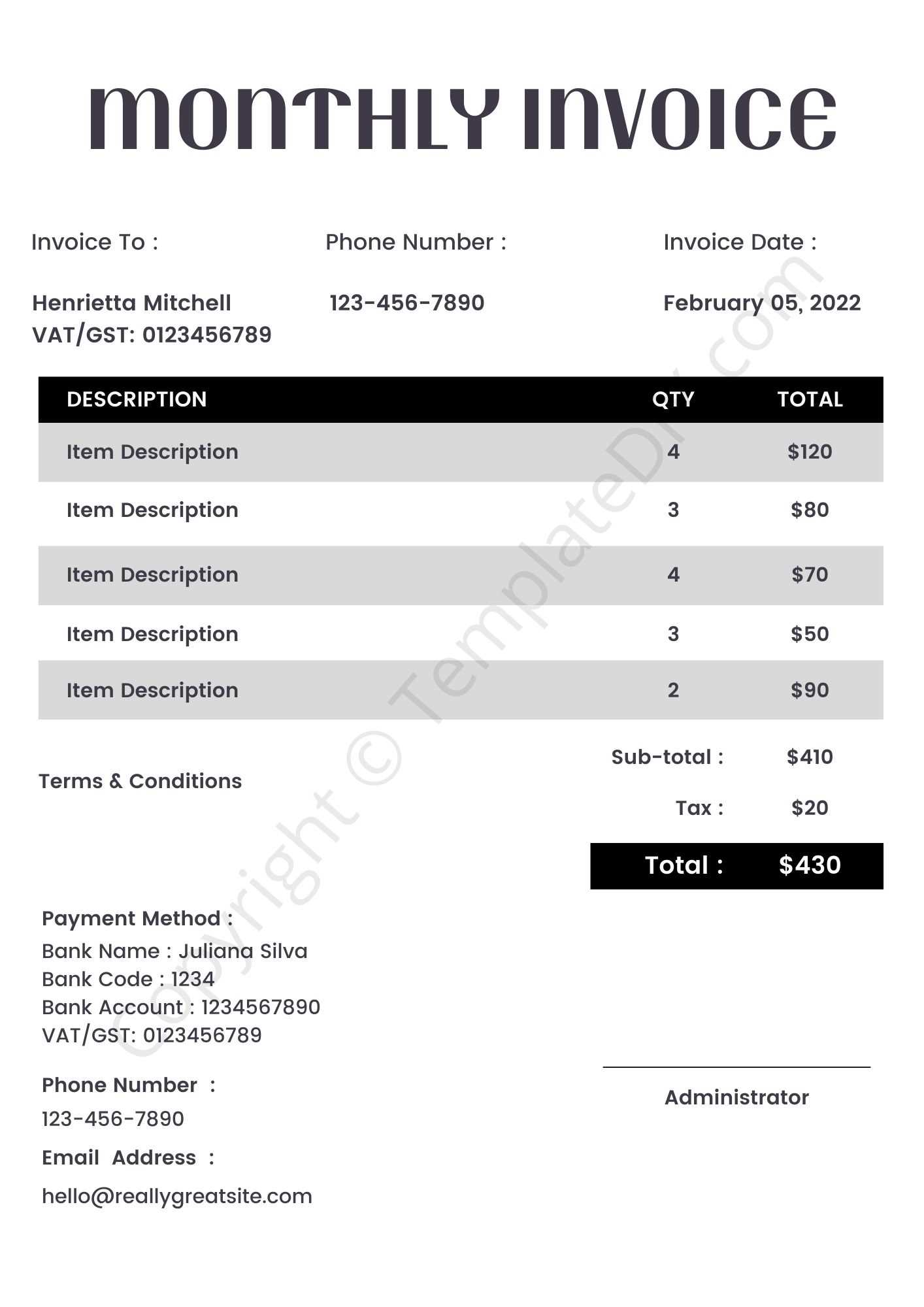

Monthly Invoice Statement Template for Streamlined Billing

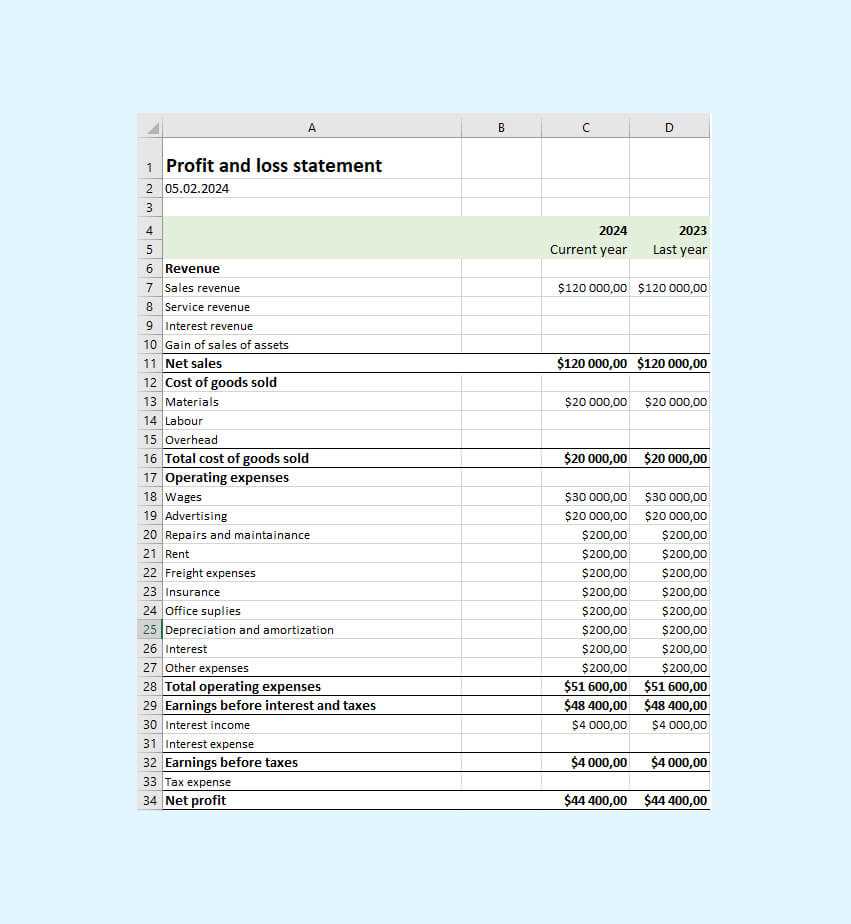

Efficient financial management is essential for any business or individual looking to stay on top of their economic health. One way to streamline financial organization is by using structured documents designed for periodic tracking. These resources simplify record-keeping, enhance accuracy, and provide a clear view of transactions over specific periods. Consistently updating and organizing records helps prevent errors and improves overall financial transparency.

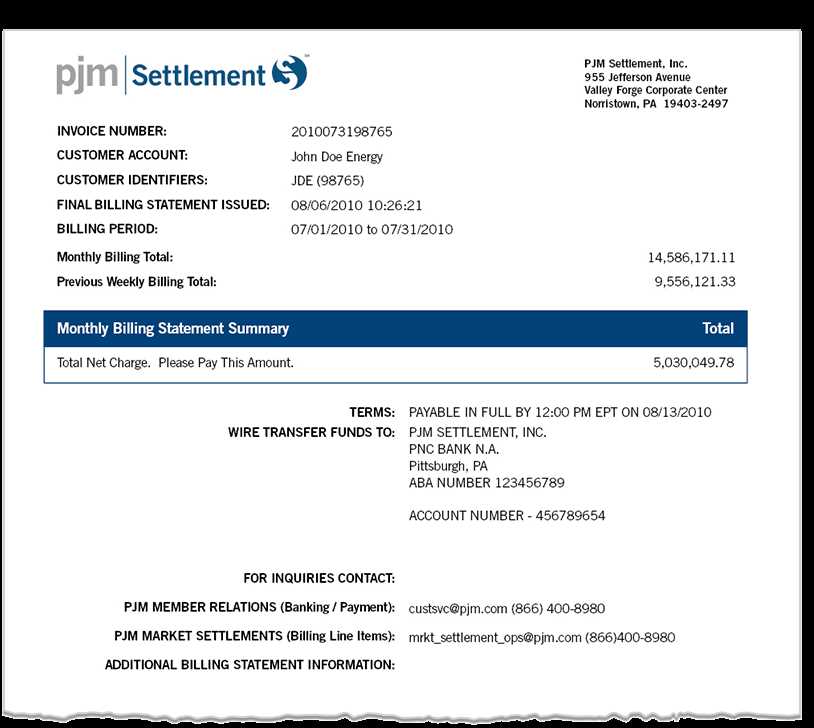

Utilizing a prepared form for financial summaries offers a simple solution to keep track of payments, outstanding balances, and overall income. With clear sections for essential details, these forms allow businesses to communicate important information seamlessly. Using them not only saves time but also reduces the margin for human error, ensuring that important details are consistently documented.

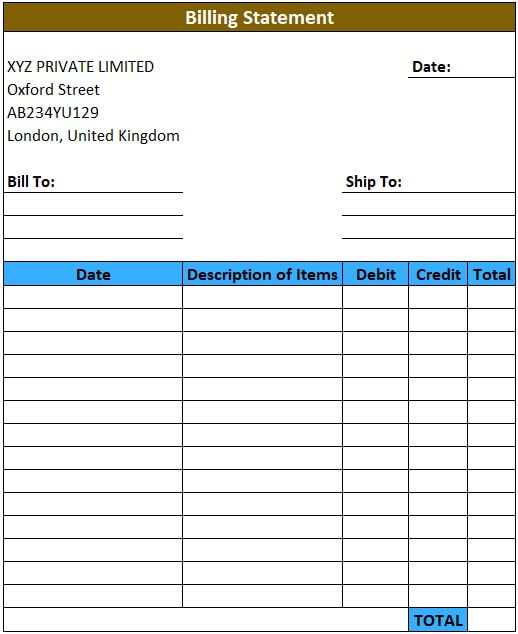

Additionally, ready-made layouts can be customized to suit specific needs, whether for small businesses, freelancers, or larger enterprises. By adapting these forms, users can easily align them with branding, include personalized details, and optimize them to reflect unique financ

Monthly Invoice Statement Template Guide

Keeping track of finances is essential for businesses and freelancers alike, as it helps manage incoming and outgoing funds with ease. Organizing this data in a structured format allows for greater clarity, making it simple to view, update, and analyze financial records regularly. Properly designed forms offer a streamlined approach to documenting financial interactions, ensuring all details are captured effectively.

Essential Sections for Financial Summaries

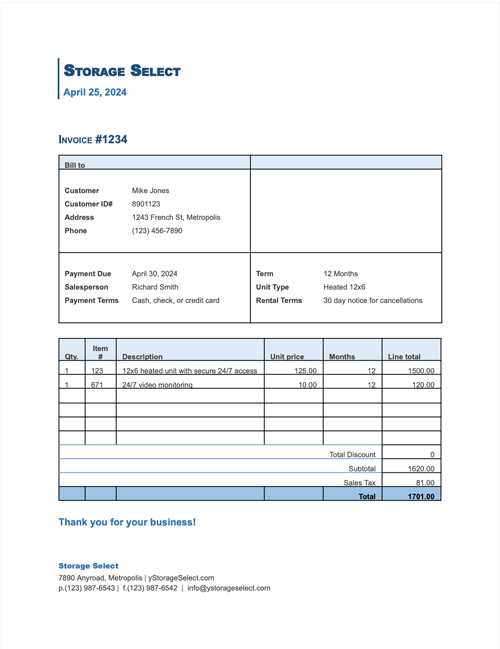

To create a practical financial summary document, it’s important to include several key sections that cover the core details of each transaction. By segmenting information, users can quickly review relevant data, assess outstanding balances, and confirm payment statuses. Below is a suggested format that can be customized to fit specific needs.

| Section | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Contact Details

Why Use an Invoice Template

Organizing financial records is a crucial aspect of running a business smoothly. Using pre-structured forms for tracking transactions provides an efficient way to ensure consistency, reduce errors, and save time. By utilizing standardized documents, businesses can streamline their billing process, maintain professional communication, and enhance their overall financial management practices. Advantages of Pre-Designed Financial Forms

By following these best practices, businesses can ensure their billing process is smooth, transparent, and efficient. This not only boosts cash flow but also fosters stronger relationships with clients through reliable and clear communication. Choosing the Right Format

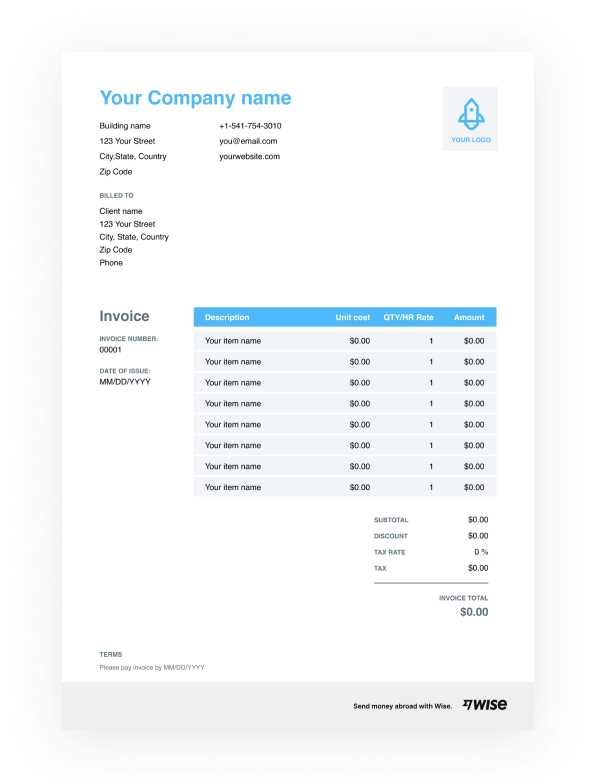

When it comes to preparing billing documents, selecting the appropriate format is crucial for both clarity and efficiency. The right layout ensures that all necessary details are easy to read and understand, reducing the chance of errors or confusion. A well-structured document not only looks professional but also helps maintain a positive relationship with clients by promoting transparency. Consider Simplicity and ClarityChoosing a format that is simple and straightforward is essential. Avoid cluttered designs or overly complex structures. A clean, well-organized document with clearly defined sections for important information like amounts, due dates, and payment methods helps clients quickly grasp the key points. Simple formats can often be more effective than overly detailed or busy designs. Customization for Business NeedsEvery business has unique needs when it comes to billing. Some may require additional fields for specific services, discounts, or taxes, while others may need a more minimalist design. Customizing the layout allows you to tailor the document to your particular requirements, making it easier for clients to navigate and for your team to process payments efficiently. By considering these factors, you can choose a format that aligns with both your business operations and your clients’ expectations, resulting in smoother transactions and fewer misunderstandings. Tools for Generating Invoices Easily

Creating accurate and professional documents can be time-consuming, but with the right tools, the process becomes much more efficient. Various software options and online services allow businesses to generate these documents quickly, ensuring that all essential details are captured and formatted correctly. Using such tools can streamline administrative tasks and help businesses save valuable time. Online Invoice GeneratorsMany platforms offer easy-to-use online tools that allow you to create custom billing documents with just a few clicks. These services typically feature pre-designed templates where you can input client details, payment terms, and service descriptions. Online invoice generators often come with additional features, such as automatic calculations and reminders, making it easier to manage payments. Accounting Software IntegrationFor businesses looking for a more comprehensive solution, accounting software packages often include tools for generating billing documents as part of their broader services. Accounting software can integrate with other financial processes, helping you track expenses, payments, and overdue accounts in one place. These tools not only automate the creation of documents but also provide a complete view of your financial situation. By leveraging these tools, businesses can enhance their billing processes, ensuring consistency, reducing manual errors, and improving overall efficiency. Whether you prefer simple online generators or full-featured accounting software, there is a solution available to suit your needs. Tracking and Managing Monthly InvoicesEffectively monitoring and overseeing billing activities is crucial for maintaining financial stability. By organizing the process, businesses can ensure timely payments, reduce errors, and prevent overdue balances. Using the right tools and practices, companies can stay on top of their finances and keep the cash flow consistent. Organizing Billing RecordsKeeping clear and organized records is essential for tracking all outgoing requests for payment. Properly documenting each transaction allows for easy access when needed. Consistent record-keeping helps businesses manage client details, due dates, and payment statuses, ensuring nothing slips through the cracks. Automation and RemindersAutomating tasks like payment reminders and overdue notifications can save time and help ensure that no bill is forgotten. Automated systems can send reminders directly to clients before or after the due date, encouraging prompt payment and reducing administrative workload. By implementing these strategies, businesses can better manage their financial activities, maintain transparency with clients, and improve overall cash flow management. Using Software to Automate BillingAutomating the billing process through software can significantly streamline financial operations, saving both time and resources. By eliminating manual tasks, businesses can reduce human error, enhance efficiency, and ensure that all financial records are accurate and up-to-date. This approach not only simplifies the administrative workload but also contributes to faster payment cycles. Key Benefits of AutomationUsing specialized software to handle payments offers several advantages:

Choosing the Right Software

Selecting the appropriate automation tool is crucial. When considering options, businesses should focus on software that integrates easily with existing systems and offers features that match their specific needs. Look for platforms that provide customization options, secure payment gateways, and robust reporting features to manage finances more effectively. Securing Invoice Data Effectively

Protecting sensitive financial data is crucial for any business, as it helps prevent unauthorized access and potential fraud. Implementing strong security measures ensures that information remains confidential and compliant with regulations. With increasing reliance on digital systems, it is essential to adopt practices that safeguard all transactions and customer details. Security Measures for ProtectionThere are several key practices that can help businesses secure their financial data:

|