Download Microsoft Word Invoice Templa

When it comes to managing payments and keeping track of financial transactions, having a clear and organized document is essential. Whether you’re a freelancer or a small business owner, simplifying the billing process can save you time and reduce errors. A well-structured document allows you to present professional and accurate details that ensure smooth business operations.

Using a pre-designed structure for creating billing records helps streamline the process. These documents can be easily customized to fit the specific needs of your business, from adding your company’s branding to adjusting payment terms. By choosing the right format, you can enhance your workflow and maintain a polished appearance that aligns with your business’s image.

Customization is key to ensuring that each statement matches your requirements while maintaining professionalism. A good setup will allow you to focus on your work, while the documentation takes care of itself. With the right approach, generating financial statements becomes a quick, hassle-free task, helping you stay organized and on top of your business finances.

Microsoft Word Invoice Templates Overview

In the modern business world, creating structured and professional financial records is an essential task. Pre-designed formats help streamline this process, offering users a simple and efficient way to organize payment details. These structured files ensure consistency, reduce errors, and present a polished appearance, reflecting a business’s commitment to professionalism.

Key Benefits of Using Pre-Designed Formats

By using structured documents, business owners and freelancers can save time and effort. Instead of creating records from scratch, these pre-made layouts offer a foundation that can be customized for specific needs. The consistency they provide ensures that every document looks cohesive, regardless of the user or situation. Additionally, these formats often include essential fields like payment terms, dates, and contact information, reducing the chances of missing crucial details.

Types of Available Formats

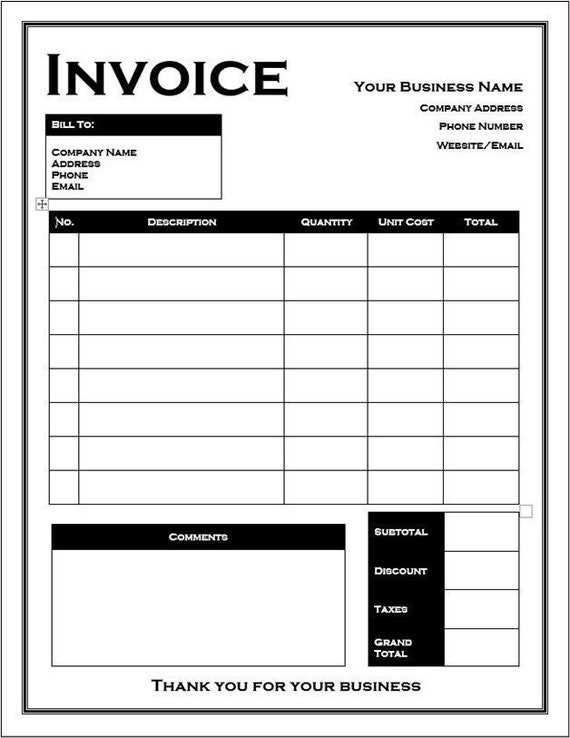

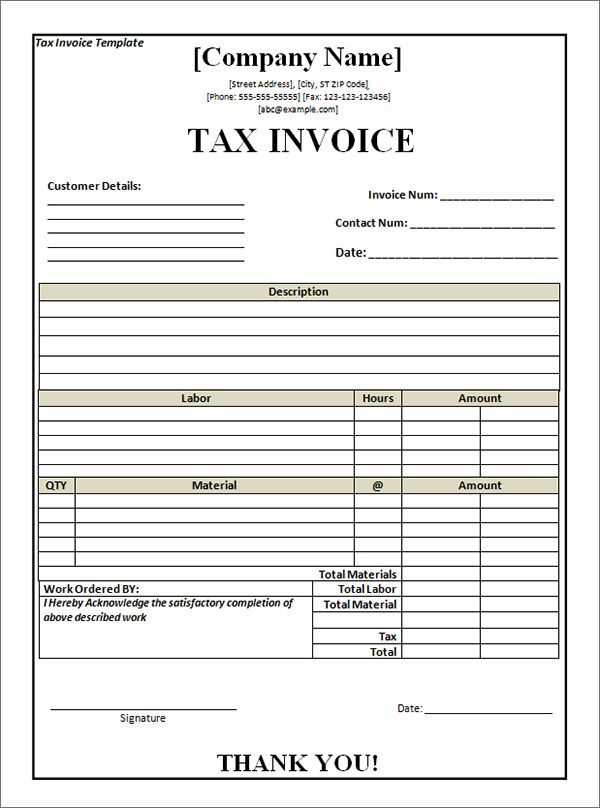

There are various types of pre-designed formats, each tailored to different industries and business needs. Some are simple and basic, while others offer more sophisticated designs with additional features like automatic totals or tax calculations. The choice depends on the user’s specific requirements and the level of customization needed.

| Format Type | Description |

|---|---|

| Basic Layout | Simplified structure for quick use, easy customization, and professional results. |

| Advanced Layout | Includes additional fields for taxes, discounts, and itemized billing, ideal for larger businesses. |

| Customizable Designs | Offers flexible options to modify the layout, colors, and branding elements for a personalized touch. |

Benefits of Using Word for Invoices

Using a structured document for managing billing allows businesses to maintain a professional appearance while ensuring accuracy. A reliable format can simplify the process of tracking payments, generating records, and customizing fields. The key benefits of such documents lie in their versatility, ease of use, and the level of control they offer over content formatting and design.

One significant advantage is the ease with which users can edit and customize the layout according to specific needs. Whether it’s adjusting the payment terms, adding logos, or modifying the overall appearance, this flexibility makes it an ideal choice for businesses of all sizes. Moreover, creating documents from scratch is unnecessary, as pre-designed structures provide a solid foundation that can be adapted to suit various situations.

Additionally, these documents are widely compatible across different devices and platforms, ensuring that the files can be easily shared and accessed. This compatibility streamlines communication, especially when collaborating with clients or partners. Whether creating a simple bill or a more detailed statement, users can rely on these documents for clarity and professionalism.

How to Download Invoice Templates

Obtaining a structured document for billing purposes is a straightforward process that can save time and enhance professionalism. Many sources offer these pre-designed layouts, allowing users to quickly find a suitable format that fits their needs. The steps involved in acquiring such documents are simple and can be completed in just a few minutes.

Finding Reliable Sources

Numerous platforms provide ready-made layouts, including both free and paid options. Popular websites, including online marketplaces and business resources, often offer a variety of designs for different industries. To ensure reliability, it’s essential to choose trusted sources that regularly update their content and offer high-quality files.

Steps to Acquire and Save the Document

Once you’ve identified the ideal source, acquiring the layout typically involves a few clicks. After selecting the design you prefer, simply follow the instructions to save the document onto your device. It’s important to ensure the format is compatible with your software, allowing for easy customization and use once it’s saved to your system.

Customizing Your Word Invoice Template

Personalizing a billing document is essential to ensure it aligns with your business’s identity and needs. By adjusting key elements such as layout, fonts, and fields, you can create a unique and professional look that reflects your brand. Customizing the document not only makes it more visually appealing but also helps tailor it to your specific requirements, such as adding your company logo or adjusting payment terms.

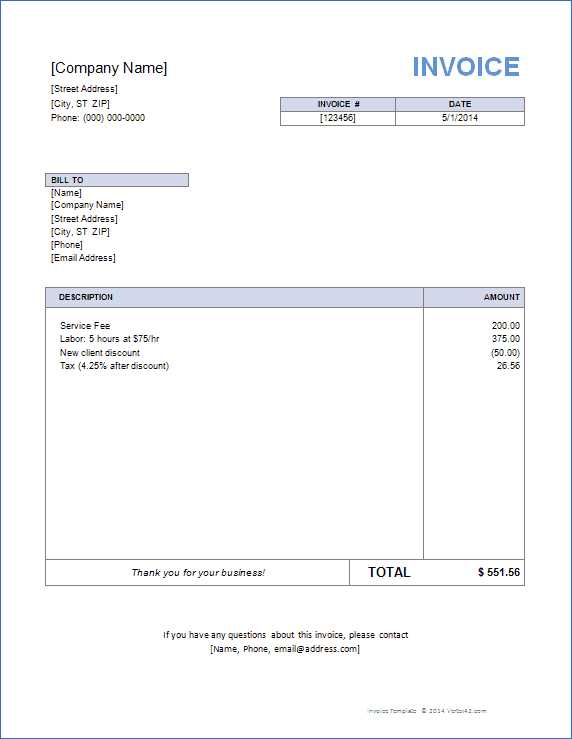

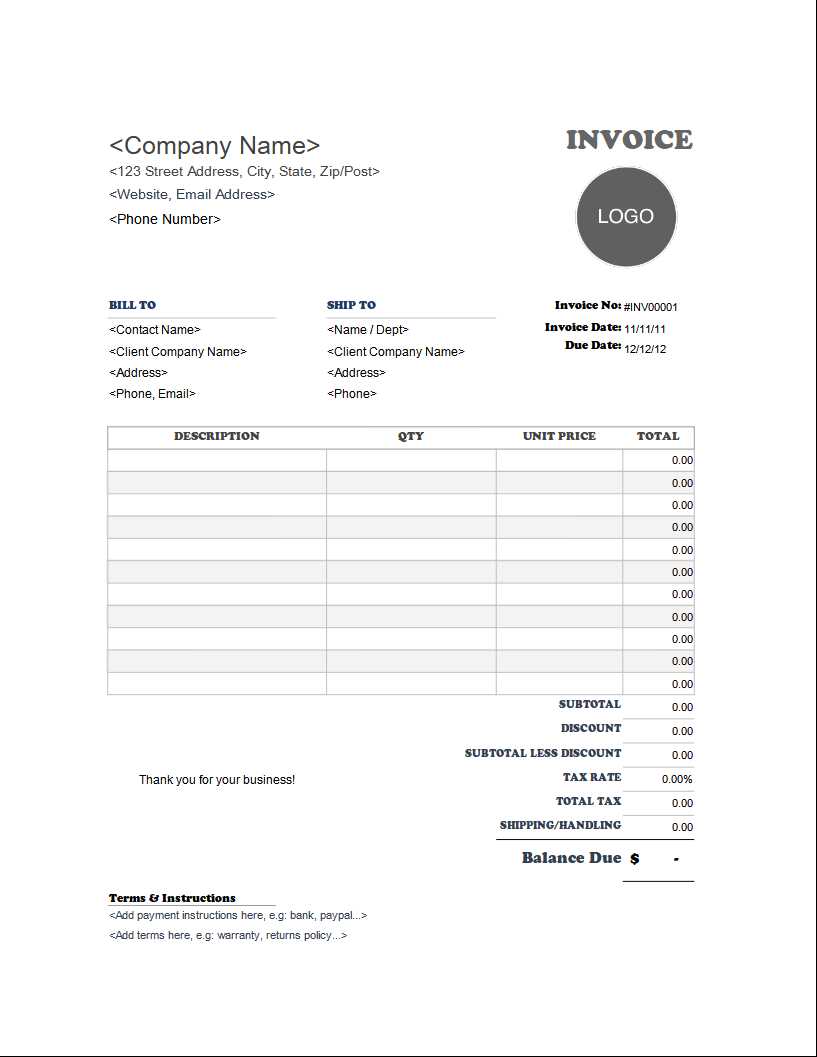

Key Elements to Customize

The most important features to personalize in a structured document are the header, footer, and content sections. The header typically includes your business name and logo, while the footer can feature your contact information, terms of service, or social media links. The content section should be tailored to include all the necessary details like item descriptions, quantities, and prices.

Using Tables for Organization

Tables are a great tool for organizing the information in your billing document. They allow you to neatly align rows of data, ensuring that everything is easy to read and understand. You can adjust the number of columns and rows to suit the type of billing you’re processing, whether it’s a simple service charge or a more complex list of products.

| Field | Customization Option |

|---|---|

| Company Name | Add your logo, adjust the font, and use your business’s color scheme. |

| Item List | Customize column headers and item descriptions as per your service/product offerings. |

| Terms and Conditions | Include your payment terms, return policies, or any other important business guidelines. |

Free vs Paid Word Templates

When choosing a pre-designed document for billing purposes, you can either go for free options or invest in premium versions. Both have their advantages, depending on your business needs. Free options often provide a basic structure that works for smaller businesses or individuals just starting. However, paid alternatives typically offer additional features, customization options, and professional designs that may better suit larger businesses or those looking for specific functionality.

Advantages of Free Options

Free options can be a great starting point for those with a tight budget. They offer a simple and quick solution for creating billing documents without any upfront cost. Here are some benefits:

- Easy to access with no cost involved.

- Basic but functional for straightforward billing needs.

- Perfect for freelancers or small businesses with minimal requirements.

Advantages of Paid Options

Paid versions tend to offer more sophisticated features, making them ideal for businesses that need extra flexibility or advanced design elements. Here are some benefits of choosing a premium version:

- Advanced customization options to match your branding.

- More professional designs with better formatting.

- Additional fields for taxes, discounts, and other business-specific requirements.

Top Features of Word Invoice Templates

Pre-designed billing documents offer a variety of features that make them a convenient and efficient choice for managing payments. These features allow users to create professional-looking records while saving time on formatting. Depending on the design, there are several key elements that enhance usability and customization.

Key Functionalities

One of the main advantages of using ready-made billing documents is the wide range of built-in features that simplify the creation process. Here are some essential functionalities:

- Automatic Calculations: Some layouts include fields that automatically calculate totals, taxes, and discounts, saving you time and reducing errors.

- Pre-Defined Fields: These documents often come with fields for payment terms, contact information, and itemized lists, making it easier to organize your billing details.

- Customizable Layouts: Many options allow you to adjust fonts, colors, and structure to match your business’s branding.

Additional Features for Professionalism

To make your billing process even more streamlined and professional, some pre-designed documents offer additional features that can enhance both the look and functionality:

- Logo Insertion: Adding your company’s logo directly to the document helps establish brand recognition.

- Multi-Currency Support: For international businesses, some formats include the ability to handle multiple currencies and exchange rates.

- Flexible Payment Methods: Including different payment options, such as bank transfers or online payment links, helps cater to a broader audience.

Saving and Printing Your Invoice

After customizing and reviewing your billing document, the next steps involve saving it for future reference and printing it for delivery to your clients. Ensuring that the file is properly stored and formatted for print will help maintain a professional presentation. Whether you plan to send the document digitally or via mail, it’s important to know how to save and print the file correctly.

Saving Your Document

Saving your document is essential to prevent any loss of information. Most commonly used software provides several options for saving your files, depending on your preferred file format and future needs.

- File Format: Save your document in a format that’s easily accessible, such as .docx or .pdf. The latter is especially useful for ensuring the layout stays consistent across different devices.

- File Location: Choose a folder or cloud storage service where you can easily locate the document later, especially if you need to use it as a template for future transactions.

- Version Control: If making multiple revisions, use file naming conventions that include the date or version number to keep track of the latest updates.

Printing Your Document

Once saved, you can print the document for physical records or delivery. Ensure the layout is adjusted for the correct paper size and printer settings before printing to avoid any formatting issues.

- Print Preview: Always use the “Print Preview” feature to check how your document will appear on paper, adjusting margins and page breaks if necessary.

- Printer Settings: Select the appropriate printer settings, such as paper size and quality, to ensure a professional printout.

- Multiple Copies: If you need to send multiple copies, use the printing options to select the number of copies and manage any duplex printing features.

| Step | Action |

|---|

| Payment Number | Payment Amount | Payment Date | Remaining Balance |

|---|---|---|---|

| 1 | $500 | 01/15/2024 | $200 |

| 2 | $200 | 02/01/2024 | $0 |

This table allows you to clearly see the payment history, making it easier to manage overdue payments and maintain accurate records.

Integrating Payment Methods in Invoices

Incorporating payment options into your billing documents ensures a seamless transaction process for your clients. Providing multiple ways for clients to settle their accounts can speed up payment cycles and improve customer satisfaction. Clearly presenting payment methods in your billing documents helps clients choose the option that is most convenient for them, reducing the risk of delays or confusion.

It is important to include a section where you list all available payment methods, such as credit cards, bank transfers, digital wallets, or checks. This should be easily visible and accessible to avoid any potential issues with payment processing.

Here are some essential details to include when specifying payment methods:

- Bank Account Information: If accepting bank transfers, include the account name, number, and any other necessary details like routing codes.

- Payment Platform Details: If you use services like PayPal or digital wallets, provide the necessary contact details or links for easy access.

- Credit Card Information: For clients paying via card, include the types of accepted cards and any additional instructions for processing payments.

- Payment Instructions: Clarify any specific steps your client should follow to ensure their payment is processed quickly and accurately.

By integrating these methods into your billing documents, you provide a clear and professional experience for your clients, making it easier for them to pay promptly and without complications.

How to Modify Invoice Layouts

Customizing the layout of your billing documents allows you to create a professional, clear, and personalized look that reflects your brand identity. By adjusting the placement of key information such as payment terms, contact details, and transaction breakdowns, you can enhance the readability and overall effectiveness of your documents. Tailoring the layout also ensures that your billing documents meet the specific needs of your business and clients.

Adjusting Document Structure

Begin by deciding which sections are essential to include in your document, such as the client’s information, services provided, payment details, and due dates. Rearranging these elements can help improve the flow of the document. For example, you might want to place the payment instructions or terms at the bottom or emphasize the total amount due at the top for quicker visibility.

Using Tables for Organized Information

One of the most efficient ways to structure your billing documents is by using tables to organize product or service information. Here’s an example of how to present your charges clearly:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Service | 1 | $500 | $500 |

| Hosting Fee | 12 months | $10 | $120 |

This table format provides a clear breakdown of charges, helping clients easily understand what they are being billed for and improving the overall transparency of the document.

By adjusting the layout to meet your needs, you can create a more effective billing experience for both you and your clients, ensuring clarity and professionalism in every transaction.

Tips for Efficient Invoice Management

Managing financial documents effectively is essential for maintaining a smooth cash flow and ensuring timely payments. By adopting a few simple strategies, you can streamline the process of creating, tracking, and organizing your billing documents. These practices not only help you stay organized but also contribute to improved client relations and reduced administrative overhead.

Organize and Categorize Documents

Maintaining an organized system for your billing records is key to efficient management. This will help you quickly locate past transactions, track payments, and prevent any errors in your records. Here are a few organizational tips:

- Use clear naming conventions: Name your documents with specific identifiers like the client name, date, or job type (e.g., “ClientName_Invoice_July2024”).

- Group by date or client: Sort your files by client or billing cycle to make future referencing easier.

- Implement a filing system: Use digital folders or cloud storage with subfolders for each client or month.

Automate and Set Reminders

Automation can save you time and ensure that important deadlines aren’t missed. By setting up reminders for payment due dates or using software to automate the creation of recurring documents, you can avoid unnecessary stress. Here are a few automation tips:

- Recurring billing setup: For clients with ongoing projects or subscriptions, set up automated recurring billing schedules.

- Payment reminders: Automatically send reminders for overdue payments to clients.

- Payment tracking: Use tracking tools to monitor which invoices have been paid and which are still pending.

By organizing your documents and incorporating automation into your routine, you can save time, reduce mistakes, and ensure smoother financial operations for your business.

Security Tips for Invoice Documents

Protecting sensitive financial information is crucial in today’s digital world. As businesses increasingly rely on electronic records, it’s important to implement security measures to safeguard your billing documents from unauthorized access and potential fraud. Adopting the right practices will ensure that both your information and that of your clients remain secure.

Protect Your Documents with Strong Passwords

One of the most basic yet effective ways to secure your financial records is by using strong passwords for document access. This is especially important when storing or sharing sensitive files online. Consider the following tips:

- Use complex passwords: Combine letters, numbers, and special characters to create hard-to-guess passwords.

- Change passwords regularly: Update your passwords periodically to minimize the risk of unauthorized access.

- Enable two-factor authentication: Add an extra layer of security by requiring an additional verification step when logging into systems or cloud storage.

Limit Access and Use Encryption

Limiting access to your billing documents and using encryption can significantly reduce the risk of data breaches. Here are some practical steps:

- Limit file access: Only share documents with authorized personnel or clients, and ensure they have the appropriate permissions to view or edit.

- Encrypt your files: Use encryption tools to protect sensitive data both during transfer and while stored on your system or cloud services.

- Secure email communication: When sending documents via email, ensure they are encrypted or use secure messaging platforms.

By following these security practices, you can reduce the chances of your financial records being compromised, giving you peace of mind while managing your business transactions.