Customizable Music Band Invoice Template for Easy Payment Management

When it comes to managing payments for your musical work, having a structured way to request compensation is crucial. Creating an organized document for financial transactions not only ensures clarity but also promotes professionalism in your dealings. Whether you’re performing at local venues, collaborating with other artists, or working with event organizers, having a reliable way to present your charges can streamline the entire process.

Crafting a well-designed payment request is essential for maintaining transparent communication with clients and collaborators. This allows you to outline the agreed-upon terms, services rendered, and any necessary details related to your performance. A clean, easy-to-read format will help avoid misunderstandings and ensure that all financial matters are settled smoothly.

Using a customizable document that fits your needs will save time and prevent errors. With a variety of formats available, you can tailor the content according to specific projects, whether it’s for a solo gig or a larger group performance. This simple yet effective tool not only helps in securing payments but also builds trust with your clients.

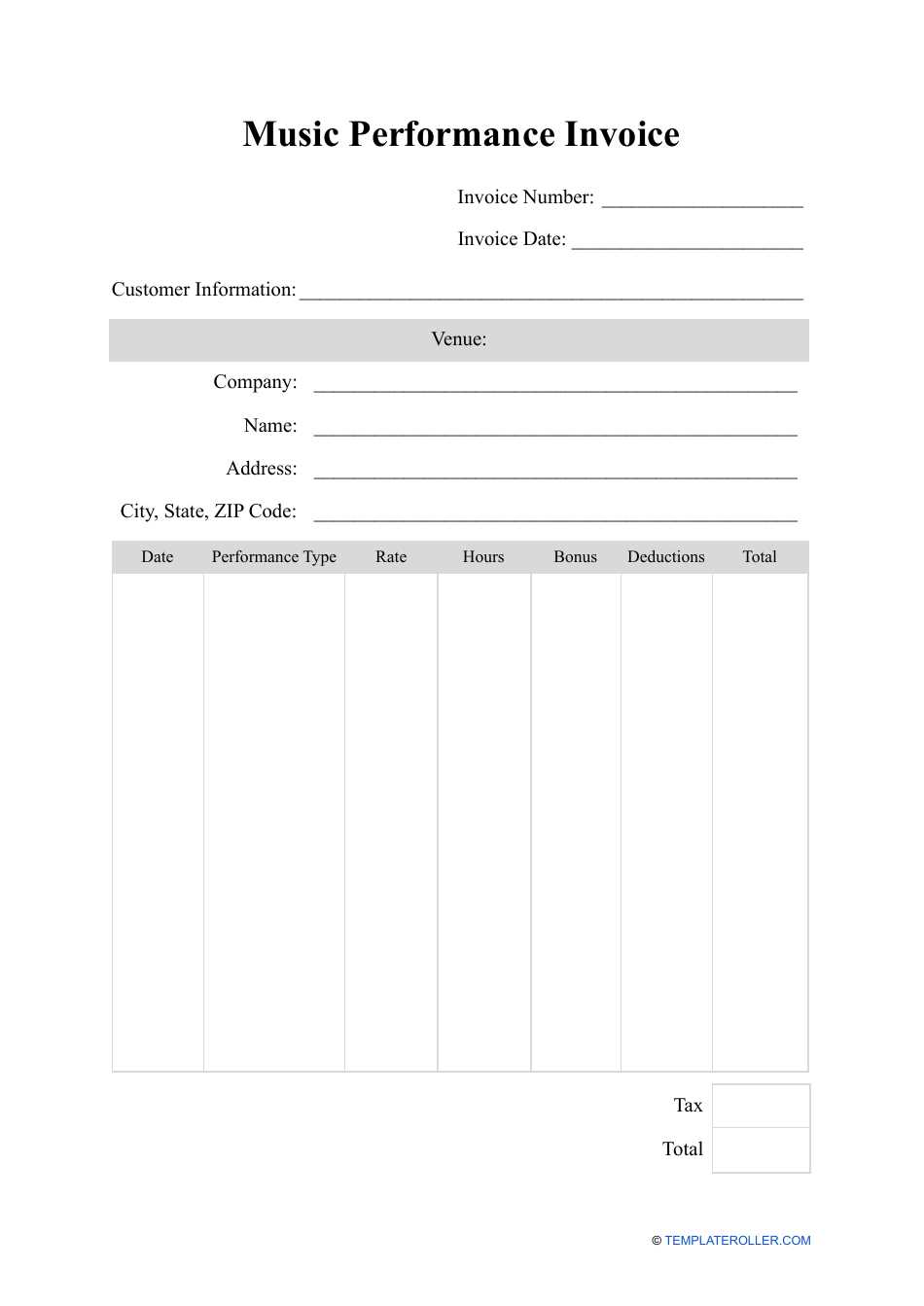

How to Create a Payment Request for Performances

Creating a clear and professional document to request payment for your musical work is an essential part of any performance. It ensures that both you and your client are on the same page regarding the services provided and the agreed-upon compensation. A well-structured request not only helps you get paid on time but also adds to your reputation as a serious artist or performer. Below, we’ll go over the steps to create an effective payment request for your performances.

Step 1: Include Essential Details

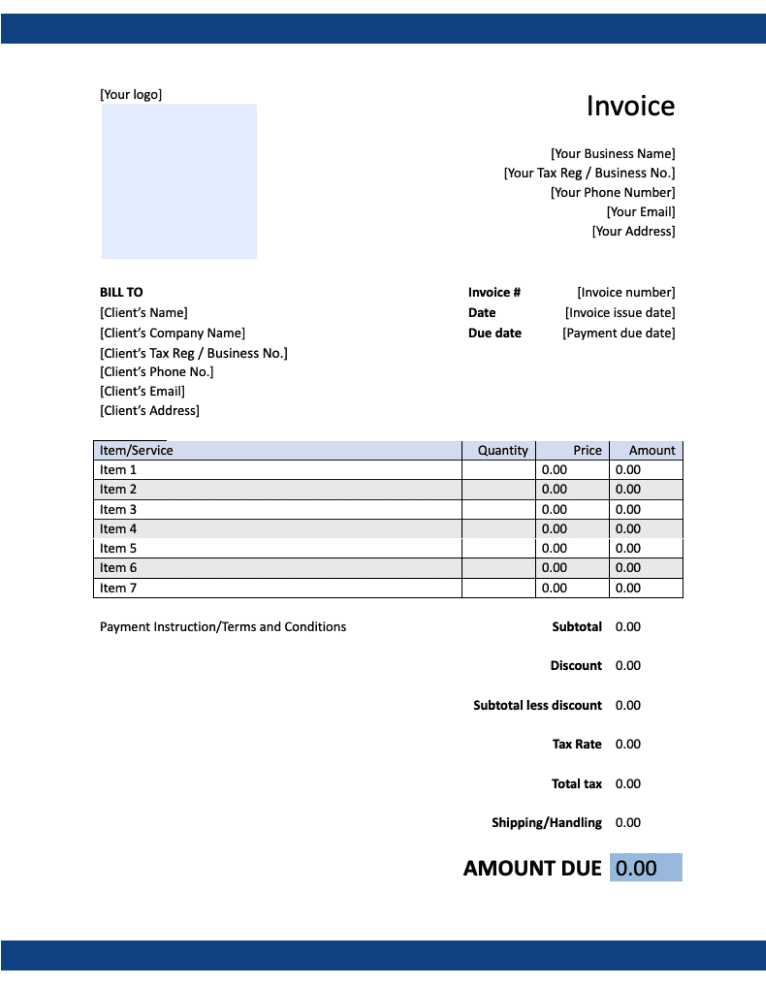

Start by making sure you provide all the necessary information. This should include your name or the name of your group, the recipient’s details, the date of the performance, and a breakdown of services rendered. The clearer the information, the easier it will be for your client to process the payment without confusion.

Step 2: Organize Payment Terms

Make sure to define payment terms, such as the due date and any additional fees for late payments. It’s important to make these terms clear upfront to avoid any future misunderstandings.

| Item Description | Amount |

|---|---|

| Performance Fee | $500 |

| Travel Expenses | $100 |

| Additional Costs | $50 |

| Total | $650 |

This table outlines a typical breakdown of charges that you might include in your payment request. Adjust it based on the specifics of your project, and make sure to double-check that all

Benefits of Using a Payment Request Format

Utilizing a pre-designed structure for billing your performances or services can save time, reduce errors, and ensure consistency in your financial dealings. Whether you’re an individual artist or part of a larger group, adopting a standardized approach for documenting payments helps streamline communication with clients and simplifies the overall process. Below are some key advantages of using a ready-made format for your financial requests.

Time-Saving and Efficiency

One of the main benefits of using a structured format is the time it saves. Instead of starting from scratch each time you need to create a document, you can quickly input the relevant details and have a professional-looking request ready to send. This allows you to focus more on your craft and less on administrative tasks.

Consistency and Professionalism

Maintaining consistency in your payment requests reflects professionalism. A well-organized format ensures that all essential details are included each time, minimizing the risk of leaving out important information. This consistency not only helps in getting paid on time but also builds trust with clients and partners.

Reliability is another major benefit, as using a pre-made structure ensures that your documents follow a proven format, reducing the chances of confusion or mistakes. Clear and precise communication is essential for any business transaction, and using a professional approach guarantees that your clients understand the terms without any ambiguity.

Key Elements of a Performance Payment Request

When preparing a document to request payment for your performance, it’s important to include all the essential information that ensures clarity and avoids confusion. A well-organized request not only helps in processing the payment smoothly but also serves as a formal record of the transaction. Below are the key components that should be included in any performance payment document.

| Element | Description |

|---|---|

| Contact Information | Include your name or group’s name, address, and phone number, as well as the client’s contact details. |

| Event Details | List the date, location, and type of event where the performance took place. |

| Itemized Charges | Break down the costs for the performance, including fees for services, travel, or additional expenses. |

| Payment Terms | Clearly state the payment due date, any applicable late fees, and the accepted payment methods. |

| Total Amount | Sum all charges and clearly show the total amount due for the event. |

By including these critical elements, you ensure that the payment process is transparent and professional, reducing the chance of misunderstandings. A detailed request reflects well on you as a performer and helps maintain strong, trusting relationships with your clients.

Choosing the Right Format for Payment Requests

Selecting the appropriate format for documenting and requesting payment is crucial to ensuring smooth transactions and professionalism. The format you choose will depend on factors such as the size of your performance, the nature of the event, and how you want to present your charges. Below, we will discuss various formats and help you determine which one suits your needs best.

Traditional vs Digital Formats

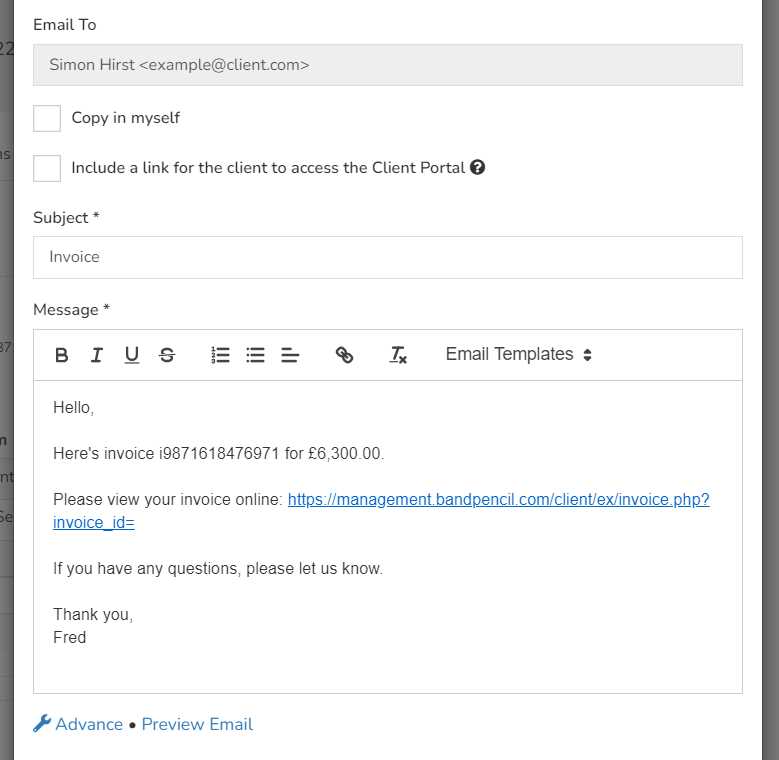

One of the first choices you’ll need to make is whether to go with a traditional paper-based request or a digital one. Traditional methods, such as printed forms, can be effective for in-person events or when working with clients who prefer physical documentation. On the other hand, digital formats offer convenience, quicker delivery, and the ability to easily track payments online.

Customizing Your Chosen Format

Regardless of the format you select, it is essential to customize it to suit the specific details of your performance or service. Customization can include adding logos, adjusting the layout, and incorporating terms that match the scope of the work you’ve done. A personalized document reflects professionalism and ensures that all the necessary details are included.

| Format | Advantages | Best For |

|---|---|---|

| Paper | Personal touch, good for in-person handover | Local performances, personal connections |

| Easy to send, trackable, professional design options | Remote work, international clients | |

| Excel/Spreadsheet | Easy to calculate totals, simple adjustments | Large groups, complex billing |

Choosing the right format ultimately comes down to your personal preference and the nature of the engagement. Whether you prefer the classic method or the convenience of digital tools, ensuring clarity and professionalism in your payment request is key to maintaining smooth financial dealings with your clients.

Why Professional Payment Requests Matter for Performers

Having a formal and well-structured document for payment requests is essential for maintaining a professional image and ensuring timely compensation for your work. Whether you’re performing at a small venue or collaborating with other artists, using a professionally formatted request demonstrates that you take your craft seriously and that financial matters will be handled efficiently. Below are some reasons why a well-designed payment request is crucial for performers.

Building Trust with Clients

A clear and professional payment request fosters trust with clients. When you present a formal document that outlines the terms, services, and amounts due, it signals to clients that you are organized and reliable. This trust can lead to repeat engagements and a stronger working relationship.

Ensuring Accurate Payments

A structured approach to financial documentation reduces the risk of errors. By clearly listing the services provided, payment terms, and any additional costs, both parties have a detailed record of the agreement. This minimizes confusion and helps avoid misunderstandings about the amount owed.

| Benefit | Explanation |

|---|---|

| Clarity | A professional format ensures all payment details are presented clearly and accurately. |

| Transparency | Breaks down charges and terms, making it easier for clients to understand what they’re paying for. |

| Organization | Helps you maintain proper records and track payments efficiently. |

In addition to providing financial transparency, a formal request allows you to set clear expectations regarding payment schedules and methods, which can help you avoid delays or disputes. Ultimately, having a professional approach to payments not only enhances your credibility but also ensures that your business operations run smoothly.

How to Customize Your Payment Request

Customizing your payment request document ensures that it aligns with your specific needs and reflects your personal or group identity. A customized document not only makes your financial communication more professional but also allows you to present the terms and services in a way that suits each unique engagement. Below are some simple steps to personalize your request and make it stand out.

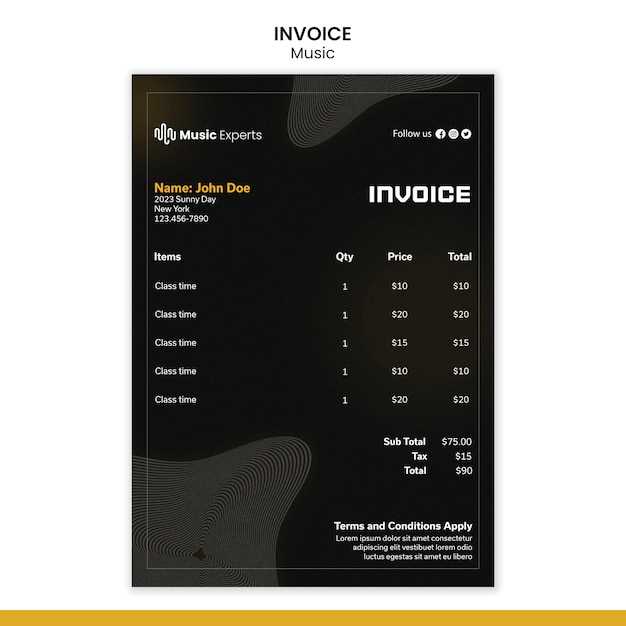

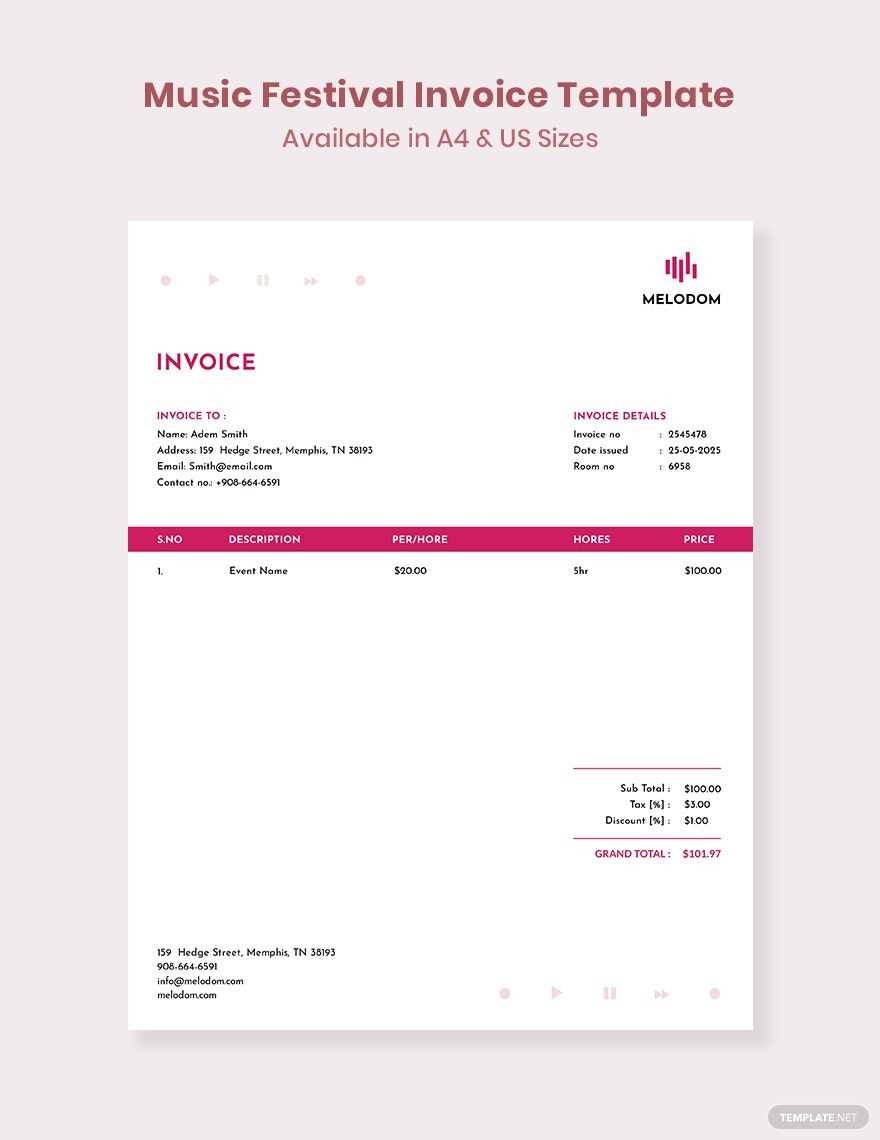

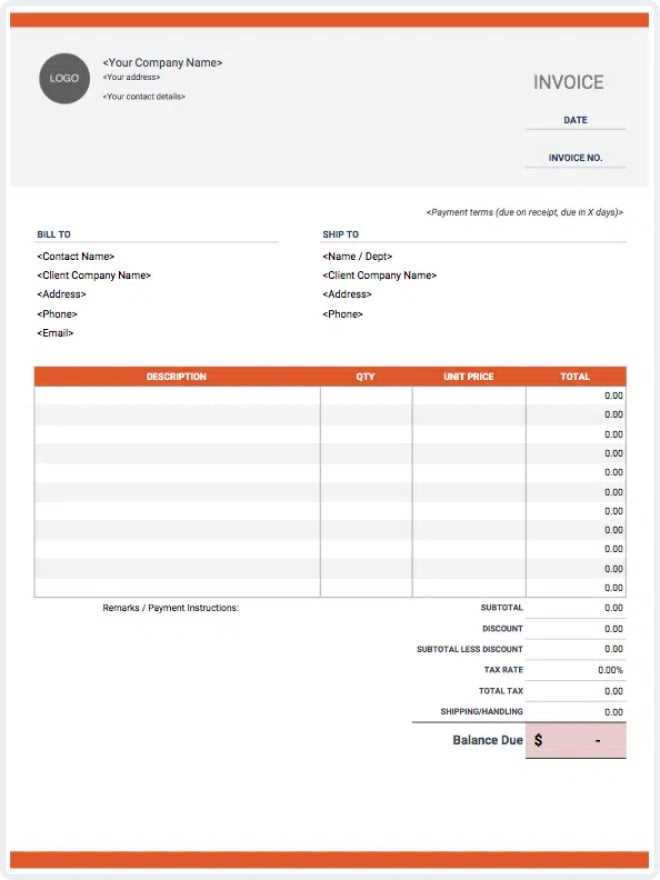

Incorporate Your Branding

Adding your logo, custom fonts, and colors to the document can give it a more professional and personalized look. This small step reinforces your identity and ensures that the document reflects your artistic style or business brand. Whether you’re an individual performer or part of a collective, maintaining consistent branding across all communications helps to establish credibility.

Adjust Layout for Different Events

Different performances may require different layouts. For example, a solo gig might need fewer details than a large event with multiple performers. Tailor your document by adjusting the layout and content to fit the scope of the engagement. For larger projects, you may want to include additional sections, such as a breakdown of individual services or multiple payment installments.

| Element | Customization Tips |

|---|---|

| Contact Details | Ensure your name, phone number, and website are easy to find at the top of the document. |

| Event Description | For complex events, include specific dates, times, locations, and special instructions or requests. |

| Itemized Breakdown | List every service or expense in detail, using simple terms that the client can easily understand. |

| Payment Terms | Adjust payment due dates and methods based on the client’s preferences or the nature of the event. |

Personalizing your payment request not only ensures that all relevant details are included but also sets the tone for a professional and smooth transaction. By making these adjustments, you enhance your reputation and create a lasting impression with your clients.

Free vs Paid Payment Request Formats

When choosing a format for requesting payment, one of the first decisions you’ll need to make is whether to use a free option or invest in a paid version. Both choices offer distinct advantages and limitations, and the right option depends on your specific needs and the level of professionalism you wish to convey. Below, we’ll explore the key differences between free and paid formats to help you make an informed decision.

Advantages of Free Formats

Free formats are a great starting point, especially for independent performers or small groups just getting started. These options often provide basic layouts that are easy to use and modify without any upfront cost. Many free options are available in various file types such as PDFs, spreadsheets, or word processors, making them flexible for different needs. Cost-effective and simple to implement, free formats can be ideal for smaller gigs or personal events where simplicity is key.

Benefits of Paid Formats

On the other hand, paid formats typically offer enhanced features, more sophisticated designs, and the ability to customize the document to a greater extent. These options often include additional elements like automated calculations, better formatting, and more advanced styling options that can make your requests look polished and professional. Paid formats may also offer additional customer support, updates, and security features. Investing in a paid version may be worthwhile if you’re dealing with larger clients or need to manage multiple performance requests efficiently.

| Aspect | Free Option | Paid Option |

|---|---|---|

| Cost | No cost | Requires purchase or subscription |

| Customization | Limited | Extensive |

| Design Quality | Basic | High-end, professional designs |

| Features | Basic layout, manual entry | Automated calculations, advanced features |

Choosing between a free or pa

Essential Information to Include in a Payment Request

When creating a document to request payment for your services, it is crucial to ensure that all necessary details are included to avoid confusion and ensure prompt processing. A well-organized request provides both you and the client with clear expectations regarding the amount owed, the services provided, and the payment terms. Below are the key pieces of information that should always be included.

- Your Name and Contact Information: Always include your full name or the name of your group, along with your address, email, and phone number. This makes it easy for the client to reach out if there are any questions regarding the payment.

- Client’s Name and Contact Information: Ensure that the client’s full name or company name is included, along with their contact details. This is important for clarity and to avoid sending the request to the wrong person.

- Event or Service Details: Include the date, location, and description of the event or service provided. This helps both parties understand what the payment is for and prevents confusion.

- Itemized List of Services: Clearly break down all charges related to the performance or service. This includes any additional costs, such as travel, accommodation, or special equipment fees.

- Total Amount Due: Ensure that the total amount due is clearly stated and includes all charges, taxes, and additional fees. This makes it easy for the client to understand exactly what they owe.

- Payment Terms: Clearly define when payment is due, whether it’s immediately, within 30 days, or based on any other agreed-upon terms. It’s also important to outline accepted payment methods (e.g., bank transfer, check, online payment).

- Late Fees or Penalties: If applicable, include details about any late fees or penalties for overdue payments. This provides an incentive for clients to pay on time.

Optional Information to Include

- Tax Information: If taxes are applicable to the payment, include the appropriate tax rate and amount. This is especially important for businesses operating in regions with specific tax regulations.

- Payment Instructions: If you are requesting a specific payment method (such as a bank transfer), provide the necessary account details or payment instructions.

- Terms and Conditions: You may also want to include a section with any terms and conditions related to your services, such as cancellation policies or special requests.

Including all of this information ensures that the request is clear and comprehensive, helping to avoid misunderstandings and ensuring smooth financial transactions.

Step-by-Step Guide to Filling Out Your Payment Request

Creating a clear and accurate document to request payment is essential for ensuring a smooth transaction. By following a systematic process, you can ensure that all necessary information is included and presented professionally. Here’s a simple guide to help you fill out your payment request, step by step.

Step 1: Add Your Contact Information

The first thing to do is add your name or your group’s name, along with your address, email, and phone number. This makes it easy for the client to reach out if they have any questions or need to discuss the payment. Ensure that this information is clearly visible at the top of the document.

Step 2: Include Client’s Information

Next, input the client’s details, including their name or company name and contact information. Make sure that this is accurate to avoid sending the payment request to the wrong person or address. This also helps establish a professional and transparent record for both parties.

Step 3: Describe the Service or Event

Provide a brief but detailed description of the service or event that was provided. Include the date, location, and nature of the performance or service. This helps both you and the client remember the details of the engagement and ensures clarity in the payment process.

Step 4: List All Charges

Clearly break down all the charges associated with the service. This can include the performance fee, travel costs, equipment rental, or any other expenses incurred. Use a clean format to list these items so that each charge is easily identifiable. For larger projects, you can include a detailed table to present this information.

Step 5: Calculate the Total Amount Due

After listing the charges, sum up the amounts to calculate the total amount due. Double-check your math to ensure accuracy. Make sure that the total is clearly highlighted, so there’s no ambiguity about the amount the client owes.

Step 6: Set Payment Terms

Define the payment terms, including when the payment is due and how it should be made. Specify the payment method (e.g., bank transfer, PayPal, cash) and any deadlines. If

Design Tips for a Professional Payment Request

Creating a well-designed document for requesting payment is essential for making a strong impression and ensuring that the information is easy to understand. A professional design not only enhances the visual appeal but also improves readability, helping your clients quickly grasp the important details. Below are some practical design tips to ensure your payment request is both attractive and functional.

Keep It Clean and Simple

When designing your document, it’s important to keep the layout clean and uncluttered. Avoid overloading the page with too much information or distracting elements. Use sufficient white space to give the document a balanced look and ensure that each section is easy to locate. A simple, well-organized design allows clients to focus on the essential details.

Use Consistent Branding

If you’re representing a group or business, it’s vital to maintain consistent branding across all documents. Incorporating your logo, brand colors, and fonts helps to create a cohesive and professional appearance. This consistency enhances your credibility and makes the document feel more legitimate and trustworthy.

Ensure Readability

Font choice plays a significant role in the design of your document. Select easy-to-read fonts for both headings and body text. Avoid using overly decorative fonts that might make it hard for the client to scan through the details quickly. A common choice for professional documents is a sans-serif font like Arial or Helvetica, which is clear and legible.

Highlight Key Information

Make sure to emphasize important information, such as the total amount due, payment terms, and due date. This can be done using bold text or larger font sizes. This helps ensure that the most critical details stand out, reducing the risk of oversight.

Organize Information with Sections

Break your document into clear sections to make it easier to read. For example, use separate areas for your contact information, the client’s details, event or service description, and the itemized charges. Grouping related information together helps improve clarity and allows the reader to locate the data they need without effort.

| Delivery Method | Advantages | Considerations | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fast, cost-effective, easy to track | Check for correct email address and file format | |||||||||||||||||||||||||||

| Postal Mail | Official and formal, physical documentation | Longer delivery time, additional cost | ||||||||||||||||||||||||||

| Online Payment Platform | Convenient for both parties, instant payment | Client needs to be familiar with the platf

Payment Terms Every Group Should UseSetting clear and fair payment terms is essential for any group or performer to ensure timely compensation and avoid misunderstandings with clients. Payment terms outline the expectations for when and how the payment should be made, and they protect both parties by providing structure and clarity. Below are the key payment terms that every group should consider using to maintain professionalism and secure prompt payment. Clear Payment Due Dates

One of the most important aspects of payment terms is specifying when the payment is due. Whether it’s immediately after the performance or within 30 days, setting a clear deadline helps ensure that both you and your client are on the same page. A specific due date also reduces the chance of late payments and sets expectations for the client from the start. For example, you might say: “Payment is due 30 days from the date of service.” Late Payment PenaltiesIncluding a late payment clause is a valuable way to encourage clients to pay on time. A penalty or interest fee for overdue payments gives clients an added incentive to meet the payment deadline. This can be a fixed fee or a percentage of the total amount due. For example: “A 5% late fee will be applied for every 7 days after the due date.” Ensure that these penalties are reasonable and clearly communicated to avoid disputes. Accepted Payment MethodsClearly stating the methods of payment you accept is crucial for smooth transactions. This might includ Tracking Payments and Requests EffectivelyMonitoring payments and keeping track of all requests is crucial for maintaining healthy financial management. By having a system in place to track which payments have been made, which are pending, and which are overdue, you can avoid confusion and ensure timely follow-ups. Below are some strategies for effectively managing and tracking your payment requests. Use a Spreadsheet for OrganizationOne of the most efficient ways to track your payments is by creating a simple spreadsheet. This method allows you to record all details such as the amount due, payment date, client name, and payment status. You can also use color-coding to quickly see which payments are completed and which are still outstanding. For example, green for paid, yellow for pending, and red for overdue. Spreadsheets are flexible and customizable for your specific needs. Consider Accounting SoftwareIf your group handles multiple requests regularly, accounting software can help automate tracking. Platforms like QuickBooks, FreshBooks, or Xero allow you to send payment requests, track payments, and even send automatic reminders for overdue payments. These tools can save you time by automatically generating reports and keeping a running total of payments received. Regular Follow-Ups and RemindersIt’s essential to stay on top of payments by sending reminders to clients whose payments are overdue. Set a reminder to follow up every few days or weeks based on your payment terms. A polite email or phone call can often prompt clients to take action and settle the outstanding amount. Sending gentle reminders helps maintain professionalism and keeps payments flowing smoothly. Payment Status Table

Stay Consistent with Records

|

| Legal Consideration | Key Details |

|---|

| Description | Amount |

|---|---|

| Service Fee | $500.00 |

| Sales Tax (10%) | $50.00 |

| Total Amount Due | $550.00 |

By displaying the tax breakdown clearly, you ensure that both you and your client are on the same page regarding the total amount due, including any taxes. Always include the tax rate you applied, the tax amount, and the final total so the client can verify the figures. This level of detail promotes trust and professionalism.

Common Mistakes to Avoid in Performance Payment Requests

When preparing a request for payment, it’s easy to overlook some important details that could lead to confusion or even delays in receiving payment. Avoiding common errors in these documents is essential for maintaining professionalism and ensuring smooth financial transactions. Below are some common mistakes to avoid when preparing payment requests for your services.

1. Missing or Incorrect Payment Terms

One of the most common mistakes is failing to clearly state the payment terms. This includes the due date, acceptable payment methods, and any penalties for late payments. If this information is unclear or missing, clients may not be aware of when they are expected to pay or how they should submit the payment. Always specify a clear due date, whether it’s a fixed date or based on a certain number of days from the service date. Additionally, outline any late fees to ensure the client understands the consequences of not paying on time.

2. Not Including All Relevant Details

Another common mistake is not including all relevant details on the request. This includes things like a description of the services provided, the agreed-upon rates, and any additional costs such as taxes or travel expenses. Without these details, the client may be confused or question the charges. Always include a breakdown of the services rendered, the amount charged for each, and any additional charges. This transparency helps prevent misunderstandings and establishes a professional image.

To ensure accuracy and professionalism, it’s crucial to double-check the payment request before sending it. Confirm that all necessary information is included and that everything is accurate. This will not only help you get paid on time but also build trust with your clients.