Complete Guide to Ncr Invoice Template for Easy Billing

Efficient billing is essential for any business, regardless of its size or industry. Having a clear and professional method for generating financial documents can save time, reduce errors, and ensure smooth transactions with clients. By using customizable billing forms, businesses can maintain consistency and professionalism while also tailoring each document to suit specific needs.

In this guide, we will explore the benefits of using structured billing forms that are easy to adapt, allowing you to simplify the way you manage payments and client communications. These tools not only enhance your overall workflow but also provide flexibility in presenting financial details clearly and accurately.

Whether you’re just starting out or looking to improve your current system, adopting a streamlined approach to creating and managing financial records can significantly boost your business efficiency. Let’s dive into the practical steps and key features that make these forms a valuable asset for any organization.

Understanding the Importance of Ncr Invoice Template

Having a standardized method for creating billing documents is crucial for maintaining an organized and efficient financial workflow. A well-structured form allows businesses to streamline their processes, ensuring accuracy in transactions while reducing the chances of costly errors. The ability to customize such documents according to business needs adds flexibility and professionalism to your client interactions.

Key Advantages of Using a Structured Billing Form

Using a consistent billing format offers numerous benefits. It simplifies the process of generating accurate financial documents, saving time and effort for your team. Additionally, these forms ensure that all necessary details are included, leaving no room for omissions that could cause misunderstandings or delays in payment. Moreover, standardized forms help project a professional image to clients, reinforcing trust and reliability.

How It Contributes to Business Efficiency

Efficiency is a critical factor in any business operation, and the ability to quickly create clear, precise financial documents contributes directly to this. By minimizing manual input and offering customizable fields, businesses can ensure quicker turnaround times and a reduction in human error. As a result, payment cycles are shortened, and customer satisfaction is improved.

| Benefit | Explanation |

|---|---|

| Time Efficiency | Streamlined creation of documents reduces time spent on manual adjustments and calculations. |

| Accuracy | Standardized forms help avoid mistakes by ensuring all required fields are filled out correctly. |

| Professionalism | A well-designed form projects a polished and professional image to clients, building trust. |

| Customization | Flexible fields allow businesses to tailor the form to their specific requirements. |

What is an Ncr Invoice Template

At its core, this tool is a pre-designed document that businesses can use to issue financial records for services or products sold. It is intended to standardize and simplify the process of generating important business paperwork. Rather than starting from scratch each time, this document allows for quick and consistent creation, saving time and reducing the chance for errors.

Purpose and Functionality

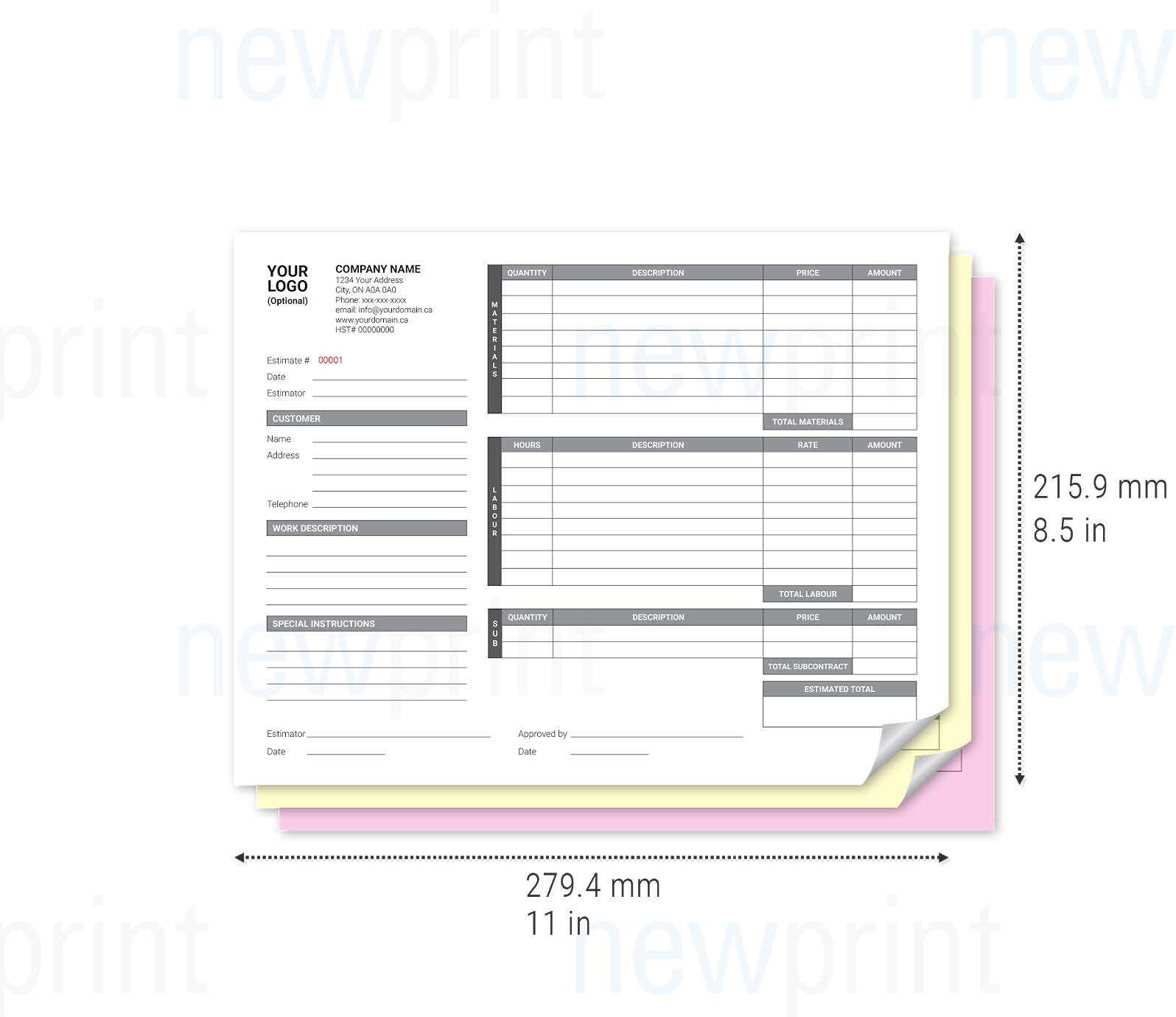

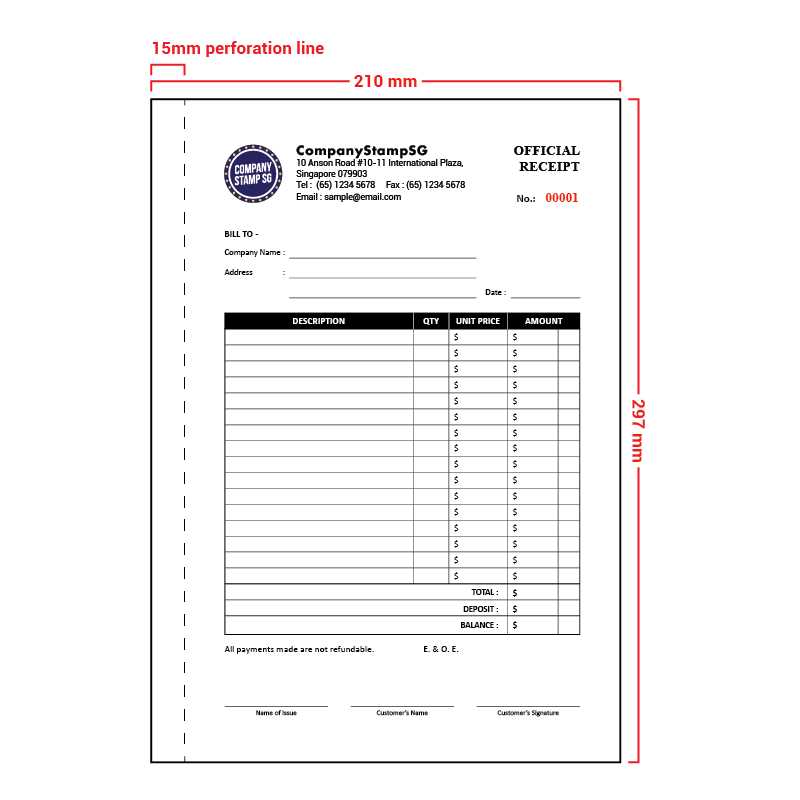

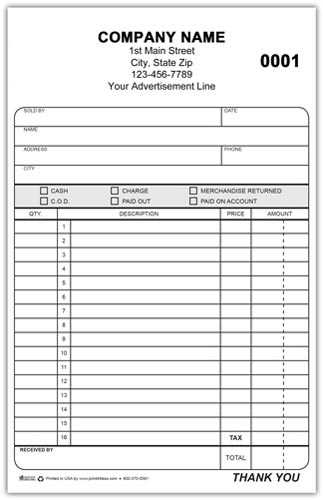

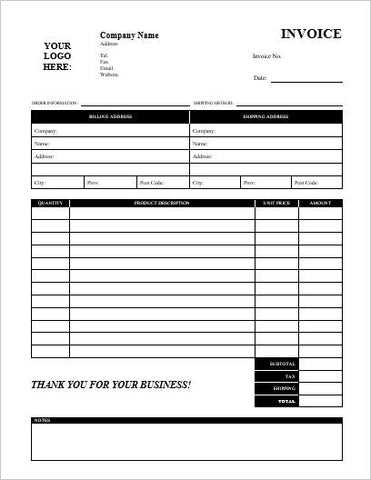

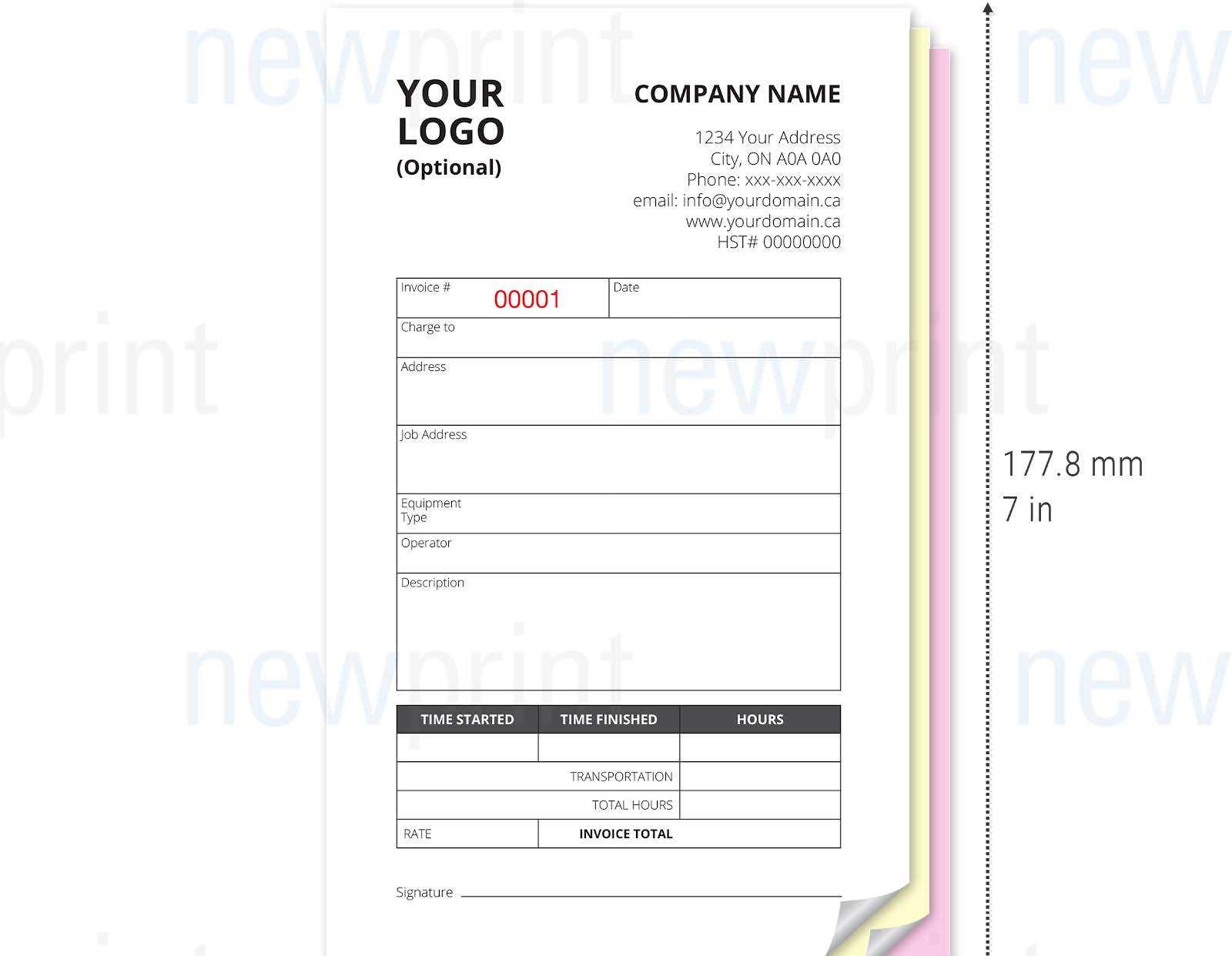

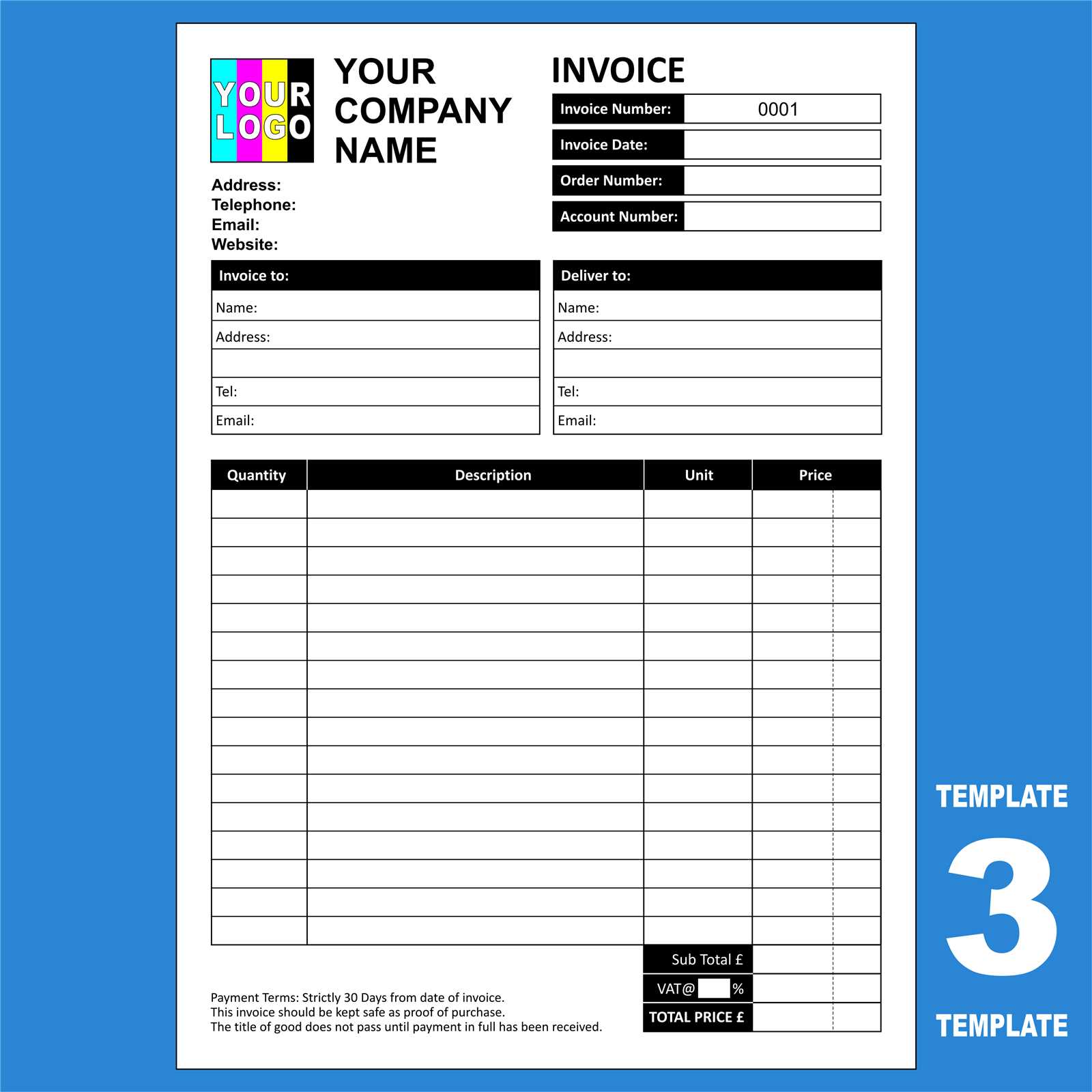

The primary purpose of this structured document is to clearly communicate the details of a transaction, ensuring that all necessary information is included. It typically contains sections for listing the buyer’s and seller’s details, item descriptions, quantities, prices, and payment terms. This standardized format ensures that no key data points are overlooked, facilitating smoother business operations.

Customization Options

Although this form follows a set structure, it is designed to be adaptable to different business needs. The ability to modify sections such as payment terms, discount codes, or tax rates makes it versatile for various industries. Customization allows companies to personalize the document according to their branding and specific transaction requirements.

Key Features of Ncr Invoice Template

A well-designed billing document offers several key features that enhance its functionality and usability for businesses. These features not only make it easier to create accurate financial records but also ensure consistency across all transactions. Understanding the main attributes of such a form helps businesses maximize its benefits while ensuring a professional and organized approach to financial communications.

Essential Features for Effective Use

- Customizable Fields: The ability to modify sections such as payment terms, item descriptions, and client details allows businesses to tailor the document to meet their specific needs.

- Predefined Structure: The document follows a structured layout that ensures all necessary information is included, reducing the risk of omitting important details.

- Clear Itemization: An organized space for listing goods or services, along with quantities, unit prices, and totals, makes it easier for both parties to review the transaction details.

- Tax and Discount Calculations: Built-in fields for applying tax rates and discounts help automate calculations, improving accuracy and reducing manual input errors.

- Branding Options: Customizable branding elements, such as logos and color schemes, help businesses present a polished and professional image to clients.

Additional Features for Enhanced Functionality

- Payment Terms and Deadlines: Clearly defined payment terms, including due dates and late fees, ensure transparency and help manage cash flow.

- Multi-Currency Support: For international transactions, the ability to include different currencies can facilitate smoother cross-border billing.

- Digital Compatibility: Many forms are designed to be easily shared or printed in digital formats, offering flexibility for both online and offline businesses.

- Record Keeping: Automatic numbering and reference IDs help maintain a chronological and easily searchable archive of all financial documents.

Why Use an Ncr Invoice Template

Implementing a standardized billing document offers several advantages for businesses looking to streamline their operations. Instead of creating a new document from scratch each time a transaction occurs, businesses can save time and reduce errors by using a pre-designed, customizable form. This approach ensures that all essential information is included, leading to smoother transactions and more efficient financial management.

Efficiency and Time-Saving

One of the most significant reasons to adopt a preformatted document is the efficiency it provides. By using a ready-made structure, businesses can avoid the tedious task of manually setting up every section of a financial document. This time-saving feature allows teams to focus on other important tasks, increasing overall productivity.

Improved Accuracy and Consistency

Using a consistent format reduces the chances of making mistakes that can arise from manually creating documents. A predefined structure ensures that all critical data, such as client details, prices, and terms, are correctly inputted and accounted for. This consistency helps maintain a professional appearance and reduces the likelihood of misunderstandings or disputes with clients. Accuracy is essential in financial records, and a structured document guarantees that every important element is covered.

In addition to these benefits, a customizable design allows businesses to align the document with their branding, creating a professional and cohesive look. Whether you need to adjust payment terms or include custom fields, the flexibility of this tool helps you meet specific business requirements efficiently.

Benefits of Customizing Your Invoice

Customizing financial documents to fit the unique needs of your business offers several advantages, helping to create a more professional and personalized experience for clients. When tailored to reflect specific business details and transaction conditions, these forms can improve communication, enhance your brand image, and streamline your billing process. The ability to adjust fields and layout ensures that all relevant information is presented clearly and consistently.

Personalization can also provide an opportunity to reinforce your brand identity. By adding your logo, adjusting color schemes, or incorporating business-specific terminology, the document can be aligned with your company’s overall image, leaving a lasting impression on your clients.

| Benefit | Explanation |

|---|---|

| Professional Appearance | Customizing allows you to include your logo and business details, giving the document a polished, cohesive look that reinforces your brand identity. |

| Clearer Communication | Personalized forms allow you to include specific terms, discounts, and payment methods, reducing confusion for clients and ensuring smoother transactions. |

| Improved Client Experience | Tailoring the form to the client’s needs or preferences creates a more positive experience, showing attention to detail and care in your business dealings. |

| Flexibility | With customizable sections, you can easily adjust for different types of transactions, whether it’s adding new items, taxes, or payment options. |

| Brand Consistency | Consistent branding across all your financial documents helps to maintain a professional and uniform image that clients recognize and trust. |

How to Create an Ncr Invoice Template

Creating a structured billing document requires careful planning and an understanding of the essential elements that need to be included. By following a few simple steps, you can design a customized form that fits the specific needs of your business and streamlines your financial processes. The goal is to ensure clarity, consistency, and accuracy in every transaction, while also maintaining a professional appearance.

Step 1: Define the Key Elements

Start by determining the critical sections that must be included in the document. These typically include details such as the client’s name and contact information, a list of goods or services provided, pricing, payment terms, and any applicable taxes or discounts. Make sure to leave space for custom notes or special instructions to ensure flexibility in future transactions.

Step 2: Choose Your Software or Tool

There are various tools and software programs available for creating such documents, ranging from simple word processors to more specialized accounting or billing software. Choose the one that best fits your needs and provides options for customization, such as adding your company logo, changing fonts, or adjusting layout settings. Many online platforms offer free templates, which can serve as a base for further customization.

Once the basic structure is set up, you can modify the design to suit your brand, adjust the layout for clarity, and ensure all important information is easily visible. By following these steps, you’ll have a practical and professional billing form that can be reused for future transactions, saving time and reducing errors in the process.

Choosing the Right Ncr Template Software

Selecting the right software for creating and managing your billing documents is a crucial step in ensuring that your financial records are accurate, professional, and efficient. The right tool can save you time, reduce errors, and offer features that allow for easy customization and integration with other business systems. With a variety of options available, it’s important to assess your business needs and choose a program that fits your workflow and objectives.

Key Factors to Consider

- Ease of Use: Look for software that has an intuitive interface and easy-to-navigate features. You don’t want a program that requires extensive training or a steep learning curve.

- Customization Options: The ability to personalize your documents, such as adding logos, changing fonts, and adjusting field layouts, is essential for branding and maintaining consistency.

- Integration with Other Systems: Consider whether the software can integrate with your accounting, CRM, or payment systems, allowing for seamless data transfer and improved workflow.

- Automation Features: Some software offers automation tools, such as automatic calculations of totals, taxes, and discounts. This can save time and reduce the likelihood of manual errors.

- Cloud-Based vs. Desktop Software: Cloud-based tools provide the advantage of access from anywhere, while desktop software may offer greater security or offline functionality.

- Customer Support: Choose software that offers reliable customer support in case you encounter any issues or need assistance with the tool’s features.

Popular Software Options

- QuickBooks: Known for its robust accounting features, QuickBooks offers customizable document templates and seamless integration with other business tools.

- Zoho Invoice: A cloud-based platform with a user-friendly interface and excellent customization options, suitable for businesses of all sizes.

- FreshBooks: Provides an intuitive and feature-rich platform, with billing automation, time tracking, and easy customization for specific business needs.

- Wave: A free accounting software that includes customizable billing forms, ideal for small businesses with basic invoicing needs.

Choosing the right software depends on the unique requirements of your business, including the level of customization needed and the types of transactions you manage. Take the time to explore different options and select a solution that aligns with your

Common Mistakes to Avoid in Ncr Invoices

When preparing financial documents for your business, it’s important to avoid common mistakes that could lead to confusion, delayed payments, or damage to your professional reputation. Small errors can snowball into larger issues if left unchecked. Understanding the most frequent mistakes and taking steps to prevent them ensures smoother transactions and a more professional interaction with clients.

Common Mistakes to Avoid

- Missing or Incorrect Client Information: Failing to include accurate client details, such as names, addresses, and contact information, can lead to confusion or delays in processing. Always double-check that these details are correct and up to date.

- Unclear Descriptions of Products or Services: Vague or incomplete descriptions can cause misunderstandings between you and your client. Provide specific details of the goods or services, including quantities, specifications, and terms of delivery.

- Incorrect Calculation of Totals: Mistakes in adding up item prices, taxes, or applying discounts can lead to financial discrepancies. Double-check all calculations before finalizing the document.

- Omitting Payment Terms: Clearly define payment expectations, including due dates, acceptable payment methods, and any late fees. Without this clarity, clients may delay payments or misinterpret terms.

- Not Including Reference Numbers: Omitting unique identifiers, such as document numbers or order references, makes it difficult to track payments and can lead to confusion in your record-keeping.

- Overcomplicating the Layout: A cluttered or overly complex design can confuse your clients and make it difficult for them to find important details. Keep the layout clean, simple, and easy to navigate.

Tips to Ensure Accuracy

- Double-Check All Information: Always review the document for accuracy before sending it out. Ensure that all details are up-to-date and correctly filled out.

- Use Automated Calculations: Many tools provide automatic tax and discount calculations, reducing the risk of manual errors.

- Include Clear Payment Instructions: Make sure your payment terms are easy to understand, so clients know exactly how and when to pay.

- Keep It Simple: A clean, straightforward layout with easy-to-read fonts and clear sections will help clients quickly grasp all necessary details.

By avoiding these common mistakes, you can ensure that your financial documents are clear, professional, and accurate, leading to

Free Ncr Invoice Template Resources

For businesses looking to streamline their billing process without investing in expensive software, there are numerous free resources available online. These tools provide customizable and easy-to-use documents, allowing businesses to quickly generate professional financial records. By utilizing these resources, companies can save both time and money while ensuring that their transactions are documented accurately.

Top Free Resources for Creating Billing Documents

- Google Docs: Google offers a variety of free, customizable templates for financial documents that are accessible from any device. With options for easy customization, businesses can quickly modify these templates to suit their specific needs.

- Microsoft Office Online: Microsoft provides several free billing document templates through its online platform. These templates are fully editable and can be downloaded for use in Excel or Word.

- Invoice Generator (Invoice Generator): A straightforward online tool that allows users to create and download basic billing records for free. This tool includes options to customize sections like item descriptions, payment terms, and amounts.

- Zoho Invoice: Zoho offers a free, cloud-based platform for creating customized billing documents. Their free version includes options for automatic calculations, branding, and invoice tracking.

- Wave Financial: Wave provides a free online tool designed specifically for small businesses. It includes customizable documents, automatic calculations, and the ability to send invoices directly to clients.

- FreshBooks Free Trial: FreshBooks offers a 30-day free trial with access to customizable billing forms. After the trial, users can choose from various pricing options based on their business needs.

How to Make the Most of Free Resources

- Choose a Platform That Fits Your Needs: Consider the specific features you require, such as payment tracking, multi-currency support, or integrations with other systems, and select the tool that best meets those needs.

- Customize Templates for Branding: Many free resources allow for easy customization of design elements such as logos, color schemes, and fonts. Take advantage of these features to create a professional and cohesive brand image.

- Stay Consistent: Make sure to use the same style and format across all your financial documents. Consistency helps present a more organized and professional image to clients.

- Use Cloud-Based Tools for Flexibility: Cloud-based resources, such as Zoho Invoice and Wave, offer the flexibility of accessing and editing documents from any device, ensuring t

How to Personalize Your Ncr Template

Customizing your billing documents is a key step in creating a professional and branded experience for your clients. Personalization not only reflects your business identity but also ensures that the document meets your specific operational needs. Whether you’re adjusting layout, adding your logo, or including custom payment terms, tailoring the document to your preferences enhances its effectiveness and strengthens your brand presence.

Steps to Personalize Your Billing Document

- Add Your Branding: Include your business logo, company colors, and contact information to ensure the document aligns with your brand. This simple addition makes the document look more professional and cohesive.

- Customize the Layout: Adjust the layout of the sections to fit your business’s unique requirements. For example, you might want to add a “Special Instructions” field or rearrange sections to highlight certain details.

- Include Custom Fields: Depending on your business, you may need to include special fields such as project codes, service descriptions, or delivery dates. Ensure these fields are easy to fill in and clear to your clients.

- Adjust Payment Terms: Modify the payment terms section to reflect your specific conditions, such as payment due dates, discounts for early payment, or late payment penalties.

- Update Currency and Taxes: Ensure the currency used matches your location or client’s region. Also, include any relevant tax rates and details that are applicable to the transaction.

Practical Example of Customization

Here is an example of how a personalized billing document could be organized:

Section Customization Example Header Company logo, business name, and contact information (phone, email, website). Client Information Client’s full name, address, and billing contact details. Itemized List Details of the goods or services provided, including description, quantity, unit price, and total cost. Payment Terms Net 30 days, early payment discount (5% if paid within 10 days), and a late fee of 2% per month. Footer Payment instructions, bank details, and any additional notes or terms. By following these steps and

How to Edit and Save Your Template

Once you’ve created or downloaded a billing document, it’s important to know how to edit and save it properly for future use. Customizing your document to fit specific business needs, client requirements, or transaction details is an essential step. Whether you are making minor updates or preparing for a new cycle of transactions, knowing how to save and retrieve your document is key to maintaining efficiency and consistency.

Editing Your Billing Document

To make sure your document is always up-to-date and relevant, follow these basic steps when editing:

- Open the Document in the Right Software: Depending on the program you’re using, make sure the document is opened in an editable format (such as Microsoft Word, Google Docs, or an accounting software tool).

- Update Client Details: If you’re working on a document for a specific client, ensure that all client information, including names, addresses, and contact details, is correct and up to date.

- Edit Itemized Lists: Update descriptions, quantities, and prices of the goods or services provided. Ensure that any discounts or special terms are clearly stated.

- Adjust Payment Information: Modify the payment due date, payment method, and any applicable late fees or discounts for early payment. Tailor the document to fit the terms of the specific transaction.

- Include Additional Notes: Add any special instructions, delivery information, or terms that may apply to the particular transaction.

Saving Your Document for Future Use

After editing your document, it’s crucial to save it in a way that ensures accessibility and security. Here are some tips for saving:

- Save in Multiple Formats: If you need to share the document with clients or colleagues, consider saving it in different formats such as PDF, Word, or Excel. This ensures compatibility with various devices and platforms.

- Name the File Clearly: Use a consistent naming convention that includes key information, such as the client’s name and the date of the transaction. For example, “ClientName_Invoice_March2024” will make it easy to search for and identify the document later.

- Use Cloud Storage for Easy Access: Saving the document on cloud platforms such as Google Drive, Dropbox, or OneDrive ensures that you can access and edit it from any device, anywhere, while also keeping the document backed up securely.

- Backup Regularly: If you’re working with important documents, regularly back them up to an external drive or cloud service to avoid data loss due to unexpected issues.

Example of Proper Saving Method

The following table illustrates how to save a document for easy retrieval and organization:

Action Recommendation File Name Include client name, document type (e.g., “Contract,” “Receipt”), and date for easy identification (e.g., “ClientName_Receipt_March2024”). File Format Save as a PDF for sharing with clients, and keep an editable v Legal Considerations for Ncr Invoices

When creating billing documents for your business, it’s crucial to understand the legal requirements and obligations that come with them. Whether you are dealing with contracts, payments, or taxes, these documents must comply with local laws and regulations to avoid any legal issues. Ensuring that your financial records are legally sound not only protects your business but also helps maintain transparency and trust with clients and partners.

Key Legal Requirements to Follow

- Accurate Record-Keeping: Legally, businesses are required to maintain accurate financial records, including billing documents. These records serve as proof of transactions and may be required for tax reporting or in case of legal disputes.

- Clear Payment Terms: Clearly defined payment terms are essential. Specify due dates, late fees, and acceptable payment methods in your documents to prevent any ambiguity. Failing to outline payment expectations can lead to misunderstandings and legal complications.

- Tax Compliance: Ensure that your documents reflect the correct tax rates for your region and include any necessary tax identification numbers. Many jurisdictions require that tax-related information be prominently displayed on business records to comply with tax laws.

- Proper Documentation of Transactions: It is important to provide a detailed record of goods or services provided, including descriptions, quantities, and pricing. This documentation is often required for audits or in the event of disputes over billing or payment.

- Retention of Documents: Depending on your jurisdiction, there may be legal requirements for how long you must keep your financial documents. Ensure you are aware of these regulations and store records accordingly to avoid potential legal issues down the line.

- Client Consent and Terms: Always ensure that your clients are aware of and agree to the terms stated in the document. This can be done by including a statement of acceptance or by requiring a signature, whether digital or physical, before processing the payment.

Ensuring Compliance with Local Laws

- Consult a Legal Professional: For any questions regarding compliance or legal concerns, consult with a business attorney or accountant who can provide tailored advice based on your location and business type.

- Stay Updated on Changes in Law: Tax laws and business regulations can change frequently. Regularly review your business practices to ensure they align with the latest legal requirements in your area.

- Use Digital Solutions: Many online tools

Integrating Ncr Invoice Template with Accounting Software

Integrating your billing documents with accounting software streamlines financial management and increases accuracy in tracking payments and expenses. By connecting your records with automated accounting tools, you can save time, reduce human error, and ensure that your financial data is always up to date. This integration allows for seamless synchronization of billing details, making it easier to manage accounts, generate reports, and keep track of outstanding payments.

Benefits of Integration

- Automated Data Entry: Once your documents are integrated with accounting software, much of the data entry process becomes automated. This eliminates the need for manual input, reducing the risk of errors and saving time.

- Real-Time Updates: Integrated software ensures that any updates to your documents, such as changes to payment status or amounts, are automatically reflected in your accounting system. This helps you maintain an accurate and up-to-date financial overview at all times.

- Efficient Reporting: With data from your billing documents automatically feeding into your accounting software, you can generate detailed financial reports with just a few clicks. These reports provide insights into your cash flow, outstanding payments, and tax liabilities.

- Improved Cash Flow Management: Integration allows you to quickly track when payments are made or missed. This enables better forecasting and management of your business’s cash flow, ensuring that you can take timely actions to follow up on overdue payments.

- Reduced Administrative Workload: By eliminating the need for manual entry and reconciliation, integration helps to significantly reduce the time spent on administrative tasks. This allows you to focus more on growing your business.

How to Integrate Your Documents with Accounting Software

Here’s a general overview of how you can integrate your financial documents with popular accounting software tools:

- Choose Compatible Software: First, ensure that your billing system or document format is compatible with the accounting software you’re using. Most modern tools like QuickBooks, Xero, or FreshBooks offer integrations with various document formats.

-

Best Practices for Using Ncr Invoices

Efficient and accurate billing is essential for maintaining smooth business operations and positive client relationships. Following best practices when creating and managing your financial documents can help you avoid errors, improve professionalism, and ensure timely payments. By adhering to well-established guidelines, you can ensure that your documents are clear, consistent, and legally compliant, which will ultimately benefit both your business and your clients.

Key Practices for Effective Billing

- Include Clear Payment Terms: Always outline clear payment terms on your documents. Specify the due date, payment methods, and any late fees that may apply. This ensures transparency and prevents confusion over when and how payments should be made.

- Be Detailed and Accurate: Provide a detailed breakdown of the goods or services provided, including descriptions, quantities, unit prices, and total costs. This level of clarity helps to avoid disputes and ensures both you and your client understand the charges.

- Use Professional Formatting: A well-organized document reflects professionalism. Ensure that the document layout is easy to read, with clearly labeled sections and a logical flow. Make sure the fonts, colors, and logos are consistent with your business’s branding.

- Double-Check for Accuracy: Before sending any document to clients, carefully check for errors. Ensure the client’s details, amounts, and dates are correct. Small mistakes can cause unnecessary delays and can harm your business reputation.

- Send Documents Promptly: Avoid delays by sending your documents as soon as the service or product is provided. Prompt delivery of billing records reflects your business’s efficiency and helps ensure timely payment.

- Track Sent Documents: Maintain a record of all documents sent to clients. Using an organized system for tracking helps you stay on top of unpaid balances and follow up when necessary.

Ensuring Legal and Tax Compliance

- Include Necessary Tax Information: Always ensure that your document includes relevant tax details, such as tax rates, tax identification numbers, and any exemptions that may apply. This is crucial for both legal compliance and proper financial reporting.

- Retain Copies of Documents: Keep copies of all financial records for legal and tax purposes. In many jurisdictions, businesses are required to retain financial documents for a certain period, so storing them safely is essential.

- Stay Updated on Laws: Tax laws and business regulations change regularly. Keep informed about any updates in your region to ensure your documents comply with the latest requirements.

Enhancing Client Relationships

- Personalize Documents: Adding a personal touch to your documents, such as including a note of thanks or a custom message, can enhance your client relationships and build goodwill.

- Offer Flexible Payment Options: If possible, provide multiple payment methods to acc

How to Print and Distribute Ncr Invoices

Printing and distributing billing records is a critical step in the payment process. Whether you’re sending hard copies or digital versions, it’s essential to ensure that your documents are presented clearly and professionally. Proper printing and distribution methods help maintain a smooth transaction process and foster positive client relationships. This section will guide you through the best practices for printing and sending your financial records, whether physically or electronically.

Steps for Printing Your Billing Documents

- Ensure Proper Formatting: Before printing, verify that your document is formatted correctly. Check that all necessary fields such as client details, item descriptions, totals, and payment terms are visible and legible. A well-organized document makes a professional impression.

- Choose the Right Printer: Use a high-quality printer to ensure your documents are clear and crisp. A laser printer typically offers better quality for text-heavy documents compared to inkjet printers, ensuring readability and a more professional appearance.

- Print on High-Quality Paper: Opt for a sturdy paper stock that conveys professionalism. A heavier paper weight, such as 24 lb or higher, gives your documents a more formal and polished look.

- Print Multiple Copies if Needed: Depending on your distribution method, ensure you print the correct number of copies. For example, one copy for the client, one for your records, and others for your internal team if necessary.

Distributing Your Billing Records

- Mailing Hard Copies: For clients who prefer physical documents, prepare them for mailing. Ensure you use an appropriate envelope and include any supporting documentation or cover letters. Choose a reliable postal service to ensure timely delivery.

- Emailing Digital Copies: Sending billing records via email is fast and efficient. Attach the document as a PDF file to ensure that formatting and layout are preserved. Always include a brief message outlining the purpose of the email and the payment terms. Double-check the recipient’s email address to avoid delivery errors.

- Using Online Platforms: Many businesses use online payment platforms or accounting software to send and manage financial documents. These platforms can automatically generate and distribute documents directly to your clients, saving time and reducing manual errors.

- Consider Client Preferences: Always ask your clients how they prefer to receive their billing documents–some may prefer digital formats for quicker processing, while others may require physical copies for their records.

By following these steps, you can ensure that your financial documents are distributed professionally, improving the efficiency of your payment process and maintaining positive client relations. Whether t

Managing Multiple Ncr Invoice Templates

Handling multiple billing records can quickly become complex, especially if you have different formats for various clients or services. Whether you’re managing different pricing structures, applying tax rates, or customizing documents for specific business needs, it’s essential to organize and streamline the process. This section provides strategies for managing multiple billing formats efficiently and ensuring consistency across all your financial records.

Organizing Different Document Formats

- Group by Client Type: Organize your documents based on different categories of clients. For instance, you may have one format for wholesale customers and another for retail clients. Label and store these formats separately to avoid confusion when generating new documents.

- Create Template Variations: Create different versions of your document to accommodate specific needs, such as discounts, taxes, or additional services. Maintain a clear naming system for each variation to easily locate them when needed.

- Use Document Management Software: Consider using document management software to centralize all your billing records. These tools allow you to store, retrieve, and edit your documents in an organized manner, ensuring you never lose track of a particular format.

- Standardize Key Information: Keep key fields consistent across all document types, such as client names, addresses, or item descriptions. Standardizing these elements reduces the chances of errors and maintains uniformity in your business communications.

Automating the Process

- Use Accounting Software: Many accounting platforms offer features to create and manage different document formats. These tools can automate much of the process, such as adding tax rates or applying specific payment terms for each client. Automating your workflow reduces the manual effort involved and minimizes the chance of errors.

- Set Up Template Libraries: If you’re using a digital document platform, consider creating a library where all your document variations are stored. This allows for easy access and consistent application of the correct format depending on the client or transaction type.

- Sync Across Systems: Integrate your document formats with other business systems, such as CRM or inventory management tools, to ensure that data flows seamlessly. This integration helps avoid duplication of effort when managing different records.

Maintaining Consistency and Accuracy

- Regular Updates: Regularly review and update your formats to ensure they reflect any changes in tax rates, pricing, or terms. Staying up to date guarantees that all your documents are compliant with the latest legal and business standards.

- Proofread Each Record: Before sending out or storing any documents, always double-check for accuracy. Even small mistakes can lead to confusion or delays in payment processing. This ensures that your records are professional and reliable.

Managing multiple billing formats doesn’t have to be overwhelming. By creating clear categories, automating repetitive tasks, and maintainin

How Ncr Invoice Templates Improve Efficiency

Using standardized billing formats can significantly enhance the efficiency of your business operations. By streamlining the creation, processing, and management of your financial documents, these organized formats save time, reduce errors, and improve consistency across your workflow. This section will explore the various ways that well-structured billing formats can boost your efficiency and contribute to smoother business operations.

Time-Saving Benefits

- Quick Document Creation: Pre-designed formats allow you to quickly fill in the required fields, such as client details, items, and pricing. This minimizes the need for manual data entry, significantly speeding up the document creation process.

- Reusable Formats: Once you’ve created a document format, you can reuse it for future transactions. This eliminates the need to start from scratch each time, ensuring faster preparation of records for each new client or project.

- Automation of Repetitive Tasks: Many modern platforms allow you to automate tasks like tax calculations, applying discounts, or generating totals. This further streamlines the process, reducing the time spent on calculations and ensuring accuracy.

Minimizing Errors and Ensuring Accuracy

- Consistent Structure: A pre-structured document ensures that all necessary elements are included each time. This prevents important information from being overlooked, such as payment terms or client details, reducing the chances of mistakes.

- Built-in Checks: Many digital systems offer built-in checks, such as verifying tax calculations or flagging missing information. These features catch errors before the document is finalized, minimizing the risk of sending incorrect or incomplete records.

- Reduction of Human Error: By using a template, you reduce the need for repetitive manual entries, decreasing the likelihood of typographical errors or inconsistent formatting, which can often occur when starting from scratch every time.

Improved Professionalism and Consistency

- Standardized Branding: Using a uniform document format ensures that your business branding–such as logos, fonts, and colors–remains consistent across all client interactions. This helps reinforce your brand identity and projects professionalism to your clients.

- Clear and Structured Communication: Consistency in document presentation ensures that all financial records are easy to read and understand. A professional, well-organized document reduces confusion and presents a clear picture of what the client is being charged for.

- Client Trust: When clients receive well-structured, clear, and accurate records, they are more likely to trust your business and feel conf

Tips for Effective Invoice Management

Proper management of financial documents is essential for maintaining smooth business operations and ensuring timely payments. By adopting effective practices for organizing, tracking, and sending your billing records, you can streamline your workflow, reduce errors, and improve cash flow. This section provides practical tips on how to effectively manage your financial documents for better results.

Organizing Your Billing Records

- Centralized Storage: Store all your financial documents in one central location, whether physical or digital. This makes it easier to access records quickly when needed and reduces the risk of losing important information.

- Label and Categorize: Create categories based on client type, payment status, or billing cycle. Label your documents with clear identifiers, such as client names or invoice numbers, to help you locate specific records more easily.

- Use Digital Systems: Digital systems offer better organization and searchability. Consider using accounting software that allows you to store, track, and retrieve documents with ease, reducing manual filing and paperwork.

Tracking Payment Status

- Maintain a Payment Calendar: Keep track of payment due dates and deadlines using a calendar. This helps you monitor outstanding payments and follow up with clients in a timely manner to avoid delays.

- Record Partial Payments: If a client makes a partial payment, make sure to update the record immediately to reflect the new outstanding balance. This will ensure accuracy and prevent confusion.

- Automate Reminders: Set up automated payment reminders through your accounting platform. Sending reminders for upcoming or overdue payments helps prompt clients to settle their balances on time.

Tips for Efficient Processing and Distribution

- Ensure Accuracy Before Sending: Double-check all details in your financial records before sending them out. Ensuring accuracy in amounts, client information, and payment terms reduces the need for follow-up communications.

- Standardize Your Document Format: Use consistent formatting across all your billing records. A standardized format makes it easier to generate documents, reduces errors, and enhances professionalism in client communication.

- Leverage Electronic Delivery: Where possible, send your documents electronically to speed up the distribution process. Emailing financial documents not only saves time but also ensures quick delivery, allowing clients to review and pay faster.

Staying Compliant and Organized

- Track Tax Rates and Regulations: Ensure your documents reflect the latest tax laws and regulations. Regularly review your accounting system for updates related to taxes and ensure all required fields are included in your billing records.

- Keep Backup Copies: Always have backup copies of your documents in case of system failure or accidenta