Free Moving Company Invoice Template for Easy Billing

In the fast-paced world of relocation services, keeping track of transactions and ensuring smooth billing processes is essential for both service providers and customers. Having a well-structured document to outline services rendered can help businesses maintain professionalism and transparency. This also provides clients with clear breakdowns of costs and payment details.

Utilizing customizable documents can simplify the task of generating accurate records for each job. These documents can be adapted to suit specific business needs, making the process of managing payments more organized and efficient. Whether you are a small operator or part of a larger team, adopting a streamlined system ensures that no details are overlooked.

By utilizing pre-designed solutions, service providers can save valuable time, avoid errors, and improve cash flow management. These resources allow for quick generation of billing forms, ensuring that all necessary information is included without the need to start from scratch each time. With the right approach, businesses can ensure they meet clients’ expectations and maintain a smooth financial operation.

Free Invoice Templates for Moving Services

For businesses offering relocation assistance, having a reliable and easily customizable billing document is crucial. Such resources allow for efficient record-keeping and ensure that all transactions are clearly outlined for customers. These documents help both parties understand the breakdown of costs, payment deadlines, and services provided, ultimately leading to smoother financial management and fewer misunderstandings.

Why Opt for a Pre-designed Billing Form

Choosing a pre-designed format can save time and eliminate the need to create a new document for every service provided. Customizable formats allow businesses to input relevant information, such as labor hours, transport fees, and additional charges, without having to start from scratch. This streamlined process reduces human error and improves consistency across all billing records.

Where to Find Quality Billing Resources

Numerous online platforms offer easy-to-use options that cater to businesses in the relocation sector. These resources can be downloaded and tailored to meet specific needs. Some offer the option to add logos, adjust color schemes, or include personalized terms and conditions. The availability of these tools ensures that service providers, regardless of size, can maintain a professional approach to financial documentation.

Why Use a Free Invoice Template

In any service-based business, clear and accurate financial documentation is essential. Utilizing ready-made resources for billing can save valuable time and ensure consistency in every transaction. These documents simplify the process of outlining services, costs, and payment terms, making them an invaluable tool for professionals managing multiple clients and projects.

Efficiency and Time Savings

One of the main advantages of using a pre-designed billing document is the significant amount of time saved. Instead of creating a new form from scratch for each transaction, you can quickly fill in the necessary details. This reduces administrative workload and allows business owners to focus on other critical areas of operations, such as customer service or marketing.

Consistency and Professionalism

Using a standardized document ensures that all billing records follow the same format, making them easy to understand and professional in appearance. Clients are more likely to trust a business that uses clear and uniform billing practices, which helps build long-term relationships and ensures a positive reputation. Additionally, such documents minimize the risk of errors or missing information, further promoting trust and transparency.

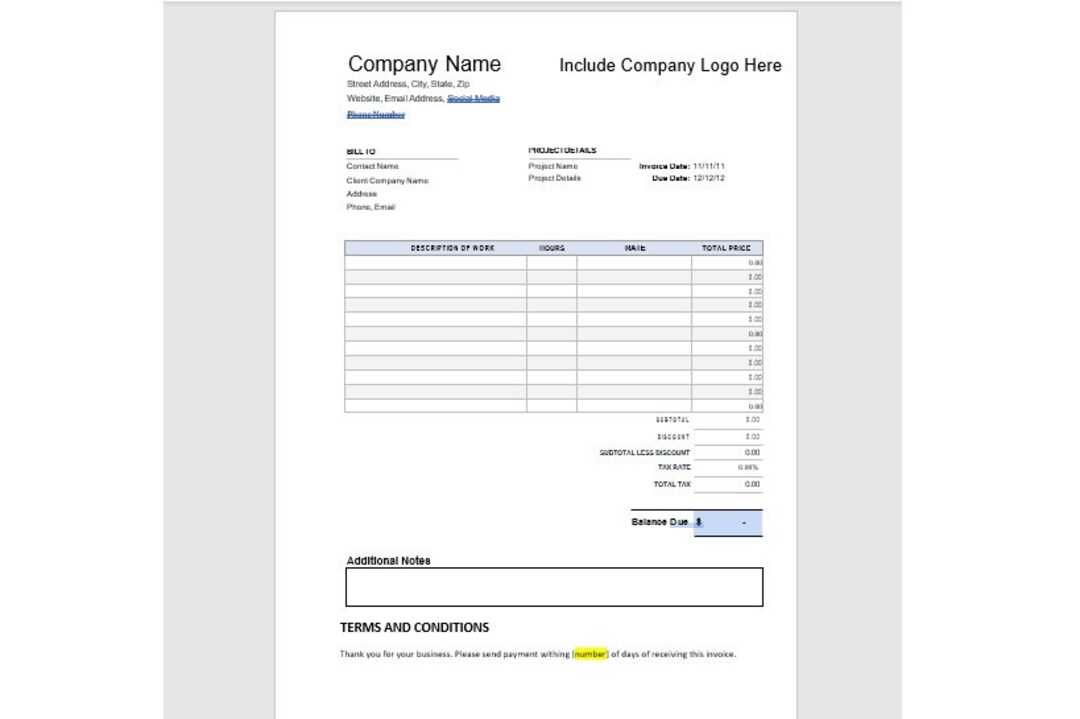

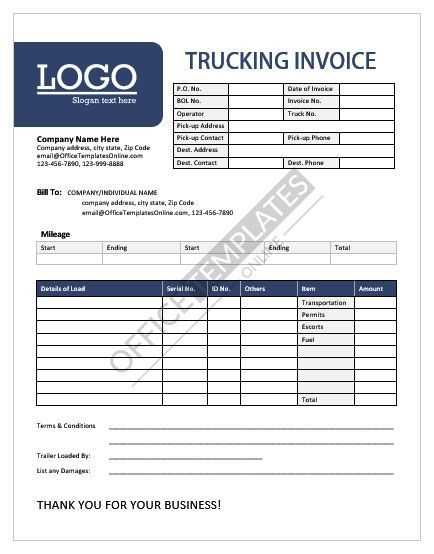

How to Customize Your Moving Invoice

When creating a document to track charges for services rendered, customization is key to ensuring that it meets both your business needs and the expectations of your clients. Personalizing this document helps reflect your brand identity, clarify pricing, and organize necessary details for smoother transactions. Customizable forms allow for flexibility, enabling you to easily adjust the content for each job.

Step-by-Step Customization Process

Follow these steps to tailor the document for your services:

- Input Your Business Details: Include your business name, address, phone number, and email address at the top. This allows clients to contact you easily and gives the document a professional touch.

- Define the Service Description: Clearly describe the tasks completed, such as packing, loading, unloading, or transportation. Ensure each service is listed separately with corresponding charges.

- Include Payment Information: Add your payment terms, due dates, and accepted payment methods to avoid confusion.

- Add Tax or Additional Fees: If applicable, make sure to include tax rates or extra charges, such as for fuel or special handling, and indicate the total at the bottom.

Branding and Design Customization

For a more personalized touch, you can adjust the design of the document:

- Logo and Colors: Add your business logo and choose color schemes that match your branding.

- Font and Layout: Modify fonts to align with your business style, ensuring the text is legible and professional.

- Terms and Conditions: Include any specific terms or disclaimers related to the services provided.

Customizing your billing documents helps streamline operations and ensures that all critical information is presented clearly and professionally, building trust with your clients.

Benefits of Using Digital Invoices

Switching to electronic billing methods offers numerous advantages for businesses of all sizes. Digital records provide a fast, efficient, and environmentally friendly way to handle transactions. By moving away from paper-based documents, businesses can streamline their operations, reduce errors, and improve their overall financial management.

Efficiency and Time Savings

One of the most significant benefits of digital records is the speed at which they can be created and sent. Rather than manually writing out details, you can instantly generate a document and email it to clients. This eliminates the need for physical delivery and speeds up the entire billing cycle.

- Instant Delivery: Send documents directly to clients without delays from postal services.

- Quick Editing: Easily make changes to the content and resend without reprinting.

- Automatic Calculations: Many digital solutions can automatically calculate totals, taxes, and discounts.

Cost-Effective and Eco-Friendly

Digital billing reduces the costs associated with printing, paper, and postage. Additionally, it contributes to environmental sustainability by eliminating the need for physical resources. This helps businesses lower their overhead while also supporting eco-conscious practices.

- No Printing Costs: Avoid expenses related to paper, ink, and office supplies.

- Storage Savings: Digital records take up less space, reducing the need for filing cabinets or physical storage.

- Eco-Friendly: Decrease your carbon footprint by moving away from paper-based processes.

Overall, digital solutions provide faster processing, reduce operational costs, and make record-keeping more sustainable, benefiting both businesses and clients alike.

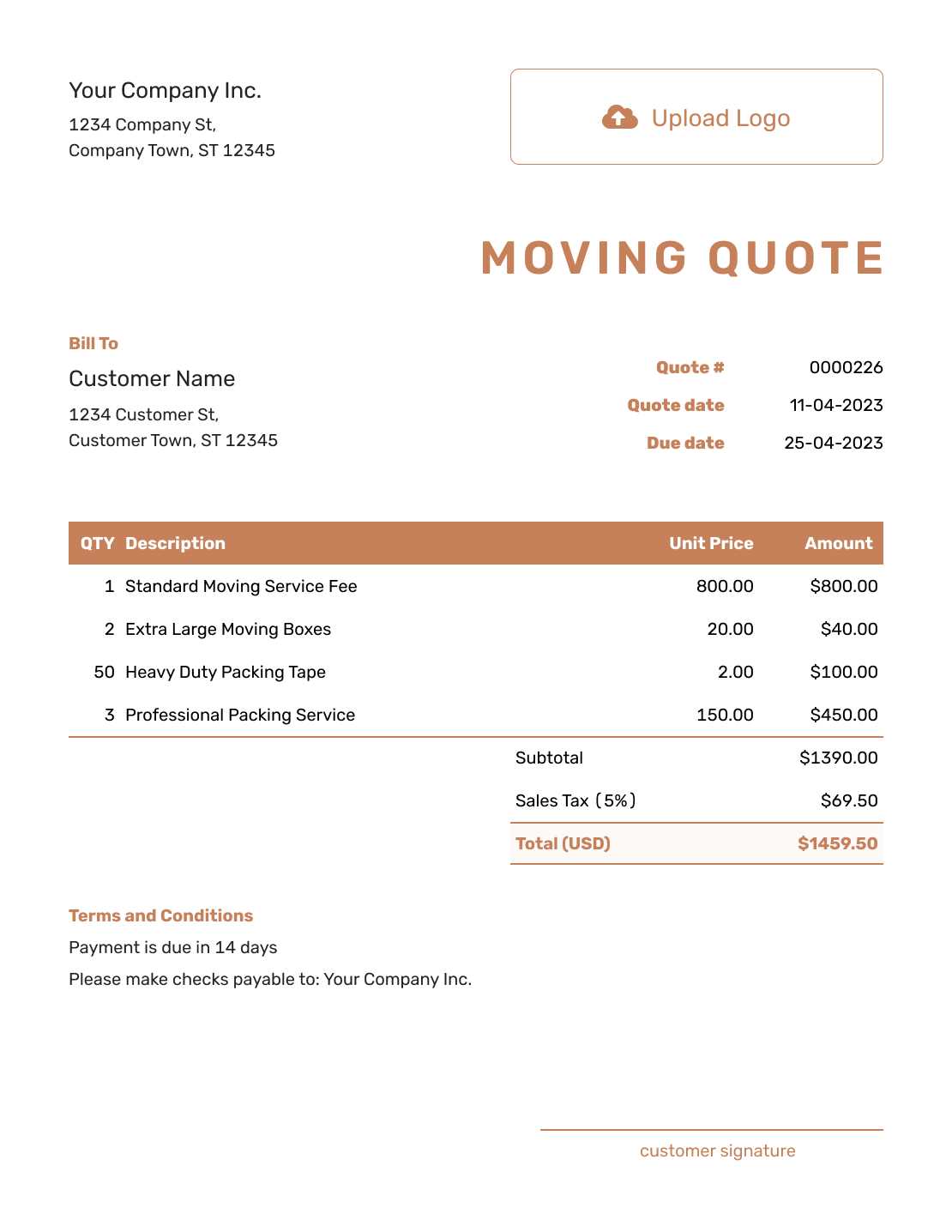

Essential Information for a Moving Invoice

When creating a document to summarize the cost of relocation services, it’s crucial to include all the necessary details to ensure clarity and avoid confusion. A comprehensive record not only outlines the work done but also provides clients with a transparent breakdown of expenses, payment terms, and other important aspects of the transaction. Including the right information helps both parties understand the charges and ensures that the process is smooth and professional.

Key Elements to Include

Below are the essential components that should be part of every billing document in the relocation industry:

| Information | Description |

|---|---|

| Business Details | Your business name, address, phone number, and email address. |

| Client Information | Client’s full name, address, and contact details for billing purposes. |

| Service Description | A detailed list of services rendered, such as packing, loading, or transporting items. |

| Cost Breakdown | Detailed charges for each service, including labor, transport, and additional fees. |

| Payment Terms | Due date, payment methods accepted, and any late payment fees or discounts. |

| Tax Information | Applicable taxes on services, if any, and the final total amount. |

| Notes or Additional Charges | Any extra details such as special requests, overage charges, or conditions. |

Why These Details Matter

Including these key elements ensures that both the service provider and the client have a clear understanding of the transaction. Properly itemizing each cost and payment term helps prevent misunderstandings and ensures timely payments. It also helps businesses stay organized and maintain a professional image with their clients.

Best Tools for Creating Invoices

Creating accurate and professional billing records is an essential task for any service provider. Fortunately, there are a variety of tools available to help streamline this process. These tools can automate calculations, customize layouts, and ensure that all necessary details are included in each document. Choosing the right software or platform can make the billing process more efficient and help businesses maintain a consistent, professional image.

Here are some of the best tools for generating professional billing records:

- FreshBooks: A user-friendly platform with customizable templates and automated reminders to streamline your billing process. FreshBooks offers great invoicing features along with expense tracking and time management.

- Zoho Invoice: This tool offers a wide range of customization options, including the ability to create recurring billing schedules and detailed reports. Zoho Invoice also integrates well with other business tools like accounting software.

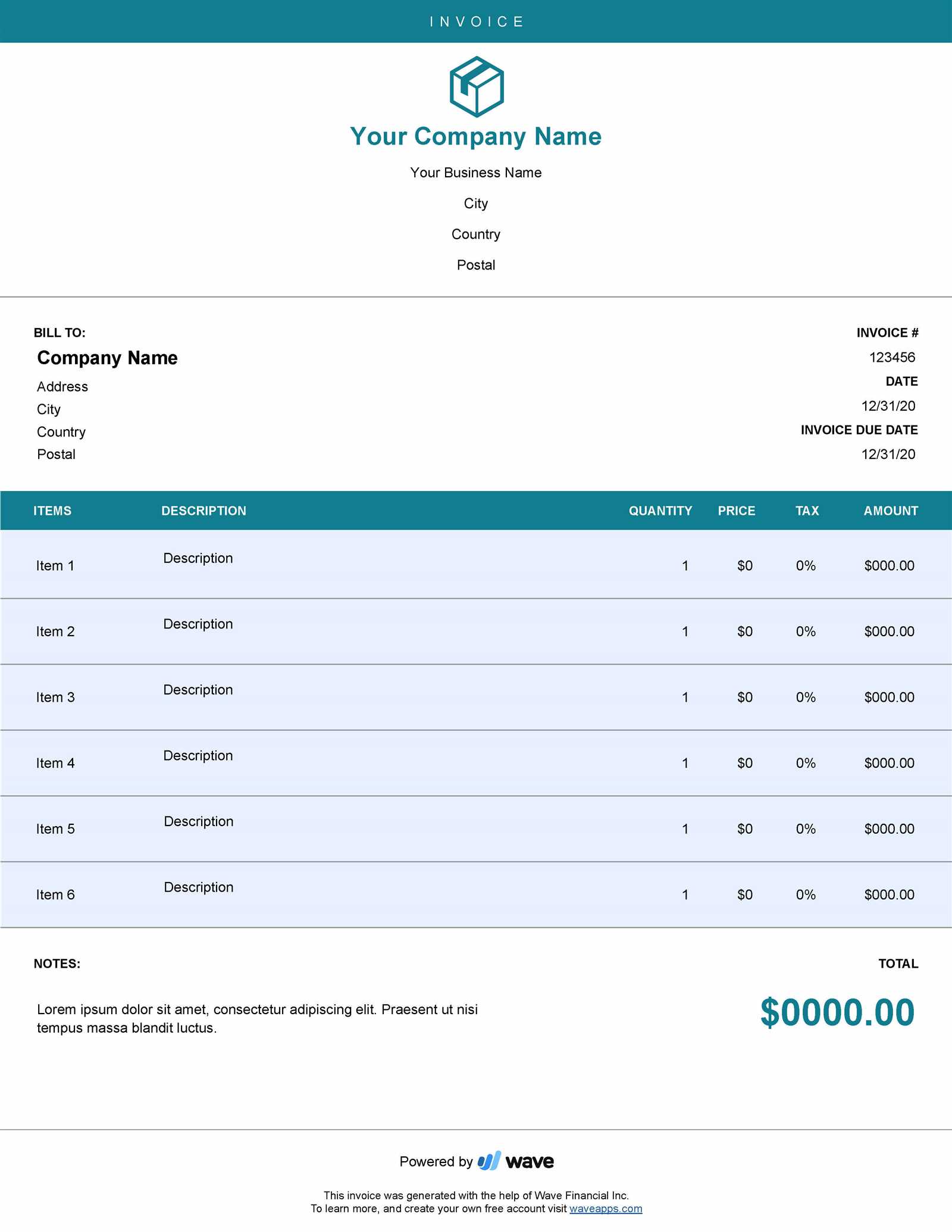

- Wave: A free solution designed for small businesses, Wave allows users to create professional-looking billing documents with ease. It also includes features for payment processing and receipt management.

- QuickBooks: QuickBooks offers robust billing and accounting features. It allows you to generate detailed billing records while keeping track of your finances, taxes, and payments all in one place.

- Invoice Ninja: A versatile invoicing software with both free and paid plans, Invoice Ninja provides excellent customization options and a wide variety of templates. It also supports recurring payments and integrates with many payment gateways.

Using these tools can save valuable time, reduce errors, and help maintain consistency across all client records. Whether you run a small operation or a larger enterprise, finding the right tool for billing is an important step in maintaining efficient financial processes.

How to Add Tax and Fees

When creating a document to summarize services rendered, it’s important to accurately reflect any additional costs such as taxes or special fees. Including these elements ensures that both the service provider and the client understand the full financial commitment. Properly calculating and adding these charges not only keeps the process transparent but also ensures compliance with local regulations.

Calculating Tax

The first step in adding taxes is to determine the correct tax rate for the location in which the services were provided. Rates can vary depending on the region, type of service, and applicable laws. Once the rate is established, you can apply it to the subtotal of the charges to calculate the tax amount.

- Step 1: Identify the applicable tax rate for your area or service type.

- Step 2: Multiply the subtotal by the tax rate (e.g., subtotal x 0.07 for a 7% tax rate).

- Step 3: Add the calculated tax amount to the subtotal to get the total cost.

Including Additional Fees

In addition to taxes, businesses may charge extra fees for various services, such as fuel surcharges, special handling, or late payment penalties. These should be clearly outlined in the document to avoid any confusion. Ensure that each additional charge is listed separately, with a brief explanation if necessary, so that clients can easily understand what they are being billed for.

- Special Handling Fees: Charges for fragile or oversized items.

- Fuel Charges: Additional costs based on distance or fuel prices.

- Late Payment Fees: Charges for payments made after the agreed deadline.

By clearly stating taxes and additional fees, you can avoid misunderstandings and maintain transparency, which is crucial for building trust and ensuring timely payments from clients.

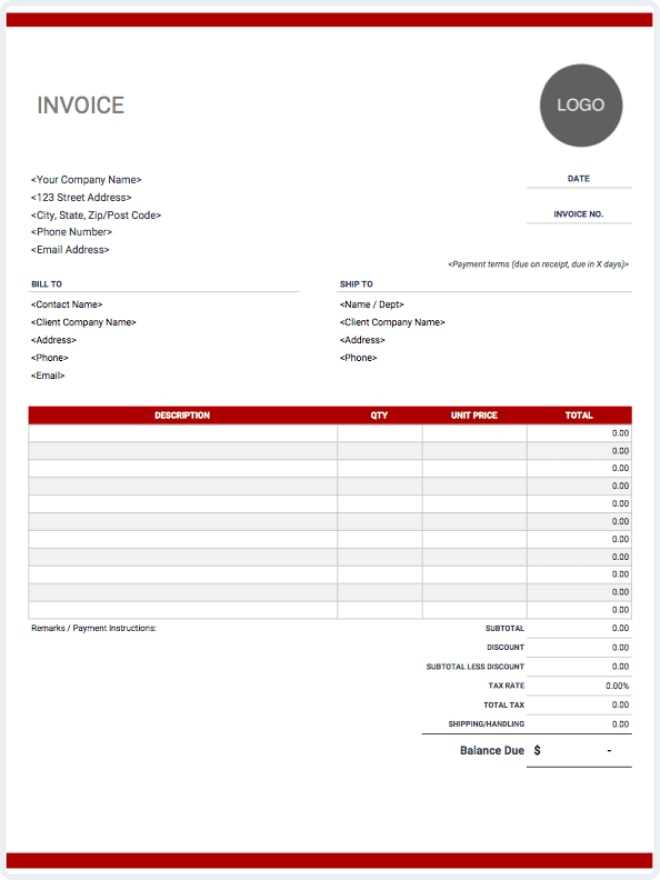

Invoice Design Tips for Moving Companies

A well-designed billing document not only serves as a record of services rendered but also reflects the professionalism of the service provider. A clear, organized, and visually appealing layout helps ensure that all essential details are easy to find and understand. The design should enhance the user experience while maintaining a professional image that supports your brand identity.

Here are some useful tips to make your billing documents stand out:

- Keep it Simple: Avoid clutter. Focus on the key information–service details, costs, payment terms–so clients can easily read and understand the document without feeling overwhelmed.

- Use Clear Headings and Sections: Break the document into clearly labeled sections, such as “Service Description,” “Payment Details,” and “Total Charges,” to guide the reader through the content logically.

- Incorporate Your Brand Identity: Include your business logo, use your brand’s colors, and select fonts that align with your company’s style. This reinforces your professionalism and consistency across all communication materials.

- Highlight Key Information: Make important details, such as the total amount due or payment due date, stand out by using bold text or larger font sizes. This draws attention to critical items and helps avoid confusion.

- Include Visual Elements: A subtle use of lines or shading can separate sections and make the document easier to navigate. However, keep the design clean and avoid overly decorative elements that might detract from the document’s clarity.

By applying these design principles, you can create a document that is not only functional but also professional, fostering trust and confidence with clients. A thoughtfully designed billing record can leave a lasting impression, encouraging repeat business and positive referrals.

Legal Considerations for Moving Invoices

When generating billing documents, it is essential to ensure that they comply with relevant laws and regulations. These legal aspects not only protect your business but also provide clarity and security for your clients. A well-structured billing record can help avoid disputes and ensure both parties understand their rights and obligations.

Several key legal factors should be considered when creating these documents:

- Clear Payment Terms: Clearly state the payment due date, accepted methods of payment, and any penalties for late payments. This helps ensure both parties understand when and how payments should be made and protects you from delayed compensation.

- Tax Compliance: Ensure the correct sales tax is applied based on the location and type of service provided. Accurate tax calculations are essential for compliance with local tax regulations and to avoid penalties.

- Transparency in Charges: All fees and charges must be clearly explained, including any extra costs like fuel surcharges or special handling fees. Hidden or vague charges can lead to legal disputes and damage your reputation.

- Contractual Agreement: Reference any prior agreements or contracts that outline terms of service. Including a brief mention of the signed agreement can help resolve any conflicts should they arise during the billing process.

- Consumer Protection Laws: Be aware of any consumer protection laws that may apply to your services, especially regarding refunds, cancellations, or disputes. Knowing these laws can help prevent legal issues and ensure fair treatment of clients.

By addressing these legal aspects, businesses can create billing documents that not only comply with regulations but also foster trust and transparency with their clients. This reduces the risk of legal issues and ensures smoother financial transactions.

Managing Invoice Payments Efficiently

Efficient payment management is crucial for maintaining a steady cash flow and ensuring that business operations run smoothly. Keeping track of payments, monitoring due dates, and following up on overdue balances can help prevent financial disruptions. Streamlining the process allows service providers to focus on their core tasks while ensuring timely payments and minimizing administrative burdens.

To manage payments effectively, consider implementing a system that tracks all issued bills, provides clear reminders, and helps facilitate quicker settlements. Below is a simple payment tracking system that can be used to stay organized:

| Invoice Number | Client Name | Issue Date | Due Date | Amount Due | Status |

|---|---|---|---|---|---|

| #001 | John Doe | 10/01/2024 | 10/15/2024 | $500 | Paid |

| #002 | Jane Smith | 10/05/2024 | 10/19/2024 | $650 | Unpaid |

| #003 | Mark Johnson | 10/07/2024 | 10/21/2024 | $450 | Paid |

Using a table like this helps organize payments and clearly shows which accounts are settled and which are pending. Regularly updating this system allows businesses to stay on top of overdue accounts and take prompt action when necessary.

Additionally, offering multiple payment options such as bank transfers, credit cards, and online payment platforms can make it easier for clients to settle their balances. Sending automated reminders or setting up recurring billing can also help ensure that payments are made on time, reducing the need for manual follow-ups.

Tracking Expenses with Invoice Templates

Efficiently tracking business expenses is essential for maintaining profitability and ensuring financial stability. Using well-structured billing records not only helps manage client payments but also provides a detailed overview of the costs associated with each service. By recording every expense, from labor to materials, businesses can track where money is being spent, identify trends, and make informed decisions to improve their operations.

Incorporating expense tracking into your billing documents allows for a seamless flow of financial data. The ability to break down costs into specific categories–such as transportation fees, equipment charges, or labor costs–ensures that every detail is accounted for. This also makes it easier to calculate the total cost of services provided and evaluate profit margins.

Benefits of Expense Tracking:

- Improved Budgeting: Understanding where expenses are being incurred allows businesses to better allocate resources and set realistic budgets for future projects.

- Tax Compliance: Properly categorizing and tracking expenses ensures that all deductions and taxes are calculated accurately during tax season, minimizing the risk of errors or audits.

- Transparency: Clear expense breakdowns help build trust with clients by showing a transparent account of how costs are determined.

Integrating expense tracking into billing records also aids in identifying areas for cost-cutting. For example, if fuel or labor charges are consistently high, businesses can explore alternatives to reduce these costs without compromising service quality.

By regularly updating and reviewing expense data in your billing records, you create a comprehensive financial snapshot that helps streamline business operations, increase efficiency, and ensure long-term profitability.

How to Avoid Common Invoice Mistakes

Billing errors can lead to delayed payments, client dissatisfaction, and financial confusion. It’s important to carefully review each billing record before sending it to ensure accuracy and professionalism. Simple mistakes such as incorrect details, missing charges, or unclear terms can cause unnecessary back-and-forth with clients, impacting cash flow and damaging relationships. By understanding and avoiding common pitfalls, businesses can maintain smooth financial operations and build trust with their clients.

Here are some key mistakes to watch out for and how to avoid them:

- Incorrect Client Information: Always double-check that the client’s name, contact details, and billing address are correct. An error in this information can delay payments and cause confusion.

- Missing or Incorrect Amounts: Ensure that all charges are accurate and clearly itemized. Failing to include taxes, service fees, or additional charges can lead to misunderstandings about the total amount due.

- Unclear Payment Terms: Always specify the payment due date, any late fees, and the accepted payment methods. Ambiguity in these terms can lead to payment delays or disputes.

- Omitting Service Descriptions: Clearly describe the services provided to ensure the client understands exactly what they are being charged for. A vague description can cause confusion or dissatisfaction with the charges.

- Failure to Include a Unique Reference Number: Assigning a unique reference number to each record helps both you and the client track payments and resolve any issues quickly. It also makes it easier to manage your accounting system.

By paying close attention to detail and checking for these common mistakes, businesses can ensure that billing records are accurate, clear, and professional, reducing the risk of errors that could affect cash flow or client trust.

Free Invoice Template for Small Businesses

For small business owners, maintaining a streamlined and professional billing process is essential to ensure timely payments and maintain cash flow. A well-structured billing document can help you manage client transactions, track payments, and minimize errors. Having a readily available document format that suits your business needs can save valuable time and reduce administrative workload, allowing you to focus on growing your business.

Why Use a Pre-Designed Document?

Using a pre-designed document allows small businesses to quickly generate accurate billing records without needing to create one from scratch each time. These ready-made formats typically include essential fields such as client details, service descriptions, payment terms, and total amounts. This can help save time, improve accuracy, and create a consistent professional appearance for all client communications.

Key Elements of a Small Business Billing Record

While the exact structure can vary, a standard document should typically include:

- Business Details: Your company name, logo, and contact information should be clearly visible at the top of the document.

- Client Information: Make sure to include your client’s name, address, and contact details.

- Service Description: A brief description of the service provided, including the quantity and rate.

- Payment Terms: Specify the due date, payment methods, and any penalties for late payments.

- Total Amount Due: Ensure all charges, taxes, and additional fees are included in the final total.

By utilizing a ready-to-use document, small businesses can ensure their billing process remains professional and efficient, reducing the risk of errors and delays.

Integrating Invoices with Accounting Software

Integrating your billing process with accounting software can streamline financial management, saving you both time and effort. By automating the connection between your billing records and your accounting system, you can ensure accurate tracking of revenue, expenses, and taxes. This integration reduces the risk of manual errors, improves financial reporting, and helps keep your business’s finances in order without requiring extensive administrative work.

Here are some of the key benefits of integrating billing records with accounting software:

- Automatic Data Sync: When you integrate your billing system with accounting software, information such as payment amounts, client details, and due dates are automatically synced. This eliminates the need to manually input data, reducing the chances of mistakes.

- Improved Accuracy: Automated integration ensures that there are no discrepancies between your billing records and financial reports. All data flows seamlessly into your accounting system, keeping everything aligned and accurate.

- Faster Payment Tracking: Accounting software can instantly update your records once a payment is made, helping you quickly track outstanding balances, overdue payments, and payments received.

- Efficient Reporting: Integrated systems generate financial reports with ease, giving you an overview of income, expenses, and taxes, which can assist with decision-making and tax filing.

- Better Financial Planning: By having all your financial data in one place, you can make better-informed decisions regarding budgets, forecasts, and investments. Integration helps maintain a clear picture of your financial health.

Many accounting software programs offer integration features that automatically import billing data from external tools or platforms. Whether you’re using cloud-based solutions like QuickBooks, Xero, or FreshBooks, or desktop versions, linking your billing records with these systems can simplify day-to-day financial management.

In conclusion, integrating billing systems with accounting tools not only saves time but also enhances financial accuracy, helping businesses stay organized and efficient while focusing on growth and success.

How to Send Invoices to Clients

Sending billing records to clients is a crucial step in ensuring timely payments and maintaining professionalism. Whether you’re working with a one-time client or a recurring customer, choosing the right method of delivery and communication can help streamline the payment process and avoid confusion. From traditional paper methods to modern digital tools, there are various ways to send billing documents, each with its own benefits and best practices.

Here are some common methods for sending billing documents and tips for making the process efficient:

1. Email Delivery

Email is one of the most popular and efficient ways to send billing records. It allows for quick delivery, enables easy tracking, and provides a record of the transaction. When sending a billing document via email, it’s important to:

- Attach the Document: Always send the billing record as an attachment (e.g., PDF) to ensure that the client can easily open and read it. Avoid pasting the details directly in the email body to prevent formatting issues.

- Personalize the Message: Include a brief message in the email, reminding the client of the payment due date, methods of payment, and any other relevant information.

- Use a Clear Subject Line: Ensure the subject line clearly indicates the purpose of the email, such as “Payment Due: [Service Name]” or “Your Recent [Business Name] Bill.” This helps the client easily identify and prioritize the email.

2. Postal Mail

While digital delivery is fast and efficient, some businesses may still prefer or need to send hard copies of their billing documents through the mail. If you choose to use postal mail, make sure to:

- Print Legibly: Ensure the document is printed clearly and includes all necessary information. A printed billing record should be as professional as a digital version.

- Use Reliable Shipping: Opt for certified or tracked mail if the amount is large or if you want to ensure that the client receives the document promptly.

- Include Return Instructions: Make it easy for clients to respond by including instructions for sending payments back, such as an address for checks or instructions for bank transfers.

3. Online Payment Platforms

For added convenience, many businesses now use online payment platforms, such as PayPal, Stripe, or Square, to send billing documents and collect payments. These services often allow you to:

- Send Automated Bills: These platforms can automatically send billing records once the service is completed, reducing manual effort.

- Track Payment Status: Most online platforms provide real-time updates on payment status, so you can easily track whether a payment has been made or is overdue.

- Offer Multiple Payment Methods: Clients can pay using a variety of methods (credit/debit card, bank transfer, or e-wallet), increasing convenience and reducing barriers to payment.

Choosing the right method to send billing records depends on your business model, client preferences, and the level of f

When to Follow Up on Unpaid Invoices

Late payments are a common challenge for many businesses. While some clients may forget about the due date or encounter payment delays, it’s essential to know when and how to follow up on outstanding balances. A timely reminder can help resolve issues before they escalate into bigger problems, while also maintaining a positive relationship with your clients. Understanding the right moment to take action is key to ensuring smooth cash flow without appearing overly aggressive.

Here are some guidelines for determining when to follow up on unpaid bills:

1. One Week After the Due Date

Sending a friendly reminder within a week after the payment deadline has passed is often the best approach. This initial follow-up should be polite and non-confrontational. A simple email or phone call can serve as a gentle reminder that payment is due, and it gives the client an opportunity to address any issues they may have encountered. Many times, delays occur simply because the client forgot or missed the due date.

2. Two Weeks After the Due Date

If the payment has still not been received after the first follow-up, it’s appropriate to send a more formal reminder. At this point, the client may have experienced unforeseen issues, or the payment may have been lost in the process. A more assertive reminder should include a clear outline of the overdue amount, any late fees (if applicable), and a new deadline for payment. You can also consider adding a polite note about how much you value the relationship and hope the matter can be resolved promptly.

3. One Month After the Due Date

If the payment remains unpaid a month after the original due date, it may be time to take more serious action. This could include a formal letter or an official notice stating that the debt is overdue and that further steps will be taken if payment is not received within a set period. You may also want to explore additional payment options, such as a payment plan or partial payments, to help the client settle the debt.

By following up in a timely and professional manner, you can avoid awkwardness while encouraging clients to settle their balances. It’s important to find a balance between being persistent and maintaining a respectful tone, ensuring that your business remains professional and cash flow is not disrupted.

How to Store and Organize Invoices

Properly storing and organizing billing records is essential for businesses to maintain accurate financial records, comply with tax regulations, and streamline operations. Whether you are handling a handful of transactions or managing a large volume of client accounts, establishing an effective system for tracking and organizing documents ensures that everything is accessible when needed. By keeping billing records well-organized, you can easily track payments, manage outstanding balances, and generate reports for tax purposes or audits.

1. Digital vs. Physical Storage

The first decision businesses need to make is whether to store documents digitally, physically, or a combination of both. Digital storage is more cost-effective and efficient, especially for businesses that handle a large volume of transactions. However, physical copies may still be necessary for legal or personal reasons, depending on the nature of the business and jurisdictional requirements.

2. Best Practices for Organizing Documents

Regardless of the storage method, following a structured system is key. Here are some best practices for organizing your records:

- Use Folders and Categories: Create specific categories for each client, project, or service provided. Digital folders should be clearly labeled with the client’s name, invoice number, and date, while physical copies can be organized in file folders or binders.

- Sort by Date: Sorting documents chronologically makes it easier to track due dates and identify overdue payments. Both physical and digital systems can benefit from this practice.

- Back-Up Files: For digital records, it’s crucial to back up files regularly to avoid data loss. Cloud storage platforms offer automatic backups and easy access from multiple devices.

3. Setting Up a Filing System

Creating an easy-to-navigate filing system helps businesses stay organized and efficient. Here’s a suggested approach for organizing both physical and digital records:

| System Type | Pros | Cons |

|---|---|---|

| Digital Storage (Cloud-based) | Quick access, space-saving, easy to back up, accessible remotely | Dependent on internet access, requires software or subscriptions |

| Physical Storage (Paper-based) | Can be used without technology, tangible for clients | Space-consuming, prone to damage, harder to access quickly |

By following a consistent and logical system for storing and organizing billing records, y