How to Use Microsoft Invoice Template for Professional Billing

In today’s fast-paced business world, managing financial transactions quickly and accurately is essential. One of the most effective ways to streamline the billing process is by using pre-designed formats that can be easily adapted to suit various needs. These ready-made documents save time, reduce human error, and ensure a professional appearance for all business communications regarding payments.

When selecting a billing format, it’s important to choose one that offers flexibility and customization. The ability to adjust elements like the company logo, payment terms, and client details ensures that the final document aligns with your brand and business requirements. By using such tools, businesses can focus on what matters most: providing excellent products and services while keeping their finances in order.

Whether you’re a freelancer, small business owner, or part of a larger enterprise, digital solutions can help create and manage financial records with ease. Simple yet effective designs are available that can be modified with just a few clicks, making the process of invoicing more efficient than ever before.

Microsoft Invoice Template Overview

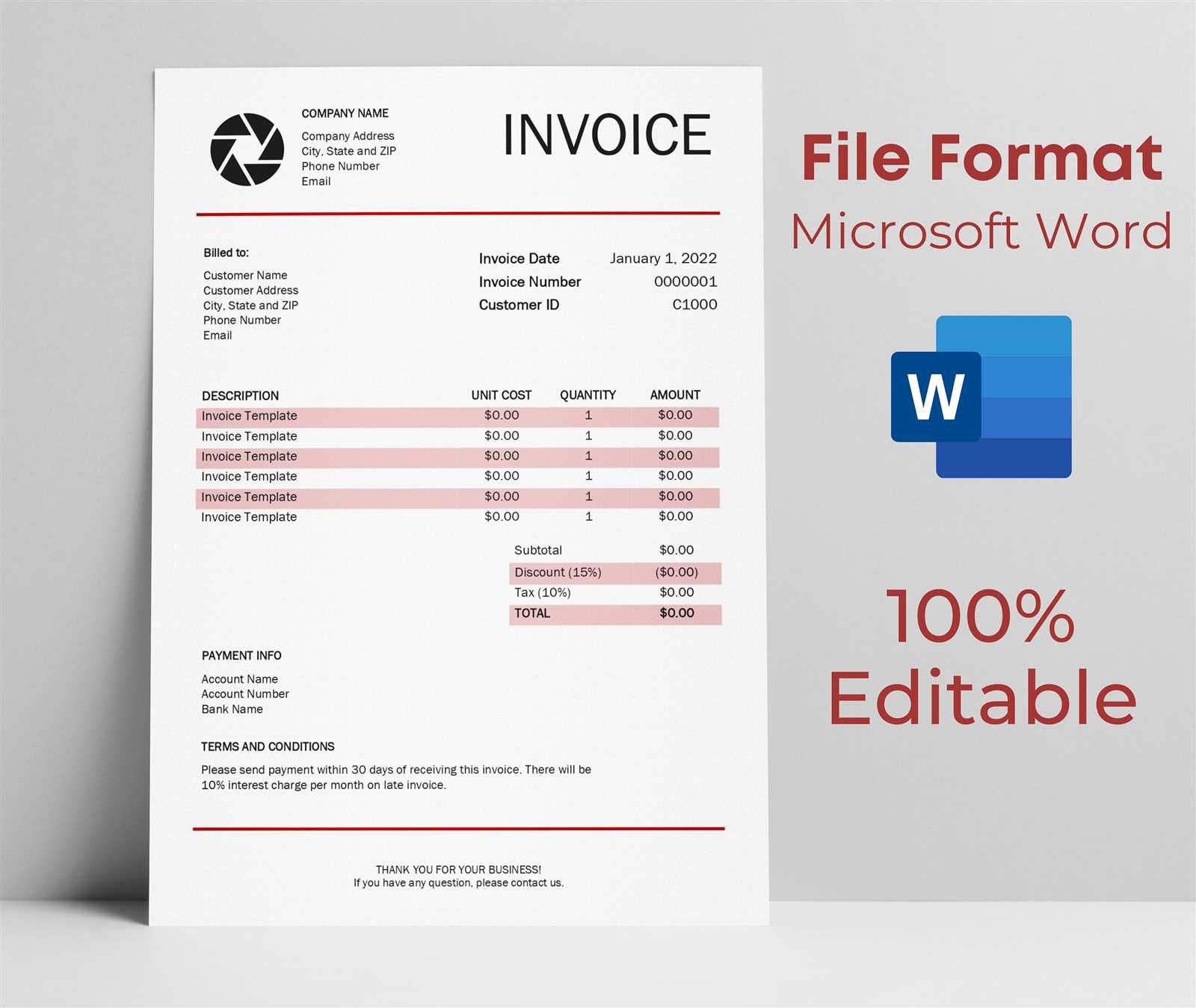

When it comes to managing business finances, having a clear and professional document to request payments is crucial. These pre-designed solutions are tailored to simplify the process of creating and sending payment requests. By offering built-in structures and fields, they enable users to focus on the content rather than formatting, making financial tasks more efficient and less time-consuming.

These ready-to-use documents typically include all the essential components needed for proper billing, such as business details, client information, itemized lists of products or services, and payment terms. With customizable sections, businesses can easily adapt the layout to suit their specific needs while maintaining a polished, professional appearance.

Here’s a quick look at the key elements commonly found in such billing documents:

| Section | Description |

|---|---|

| Company Information | Includes business name, address, and contact details. |

| Client Information | Customer name, address, and contact details. |

| Itemized List | Detailed breakdown of products or services provided. |

| Payment Terms | Due dates, payment methods, and any applicable discounts or penalties. |

| Total Amount Due | The final amount payable, after taxes and fees. |

These documents are available in various formats, and the customization options allow users to adjust every aspect to fit their specific business needs. Whether you need to issue a one-time request or set up recurring payments, these solutions provide a fast and effective way to stay organized and professional in your financial dealings.

Benefits of Using Invoice Templates

Utilizing pre-designed billing documents offers numerous advantages to businesses of all sizes. By simplifying the process of generating payment requests, these tools save valuable time and effort while ensuring consistency and professionalism. Here are some key benefits of incorporating ready-made billing solutions into your workflow.

Time Efficiency

Creating payment requests from scratch can be time-consuming. With pre-built formats, businesses can skip the formatting process and focus on adding the necessary details. This reduces the time spent on each document, enabling faster processing and quicker delivery to clients.

- Instantly available structures that require minimal adjustments

- Consistency in document creation, reducing the need for repeated formatting

- Easy adaptation to different payment situations with few clicks

Professional Appearance

These pre-made documents are designed to look polished and professional. When presenting a payment request to a client, a well-structured and aesthetically pleasing format can enhance trust and credibility.

- Clean, clear design that fosters confidence with clients

- Standardized format that adheres to best business practices

- Customizable features to align with the company’s branding

By using such solutions, businesses can streamline their billing operations, minimize errors, and maintain a high level of professionalism throughout their financial processes.

How to Download Microsoft Invoice Template

Accessing and downloading ready-made billing formats is a simple and quick process. Many software platforms offer a variety of documents that can be downloaded directly from their websites or application libraries. These pre-designed documents are available in different formats to suit the user’s needs and can be easily adapted for specific business requirements.

Steps to Download a Billing Document

Follow these easy steps to get your billing document:

- Open your preferred software or website that offers billing formats.

- Navigate to the “Templates” or “Documents” section.

- Search for “billing” or “payment request” documents using the search bar or category filters.

- Select the format that best suits your needs, whether it’s a basic or detailed structure.

- Click on the “Download” button and save the document to your computer.

Where to Find Billing Formats

Several platforms offer free or paid options for downloading pre-designed documents. Some popular options include:

- Office suite applications (such as Word and Excel)

- Online document libraries

- Business management software providers

Once downloaded, the file can be opened and customized as needed, making the billing process faster and more efficient.

Customizing Your Invoice Template in Word

Once you’ve downloaded your preferred billing document, you can easily tailor it to match your business’s branding and specific needs. Using Word, customization is simple and doesn’t require advanced technical skills. Whether you need to adjust the layout, add your company logo, or update payment terms, Word provides all the tools you need to make the document professional and unique.

Here’s how you can personalize your document:

- Change Company Information: Replace placeholder text with your business name, address, and contact details. This ensures your clients can easily reach you for questions or future payments.

- Insert Your Logo: Adding a company logo at the top of the document can help maintain your brand’s identity and make the document look more professional.

- Adjust the Layout: Use Word’s built-in tools to modify margins, fonts, and alignment to fit your style. You can also change the document’s color scheme to match your branding.

- Edit Payment Terms: Customize the payment due dates, accepted methods, and any additional conditions relevant to your business.

- Add or Remove Sections: If necessary, you can add more sections for discounts, late fees, or specific payment instructions. Conversely, you can remove any unnecessary fields.

By adjusting the content and design, you ensure that your billing documents are not only functional but also consistent with your company’s professional image.

Key Elements of an Invoice Template

To ensure that a billing document is clear, accurate, and professional, there are several essential components that must be included. These key elements provide both the business and the client with all the necessary information to process payments smoothly and avoid confusion. Understanding these elements is crucial when creating or customizing your billing documents.

Essential Components of a Billing Document

Here are the primary sections that should be present in any well-structured payment request:

- Business Information: Include the name, address, phone number, and email of the company issuing the document. This helps establish the source of the request and makes it easy for the client to contact you if needed.

- Client Information: The name, address, and contact details of the customer receiving the bill. It’s important to ensure accuracy here to prevent any delivery issues.

- Unique Document Number: Every request should have a unique identifier or reference number to track payments and maintain organization.

- Issue Date: Clearly state when the document was created or sent. This helps both parties track timelines and payment schedules.

- Payment Due Date: Indicate the date by which the payment is expected. This sets clear expectations and helps avoid late payments.

- Itemized List of Goods or Services: A detailed breakdown of what is being billed. This can include descriptions, quantities, unit prices, and total amounts for each item or service provided.

- Tax Information: Any applicable taxes (e.g., sales tax, VAT) should be clearly calculated and added to the total amount due.

- Total Amount Due: The final amount payable, including the subtotal, taxes, and any additional fees or discounts. This should be bold or highlighted for easy reference.

- Payment Methods: Specify the accepted payment methods, such as bank transfer, credit card, or online payment options.

- Terms and Conditions: Include any additional instructions or policies regarding payment terms, such as late fees, discounts for early payment, or refund policies.

Including these elements ensures clarity, reduces errors, and fosters trust between the business and the client. A well-crafted payment document helps maintain a professional image and supports smooth financial operations.

How to Add Business Logo to Invoice

Incorporating your company logo into a payment request document not only enhances its professionalism but also strengthens your brand identity. By adding your logo, clients instantly recognize your business, which fosters trust and promotes a cohesive look across all communications. Fortunately, inserting a logo into a billing document is a straightforward process that can be completed in just a few steps.

Steps to Insert a Logo in a Billing Document

Follow these simple instructions to add your company’s logo to a billing document:

- Prepare Your Logo: Ensure your logo file is ready. It should be in a common image format such as PNG, JPG, or GIF. For best results, use a high-resolution image that doesn’t become pixelated when resized.

- Open the Document: Open your billing document in your word processor or editing software.

- Insert the Image: In the toolbar, locate the “Insert” option and select “Picture” or “Image.” Choose the logo file from your computer and click “Insert.”

- Resize and Position: Once the logo is inserted, you can adjust its size by clicking and dragging the corners of the image. Position it where it fits best, usually in the header or top-left corner.

- Adjust Text Wrapping: Set the text wrapping option to “Square” or “Behind Text” to ensure that the logo doesn’t interfere with other content. This allows the text to flow naturally around the image.

After completing these steps, your payment request document will feature your logo in a professional manner, helping to establish consistency and recognition across all of your business communications.

Using Excel for Invoice Template Management

Managing payment requests using spreadsheets can offer numerous advantages, especially when it comes to automation, data tracking, and customization. Spreadsheets provide a flexible environment for organizing financial documents and keeping records up to date. By using Excel, businesses can quickly generate and modify their billing requests, track payments, and analyze financial data–all within one file.

Why Choose Excel for Billing Management?

Excel is more than just a tool for calculations; it’s a versatile platform that can be used to manage the entire billing process. Here are some of the main reasons why many businesses prefer using spreadsheets for financial recordkeeping:

- Automation: Excel allows you to create formulas that automatically calculate totals, taxes, discounts, and due dates, reducing manual errors and saving time.

- Customizability: You can tailor the document to suit your needs by adding custom fields, altering the layout, and incorporating additional features like itemized lists or conditional formatting.

- Data Tracking: Excel makes it easy to track payments over time by creating tables that log transactions, payment statuses, and outstanding amounts.

- Reusability: Once a basic structure is set up, it can be reused for multiple clients, with data such as customer names, services provided, and pricing easily adjusted.

How to Use Excel for Payment Management

To get started with Excel for managing billing requests, follow these steps:

- Create a New Spreadsheet: Open Excel and create a new blank document, which will serve as your master file for generating payment requests.

- Set Up a Basic Structure: Include the essential fields like business details, client information, itemized list, payment terms, and totals. You can use Excel’s grid to align the text and create a clean layout.

- Add Formulas: Use Excel’s formulas to automatically calculate the subtotal, tax, discounts, and final total. This minimizes the chance of errors in calculations.

- Track Payments: Create a separate sheet or section where you can record payment dates, amounts received, and any outstanding balances. This helps maintain a clear record of all transactions.

- Save and Reuse: Once the structure is ready, save the file and use it for future payment requests. You can easily make duplicates for different clients, filling in the specific details as needed.

Using Excel for managing billing requests not only saves time but also ensures that all data is neatly organized and easily accessible, making your financial management much more efficient.

Integrating Payment Methods into Templates

Including payment options directly in your billing documents can streamline the payment process for your clients. By clearly outlining available payment methods, you ensure that customers have all the necessary information to complete transactions quickly and easily. Customizing your document with various payment options helps eliminate confusion and reduces delays, making the entire financial process smoother for both parties.

Why Include Payment Methods in Billing Documents?

Providing multiple payment methods within your billing document has several benefits, including:

- Convenience: Offering a variety of payment options caters to your clients’ preferences and makes it easier for them to pay on time.

- Clarity: Clearly stating payment instructions reduces the chances of misunderstandings and ensures a faster payment process.

- Professionalism: A well-organized payment section adds a professional touch and enhances your business’s image.

Common Payment Methods to Include

There are several payment methods that you can integrate into your billing documents. The choice of options depends on the preferences of your clients and the services your business offers. Commonly accepted methods include:

- Bank Transfers: Provide your bank details, such as the account number, sort code, and any relevant routing information.

- Credit/Debit Cards: If your business supports card payments, include the necessary instructions or links to secure payment gateways.

- Online Payment Platforms: Include options like PayPal, Stripe, or other popular services. Be sure to list any required details, such as email addresses or transaction IDs.

- Checks: If you accept checks, mention the payee name, mailing address, and any relevant instructions for submitting the payment.

- Cash: For in-person transactions, simply indicate that cash is an acceptable form of payment, if applicable.

Including these details in your billing document ensures that clients are aware of all the available options and can choose the most convenient method for them, leading to quicker payments and fewer delays.

Creating Recurring Invoices with Templates

For businesses that provide ongoing services or products on a regular basis, setting up a system for recurring billing is essential. Instead of creating a new request for payment each time, you can set up a consistent structure that automatically generates documents on a predetermined schedule. This not only saves time but also ensures that payments are requested promptly and consistently, which is crucial for maintaining cash flow.

Why Use Recurring Billing?

Recurring billing is especially useful for subscription-based businesses or clients with long-term contracts. The key benefits include:

- Time Savings: By creating a standard format once, you avoid the need to manually generate a new payment request each period.

- Consistency: Your clients receive a professional, uniform document every time, which helps build trust and reliability.

- Improved Cash Flow: With automated billing, payments are more predictable, ensuring regular income for your business.

Steps to Set Up Recurring Billing

To create a recurring billing system, follow these steps:

- Create a Standard Document: Set up a payment request document with all the necessary fields like client details, service description, due date, and payment terms. Make sure the document layout is ready for regular use.

- Set a Payment Schedule: Determine how often you’ll send out the payment requests–weekly, monthly, quarterly, etc. Ensure that the due dates align with your billing cycle.

- Save a Master Copy: After customizing your document, save it as a master file that can be reused for each billing cycle. This file can be duplicated for each client or cycle.

- Automate the Process (Optional): If using advanced software or tools, consider automating the process where the document is generated and sent out on the scheduled dates. Many business management tools allow you to schedule such tasks in advance.

- Track Payments: Use a separate tracking system or spreadsheet to monitor which payments have been received and which are still outstanding. This helps avoid delays and miscommunication.

By setting up recurring billing with a consistent format, you streamline your financial operations and reduce the administrative burden of managing regular payments. Whether it’s for subscriptions, retainers, or ongoing services, this approach ensures that payments are requested on time, every time.

Setting Up Tax Rates in Billing Documents

When creating billing requests, it’s crucial to ensure that tax calculations are accurately reflected, especially when dealing with multiple clients or various product types. Setting up tax rates within your financial documents simplifies the process and helps avoid errors. This allows you to automatically calculate the correct amount of tax based on local or international tax rules, ensuring compliance and preventing any future misunderstandings with clients.

Steps to Set Up Tax Rates

To set up tax rates in your billing document, follow these steps:

- Identify the Tax Rate: Determine the applicable tax rate based on your location or the client’s jurisdiction. This could be a sales tax, VAT, or other local taxes. Be sure to research the correct rates for your region or industry.

- Customize the Document: Open your billing document and find the section where tax calculations will appear. This may be under a “Total” or “Subtotal” section, depending on the format of your document.

- Add a Tax Field: Create a line or field labeled “Tax” or “Sales Tax,” where the calculated tax amount will be displayed. This will usually be a percentage of the subtotal or a fixed amount.

- Insert Formulas (if applicable): If you are using a software with formula capabilities, you can automate the calculation of the tax by applying a simple formula. For example, multiply the subtotal by the tax rate to get the final tax amount.

- Include Tax Total: After calculating the tax, update the total amount due to include both the subtotal and the tax. Make sure the total is clearly displayed at the bottom of the document.

By setting up tax rates in your billing documents, you can reduce manual calculations, ensure consistency, and guarantee that taxes are applied correctly every time, streamlining your financial processes and improving your clients’ experience.

How to Save and Reuse Billing Templates

When creating financial documents, it’s essential to have a standardized structure that can be easily reused. By saving your billing documents as reusable files, you can eliminate the need to start from scratch every time you need to generate a new payment request. This approach not only saves time but also ensures consistency across all client communications, helping maintain a professional and efficient workflow.

Steps to Save Your Billing Document

Follow these steps to save and reuse your billing layout for future use:

- Complete the Document: Ensure that the layout, content, and any essential fields (such as business details, payment terms, and tax information) are properly filled out and formatted.

- Save the File: After finalizing the document, save it as a master copy. In most word processing programs, select “Save As” and choose a location on your computer or cloud storage where you can easily access the file later.

- Choose the Right Format: Save the document in a format that can be easily edited and reused. For example, choose .docx, .xlsx, or another editable format, so you can easily make changes without losing the structure.

- Organize Your Files: Store the saved document in a dedicated folder or cloud directory specifically for financial records. Label it clearly, such as “Billing Master File” or “Payment Request Template,” so you can quickly locate it when needed.

Reusing Your Billing Documents

Once your document is saved, it can be easily reused for multiple clients or billing cycles. Here’s how to efficiently use your saved files:

- Duplicate the File: When a new request is needed, make a copy of the saved master file. This preserves the original document and ensures you’re not accidentally editing the template.

- Update Client Information: Modify the necessary fields, such as client details, billing items, or payment terms, according to the specific transaction.

- Save as New File: After making updates, save the new document with a unique name, such as “Payment Request – Client Name – Date,” so that it’s easy to reference in the future.

By saving and reusing your billing structure, you ensure that each request is consistent, accurate, and professional. This streamlined approach helps improve efficiency and reduces the chances of mistakes in your financial paperwork.

Printable vs Digital Invoices: What’s Best?

When it comes to creating payment requests, businesses must decide between two main formats: printable and digital. Both options have their own advantages and can be chosen depending on your workflow, client preferences, and the nature of your business. Understanding the pros and cons of each method will help you determine which format best suits your needs, ensuring efficient transactions and smooth business operations.

Advantages of Printable Payment Requests

Printable documents have been a traditional method of handling transactions and can still be beneficial in certain situations. Here are some reasons why you might choose a printed format:

- Tangible Proof: Physical copies provide a tangible record for both you and your client, which can be especially important for record-keeping in certain industries.

- Client Preference: Some clients may prefer receiving a physical payment request, particularly in industries that rely heavily on paper documentation.

- Postal Delivery: If your clients do not use digital tools or prefer to receive hard copies, sending a printed document via post ensures that they get the necessary information in a format they can handle.

Advantages of Digital Payment Requests

On the other hand, digital formats offer several benefits, especially in today’s fast-paced, tech-driven environment. Here’s why many businesses opt for electronic documents:

- Speed and Convenience: Sending digital payment requests is much faster than mailing physical copies, allowing your clients to receive and process the documents instantly.

- Cost-Efficiency: Digital documents eliminate the costs associated with printing, paper, ink, and postage, making them a more affordable option in the long run.

- Environmentally Friendly: Digital formats reduce paper usage, making them an eco-friendly choice for businesses looking to minimize their environmental impact.

- Easy Tracking and Storage: Digital payment requests can be stored, searched, and retrieved with ease, making it simpler to track past transactions and organize financial records without taking up physical space.

Ultimately, the decision between printable and digital formats comes down to your specific needs and those of your clients. In many cases, offering both options may be the best solution, allowing you to cater to a wider range of preferences while maintaining flexibility in your billing process.

Common Mistakes When Using Billing Templates

While using pre-designed billing documents can save time and effort, there are several common pitfalls that businesses may encounter. Many of these errors can be easily avoided with careful attention to detail. Making these mistakes can lead to confusion, delayed payments, or even legal issues. Below, we highlight some of the most frequent missteps and offer tips on how to avoid them.

1. Incorrect or Missing Client Information

One of the most basic but critical mistakes is failing to include accurate client details. Errors in the client’s name, address, or contact information can result in confusion or payment delays. To prevent this, always double-check the information before sending out a billing request.

- Check for spelling errors: Ensure the client’s name, company name, and address are correctly spelled.

- Verify contact information: Double-check the phone number or email address to ensure any follow-up can be completed smoothly.

2. Forgetting to Include Payment Terms

Clearly outlining payment terms is essential to avoid misunderstandings. Failing to specify due dates, late fees, or accepted payment methods can lead to confusion or delayed payments. Be sure to clearly state your terms in the document.

- Include a due date: Specify when the payment is due and what happens if the client misses the deadline.

- Outline late fees: If you charge late fees, ensure they are clearly mentioned in the document.

- List payment methods: Clearly display the acceptable methods for payment, such as bank transfer, credit card, or online services.

3. Incorrect Calculations or Missing Totals

Calculating totals incorrectly or failing to include a grand total is another common mistake. Even if you are using an automated document, always double-check that the figures match the agreed-upon price and services rendered.

- Verify item prices: Ensure that each item or service is correctly priced and tallied.

- Include taxes: Make sure any applicable taxes are properly calculated and added to the final amount.

- Check for rounding errors: Even small discrepancies can add up, so ensure numbers are rounded properly and totals match.

4. Using Outdated or Wrong Formats

Using an outdated version of a document or one that doesn’t conform to legal requirements can be problematic. This could lead to issues with legal compliance or difficulty in processing payments. Keep your docume

Security Features in Billing Documents

When handling financial transactions, it’s crucial to ensure the security of your payment requests. Whether you are sending them digitally or printing them, protecting sensitive information from unauthorized access is essential. Fortunately, many modern document formats come with built-in security features that allow you to safeguard client details, payment amounts, and other confidential data. Understanding these features can help you maintain the integrity of your billing process and protect both your business and clients.

1. Password Protection

One of the most effective ways to secure your financial documents is by setting up password protection. This feature restricts access to your files, ensuring that only authorized individuals can view or edit the contents. By applying a password, you can prevent unauthorized users from accessing sensitive client information or altering payment terms.

- Strong Passwords: Use complex, unique passwords that are difficult to guess or crack.

- Change Passwords Regularly: Regularly update your passwords to maintain a higher level of security.

- Limit Password Sharing: Ensure that only necessary individuals have access to the password to prevent unauthorized access.

2. Digital Signatures

Digital signatures are another powerful security feature that ensures the authenticity of your payment requests. A digital signature verifies the sender’s identity and confirms that the document has not been altered after it was signed. This adds a layer of trust and security, especially when dealing with important or high-value transactions.

- Ensure Authenticity: Digital signatures validate that the sender is who they claim to be and prevent tampering with the document.

- Legally Binding: In many jurisdictions, digital signatures are legally binding, offering added protection for both parties in a transaction.

3. Encryption

Encrypting your billing documents is another way to ensure they remain secure. Encryption converts the document’s contents into a code that can only be decrypted with the correct key or password. This prevents anyone who intercepts the document from reading or tampering with it, making it especially useful when sending payment requests over email or other unsecured channels.

- End-to-End Encryption: Use encryption tools that protect your documents both during transmission and storage.

- Secure File Sharing: When sharing billing documents, always use encrypted channels or trusted file-sharing platforms.

4. Limited Access and Permissions

Limiting access to your financial documents ensures that only authorized personnel can make changes or access sensitive data. Many document management systems allow you to set permissions for different users, ensuring that only certain individuals can edit or view specific information. This feature is especially helpful in businesses with multiple employees or contractors working on financial records.

- Assign Roles and Permissions: Set clear access levels for each user to minimize the risk of accidental data exposure or mod

Alternatives to Traditional Billing Document Templates

While many businesses rely on standard tools to create payment requests, there are various other methods and software solutions available that offer additional features, flexibility, and ease of use. Exploring alternatives can help businesses find the best solution for their specific needs, whether they prioritize automation, customization, or integration with other systems. Below are some popular alternatives to traditional billing document layouts.

1. Online Billing Platforms

Online platforms designed specifically for creating and managing payment requests offer several advantages over traditional software. These platforms often provide automation, easy customization, and integration with accounting tools. They can be particularly useful for businesses with frequent or recurring billing needs.

- Automatic Calculations: Many online platforms automatically calculate totals, taxes, and discounts, reducing the risk of errors.

- Recurring Billing: Some platforms allow businesses to set up recurring invoices, saving time on repetitive tasks.

- Payment Gateway Integration: Many solutions include built-in options for clients to pay directly through the invoice, streamlining the payment process.

2. Cloud-Based Document Editors

Cloud-based document editors like Google Docs or Zoho Docs offer an easy way to create and store payment requests online. These tools provide templates, collaboration features, and access from any device with an internet connection. They are particularly useful for small businesses or freelancers looking for a simple yet effective way to create professional documents.

- Real-Time Collaboration: Multiple team members can collaborate on the same document in real-time, ensuring efficiency in the billing process.

- Cloud Storage: Billing documents are stored in the cloud, making it easy to access and share them from anywhere.