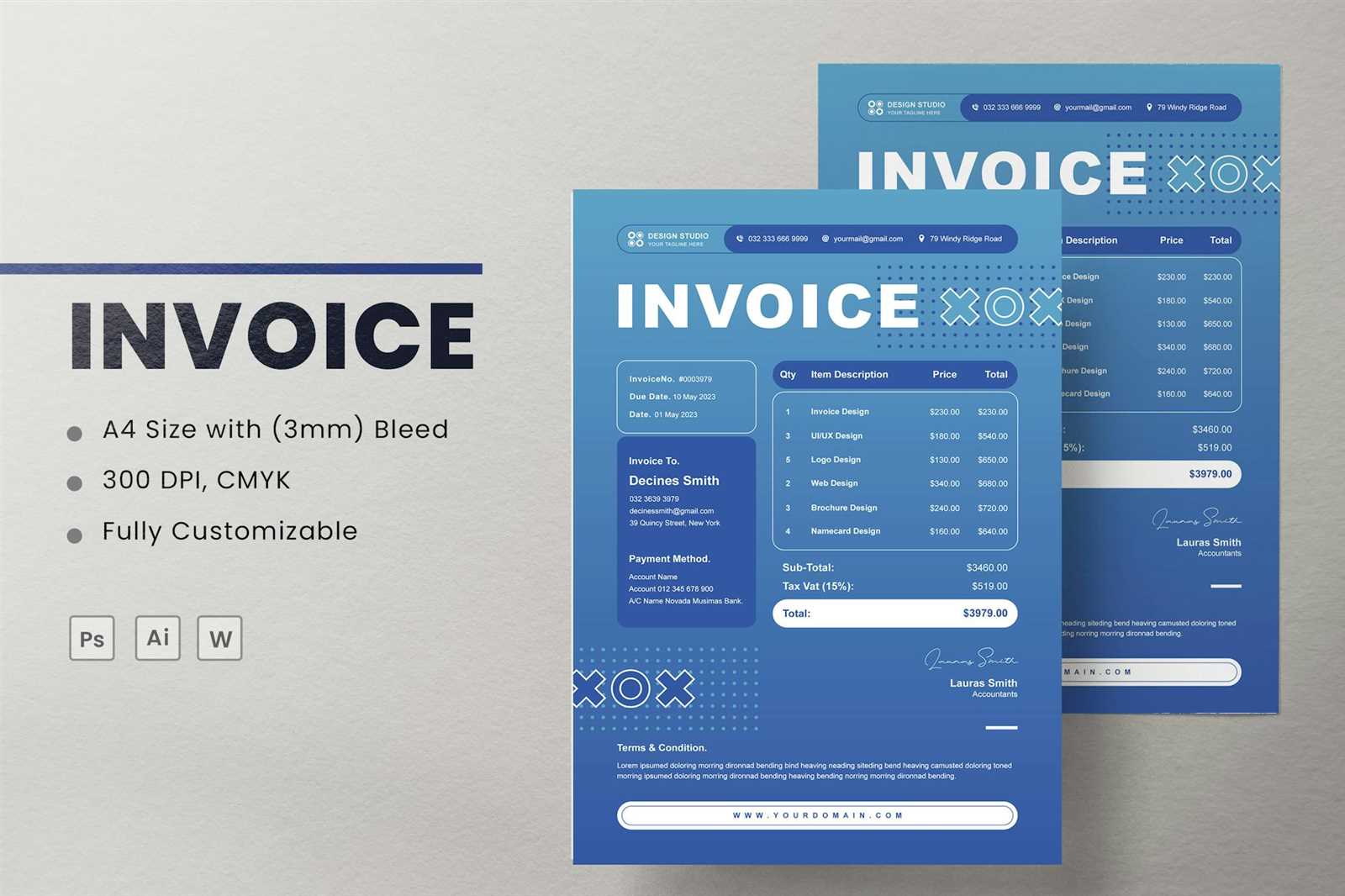

Modern Invoice Template for Effortless and Professional Billing

In today’s fast-paced business world, creating clear, professional documents for financial transactions is crucial. A well-structured bill not only ensures timely payments but also reflects the professionalism of a company. With the right tools, businesses can streamline their payment processes and reduce errors, leading to better cash flow management.

Customizable forms designed for quick creation and easy tracking of financial records are becoming increasingly popular. These tools offer flexibility and allow businesses to present detailed charges in an organized manner, improving client communication and satisfaction. Whether you’re a freelancer or managing a larger company, having an effective system in place can significantly impact your operations.

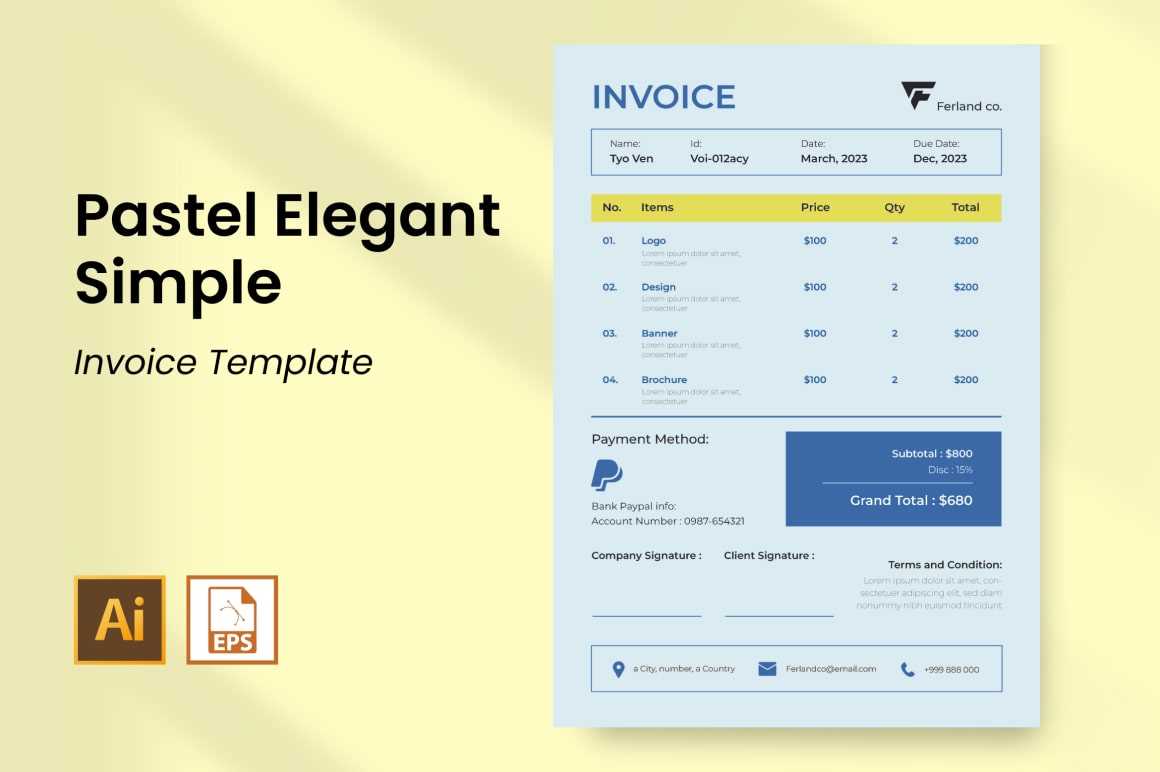

Adopting a user-friendly format that fits your brand and meets legal requirements can save both time and effort. From adding logos to adjusting fields for different services, the ability to tailor documents enhances efficiency. In the following sections, we will explore key considerations and options to help you find the perfect solution for your needs.

Modern Invoice Template: A Complete Guide

Creating clear and efficient billing documents is essential for any business, whether you’re a freelancer, a small enterprise, or a large corporation. The right structure not only ensures your clients understand what they are being charged for, but also promotes timely payments and minimizes confusion. This guide will walk you through the essential elements of a well-designed financial document and provide tips for creating one that works for your specific needs.

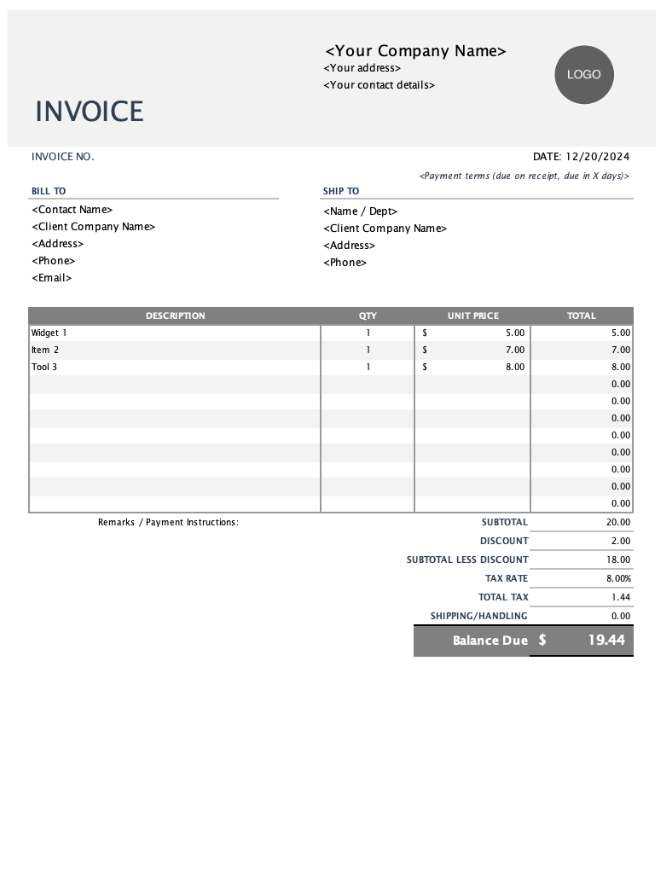

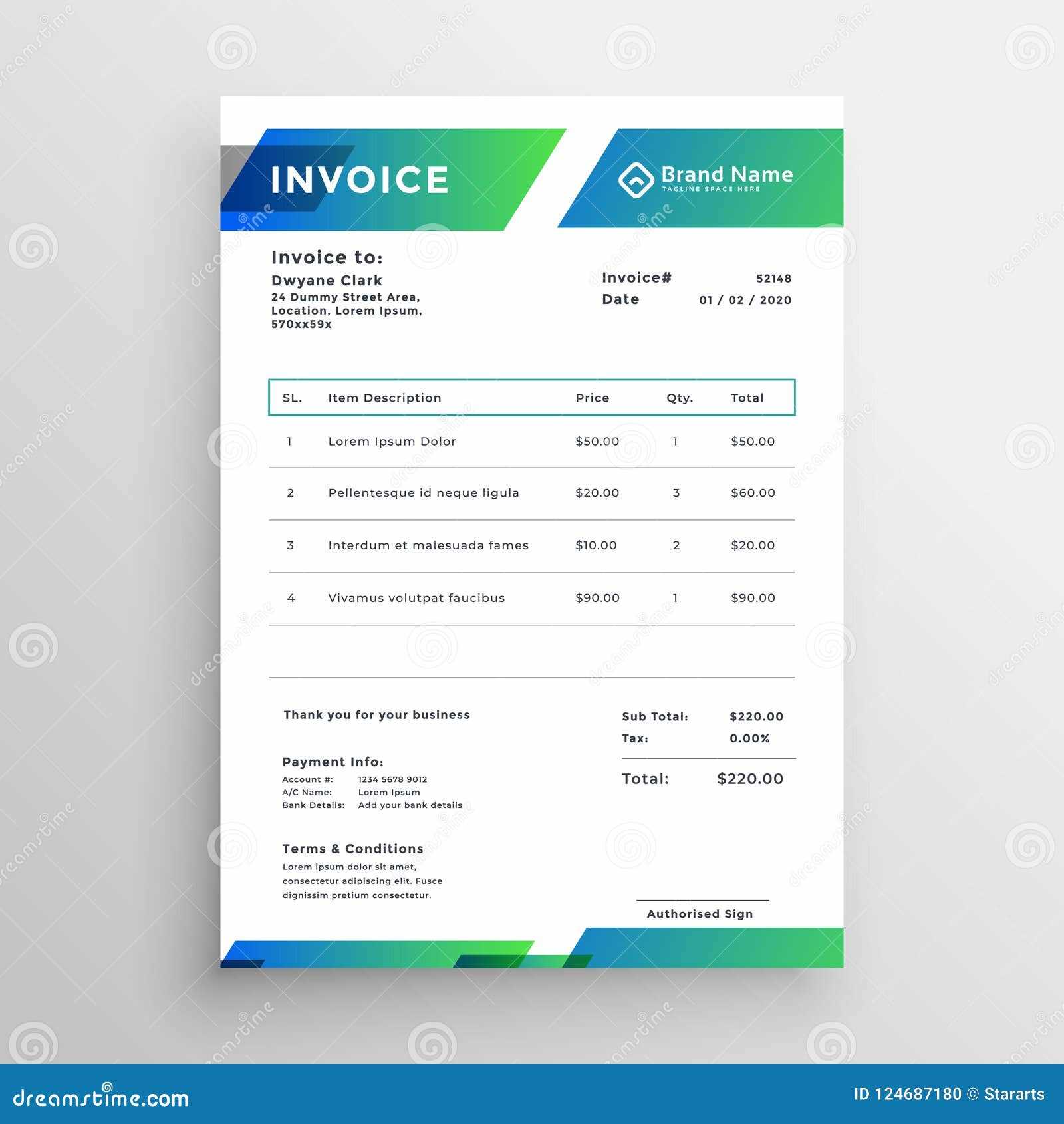

When designing a document for billing purposes, it’s crucial to include the necessary details while keeping the layout clean and professional. There are several key components that should be present, regardless of the complexity of the services provided. Below are the most important aspects to consider:

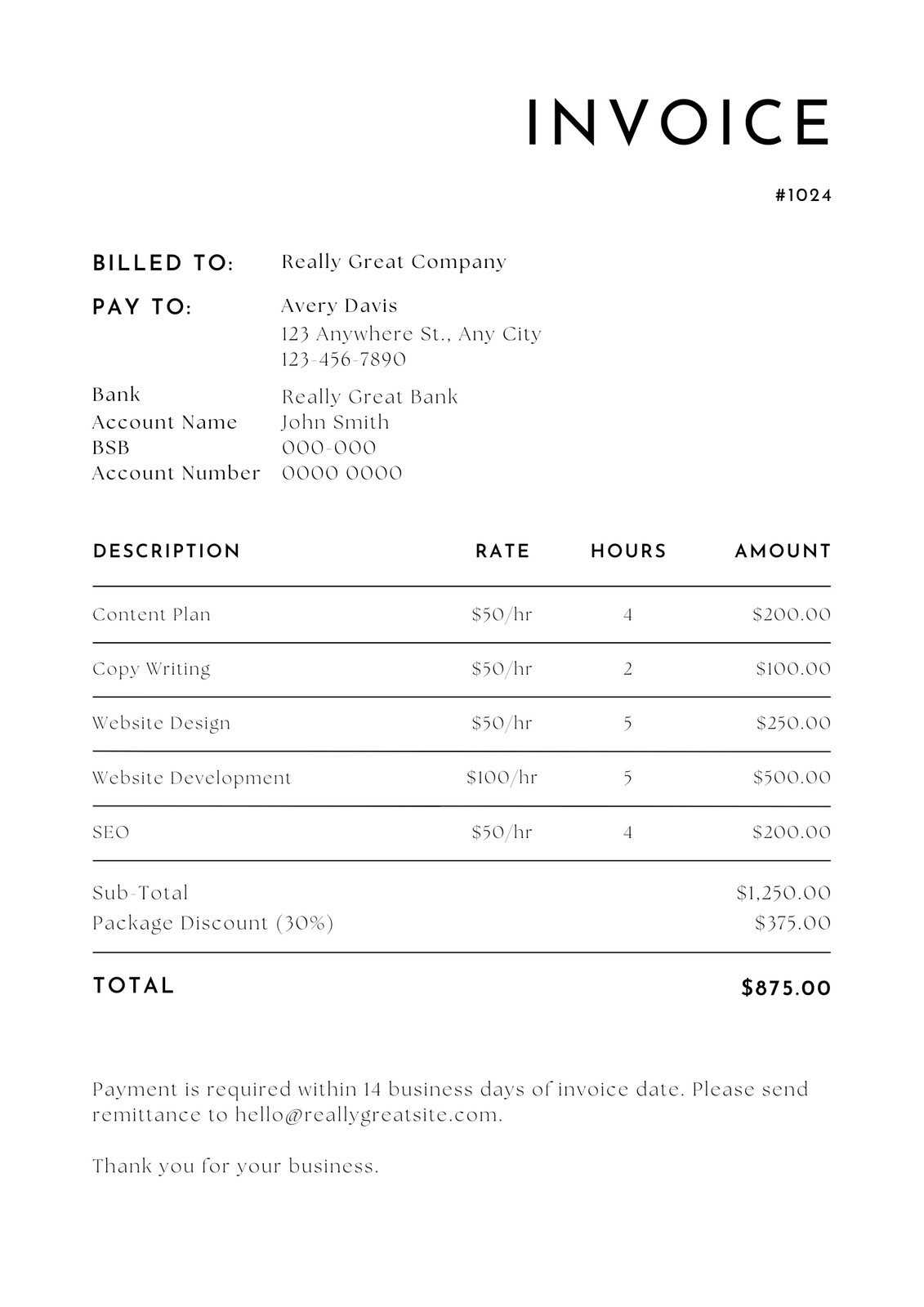

- Client Information: Clearly display your client’s name, address, and contact details. This ensures that both parties can easily refer to the document in case of any questions.

- Service Breakdown: Provide a detailed list of services or products provided, including quantities, rates, and any applicable discounts.

- Total Amount Due: Clearly state the total amount owed, ensuring all calculations are accurate and easy to follow.

- Payment Terms: Specify the due date and any penalties for late payment to encourage timely settlements.

- Payment Methods: Include clear instructions on how payments can be made, whether through bank transfer, credit card, or another method.

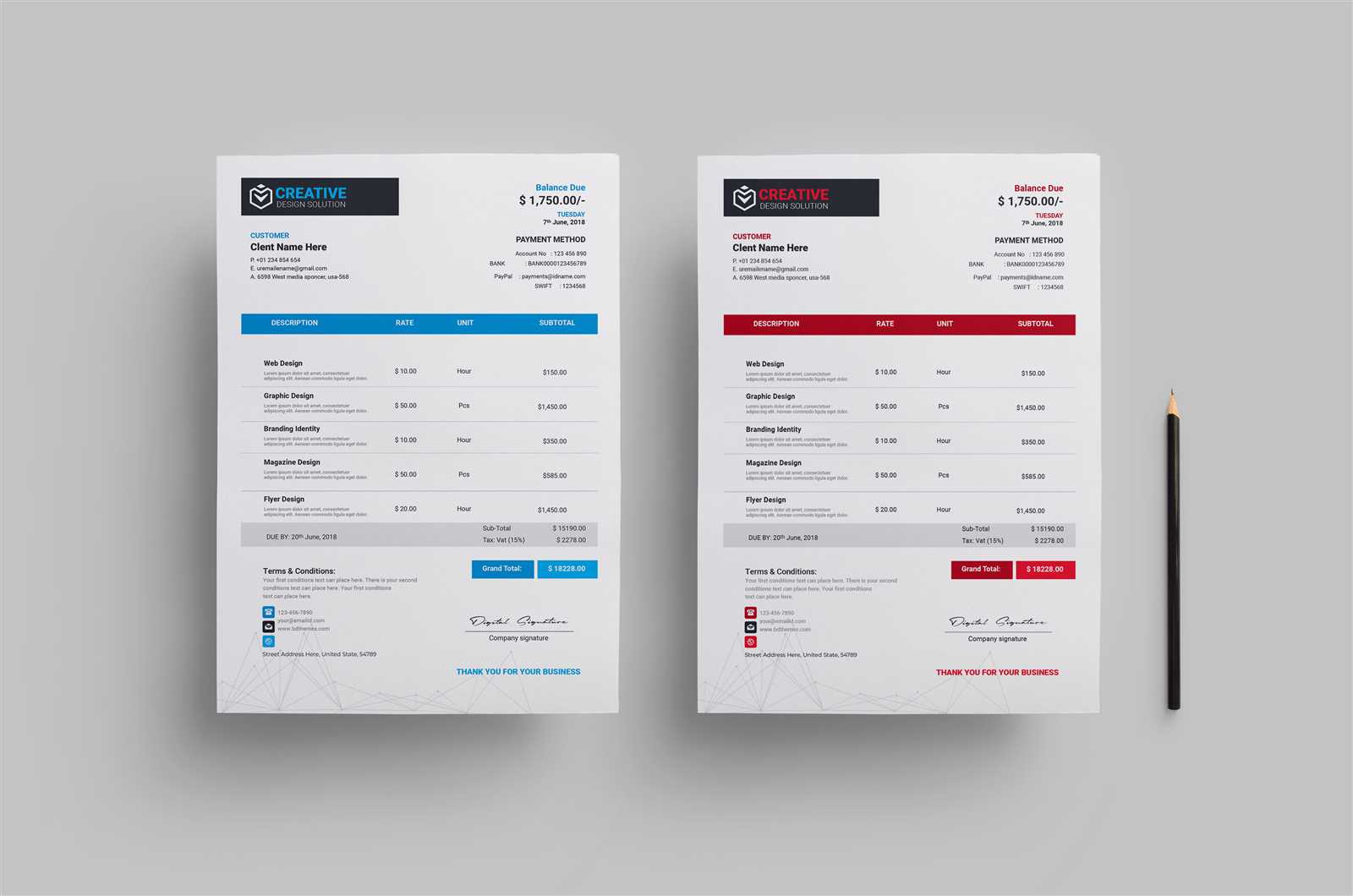

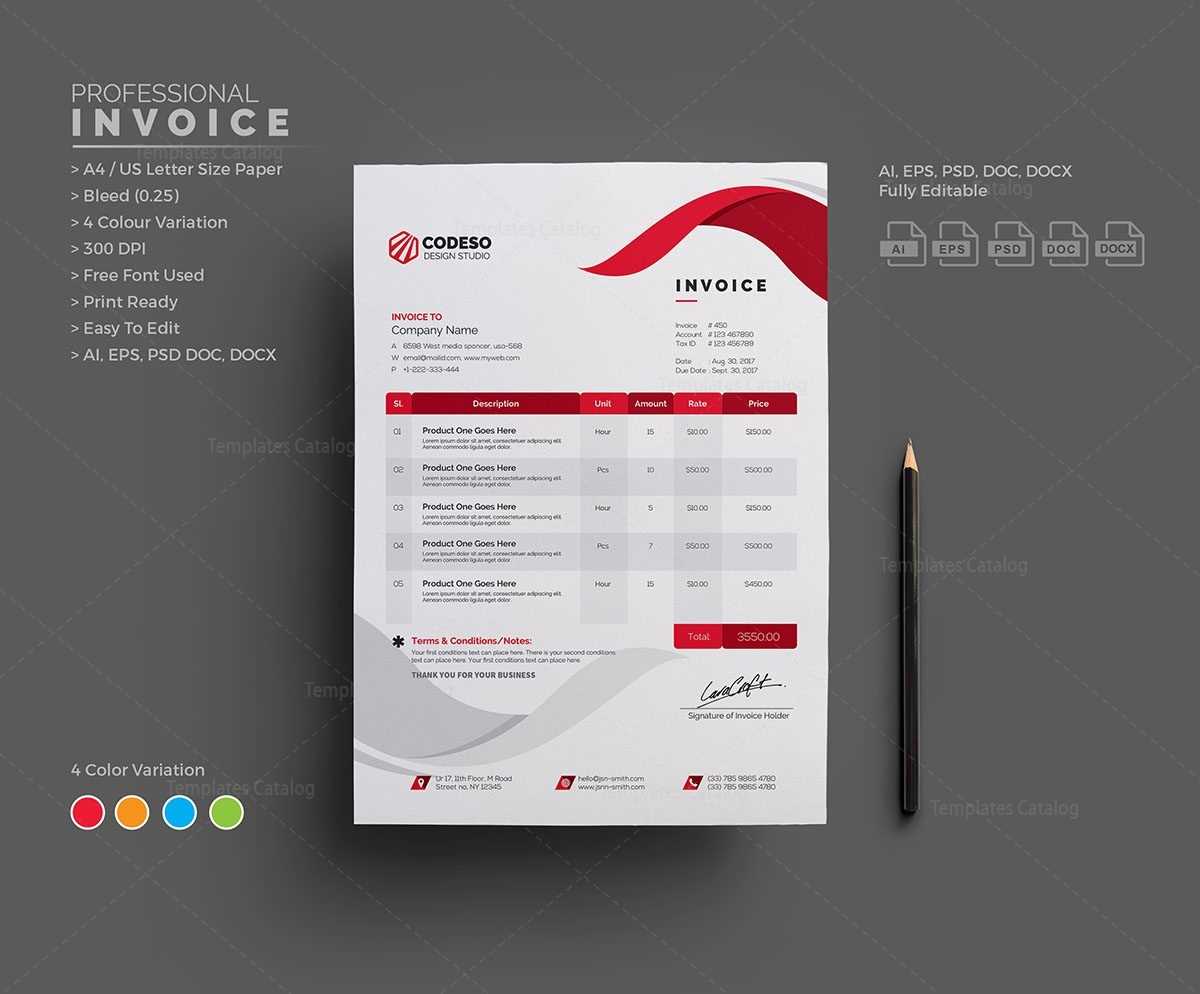

Once you’ve established the essential elements, consider the aesthetic presentation of your document. A professional design can help reinforce the credibility of your business. Some important tips for a polished look include:

- Use a consistent color scheme that reflects your brand identity.

- Incorporate your company logo to add a personal touch and enhance brand recognition.

- Choose a simple, legible font that’s easy to read on both desktop and mobile devices.

By following these guidelines, you can create billing documents that are not only functional but also aligned with your business’s image. A clean and professional appearance helps build trust with clients, making it easier for them to process payments promptly.

In the next sections, we will explore various tools and platforms that can assist you in designing and managing your documents, as well as discuss common pitfalls to avoid when using such tools.

Why Use a Modern Invoice Template

Having a well-organized and clear billing document is critical for any business. A streamlined and professional approach to billing not only helps in reducing mistakes but also ensures that transactions are understood by both the business and the client. Using a structured format designed to highlight all necessary details improves accuracy and minimizes confusion, contributing to smoother financial operations.

One of the key benefits of utilizing an efficient billing solution is the significant time savings. Manual creation of financial documents can be tedious and error-prone. By adopting an optimized layout, businesses can quickly generate documents with accurate information, leaving more time for focusing on core business activities. Below are some specific reasons why businesses should opt for a structured approach to billing:

Time Efficiency and Consistency

Automating the creation of financial records with a pre-designed layout reduces the amount of time spent on each individual document. This ensures a consistent format across all your communications, which can help improve your professional image. Templates often include placeholders for client and service details, making it easy to fill in relevant information without having to manually adjust the structure every time.

Improved Professionalism and Accuracy

Using a well-constructed billing solution ensures that every document is presented clearly and uniformly. Accuracy is paramount when handling financial matters, and a carefully designed structure minimizes the risk of mistakes, such as incorrect calculations or missing information. By including all essential fields–like payment terms, amounts, and contact information–these solutions enhance the credibility of your business.

In addition to the practical benefits, a polished and uniform design helps establish your brand identity. Whether you are a freelancer or managing a larger team, maintaining a professional appearance in your financial communications leaves a lasting impression on clients and builds trust.

Key Features of an Ideal Invoice

A well-designed billing document is essential for maintaining clear communication and ensuring that payments are made on time. It should not only present essential information but also be structured in a way that is easy to read and understand. There are several key elements that contribute to the effectiveness of such documents, making them both practical and professional.

To ensure clarity and accuracy, the following components should always be included:

- Contact Information: Clearly display both your business details and the client’s contact information. This should include names, addresses, phone numbers, and email addresses to avoid any confusion in communication.

- Unique Reference Number: Assign a unique number to each document for easy tracking and future reference. This is especially helpful when managing multiple clients and transactions.

- Detailed List of Charges: Provide a breakdown of products or services provided, along with individual prices, quantities, and applicable taxes. This transparency helps clients understand exactly what they are paying for.

- Total Amount Due: Ensure that the total amount is clearly highlighted at the end of the document. This makes it easy for the client to quickly identify the payment required.

- Payment Terms: Specify due dates, payment methods, and any penalties for late payments. Clear payment terms help set expectations and reduce payment delays.

- Company Branding: Include your business logo and consistent branding elements to enhance professionalism and reinforce your identity.

- Legal Information: Make sure to include any necessary legal disclaimers or tax identification numbers required by law in your country or industry.

These essential elements, when properly combined, ensure that your billing documents serve their purpose–facilitating smooth financial transactions while enhancing the professionalism of your business. Each of these features plays a critical role in reducing misunderstandings and promoting timely payments.

Benefits of Customizable Invoice Templates

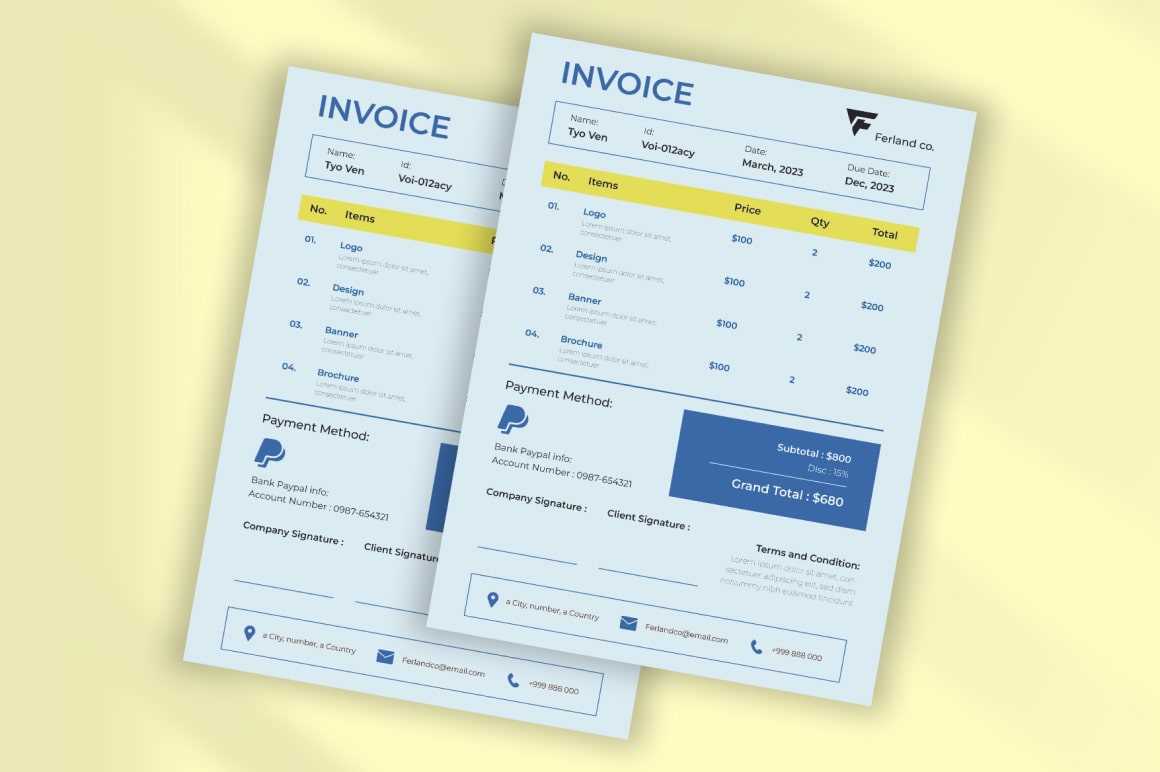

The ability to adjust and personalize billing documents can significantly improve efficiency and professionalism. Customizable forms allow businesses to create a unique look while ensuring all necessary information is included. This flexibility not only saves time but also helps tailor the document to the specific needs of different clients or projects.

Here are some key advantages of using adaptable billing solutions:

Enhanced Professionalism and Branding

One of the most significant benefits of a customizable approach is the ability to integrate your company’s branding. By adding your logo, choosing specific colors, and maintaining consistent fonts, you create a cohesive image across all client communications. This helps strengthen your brand’s identity and leaves a positive impression on clients.

Increased Flexibility and Efficiency

Customizable forms can be easily modified to accommodate varying types of transactions, whether for one-time services or ongoing contracts. This flexibility reduces the time spent on document creation, as you don’t need to start from scratch with each new client or project. A pre-set structure allows for quick updates and ensures that all required fields are completed correctly.

Some other benefits include:

- Adaptability: Customize fields to suit different types of products, services, or pricing models.

- Easy Integration: Many customizable forms can be linked with accounting or project management software, streamlining the entire billing process.

- Clear Communication: Tailor the document to highlight the most relevant details for your client, improving clarity and reducing the likelihood of misunderstandings.

- Time-Saving: Templates with pre-set fields and formats save time by eliminating the need to re-enter the same details repeatedly.

Overall, the ability to customize your billing documents adds both convenience and professionalism, helping to ensure that transactions run smoothly while strengthening your client relationships.

How to Choose the Right Invoice Design

Selecting the right layout for your billing document is crucial for both functionality and professionalism. The design should reflect your business’s identity while ensuring the document is clear, easy to navigate, and contains all necessary information. A well-chosen format helps avoid confusion, accelerates payment processing, and strengthens your brand image.

When deciding on the best design for your billing records, there are several factors to consider. The right approach depends on the nature of your business, the preferences of your clients, and the complexity of the transactions. Here are a few key considerations when selecting the right layout:

Clarity and Simplicity

Make sure that the design is clean and easy to read. A cluttered layout can make it difficult for clients to quickly understand the amounts due or the services provided. Focus on creating a balanced structure where each section is clearly defined and information is presented logically.

Customization and Branding

Choose a layout that can be tailored to suit your brand. This includes incorporating your logo, brand colors, and fonts to create a cohesive look across all documents. A design that reflects your brand helps reinforce your identity and gives your business a polished, professional appearance.

Here are some additional factors to consider when choosing the right format:

- Use of Space: Ensure that the layout utilizes space effectively without overcrowding any section. Adequate spacing between text and sections makes the document easier to read and visually appealing.

- Predefined Fields: Look for designs that offer clearly marked fields for client information, service descriptions, and payment details. This ensures that you can quickly enter the relevant data without confusion.

- Flexibility for Multiple Transactions: Choose a format that can be adapted to both one-time services and recurring contracts. A flexible layout saves time and effort when dealing with different types of billing scenarios.

- Mobile-Friendly: Make sure that the design works well across various devices, particularly mobile phones. Many clients may view documents on their phones, so it’s essential that your layout is responsive and legible on smaller screens.

By taking these considerations into account, you can choose a design that not only meets your needs but also enhances your professionalism and client relationships. The right format can make all the difference in ensuring timely payments and fostering trust with your clients.

Top Tools for Creating Invoices

Creating professional and accurate billing documents doesn’t have to be time-consuming or complex. There are various tools available that simplify the process, allowing businesses to generate well-structured and error-free documents with ease. Whether you’re looking for a simple solution or a more advanced platform with additional features, the right tool can help streamline your financial operations and improve overall efficiency.

Below are some of the most popular tools used for creating billing documents, each catering to different business needs and preferences:

1. QuickBooks

QuickBooks is one of the most widely used platforms for accounting and billing. It offers customizable forms and integrates with various payment processors. With QuickBooks, you can create professional documents, track payments, and manage your financial records in one place. It’s ideal for businesses that need a full-fledged accounting solution alongside document creation.

2. FreshBooks

FreshBooks is known for its user-friendly interface and simplicity. It allows you to create and send professional documents quickly while also offering tracking features to monitor payments. FreshBooks is particularly useful for freelancers and small businesses, providing easy customization and automatic reminders for overdue payments.

Other popular tools for document creation include:

- Wave: A free solution that offers essential features for creating and sending billing documents. Ideal for startups and small businesses on a budget.

- Zoho Invoice: Provides customizable forms with multiple templates and integration with Zoho’s suite of apps, making it a good choice for businesses already using Zoho products.

- Invoice Ninja: A robust platform with both free and paid options, offering time tracking, project management, and client management features alongside document creation.

These tools not only help in creating clear, professional billing documents but also automate tasks such as reminders and payment tracking. Selecting the right tool depends on your business’s size, needs, and budget, but any of these platforms can significantly improve your billing process.

Best Practices for Professional Invoicing

Creating well-structured and clear billing documents is essential for maintaining professional relationships with clients. A properly designed record not only ensures accurate payments but also reflects positively on your business. By following certain best practices, you can avoid common pitfalls and enhance both the clarity and efficiency of your financial communication.

Clear and Concise Information

The most important aspect of any billing document is clarity. Ensure that all relevant information is presented in an easily understandable manner. Avoid clutter and ensure that each section is well-organized so the client can quickly identify the necessary details, such as the amount due and the services provided. Below is an example of the key sections that should be included in every document:

| Section | Details |

|---|---|

| Client Information | Full name, address, phone number, and email address |

| Service Breakdown | Detailed description of each service or product, including prices and quantities |

| Amount Due | The total payment required, clearly highlighted |

| Payment Terms | Due date, payment methods, and penalties for late payment |

Timely and Consistent Follow-ups

Sending reminders before the due date and following up after it has passed ensures that payments are received on time. Set clear expectations for payment deadlines and automate reminders to avoid delays. Consistency in communication is key to maintaining professionalism and ensuring that your clients prioritize your documents.

By adhering to these best practices, businesses can improve their billing processes, reduce errors, and foster better relationships with their clients. The goal is to create a smooth, efficient transaction process that reflects the professionalism of your company.

How to Personalize Your Invoice Template

Personalizing your billing documents is a great way to enhance your business’s professionalism and strengthen your relationship with clients. By tailoring the design and content to reflect your brand and the specific needs of each client, you can create a more memorable and effective communication tool. Customization allows you to stand out, provide clarity, and make your documents more engaging.

Here are some key ways to personalize your billing documents:

- Incorporate Your Brand Identity: Add your company logo, use your brand’s colors, and choose fonts that match your website and marketing materials. This helps maintain a consistent visual identity across all client communications.

- Client-Specific Details: Include personalized messages or notes to clients, such as a thank-you message or details about the services you’ve provided. This adds a personal touch and can foster stronger client relationships.

- Custom Payment Terms: Adjust the payment terms based on the type of client or project. For example, long-term clients might receive more flexible payment options, while one-time projects may have stricter deadlines.

- Custom Fields: Add specific fields that are relevant to your business and services. For example, if you provide consulting services, you may want to include sections for consulting hours or project milestones.

Personalizing your billing documents ensures that they are not only functional but also aligned with your business values. Custom details such as a tailored message or specific payment terms can leave a positive impression, encouraging timely payments and repeat business.

Integrating Your Invoice Template with Accounting Software

Linking your billing documents with accounting software can greatly improve efficiency and accuracy in your financial management. Automation of key processes such as data entry, tracking payments, and generating reports helps reduce human error and saves valuable time. By integrating your billing solution with an accounting platform, you can streamline your workflow, ensure consistency, and keep all your financial information in one place.

Benefits of Integration

Integrating your billing system with accounting software offers a number of advantages that can improve both day-to-day operations and long-term financial tracking:

- Time Savings: Automate repetitive tasks, such as entering payment details or calculating taxes, to avoid manual work and reduce the chance of errors.

- Consistency: Keep all your financial data synchronized across platforms, ensuring that you always have up-to-date information about income, expenses, and payments.

- Improved Accuracy: Integration minimizes data entry errors by automatically populating billing details into your accounting system, providing more accurate records for tax filing and financial analysis.

- Efficient Reporting: With integrated systems, you can easily generate detailed financial reports that include information from both your billing and accounting data.

Popular Tools for Integration

There are several accounting platforms that allow for seamless integration with customizable billing solutions. Some of the most popular tools include:

- QuickBooks: Offers integration with many billing solutions, allowing businesses to automatically import transaction data and track payments efficiently.

- FreshBooks: Known for its user-friendly interface, FreshBooks can connect with various accounting software to provide an all-in-one solution for invoicing and financial management.

- Xero: Xero’s accounting software integrates with multiple invoicing tools, providing a streamlined way to manage finances, from creating bills to reconciling payments.

- Wave: A free tool that integrates both billing and accounting functionalities, perfect for small businesses and startups.

By integrating your billing documents with accounting software, you can simplify the entire financial process, ensuring greater accuracy, faster invoicing, and more efficient reporting. This connection between systems enables businesses to focus more on growth and client relations while maintaining smooth financial operations.

Common Mistakes in Invoice Creation

Creating accurate and clear billing documents is crucial for maintaining professional relationships and ensuring timely payments. However, many businesses make common errors when preparing these documents, leading to confusion, delayed payments, and even lost revenue. Identifying and addressing these mistakes can help streamline your billing process and ensure that you get paid on time without complications.

1. Missing Essential Information

One of the most frequent mistakes is omitting key details that are necessary for the client to process the payment efficiently. Essential information includes:

- Contact Details: Both your business’s and the client’s full contact information should be clearly visible.

- Clear Payment Terms: Including the payment due date, accepted payment methods, and any late payment penalties ensures that clients are fully informed.

- Unique Reference Number: Every billing document should have a unique number for tracking and record-keeping purposes.

2. Incorrect Calculations or Data

Simple arithmetic mistakes can undermine your professionalism and lead to disputes or delays in payment. Ensure that:

- Tax Calculations are correct based on local tax rates and business type.

- Quantities and Prices are accurate and match the services or products delivered.

- Totals are calculated correctly, including discounts, taxes, and any additional charges.

Double-checking your numbers and using automated systems can help reduce these errors.

3. Lack of Consistency in Format

Inconsistent formatting can confuse clients and make your documents appear unprofessional. Stick to a consistent layout, including:

- Font Style and Size: Use a readable font and ensure that the text is clear and legible.

- Section Organization: Keep sections like service descriptions, payment details, and totals well-structured and easy to navigate.

- Branding: Maintain consistent use of your company logo, color scheme, and other brand elements across all billing documents.

By addressing these common mistakes, you can ensure that your billing documents are clear, professional, and accurate, improving both client trust and timely payments.

How to Automate Your Invoices

Automating your billing process can save you valuable time, reduce human error, and improve your cash flow. By setting up automated systems to handle routine tasks such as creating, sending, and tracking billing documents, you can focus on growing your business while ensuring timely payments. Automation helps streamline financial operations, making the entire process more efficient and less prone to mistakes.

Benefits of Automating Billing

Implementing automation in your billing process offers several key advantages:

- Time Efficiency: Automated systems generate and send documents instantly, freeing up your time for other important tasks.

- Reduced Errors: Automation eliminates manual entry, minimizing the risk of calculation mistakes and missing information.

- Improved Cash Flow: Timely and consistent billing means you’re more likely to receive payments on schedule.

- Consistency: Automated processes ensure your billing format, terms, and details remain consistent across all transactions.

Steps to Automate Your Billing Process

Follow these steps to implement automation in your billing system:

| Step | Action |

|---|---|

| 1. Choose the Right Tool | Select a platform that integrates with your existing accounting system and offers automated billing features. |

| 2. Set Up Templates | Create reusable document templates that include all necessary fields like client information, pricing, and terms. |

| 3. Customize Payment Terms | Set up recurring billing schedules, including automatic payment reminders and overdue notices. |

| 4. Integrate with Payment Processors | Link your billing system with payment gateways to allow for seamless, automatic transactions. |

| 5. Monitor and Adjust | Regularly review your automated system to ensure it’s running smoothly and make adjustments as needed. |

By automating your billing documents, you’ll create a more efficient process that reduces administrative workload and improves your overall business operations. With the right tools in place, invoicing becomes a seamless and hassle-free part of your financial workflow.

Invoicing for Small Businesses

For small businesses, having an efficient and professional billing process is essential for maintaining cash flow and managing financial operations. Whether you’re a freelancer, contractor, or a growing small enterprise, sending clear and accurate payment requests is critical for ensuring that you get paid on time and build trust with your clients. A well-organized system not only improves client relationships but also simplifies accounting and tax preparation.

Key Considerations for Small Business Billing

When setting up your billing system, there are several important factors to keep in mind:

- Clarity and Detail: Always ensure that your billing documents contain clear descriptions of the services provided, including quantities, rates, and any applicable taxes or discounts. This transparency prevents confusion and potential disputes.

- Timely Delivery: Send billing documents promptly after the work is completed. This sets clear expectations and encourages timely payments. Delayed billing can often result in delayed payments.

- Professional Appearance: The format of your billing documents should look professional and align with your brand. This helps reinforce your business’s image and can leave a lasting impression on clients.

Simple Tools for Efficient Billing

There are several tools designed specifically for small businesses to streamline the process of creating and managing payment requests:

- Free Billing Software: Tools like Wave and PayPal allow small businesses to create and send simple, professional billing documents without a fee.

- Accounting Integration: Platforms like FreshBooks and QuickBooks integrate with accounting software, helping small businesses automatically track payments and manage finances.

- Recurring Billing Options: For businesses with repeat clients, automated billing solutions can handle recurring payments and generate monthly or quarterly billing cycles without manual input.

Adopting these tools and best practices will allow small business owners to focus on growth and client acquisition, knowing their financial processes are in order. By simplifying the billing process, you ensure smoother cash flow and reduce administrative burdens.

Legal Requirements for Invoice Templates

When creating billing documents, it’s crucial to ensure that they meet the legal requirements set by tax authorities and business regulations in your jurisdiction. Complying with these regulations not only helps you avoid penalties but also ensures transparency and professionalism in your financial dealings. Different countries have specific rules about what needs to be included in a billing document to make it legally valid.

Essential Legal Elements

Regardless of location, there are key pieces of information that should always appear in your billing documents to comply with legal standards:

- Business Identification: Include your full business name, address, and contact details, along with your business registration number if applicable.

- Client Information: Clearly state the client’s name and address to ensure the document is properly linked to the correct party.

- Unique Identification Number: Each billing document should have a unique reference number for tracking and auditing purposes.

- Tax Details: Include the applicable tax rates, tax identification number, and the total tax amount on the bill, as required by local regulations.

- Clear Breakdown of Charges: List each product or service provided with clear descriptions, quantities, unit prices, and the total amount due.

- Payment Terms: Specify the due date for payment, available payment methods, and any late fees or discounts for early payments.

Jurisdiction-Specific Considerations

The legal requirements for billing documents can vary significantly depending on the country or region. Here are some specific considerations for certain jurisdictions:

- European Union: In many EU countries, you must include both the buyer’s and seller’s VAT (Value Added Tax) registration numbers for tax reporting purposes.

- United States: While the U.S. does not require specific invoicing rules for most businesses, some states may require certain industries (like construction or real estate) to include additional information, such as work descriptions or licenses.

- Australia: Businesses in Australia are required to include an Australian Business Number (ABN) and comply with GST (Goods and Services Tax) reporting in their billing documents if registered for GST.

- United Kingdom: UK businesses must include their VAT number (if applicable) and follow specific rules for VAT-invoicing, ensuring that the tax is calculated correctly.

Staying informed of these legal requirements is essential to ensure compliance and avoid potential fines or disputes. By including all necessary information and understanding the laws governing your billing process, you can keep your business running smoothly and maintain professional relationships with clients.

How to Handle Invoice Disputes

Disputes over payment requests are not uncommon in business, and when they arise, it’s important to address them professionally and efficiently. A dispute could occur for various reasons, such as errors in the amount billed, disagreements over the terms, or dissatisfaction with the goods or services provided. Handling these situations with clarity and fairness not only resolves the issue but also helps maintain a positive relationship with your client.

1. Stay Calm and Professional

When a dispute arises, the first step is to remain calm and avoid reacting impulsively. It’s essential to approach the situation with professionalism and an open mind. Consider the following actions:

- Listen Carefully: Allow the client to explain their concerns fully without interruption. Understanding the root cause of the issue will help you find a fair resolution.

- Acknowledge the Issue: Acknowledge the client’s perspective and express a willingness to resolve the matter amicably. This shows that you value the relationship and are committed to finding a solution.

- Keep Communication Clear: Use clear and concise language when discussing the dispute. Avoid jargon or complicated explanations that may confuse the situation further.

2. Review the Details

Before taking further steps, review the billing document and relevant details thoroughly. This includes:

- Check for Errors: Ensure that all the information on the payment request is correct. This includes the amounts, services or products listed, and any applicable taxes or discounts.

- Review the Agreement: Go over the terms agreed upon with the client to ensure that everything was delivered as promised. If there are discrepancies, identify where the issue may have arisen.

- Verify Payment Records: Confirm whether a payment was already made or if there’s a delay in processing on the client’s end.

3. Resolve the Dispute

Once you’ve reviewed all the details and identified the source of the issue, you can propose a solution. Here are a few steps to take:

- Adjust the Amount: If there was an error on your part, such as an overcharge or miscalculation, offer to issue a corrected document with the appropriate changes.

- Clarify Terms: If the issue stems from a misunderstanding of the payment terms, provide a clear explanation and be willing to negotiate terms that are acceptable to both parties.

- Offer Compromise: If the dispute is over dissatisfaction with the services or products provided, consider offering a partial refund, credit, or additional services to settle the matter.

Document any agreements or changes made to ensure both parties are on the sam

Creating a Consistent Invoice Branding

Establishing a consistent and professional brand identity in your payment documents is essential for building trust and reinforcing your business’s image. When clients receive well-designed, cohesive billing materials, it not only enhances their perception of your business but also strengthens your overall branding. A consistent approach helps ensure that your documents align with your company’s visual identity and leave a lasting impression.

Key Elements of Consistent Branding

To create a strong, recognizable look for your billing documents, consider incorporating the following elements:

- Logo: Place your company logo prominently at the top of the document. It’s a clear reminder of your business and helps clients easily identify your materials.

- Brand Colors: Use your brand’s colors consistently throughout the document. This includes the header, footer, and any other elements like borders or icons. Consistency in color helps establish a professional and cohesive visual style.

- Typography: Choose one or two fonts that reflect your brand’s personality and use them throughout your documents. Avoid using too many different fonts to maintain a clean, professional look.

- Company Tagline or Mission: Including a brief tagline or statement that encapsulates your business values can add a personal touch while reinforcing your brand messaging.

Benefits of a Consistent Design Approach

Using a consistent design across all your billing materials offers several benefits:

- Professional Appearance: Well-designed documents convey a sense of professionalism and attention to detail, making your business appear more credible.

- Brand Recognition: Clients will more easily recognize your business when your design elements are consistent across various touchpoints, whether it’s your website, emails, or physical materials.

- Customer Confidence: When customers receive clear, consistent, and professional billing documents, it builds confidence in your business practices, reducing the likelihood of confusion or disputes.

- Ease of Navigation: A uniform design ensures that your clients can easily locate key information, such as payment due dates, amounts owed, and terms.

Consistency in your billing documents is more than just an aesthetic choice – it’s a crucial part of your business’s identity and professionalism. By maintaining a cohesive brand appearance, you can create stronger relationships with your clients and present your business in the best possible light.

Staying Organized with Digital Invoices

In today’s fast-paced business environment, maintaining an organized system for managing payment requests is crucial. Digital documents offer a practical way to streamline your workflow, reduce paper clutter, and ensure that all billing information is easily accessible. By adopting a digital approach, you can stay on top of payments, improve efficiency, and reduce the risk of errors, making it easier to track and manage your business finances.

Benefits of Digital Billing

Utilizing digital billing systems offers several advantages over traditional paper-based methods:

- Easy Storage and Retrieval: Digital records can be stored on your computer or in the cloud, making it easy to search, organize, and retrieve documents at any time, without the need to sift through piles of paperwork.

- Faster Processing: Sending digital billing documents eliminates the need for printing, mailing, and waiting for physical delivery, speeding up the process for both you and your clients.

- Reduced Risk of Errors: Digital documents can be easily edited and corrected, reducing the likelihood of mistakes that might occur when filling out paper forms manually.

- Improved Security: Digital files can be encrypted and password-protected, providing an extra layer of security compared to paper records, which can be lost, damaged, or stolen.

Best Practices for Organizing Digital Payment Requests

To make the most of your digital billing system, consider these best practices for staying organized:

- Use Cloud Storage: Store all your digital files in a secure cloud-based storage service. This ensures that your documents are backed up and can be accessed from any device at any time.

- Label Files Clearly: When saving your documents, use a consistent and descriptive naming convention, such as “ClientName_InvoiceNumber_Date.” This will make it easy to find specific records when needed.

- Organize by Categories: Create folders to sort your documents by client, month, or year. This will allow you to quickly retrieve any necessary information when reviewing past billing documents.

- Automate Payment Tracking: Use accounting software or digital tools that automatically track payments, send reminders, and update your records when invoices are paid. This helps keep everything in one place without manual input.

- Regular Backups: Ensure that your digital files are regularly backed up to avoid the risk of losing important documents in case of a technical issue.

By incorporating these practices into your digital billing routine, you can maintain a more organized and efficient system that saves time and reduces stress. Digital records not only help you stay on top of payments, but they also allow you to better manage your business finances and improve overall operational efficiency.