Free Microsoft Excel Invoice Template for Simple and Professional Billing

Efficient billing is essential for any business, whether you’re a freelancer, small business owner, or large corporation. Having a structured and professional system in place can help ensure timely payments and avoid errors. One of the most effective ways to create and manage billing documents is by using a flexible digital tool that allows you to customize and automate key aspects of your financial records.

Using pre-designed spreadsheets for payment requests provides a user-friendly solution to streamline the process. These customizable files offer a wide range of features that cater to different business needs, from simple services to complex transactions. They not only save time but also help maintain consistency and accuracy across your billing cycles. With a few adjustments, you can create documents that meet your specific requirements while presenting a polished and professional image to your clients.

By leveraging the power of automated calculations and dynamic fields, you can simplify the creation of payment documents. This method eliminates the need for manual calculations and repetitive data entry, allowing you to focus on other important tasks. Whether you need to track payments, apply taxes, or include discount codes, these solutions provide all the necessary tools to keep your business organized and efficient.

Microsoft Excel Invoice Template Overview

Using a pre-designed document for billing is a highly efficient way to manage and organize payment requests. These ready-made sheets allow businesses to quickly generate accurate records, ensuring that all essential details are included and formatted correctly. They serve as an easy solution for freelancers, small business owners, and larger companies alike, offering a professional touch with minimal effort.

Such customizable files provide a variety of features to meet different needs, from basic services to more complex billing scenarios. Here are some of the key benefits:

- Time-saving automation: Pre-filled calculations and automatic data entry help reduce manual effort.

- Consistency: These documents ensure that all necessary fields are included and formatted the same way each time.

- Customization: Easily adjust the layout and information to fit specific business requirements.

- Professional appearance: Designed to present a polished and credible image to clients.

- Record-keeping: Built-in tracking tools allow you to maintain a clear overview of payments and outstanding balances.

These documents are especially valuable for those who want a reliable and flexible tool for managing financial transactions. Whether you’re handling a few clients or a large volume of orders, such a system helps ensure that everything stays organized and payments are processed on time.

Why Use Excel for Invoices

Managing billing documents efficiently is a critical part of any business operation. Using a digital solution for creating and organizing payment requests offers numerous advantages over traditional paper methods. A widely used tool for this purpose is a spreadsheet application, which provides flexibility, automation, and ease of customization. By leveraging such software, businesses can streamline their billing processes, reduce errors, and enhance productivity.

Advantages of Using a Spreadsheet for Billing

There are several reasons why businesses turn to spreadsheet software for managing financial documents:

- Automation: Built-in features, such as automatic calculations, allow for faster and more accurate creation of payment requests.

- Customization: You can tailor the document layout to fit your specific needs, adding or removing fields as required.

- Cost-effective: Unlike specialized software, spreadsheet tools are often free or already included in office suites, making them a low-cost solution.

- Easy updates: Changing pricing, adding taxes, or adjusting terms is simple and quick, ensuring your billing process stays current.

- Accessibility: Files are easy to share and can be accessed on multiple devices, improving collaboration and communication with clients.

Why Professionals Prefer Spreadsheets

For many professionals, the combination of flexibility, ease of use, and advanced functionality makes spreadsheet applications an ideal tool for managing payment records. These tools are designed to meet both basic and advanced business needs, whether you’re managing a single transaction or dealing with multiple accounts. The ability to modify the structure and functionality ensures that businesses can adapt to various types of clients, industries, and payment models.

Benefits of Customizable Invoice Templates

Having the ability to adjust billing documents to suit your business needs provides numerous advantages. Customizable forms allow businesses to create professional, consistent records that align with specific industry requirements or client preferences. This flexibility ensures that every payment request is tailored, accurate, and reflects the business’s unique brand and services.

Key Advantages of Customizable Billing Documents

Here are some of the major benefits of using fully adjustable documents for managing financial transactions:

- Flexibility: You can modify fields, add specific information, or adjust the design to match your brand identity or client requirements.

- Accuracy: Customizable features allow you to automatically calculate totals, taxes, and discounts, reducing the chances of errors.

- Time-saving: Once you create a customized format, you can reuse it for multiple clients, saving time on repetitive tasks.

- Professional appearance: Custom designs help present a polished, uniform look that enhances your business’s credibility.

- Scalability: As your business grows, the ability to easily modify your documents to reflect new products, services, or terms is invaluable.

How Customization Improves Workflow

Customizable billing documents improve efficiency by reducing manual entry and offering dynamic tools for tracking payment history. This makes the overall process quicker and more streamlined, freeing up time for other important tasks. Below is a comparison of how standard and customizable solutions impact workflow:

| Feature | Standard Billing Document | Customizable Document |

|---|---|---|

| Flexibility | Limited fields and layout | Fully adjustable for different needs |

| Accuracy | Manual calculations required | Automatic calculations, reduced errors |

| Efficiency | Repetitive setup for each new document | Reusable format, faster processing |

| Branding | Uniform design | Customizable design with business logo |

Incorporating customizable features into your payment requests helps streamline processes and ensures that all necessary information is included without unnecessary complexity. The ability to personalize your documents boosts both efficiency and client satisfaction.

How to Download an Excel Invoice Template

Obtaining a ready-made document for creating billing records is quick and easy. By downloading a pre-designed sheet, you can immediately start using it for your business without the need to build one from scratch. Whether you choose a free option or opt for a more advanced version, the process of acquiring a customizable document is straightforward and accessible to everyone.

Follow these simple steps to download and begin using a billing document:

- Search for a trusted source: Look for reputable websites that offer free or paid digital documents for business use. Many online platforms provide a variety of options with different designs and features.

- Select the right format: Ensure the document is compatible with the software you intend to use. Most downloadable sheets come in commonly supported file formats, such as .xlsx or .ods.

- Check customization options: Review the features of the document before downloading. Look for one that allows you to easily edit fields, add your business information, and adjust the layout.

- Download the file: Once you’ve selected the appropriate document, click the download link and save the file to your computer or cloud storage for easy access.

- Open and start editing: Open the downloaded file in your preferred application and begin customizing it for your business needs. Add your company logo, contact information, and any necessary pricing details.

- Open your preferred spreadsheet tool: Start by opening a new document in your chosen software. If you’re working with a pre-designed file, simply open it to begin customizing.

- Enter your business details: At the top of the document, include your company’s name, address, phone number, and email. This information should be easy to spot so that your client can reach you if needed.

- Include client information: Below your details, add the recipient’s name, company, address, and contact information. Ensuring accuracy here will help avoid confusion later.

- Assign a unique reference number: Create an invoice number or reference code to easily track each payment request. This number should be unique for each document you issue.

- List the items or services: Clearly describe the products or services provided, along with the corresponding price for each. Include the quantity, unit price, and any applicable taxes or discounts.

- Calculate totals: Use automatic calculations for subtotal, taxes, discounts, and total amount due. This ensures accuracy and reduces the risk of errors in manual calculations.

- Add payment terms: Specify the due date for payment and any applicable late fees or discounts for early payment. This section sets expectations for your clients.

- Include payment instructions: Provide your client with clear instructions on how to make the payment. Include accepted payment methods such as bank transfer, credit card, or online payment services.

- Final review: Double-check all the information for accuracy and ensure that your document is formatted neatly. A well-organized, error-free billing record helps maintain professionalism.

- Save and send: Once your document is complete, save it in a suitable file format (such as .xlsx or .pdf) and send it to your client. Make sure to keep a copy for your records.

Step-by-Step Guide to Creating an Invoice

Creating a well-organized payment request is essential for maintaining professionalism and ensuring that transactions are completed smoothly. The process of designing a billing document doesn’t have to be complicated. By following a clear and straightforward set of steps, you can easily produce accurate and customizable documents that meet your business needs.

Here’s a simple guide to help you create a billing record from scratch or using a pre-designed file:

By following these simple steps, you can create a professional billing record that accurately reflects your products or services, ensuring smooth transactions and timely payments.

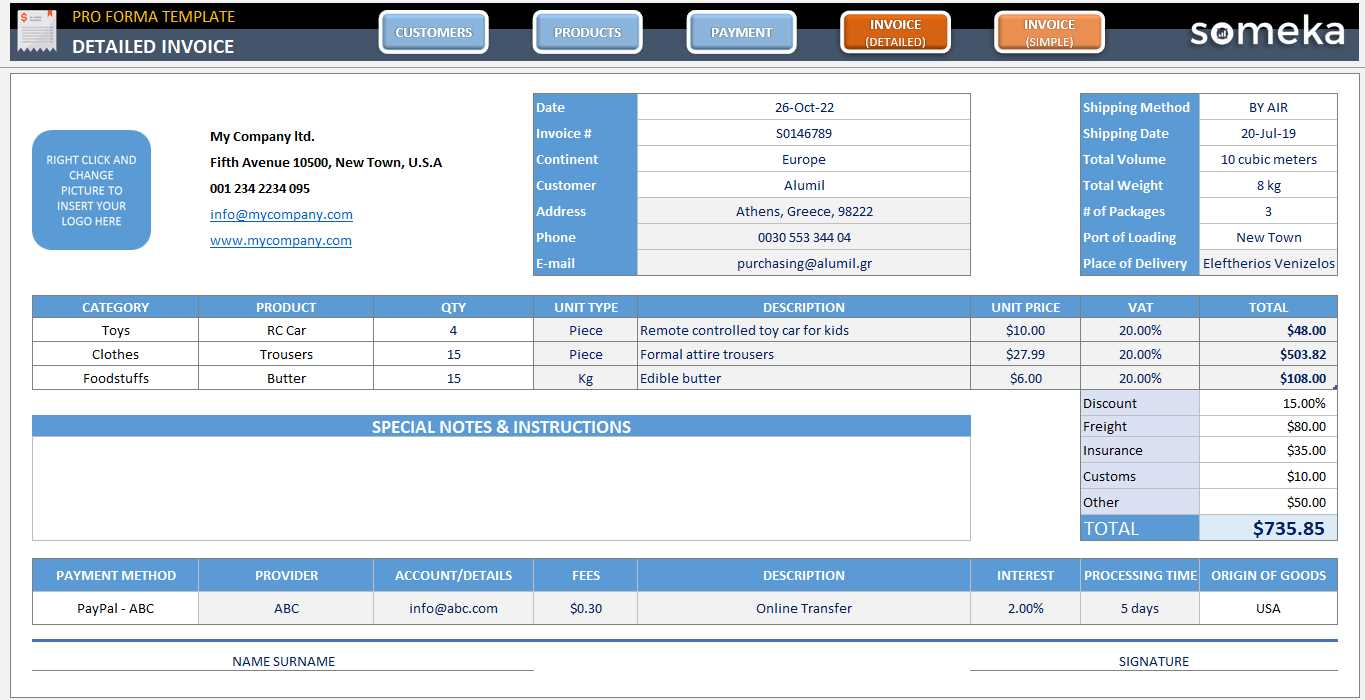

Key Features of Excel Invoice Templates

When using a pre-designed document for generating payment requests, it’s important to understand the key features that make these files both efficient and easy to use. These essential components help streamline the process, ensuring that all necessary information is included and calculations are accurate. With customizable fields and built-in functionality, these tools are designed to simplify billing tasks for businesses of any size.

Here are some of the most valuable features you’ll find in customizable billing documents:

- Automated Calculations: Many of these files come with formulas that automatically calculate totals, taxes, and discounts, reducing the risk of errors and saving time.

- Customizable Layouts: The layout of the document can be adjusted to suit your needs. You can change the font, colors, and positioning of fields to align with your company’s branding or preferences.

- Itemized Billing: Easily list multiple items or services, along with their quantities, unit prices, and totals. This helps keep the payment request clear and transparent for your clients.

- Built-in Payment Tracking: Some documents include spaces to track the payment status, allowing you to monitor whether a payment has been made or if the client still owes an outstanding balance.

- Professional Design: Pre-designed templates come with an organized, polished structure that makes the document look professional and credible, enhancing your business’s image.

- Invoice Numbering: Unique reference numbers can be automatically assigned to each document, helping you maintain an organized and systematic record of all transactions.

- Due Date & Terms: Payment due dates and terms can be easily included, setting clear expectations f

Top Templates for Different Business Needs

Different types of businesses have unique billing requirements, which is why it’s important to choose a document that suits your specific needs. Whether you’re a freelancer, a retailer, or a service provider, having the right structure can streamline your operations and improve client interactions. By selecting the most appropriate format, you can ensure that all necessary details are included and tailored to your industry.

Best Options for Various Business Types

Here’s a breakdown of some of the top pre-designed documents that cater to different business needs:

Business Type Recommended Document Features Freelancers Simple layout, hourly rates, project descriptions, payment terms, and quick customization options. Retailers Itemized lists with quantities and unit prices, tax calculations, discount options, and payment tracking. Service Providers Detailed descriptions of services rendered, hourly rates or flat fees, payment terms, and client contact info. Consultants Clear breakdown of consulting hours, project milestones, due dates, and payment methods. Small Businesses Comprehensive layouts with client information, item/service descriptions, subtotal calculations, and professional design. Customizable Features for Specific Industries

Each business type benefits from different features that can be customized to suit its needs. For instance, a retailer may requi

How to Personalize Your Invoice Template

Customizing your billing document ensures that it reflects your business’s identity while meeting the unique needs of your clients. By personalizing the structure and content, you can create a more professional and consistent look that enhances your brand and makes the document more recognizable. Personalization also allows you to tailor the payment request to your specific services, products, and payment terms.

Steps to Personalize Your Billing Document

Follow these steps to make your document uniquely yours:

- Add Your Logo: Include your company’s logo at the top of the document. This gives it a branded, professional appearance and reinforces your business identity.

- Set Your Business Information: Ensure your business name, address, phone number, and email are clearly displayed. This makes it easy for clients to contact you if needed.

- Customize the Layout: Adjust the design of the document to align with your preferences. This can include changing the font, colors, or header styles to match your brand’s aesthetic.

- Modify Payment Terms: Clearly define your payment terms, including the due date, late fees, and available payment methods. This helps avoid any confusion with clients regarding when and how to pay.

- Include a Personalized Message: Add a thank-you note or a custom message to enhance client relations. A simple “Thank you for your business” or “Looking forward to working with you again” can leave a positive impression.

- Specify Products or Services: Tailor the description of the items or services you’re charging for. Include detailed information, such as quantities, rates, and any special terms related to the spec

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for ensuring timely payments and maintaining a strong relationship with clients. However, there are several common mistakes that businesses often make when preparing these documents, which can lead to confusion, delays, or even disputes. Being aware of these pitfalls and taking steps to avoid them can help ensure that your payment requests are clear, effective, and error-free.

Here are some of the most common mistakes to watch out for:

- Missing Contact Information: Failing to include your business name, address, phone number, and email can make it difficult for clients to reach you with questions or issues related to the payment.

- Incorrect Client Details: Double-check that the client’s name, address, and contact information are accurate. Errors here can lead to confusion and delay payments.

- Omitting or Incorrect Payment Terms: Always specify the due date, payment methods, and any late fees or early payment discounts. Vague or missing terms can lead to misunderstandings.

- Not Using Unique Invoice Numbers: Each payment request should have a unique reference number for easy tracking. Without this, you may have trouble managing and referencing transactions.

- Unclear Descriptions of Goods or Services: Avoid vague or generic terms. Be specific about what was delivered, including quantities, rates, and any special conditions related to the order.

- Forgetting to Include Taxes and Discounts: If applicable, make sure to properly list any taxes, discounts, or additional charges. Failing to include these can lead to confusion over the total amount due.

Best Practices for Organizing Invoices

Proper organization of billing records is crucial for maintaining smooth business operations and ensuring that payments are received promptly. A well-structured system allows you to easily track outstanding payments, quickly access past transactions, and reduce the risk of errors. Implementing a clear and consistent approach for managing your payment requests can save time, improve cash flow, and enhance client relationships.

Here are some best practices for organizing your billing records:

- Use Unique Reference Numbers: Assign a unique number to each document to make it easy to track and reference. This helps prevent confusion and ensures that all transactions are properly recorded.

- Maintain a Consistent Naming Convention: Use a consistent format for naming your documents, such as “Invoice_[Number]_[ClientName]”. This makes it easier to search and retrieve files when needed.

- Organize by Date: Sort your documents by the date they were issued, either by month or year. This helps ensure that payment cycles are easy to monitor and deadlines are met.

- Store Digital Copies Securely: Keep a digital copy of all your records in a cloud storage system or a secure local file folder. Make sure your files are backed up to prevent data loss.

- Keep a Physical Backup (If Necessary): If your business still relies on paper billing, make sure to keep a physical copy of each payment request in a well-organized filing system, labeled by date or client name.

- Trac

How Excel Helps with Invoice Tracking

Tracking payment requests efficiently is crucial for businesses to maintain steady cash flow and ensure that outstanding payments are followed up on promptly. The right tools can make tracking simpler and more accurate, reducing the chance of errors and missed deadlines. Spreadsheet software, with its built-in functions and flexibility, offers a powerful solution for organizing and managing payment records.

Here’s how spreadsheet software can be an invaluable tool for tracking your payment requests:

- Automated Calculations: By using formulas, you can automatically calculate totals, taxes, and discounts. This reduces the chances of human error and ensures accuracy every time you issue a payment request.

- Organized Tracking: You can create columns for key information, such as payment due dates, client names, amounts owed, and payment status. This makes it easy to keep track of every transaction in one organized place.

- Real-Time Updates: Any changes made in the file–whether it’s an updated payment status or a revised amount due–can be seen immediately. This ensures that you always have the latest data at hand.

- Customized Filters: Use filters to quickly sort your records by client, date, or payment status. This lets you focus on specific transactions, such as overdue payments, or view your records in the order you need.

- Payment History: With each payment request, you can create a detailed history that tracks when payments were made and whether they were on time or delayed. This helps you identify patterns in payment behavior and manage follow-ups accordingly.

- Automatic Reminders: Set up conditional formatting

Integrating Payment Methods into Excel Invoices

Offering clear and convenient payment options can significantly improve the payment process for your clients. Integrating various payment methods directly into your billing documents ensures that clients know exactly how to settle their accounts. Whether you accept credit cards, bank transfers, or online payments, making payment instructions easily accessible can streamline the process and reduce delays.

Here are several ways to integrate payment methods into your billing documents:

- Provide Bank Account Details: Include your bank name, account number, and routing number for clients who prefer to make payments via direct bank transfer. This information should be placed clearly near the payment due section.

- Include Online Payment Links: If you use online payment platforms such as PayPal or Stripe, include clickable links or QR codes that clients can use to make instant payments. This simplifies the process and can speed up payment receipt.

- Specify Credit Card Details: If you accept credit card payments, list the card types you accept (Visa, MasterCard, etc.) and provide instructions for how clients can pay. Some systems allow for card payment integration directly into the document.

- Offer Mobile Payment Options: In today’s digital world, many businesses also allow mobile payment methods. Include QR codes or phone numbers for apps like Venmo or Apple Pay, allowing clients to complete transactions via their mobile devices.

- Clarify Payment Terms: Make sure to specify payment terms for each payment method. For example, mention any additional fees associated with certain payment options, or offer a discount for early payment via a specific method.

- Provide Clear Instructions: F

How to Handle Taxes in Your Template

Correctly applying taxes to your billing documents is essential for compliance with local laws and for maintaining transparency with your clients. Tax rates can vary depending on location, product or service type, and other factors. By properly incorporating tax calculations into your payment requests, you ensure that both you and your clients are on the same page regarding the total amount due.

Here are some steps for handling taxes effectively in your billing records:

- Identify Applicable Tax Rates: Research the tax rates that apply to your products or services, whether they are based on sales tax, VAT, or other local taxes. These rates may vary depending on where you or your client is located.

- Include Tax Categories: If your business deals with multiple tax rates (e.g., standard rate, reduced rate, exempt), create separate fields for each category. This allows you to accurately apply and display different rates for different items or services.

- Calculate Tax Separately: To avoid confusion, break down the tax amount separately from the subtotal. Displaying tax clearly helps clients understand how much they are being charged for tax purposes and gives them a transparent view of their total payment.

- Set Automatic Tax Calculations: Many spreadsheet programs allow you to create formulas that automatically calculate taxes based on the amount and applicable rate. Setting this up will save time and reduce the chances of manual calculation errors.

- Use Clear Descriptions: Make sure to include a line in your billing documents that clearly labels the tax amount. A simple description like “Sales Tax” or “VAT” followed by the applicable rate (e.g., 10%) helps keep things clear.

- Apply Tax for Each

Why Automate Your Invoicing with Excel

Automating your billing process can save you time, reduce errors, and improve overall efficiency. Manual creation of payment requests can be time-consuming, prone to mistakes, and often leads to delays in sending out or tracking payments. By using automated tools, you can streamline the process, ensure consistency, and maintain accurate financial records without the burden of repetitive tasks.

Here are several reasons why automating your payment request process is a smart decision:

- Save Time: Automation speeds up the creation of payment records, allowing you to focus on more important tasks. Once set up, you can generate multiple documents with minimal effort, saving hours of manual work.

- Increase Accuracy: Automated formulas and preset fields minimize the risk of human error, ensuring that calculations (such as totals, taxes, and discounts) are accurate every time.

- Reduce Repetition: Automating routine tasks like generating repetitive payment requests or applying the same formulas across multiple documents means less duplication of effort and more consistent results.

- Improve Cash Flow Management: By automating reminders and tracking, you can stay on top of outstanding payments and follow up promptly with clients. This reduces the chances of missed or delayed payments, improving your business’s cash flow.

- Standardize Your Documents: Automation ensures that all your payment records have a uniform layout and consistent formatting. This contributes to professionalism and makes it easier for clients to understand and process payments.

- Manage Large Volumes Efficiently: For businesses that deal with a high volume of transactions, automating the process ensures that you can handle large numbers of records without compromising on accuracy or organization.

- Track Payment Statuses: Automation allows you to se

Excel Invoice Templates for Freelancers

For freelancers, keeping track of payments and ensuring that each client is billed correctly is essential for smooth business operations. Having an organized and professional method for managing payment requests not only helps maintain a positive relationship with clients but also ensures that freelancers are paid on time. Using customizable billing documents can simplify this process, providing flexibility and efficiency tailored to individual business needs.

Here’s why freelancers can benefit from using spreadsheet tools for their billing needs:

- Professional Appearance: A well-structured billing document gives a professional look, which is important for maintaining credibility with clients. Clear itemized listings and detailed payment terms ensure transparency.

- Flexibility: Freelancers often work on a variety of projects with different rates and terms. Customizable documents allow you to adjust the format and calculations to suit each unique job.

- Time-Saving Features: Using automated formulas to calculate totals, taxes, or discounts speeds up the process, especially when dealing with multiple clients or ongoing projects.

- Easy Record-Keeping: With built-in tracking options, freelancers can easily monitor payments, flag overdue accounts, and generate reports on earnings over time.

Below is an example of how a freelance billing document could be structured:

Client Name Project Description Hours Worked Hourly Rate Amount Due Payment Status Client A Website Design Improving Client Relations with Professional Invoices

Creating well-structured and professional payment requests is more than just a way to get paid. It’s an opportunity to build trust and credibility with your clients. The way you present your financial documents can leave a lasting impression and can directly impact how clients perceive your business. A clear, accurate, and well-organized payment request demonstrates that you are professional, detail-oriented, and trustworthy–traits that clients value highly.

Here’s how presenting professional documents can improve your client relationships:

- Builds Trust: By providing a transparent and easy-to-read document, you show clients that you are upfront about costs, payment terms, and the services rendered. This reduces the likelihood of disputes and builds long-term trust.

- Shows Professionalism: A clean, well-designed document demonstrates that you take your business seriously. Clients are more likely to return to businesses that appear organized and reliable.

- Reduces Confusion: Clear itemization of services and costs ensures that your client fully understands the charges, which can prevent misunderstandings or disputes later on. Providing all relevant details in one place allows for quick reference and clarity.

- Enhances Communication: Including essential information, such as payment terms, due dates, and accepted payment methods, fosters better communication with your clients and ensures everyone is on the same page regarding expectations.

- Increases Likelihood of Timely Payments: Professional-looking documents often prompt quicker responses. When clients receive clear, easy-to-understand payment requests, they are more likely to process payments on time.

Key Elements of a Professional Billing Document

To further strengthen your client relationships, it’s important to include several key components in your financial documents:

- Company Branding: Incorporating your logo, brand colors, and contact details adds a personal touch and makes the document feel official.

- Clear Itemization: Break down the services or products provided, along with their costs. This level of detail shows your client exactly what they’re paying for.

- Payment Terms and Due Dates: Clearly stating when payment is due and any applicable penalties for late payments will set expectations and encourage timely responses.

- Multiple Payment Options: Offering various payment methods (e.g., credit card, online payment platforms, or bank transfer) gives clients flexibility and encourages swift action.

The Impact of Consistency

Consistency in your billing documents not only reinforces your brand but also provides a more predictable experience for your clients. When you consistently provide high-quality, professional financial records, clients will appreciate the efficiency and organization, fostering a positive relationship and encouraging repeat business.

By investing time in crafting professional payment requests, you elevate your client interactions, minimize misunderstandings, and ensure smoother transactions. This attention to detail can make all the difference in nurturing lasting, positive client relationships.