Microsoft Word Invoice Template 2015 Free Download and Customization Tips

Managing finances and ensuring smooth transactions with clients is a crucial part of any business. One of the most effective ways to streamline this process is by using a customizable document that simplifies the billing process. Whether you’re a freelancer, small business owner, or running a larger company, having a structured format for requesting payments is essential.

In this guide, we will explore how you can utilize ready-made formats that allow for easy customization to fit your specific needs. These tools enable you to generate professional-looking records quickly, minimizing the time spent on paperwork and reducing the chance of errors in your financial documents.

By leveraging these resources, you can focus more on growing your business while ensuring that each transaction is clear and well-documented. Read on to discover how to personalize your forms and ensure they meet all your invoicing needs, from layout design to payment terms.

Microsoft Word Invoice Template 2015 Overview

For any business, keeping track of payments and ensuring clear communication with clients is essential. One of the most effective ways to do this is by using a document format that simplifies the billing process. This tool offers a structured design to help businesses quickly generate professional payment requests. With easy-to-use features, it saves time and minimizes errors, allowing entrepreneurs to focus on growing their business instead of administrative tasks.

The resource provides a wide range of customization options, letting you adjust the document to match your brand and specific invoicing needs. Whether you’re sending one-time charges or recurring bills, this method allows you to generate clear, organized records that can be tailored in just a few clicks.

Key Features

Here are some of the essential features included in the document design:

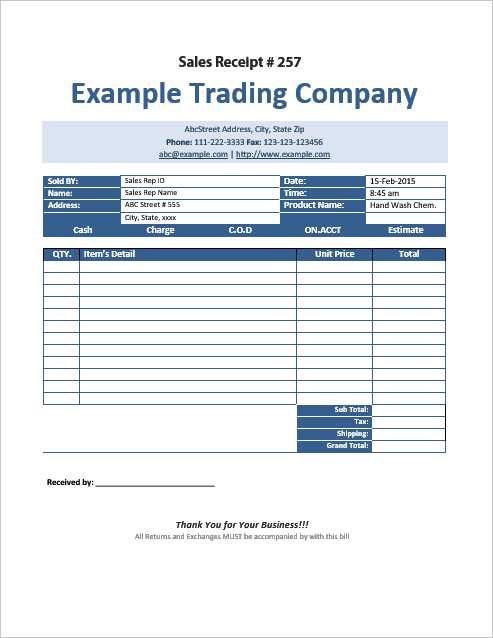

| Feature | Description |

|---|---|

| Customizable Fields | Allowing users to insert company details, client information, payment terms, and itemized charges. |

| Professional Layout | Ensures that the document looks clean and well-structured, presenting all necessary information in an organized manner. |

| Automatic Calculation | Enables automatic math functions for totals, taxes, and discounts to minimize errors in the document. |

| Easy to Share | Designed for quick sharing, whether through email or print, ensuring your clients receive their billing information promptly. |

Advantages of Using This Solution

By opting for this pre-designed document format, businesses can save valuable time and avoid unnecessary complications. It reduces the need for manual formatting, while still providing all the essential information in a clear and concise way. This simplicity not only improves efficiency but also enhances the professionalism of your interactions with clients.

Why Choose Word for Invoices

When it comes to creating payment requests, simplicity and flexibility are key. Using a familiar text editing software offers several advantages, especially for those looking for a straightforward solution without the need for complicated tools. This approach allows for quick customization and ensures a professional look without a steep learning curve.

Here are some of the main reasons why this tool is an excellent choice for businesses and freelancers alike:

- Familiar Interface: Most users are already comfortable with text editing software, making it easy to create, customize, and manage documents without additional training.

- Easy Customization: You can quickly modify the layout, fonts, and content to match your branding or specific business needs, whether you’re a small startup or an established company.

- Wide Compatibility: Documents created in this software can be easily shared and opened on most devices, ensuring that your clients have no trouble accessing their payment requests.

- Templates for Various Needs: You can find pre-designed formats that offer a professional look, saving time and effort when creating payment requests.

In addition, this tool supports functions like adding tables, images, and calculations, which makes it a versatile solution for any type of business transaction.

Ultimately, the combination of ease of use, customization, and compatibility makes this software an ideal choice for anyone looking to streamline the billing process and maintain a professional appearance with minimal effort.

How to Download the Template

Getting access to a ready-made document format for payment requests is simple and can save a lot of time. These pre-designed layouts are easily downloadable and ready for use with just a few clicks. Once you’ve obtained the format, you can quickly customize it to suit your business needs. Follow the steps below to get started.

Step 1: Visit a Trusted Source

First, you’ll need to find a reliable website that offers free or paid document layouts. Many platforms provide downloadable files in a variety of formats, including those compatible with popular text editing programs. Make sure to choose a site that offers updated and safe downloads to avoid any issues with the file.

Step 2: Select the Desired Layout

Once on the site, browse through the available options and select the one that best fits your needs. Most websites will offer a range of styles, from simple designs to more detailed, professional layouts. Pay attention to the details of each format to ensure it aligns with your business type and preferences.

After selecting the document, click the download button and choose the location on your computer where you’d like to save the file. The downloaded file will usually be in a format that can be opened by most text editors, allowing you to get started immediately.

With the template downloaded, you are now ready to begin personalizing it to match your brand and invoicing requirements.

Customizing Your Invoice in Word

Once you’ve downloaded your preferred billing document, the next step is to personalize it to fit your specific needs. Customizing your document helps ensure that it reflects your business identity while providing all necessary details for your clients. With a few simple adjustments, you can tailor the layout, content, and design to make it both professional and functional.

Adjusting Business Information

The first section to customize is the business details. Make sure to input your company name, logo, address, contact information, and any other relevant details. This ensures that your clients can easily identify who the payment request is from and how they can reach you for any inquiries.

Adding Client and Payment Details

Next, focus on the client’s information, including their name, address, and contact number. Additionally, ensure that the payment terms, due date, and total amount are accurately filled out. You can also adjust the layout of these fields to ensure readability and clarity for your client.

| Section | Details to Customize |

|---|---|

| Business Information | Company name, logo, address, phone, email |

| Client Information | Client name, address, contact number |

| Payment Terms | Due date, payment methods, discounts (if any) |

| Itemized Charges | Descriptions, quantities, unit prices, totals |

Once you’ve made these adjustments, the next step is to ensure that all numbers and calculations are accurate. You can either input totals manually or use available functions to calculate totals and taxes automatically, depending on your software’s capabilities.

By taking the time to customize your document, you ensure that it meets both your business requirements and your client’s expectations, creating a polished, professional image with each billing cycle.

Essential Elements of an Invoice

Creating a well-structured payment request document requires including several key components. These elements ensure that both you and your clients have a clear understanding of the transaction, terms, and due dates. Whether you’re a freelancer or a business owner, these essential sections help streamline communication and maintain professionalism.

The following are the core elements that every payment request document should contain:

- Business Information: Your company’s name, address, phone number, and email address should be clearly displayed at the top of the document. This allows the client to easily identify who is sending the request.

- Client Information: Include the name and contact details of the recipient to ensure that the correct person is billed. This also helps with communication in case of any issues with the payment.

- Unique Reference Number: A reference number or invoice number is crucial for tracking payments and for your internal records. It helps distinguish this particular payment request from others.

- Itemized List of Services or Products: Provide a detailed list of the products or services rendered, including quantities, unit prices, and descriptions. This ensures transparency and helps the client understand exactly what they are paying for.

- Payment Terms: Clearly state the payment terms, including the due date, accepted payment methods, and any late fees or discounts for early payments. This ensures there’s no confusion about when and how the payment should be made.

- Total Amount Due: At the bottom of the document, provide a clear total amount due, including any taxes, fees, or discounts. This gives the client an easy-to-read summary of the payment requirements.

- Notes or Additional Information: If necessary, include any additional details or terms, such as special instructions or a thank-you message for the business relationship. This section can also be used to clarify any conditions or agreements that may apply to the transaction.

By including all of these components in your payment requests, you ensure that your documents are clear, complete, and professional, minimizing confusion and helping to facilitate timely payments.

Setting Up Your Business Information

Including accurate and clear business details in your payment requests is essential for professional communication and effective record-keeping. By providing all the necessary contact and company information, you ensure that your clients know exactly who the request is from, how to get in touch with you, and where to send payments. This section of your document should be precise and easy to find.

Key Information to Include

The first step in setting up your business details is to ensure you have all the required information readily available. Here’s a breakdown of the key elements you should include:

- Company Name: Make sure your business name is clearly displayed. This should be the official name under which your business operates.

- Business Address: Include your physical or mailing address so clients know where to send correspondence or payments.

- Phone Number: Add a direct contact number where clients can reach you for inquiries or assistance.

- Email Address: Provide an email address for quick communication and to facilitate digital transactions.

- Website (Optional): If applicable, include your company’s website for clients who may need more information about your services or products.

Formatting Your Business Information

Once you’ve gathered all the necessary details, it’s important to organize them in a clean and readable format. The business section should be placed at the top of the document, typically aligned to the left or centered, so that it’s the first thing your client sees. You can use bold text for your business name and make sure the contact information is listed clearly for easy access.

Ensuring the clarity of your business information helps establish professionalism and trust with your clients. It also simplifies the invoicing process and avoids confusion regarding where payments should be directed.

Adding Client Details to Your Invoice

Including accurate client information in your billing documents is crucial for maintaining clear communication and ensuring that payments are correctly processed. By adding the right details, you make it easier for clients to understand the transaction and for both parties to keep proper records. Ensuring that this section is well-organized and correctly filled out will prevent misunderstandings and potential delays.

The client details section should be clearly visible, typically positioned below your business information. This area includes essential identifiers such as the client’s name, address, and contact information, helping both you and your client stay on the same page throughout the transaction process.

What to Include in Client Details

Here are the key elements to include when entering client information:

- Client Name: Ensure the client’s full name or company name is correctly spelled and prominently displayed.

- Address: Include the client’s billing address, which may be different from their physical address if the payment is being sent elsewhere.

- Phone Number: Provide a phone number for easy communication, in case there are any questions or issues with the payment.

- Email Address: Include an email address for digital correspondence or if the document will be sent electronically.

Formatting Client Information

Once you’ve collected the client’s details, it’s important to ensure that they are clearly presented. You can format this section by separating each piece of information with bullet points or using a neat table layout for easier reading. Use bold text for the client’s name to make it stand out, and ensure the contact details are aligned properly for a professional appearance.

By clearly presenting your client’s information, you not only ensure accuracy but also show your commitment to professionalism, which helps build trust and streamline communication with your clients.

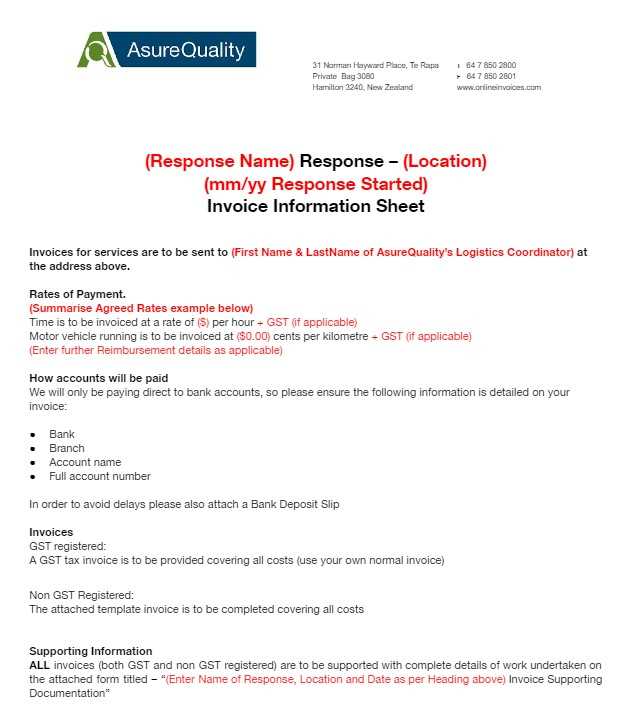

Choosing the Right Payment Terms

Setting clear payment terms is essential for avoiding confusion and ensuring timely transactions. When creating a billing document, it’s important to outline the conditions under which payment is expected, including deadlines, accepted methods, and any penalties for late payments. Choosing the right terms not only helps you get paid on time but also sets the foundation for a professional relationship with your clients.

Establishing the correct payment terms depends on the nature of your business and the preferences of your clients. Here are some of the most common payment terms to consider when preparing your billing document:

Common Payment Terms to Include

- Due Date: Clearly specify the date by which payment is expected. This helps the client understand when their payment is due and prevents delays.

- Early Payment Discounts: Offering a discount for early payment can encourage clients to settle their balances quicker. For example, “2/10 Net 30” means a 2% discount if paid within 10 days, with the full amount due in 30 days.

- Late Payment Fees: Clearly state any penalties or interest that will be charged if the payment is not received by the due date. This ensures that clients understand the consequences of late payment.

- Installment Payments: If large payments are involved, offering installment options may be beneficial. Specify the dates and amounts for each installment to ensure clarity.

- Accepted Payment Methods: Indicate which forms of payment you accept, such as bank transfers, checks, credit cards, or online payment systems.

Considerations When Setting Terms

When choosing your payment terms, take into account the nature of your business, your client’s payment habits, and your own cash flow needs. Offering flexible terms can help build long-term relationships, but you must ensure that the conditions align with your financial requirements. Also, be sure to review your payment terms regularly to ensure they continue to meet the needs of both you and your clients.

By clearly outlining your expectations and offering reasonable terms, you not only protect your business interests but also establish transparency and trust with your clients.

Formatting Your Invoice for Clarity

Proper formatting is crucial for ensuring that your payment request is both professional and easy to understand. A well-organized document not only helps convey the necessary information clearly but also reduces the chance of mistakes or confusion. By focusing on layout, font choices, and alignment, you can create a document that is both visually appealing and highly functional.

Here are some key tips to consider when formatting your billing document for maximum clarity:

Key Formatting Tips

- Use Clear Headings: Start with a clear header that includes your business information and the client’s details. Make sure each section, such as services provided, payment terms, and totals, is separated by bold or larger font headings to guide the reader through the document.

- Keep it Simple: Avoid overcomplicating the design with unnecessary elements. Stick to a clean, straightforward layout with ample white space to allow the information to breathe and make it easier to read.

- Align Numbers Correctly: Ensure that amounts, taxes, and totals are aligned neatly in columns. This helps the reader quickly compare charges and ensures accurate calculations.

- Highlight Important Information: Use bold or italicized text to emphasize key details like due dates, total amounts, and payment methods. This ensures these important items stand out to your client.

- Use a Consistent Font: Choose a professional and easy-to-read font, such as Arial or Times New Roman, and ensure consistency throughout the document. Avoid using too many font styles or sizes, as this can create visual clutter.

Organizing Your Document

Once you’ve set the basic format, organize your sections logically to ensure smooth flow. Start with your business and client information at the top, followed by a detailed breakdown of services or products provided, and finish with the total amount due and payment instructions. A consistent structure will help your client quickly understand the document and prevent any confusion about charges.

By prioritizing clarity in your document’s format, you not only enhance its professionalism but also make it easier for your client to process and pay on time. A well-formatted billing document reflects your attention to detail and commitment to transparent business practices.

Using Excel for Invoice Calculations

For many businesses, calculating totals and taxes manually can be time-consuming and prone to error. Using a spreadsheet program provides a fast, reliable way to perform these calculations automatically. With the ability to set up formulas and templates, spreadsheets streamline the billing process, saving you time and reducing the risk of mistakes.

Here’s how you can use spreadsheet software to make invoice calculations faster and more accurate:

Setting Up Calculations in a Spreadsheet

- Itemized List of Products or Services: Begin by creating a table where each row represents an item or service, including columns for descriptions, quantities, unit prices, and totals. This breakdown helps ensure that each charge is clear and properly calculated.

- Using Formulas for Totals: Instead of manually adding each item’s cost, use simple formulas like =Quantity * Price to automatically calculate totals for each line item. This will ensure your math is always accurate and reduce the chance of errors.

- Calculating Taxes: If applicable, use a formula to calculate taxes based on the subtotal. For example, =Subtotal * Tax Rate will quickly provide the tax amount, which can then be added to the total cost of the products or services.

- Discounts: If you’re offering discounts, use another formula to deduct the appropriate amount from the subtotal. For instance, =Subtotal – Discount to calculate the new amount due after applying a discount.

Creating and Managing Templates

Once you’ve set up the necessary formulas, save your file as a template for future use. This way, you won’t need to redo the calculations each time you create a new billing document. Simply update the product or service details, and the calculations will update automatically. You can even customize the template to include your company’s branding, payment terms, and other important details.

Using a spreadsheet for calculations not only makes the process faster but also ensures accuracy in every aspect of your billing. It removes the need for manual math and helps you avoid costly mistakes, allowing you to focus on growing your business.

Adding Tax Rates to Your Invoice

Incorporating the correct tax rates into your payment requests is essential for ensuring compliance and transparency. Tax calculations can vary depending on location, industry, and specific products or services, so it’s crucial to apply the right rates to each transaction. This process helps avoid discrepancies and ensures your clients are charged accurately, while also keeping your business in line with local regulations.

Here are the key steps to properly add tax rates to your billing documents:

Steps for Adding Taxes

- Identify the Applicable Tax Rate: Research the applicable sales tax rate for your location and industry. Different regions may have varying rates, and certain products or services may be exempt from tax. Make sure to apply the correct rate based on these factors.

- Calculate Taxable Amounts: Determine which items or services on the bill are taxable. Some products or services might be exempt from tax, so ensure you separate taxable and non-taxable items when calculating totals.

- Apply the Tax Formula: Use a formula to calculate the tax on taxable items. For example, to calculate the tax, multiply the taxable amount by the tax rate (Tax = Amount * Tax Rate). This ensures accuracy and helps automate the process.

- Clearly Display Tax Amounts: Make sure the tax amount is clearly shown as a separate line item on the payment request. This transparency helps the client understand exactly how much tax they are being charged.

- Include Tax Rate Information: Include the exact tax rate applied, and indicate if it is subject to change or different depending on the service or product. This avoids any confusion on the client’s side and ensures clarity regarding the charges.

Different Tax Scenarios to Consider

In some cases, you may need to apply different tax rates for different items. For example, certain goods or services might be subject to a standard rate, while others may qualify for reduced rates or exemptions. You can handle these variations by breaking down each item into its own row on the bill and applying the corresponding tax rate to each one.

Properly applying tax rates to your billing documents not only ensures compliance with tax laws but also demonstrates professionalism and attention to detail. Clear tax calculations help maintain trust with your clients and prevent any confusion

How to Save and Share Your Invoice

Once you’ve created your billing document, it’s important to save it in a secure and accessible format. Additionally, sharing the document with your clients in a professional manner ensures timely payment and proper record-keeping. Knowing how to save, organize, and send your payment requests effectively can save you time and minimize the chances of errors.

Here are the best practices for saving and sharing your payment request document:

Saving Your Document

- Choose the Right File Format: Save your document in a widely accepted format like PDF. This ensures that the client can open the file on any device without issues, and it preserves the formatting exactly as you intended.

- Give the File a Descriptive Name: Use a naming convention that includes key details such as the client’s name, the invoice number, and the date. For example, “ClientName_Invoice_001_2024” makes it easy to identify and locate later.

- Organize Your Files: Store your payment requests in a dedicated folder or system to ensure that all invoices are properly filed and easy to find. Keeping your files well-organized helps you track payments and manage financial records more efficiently.

Sharing Your Document

- Email: The most common method of sharing billing documents is via email. Attach the saved PDF or file, and include a clear message in the body of the email. Mention the due date and any other important information, such as payment instructions or late fees, if applicable.

- Online Payment Systems: If you use an online payment platform or accounting software, you can upload the document directly to the system and share a payment link. This streamlines the process for both you and your client.

- Postal Mail (if required): If your client prefers or requires a physical copy, print the document and send it through postal mail. Be sure to use a reliable service to ensure timely delivery.

By choosing the right format, file name, and delivery method, you can ensure that your payment request is professionally presented and easily accessible to your clients. Properly saving and sharing your document helps maintain clarity, reduces the chances of errors, and speeds up the payment process.

Common Mistakes to Avoid in Invoices

While creating payment documents, small errors can lead to delays, confusion, or even disputes with clients. Ensuring accuracy and clarity in every aspect of your billing is essential for maintaining a professional relationship and ensuring that payments are processed on time. Recognizing and avoiding common mistakes can save you time, prevent misunderstandings, and help you establish a more efficient invoicing system.

Frequent Errors to Watch For

- Incorrect or Missing Client Information: Always double-check that the client’s name, address, and contact details are accurate. Mistakes in client information can cause delays in payment processing and affect your credibility.

- Failure to Include Invoice Number: Each payment document should have a unique identifier, such as an invoice number. This helps both you and your client track payments and resolve any discrepancies quickly.

- Omitting Payment Terms: If you don’t clearly state payment terms, such as the due date or accepted payment methods, clients may be confused about when and how to make the payment, which can lead to delays.

- Errors in Calculation: Mistakes in adding up totals, taxes, or discounts can cause frustration for both parties. Double-check all calculations or use automated tools to ensure accuracy.

- Not Detailing Products or Services: Always provide a clear breakdown of what the client is being charged for. Vague or unclear descriptions can lead to misunderstandings and disputes over the charges.

- Not Including the Tax Rate: If taxes are applicable, ensure that the correct tax rate is clearly stated and the total amount is calculated. Failing to include this detail can create confusion or even legal issues.

Additional Tips to Ensure Accuracy

- Check Formatting: Consistent formatting helps make your billing document easier to read. Use clear headings, organized tables, and properly aligned numbers to ensure your client can easily understand the charges.

- Review Contact Information: Ensure that your business contact information, such as your phone number or email, is up to date so clients can reach out if they have questions.

- Keep Copies of All Documents: Save copies of every payment document you send, in case you need to refer to them later for tracking purposes or resolving any issues that arise.

By paying attention to these details and avoiding common mistakes, you can streamline the payment process, reduce confusion, and maintain positive client relationships. A well-prepared billing document reflects your professionalism and helps build trust with your clients.

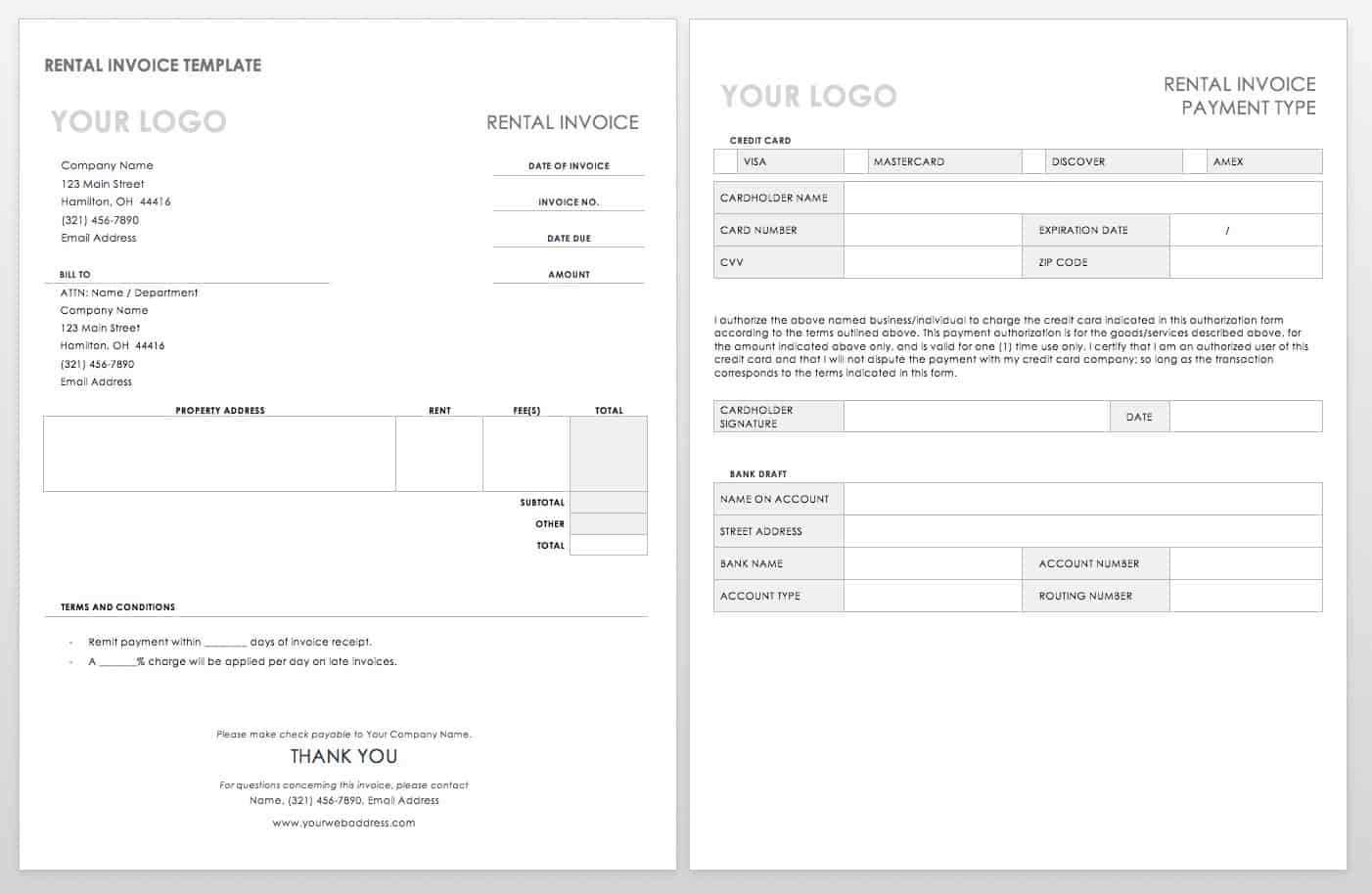

Templates for Different Invoice Needs

Not all billing documents are the same, as businesses and clients have varying requirements depending on the nature of the services or products provided. To streamline the process, it’s helpful to have different types of document formats to suit various billing scenarios. By using specialized layouts, you can ensure clarity and accuracy, making it easier for your clients to understand the charges and payment terms.

Here are some common types of billing documents, each designed to meet specific business needs:

Types of Billing Document Formats

| Document Type | Best For | Key Features |

|---|---|---|

| Basic Billing | One-time purchases or single services | Simple format with essential details such as item descriptions, amounts, and totals. |

| Recurring Billing | Subscription-based services or repeat clients | Clear breakdown of recurring charges, with due dates and frequency of payments. |

| Itemized Billing | Detailed listing of multiple services or products | List of each item or service with quantity, rate, and individual totals for each line item. |

| Proforma Billing | Estimates or preliminary billing | Preliminary estimate of costs without a final total, often used for negotiations. |

| Timesheet Billing | Hourly-based services | Details hours worked, hourly rate, and total amount due based on time tracked. |

Each of these formats can be customized according to your specific business needs. For instance, if you provide services on an ongoing basis, you may prefer a format that clearly indicates the frequency of payments and any recurring charges. On the other hand, if you provide detailed project-based work, an itemized layout can help clarify individual costs for each part of the service.

Choosing the right layout for your billing documents helps you communicate efficiently with clients, reduces confusion, and streamlines the entire payment process. By selecting a format tailored to your specific needs, you can maintain a professional appearance while also ensuring the document includes all necessary details for accurate payments.

Using Word Processing Software for Recurring Billing

When you offer subscription-based services or work with clients on an ongoing basis, creating a system for managing repeated payments is essential. Using a text editing program to set up a recurring billing document can simplify the process, saving you time while ensuring consistency in each payment cycle. By setting up a reusable format, you can avoid the hassle of creating new documents from scratch each time.

Here’s how to effectively manage recurring billing using a document editor:

Setting Up a Recurring Billing Document

- Create a Consistent Layout: Design a standard layout for your payment documents that includes all necessary fields such as the client’s information, payment details, and a description of the recurring services. This will save you time when you need to generate new bills for each cycle.

- Use Placeholder Text: Include placeholders for the date, service period, or specific charges that will vary with each billing cycle. This makes it easy to update each document without manually reformatting or recreating the layout.

- Include Payment Frequency: Be clear about the frequency of payments (e.g., monthly, quarterly, annually). This transparency ensures your clients know when to expect charges and helps maintain regular cash flow.

Automating Updates and Customization

- Reuse the Document: After you create the first version of your recurring payment document, save it as a template. Each time a new billing cycle starts, simply open the template, update the dates and amounts, and save it with a unique name for each period.

- Ensure Accuracy with Custom Fields: Some text editing programs allow you to set up fields that automatically update, such as the date of the next billing cycle. Make use of these features to save time and reduce the risk of errors.

By setting up a simple and effective system for recurring billing in a text editor, you can maintain consistency in your payment requests, reduce the time spent on administrative tasks, and ensure that clients are billed accurately and on time. This approach helps create a smooth and professional billing experience, building trust and improving cash flow.

Benefits of Word Invoice Templates

Using a pre-designed document layout for billing purposes offers significant advantages for businesses of all sizes. By having a consistent, ready-made format, you can save time and reduce errors while maintaining a professional image. These layouts are specifically crafted to ensure that all necessary information is included and properly formatted, which helps in improving the overall billing process.

Here are some of the key benefits of using pre-designed billing layouts:

- Time Efficiency: Instead of starting from scratch every time you need to create a billing document, a pre-made layout allows you to quickly plug in the necessary details, making the process faster and more efficient.

- Consistency: A standardized layout ensures that all your payment requests have the same structure. This consistency builds professionalism and trust with clients, as they will always know where to find key details such as the total amount due, payment terms, and due dates.

- Customization: While these layouts are pre-designed, they are also customizable to suit the unique needs of your business. You can easily adjust sections to reflect different services, discounts, or tax rates, making the document flexible and adaptable to your specific requirements.

- Accuracy: Using a structured layout ensures that all critical information is included and aligned correctly. This reduces the likelihood of omitting important details, such as payment instructions, and helps avoid calculation errors.

- Professional Appearance: A well-structured and visually appealing document gives clients the impression of professionalism and care. This can positively influence their perception of your business and make them more likely to pay promptly.

By using a pre-designed layout for your billing documents, you streamline your operations, improve accuracy, and present a polished image to your clients. This approach not only saves time but also ensures that your billing process runs smoothly and efficiently, benefiting both your business and your clients.

Free Invoice Templates for Businesses

For businesses looking to streamline their billing process, using pre-made layouts can be a great way to save time and reduce the risk of errors. Fortunately, there are a variety of free options available that cater to different industries and needs. These free layouts provide all the essential fields and structures required for clear, professional billing, without the need for expensive software or extensive design work.

Here are some advantages of using free layouts for your billing needs:

Advantages of Free Billing Layouts

- Cost-Effective: Free layouts help businesses cut down on expenses. They provide a cost-effective way to create professional-looking billing documents without purchasing expensive invoicing software.

- Easy to Use: Many free layouts are designed with simplicity in mind. They are easy to fill in, even for businesses with no design experience, allowing you to generate accurate billing documents quickly.

- Time-Saving: With pre-designed fields, there’s no need to worry about formatting each document manually. Simply enter the necessary details, and you’re ready to send it to your client.

- Professional Appearance: Free layouts are often designed by professionals, ensuring that your documents look polished and well-organized. A clean, well-structured layout helps reinforce your business’s credibility and trustworthiness.

Where to Find Free Layouts

- Online Resources: Many websites offer free downloadable documents that can be easily customized to suit your business needs. These resources often provide various formats, such as PDF, Excel, or text documents, ensuring compatibility with your system.

- Business Software: Some business software, including free accounting tools, may also offer a selection of pre-designed billing documents that are easily accessible to users.

- Template Sharing Communities: Online forums and communities often share free document layouts created by others. These can be a great source of inspiration and variety, catering to specific industries or preferences.

By utilizing free layouts for your billing system, you can save time, reduce costs, and ensure that your documents meet professional standards. Whether you run a small startup or manage a large organization, these free resources provide a simple solution to maintain accurate and effective billing practices.

How to Print and Deliver Your Billing Document

Once you’ve prepared your billing document, the next step is ensuring that it reaches your client in a timely and professional manner. Whether you prefer to send your bills electronically or via traditional mail, it’s important to choose the right method for delivery to maintain clear communication and ensure prompt payment.

Below are the steps to help you effectively print and deliver your billing documents:

Printing Your Billing Document

- Check for Accuracy: Before printing, review all details to ensure there are no errors in amounts, dates, or client information. A well-checked document reduces the risk of misunderstandings.

- Select Proper Paper Size: Choose the appropriate paper size (usually letter or A4) based on the layout of your document to ensure everything fits neatly on the page.

- Use High-Quality Paper: If you’re delivering a physical copy, print the document on high-quality paper to convey professionalism.

- Ensure Proper Formatting: Make sure that your document is formatted correctly before printing, with proper margins, alignment, and font size for easy readability.

Delivering Your Billing Document

- Email Delivery: For quicker service, sending the document as a PDF attachment via email is the most efficient option. This ensures fast delivery and allows your client to easily access, print, and pay electronically.

- Postal Mail: If you prefer to deliver a physical copy, print the document and send it via postal service. Be sure to use a professional envelope and ensure that the document is securely enclosed to avoid damage.

- In-Person Delivery: For local clients, in-person delivery is another option. Ensure that you hand the document over personally and get a receipt of acknowledgment to avoid any disputes later.

- Online Payment Platforms: If you’re using an online payment platform or accounting system, you can often send the document directly through the platform. These systems can track delivery and payment statuses.

Choosing the right delivery method for your billing documents ensures that your clients receive them promptly and in the proper format. Whether you’re printing a hard copy or sending it electronically, delivering clear and accurate documents builds trust and supports efficient financial transactions.