Moving Company Invoice Template for Easy Billing

When offering relocation services, providing clear and accurate documentation is essential for smooth transactions. A well-structured billing document ensures both parties understand the terms and costs involved, fostering trust and transparency. This essential tool helps manage finances effectively, saving time and reducing errors in calculations.

Creating a detailed and easy-to-understand record for services rendered can significantly improve communication with clients. By customizing this document, businesses can maintain a professional appearance, track payments, and clearly present the charges for each aspect of the service. Whether you’re handling one-time jobs or recurring contracts, this approach is crucial for maintaining financial organization and improving customer satisfaction.

Moving Service Billing Document Guide

Having a structured document for billing is crucial when providing relocation assistance. A well-organized record helps both the service provider and the client to track the details of the transaction, ensuring clarity and reducing misunderstandings. This guide will walk you through the key elements needed for creating a professional document that reflects your services accurately and efficiently.

Whether you’re billing for a single project or a long-term contract, ensuring that the details are properly outlined is essential for maintaining financial order. From the client’s information to a breakdown of services provided, each component should be tailored to suit the nature of the job and the expectations of the customer. A comprehensive and clear billing document not only serves as proof of the service but also as a reference for future transactions.

Why Use a Billing Document Format

Utilizing a predefined structure for financial records ensures consistency, reduces errors, and saves time when managing payments for services. By following a set format, you can streamline the process, providing clear details of each transaction while maintaining a professional image. Such a system not only helps you organize billing more efficiently but also allows your clients to quickly understand the charges involved.

Benefits of Using a Structured Billing Record

- Time Efficiency: Pre-designed documents allow for quicker processing, as you don’t need to start from scratch each time.

- Professionalism: A consistent format gives clients confidence in your business practices and helps maintain a high standard.

- Accuracy: Using a standard format ensures that all necessary details are included, reducing the risk of errors in calculations or missing information.

- Easy Customization: These records can be adjusted to fit the specifics of each job, allowing for flexibility in pricing and services offered.

How It Helps with Client Relationships

- Transparency: Clients appreciate clear and straightforward financial records, which build trust and improve customer satisfaction.

- Clear Breakdown: By listing all charges, services, and terms, both parties have a clear understanding of what is being billed and why.

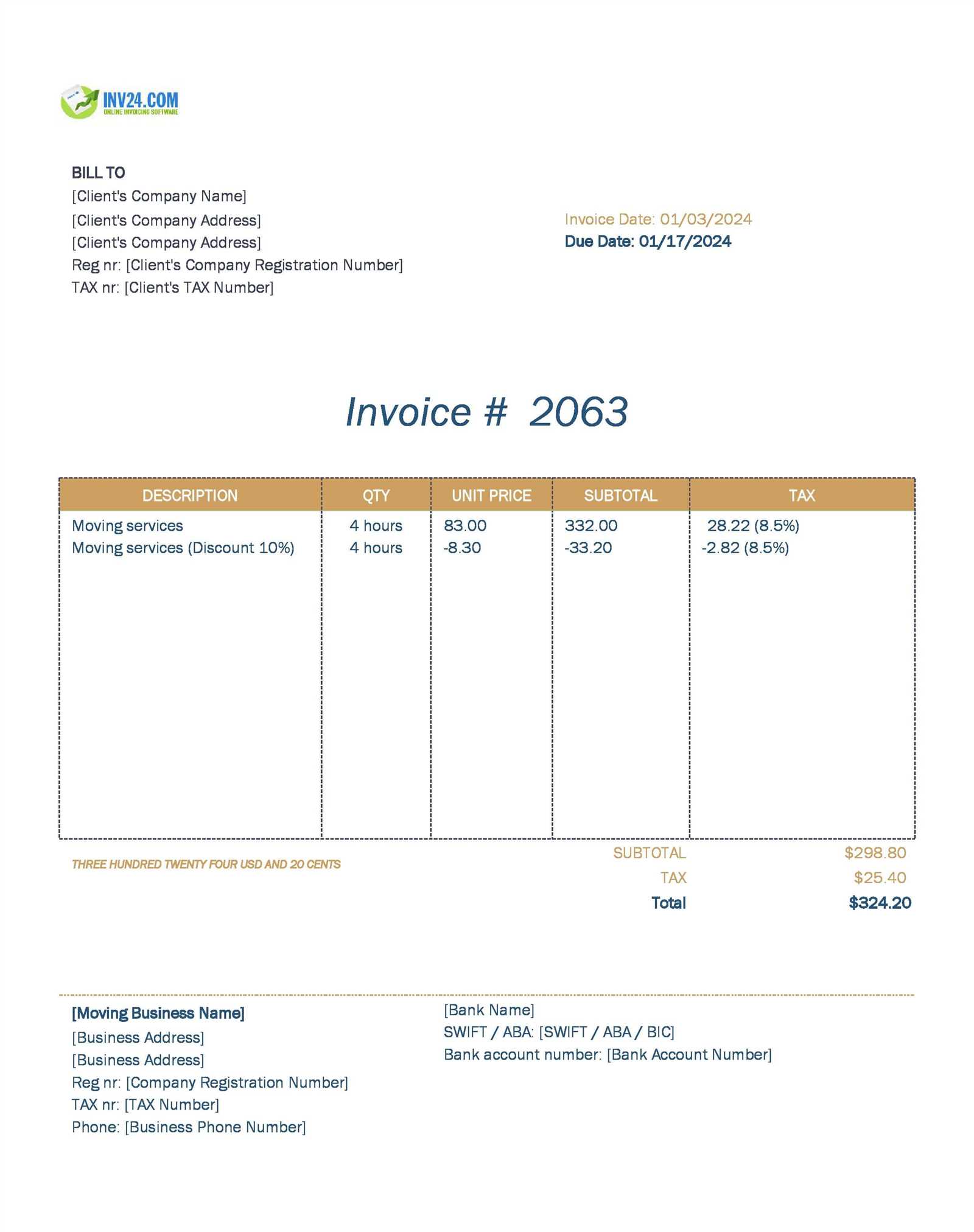

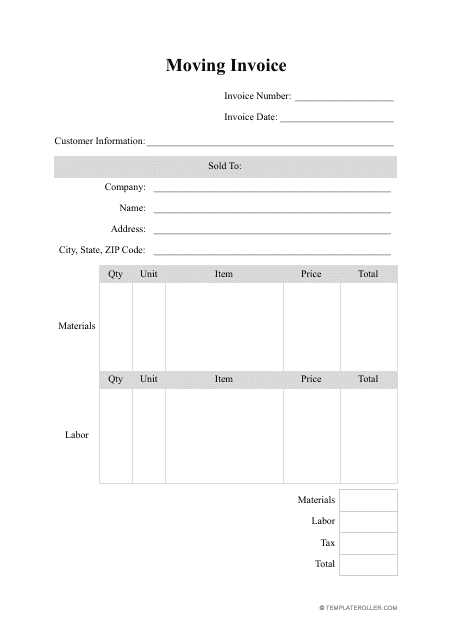

Key Elements of a Billing Document

To create a clear and comprehensive record for services rendered, it’s important to include essential details that outline the scope of work and the associated costs. A well-structured financial document ensures that both the service provider and client have a shared understanding of the terms of the transaction. This section covers the crucial components that should be included in every billing document for relocation assistance.

Essential Details to Include

- Client Information: Always include the full name, address, and contact details of the client receiving the service.

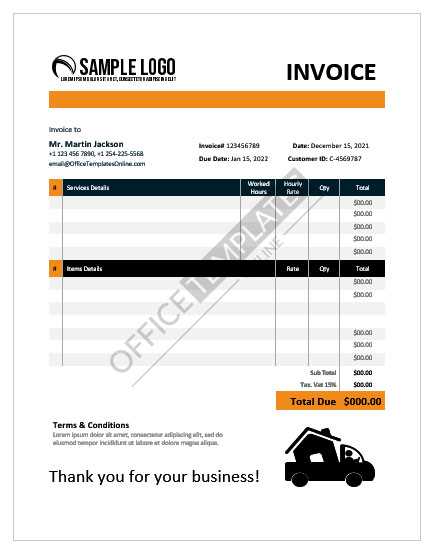

- Service Provider Information: Include the name, address, and contact details of your business or service, along with any relevant identification or license numbers.

- Date of Service: Specify the date(s) when the service was provided to clearly identify the timeframe of the transaction.

- Detailed Description of Services: List each task or phase of the work completed, including any specific requirements or special requests from the client.

Financial Breakdown

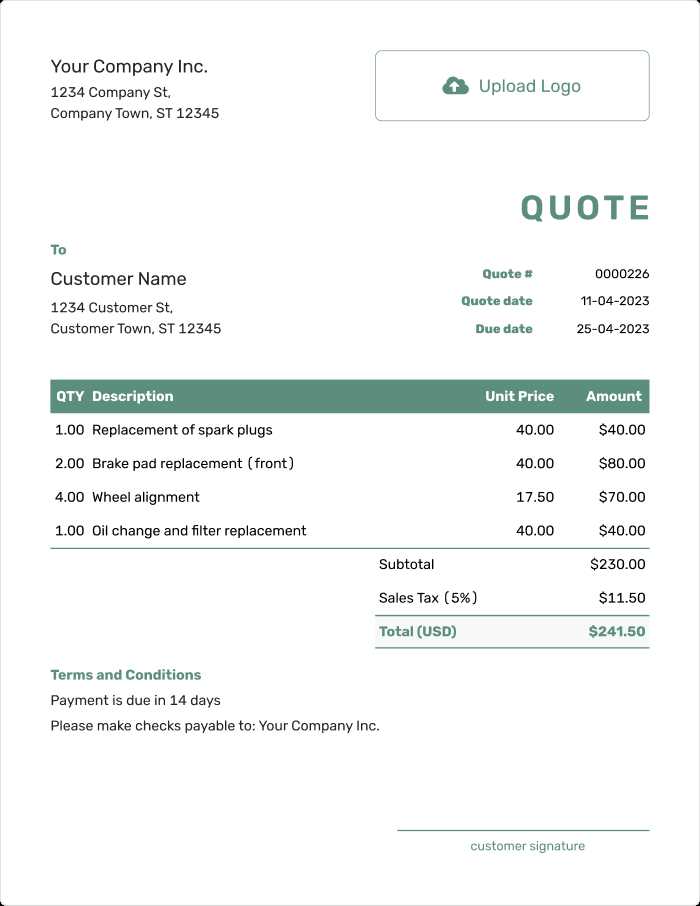

- Charges for Services: Include a breakdown of the cost for each task or service performed. If applicable, list hourly rates, materials, and any extra services provided.

- Taxes: Clearly show any applicable tax rates and the total tax amount added to the charges.

- Total Amount Due: Summarize the full amount to be paid, including the services rendered and any additional charges.

- Payment Terms: Define the payment method, due date, and any late fees or early payment discounts that apply.

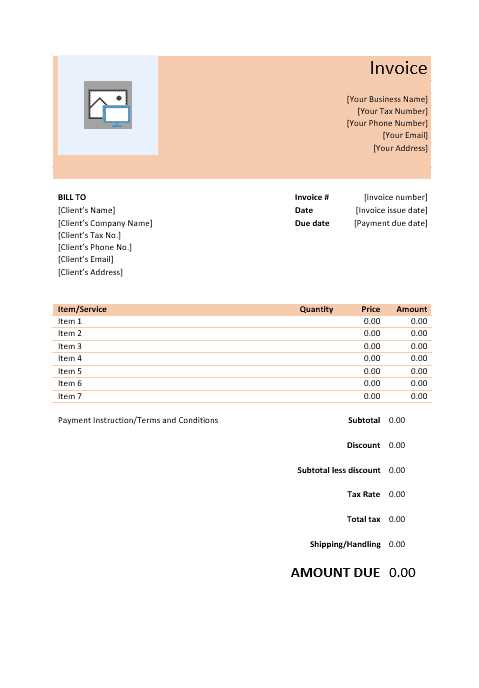

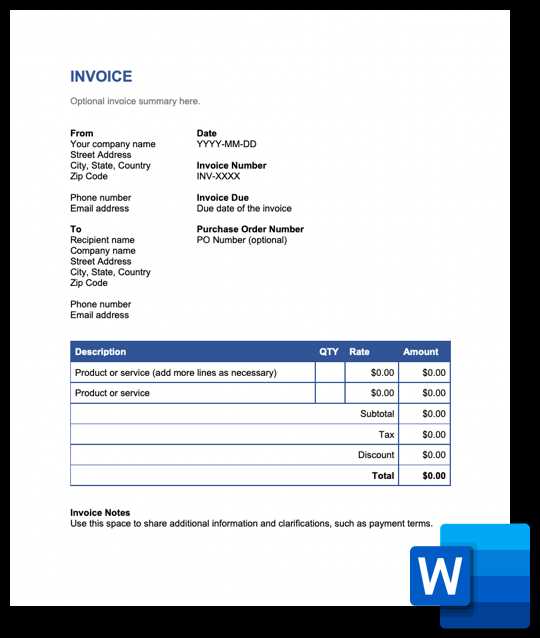

How to Customize Your Billing Document

Personalizing your financial record helps ensure that it fits the specific needs of your business and reflects the nature of the service provided. By adjusting certain details, you can create a document that is not only professional but also aligned with your brand and operational requirements. This section provides guidance on how to tailor your billing documents to suit different types of services and client preferences.

Personalizing Document Details

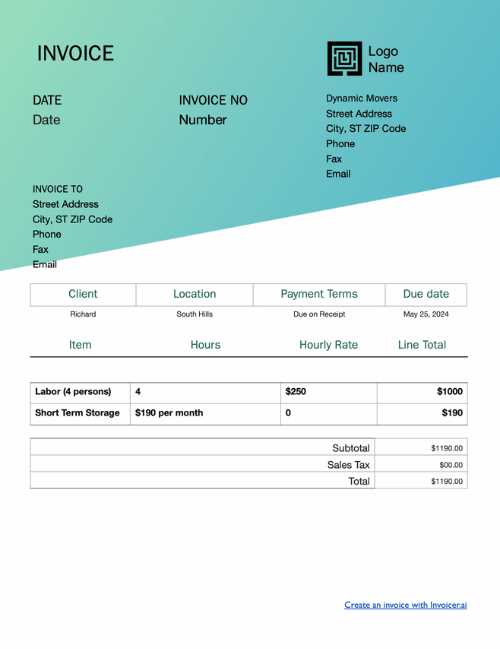

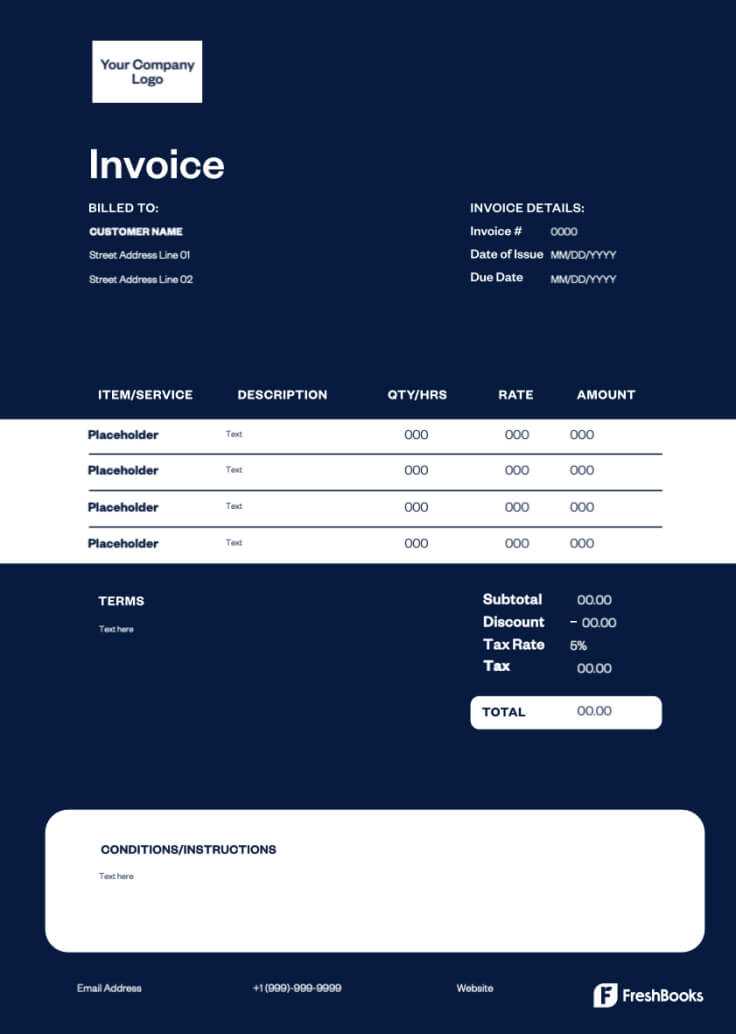

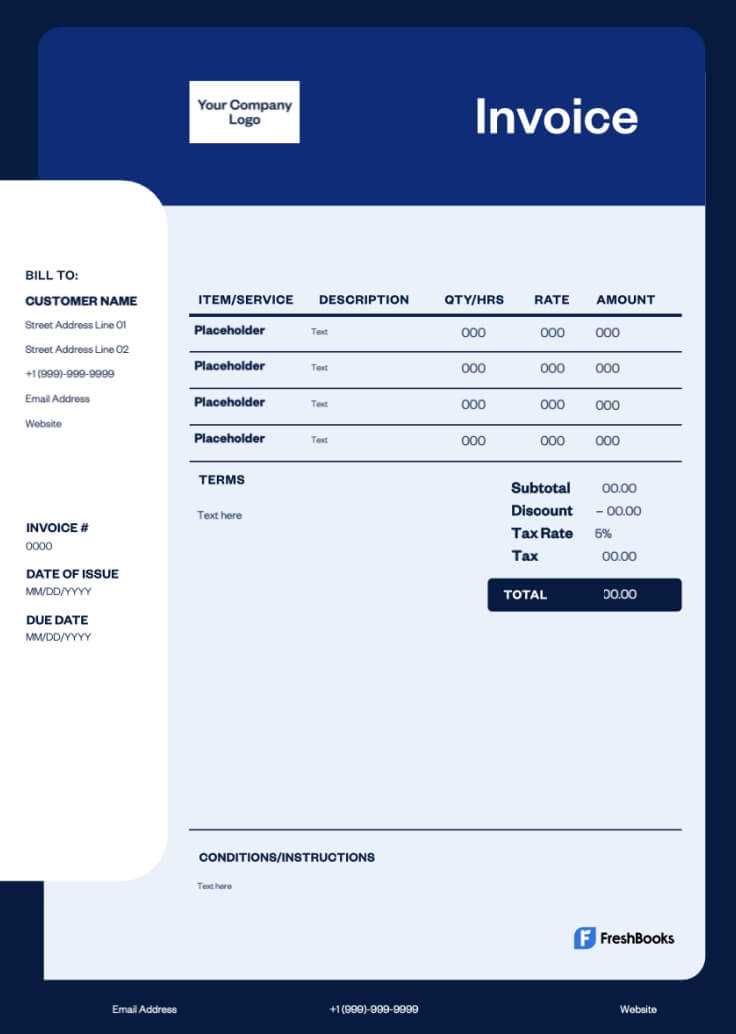

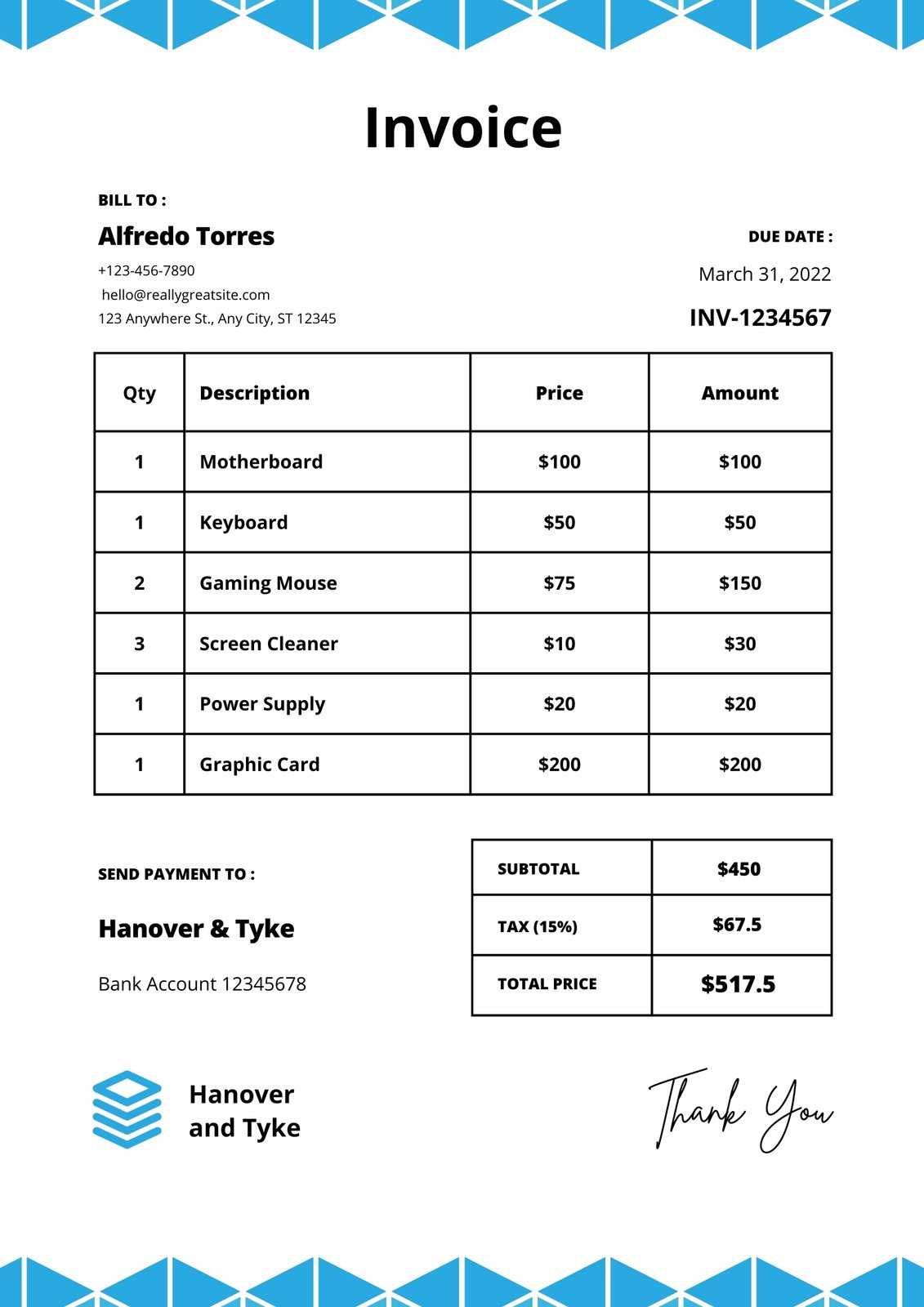

- Business Branding: Add your logo, brand colors, and contact information to create a document that represents your business identity.

- Client-Specific Information: Customize the document with relevant details for each client, such as their address, contact info, and any special requests they may have made.

- Service Descriptions: Modify the descriptions of services based on the specifics of the job, providing a clear breakdown of each task performed.

Adjusting Payment Terms

- Payment Methods: Specify the different payment methods you accept, such as bank transfers, credit cards, or digital payment platforms.

- Due Dates: Set customized due dates based on the agreement with your client or the complexity of the services provided.

- Late Fees and Discounts: Include terms for late payment fees or early payment discounts, if applicable.

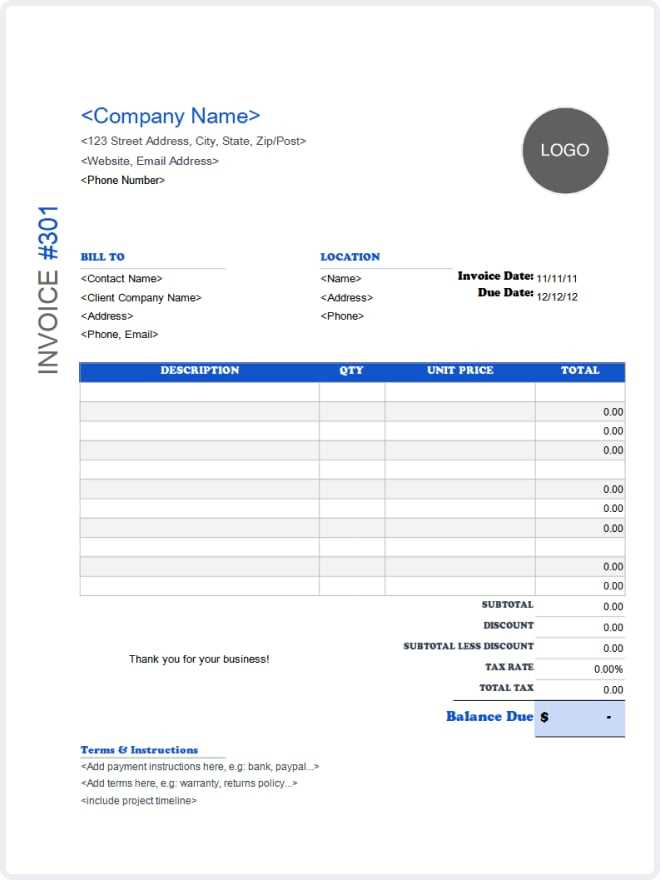

Choosing the Right Billing Document Format

Selecting the appropriate structure for your financial records is crucial for ensuring clarity and professionalism. The format you choose will affect how easily your clients understand the details of their charges, and how efficiently you can manage and track payments. In this section, we’ll explore different formats and guide you on selecting the best one for your needs.

The format you adopt should reflect the nature of the services provided and align with your business processes. It should also be adaptable to various types of jobs, whether one-time or recurring, and be easy for both you and your clients to manage. A simple, yet flexible structure allows for better organization and can make billing more efficient and transparent.

Key considerations when choosing a format include:

- Clarity: Ensure that the format is easy to read and understand, with a logical flow from client information to payment terms.

- Customizability: Look for a structure that can be tailored to fit various services and payment agreements, from hourly rates to flat fees.

- Professional Appearance: The format should reflect the professionalism of your business, giving clients confidence in your practices.

- Integration: Choose a format that can easily integrate with accounting software or systems for seamless record-keeping.

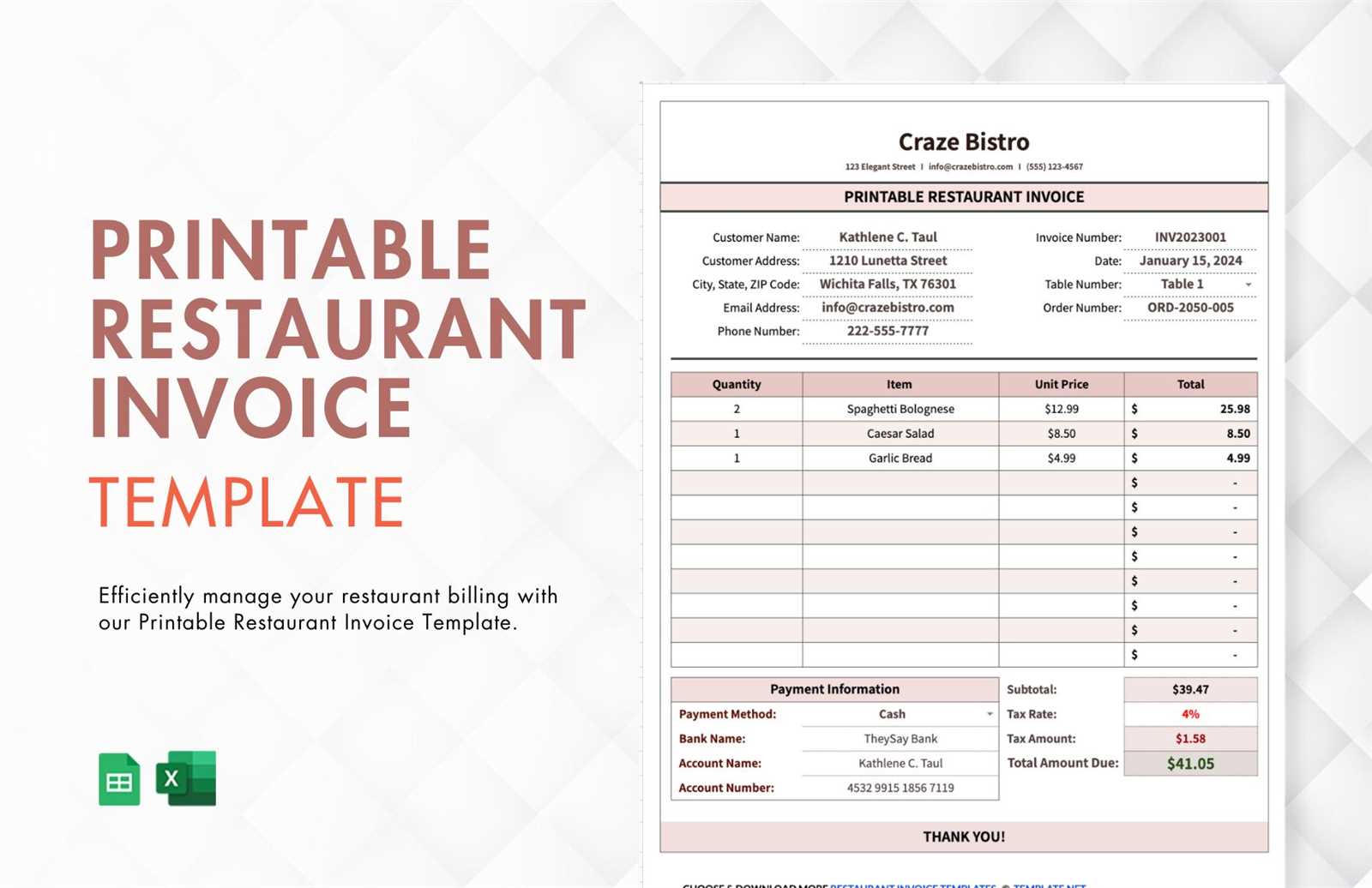

Essential Information for Clients

Providing clear and comprehensive details in your financial records is key to ensuring that your clients understand the charges and terms of service. By including all necessary information, you help avoid confusion and create a transparent, professional relationship. This section outlines the key details that should always be included to ensure both parties are on the same page.

- Client’s Full Name and Contact Information: Ensure that the client’s name, address, phone number, and email are correctly listed, making it easy to contact them if needed.

- Detailed Service Descriptions: Provide a clear breakdown of the work performed, including the type of service, any special requests, and the time spent on each task.

- Dates of Service: Include the specific date(s) the service was rendered, so both parties have a clear understanding of when the work took place.

- Itemized Charges: List each charge individually, whether for labor, materials, or additional services, so the client can see how the final amount is calculated.

- Payment Terms: Outline when payment is due, the preferred methods of payment, and any discounts, late fees, or other terms agreed upon.

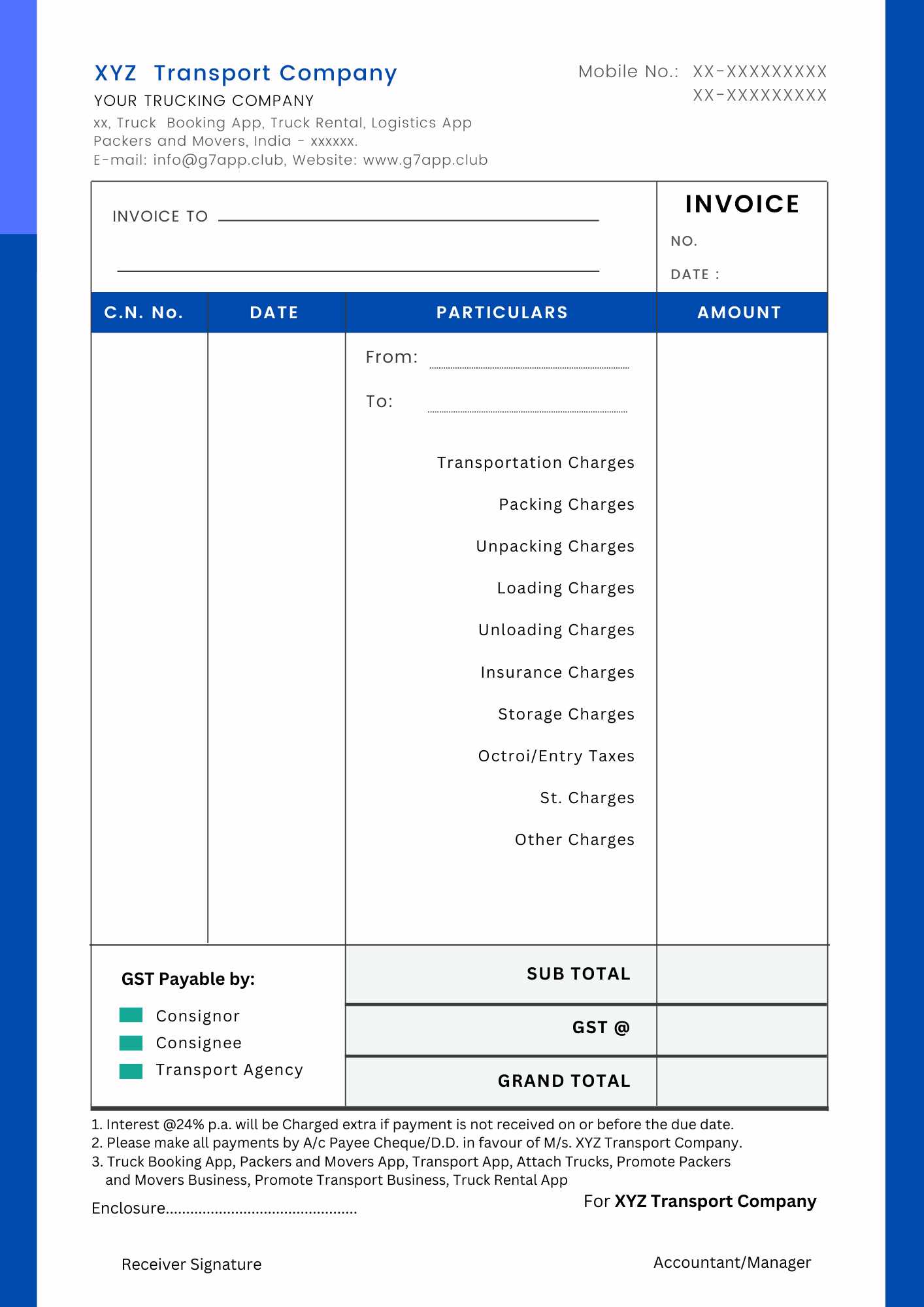

Common Relocation Charges to Include

When preparing a financial document for relocation services, it’s important to account for all possible costs involved in the process. By including a detailed list of charges, you ensure that your clients have a clear understanding of the services rendered and the associated fees. Here are some common charges that should be considered when drafting a comprehensive billing record.

- Labor Costs: This includes the time spent by the crew in packing, loading, unloading, and organizing items during the relocation process. It’s often billed by the hour or as a flat rate based on the size of the job.

- Transport Fees: Charges related to the distance traveled, fuel costs, and vehicle use should be clearly stated, especially for long-distance or interstate moves.

- Materials: The cost of packing supplies such as boxes, tape, padding, and other protective materials used during the relocation should be included separately.

- Special Handling: If specific items require extra care, such as fragile or bulky items, you may need to charge an additional fee for handling, packing, or transport.

- Storage: If the items are being temporarily stored, either before or after the move, the cost of storage space should be outlined in the document.

- Insurance: If insurance is provided for the relocation, whether for the items being moved or for the transport process itself, this cost should be included as an optional or required charge.

Creating a Professional Look

Establishing a polished and organized appearance for your financial documents is essential to maintaining credibility and professionalism. A well-designed document not only helps convey important information clearly but also leaves a positive impression on clients. In this section, we’ll explore key elements to consider when designing a professional and clean financial record.

- Consistent Layout: Ensure that the information is logically arranged, with each section clearly labeled and easy to follow. Consistency in layout makes the document more user-friendly and enhances readability.

- Branding Elements: Incorporate your business’s logo, color scheme, and font choices to create a cohesive and recognizable look. This helps establish your brand identity and makes the document appear more official.

- Clear Headings: Use distinct headings for each section (such as client information, services rendered, and payment details) to allow for quick navigation. Bold or larger fonts can make headings stand out for better visibility.

- Spacing and Margins: Proper spacing between sections and within paragraphs ensures that the document doesn’t appear cluttered. Adequate margins around the edges give a clean and organized appearance.

- Font Choice: Choose professional, easy-to-read fonts such as Arial, Times New Roman, or Calibri. Avoid using overly decorative fonts that could make the document harder to read.

- Alignment: Align text consistently, such as left-aligning descriptions and right-aligning monetary amounts. This makes the document appear neat and structured.

Billing Document Software Options

Choosing the right software to create and manage your financial records can significantly enhance your efficiency and accuracy. With a variety of options available, each offering unique features, it’s important to select one that suits your business needs. This section will guide you through some of the best software options for creating and managing professional billing documents.

Top Software for Billing Records

- FreshBooks: A popular choice for small businesses, FreshBooks offers customizable financial records, easy client management, and robust reporting features.

- QuickBooks: Known for its comprehensive accounting features, QuickBooks allows users to create detailed billing records, track payments, and manage expenses seamlessly.

- Zoho Invoice: A cloud-based solution that provides customizable templates, automated reminders, and integration with other Zoho applications, making it a great choice for business owners looking for a streamlined process.

- Wave: Free to use, Wave offers a simple yet effective platform for creating and managing financial records, with features like automatic invoice generation and payment tracking.

Features to Look For

- Customization: Ensure that the software allows you to personalize your documents to align with your business branding and service offerings.

- Automation: Look for options that can automatically calculate totals, apply taxes, and send reminders to clients.

- Integration: Choose software that integrates with other business tools such as accounting software or payment processors to streamline your workflow.

- Reporting Tools: A good software should allow you to track payments, generate reports, and analyze your business performance with ease.

How to Send Billing Documents Effectively

Sending billing documents in an efficient and timely manner is key to maintaining smooth financial operations. Whether you’re sending physical or digital records, the way you present and communicate the details can affect both client relationships and payment speed. In this section, we’ll explore effective strategies for sending financial documents to ensure prompt payments and clear communication.

Choose the Right Delivery Method: The delivery method you choose can impact how quickly your clients receive and process the billing information. If sending via email, ensure the document is attached in a widely accepted format, such as PDF, to preserve formatting. For physical mail, choose reliable postal services and ensure the address is accurate.

Timing Matters: Send documents promptly after the service is completed, ideally within a few days. Delays in sending financial records can cause confusion and delays in payment. Establish a routine to streamline this process, such as sending them at the end of each workweek or immediately following job completion.

- Include Clear Payment Terms: Be specific about when payment is due, accepted methods of payment, and any late fees or discounts for early payment. Clarity here helps clients know what to expect and when.

- Double-Check Details: Ensure that all details in the billing document are accurate–client information, service descriptions, charges, and payment terms. Mistakes can cause unnecessary delays in payment processing.

- Follow Up Professionally: If a payment hasn’t been made by the due date, follow up with a polite reminder. You can automate this process using accounting software to send reminders or manually follow up via email or phone.

Tips for Organizing Payment Terms

Clearly defined payment terms are essential for maintaining healthy cash flow and establishing strong professional relationships with clients. Having a well-structured approach to payment expectations ensures that both you and your clients are on the same page, reducing misunderstandings and delays. This section will provide useful tips for organizing and communicating payment terms effectively.

- Specify Payment Deadlines: Clearly state the due date for payment to avoid confusion. This can be either a fixed date or a period after service completion, such as “Due within 30 days.”

- Offer Multiple Payment Methods: Make it easy for clients to pay by offering different payment options, such as credit cards, bank transfers, or digital wallets. This flexibility can speed up the payment process.

- Set Late Fees or Penalties: To encourage timely payments, include a late fee clause in your terms. Specify the interest rate or flat fee for overdue payments and the timeframe after which this fee will be applied.

- Consider Discounts for Early Payment: Offering a discount for early payments can motivate clients to settle their accounts sooner. For example, a 2% discount if paid within 10 days encourages faster transactions.

- Outline Payment Structures for Large Projects: For larger projects, break down the payments into milestones or stages. This ensures both parties are comfortable with the payment process and progress is tracked more effectively.

Be Transparent and Consistent: Make sure your payment terms are easy to understand and consistently applied across all clients. Transparency builds trust and helps avoid future disputes.

Handling Discounts and Special Rates

Offering discounts or special rates can be an effective way to attract new clients, encourage repeat business, and foster long-term relationships. However, it’s important to handle these financial adjustments carefully to ensure clarity and avoid any confusion. This section will guide you on how to manage and communicate discounts and special rates efficiently.

- Define Discount Criteria: Be clear about the circumstances under which a discount applies. Whether it’s for early payment, volume purchases, or promotional periods, setting clear guidelines helps avoid misunderstandings.

- Communicate Discount Details: Ensure that all discounts are clearly outlined on the billing document, with specific amounts or percentages noted. Transparency here allows clients to see the benefit they are receiving.

- Include Expiration Dates: If a discount is time-sensitive, be sure to specify the expiration date. This motivates clients to take advantage of the offer within the given timeframe.

- Set Limits for Special Rates: For special offers, set limits on how often they can be used, by whom, or for what types of services. This helps manage expectations and prevents the discount from being abused.

- Track Discount Usage: Keep track of all discounts and special rates applied to ensure you don’t inadvertently lose revenue. Regularly review your discount policies and assess their impact on your bottom line.

- Offer Tiered Discounts: For larger orders or long-term clients, consider offering tiered discounts based on volume or contract duration. This provides an incentive for clients to commit to larger or extended services.

Be Consistent and Fair: Ensure that your discount practices are consistent for all clients and that the terms are the same across all similar transactions. This helps maintain fairness and trust in your business relationships.

Tracking Payments with Billing Records

Effectively monitoring payments is essential for maintaining accurate financial records and ensuring your business operates smoothly. By using well-structured billing documents, you can easily track the status of payments, identify overdue accounts, and maintain financial clarity. This section will explain how to efficiently track payments and maintain organization with proper records.

One effective way to monitor payments is by creating a clear record of all transactions. Keeping track of the payment date, amount, and method used allows you to quickly identify if a payment has been received and whether there are any outstanding balances. Below is a simple example of how this information can be organized:

| Client Name | Amount Due | Amount Paid | Payment Date | Payment Status |

|---|---|---|---|---|

| John Doe | $500 | $500 | 01/10/2024 | Paid |

| Jane Smith | $300 | $150 | 03/10/2024 | Partial Payment |

| Mark Johnson | $600 | $0 | Pending | Unpaid |

Monitor Payment Status: Regularly update your records to reflect any changes in payment status. Whether it’s a partial payment, full payment, or overdue account, keeping track ensures you are aware of any issues as soon as they arise.

Set Up Reminders: Use reminders for overdue payments. Automated alerts or manual follow-ups can help ensure clients are notified promptly if a payment is late, minimizing delays and helping to maintain a steady cash flow.

Legal Considerations for Billing Documents

When creating financial records for services rendered, it is important to understand the legal implications surrounding such documents. Proper documentation ensures that both parties are protected and that all transactions comply with applicable laws. This section outlines key legal considerations when drafting and managing billing records for services provided.

Legal requirements for billing records vary depending on the jurisdiction, the nature of the services provided, and the agreement between the client and the service provider. In general, it’s essential to include certain mandatory information to protect both your business and your clients. Below are some important points to consider:

Key Legal Elements to Include

- Clear Terms and Conditions: Always specify the agreed-upon terms of service, payment schedules, and any relevant policies. This reduces the chance of disputes over payment deadlines or services provided.

- Accurate Billing Information: Ensure that all details on the billing record, such as the client’s contact information, service description, and agreed fees, are accurate and up-to-date.

- Taxes and Legal Compliance: Depending on the jurisdiction, you may be required to include certain taxes or comply with specific legal obligations such as VAT or sales tax. Be sure to apply the correct tax rates and legal fees.

- Late Payment Penalties: If applicable, include clauses regarding late payment penalties. This can legally enforce timely payment and protect your cash flow.

Managing Disputes and Legal Actions

In case of a dispute regarding the billing record, it is important to have proper documentation to support your claims. This may include signed agreements, receipts, or proof of service. Having a clear, professional document helps you avoid potential legal issues and provides a solid basis for resolving any conflicts that may arise.

Table: Sample Legal Information for Billing Record

| Legal Element | Description |

|---|---|

| Service Agreement | Clearly defines the scope of services and any terms regarding service delivery. |

| Payment Schedule | Specifies when payments are due and any penalties for late payments. |

| Tax Rates | Details applicable taxes based on local tax laws. |

| Cancellation Policy | Outlines any conditions under which the agreement may be terminated by either party. |

By following these legal guidelines, you can avoid potential legal issues and ensure that your financial documents are both professional and compl

How to Deal with Late Payments

Late payments can be a common issue for service providers, and dealing with them effectively is crucial to maintaining a healthy cash flow. Understanding how to address delayed payments ensures that your business operations run smoothly and that clients respect the agreed-upon terms. This section provides practical steps to handle overdue payments while maintaining professionalism.

The first step in addressing late payments is to remain calm and diplomatic. Often, delays happen due to factors beyond a client’s control, such as administrative errors or financial setbacks. However, it’s important to communicate clearly and professionally about the overdue amounts to prevent misunderstandings. Below are a few tips to handle late payments effectively:

Steps to Address Late Payments

- Send a Friendly Reminder: If payment is overdue, start with a polite reminder. Sometimes, clients simply forget to process payments, and a friendly nudge can resolve the situation quickly.

- Follow-Up with a Formal Notice: If the initial reminder doesn’t work, send a more formal notice that outlines the amount owed, payment terms, and any late fees that may apply. This should be a professional and courteous message.

- Offer Payment Plans: For clients facing financial difficulties, offering a payment plan can help maintain goodwill while ensuring that you still receive payment over time.

- Enforce Late Fees: If your contract includes late fees, make sure to enforce them. This not only encourages timely payments but also compensates for the inconvenience caused by the delay.

Handling Persistent Late Payments

If payments continue to be delayed, more serious actions may be required. However, it is important to approach this stage with professionalism and tact to avoid damaging your relationship with the client. Consider taking legal action only when necessary and after trying all other avenues.

Table: Steps to Handle Late Payments

| Step | Action |

|---|---|

| Friendly Reminder | Send a polite message to inform the client of the overdue payment. |

| Formal Notice | Provide a more detailed written notice specifying payment terms and late fees. |

| Payment Plan | Offer flexible terms for clients unable to pay the full amount immediately. |

| Late Fees | Apply agreed-upon fees for overdue payments to encourage timely payment. |

By following these steps, you can ensure that your business maintains a steady cash flow while preserving strong client relationships. Handling late payments in a timely and professional manner will also set clear e

Setting Up Recurring Billing

Setting up a system for automatic and repeated billing can simplify your financial processes and ensure consistent cash flow. By offering clients the option for recurring payments, you make it easier for them to manage their expenses while also reducing administrative tasks for your business. This process is especially beneficial for services that involve ongoing work or regular deliveries. Below, we outline the essential steps to set up an effective recurring billing system.

The first step in setting up recurring charges is selecting the right software or payment processor. Many platforms are designed to automate this process, making it easier to handle transactions, track payments, and generate reports. Once the software is in place, you can customize the frequency and terms of payments based on the specific needs of your clients and the nature of your service.

Next, it is essential to communicate the billing structure clearly with your clients. They should be informed about the frequency of charges, payment amounts, and when payments will be processed. Transparency is key to building trust and avoiding confusion in the future.

Setting up recurring billing is not only about automating payments but also ensuring that your clients have a seamless experience. Providing different payment options, such as credit card or bank transfer, can improve convenience and increase the likelihood of timely payments.

Incorporating Taxes into the Template

When generating payment documents, it is crucial to correctly calculate and display applicable taxes. Taxes can significantly affect the total cost of services or goods, and incorporating them properly ensures accuracy and transparency for both parties. Whether you’re applying sales tax, VAT, or service charges, it’s important to understand the specific tax requirements for your region or business type.

One of the first steps is to determine the correct tax rate to apply based on the service type and location. Many tax laws vary depending on the jurisdiction, so be sure to keep updated on local regulations. Once the applicable rate is established, the next step is to clearly break down the tax in the payment document.

Steps to Include Taxes Effectively

- Determine the tax rate for the specific service or good provided.

- Ensure that tax rates are aligned with local regulations or the agreed-upon terms with the client.

- Clearly list tax amounts on the payment document for transparency.

- Consider adding tax information in a separate section or table for clarity.

When incorporating tax information into the payment document, it’s essential to have a well-organized and clear layout. Below is a sample table format that can help organize the tax-related details:

| Description | Amount |

|---|---|

| Service Fee | $100.00 |

| Sales Tax (8%) | $8.00 |

| Total Amount | $108.00 |

This table clearly displays the tax amount alongside the original service charge, allowing the client to easily understand the full cost breakdown. By incorporating taxes in this way, you create a professional and transparent payment process.

Free vs Paid Invoice Templates

When selecting a payment document format for your business, you will encounter both free and paid options. Each of these choices offers distinct advantages and disadvantages, and understanding these differences can help you make an informed decision based on your needs. Whether you’re a small business owner or an individual providing services, choosing the right option can improve efficiency and professionalism in handling financial transactions.

Free formats are widely available and can be a great starting point for those just getting into the habit of managing payments. However, they might come with certain limitations, such as fewer customization options or a lack of advanced features. On the other hand, paid formats typically offer a greater degree of personalization, additional features, and sometimes customer support. Below is a comparison of free versus paid options:

Advantages of Free Formats

- Cost-effective–no upfront payment is required.

- Quick to access–can often be downloaded or used immediately.

- Simple and easy to use for individuals or small businesses with basic needs.

Advantages of Paid Formats

- More professional design and branding options.

- Advanced features such as automatic calculations, integration with accounting software, and customized branding.

- Ongoing customer support and updates.

Ultimately, the decision between free and paid options depends on the complexity of your business and your need for customization. Free options can work well for basic billing needs, but paid formats may be more beneficial for businesses that require detailed features and branding flexibility.