NDIS Invoice Template for Word

Creating professional payment records can be a time-consuming task, but it doesn’t have to be. With the right tools, you can ensure that your billing is efficient, accurate, and in line with necessary regulations. This section will explore how to simplify the process of generating clear and organized financial documents for your services.

Using pre-designed formats offers a simple solution that can be easily adjusted to fit specific requirements. These documents are designed to meet industry standards, helping you avoid errors and ensuring compliance with essential guidelines.

By utilizing these customizable solutions, you can save time and reduce the potential for mistakes, allowing you to focus on your core tasks while ensuring timely payment. Let’s look at how to make the most of these helpful resources.

NDIS Invoice Template Overview

Managing financial documents for your services is crucial for maintaining clear records and ensuring timely payments. The use of a structured document can help streamline this process, making it easier to create and send accurate statements to your clients. This section provides an overview of how these documents work and the key elements they include.

Key Components of the Document

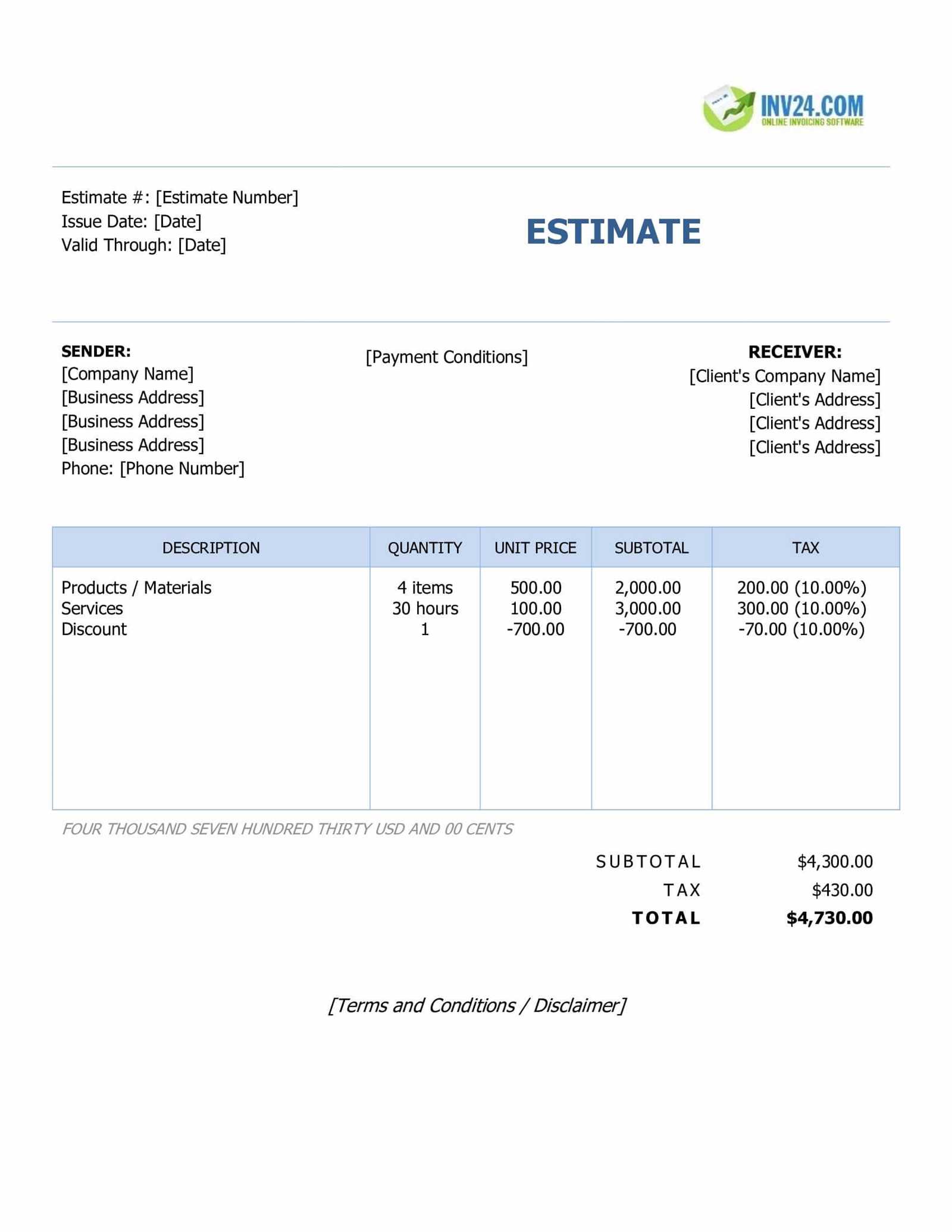

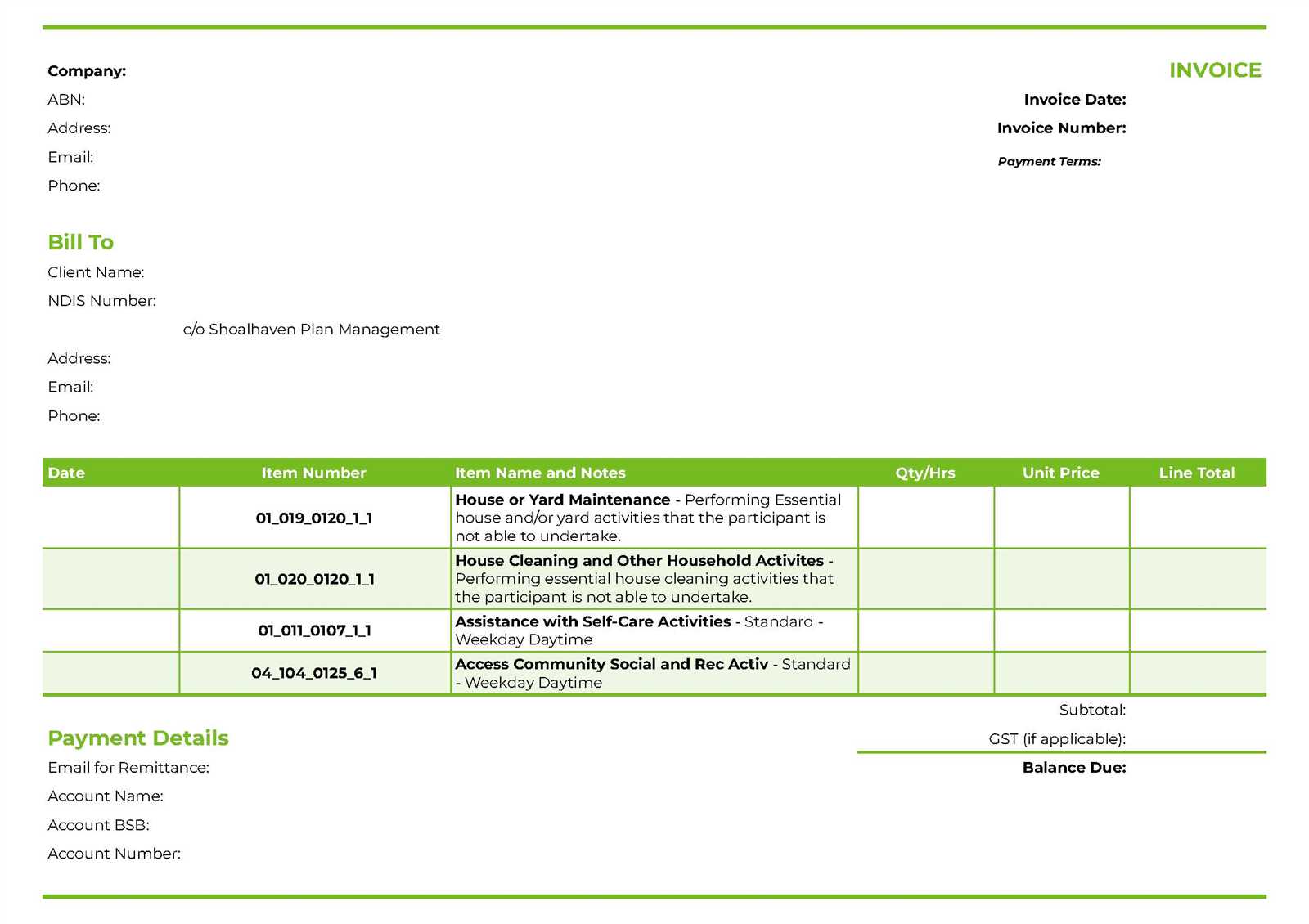

When setting up a financial record, certain fields are essential for clarity and professionalism. These elements help ensure that all necessary information is included for smooth processing and compliance with regulatory requirements. Below are the key components:

- Service Provider Details: Your name, contact information, and registration number (if applicable).

- Recipient Details: The client’s information, including name, address, and any relevant identification.

- Service Description: A clear breakdown of the services provided, including dates and specific tasks.

- Amount and Payment Terms: The total charges, payment due dates, and accepted payment methods.

- Reference Numbers: Any tracking or reference numbers necessary for both parties to identify the document easily.

Benefits of Using a Structured Document

Opting for a structured document offers numerous advantages in terms of organization and efficiency. Here are a few key benefits:

- Consistency: A standardized format ensures that every record follows the same structure, reducing the chances of missing critical information.

- Professionalism: A well-organized record reflects positively on your business, reinforcing trust with your clients.

- Efficiency: Using a predefined format saves time and effort, allowing for quick generation and modification of records when needed.

Why Use a Template for Invoices

Creating consistent and professional financial documents can be challenging, especially when managing multiple clients or transactions. Using a predefined structure helps ensure accuracy and saves valuable time, allowing you to focus on other important tasks. This section explores the advantages of relying on a structured format for your billing needs.

Time-Saving Benefits

When generating financial records, having a ready-to-use format simplifies the process. Rather than creating a new document from scratch each time, you can quickly input relevant details into an existing framework. This streamlined approach minimizes time spent on formatting and increases productivity.

Ensuring Accuracy and Compliance

Consistency is key to avoiding errors and ensuring that your documents meet necessary standards. A structured framework ensures that all required fields are included, reducing the risk of missing important information. Additionally, it helps maintain compliance with industry regulations, which may vary depending on the services provided.

Key Features of NDIS Invoice Templates

A well-structured financial document is essential for maintaining clarity and professionalism in your billing process. These documents are designed with specific elements that make the record-keeping and payment process straightforward. Below are the key features that make these formats particularly useful.

- Customizable Layout: The format is adaptable, allowing you to modify text fields, colors, and other design elements to suit your business branding or personal preferences.

- Predefined Fields: The document includes predefined sections for important details such as service descriptions, payment terms, and contact information, ensuring that nothing is overlooked.

- Compliance with Regulations: The structure often adheres to industry-specific guidelines, making it easier to ensure that your records meet legal and contractual requirements.

- Easy-to-Fill Forms: With clear placeholders and organized fields, these documents simplify data entry, allowing for quick and error-free completion.

- Automated Calculations: Some versions include built-in calculation features to automatically compute totals, taxes, and other costs, reducing the chance of mistakes.

- Multiple Export Options: You can save and share the document in various formats, such as PDF, for easy delivery to clients and quick archiving.

How to Download the Template

Getting a pre-designed document format is a straightforward process that allows you to start organizing your records immediately. Whether you need it for personal use or business, downloading this ready-to-use framework ensures that you have a structured tool for managing your financial documents. This section explains how to download and get started with these resources.

Step-by-Step Guide

Follow these simple steps to download your document format:

- Visit a trusted website offering customizable financial documents.

- Choose the appropriate format that suits your needs, ensuring it is compatible with your software.

- Click the download button to save the file to your device.

- Open the file in your chosen program to begin customization and data entry.

Where to Find Downloadable Resources

You can find downloadable document formats on various websites, including industry-specific resources, business solution platforms, or document-sharing sites. Many offer free downloads, while others may require a small fee for premium features.

Customizing Your NDIS Invoice Template

Personalizing your financial document is key to ensuring it reflects your business needs and maintains professionalism. Customization allows you to adjust details such as your business logo, client information, and payment terms to create a document that works for you. This section covers the steps to customize the format effectively.

Adjusting Design Elements: Begin by modifying the layout and appearance of the document. You can add your business logo, change font styles, or adjust the color scheme to match your branding. These design elements help make the document more visually appealing and professional.

Updating Essential Fields: Ensure that all necessary fields are correctly filled in. You can personalize the document with your company name, address, and contact details, as well as the recipient’s information. Additionally, customize sections such as service descriptions and payment terms to reflect the specifics of your transaction.

Make sure to save a copy of the customized version for future use, so you can quickly generate accurate and professional records each time.

Common Fields in an NDIS Invoice

When creating a financial record, certain key elements are necessary to ensure clarity, accuracy, and professionalism. These fields provide essential information for both the service provider and the client, making it easier to process and track payments. Below are the most common fields found in these documents.

Provider Information: This section includes the business or individual providing the service. It typically contains the name, address, phone number, and any registration or identification number required by law or industry standards.

Recipient Information: The details of the client receiving the service, including their full name, address, and relevant identification numbers. This helps ensure that the document is correctly attributed and can be easily matched with the client’s records.

Service Details: A clear description of the services rendered, including the dates on which they were provided, the specific tasks performed, and any relevant notes. This section ensures both parties are aligned on what was delivered.

Amount and Payment Terms: The total charge for services rendered, along with any applicable taxes, discounts, or additional costs. This section also outlines payment terms, such as due dates, accepted payment methods, and any late fees for overdue payments.

Including these fields ensures that the document is complete and professional, and that there are no misunderstandings between service providers and clients.

NDIS Invoice Template Compatibility

Ensuring that your financial document format works seamlessly across different software and platforms is essential for efficiency and accessibility. Compatibility guarantees that you can easily open, edit, and share the document without encountering technical issues. In this section, we’ll explore the compatibility features that make this format versatile and user-friendly.

Software Compatibility

The document can be used with a wide range of software programs, from basic text editors to more advanced spreadsheet and document management tools. This versatility ensures that no matter what software you prefer, you’ll be able to open and modify the document without issues. Some of the most common software options include:

- Microsoft Office: This format works perfectly with popular software like Microsoft Excel, PowerPoint, and others, making it a convenient choice for many businesses.

-

Benefits of Using Word for Invoices

Using a widely available word processing program to create financial documents offers several advantages, from ease of use to flexibility. This method allows for quick formatting, customization, and sharing of documents, making it a popular choice for professionals and small business owners alike. Below, we explore some of the key benefits of using this tool for billing purposes.

Ease of Customization

One of the main benefits of using a word processing program is the ease with which you can customize your documents. With a simple interface, you can easily adjust the layout, fonts, colors, and other design elements to suit your branding. This flexibility allows you to create a professional, personalized document without needing specialized software.

Compatibility and Accessibility

Most people are familiar with word processing software, and it is compatible with a wide range of devices and platforms. Whether you are working on a desktop, laptop, or tablet, you can access and edit your document without encountering technical barriers. Additionally, sharing files is simple, as many people already have the necessary software to open and read these documents.

Using a word processing program for financial records simplifies document creation, enhances personalization, and ensures easy access across various devices and platforms.

Step-by-Step Guide to Using the Template

Using a pre-designed document format can greatly streamline the process of creating accurate and professional financial records. By following a few simple steps, you can quickly fill in the necessary details and customize the layout to suit your needs. This guide walks you through the process, ensuring that you can make the most of the tool.

Step 1: Download the Document

Begin by downloading the document format from a trusted source. Make sure the file is compatible with your software, whether it’s a word processor, spreadsheet tool, or other editing software.

Step 2: Open the Document

Once the file is downloaded, open it in your preferred editing software. The layout will already be set up, but you’ll need to fill in the necessary information.

Step 3: Enter Your Business Details

In the designated sections, input your business name, contact details, and any other required information, such as your business registration number. This ensures the document is personalized and ready to be shared.

Step 4: Add Client Information

Next, enter the recipient’s details, including their name, address, and any necessary identification or account numbers. This step is crucial for ensuring that the document is properly attributed.

Step 5: Input Service Information

Describe the services provided, including dates, details of the work performed, and any relevant notes. Be clear and specific to avoid confusion.

Step 6: Review and Finalize

Double-check the information you’ve entered to ensure everything is accurate. Pay attention to spelling, dates, and payment terms before finalizing the document.

Step 7: Save and Send

Once you’re satisfied with the document, save it in the desired format (e.g., PDF or editable file). You can then email it to your client or print it for physical delivery.

By following these steps, you can quickly generate professional and accurate records that meet your business needs.

Understanding NDIS Billing Requirements

To ensure accurate and timely payments, it’s essential to understand the specific requirements for creating and submitting financial documents for government-funded services. These guidelines help ensure that your records meet necessary standards and can be processed efficiently. This section outlines the key billing requirements that must be followed.

Compliance with Funding Guidelines: Every service provider must adhere to the regulations set by the funding body. These rules specify what information needs to be included in your financial documents, such as the correct codes for services rendered, as well as the appropriate format for submission. It’s crucial to stay updated with any changes in these guidelines to avoid delays or errors.

Detailed Service Descriptions: A clear and detailed description of the services provided is mandatory. This ensures that the services are correctly attributed to the funding program. Providing concise information about what was done, when it was done, and the time spent on each service is necessary for compliance and transparency.

Accurate Record-Keeping: Maintaining accurate and complete records is vital for both legal and financial reasons. This includes proper documentation of all interactions, services provided, and payments received. Accurate records not only help with billing but also assist in audits and any future inquiries.

By following these billing requirements, you ensure that your services are reimbursed correctly and that all necessary legal and financial standards are met.

How to Format NDIS Invoices Correctly

Correct formatting of financial records is essential to ensure that all required information is easily readable and compliant with industry standards. By following a structured approach, you can avoid errors and ensure your documents are processed without delays. This section covers the key steps for formatting financial documents effectively.

Include All Required Information

The most important step in formatting is making sure all necessary details are included. These typically include the recipient’s name and contact details, the services provided, dates, and the agreed-upon rates. Additionally, your business name, contact information, and any relevant registration numbers should be clearly displayed. This information helps ensure that the document is complete and accurate.

Maintain a Clear and Consistent Layout

When it comes to layout, clarity is key. Use headings and bullet points to break up sections of information. Make sure that each service is listed separately with clear descriptions, quantities, and individual costs. This helps the reader quickly find the information they need. Consistent use of fonts, spacing, and alignment contributes to a professional appearance and ensures readability.

Payment Terms and Details:

Be sure to clearly outline payment terms, such as the due date and any late fees or penalties. This ensures that the recipient knows exactly when payment is expected and under what conditions. It’s also important to provide clear instructions on how the payment should be made, such as bank account details or online payment methods.By following these steps, you can ensure your financial documents are correctly formatted, easy to understand, and meet all necessary standards for processing.

Maintaining Accurate Record Keeping

Proper record keeping is a fundamental practice for any business, especially when dealing with financial transactions. Accurate and organized records not only ensure that you stay compliant with regulations but also provide valuable insights for managing your operations effectively. This section outlines how to maintain precise and reliable records for your financial documents.

Regular Updates and Monitoring:

Consistently updating and reviewing your records ensures that no important information is overlooked. By establishing a routine for data entry and reviewing documents periodically, you can spot potential discrepancies early and take corrective actions. This includes recording all relevant transaction details, such as dates, amounts, and descriptions of services rendered.Organizing Financial Data:

Proper organization is crucial for easy retrieval and future reference. Use a system that works for your business, such as categorizing records by date, client, or type of service. Digital tools can be particularly helpful in organizing and storing records safely. If you use physical documents, ensure that they are stored securely and are easily accessible when needed.Record Type Details to Include Frequency of Review Client Information Name, contact details, service details Monthly Transaction Records Date, amount, service description, payment status Weekly Service Contracts Service agreement terms, payment terms Annually Backup and Security:

Ensure that your records are backed up regularly, especially if you’re storing them digitally. Using cloud storage or external drives can preventHow to Save and Share Your Invoice

Once your financial document is complete, it’s important to save and share it in a way that ensures both security and ease of access. Properly saving the file in the correct format and sharing it with the recipient in a professional manner are key to a smooth transaction process. This section provides an overview of how to save and send your financial documents efficiently.

Saving Your Financial Document

The first step is ensuring that your file is saved in a reliable format. Commonly used formats like PDF ensure that the document retains its formatting and can be opened by anyone, regardless of the software they use. It’s also a good idea to use clear and descriptive file names to help you easily find the document when needed.

Recommended File Formats:

There are several formats available for saving your document. Below are the most commonly used options:

Format Advantages Best For PDF Retains formatting, universally accessible Sharing with clients or organizations Excel Easy to edit, useful for large amounts of data Internal use or tracking payments DOCX Editable, compatible with most word processors Drafting or internal collaboration Sharing Your Financial Document

Once the document is saved, it’s time to share it with the relevant party. Email is the most common method for sending financial records. When sending via email, it’s best to include a brief message explaining the documen

Templates vs Manual Invoice Creation

When managing financial records, two common approaches are often considered: using pre-designed documents versus manually creating each record from scratch. Both methods have their advantages and challenges, depending on your needs and the volume of documents you manage. This section will explore the key differences between these two approaches, helping you decide which is best for your situation.

Advantages of Using Pre-Designed Documents

Pre-designed documents, often available in various formats, are a convenient option for streamlining the billing process. These ready-made files come with the necessary fields and layouts already set up, making them easy to use with minimal adjustments. Here are some key benefits:

- Consistency: Pre-designed documents maintain uniformity across all financial records, ensuring that each one follows the same structure and format.

- Time-saving: With the essential fields already filled out, you can focus on entering specific details rather than designing a layout from scratch.

- Professional appearance: Well-designed files often come with polished layouts, making them appear more professional and organized when sent to clients or partners.

Challenges of Pre-Designed Documents

While convenient, using pre-designed documents may have some limitations. These can include:

- Less flexibility: Pre-designed forms may not allow for customization of certain fields or elements that you may need for specific transactions.

- Standardization limitations: If your needs are unique, a pre-designed document may not fully address all the requirements of your specific industry or service.

Benefits of Manually Creating Records

On the other hand, manually creating your financial records gives you full control over the layout and content. This approach allows for greater flexibility, but it also requires more time and effort. Some key advantages include:

- Full customization: You can tailor each document to meet the specific needs of the client, transaction, or service.

- Flexibility: There is no need to follow a pre-designed str

Ensuring Timely NDIS Invoice Submission

Submitting financial records on time is crucial for maintaining smooth operations and avoiding delays in payments. Timely submission not only ensures compliance but also helps in managing cash flow efficiently. This section discusses key strategies to ensure that your records are submitted promptly and correctly, avoiding unnecessary complications.

Steps to Ensure Timely Submission

Following a set process can help you stay on top of submission deadlines and prevent delays. Here are some essential steps to follow:

- Set a Clear Deadline: Always establish a specific date for submitting each document. Mark this deadline on your calendar or digital system to avoid last-minute rushes.

- Organize Documentation Early: Start collecting the necessary details for your records ahead of time. This includes gathering client information, services rendered, and applicable costs.

- Double-Check Accuracy: Before submitting any records, review them for errors. This helps avoid the need for revisions, which could delay payment processing.

- Use Digital Tools: Leverage digital platforms or management tools to track your submissions. Many tools offer reminders and deadlines, which can help keep the process on track.

Dealing with Delays and Issues

Despite your best efforts, sometimes delays can occur. It is important to have a plan in place for handling such situations:

- Notify Early: If you anticipate a delay, inform the recipient or relevant department as soon as possible. Early communication can often resolve potential issues before they escalate.

- Monitor Payment Status: After submission, keep track of the payment status to ensure that everything proceeds smoothly. This can help identify any issues early on.

- Establish a Contingency Plan: Have a backup system for dealing with potential submission problems, such as technical issues or missing documentation.

By adhering to these steps, you can ensure that your financial records are submitted in a timely manner, reducing stress and keeping your processes running smoothly.

Common Mistakes to Avoid with Invoices

When managing financial documents, it’s easy to overlook details that could lead to errors or delays in processing. These mistakes can not only cause confusion but also lead to missed payments or disputes. In this section, we will discuss common errors that individuals and businesses should avoid when handling their financial records.

1. Incorrect or Missing Information

One of the most common mistakes is providing inaccurate or incomplete details. This can cause significant delays in processing or lead to rejection of the document. Pay close attention to the following:

- Client Information: Ensure that the client’s name, address, and other contact details are accurate.

- Service Descriptions: Clearly describe the services or products provided, including quantities and rates.

- Payment Terms: Specify the due date and any applicable payment instructions clearly.

2. Failing to Follow Formatting Standards

Another mistake is not adhering to the required formatting conventions. Whether it’s for legal or organizational purposes, consistent formatting helps in the efficient review and processing of documents. Consider the following:

- Consistency: Use a consistent font, font size, and layout throughout the document.

- Clear Structure: Group related information, such as item descriptions and totals, into easily identifiable sections.

3. Not Double-Checking the Total Amount

Always verify the totals before submitting any document. Simple calculation errors or rounding mistakes can result in discrepancies, leading to confusion or delayed payments. Double-check all amounts and ensure they match the details in the document.

4. Ignoring Legal Requirements

Each region or industry may have specific legal requirements for financial documents. Ignoring these can lead to penalties or disputes. Always ensure that your document complies with any relevant regulations, including tax requirements, identification numbers, or other mandatory fields.

By avoiding these common mistakes, you can ensure smoother transactions, reduce the risk of delays, and maintain good relationships with clients or service providers.

Improving Efficiency with Invoice Templates

Creating financial records from scratch can be a time-consuming task, especially when the same format is required repeatedly. By using predefined structures, you can streamline the entire process, saving both time and effort. This section explores how using structured formats can enhance your productivity and reduce the likelihood of errors.

1. Speeding Up the Process

Using a ready-made layout allows you to avoid re-entering basic details each time. Instead of designing a new document for every transaction, you can simply update the necessary fields, such as client information, dates, and amounts. This significantly reduces the time spent on creating each record.

- Predefined Fields: Common fields such as service descriptions, rates, and payment terms are already included, allowing for quicker document preparation.

- Automation: Many modern tools offer features that can auto-fill certain information based on previous entries or data from other documents.

2. Reducing Human Error

Manual creation of financial documents leaves room for mistakes, especially when dealing with complex calculations or multiple entries. Using an established structure minimizes the risk of errors such as missing details or incorrect calculations. This ensures more accurate and reliable records.

- Standardized Layout: A consistent layout helps ensure that no important sections are omitted and that all necessary information is presented clearly.

- Accuracy in Calculations: Many tools built around these formats offer automated calculations, reducing the chances of miscalculations or omissions.

3. Better Organization

Having a consistent format makes it easier to keep track of your documents. Whether you are managing a few or hundreds of transactions, a well-organized structure ensures that records are easy to find and review. It also helps maintain uniformity across all of your documents, making them look more professional and easier to understand.

By implementing structured formats for your financial records, you not only save time but also enhance the accuracy and professionalism of your transactions.

Where to Find More NDIS Resources

Accessing the right tools and materials is crucial for staying informed and compliant in any field, especially when dealing with government programs or services. There are various places to locate reliable resources that provide guidance, templates, and tools to assist with documentation and management. These resources are invaluable in helping you maintain accuracy and efficiency in your work.

1. Official Websites

The official websites of relevant government agencies or organizations often offer a wealth of information. They provide updated rules, guidelines, and downloadable files designed to assist with proper documentation. These resources are typically the most reliable, as they come directly from the governing bodies.

- Government Portals: Many countries have dedicated government portals where you can find guides, forms, and other official documents.

- Regulatory Bodies: Websites from regulatory agencies or associations often offer updated templates and best practices to ensure compliance.

2. Online Forums and Communities

Another excellent source of resources can be found in online forums and community groups. These spaces allow professionals to share advice, tips, and documents. Many individuals actively engage in these communities to exchange insights and help others with common issues.

- Social Media Groups: Facebook, LinkedIn, and other platforms have groups dedicated to relevant sectors where people regularly share resources and advice.

- Specialized Forums: Certain industries may have dedicated forums where members can access templates, articles, and other helpful materials.

3. Educational Institutions and Training Providers

Many educational institutions and training programs provide access to specialized materials that are helpful for professional development. These resources often include up-to-date examples, case studies, and tutorials that guide users through the intricacies of best practices in their respective fields.

- Online Courses: Many platforms offer courses focused on professional development, and these often include helpful templates and tools.

- Workshops and Webinars: Attending relevant workshops or webinars can provide live access to experts and downloadable materials designed to improve workflow.

By utilizing these resources, you can stay informed and efficient, ensuring that your documentation and processes are up to date and compliant wit