Free Microsoft Excel Invoice Template for Easy Billing

For anyone running a small business or working as a freelancer, managing financial transactions efficiently is crucial. One of the key elements in this process is generating accurate and professional-looking payment requests. With the right tools, it is possible to produce well-structured, customized statements that reflect your brand and meet your clients’ needs.

Many users prefer using widely available software programs to create these documents due to their accessibility and ease of use. These tools provide various customizable options, allowing individuals to create visually appealing and clear payment summaries without the need for complex design software. This approach is perfect for those looking to save time and resources while maintaining professionalism.

Streamlining the billing process and keeping track of financial interactions has never been easier. By utilizing a basic yet highly efficient tool, individuals can ensure that their records are accurate, organized, and readily available when needed. Whether you’re sending a single request or managing multiple clients, this approach makes the task straightforward and efficient.

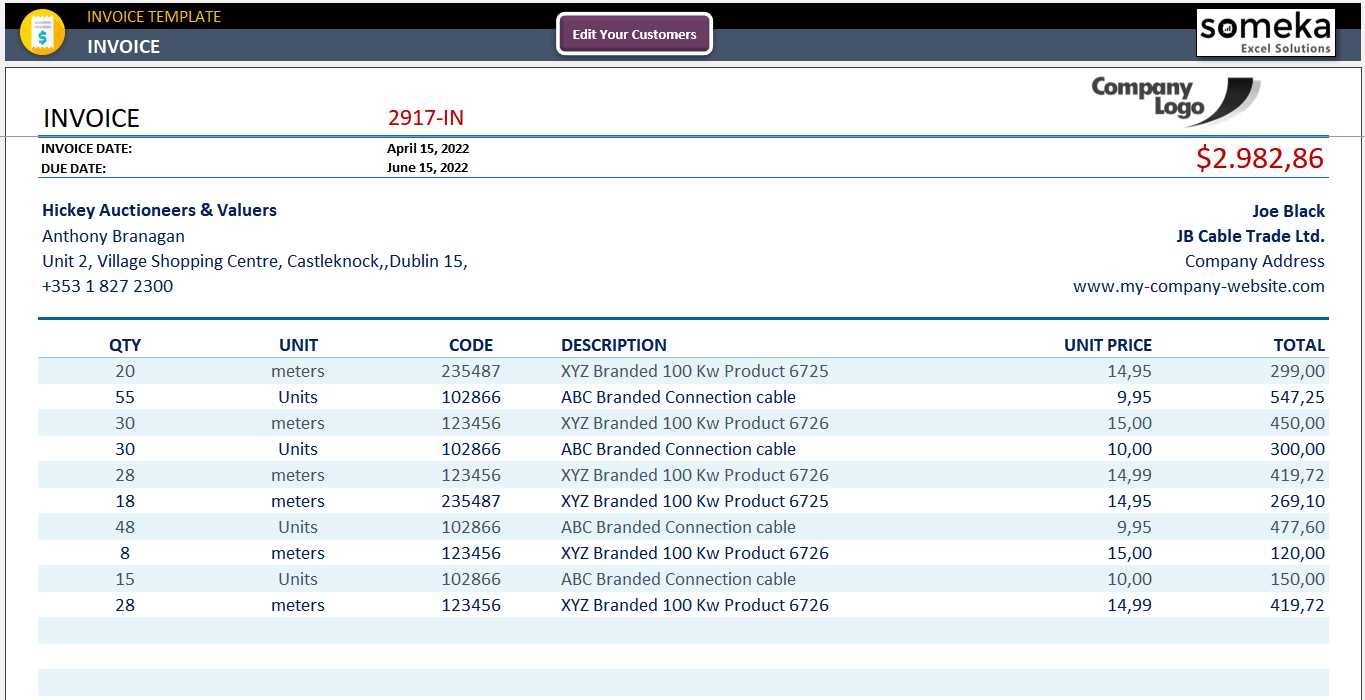

Microsoft Excel Invoice Template Overview

Creating professional billing documents can be a time-consuming task, especially when accuracy and clarity are essential. However, with the right tools, this process becomes far easier and quicker. By using simple yet powerful software, users can generate well-structured payment requests that help maintain a professional image while ensuring all necessary details are included.

These tools allow for significant flexibility in designing and customizing the document to meet individual needs. Whether you are a freelancer or a small business owner, having an easy-to-use method for generating clear, concise payment records is vital. The simplicity of these tools makes them an ideal choice for those who want efficiency without sacrificing quality.

Key Features of Billing Documents in This Format

One of the primary advantages of using such tools is their ability to automatically calculate totals, taxes, and discounts, which reduces the chance of errors. Additionally, these programs often come with predefined fields, such as company names, contact details, and payment terms, making it easier to customize documents for each client.

Customization and Flexibility

While these software options come with built-in layouts, users have the ability to make changes according to their preferences. From adjusting fonts and colors to adding custom branding elements, the flexibility is high. This ensures that each document aligns with the user’s unique style and professional requirements, further enhancing the overall client experience.

How to Use Free Invoice Templates in Excel

Using a structured document for generating payment requests is an efficient way to ensure accuracy and maintain professionalism. With the right software, you can easily create these records by leveraging pre-designed layouts that save time and reduce manual input. Here’s a simple guide on how to take full advantage of such resources to streamline your billing process.

Step-by-Step Process to Get Started

To begin using these tools, follow these easy steps:

- Open the software and search for pre-built document layouts designed for billing purposes.

- Choose the most appropriate design based on your business needs, whether it’s a basic layout or a more detailed one with sections for discounts and taxes.

- Fill in the required details, such as your business name, client information, and payment terms.

- Modify the content to include specific products or services, quantities, and prices relevant to the current transaction.

- Review the document for accuracy and save it in your preferred format before sending it to your client.

Customizing Your Document for Branding

One of the main benefits of using such resources is the ability to personalize the document according to your branding. This can include adding:

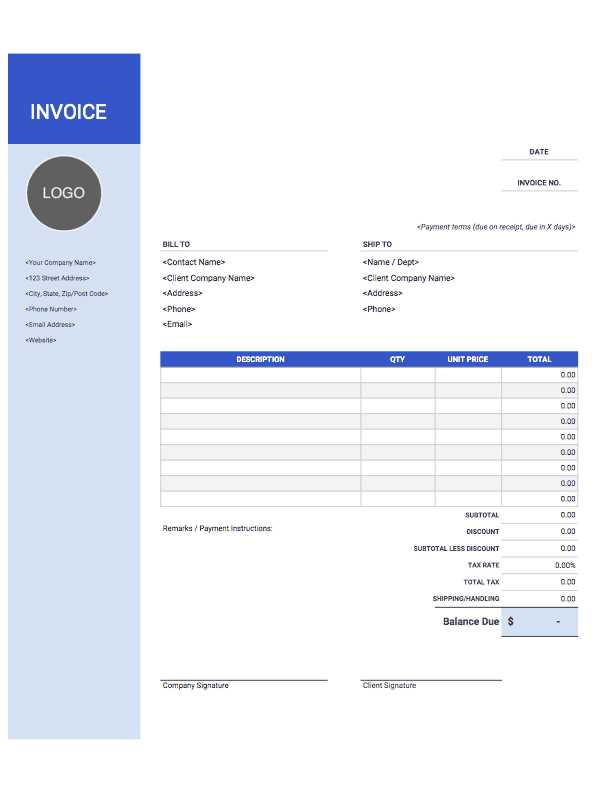

- Your company logo and colors for a consistent visual identity.

- Custom fields for payment terms or notes that reflect your business policies.

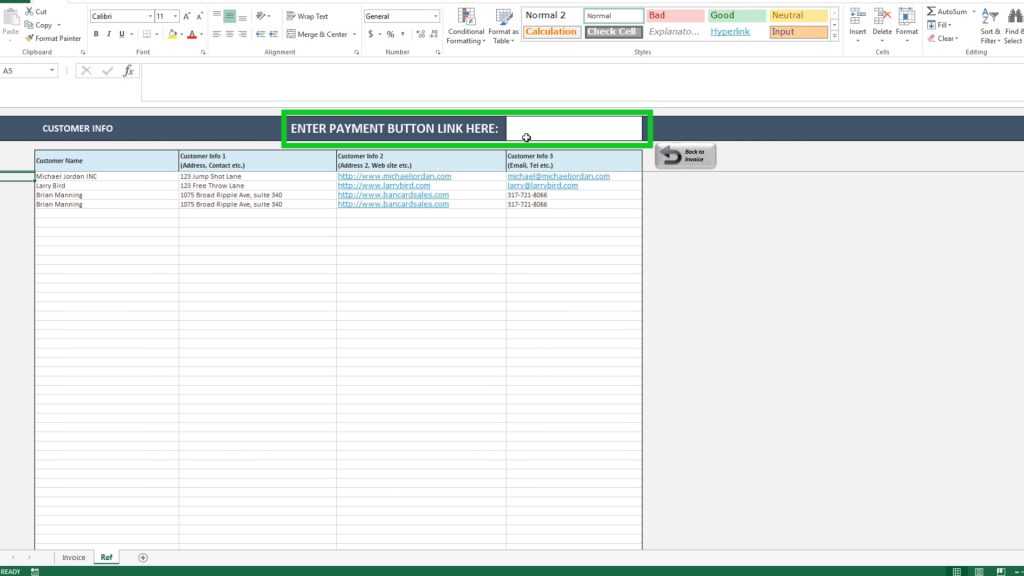

- Predefined payment options, such as bank details or online payment links, to make transactions easier for your clients.

By following these simple steps, you can quickly create polished and professional payment requests that align with your business needs.

Advantages of Using Excel for Invoices

Creating accurate and well-structured payment records is crucial for maintaining a professional business image. The right software not only makes this process faster but also ensures that all necessary information is included without errors. Using an efficient tool for billing can provide several key benefits that save both time and effort while helping businesses maintain organized financial records.

Flexibility is one of the primary advantages of using such programs. With various customizable fields, you can easily adjust the layout to suit your needs. Whether you are working with different clients or offering a range of services, it’s easy to modify the document to reflect these variations accurately. This adaptability ensures that the document remains relevant and tailored to each situation.

Cost-effectiveness is another significant benefit. Many businesses, especially small enterprises, look for affordable solutions to handle billing. Since these tools are often readily available at no additional cost for basic use, they offer a budget-friendly way to create professional documents without investing in expensive software.

Additionally, automation features within the software can significantly reduce the time spent on manual calculations. The ability to automatically sum totals, apply taxes, and even offer discounts ensures that your documents are error-free and consistent with each use. This minimizes the chances of mistakes, especially when dealing with multiple transactions or complex pricing structures.

Overall, using such tools for creating payment records allows businesses to focus more on their core activities, while keeping financial tasks straightforward and organized.

Customizing Your Free Invoice Template

Tailoring your billing documents to match your business style is a key step in maintaining a professional and consistent image. Customizing these files allows you to reflect your brand, make your documents stand out, and ensure that they meet specific requirements for each transaction. With a few simple adjustments, you can create personalized records that align with your business identity.

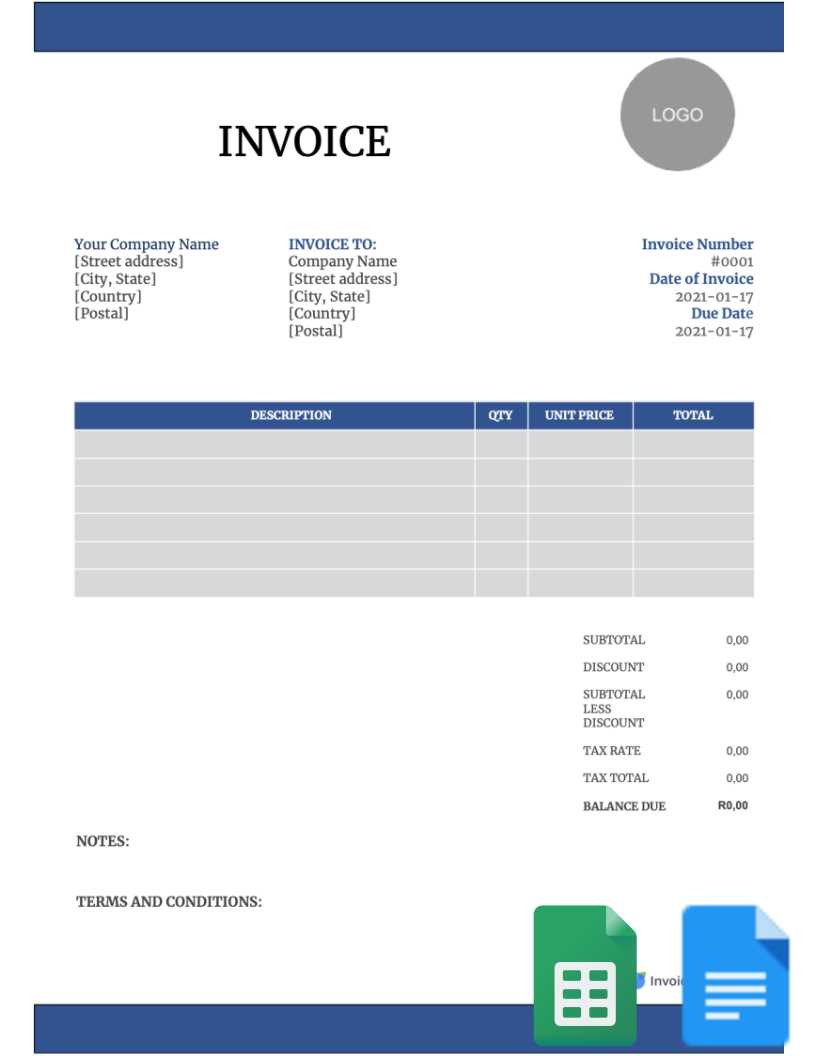

One of the easiest ways to customize is by adjusting the layout and content to include your company’s details, logo, and preferred colors. This not only makes the document look polished but also ensures that important information is immediately visible to your clients. Below is an example of a basic structure you can adjust:

| Field | Example |

|---|---|

| Company Name | Your Business Name |

| Client Name | Client’s Name |

| Date | 01/01/2024 |

| Payment Terms | Due within 30 days |

| Item Description | Consulting Service |

| Amount | $500 |

Another way to personalize your documents is by adding extra sections that are relevant to your specific business needs. For example, you might want to include a section for payment instructions, a note about late fees, or a field for a reference number. These additions can make the process more efficient and align the document with your business practices.

Ultimately, the ability to customize allows you to create a unique document that is both functional and aligned with your company’s branding, making your interactions with clients even more professional.

Best Practices for Creating Invoices in Excel

Creating clear, professional payment requests is essential for maintaining good relationships with clients and ensuring timely payments. Following a few best practices when generating billing documents can help streamline the process, reduce errors, and improve the overall quality of your records. These practices ensure that the documents are not only accurate but also polished and easy to understand.

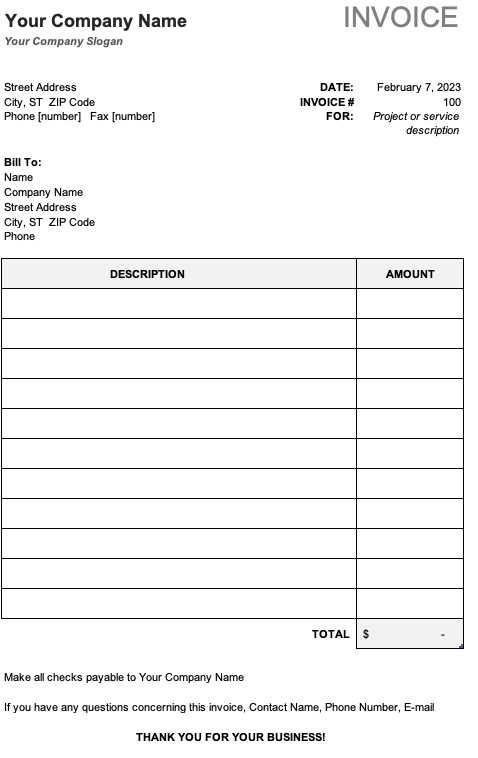

First and foremost, always ensure that the document includes all necessary information. This includes your business details, client information, a clear description of the products or services provided, and the agreed-upon payment terms. Having this information readily available and clearly formatted helps avoid confusion and ensures that both parties are on the same page.

Another key practice is consistency in design and layout. Stick to a clean, simple format that’s easy to read. Use clear headings, organized tables, and enough white space to make the document visually appealing. Avoid clutter and excessive design elements that might distract from the core content. Consistency in your documents builds trust and enhances professionalism.

It’s also important to check for errors before sending the document. Double-check numerical data such as totals, taxes, and discounts, as well as client details like contact information and billing address. Even a small mistake can cause confusion or delays in payment, so careful review is a crucial step in the process.

Lastly, always save your records in an appropriate format for sharing. While most tools offer various file-saving options, using a format that is universally accessible, such as PDF, ensures that the document can be opened and viewed without any issues, regardless of the client’s software. This simple step helps prevent problems and ensures smooth communication.

How to Add Taxes to Your Excel Invoice

Including taxes in your payment records is a critical step in ensuring accuracy and compliance with local regulations. Calculating and applying the correct tax rate can sometimes be complex, but with the right approach, it becomes a simple task. By adding a tax calculation feature, you can automate the process and avoid manual errors while maintaining transparency with your clients.

Step-by-Step Guide to Adding Taxes

To add taxes to your billing documents, follow these steps:

- Identify the tax rate applicable to your services or products. This can vary depending on the location and type of goods or services you provide.

- In your document, add a row or section for the tax amount, typically placed below the list of items or services.

- Use the basic formula to calculate the tax amount. For example, multiply the subtotal by the tax rate: Subtotal x Tax Rate = Tax Amount.

- Include the total amount, which will be the sum of the subtotal and the tax amount.

Example Tax Calculation

Here is an example of how the tax breakdown might look in your document:

| Item | Price |

|---|---|

| Consulting Service | $500 |

| Subtotal | $500 |

| Tax (10%) | $50 |

| Total | $550 |

By following these steps, you can easily calculate and display taxes on your payment records, making the process smoother and ensuring clarity for your clients.

Step-by-Step Guide to Invoice Creation

Creating a well-organized payment request is an essential task for any business, as it ensures that both the service provider and the client are on the same page. A clear and detailed record not only helps avoid misunderstandings but also guarantees smooth financial transactions. Below is a step-by-step guide to help you create an accurate and professional document for your billing needs.

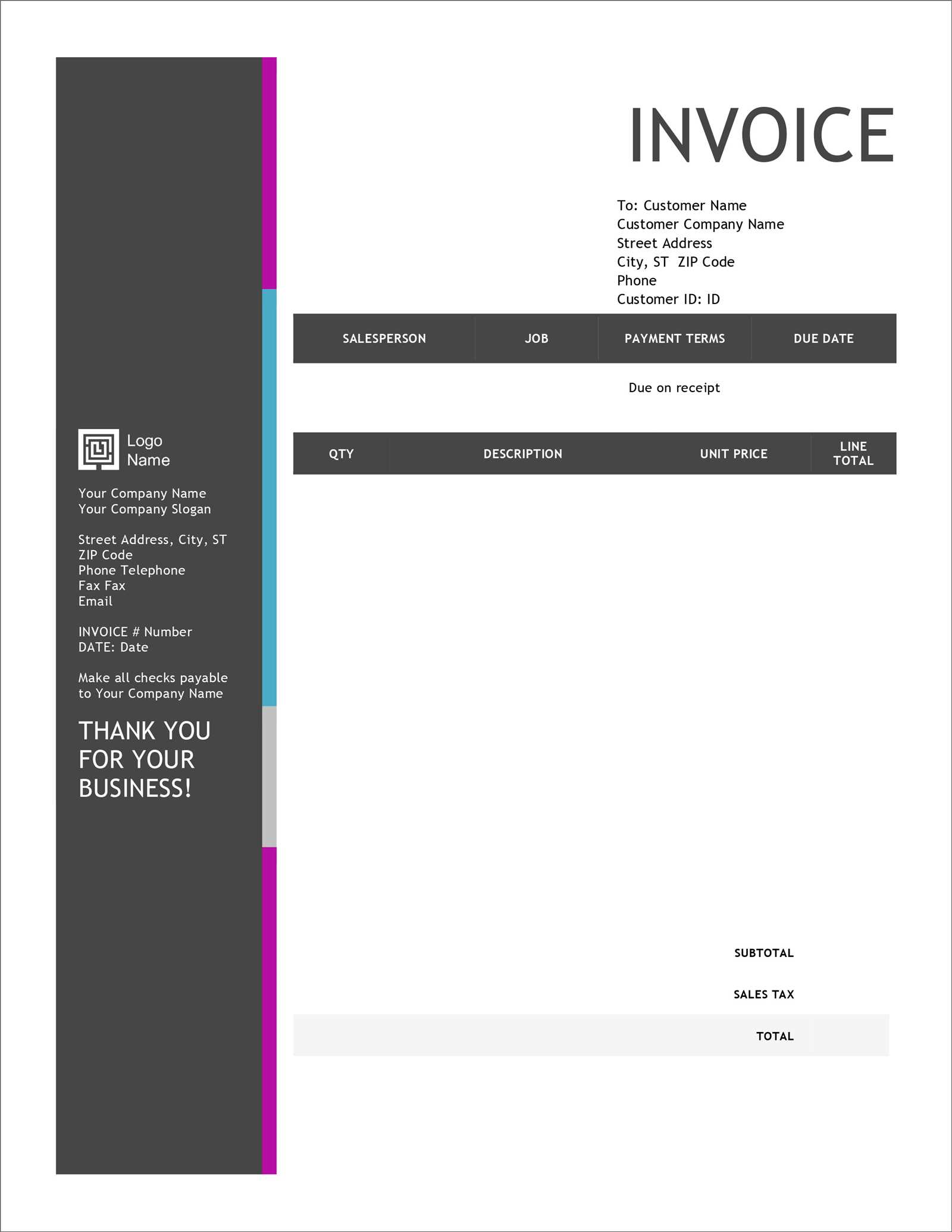

1. Set Up Your Document

The first step in creating a payment request is setting up the document layout. Start by adding your business information at the top, including the company name, address, contact number, and email. This allows your client to quickly identify who the document is from. Next, include the client’s details, such as their name, address, and contact information.

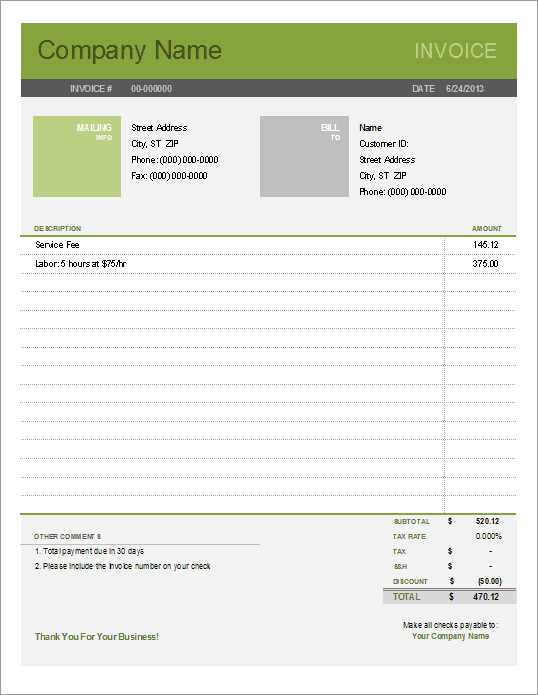

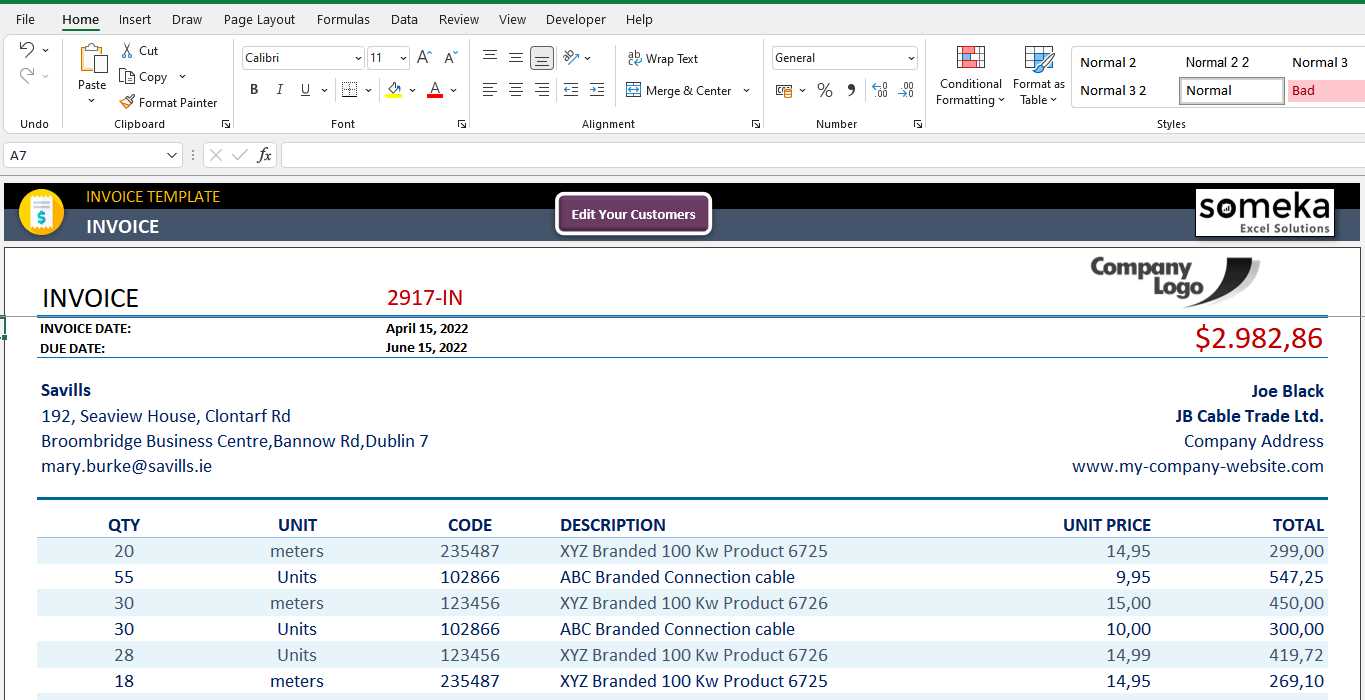

2. Add a Detailed List of Services or Products

After including the basic information, you should provide a detailed list of the services or products you provided. For each item, include the description, quantity, price per unit, and the total amount. This breakdown ensures that your client understands what they are being charged for, helping avoid confusion. You can also add extra columns for additional details, such as discounts or taxes, if applicable.

| Item Description | Quantity | Price per Unit | Total |

|---|---|---|---|

| Web Design Service | 1 | $500 | $500 |

| SEO Consultation | 3 | $100 | $300 |

| Subtotal | $800 |

By providing clear, itemized information, you ensure that the document is easy to understand and helps prevent any confusion about the charges.

3. Apply Payment Terms and Additional Information

Once the list of items is complete, it’s important to specify the payment terms. Clearly state the due date for payment, any late fees, and accepted methods of p

Why Choose Excel Over Other Invoice Tools

When it comes to creating payment documents, many tools are available to help businesses streamline their billing process. However, using a widely accessible and versatile tool has distinct advantages over more specialized software. With its flexibility and ease of use, this program offers several benefits that make it an ideal choice for many small businesses and freelancers.

One of the biggest advantages is customizability. Unlike many dedicated billing programs, which often have rigid formats, this software allows users to fully adjust the layout to their needs. You can add or remove sections, customize fonts, and even change the design to match your company’s branding. This level of control over the document’s appearance and structure ensures that it meets specific requirements and is aligned with your business style.

Cost-effectiveness is another compelling reason. Many specialized billing platforms come with monthly subscription fees, which can add up over time. In contrast, the tool is often available as part of commonly used office software, meaning there are no additional costs involved. This makes it an ideal option for businesses looking to save money while still creating professional-looking documents.

Automation is also a significant benefit. Once you’ve set up a document, calculations such as totals, taxes, and discounts can be automatically generated with simple formulas. This reduces the risk of errors and saves time compared to manually performing calculations in other software or on paper.

Finally, the tool’s wide accessibility and compatibility with different devices ensure that users can create, edit, and share their documents easily. Whether you’re working from a desktop, laptop, or mobile device, the software is often available on multiple platforms, making it a convenient choice for businesses of all sizes.

For these reasons, many small businesses and independent professionals choose this versatile option over other specialized billing tools.

How to Save and Share Your Excel Invoices

After creating a professional payment document, the next important steps are saving and sharing it with your client. Properly saving your documents ensures they are stored securely and can be easily accessed when needed. Sharing the file in a way that is both efficient and compatible with the recipient’s software is equally important. Below are some simple methods for saving and distributing your records effectively.

Saving Your Documents

When saving your completed document, it’s essential to use a format that is both accessible and secure. Here are a few options:

- Save as Excel File: Saving the document in its original format (.xlsx) allows you to easily make future edits or updates. This is ideal for ongoing projects or recurring clients where you might need to adjust the details later.

- Save as PDF: Converting the document into PDF format ensures that the layout and design will remain intact regardless of the software the recipient uses. This is especially useful for final versions that you don’t expect to change.

- Save with Version Control: If you frequently update documents, consider saving with version numbers (e.g., “Invoice_v1”, “Invoice_v2”) to keep track of changes over time.

Sharing Your Documents

Once your document is saved, you can share it in several ways. Here are some of the most common options:

- Email: Attach the document directly to an email. If you saved it as a PDF, most email services will easily accept and send it. Be sure to include a brief message outlining the purpose of the document.

- Cloud Storage: If the file is too large or if you want to give clients access to multiple documents, upload the file to cloud storage (e.g., Google Drive, Dropbox). Then, share a link with your client, ensuring they have the necessary permissions to view or download the file.

- File Transfer Services: For larger files, you might use a file transfer service like WeTransfer to send the document securely and without size restrictions.

By following these methods, you can easily save and share your payment records, ensuring that they reach your clients promptly and professionally.

Top Features of Free Excel Invoice Templates

Using pre-designed documents for billing can simplify the process, providing structure and saving valuable time. These pre-made layouts come with several built-in features that enhance functionality and help businesses create professional-looking payment requests effortlessly. Here are some of the top features that make these resources so valuable and popular.

1. Customizable Layouts

One of the most significant benefits of using these pre-built formats is the ability to fully customize the document to fit your business needs. You can easily adjust fields, fonts, and colors to align with your company’s branding. Whether you need to add additional sections or rearrange the content, the layout flexibility makes it simple to create a unique document for each transaction.

2. Automatic Calculations

Another key feature is the built-in formulas for automatic calculations. Whether you’re calculating subtotals, taxes, or discounts, these templates can automatically perform the math for you, ensuring that the numbers are accurate and consistent. This reduces the chance of manual errors and saves time when managing multiple billing records.

3. Itemized List of Charges

These formats usually include an itemized section where you can list each product or service provided, including quantity, unit price, and total cost. This clarity makes it easier for clients to understand the charges and avoid confusion. Additionally, having an itemized breakdown ensures that all details are accounted for in case of discrepancies.

4. Built-In Tax Calculations

Many pre-designed layouts also come with the option to add tax fields, which automatically calculate the tax amount based on the entered subtotal. This feature is particularly useful for businesses that operate in regions with varying tax rates, as it simplifies the calculation process and helps ensure compliance with local tax laws.

5. Multiple Payment Methods

Most layouts allow you to include a section for specifying payment options, such as bank transfers, online payments, or checks. This flexibility helps clients choose their preferred payment method, making it easier to complete transactions on time.

6. Professional Design

The visual appeal of these resources cannot be overstated. Designed with simplicity and professionalism in mind, these layouts help create clear, organized documents that leave a positive impression on your clients. The clean format ensures that your payment records are easy to read, further enhancing your business’s credibility.

7. Time-Saving and Easy to Use

The best part is that these documents are ready to go. Simply fill in the details, and you’re ready to send them out. This efficiency saves time compared to creating payment records from scratch and eliminates the need for extensive design knowledge or complicated software.

With these powerful features, it’s no wo

Common Mistakes to Avoid in Excel Invoices

While creating billing documents in a spreadsheet can be efficient, there are several common mistakes that businesses often make. These errors can lead to confusion, delays in payments, and a less professional appearance. Being mindful of these mistakes will help you ensure accuracy and maintain positive relationships with your clients.

1. Incorrect Calculations

One of the most frequent mistakes is failing to double-check the math. If the totals or taxes are incorrectly calculated, it could result in overcharging or undercharging the client, leading to potential conflicts. Even if you’re using built-in formulas, it’s crucial to ensure that the formulas are correctly applied to all relevant fields.

To avoid this mistake, use simple formulas for addition, multiplication, and percentages. For example, make sure that the subtotal is correctly calculated and that the tax field multiplies the correct percentage. Double-checking all calculations will help prevent errors that could negatively affect your business’s reputation.

2. Missing Client or Business Details

Another common oversight is neglecting to include all the necessary information in the document. This includes your company’s name, contact details, and the client’s information, such as their billing address and payment terms. Without these details, your client might have trouble identifying the document or knowing how to contact you for follow-up questions.

To avoid this, make sure your documents always contain the following key information:

- Your business name and contact details

- Client’s name and billing information

- Clear payment terms and due dates

Including all relevant information will not only make your records look more professional but also improve communication with your clients.

3. Lack of Clear Descriptions

Failure to clearly describe the products or services provided is another issue that can cause misunderstandings. Clients may be unclear about what they’re being charged for, which can lead to confusion or disputes. Always provide a detailed description for each item, including the quantity, rate, and any special terms or discounts that apply.

To avoid this mistake, ensure that each service or product listed includes:

- A brief, clear description

- Quantity or hours worked

- Price per unit

- Total cost for each line item

By clearly itemizing your charges, you minimize the risk of confusion and demonstrate professionalism.

4. Not Including Payment Methods

Omitting payment methods or instructions can delay the payment process. If the client isn’t sure how to pay, they may take longer to send the payment or contact you for clarification. Always include clear instructions on how clients can make payments, whether via bank transfer, credit card, or online payment systems.

To ensure smooth transactions, always include the following in the payment section:

- Accepted payment methods

- Bank details or payment links (if applicable)

- Late fee policy (if any)

5. Not Saving or Backing Up Files Properly

Another common issue is failing to save or back up your records properly. Losing billing documents can be costly, especially when clients ask for copies of previous payments or if you need to review past transactions. Always save your documents in secure locations and back them up regularly.

To avoid losing important files:

- Save your documents with clear file names (e.g., “Invoice_2024_001”)

- Use cloud storage or external backups to ensure safety

By avoiding these mistakes, you can improve the accuracy and professionalism of your payment documents, ensuring smooth financial transactions and better client relationships.

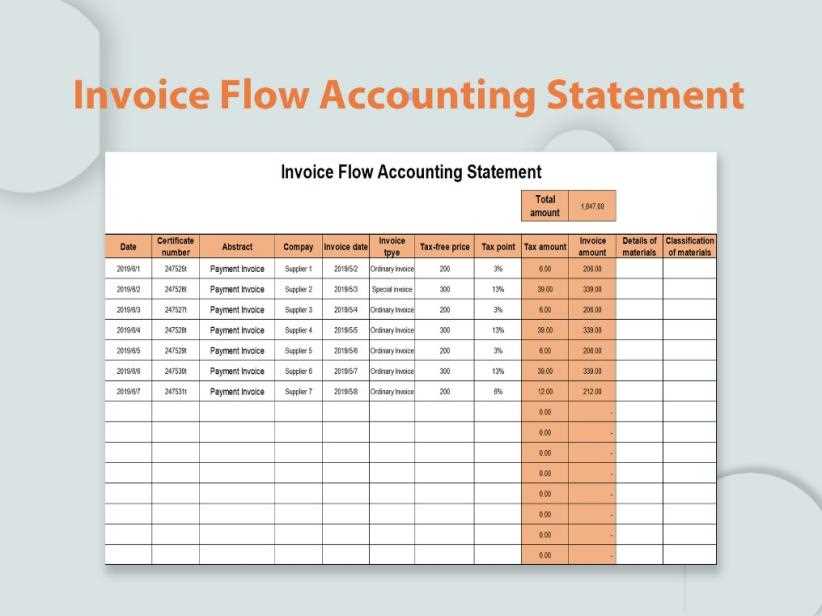

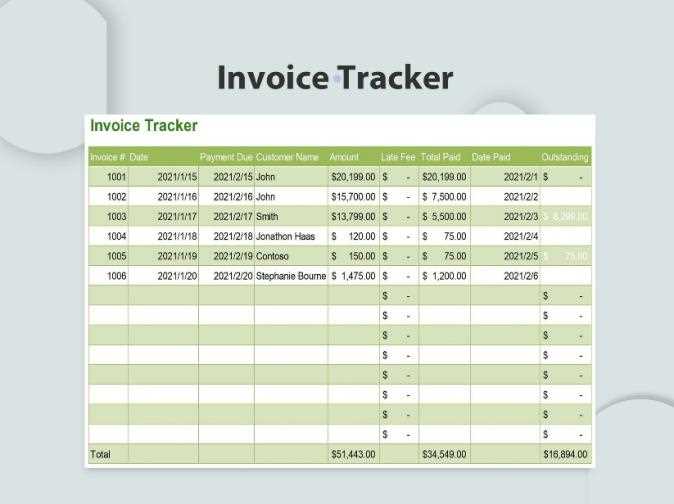

How to Track Payments Using Excel Templates

Tracking payments effectively is an essential part of managing your business’s finances. By keeping a detailed record of which transactions have been paid and which are still outstanding, you can maintain better control over your cash flow. Using pre-designed billing layouts, you can easily monitor the status of payments and ensure that nothing slips through the cracks.

1. Set Up a Payment Tracking Sheet

The first step is to create a dedicated sheet within your document for tracking payments. This section should include columns for the following information:

- Invoice Number: A unique identifier for each transaction.

- Client Name: The name of the customer or business you are billing.

- Amount Due: The total amount requested from the client.

- Payment Date: The date when payment is made or when it is expected.

- Status: An indicator of whether the payment is “Paid,” “Pending,” or “Overdue.”

- Payment Method: The method used for the transaction (e.g., bank transfer, credit card).

This simple setup allows you to monitor each payment and track its status with ease. You can even use color coding or conditional formatting to visually highlight overdue payments or completed transactions.

2. Use Formulas for Automatic Updates

By applying basic formulas, you can automate calculations and status updates. For example, you can use an IF function to automatically mark the payment status based on the payment date and amount. Here’s an example of a formula that could automatically set the payment status:

=IF(TODAY()>C2, "Overdue", IF(D2="Paid", "Paid", "Pending"))

In this formula, C2 represents the payment due date, and D2 represents the cell where the payment status is recorded. This way, as soon as a payment is made or the due date passes, the status will update automatically, saving you time and effort.

3. Create a Summary of Outstanding Payments

Another useful feature is to add a summary section at the top of your tracking sheet that aggregates the total amount of unpaid or overdue balances. You can use the SUMIF function to calculate the total amount that has yet to be paid:

=SUMIF(E:E, "Pending", C:C)

This formula sums all the amounts in column C where the status in column E is marked as “Pending.” By having this summary, you can quickly see how much is outstanding without having to scroll through the entire sheet.

4. Regularly Update Your Records

To ensure your payment tracking is accurate, update the sheet regularly. After each transaction, enter the payment date, method, and status so that the information stays current. This practice will provide you with an up-to-date view of your financial situation at all times.

By effectively using these features, you can turn a simple spreadsheet into a powerful tool for managing payments and ensuring your business’s finances are always in order.

Excel Templates for Freelancers and Small Businesses

For freelancers and small business owners, managing finances can be a challenging task. With a limited budget and resources, it’s important to use tools that streamline operations and reduce administrative overhead. Pre-designed documents can help you keep track of transactions, manage billing, and maintain a professional appearance without the need for costly software or complex systems.

Key Features for Freelancers and Small Business Owners

When looking for an efficient billing solution, certain features stand out for freelancers and small businesses. Here are some of the essential functionalities:

- Customizable Fields: The ability to modify details such as client names, services offered, and payment terms makes it easy to tailor each document to specific projects or clients.

- Automatic Calculations: Built-in formulas allow for easy and accurate calculations of totals, taxes, and discounts, eliminating the risk of human error.

- Tracking and Due Dates: Clear fields for payment due dates and status updates help you stay on top of pending payments and follow up with clients when necessary.

- Professional Layouts: Pre-designed documents ensure that your records have a polished, professional appearance, improving your business’s credibility and customer trust.

Why Freelancers and Small Businesses Benefit

Freelancers and small businesses have unique needs when it comes to managing their financial documents. Here’s why using pre-designed billing formats is particularly beneficial:

- Cost-Effective: These resources are available at little to no cost, making them an ideal solution for entrepreneurs working with tight budgets.

- Time-Saving: Ready-made formats eliminate the need to design billing documents from scratch, saving you valuable time and effort.

- Easy to Use: With a user-friendly layout, even those with limited experience in document creation can quickly generate professional-looking records.

- Efficient Record-Keeping: By organizing client payments and transaction history in a single document, it becomes easier to monitor cash flow and prepare for tax season.

By using these practical and customizable solutions, freelancers and small businesses can focus more on

Tips for Making Professional Invoices in Excel

Creating polished, professional billing documents is essential for maintaining a credible business image. Whether you’re a freelancer or a small business owner, the appearance and accuracy of your financial records can leave a lasting impression on clients. With the right tools and attention to detail, you can create well-organized, clear, and visually appealing records that reflect the professionalism of your services.

1. Use a Clean and Simple Design

Keeping your billing records clean and uncluttered is key to making them easy to read. Avoid overloading the document with unnecessary information or flashy colors that may distract from the essential details. Here are some design tips to follow:

- Minimalist layout: Stick to a simple structure that focuses on the most important information–such as client details, itemized services, and payment terms.

- Consistent fonts: Use professional fonts such as Arial or Calibri and maintain consistency throughout the document for readability.

- Clear headings: Use bold or larger text to highlight headings (e.g., “Amount Due,” “Payment Terms,” etc.) so clients can quickly find the information they need.

2. Include All Relevant Information

Ensure that your document contains all the essential details. Missing information can cause confusion and delay payments. Include the following key elements:

- Your business details: Always include your company name, address, and contact information.

- Client information: Include your client’s full name, address, and other relevant details like their business name, if applicable.

- Service descriptions: Be clear and specific about what was provided, including quantities, rates, and any special terms or discounts applied.

- Payment terms: Clearly state the due date, late fees (if applicable), and accepted payment methods.

3. Keep the Document Organized and Easy to Follow

Organization is crucial when it comes to billing documents. An organized document not only helps you stay on top of your transactions but also

How to Automate Your Invoice Process in Excel

Managing billing manually can be time-consuming and prone to errors. By automating certain aspects of your billing process, you can save time, reduce mistakes, and ensure consistency in your records. Whether you’re a freelancer or a small business owner, streamlining the creation and tracking of transactions is crucial for maintaining smooth operations. Here’s how you can use built-in features and formulas to automate your financial processes.

1. Use Formulas for Calculations

One of the most important aspects of automating the billing process is using formulas for calculations. This ensures that amounts, taxes, and totals are automatically calculated, reducing the need for manual input. Here are some formulas to get started:

| Description | Formula |

|---|---|

| Subtotal | =SUM(B2:B10) |

| Tax Calculation (e.g., 10%) | =C12*0.10 |

| Total Amount Due | =C12+D12 |

In this example, B2:B10 would contain individual item costs, C12 is the subtotal, and D12 is the tax amount. By applying these formulas, you can automate the entire calculation process, ensuring accuracy and saving time.

2. Automate Date Tracking

Keeping track of payment due dates and statuses is essential for maintaining smooth cash flow. You can automate this by using dynamic date functions. For instance:

- Todays Date: Use the formula =TODAY() to automatically update the current date.

- Payment Due Date: By setting a due date for each entry, you can use the formula =IF(TODAY()>D2, “Overdue”, “Pending”) to automatically track overdue payments.

This allows you to stay on top of deadlines and follow up on payme