Microsoft Free Invoice Template for Simple and Effective Billing

Why Choose Microsoft for Invoicing

How to Download an Invoice Template

Customize Your Invoice with Microsoft

Top Features of Free Invoice Templates

Using Microsoft Templates for Small Business

Step-by-Step Guide to Invoice Creation

Benefits of Free Invoice Templates

How to Add Your Logo to Templates

Tracking Payments with Microsoft Invoices

Saving and Sharing Your Invoices Easily

How to Use Microsoft Excel for Invoicing

Integrating Microsoft Templates with Accounting Software

Creating Recurring Invoices in Microsoft

Common Mistakes to Avoid When Invoicing

Why Free Invoice Templates Save Time

Microsoft Free Invoice Template Overview

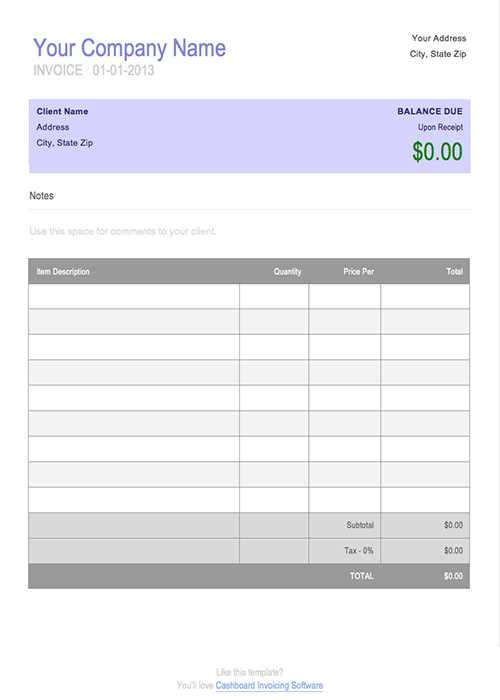

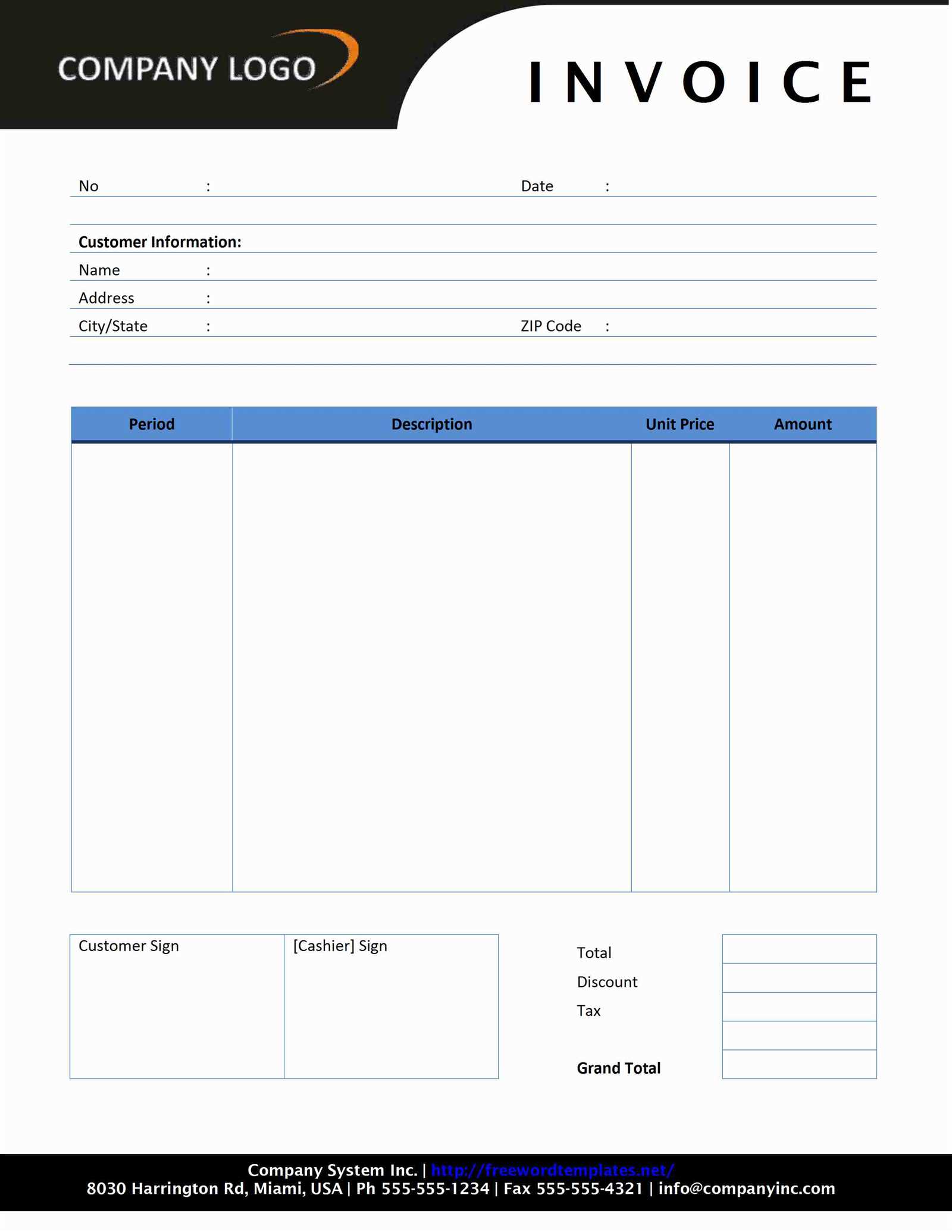

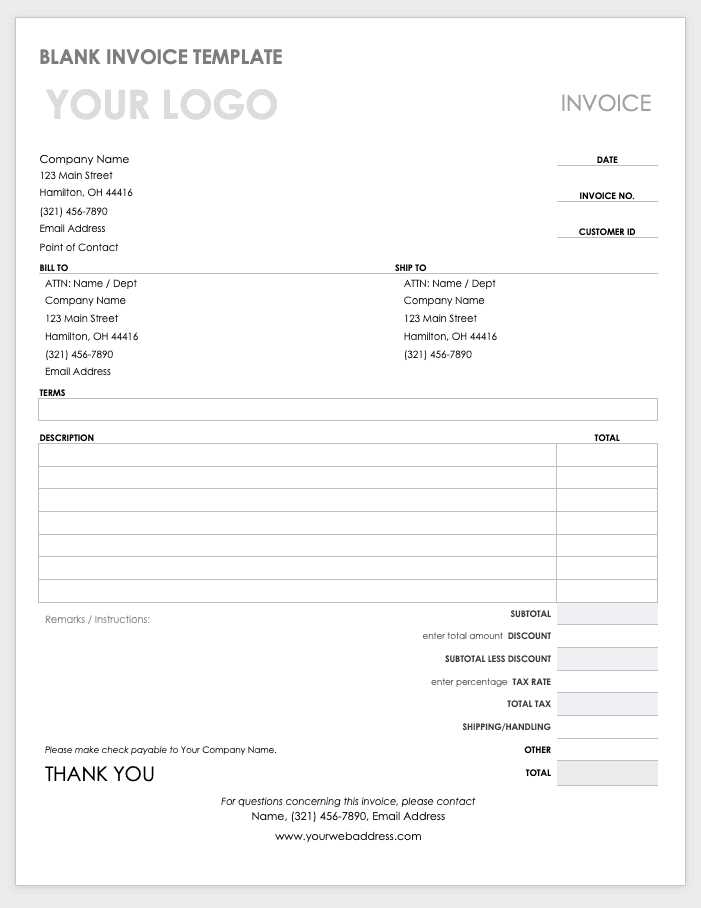

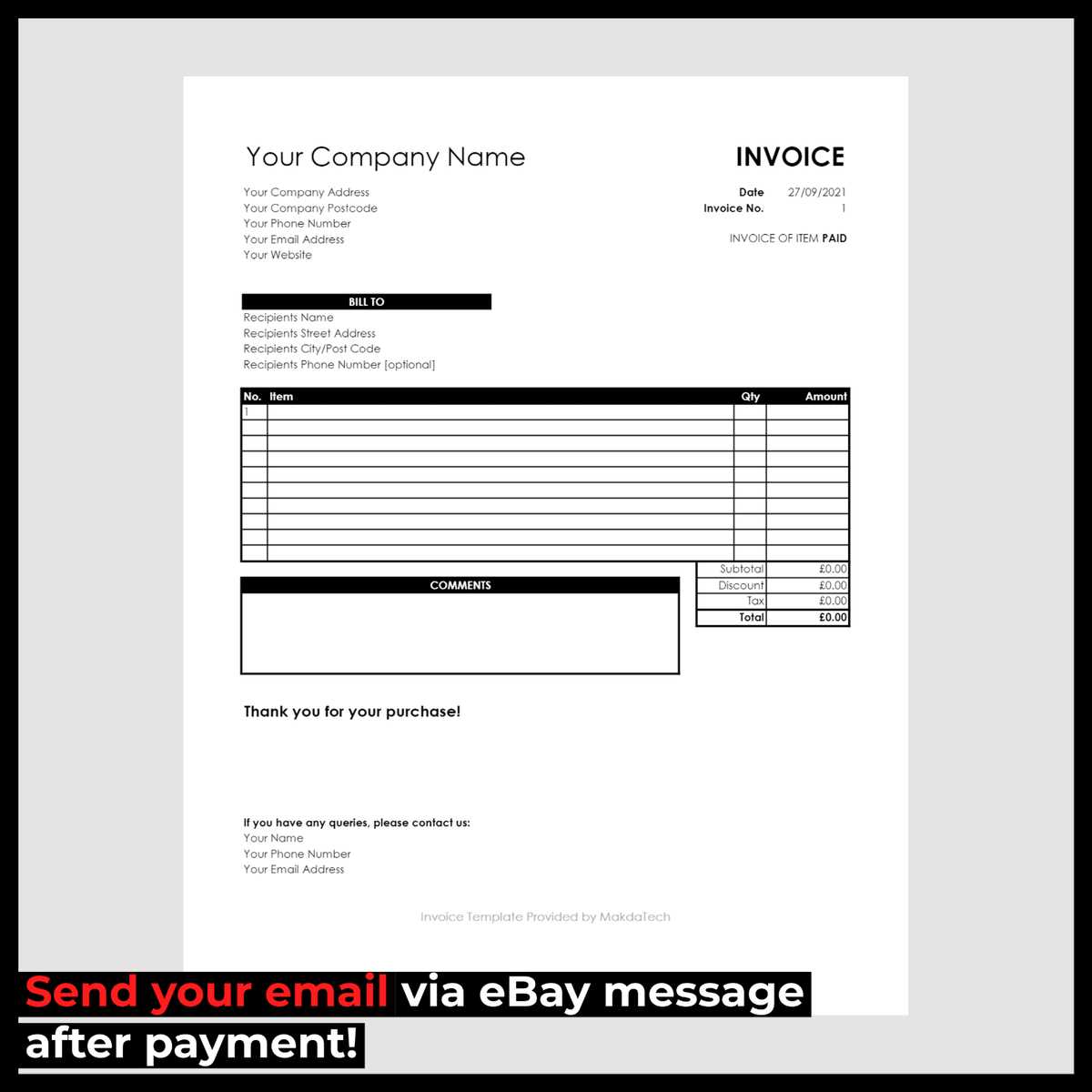

Creating professional billing documents can be a time-consuming task, but with the right tools, it becomes much easier. Using ready-made documents that are customizable and simple to use helps streamline the billing process for both individuals and businesses. These tools provide users with the flexibility to create, edit, and manage payment records without the need for specialized knowledge or software.

Customizable formats allow for easy adjustment of the document to fit various business needs, whether for one-time clients or recurring services. The ability to add personal branding elements, such as logos and contact information, makes these documents suitable for any professional setting. With user-friendly features and clear layouts, these documents ensure accuracy and save valuable time, helping businesses stay organized and efficient.

Furthermore, these documents are often available in multiple file formats, making them accessible across different platforms. The simplicity of inputting client data, adjusting payment terms, and generating final copies makes the entire process much faster. Whether you’re an entrepreneur or part of a large organization, using such tools ensures you can manage billing tasks with confidence and professionalism.

Microsoft Free Invoice Template Overview

Creating professional billing documents can be a time-consuming task, but with the right tools, it becomes much easier. Using ready-made documents that are customizable and simple to use helps streamline the billing process for both individuals and businesses. These tools provide users with the flexibility to create, edit, and manage payment records without the need for specialized knowledge or software.

Customizable formats allow for easy adjustment of the document to fit various business needs, whether for one-time clients or recurring services. The ability to add personal branding elements, such as logos and contact information, makes these documents suitable for any professional setting. With user-friendly features and clear layouts, these documents ensure accuracy and save valuable time, helping businesses stay organized and efficient.

Furthermore, these documents are often available in multiple file formats, making them accessible across different platforms. The simplicity of inputting client data, adjusting payment terms, and generating final copies makes the entire process much faster. Whether you’re an entrepreneur or part of a large organization, using such tools ensures you can manage billing tasks with confidence and professionalism.

How to Download an Invoice Template

Obtaining a customizable document for billing purposes is simple and convenient. Whether you’re working from home or managing a business, you can easily access professional document formats that suit your needs. These documents are designed to be downloaded quickly and ready for use in just a few steps.

Step 1: Choose a Trusted Source

Start by selecting a reliable platform or website that offers various business document formats. Many online services provide a range of customizable options that are compatible with widely used software. Ensure that the source is legitimate to avoid any security risks when downloading files.

Step 2: Download and Save the Document

Once you’ve selected the desired format, simply click the download link. The document will typically be saved in a format like Excel or Word, making it easy to open and edit on your computer. Be sure to save the file to a location where you can easily find it later.

How to Download an Invoice Template

Obtaining a customizable document for billing purposes is simple and convenient. Whether you’re working from home or managing a business, you can easily access professional document formats that suit your needs. These documents are designed to be downloaded quickly and ready for use in just a few steps.

Step 1: Choose a Trusted Source

Start by selecting a reliable platform or website that offers various business document formats. Many online services provide a range of customizable options that are compatible with widely used software. Ensure that the source is legitimate to avoid any security risks when downloading files.

Step 2: Download and Save the Document

Once you’ve selected the desired format, simply click the download link. The document will typically be saved in a format like Excel or Word, making it easy to open and edit on your computer. Be sure to save the file to a location where you can easily find it later.

How to Download an Invoice Template

Obtaining a customizable document for billing purposes is simple and convenient. Whether you’re working from home or managing a business, you can easily access professional document formats that suit your needs. These documents are designed to be downloaded quickly and ready for use in just a few steps.

Step 1: Choose a Trusted Source

Start by selecting a reliable platform or website that offers various business document formats. Many online services provide a range of customizable options that are compatible with widely used software. Ensure that the source is legitimate to avoid any security risks when downloading files.

Step 2: Download and Save the Document

Once you’ve selected the desired format, simply click the download link. The document will typically be saved in a format like Excel or Word, making it easy to open and edit on your computer. Be sure to save the file to a location where you can easily find it later.

Using Microsoft Templates for Small Business

For small businesses looking to streamline administrative tasks, digital solutions offer an efficient way to manage everyday operations. Pre-designed documents, which cater to various business needs, allow entrepreneurs to save time and focus more on growth. These resources are customizable and provide a professional look with minimal effort, making them an ideal option for those with limited design skills or resources.

Streamlining Operations

Utilizing ready-made documents can greatly reduce the complexity of managing financial records, client communications, and project tracking. With a range of options to suit different needs, entrepreneurs can quickly generate professional-looking documents without starting from scratch. These tools help ensure consistency and accuracy in business dealings, while also enhancing productivity.

Customization and Ease of Use

One of the key advantages of using such digital resources is the ease with which they can be customized. Whether you need to adjust the layout, change wording, or add specific details, these tools provide flexibility without requiring advanced software knowledge. This empowers small business owners to maintain control over their branding while still benefiting from time-saving features.

Efficiency and professionalism come hand in hand when you leverage digital solutions that help automate routine tasks, ensuring that even small businesses can compete with larger enterprises on an equal footing.

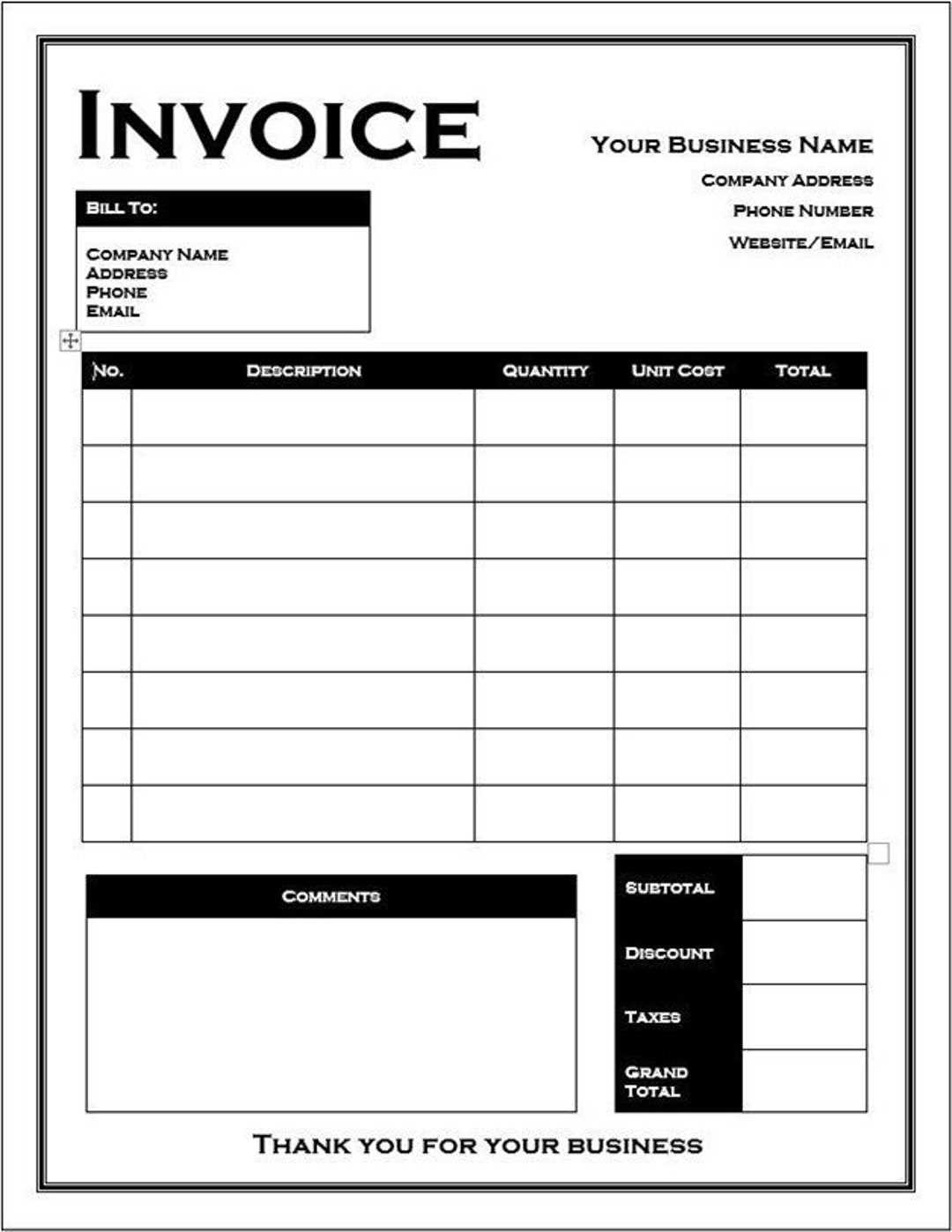

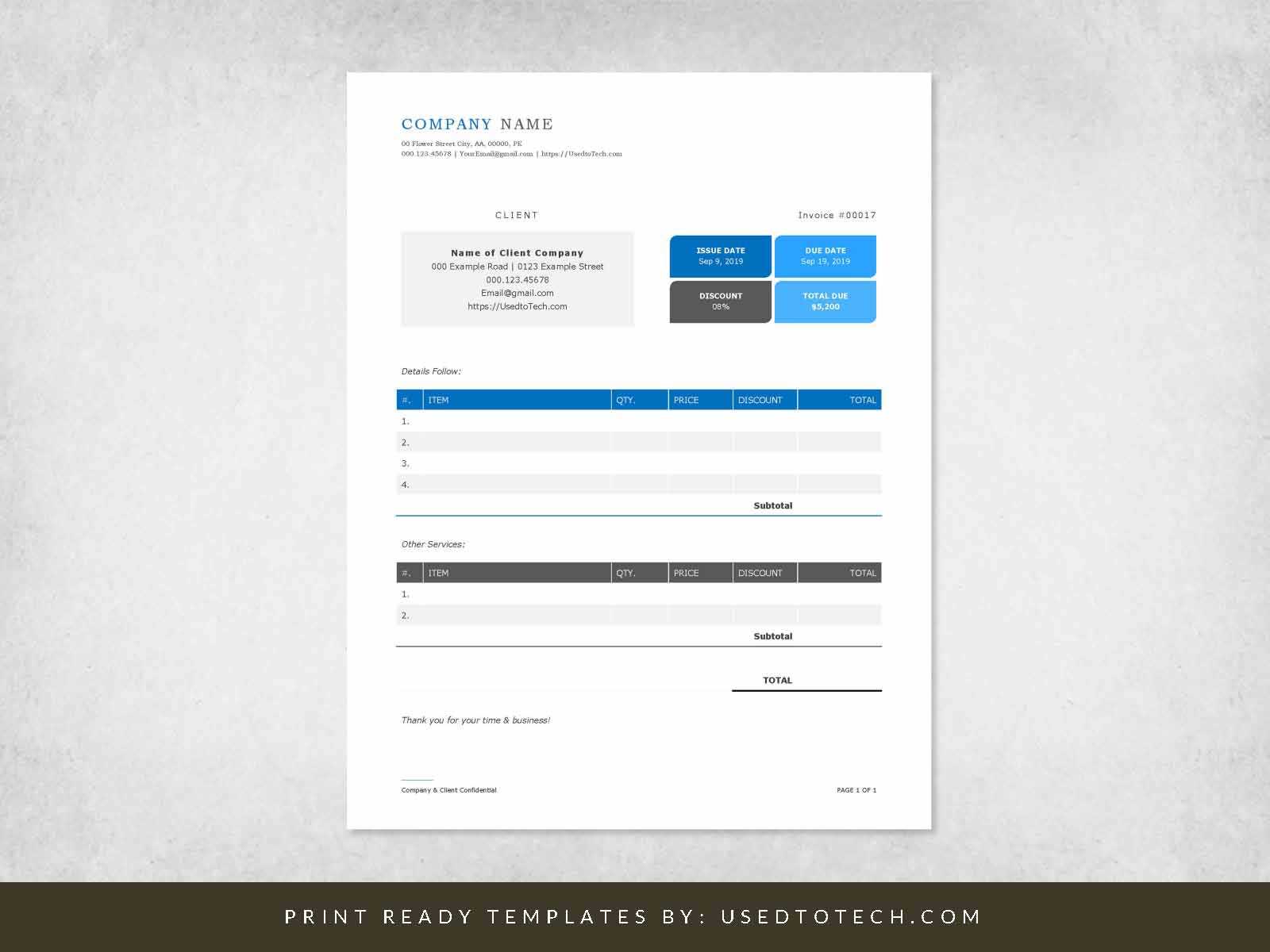

Step-by-Step Guide to Invoice Creation

Creating well-organized documents for billing purposes is an essential task for any business. A clear and professional document helps maintain smooth financial transactions and ensures that both parties understand the terms of payment. Following a structured process to create these documents can save time, reduce errors, and improve the overall client experience.

Step 1: Gather Necessary Information

Before starting the document, collect all relevant details such as the business name, contact information, customer details, and a description of the products or services provided. This is crucial for creating an accurate and comprehensive record. Include any applicable dates, such as the service date and due date, to ensure clarity in the transaction.

Step 2: Choose a Layout and Customize It

Once you have all the essential information, select a layout that suits your business needs. Customize the design to match your branding by adding your logo, adjusting fonts, or incorporating colors that represent your company. A visually appealing and consistent format helps enhance your professionalism and makes the document easy to read.

Attention to detail during this process ensures that the document not only looks polished but also provides clear and accurate information, minimizing any potential confusion.

Step 3: Calculate Amounts and Add Terms

Be sure to include precise pricing details for each product or service, as well as any applicable taxes, discounts, or additional charges. Clearly state the total amount due and the payment terms, including the due date and accepted payment methods. This transparency helps to avoid misunderstandings and fosters trust with your clients.

Effective communication in these steps helps you establish a positive relationship with your clients, encouraging timely payments and future business interactions.

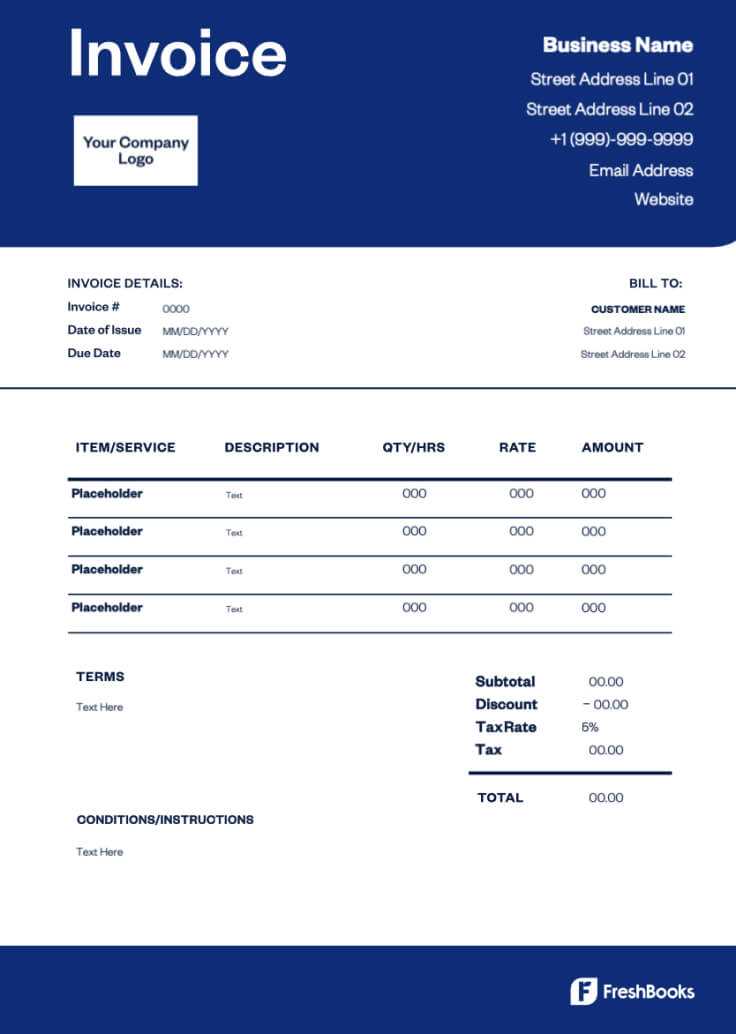

Benefits of Free Invoice Templates

Utilizing pre-designed documents for billing purposes offers several advantages for small businesses and freelancers. These resources can significantly reduce the time and effort required to create accurate, professional records, ensuring that important financial transactions are handled smoothly and efficiently. With these tools, businesses can maintain consistency while also streamlining their administrative tasks.

Cost-Effective Solution

One of the primary benefits of using pre-made documents is the cost savings. Instead of hiring a designer or purchasing expensive software, businesses can access high-quality layouts without any additional expense. This is especially valuable for small companies that may have limited budgets but still want to present a professional image to their clients.

Time-Saving and Easy to Use

Pre-designed documents allow users to quickly input necessary information without the need for complex formatting or design work. The simple, user-friendly interface enables even those with limited technical skills to create professional-looking records in minutes. This quick turnaround can free up valuable time for other business tasks.

Efficiency is key when it comes to managing business operations. By using ready-made documents, companies can ensure that they are always prepared to handle transactions without delays or confusion.

Customization for a Personal Touch

While these tools offer convenience, they also allow for customization. Business owners can easily adjust the content, layout, and design elements to suit their branding. This flexibility ensures that each document is unique to the business while maintaining the necessary professional appearance.

Personalization combined with simplicity makes these resources a highly effective choice for businesses looking to manage their financial documentation efficiently and professionally.

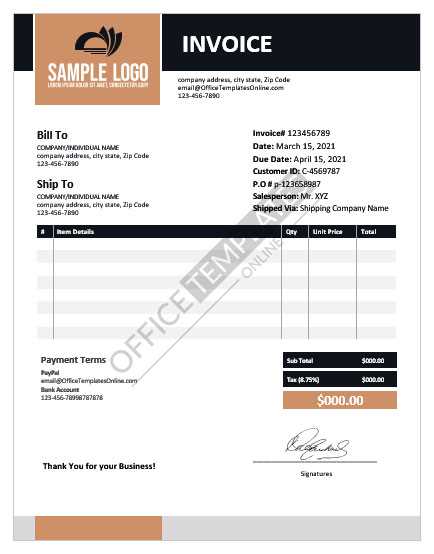

How to Add Your Logo to Templates

Incorporating your brand’s logo into essential business documents helps establish a professional and cohesive identity. Whether you are preparing a billing statement, a contract, or any other document, adding your logo can enhance your brand recognition and create a polished look. The process of inserting your logo into these documents is quick and straightforward, allowing you to personalize them easily while maintaining a high level of professionalism.

Steps to Insert Your Logo

Follow these simple steps to add your logo to any document template:

| Step | Action |

|---|---|

| 1 | Open the document you wish to edit. |

| 2 | Click on the header or the area where you want to insert the logo. |

| 3 | Go to the “Insert” tab and select the “Picture” or “Image” option. |

| 4 | Browse your computer for the logo file and select it. |

| 5 | Resize and position the logo according to your preference. |

| 6 | Save the document to retain your changes. |

Customizing your documents by adding a logo can make a significant difference in how your business is perceived by clients and customers. A consistent visual identity across all your documents strengthens your brand’s presence and builds trust.

Additional Tips

Ensure that your logo is clear and high-quality for the best results. Avoid overly large or small logos that may look out of place or unprofessional. Also, consider placing the logo in areas where it won’t interfere with important details, such as the top left or right corner of the page.

Branding is an essential aspect of business communication. By adding your logo, you not only create a more personalized experience for your clients but also reinforce your business’s visual identity.

Tracking Payments with Microsoft Invoices

Effectively managing payments is crucial for maintaining cash flow and ensuring the financial health of your business. By utilizing digital billing systems, you can easily track outstanding balances, monitor when payments are made, and identify any overdue amounts. A streamlined system for monitoring these transactions not only helps with organization but also improves communication with clients about their payment status.

Steps to Track Payments

To stay on top of incoming payments and manage your financial records, follow these steps:

- Issue the document with clear payment terms and due dates.

- Keep a record of each payment made by your clients, including the amount and date of payment.

- Update the status of the payment once it is received, marking it as paid or partially paid.

- Review overdue payments regularly to follow up with clients on outstanding balances.

Organizing Payment Information

Maintaining a payment tracking system involves more than just recording the amounts. It is essential to keep this information in a structured format for easy access and reference. Here are some ways to organize this data:

- Use separate records for each client or project to track payments and balances effectively.

- Set up reminders for upcoming due dates to ensure timely follow-ups with clients.

- Maintain a summary sheet of all received payments and outstanding amounts to assess cash flow at a glance.

Accurate tracking helps businesses avoid cash flow issues, identify trends, and reduce the time spent on administrative follow-up. By automating and organizing your payment records, you can focus more on growing your business and less on tracking financial details.

Helpful Features

Digital systems often come with features that can make payment tracking even more efficient:

- Automatic reminders for clients when payments are due or overdue.

- Real-time status updates on outstanding or completed transactions.

- Built-in reports to summarize payment history, providing a clear overview of finances.

Utilizing these features allows you to stay organized and maintain better control over your finances, ensuring smooth operations and strong client relationships.

Saving and Sharing Your Invoices Easily

Efficiently saving and sharing important business documents is key to maintaining a smooth workflow. With digital solutions, storing and distributing files can be done quickly and securely, reducing the chances of errors and lost paperwork. By utilizing simple tools, you can easily keep track of your records and share them with clients or colleagues with just a few clicks.

Saving Documents for Future Use

Once your business documents are created, it’s essential to save them in a format that is both secure and easily accessible. Most software allows you to save files in popular formats like PDF or Word, ensuring compatibility across various devices and systems. To maintain organization:

- Create specific folders for each client or project to store related files.

- Use clear naming conventions for easy retrieval, such as “ClientName_Invoice_2024-11-06”.

- Regularly back up your files to cloud storage or external drives to prevent data loss.

Sharing Documents with Clients

Sharing documents digitally offers a fast and convenient way to send important information to your clients. You can email the file directly, or if the client prefers, share it through a cloud storage link for easier access. When sharing:

- Ensure that the file format is compatible with your client’s system, typically PDF for universal readability.

- Provide a brief message outlining what the document contains and any necessary actions (e.g., payment terms or due dates).

- Consider using password protection for sensitive documents to ensure privacy and security.

Digital storage and sharing eliminate the need for physical paperwork and reduce the risk of losing important documents, making it easier to stay organized and professional. This process also improves efficiency, allowing you to focus on more critical aspects of running your business.

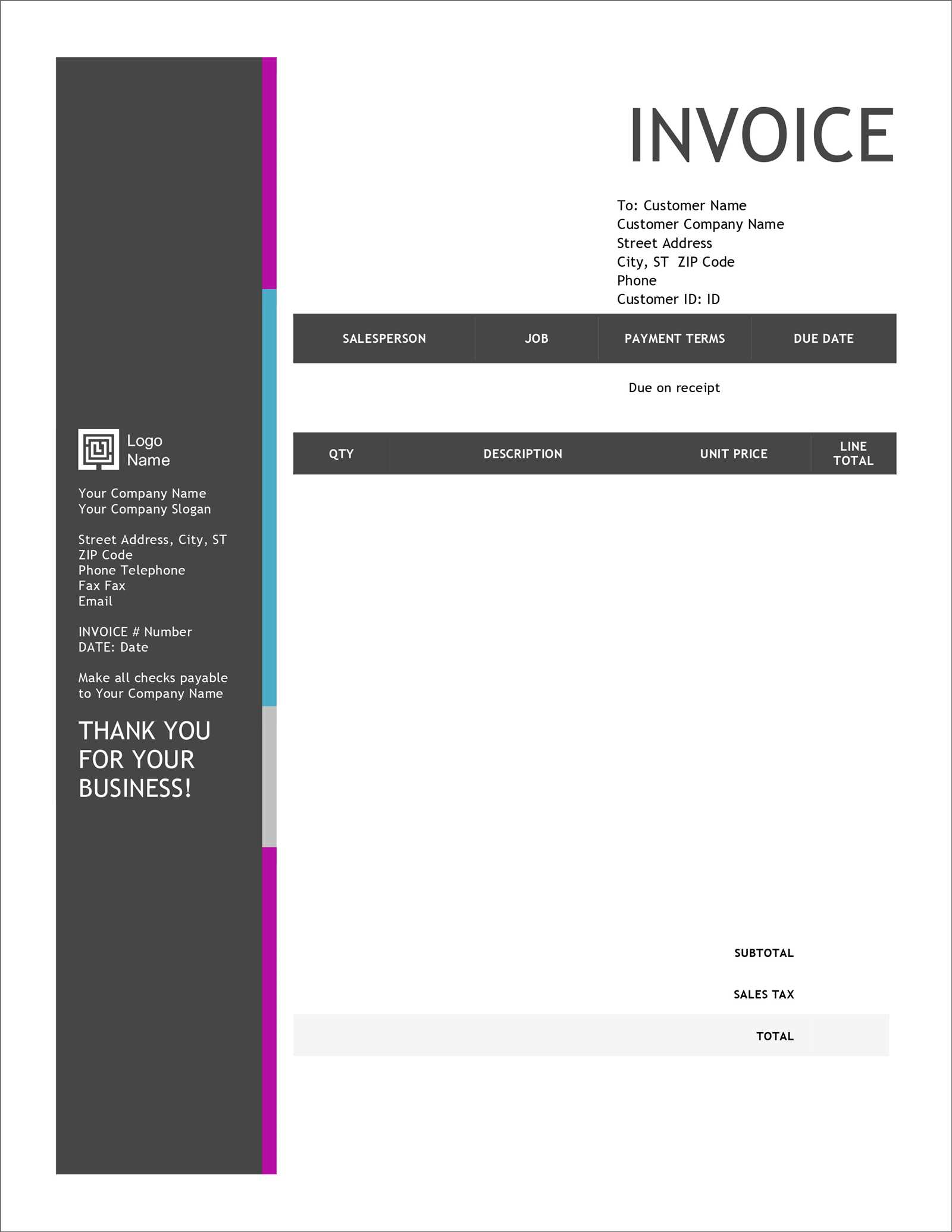

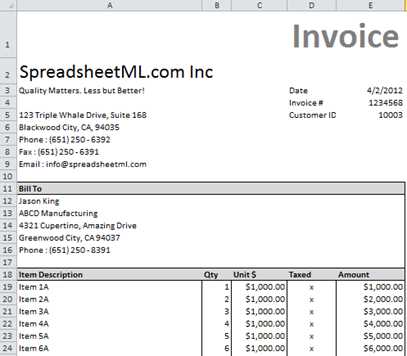

How to Use Microsoft Excel for Invoicing

Creating and managing billing documents can be made easy with spreadsheet software. Excel is a powerful tool for handling various business tasks, including generating professional billing records. By utilizing its functions and features, you can quickly calculate totals, track payments, and customize the layout to fit your needs–all in one document.

Step 1: Set Up Your Document

Start by opening a new spreadsheet and setting up your layout. Here are the key sections you should include:

- Your business name, logo, and contact details at the top.

- Client information such as name, address, and contact details.

- A list of products or services provided, including descriptions, quantities, and unit prices.

- A summary section for total amount due, taxes, and any additional fees.

- Payment terms, including due date and accepted methods of payment.

Organizing your document in this way will ensure that all necessary details are included and clearly presented, making it easier for clients to understand the charges and payment terms.

Step 2: Use Excel Functions to Automate Calculations

Excel’s built-in functions can save you time by automatically calculating totals and taxes. Here are a few examples:

- Use the SUM function to add up the prices of individual items and calculate the total amount due.

- Use multiplication formulas to calculate the total cost for each item based on quantity and unit price.

- If you charge sales tax, use a percentage formula to calculate the tax on the subtotal.

These simple formulas can streamline the process and reduce the risk of errors in your documents. With just a few clicks, you can generate accurate totals for every transaction.

Step 3: Customize Your Layout

Excel allows you to format your document so it looks professional and aligns with your branding. You can:

- Change fonts, adjust column widths, and apply colors to make the document visually appealing.

- Add borders or shading to separate sections and enhance readability.

- Insert your logo and any other branding elements that reflect your business identity.

Personalizing your document helps create a cohesive image for your business and ensures that your communications stand out in a professional manner.

By using Excel, you not only streamline the invoicing process bu

Integrating Microsoft Templates with Accounting Software

Integrating pre-designed business documents with accounting software can significantly streamline financial management. By connecting your billing records with automated systems, you can reduce manual data entry, minimize errors, and ensure that all your financial data is organized in one place. This integration helps create a seamless workflow from generating records to tracking payments, all while maintaining accuracy and efficiency.

Many accounting software programs allow you to import or link custom-designed documents, making it easy to transfer information directly into your financial records. This eliminates the need to manually enter data from one system to another, saving time and reducing the risk of mistakes. For example, you can quickly import a billing statement into your accounting system, and the software will automatically update client balances, taxes, and totals.

By connecting these systems, businesses can maintain a more accurate, up-to-date overview of their finances, all without having to switch between multiple tools or re-enter the same information. This integration enhances overall productivity and ensures that financial records are kept in sync across various platforms, reducing discrepancies and simplifying the reconciliation process.

Streamlining processes through automation ensures that financial tasks are completed faster, with less effort, and more reliability, ultimately allowing businesses to focus on growth and operations rather than administrative tasks.

Creating Recurring Invoices in Microsoft

Managing ongoing billing for clients with regular payments can be time-consuming. Setting up automatic billing cycles allows businesses to streamline their operations and ensure consistency in revenue collection. By using digital tools, you can create repeating billing documents that will save time and reduce the need for manual updates every cycle. This approach also helps maintain a professional relationship with clients by ensuring they are billed promptly and accurately on a set schedule.

Steps to Create Recurring Billing Documents

To automate the creation of recurring records, follow these steps:

- Open a new document and set up the layout for your standard billing entry, including necessary details such as client name, products or services, pricing, and payment terms.

- Ensure the payment schedule (monthly, quarterly, etc.) is clearly defined on the document, including due dates and any applicable discounts or terms for early payments.

- Save this document as a master copy, which will be used to create future records for the same client.

- Use the copy and paste function to replicate the original layout each time a new cycle is due, updating any details that need to change, such as the current date or new charges.

- Once you have generated the new document, send it to the client or save it for your records, depending on your preferred process.

Automating with Advanced Features

Some software tools allow for even more automation, such as setting up scheduled reminders or linking to payment gateways. These advanced features make it easy to:

- Automatically generate and send billing documents at predetermined intervals without needing to manually create each one.

- Send reminders to clients about upcoming due dates to help ensure timely payments.

- Sync with payment systems to track when payments are made and update client balances accordingly.

Automation not only saves time but also helps reduce the risk of errors or missed deadlines, ensuring that your business can handle recurring payments with minimal effort. This method also enhances the client’s experience, as they will receive consistent and timely billing information without delay.

Common Mistakes to Avoid When Invoicing

Billing documents are crucial for ensuring proper payment and maintaining a professional relationship with clients. However, errors in these documents can lead to confusion, delayed payments, and a lack of trust. To avoid these issues, it is important to be aware of common mistakes and take steps to prevent them. By doing so, you can ensure that your financial transactions run smoothly and that your clients receive clear and accurate information.

1. Missing Key Information

One of the most common mistakes is leaving out important details that help the client understand the charges. This can lead to delays or disputes. Always make sure to include the following:

- Your business name, logo, and contact information.

- Client’s name, address, and contact details.

- Clear descriptions of the services or products provided.

- Payment terms, including due date and accepted methods of payment.

- The total amount due, including taxes and additional fees.

2. Incorrect or Missing Dates

Another mistake is forgetting to include or incorrectly listing the issue date or due date. This can cause confusion about when payment is expected. Be sure to:

- Clearly state the date the document was created.

- Ensure the payment due date is accurate and easy to find.

- Update the date each time you create a new document to reflect the current billing cycle.

3. Calculation Errors

Manual errors in calculations, such as adding incorrect totals or miscalculating taxes, are common but avoidable. To prevent this, always:

- Double-check the math before finalizing the document.

- Use automated calculations where possible to reduce human error.

- Ensure that the tax rate and any discounts are applied correctly.

4. Not Keeping Track of Past Payments

It’s essential to track payments against your documents to avoid confusion about outstanding balances. Failing to do so can lead to sending duplicate requests or misunderstanding what the client owes. Make sure to:

- Record all payments promptly.

- Update the status of each document (paid, partially paid, overdue) after receiving payment.

- Regularly review and follow up on outstanding amounts to ensure timely settlements.

Avoiding these common mistakes ensures your billing process remains accurate and professional. By taking care to include all relevant details, double-checking calculations, and keeping track of payments, you can maintain smooth financial operations and foster good relationships

Why Free Invoice Templates Save Time

Efficiently managing billing documents is essential for small businesses and freelancers. Pre-designed formats allow users to generate professional-looking records without the need to start from scratch. This simple solution not only saves time but also reduces the risk of errors, helping business owners streamline their administrative tasks and focus on more important aspects of their work.

How Pre-Designed Documents Save Time

Using ready-made documents simplifies the process in several ways. Here’s how it works:

| Benefit | How it Saves Time |

|---|---|

| No Design Work Needed | Pre-formatted files come with a professional layout, so you don’t need to spend time designing each record from scratch. |

| Easy Data Entry | Simply fill in the required fields (e.g., client details, products/services, amounts) without worrying about layout adjustments. |

| Consistency | By using the same design for all documents, you ensure consistency, making it faster to generate new records for every transaction. |

| Quick Customization | Ready-made files are flexible, allowing you to quickly adjust information, like payment terms or itemized lists, as needed. |

Additional Time-Saving Features

Many digital solutions come with added features that further reduce the time spent on administrative tasks:

- Automatic calculation of totals, taxes, and discounts.

- Built-in fields for recurring services, making it easy to set up repeat billing.

- Pre-set templates for different business needs (e.g., sales, services, rentals) that can be customized without creating new documents from scratch.

Using pre-designed documents allows you to manage your billing process quickly and efficiently, freeing up time for tasks that directly impact business growth and client relationships.