Download Musician Invoice Template in Word Format for Easy Billing

When you work in the creative industry, getting paid for your work is just as important as creating it. Keeping track of payments, issuing receipts, and managing finances can quickly become overwhelming without the right tools. Luckily, having a professional document to outline transactions can simplify this process and ensure clarity for both you and your clients.

By using a customizable format, you can efficiently detail the services provided, payment terms, and any other relevant information. This organized approach not only looks professional but also helps maintain a transparent record of all financial interactions. Whether you’re providing one-time services or recurring projects, having a consistent method for documentation can save time and avoid confusion.

Easy-to-use documents make it simple to create clear and accurate records. With the right design, you can tailor the information to suit your needs, making sure every client receives the necessary details in a format they can easily understand. In addition, automating and standardizing the process reduces the chance for errors, leaving you to focus on what matters most–your creative work.

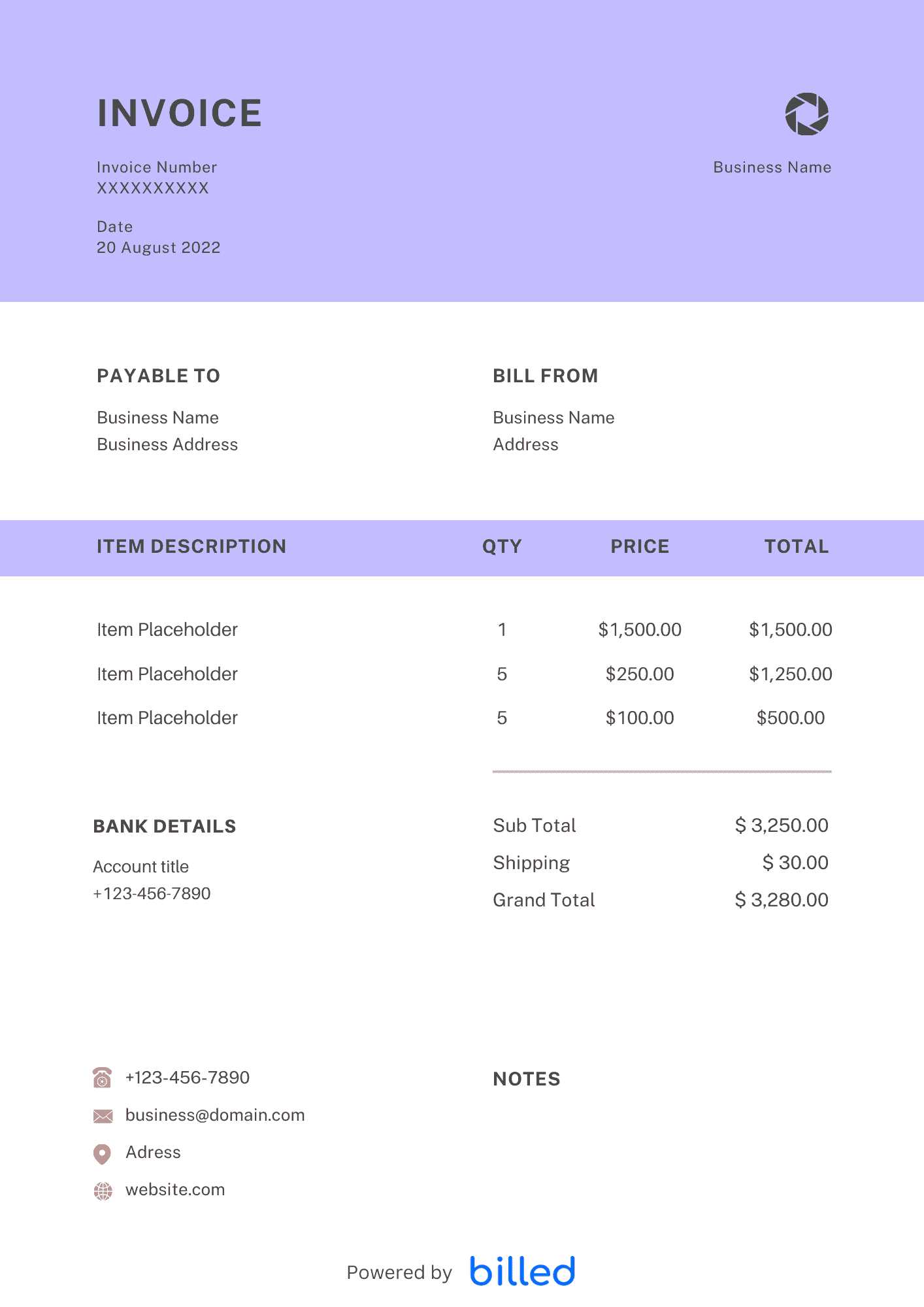

Musician Invoice Template in Word Format

For anyone offering creative services, having a professional way to document payments and agreements is essential. Using a simple, customizable document in a familiar format allows you to generate professional records with minimal effort. This approach not only saves time but also ensures that both you and your clients are on the same page regarding terms and conditions.

Benefits of Using a Digital Document

Opting for a digital document format brings numerous advantages. First, it allows for quick and easy customization, enabling you to adjust details like service descriptions, rates, and payment terms for each project. Additionally, it ensures that your records are neat, legible, and stored in an accessible format, which is perfect for keeping everything organized.

How to Customize for Your Needs

Personalizing your document is simple, with easy-to-fill fields that allow you to input essential information such as client name, payment amount, and due dates. You can also add your branding elements, such as logos or color schemes, giving the document a polished and professional appearance. Whether you’re working on a one-time job or long-term collaboration, this customizable format helps you stay organized and on top of your finances.

Why You Need an Invoice Template

Having a structured document to record payments and services is essential for anyone offering professional services. It helps ensure that both parties are clear on the terms of the transaction, reducing the likelihood of misunderstandings or disputes. By using a consistent format, you can streamline the billing process, making it easier to track payments and maintain financial records.

Without a standardized system, it can be easy to overlook important details, such as due dates, service descriptions, or payment terms. A well-organized document ensures that no important information is missed and helps you present yourself in a more professional light. This is especially important for those who rely on regular work, as it builds trust and shows clients that you are serious about your business.

Efficiency is another key benefit. Instead of creating a new record from scratch each time, you can reuse and customize an existing structure, saving valuable time. This consistency not only helps with client satisfaction but also makes it easier to manage taxes and other financial records at the end of the year.

Benefits of Using Word for Invoices

Using a widely accessible software to create billing documents offers a range of advantages, particularly for individuals who need flexibility and ease of use. With this type of program, you can quickly draft clear and professional records that can be easily shared or printed. The program’s user-friendly interface and simple formatting tools make it an ideal choice for those who don’t need complex accounting systems but still want a reliable way to manage payments.

One of the primary benefits is the ability to customize the document to suit your needs. Whether you’re handling a one-time project or recurring work, you can easily modify the details, such as rates, dates, and descriptions, without hassle. Additionally, the software’s compatibility with other systems ensures that your document can be quickly converted or shared in various formats, making communication with clients and accountants smooth and efficient.

The program also provides the benefit of creating polished, professional-looking documents without the need for specialized design skills. Built-in templates and formatting options ensure that your records appear clean and organized, contributing to a positive impression with clients. Whether you’re sending it via email or printing it for in-person delivery, your document will maintain its clarity and professionalism.

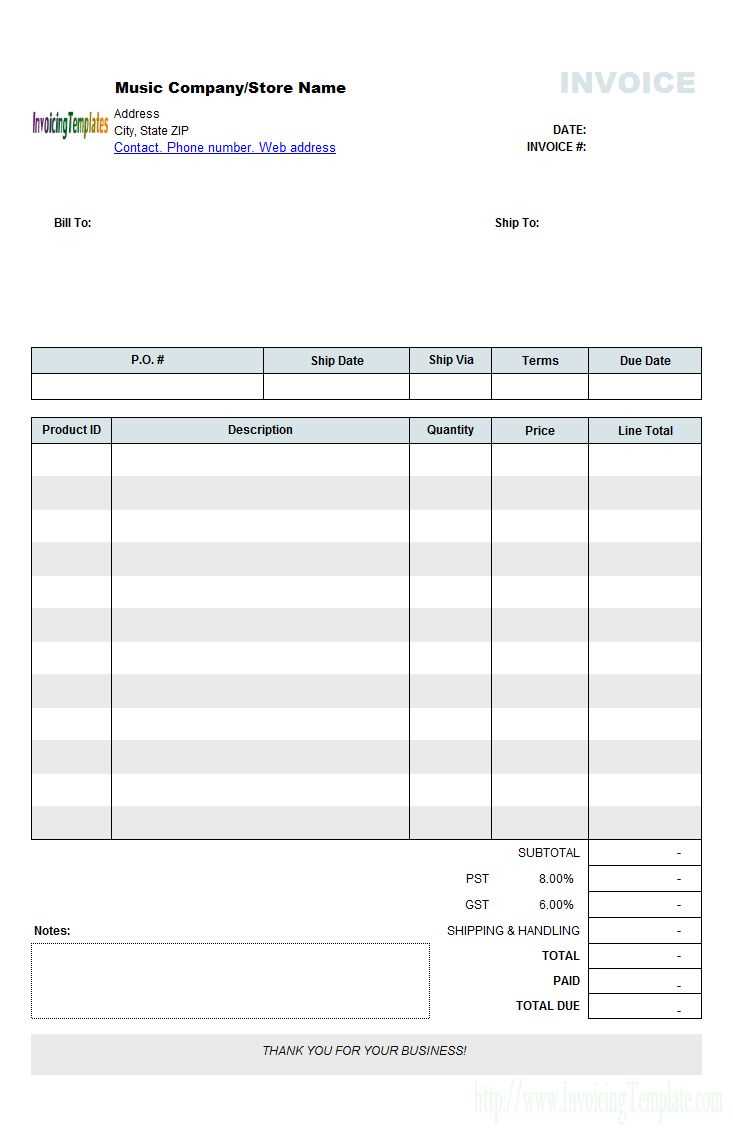

How to Create a Musician Invoice

Creating a professional document to request payment for your services can be done in a few simple steps. The key is to ensure that all the necessary details are included, so the client understands the terms clearly. By following a clear and organized structure, you can produce an easy-to-read record that covers all the important aspects of the transaction.

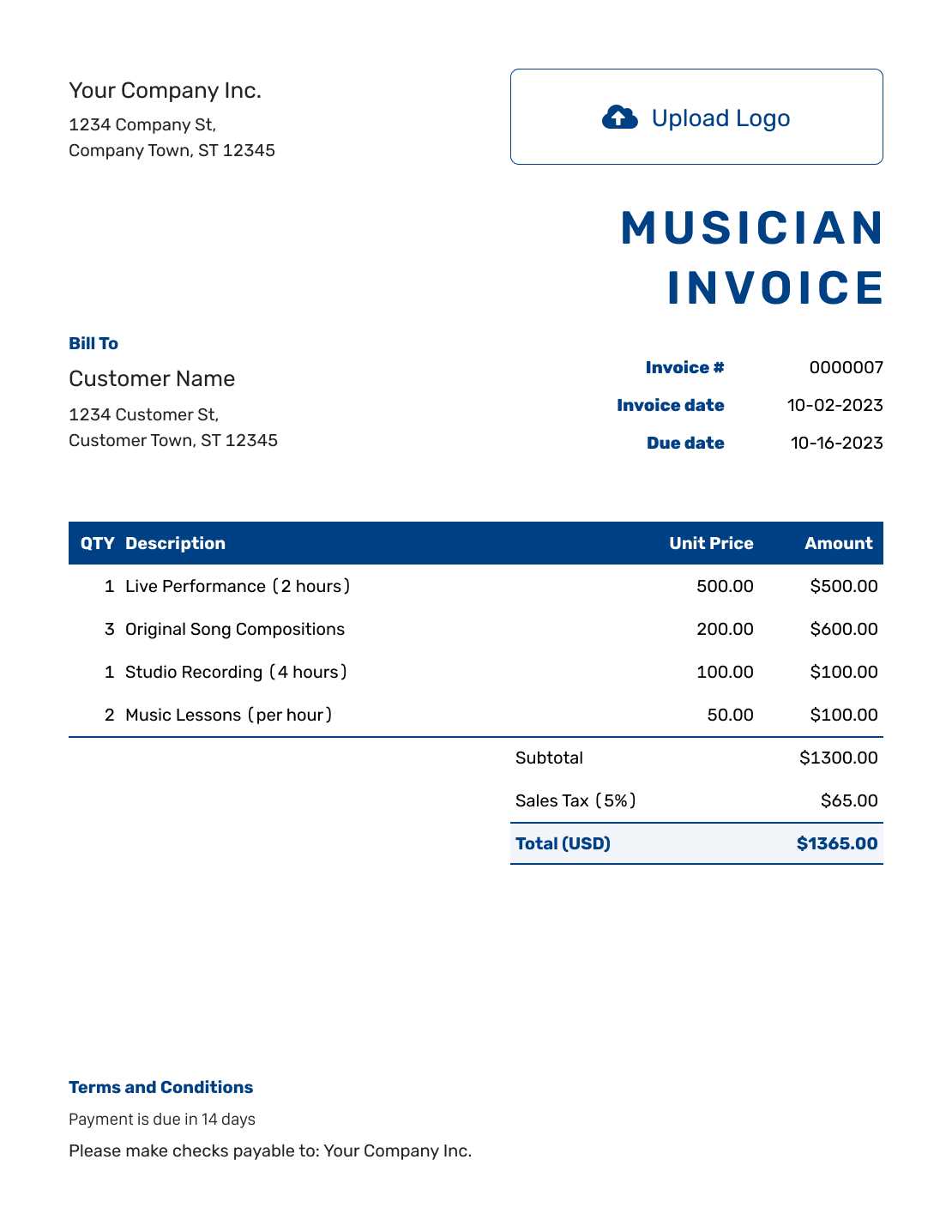

To begin, you’ll need to include some basic information about both you and the client. This includes your name, contact information, and a description of the work completed. You will also want to specify the total amount due, payment terms, and the deadline for payment. This not only helps avoid any confusion but also ensures that both parties are on the same page regarding the financial aspects of the agreement.

| Item | Description | Amount |

|---|---|---|

| Service Provided | Details of the work performed | $500 |

| Additional Costs | Any additional charges or expenses | $50 |

| Total | Sum of all charges | $550 |

Once the essential details are included, ensure that your document is easy to understand and professional in appearance. This can be done by using clear fonts, adding your branding, and organizing the information in an easily digestible format. By taking these simple steps, you’ll create a document that looks polished and helps you manage your transactions effectively.

Essential Details for Musician Invoices

When preparing a payment request document, it is crucial to include all the necessary information to ensure transparency and clarity for both parties. A well-organized record helps avoid misunderstandings and ensures that the payment process goes smoothly. By outlining the key details clearly, you can create a document that is both professional and effective in securing prompt payment.

The most important elements to include are the description of the services provided, the agreed-upon rates, and any additional fees or costs. You should also provide clear payment instructions, including how and when the client should settle the amount. Including all these elements will prevent any confusion and help both you and your client stay organized.

| Detail | Explanation |

|---|---|

| Your Contact Information | Include your name, address, phone number, and email. |

| Client Information | List the client’s name, address, and contact details. |

| Service Description | Clearly outline the services provided, including dates and specifics. |

| Payment Terms | State the amount due, payment method, and deadline for payment. |

| Additional Charges | List any additional costs, such as travel or equipment fees. |

By incorporating these essential details, you will have a complete and accurate document that meets the needs of both parties involved. It not only improves the professionalism of your business but also makes the entire payment process more efficient and straightforward.

Customizing Your Invoice Template

Personalizing your payment request document allows you to align it with your brand and specific needs. Customization ensures that each record is not only functional but also reflects your unique style and professional image. By making a few adjustments, you can create a document that feels tailored and well-organized, providing both clarity and a personal touch for your clients.

Key Elements to Customize

When modifying a standard payment request format, here are the main areas to focus on:

- Header Information: Include your business name, logo, and contact details for a professional appearance.

- Service Descriptions: Adjust the language and details to reflect the exact nature of the work completed for the client.

- Payment Terms: Tailor the payment deadlines and methods to suit the specific agreement with each client.

- Branding: Add custom fonts, colors, or design elements that align with your business identity.

How to Ensure Professionalism

While customizing, it’s important to maintain a clean and organized layout. Avoid cluttering the document with excessive information or overly complicated designs. Focus on making the details easy to read and ensuring all necessary sections are present. A well-structured document not only makes it easier for clients to understand the charges but also adds to your credibility as a professional.

- Consistency: Ensure that your fonts and colors match your brand across all documents.

- Clear Section Dividers: Use clear headings and bullet points to break up information and improve readability.

- Contact Information: Always ensure your contact information is easy to find and up to date.

Customizing these elements will help you create an effective and professional document that reflects your business standards, streamlines communication, and enhances client satisfaction.

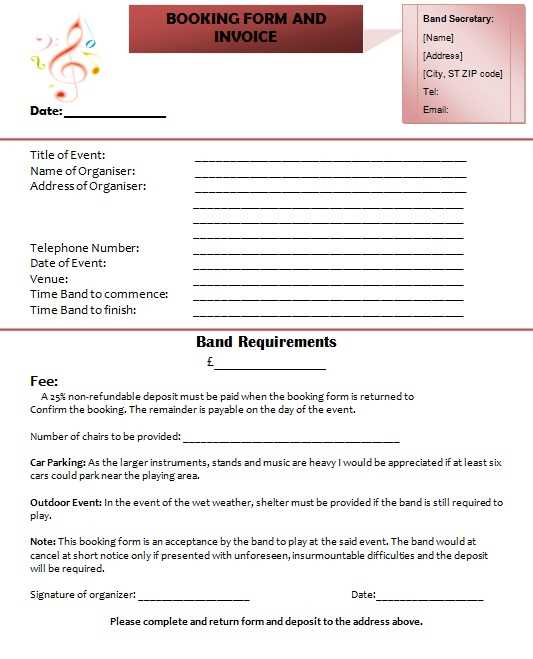

How to Include Payment Terms

Clearly outlining payment expectations is essential for avoiding misunderstandings and ensuring timely compensation for your work. Payment terms define how and when the client is expected to pay, and they should be as precise and straightforward as possible. By specifying the conditions in advance, you can set a professional tone and reduce the chances of delayed or missed payments.

Key Elements of Payment Terms

When writing payment terms, it’s important to cover the following details:

- Payment Due Date: Clearly state the exact date by which the payment should be made. This eliminates any confusion about deadlines.

- Accepted Payment Methods: Specify the types of payments you accept, such as bank transfers, checks, or online payment platforms.

- Late Payment Penalties: If applicable, include a section about late fees or interest charges if the payment is not made by the due date.

- Deposit or Advance: Indicate if a deposit or advance payment is required before work begins, and outline the amount or percentage.

How to Communicate Payment Terms Effectively

Once the payment details are included, it’s important to present them clearly. Use bold text or bullet points to make them stand out, and ensure the terms are easy to find within the document. By making the payment terms prominent and easy to understand, you ensure that your clients know exactly what to expect and when to make the payment. This professionalism builds trust and helps ensure timely compensation for your services.

Common Mistakes to Avoid in Invoices

When preparing a document to request payment for your services, it’s easy to overlook small details that can cause confusion or delays. Making common mistakes in these records can lead to missed payments, misunderstandings, and a lack of professionalism. By being mindful of these errors and addressing them proactively, you can ensure smoother transactions and maintain a positive relationship with your clients.

Frequent Errors to Watch Out For

- Incomplete Contact Information: Missing or incorrect contact details can cause delays in communication and payment. Always double-check that your contact information is accurate and up to date.

- Vague Descriptions of Services: Failing to clearly describe what work was completed can lead to confusion. Be specific and detailed about the services provided, including dates and deliverables.

- Omitting Payment Deadlines: Without a clear payment due date, clients may delay payment unintentionally. Always state the exact date or number of days for payment.

- Incorrect Calculations: Simple math errors, such as adding wrong totals or missing taxes, can result in incorrect amounts being charged. Double-check all calculations to avoid this mistake.

- Failure to Include Payment Methods: If you don’t specify how you want to be paid, your client may be confused or delayed in making the payment. Always mention accepted payment methods clearly.

How to Ensure Accuracy

To avoid these issues, carefully review each document before sending it. Take the time to verify all the details, from the payment amount to the terms. Using clear, concise language and a well-structured format can also help prevent misunderstandings. By being thorough and precise, you show professionalism and help maintain good client relations.

Tracking Payments with Invoices

Keeping track of payments for your services is crucial to ensure timely compensation and avoid potential financial discrepancies. By using well-structured records, you can monitor outstanding balances, confirm that payments are made on time, and have a clear overview of your financial transactions. This helps you stay organized, avoid confusion, and manage cash flow effectively.

Effective Ways to Track Payments

There are several key methods to ensure that payments are tracked accurately:

- Mark Paid Status: When a payment is received, mark the record as “Paid” or include the date the payment was made. This helps you easily distinguish between completed and pending payments.

- Payment Reminders: Include reminders for upcoming payments or overdue amounts. You can even automate these notifications to streamline the process.

- Record Partial Payments: If the client makes a partial payment, make sure to update the document with the remaining balance. This helps you avoid confusion later on.

- Track Payment Dates: Always note the exact date when a payment is received. This will help you ensure that you are adhering to the agreed-upon payment terms.

Tools for Efficient Payment Tracking

Using digital tools to manage your records can significantly improve your ability to track payments. Many accounting and finance software programs allow you to input payment details directly into the system, automatically updating your records as payments come in. Additionally, spreadsheet programs can help you create a simple payment tracking system where you can log the status and dates of all transactions.

- Excel or Google Sheets: Use spreadsheets to create a payment tracker with columns for service description, amount due, amount paid, and balance.

- Accounting Software: Programs like QuickBooks or FreshBooks offer built-in features for tracking payments and generating financial reports.

By keeping a detailed and organized record of payments, you can ensu

Free vs Paid Musician Invoice Templates

When choosing a document for requesting payments, there are both free and paid options available. Each type has its own set of advantages and drawbacks, depending on your needs. Free templates are a good option for those just starting out or looking for a basic, no-cost solution. On the other hand, paid options may offer more advanced features and customization, ideal for those who require a more professional, polished look or additional functionality.

Before deciding, it’s important to weigh the benefits of each. Free documents often provide basic functionality, which may be sufficient for simple projects. However, paid formats tend to offer more customization, integrations, and support, which can be invaluable for businesses with more complex needs or those looking to streamline their financial processes.

Comparison of Free and Paid Options

| Feature | Free Option | Paid Option |

|---|---|---|

| Customization | Limited, mostly fixed formats | Highly customizable, including branding elements |

| Design Quality | Basic, simple layout | Professional design with advanced styling |

| Support | None or minimal | Access to customer support and updates |

| Integrations | None | Can integrate with accounting or payment systems |

| Cost | Free | Paid subscription or one-time fee |

While free options can be a good starting point, they may not meet all the requirements of a growing business or more professional services. Paid versions, though they come with a cost, can provide long-term value with their added features and flexibility. Ultimately, your choice will depend on the complexity of your needs and how much you’re willing to invest in streamlining your payment requests.

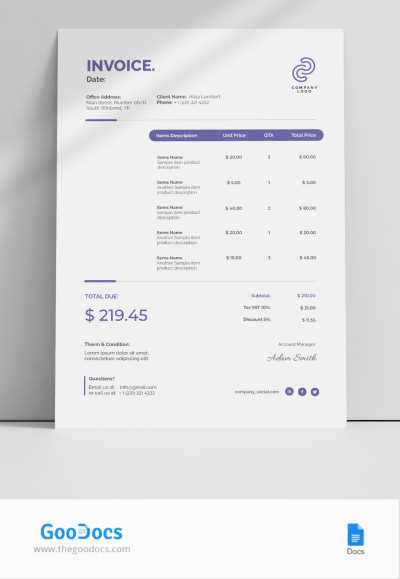

Best Practices for Invoice Design

Creating a clear and professional document to request payments is essential for maintaining positive relationships with clients. The design of your payment request document not only reflects your professionalism but also ensures that the important information is easily accessible and understood. A well-organized structure and clean layout can make a significant difference in how your client perceives your business.

Key Design Principles

When designing your payment request document, focus on clarity, simplicity, and ease of use. Here are some key design principles to consider:

- Keep It Simple: A clean, minimal design is often the most effective. Avoid cluttering the document with unnecessary elements. Stick to the essentials to ensure that the information stands out.

- Use Consistent Branding: Incorporate your business logo, colors, and fonts into the design to create a cohesive brand identity. This adds a level of professionalism and makes your documents instantly recognizable.

- Clear Information Hierarchy: Organize your document with clear headings, subheadings, and sections. Ensure that the most important details, like payment amount and due date, are easy to find and clearly labeled.

- Readable Fonts: Choose fonts that are easy to read, both in print and on screen. Avoid overly decorative fonts and stick to professional, legible choices like Arial or Helvetica.

- Plenty of White Space: Leave enough space between sections and text blocks to avoid visual clutter. This makes the document easier to navigate and more visually appealing.

Additional Design Tips

- Highlight Key Dates: Use bold or larger text to emphasize critical dates like payment due dates or service completion dates.

- Include Contact Information: Ensure your contact details (email, phone number, website) are clearly visible at the top or bottom of the document.

- Use Tables for Charges: A table format is an effective way to display itemized charges, ensuring that clients can easily see what they are being billed for.

- Payment Instructions: Clearly outline the methods and terms of payment. Use bullet points or a separate section to make this informatio

Legal Considerations for Music Invoices

When preparing a document to request payment, it’s essential to ensure that it meets all legal requirements. This protects both the service provider and the client, ensuring that all transactions are clear, transparent, and legally binding. There are several legal aspects to consider, from including the correct terms to complying with tax regulations, which help avoid disputes and ensure smooth business operations.

Key Legal Aspects to Include

To ensure your payment request documents are legally sound, here are the main considerations to keep in mind:

- Clear Terms and Conditions: Outline the terms of the agreement, including payment deadlines, late fees, and any other conditions. This ensures that both parties are on the same page regarding expectations and obligations.

- Accurate Payment Amount: Clearly state the amount due for services rendered. This should be precise and reflect any agreed-upon rates, taxes, or additional fees.

- Business Identification: Include your legal business name, address, and tax identification number (TIN) if applicable. This helps establish your business identity and ensures that the document complies with local laws.

- Client Information: Ensure that the client’s details, such as their full name and address, are correct. This helps avoid disputes and provides clarity in case of any legal action.

- Tax Information: If applicable, include the relevant tax rate or VAT details. Compliance with tax laws is essential, and providing this information helps ensure that your document is legally compliant.

Best Practices for Compliance

To avoid potential legal issues, it’s important to follow best practices for compliance and accuracy:

- Review Local Regulations: Make sure you are familiar with the legal requirements for financial documents in your country or region. This can include tax rates, business registration details, and required language.

- Use Clear and Precise Language: Avoid ambiguous terms. Use simple, clear language to describe the services provided, the amounts charged, and any deadlines or penalties.

- Record Transactions Properly: Keep accurate records of all payments made, including receipts or confirmation emails. This will protect you in case of any future disputes or audits.

- Consult a Legal Expert: If you’re unsure about any legal aspects, consult with a legal professional to ensure your documents are compliant with all applicable laws.

By following these legal considerations, you can ensure that your payment requests are not only professional but al

Using Invoices for Tax Purposes

Properly documenting payments and income is essential for tax purposes, and well-organized payment request records play a key role in this process. These records help you track earnings, calculate tax obligations, and maintain transparency during audits. By ensuring that all required information is accurately recorded, you can simplify the filing process and avoid potential tax issues.

Tax authorities often require detailed documentation of your income, and having clear, itemized records makes it easier to report your earnings and claim any relevant deductions. Additionally, maintaining these records helps demonstrate that you are following legal requirements for taxation, which is essential for avoiding penalties or audits.

Important Details for Tax Compliance

For tax purposes, it’s crucial to include specific details in your payment records to meet legal standards:

- Payment Amounts: Clearly state the amount paid for services rendered. This helps you keep track of total earnings and ensures you accurately report income.

- Tax Information: If applicable, include the relevant tax rate or VAT (Value Added Tax) amount in your records. This ensures compliance with tax laws and simplifies the calculation of your liabilities.

- Business Identification: Include your legal business name, tax identification number (TIN), or VAT number if relevant. This is important for both tax filings and keeping accurate financial records.

- Payment Dates: Record the date when the payment was made. This can help you track income for the correct tax year and avoid errors when filing your taxes.

How Proper Record-Keeping Helps You

Using detailed payment documentation not only helps with tax filings but also ensures that you have the necessary evidence in case of an audit. Clear records can demonstrate the legitimacy of your income and expenses, making the process smoother and more straightforward. Moreover, by maintaining organized records, you can stay on top of any potential deductions or credits that might apply to your business, potentially lowering your overall tax liability.

In conclusion, properly managing your payment records is vital for ensuring compliance with tax laws and streamlining your financial processes. By maintaining detailed and accurate records, you can confidently file your taxes, avoid legal complications, and focus on growing your business.

Integrating Invoices with Accounting Software

Linking payment request documents to accounting software is an effective way to streamline financial processes, saving time and reducing human error. This integration allows for automatic tracking of payments, easy generation of financial reports, and better management of cash flow. By using specialized software, you can centralize all financial data in one place, making accounting tasks much simpler and more efficient.

With the right tools, you can automate key tasks like tracking payments, calculating taxes, and reconciling bank statements. Additionally, many accounting programs offer features that allow you to customize and integrate payment requests directly with your financial records. This eliminates the need for manual entry and reduces the chances of discrepancies between your records and actual transactions.

Benefits of Integration

- Time-Saving Automation: Automatically sync payment details with your accounting software, reducing the need for manual data entry and helping you stay organized without extra effort.

- Real-Time Financial Tracking: Get up-to-date information on your cash flow and outstanding payments, allowing you to make informed financial decisions quickly.

- Accurate Reporting: Integrated systems can generate detailed financial reports, such as profit and loss statements, tax reports, and balance sheets, without having to manually compile data from multiple sources.

- Improved Accuracy: Reduces human error by automatically pulling payment data into your accounting system, ensuring all amounts, dates, and transaction details are correctly recorded.

- Easy Tax Preparation: Integration simplifies the tax filing process by providing all the necessary data in one place, ensuring you’re fully compliant with tax regulations.

How to Integrate with Accounting Software

Most modern accounting platforms, such as QuickBooks, FreshBooks, or Xero, offer integration with various payment processing systems. These platforms allow you to automatically link records, track payments, and manage accounts more effectively. Setting up the integration typically involves the following steps:

- Choose the Right Accounting Software: Select software that supports invoice integration with your payment processing system.

- Link Payment Systems: Connect your preferred payment gateway (e.g., PayPal, Stripe) with the accounting software.

- Enable Automatic Syncing: Set up your system to automatically sync payment details to your accounting records as soon as payments are processed.

- Verify Integration: Check that all transactions are correctly recorded and synced to avoid errors in your financial statements.

Integrating your payment request documents with accounting software not only reduces administrative burden but also enhances the overall financial management of your business. By automating routine tasks, you can focus more on growing your business while ensuring accurate and up-to-date records for tax and reporting purposes.

Tips for Professional Invoice Presentation

When creating payment requests, how you present your document can be just as important as the information it contains. A professional appearance helps convey credibility and establishes trust with your clients. A well-structured document not only ensures clarity but also enhances your reputation by demonstrating attention to detail. Here are some tips to help you create a polished, professional-looking document that will leave a positive impression.

Essential Elements for a Professional Presentation

Ensuring your document looks professional requires careful attention to detail. Below are key elements to include for a polished appearance:

Element Why It’s Important Clear Header Displays your business name and logo, creating a branded identity. Itemized List Breaks down services and charges clearly, making it easy for clients to understand what they are paying for. Consistent Formatting Using uniform fonts, text sizes, and spacing ensures the document looks neat and organized. Contact Information Including your business contact details helps clients reach you easily in case of questions or issues. Due Date and Payment Terms Clarifies when the payment is due and any penalties for late payments, ensuring clear expectations. Design Tips for a Polished Look

In addition to the necessary information, the overall design of your document contributes to its professionalism:

- Use a Clean Layout: Avoid clutter by leaving enough white space between sections, making the document easier to read and navigate.

- Choose Readable Fonts: Stick to professional, easy-to-read fonts like Arial or Helvetica. Avoid decorative fonts that may distract from the content.

- Align Text Properly: Align text consistently, using left or center alignment to create a clean, structured layout.

- Include Your Branding: Incorporate your logo, colors, and branding elements subtly to reinforce your brand identity.

- Highlight Important Details: Use bold or larger text to emphasize key information such as the payment due date and amount due.

By focusing on these design

How to Send Invoices to Clients

Once your payment request document is ready, the next important step is ensuring it reaches your client in the right format and at the appropriate time. Sending a clear and professional request for payment helps maintain strong client relationships and ensures prompt processing. There are several methods to consider, each with its own advantages. Below are steps and best practices for effectively sending payment requests to your clients.

Methods for Sending Payment Requests

There are different ways to deliver payment requests depending on your business and client preferences. Below are common methods you can use:

- Email: One of the most common and efficient methods is sending your request via email. You can either attach the document as a PDF file or include it in the body of the email. Make sure to provide clear instructions on how the client can make the payment.

- Online Payment Platforms: Many platforms, such as PayPal, Stripe, or Square, offer an easy way to generate and send payment requests directly to clients. These services often include options for clients to pay directly through the platform, simplifying the process for both parties.

- Postal Mail: For clients who prefer traditional methods, you can send a printed version of the document by post. This might take longer but could be necessary for specific clients or situations that require physical documentation.

- Accounting Software: If you use accounting software, many of these platforms have built-in features that allow you to send payment requests directly to clients. These services often provide tracking capabilities, so you can monitor when your client receives and views the document.

Best Practices for Sending Payment Requests

To ensure your request is professional and prompts timely payment, follow these best practices:

- Include a Clear Subject Line: If sending by email, use a subject line that clearly indicates the purpose of the message, such as “Payment Request for [Your Service]” or “Amount Due for [Service Name].”

- Personalize the Message: Always address your client by name and include a polite message about the payment. A personal touch shows professionalism and helps maintain a good relationship.

- Provide Payment Instructions: Clearly explain how the client can make the payment, including acceptable payment methods, account details, or links to payment platforms.

- Set Clear Payment Deadlines: Include the due date for the payment and any penalties for late payments. This helps set expectations and encourages clients to pay on time.

- Follow Up: If you don’t receive payment by the due date, send a polite reminder email or message. Keep the tone friendly but professional.

Sending a payment request is an important task that can impact cash flow and client relationships. By choosing the r

Creating Recurring Invoices for Regular Gigs

For those who provide services on a regular basis, managing payment requests efficiently can save time and reduce administrative work. Recurring payment requests are essential for consistent income, especially when you have ongoing contracts or regular clients. Automating this process allows you to set up a system that generates and sends payment requests automatically, reducing the need for manual creation each time.

When creating recurring payment requests, it’s important to include all necessary details to ensure smooth transactions. This includes clear terms, repeatable billing cycles, and appropriate payment methods. Below are steps to set up and manage these types of requests efficiently.

Key Elements of Recurring Payment Requests

When crafting a recurring request document, there are a few essential elements to include to ensure clarity and consistency with your client:

Element Why It’s Important Service Description: Clearly outline the recurring service(s) provided, specifying what is included in each payment. Billing Cycle: Specify whether payments are due weekly, monthly, or on another schedule. This sets clear expectations for both you and the client. Payment Amount: Clearly list the agreed-upon payment amount for each cycle to avoid any confusion. Start and End Dates: Specify the starting date of the recurring cycle and, if applicable, the end date. This helps both parties understand the length of the agreement. Payment Method: Provide clear instructions on how payment should be made, whether it’s via bank transfer, credit card, or an online payment platform. How to Automate Recurring Payments

Many accounting platforms offer features that allow you to automate recurring payment requests. Setting up this automation involves:

- Selecting a Payment Platform: Choose an online payment service such as PayPal, Square, or QuickBooks that supports recurring billing.

- Setting Payment Frequency: Determine the frequency of your payment requests, whether weekly, monthly, or another cycle, and input it into the platform.