensive software, making them an ideal solution for startups and small businesses.

Where to Find Free 30-Day Payment Forms

Many online platforms offer free downloadable versions of these forms. You can find them on:

- Business Websites: Many business resource websites offer free forms for download, along with guides on how to use them effectively.

- Office Software: Programs like Microsoft Word or Google Docs often have free templates available within their systems that can be easily adapted for your use.

- Specialized Platforms: Websites dedicated to small business resources frequently offer free and customizable billing documents designed to meet common payment terms.

By taking advantage of these free resources, businesses can quickly set up an efficient and professional payment process, ensuring a smoother transaction experience for both parties.

Customizing Your 30-Day Payment Document

Personalizing a 30-day payment document is an important step in ensuring that it aligns with your business branding and meets the specific needs of your clients. Customization allows you to make the document more professional and relevant to your business operations, providing a clear and cohesive look that helps strengthen your relationships with clients. Whether you’re modifying a pre-designed form or creating your own, there are several key elements that can be tailored to reflect your unique brand and ensure efficient communication.

| Customization Element | How to Customize |

|---|---|

| Business Information | Update your business name, logo, contact details, and website to make the document official and easily recognizable. |

| Client Details | Modify the client’s name, company name, and address to ensure that the document is directed correctly. |

| Terms and Conditions | Adjust payment terms, penalties for late payments, and any discounts or offers that may apply to the transaction. |

| Design and Layout | Personalize the look by selecting fonts, colors, and spacing that reflect your business identity, making the document both functional and visually appealing. |

By tailoring these elements, you ensure that your 30-day payment document serves its purpose effectively while also reinforcing your professional image. Customization is a simple yet powerful way to create a more personalized experience for your clients, leading to smoother transactions and stronger business relationships.

Common Mistakes to Avoid in Payment Documents

While creating a billing document with a clear payment period is essential for smooth transactions, several common errors can lead to confusion, delays, or disputes with clients. By being aware of these mistakes, businesses can avoid unnecessary complications and maintain positive relationships with their customers. Below are some of the most frequent issues to watch out for when preparing your payment statements.

- Incorrect Due Date: Failing to clearly specify the due date or making an error in calculating it can lead to confusion about when payment is expected. Always ensure the due date is clearly marked and corresponds with the 30-day period.

- Omitting Payment Instructions: Without clear payment details, clients may struggle to make their payments. Be sure to include information on how payments should be made, such as bank account numbers or payment platforms.

- Missing Contact Information: If your contact details are incomplete or incorrect, clients may not be able to reach out with questions or payment concerns. Always double-check your contact information to ensure it’s accurate.

- Not Itemizing Services or Products: Providing a vague description of the services or products can lead to misunderstandings. List each item or service with clear details to avoid any confusion about what the client is being charged for.

- Failing to Include Late Fees: If your payment terms include penalties for late payments, make sure these are clearly outlined in the document. This helps set expectations and encourages timely payments.

- Inconsistent Formatting: A document that is hard to read due to inconsistent fonts, spacing, or layout can lead to confusion. Ensure that the document is neat and easy to navigate, with all information clearly separated and easy to find.

By avoiding these common mistakes, you can create a clear and professional billing statement that helps ensure timely payments and maintains strong client relationships. A well-organized document can save time, reduce misunderstandings, and create a more efficient billing process for both you and your clients.

How to Calculate Payment Due Dates

Accurately calculating the payment due date is a crucial aspect of ensuring that both you and your clients understand when the transaction needs to be completed. For businesses offering a specific payment period, like 30 days, it’s important to calculate the due date correctly to avoid confusion or missed payments. This process is straightforward but requires attention to detail to ensure both the date and the terms are clearly communicated.

Steps for Calculating the Due Date

Follow these simple steps to calculate the payment due date:

- Identify the Transaction Date: Start by noting the date when the goods or services were provided or the agreement was made. This will serve as the reference point for the payment period.

- Determine the Payment Term: For most standard business terms, this will be 30 days. However, if your agreement includes different terms (e.g., 15, 45, or 60 days), use that duration instead.

- Count the Days: Starting from the transaction date, count the days forward to reach the agreed-upon payment period. Make sure to include weekends and holidays unless stated otherwise in your payment terms.

- Adjust for Weekends and Holidays: If the due date falls on a weekend or holiday, adjust it to the next business day. This ensures that your client has a clear, realistic deadline to meet.

Example Calculation

Let’s assume you provided a service on October 1, and your payment terms are 30 days. Here’s how you would calculate the due date:

- Transaction Date: October 1

- Payment Terms: 30 days

- Due Date: October 31

If October 31 falls on a weekend, adjust the due date to the next business day (e.g., November 2). This keeps the payment expectations clear and r

Legal Considerations for 30-Day Payment Terms

When establishing payment terms with a 30-day period, businesses must ensure that the terms are legally sound and enforceable. It’s important to be aware of the legal framework that governs these agreements to avoid potential disputes or complications down the line. Clear and legally compliant payment terms protect both parties and help maintain professional relationships. Below are key legal aspects to consider when setting up such payment terms.

Contractual Clarity and Specificity

Clearly defined terms are essential for any legally binding agreement. When offering a 30-day payment period, it’s crucial that the terms of payment are clearly stated in writing. This includes the exact due date, late payment penalties, and any conditions that may apply to early payment or discounts. By including these details in your agreement, you minimize the risk of misunderstandings.

Late Fees and Penalties

Many businesses include late fees or interest charges for overdue payments. If you plan to impose such fees, it is important to clearly state the conditions under which these penalties will apply. Make sure to comply with local laws regarding interest rates and late payment penalties, as these can vary significantly depending on your jurisdiction. Without a clearly defined policy on late fees, you may be unable to enforce them legally.

Additionally, the consumer protection laws in your area may govern how these penalties are applied, so it’s wise to consult with a legal professional to ensure your payment terms comply with local regulations.

Jurisdiction and Dispute Resolution

It’s also important to define the jurisdiction under which disputes will be settled. If a payment disagreement arises, specifying the location where disputes will be resolved ensures that both parties are clear on the legal framework governing the agreement. Many businesses choose to specify arbitration or mediation as preferred methods of dispute resolution, which can be a faster and more cost-effective way to resolve conflicts compared to litigation.

Being aware of these legal considerations will help you set clear and enforceable payment terms, reducing the risk of future disputes while ensuring that your business operat

How 30-Day Payment Terms Affect Cash Flow

Offering a 30-day payment period can significantly impact your business’s cash flow. While these terms are common in many industries and provide flexibility for clients, they also mean that businesses must plan carefully to ensure they have sufficient working capital during the waiting period. Understanding how this payment structure affects cash flow is essential for businesses to maintain smooth operations and avoid financial strain.

Delayed Revenue Recognition

When a payment term of 30 days is agreed upon, businesses are required to wait a full month before receiving payment for goods or services provided. This delay can create a gap between delivering products or services and receiving the revenue. If a business has several clients with similar terms, this delay can accumulate, potentially creating cash flow issues, especially for companies with high operating costs.

Businesses that rely heavily on cash flow for daily operations need to plan for these delays by maintaining a buffer in their reserves. Having a solid cash management strategy can help avoid disruptions caused by delayed payments.

Impact on Short-Term Liabilities

The 30-day payment cycle can affect how quickly a company can cover its short-term liabilities, such as salaries, rent, or utilities. If payments from clients are delayed or inconsistent, businesses may struggle to meet their financial obligations on time. In such cases, companies might need to rely on credit or loans to bridge the gap between when expenses are due and when payments are received.

To mitigate these risks, businesses should consider maintaining a flexible credit policy, diversifying their payment terms, or establishing a line of credit to ensure liquidity during slower periods. Analyzing cash flow regularly helps ensure that the business remains solvent while waiting for payments to come through.

By understanding how 30-day payment terms affect cash flow, businesses can better manage their finances and avoid the pitfalls of delayed payments, ensuring smoother financial operations and long-term sustainability.

How to Track Unpaid 30-Day Payment Documents

Tracking unpaid payments is crucial for maintaining healthy cash flow and avoiding financial disruptions. When offering a 30-day payment period, it’s essential to have a clear system in place to monitor overdue payments. Keeping track of outstanding balances ensures that you can take timely actions, such as sending reminders or following up with clients. Here are some effective methods to track unpaid 30-day payment documents and ensure timely payments.

Methods for Tracking Unpaid Payments

There are several ways to monitor outstanding balances and ensure that payments are made on time:

- Manual Tracking: For smaller businesses, keeping a spreadsheet with all payment details can be an effective way to monitor unpaid amounts. By entering key details such as client name, due date, amount due, and payment status, you can quickly see which payments are overdue.

- Accounting Software: Using accounting software can automate much of the tracking process. Many software options allow you to input payment terms and due dates, automatically flagging unpaid amounts once the due date passes. This ensures no payment is overlooked.

- Payment Reminders: Setting up reminders, either manually or through your accounting system, will ensure that you follow up promptly when payments are overdue. Regular reminders can encourage clients to prioritize their outstanding balances.

Tracking System Overview

The table below illustrates a simple method for tracking unpaid payments using a manual tracking system:

| Client Name | Transaction Date | Amount Due | Due Date | Status |

|---|---|---|---|---|

| Client A | October 1 | $1,000 | October 31 | Unpaid |

| Client B | October 5 | $500 | November 4 | Paid |