Microsoft Word Invoice Template for Mac Easy Customization and Download

Creating clear and professional billing documents is an essential task for any business or freelancer. Having a reliable system to generate these documents efficiently can save both time and effort. Whether you’re invoicing clients for products, services, or consulting, using customizable formats can make a significant difference in ensuring your communications remain consistent and professional.

With the right software, crafting well-organized and easy-to-read billing records is straightforward. By selecting a suitable design and adjusting it to fit your needs, you can produce documents that reflect your brand’s professionalism. This approach not only enhances your image but also ensures that your clients receive accurate and comprehensible statements of charges.

Adaptable formats allow you to incorporate necessary details like payment terms, contact information, and tax calculations seamlessly. Whether you are handling small projects or larger contracts, having an adaptable framework for your financial correspondence will support efficient business management.

Microsoft Word Invoice Template for Mac

Creating billing documents efficiently is key to managing any business. A simple, customizable structure can make the process smooth and quick. Whether you’re a small business owner or a freelancer, having the right format allows you to focus more on your work rather than the details of document design.

Customizing Your Billing Documents

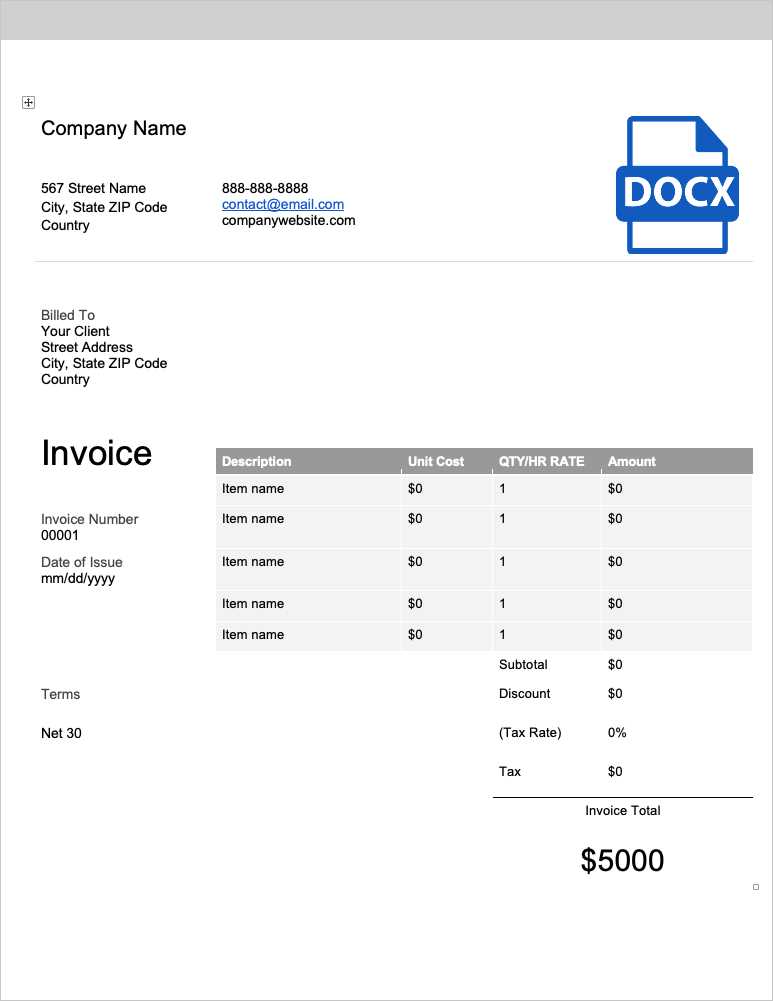

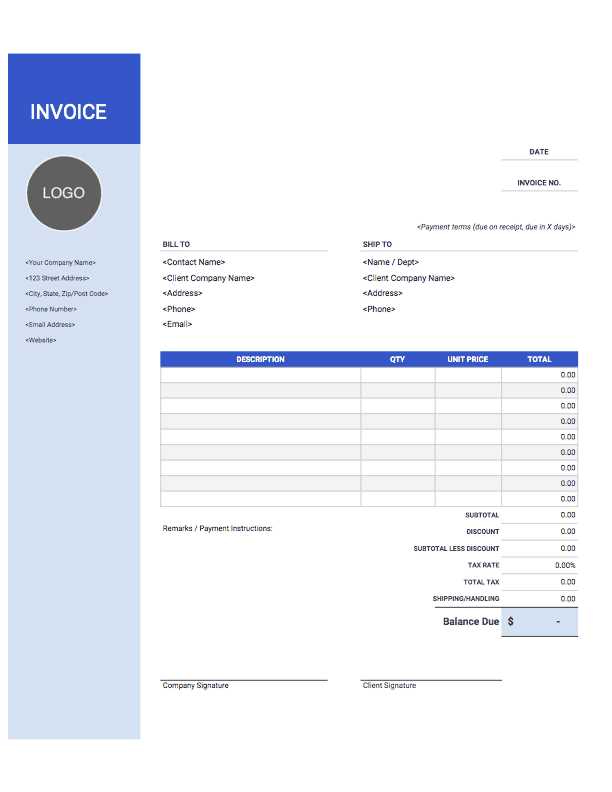

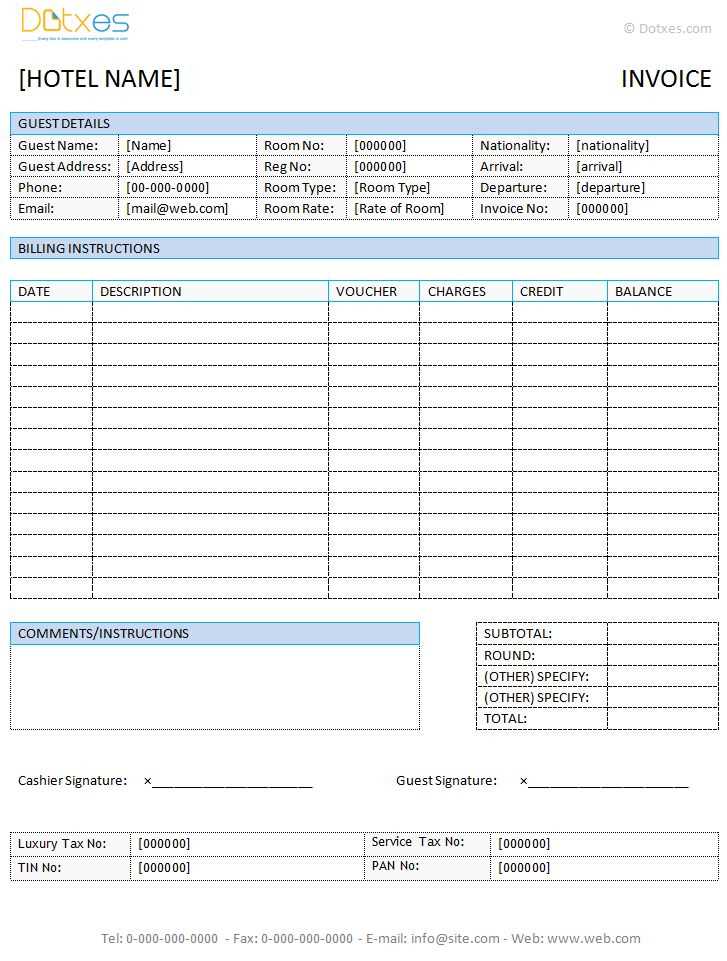

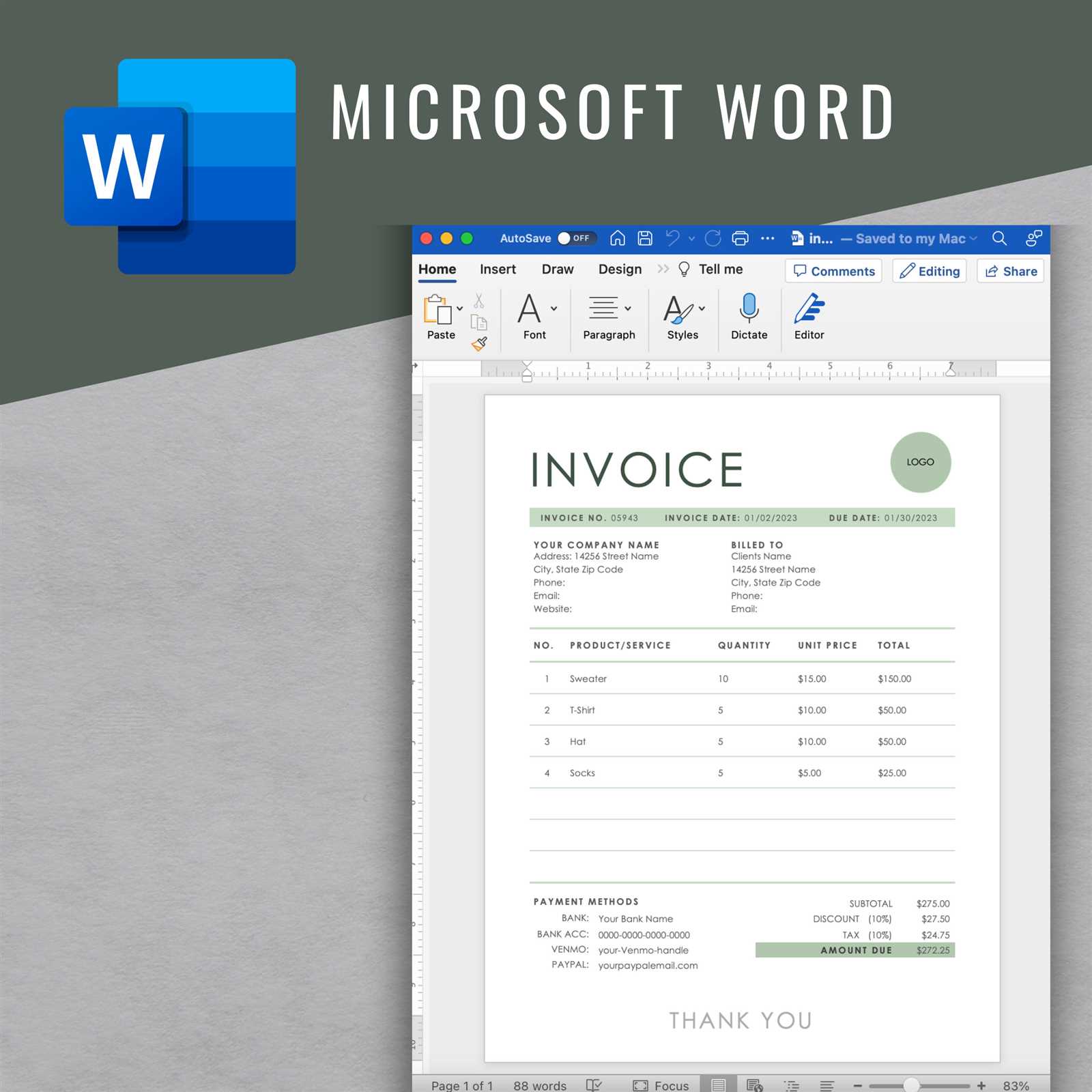

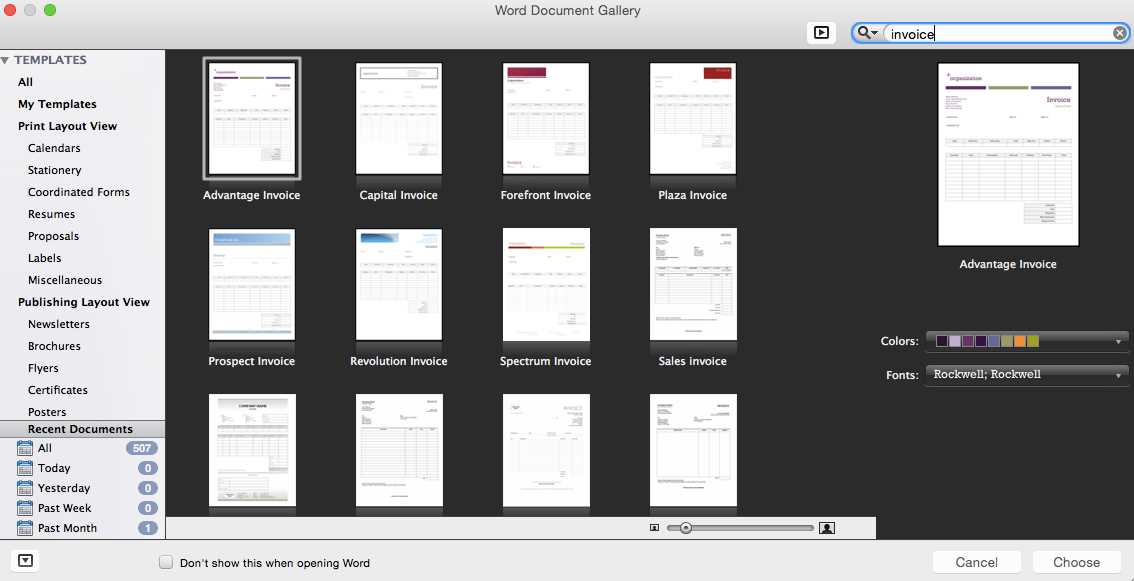

With various pre-built formats available, adjusting the layout to match your business’s needs is straightforward. From adding your logo to adjusting the payment terms, you can easily personalize the document to reflect your branding and professional standards. A well-structured document not only looks clean but also helps prevent any confusion when it comes to payments.

Key Features to Look for

When selecting a suitable format, it’s important to ensure it includes all essential fields. Look for layouts that allow you to include company details, service descriptions, and payment deadlines. Additionally, consider using automated calculations for taxes or discounts, which can save time and reduce the likelihood of errors.

Benefits of Using Invoice Templates

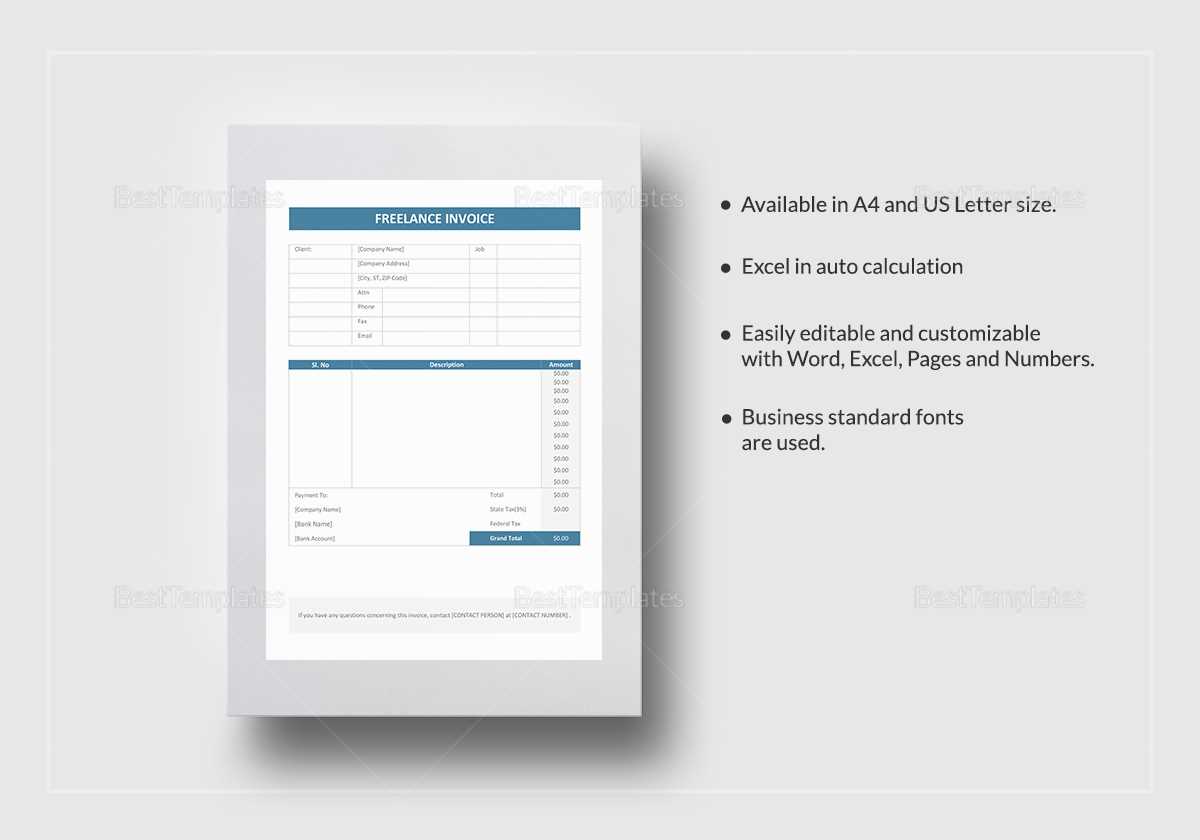

Utilizing pre-designed billing formats brings significant advantages to both small business owners and freelancers. These ready-to-use structures streamline the process, saving valuable time and effort while ensuring consistency in every document issued. With a few simple adjustments, you can create professional and accurate statements quickly, which enhances the efficiency of your operations.

One of the primary benefits is the reduction in errors. Having fields already laid out ensures that important information, such as payment terms, amounts, and due dates, are never overlooked. Additionally, the structured format helps maintain clarity, making it easier for clients to understand the charges and reducing the likelihood of disputes.

Moreover, pre-configured documents often come with built-in features like automatic tax calculations or customizable fields, allowing for greater flexibility and accuracy. This can be especially useful for businesses dealing with fluctuating rates or offering different services, making the process of managing finances even more efficient.

How to Customize Word Invoice Templates

Customizing your billing documents allows you to tailor them to your specific business needs, ensuring they reflect your brand and convey the right message to clients. With simple adjustments, you can personalize each section, from the company logo to the payment terms, making sure everything aligns with your professional standards.

The first step is to adjust the layout. Many available formats allow you to change fonts, colors, and spacing. This gives you the flexibility to match the document with your branding style. You can also reposition sections to highlight important details, such as due dates or special discounts.

Next, focus on the content. Ensure all essential fields are included, such as your contact information, payment instructions, and detailed service descriptions. By replacing generic placeholders with your specific business data, you create a personalized experience for your clients. Additionally, consider adding custom fields like taxes or project milestones to further reflect the nature of your work.

Choosing the Best Template for Your Business

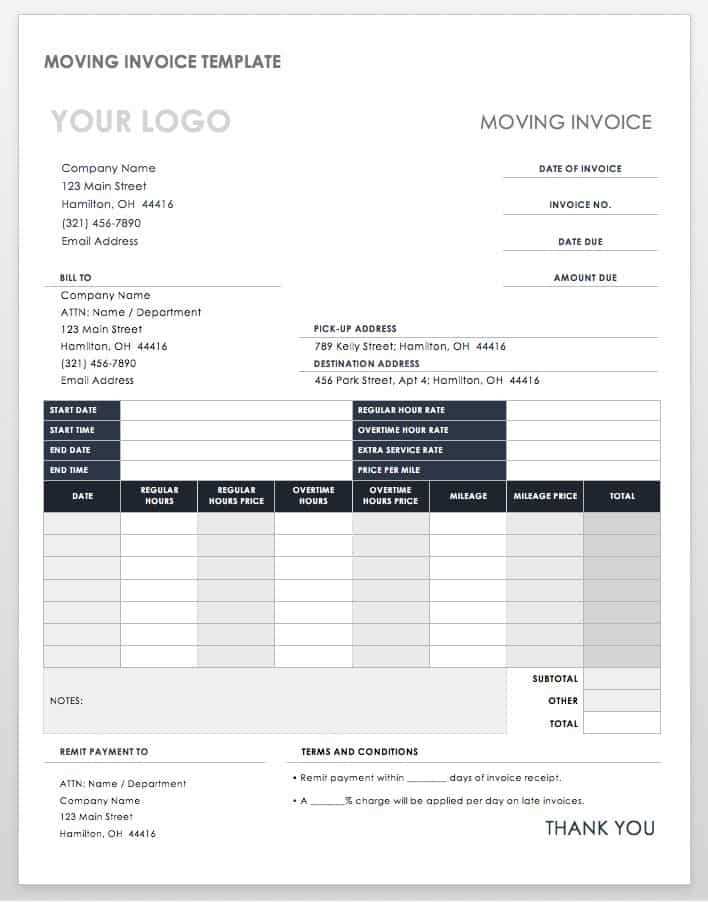

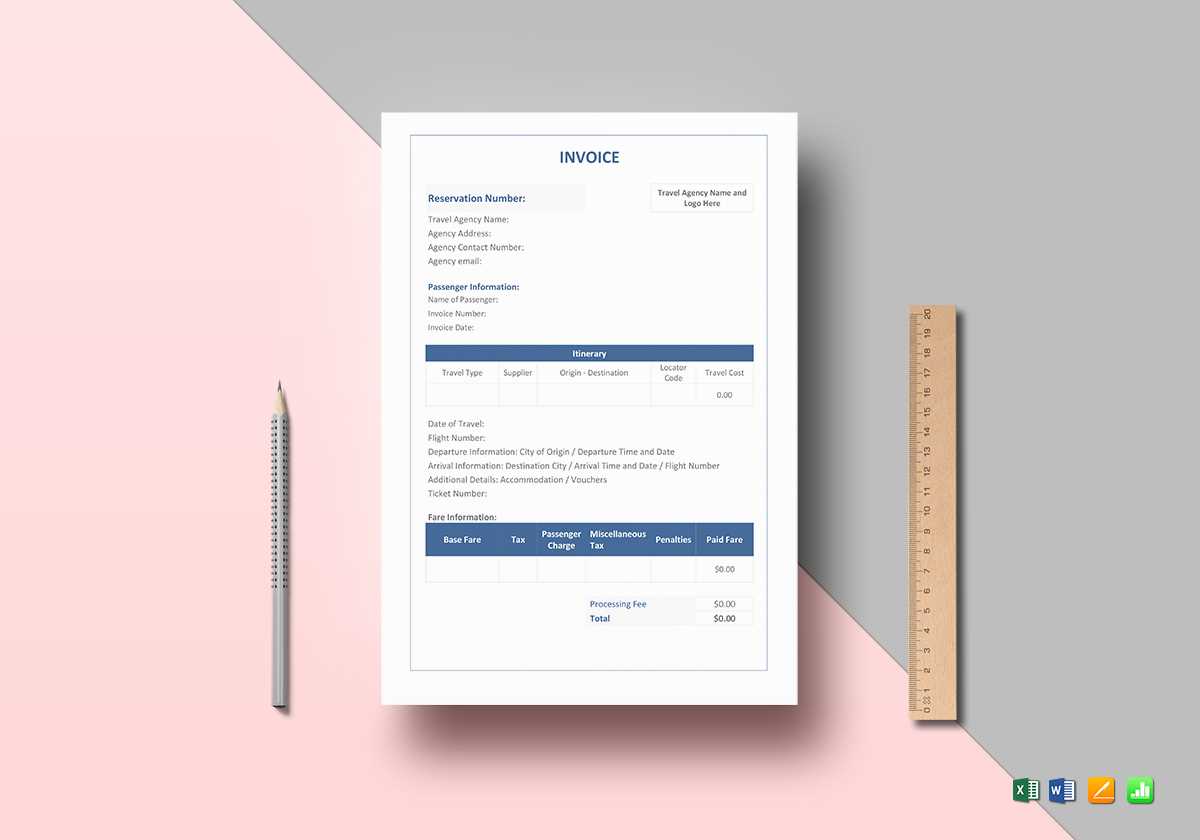

Selecting the right format for your billing documents is essential to ensure they meet both your operational needs and the expectations of your clients. The ideal structure should reflect your company’s professional image while offering all the necessary fields to present clear and detailed payment information.

Consider the type of services or products you offer when choosing a layout. A simple design may be sufficient for straightforward transactions, while a more detailed format might be necessary for complex services or long-term projects. Additionally, make sure the chosen structure allows for flexibility in adjusting fields such as pricing, quantities, and project details.

Look for layouts that provide a balance between readability and functionality. A well-organized document with a clear flow of information will enhance client understanding and reduce any potential confusion about charges. Finally, ensure that the chosen design is easily customizable, so it can evolve as your business grows or changes.

Step-by-Step Guide to Invoice Creation

Creating a professional billing document is a straightforward process when you follow a clear and organized approach. By breaking the task down into manageable steps, you can ensure that every necessary detail is included and that the final document is both accurate and easy to understand.

Here is a simple guide to help you create your own billing document:

| Step | Action | Details |

|---|---|---|

| 1 | Choose a Format | Select a design that suits your business needs, whether it’s simple or detailed. |

| 2 | Enter Your Business Details | Include your company name, address, phone number, and email. |

| 3 | Add Client Information | Input your client’s name, address, and contact details. |

| 4 | List Services or Products | Provide a detailed description of the products or services provided, including prices and quantities. |

| 5 | Include Payment Terms | Clearly state the payment due date and accepted payment methods. |

| 6 | Review and Finalize | Check for accuracy and ensure all necessary information is included before sending. |

By following these steps, you can ensure that each billing document is thorough and professional, helping to maintain clear communication with your clients and streamline your business operations.

Common Mistakes in Invoice Design

Creating a professional billing document requires attention to detail, but common mistakes can easily slip through the cracks, leading to confusion or delays in payment. These errors often stem from poorly organized information or a lack of clarity, which can result in missed payments or disputes with clients.

Below are some of the most frequent mistakes people make when designing their billing documents:

| Error | What to Avoid | How to Fix It |

|---|---|---|

| Lack of Clear Contact Information | Not including your business or client’s contact details can lead to confusion. | Ensure your business details, along with the client’s information, are clearly displayed at the top of the document. |

| Missing Payment Terms | Leaving out the payment due date or method can delay the transaction. | Always specify the payment terms, including due date and accepted payment methods, to avoid misunderstandings. |

| Overcrowded Layout | A cluttered design makes it hard for clients to read and understand the charges. | Keep the layout clean and organized by using sufficient white space and clear headings for each section. |

| Unclear Descriptions | Using vague terms or abbreviations may confuse clients about what they are being charged for. | Provide detailed descriptions of each service or product, including quantities, prices, and any applicable taxes. |

| Not Including Tax Information | Forgetting to calculate or list taxes can lead to errors in payments. | Always include a breakdown of taxes and other additional charges, clearly labeled in the document. |

By addressing these common mistakes, you can create a more professional and efficient billing experience for both you and your clients, ensuring that payments are processed quickly and accurately.

How to Add Your Business Logo

Incorporating your business logo into your billing documents is an important step in establishing a professional identity. The logo not only helps reinforce your brand but also ensures consistency across all communications with clients. Here’s a simple guide on how to add your logo to any billing document.

Follow these steps to include your logo in your design:

- Prepare Your Logo: Make sure your logo file is in a suitable format, such as PNG, JPEG, or SVG. The file size should be optimized for quick loading and high quality.

- Open the Document: Open your document and locate the header section where you want your logo to appear.

- Insert the Logo: Depending on the software you are using, navigate to the insert menu and select “Image” or “Picture”. Choose the logo file from your computer and insert it into the document.

- Resize and Position: Adjust the size of the logo to ensure it fits neatly within the header area. Make sure the logo is clearly visible but not overpowering the other content.

- Align the Logo: Position the logo to the left, center, or right of the header, depending on your layout preference. Ensure there is enough space around the logo for a clean and professional appearance.

- Save the Document: After inserting and positioning the logo, save the document in your preferred format, ready for sending to clients.

By following these steps, you can easily add your logo to your billing documents, giving them a polished, professional look that represents your business effectively.

Saving and Exporting Your Invoice

Once you have completed your billing document, it’s important to save it in a format that preserves its layout and ensures easy access for future use. Exporting it to a commonly used file format is crucial for sharing the document with clients in a professional manner while keeping the file size manageable.

Follow these steps to save and export your document:

| Step | Action | Details |

|---|---|---|

| 1 | Choose the Save Option | Click “Save As” to choose the destination folder and file name for your document. |

| 2 | Select File Format | Save your document in formats like PDF, DOCX, or another format suitable for your needs. |

| 3 | Export as PDF | If you want a professional, universally accessible format, export the document as a PDF. This preserves all formatting. |

| 4 | Compress for Email | If your document is too large, compress the file to reduce its size before sending it via email. |

| 5 | Double-Check File Name | Ensure the file name is clear and includes relevant details like the client’s name and the date. |

By following these steps, you can save and export your document in the right format, ensuring it’s ready to be sent out professionally and efficiently.

Integrating Payment Terms in Invoices

Clearly outlining payment terms in your billing documents is essential for managing cash flow and ensuring that clients understand the expectations regarding payment. This information sets clear guidelines for both parties, reducing the risk of misunderstandings or delayed payments.

To effectively include payment conditions in your billing documents, consider the following tips:

- Specify the Payment Due Date: Clearly state when the payment is expected. It could be a set number of days after the document is issued or a specific calendar date.

- Define Accepted Payment Methods: Include all the methods through which you accept payments, such as credit cards, bank transfers, checks, or online payment platforms.

- Offer Early Payment Discounts: If applicable, consider providing a discount for early payment. This can incentivize clients to pay sooner.

- Include Late Payment Fees: Outline any fees for overdue payments. This may encourage clients to make timely payments and ensure that late fees are understood upfront.

- Clarify Currency and Amount: Ensure that the currency used is clear, especially for international clients. This avoids confusion, especially if different currencies are involved.

- Use Simple Language: Avoid overly complex legal jargon. Use simple and straightforward terms so that your client easily understands the expectations.

By clearly stating payment terms, you can help ensure smoother transactions and avoid delays, creating a more professional experience for both you and your clients.

Automating Invoice Generation on Mac

Automating the creation of billing documents can save valuable time and reduce the risk of human error. By using the right tools, you can streamline the entire process, from generating and filling in details to sending it directly to clients, all with minimal effort.

There are various ways to automate the creation of these documents on a computer, especially for users working within the Apple ecosystem. Below are some methods you can use to simplify this task:

Using Spreadsheet Software

One of the simplest ways to automate your billing process is by using spreadsheet software. Many of these tools have built-in features that allow you to set up custom templates, auto-fill fields, and even calculate totals automatically.

- Setup Custom Formulas: Create formulas to calculate totals, taxes, and discounts based on the details entered in predefined fields.

- Use Data Validation: This ensures that all necessary information, like client details and due dates, is entered correctly.

- Save as a Template: Once you create a custom layout, save it as a reusable template for future use.

Using Dedicated Invoice Software

If you require more advanced features, consider using dedicated software solutions. These applications often offer automation features that can handle recurring billing, track payment statuses, and send reminders when payments are overdue.

- Automate Recurring Billing: Set up recurring cycles for clients who are billed on a regular basis.

- Payment Integration: Many tools can integrate with online payment systems to streamline the payment process directly from the document.

- Track Expenses: Some software also allows you to input and track your business expenses alongside your invoices.

By adopting these automated methods, you can ensure consistent, error-free billing without spending unnecessary time on manual tasks.

Using Excel with Word Invoice Templates

Combining the power of spreadsheet software with document editing applications allows for greater flexibility and efficiency when managing billing processes. By using both tools together, you can easily create customized forms, manage financial data, and streamline your accounting tasks.

Here’s how you can leverage spreadsheet software alongside your document designs to create dynamic and professional billing documents:

- Data Management: Use spreadsheets to store client information, itemized lists, and pricing data. This makes it easy to update and reuse across multiple billing documents.

- Automated Calculations: Set up formulas in the spreadsheet to automatically calculate totals, taxes, and discounts, reducing the risk of manual errors.

- Merge Data into Documents: After entering data into a spreadsheet, you can merge it into your document layout. This way, you don’t have to manually input the same information each time.

By connecting the functionality of both tools, you can manage your records more effectively and produce highly accurate, custom documents quickly. The integration of spreadsheet data into your billing designs can save both time and effort, making the overall process more efficient.

Tracking Payments Using Invoice Templates

Monitoring and managing payments is a crucial aspect of maintaining healthy cash flow in any business. By organizing your billing documents effectively, you can keep track of which clients have paid and which still owe money, ensuring timely payments and reducing the risk of overdue debts.

Here are some strategies to help you track payments using customized billing forms:

Adding Payment Status Columns

Including a payment status column within your forms allows you to easily update and monitor the progress of payments. This section helps you to track whether an invoice is paid, pending, or overdue.

- Paid: Mark the item as “Paid” once the full payment has been received.

- Pending: Mark the item as “Pending” when the payment is still due, but not yet overdue.

- Overdue: Indicate overdue payments with a different color or label to make them stand out.

Using Date and Payment Reference Fields

By including specific fields such as the payment date and reference number, you can make tracking more organized and efficient.

- Payment Date: Record the exact date when a payment is received to keep an accurate payment history.

- Reference Number: Use a unique reference number for each payment, especially when using multiple payment methods or processing transactions through different systems.

By incorporating these features into your forms, you can simplify the tracking of payments, allowing you to quickly identify unpaid or overdue amounts. Keeping these records up to date helps ensure a smooth financial operation and reduces confusion when managing multiple clients or transactions.

Why You Should Avoid Overcomplicated Templates

Simplicity is often the key to creating effective and user-friendly documents. When designing billing forms, it’s important to keep the structure clear and intuitive. Overcomplicating the design with too many features or excessive details can lead to confusion and inefficiency, both for you and your clients.

Here are some reasons why sticking to a simple, streamlined design is preferable:

- Ease of Use: Complex layouts can make it difficult to find essential information quickly. Clients and employees should be able to understand and navigate the document without confusion.

- Time Efficiency: Overly detailed forms require more time to fill out and maintain. A straightforward layout speeds up the process of creating and updating documents, saving valuable time.

- Reduced Risk of Errors: A more complex design often leads to mistakes in data entry or misinterpretation. Simplified documents reduce the chances of making costly errors.

To illustrate the difference, consider the following example:

| Complicated Design | Simplified Design |

|---|---|

| Multiple sections with excessive details, graphics, and unnecessary fields | Basic layout with clear sections for the necessary information, like client details and payment amount |

| Requires additional time to fill in and update | Quick and easy to update, even for those who are not familiar with the document |

| Can cause confusion due to too much information at once | Easy to understand and complete with no clutter |

A streamlined design helps to maintain clarity, improve productivity, and minimize errors. By keeping things simple, you not only make your job easier but also improve the overall experience for your clients.

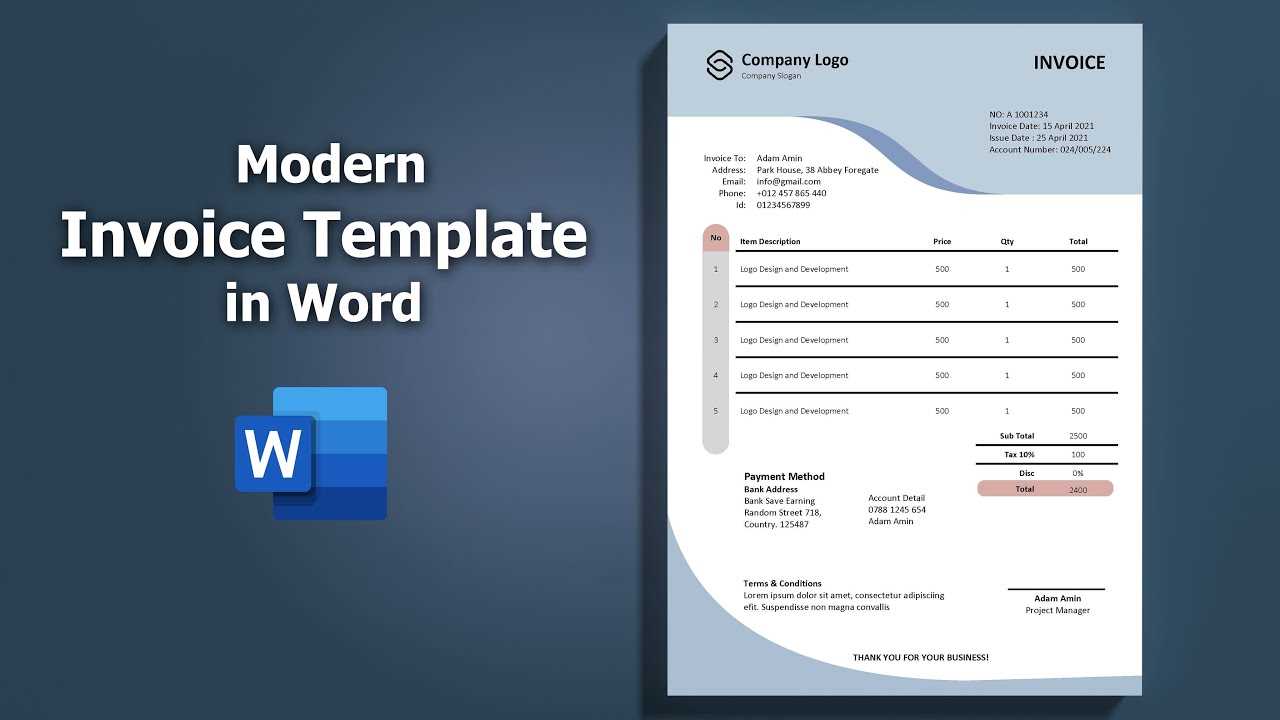

Customizing Fonts and Layout for Professional Look

The visual appeal of your documents plays a crucial role in creating a positive impression. When designing business documents, it’s important to focus on clean aesthetics and professional layout. The right choice of fonts and arrangement can enhance readability and convey a sense of reliability and trustworthiness to your clients.

Customizing fonts and layout can significantly elevate the overall quality of your billing documents, ensuring they look polished and aligned with your brand identity. Here’s how you can make simple adjustments for a more professional appearance:

Choosing the Right Fonts

Font selection is one of the key elements that influence the overall tone of a document. Opting for legible, simple fonts ensures clarity while maintaining a professional vibe. Here are some recommended font choices:

- Serif Fonts: These fonts, such as Times New Roman or Georgia, have small lines or decorations at the ends of letters. They are often considered more traditional and formal.

- Sans-serif Fonts: Fonts like Arial or Helvetica offer a cleaner, more modern look. They are often easier to read on digital screens.

- Highlighting Key Information: Use bold or italic fonts sparingly to highlight important information such as totals or due dates.

Optimizing Layout and Spacing

Layout plays a significant role in guiding the reader’s eye through the document. A well-organized structure not only looks more appealing but also makes information easier to find.

- Consistent Margins: Set uniform margins on all sides to create a balanced and clean layout.

- Clear Section Dividers: Use lines or blank spaces to separate sections such as client information, itemized charges, and payment details.

- Proper Line Spacing: Adequate space between lines and sections improves readability and prevents the document from looking too crowded.

By customizing fonts and layout, you ensure that your documents not only look professional but also reflect your brand’s identity. With a little attention to detail, your business correspondence will make a lasting and positive impression on your clients.

Understanding Legal Requirements for Invoices

Creating and sending business documents requires careful attention to both formatting and legal considerations. It is essential to ensure that your billing statements adhere to the specific legal regulations in your region. These documents are not just tools for requesting payment, but also crucial records for tax purposes and contractual compliance.

Each country or jurisdiction may have its own set of requirements regarding the information that must appear in a billing document. While these guidelines can vary, there are several common legal elements that should be included to ensure your statements are both valid and legally binding.

Key Information Required on Billing Documents

To avoid issues with payment or legal challenges, your documents should include specific details. These are some of the most commonly required pieces of information:

- Business Information: Include the full name, address, and contact details of both your business and the recipient. This ensures clarity in case of disputes or further communication.

- Unique Identification Number: This can include an order number, transaction ID, or a reference code to uniquely identify the document.

- Itemized List of Goods/Services: Clearly describe the goods or services provided, including quantities and unit prices, to avoid misunderstandings.

- Payment Terms: State the agreed-upon payment terms, including deadlines, methods, and any penalties for late payment.

- Tax Information: Include tax rates and breakdowns where applicable, such as sales tax, VAT, or other required taxes specific to the jurisdiction.

- Total Amount Due: Clearly show the total amount due, including any taxes, discounts, or additional charges.

Compliance with Local Laws

Each region may have its own set of rules for invoicing, especially regarding tax collection and record keeping. For example, some countries require the inclusion of specific tax identification numbers, while others may mandate that the document be submitted to tax authorities in certain formats. It is crucial to research the requirements for your jurisdiction to ensure your statements comply.

- Tax Regulations: Many countries require that businesses include detailed information about tax rates, such as VAT or GST, to comply with local tax laws.

- Record-Keeping: Legal requirements often dictate how long you must retain copies of billing statements for auditing and tax reporting purposes.

- Electronic Billing: In some regions, there may be specific rules about whether electronic invoices are acceptable or whether they need to be submitted in physical form.

Best Practices for Sending Invoices on Mac

When it comes to delivering payment requests, ensuring that your process is both professional and efficient is key. Using the right tools and practices for sending documents can help streamline your workflow and make the experience seamless for both you and your clients. Whether you’re sending digital or physical documents, there are several best practices to follow to ensure accuracy and professionalism.

Ensure Clear and Professional Formatting

The way you present your payment requests is just as important as the information it contains. A clean, organized layout helps prevent confusion and ensures the recipient understands the details clearly. Here are some essential tips for creating a professional-looking document:

- Use Consistent Fonts: Stick to standard fonts like Arial or Times New Roman, which are easy to read. Avoid excessive use of bold or italics.

- Maintain Logical Structure: Ensure that sections such as billing details, descriptions, and payment terms are clearly separated and easy to follow.

- Keep It Simple: Avoid cluttering your document with unnecessary design elements or text. The simpler and cleaner the layout, the more professional it will appear.

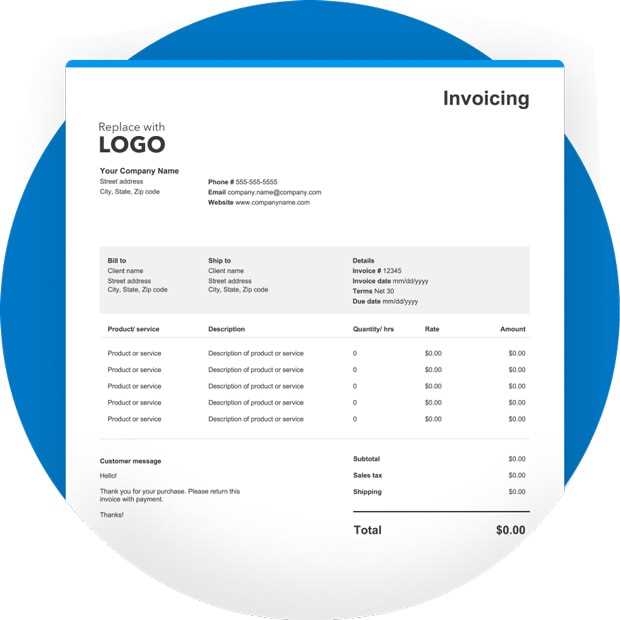

Choose the Right File Format for Delivery

When sending payment documents electronically, it’s crucial to choose the appropriate file format to ensure that your document can be easily opened and viewed by the recipient. Here are some file formats to consider:

- PDF: PDF is widely used and ensures that your document’s layout remains intact, regardless of the device or software the recipient uses. It’s a preferred choice for most businesses.

- Excel: If you have dynamic data, like itemized lists or calculations, Excel allows recipients to interact with the numbers directly. Just make sure the recipient is comfortable with this format.

- JPEG or PNG: If you need to send a quick, visual payment request, a well-designed image can be useful. However, it’s not recommended for formal transactions.

Send Through Secure and Reliable Channels

To avoid potential issues such as lost documents or delays, always send your payment requests using reliable and secure methods. Here are some ways to send your documents safely:

- Email: When sending digitally, email is the most common and efficient method. Ensure the document is attached properly and the subject line clearly identifies the purpose of the email.

- Online Billing Systems: For recurring billing or managing multiple clients, using an online system that automates invoice sending is a good choice. These platforms often include tracking and receipt confirmations.

- Postal Servi