Monthly Rent Invoice Template Excel for Streamlined Payment Tracking

Managing payments for leased properties can be a time-consuming task, especially when dealing with multiple tenants or varying payment dates. A well-organized approach to billing can significantly reduce administrative burdens, ensuring accuracy and timely collection. By using a digital solution, property owners can simplify the entire process and maintain clarity over financial records.

With the right tools, property owners can create documents that automatically calculate charges, track payment statuses, and provide an easy-to-understand breakdown for tenants. This helps not only in minimizing errors but also in creating professional, reliable communication with renters. Such systems enable landlords to stay on top of their financial management and focus on other essential tasks.

Using customizable digital formats for invoicing provides flexibility and adaptability to suit various lease agreements. Whether dealing with residential or commercial properties, this approach can be adjusted to meet specific needs and preferences, saving valuable time and reducing the risk of misunderstandings between landlords and tenants.

Monthly Rent Invoice Template Excel

For property owners and managers, creating consistent and accurate billing records is crucial to maintaining clear financial communication with tenants. A structured system allows for easier tracking of payments, better organization, and more efficient management of finances. Implementing a digital method for generating these records ensures that all necessary details are included and that invoices can be quickly updated when needed.

Key Advantages of Digital Billing Solutions

Utilizing a digital solution for payment records offers numerous benefits. It helps in reducing human error, automating calculations, and providing an easy-to-read format for both tenants and property managers. Customizable fields allow landlords to adjust the format based on the specific terms of the lease, whether it’s adjusting for extra charges, discounts, or varying payment schedules. With this approach, the need for manual entry or complex spreadsheets is minimized.

How to Get Started with a Digital Solution

Setting up a digital invoicing method requires just a few basic steps. First, ensure that you have a consistent layout that includes all necessary information, such as tenant details, amount due, payment due dates, and any applicable late fees or adjustments. Then, use a platform that allows for easy modification of these fields so that each billing cycle is reflected accurately. With this system in place, property owners can easily track unpaid balances and streamline the entire invoicing process.

Why Use an Excel Template for Rent Invoices

Using a digital format for generating billing statements provides a practical way to manage payments and keep records organized. With a well-structured system in place, property managers can ensure that each statement is accurate, consistent, and tailored to specific tenant agreements. A customizable platform allows for quick adjustments, making the process of tracking and collecting payments much more efficient.

One of the main advantages of using such a tool is its ability to automate calculations, reducing the chances of errors. By inputting the correct data once, the platform can handle repetitive tasks like summing totals, adding late fees, and applying discounts. This automation saves time and ensures that every document is processed the same way, with minimal effort required from the user.

Furthermore, the flexibility of digital solutions allows property managers to customize fields and designs based on their specific needs. From adjusting payment terms to creating professional-looking statements, this approach ensures that each billing cycle is handled efficiently and reflects the required details accurately. Customization and accuracy are key reasons why many choose to implement such systems for managing financial documentation.

Benefits of Customizable Rent Invoice Templates

Having the ability to personalize financial documents is crucial for effective property management. Customization allows landlords to adapt the layout and content of billing statements to fit the specific needs of their business and tenants. This flexibility makes it easier to ensure that every document reflects the right terms and conditions, helping to maintain clear and professional communication.

With a customizable solution, property owners can modify key sections based on the individual terms of each lease agreement. This ensures that no important details are overlooked and allows landlords to include specific clauses or charges that may apply. The ability to adjust invoices also means that changes can be quickly implemented without starting from scratch each time a new statement is created.

- Flexibility: Tailor the document to meet the needs of different tenants and property types.

- Accuracy: Ensure all fields are correct, including charges, dates, and payment methods, to avoid confusion.

- Professional Appearance: Customize the design to present a polished and cohesive look that reflects your business.

- Time Savings: Modify a pre-set document rather than creating each billing statement from the ground up.

- Consistency: Maintain a uniform format across all statements, creating a more organized system for tracking payments.

By taking advantage of these benefits, landlords and property managers can streamline their billing processes while ensuring a professional and error-free experience for their tenants.

How to Create a Rent Invoice in Excel

Creating a digital billing document for your tenants is an essential step in managing rental payments. By utilizing a simple yet effective digital tool, you can ensure that all the necessary information is included in each statement, providing clear communication and improving payment tracking. With a few basic steps, you can set up a document that automatically calculates amounts due and adjusts for different payment terms, simplifying your accounting process.

Step-by-Step Process

To begin, open a new worksheet and start by laying out the key components of the statement. It is important to have spaces for tenant information, lease dates, payment details, and any additional charges or fees. Here is a basic layout of what should be included:

| Item | Description |

|---|---|

| Tenant Name | Enter the full name of the tenant. |

| Address | Include the rental property’s address. |

| Lease Dates | Specify the start and end dates of the lease period. |

| Amount Due | State the total amount due for the billing period. |

| Payment Due Date | Indicate when the payment must be made. |

| Late Fees | Specify any late charges if applicable. |

Automating Calculations

Once the basic layout is in place, you can enhance your document by adding automatic calculations. For example, you can set up formulas to sum amounts due or calculate late fees based on the payment date. This will save time and ensure that your figures are always accurate. By using simple formulas, such as summing cells or multiplying amounts by a set percentage, your document will become a powerful tool for tracking payments.

Finally, don’t forget to format the document to make it clear and professional. This can include adjusting column widths, adding borders, and bolding key information to make it easy for tenants to understand their obligations. Once set up, you can reuse the document each month by simply changing the relevant information, such as the dates and payment amounts, ensuring consistency and efficiency in your billing process.

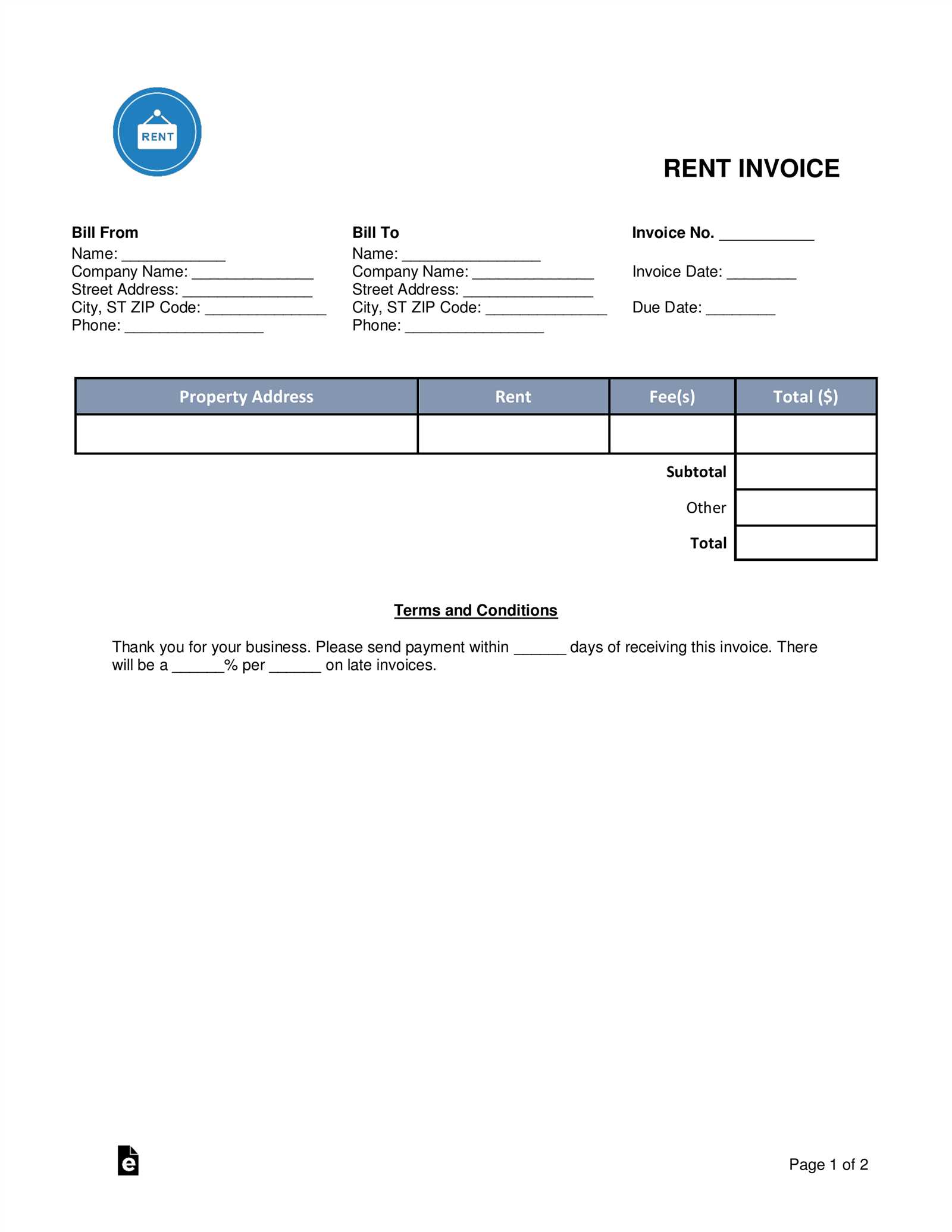

Key Features of an Effective Rent Invoice

An effective billing document is more than just a statement of what’s owed. It serves as a clear communication tool between property managers and tenants, ensuring transparency and minimizing potential disputes. To achieve this, several key components must be included to make the document not only accurate but also easy to understand.

Essential Information to Include

At a minimum, each document should contain essential information that clearly identifies the transaction. This includes:

- Tenant Details: Full name, address, and contact information of the tenant.

- Property Information: The address of the rental property or unit.

- Payment Amount: The exact amount due, including any extra charges, fees, or discounts.

- Payment Due Date: The date by which the payment must be made.

- Late Fee Clause: Clearly outline any penalties for late payment and the conditions under which they apply.

Professional Layout and Design

The design of the document plays a significant role in its effectiveness. A clean, easy-to-read format helps avoid confusion. Using bold headings, consistent fonts, and structured columns enhances readability, making it easier for tenants to find the details they need at a glance. A well-organized layout also builds professionalism and trust between the landlord and tenant.

Incorporating these key features ensures that the document not only communicates the necessary financial details but also fosters a clear and transparent relationship between both parties.

Tracking Payments with Excel Rent Invoices

Effective payment tracking is an essential part of managing rental properties, ensuring that all transactions are recorded accurately and that outstanding balances are easily identifiable. By using a digital platform to track payments, landlords can quickly access financial data, monitor overdue balances, and manage cash flow without the need for manual calculations. A properly set-up document can automate many of these processes, making it easier to stay organized and maintain financial clarity.

Creating a Payment Tracking System

To efficiently track payments, it’s important to include key elements in your system. One of the most valuable features is a column for payment status, where you can mark whether a tenant has paid, is overdue, or has made a partial payment. This allows for quick identification of which tenants are up to date and which are falling behind. You can also add columns for payment dates and amounts received, ensuring all transactions are accurately recorded.

| Tenant Name | Amount Due | Payment Date | Status |

|---|---|---|---|

| John Doe | $1200 | 01/15/2024 | Paid |

| Jane Smith | $1200 | 01/18/2024 | Late |

Automating Payment Updates

One of the best ways to stay on top of payments is to use formulas that automatically update as new information is entered. For example, you can set up conditional formatting to highlight overdue payments, automatically sum the total amount received each month, or calculate late fees. This helps reduce manual work and keeps the records up to date without requiring constant attention. Additionally, a payment tracking system can easily be shared with tenants to maintain transparency and foster trust.

By building a robust system for payment tracking, property owners can ensure that all transactions are accurately recorded, reducing the risk of errors and misunderstandings. It also provides a quick reference for landlords to manage finances and take necessary actions if any issues arise.

How to Automate Rent Billing in Excel

Automating the billing process for rental properties can save time, reduce human error, and improve the efficiency of financial management. With a few simple tools and functions, landlords can set up a system where payments, due dates, and other details are calculated automatically. This allows property managers to focus on other tasks while ensuring that billing statements are generated accurately and on time.

Setting Up Automation Features

To automate your billing, you first need to organize the key data into a structured format. Key columns may include tenant names, payment amounts, due dates, and payment statuses. Once the information is entered, you can set up formulas to calculate totals, overdue fees, and track payments automatically. Here’s an example of a basic layout to track these details:

| Tenant Name | Amount Due | Due Date | Amount Paid | Payment Status | Late Fee |

|---|---|---|---|---|---|

| John Doe | $1200 | 01/01/2024 | $1200 | Paid | $0 |

| Jane Smith | $1200 | 01/01/2024 | $0 | Late | $50 |

Using Formulas for Automation

Once the structure is in place, you can automate calculations using Excel’s built-in functions. For example:

- SUM: Automatically total the amounts due and received.

- IF: Calculate late fees based on whether payment has been made by the due date.

- DATEDIF: Automatically calculate how many days late a payment is, which can trigger late fee calculations.

For example, an IF formula can check if the payment is made on time and, if not, apply a late fee. Additionally, you can use conditional formatting to highlight overdue payments in red, making it easier to spot tenants who haven’t paid on time.

By setting up these automated features, landlords can ensure a more streamlined and accurate billing process with minimal manual intervention, reducing the risk of errors and improving overall efficiency.

Essential Fields to Include in Rent Invoices

When creating a billing document for tenants, it’s essential to include specific details to ensure clarity, accuracy, and proper tracking. A well-organized document helps both landlords and tenants understand the financial obligations, payment status, and any applicable fees. Including the right fields allows for smooth communication and reduces the likelihood of disputes or confusion over charges.

Key Information to Include

Here are the critical fields that should be part of every statement:

- Tenant Name and Address: Clearly identify who the document is for and the rental property address.

- Billing Period: Specify the period the payment covers, whether it’s monthly or for a different duration.

- Amount Due: Clearly state the total amount owed for the billing period, including any additional charges or adjustments.

- Due Date: The date by which the payment should be made, helping both parties stay on track.

- Payment Instructions: Provide clear details on how the payment can be made (e.g., bank transfer, check, online payment portal).

- Late Fee Clause: If applicable, include any penalties for late payments and the conditions under which they apply.

- Payment Status: This section should indicate whether the payment has been made, is pending, or is overdue.

Additional Considerations

Including these fields not only ensures that the tenant receives all necessary details but also provides a transparent record for the property manager. By having a consistent format with these key components, you can avoid confusion and ensure that every transaction is clear and properly documented. Additionally, providing space for special notes or instructions can help address any specific circumstances, like prorated charges or maintenance fees.

Common Mistakes to Avoid in Rent Invoices

When managing financial records for tenants, small errors in the billing documents can lead to confusion, disputes, or even missed payments. It’s important to ensure that each statement is clear, accurate, and complete to maintain a smooth relationship with tenants and avoid unnecessary complications. Understanding common mistakes in billing documents can help landlords create professional and error-free records every time.

Frequent Errors to Watch Out For

Here are some of the most common mistakes to avoid when preparing your billing statements:

- Incorrect Amounts: Ensure that all charges, including base amounts, late fees, and any adjustments, are accurate. Mistakes in calculations can lead to confusion and mistrust.

- Missing Payment Dates: Always specify the exact date when the payment is due. Without a clear due date, tenants may delay payments or forget entirely.

- Inaccurate Tenant Information: Double-check that tenant names, rental property addresses, and other identifying details are correct. Errors in this area can cause unnecessary delays or disputes.

- Lack of Payment Instructions: Clearly outline how tenants can make their payments, whether by bank transfer, check, or online portal. Without this information, tenants may face difficulties making payments on time.

- Failure to Track Payment Status: Keep track of whether payments are made or overdue. Failing to update the status regularly can lead to confusion and missed follow-ups.

- Not Including a Late Fee Clause: If there are penalties for late payments, make sure they are clearly outlined in the document. This ensures tenants understand the consequences of not paying on time.

Ensuring Accuracy and Professionalism

To avoid these common mistakes, always double-check the details before sending out any billing document. Automation tools, such as formulas in spreadsheets, can also help reduce the likelihood of calculation errors. By maintaining a consistent format and including all the necessary information, you’ll create documents that are professional, clear, and easy for tenants to understand.

Improving Rent Collection Efficiency with Excel

Efficiently collecting payments from tenants is essential for maintaining a smooth cash flow and managing property finances. By leveraging digital tools, landlords can streamline the process, reduce human error, and ensure that payments are tracked and processed quickly. With a structured approach, you can automate many aspects of billing and payment collection, allowing you to spend less time on administration and more time managing your property.

Automating Payment Tracking

One of the most effective ways to improve the collection process is by setting up a system that automatically tracks payments, due dates, and outstanding balances. Using formulas and functions, you can create a system that alerts you when payments are due, calculates overdue amounts, and applies late fees if necessary. Here’s an example of a payment tracking table that can be set up to automate the collection process:

| Tenant Name | Amount Due | Due Date | Amount Paid | Status | Late Fee |

|---|---|---|---|---|---|

| John Doe | $1200 | 01/01/2024 | $1200 | Paid | $0 |

| Jane Smith | $1200 | 01/01/2024 | $0 | Late | $50 |

Utilizing Formulas for Efficiency

By using formulas, such as SUM for total payments or IF statements for overdue fees, you can easily manage financial data and update your records with minimal effort. For example, the IF function can automatically calculate late fees based on the payment status or the number of days the payment is overdue. This automation reduces the time spent on manual calculations and helps ensure the accuracy of your records.

Additionally, conditional formatting can be used to highlight overdue payments in red, making it easier to identify tenants who have not paid on time. With these tools in place, landlords can significantly improve their rent collection processes, making them more efficient and less prone to errors.

How to Organize Rent Invoices for Multiple Tenants

Managing billing records for multiple tenants can be challenging, especially when there are varying due dates, amounts, and payment schedules. A well-organized system helps ensure that no payment is missed, that late fees are properly applied, and that tenants’ details are easily accessible. By structuring your documents and processes in a way that allows for quick updates and clear tracking, you can streamline the process and reduce administrative errors.

Steps to Organize Billing Records

Here are several steps to efficiently manage billing records for multiple tenants:

- Centralized Record Keeping: Use a single document or file to track all tenants’ payments. This prevents confusion and ensures that everything is in one place for easy access.

- Separate Columns for Key Information: Organize data into columns for tenant names, property addresses, amounts due, due dates, payment statuses, and any additional charges. This helps quickly locate the necessary information for any tenant.

- Group Tenants by Payment Date: To make it easier to monitor payments, you can group tenants by the payment period. For example, have separate sections for tenants whose payments are due at the beginning, middle, or end of the month.

- Track Payment Status: Add a column to indicate whether a tenant has paid, is late, or has made a partial payment. This allows for quick identification of tenants who need reminders or follow-ups.

Example of an Organized Record

The following is an example of how a properly organized record for multiple tenants may look:

| Tenant Name | Property Address | Amount Due | Due Date | Amount Paid | Payment Status | Late Fee |

|---|---|---|---|---|---|---|

| John Doe | 123 Elm St | $1200 | 01/01/2024 | $1200 | Paid | $0 |

| Jane Smith | 456 Oak Ave | $1100 | 01/05/2024 | $0 | Late | $50 |

Tips for Effective Organization

- Use Conditional Formatting: Apply color coding to quickly identify overdue payments or tenants who have made partial payments.

- Automate Calculations: Use formulas to calculate total amounts due, payments received, and late fees automatically, reducing the chance of errors.

- Set Reminders: Set up automated reminders to notify you when payments are due, ensuring you stay on top of follow-ups for overdue accounts.

By fo

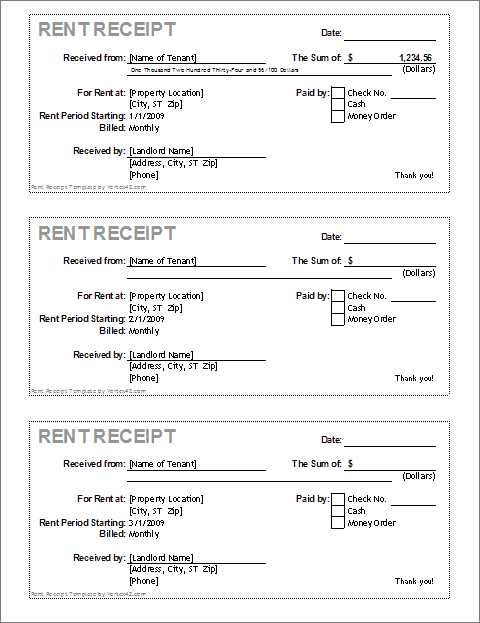

Using Excel for Rent Payment History

Tracking payment history is a crucial part of managing rental properties. By keeping an organized record of all transactions, landlords can ensure that payments are properly documented, monitor outstanding balances, and address any discrepancies promptly. Utilizing a spreadsheet allows for easy access to financial data, making it simple to track payments over time and identify patterns or issues that require attention.

Benefits of Tracking Payment History

Maintaining a clear payment history provides several key benefits:

- Accurate Financial Records: Having a detailed log of every payment helps ensure that all transactions are properly recorded and up-to-date.

- Dispute Resolution: In case of a payment dispute, a comprehensive payment history provides the necessary evidence to resolve issues quickly and fairly.

- Payment Patterns: Tracking payment history over time can help identify trends, such as consistent late payments or early settlements, which can inform future decisions.

- Tax and Reporting: Having a complete record simplifies the process when filing taxes or generating reports for accounting purposes.

How to Organize Payment History in a Spreadsheet

Here’s how to set up a simple payment history system in a spreadsheet to track payments effectively:

- Set Up Key Columns: Include columns for tenant names, payment amounts, payment dates, and payment status (e.g., paid, pending, overdue). This allows for quick identification of any missing or overdue payments.

- Use Filters: Use filters to sort payments by date, tenant, or payment status. This can help you quickly focus on a specific tenant or review payments for a given period.

- Track Outstanding Balances: Include a column to track the remaining balance due for each tenant. This ensures that you can see which tenants have paid in full and which may still owe money.

Example of Payment History in a Spreadsheet

Here’s an example of how your payment history table might look:

| Tenant Name | Amount Due | Payment Date | Amount Paid | Balance Remaining |

|---|

| Tenant Name | Property Address | Base Amount | Additional Charges | Total Amount Due | Due Date | Amount Paid |

|---|---|---|---|---|---|---|

| John Doe | 123 Maple St | $1200 | $50 | $1250 | 01/01/2024 | $1250 |

| Jane Smith | 456 Oak Ave | $1100 | $75 | $1175 | 01/05/2024 | $0 |

By following these steps and regularly reviewing your documents, you can ensure that your billing system is up to date and accurate. These adjustments also provide a more professional appearance, which helps foster clear communic

Tips for Professional Rent Invoice Design

A well-designed billing document reflects professionalism and helps build trust between landlords and tenants. A clear and organized document not only ensures that the payment process runs smoothly, but it also provides a positive impression of your management style. The right design can make all the difference, ensuring that important information is easy to find and understand. Below are some tips for creating a visually appealing and functional billing document.

Key Elements for a Professional Design

When designing your billing document, consider the following elements to improve both aesthetics and usability:

- Clear Header Information: Ensure that the header includes essential details such as your business name, logo, and contact information. This helps tenants easily identify who the document is from and how to reach you if they have questions.

- Consistent Formatting: Use a consistent font, color scheme, and layout throughout the document. This creates a sense of organization and makes the document easier to read.

- Well-Organized Sections: Break the document into logical sections, such as tenant information, payment details, and outstanding balance. Use headings or lines to separate each section, so tenants can quickly find what they need.

- Legible Font and Size: Choose fonts that are easy to read and use a reasonable font size (usually between 10–12 points). Avoid overly decorative fonts that may be hard to read, especially in important sections like amounts due and payment dates.

Additional Design Tips

- Incorporate Color Wisely: Use color to highlight important sections, such as the total amount due or the due date, but avoid using too many colors that can make the document appear cluttered.

- Leave Ample White Space: Don’t overcrowd the document. Leave space between sections and ensure that text doesn’t run too close to the edges of the page. White space creates a cleaner look and improves readability.

- Include Payment Instructions: Make sure that payment instructions or details on how to pay are clearly outlined. If you offer multiple payment methods, provide them in an easy-to-understand format.

- Incorporate a Footer: A footer can include your business’s terms and conditions, late fee policy, or legal information. It’s a great way to reinforce your professionalism and provide tenants with additional information they may need.

By following these design tips, you will not only create a more organized and effective billing document but also make a lasting positive impression on your tenants. A professional appearance can foster better communication and set the tone for a smooth landlord-tenant relationship.

Free Excel Templates for Rent Invoices

For those managing rental properties, having an efficient way to create and track billing documents is essential. Fortunately, there are numerous free tools available online that make this process faster and more organized. These tools provide ready-made solutions that can be easily customized, helping landlords quickly generate documents without having to start from scratch. Whether you’re a first-time landlord or a property management professional, free templates can save valuable time and effort.

Where to Find Free Billing Templates

There are many websites and platforms that offer free resources for creating billing documents. Some popular places to search include:

- Online Template Libraries: Websites like Microsoft Office, Google Sheets, and other document-sharing platforms provide free, customizable templates for property managers.

- Real Estate Blogs and Forums: Many property management blogs offer free downloadable templates designed specifically for landlords, often including helpful tips and customization instructions.

- Open Source Platforms: Some open-source platforms offer free resources and templates designed for managing financial transactions and rental agreements.

Benefits of Using Free Templates

Opting for a pre-made solution can significantly streamline your billing process:

- Time Efficiency: Ready-to-use documents allow you to focus on other important aspects of property management while ensuring your billing records are accurate.

- Customization: Free templates can be easily modified to fit your specific needs, from adding extra fields to adjusting payment terms or adding logos.

- No Cost: These resources are available at no charge, which is particularly helpful for smaller property owners or those with limited budgets.

- Improved Accuracy: Pre-designed templates ensure that no critical details are left out, making it easier to keep track of financial transactions.

Using free templates for creating your billing documents can simplify your management tasks, ensuring accuracy and professionalism without the added expense of custom software or design services.