Download Free Musician Invoice Template for Easy Payment Tracking

As an artist providing services in the music industry, handling your finances can often feel like a challenging task. Ensuring timely payments and maintaining clear communication with clients is essential to sustaining a successful career. Having a structured document to outline your fees, terms, and payment details can make all the difference in managing your business efficiently.

Using a well-designed document to request payment not only helps keep track of earnings but also adds a level of professionalism to your work. Whether you’re performing at a venue, producing a track, or offering music lessons, it’s important to set clear expectations with your clients. This approach ensures both parties are aligned and can avoid misunderstandings regarding compensation.

In this article, we’ll explore how to create, personalize, and manage such documents to streamline your payment processes. You’ll learn how these tools can save time, minimize errors, and protect you from disputes, helping you focus more on your craft than on administrative tasks.

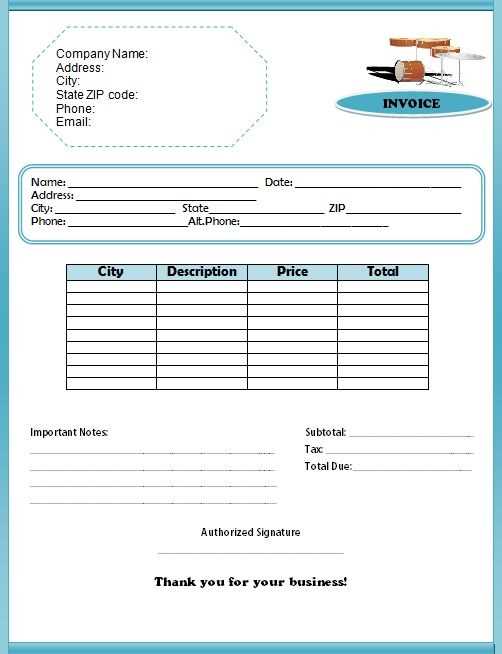

Musician Invoice Template Overview

When working in the creative industry, especially in music, it is essential to have a system in place for managing payments. An organized method for documenting work completed, fees charged, and payment details helps establish transparency and ensures both parties are clear on financial expectations. These tools are particularly important for freelancers and independent contractors who may not have a regular payroll system in place.

Such a document serves as a formal request for payment, listing services rendered, agreed-upon rates, and payment terms. It is designed to streamline financial transactions, reducing confusion and delays. A well-structured form ensures that you can quickly generate professional documents that meet both legal and contractual requirements.

In the following sections, we will cover how to customize these forms for different types of services in the music business, how to track payments, and how they can be adapted for both one-time and ongoing projects. With the right approach, this tool becomes an invaluable asset in maintaining order and professionalism in your financial dealings.

Why Musicians Need an Invoice Template

Managing financial transactions in the creative industry can be complex, especially for individuals offering their skills on a freelance or contract basis. Clear documentation of services, payment terms, and amounts is essential to avoid confusion and ensure timely compensation. Without a proper method of outlining the details, misunderstandings may arise, leading to delayed payments or disputes.

Using a structured document to outline work performed and fees ensures both parties are on the same page. It acts as a formal record, helping to maintain professionalism in every transaction. Whether it’s a live performance, recording session, or music lesson, having a reliable way to present your payment requests fosters trust and makes the entire process more efficient.

Additionally, this approach offers significant benefits for financial tracking. It enables you to monitor paid and outstanding balances, which can help with budgeting and tax filing. By streamlining the process of requesting payment, you can spend more time focusing on your creative work and less time dealing with administrative tasks.

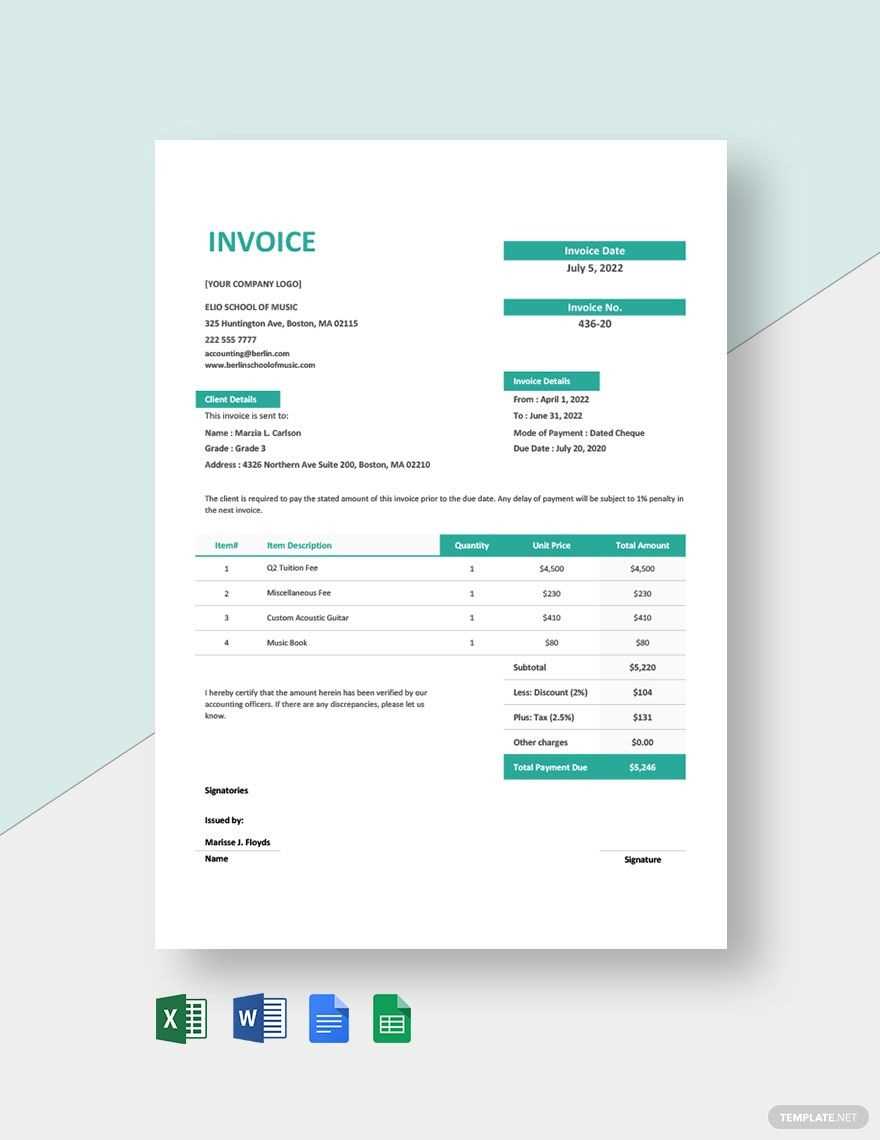

Essential Elements of a Musician Invoice

For a payment request to be effective and professional, it must contain key information that both parties can refer to in case of questions or issues. A well-organized document helps prevent misunderstandings and ensures that payment terms are clear and enforceable. The following are the essential components to include when creating a financial request for your services:

- Contact Information: Both your name or business name and the client’s contact details should be clearly listed. This ensures both parties know who the request is coming from and who it is addressed to.

- Unique Reference Number: Including a unique identifier for each document helps you stay organized and easily track payments, especially when managing multiple clients.

- Date of Issue: The date when the request is created should be included to establish when the payment is due and to provide a timeline for both parties.

- Detailed List of Services: Clearly outline the services or work provided, including any specific terms of the project. This helps avoid confusion about what was agreed upon and delivered.

- Payment Terms: Include the agreed payment amount, payment due date, and accepted methods of payment. It is also helpful to note any late payment penalties or early payment discounts, if applicable.

- Tax Information: If necessary, include tax rates or other financial details that are required by law, especially if you are operating as a business.

- Additional Notes: Any relevant terms or clarifications should be included at the bottom of the document, such as cancellation policies, refunds, or other special instructions.

By including these elements, you ensure that both you and your clients have a clear understanding of the transaction, helping to maintain a professional relationship and reducing the likelihood of disputes or delays in payment.

How to Customize Your Invoice Template

Customizing your financial request document ensures it accurately reflects your business and meets the specific needs of each client. By tailoring your request, you can present a professional image while providing all the relevant details. This allows for a smoother payment process and reduces confusion or errors. Here’s how you can personalize your payment request forms:

1. Adjust the Layout and Design

The layout and design of your document should align with your personal or business branding. It should be clean, easy to read, and professional. You can make the following adjustments:

- Logo and Branding: Include your logo, business name, and contact information at the top to give the document a personalized touch.

- Font Style and Size: Use clear, readable fonts. Choose a consistent style and size throughout the document to maintain a professional appearance.

- Color Scheme: Select colors that match your branding but make sure they don’t overwhelm the content. Keep it simple and professional.

2. Tailor the Information Sections

Every client and project is unique, so your request document should reflect the specific details of each transaction. Here’s how you can adjust the content:

- Services Rendered: Clearly describe the work you have completed. Specify the nature of the service, duration, and any special terms or conditions.

- Rates and Fees: If you offer different pricing for various services, customize the form to include detailed breakdowns of the rates for each service provided.

- Payment Instructions: Adjust the payment methods and terms according to the preferences of each client, whether that’s bank transfer, check, or online payment systems.

By customizing your document, you make it more relevant to the specific job and client, helping to avoid any confusion or delays in the payment process.

Choosing the Right Invoice Format

Selecting the appropriate format for your payment request is essential to ensuring clarity and professionalism. The right structure not only makes it easier for clients to understand but also helps you stay organized. Different types of projects or clients might require different formats, so it’s important to choose one that suits both your needs and the client’s expectations.

There are several formats available, each with its own advantages depending on the complexity of your services and the payment method. Below is a comparison of common formats to help you make an informed decision:

| Format | Best For | Advantages |

|---|---|---|

| Simple List | Small projects or one-time services | Easy to create, minimal details, fast turnaround |

| Itemized Breakdown | Ongoing projects with multiple services | Clear and detailed, helps avoid misunderstandings |

| Recurring Invoice | Subscription-based services, long-term contracts | Automates recurring payments, consistent format |

| Online Payment System | Clients preferring digital payment methods | Fast and convenient, tracks payments automatically |

Once you understand the different formats, choose the one that aligns with the type of work you do and the preferences of your clients. A well-chosen format not only streamlines the payment process but also enhances your professionalism and efficiency.

Benefits of Using a Music Invoice Template

Adopting a structured document for requesting payment offers several advantages that can make managing your business more efficient. These tools are designed to streamline the process, reduce errors, and ensure timely payments. By utilizing a professional payment request system, you can focus more on your craft while maintaining a high level of organization.

Efficiency: One of the main benefits is the time saved. With a pre-designed document, you can quickly fill in the necessary details and send it off to clients, eliminating the need to create a new document for each transaction.

Consistency: Using the same format for all your requests helps ensure consistency in your communications. This professional approach builds trust with clients and makes your business appear more organized and reliable.

Accuracy: A standardized approach reduces the risk of errors, whether it’s calculating fees or missing out on important details. It helps you stay on top of your financials by clearly listing all charges, payment terms, and due dates.

Legal Protection: Having a formal payment request also serves as a legal document that can protect both you and your client. By including clear terms and conditions, you ensure that both parties are aware of their obligations, which can help prevent disputes.

Branding: Customizing your document with your logo, contact information, and branding elements not only adds a professional touch but also reinforces your identity as a business, helping you stand out in a competitive industry.

Overall, using a well-crafted payment request form can make the financial side of your business smoother and more professional, allowing you to focus on what you do best.

Common Mistakes in Musician Invoices

Even with a clear and structured payment request, it’s easy to make mistakes that could lead to confusion, delays, or disputes. These errors often occur when the document lacks important details or contains inaccuracies that can complicate the payment process. Avoiding these common mistakes can help ensure that payments are received on time and your business runs smoothly.

- Missing Contact Information: Failing to include full contact details for both yourself and the client can lead to confusion and delays. Ensure that names, addresses, phone numbers, and email addresses are listed clearly.

- Unclear Payment Terms: Not specifying when payment is due or how it should be made can create misunderstandings. Always include clear payment deadlines and the methods of payment you accept.

- Incorrect Amounts: Double-check the amounts for services rendered. Simple arithmetic errors can cause frustration and delay payments. It’s crucial to accurately list the agreed-upon rates and totals.

- Omitting Additional Charges: If there are any extra fees, such as travel costs or additional hours worked, these should be clearly outlined. Failing to mention them upfront may cause clients to be surprised or unwilling to pay them later.

- Lack of Detailed Descriptions: Being vague about the services provided can lead to disputes over what was actually delivered. Always provide a detailed description of the work completed, including dates, location, and any special conditions agreed upon.

- Not Including Tax Information: Depending on your location and business structure, tax details may be necessary. Omitting tax rates or not including them correctly can create confusion and potential legal issues.

- Forgetting to Include a Reference Number: A reference number is essential for organizing and tracking payments. Without it, it can become difficult to match up payments with specific transactions, especially if you have multiple clients.

By being aware of these common mistakes and taking the time to carefully review your documents, you can reduce the likelihood of payment delays and ensure a smoother financial process for both you and your clients.

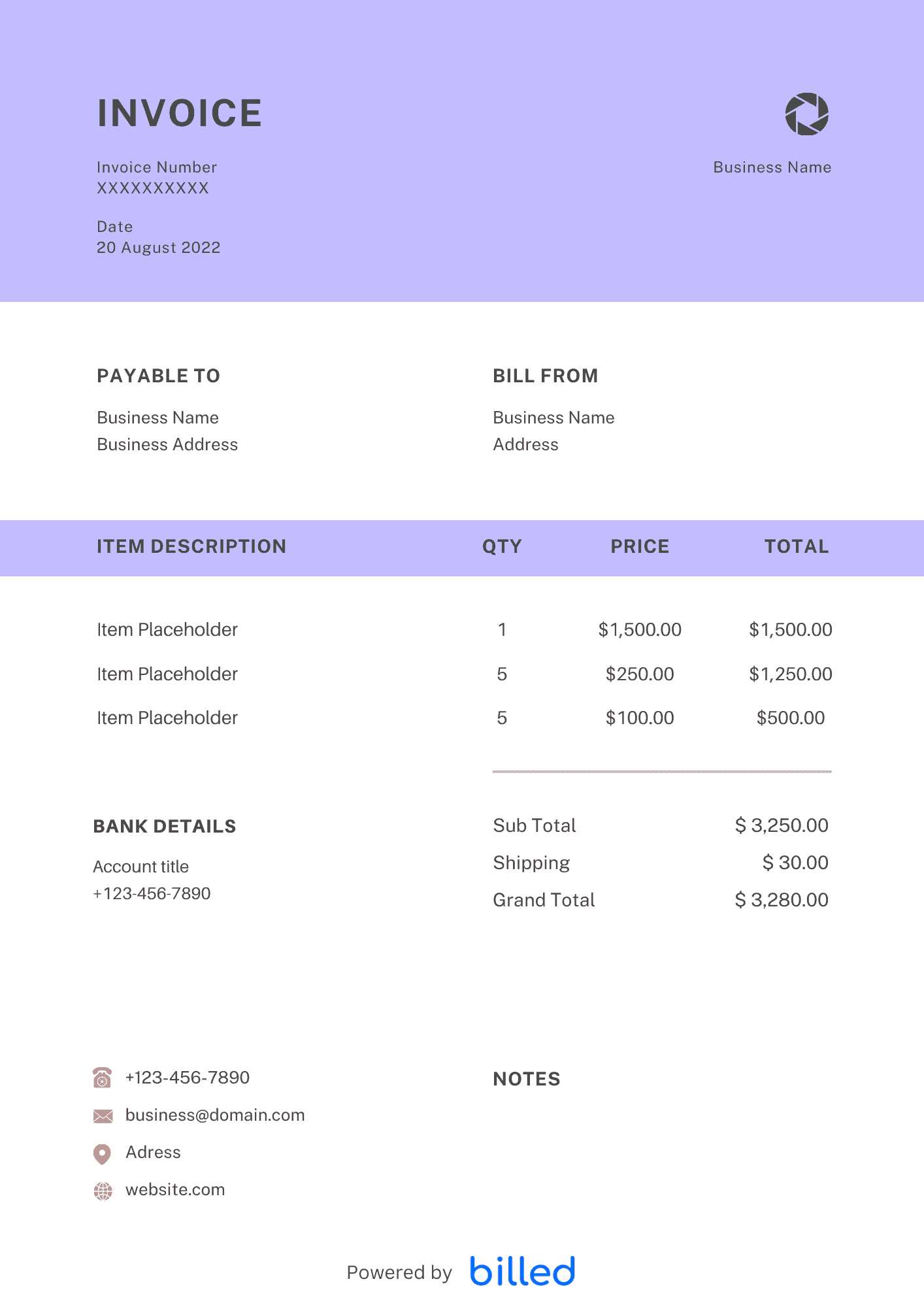

Free vs Premium Musician Invoice Templates

When it comes to creating professional payment requests, there are both free and premium options available. Each choice offers distinct advantages depending on your needs and the level of customization you require. Understanding the differences between these options can help you decide which one best suits your business and workflow.

Free tools are often sufficient for simple requests and basic formatting, while premium options provide more advanced features and design flexibility. Below is a comparison of the key differences between the two:

| Feature | Free Options | Premium Options |

|---|---|---|

| Customization | Basic customization (logos, colors, fonts) | Advanced customization (layouts, design elements, branding options) |

| Design Quality | Simple, minimal designs | High-quality, professionally designed layouts |

| Features | Basic fields for work details and payment terms | Advanced fields (tax rates, discounts, payment tracking, recurring billing) |

| Support | Limited or no customer support | Priority customer support, updates, and tutorials |

| Cost | Free | Paid subscription or one-time purchase |

For individuals or businesses just starting out or with basic needs, free options may be sufficient. However, if you require more advanced features, greater customization, and professional-level design, premium choices provide the tools needed to elevate your requests and create a more polished image for your business.

How to Track Payments with Invoices

Effectively tracking payments is crucial for maintaining financial stability and ensuring that you are compensated for your work. Having a system in place to monitor outstanding balances and track received payments allows you to stay organized and avoid confusion. By carefully managing your payment requests, you can quickly identify when payments are due and follow up as necessary.

1. Assign Unique Reference Numbers: One of the simplest ways to track payments is by using unique reference numbers for each request. This helps you quickly identify which payment corresponds to which project. You can also reference these numbers in communications with clients to avoid confusion.

2. Include Payment Status Fields: Clearly mark whether the payment is pending, partially paid, or completed. This can be done using checkboxes or status indicators. Updating the status as soon as a payment is made or received will help you stay on top of your financials.

3. Create a Payment Log: Maintaining a separate log or spreadsheet that lists all payments received allows you to track financial transactions over time. This log should include information such as the date of payment, the amount paid, and the method used (e.g., bank transfer, PayPal, etc.).

4. Set Up Reminders for Outstanding Payments: If you are working on multiple projects or with many clients, it can be easy to forget about overdue payments. Setting up reminders, either manually or using invoicing software, ensures that you don’t miss follow-up opportunities. This will help ensure you get paid on time.

5. Use Digital Payment Tracking Tools: Many online payment systems, such as PayPal or bank portals, allow you to integrate payments directly into your tracking system. These tools automatically update the status of payments and can even generate reports to help you analyze your cash flow.

By incorporating these methods into your financial process, you can keep track of every transaction, reduce the risk of missed payments, and ensure that you stay on top of your financial obligations.

Understanding Invoice Terms and Conditions

Clearly outlining the terms and conditions in your payment request is crucial for setting expectations and protecting both parties involved. These terms act as a contract that ensures both you and your client are on the same page regarding payment schedules, fees, and any other important aspects of the transaction. Having these details in writing helps prevent confusion and provides a reference point in case of disputes.

Key Terms to Include

1. Payment Due Date: Clearly state when payment is expected. This is crucial for avoiding delays and ensuring a smooth cash flow. Common terms include “due upon receipt,” “net 30,” or “due within 15 days.”

2. Accepted Payment Methods: Specify the methods of payment you accept, such as bank transfer, credit card, PayPal, or checks. This ensures clients know how to pay you and prevents delays caused by confusion over payment options.

3. Late Payment Penalties: Outline any fees or interest that will apply if the payment is not made on time. For example, you may charge a percentage of the outstanding amount for each week the payment is delayed.

Additional Considerations

4. Refund and Cancellation Policies: If applicable, include any terms regarding refunds or cancellations. This is especially important for services where the work may be partially completed before cancellation.

5. Scope of Services: Be clear about what is included in the agreed price. This can include hours worked, specific tasks performed, or the final deliverables, ensuring there is no ambiguity over the expectations.

6. Taxes: Depending on your location, taxes may need to be added to the total amount. Clearly state whether tax is included in the quoted price or will be added separately. This helps prevent misunderstandings at the time of payment.

By taking the time to define these terms, you protect yourself and ensure that the transaction proceeds smoothly. Clearly written conditions help avoid disputes and foster a more professional relationship with clients.

How to Organize Your Invoices Efficiently

Proper organization of your payment requests is essential for maintaining a clear overview of your finances. A well-structured system helps you track outstanding payments, avoid missing deadlines, and ensure that your records are always accessible when needed. By implementing effective organizational practices, you can manage multiple clients and projects with ease, ultimately saving time and reducing stress.

1. Categorize Your Documents

Start by organizing your payment records into categories based on different factors, such as:

- Client Name: Group documents by client, which makes it easier to track payments for each individual.

- Project Type: Sort by the type of work you provided, whether it’s live performances, studio sessions, or music lessons.

- Status: Keep track of paid and outstanding balances. Categorizing by payment status helps ensure timely follow-ups on overdue payments.

2. Use Digital Tools for Automation

Digital tools can greatly streamline the organization process. Many online platforms offer features that automatically categorize your payment records and send reminders for overdue payments. Consider using:

- Cloud Storage: Store your documents in a secure, easily accessible cloud storage service, allowing you to access them from anywhere.

- Accounting Software: Software like QuickBooks or FreshBooks helps automate the tracking of payments, organize financial records, and even create customized payment requests.

By leveraging these tools, you can save time and ensure that your records are always accurate and up-to-date.

Invoice Template Software for Musicians

For those in the creative industry, using specialized software to generate payment request documents can significantly simplify administrative tasks. These tools offer easy-to-use interfaces and customization options, allowing you to focus on your craft while ensuring that your financial records remain organized and professional. Whether you’re handling one-time projects or recurring engagements, invoice management software can save you time and reduce errors.

Key Features of Invoice Software

Different software solutions offer a variety of features designed to streamline the payment request process. Here are some essential functionalities to look for:

| Feature | Free Options | Premium Options |

|---|---|---|

| Customization | Basic customization (logo, text, and colors) | Advanced customization (full branding, layout control) |

| Recurring Billing | No recurring payment options | Automated recurring billing for regular clients |

| Payment Integration | Limited integration with payment systems | Direct integration with PayPal, Stripe, and other gateways |

| Tax Calculations | Manual tax entry | Automatic tax calculations based on region |

| Reporting | Basic reporting tools | Advanced financial reporting and analytics |

Popular Software Options

There are a variety of software tools available that cater to different needs. Some well-known options include:

- FreshBooks: A popular choice for freelancers, offering invoicing, time tracking, and expense management all in one platform.

- QuickBooks: Ideal for those looking for comprehensive accounting solutions, with features such as payment tracking, invoicing, and tax preparation.

- Zoho Invoice: A flexible tool that provides a variety of templates, custom branding options, and integration with multiple payment gateways.

- Wave: A free solution offering invoicing, accounting, and receipt scanning, making it ideal for small businesses and independent contractors.

Choosing the right software depends on your specific needs–whether it’s simple one-off payments or recurring services. Using the right tool can make your financial mana

Including Taxes in Your Music Invoice

Including taxes in your payment requests is an essential part of maintaining transparency and legal compliance in your business transactions. Taxes ensure that you meet the requirements set by local, state, or national tax authorities. Whether you’re required to collect sales tax, VAT, or other types of tax, it’s crucial to correctly apply these charges to avoid legal issues and ensure proper accounting.

Here are some important steps to follow when including taxes in your payment requests:

- Understand the Tax Requirements: Different regions and countries have varying tax laws. Make sure you are aware of the specific tax obligations based on your location and the location of your clients. For example, some areas may require sales tax on services, while others may not.

- Specify the Tax Rate: Clearly indicate the applicable tax rate on your payment request. This could be a percentage of the total amount, and it’s essential to break it down for the client. For example: “Sales Tax (8%): $20.00.”

- Include Tax Identification Information: Some regions require businesses to display their tax identification numbers (TIN) or VAT number. Make sure to include this information, if applicable, on your document to avoid confusion and ensure compliance.

- Separate Tax Amount from Service Fees: It’s important to list the tax amount separately from the service charges. This allows your clients to see the exact breakdown of their total payment, making the document clearer and more professional.

- Track Tax Payments for Record-Keeping: Keep records of all the taxes you’ve collected, as you may need to report this information to tax authorities. Having a system in place for tracking taxes can help with both compliance and financial planning.

By including accurate tax information, you ensure that your transactions are transparent and compliant with local regulations. This helps build trust with your clients and reduces the risk of any future disputes or audits.

Protecting Your Work with Proper Invoicing

Properly documenting your services through detailed payment requests is an essential way to protect your intellectual property and ensure fair compensation. By outlining the terms and conditions clearly, you establish an official record of the agreement, which serves as legal protection should any disputes arise. A well-structured payment request not only helps ensure that you are paid but also helps prevent misuse or misunderstanding of the work you’ve done.

1. Define Ownership and Usage Rights

One of the most important aspects of protecting your work is clearly defining who owns the rights to the material you’ve created. This includes specifying:

- Ownership: Indicate whether you are transferring ownership of the work or licensing it for a specific use. This prevents clients from assuming they have full rights to the content.

- Usage Limitations: Clarify any restrictions on how the work can be used, whether it’s for personal use, commercial purposes, or any other specific conditions.

- Copyrights: Ensure you state if the copyright remains with you or if it’s transferred to the client, depending on your agreement.

2. Include Clear Payment Terms

Having well-defined payment terms in your documents ensures you are paid promptly and according to the agreed schedule. These terms should cover:

- Payment Deadlines: Specify when payments are due (e.g., upon receipt, net 30 days, etc.).

- Late Payment Penalties: Outline any fees or interest for overdue payments to discourage delays and protect your financial interests.

- Refund and Cancellation Policies: If applicable, state whether the client is entitled to a refund or cancellation and under what circumstances.

By including these key elements in your documents, you reduce the chances of disputes and ensure that you are protected in the event of a misunderstanding or legal issue. Clear, thorough documentation serves as a safeguard for both you and your clients, maintaining a professional relationship built on mutual respect and clarity.

How to Handle Late Payments in Invoices

Late payments are a common challenge in business transactions, and they can affect your cash flow and productivity. It’s essential to have a clear process in place for handling overdue payments to ensure that you’re compensated for your work in a timely manner. Establishing firm yet professional practices for dealing with delays can help maintain positive client relationships while also protecting your financial stability.

Here are some steps to take when dealing with late payments:

| Action | Description | Recommended Timeframe |

|---|---|---|

| Send a Friendly Reminder | If a payment is slightly overdue, send a polite reminder to your client. Sometimes, clients simply forget or miss the payment deadline. | 1-3 days after the due date |

| Issue a Formal Reminder | If the payment is still not made, send a formal reminder that includes details of the outstanding amount and any late fees, if applicable. | 7-10 days after the due date |

| Apply Late Fees | To encourage timely payment, introduce a late fee policy. Clearly state these fees in your terms to deter future delays. | 14-21 days after the due date |

| Offer Payment Plans | If a client is unable to pay the full amount at once, offer flexible payment options. This shows goodwill while ensuring you still receive payment. | Depends on agreement with the client |

| Escalate to Collection | If payments remain unpaid after repeated attempts, you may need to hand over the debt to a collection agency or pursue legal action. This is usually a last resort. | 30+ days after the due date |

Having a clear payment policy and consistently following up with clients will help you manage late payments effectively. By remaining professional and assertive, you can protect your finances and encourage prompt payment from clients, while still preserving good working relationships.

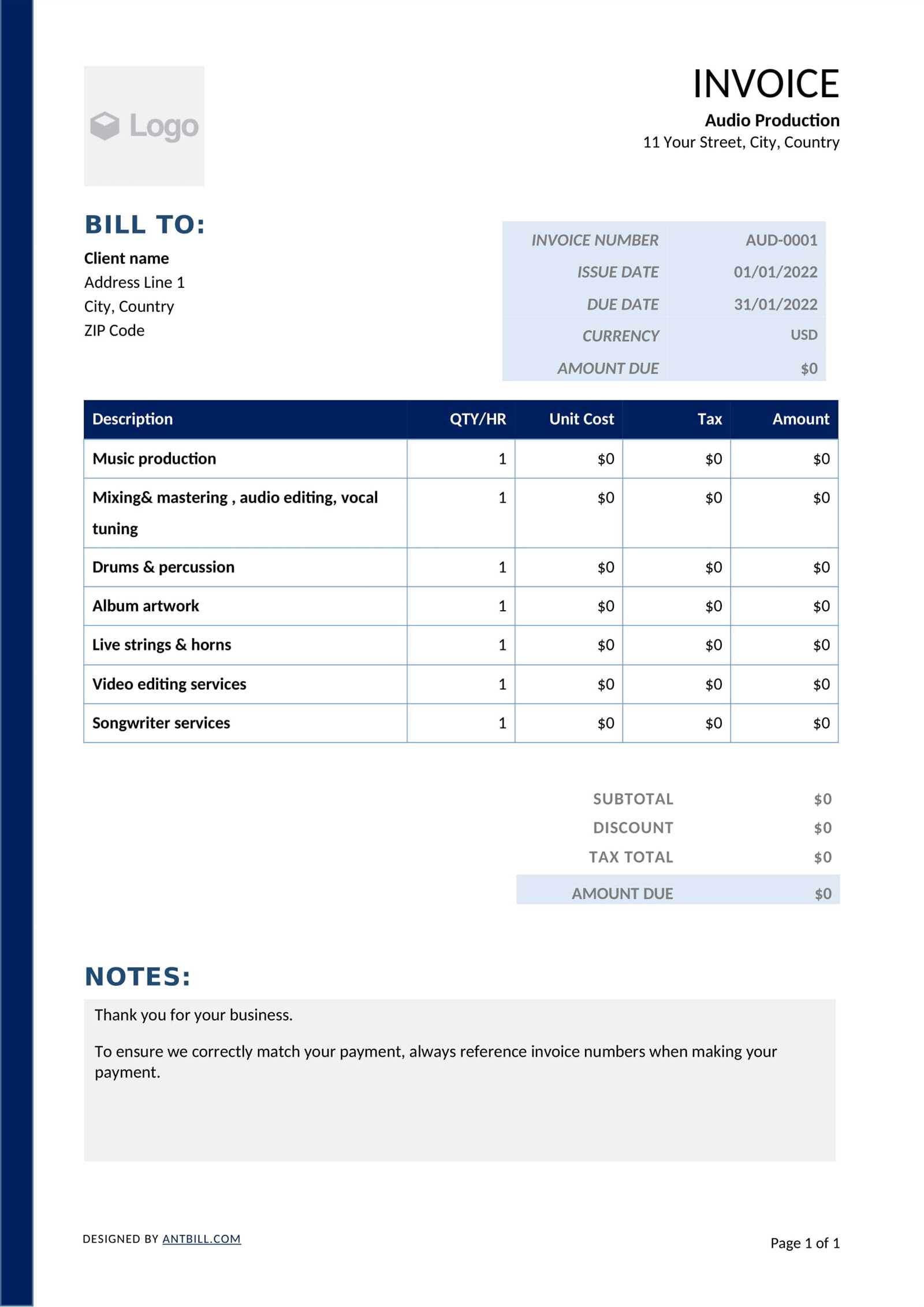

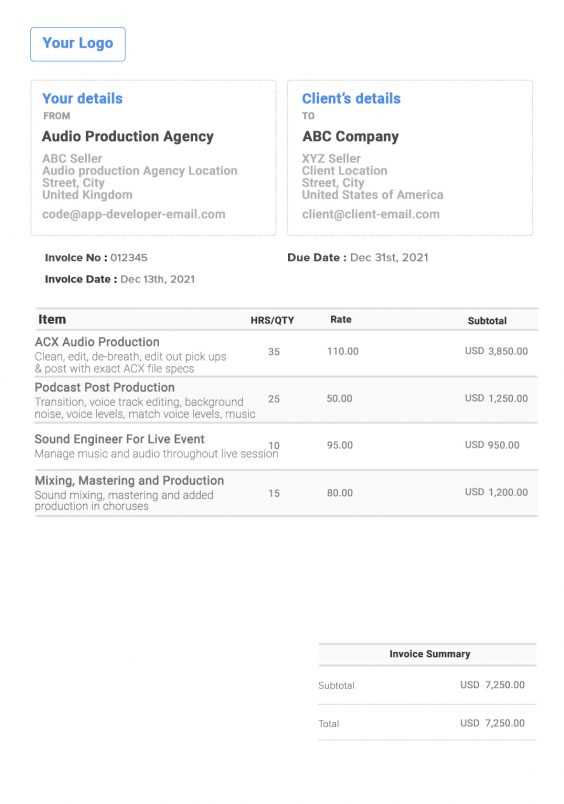

Creating Invoices for Different Music Projects

When working on various types of music-related projects, it’s important to tailor your payment requests to reflect the specific nature of each project. Whether you are recording an album, performing live, or providing music lessons, the details of the project will determine how the payment request is structured. Customizing your documents to suit different engagements ensures clarity and helps maintain a professional relationship with your clients.

Types of Music Projects and Payment Structures

Different music-related services often require distinct approaches when it comes to pricing and payment breakdowns. Below are some common types of music projects and the factors to consider when creating payment requests:

| Project Type | Factors to Consider | Payment Structure |

|---|---|---|

| Live Performances | Duration of the performance, travel costs, number of musicians involved | Flat fee per show or hourly rate, plus travel expenses |

| Studio Recording | Session time, number of tracks, additional production work | Hourly or per-track rate, plus any additional fees for mixing or mastering |

| Music Lessons | Lesson duration, frequency, location (online or in-person) | Hourly or per-lesson fee, with discounts for long-term packages |

| Composing or Arranging | Length and complexity of the composition, usage rights | Flat rate per composition, with additional fees for licensing or revisions |

Customizing the Document for Each Project

When creating your payment requests for different types of music projects, make sure to include the following elements that are specific to each type of service:

- Project Description: Provide a detailed description of the work performed, such as the number of songs recorded, the length of the performance, or the number of lessons given.

- Payment Breakdown: Clearly outline how the fee is structured, whether it’s hourly, per-track, or based on a flat fee.

- Additional Costs: If there are any extra expenses, such as travel, equipment rental, or production costs, list them separately to ensure transparency.

- Payment Terms: Specify the agreed payment schedule (e.g., deposit upfront, balance on completion), including due dates and any late fee policies.

By customizing your payment requests for different types of projects, you make it easier for clients to understand the charges and es

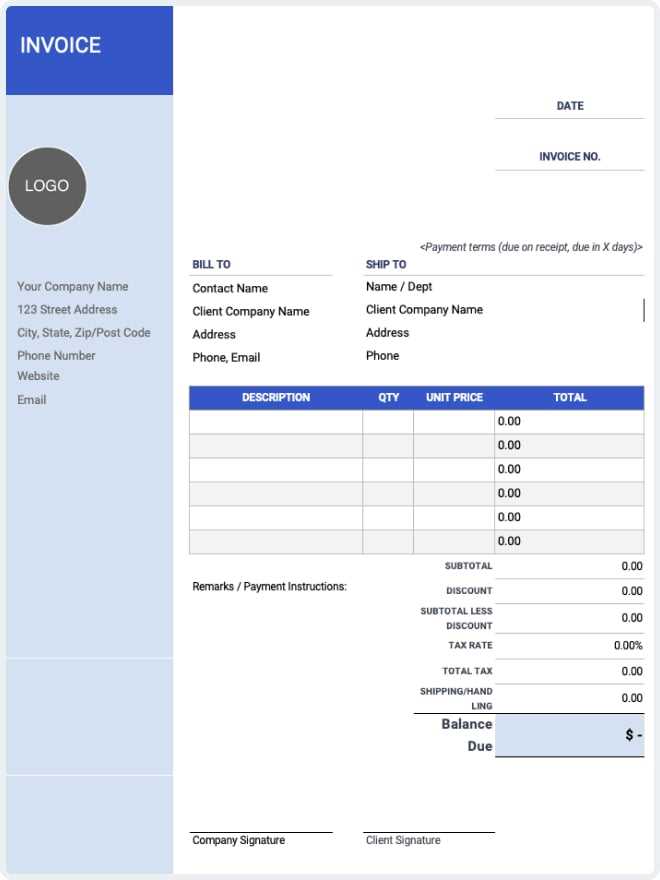

Tips for Professional Invoice Design

Creating a visually appealing and easy-to-read payment request is crucial for making a good impression on your clients. A well-designed document not only reflects your professionalism but also ensures that the information is clear and accessible. By focusing on key elements such as layout, fonts, and structure, you can create a polished document that enhances your reputation and helps ensure timely payments.

1. Keep It Simple and Clean

Clarity is essential when designing a payment request. A cluttered or overly complex design can confuse clients, leading to misunderstandings or delays. Here are some design tips for maintaining simplicity:

- Minimalist Layout: Use a straightforward layout with sufficient white space between sections. This makes the document easier to read and more professional.

- Clear Sections: Break the document into clear sections, such as services provided, payment terms, and contact information. This allows clients to quickly locate the relevant details.

- Legible Fonts: Choose a clean, readable font such as Arial or Helvetica, and ensure the text is large enough to read easily. Avoid overly decorative fonts that can distract from the content.

2. Include Essential Information

Ensure that all necessary details are present for both you and your client. The more information you provide upfront, the fewer chances there are for confusion later. Here are some key details to include:

- Client and Service Provider Information: Include both parties’ names, addresses, and contact details. This helps prevent confusion about who is responsible for the payment.

- Project Description: Provide a detailed breakdown of the services rendered, including dates, hours, or any other relevant specifics.

- Payment Terms: Clearly outline payment due dates, accepted payment methods, and any penalties for late payments.

- Unique Identification Number: Include an invoice number to help track and organize your documents, which also aids in bookkeeping and tax preparation.

By focusing on simplicity, clarity, and essential details, you can create a professional, functional payment request that ensures smooth transactions and leaves a positive impression on your clients.