Microsoft Office Excel Invoice Template for Efficient Billing

Managing billing and payments efficiently is essential for any business. With the right tools, you can simplify the process and ensure that all transactions are tracked accurately. One of the most effective ways to handle this task is by using a customizable digital document designed for generating professional payment requests.

Whether you’re a freelancer, small business owner, or part of a larger enterprise, having a consistent and easy-to-use method for generating statements is crucial. By utilizing a customizable spreadsheet, you can quickly produce professional documents that are tailored to your specific needs, all while saving time and reducing errors. These documents allow for clear communication with clients, helping to establish trust and streamline financial operations.

Adaptable and user-friendly solutions allow you to modify details, such as dates, amounts, and descriptions, with minimal effort. As a result, you can focus more on your work and less on administrative tasks. Moreover, with built-in features to automate calculations, these tools offer an efficient way to handle everything from basic billing to more complex financial tracking.

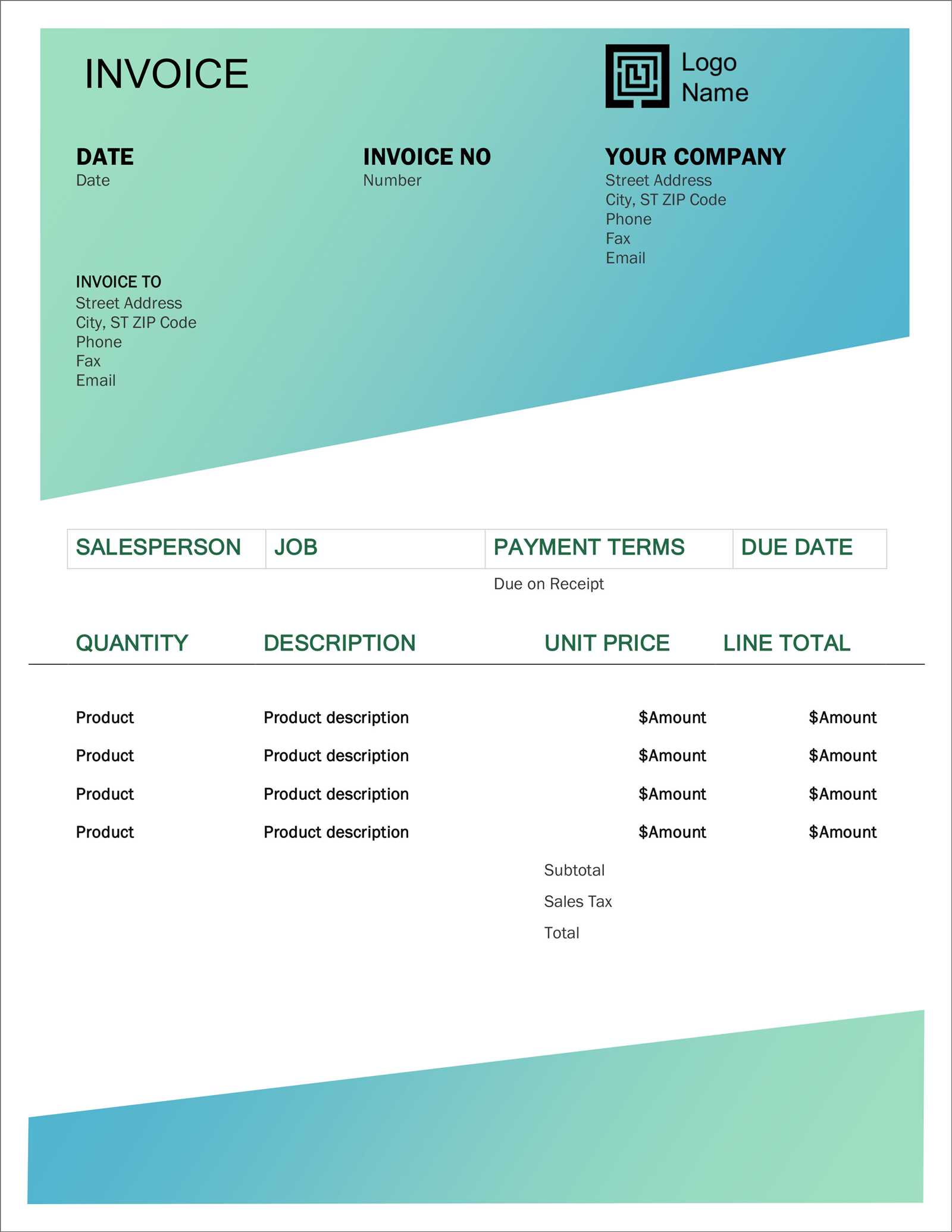

Microsoft Office Excel Invoice Template Overview

Creating professional financial documents is an essential part of any business operation. A well-structured document allows businesses to maintain clear and organized records of transactions. With the right tools, this task becomes simple, efficient, and customizable to meet individual needs. Using a digital solution for generating these documents helps businesses save time and avoid manual errors.

The solution we’re discussing offers a customizable and user-friendly structure that can be adjusted for different business requirements. From small tasks like modifying item details to more complex functions like automating calculations, this tool offers flexibility for any scale of operations. It’s an ideal choice for freelancers, small businesses, or even larger enterprises looking to streamline their billing and record-keeping processes.

| Feature | Description |

|---|---|

| Customization | Easy to adjust fields like dates, item descriptions, and amounts. |

| Automation | Automatic calculations reduce manual errors and save time. |

| Clarity | Clear, professional layout improves communication with clients. |

| Flexibility | Suitable for various types of transactions and industries. |

| Accessibility | Easy to create and modify without requiring advanced technical skills. |

By leveraging this system, businesses can improve efficiency, reduce errors, and create accurate records that facilitate smoother financial management. It’s a reliable tool that ensures every transaction is documented clearly and professionally, making it an invaluable asset for any organization.

Benefits of Using Excel for Invoices

Using a digital solution to create billing documents offers numerous advantages for businesses of all sizes. A well-structured system allows you to quickly generate accurate statements, streamline administrative tasks, and improve overall efficiency. With customizable features, it’s easy to tailor each document to meet specific needs, saving both time and effort.

Key Advantages

- Cost-effective: Unlike specialized software, using a spreadsheet program is often free or comes with a lower cost, especially if it’s already included in your software suite.

- Customization: You can easily modify fields such as client information, product details, and payment terms to suit your unique business needs.

- Automation: Built-in functions allow for automated calculations, reducing the chance for human error in totals and tax computations.

- Easy record-keeping: All documents are saved in a central location, making it easier to track past transactions and organize your financial records.

- Time-saving: The ability to create and reuse previous documents cuts down on the time spent generating new ones, helping you focus on more important tasks.

Improved Professionalism

- Clear Layout: The professional appearance of well-designed documents helps enhance client trust and portrays a competent business image.

- Consistency: Using the same format for all billing documents ensures consistency, making it easier for clients to understand and process your requests.

- Simple Tracking: Built-in tools help you quickly locate previous documents, making follow-ups and financial analysis easier to manage.

Overall, utilizing a digital document system for creating billing statements is an efficient, cost-effective, and professional approach that benefits both businesses and clients alike. It simplifies day-to-day operations and ensures smooth financial management with minimal effort.

How to Create an Invoice in Excel

Generating a billing document in a spreadsheet program is a straightforward process that allows you to customize and organize all necessary details for a transaction. By following a few simple steps, you can create a professional document that outlines products or services provided, payment amounts, and due dates. This approach not only streamlines your workflow but also ensures accuracy and consistency in your financial records.

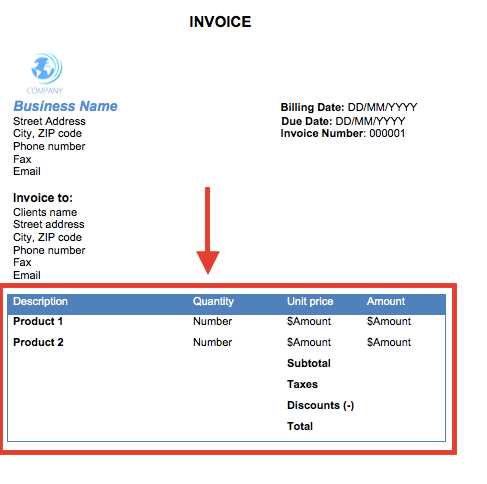

To begin creating your billing document, you will first need to set up a clean and structured layout. Focus on organizing essential fields such as your business information, client details, itemized list of goods or services, and totals. A well-arranged structure will make it easy for both you and your client to read and understand the content.

Steps to Create Your Document:

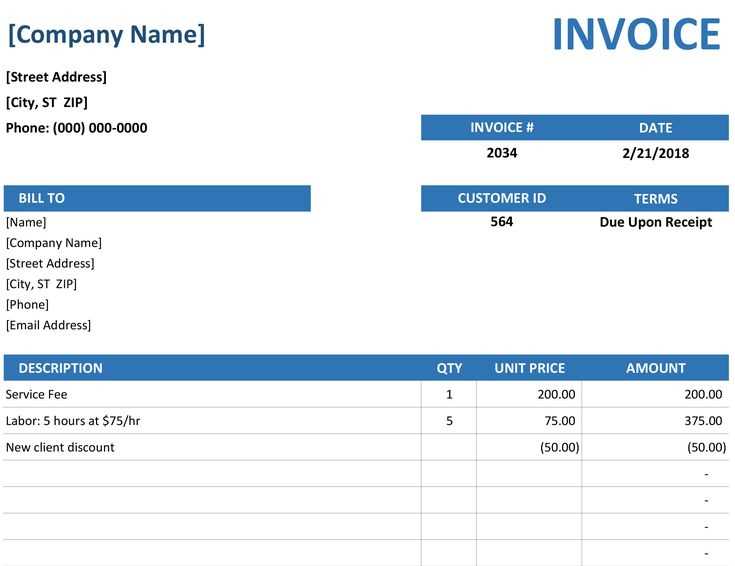

- Set Up the Header: Start by entering your business name, address, contact information, and logo if applicable. Then, add the recipient’s name and contact details beneath this, making sure both parties’ information is clearly distinguishable.

- Add the Date and Document Number: Assign a unique reference number to each document for easy tracking. Include the date the transaction is being processed and the due date for payment.

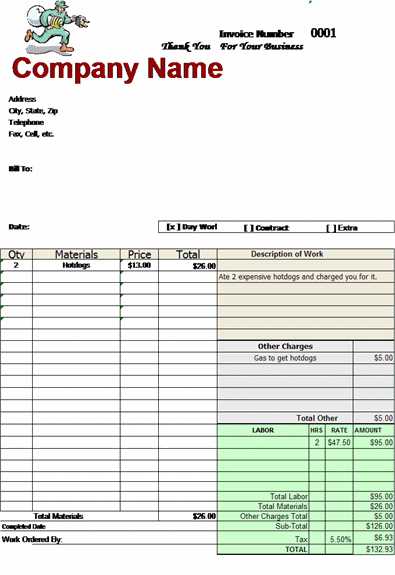

- List Products or Services: Create columns for a detailed breakdown of what was sold, including descriptions, quantities, unit prices, and total amounts. This will allow for a transparent record of the transaction.

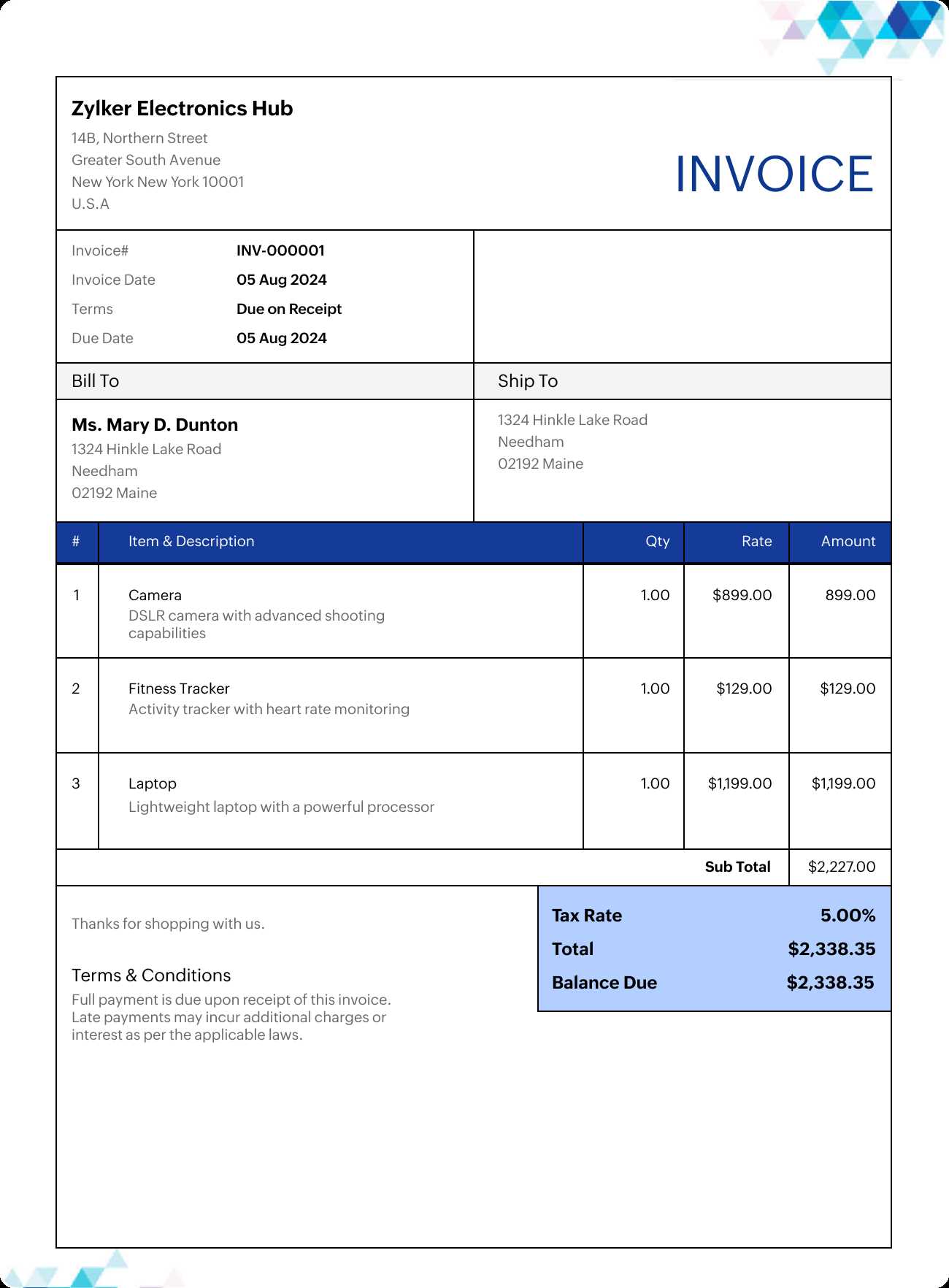

- Calculate Subtotal, Tax, and Total: Use built-in formulas to automatically calculate the subtotal of items, apply tax rates where applicable, and compute the final total. This eliminates manual calculations and reduces errors.

- Payment Terms and Notes: Include any terms of payment, such as early payment discounts or late fees. You can also add special instructions or additional notes if necessary.

- Finalize and Save: After reviewing the document for accuracy, save the file in a format that is easy to share, such as PDF, or keep it for your records in a secure location.

Once you’ve created your document, it’s easy to reuse the structure for future transactions, adjusting only the specific details. By using a digital tool to create your billing statements, you ensure that every document is consistent, accurate, and professional.

Customizing Your Excel Invoice Template

Customizing a billing document allows you to tailor it to your specific business needs, ensuring that all necessary information is included in a clear and professional format. The ability to modify various sections of the document helps you align it with your brand identity and ensures consistency across all financial transactions. With the right adjustments, you can create a document that suits the way your business operates while maintaining a polished, professional appearance.

Here are some key ways to customize your billing document:

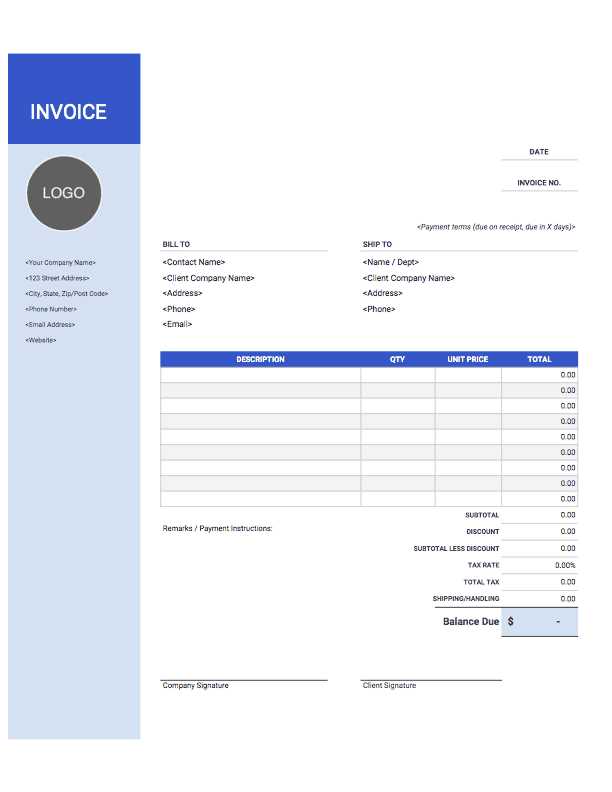

- Adjusting the Layout: Organize the sections of the document to match the flow of your business. For example, you can place your business logo at the top, followed by contact information, the recipient’s details, and the breakdown of items or services. A clear and easy-to-read layout helps clients quickly identify the important information.

- Adding Your Logo and Branding: Incorporate your business logo and color scheme to make the document reflect your brand identity. This adds a professional touch and reinforces your company’s image.

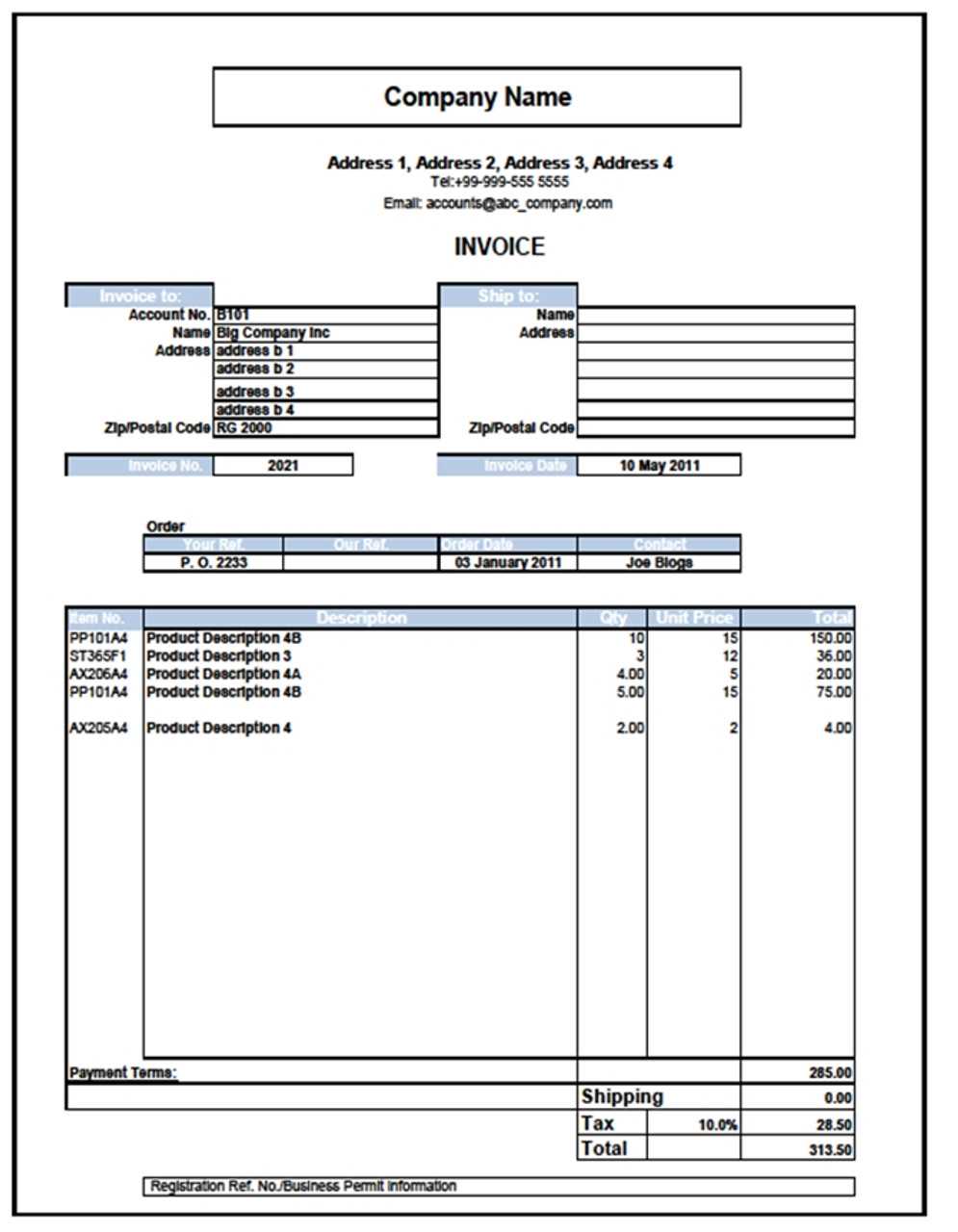

- Changing the Column Structure: Depending on the type of business you run, you may need to modify the columns used to describe your goods or services. For example, you might add a “SKU” or “Product Code” column if relevant, or provide additional columns for notes or special instructions.

- Setting Up Payment Terms: Customize the payment section with your specific terms, such as payment deadlines, discounts for early payments, or late fees for overdue invoices. This ensures that clients understand your expectations and promotes timely payments.

- Modifying Calculation Formulas: Adjust built-in formulas to fit your pricing model. For instance, you can update tax rates, apply different discount percentages, or include custom calculations for shipping and handling.

- Including Additional Notes: If necessary, add custom notes to the footer, such as thank-you messages, refund policies, or legal disclaimers. This section helps personalize the document and provides further clarity to your clients.

Reusing and Maintaining Customization: Once you’ve customized your document, save it as a master version that can be reused for future transactions. By doing so, you can maintain consistency in all of your billing documents and save time on creating new ones. Each time you create a new statement, simply update the relevant information, such as dates, amounts, and client details.

By personalizing your billing documents, you not only enhance the professionalism of your communications but also ensure that your statements accurately represent your business’s unique requirements.

Top Features of Excel Invoice Templates

When creating billing documents, certain features can significantly improve the process, making it easier and more efficient to generate accurate and professional statements. A well-designed document should not only include essential information but also provide tools that automate tasks, reduce errors, and enhance readability. Below are some of the key features that make digital solutions for creating billing documents highly effective.

Key Features

- Predefined Structure: Ready-to-use formats provide a clear, organized layout that includes all necessary fields, reducing the need for time-consuming formatting and design work.

- Automatic Calculations: Built-in formulas for adding up totals, calculating taxes, and applying discounts eliminate manual calculation errors and save time.

- Customizable Fields: Easily modify sections such as item descriptions, quantities, and pricing to suit the specific details of each transaction.

- Branding Options: Incorporate your business logo, custom colors, and fonts to match your company’s branding, making the document both professional and personalized.

- Invoice Numbering: Automatically generate sequential invoice numbers for easy tracking and organization, ensuring no document is overlooked.

- Payment Terms and Due Dates: Clearly display payment deadlines, accepted methods, and any additional terms such as late fees or early payment discounts, reducing confusion for clients.

- Client and Business Information: A space for both your contact details and the client’s information helps establish clear communication and ensures accuracy in transaction records.

- Tax Calculation: Pre-set tax rate fields help calculate taxes automatically based on the entered subtotal, simplifying the process and ensuring compliance.

- Easy Data Entry: The straightforward input fields make it easy to enter data for each transaction, saving time and reducing the likelihood of mistakes.

Benefits of These Features

- Time-saving: By automating many of the processes involved in billing, these tools allow you to focus on your core business tasks rather than administrative work.

- Accuracy: Automated calculations and clear structures minimize the risk of errors, ensuring that each document is correct and professional.

- Professional Appearance: Customization options help you present a polished, branded look that reflects the professionalism of your business.

- Ease of Use: With user-friendly formats, even those without extensive technical knowledge can quickly adapt to using these documents, ensuring smooth implementation across the organization.

These features combined make billing processes more

Common Mistakes to Avoid in Invoices

Creating a billing document might seem simple, but there are several common errors that can lead to confusion, delayed payments, or even disputes with clients. Paying attention to detail and ensuring that every part of the document is accurate and clear is crucial to maintaining professionalism and ensuring smooth financial transactions. Below are some of the most frequent mistakes made when generating financial statements and how to avoid them.

Frequent Errors

- Missing or Incorrect Contact Information: Failing to include accurate business and client contact details can lead to confusion or delays in communication. Always double-check that all addresses, phone numbers, and email addresses are correct.

- Incorrect Dates: The date of issue and payment due date must be clearly stated and accurate. Errors in these dates can cause payment delays or miscommunication with clients about when the transaction should be completed.

- Unclear Payment Terms: Not specifying payment methods, due dates, or any applicable penalties for late payments can lead to misunderstandings. Clearly outline your payment terms, including accepted methods (e.g., bank transfer, credit card) and deadlines.

- Missing Invoice Number: Failing to assign a unique invoice number can make tracking difficult. Always include a sequential number for each billing statement to keep your records organized.

- Inconsistent or Missing Item Descriptions: If the products or services listed are unclear or missing important details (e.g., quantities, unit prices), it can cause confusion and disputes. Ensure that each item is clearly described, and include all relevant information, such as quantities and unit prices.

- Math Errors: Simple mistakes in totaling amounts or calculating taxes can have serious consequences. Use built-in formulas or double-check your calculations to ensure accuracy.

- Omitting Tax Information: Not including the appropriate tax rates or failing to clearly show tax calculations can lead to problems with clients or regulatory authorities. Always ensure that taxes are included, if applicable, and make them clearly visible on the document.

- Neglecting to Add Additional Charges: Forgetting to include shipping fees, handling costs, or other additional charges can create confusion later on. Ensure that all applicable fees are added to the final total.

- Unprofessional Formatting: A cluttered or hard-to-read layout can make your document look unprofessional and cause difficulty for clients to understand the details. Keep the layout clean and organized with clearly labeled sections.

How to Prevent These Mistakes

- Double-check everything: Before sending out a billing statement, review all

Free Excel Invoice Templates for Small Businesses

For small businesses, managing financial transactions efficiently is crucial. One of the easiest ways to streamline the billing process is by using pre-made, customizable documents. These ready-to-use solutions provide a simple way to create professional, accurate statements without needing to invest in expensive accounting software. Free options are available that offer flexibility and key features suited to the needs of small businesses.

Using these free tools, you can quickly generate well-structured statements that include all the necessary details, from itemized lists to payment terms, without any complicated setup. Here are some advantages of using these ready-to-use options:

Benefits of Using Free Solutions

- No Cost: Many businesses, especially startups or small enterprises, are looking for budget-friendly solutions. Free document solutions allow you to save money while still maintaining a professional appearance.

- Time Efficiency: Pre-made structures help save valuable time. Instead of starting from scratch, you can customize an existing format to fit your needs quickly.

- Easy Customization: These options are usually designed with flexibility in mind, allowing you to change fields like client information, item descriptions, or tax rates according to your business requirements.

- Professional Appearance: Even without advanced software, you can create polished and professional documents that enhance your credibility with clients.

- Built-in Calculations: Many free solutions include automated calculations for subtotals, taxes, and discounts, reducing the chances of errors in your financial statements.

Where to Find Free Templates

- Online Platforms: Websites offering free resources often provide a variety of document structures that cater to different business types and transaction needs. Popular platforms like Google Docs, or independent business resource websites, are excellent places to start.

- Spreadsheet Software: If you already use a spreadsheet program, you might find free templates directly available within the application or its template gallery. These templates are pre-configured and can be adapted to your specific needs.

- Community Forums and Blogs: Many small business communities and blogs share free downloadable resources, including customized templates that have been tested by others in similar industries.

Things to Keep in Mind

- Customization Limits: Some free solutions might not offer as much flexibility as premium options, so it’s important to check if the template meets your specific needs.

- File Format: Ensure the template is available in a format compatible with your preferred software to avoid technical difficulties.

- Security and Privacy: When downloading free resources from the web, be sure to use trusted sites to ensure that your financial data remains secure.

By leveraging these free resources, small businesses can ensure they have the right tools to manage their finances efficiently, while keeping costs low. Customizable, easy-to-use options allow for a professional and reliable approach to billing, no matter the size of the company.

Designing a Professional Invoice in Excel

Creating a well-designed financial document is crucial for presenting a professional image to clients while ensuring clarity in transactions. A good design not only makes the document easy to read but also reflects the credibility of your business. With the right structure and a few key design principles, you can craft a polished and efficient document that effectively communicates all necessary details.

Key Design Elements

When designing your billing statement, it’s important to focus on certain elements that will enhance both its usability and visual appeal. These include layout, typography, and organization of information. Here’s what to consider:

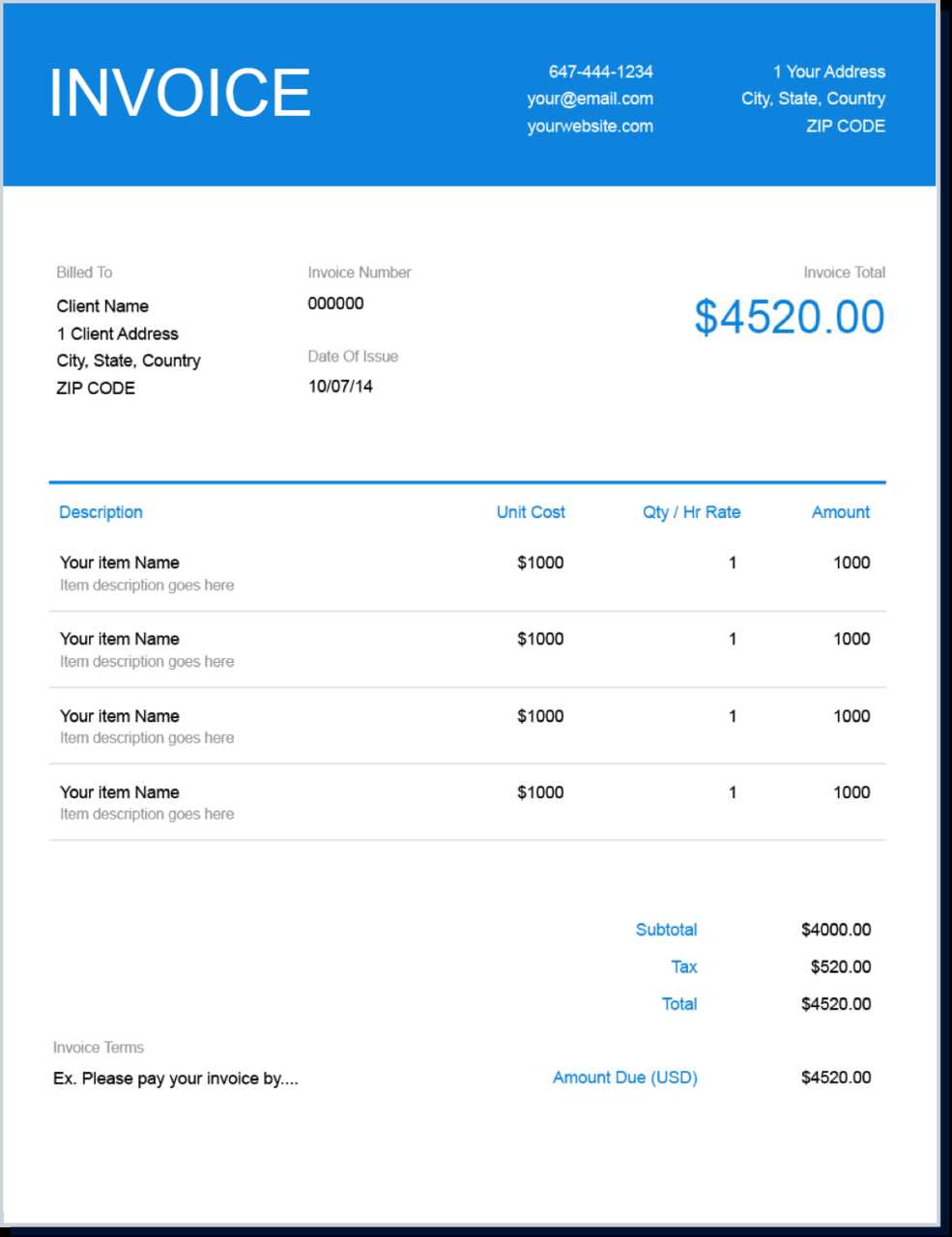

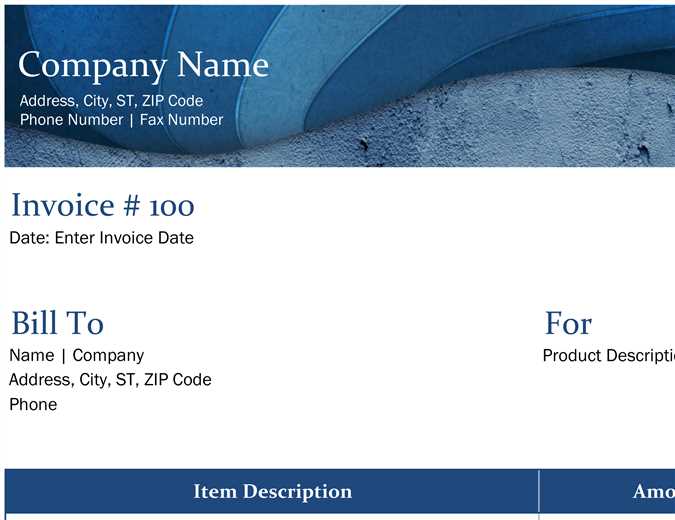

- Clear Structure: Start with a logical flow of information. Your business name and client’s details should be easily visible at the top, followed by the list of products or services, payment terms, and totals. This ensures that each section is easily identifiable at a glance.

- Branding: Incorporate your company’s logo, colors, and fonts to maintain brand consistency. This adds a professional touch and makes the document instantly recognizable as coming from your business.

- Readable Font: Use clean, legible fonts. Avoid overly decorative styles, as clarity is key. Standard fonts like Arial, Calibri, or Times New Roman are good choices for professional documents.

- Whitespace: Ensure there’s enough whitespace between sections. A cluttered document can confuse the reader. Use spacing effectively to make the document look clean and organized.

Example of a Professional Design

Section Description Header Include your business name, logo, and contact details. Also, add the client’s name and address to make the document personalized. Itemized List Break down products or services with columns for description, quantity, unit price, and total cost. This helps clients easily understand the charges. Subtotal Provide a clear subtotal before taxes and additional fees, ensuring the client sees how the final total is calculated. Tax and Additional Charges Clearly list applicable taxes and any extra fees (e.g., shipping, handling) to avoid confusion. Final Total Display the final amount due, prominently positioned at the bottom, making it easy for the client to identify the amount payable. By using these design principles, you can create a professional-looking billing statement that not only communicates important financial information clearly but also leaves a positive impression on your clients.

Using Excel for Recurring Billing

Managing recurring payments can be challenging, especially when you have a variety of clients or services with different billing cycles. Using a spreadsheet to automate and track these regular charges allows you to stay organized and ensure consistency in your financial records. With a few simple tools, you can create a system to track, calculate, and generate recurring bills efficiently, without the need for specialized software.

Setting up a system for recurring charges in a spreadsheet involves organizing your billing cycles, amounts, and payment terms in a way that can be easily replicated and updated. Here are some key steps to set up and manage these regular transactions:

Steps to Set Up Recurring Billing

- List of Clients: Begin by creating a list of clients and their corresponding services or products. Include essential details like start dates and payment amounts.

- Set Billing Cycles: Organize the payment frequencies (e.g., weekly, monthly, quarterly) in separate columns. This allows you to easily track which clients need to be billed and when.

- Use Formulas for Automatic Calculations: You can create formulas that automatically update payment amounts based on the billing cycle. For instance, if the amount changes after a specific period, use a simple formula to adjust the charges accordingly.

- Track Payments: Add columns to track when payments are received and whether the client is up to date with their payments. This will help you follow up on any overdue accounts promptly.

- Set Reminders: To ensure you don’t miss billing cycles, you can set up date-based reminders or use conditional formatting to highlight upcoming payment dates in the spreadsheet.

Benefits of Using a Spreadsheet for Recurring Billing:

- Cost-Effective: Unlike paid software options, a spreadsheet is free and easy to use, making it a great choice for small businesses with simple billing needs.

- Flexibility: You can easily customize the spreadsheet to meet the specific needs of your business, from adding new clients to adjusting billing cycles.

- Transparency: The clear layout of a spreadsheet makes it easy to track and review all recurring payments, ensuring you don’t overlook any important details.

By setting up a recurring billing system in a spreadsheet, you can automate much of the manual work involved in generating regular bills, saving you time and reducing errors in the process. This approach can help your business maintain a steady cash flow while keeping client information organized and accessible.

How to Automate Invoice Calculations in Excel

Automating calculations in a financial document can save time, reduce errors, and ensure consistency in your billing process. By setting up basic formulas and functions, you can make sure that totals, taxes, discounts, and other charges are calculated automatically. This not only speeds up the process but also allows you to focus on other important aspects of your business.

Setting Up Basic Calculations

To automate calculations in your billing document, the first step is to ensure you have all the necessary data laid out in a clear, organized format. You’ll need columns for item descriptions, quantities, unit prices, and totals. Once the structure is set, you can use simple formulas to calculate the final amount due. Below are the most common calculations to automate:

- Item Total: Multiply the quantity by the unit price. For example, in a spreadsheet, the formula could look like this:

=B2*C2(where B2 is quantity and C2 is unit price). - Subtotal: Add up the individual item totals. This can be done using the

SUMfunction. For example:=SUM(D2:D10)(where D2 to D10 contains the item totals). - Tax Calculation: Apply the tax rate to the subtotal. Use a formula like:

=D11*0.10(where D11 is the subtotal and 0.10 represents a 10% tax rate). - Total Amount Due: Add the subtotal and the tax amount to find the final amount due. The formula would be:

=D11+D12(where D11 is the subtotal and D12 is the tax).

Using Advanced Functions for Automation

Once you have the basics set up, you can take automation a step further with advanced functions to handle more complex scenarios, such as discounts or varying tax rates. For example:

- Discounts: If you offer a percentage discount, you can automatically apply it by using the formula

=D11*(1-0.10)(where D11 is the subtotal and 0.10 is the 10% discount). - Multiple Tax Rates: If your business operates in multiple locations with different tax rates, you can set up separate columns for tax rates and use conditional logic (e.g.,

IFstatements) to apply the correct tax rate based on location or product type.

Benefits of Automation:

- Accuracy: By automating the calculations, you eliminate the risk of manual errors, ensuring that every total is correct.

- Efficiency: The process of creating a bill becomes much quicker since you don’t need to manually calculate each total.

- Consistency: Automated calculations ensure that every billing document follows the same formula, maintaining consistency across all transactions.

By setting up automated calculations in your billing documents, you can streamline your invoicing process, improve accuracy, and save time, ultimately improving your workflow and reducing the likelihood of mistakes.

Organizing Your Invoice Data in Excel

Properly organizing your financial records is crucial for maintaining clarity and efficiency, especially when dealing with multiple clients and transactions. Structuring your data effectively ensures you can quickly locate and analyze specific details, making it easier to track payments, due dates, and outstanding balances. An organized document not only enhances your workflow but also helps maintain accuracy in your financial reporting.

Key Principles for Organizing Data

To organize your financial records efficiently, it’s important to separate different types of information into distinct sections or categories. This will help keep everything in order and allow for easy updates or modifications as needed. Below are some key steps to consider when structuring your data:

- Separate Columns for Each Category: Create columns for essential details such as client name, billing address, service/product description, quantity, unit price, and total cost. This makes it easy to filter and sort the data as needed.

- Use Headers for Easy Navigation: Label each column clearly so that you can easily understand what each data point represents. This allows you to scan the document quickly and find the information you need.

- Include Dates and Due Dates: Keep track of transaction dates and payment deadlines. Having this information clearly visible helps with timely follow-ups and ensures you don’t miss payment deadlines.

- Use Separate Sheets for Different Clients or Periods: If you have a large volume of data, consider organizing records by client or by billing period. This can be done by creating different sheets within the same document for each client or timeframe.

Example of Organized Data Structure

Client Name Service/Product Description Quantity Unit Price Total Cost Issue Date Due Date Client A Consulting Service 10 $100 $1000 2024-10-01 2024-10-15 Client B Web Design 1 $2000 $2000 2024-10-03 2024-10-17 Integrating Excel Templates with Accounting Software

Connecting your financial documents to accounting software can significantly streamline your business operations. By integrating pre-designed billing structures with more sophisticated accounting tools, you can automate data transfer, improve accuracy, and save time on manual entry. This integration allows for smoother workflows, better reporting, and enhanced oversight of your financial activities, making it easier to manage accounts, track payments, and generate detailed financial reports.

Benefits of Integration

When you link your financial documents with accounting software, several advantages arise that enhance both your operational efficiency and the accuracy of your financial records:

- Time Savings: Automatically transferring data between your documents and accounting software eliminates the need for repetitive data entry, freeing up valuable time.

- Accuracy: Reduces the risk of human error in transferring data, ensuring that all numbers are aligned and that calculations are consistent across both platforms.

- Streamlined Workflow: Seamlessly syncing data between your financial records and software allows for more efficient processes, from creating billing statements to tracking payments and expenses.

- Real-time Financial Updates: Integration allows for up-to-date financial data, providing you with accurate, real-time information without the need to manually update records.

How to Integrate Your Documents with Accounting Software

Integrating your financial records with accounting software is simpler than it may seem. Follow these steps to connect your pre-made documents to accounting platforms:

- Export Data from Documents: Many software systems allow for importing data from spreadsheet files. Ensure your financial document is properly formatted (e.g., CSV or XLSX) for easy import into the accounting software.

- Use API or Third-Party Tools: Some platforms offer API integrations or third-party tools that sync data from your spreadsheets into the software. These tools can automate the transfer of information like payment amounts, client details, and billing dates.

- Map Data Fields: To ensure the correct transfer of information, map the relevant fields in your financial documents to those in the accounting software (e.g., map “Total Amount” to “Amount Due”).

- Automate Recurring Entries: If you regularly bill clients for the same amount or services, set up recurring billing cycles within your software to automatically sync data for recurring p

How to Track Payments Using Excel Templates

Monitoring payments and keeping track of outstanding balances is crucial for any business. Using a structured document to record transactions helps you stay organized and ensures that you are aware of which clients have paid and which still owe money. By leveraging a few simple functions and organizing your data effectively, you can easily track payments, set up reminders for overdue amounts, and maintain an up-to-date record of your finances.

Setting Up Payment Tracking in Your Document

To track payments efficiently, the key is to structure your document in a way that allows for easy input and analysis of each transaction. Start by including the following essential fields:

- Client Information: Include the client’s name, billing address, and contact details to keep everything in one place.

- Transaction Details: Create columns for the description of the service or product provided, along with the amount due for each entry.

- Payment Status: Have a dedicated column to mark whether the payment has been made, is pending, or overdue.

- Payment Date: Record the date when each payment is received to help track when a payment is due again or when it was completed.

- Amount Paid: Create a column to input the actual payment amount made by the client, which will help you calculate any outstanding balances.

Automating Payment Tracking

One of the biggest advantages of using a document for payment tracking is the ability to automate certain calculations to ensure accuracy and reduce manual work. Consider setting up the following automated processes:

- Outstanding Balance Calculation: Use a simple formula to subtract the payment amount from the total due. For example, if the total due is in cell

B2and the amount paid is inC2, the formula for the balance would be=B2-C2. - Conditional Formatting for Payment Status: Use conditional formatting to automatically color-code payment status (e.g., green for “Paid,” red for “Overdue”). This allows you to visually track which clients have outstanding payments.

- Due Date Alerts: Use date-based formulas like

IFto highlight overdue payments. For example, you could set a rule to flag any payments that are due today or in the past.

Example of Payment Tracking Setup:

Client Name Service/Item Total Amount Amount Paid Balance Payment S Why Excel Is Ideal for Invoicing

When it comes to managing billing and financial records, many businesses find that a flexible, customizable spreadsheet is an ideal solution. The ability to create, edit, and calculate financial data easily in one platform makes it a go-to tool for tracking payments, issuing statements, and keeping records up-to-date. Its straightforward interface and powerful functionality allow users to design their own structures tailored to their specific needs.

Key Benefits of Using a Spreadsheet for Billing

There are several advantages to using a spreadsheet for managing transactions and creating billing records:

- Customization: A spreadsheet offers full control over the structure of your billing document, allowing you to adjust it to your exact specifications. You can easily add or remove fields, change layouts, and create sections to suit your business model.

- Automation: By incorporating formulas and functions, you can automate many of the calculations in your financial documents. This reduces errors and saves time when calculating totals, taxes, discounts, and balances.

- Cost-Effective: Spreadsheets are widely available and often come with other essential software, making them a low-cost option for managing your business’s financial records. There’s no need for expensive specialized billing software when a spreadsheet can do the job just as effectively.

- Easy to Use: Even without advanced technical skills, users can quickly learn to create and manage basic financial documents in a spreadsheet. With pre-built functions and templates, it’s easy to get started.

- Data Organization: You can organize your financial data in a logical, consistent manner, making it simple to track payments, due dates, and outstanding balances. This organization is key for maintaining accurate records and easily identifying potential issues.

- Compatibility: Spreadsheets can easily be shared, exported, and integrated with other tools, making it simple to collaborate with your team or send documents to clients. You can also back up or store your data in cloud-based systems for added security and accessibility.

Practical Uses for a Spreadsheet in Financial Management

In addition to creating billing statements, spreadsheets are useful for a variety of financial tasks:

- Tracking Payments: By adding columns to track the amount paid, the balance remaining, and the payment status, you can easily stay on top of which clients have paid and which still owe money.

- Generating Reports: By organizing your data in a spreadsheet, you can quickly generate financial reports that summarize your income, expenses, and outstanding balances.

- Managing Recurring Payments: Spreadsheets can be set up to handle recurring payments, allowing you to create billing cycles and automate the generation of bills for regular clients.Exporting and Printing Excel Invoices

Once your financial documents are ready, it is important to efficiently export or print them for distribution. Exporting and printing allow you to share your records with clients or keep hard copies for your business’ accounting purposes. The ability to convert your records into different formats or print them directly from the document ensures that you have the flexibility to manage your business communications in a way that suits your needs.

Exporting Your Documents

Exporting your financial records to different formats is useful when you need to send them electronically to clients, colleagues, or stakeholders. You can easily convert your data to various file types, ensuring compatibility with different software or email platforms.

- Export to PDF: A popular choice for sharing finalized documents, PDF ensures that the formatting and layout remain consistent regardless of the device or software being used to view the file. To export, go to the “File” menu and select “Save As,” then choose PDF as the file type.

- Export to CSV or TXT: If you need to use the data in other applications or systems, exporting your data in CSV (Comma Separated Values) or plain text format makes it easy to import into accounting software or databases.

- Export to HTML: For clients who prefer viewing documents in a web browser, exporting your document to an HTML file can make it accessible from any device with internet access.

- Cloud Storage Options: Saving your document directly to cloud storage such as Google Drive, Dropbox, or OneDrive gives you quick access to your file from anywhere and enables easy sharing through a link.

Printing Your Documents

Printing is an essential part of any business’s document management process, especially when you need to provide physical copies for clients or file them for future reference. When printing, it’s important to ensure that your documents are formatted correctly and that all necessary details are visible on the printed version.

- Check Print Settings: Before printing, make sure your document is properly aligned for your printer. Set the correct page size (e.g., A4, letter size) and orientation (portrait or landscape), depending on the layout of your document.

- Adjust Margins and Scaling: If parts of your document are being cut off, adjust the margins and scaling settings to ensure that all content fits properly on the page.

- Preview Before Printing: Always use the “Print Preview” feature to check how your document will appear when printed. This will help you catch any formatting issues or missing elements before sending it to the printer.

- Print Multiple Copies: If you need to print multiple copies of the same document, make sure to adjust the number of copies in the print dialog box.

Exporting and printing your financial records is a key aspect of keeping accurate and organized business documentation. Whether you’re sending electronic files or providing physical copies, ensuring that your documents are properly formatted and accessible will help