Microsoft Access Invoice Database Template for Streamlined Billing

Managing financial transactions efficiently is a crucial part of running any business. A well-organized system to handle sales, payments, and client records can save time, reduce errors, and improve overall productivity. The right tools can automate many tasks, allowing for quicker processing and better accuracy in keeping track of expenses and revenues.

Custom solutions are often the best way to address specific business needs. With an easily customizable platform, businesses can create a system tailored to their unique workflow, ensuring that the solution grows alongside their operations. This flexibility helps streamline day-to-day tasks, such as generating receipts, tracking payments, and storing client information securely.

With the right framework, it’s possible to create a solution that offers both simplicity and power. Whether you’re an entrepreneur just starting out or a growing company with complex invoicing needs, there are tools that can enhance the way you manage financial records. Automation, reporting, and real-time tracking all become simpler, letting businesses focus more on growth and customer satisfaction.

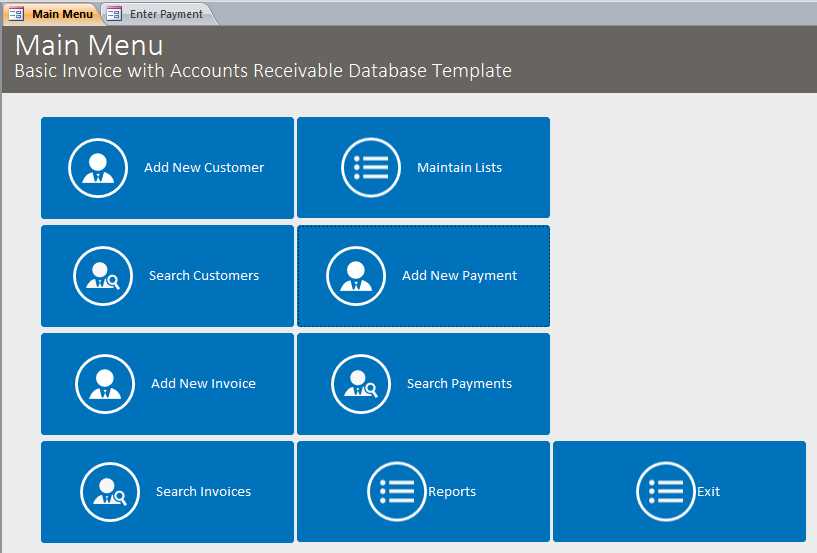

Microsoft Access Invoice Database Template Overview

For businesses seeking an efficient way to manage their financial transactions, a well-structured system can make a significant difference. Such a solution allows for easy creation, tracking, and management of billing records, helping companies save time and reduce manual errors. The ability to automate processes like generating receipts, tracking payments, and storing client details can transform routine tasks into seamless operations.

Key Features of a Financial Management System

The right system offers several key features that can simplify your workflow. Customizable fields allow businesses to tailor the setup to meet their specific needs, whether it’s adjusting for different tax rates, payment terms, or customer-specific details. The ability to generate automated reports provides valuable insights into the financial health of the business, helping managers make informed decisions.

Benefits of a Tailored Financial Solution

One of the main advantages of a customized solution is its flexibility. With the right structure in place, businesses can integrate various elements, from payment tracking to detailed sales reports, all in one place. This not only improves efficiency but also enhances accuracy in record-keeping. By streamlining administrative tasks, businesses can focus more on core operations and customer satisfaction.

Benefits of Using Access for Invoices

Utilizing an efficient system to handle billing processes can greatly enhance business operations. An organized platform allows for quick data entry, seamless tracking, and easy access to important financial records. This can save valuable time, minimize human errors, and streamline the entire process from creation to payment tracking.

Key Advantages of Automated Billing Systems

Automating billing procedures provides several important benefits, such as reducing the likelihood of errors, improving consistency in documentation, and ensuring faster processing. This type of solution can also improve overall organization by keeping all client records and transaction history in one centralized location. The main advantages include:

| Benefit | Description |

|---|---|

| Time-saving | Automating routine tasks such as creating and sending bills saves valuable time. |

| Reduced Errors | Automated calculations and tracking reduce human mistakes in entries and calculations. |

| Enhanced Reporting | Instant generation of financial reports for easy analysis and decision-making. |

| Customization | Ability to tailor forms, fields, and calculations based on specific business needs. |

| Centralized Data | All records are stored in one system, providing quick access to customer and financial details. |

Improved Workflow and Organization

By centralizing all billing information, this system offers a better overview of the entire financial process. From client data to payment history, everything is at your fingertips, enabling faster decision-making and easier communication with clients. Customizable reports and quick access to important metrics further optimize daily operations.

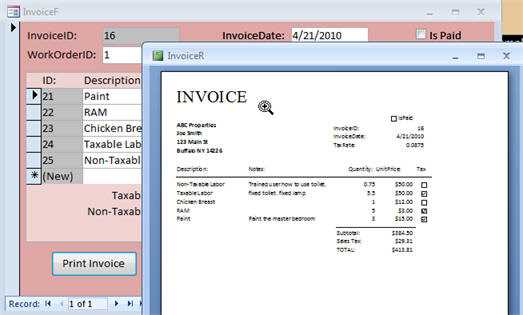

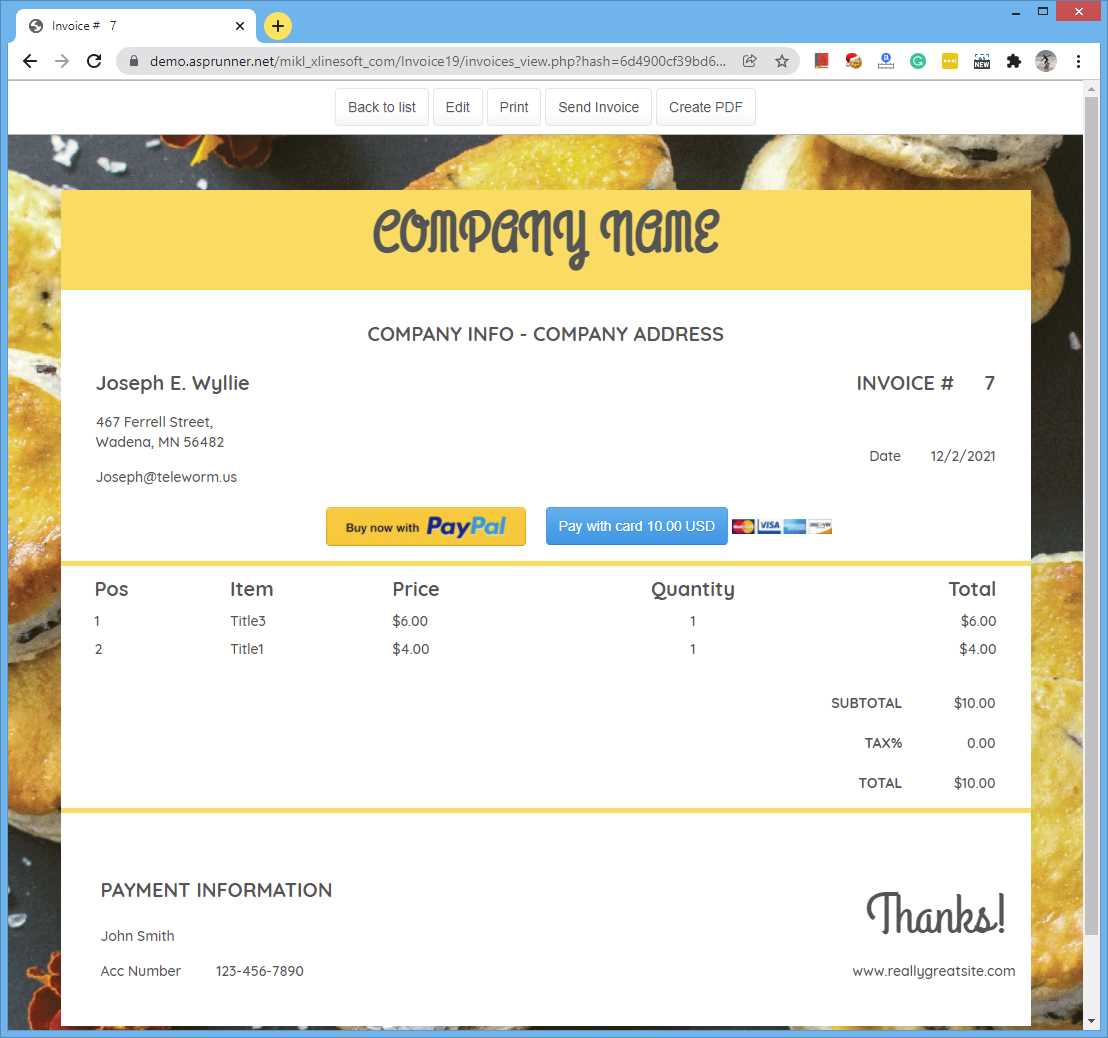

How to Create an Invoice Template in Access

Creating a customized billing system is a straightforward process that can significantly improve your workflow. By setting up a structured document that suits your business needs, you can automate essential tasks such as generating receipts, tracking payments, and organizing client information. Customization allows for flexibility, ensuring that the solution works effectively for your unique requirements.

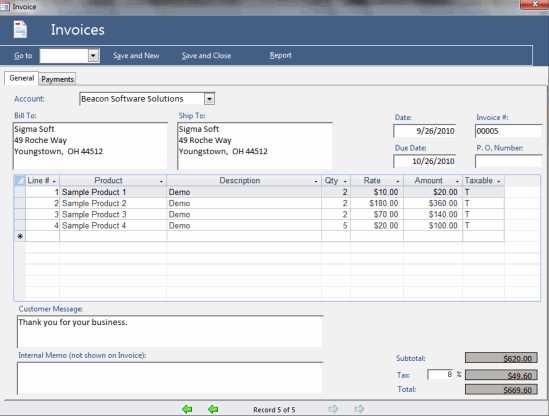

Step-by-Step Guide to Designing a Billing Form

To begin, open your chosen program and create a new project. Set up a clean layout for your form that includes essential fields such as client names, contact information, item descriptions, prices, and dates. Using predefined styles and formatting options ensures consistency and professionalism across your generated records. The following steps outline how to create the main sections of the form:

- Create a New Project: Start with a blank document or select a basic form template to begin designing.

- Define Fields: Add the necessary fields for your clients, products, services, taxes, and payment details. Customize the labels and field types according to your needs.

- Apply Formatting: Use formatting tools to adjust the layout, fonts, and colors to match your branding or personal preferences.

- Automate Calculations: Set up automatic calculations for totals, taxes, and discounts, ensuring that values are updated dynamically.

Finalizing and Customizing Your Document

Once the basic structure is in place, test your document by entering sample data to ensure all fields and calculations function correctly. You can further personalize the layout with your company logo, payment terms, or any other specific elements that reflect your business style. After customization, save the template, and you’re ready to generate professional documents whenever needed.

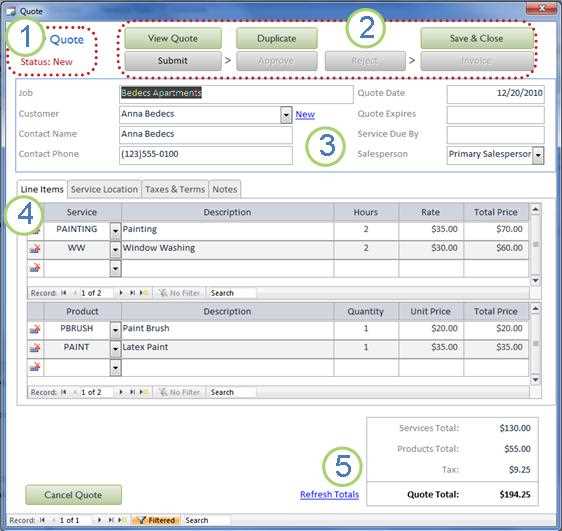

Customizing Your Invoice Database Template

Personalizing your billing system to meet the specific needs of your business can enhance efficiency and ensure accuracy. Customization allows you to tailor the structure and features to better reflect your company’s operations and client requirements. Whether it’s adjusting fields, adding new calculations, or incorporating your branding, modifying the solution to suit your needs can greatly improve the workflow.

Steps to Tailor Your Billing System

To make your system more effective, you can adjust several aspects of the structure and design. Here are some key elements to focus on:

- Modify Field Labels: Change the default field names to match your business terms, such as replacing “Product” with “Service” or “Quantity” with “Hours Worked.”

- Add Custom Fields: If your business requires additional details (such as a client’s account number or special discounts), add custom fields to capture this information.

- Update Layout and Design: Customize the appearance of the form by adjusting fonts, colors, and sections to align with your company’s branding.

- Automate Calculations: Set up formulas to automatically calculate totals, taxes, and any applicable discounts, ensuring consistent and accurate financial records.

Enhancing Functionality

Once you’ve adjusted the basic design, you can improve the functionality by integrating advanced features. For example:

- Set Up Payment Tracking: Include fields to record payment dates, methods, and amounts. This helps keep track of paid and unpaid invoices.

- Generate Reports: Customize report formats to include summaries of client payments, outstanding invoices, and total revenue.

- Implement Conditional Formatting: Highlight overdue invoices or unpaid balances automatically to ensure timely follow-ups.

These customizations ensure that the system functions efficiently, saves time, and minimizes errors, while also providing a more personalized experience for your clients and your business operations.

Top Features of Microsoft Access Templates

Customizable billing systems come with a variety of features that enhance the way businesses handle financial records and transactions. These tools are designed to streamline processes, increase efficiency, and ensure accuracy in tracking sales, payments, and client data. By incorporating advanced functionalities, users can create solutions that meet their specific needs and improve overall operations.

Some of the most valuable features of a well-designed billing system include the ability to automate calculations, generate detailed reports, and provide easy access to customer information. These capabilities help businesses save time and reduce human error while offering a professional and organized approach to managing financial data.

- Automated Calculations: Automatically calculate totals, taxes, and discounts based on user input, ensuring accuracy and saving time.

- Customizable Forms: Adjust field names and layouts to match your specific business needs, such as adding client-specific information or adjusting product/service details.

- Report Generation: Create professional reports to track payments, sales, outstanding balances, and other financial details in a customizable format.

- Data Integration: Seamlessly link client data, payment records, and inventory management, providing a centralized system for all relevant information.

- Search and Filter Capabilities: Easily search for specific transactions or customer details and filter results to find the information you need quickly.

- Security Features: Password protection and user access controls ensure that sensitive financial data is kept secure from unauthorized access.

These features help businesses create a streamlined, professional workflow, making it easier to manage transactions and stay organized. With these tools, users can reduce the time spent on manual processes and focus more on growing their business and improving customer satisfaction.

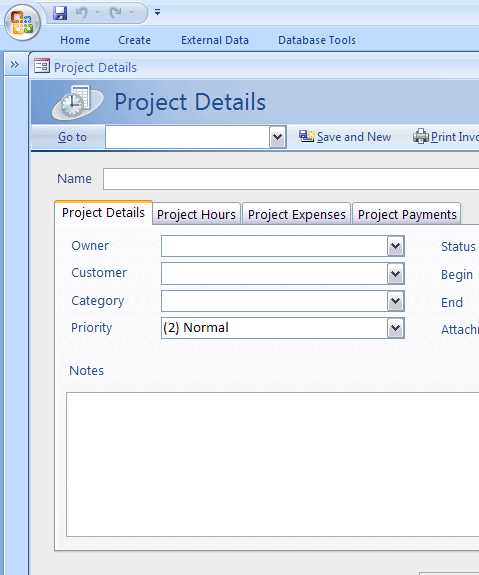

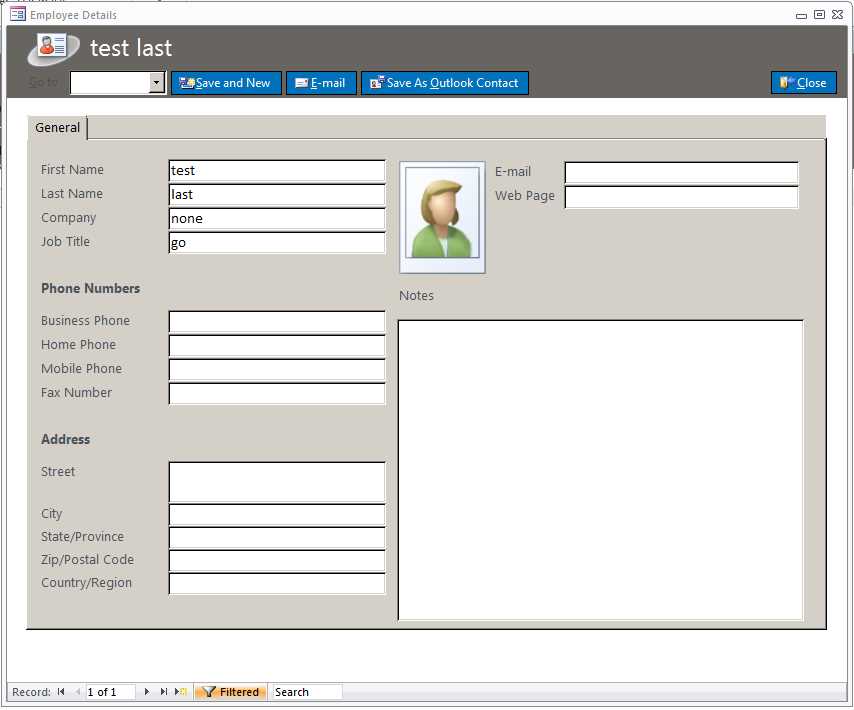

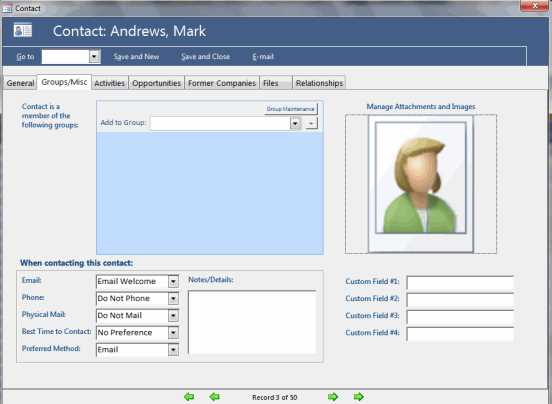

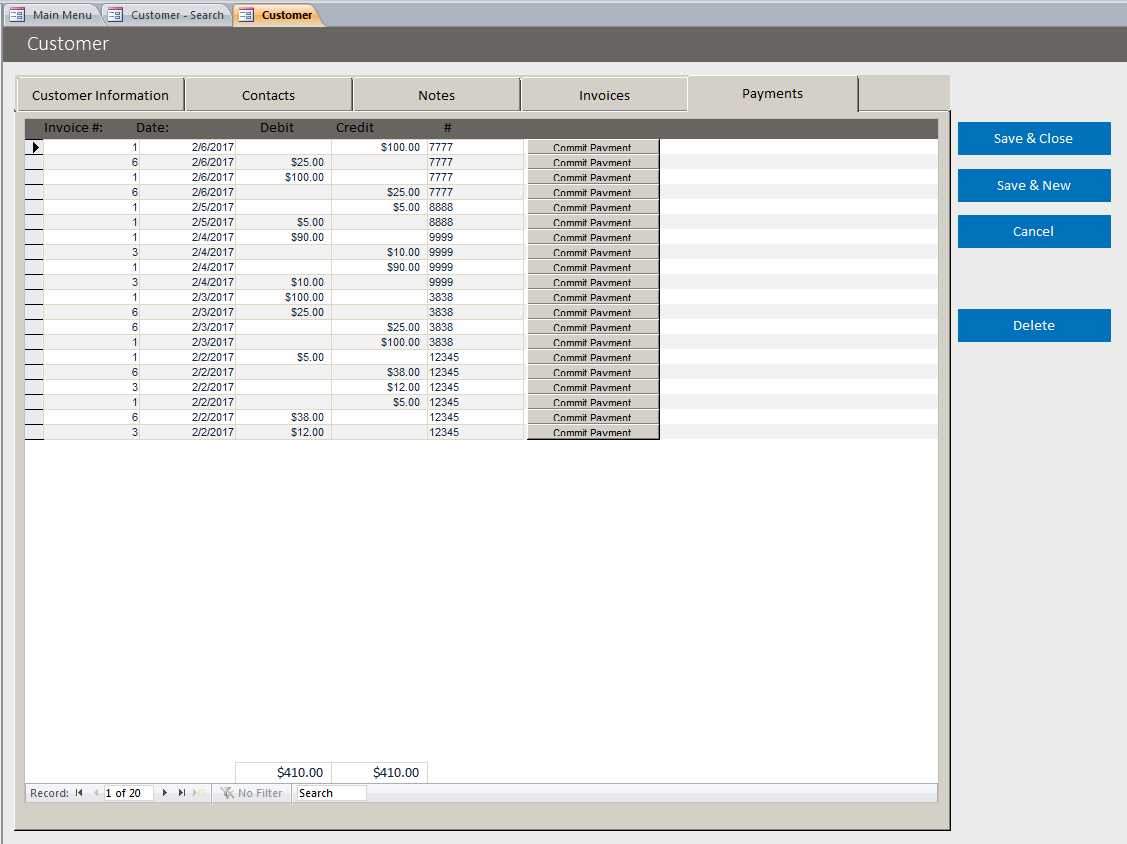

Managing Customer Information in Access

Effectively organizing and managing customer information is essential for any business. A robust system allows companies to store and retrieve client details quickly, track interactions, and maintain accurate records for future reference. Centralizing customer data not only improves efficiency but also enhances customer service by providing easy access to relevant information whenever needed.

Setting Up Customer Profiles

One of the key steps in managing customer information is creating detailed profiles for each client. These profiles typically include contact information, billing addresses, transaction history, and notes on previous interactions. Organizing this data ensures that you can quickly access important details, whether you’re preparing a report or contacting a customer for follow-up. To ensure all relevant information is captured, you can add customized fields specific to your business needs, such as membership status or special preferences.

Tracking Customer Interaction and History

Another important aspect of customer management is keeping track of past transactions and interactions. By recording purchase history, payment dates, and any service-related communication, businesses can better understand customer behavior and anticipate future needs. This history can be used to improve service, offer personalized discounts, or even remind clients of upcoming renewal dates, ensuring that businesses stay proactive in their customer relationships.

With a well-organized system, you can ensure that all customer data is stored securely, updated regularly, and easily accessible when needed. This will ultimately lead to stronger customer relationships and more streamlined operations.

Setting Up Invoice Numbering System

Establishing a consistent and logical numbering system for billing documents is crucial for maintaining order and tracking transactions. A well-organized system allows businesses to efficiently manage their records and quickly locate specific invoices when needed. It also helps ensure that no document is missed or duplicated, which is essential for accurate financial reporting and auditing.

Choosing the Right Numbering Format

When setting up a numbering system, it’s important to choose a format that works best for your business. A common practice is to use a sequential format, such as “INV-001,” “INV-002,” and so on. However, more advanced systems can incorporate additional elements such as:

- Yearly Prefix: Adding the year to the numbering system (e.g., “2024-001”) helps categorize invoices by the year they were issued, making it easier to track records over time.

- Client-Specific Codes: For businesses with a large client base, including a unique identifier for each client within the invoice number (e.g., “C123-001”) can help quickly associate invoices with specific customers.

- Invoice Type: Including a code for different types of invoices (e.g., “S” for sales and “R” for refunds) can help distinguish between various categories of transactions.

Implementing Automatic Number Generation

To avoid errors and ensure consistency, many businesses set up an automatic numbering system that increments the number each time a new document is created. This eliminates the need for manual tracking and reduces the chances of human error. Most billing solutions allow for easy configuration of an automated system, which can also be set to reset at the beginning of each year or month, depending on your preference.

By implementing a clear and efficient numbering system, businesses can improve their record-keeping, simplify the process of finding specific documents, and ensure that their billing operations run smoothly.

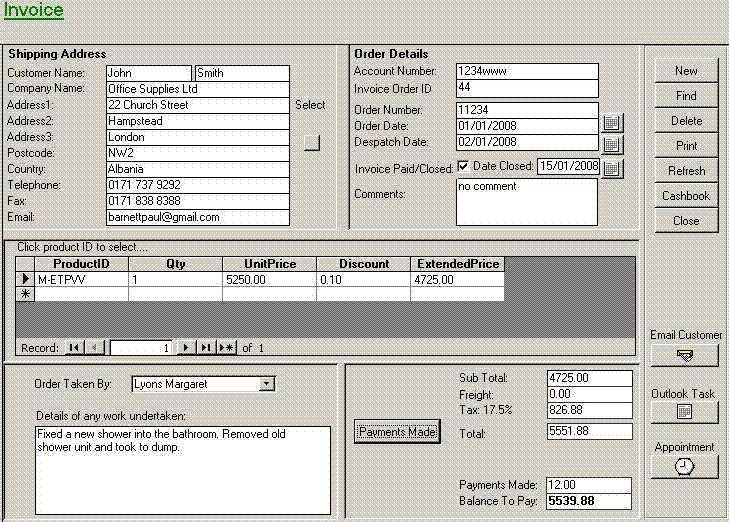

Tracking Payments with Access Invoice Database

Efficiently tracking payments is essential for maintaining healthy cash flow and ensuring that all transactions are accounted for. By organizing payment details in a structured system, businesses can quickly verify received payments, identify outstanding balances, and maintain accurate financial records. An automated system also reduces manual errors and helps businesses stay on top of their billing cycle.

Recording Payment Information

When managing customer payments, it is important to include key details such as the payment date, amount, method of payment, and any reference numbers. This information should be linked to the corresponding billing record so that payment history can be easily tracked. Custom fields can be added to capture additional payment-related data, such as transaction IDs, payment terms, and notes regarding partial payments.

- Payment Date: The date the payment was received.

- Amount Paid: The total amount that has been paid toward the bill.

- Payment Method: Indicate whether the payment was made by cash, check, bank transfer, or credit card.

- Reference Number: Include any transaction or reference number related to the payment for future reference.

Automating Payment Updates

To streamline the process, many systems allow for automatic updates once a payment is recorded. For example, when a payment is entered, the system can automatically adjust the outstanding balance and mark the invoice as paid or partially paid. This automation saves time and ensures that records are always up to date. Additionally, reports can be generated to review payment status across all outstanding invoices, making it easier to follow up on overdue accounts.

By integrating a payment tracking system into your workflow, businesses can gain better control over their finances, reduce administrative workload, and improve their overall billing accuracy.

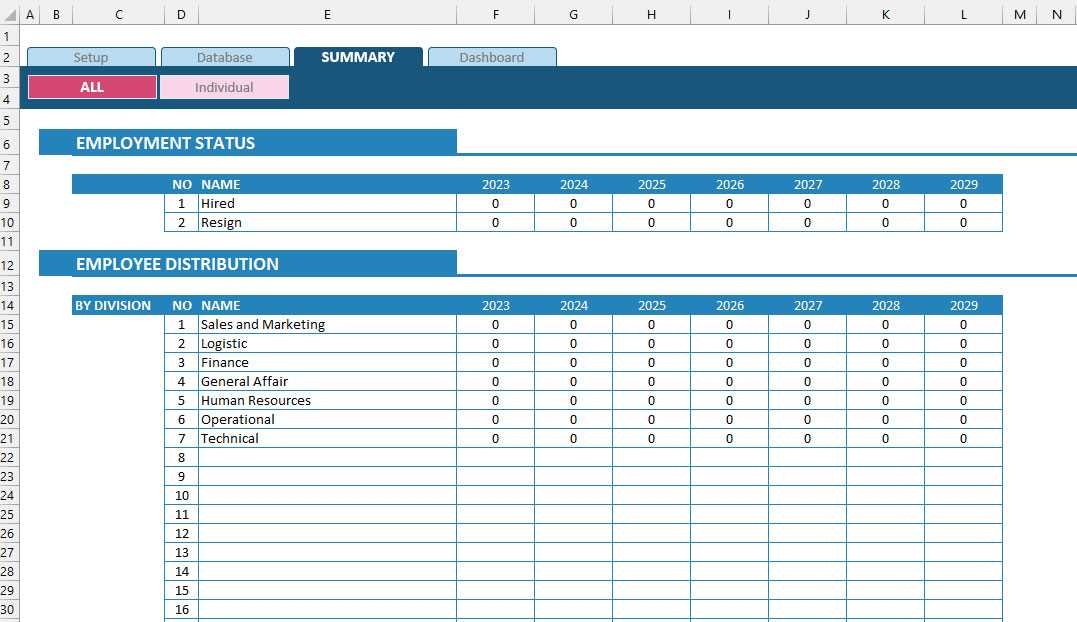

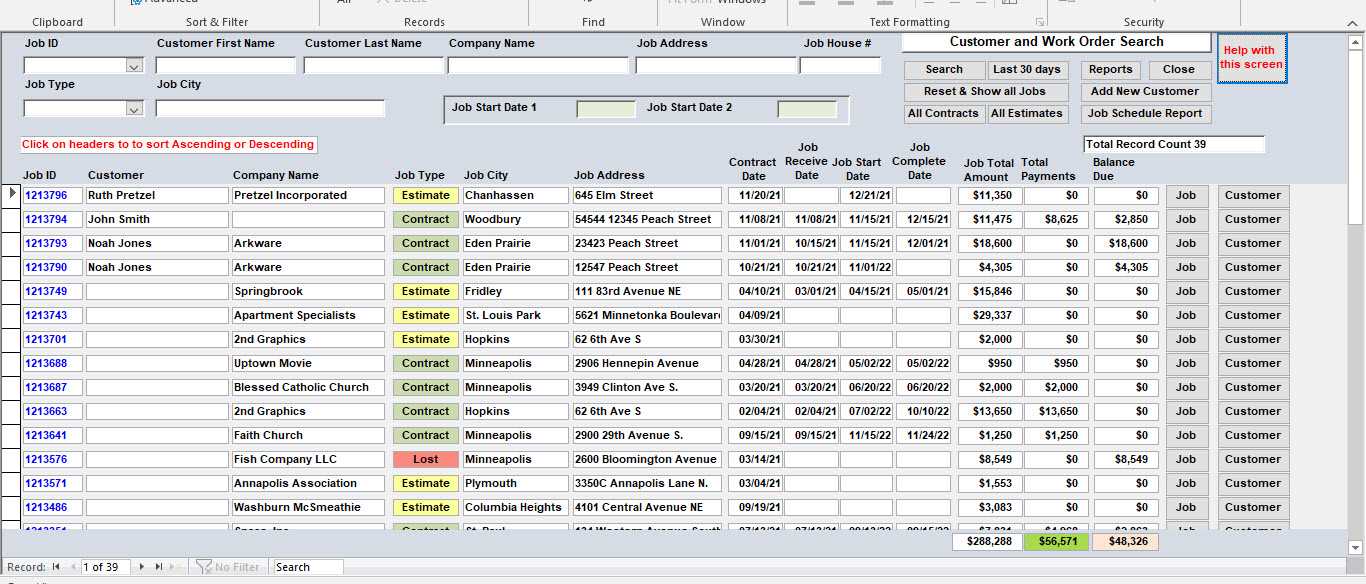

Generating Reports with Microsoft Access

Creating detailed reports is a vital part of managing any business, as it provides valuable insights into financial performance, outstanding payments, and other key metrics. A well-organized reporting system allows for quick data analysis, helping businesses make informed decisions based on real-time information. By automating the process of report generation, companies can save time and reduce the risk of errors in manual data entry.

Types of Reports You Can Generate

There are various types of reports that can be generated to monitor different aspects of your business. Some common examples include:

- Sales Reports: Summarize the total sales within a given period, allowing you to track revenue and assess business growth.

- Outstanding Balances Report: Lists clients with unpaid invoices, helping you manage accounts receivable and follow up on overdue payments.

- Payment History Report: Tracks the payments made by each customer, offering a clear view of paid and unpaid amounts over time.

- Tax Summary Report: Calculates the tax collected across all transactions, making it easier to file taxes and comply with regulations.

Customizing Report Formats

Reports should be tailored to meet the specific needs of your business. You can customize the layout and design of each report to highlight the most important data, ensuring that the information is both easy to read and relevant. Some common customizations include:

- Filtering Data: Narrow down the data displayed in reports by specific criteria, such as date ranges, client names, or payment statuses.

- Group and Summarize: Organize data into categories or groups, such as by month, product type, or region, to get a more structured view.

- Visual Elements: Incorporate charts or graphs to better illustrate trends, such as payment patterns or sales performance.

By using a report generation system, businesses can keep track of their financial data with ease, make timely adjustments to their operations, and maintain a clear overview of their financial health.

How to Add Tax and Discount Fields

Incorporating tax and discount fields into your billing system ensures that all relevant financial adjustments are accurately calculated. These fields allow you to apply taxes to sales transactions based on location or product type, and offer discounts to customers, whether as a percentage or fixed amount. Properly setting up these fields simplifies the billing process, ensuring that calculations are correct and consistent across all transactions.

Adding Tax Fields

To include tax in your billing system, you’ll need to create a field that calculates the tax based on the applicable rate. Here’s how to set up a tax field:

- Determine Tax Rate: Decide whether your business will apply a fixed tax rate or different rates based on product categories or customer location.

- Create a Tax Field: Add a field for the tax amount in your billing document, where the calculated value will be displayed. This can be a calculated field that multiplies the sale amount by the tax rate.

- Automate Tax Calculation: Set up the formula to automatically apply the tax rate to the total before finalizing the bill. Ensure this calculation updates as prices or tax rates change.

- Include Tax Breakdown: It’s helpful to show the tax amount separately on the final bill so clients can see how much tax they are paying.

Adding Discount Fields

Offering discounts can improve customer satisfaction and drive sales. You can create discount fields to automatically apply discounts based on specific rules, such as a percentage off the total or a fixed amount deducted from the subtotal. To add discount fields, follow these steps:

- Choose Discount Type: Decide if the discount will be a percentage of the total or a fixed amount. You may also choose to offer discounts based on certain criteria, such as volume purchases or promotional codes.

- Create Discount Field: Add a field to input either the discount percentage or amount. This can be linked to the total value of the sale or applied as a flat-rate discount.

- Set Up Conditional Discounts: If you want to automate discount applications based on specific rules, set up conditional formatting. For example, a discount may apply only if the total exceeds a certain threshold or if the customer is eligible for a seasonal offer.

- Display Discounted Price: Ensure that both the original price and the discounted price are visible on the final document so the customer can clearly see the savings.

By setting up tax and discount fields, your system will be able to handle complex billing scenarios while maintaining accuracy. These fields not only improve the client experience but also help streamline your accounting and financial reporting tasks.

Ensuring Accuracy in Invoice Calculations

Accurate financial calculations are crucial for any business to ensure correct billing and maintain trust with clients. Mistakes in total amounts, taxes, discounts, or any other calculation can lead to disputes, loss of revenue, or issues with compliance. Implementing systems that automate these calculations, while providing oversight for manual checks, ensures that the entire billing process is error-free and efficient.

Steps to Ensure Accurate Calculations

Here are several steps to take when setting up a system for precise financial calculations:

- Use Automated Formulas: Ensure that all calculations, such as totals, taxes, and discounts, are automated. This reduces human error and ensures consistency across all billing records.

- Double-Check Rate Inputs: Always verify that the rates used for calculations, such as tax percentages and discount values, are correct and up-to-date. Regularly review and adjust these values based on changes in tax laws or promotional offers.

- Verify Unit Pricing: Ensure that the unit price for each product or service is accurate before performing any calculations. Incorrect unit prices can result in incorrect totals or wrong amounts charged to customers.

- Implement Error-Checking Mechanisms: Set up alerts or checks that highlight any discrepancies, such as an unusually high or low total or missing values. This helps catch mistakes before finalizing the bill.

Testing and Reconciliation

To further minimize the risk of errors, businesses should test their system periodically and reconcile the results with external records:

- Run Sample Calculations: Periodically test the system by entering sample data and ensuring that the calculations match expectations. For example, test various combinations of taxes, discounts, and quantities to verify the final totals.

- Cross-Reference with Other Records: Regularly reconcile the calculated totals with other records, such as bank statements or payment logs, to identify any discrepancies early on.

- Provide Manual Verification Options: For complex transactions, allow for manual verification or overrides to ensure the system is working correctly while still offering flexibility for unique cases.

By focusing on accuracy at every stage of the billing process, businesses can ensure that their financial records are reliable, build client trust, and avoid costly mistakes that may affect both revenue and reputation.

Automating Invoice Creation in Microsoft Access

Automating the creation of billing documents streamlines the financial workflow and reduces the chances of human error. By setting up an automated system, businesses can generate accurate, professional bills in just a few clicks, saving time and effort. This process not only increases efficiency but also ensures that all necessary details–such as customer information, product or service details, and payment terms–are correctly populated each time a document is created.

Setting Up Automation for Invoice Generation

To automate the creation of billing documents, a well-structured system is necessary. The system should be designed to automatically pull customer data, product details, and pricing from existing records, while also calculating taxes, discounts, and totals. Here’s how you can set up automation for creating invoices:

- Centralized Customer Information: Ensure that all customer details, such as names, addresses, and contact information, are stored in a centralized location. This allows for quick retrieval when generating bills.

- Product or Service Listings: Maintain a catalog of all products and services offered, along with their prices. When creating a bill, the system should automatically fetch the relevant items and prices based on the order or service provided.

- Automated Calculations: Set up formulas that automatically calculate totals, taxes, and discounts based on predefined rates. This minimizes errors and speeds up the process.

- Sequential Numbering: Automate the numbering system for each billing document, ensuring that each generated document has a unique and sequential reference number.

Enhancing Efficiency and Accuracy

Once the system is set up, it will allow for the rapid generation of billing documents without requiring manual input for each transaction. With all necessary details automatically populated and calculations performed on-the-fly, the entire process becomes more efficient. Moreover, automation ensures that no steps are overlooked, preventing mistakes that can occur with manual entry.

- Quick Document Creation: With a few clicks, a new billing document is generated with all customer and transaction details, ready to be printed or sent electronically.

- Reduced Errors: By automating calculations and document population, the risk of errors is significantly reduced, improving the overall accuracy of billing.

- Customizable Features: The system can be customized to include specific fields, such as payment terms, due dates, or special instructions, ensuring that each bill meets the business’s needs.

By automating the creation of billing documents, businesses can handle transactions more efficiently, reduce administrative workload, and ensure a higher level of consistency and accuracy in financial operations.

Improving Data Security in Access Databases

Ensuring the security of business data is paramount to protect sensitive information from unauthorized access, corruption, or theft. As businesses handle a growing volume of financial records, customer details, and transaction histories, securing this information becomes a top priority. Implementing robust security measures helps safeguard against data breaches and ensures that only authorized personnel can access and modify critical business data.

Key Security Practices for Protecting Business Data

To strengthen data security within your system, there are several best practices you can adopt:

- User Authentication: Require strong authentication methods, such as unique user IDs and passwords, to limit access to authorized users only. Ensure that passwords are stored securely, using encryption where possible.

- Role-Based Access Control: Implement role-based access control (RBAC) to assign specific permissions to different user roles. For example, administrative users may have full access, while regular users might only be able to view or edit certain records.

- Data Encryption: Encrypt sensitive information both at rest and in transit. This ensures that even if the data is intercepted, it remains unreadable without the decryption key.

- Backup and Recovery: Regularly back up your data to a secure location to prevent loss in case of system failure or security incidents. Having a recovery plan in place ensures you can restore data quickly and accurately.

Additional Techniques for Enhanced Security

Beyond the basic security practices, there are additional steps that can be taken to further improve data protection:

| Security Measure | Benefit |

|---|---|

| Audit Trails | Tracking all user activities helps detect suspicious actions and maintain accountability. |

| Database Locking | Prevent unauthorized users from making changes by locking certain records or fields. |

| Regular Security Updates | Ensure that your system is up to date with the latest security patches to protect against known vulnerabilities. |

By implementing these security measures, businesses can significantly reduce the risk of data loss, unauthorized access, and corruption. Proper security protocols not only protect sensitive information but also help maintain trust with customers and stakeholders, ensuring long-term business success.

Integrating Access with Other Software

Integrating your billing and financial management system with other software applications can enhance operational efficiency and provide a seamless experience across different platforms. Whether it’s linking customer management tools, accounting software, or inventory management systems, integration enables data to flow between programs automatically, reducing the need for manual entry and minimizing the risk of errors. This integration creates a unified system where all components work together harmoniously, streamlining workflows and ensuring consistency across all areas of your business.

Common Integration Scenarios

There are several common scenarios where integrating your billing system with other software applications can significantly improve efficiency:

- Customer Relationship Management (CRM) Systems: By connecting your billing system with CRM software, customer information such as contact details, purchase history, and communication logs can be automatically imported into your billing system, ensuring consistency and saving time on data entry.

- Accounting Software: Integration with accounting software allows for automatic updates of financial transactions, such as payments and outstanding balances, reducing the need for manual synchronization. This ensures accurate accounting records and simplifies financial reporting.

- Inventory Management Tools: When integrated with inventory management software, your system can automatically track the availability of products or services, update stock levels, and generate purchase orders when necessary, helping you maintain control over stock without manual updates.

Benefits of Integration

Integrating your billing system with other tools offers several key benefits that can improve overall business operations:

- Time Savings: Automation of data transfer between software applications eliminates the need for double entry and repetitive tasks, freeing up time for other essential activities.

- Increased Accuracy: Automated data synchronization reduces human error and ensures that your financial and customer data remains accurate and up to date across all platforms.

- Better Decision Making: Integration allows you to generate more comprehensive reports by pulling data from various sources, offering you a clearer view of your business performance and supporting better decision-making.

- Improved Customer Experience: With integrated systems, you can deliver faster, more accurate service to customers, from timely billing to up-to-date information on orders, payments, and shipments.

By integrating your billing system with other software solutions, you can create a more efficient, accurate, and connected business environment that benefits both internal operations and customer satisfaction.

Best Practices for Invoice Database Management

Efficient management of billing records is crucial for maintaining a smooth financial workflow and ensuring that all transactions are tracked accurately. Properly organized systems not only help prevent errors but also improve overall business efficiency. By adopting best practices for managing financial records, businesses can streamline their operations, maintain transparency, and ensure timely billing while keeping client data secure.

Organizing and Structuring Billing Data

One of the first steps in effective record management is organizing the data in a structured and consistent manner. This ensures that information is easy to retrieve and analyze when needed. Here are key practices for structuring your billing data:

- Consistent Naming Conventions: Use clear and consistent naming conventions for fields and records. This makes it easier for team members to identify relevant information and reduces the risk of errors.

- Segment Data by Categories: Categorize billing records by relevant criteria such as customer, transaction type, or payment status. This allows for quicker searches and more effective report generation.

- Ensure Unique Identifiers: Assign a unique identifier to each transaction or record to avoid confusion and ensure that each entry is easily distinguishable.

Maintaining Data Integrity and Security

Keeping billing records secure and accurate is essential for any business. Data integrity and security practices help protect sensitive information and prevent unauthorized access. Consider the following practices:

- Regular Backups: Ensure that all data is backed up regularly to prevent loss in case of technical issues. Create a backup schedule and store backups in a secure location.

- Role-Based Access: Limit access to sensitive billing data by implementing role-based access control (RBAC). Ensure that only authorized personnel can modify or view specific records.

- Data Validation: Set up data validation rules to ensure that only accurate and valid information is entered. This helps maintain consistency and reduces the chance of errors.

Efficient Reporting and Analytics

Generating reports and analyzing billing data is key to managing business finances effectively. By implementing best practices for reporting and analytics, businesses can gain valuable insights into their operations:

- Automated Reports: Set up automated reports to regularly track important metrics such as outstanding balances, payment statuses, and revenue. This helps keep management informed and reduces the manual effort involved in generating reports.

- Customizable Dashboards: Create dashboards that provide a real-time overview of key financial data. Dashboards can help business owners and managers quickly assess performance and make data-driven decisions.

- Regular Audits: Conduct regular audits of your financial records to identify discrepancies, errors, or fraudulent activity. Regular checks ensure that your records remain accurate and compliant with accounting standards.

By following these best practices, businesses can maintain a well-organized and secure system for managing billing information, ensuring that records are reliable, a

How to Share Your Invoice Database

Sharing your financial records with team members or external partners can enhance collaboration and ensure that everyone has access to up-to-date information. Whether you’re sharing billing details with colleagues, accountants, or clients, having a secure and efficient way to share your information is essential. There are several methods to share your system, each with different levels of accessibility and security, depending on your needs.

Options for Sharing Your Financial Records

There are various ways to share your records, depending on how you want others to access and interact with the information:

- Cloud-Based Sharing: One of the most efficient ways to share data is by using cloud services. Storing your financial records in a cloud environment allows you to share them instantly with anyone who has the right permissions. Many cloud platforms also allow for real-time collaboration, enabling multiple users to view or edit the information simultaneously.

- Network Sharing: If your business has a local network, you can store your records on a centralized server, allowing authorized users to access the files from different computers within the same network. This method is ideal for businesses with a small team working from the same office.

- Email Sharing: For simpler scenarios, you can email your billing documents or records as attachments. While this method is quick, it’s less secure and harder to manage, especially for large files or for ongoing collaborations.

- Third-Party Integration: Some third-party software can integrate with your system, enabling you to share data more securely. For example, sharing billing records through an accounting software platform can automatically sync and share updated records with other users or systems, reducing manual intervention.

Best Practices for Secure Sharing

While sharing data can enhance productivity, it’s important to ensure that the information is shared securely and in compliance with privacy regulations. Follow these best practices to protect your data:

- Set Permissions: Make sure you control who has access to your financial records. Set permissions to determine whether users can only view the data or make changes. This will help prevent unauthorized modifications.

- Use Encryption: If sharing via email or cloud storage, use encryption to protect sensitive data. Encrypted files are unreadable without the correct decryption key, adding an extra layer of security.

- Limit Sharing: Only share your data with trusted individuals or entities. Be mindful of what information you share and avoid sending unnecessary details that are not required for the task at hand.

- Regular Audits: Periodically review who has access to your records and update permissions as needed. This ensures that only authorized personnel can view or modify the information.

By selecting the right method for sharing and following secure sharing practices, you can effectively collaborate with others while maintaining the integrity and confidentiality of your business records.