How to Use a Multi Currency Invoice Template for International Transactions

In today’s global economy, businesses frequently deal with clients and partners across borders. This requires handling payments in different financial systems, often involving diverse national standards and values. Managing transactions in various denominations can be challenging, especially when it comes to ensuring accuracy and transparency in financial documents.

Accurate record-keeping becomes essential to avoid misunderstandings and ensure timely settlements. With the right tools, businesses can easily adapt their invoicing methods to accommodate multiple financial systems. These solutions are designed to simplify calculations, reduce manual errors, and streamline the overall billing process.

Automating these tasks can lead to smoother operations, greater efficiency, and better relationships with international clients. Whether you’re invoicing for services rendered or goods sold, the ability to clearly present values in various denominations is key to maintaining professionalism and trust in global transactions.

What is a Multi Currency Invoice Template

In global business transactions, companies often deal with customers or suppliers from different countries, requiring the ability to handle payments in various monetary units. To ensure accurate and efficient processing of such payments, businesses use specialized documents that can accommodate multiple financial systems within a single record. These tools are designed to present amounts clearly, allowing both the seller and buyer to understand and agree on the value of the transaction.

A document built to handle several different forms of money at once serves as an effective solution to this challenge. It provides the structure needed to list products or services alongside their respective prices in different denominations. This helps to avoid confusion and potential disputes, particularly when exchange rates fluctuate or if clients are unsure of conversion rates.

- Clear presentation of amounts in various monetary units

- Ability to handle fluctuating exchange rates

- Helps businesses keep track of international transactions

- Reduces errors in manual calculations

Such documents typically include a section for detailing the rates, a space to indicate the total sum in each applicable form of money, and a final total value, converted back to the preferred payment method of the sender or recipient. These structures help businesses manage financial interactions smoothly across international borders, while providing the necessary transparency for both parties involved.

Benefits of Using Multi Currency Invoices

When conducting business internationally, managing financial records across different nations and their respective monetary units can quickly become complex. Utilizing a document designed to handle transactions in various denominations brings multiple advantages, making the entire process more streamlined and less prone to error. These benefits help businesses maintain efficiency, clarity, and consistency in their global operations.

One of the primary advantages is the reduction of manual errors. With automated calculations and built-in conversion features, businesses can avoid mistakes that typically occur when dealing with multiple financial systems. This ensures that the correct amount is charged or paid, no matter the exchange rate fluctuations.

Transparency is another key benefit. By clearly showing the price in both the buyer’s and seller’s preferred units, misunderstandings about amounts due are minimized. This fosters trust between international partners and promotes smoother transactions.

Furthermore, using such documents can lead to time savings. The structure and functionality of these records automate many aspects of the billing process, reducing the need for manual adjustments and repeated recalculations. This saves businesses valuable time, allowing them to focus on other important tasks.

Finally, these tools can help improve financial management. With everything neatly documented and organized, businesses can easily track expenses and payments across different countries. This helps in generating reports, auditing, and ensuring compliance with international tax laws.

How to Create a Multi Currency Invoice

Creating a document that can handle transactions in multiple financial units requires careful planning and attention to detail. The process involves not only listing products or services but also incorporating relevant exchange rates, payment methods, and ensuring that the final amounts are clearly presented. The goal is to make sure both parties understand the financial details, regardless of where they are located or which system they use.

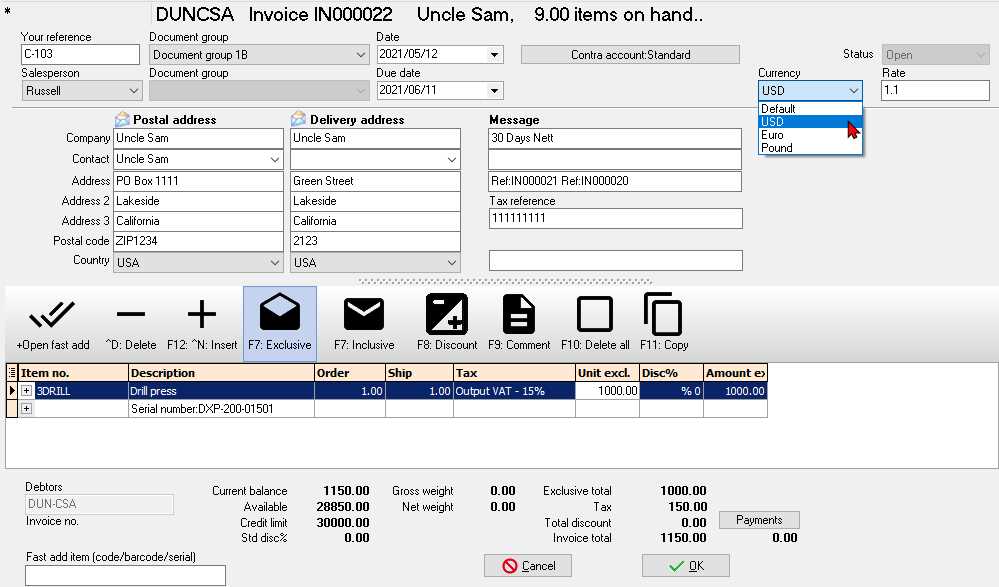

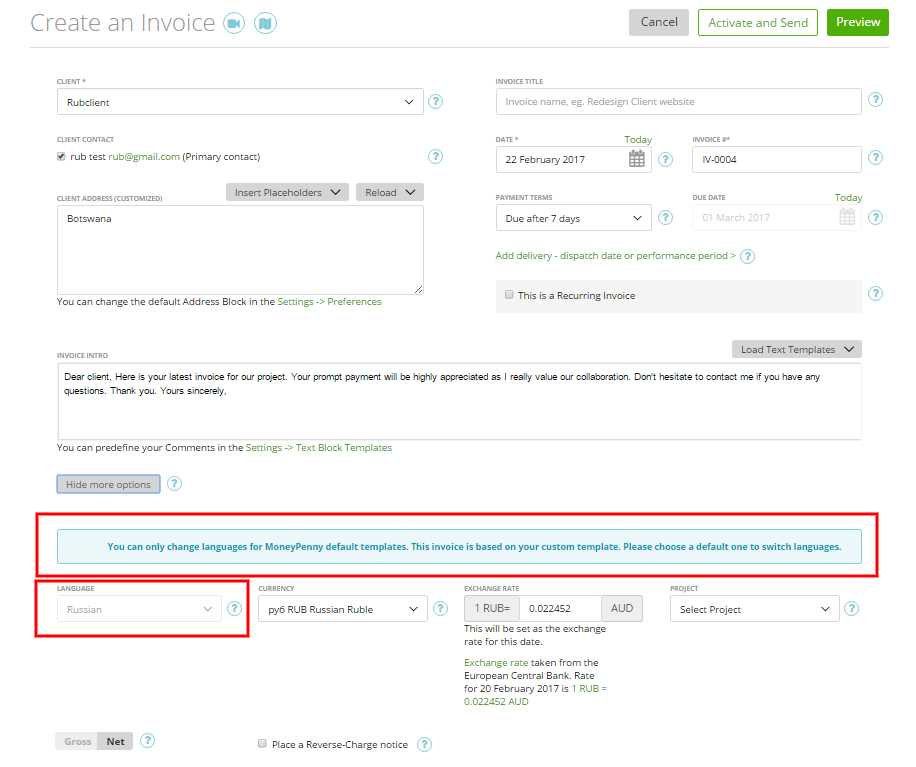

Step 1: Choose the Right Software or Tool

The first step in creating such a record is selecting a tool that can manage various financial systems. Many online platforms and accounting software offer built-in features for international transactions. These tools will automatically handle the conversion rates and allow for easy adjustments based on real-time exchange rate data.

Step 2: Add Item Details and Pricing

Next, list the goods or services being offered along with their respective prices. For each line item, you should include:

- A description of the product or service

- The price in the seller’s primary unit

- The applicable exchange rate (if relevant)

- The converted price in the buyer’s preferred unit

Ensure that the exchange rates are accurate and updated regularly to reflect the current market conditions. Many software tools integrate real-time rates, but if you are doing this manually, use trusted sources like financial institutions or currency converters.

Step 3: Specify Payment Terms

After listing all items and their corresponding values, it is essential to specify the payment terms clearly. This should include:

- Preferred payment method(s)

- Due date

- Any applicable late fees or discounts for early payments

Make sure the document includes the total amount in each currency as well as the final amount after conversions. This will ensure both parties are on the same page regarding the financial details of the transaction.

Essential Features of Multi Currency Invoices

When handling transactions that involve different national monetary systems, it is essential that the documentation reflects all necessary details in a clear and organized manner. A well-designed billing record should not only present values in multiple financial units but also ensure that every component of the transaction is accounted for. Several key features make such records effective for both the seller and the buyer, reducing errors and promoting transparency.

Accurate Conversion and Exchange Rate Integration

One of the most important aspects of a document dealing with various financial systems is the ability to accurately convert values. The exchange rate must be clearly displayed, and the tool used to generate the document should automatically adjust based on real-time data. This ensures that the amounts are correct at the time of billing and minimizes the risk of discrepancies between the buyer and seller.

Multiple Payment Methods and Clear Terms

A robust document should include sections for various payment methods and clearly outline the terms of the transaction. Whether the buyer prefers to pay via bank transfer, credit card, or digital wallet, the document should be flexible enough to accommodate different options. The payment terms should specify:

- Due dates

- Any applicable discounts or late fees

- Preferred payment channels

By providing this information, both parties can avoid misunderstandings and ensure a smooth transaction process.

Transparency is a core feature of such records. Including detailed calculations for each item, exchange rate, and payment method ensures that both parties have a clear understanding of the amounts involved. This can help maintain good business relationships and promote trust in international dealings.

Finally, these records should be adaptable, allowing for easy editing and updates. Whether dealing with fluctuating exchange rates or changing payment methods, having a flexible format ensures that businesses can respond to evolving needs quickly and accurately.

Best Software for Multi Currency Invoices

When managing international transactions, using the right software can significantly streamline the process of handling payments in different monetary systems. A reliable tool not only simplifies calculations but also ensures that all required financial details are presented correctly. The right solution can automate conversions, reduce errors, and provide easy access to necessary features, such as payment tracking and reporting.

Top Features to Look for in Software

Before choosing software for handling international financial records, it’s essential to consider several key features that will make the process more efficient:

- Automatic Exchange Rate Integration: The software should integrate real-time exchange rates to ensure accurate calculations.

- Customizable Templates: Having a flexible layout for your documents makes it easier to adapt to various business needs.

- Multi Payment Method Support: The tool should allow various payment options, such as bank transfers, online payment systems, and credit cards.

- Reporting and Analytics: The ability to generate detailed reports on transactions across different countries and financial units is crucial for tracking and auditing.

Recommended Software for International Transactions

Here are some of the best tools that cater to businesses dealing with global customers and suppliers:

- QuickBooks: A popular accounting software that supports international payments and currency conversion, making it a great option for small to medium-sized businesses.

- Zoho Books: Offers a robust invoicing system with multi-currency support, allowing businesses to create detailed records for global transactions.

- FreshBooks: Known for its user-friendly interface, FreshBooks is perfect for small businesses and freelancers needing to handle international payments efficiently.

- Xero: This software is ideal for businesses of all sizes, with comprehensive features for managing payments in various financial systems and generating insightful reports.

Each of these tools provides key features for businesses that frequently handle international transactions, allowing for seamless and accurate financial management.

How to Add Multiple Currencies to Invoices

When dealing with clients or suppliers from different countries, it is essential to present prices in various monetary units. Adding several forms of money to your financial documents allows both parties to understand the value of the transaction, regardless of their location. This process ensures that both the seller and the buyer are on the same page regarding the amounts due, reducing the risk of confusion or mistakes.

Step 1: Determine the Relevant Monetary Units

Before you can add different financial units to the document, you must first identify which ones are needed. Depending on your client or partner’s location, you may need to list prices in their preferred financial system. Start by considering:

- Where your client is based

- Which currencies are commonly used in the region

- The client’s preferred method of payment

By understanding these factors, you can ensure that the document reflects the correct monetary units for both parties.

Step 2: Use an Automated Tool for Conversion

One of the easiest ways to add several financial systems to a document is by using software that automatically converts prices based on real-time exchange rates. Many invoicing platforms come with built-in features that allow you to select the appropriate units and automatically adjust the amounts. This ensures accuracy and saves time compared to manually calculating conversions.

- Ensure the software updates exchange rates regularly

- Double-check the final values to confirm the calculations are correct

- Include a note about the exchange rate used at the time of the transaction

Using an automated tool will reduce the risk of errors and make the entire process more efficient, especially when dealing with multiple payments across various financial systems.

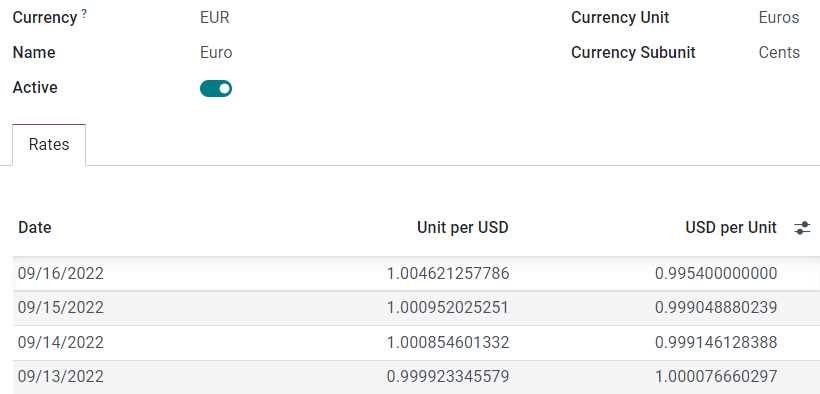

Managing Exchange Rates in Invoices

When dealing with international transactions, handling the fluctuations in financial values becomes a key challenge. Accurate management of exchange rates ensures that both parties involved in the transaction are clear on the value being exchanged. Without proper oversight, there is a risk of discrepancies in payment amounts, which can lead to misunderstandings or delayed payments. Understanding how to properly manage and incorporate these rates is essential for smooth and transparent transactions.

Step 1: Choose Reliable Exchange Rate Sources

To accurately reflect the current value of various financial systems, it is crucial to use trusted sources for exchange rates. Reliable sources ensure that the data used for conversions is up-to-date and accurate. Some of the best options include:

- Central banks or government websites

- Trusted financial institutions

- Popular currency exchange platforms

By relying on these sources, businesses can ensure that the rates reflected in their financial documents are consistent with the current market value, avoiding discrepancies that may arise from outdated or incorrect data.

Step 2: Set Up Automatic Rate Updates

Many software tools now offer automatic updates for exchange rates. This feature is crucial for businesses that deal with international clients regularly, as it removes the need for manual updates and reduces the risk of error. Using software that updates rates in real-time or at regular intervals ensures that the values in the financial records reflect the most accurate information at all times.

- Look for tools that integrate with global financial data providers

- Set up alerts for significant exchange rate changes

- Ensure exchange rates are reflected in both the buyer’s and seller’s preferred financial units

With automated updates, the process of managing exchange rates becomes far less time-consuming and more reliable, particularly in volatile markets where exchange rates may change frequently.

Step 3: Clearly Display Rates and Total Amounts

It is important to clearly communicate how the exchange rates are applied within the document. This transparency helps both parties understand how the final amount is calculated. Include the following information:

- The exchange rate used for each financial system involved

- The exact amount in each unit of money

- The final total after conversion

By doing this, you not only maintain transparency but also reduce the likelihood of confusion or disputes later on. It’s also a good practice to note the date the exchange rate was applied to avoid any questions regarding timing.

Why Multi Currency Invoices Are Important for Global Business

In an increasingly interconnected world, businesses often operate across borders, dealing with customers and suppliers who use different financial systems. Managing transactions between different monetary units is not only necessary for seamless operations, but it also ensures clarity and trust in financial dealings. The ability to handle and clearly present payments in various units is a critical tool for businesses that engage with global markets.

Building Trust and Reducing Discrepancies

By using proper financial documents that accommodate multiple forms of money, businesses can avoid confusion and ensure that both parties have a clear understanding of the total amount being exchanged. This transparency is vital in fostering trust between international partners. A clear breakdown of amounts, including exchange rates and any applicable fees, ensures that neither party feels misled or confused about the payment terms.

Improving Efficiency and Streamlining Transactions

When businesses deal with global transactions, manually calculating conversions or handling multiple records can be time-consuming and error-prone. By integrating a system that automatically manages different forms of financial units, businesses save valuable time and reduce the risk of costly mistakes. This improved efficiency helps to ensure that payments are processed quickly and accurately, which is essential for maintaining smooth business operations across borders.

Furthermore, when international clients can see the price in their local financial unit, they are more likely to proceed with the transaction. This increases the likelihood of timely payments and fosters a positive relationship between the business and its global partners.

Common Mistakes When Using Multi Currency Invoices

When handling international transactions, it’s easy to make errors that can lead to confusion or disputes. These mistakes often arise from miscalculations, unclear presentation of amounts, or overlooking critical details when dealing with payments in different financial systems. Understanding and avoiding these common pitfalls can save businesses time, money, and help maintain trust with global partners.

Failure to Update Exchange Rates

One of the most frequent mistakes is not keeping exchange rates up-to-date. Since exchange rates fluctuate regularly, relying on outdated data can lead to discrepancies between the agreed amount and what is actually charged. This can cause confusion and disputes with clients, as they may feel that they are being charged incorrectly.

Solution: Always use tools that provide real-time updates on exchange rates. Many invoicing platforms can automatically adjust the rates, ensuring that the amounts are calculated accurately at the time of the transaction.

Not Specifying the Date of Conversion

Another common issue is failing to indicate when the exchange rate was applied. Without this detail, both parties may have different interpretations of the value at the time of the transaction. This can lead to misunderstandings, particularly if rates change rapidly due to market fluctuations.

Solution: Always specify the exact date when the exchange rate was used. Including this information ensures that both parties are on the same page and avoids any confusion later on.

Overlooking Fees and Additional Costs

Some businesses make the mistake of not factoring in transaction fees or conversion costs when dealing with different financial systems. These additional charges can impact the final amount due, leading to unexpected surprises for the buyer or seller.

Solution: Clearly outline any additional fees related to the transaction, whether for payment processing, conversions, or bank charges. By disclosing these fees upfront, both parties can agree to the final cost and avoid later disputes.

Not Accounting for Local Taxation Rules

Another error is neglecting to consider local tax laws when handling international transactions. Different countries have varying tax rates, and failing to account for them can lead to legal issues or financial discrepancies.

Solution: Make sure to research and include any applicable taxes based on the buyer’s or seller’s location. Including this information will help ensure compliance with local laws and provide a clearer breakdown of the total amount.

How to Handle Currency Conversions in Invoices

When conducting international business, accurate conversion of financial amounts is crucial to ensure that both parties agree on the value of the transaction. Handling these conversions properly helps prevent misunderstandings and ensures that the correct payment is made. Whether you are selling goods abroad or receiving payments in a different financial system, the process of conversion should be clear, transparent, and easy to follow for both the buyer and the seller.

Here’s a step-by-step guide on how to handle conversion of amounts when dealing with different financial systems:

Step 1: Determine the Exchange Rate

The first step in any conversion process is to determine the exchange rate that will be applied to the transaction. This rate fluctuates over time, so it is important to use an accurate and up-to-date source. Many businesses rely on online financial platforms or tools that provide real-time exchange rates to ensure accuracy.

Step 2: Calculate the Converted Amount

Once the exchange rate is determined, the next step is to calculate the converted amount. For example, if you are converting from USD to EUR, you would multiply the amount in USD by the exchange rate to get the equivalent value in EUR. This process should be done for each item listed in the financial record that involves a foreign payment.

| Item | Price (USD) | Exchange Rate (USD to EUR) | Price (EUR) |

|---|---|---|---|

| Product A | 100 | 0.85 | 85 |

| Product B | 50 | 0.85 | 42.5 |

In this example, you would take the price in USD (100 and 50), multiply it by the exchange rate (0.85), and arrive at the price in EUR (85 and 42.5, respectively).

Step 3: Clearly Present Converted Amounts

Once all items have been converted, ensure that the final document clearly displays both the original amounts and the converted amounts. Transparency is key here; the buyer should be able to see exactly how the conversion was calculated and the total value in their local financial system.

For clarity, consider including the exchange rate used and the date it was applied, as this information can be useful for both parties, particularly if there are fluctuations in the rate before the payment is completed.

Step 4: Factor in Additional Costs

In addition to the base cost of products or services, consider any additional fees that might apply to the transaction, such as bank fees or payment processing charges. These costs should be clearly

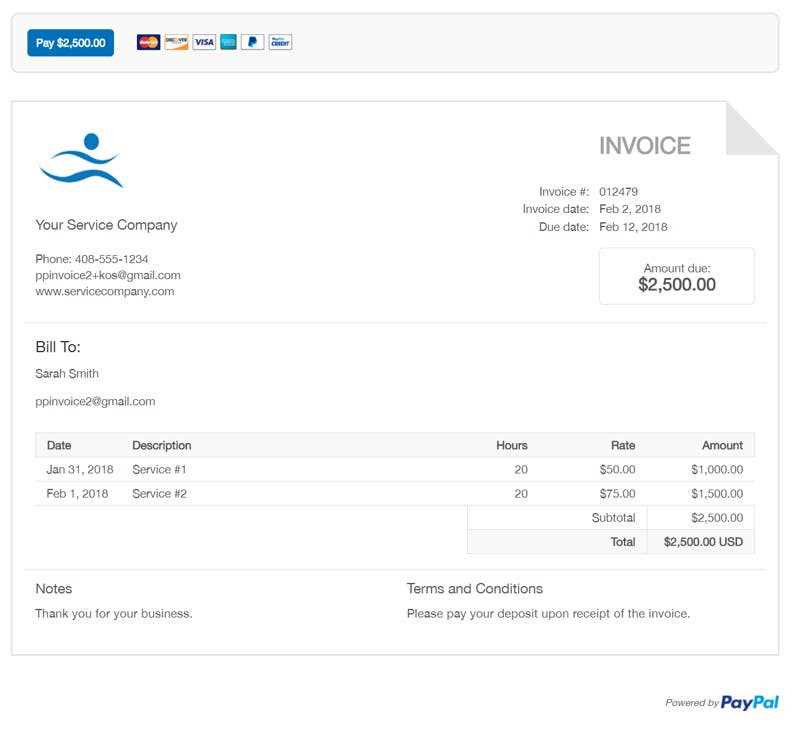

Setting Up Payment Methods for Multi Currency Invoices

When dealing with transactions involving different financial systems, it is essential to provide your clients with flexible and convenient payment options. Setting up a variety of payment methods not only facilitates smoother transactions but also ensures that both parties are able to complete payments in a way that suits their preferences and the currency involved. Offering multiple methods is crucial for businesses engaged in global operations, as it enables international clients to pay easily, reducing delays and potential issues.

Step 1: Understand Client Preferences

The first step in setting up effective payment methods is understanding what your clients prefer. Different regions and industries often have specific payment habits or regulations that influence their choices. To ensure ease of payment, consider these common options:

- Bank Transfers: Widely used for large transactions, particularly in B2B exchanges.

- Credit and Debit Cards: Convenient for smaller, consumer-level transactions and accepted globally.

- Online Payment Systems: Services like PayPal, Stripe, or Alipay allow for quick and easy payments, especially for international clients.

- Cryptocurrency: An emerging option for businesses looking to offer flexible, decentralized payment options.

Knowing which payment methods your clients prefer will help you decide which ones to offer and ensure that the transaction process is as smooth as possible.

Step 2: Enable Multi-Currency Payment Systems

Once you know which payment methods to offer, the next step is ensuring that they support transactions in multiple financial systems. Payment processors that are designed for global businesses typically offer currency conversion tools, allowing clients to pay in their local unit of money while ensuring you receive the correct amount in your preferred system.

- Global Payment Gateways: Platforms like PayPal and Stripe allow for payments in different financial systems and automatically convert the funds based on real-time exchange rates.

- Bank Accounts with Multi-Currency Support: Some banks offer accounts that can hold funds in different monetary units, making it easier for international clients to pay directly in their preferred system.

Using these services ensures that clients can pay in the financial system they are most comfortable with, while also simplifying the process on your end.

Step 3: Communicate Payment Details Clearly

Finally, it’s essential to communicate the available payment methods clearly to your clients. This can be done by listing all accepted methods on your financial documents and invoices. Include the following details:

- The payment options available for each region

- Any additional fees that may apply to specific methods

- Clear instructions for making payments, including bank details, payment links, or account numbers

Clear communication helps avoid confusion and ensures that payments are processed without delay, leading to faster transactions and better relationships with global clients.

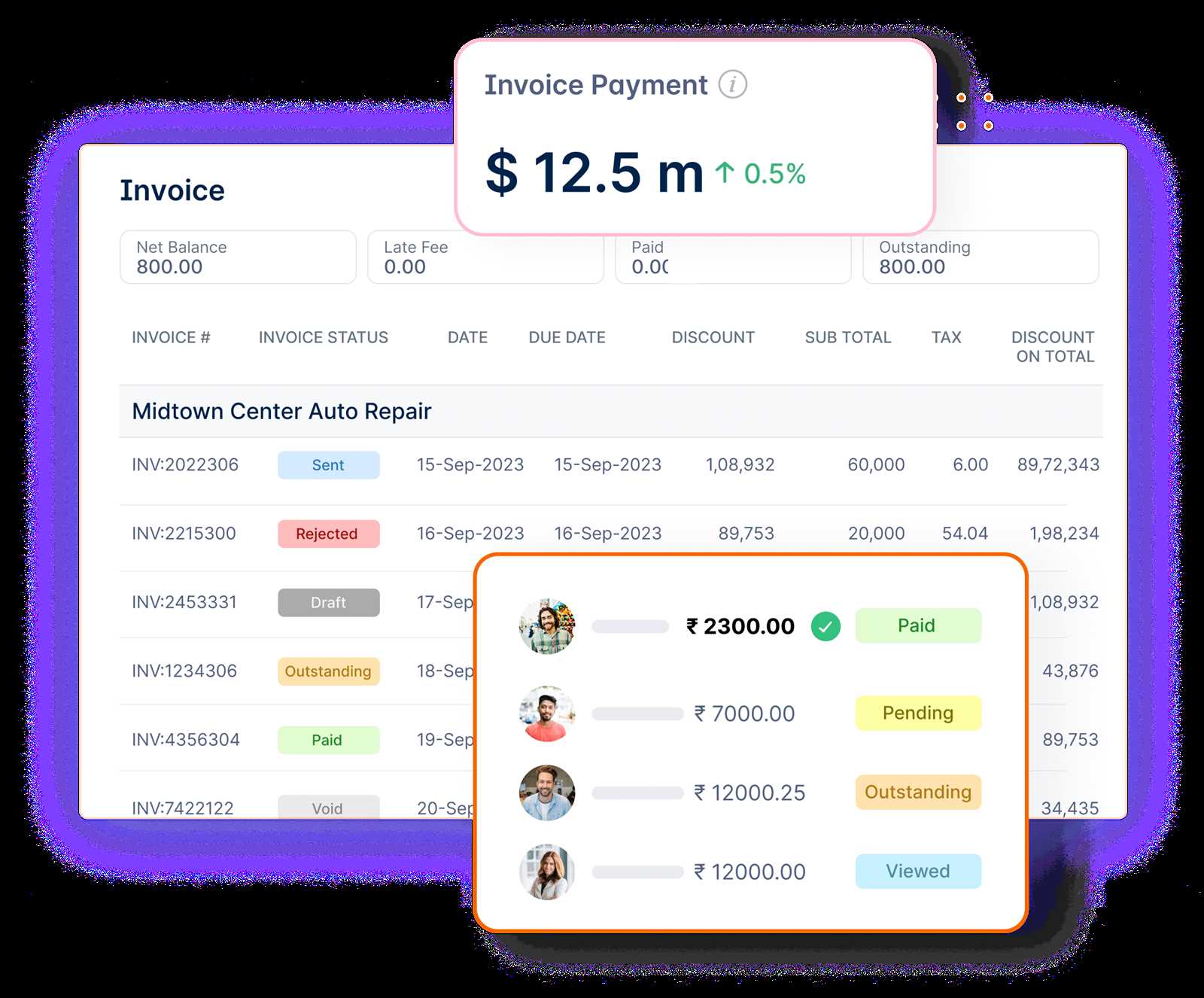

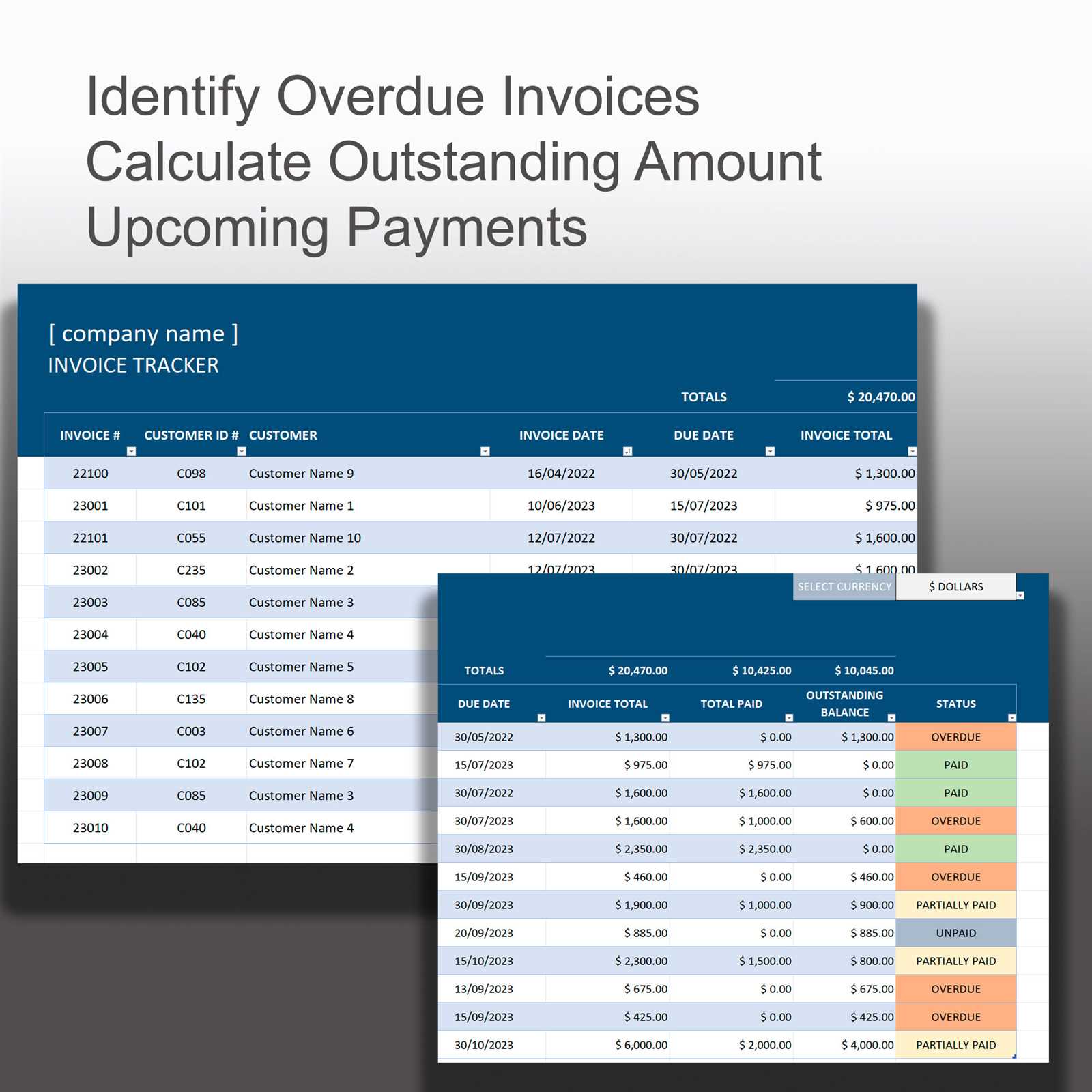

Integrating Multi Currency Invoices with Accounting Systems

When conducting international transactions, it’s essential to ensure that financial records are accurately reflected in your accounting systems. Integrating documents that feature various monetary units with your accounting software streamlines the process of managing payments, taxes, and financial reporting. This integration helps eliminate manual data entry, reduces errors, and ensures that all transactions are properly accounted for across different financial systems.

Step 1: Choose an Accounting System with Multi-Currency Support

The first step to seamless integration is selecting an accounting system that can handle transactions in multiple financial units. Many modern accounting software platforms offer built-in support for handling international payments and can automatically manage conversions and adjustments. Some key features to look for include:

- Automatic Conversion: The ability to automatically convert amounts based on real-time exchange rates.

- Global Tax Management: Built-in tools to handle varying tax rates for different regions.

- Multi-Region Support: The ability to manage accounts in different financial systems without the need for separate records.

Choosing a system with these capabilities ensures that you can easily integrate documents with your accounting software, simplifying both record-keeping and financial analysis.

Step 2: Automate Data Transfer from Financial Documents

Once your accounting system is set up, the next step is automating the process of transferring data from your financial documents to your software. Many modern accounting tools integrate with invoicing and payment platforms, allowing for smooth data importation. By setting up automatic synchronization between systems, you reduce the chances of manual errors and ensure that all payments and conversions are accurately recorded.

Automation also allows you to track payments in real-time, manage outstanding balances across different financial units, and generate comprehensive reports without the need for manual data input. This saves valuable time and provides up-to-date financial information at your fingertips.

Step 3: Reconcile Accounts Across Multiple Financial Systems

Integrating documents with various financial systems also makes reconciliation easier. When dealing with multiple forms of money, it’s essential to reconcile the amounts in each system to ensure accurate records. Most accounting software tools will allow you to track payments in different currencies and automatically adjust balances based on the exchange rate applied at the time of the transaction.

- Monitor Outstanding Balances: Keep track of unpaid amounts in various monetary units and automate reminders.

- Generate Accurate Financial Reports: Use integration tools to pull data directly into balance sheets and income statements, adjusting for exchange rates as needed.

- Stay Tax-Compliant: Ensure that all taxes are calculated based on the correct rates for each financial system involved in the transaction.

By automating the reconciliation process, businesses can ensure that their financial statements reflect the true value of all transactions, regardless of the monetary systems involved.

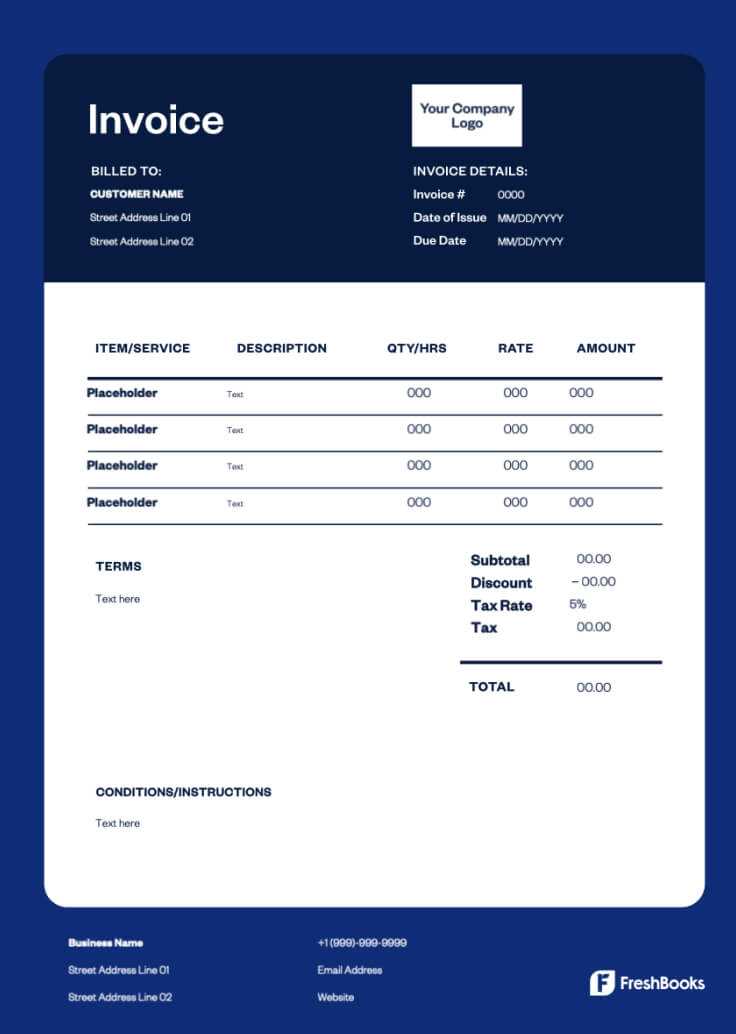

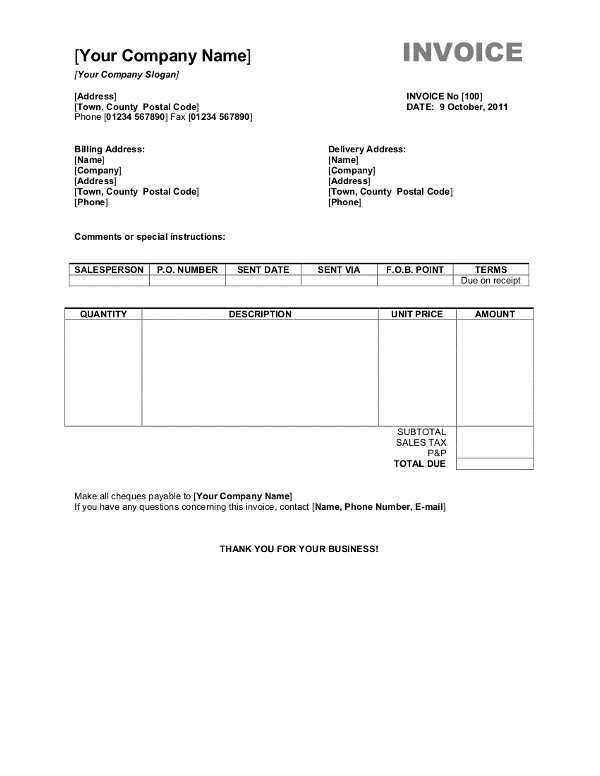

How to Design an Effective Invoice Template

Creating a professional and clear document for billing your clients is essential for maintaining strong business relationships and ensuring smooth financial transactions. A well-designed document should clearly present all necessary details, such as item descriptions, prices, terms, and payment instructions. This not only helps the client understand what they are being charged for, but also improves the chances of timely payments. In this section, we will discuss key elements to consider when designing a billing document that is effective and easy to understand.

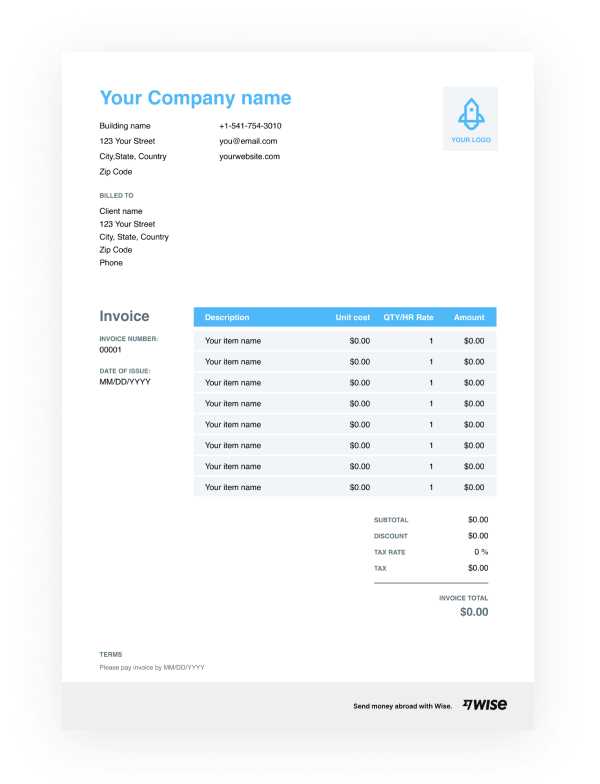

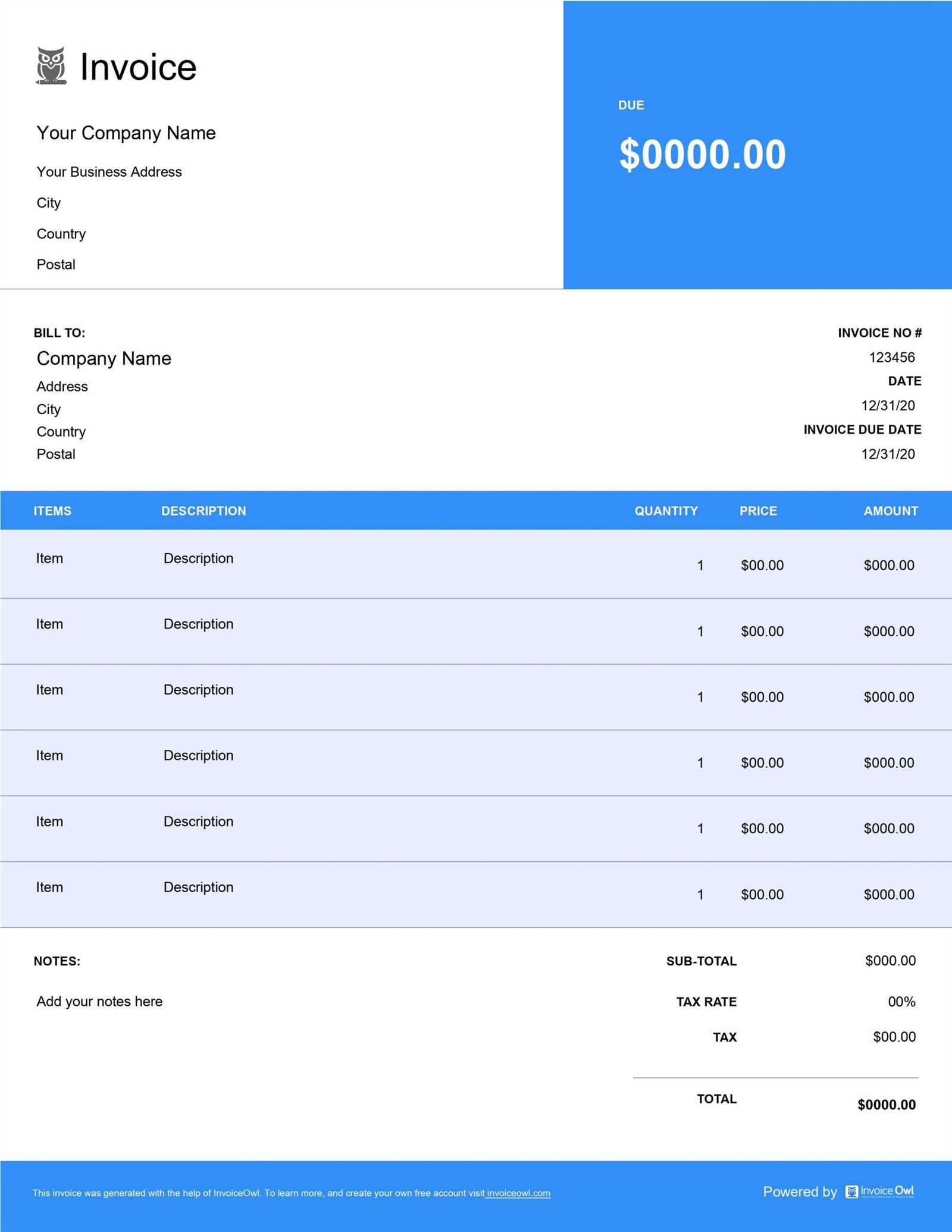

Key Elements of an Effective Billing Document

The layout and structure of your billing document should be simple, clean, and consistent. Here are some essential components to include:

- Business Information: Clearly list your business name, contact details, and any relevant account numbers.

- Client Information: Include the name, address, and contact details of the person or company being billed.

- Itemized List: Break down the products or services provided, including quantity, unit price, and total cost for each item.

- Terms and Conditions: State the payment due date, any penalties for late payments, and accepted payment methods.

- Clear Totals: Present the subtotal, taxes, discounts, and total amount due in an easy-to-read format.

Design and Layout Tips

A clean and organized layout can make a big difference in how easily your billing document is understood. Here are some design tips:

- Use a Grid Layout: A table format works well for itemized lists, keeping everything aligned and easy to read.

- Choose Readable Fonts: Use simple fonts such as Arial or Helvetica, which are easy to read both in print and digital formats.

- Include Branding: Incorporate your business logo and color scheme to make the document feel professional and on-brand.

Example of an Effective Billing Document

Here is an example of how an itemized list might look in your document:

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Product A | High-quality widget | 2 | $50.00 | $100.00 |

| Product B | Premium service | 1 | $150.00 | $150.00 |

By presenting the information in this way, you make it easy for the client to understand what they are being charged for and how the total was calculated. This clarity can help avoid confusion and speed up the payment process.

Understanding Local Tax Rates for Global Invoices

When engaging in international transactions, it’s crucial to understand how tax rates differ across regions. Each country or even local jurisdiction may have specific tax laws that impact how much a buyer will owe. This knowledge is vital for ensuring that your billing documents are accurate, compliant with tax regulations, and fair to all parties involved. Whether you are selling goods, providing services, or dealing with digital products, understanding these tax rules can help you avoid unexpected costs and ensure a smoother transaction process.

Researching Regional Tax Rates

Tax rates can vary widely between different regions and depend on factors like the type of goods or services provided, the place of business, and even the buyer’s location. In some countries, tax is applied to all sales, while others may only tax specific goods or services. To stay compliant and avoid legal issues, you need to be aware of:

- Sales Tax: Applied to the sale of physical goods in many regions, but can differ in percentage from one place to another.

- Value-Added Tax (VAT): A consumption tax used by many countries, including those in the European Union. VAT rates vary depending on the country and the type of product or service.

- Digital Goods Tax: Some regions tax digital products, like software, music, or e-books, at different rates than physical products.

Applying the Correct Tax Rate

Once you’ve identified the appropriate tax rate for the product or service you are providing, it’s essential to accurately apply it to your billing documents. This can often be done automatically if you use accounting software or invoicing platforms that support regional tax settings. However, if you’re doing it manually, consider the following steps:

- Identify the Tax Jurisdiction: Determine where your business is registered and where the buyer is located. The tax rate typically depends on the buyer’s location.

- Ensure Correct Tax Calculations: Apply the appropriate percentage to the price of the product or service. Keep in mind that some items may be exempt from tax or taxed at a different rate.

- Provide Tax Breakdown: Clearly display the tax amount in your billing records, along with the base price and total amount due, so the buyer understands how much tax is being charged.

Accurate tax calculations are crucial for maintaining transparency, avoiding disputes, and ensuring compliance with international tax laws. By staying informed about the varying tax rates around the world, businesses can operate efficiently and build trust with their international clients.

Legal Considerations for Multi Currency Invoices

When handling transactions across different financial systems, it’s important to be aware of the legal aspects involved. Dealing with multiple monetary units in your billing process requires compliance with international trade laws, taxation rules, and contract terms. Understanding the legal implications of accepting payments in various financial systems can help you avoid disputes, ensure proper reporting, and meet local regulations. Below, we discuss the key legal considerations businesses should keep in mind when dealing with transactions in multiple financial systems.

Understanding International Trade Regulations

Different countries have different laws that govern how businesses can engage in cross-border transactions. Some regulations may impact how payments are processed, which taxes are applicable, and how contractual obligations are fulfilled. When dealing with international clients, it is crucial to:

- Comply with Export Laws: Ensure that your products or services are legally allowed to be sold in the target country, and that you are adhering to any necessary licensing or compliance requirements.

- Follow Contract Laws: Review contracts for international transactions to ensure that all parties are clear on payment methods, deadlines, and dispute resolution procedures.

- Adhere to Payment Terms: Ensure that payment deadlines are clearly stated and that the terms reflect the legal framework of both your country and the buyer’s location.

Tax and Compliance Considerations

In addition to trade laws, it is essential to understand the tax regulations of the countries involved in the transaction. Failure to comply with local tax laws can lead to legal disputes, fines, or penalties. Important tax-related considerations include:

- Value-Added Tax (VAT) and Sales Tax: Some countries impose VAT or sales tax on international transactions. Ensure you apply the correct tax rates based on the buyer’s location and the type of product or service sold.

- Withholding Tax: Many countries require a withholding tax on payments made to foreign businesses. Familiarize yourself with the rates and exemptions that may apply to your situation.

- Double Taxation Agreements: Check if the countries involved have treaties that allow businesses to avoid being taxed twice for the same transaction. These treaties can often reduce the amount of tax owed on cross-border payments.

It is crucial to keep up to date with changing tax laws in various regions to avoid non-compliance. Consulting with a legal expert or accountant specializing in international trade can help mitigate potential issues and ensure that all regulations are followed.

How to Ensure Accuracy in Multi Currency Invoices

Ensuring accuracy in financial documents, especially when dealing with different monetary systems, is crucial for both businesses and clients. Inaccurate calculations or incorrect exchange rates can lead to financial discrepancies, missed payments, and potential disputes. To maintain trust and professionalism, it’s important to take proactive steps in verifying the details of each transaction, particularly when multiple forms of money are involved. Below are essential strategies to ensure precision when preparing your billing documents.

1. Use Reliable Exchange Rate Data

One of the most common sources of error in financial documents involving different forms of money is the use of outdated or incorrect exchange rates. To avoid this, always ensure that the exchange rates used are accurate and up to date. Some methods for ensuring accuracy include:

- Automatic Rate Fetching: Use software that automatically fetches real-time exchange rates from trusted financial sources.

- Double-Check Rates: Manually verify exchange rates through reliable platforms or financial institutions before finalizing the document.

- Fix the Rate: If you are dealing with long-term projects or contracts, consider locking in the exchange rate at the time of agreement to avoid fluctuations.

2. Validate Payment Terms and Amounts

It’s important to ensure that all payment terms are clearly defined and that amounts are correctly calculated in the relevant monetary systems. Double-check the following:

- Correct Itemized Prices: Confirm that the individual prices for products or services are calculated correctly based on the applicable exchange rate.

- Accurate Totals: Add up the totals carefully, ensuring that any applicable discounts, taxes, or additional fees are included correctly.

- Correct Payment Method: Make sure the chosen payment method supports transactions in the specified monetary units without causing confusion or errors.

3. Incorporate Clear and Detailed Records

Transparency is key when working with clients across borders. Including clear, detailed records within your documents can help prevent misunderstandings. Consider including:

- Exchange Rate at Time of Transaction: Clearly state the rate used at the time of the transaction to ensure transparency and avoid future disputes over fluctuating rates.

- Local Tax Information: Specify any taxes applied based on the client’s location to ensure proper compliance and avoid confusion about final payment amounts.

- Conversion Calculations: Provide a breakdown of how the converted amount was calculated, including the base price and how the exchange rate was applied.

By taking these steps, businesses can reduce the risk of errors in their financial documents and maintain smoother, more accurate international transactions.

Future Trends in Multi Currency Invoicing

The landscape of international transactions is rapidly evolving as businesses continue to expand globally. As companies increasingly deal with clients, suppliers, and partners across borders, managing financial exchanges in various monetary units has become a vital component of business operations. The future of managing these transactions lies in streamlining the process and leveraging emerging technologies that enhance accuracy, efficiency, and compliance. This section explores the key trends that are shaping the future of financial documentation in global business transactions.

1. Automation and AI Integration

Automation is one of the most significant trends that will continue to reshape the way businesses manage financial exchanges. Artificial Intelligence (AI) and machine learning are already being integrated into many financial tools to help companies automatically convert and calculate amounts across different monetary systems. These technologies can:

- Reduce Manual Errors: Automation ensures that exchange rates, totals, and tax rates are accurately applied, reducing the chances of human error.

- Speed Up Transactions: By automating calculations, businesses can save valuable time when generating documents, enabling faster invoicing cycles.

- Improve Compliance: AI can help businesses stay updated with the latest regulatory requirements and tax laws across different regions, ensuring better compliance.

2. Blockchain for Secure Cross-Border Payments

Blockchain technology is revolutionizing the way businesses handle cross-border transactions. By providing a secure, transparent, and decentralized ledger, blockchain offers numerous advantages for businesses working with various financial systems:

- Transparency: Blockchain ensures that every transaction is recorded on an immutable ledger, providing transparency and traceability of payments across borders.

- Lower Transaction Costs: With blockchain, businesses can eliminate intermediaries and reduce transaction fees, making international payments more cost-effective.

- Faster Settlements: Blockchain enables near-instantaneous transactions, reducing the time it takes to settle payments, which is particularly beneficial for global businesses dealing with different time zones.

3. Centralized Digital Payment Systems

With the rise of digital wallets and centralized payment platforms, businesses are increasingly adopting integrated systems to manage payments in multiple monetary units. These platforms are expected to become even more sophisticated, offering:

- Real-Time Conversion: Digital payment platforms will enable businesses to convert payments in real-time, using the most up-to-date exchange rates for transactions.

- Seamless Integration: These platforms