How to Create an Effective Invoice Template for Modeling

Designing a professional and efficient document for tracking transactions is a crucial aspect of managing financial interactions. By customizing these documents, businesses can ensure clarity and consistency, which improves communication with clients and simplifies record-keeping. An organized approach helps avoid errors and ensures that important details are not overlooked.

With the right structure, these documents can be tailored to suit specific needs, whether it’s for a small business or a large corporation. Incorporating key elements such as payment terms, contact information, and clear breakdowns of charges makes them easier to understand and process. Having a flexible, yet standardized format is essential for streamlining financial tasks and ensuring smooth operations.

Choosing the right approach for designing these financial records is essential. From selecting a design program to ensuring legal compliance, the process involves understanding what details are most important and how to present them in the most effective way. The right design not only promotes professionalism but also enhances the efficiency of your financial workflows.

Creating a Professional Billing Document

Designing a well-organized financial document is a key element for any business that wants to streamline its transactions. By crafting a clear and structured record, businesses can ensure that all necessary details are communicated effectively to clients. This document not only serves as a tool for payment tracking but also enhances the professionalism of your business operations.

To create a document that works for your business, it’s important to focus on several factors, including clarity, consistency, and adaptability. Each section should be tailored to meet your specific needs, whether it’s for a one-time transaction or a recurring agreement. A well-crafted format reduces confusion and prevents errors, making financial processes smoother and more efficient.

Key Elements to Include

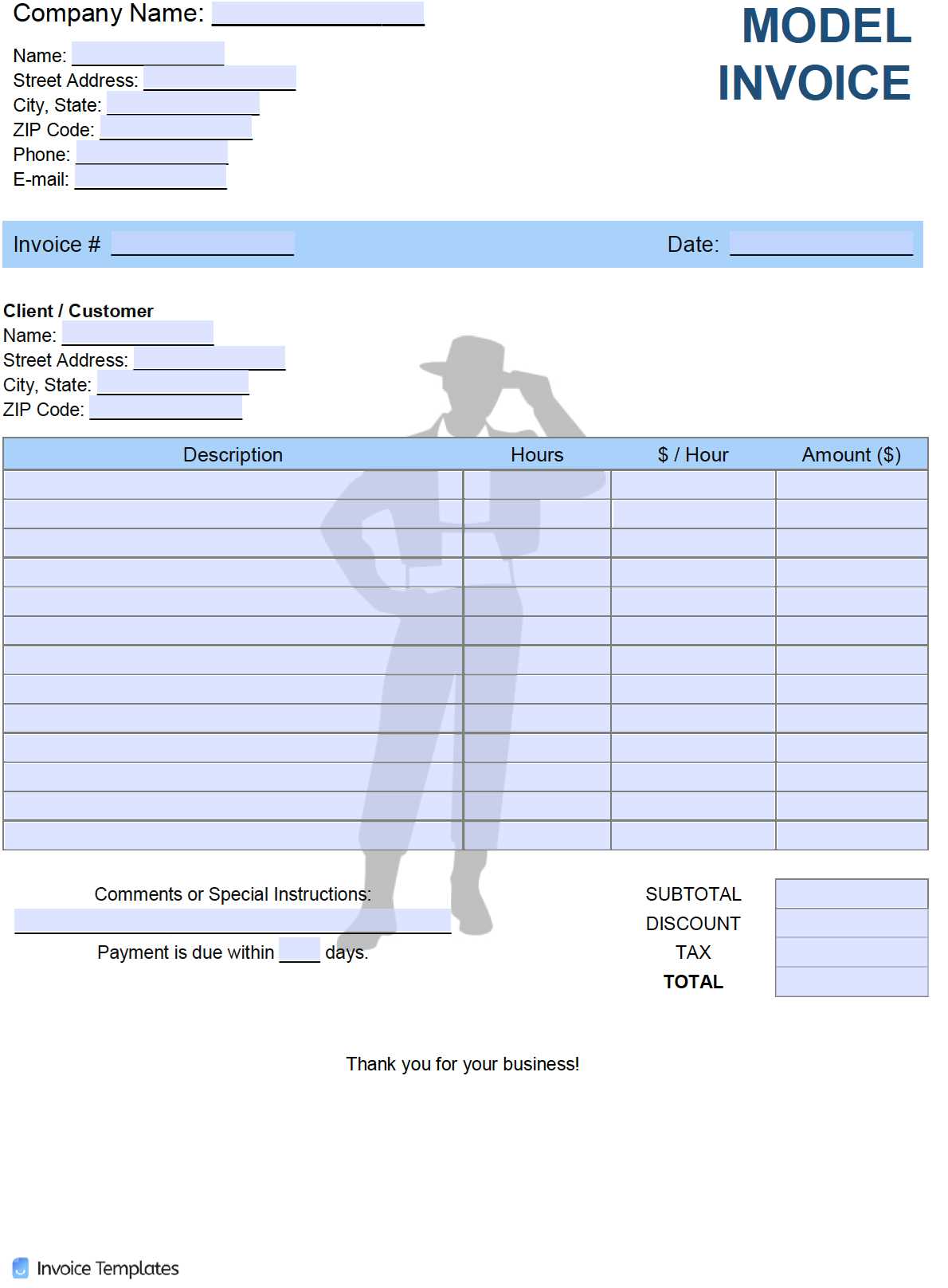

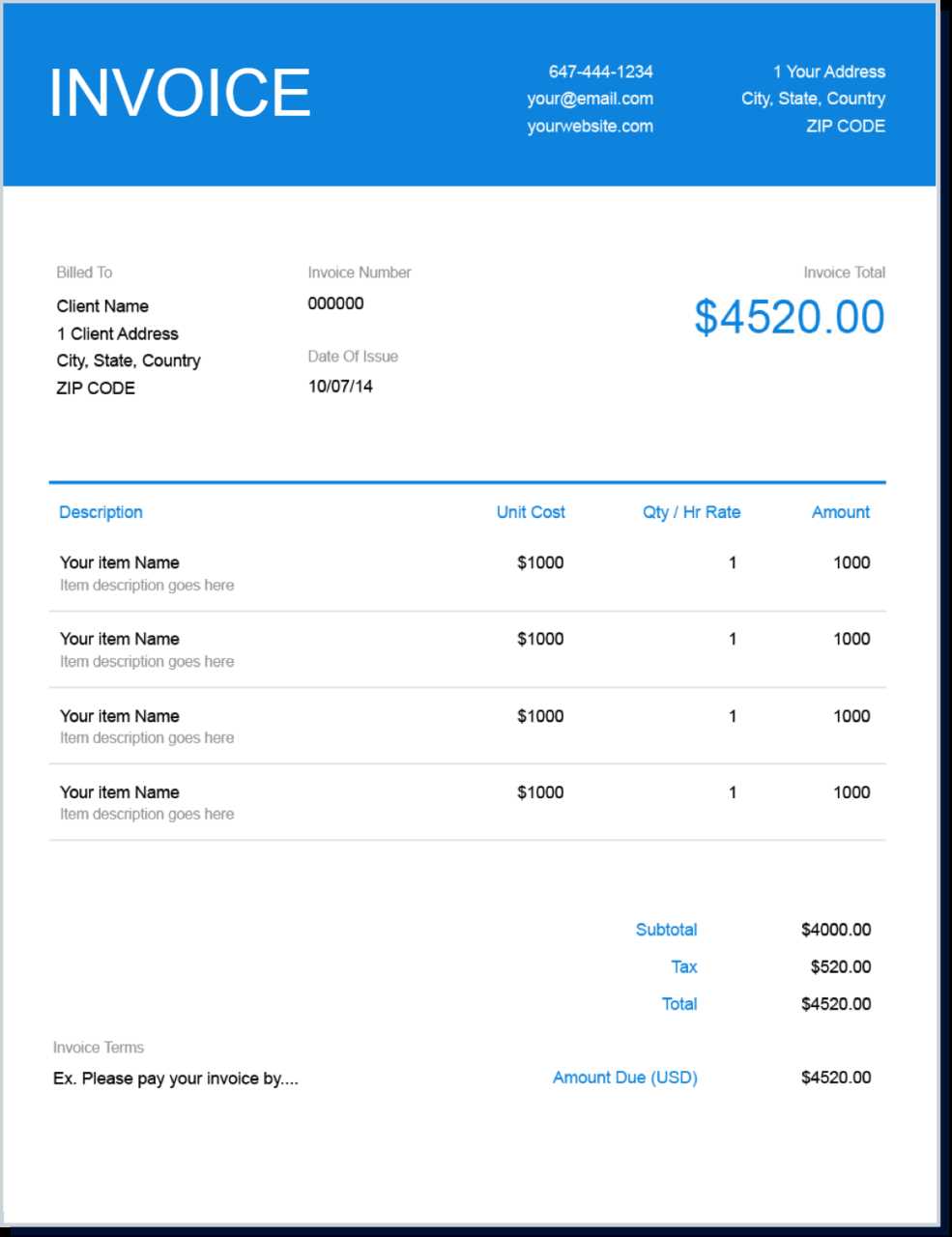

When constructing a financial document, the following sections are essential for a clear and professional presentation:

| Section | Purpose |

|---|---|

| Contact Information | To identify the parties involved in the transaction |

| Transaction Breakdown | To list individual charges and provide clear explanations |

| Payment Terms | To clarify when and how payment is expected |

| Legal Details | To include any relevant contractual or regulatory information |

| Totals and Taxes | To ensure the correct sum is presented, including any applicable taxes |

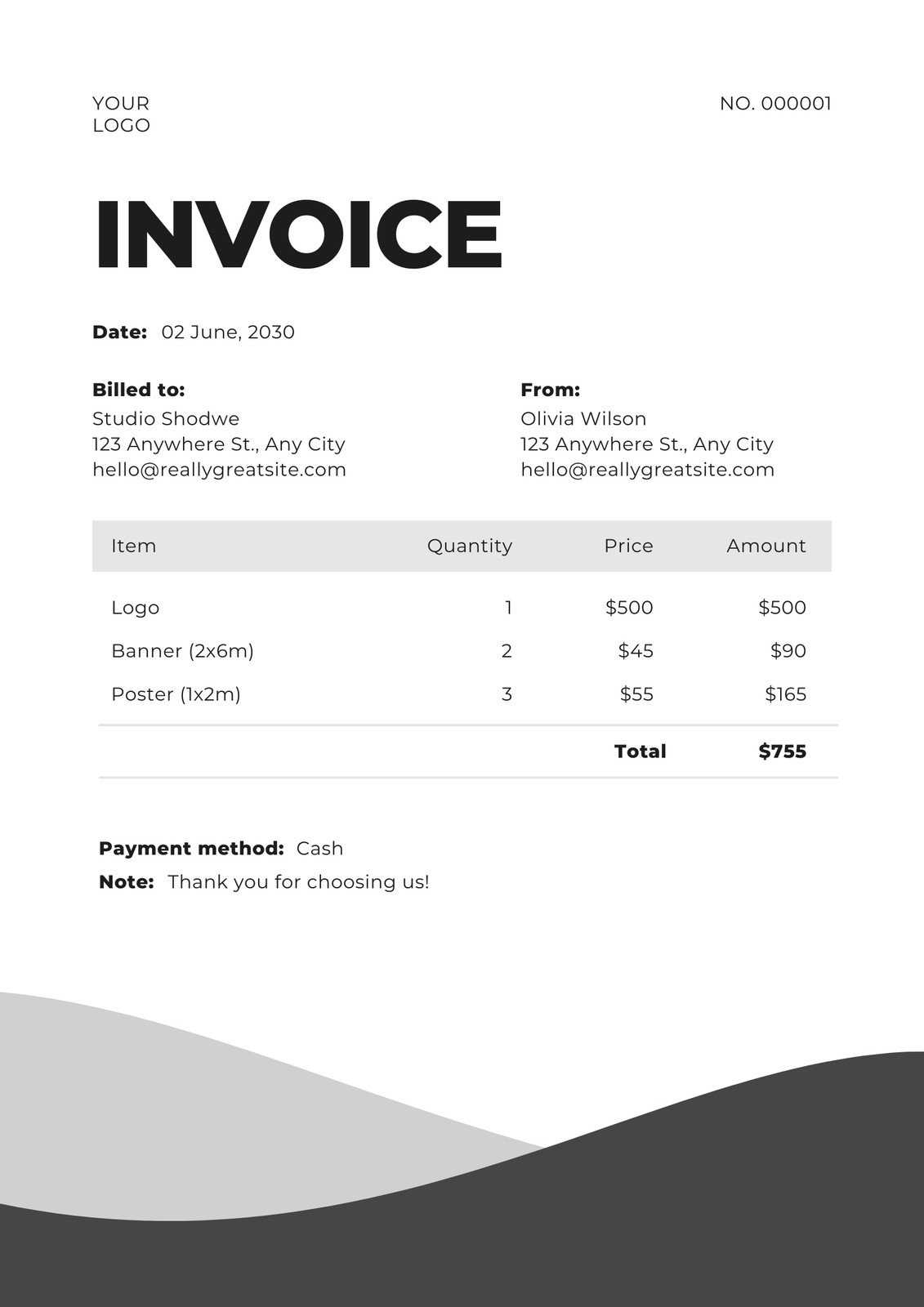

Designing for Efficiency

The layout of your document is just as important as its content. A clean, easy-to-read format will ensure that the reader can quickly grasp the necessary details. Use appropriate headings, clear fonts, and enough spacing to avoid clutter. Additionally, include consistent alignment for all financial figures

Understanding the Basics of Billing Documents

Creating an effective document to record financial transactions is essential for maintaining clear and professional business practices. These documents serve as both a record of the exchange and a tool for facilitating smooth payment processes. By understanding the core elements that make up such a document, businesses can ensure accuracy and efficiency when handling payments and client relationships.

At its core, a financial document must present the necessary details in a structured, easy-to-understand manner. By clearly communicating what the customer owes, when payment is due, and any other relevant terms, this document helps avoid confusion and ensures timely transactions. Understanding the key components that should be included allows you to create a functional and professional document suited to your specific needs.

Essential Elements of a Billing Record

To build a solid structure, there are several important sections that should always be included in a financial record:

- Business Information: Clearly state the company’s name, address, and contact details.

- Client Information: Include the customer’s name and contact details to ensure the document reaches the right person.

- Description of Services or Goods: A detailed breakdown of the products or services provided, including quantities and prices.

- Payment Terms: Specify payment deadlines, acceptable payment methods, and any late fee policies.

- Totals and Taxes: Clearly outline the total cost of the transaction, including any applicable taxes or discounts.

Why Structure Matters

The design and organization of a financial document play a crucial role in ensuring its effectiveness. A clear structure allows clients to quickly understand what is being charged and what is expected of them. It reduces confusion, improves payment processing, and enhances the overall professional image of your business. Additionally, a well-structured document ensures that all relevant legal and financial information is presented in an easily accessible way.

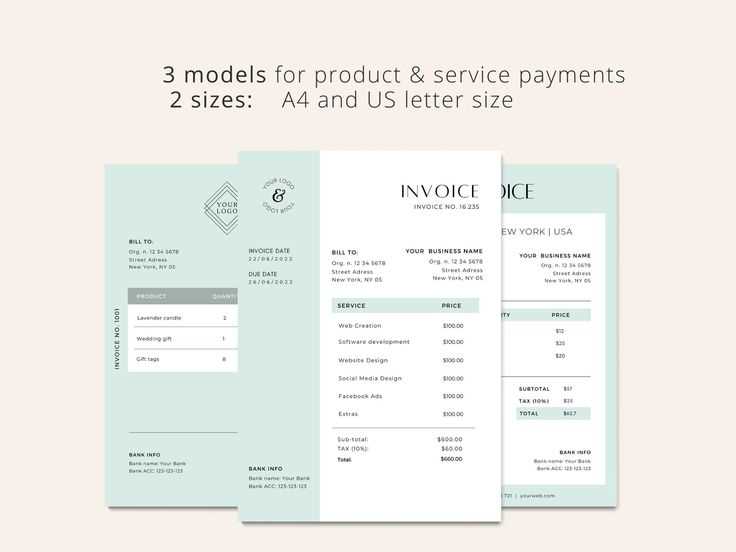

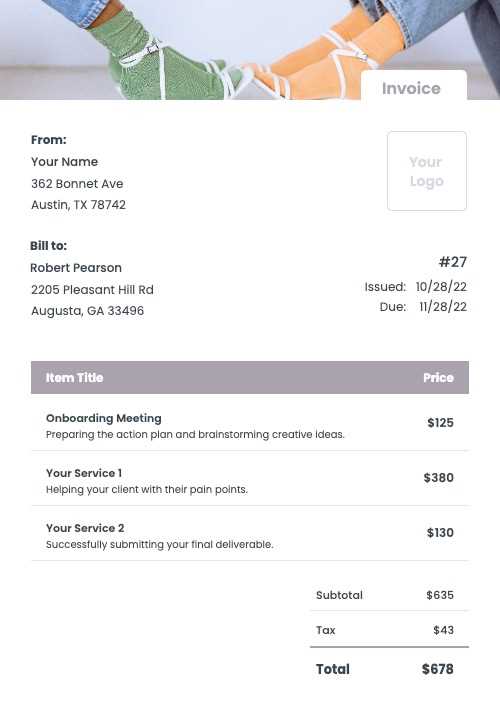

Why Customize Your Billing Document Design

Customizing your financial documents allows you to tailor the look and feel to meet your specific business needs, ensuring both professionalism and clarity. A personalized design not only helps your brand stand out but also enhances the functionality of the document, making it easier for clients to understand the terms and details of the transaction. A unique design can reflect the identity of your company, fostering trust and promoting consistency in all communications.

By adjusting the layout, colors, and typography, you can create a distinctive document that aligns with your branding. Furthermore, customizing the structure of your document allows you to prioritize the information most important to your business, ensuring that key details like payment terms, services provided, or due dates are highlighted effectively.

Strengthening Brand Identity

When you create a unique design for your financial documents, you are essentially reinforcing your brand image. By including your logo, business colors, and specific font styles, you make the document immediately recognizable. This subtle branding adds an extra layer of professionalism and helps build trust with clients, making your business appear more polished and reliable.

Improved Clarity and User Experience

Customizing the layout of your document can also improve how information is presented. By organizing sections in a way that makes sense for your workflow, you ensure that your clients can easily find the details they need. Whether it’s payment instructions, service descriptions, or due dates, a well-designed document makes it easier for clients to review the transaction and make timely payments. This reduces the likelihood of misunderstandings and helps ensure a smooth, efficient process for both parties.

Key Elements of a Professional Billing Document

To ensure that your financial documents are clear, professional, and functional, it’s essential to include specific key components. These sections help organize the information in a way that is easy to understand, ensuring that both parties are on the same page regarding the transaction. A well-structured record not only simplifies payment processing but also enhances your business’s credibility and professionalism.

Each part of your document should serve a distinct purpose, from identifying the parties involved to detailing the charges and payment terms. The goal is to create a document that leaves no room for confusion, with all necessary information clearly presented and easily accessible. Below are the most important elements that should be included in every well-crafted financial document.

| Section | Description | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header Information | Include your business name, address, phone number, and email, along with the client’s details. This helps to clearly identify both parties involved in the transaction. | ||||||||||||||||||||||

| Unique Reference Number | Assign a unique number to the document for tracking purposes, making it easier to reference in future communications. | ||||||||||||||||||||||

| Detailed Description of Services or Products | Provide a clear breakdown of the goods or services provided, including quantities, unit prices, and any additional charges or discounts applied. | ||||||||||||||||||||||

| Payment Terms | Clearly state the due date for payment, the accepted payment methods, and any applicable late fees or discounts for early payment. | ||||||||||||||||||||||

| Totals and Taxes | Include the total amount owed, clearly separating the cost of items, taxes, and any other charges. This helps ensure transparency and prevents misunderstandings. |

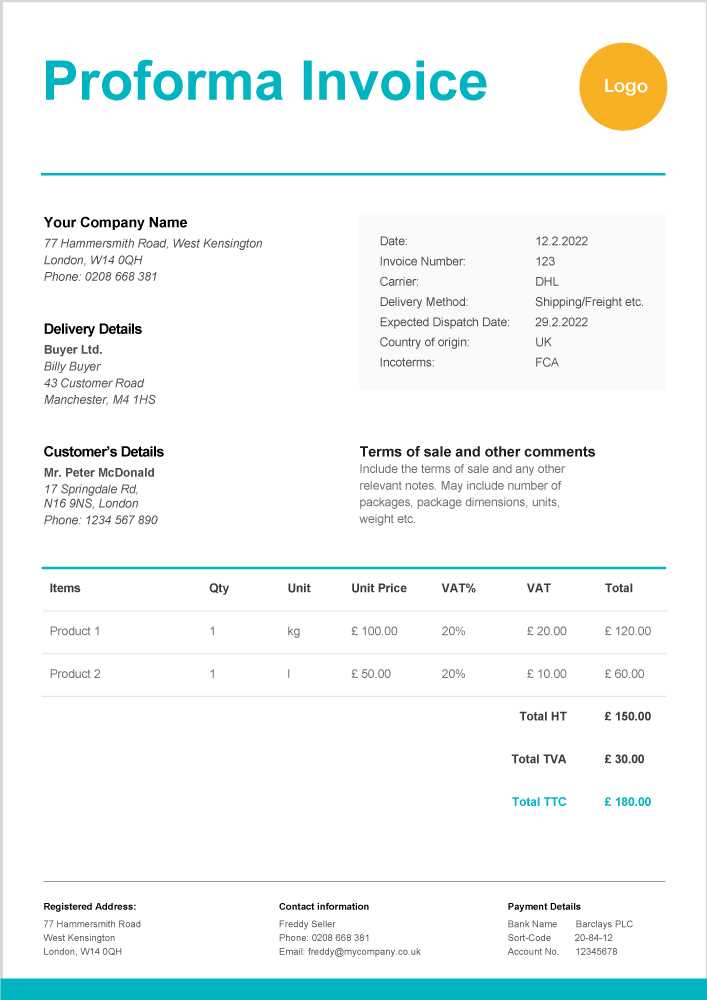

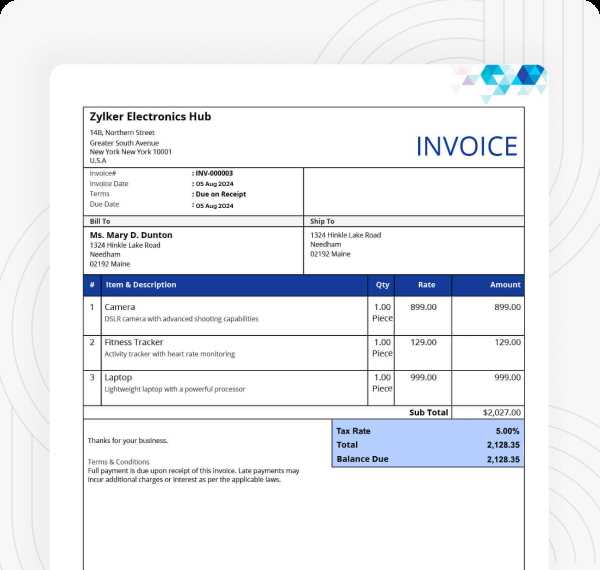

| Document Type | Purpose |

|---|---|

| Standard Billing | Used for one-time transactions, detailing products/services and payment terms. |

| Recurring Billing | For subscription-based services or ongoing agreements with regular payment schedules. |

| Proforma Document | Issued before the actual payment to provide an estimate of costs for approval. |

| Credit Note | Used when a customer returns goods or when an error is found in a previous billing document. |

By managing multiple bill

Common Mistakes in Document Design

When creating professional billing records, even small errors in design can lead to confusion, delayed payments, or even damage to your reputation. It’s important to avoid common pitfalls that can affect the clarity and accuracy of your documents. Whether it’s missing information, unclear formatting, or overlooked details, these mistakes can complicate the transaction process for both you and your clients.

In this section, we’ll explore some of the most frequent mistakes made when creating financial documents and offer tips on how to avoid them. By understanding these common issues, you can ensure that your documents are professional, clear, and effective in communicating payment expectations.

Common Design Mistakes

- Inconsistent Formatting: Using different font styles, sizes, or colors throughout the document can make it difficult for clients to follow and can detract from its professional appearance. Stick to a consistent style for readability.

- Missing Key Information: Leaving out crucial details such as due dates, payment methods, or contact information can lead to confusion and delayed payments. Always double-check that all necessary sections are included and correct.

- Poor Layout: A cluttered or confusing layout can overwhelm the reader. Avoid cramming too much information into a small space and ensure there is adequate white space to separate sections.

- Unclear Payment Terms: Vague or unclear payment instructions can lead to misunderstandings. Be specific about the due date, payment methods, and any additional fees or discounts.

Legal and Financial Mistakes

- Incorrect Tax Information: Failing to apply the correct tax rates or forgetting to mention taxes altogether can cause compliance issues. Always check local tax regulations and include them in the document.

- Missing Reference Numbers: Not including a unique reference number or transaction ID can complicate tracking and make it harder for both parties to reference the document in future communications.

- Failure to Include Terms of Service: If there are any specific agreements, terms, or conditions tied to the transaction, these should be clearly stated to avoid any legal disputes later.

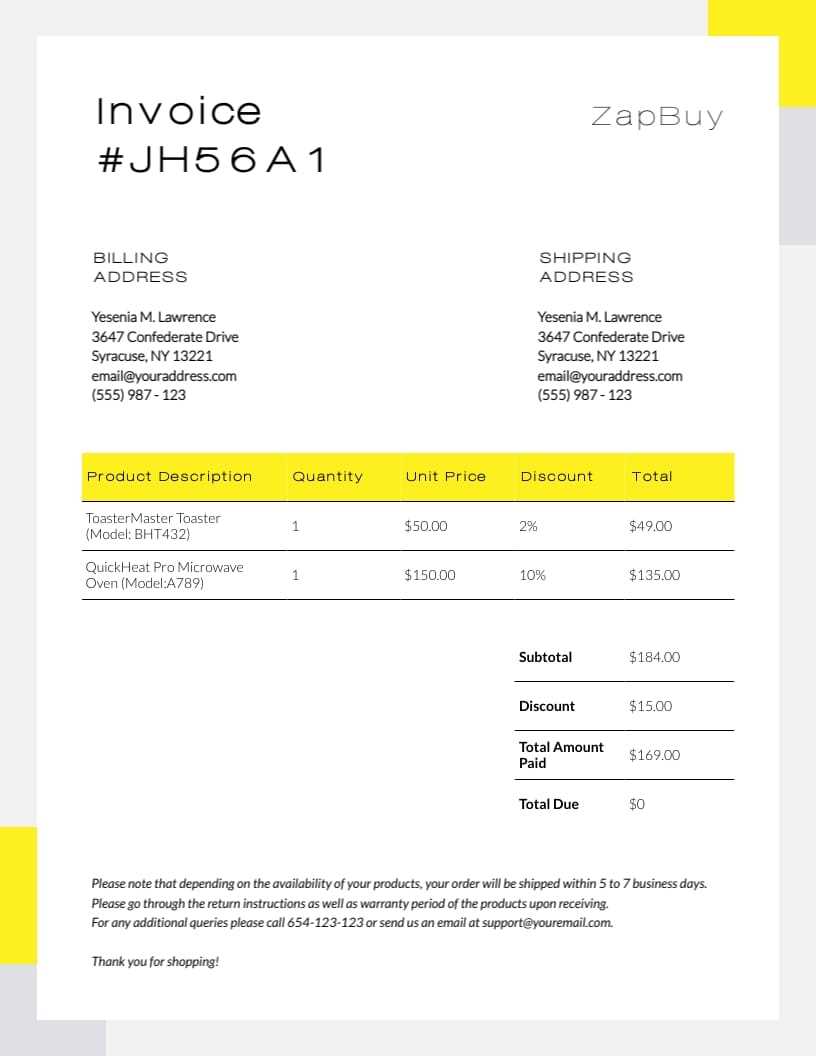

- Product List: Include clear descriptions of each item, with quantities and prices.

- Shipping Information: Clearly display shipping addresses and tracking numbers if applicable.

- Discounts and Offers: Highlight any discounts applied, with a total discount value shown separately.

- Consistency: Automated systems ensure that every document follows the same format, reducing the risk of human error and maintaining a professional appearance.

- Time Efficiency: By automating routine tasks, you free up time for other important aspects of your business, like customer service and project development.

- Customization: Even with automation, documents can be tailored to individual clients or transactions, ensuring that specific needs are met.

- Faster Processing: Generate and send out documents instantly, improving cash flow and reducing delays in payments.

- Tax Information: Clearly state the tax rate applied to the transaction and provide an itemized breakdown of applicable taxes, such as sales tax or VAT. Ensure that the correct tax codes are used, based on your location and the client’s location.

- Company Registration Details: In many jurisdictions, it is required to include your business’s registration number, legal name, and address on financial records.

- Terms and Conditions: Include payment terms, due dates, and any applicable late fees or interest charges. Clearly state any return policies or warranties if applicable to your products or services.

- Client Information: Always ensure the client’s name, address, and tax ID number (if required) are included, especially for businesses operating internationally.

- Stay Updated on Local Laws: Regularly review and update your documents to align with changing tax rates, legal standards, or industry regulations.

- Use Legal Templates: Whenever possible, work with templates designed specifically to meet legal requirements, ensuring they are tailored to your region or industry.

- Consult a Legal Professional: To avoid potential risks, consider consulting a legal expert who can help ensure that your financial documents meet all legal standards and best practices.

- Currency and Exchange Rates: Always use the appropriate currency for each transaction. Include both the symbol and currency code (e.g., USD, EUR, GBP), and when necessary, add the exchange rate used for conversions between different currencies.

- Language and Localization: Ensure that your documents are available in the language of the recipient. This includes translating key terms and adapting formats such as date and number conventions, which may differ between regions.

- Tax Compliance: Different countries have different tax regulations. Make sure to include the correct tax rates, such as VAT or GST, and mention any exemptions or international tax codes. Ensure that all necessary details required by local tax authorities are included.

- Use Multilingual Support: If you do business in multiple regions, consider using a document generation system that supports multiple languages to cater to diverse client bases.

- Include Contact Information: Provide international contact details, including phone numbers with country codes and international email addresses, to ensure clients can reach you regardless of location.

- Clear Payment Instructions: Clearly state payment methods that are commonly used in the client’s region (e.g., wire transfers, PayPal, local payment platforms) and indicate any inter

Using Billing Documents for Time Management

Efficient time management is crucial for any business, and creating accurate, organized financial records can play a significant role in this process. By using standardized formats, businesses can streamline the documentation process, reducing the time spent on repetitive tasks. When you have a structured system in place, you not only save time but also ensure consistency, which is vital for tracking payments and managing client relationships.

Automating and organizing the generation of financial records allows business owners to focus more on their core activities. By using pre-designed structures for each transaction, you minimize the need for manual input, enabling quicker turnaround times for both clients and internal teams. This approach also helps in maintaining a consistent approach to record-keeping, which can simplify future financial reporting and decision-making.

Benefits of Standardized Documents for Time Efficiency

- Faster Processing: With set templates, you eliminate the need to manually format and organize each document. This speeds up the billing process, allowing you to send records out faster and receive payments more quickly.

- Reduced Errors: By having a consistent format, you reduce the chances of making mistakes in your financial records. Less time spent correcting errors means more time spent on other important business tasks.

- Clear Client Communication: Standardized formats make it easier for clients to understand and process your documents. When clients can quickly identify important details such as amounts, due dates, and payment terms, the overall payment cycle is faster and smoother.

Time-Saving Tips for Efficient Document Management

- Pre-fill Regular Details: If certain information remains consistent across documents (e.g., your company name, contact details), make sure it’s pre-filled to save time on every transaction.

- Automate Recurring Transactions: Set up automatic generation for recurring billing situations, such as subscriptions or ongoing services, to ensure timely and consistent documentation without additional effort.

- Keep Track of Templates: Maintain an organized collection of document formats tailored to different services or client needs. Having the right format ready for each situation minimizes time spent adjusting or creating new documents from scratch.

By using standardized structure

Best Practices for Saving and Storing Billing Documents

Properly saving and organizing your financial documents is key to maintaining an efficient, compliant, and easily accessible record-keeping system. Whether for internal use, tax purposes, or client reference, having a solid method for storing these records ensures you can retrieve them quickly and securely when needed. By following best practices for saving and storing, businesses can prevent data loss, avoid legal issues, and streamline accounting processes.

It’s essential to choose a system that works for both the volume of documents you handle and the level of security required. This may include cloud storage solutions, physical filing systems, or a combination of both. The goal is to create a method that not only keeps documents safe but also makes them easy to locate, track, and manage over time.

Key Considerations for Organizing Financial Records

- Digital vs. Physical Storage: Digital storage is typically more secure and easier to organize, while physical records may be necessary for compliance in some regions. Consider maintaining a hybrid approach based on your business’s needs.

- File Naming Conventions: Use clear and consistent file names that include key details such as the client name, document type, and date. This will help you easily locate and identify documents later.

- Access Control and Security: For digital storage, make sure access to your documents is restricted to authorized personnel only. Use encryption and regular backups to protect sensitive data.

- Retention Periods: Depending on your region or industry, there may be legal requirements for how long you must retain financial records. Ensure your system aligns with these rules to stay compliant.

Storing and Organizing Financial Records: A Table Overview

Method Pros Cons Digital Storage (Cloud/Local) Easy to organize, quick access, secure with proper encryption, space-saving Requires internet for cloud access, security risks if not properly managed Physical Filing Systems Simple to maintain, no technical knowledge required Space-consuming, harder to search, vulnerable to physical damage Hybrid System Provides both flexibility and security, redundancy in case of system failure Can be complex to manage, may require extra resources for maintenance By following these best practices, you can ensure that your financial documents are stored securely, remain accessible, and are compliant with relevant laws and regulations. This helps improve operational efficiency and protects your business from potential risks related to record-keeping.

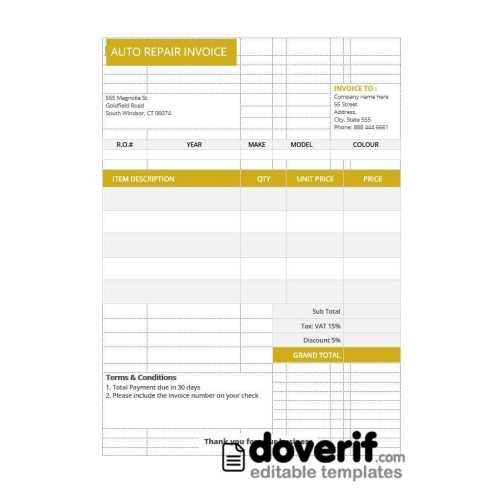

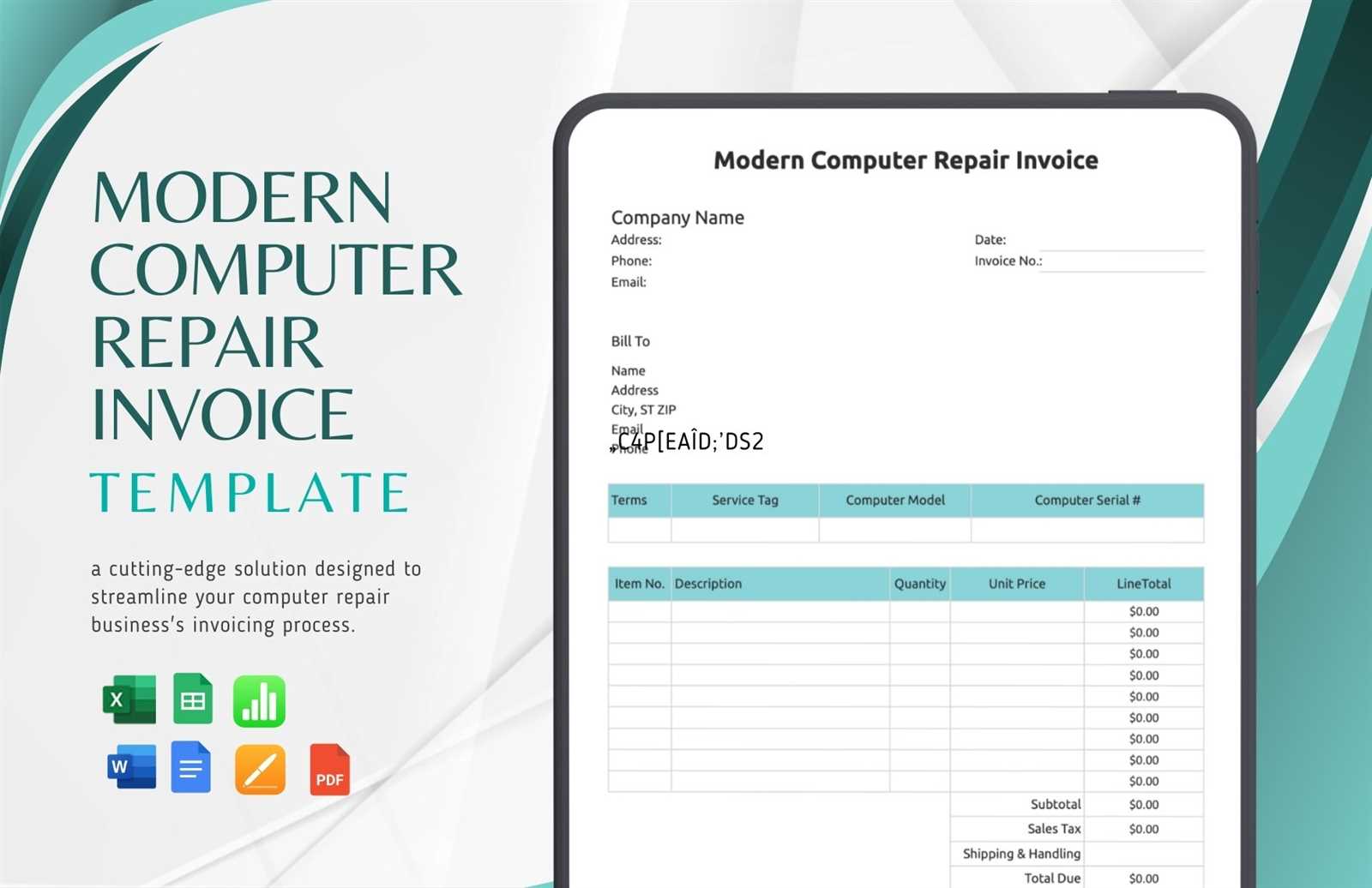

Creating Billing Documents for Different Industries

Each industry has its own set of requirements when it comes to billing and financial documentation. Customizing your document format to fit the specific needs of your sector ensures that all relevant details are included, making the process easier for both you and your clients. Whether you’re in retail, consulting, or the service industry, understanding how to tailor your documents to your industry can save time and prevent misunderstandings.

Different industries may require unique fields, terminology, or layouts to ensure clarity and compliance. By designing documents that reflect these needs, you create a more efficient workflow and improve the customer experience. In the following sections, we’ll look at examples of how different industries can benefit from tailored document designs.

Retail and E-Commerce

For businesses in retail or e-commerce, a simple and clear layout is essential. Key elements often include product names, quantities, prices, and shipping details. It’s also important to have a clear breakdown of taxes, discounts, and shipping costs. Additionally, including order numbers and tracking information can help ensure a smooth transaction.

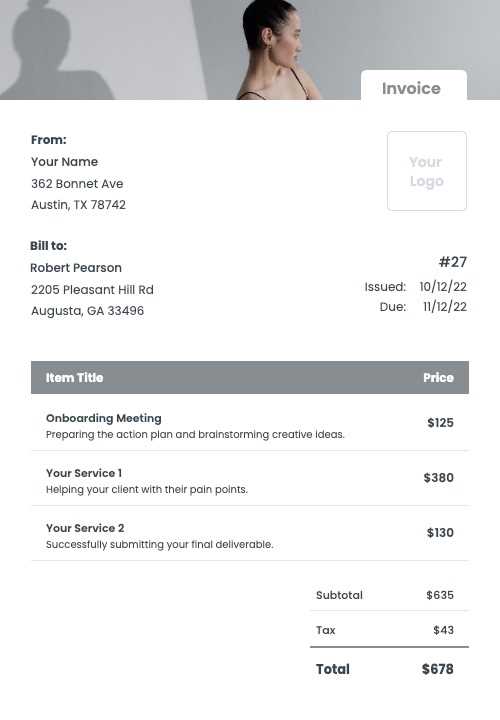

Consulting and Professional Services

For consultants or service providers, documents often need to include hourly rates, service descriptions, and time logs. These billing records may also need to reflect retainer agreements or project milestones. Providing a detailed breakdown of services ensures that clients understand exactly what the

Automating Billing Document Generation

Automating the creation of financial records can significantly streamline your business processes, saving time and reducing the potential for errors. By using pre-set structures, you can generate consistent and accurate documents quickly, ensuring that all essential information is included every time. Automation also makes it easier to scale your business, as generating a large number of records becomes more efficient without sacrificing quality or accuracy.

With automation, much of the manual work involved in creating financial documents–such as entering client details, amounts, and service descriptions–can be done automatically based on pre-defined rules or data input. This allows businesses to focus on more important tasks while ensuring that each document is professionally formatted and complies with necessary regulations.

Here are some benefits of automating the generation of financial documents:

By integrating automated systems into your workflow, you can ensure that each document is generated quickly, accurately, and consistently, leading to smoother operations and a more professional business image.

How to Ensure Legal Compliance in Billing Documents

Ensuring that your financial documents comply with local laws and regulations is critical for maintaining professionalism and avoiding legal complications. Failing to meet legal requirements can lead to penalties, disputes, or even legal action. It’s essential to understand the necessary components and standards required in your industry or region to keep your documents valid and enforceable.

Legal compliance in billing records goes beyond just providing the correct payment information. It includes adherence to tax laws, payment terms, and the inclusion of required details such as your company’s registration number or client’s tax identification. Customizing your documents to meet these requirements ensures that both you and your clients remain protected throughout your business transactions.

Essential Legal Elements to Include

Steps to Maintain Compliance

By integrating these practices, you can ensure that your financial documents not only look professional but also remain legally compliant, helping to protect your business and build trust with your clients.

Designing Billing Documents for International Use

When conducting business across borders, creating financial documents that can be understood and processed by clients from different countries is essential. Designing documents that are suitable for international use requires a thoughtful approach to language, currency, tax compliance, and local regulations. These documents must be clear, accurate, and adaptable to different legal and financial systems while maintaining a professional appearance.

Global business operations often involve various currencies, languages, and tax rules, all of which must be reflected in your documents to avoid confusion or legal issues. Customizing your documents to fit these diverse needs helps ensure smooth transactions and builds trust with international clients.

Key Considerations for International Documents