Get the Best MS Word Invoice Template for Your Business

Designing professional billing documents can be time-consuming, especially when you need to ensure every detail is correct. Whether you’re running a small business or freelancing, having an efficient way to generate these documents is crucial. Using pre-designed formats can save time while maintaining a polished and consistent appearance across all your transactions.

Customizable layouts offer a straightforward solution, allowing you to adjust the content to meet your specific needs. These ready-made structures not only streamline the process but also provide clarity and consistency, ensuring your clients receive well-organized statements. From adding payment terms to including your branding, it’s possible to create documents that reflect your business identity without extra effort.

By choosing a flexible and user-friendly system, you can easily update and send your completed documents without the hassle of starting from scratch each time. This approach is ideal for anyone looking to improve their workflow and maintain professionalism in their financial communications.

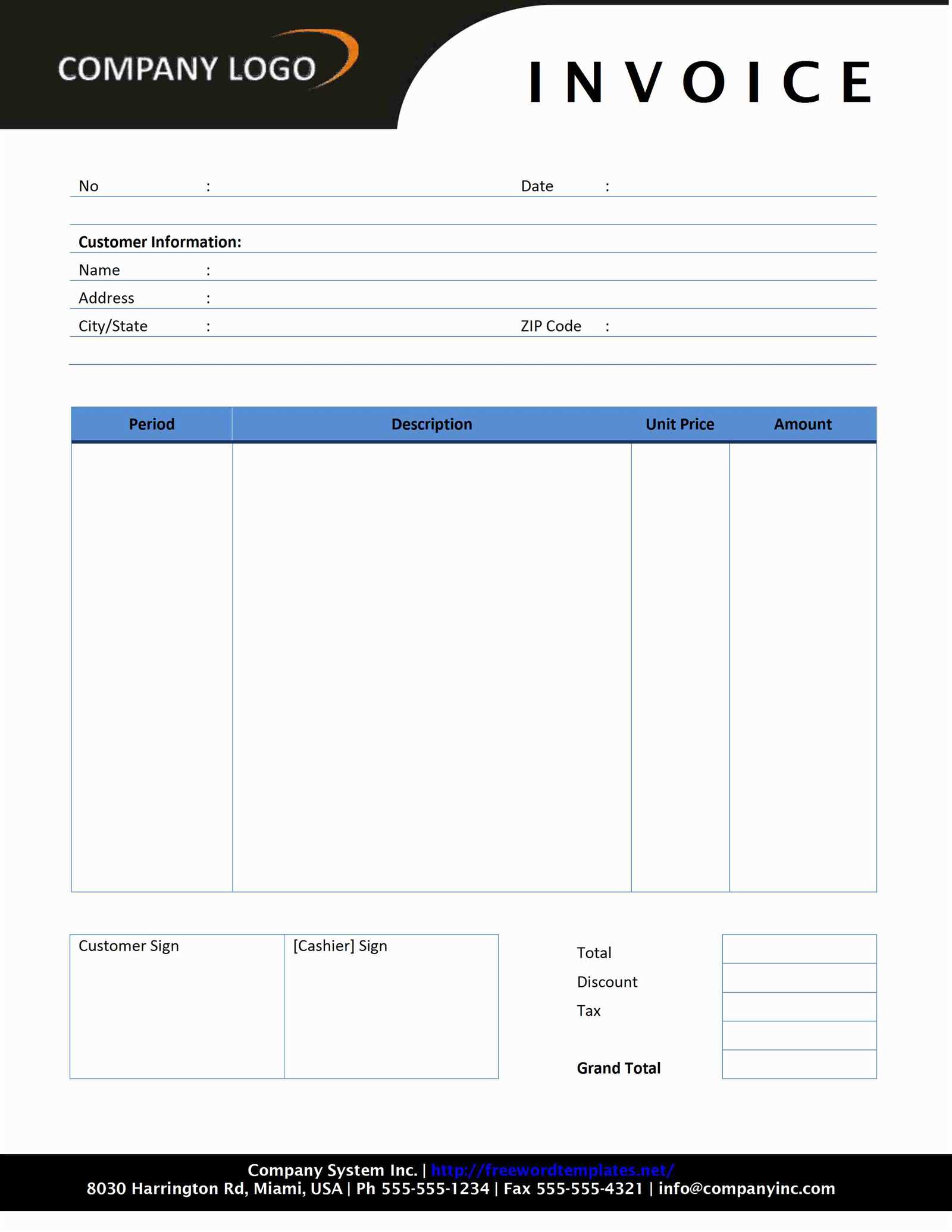

MS Word Invoice Template Overview

Using pre-designed documents for billing purposes can significantly enhance efficiency, providing a professional touch to every transaction. These ready-made formats are highly customizable, allowing businesses to quickly generate polished statements without starting from scratch each time. Whether you’re managing a large client base or handling small-scale transactions, having a reliable structure can save time and ensure consistency in your financial communications.

One of the main advantages of these ready-to-use layouts is their simplicity. With the right structure, you can include essential details such as payment terms, service descriptions, and contact information, all while keeping the document clean and organized. This allows for a streamlined approach, reducing the risk of missing key information while maintaining a professional appearance.

Moreover, these formats can be easily adapted to suit various industries, from freelance work to retail businesses. The flexibility of these documents means you can tweak elements like fonts, colors, and logos, making them fit your brand’s identity and style. This customization ensures that each document is not only functional but also aligns with your company’s image.

Why Choose MS Word for Invoices

Choosing the right software for creating billing documents can make a significant difference in your business’s efficiency and professionalism. One of the main reasons many businesses prefer MS Word is its accessibility and ease of use. The program offers a range of features that simplify the process of generating accurate, consistent, and well-organized statements for clients. Here are a few reasons why it stands out:

- User-Friendly Interface: MS Word provides an intuitive interface that allows both beginners and experienced users to quickly create and edit documents without a steep learning curve.

- Customization Options: With the flexibility to modify fonts, layouts, colors, and logos, you can make each document reflect your business’s branding and style.

- Accessibility: MS Word is widely available across many devices, ensuring you can access and edit your documents from anywhere, at any time.

- Wide Compatibility: Documents created in MS Word can be easily shared and opened by clients or collaborators, regardless of their operating system or software preference.

- Efficient Formatting Tools: MS Word offers built-in features such as tables, alignment tools, and automatic calculations that make structuring and updating your documents seamless.

Additionally, MS Word is compatible with other Microsoft Office tools and third-party software, making it easy to integrate with your existing accounting or document management systems. This seamless integration allows for greater workflow automation and minimizes the chances of errors or inconsistencies in your financial communications.

Benefits of Using Invoice Templates

Using pre-designed structures for generating billing documents offers numerous advantages that can streamline administrative tasks and improve business efficiency. These ready-made formats eliminate the need for starting from scratch with each new transaction, saving time while ensuring consistency in your communications. Here are some of the key benefits:

- Time-Saving: Pre-designed formats allow you to quickly fill in relevant details without having to format the document each time. This speeds up the billing process, freeing up time for other important tasks.

- Consistency: A uniform structure ensures that all your documents look professional and are formatted in the same way, which enhances your business’s credibility and helps avoid errors.

- Professional Appearance: Ready-made documents are often designed with a polished and clean layout, making your communications look more professional and helping to build trust with clients.

- Customization: Many of these structures allow for easy adjustments, letting you add your business logo, modify payment terms, or adjust sections to meet specific needs.

- Minimized Errors: The built-in sections and fields reduce the likelihood of missing important information or making formatting mistakes, ensuring accuracy and completeness.

In addition, using such formats ensures that you are always adhering to best practices in financial documentation, which can be crucial for maintaining proper records, managing taxes, and ensuring compliance with regulations. With a few clicks, you can generate reliable, well-structured documents that meet the standards expected by clients and partners alike.

How to Customize MS Word Templates

Customizing a ready-made document layout is a straightforward process that allows you to tailor it to your specific business needs. By adjusting key elements such as design, structure, and content, you can ensure the document reflects your brand identity and meets all your functional requirements. Here’s how you can easily modify a pre-designed layout:

- Edit Text Fields: Start by replacing the placeholder text with your own details, such as business name, contact information, client name, and services rendered. This will personalize the document to fit your specific transaction.

- Adjust Layout and Design: Change font styles, sizes, and colors to match your branding. You can also modify section headings or the arrangement of elements for better readability.

- Add or Remove Sections: If there are extra fields you don’t need, simply delete them. Conversely, you can add custom fields for things like additional services, discounts, or taxes.

- Include Branding Elements: Insert your logo or company slogan at the top or bottom of the document to give it a unique look and feel that aligns with your corporate identity.

- Modify Payment Terms and Conditions: Tailor the payment instructions and terms to suit your business model, such as payment deadlines, bank account information, or specific service policies.

With these simple changes, you can create a customized document that’s professional, functional, and uniquely yours, all while saving valuable time on repetitive formatting tasks. Adjusting these details ensures that your communications remain consistent with your business values and client expectations.

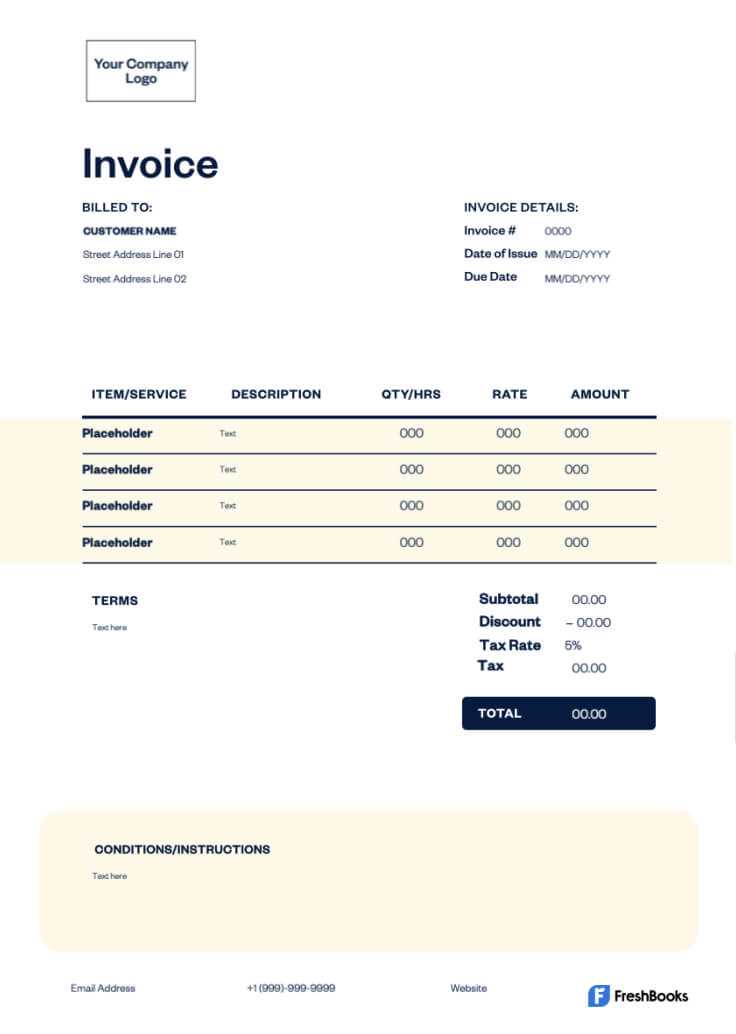

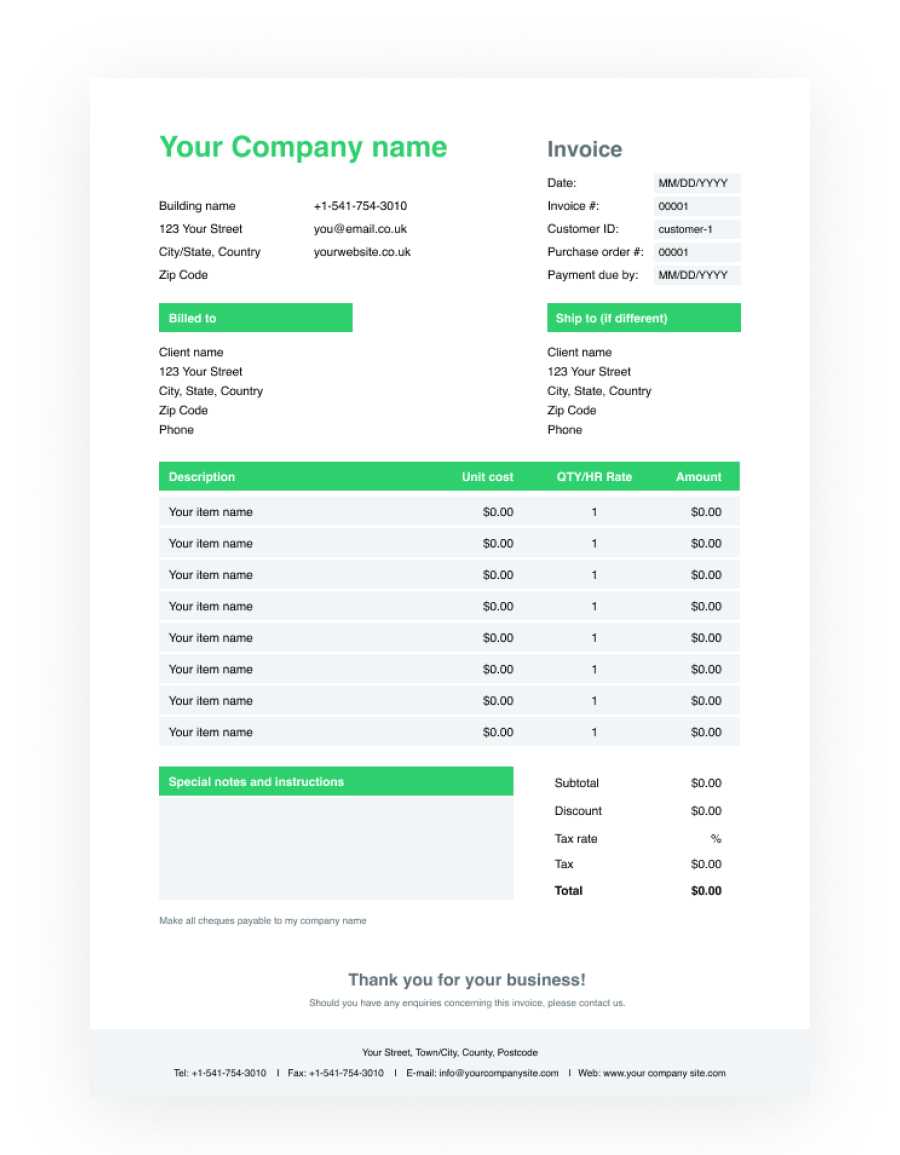

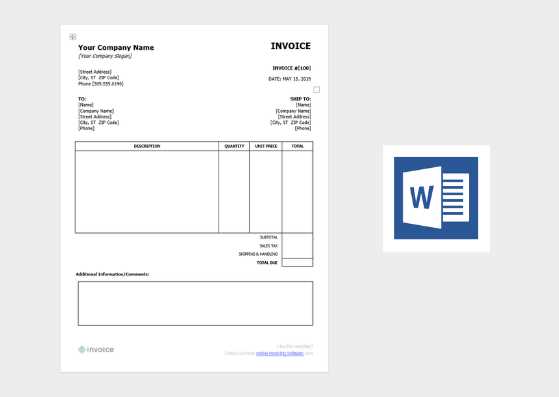

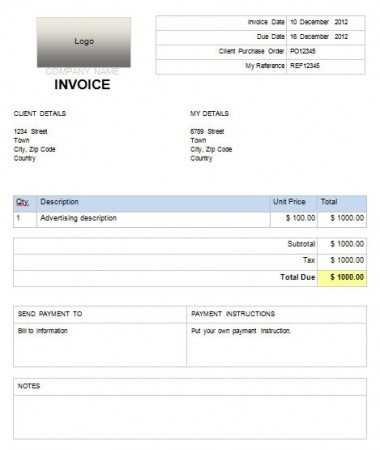

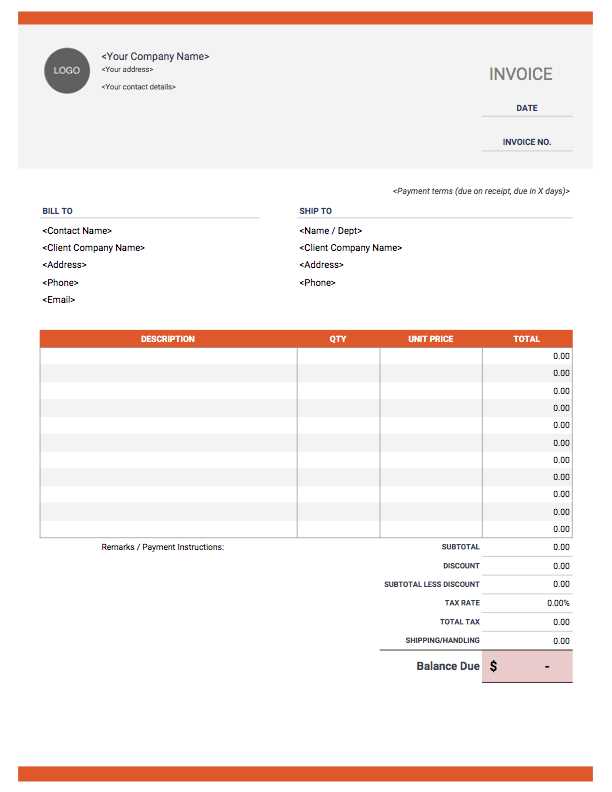

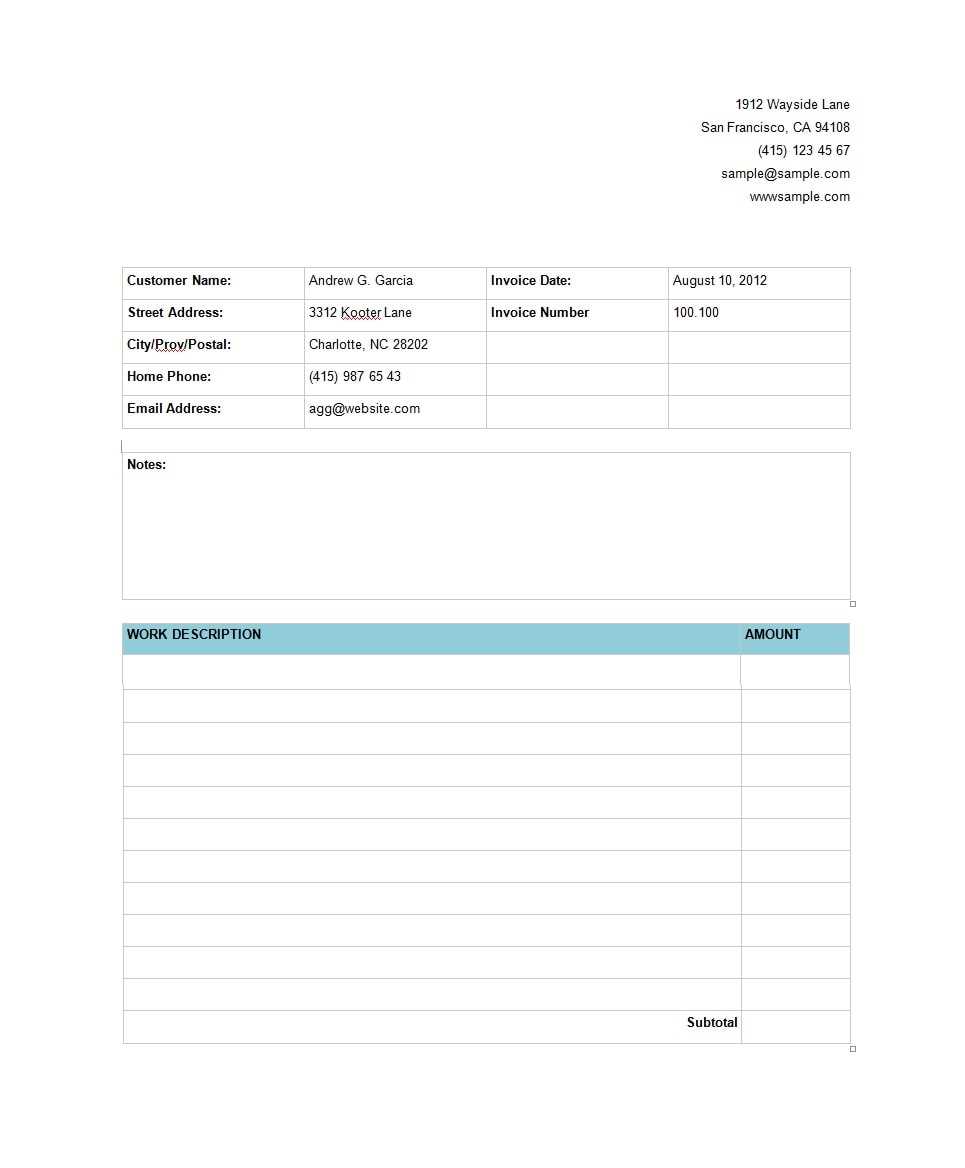

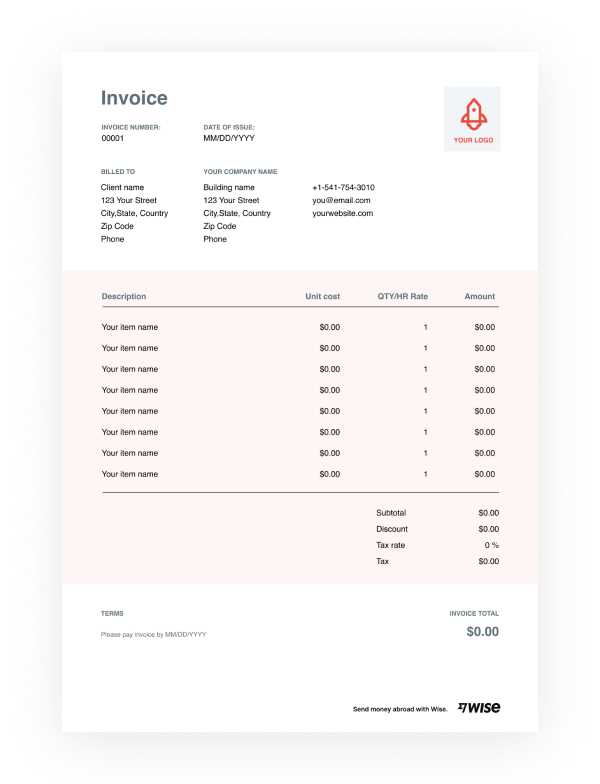

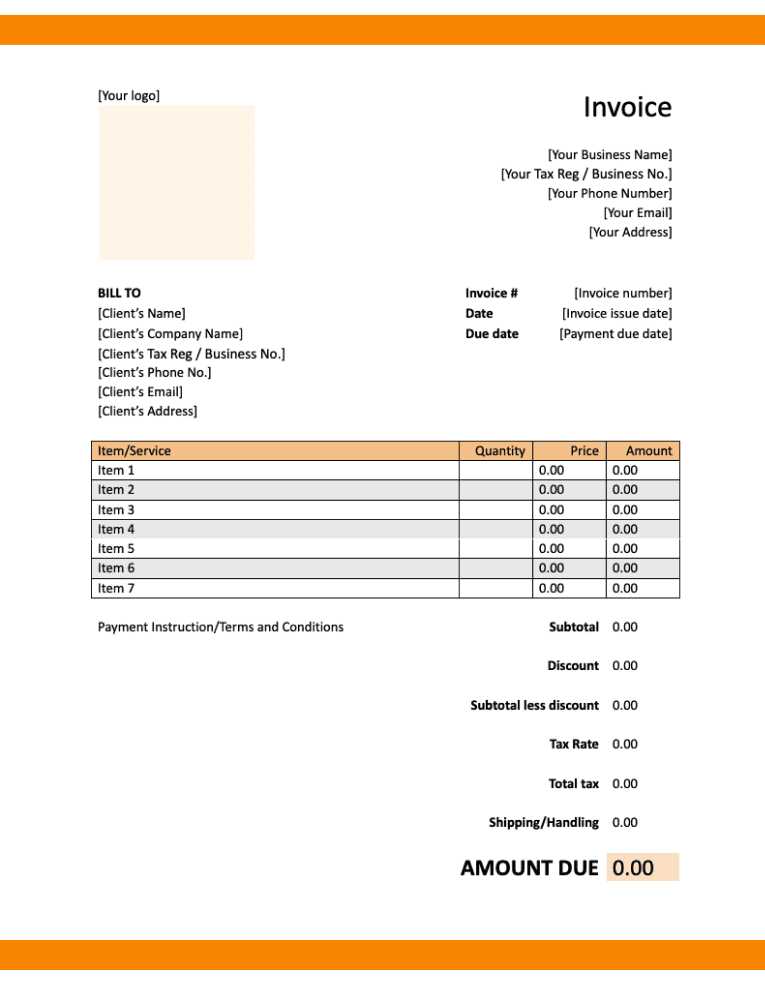

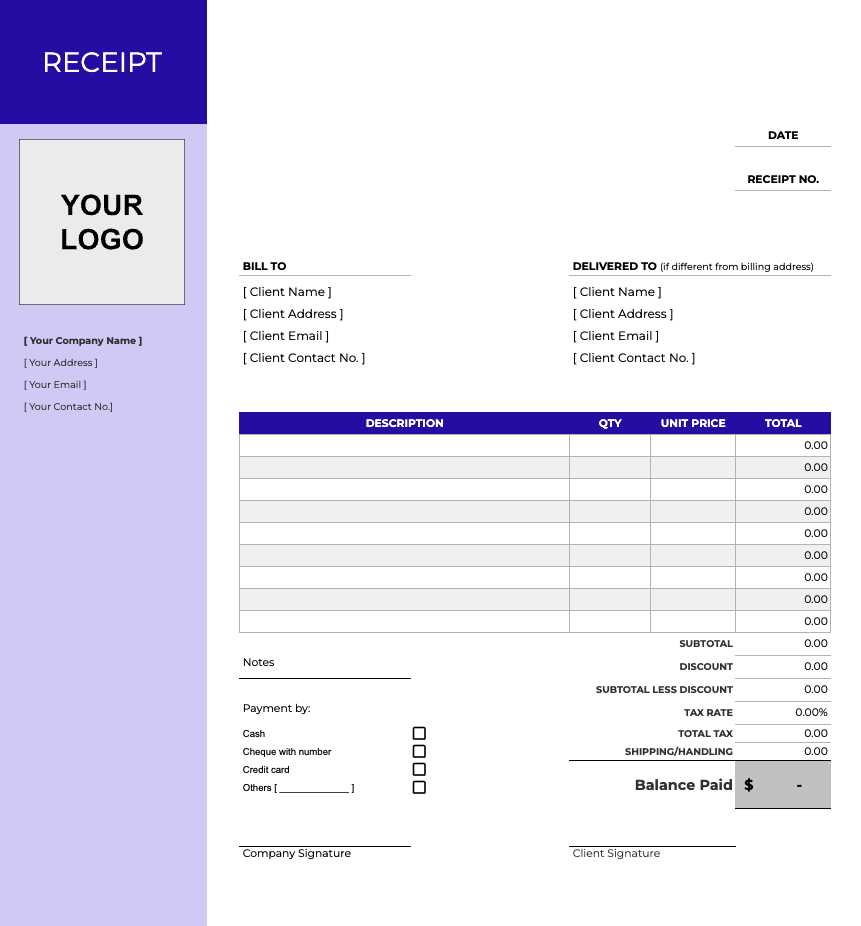

Free MS Word Invoice Templates to Download

Finding high-quality, customizable layouts for your billing documents can be challenging, but fortunately, there are many free resources available online. These pre-designed structures provide a convenient way to create professional statements without needing to build them from scratch. Whether you’re a freelancer, small business owner, or part of a larger company, downloading a free design can save time and effort while ensuring consistency and accuracy in your financial communications.

Where to Find Free Templates

There are numerous websites offering free downloadable structures, many of which are easily editable and suitable for various industries. Popular platforms like Microsoft Office’s template gallery, Google Docs, or other online resources offer a variety of customizable options. These designs typically include fields for essential details such as client information, services, and payment terms, making them an ideal starting point for any professional document.

How to Download and Use

To get started, simply choose a layout that best fits your needs, click the download button, and open the file in your preferred software. Once opened, you can modify the content, adjust the design elements, and save the file for future use. With just a few clicks, you can create a polished, professional document that aligns with your business’s branding and requirements.

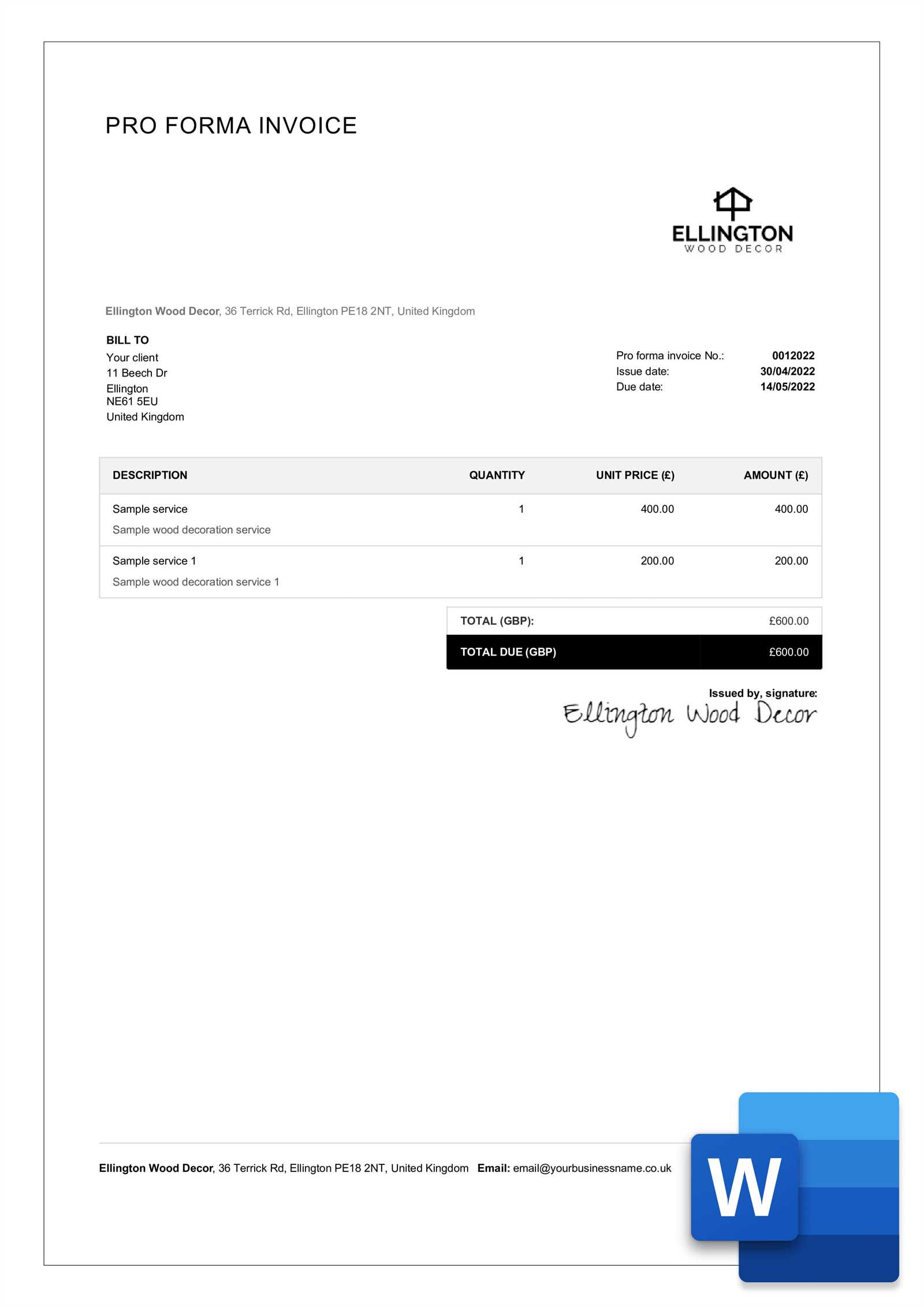

How to Add Your Business Logo

Including your company logo in billing documents helps reinforce your brand identity and adds a professional touch to every transaction. It is an easy process that can be done in just a few steps, ensuring that your document looks cohesive and represents your business accurately. Below is a simple guide on how to insert your logo into your billing statements.

Step 1: Prepare Your Logo File

Before adding your logo, make sure the image file is of high quality and in a supported format, such as PNG, JPEG, or GIF. It’s also important to have a version of the logo with a transparent background for a cleaner look, especially if you’re placing it over a colored or patterned background.

Step 2: Insert the Logo into the Document

Once your logo is ready, open the document where you want to add it. Navigate to the header section where logos are typically placed. Then, select the “Insert” tab and click on the “Pictures” or “Image” option. Browse to the location of your logo file, select it, and click “Insert.” You can then resize and position it in the header to fit seamlessly with the rest of your content.

Tip: To ensure the logo does not distort, hold the “Shift” key while resizing it to maintain its original proportions. You can also adjust the alignment, making it left, center, or right-aligned depending on your design preferences.

By adding your company’s logo to each document, you enhance its visual appeal and help clients easily recognize your brand. This simple step contributes to a more professional image and can help build trust and consistency in your client relationships.

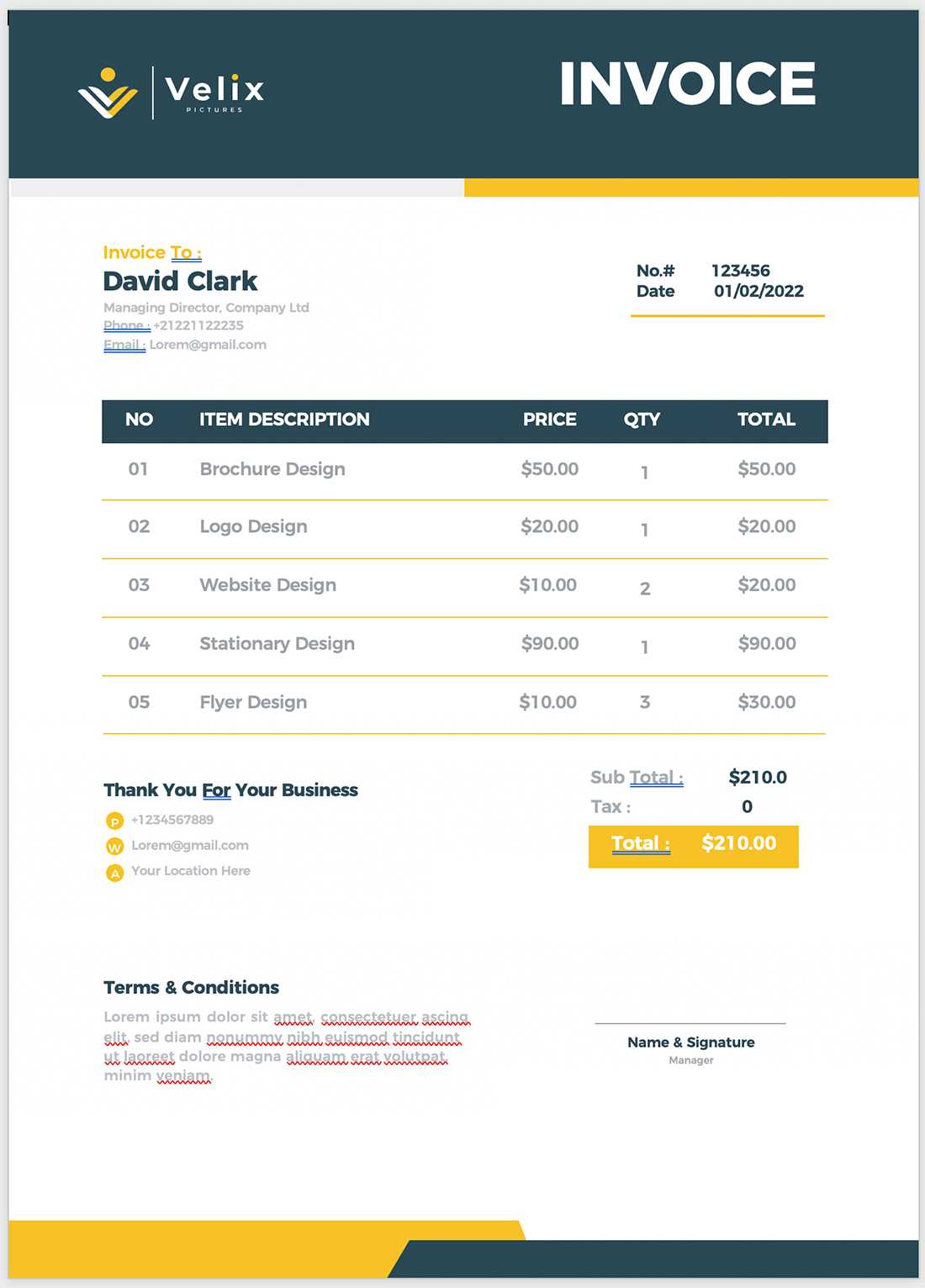

Step-by-Step Guide to Creating Invoices

Creating clear, professional billing documents is essential for maintaining a smooth business operation. By following a few simple steps, you can generate well-organized statements that include all the necessary details, ensuring that clients receive accurate and complete information. Below is a step-by-step guide to help you craft a professional and effective document every time.

- Step 1: Select a Layout – Begin by choosing a structure that suits your business needs. Whether you’re offering a service or a product, select a design that clearly highlights all the key elements of the transaction.

- Step 2: Include Your Company Information – Add your business name, address, phone number, and email at the top of the document. This makes it easy for clients to contact you if needed.

- Step 3: Add Client Details – Include your client’s name, company name (if applicable), and contact details. This helps avoid any confusion about who the statement is for.

- Step 4: Specify the Products or Services – Clearly list all products or services provided, along with their individual costs, quantities, and descriptions. Ensure that all items are easy to read and understand.

- Step 5: Include Payment Terms – Define payment methods, deadlines, and any applicable late fees. This helps set clear expectations and reduces the chance of payment delays.

- Step 6: Calculate the Total – Add up the individual costs and apply any discounts, taxes, or additional charges. Clearly show the total amount due at the bottom of the document.

- Step 7: Add a Thank-You Note – A short note expressing appreciation for the client’s business can leave a positive impression and encourage timely payments.

Once you’ve filled out all the necessary details, review the document for accuracy, and make any final adjustments. After ensuring that everything is correct, save the file and send it to your client. Following these steps consistently will help you create clear and professional documents that reflect well on your business.

Incorporating Payment Terms in Your Template

Clearly stating payment terms in your billing documents is essential for ensuring smooth transactions and maintaining good relationships with clients. By outlining payment expectations upfront, you eliminate any confusion about deadlines, amounts, or methods of payment. Including these details in your document provides transparency and helps set professional standards for your business.

Specify Payment Deadlines: Include clear due dates for payments, whether it’s “due upon receipt,” “net 30 days,” or another time frame. This makes it easy for your clients to know when payments are expected and helps avoid late fees or delays.

Define Accepted Payment Methods: Make sure to list all the available payment options, such as bank transfers, credit cards, or online payment platforms. Providing multiple payment methods can make it easier for clients to pay promptly.

Include Late Payment Penalties: If applicable, outline any late payment fees or interest charges that will be incurred if the payment is not received on time. This helps encourage timely payments and ensures that you’re compensated for any delays.

Offer Discounts for Early Payment: Some businesses include a small discount for early payments, such as a 2% discount if paid within 10 days. If you choose to offer this, be sure to clearly state the terms in the document to incentivize prompt payment.

By incorporating these payment terms directly into your document layout, you ensure that all parties are on the same page regarding financial expectations. A well-defined structure not only helps with cash flow but also maintains a professional tone and minimizes the chances of misunderstandings.

Setting Up Automatic Calculations in Word

Adding automatic calculations to your billing documents can save time and reduce errors, especially when dealing with multiple items, taxes, or discounts. With the right setup, you can ensure that totals, taxes, and other calculations update automatically, making it easier to manage and track payments. Here’s how you can set up these features in your document.

One of the most effective ways to enable automatic calculations is by using tables within your layout. By structuring the details of each item or service in a table format, you can apply formulas to calculate totals, taxes, or other charges based on the data you enter.

| Item | Quantity | Price | Total |

|---|---|---|---|

| Service A | 2 | $50 | =B2*C2 |

| Service B | 3 | $30 | =B3*C3 |

| Subtotal | =SUM(D2:D3) | ||

| Tax (5%) | =D4*0.05 | ||

| Total | =D4+D5 |

Step 1: To calculate totals automatically, select the cell where you want the result to appear and use a formula. For example, to calculate the total for each item, use a simple multiplication formula like =B2*C2 (Quantity * Price). Similarly, you can sum totals with =SUM(D2:D3) for the subtotal and apply a percentage formula for tax or discounts.

Step 2: Once

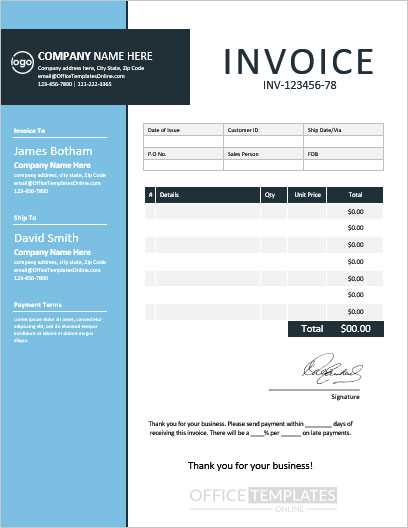

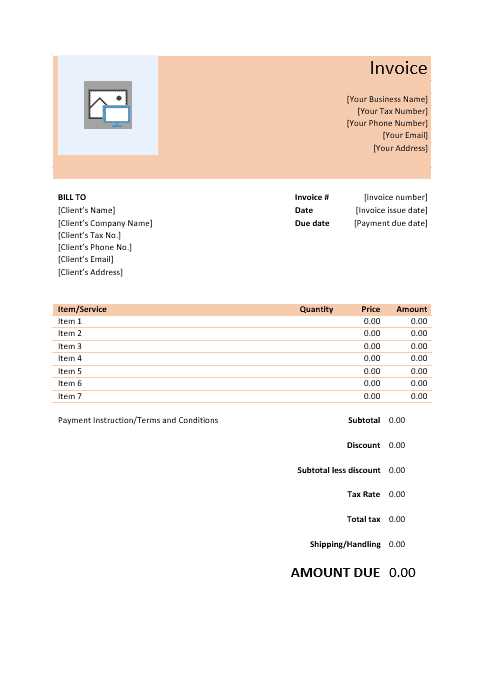

Choosing the Right Template Style for Your Business

Selecting the appropriate design for your billing documents is essential to ensure that they reflect your business’s identity while maintaining clarity and professionalism. The style you choose should not only align with your brand image but also make it easy for clients to understand the details of the transaction. A well-designed document can improve communication, boost credibility, and ensure that payments are processed smoothly.

Consider Your Industry

Different businesses have varying needs when it comes to billing document design. For example, a creative freelancer might prefer a more modern, visually striking layout, while a law firm might opt for a more formal, straightforward design. It’s important to choose a style that suits the nature of your services or products, as well as the preferences of your clients.

Keep It Clean and Simple

Regardless of your industry, simplicity should be a priority. A clean and well-organized layout will make it easier for your clients to read and understand the key information, such as the services rendered, prices, and payment terms. Avoid cluttering the document with unnecessary elements that could distract from the important details.

| Business Type | Recommended Style | Design Features |

|---|---|---|

| Freelancers (Designers, Writers) | Creative and Modern | Bold fonts, color accents, minimalistic layout |

| Law Firms, Accountants | Professional and Formal | Classic fonts, monochrome colors, structured layout |

| Retailers | Clean and Functional | Simple tables, clear pricing, branded colors |

By carefully considering the design features and layout that best represent your business, you can ensure your billing documents are not only functional but also align with your brand’s aesthetic and professionalism. Choose a style that makes sense for your industry, while prioritizing clarity and ease of use for your clients.

Tips for Professional Invoice Design

A well-designed billing document not only ensures clarity but also leaves a lasting impression of professionalism. Whether you’re a freelancer or a business owner, the design of your financial communications plays a key role in how your business is perceived. A clean, organized, and aesthetically pleasing layout can foster trust with clients and help streamline payment processing. Below are some essential tips to ensure your documents are both functional and visually appealing.

1. Keep It Simple and Organized

Simplicity is key in design. A cluttered document can confuse the recipient and make it harder to quickly find essential information. Ensure that your document includes only the necessary fields and that they are logically organized for easy reading. Use clear headings, white space, and clean lines to guide the reader through the information.

2. Consistent Branding

Your document should reflect your brand’s identity, so ensure that you incorporate your business’s logo, color scheme, and font style. Consistent branding not only reinforces your business identity but also adds a professional touch that makes your documents stand out.

3. Use Clear, Readable Fonts

Choose fonts that are easy to read and look professional. Avoid using too many different fonts or overly decorative styles that might detract from the clarity of the information. A simple sans-serif font like Arial or Helvetica is often a good choice for modern and clean readability.

4. Include All Essential Information

Make sure that every document contains the necessary elements: your company details, client’s details, a description of services/products, total costs, payment terms, and any other relevant information. A well-structured layout makes this information easy to locate and reduces the chances of errors or omissions.

| Section | Important Details |

|---|---|

| Header | Your business name, logo, and contact info |

| Client Info | Client’s name, company, and contact details |

| Services or Products | Description, quantity, price, and total cost for each item |

| Payment Terms | Due date, payment methods, and any late fees or discounts |

| Footer | Thank-you note, business registration, or legal disclaimers |

5. Add a Personal Touch

A small thank-you note or a personalized message can make a big difference. It shows appreciation for the client’s business and encourages positive long-term relationships. Keep it professional, but a brief note of gratitude can set you apart from others.

By following these tips and paying attention to the design of your billing documents, you not only improve clarity but also enhance your business’s professionalism and image. A polished and thoughtfully designed document can strengthen client trust, improve payment processing, and contribute to the overall success of your business.

How to Save and Share Your Invoice

Once you have created your billing document, it’s important to save it in a format that ensures easy access and sharing with your clients. Properly saving and sharing your documents can streamline the payment process and maintain a professional image. There are various options available for both saving your document and sending it to your clients securely and efficiently.

Saving Your Document

First, choose the best format for your needs. The most common file types for professional documents are PDF and DOCX. PDFs are often preferred because they preserve the layout and prevent any unwanted editing, ensuring that the document looks exactly as intended when viewed by the client. To save your document as a PDF, simply click “Save As” in your program, select “PDF” from the file format options, and save it to your desired location. If you need to edit the document later, you can save it in a Word-compatible format like DOCX.

Sharing Your Document

After saving your file, you can share it with your client via email or file-sharing services. Email is the most common method, but if your document is large or requires secure transfer, consider using cloud storage services like Google Drive, Dropbox, or OneDrive. When using cloud storage, make sure to set appropriate permissions to ensure the recipient can access the document without issues. Additionally, always double-check that the recipient’s email address is correct to avoid sending sensitive information to the wrong person.

By following these steps, you ensure that your document is not only secure but also accessible and easy to manage. A well-organized and correctly saved document will make it easier for clients to view and process payments, enhancing the overall business transaction experience.

MS Word Template vs. Online Invoicing Software

When it comes to managing and sending billing documents, businesses often have to choose between traditional methods, such as using pre-designed documents, and more modern solutions like cloud-based billing platforms. Each approach has its own set of advantages, depending on your business needs, workflow, and desired level of automation. Below, we’ll compare the two options to help you decide which method works best for you.

MS Word Document

Using a pre-designed document in a software program offers flexibility and familiarity. It’s a straightforward option that doesn’t require a subscription or learning curve. Here are some advantages and disadvantages of this method:

- Pros:

- Cost-effective, as you only need the software you already use.

- Customizable to suit your specific needs and branding.

- Simple to use for those who are already familiar with the program.

- Cons:

- Manual entry for every document, which can be time-consuming.

- No built-in tracking for payments or overdue invoices.

- Limited automation for calculations and updates.

Online Billing Platforms

On the other hand, online invoicing services offer specialized tools designed to streamline the billing process. These platforms come with features that simplify tasks and improve workflow. Here are the pros and cons of using an online service:

- Pros:

- Automation for recurring billing and payment reminders.

- Integrated payment gateways for quick, easy transactions.

- Cloud-based access, allowing you to create and manage documents from anywhere.

- Real-time tracking of paid and unpaid balances.

- Cons:

- Monthly or annual subscription fees.

- May require some time to learn new features and interfaces.

- Limited customization compared to traditional document creation software.

Ultimately, the choice between using a traditional document system and a cloud-based solution depends on your business’s needs. If you have a small operation with limited billing needs, using a software document may be sufficient. However, if your business is growing or requires more complex billing processes, an online platform with automated

Common Mistakes to Avoid with Invoices

Creating and sending billing documents may seem straightforward, but there are several common mistakes that can lead to delays, confusion, or even lost payments. Avoiding these errors can help maintain professionalism, ensure timely payments, and improve client relationships. Here are some of the most frequent mistakes and how to prevent them.

1. Missing or Incorrect Contact Information

One of the simplest mistakes is forgetting to include or incorrectly entering contact details. If your client can’t easily identify your business or if there’s confusion about how to reach you for questions or payments, it can lead to delays. Always double-check that your business’s name, address, phone number, and email are correct and visible.

2. Ambiguous Payment Terms

Unclear payment terms can lead to misunderstandings. Whether you’re specifying due dates, accepted payment methods, or late fees, clarity is key. Be sure to clearly state when payment is due, how clients can pay, and any consequences for overdue payments. Vague terms can delay payment and harm your cash flow.

| Mistake | Impact | How to Fix It |

|---|---|---|

| Missing Contact Information | Confusion for clients, delayed payments | Double-check your details; include phone number, email, and business address |

| Unclear Payment Terms | Missed or delayed payments | Clearly state payment deadlines, methods, and penalties for late payments |

| Incorrect Amounts or Calculations | Potential disputes or delayed payments | Double-check all figures, use automatic calculations when possible |

| Not Including a Unique Reference Number | Difficulty tracking payments or matching to specific projects | Include a unique reference number or invoice ID for each document |

3. Incorrect Amounts or Calculations

Simple errors in totaling the amounts or applying taxes can lead to confusion or disputes. Always double-check your calculations, and consider using automatic features in your document design to minimize the risk of human error. Consistency and accuracy in pricing h

How to Secure Your Invoice Files

Securing your billing documents is critical to protect sensitive financial information and maintain trust with your clients. As these documents often contain personal, business, and financial details, unauthorized access could lead to identity theft, fraud, or other risks. Below are some important strategies to ensure the safety of your files from both external and internal threats.

1. Password Protection

One of the most effective ways to protect your files is by adding password protection. Many document management programs allow you to set a password that must be entered before the file can be opened or edited. By applying a strong, unique password, you can significantly reduce the risk of unauthorized access to your sensitive documents.

2. Encryption

Encrypting your files adds an extra layer of security by transforming the data into a format that can only be read with a specific decryption key. This is particularly important when sending billing documents through email or storing them in cloud services. Encryption ensures that even if your files are intercepted, they cannot be read without the decryption key.

| Security Method | Benefits | How to Implement |

|---|---|---|

| Password Protection | Prevents unauthorized access by requiring a password to open the file. | Use your document software’s password protection feature (e.g., Microsoft Office, PDF editors). |

| Encryption | Protects sensitive data from being accessed or viewed by unauthorized parties. | Use encryption software or cloud services that offer built-in encryption (e.g., Dropbox, Google Drive). |

| Secure Storage | Ensures that your files are stored in a protected location, reducing risk of theft or loss. | Store documents on encrypted drives or secure cloud storage services with strong access controls. |

| Access Controls | Limits who can access, view, or edit the files. | Use file-sharing platforms that allow you to set user permissions (e.g., view-only, edit, etc.). |

3. Secure Storage Solution

Best Practices for Invoice Tracking

Tracking your billing documents is crucial for maintaining a healthy cash flow and avoiding payment delays. By adopting organized and systematic methods for tracking, you can ensure that all transactions are accounted for, follow up on unpaid amounts efficiently, and maintain strong relationships with your clients. Below are some best practices to help you manage and track your financial documents effectively.

1. Assign Unique Numbers to Each Document

One of the most important steps in tracking your financial records is assigning a unique reference number to each document. This helps both you and your clients identify specific transactions quickly, avoiding confusion in case of disputes or follow-up communications. Ensure that each document has a sequential number that is easy to locate and track.

2. Use a Centralized System for Tracking

Storing and tracking your billing records in a single, centralized system is essential for staying organized. Whether you use an accounting software program, a spreadsheet, or a cloud-based system, make sure all your records are stored in one place. This will make it easier to find past transactions, check payment statuses, and generate reports when necessary.

| Best Practice | Benefits | How to Implement |

|---|---|---|

| Unique Reference Numbers | Helps easily track and identify documents, minimizing confusion. | Assign a sequential number to each document. Ensure it is unique and easy to find. |

| Centralized System | Prevents loss of records, simplifies tracking, and improves efficiency. | Use accounting software, cloud-based storage, or spreadsheets to store all records in one place. |

| Regular Updates | Helps keep track of unpaid amounts and ensures prompt follow-ups. | Update your tracking system regularly with payment statuses and due dates. |

| Automated Reminders | Reduces human error and ensures timely follow-ups. | Set up automated payment reminders or alerts for overdue documents. |

3. Regularly Update Your Records

Updating your tracking system regularly ensures that you’re always aware of the status of each transaction. As payments are made, be sure to mark them as “paid” in your tracking system. This will prevent duplicate reminders or overdue notices being sent to clients who have already settled their balance. Regular updates also help you identify overdue payments and take the necessary steps to follow up promptly.

4. Set Automated Reminders

Automating your payment reminders can save time and reduce the risk of missing important follow-ups. Many cloud-based platforms and accounting software offer the ability to set reminders that automatically notify clients when payments are due or overdue

How MS Word Templates Improve Efficiency

Using pre-designed documents can significantly boost productivity and streamline everyday tasks, especially when managing repetitive processes like creating billing records. By automating key elements and reducing manual input, these documents save time and help eliminate errors. Below, we explore how utilizing such solutions can enhance workflow efficiency and ensure accuracy in business operations.

1. Faster Document Creation

One of the biggest advantages of using a pre-designed format is the speed at which you can generate professional documents. With fields and sections already structured, there is no need to start from scratch each time. Simply fill in the required information, and your document is ready to be sent out, making the process much quicker and less tedious.

2. Reduced Errors

Manual document creation increases the risk of human error, especially when dealing with repetitive tasks like calculations or formatting. Pre-designed layouts often include built-in formatting and automatic features to reduce mistakes. This ensures that the final document is polished and accurate, saving time spent on corrections and rework.

| Benefit | Impact | How It Improves Efficiency |

|---|---|---|

| Faster Document Creation | Reduces the time needed to create each document from scratch. | Pre-built structures allow quick editing and customization without starting from zero. |

| Reduced Errors | Minimizes mistakes in formatting, calculations, or missing information. | Built-in features and pre-set fields automatically handle calculations and formatting. |

| Consistency Across Documents | Maintains a uniform appearance for all client-facing materials. | Using the same layout for each document ensures professionalism and coherence. |

| Easy Customization | Allows quick adaptation to different needs and client specifications. | Editable fields make it easy to personalize each document without major changes. |

3. Consistency Across Documents

Maintaining a consistent appearance in your documents helps to build professionalism and trust with your clients. With pre-designed layouts, every document you generate will follow the same format, ensuring uniformity in font styles, logos, and general design. This consistency reduces the need for constant adjustments and guarantees a polished final product.

4. Easy Customization

While pre-designed documents save time, they also offer flexibility for customiza

Integrating MS Word Invoices with Accounting Systems

Seamlessly connecting your billing documents with accounting software can greatly enhance the efficiency of your financial operations. By syncing data from your payment records directly into your accounting system, you can streamline your bookkeeping, reduce the likelihood of errors, and ensure that all records are up-to-date. Below, we explore the benefits and steps for integrating such documents with financial platforms.

1. Streamlined Data Entry

One of the key advantages of integrating billing documents with an accounting system is the reduction of manual data entry. Instead of re-entering payment details into your accounting software, you can simply transfer the necessary information directly from your generated documents. This integration helps eliminate duplicate efforts, saving valuable time and reducing the risk of human error.

2. Automated Record-Keeping

With automated integration, your system can instantly update financial records as soon as a transaction is completed. This real-time synchronization ensures that all of your financial statements are current, making it easier to track unpaid amounts, monitor cash flow, and reconcile accounts. Automation also frees up time that would otherwise be spent manually updating records or following up on discrepancies.

| Benefit | Impact | How It Works |

|---|---|---|

| Streamlined Data Entry | Reduces manual input and improves data accuracy. | Information from generated documents is automatically entered into the accounting system. |

| Automated Record-Keeping | Ensures up-to-date financial records with minimal manual effort. | Real-time synchronization updates financial data as payments are processed. |

| Efficient Reporting | Quickly generate financial reports without manually compiling data. | Integration allows for easy generation of profit-and-loss statements or balance sheets. |

| Improved Accuracy | Minimizes errors due to manual data entry or oversight. | Automated data transfers reduce the risk of errors and discrepancies in financial records. |

3. Efficient Reporting

By integrating your billing documents with accounting platforms, you can generate detailed reports with just a few clicks. These reports can provide insight into sales, tax liabilities, payment history, and outstanding balances. This level of efficiency not only saves time but also helps you make data-driven decisions based on up-to-date financial information.

4. Improved Accuracy

Manual data entry often leads to discrepancies, whether through typos or miscalculations. By automating the integration of your financial documents with accounting software, you reduce these risks and ensure that the information is consistent across all platforms. This leads to more accurate financial records, which is essential for tax reporting, audits, and overall business health.

Integrating your billing records with accounting software not only simplifies the process of