How to Create an Ndis Invoice Template

Efficiently managing financial documentation is crucial for any service provider. Properly formatted billing statements ensure clarity for both providers and clients, reducing errors and delays in payments. Having a standardized structure for these documents simplifies the process and ensures compliance with relevant regulations.

In this guide, we will explore how to design a well-structured billing form that caters to the specific needs of service-based industries. This document should include essential details, such as service descriptions, payment terms, and contact information, while also being easy to customize for different clients.

By focusing on accuracy and consistency, service providers can streamline their billing process, leading to faster payments and fewer disputes. Whether you’re managing a small business or a larger organization, adopting a standardized approach to financial documentation can enhance professionalism and efficiency.

Understanding NDIS Invoice Templates

For service providers working with governmental or healthcare programs, creating clear and professional billing documents is essential. These documents must not only detail the services rendered but also comply with specific industry regulations. Understanding how to structure these documents effectively ensures that payments are processed without delay and in line with the requirements of funding bodies.

Key Elements of a Billing Document

Each billing document should include several critical components to guarantee that it meets the necessary standards. These elements help streamline the payment process, avoid discrepancies, and ensure that clients understand the charges. The following table outlines the key components that should be included:

| Component | Description |

|---|---|

| Client Information | Details such as name, address, and contact information. |

| Service Details | A clear description of the services provided, including dates and duration. |

| Pricing | Breakdown of costs for each service or product provided. |

| Payment Terms | Payment due dates, accepted methods, and any discounts or late fees. |

| Reference Numbers | Unique identifiers for the billing document and client for tracking purposes. |

Why Structure Matters

The correct arrangement of these elements ensures that both the provider and client have a mutual understanding of the billing process. It also helps in maintaining transparency, which is essential when handling funding or reimbursement programs. By adhering to a clear, consistent format, service providers can minimize confusion and improve the efficiency of financial transactions.

What is an NDIS Invoice Template

A well-structured billing document is essential for service providers who need to submit payment requests in compliance with specific regulations. Such documents allow service providers to clearly communicate the services rendered, associated costs, and payment terms to clients or funding bodies. Using a predefined structure makes the process more efficient and ensures consistency in each submission.

Purpose of a Standardized Billing Document

These financial documents serve several key purposes in ensuring smooth transactions between service providers and clients. By following a set structure, it becomes easier to maintain accuracy and transparency. The main goals are to:

- Clearly outline the services provided and their costs.

- Ensure all required information is included for easy processing.

- Facilitate quicker approval and payment by clients or organizations.

- Minimize errors and misunderstandings in financial transactions.

Core Elements of the Billing Document

To meet these goals, a properly structured document should contain the following key elements:

- Service Description: Clear details on the nature of the services rendered, including dates and duration.

- Client Information: Full details of the recipient, including name, address, and contact

Key Features of NDIS Invoices

Creating accurate and detailed billing documents is essential for service providers to ensure timely payments and compliance with industry guidelines. The key features of such documents are designed to clearly present the services provided, the costs involved, and the necessary payment details. These elements help to avoid confusion and ensure smooth financial transactions.

Essential Components for Clear Billing

Each billing document should be structured to include specific components that meet regulatory standards and make it easy for the recipient to process the payment. The most important features include:

- Detailed Service Descriptions: A clear explanation of the services provided, including dates, times, and specific tasks completed.

- Accurate Pricing Information: A breakdown of costs for each service or product, including unit rates and any applicable discounts or surcharges.

- Client Identification: Full details of the client, including name, address, and identification numbers, ensuring that the payment is directed to the correct recipient.

- Payment Terms: Clear instructions regarding payment deadlines, acceptable methods of payment, and any penalties for late payments.

- Unique Reference Number: A specific identifier for the document, allowing for easy tracking and future reference.

Ensuring Compliance and Accuracy

The inclusion of these key features ensures that the document adheres to regulatory requirements and helps both the provider and the recipient to quickly verify the details. This structure not only makes the process more efficient but also reduces the risk of delays or disputes over payment. By focusing on these elements, service providers can ensure that their financial documents are accurate and easily processed.

Why You Need an NDIS Template

For service providers working within regulated sectors, having a standardized structure for financial documentation is crucial. It ensures that all necessary information is included, reduces the risk of errors, and streamlines the overall billing process. A consistent format not only aids in the quick processing of payments but also helps maintain clarity and professionalism in communications with clients and funding bodies.

Benefits of Using a Standardized Document

Adopting a predefined structure for your billing statements offers numerous advantages, including:

- Improved Accuracy: A set format ensures that all required details are included and nothing is overlooked, reducing the chance of mistakes.

- Faster Payment Processing: With all necessary information presented clearly, clients and organizations can process payments without delays.

- Consistency: Using the same structure for each submission ensures that there is no confusion between different clients or service periods.

- Compliance: A standardized document helps ensure that all regulatory requirements are met, avoiding potential issues with reimbursement or funding approvals.

Streamlining Your Workflow

By using a standardized approach, service providers can save time on each billing cycle. Instead of manually creating new documents from scratch, a template allows for quicker customization and submission. This streamlined workflow ultimately leads to more efficient financial management, helping service providers focus on delivering high-quality care while minimizing administrative tasks.

How to Customize Your NDIS Invoice

Personalizing your financial documents allows you to tailor them to your specific needs, ensuring that all relevant information is included for each client. Customization can help make your billing process more efficient and provide a professional appearance that aligns with your branding. By adjusting key sections of the document, you can ensure it meets the unique requirements of each service and client while maintaining compliance with industry standards.

To effectively customize your billing document, focus on the following key areas:

- Client Information: Ensure that the document includes the client’s full name, address, and any relevant identification numbers. Customizing this section for each client avoids confusion and ensures proper tracking of payments.

- Service Details: Modify the description of services provided to reflect the specific tasks completed for each client. This section should include dates, hours worked, and any specific details related to the service provided.

- Pricing Breakdown: Adjust the pricing to reflect the rates agreed upon with each client, including any applicable discounts, taxes, or additional charges. This ensures transparency and avoids misunderstandings about costs.

- Payment Instructions: Customize the payment terms to include due dates, payment methods, and any late fees or early payment discounts. This section should be clear to prevent delays in payment processing.

By focusing on these elements, you can ensure that each document is both accurate and professional. Customizing your billing documents not only improves your workflow but also enhances client trust and satisfaction.

Common Errors in NDIS Invoices

While preparing financial documents, it’s easy to overlook details that could cause delays or issues with payment processing. Common mistakes can lead to confusion, unnecessary back-and-forth, or even non-payment. By being aware of these errors, service providers can take steps to avoid them, ensuring smoother financial transactions and faster payments.

Frequent Mistakes to Avoid

Some of the most common errors in billing documents include:

- Missing Client Information: Not including the client’s full name, contact details, or identification number can lead to confusion, especially if there are multiple clients with similar names.

- Incorrect Service Descriptions: Failing to clearly describe the services provided, or listing inaccurate dates or times, can create misunderstandings and disputes.

- Pricing Errors: Including the wrong rates, missing taxes, or miscalculating the total cost can lead to payment delays or a refusal to pay until corrections are made.

- Omitting Payment Terms: Not clearly stating payment deadlines, accepted payment methods, or consequences for late payments can cause confusion and result in delayed transactions.

- Inaccurate Reference Numbers: Missing or incorrect reference numbers can make it difficult for clients or funding bodies to track the document, leading to processing delays.

Preventing Errors and Ensuring Accuracy

To avoid these issues, it’s essential to carefully review each document before submission. Double-check all the key details, such as service descriptions, prices, and client information, to ensure they are correct. By catching these common mistakes early, you can ensure that your documents are processed smoothly and payments are made on time.

Benefits of Using Templates for Billing

Using a standardized format for your financial documents can significantly improve efficiency and accuracy. Pre-designed structures help streamline the billing process, ensuring that all necessary details are included, reducing the chance of mistakes, and making the overall workflow more consistent. This approach benefits both service providers and clients by making transactions clearer and faster.

Time-Saving and Efficiency

One of the main advantages of using a predefined structure for billing documents is the amount of time saved. Instead of creating a new document from scratch each time, you can quickly adjust and customize an existing format. This efficiency allows you to focus more on service delivery rather than administrative tasks.

Consistency and Professionalism

Another key benefit is the consistency in presentation. A set format ensures that all necessary information is always included, providing a professional appearance that can increase client trust and satisfaction. By maintaining a uniform approach to all financial transactions, you present a more organized and reliable business image.

Overall, using a structured format for your billing ensures that all payments are processed on time, mistakes are minimized, and clients receive clear and accurate financial documents. This leads to smoother operations and a more streamlined approach to business management.

Best Practices for NDIS Invoicing

To ensure timely payments and maintain professional relationships with clients, it’s essential to follow certain guidelines when preparing financial documents. By adhering to best practices, service providers can avoid common mistakes, streamline their billing process, and foster greater trust with their clients. Implementing these practices helps in maintaining accuracy, consistency, and compliance with industry standards.

Key Practices to Follow

- Include Clear Service Descriptions: Always provide detailed descriptions of the services provided, including specific dates, hours, and any special instructions. This ensures transparency and helps clients understand what they are being charged for.

- Ensure Correct Pricing: Double-check that rates are accurate and in line with agreements. Be sure to list any discounts, taxes, or additional fees separately to avoid confusion.

- Use a Standardized Format: Consistently use a format that includes all required information, such as service descriptions, client details, and payment terms. This consistency improves readability and reduces errors.

- Clearly Define Payment Terms: State payment deadlines, acceptable methods of payment, and any penalties for late payments. Clear instructions help avoid delays and misunderstandings.

- Track Payments and Deadlines: Keep a record of submitted documents, payment dates, and outstanding amounts. This will help you stay organized and follow up promptly if payments are

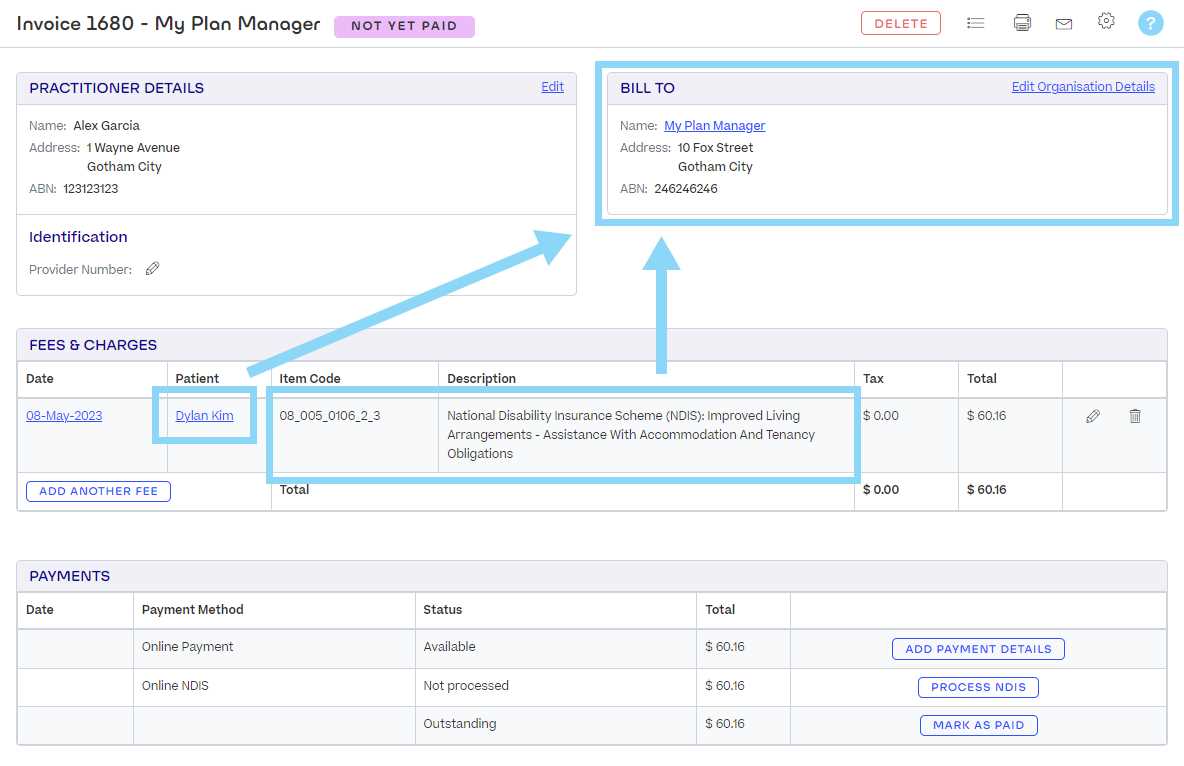

Steps to Create an NDIS Invoice Template

Creating a well-organized and effective billing document is essential for service providers who need to submit clear and accurate statements. By following a step-by-step approach, you can ensure that all the necessary components are included, making the process smoother and reducing the risk of errors. A properly structured document simplifies payment tracking and enhances professionalism.

To create an effective financial statement format, follow these steps:

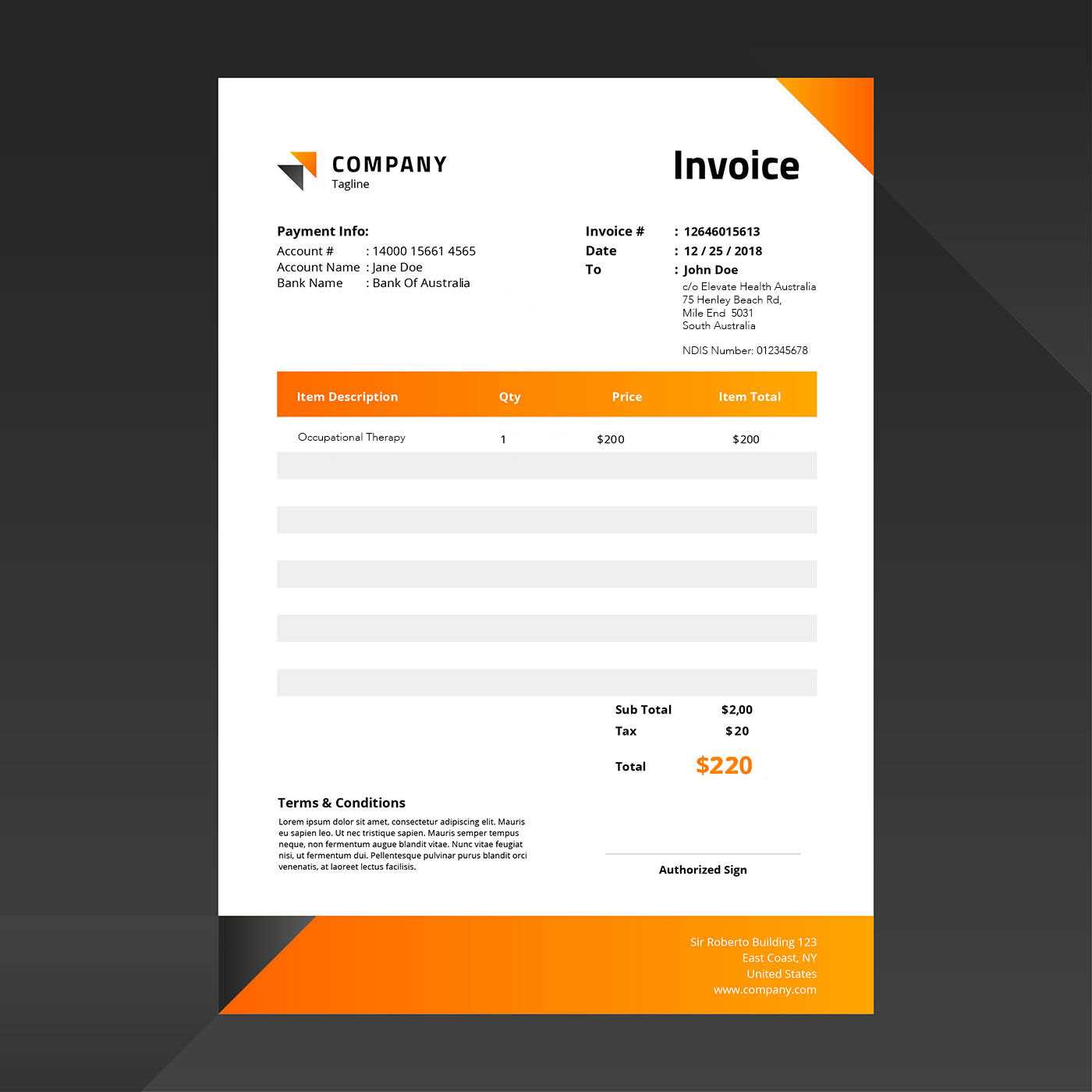

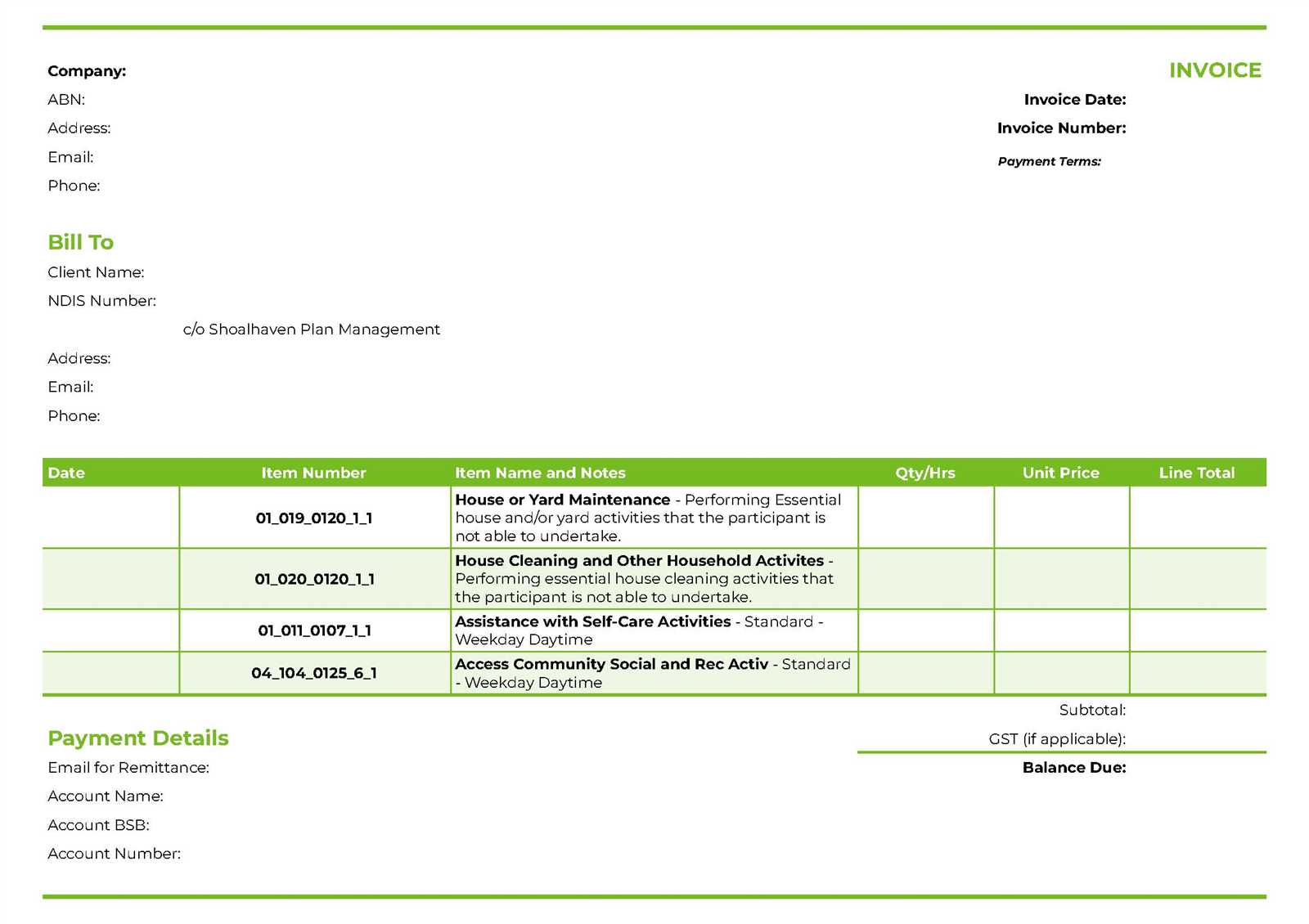

- 1. Choose a Layout: Start by selecting a layout that is simple yet professional. A clean design ensures that all information is easy to find and read. Consider including a header with your business name and contact details.

- 2. Add Client Information: Include fields for the client’s full name, address, and contact details. It’s essential to ensure this section is customizable for each client to avoid errors.

- 3. Define Service Details: Create sections where you can list the specific services provided, including dates, hours worked, and descriptions of the tasks completed. This section should be adaptable based on each client’s unique needs.

- 4. Include Pricing and Calculations: Clearly outline the costs for each service or task performed. Include areas for unit prices, quantities, and any applicable taxes or discounts, along with the total amount due.

- 5. Set Payment Terms: Establish a section for payment terms, including due dates, accepted payment methods, and any penalties for late payments. This ensures clarity for both parties.

- 6. Save as a Reusable Format: Once you’ve created the document structure, save it in a reusable format, such as a PDF or Word document, so it can be easily adapted for future use.

By following these steps, you’ll have a structured and efficient billing format that ensures accuracy, reduces administrative work, and helps maintain professional standards in your financial communications.

How to Ensure Compliance with NDIS Guidelines

Following the proper guidelines for preparing and submitting financial documents is crucial to ensure that all parties involved are protected and that payments are processed efficiently. Compliance with industry regulations helps minimize errors and prevents delays in receiving payments. By understanding and applying the necessary rules, you can maintain the integrity of your financial transactions.

Key Compliance Requirements

It is essential to include all necessary details and follow specific rules when preparing documents to ensure compliance. The table below outlines some key aspects to consider:

Requirement Description Client Information Ensure that the client’s name, contact details, and identification number are included to avoid any confusion. Service Details Clearly describe the services rendered, including dates, times, and the nature of the work performed. Pricing Structure Provide a breakdown of costs, including service rates, taxes, and any applicable discounts or additional charges. Payment Terms Specify payment deadlines, accepted payment methods, and any penalties for late payments to ensure clarity and avoid disputes. Documentation Ensure all required supporting documents are included, such as service agreements or reports, to justify the charges. Steps to Stay Compliant

- Stay Updated: Regularly review any changes to industry standards and guidelines to ensure your documents are up to date.

- Use Approved Formats: Use formats and templates that comply with regulations to ensure all necessary information is included.

- Accurate Record Keeping: Maintain thorough records of all services provided and payments made to support future audits and reviews.

- Regular Audits: Perform internal audits to check that your documents consistently meet regulatory requirements and improve your billing process

Choosing the Right Software for Invoicing

Selecting the right software to manage billing tasks is crucial for maintaining efficiency, accuracy, and compliance in financial transactions. The ideal tool should be easy to use, customizable, and capable of generating error-free statements. With the right software, service providers can streamline the billing process, reduce administrative burden, and ensure that all client details and service charges are properly documented.

Factors to Consider When Choosing Software

- User-Friendliness: Choose a platform that is intuitive and easy to navigate. The simpler it is to use, the less time you’ll spend on training and the fewer mistakes you’ll make.

- Customization Options: Make sure the software allows you to tailor the documents to meet your specific needs, such as adding custom fields, service descriptions, or pricing structures.

- Compliance Features: Select a tool that ensures your financial statements adhere to the relevant regulations. This is particularly important for avoiding delays and ensuring smooth payments.

- Automation: Look for software that offers automation features, such as recurring billing and automatic payment reminders. These tools can save time and reduce the risk of human error.

- Integration with Other Systems: Opt for a solution that integrates seamlessly with your existing accounting or management software. This helps avoid double entry and ensures accuracy across all platforms.

- Customer Support: Good customer support is essential for troubleshooting issues quickly and ensuring your software runs smoothly.

Popular Software Options

- QuickBooks: A widely used option that offers comprehensive invoicing and accounting features, making it suitable for businesses of all sizes.

- FreshBooks: Known for its user-friendly interface and strong customer support, this tool is ideal for freelancers and small businesses.

- Zoho Books: A cost-effective solution that integrat

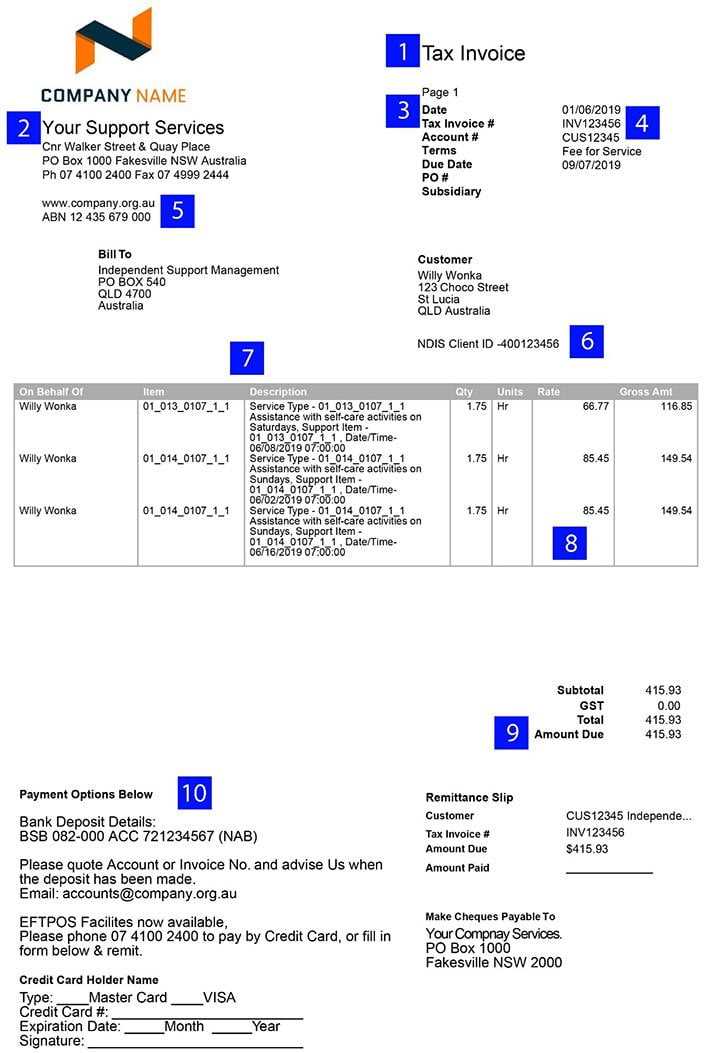

Understanding Billing Codes and Guidelines

In any industry that deals with providing services to clients, it is crucial to follow a clear and structured system for documenting and processing payments. This ensures that all charges are legitimate, transparent, and align with industry regulations. Billing codes and associated guidelines are vital tools in this process, helping to categorize services accurately and ensuring that payments are processed smoothly and in accordance with set standards.

What Are Billing Codes?

Billing codes are standardized numerical or alphanumeric identifiers used to classify specific services, products, or procedures. These codes make it easier to track services provided and ensure that each charge is appropriately linked to a specific service rendered. Correct use of these codes is essential for accuracy in documentation and for ensuring that payments are made correctly and in a timely manner.

- Standardization: Billing codes help maintain consistency in the documentation process, making it easier for providers and payers to understand the charges and services involved.

- Compliance: Proper use of codes ensures that billing is compliant with regulations and avoids issues related to incorrect or incomplete submissions.

- Accuracy: Using the right codes helps reduce errors in service billing and increases the chances of faster payment processing.

Key Guidelines to Follow

In addition to understanding billing codes, it is important to follow specific guidelines when preparing billing documents. These guidelines dictate how to structure and submit claims, ensuring they meet regulatory requirements and minimize the risk of errors or rejections. Common guidelines include:

- Detailed Descriptions: Always include a clear and concise description of the services provided, ensuring that the client and payer can easily understand what is being billed.

- Accurate Dates and Times: Provide precise information about the service date and duration, as well as any relevant details such as location or special conditions.

- Correct Codes: Ensure that the correct billing codes are used to categorize each service. Using inaccurate or outdated codes can lead to payment delays or denials.

- Clear Payment Terms: Specify payment deadlines and accepted payment methods, including any applicable la

Common Mistakes to Avoid in Billing

Billing errors can lead to delays in payments, confusion for clients, and compliance issues. Avoiding common mistakes in the billing process is essential for ensuring that payments are processed smoothly and accurately. From missing information to incorrect charges, these mistakes can cause unnecessary complications that could have been easily prevented with careful attention to detail.

Missing or Incorrect Client Information

One of the most frequent errors in billing documents is the omission or inaccuracy of client details. This can result in claims being rejected or delayed, as it makes it difficult for the payer to match the document with the correct client. Ensure that the full name, address, contact details, and unique identifiers of the client are included correctly.

- Full Name: Double-check the spelling and accuracy of the client’s name to avoid discrepancies.

- Unique Identifiers: Make sure any unique codes or reference numbers are accurately entered to avoid confusion.

- Contact Information: Verify that the correct phone number and email address are listed for follow-up communication.

Using Incorrect Service Codes

Each service provided should be categorized correctly using the appropriate billing code. Incorrect codes can lead to delays in payment processing and may even result in claims being rejected. Always make sure to cross-check the codes with the latest available guidelines and updates to ensure accuracy.

- Outdated Codes: Be sure to use the most current service codes to avoid issues with payment processing.

- Misassigned Codes: Ensure that each service is correctly categorized, especially when multiple services are provided in a single document.

Not Including Detailed Descriptions

Vague or unclear descriptions of services can cause confusion and result in rejected claims. Each service or product provided should be described in sufficient detail to help the payer understand exactly what was delivered. Always include specific details such as dates, service durations, and any special conditions that apply.

- Service Dates:

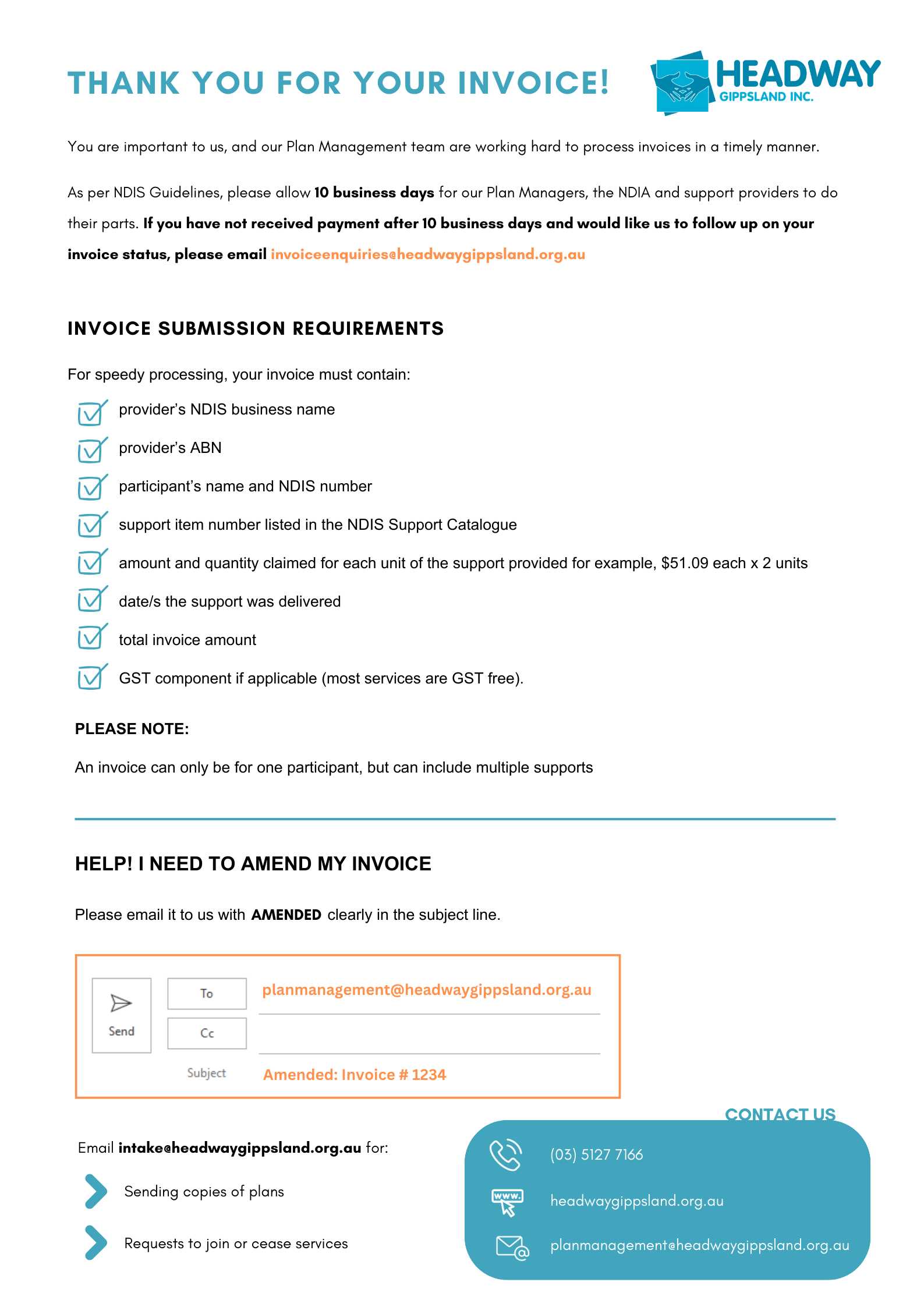

How to Submit Your Billing Documents Correctly

Submitting billing records accurately and following the correct procedure is vital for ensuring timely payment and avoiding delays. When the submission is done incorrectly, it can lead to rejections, processing issues, and extended waiting periods. To ensure a smooth process, it’s essential to follow a series of steps to meet all the requirements and guidelines.

Step 1: Verify All Required Information

Before submitting any billing documents, double-check that all the necessary details are included. Missing or incorrect information can result in rejections and delays in processing. Make sure that you have provided complete and accurate details about the client, services rendered, and charges. Below is a checklist of important details to verify:

Required Information Action Client’s Full Name Ensure the spelling is correct and matches the official records. Client’s Address Verify that the address is up-to-date and correct. Service Date and Duration Confirm that the dates and hours of service are accurate. Service Description Include a clear description of the services provided with no ambiguity. Billing Amount Ensure that all amounts are calculated correctly and include applicable taxes. Step 2: Submit Through the Correct Channel

It is important to submit the completed documents through the proper platform or system designated by the payer. Some may require electronic submissions via online portals, while others may accept physical copies. Make sure you follow the guidelines on how to submit, including file formats, submission deadlines, and any supporting documentation needed.

- Electronic Submission: Verify that the correct file format is used (e.g., PDF, Excel) and that the file is named appropriately.

- Physical Submission:

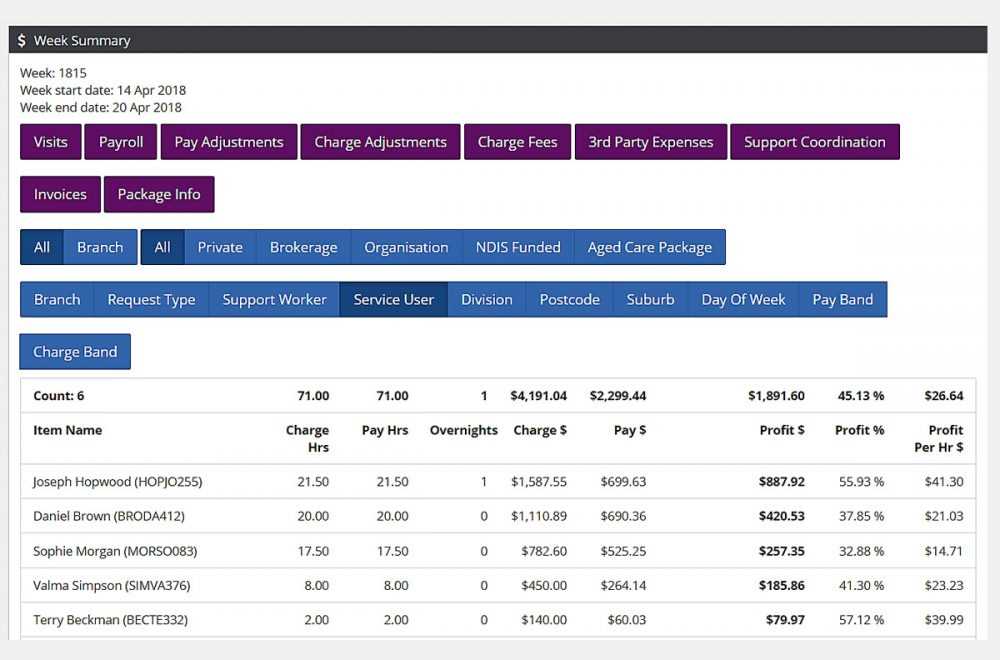

Tracking Payments from Clients

Efficiently tracking payments is crucial for managing financial records and ensuring that all transactions are processed on time. Without a clear tracking system, it becomes difficult to reconcile accounts and ensure timely reimbursement for services rendered. By setting up proper tracking methods, you can easily monitor the status of your payments and take quick action if any discrepancies arise.

Methods for Tracking Payments

There are several effective ways to track payments from clients. Depending on the volume of transactions and available resources, you can choose a method that suits your needs. Below are some common options:

- Spreadsheet Tracking: Create a spreadsheet to monitor payments. Each entry should include details like the client’s name, payment amount, date received, and payment status.

- Accounting Software: Use specialized accounting software to manage and track client payments automatically. These tools can generate reports, send reminders, and sync with bank accounts.

- Manual Ledger: For smaller operations, a manual ledger can work to keep track of transactions. Ensure that all details are logged promptly to avoid errors.

Important Information to Record

When tracking payments, it’s essential to record key information accurately to avoid confusion and discrepancies. Some important details to include are:

- Client Information: Always log the client’s full name, reference number, or account ID.

- Payment Amount: Include the exact amount received, ensuring that it aligns with the agreed-upon amount.

- Payment Date: Track when the payment was made to keep a record of payment history.

- Payment Method: Note whether the payment was made via bank transfer, cheque, or other methods.

- Outstanding Balance: Regularly update any unpaid amounts or credit adjustments to stay informed of the client’s balance.

By maintaining an organized payment tracking system, you can ensure that all transactions are accounted for and reduce the likelihood of errors or payment delays. Regular reviews of your payment status will also allo

Templates for Different Service Types

Different services often require distinct approaches to documentation, and it’s essential to tailor your billing and record-keeping to the specific needs of each service type. Depending on the nature of the support or assistance provided, the format and structure of the documentation may vary. Customizing your forms to match the service provided ensures clarity, compliance, and smooth processing of payments.

Support Services

For services providing direct support, such as personal care or assistance with daily activities, it’s crucial to have a clear breakdown of hours worked, services provided, and the corresponding rates. These records often include the following key details:

- Hours of Service: Clearly document the duration of the service provided.

- Type of Support: Specify the exact nature of the support, whether it is personal care, transportation, or community access.

- Service Provider Details: Include the name, contact information, and registration number of the service provider.

Therapeutic and Allied Health Services

For services related to therapy or allied health, such as physiotherapy or occupational therapy, the documentation should reflect the treatment provided. Essential elements for these services may include:

- Type of Therapy: Specify the therapy provided (e.g., speech therapy, physiotherapy).

- Assessment and Goals: Include details of any assessments done and the goals set for the client’s progress.

- Treatment Plan: Outline the steps or methods employed during each session.

Plan Management and Administration

When managing the overall plan for the client, including funding allocation and budget management, it is important to keep detailed records of all transactions and services booked. These records often require:

- Funding Allocations: Clear breakdowns of how funds are allocated for different services or supports.

- Service Agreements: Include detailed agreements about what services are provided and their cost.

- Payment Schedules: Track pay

Tips for Streamlining Your Billing Process

Efficient billing is essential to maintaining smooth operations and ensuring timely payments. By optimizing your billing process, you can reduce errors, save time, and ensure that your clients are billed accurately and promptly. Here are some practical tips to help you streamline your billing procedures.

1. Automate Routine Tasks

Automation can significantly reduce the time spent on repetitive tasks, such as generating records and tracking payments. Consider using billing software that automatically populates client information and services provided, saving you from entering the same data repeatedly.

- Set up templates: Use pre-set forms for common services to quickly input details.

- Schedule reminders: Automate reminders for payment due dates to prevent delays.

2. Maintain Accurate Records

Accurate and up-to-date records are crucial for smooth billing. Keep detailed logs of services provided, hours worked, and any relevant changes in the client’s needs or funding. This will make it easier to generate accurate billing documentation when needed.

- Track services regularly: Document each service as soon as it’s completed to avoid missing any details.

- Review client agreements: Regularly update service agreements to reflect any changes in terms or rates.

3. Use Clear and Consistent Formats

Consistency is key to reducing confusion and ensuring that all parties understand the billing statements. By using standardized formats for service descriptions, pricing, and payment schedules, you will minimize errors and simplify the process for both your team and your clients.

- Adopt a consistent layout: Ensure that all billing forms follow a standardized format for clarity.

- Clearly label charges: Break down services, rates, and totals in an easy-to-understand format.

4. Integrate Payment Methods

Make it easy for clients to pay by offering a variety of payment options, such as bank transfers, online payments, or credit card processing. Integration with online payment platforms can help reduce processing time and make it easier f