Monthly Payment Invoice Template for Efficient Billing and Tracking

Managing consistent billing processes is crucial for businesses that offer regular services or products. Having a reliable system in place ensures timely payments, maintains professionalism, and improves overall financial organization. A well-structured document that outlines charges and terms plays an important role in keeping transactions transparent and smooth.

Streamlining financial operations can be achieved through standardized documents that help both businesses and customers stay on the same page. Customizing these records to reflect specific needs can save time and reduce confusion, making the entire process more efficient.

Whether you’re an independent contractor, a small business owner, or managing a larger organization, it’s important to have a tool that adapts to your workflow. Using a standardized document that can be easily tailored helps avoid discrepancies and ensures your billing remains clear and accurate every time.

Monthly Payment Invoice Template Guide

Creating consistent billing documents for ongoing services ensures clarity in financial transactions. These records not only help communicate amounts owed but also outline expectations and terms, which helps both parties stay organized. A structured format for these documents can simplify the entire process and reduce the likelihood of misunderstandings.

The key to an effective document is its simplicity and adaptability. By following a clear and professional structure, you can streamline billing for various types of recurring services or products, whether you are a freelancer, small business owner, or part of a larger enterprise.

| Section | Description |

|---|---|

| Header | Contains company or service provider details, client information, and the document date. |

| Details of Charges | Breakdown of all services or products being billed, including quantity, rate, and total cost. |

| Terms and Conditions | Outlines the payment deadline, late fees, and any other relevant policies. |

| Footer | Includes additional information such as payment methods, contact details, and legal disclaimers. |

By using a structured approach like the one above, you can ensure that all necessary information is included and easy to understand. This not only saves time but also creates a professional experience for your clients, ultimately enhancing your business’s financial efficiency.

Understanding the Importance of Invoices

Proper documentation of financial transactions is a fundamental aspect of any business. These records not only ensure that all services or products provided are accounted for but also serve as a formal agreement between the service provider and the client. The clarity and accuracy of these documents are essential for maintaining trust and transparency in any business relationship.

Clear and detailed records help avoid misunderstandings and disputes regarding charges, terms, or expectations. By outlining specific details such as amounts, deadlines, and services rendered, both parties have a reference point, which can be crucial for resolving any issues that arise. These documents also serve as an official record for tax purposes and financial audits.

Timely and accurate records help build a reputation of reliability and professionalism. Clients are more likely to return to businesses that provide organized and transparent documentation, which can foster long-term relationships and secure repeat business.

Key Features of an Invoice Template

When designing a billing document for ongoing services or products, certain elements are essential to ensure clarity, professionalism, and efficiency. These features help businesses communicate important information clearly, reducing the chances of disputes and simplifying the transaction process for both the service provider and the client.

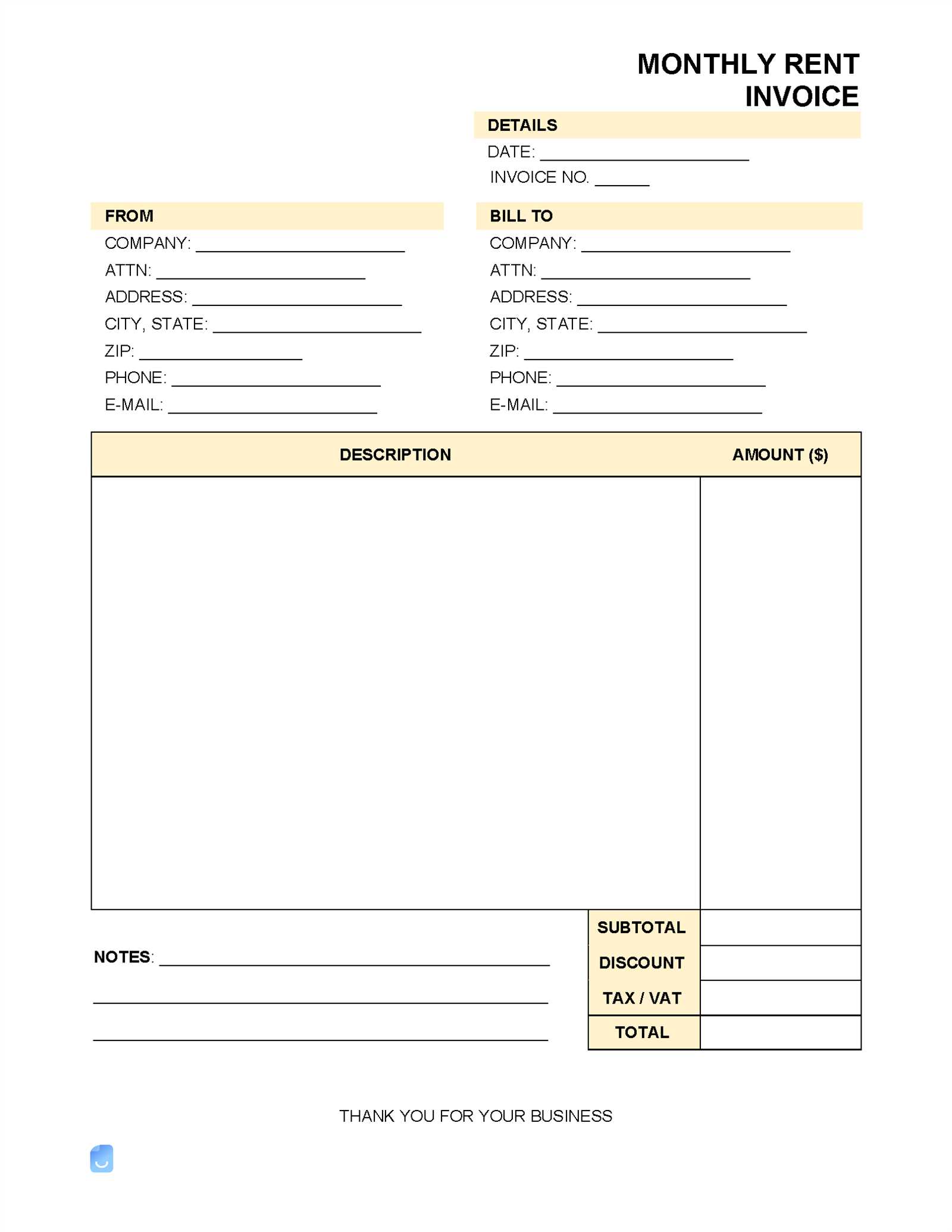

Clear Structure and Organization

A well-structured document should have a logical flow, making it easy for clients to understand the breakdown of charges. This includes clear sections for personal information, a detailed list of services or products, and total amounts due. An organized layout helps ensure that nothing is overlooked, making the document user-friendly for both parties.

Payment Terms and Details

One of the most critical components is specifying payment terms. This includes outlining deadlines, any late fees, accepted payment methods, and specific instructions on how and where to make the payment. Having this information readily available ensures both sides know exactly what is expected, minimizing confusion.

Customizing Templates for Your Business

Tailoring your billing documents to suit the unique needs of your business is essential for streamlining the process and maintaining a professional image. By adjusting specific elements, you can ensure that these records reflect your brand, provide relevant information, and cater to the preferences of your clients. Customization allows for greater flexibility and efficiency, helping to avoid common errors and ensure clarity in every transaction.

Here are some ways to personalize your documents for a more cohesive and effective billing experience:

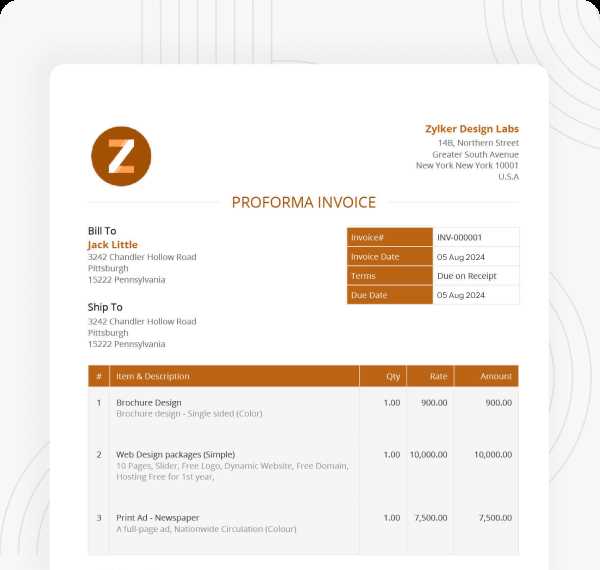

- Branding – Include your company logo, colors, and contact details to give the document a professional, branded appearance.

- Payment Terms – Adjust the payment deadlines, late fee policies, and accepted payment methods to match your business practices.

- Item Descriptions – Clearly describe services or products with customizable fields to accommodate your specific offerings.

- Additional Notes – Add any personalized instructions, disclaimers, or promotional offers that are relevant to your customers.

By modifying these sections, you can create a more personalized experience for your clients while keeping your billing process efficient and professional.

How to Set Payment Terms Effectively

Establishing clear and fair terms for settling amounts due is crucial for maintaining smooth cash flow and fostering good relationships with clients. Well-defined payment expectations help both the service provider and the customer understand their responsibilities, reducing confusion and ensuring timely transactions. When setting these terms, clarity and flexibility are key factors that promote trust and minimize disputes.

Here are some tips for setting payment expectations effectively:

- Specify Deadlines – Clearly state the due date for settling balances to avoid delays. Make sure your clients know when to expect the request and when payment is required.

- Outline Late Fees – Include a penalty for late payments, if necessary, to encourage prompt settlements. This should be reasonable and clearly stated in the document.

- Define Accepted Payment Methods – Specify the payment methods you accept, whether through bank transfer, credit card, checks, or online platforms. Make it easy for clients to know their options.

- Offer Flexible Terms for Long-Term Clients – For recurring clients, consider offering more flexible payment arrangements such as installment plans or early-bird discounts.

- Clarify Refund and Dispute Policies – Be clear about how any issues regarding charges will be handled. Include a procedure for handling disputes or refund requests to maintain professionalism.

By following these guidelines, you can ensure that both parties are on the same page regarding payment expectations, helping to prevent misunderstandings and foster long-term business relationships.

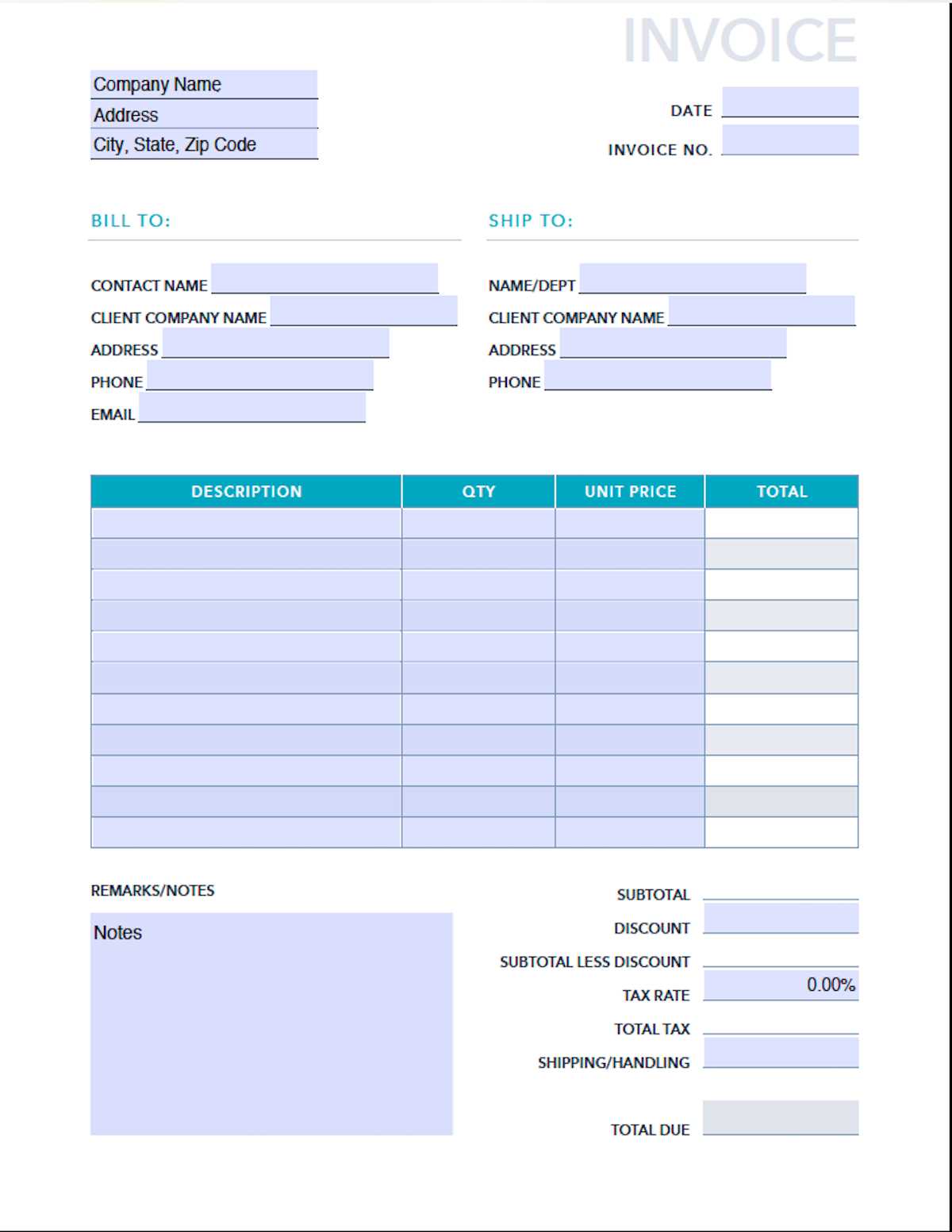

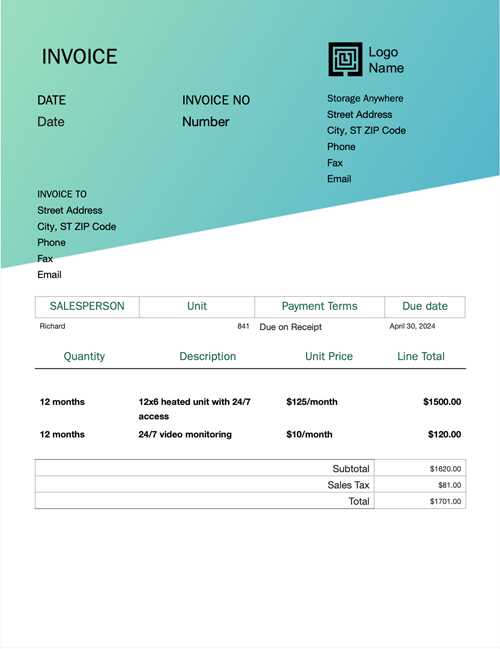

Choosing the Right Invoice Format

Selecting the appropriate format for your billing documents is essential for maintaining clarity and professionalism. The right structure not only makes it easier for clients to understand the charges but also ensures that all necessary information is presented in an organized and visually appealing way. A well-chosen format can save time, reduce errors, and enhance the overall customer experience.

Consider the type of service you offer when selecting a format. A straightforward service may require a simple layout, while more complex projects or product offerings might need a detailed breakdown. It’s important to choose a format that suits both your business model and the preferences of your clients.

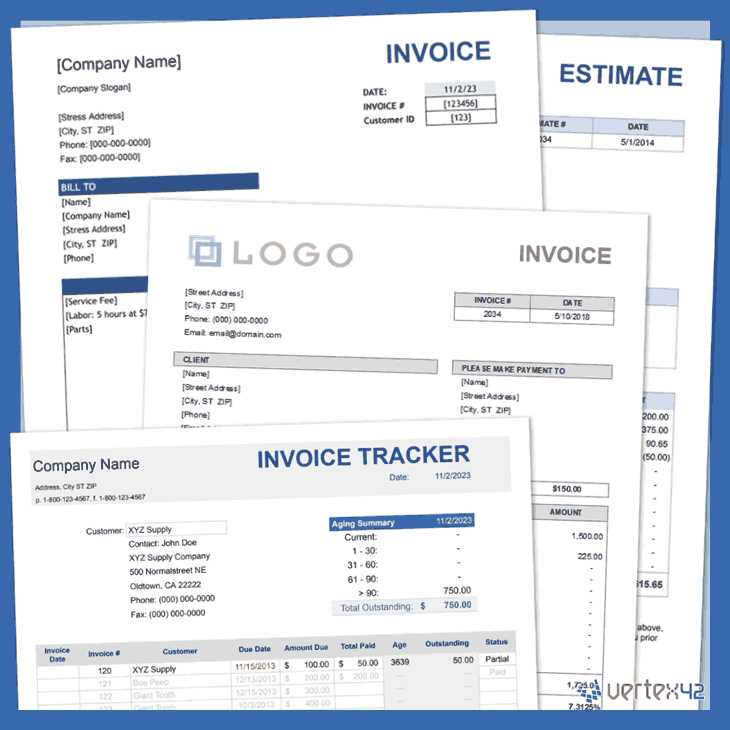

Common formats include:

- Basic Format – Ideal for simple services or one-time transactions, this format includes just the essential information such as the amount, client details, and payment instructions.

- Itemized Format – Suitable for more complex services or multiple products, this format lists individual items with descriptions, rates, and totals, making it clear how the final amount is calculated.

- Professional Template – For larger businesses or high-end services, a polished, branded format with your company logo, colors, and comprehensive payment terms is often preferred.

Choosing the right format will help streamline your billing process and leave a positive impression on your clients, ensuring a smooth and efficient transaction every time.

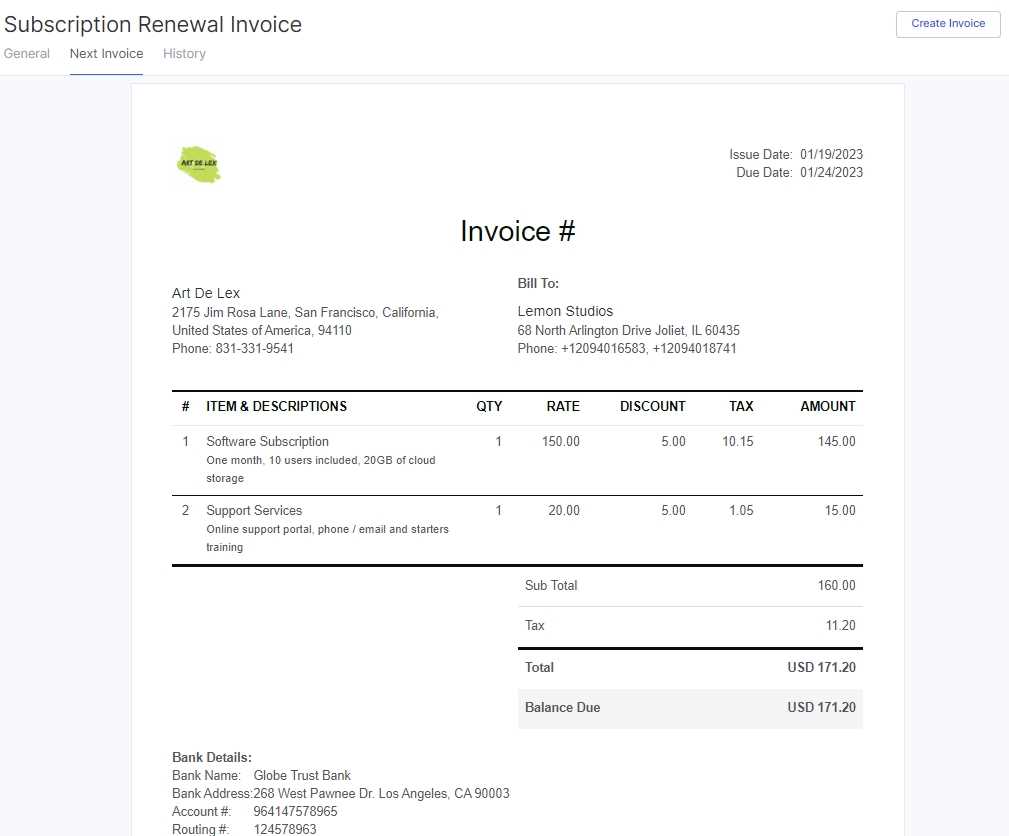

Incorporating Tax Information in Invoices

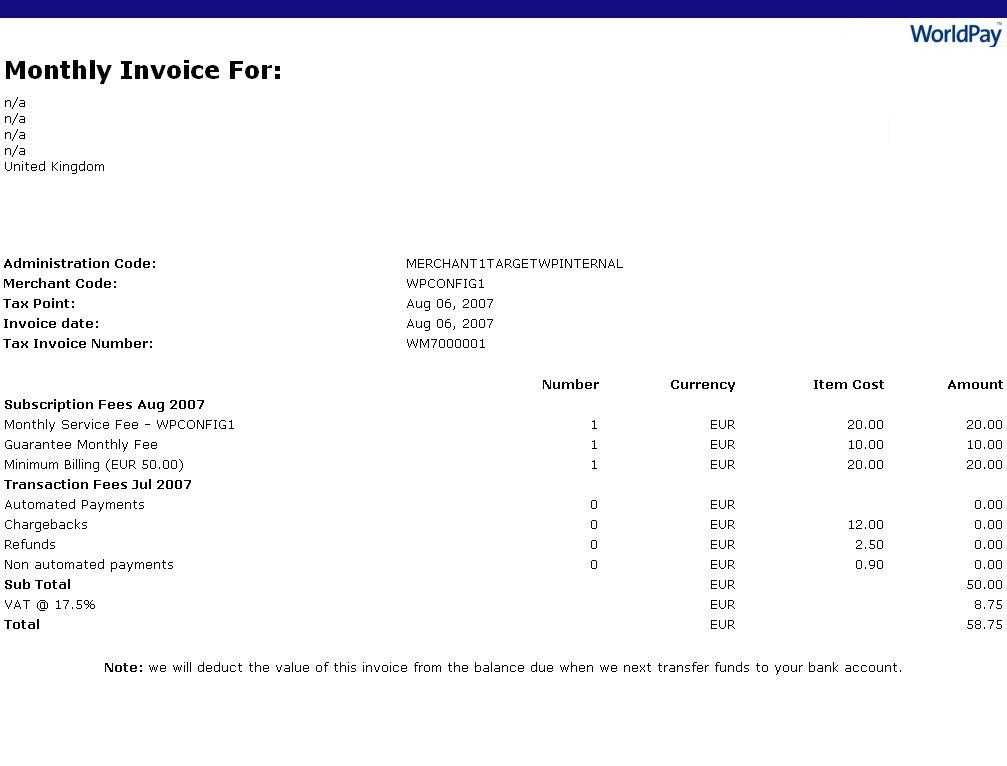

Including accurate tax details in billing documents is crucial for both legal compliance and clarity. Properly documenting tax rates and amounts ensures that clients understand their financial obligations and prevents issues during audits or disputes. It’s essential to specify which taxes apply to the transaction and how they are calculated to maintain transparency and professionalism.

Understanding Tax Requirements

Different regions have varying tax laws that affect how charges should be calculated. Make sure you are familiar with local tax regulations, including sales tax, VAT, or other relevant taxes, and apply them correctly to your charges. Including this information in your documents helps avoid confusion and assures clients that you are following the necessary legal procedures.

Best Practices for Tax Details

When adding tax information to your documents, ensure that you:

- List the Tax Rate Clearly – Specify the percentage or flat rate applied to the total amount.

- Break Down Tax Amounts – Show the calculated tax as a separate line item to provide full transparency.

- Include Legal Tax Identification Numbers – If applicable, include your business’s tax ID number or VAT registration number to demonstrate compliance with tax laws.

- Use Correct Terminology – Clearly label each tax line to avoid confusion, especially when dealing with multiple types of taxes.

By following these practices, you ensure that your documents are not only legally compliant but also help maintain a clear and professional relationship with your clients.

Tracking Payments Using Invoice Templates

Effectively managing and monitoring financial transactions is essential for maintaining healthy cash flow and ensuring timely compensation for services rendered. Properly structured billing documents can help track outstanding balances and identify when payments have been received. By incorporating specific sections dedicated to payment status, businesses can stay organized and reduce the risk of missed or delayed payments.

By using a structured approach to record payment status and due dates, businesses can quickly identify which transactions are pending, completed, or overdue. A well-maintained record also facilitates smoother follow-ups with clients and ensures that all financial data is easily accessible when needed.

Utilizing these tools enhances the overall financial management process and supports clear communication between service providers and their clients, creating a more efficient billing cycle.

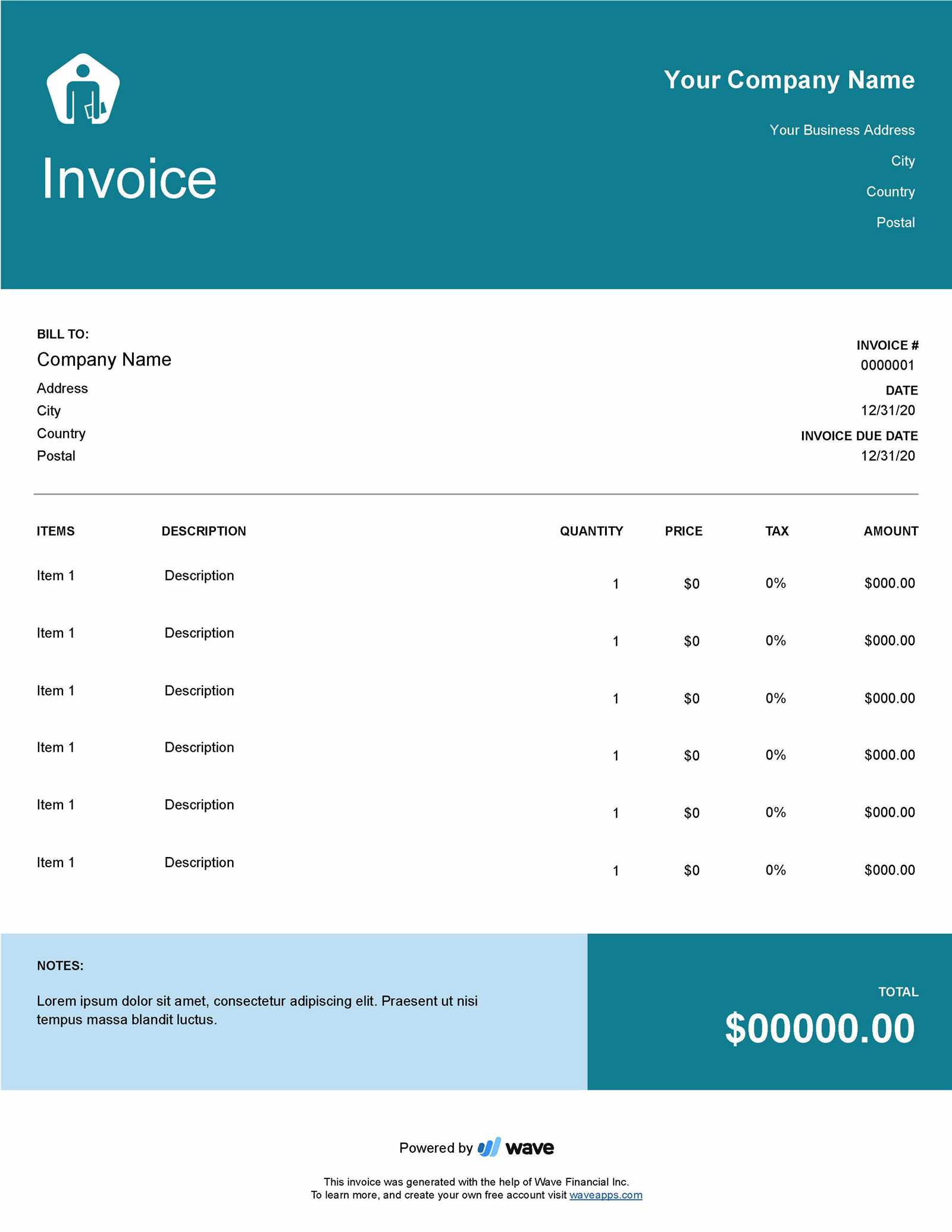

Integrating Branding into Your Invoices

Adding a unique touch to your financial documents can significantly enhance your company’s identity and leave a lasting impression on clients. By incorporating branding elements into these records, you ensure that your business stands out while maintaining a professional appearance. This approach not only reinforces your brand but also builds trust and credibility with your clients.

Here are some effective ways to integrate branding into your financial documents:

- Company Logo – Place your company logo at the top or in a prominent area to instantly identify your business.

- Color Scheme – Use your brand’s colors for text, borders, and backgrounds to create consistency with other materials.

- Font Style – Choose fonts that match your branding guidelines to maintain a cohesive look across all business documents.

- Tagline or Slogan – Add a brief company tagline or slogan to remind clients of your values or unique selling proposition.

- Contact Information – Ensure that your business’s contact details (email, phone, website) are easily visible, reinforcing your professional image.

By including these elements, you can turn what is typically seen as a functional document into an opportunity to reinforce your business’s identity and foster stronger connections with clients.

Reducing Errors with Automation Tools

Manual processes are often prone to human error, especially when dealing with repetitive tasks such as generating financial records or tracking transactions. Automation tools can significantly reduce these mistakes by streamlining routine operations and ensuring consistency in every document. By automating tasks like calculations, data entry, and document generation, businesses can save time and avoid costly errors that may impact client relationships and cash flow.

Here are some ways automation tools can help minimize errors in your billing process:

- Automated Calculations – Automatically calculate totals, taxes, and discounts to ensure accuracy without the risk of manual miscalculations.

- Data Entry Integration – Sync client details and payment history with your system, reducing the chances of entering incorrect information.

- Recurring Billing Automation – Set up recurring billing schedules for ongoing services to ensure timely and accurate invoicing without the need for manual intervention.

- Template Customization – Use pre-designed templates that automatically populate with the correct information, saving time and reducing formatting errors.

- Error Alerts – Set up notifications for discrepancies, such as mismatched amounts or missing information, to address issues before they become problems.

Implementing these tools not only reduces the likelihood of errors but also improves efficiency, allowing businesses to focus more on strategic tasks rather than manual administrative work.

Best Practices for Invoice Design

Creating professional and clear billing documents is essential for maintaining a positive client experience. A well-designed record not only ensures that all necessary details are conveyed clearly but also reinforces your brand’s image. The layout and style of the document should facilitate easy comprehension, guiding clients to quickly understand the charges and payment instructions.

Here are some key practices to follow when designing your billing documents:

- Keep it Simple and Organized – Use a clean, straightforward layout that prioritizes key information like amounts due, service descriptions, and due dates. Avoid cluttering the page with unnecessary details or complex visuals.

- Use Clear Headings and Sections – Organize the document into logical sections such as contact details, services provided, and payment terms. Each section should be clearly labeled to help clients quickly find the information they need.

- Highlight Important Details – Use bold or larger fonts for critical information such as the total amount due and payment deadlines. This ensures that these elements stand out and cannot be overlooked.

- Incorporate Your Branding – Add your company logo, color scheme, and fonts to align with your overall branding. This helps make your document easily recognizable and reinforces your professional image.

- Ensure Proper Alignment and Spacing – Proper alignment of text and adequate spacing between sections makes the document more readable and aesthetically pleasing. Avoid cramming too much information into one area of the page.

By following these best practices, you can create well-organized, professional documents that will be easy for clients to understand and more likely to result in timely transactions.

Common Mistakes to Avoid in Invoices

When creating billing documents, small errors can lead to confusion, delays, or even disputes with clients. Ensuring the accuracy and clarity of these documents is crucial for maintaining good business relationships and avoiding payment issues. By understanding and avoiding common mistakes, businesses can streamline their financial processes and build trust with clients.

Missing or Incorrect Information

One of the most common mistakes is failing to include essential details or providing incorrect information. Missing client names, incorrect dates, or wrong service descriptions can lead to confusion and delays in processing payments. Always double-check to ensure the following are accurate:

- Client contact details

- Service dates and descriptions

- Amount due and tax calculations

- Due date and payment instructions

Inconsistent or Unclear Formatting

Another frequent issue is unclear or inconsistent formatting. A disorganized or hard-to-read document can make it difficult for clients to understand the charges or payment terms. Ensure the layout is clear, with adequate spacing and clearly labeled sections for each part of the document. This helps your clients process the information quickly and easily.

Avoiding these common mistakes will help create accurate, professional, and easy-to-understand billing records that promote timely payments and prevent misunderstandings.

Legal Considerations for Monthly Invoices

When issuing regular charges for services or goods, it’s crucial to ensure compliance with legal frameworks. A clear understanding of contractual obligations, terms of service, and jurisdictional rules can prevent misunderstandings and protect both parties involved in the transaction. Below, we delve into some key aspects to consider before sending out any financial requests to clients or customers.

Key Legal Elements to Include

Any financial request document should outline the essential elements of the agreement, including the amount owed, the frequency of the charge, and due dates. A comprehensive description of what is being billed for is vital to avoid disputes. Additionally, detailing payment terms–such as late fees, interest, and available methods–can help safeguard the issuer’s interests.

| Legal Element | Purpose |

|---|---|

| Amount | Defines the sum due for goods or services rendered. |

| Due Dates | Establishes clear expectations for when the financial obligation must be settled. |

| Payment Terms | Details conditions under which payments are made or overdue fees are applied. |

| Legal Jurisdiction | Specifies the governing law for any potential disputes. |

Dispute Resolution and Collection Procedures

It is vital to outline the steps for resolving conflicts related to payments. In the event of non-payment, an issuer may need to engage in collection practices or legal action. Clearly defining these procedures in the initial terms can avoid unnecessary delays and help both parties know their responsibilities in the case of a dispute.

How to Save Time with Templates

Streamlining repetitive tasks can significantly improve efficiency, particularly when dealing with regular financial transactions. By utilizing pre-designed documents, one can eliminate the need to start from scratch each time, allowing more focus on the core aspects of the business. This method not only saves time but also ensures consistency in communication.

Benefits of Using Pre-Formatted Documents

- Reduces the time spent on drafting and customizing details for each client.

- Ensures consistency in terms, layout, and language used across all requests.

- Minimizes human error by providing a standard framework that can be easily updated.

How to Get the Most Out of Pre-Designed Forms

To maximize efficiency, ensure that your pre-made documents are easily adaptable to various situations. Customizable fields, such as customer names, amounts, and dates, should be readily editable without disrupting the overall structure. Using software that integrates with accounting systems can further streamline the process, allowing you to automatically populate required fields.

- Choose software or platforms that allow quick updates and automation.

- Regularly review and modify your documents to keep them in line with any business or legal changes.

- Ensure all essential information is included but leave room for easy customization when needed.

Using Templates for Recurring Clients

For clients with ongoing relationships, establishing a streamlined process for documenting charges can greatly reduce administrative time. With a structured format in place, you can quickly adjust the details for each cycle without needing to start anew. This not only saves time but also ensures consistency and accuracy across all interactions with regular customers.

Advantages of Using Pre-Formatted Documents for Regular Clients

Having a predefined structure for recurring transactions offers several benefits:

- Quick customization for each client without repeating the entire process.

- Consistency in the presentation and structure of the request, improving professionalism.

- Reduced risk of errors since the framework remains the same for each cycle.

Essential Elements to Include for Recurring Transactions

When using a standardized approach for recurring clients, it’s important to ensure that all critical information is included and adjustable where necessary. Below are the key components:

| Element | Description |

|---|---|

| Client Information | Name, contact details, and account number for quick identification. |

| Service Period | Clearly indicate the time frame for which the charges apply (e.g., weekly, quarterly). |

| Amount | Set charges that may remain constant or change with each cycle. |

| Due Dates | Provide specific deadlines for each cycle to ensure timely processing. |

By tailoring these elements to the specific needs of your recurring clients, you can enhance the overall efficiency of the billing process and maintain a positive professional relationship.

Benefits of Digital Invoicing

Switching to electronic formats for documenting financial requests offers numerous advantages over traditional paper-based methods. With faster processing, enhanced accuracy, and increased security, digital systems have become the preferred choice for businesses looking to streamline their administrative workflows. Below are some of the key benefits of adopting digital solutions for billing.

Efficiency and Speed

- Instant delivery to clients via email or automated systems, eliminating postal delays.

- Quick updates and modifications, reducing the time spent on manual edits.

- Automated reminders and alerts, ensuring clients are informed of upcoming due dates without extra effort.

Cost Savings and Environmental Impact

- Eliminates the need for paper, ink, postage, and other physical resources, resulting in lower operational costs.

- Reduces environmental impact by minimizing waste and lowering carbon footprint.

- Helps businesses scale operations without increasing administrative overhead.

Security and Compliance

- Encrypted digital records enhance security, protecting sensitive financial data from unauthorized access.

- Easy to comply with legal and regulatory requirements through built-in tools for tracking and record-keeping.

- Digital logs are more easily stored, backed up, and retrieved, ensuring business continuity in case of emergencies.

By embracing electronic billing solutions, businesses can not only reduce costs and save time but also improve their overall operational efficiency while staying secure and compliant with industry standards.

Where to Find Quality Invoice Templates

Finding reliable resources for creating accurate and professional billing documents is essential for businesses of any size. High-quality designs not only save time but also ensure clarity and consistency in every transaction. Fortunately, there are numerous platforms available that provide ready-to-use, customizable options to meet specific business needs.

Reliable Sources for Downloading or Creating Documents

- Online design platforms: Websites like Canva and Adobe Spark offer user-friendly tools to create professional-looking billing forms quickly.

- Accounting software: Many tools such as QuickBooks or Xero include built-in templates tailored to different industries.

- Business document marketplaces: Platforms like Etsy or Template.net provide a wide variety of customizable documents for purchase or free download.

Key Features to Look for in a Quality Document

When selecting a resource, ensure that the template has the following elements for maximum effectiveness:

| Feature | Why It’s Important |

|---|---|

| Customizability | Ability to modify details like client information, charges, and terms for each transaction. |

| Professional Design | Ensures that the document looks polished and represents the business well. |

| Clear Structure | A clean layout that makes it easy to read and understand for both the business and the client. |

| Compatibility | Ensure the document works with different devices and software for easy use and sharing. |

By choosing a resource that provides templates with these features, businesses can efficiently create clear, accurate, and professional documentation for all transactions.