Microsoft Word Photography Invoice Template for Easy Billing

Running a creative business requires not only talent but also efficient administrative practices. One essential part of this process is the ability to send clear and professional billing statements to clients. A well-designed billing document can help you maintain a positive relationship with clients and ensure you are paid on time. Using the right tools to generate these documents makes the process faster and more accurate, saving you time and reducing the risk of errors.

By customizing your own billing document using familiar software, you can create a solution that works perfectly for your needs. It allows you to maintain consistency in your business dealings while ensuring all important information is presented clearly. Whether you’re charging for a one-time service or a package deal, having the right format makes all the difference in how clients perceive your professionalism.

With the right resources, creating personalized statements becomes a straightforward task. The following guide will help you understand how to craft a functional, visually appealing, and easy-to-use document that suits your business and helps you get paid smoothly and efficiently.

Photography Billing Document Design

Creating a personalized billing document for your business ensures that all payments are clear and well-organized. By using simple software, you can design a professional-looking document that includes all the necessary details, making it easy to send to clients. A well-structured format helps reduce confusion and keeps your financial records in order.

Here are the key components you should include when designing your custom billing document:

- Client Information: Always include your client’s name, address, and contact details. This ensures the document is correctly attributed and avoids any mix-ups.

- Service Description: Clearly list the services provided, including any packages or specific offerings. Be as detailed as necessary to ensure both parties understand the scope of work.

- Pricing Breakdown: Provide a detailed breakdown of costs, including the rate for each service or item. This transparency helps avoid confusion about pricing.

- Payment Terms: Specify due dates, payment methods, and any late fees, if applicable. Clear payment terms help ensure prompt payment.

- Additional Notes: Include any other relevant information, such as project timelines, special agreements, or discounts offered.

Using a pre-designed layout in familiar software can speed up the creation process. You can easily customize it with your logo, colors, and preferred formatting, giving it a personal touch that aligns with your business branding.

With a structured and easy-to-read document, you ensure that your clients receive clear, professional communication and that your business

Why Use a Photography Invoice Template

Creating consistent and professional billing documents is essential for any creative business. A well-organized format not only streamlines the payment process but also ensures clarity for both the service provider and the client. By using a pre-made structure, you save time, reduce mistakes, and maintain a high level of professionalism in your business dealings.

Save Time and Effort

One of the main advantages of using a pre-designed layout is the time you save. Instead of starting from scratch each time, you simply enter the relevant details, such as service descriptions, pricing, and client information. This significantly reduces the time spent on administrative tasks, allowing you to focus more on your creative work.

Maintain Professionalism

A polished billing document can make a big impact on how clients perceive your business. A standardized format ensures that your communications are clear, consistent, and professional. This can help you build trust and enhance your reputation, leading to better client relationships and more repeat business.

How to Create a Custom Billing Document

Designing a personalized billing document from scratch gives you full control over its appearance and content. By customizing the layout to fit your business needs, you ensure that all important details are included and presented clearly. The process is straightforward and can be done using commonly available software. Here’s how you can create a custom billing document in just a few simple steps.

Step-by-Step Guide

- Start with a Blank Document: Open your software and begin with a blank page. This allows you to fully customize the layout without any preset formatting.

- Add Your Business Information: At the top of the page, include your business name, logo, and contact details. This gives the document a professional look and makes it easy for clients to reach you.

- Insert Client Information: Below your business details, create a section for your client’s name, address, and contact information. This helps identify the recipient of the billing statement.

- List the Services Provided: Clearly describe the services you delivered, breaking them down by type, quantity, or duration as needed. This ensures the client understands what they are being charged for.

- Detail the Pricing: List the cost for each service or item. Be sure to include any applicable taxes or discounts. Use a table or simple bullet points to make this section easy to read.

- Specify Payment Terms: Include important payment details such as the due date, accepted payment methods, and any late fee policies.

- Include a Notes Section: Add any additional information relevant to the transaction, such as terms of the agreement or project timelines.

- Save and Customize: Save your document as a template for future use, adjusting only the specific details each time. This helps speed up the process for future billing statements.

Once you’ve added all the necessary details, review the document for accuracy and clarity. Make sure the layout is clean and easy to read, as this reflects your professionalism and can impact client satisfaction.

Key Features of an Effective Billing Document

An effective billing document is more than just a request for payment; it is a professional representation of your business. The structure and content should be clear, accurate, and easy to understand. Including the right elements ensures that both you and your client are on the same page, which helps facilitate smooth transactions and builds trust.

Essential Elements of a Billing Document

- Clear Contact Information: Include your business name, address, phone number, and email. This makes it easy for clients to reach out with any questions or concerns.

- Client Details: Always add your client’s name, address, and contact information. This personalizes the document and helps prevent any confusion.

- Service Breakdown: A detailed list of the services or products provided, including quantity, rate, and a brief description. This ensures transparency in what is being billed.

- Itemized Pricing: A clear and detailed breakdown of the costs involved, including the price for each service or product, any discounts, and taxes. This avoids any ambiguity regarding the charges.

- Payment Terms: Specify the due date, accepted payment methods, and any late fees or penalties. Clear terms set expectations for both parties and help prevent payment delays.

Design and Layout Considerations

- Professional Design: Use clean, consistent formatting. A well-structured layout improves readability and enhances your business image.

- Clear, Legible Fonts: Ensure that the text is easy to read, with proper spacing and font size. A cluttered document can lead to misunderstandings.

Essential Information for Billing Statements For any business transaction, it’s crucial to include the right details to ensure clarity and prevent misunderstandings. A billing document should not only request payment but also provide all necessary information to make the process smooth and transparent. Including the essential components ensures that both parties understand what is owed and why, helping to avoid disputes and delays.

Key Information to Include

- Your Business Information: Always list your full business name, address, phone number, and email. This makes it easy for clients to contact you if they have any questions regarding the payment.

- Client Details: Include your client’s full name, address, and contact details. This ensures that the billing document is correctly attributed and helps avoid any confusion over who is being billed.

- Unique Document ID: Assign a unique number or code to each document for easy tracking. This can help both you and your client quickly reference the specific transaction in future communications.

- Detailed Service List: Include a breakdown of all the services provided, with descriptions and the dates they were performed. For example, if you’re billing for a specific event or session, list the date and what was delivered (e.g., editing, shooting, etc.).

- Pricing Information: Clearly outline the cost of each service, including any taxes, discounts, or additional fees. This helps maintain transparency and avoids confusion over the amount due.

- Payment Terms: Specify when the payment is due, the accepted methods of payment, and any late fees or penalties for overdue balances. Clear terms help set expectations for both parties.

- Additional Notes: If there are any specific agreements or terms regarding the transaction (e.g., usage rights for images, payment plans, etc.), include them in this section to avoid misunderstandings later.

Formatting for Clarity

- Clear Section Headings: Use headings for each part of the document (e.g., “Client Information,” “Service List”) to improve readability and organization.

- Readable Layout: Keep the document well-spaced and structured, using tables or bullet points for easy navigation through the details.

- Professional Design: Incorporate your business branding–such as logo, fonts, and colors–so the document reflects your brand’s identity and professionalism.

By including all these key details and organizing them effectively, you ensure that your billing documents are clear, professional, and help foster positive client relationships.

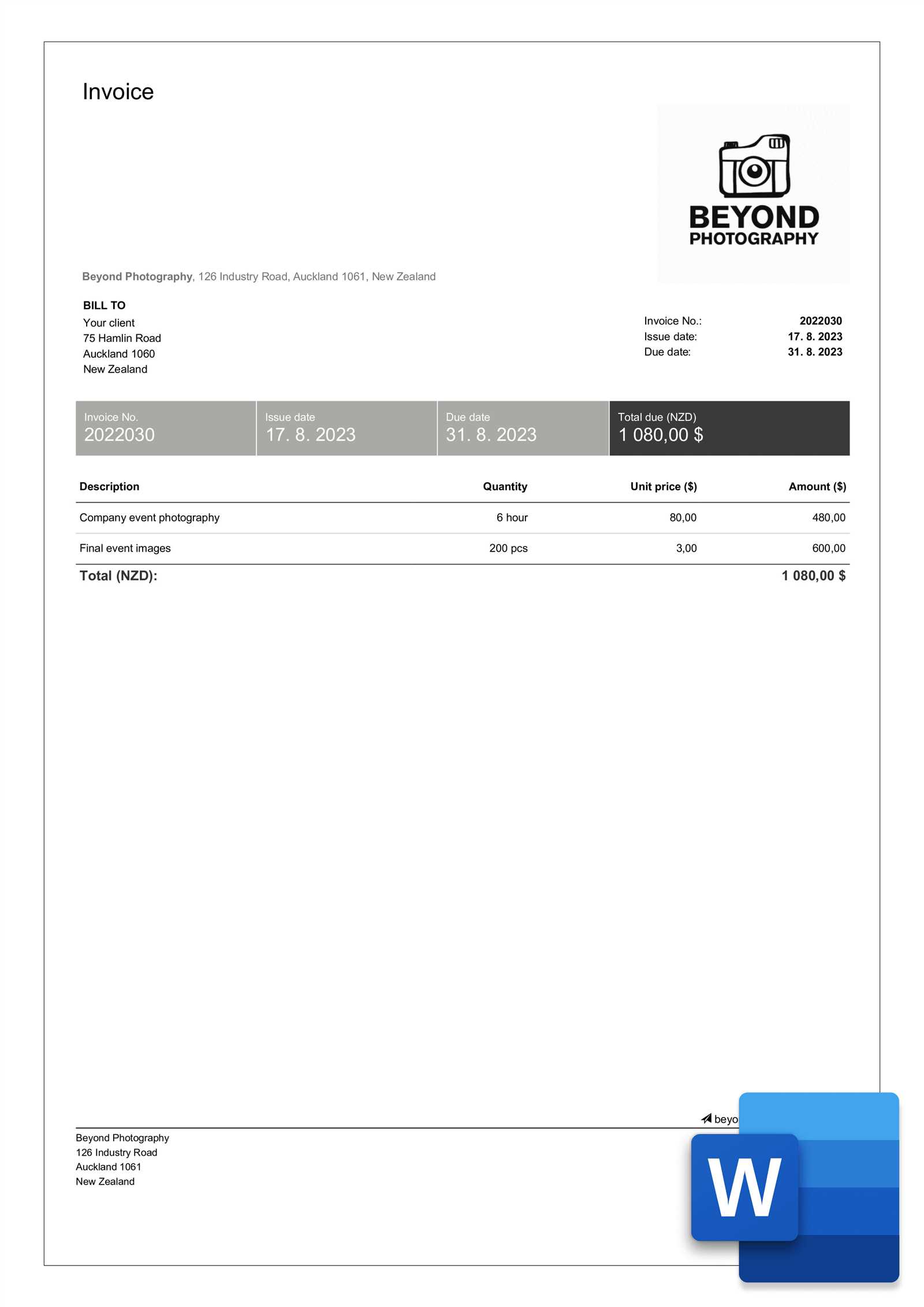

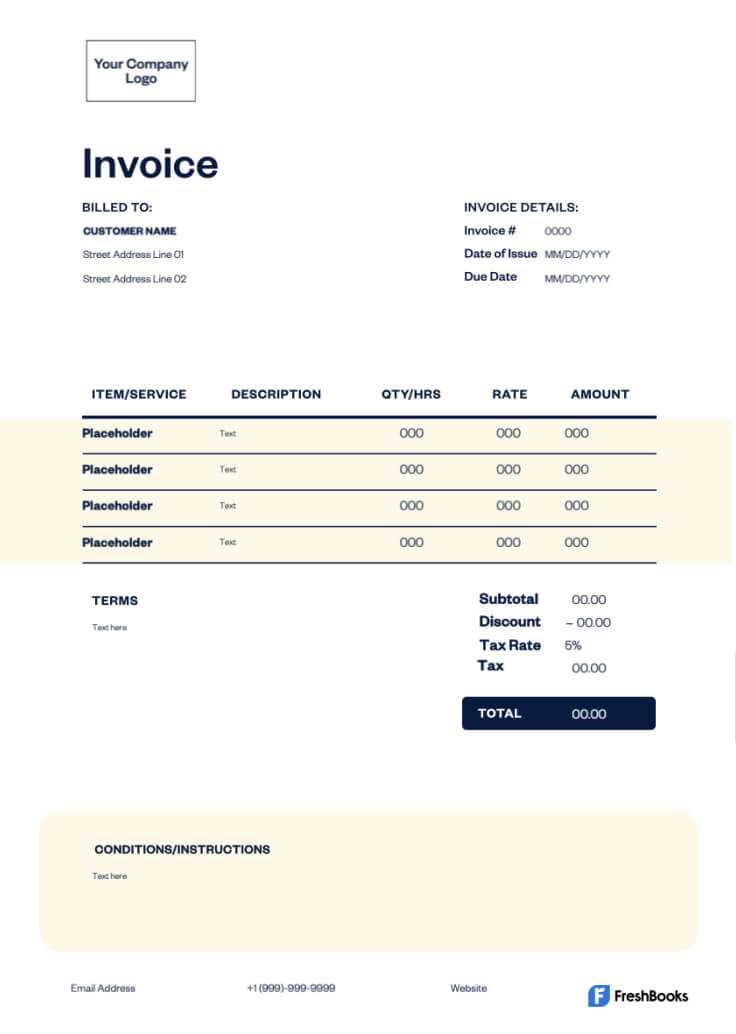

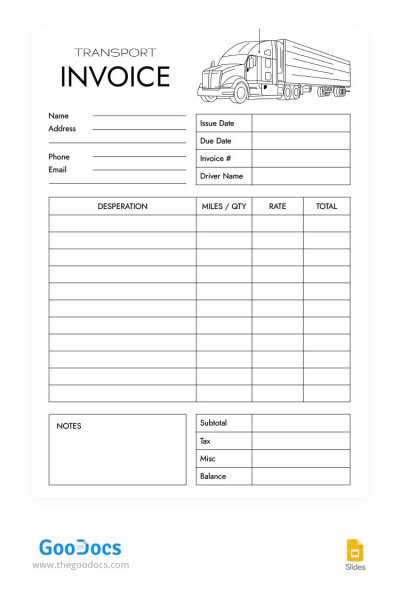

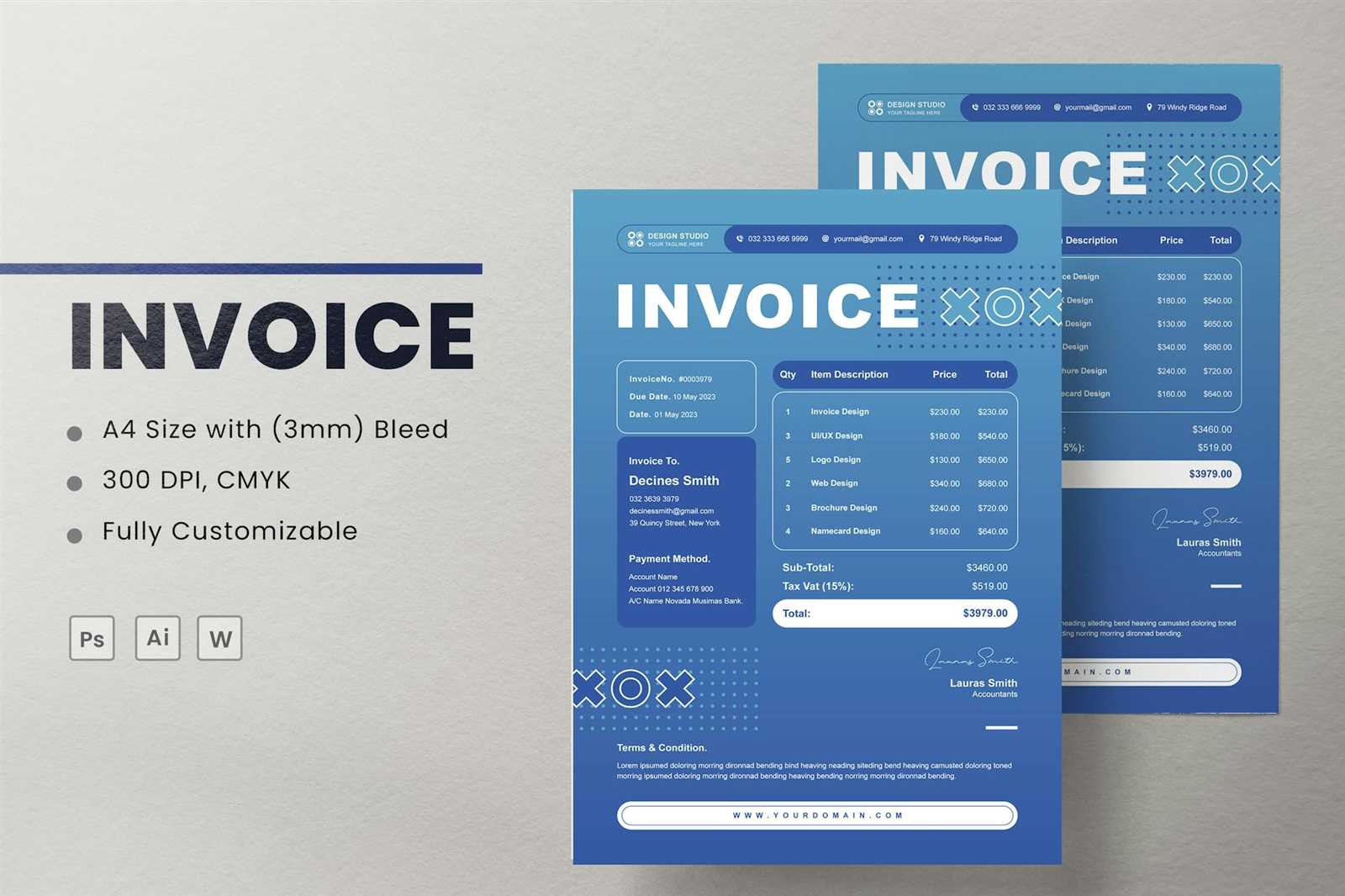

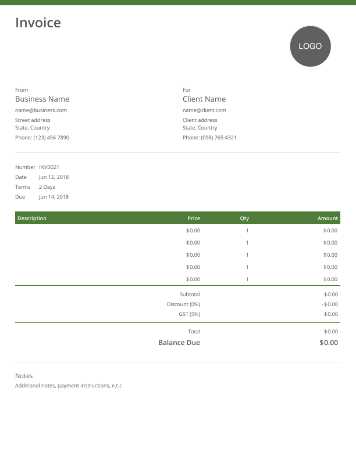

Free Templates for Photography Billing Statements

For business owners looking to streamline their billing process, free ready-made layouts can be an invaluable tool. These pre-designed documents help you save time and effort, offering a simple starting point that can be easily customized. With just a few tweaks, you can create a professional billing statement that aligns with your brand and ensures clarity in every transaction.

There are many free resources available online that provide high-quality, customizable documents. These layouts typically include all the essential components, such as contact details, service descriptions, and payment terms. You can download and use them as-is, or adjust the format and design to suit your specific needs.

Using a free layout allows you to avoid the complexity of designing from scratch while still ensuring that your billing documents are both professional and functional. Whether you’re a small business owner or a freelancer, these free resources are an excellent way to simplify your administrative work without sacrificing quality.

Formatting Tips for Professional Billing Documents

Proper formatting is key to ensuring that your billing documents look polished and are easy for clients to understand. A well-structured layout not only improves the document’s readability but also reinforces your professionalism. By paying attention to the details, you create an impression of efficiency and clarity, which can positively impact your relationship with clients.

Key Formatting Tips

- Use a Clean Layout: Keep the layout simple and organized. Avoid cluttering the document with too much text or unnecessary information. A clear structure makes it easier for clients to quickly find the details they need.

- Highlight Important Information: Use bold or larger fonts for key sections such as the total amount due, payment due date, and client details. This helps ensure that the most important information stands out.

- Keep Fonts Consistent: Stick to one or two readable fonts throughout the document. Using too many different fonts can make the document look chaotic and unprofessional.

- Align Information Properly: Use alignment techniques (such as left or center alignment) to keep the text and numbers neat. For example, prices should be aligned right, making them easier to read and compare with the description.

- Break Up Sections with Headings: Use headings and subheadings to break the document into clearly defined sections. Common sections include client information, service details, pricing, and payment terms. This improves overall readability and organization.

- Incorporate Tables for Itemized Costs: For a clearer view of charges, use tables to list the services or products provided along with their individual costs. This makes the breakdown easy to follow and minimizes confusion.

- Ensure Adequate Spacing: Don’t cram information into tight spaces. Use sufficient white space between sections, text, and numbers. This increases readability and gives the document a more professional, organized appearance.

Additional Design Considerations

- Branding: Include your business logo and use brand colors to maintain consistency with your overall brand identity. A cohesive design adds credibility to your billing documents.

- Legibility: Always use font sizes and styles that are easy to read. Avoid fancy or overly decorative fonts that can hinder readability, especially for numb

Common Mistakes to Avoid in Billing Documents

When preparing billing statements, it’s important to ensure that all details are correct and clearly presented. Small errors can lead to confusion, delayed payments, or even strained client relationships. By avoiding some of the most common mistakes, you can create a smoother experience for both you and your clients, ensuring prompt and accurate payments.

Key Mistakes to Avoid

- Missing or Incorrect Contact Information: Always double-check the accuracy of your contact details, including both your own and your client’s. Incorrect addresses or phone numbers can cause delays or confusion.

- Unclear Service Descriptions: Failing to clearly explain the services or products provided can lead to misunderstandings. Be specific about what was delivered and include relevant details such as dates or quantity.

- Omitting Payment Terms: One of the most important aspects of any billing document is the payment terms. Failing to include due dates, acceptable payment methods, or any late fees can result in delayed payments or disputes.

- Incorrect Calculations: Double-check all calculations, including pricing, taxes, and discounts. Mistakes in math can cause frustration for both you and your clients, and may require additional follow-ups to resolve.

- Not Using a Unique Document Number: Every billing document should have a unique identifier. Without this, it becomes difficult to track and reference past transactions, especially if you’re dealing with multiple clients or projects.

- Overcomplicating the Design: A cluttered or overly complex layout can confuse the reader. Stick to a simple and clean design, ensuring the most important information stands out.

- Failure to Proofread: Simple typos or grammatical errors can give a negative impression of your business. Always review your document for spelling and formatting mistakes before sending it out.

Additional Tips

- Keep It Professional: Even if you’re working with a regular client or friend, always maintain a professional tone in your billing statements. A casual or unpolished document can undermine your business credibility.

- Don’t Forget the Branding: Adding your logo or business name reinforces your brand identity and makes the document look more official and trustworthy.

By avoiding these common mistakes, you can ensure that your billing process is efficient, professional, and free from confusion. This will help build trust with your clients and contribute to smoother transactions overall.

How to Add Your Logo to Billing Documents

Incorporating your business logo into your billing documents is a simple but effective way to reinforce your brand and maintain a professional appearance. A well-placed logo not only gives your document a polished look but also makes it instantly recognizable to your clients. Here’s a step-by-step guide on how to add your logo to your billing statements efficiently.

Steps to Add Your Logo

- Prepare Your Logo: Ensure that your logo is saved in a high-quality format, such as PNG, JPG, or SVG. It’s best to use a file with a transparent background to avoid any unsightly borders.

- Open Your Document: Start by opening your billing document in your preferred software. Begin with a blank page or open an existing document that you want to customize.

- Select the Header Section: The top of your document is the most common place for your logo. Click on the header area (if it’s not already open) to add the image, ensuring it’s visible but doesn’t overcrowd the layout.

- Insert the Logo: Look for the “Insert” or “Add Image” option in the menu, then select the image file containing your logo. Adjust the size so it fits well in the header without dominating the space.

- Align the Logo: Most software will allow you to align the image either to the left, right, or center. Choose the alignment that best suits your design preferences and ensures the logo complements the overall look.

- Resize if Necessary: If the logo appears too large or small, resize it to maintain balance and clarity. Be sure not to stretch or distort the image to ensure it remains shar

Tips for Organizing Your Billing Documents

Properly organizing your billing documents is essential for maintaining efficiency and staying on top of payments. A well-structured filing system allows you to quickly access records, track payments, and avoid confusion. Whether you’re managing a small freelance business or a larger operation, these tips will help you keep everything in order and ensure your workflow remains smooth.

Effective Organization Strategies

- Use a Consistent Naming Convention: Consistent file naming helps quickly identify specific billing records. Include details like the client’s name, the document type, and the date (e.g., “JohnDoe_Invoice_2023-10-01”). This makes it easy to search and retrieve documents later.

- Store Files by Date: Organize your records chronologically, either by month or year. This method helps track overdue payments and ensures you’re following up on older transactions.

- Separate Drafts and Final Versions: Keep draft documents separate from finalized ones. You can organize them in different folders or use file names like “Draft” or “Final” to distinguish between the two.

- Create Folders by Client: If you manage multiple clients, create individual folders for each one. This will help you keep all related documents in one place, making it easier to track each client’s transactions.

Utilizing Tables for Better Tracking

In addition to organizing your files, creating a table to track payments and due dates can help you stay on top of your finances. Below is an example of how you can structure such a table:

Client Name Document ID Amount Due Due Date Status How to Use Word’s Table Feature

Tables are an incredibly useful tool for organizing data and presenting information in a structured, easy-to-read format. In many business documents, including billing statements, tables help present financial details, service descriptions, and itemized costs in a clear and professional manner. Understanding how to create and manipulate tables can save time and improve the readability of your documents.

Creating a Table

To insert a table into your document, follow these simple steps:

- Click on the area of your document where you want the table to appear.

- Navigate to the “Insert” tab in the toolbar.

- Click the “Table” button. A grid will appear, allowing you to select the number of rows and columns you want in your table.

- Click and drag to select the desired size of your table, then release the mouse button to insert it.

Customizing the Table

Once the table is inserted, you can easily customize it to suit your needs. You can adjust the size of rows and columns, change the alignment of text within cells, and apply styles for a professional look.

- Resize Rows and Columns: Hover over the borders of the rows or columns until the cursor changes to a double arrow. Click and drag to resize them as needed.

- Merge Cells: Select multiple cells you want to combine, right-click, and choose “Merge Cells.” This is helpful when you want to group related information in one area.

- Text Alignment: To align text within a cell, select the text and use the alignment options in the toolbar (left, center, or right alignment). This helps keep your content organized and readable.

- Adding or Deleting Rows and Columns: Right-click a row or column, then select either “Insert” or “Delete” to adjust the table’s layout as required.

Example Table for Billing Information

Here is an example of how you might use a table to present billing details clearly:

Service Description Quantity Unit Price Total Customizing Billing Documents for Different Jobs

Customizing your billing documents to suit the specifics of each job is essential for ensuring clarity and professionalism. Each project or service you provide may require different details or formats depending on the nature of the work, the client, and the payment structure. By tailoring your documents, you can accurately reflect the work completed and make it easier for your clients to understand the charges.

Adjusting for Various Services

For different types of work, it’s important to modify the structure of your billing statement. Here are a few adjustments you might consider based on the nature of the job:

- Hourly vs. Flat Rates: For jobs billed by the hour, make sure to clearly list the number of hours worked, the hourly rate, and the total charge. For fixed-price jobs, break down the pricing into individual tasks or milestones to provide transparency.

- Project-Specific Details: Some jobs require detailed breakdowns. If you are working on a project with multiple stages, such as editing, consultation, and final delivery, list each phase separately along with its corresponding cost.

- Milestone-Based Payments: If your payment structure involves multiple installments based on milestones (e.g., 50% upfront, 50% upon completion), clearly indicate this in your

How to Calculate Photography Fees

Determining the right fees for your services is crucial for both covering your costs and ensuring a fair profit margin. Calculating the correct pricing involves factoring in your time, the equipment used, the location of the work, and any additional expenses that might arise. Understanding these components will help you build a pricing structure that is both competitive and sustainable.

Key Factors to Consider

Here are some key elements to consider when setting your rates:

- Time: This includes the hours spent preparing for the shoot, the actual shooting time, and post-production work such as editing and retouching.

- Equipment Costs: Consider the wear and tear on your gear, as well as any special equipment that might be required for specific projects, like lighting setups or drones.

- Location and Travel: If the job requires traveling to a location, you should account for transportation, accommodation, and any other related costs.

- Market Rates: Research the going rates in your area for similar services to ensure your prices are competitive, but also reflective of your experience and expertise.

- Client Type: Prices might vary depending on whether you’re working with corporate clients, small businesses, or individuals, with larger clients often requiring more formal pricing structures.

Pricing Structure Example

Below is an example of how you might structure your pricing:

Service Description Unit Rate Total Shooting (Hourly) 3 hours $100/hour $300 Post-Production (Hourly) 2 hours $50/h Ensuring Legal Compliance with Billing Documents

When creating billing documents, it is essential to ensure that they meet legal requirements to avoid potential disputes, fines, or non-compliance issues. Depending on the country or region in which you operate, there may be specific regulations regarding tax, data protection, and business practices that you must adhere to. Understanding these legal obligations will help protect both your business and your clients.

Key Legal Elements to Include

To ensure that your billing documents are legally compliant, make sure they contain the following key elements:

- Business Information: Include your business name, address, and contact details. In some regions, you may also be required to list your business registration number or VAT identification number.

- Client Information: Provide the client’s full name or company name, address, and contact details. This ensures the document is properly attributed and traceable.

- Clear Description of Goods or Services: Describe the products or services provided in detail. This provides transparency and helps avoid misunderstandings about the transaction.

- Pricing and Payment Terms: Clearly state the agreed-upon amount for each service or product, any taxes applied, and the total due. Include payment terms such as the due date, late fees, and accepted payment methods.

- Tax Information: Depending on your jurisdiction, you may be required to include tax rates, such as sales tax or VAT, along with your tax registration number.

Staying Compliant with Tax Laws

Tax regulations can vary greatly depending on your location and the type of service provided. It is essential to ensure that your billing documents reflect the correct tax information and follow local laws. Here are some tips to remain compliant:

- Know the Applicable Taxes: Research the specific t

Sending Billing Documents via Email or Print

Sending billing documents to clients can be done in a variety of ways, each with its own advantages. Whether you choose to send them electronically via email or physically through traditional mail, the method you use can impact how quickly payments are made and how professional your communication appears. It’s important to choose the right option based on the client’s preferences, the nature of the transaction, and the urgency of the payment.

Benefits of Sending Billing Documents by Email

Electronic delivery is becoming increasingly popular due to its speed and convenience. Here are some reasons why sending documents via email can be advantageous:

- Speed: Emails are delivered instantly, making them ideal for time-sensitive payments or when clients need quick access to their billing information.

- Cost-Effective: There are no printing or postage costs involved when sending billing documents electronically.

- Tracking: With email, you can track whether your client has opened the document, ensuring that the billing information has been received.

- Environmental Impact: Email eliminates the need for paper, making it a more eco-friendly option for both businesses and clients.

Best Practices for Sending Documents by Email

When sending documents electronically, follow these best practices to ensure professionalism:

- Use a Professional Email Address: Send from a business email address rather than a personal one to maintain credibility and professionalism.

- Attach Documents in PDF Format: Attach your billing document as a PDF to ensure it maintains its formatting and is easily accessible for the client.

- Write a Clear Subject Line: The subject should indicate the purpose of the email, such as “Your Recent Billing Statement” or “Payment Due for Services Rendered.” This helps your client recognize the importance of the email.

- Include a Payment Link: If applicable, include a direct payment link or instructions on how the client can pay online for convenience.

Sending Billing Documents by Mail

Although digital communication is often quicker, some clients may prefer receiving physical copies of billing documents. Sending documents by mail can still be an important option, particularly for businesses dealing with clients who are not familiar with or do not prefer electronic communication.

- Professional Presentation: Printed documents should be professionally formatted and neatly presented. Use high-quality paper and include your business logo to make the document look official.

- Postage and Delivery Time: Be aware of the time it takes for postal services to deliver your documents, especially if the client requires the document urgently.

- Tracking and Confirmation: Consider using tracked mail to ensure that your client receives the document and to avoid disputes over non-receipt.

Example of Billing Details Sent by Email

Below is an example of a billing breakdown that could be sent via email:

Service Description Quantity Unit Price Total Consultation 2 hours $80 $160 Event Coverage 5 hours $120 $600 Post-Production 3 hours $60 $180 Total $940 For both email and print, ensuring that the details are clear and professional will help maintain smooth communicat

How to Track Paid and Unpaid Billing Documents

Effectively managing and tracking payments is essential for maintaining cash flow and avoiding confusion with clients. Keeping an organized record of which documents have been paid and which are still pending ensures that you can follow up on overdue payments promptly. There are several methods available to help you track outstanding balances and settled amounts, and the right approach can save you time and reduce errors.

Using a Manual Tracking System

For smaller businesses or freelance work, manually tracking paid and unpaid documents can be an effective method. This could be done using a simple spreadsheet or physical ledger. Here are the steps to keep track:

- List Each Document: Include basic details such as the document number, date issued, client name, and the total amount due.

- Mark Paid and Unpaid: As payments are received, mark each document as “paid.” For outstanding documents, keep track of the due date and any partial payments made.

- Track Payment Methods: Note whether the payment was made via credit card, bank transfer, or check. This can help you quickly identify any payment issues.

- Follow Up on Overdue Payments: Set reminders for when payments are due and follow up with clients who haven’t paid within the agreed time frame.

Using Accounting Software or Online Tools

For larger businesses or those with a higher volume of transactions, using accounting software or online platforms can streamline the tracking process. These tools offer automated tracking features and real-time updates on payment status. Some of the benefits include:

- Automated Payment Tracking: Accounting software automatically updates the status of each document when payment is made, reducing the chances of

How to Track Paid and Unpaid Billing Documents

Effectively managing and tracking payments is essential for maintaining cash flow and avoiding confusion with clients. Keeping an organized record of which documents have been paid and which are still pending ensures that you can follow up on overdue payments promptly. There are several methods available to help you track outstanding balances and settled amounts, and the right approach can save you time and reduce errors.

Using a Manual Tracking System

For smaller businesses or freelance work, manually tracking paid and unpaid documents can be an effective method. This could be done using a simple spreadsheet or physical ledger. Here are the steps to keep track:

- List Each Document: Include basic details such as the document number, date issued, client name, and the total amount due.

- Mark Paid and Unpaid: As payments are received, mark each document as “paid.” For outstanding documents, keep track of the due date and any partial payments made.

- Track Payment Methods: Note whether the payment was made via credit card, bank transfer, or check. This can help you quickly identify any payment issues.

- Follow Up on Overdue Payments: Set reminders for when payments are due and follow up with clients who haven’t paid within the agreed time frame.

Using Accounting Software or Online Tools

For larger businesses or those with a higher volume of transactions, using accounting software or online platforms can streamline the tracking process. These tools offer automated tracking features and real-time updates on payment status. Some of the benefits include:

- Automated Payment Tracking: Accounting software automatically updates the status of each document when payment is made, reducing the chances of errors.

- Real-Time Reporting: You can quickly generate reports to see which documents are unpaid, which clients have overdue balances, and which payments are still pending.

- Integration with Payment Systems: Many accounting platforms allow you to link directly to payment gateways, making it easy to track payments as soon as they are processed.

- Reminders and Notifications: Automated reminders can be sent to clients when payments are due, or after a certain period of non-payment, which helps maintain consistent cash flow.

Example of Tracking Paid and Unpaid Documents

The following table shows how you can track paid and unpaid documents, whether manually or with software:

Document Number Client Name Amount Due Status Payment Date #001 John Doe $500 Paid 2024-10-05 #002 Jane Smith $300 Unpaid N/A #003 ABC Corp $1,200 Paid 2024-10-07 #004 XYZ Ltd $700 Unpaid N/A By regularly monitoring the status of your billing documents, you can ensure that you’re getting paid on time and follow up efficiently with clients who still owe you money. Whether you use manual tracking methods or automated software, consistency is key to staying on top of your finances.