Free Medical Invoice Template for Quick and Easy Billing

Managing payments in the healthcare industry can often be a complex task, requiring precise documentation and attention to detail. Having a structured document for billing not only ensures accuracy but also helps streamline the overall process. This tool allows healthcare professionals to easily issue clear and organized statements, improving both patient satisfaction and financial operations.

By utilizing a well-designed billing format, service providers can ensure that all essential information, such as treatment details, charges, and payment terms, are presented clearly. With customizable options available, it becomes easier to adjust the document to fit specific needs, reducing the chances of errors and misunderstandings.

Adopting a reliable and user-friendly billing system can save time and reduce administrative costs, allowing healthcare providers to focus more on patient care. Whether you are an individual practitioner or part of a larger practice, a simple yet effective billing format can make a significant difference in your operations.

Free Billing Document Guide

Efficient billing is crucial for any healthcare practice, and utilizing a structured document can significantly simplify the process. Whether you are an independent professional or part of a larger organization, a clear and concise billing sheet ensures that all necessary information is presented in a professional manner. This guide will help you understand how to set up a useful billing format without incurring additional costs.

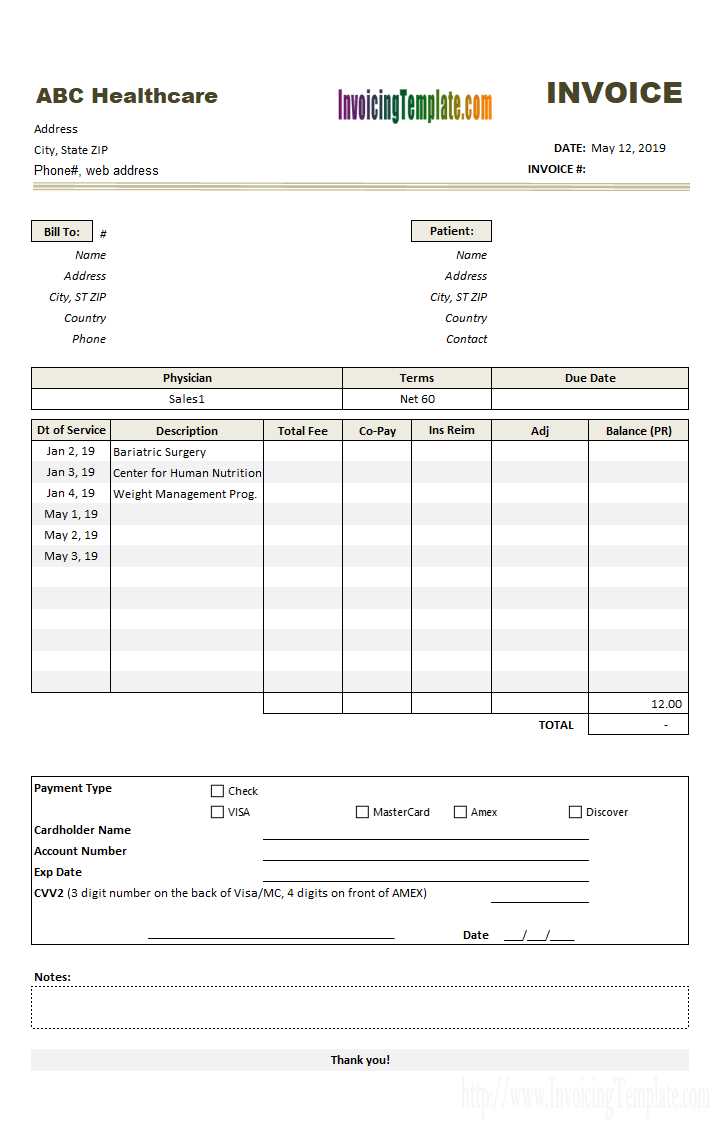

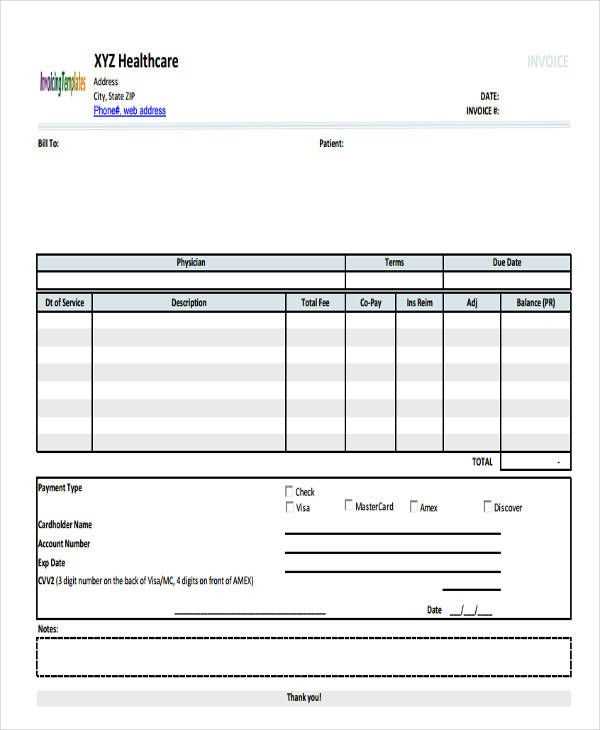

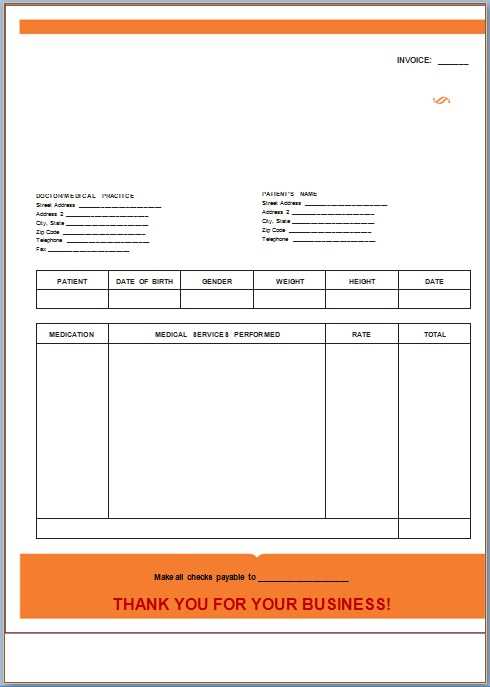

Many billing documents available online offer customizable fields, allowing you to personalize the format to suit your needs. These documents can be easily edited to include patient details, services provided, and payment terms, ensuring transparency and clarity for both providers and clients. Below is a simple example of what such a document might include:

| Field | Description |

|---|---|

| Service Date | Provide the date when the service was rendered. |

| Patient Name | Include the full name of the patient receiving the treatment. |

| Service Description | A brief summary of the service or treatment provided. |

| Amount Charged | State the amount due for the service provided. |

| Payment Terms | Detail the payment expectations, such as due date and accepted payment methods. |

By using a simple structure like the one above, you can keep your billing organized and efficient. The goal is to maintain professionalism while ensuring that both parties clearly understand the charges and payment conditions. This will help streamline the billing process and reduce the chance of disputes over payments.

What Is a Billing Document Format?

A billing document format is a standardized structure designed to record and communicate the charges for services provided. It serves as a formal request for payment from a service provider to a client, detailing the costs for specific treatments or consultations. This type of document ensures that both parties are clear on the charges and payment expectations.

Typically, such a format includes essential information like the patient’s name, date of service, description of the treatment, and the total amount owed. It helps avoid confusion and ensures that all necessary details are presented in a professional manner. With a clear layout, a well-organized billing sheet can streamline administrative tasks, making it easier to track payments and maintain accurate records.

Using a structured billing document not only simplifies the process of requesting payment but also promotes transparency between healthcare providers and their clients. By including all relevant details in a concise format, it enhances the efficiency of billing procedures and reduces errors in financial transactions.

Benefits of Using Free Billing Formats

Using a pre-designed billing format offers several advantages that can significantly enhance the efficiency and accuracy of the payment process. These formats are available at no cost, allowing businesses to save money while still ensuring that all necessary information is clearly presented. By utilizing a ready-made structure, service providers can focus more on their core activities rather than spending time creating documents from scratch.

Time and Cost Savings

One of the primary benefits of using a free billing structure is the time and cost savings. Instead of investing resources in designing a custom document or purchasing expensive software, businesses can simply download and start using a free format right away. This allows you to allocate more time to tasks that directly impact patient care or other key operations.

Ease of Use and Customization

Another major benefit is the ease of use. Most free billing formats are designed to be user-friendly and customizable, meaning you can adjust the document to suit your specific needs. Whether you’re an independent practitioner or part of a larger healthcare facility, you can make changes to the fields, fonts, and overall layout without the need for advanced technical skills.

| Benefit | Description |

|---|---|

| Cost Efficiency | Access to high-quality documents without spending money on professional design or software. |

| Time Saving | Pre-designed formats save you time by eliminating the need for creating billing documents from scratch. |

| Customization | Easy to modify the layout and content to fit the specific needs of your practice or service. |

| Professional Appearance | Ensure that all billing documents look organized and professional, which can improve client trust. |

By taking advantage of these ready-made formats, healthcare providers can ensure that their billing processes are efficient, professional, and hassle-free. These tools help keep everything organized and facilitate smooth financial transactions, benefiting both providers and clients alike.

How to Customize Your Billing Document

Customizing your billing document allows you to tailor it to the specific needs of your practice, ensuring that all relevant details are included and presented clearly. A personalized document can help maintain professionalism and improve communication with clients by reflecting your unique branding, payment terms, and service offerings.

To effectively customize your billing document, start by reviewing the standard fields and deciding which ones need to be adjusted or added. Most formats allow you to easily modify details such as the layout, font style, and field names, so you can include any specific information required for your business.

Essential Fields to Adjust

Depending on your service type, you may need to modify certain sections to reflect your practices accurately. Here are some essential fields to consider customizing:

| Field | Customization Suggestion |

|---|---|

| Service Description | Modify the description to fit the specific treatments or consultations you provide. |

| Patient Information | Add additional fields if necessary, such as patient ID or insurance details. |

| Payment Terms | Specify your preferred payment methods, deadlines, and any late fees. |

| Logo and Branding | Insert your practice’s logo and color scheme to maintain a professional brand appearance. |

Customizing these fields ensures that your billing document is not only clear and accurate but also reflects the professionalism of your business. A well-tailored document helps establish trust with clients and reduces the likelihood of confusion over payments or services rendered.

Top Features to Look for in Billing Formats

When selecting a billing document for your practice, it’s important to consider specific features that can improve both efficiency and clarity. A well-designed format not only ensures that all relevant information is included but also enhances the professionalism of your communications. Below are some key features to look for when choosing the ideal billing document for your needs.

Essential Features for an Effective Billing Format

The following elements should be included in any format to ensure it meets your needs and maintains a high standard of accuracy:

- Customizable Fields: Look for a document that allows you to modify fields such as patient information, service descriptions, and payment terms. This flexibility ensures the format can adapt to your specific services.

- Clear Layout: A clean, well-organized layout improves readability and helps avoid confusion. It should be easy for both clients and administrative staff to navigate.

- Professional Design: The document should have a polished, formal appearance that reflects the professionalism of your practice. Elements like logos, color schemes, and fonts should align with your branding.

Additional Considerations

In addition to the basic features, there are a few extra attributes that can further enhance the functionality of your billing document:

- Automatic Calculations: Some formats offer built-in formulas to automatically calculate totals, taxes, and discounts. This can save time and reduce human error.

- Multiple Payment Options: Ensure the format includes space to list different payment methods, such as credit cards, bank transfers, or checks.

- Compliance with Legal Requirements: The document should be adaptable to meet any regulatory or legal standards specific to your industry or region.

By focusing on these features, you can ensure that your billing document not only serves its primary function of collecting payments but also improves the overall efficiency of your billing process.

Why Choose Free Over Paid Billing Formats

Choosing a cost-effective billing document solution can be a smart move for many businesses, especially those looking to save on expenses without sacrificing quality. While premium options may offer additional features or customization, free alternatives can provide all the essential functions you need to maintain an organized billing process. For many small practices or startups, opting for a no-cost format is a practical decision that can still yield professional results.

Free formats often come with the core elements required for efficient billing, such as customizable fields, clear layouts, and space for all necessary service details. These templates are designed to be straightforward and easy to use, allowing businesses to focus on what matters most–providing high-quality service without getting bogged down in complex or costly software solutions.

By selecting a free format, you can avoid the upfront costs associated with premium options while still maintaining professionalism in your communications. These documents are typically just as effective for tracking payments, sending statements, and ensuring that your billing process runs smoothly, making them an excellent option for many providers.

Where to Find Free Billing Document Formats

Finding a reliable, no-cost solution for your billing needs is easier than ever. Many online platforms offer downloadable formats that can be used without spending a dime. Whether you need a simple layout or something more complex, there are numerous websites that provide customizable billing documents designed to meet your specific requirements. Below are some of the best places to search for them.

Top Sources for Downloading Billing Formats

- Online Office Platforms: Websites like Google Docs and Microsoft Office often provide free templates that you can access and customize directly within their suites.

- Freelance Resource Websites: Platforms such as Fiverr or Upwork sometimes offer free basic document samples created by professionals in the field.

- Template Providers: Many specialized websites like Template.net and Vertex42 offer free versions of their billing formats, which are easy to edit and personalize for your needs.

- Open-Source Document Platforms: Websites like OpenOffice.org and LibreOffice provide a variety of free documents, including billing formats, that you can download and modify.

Why These Sources Work

- Variety and Customization: These platforms typically offer a wide range of document styles, giving you flexibility to choose the one that best suits your practice or business.

- Ease of Use: Most of these sources provide simple, intuitive formats that can be customized quickly, without requiring advanced design skills or knowledge of specialized software.

- Quality and Professionalism: Despite being free, many of these formats maintain a high standard of design and structure, ensuring your documents are professional and well-organized.

By taking advantage of these readily available resources, you can save both time and money while ensuring your billing documents are effective and presentable. Whether you’re an independent practitioner or part of a larger operation, these free sources can meet your needs and help streamline your payment process.

Best Practices for Billing in Healthcare

Efficient billing practices are essential for maintaining smooth financial operations in any healthcare setting. Ensuring accuracy, clarity, and timely processing not only helps with cash flow but also builds trust with patients. By following best practices, you can reduce errors, improve patient satisfaction, and make the payment process more transparent for everyone involved.

Key Considerations for Efficient Billing

There are several important factors to keep in mind when creating and managing your billing documents. Adopting these practices will help ensure your processes are both efficient and effective:

- Ensure Accuracy: Always double-check patient details, services rendered, and costs. Small mistakes in these areas can lead to confusion and delayed payments.

- Provide Clear Descriptions: Clearly describe each service provided, including any relevant codes or terms that the patient may need to understand. This reduces confusion and questions about the charges.

- Include Payment Terms: Make sure to include clear payment terms, such as due dates and accepted payment methods. This helps set expectations for when and how payment is expected.

- Be Transparent: Transparency in billing is crucial. Provide itemized bills that allow patients to easily see the breakdown of charges for each service or treatment.

Leveraging Technology for Streamlined Billing

In addition to these practices, technology can significantly enhance the billing process. Using software or digital tools designed for billing management helps automate calculations, track payments, and send reminders to patients. This minimizes the chances of errors and speeds up the entire payment cycle.

By integrating these best practices into your billing process, you will create a more efficient and professional system that benefits both your practice and your patients. Clear communication, accuracy, and the right tools are key to successful financial management in healthcare.

How to Ensure Accurate Billing

Accurate billing is crucial for maintaining a healthy financial system within any practice or business. Errors in the billing process can lead to delays, disputes, and unnecessary confusion. To minimize these issues and streamline your operations, it is important to implement best practices that ensure precision and clarity at every step.

Here are several key strategies that can help guarantee accuracy in your billing process:

Steps to Achieve Accuracy

- Double-Check Patient Information: Always verify patient details, such as their name, address, and insurance information, before creating any billing document. This ensures that there are no mistakes in identifying the correct person.

- Review Services Rendered: Confirm that the services provided are correctly documented, including dates, descriptions, and applicable codes. Make sure all treatments are listed with proper detail to avoid confusion.

- Verify Prices and Rates: Ensure that the prices for each service are accurate and up-to-date. This includes checking any discounts, adjustments, or additional charges to make sure they are correctly applied.

- Use Automated Tools: If possible, integrate billing software that can automatically calculate totals, taxes, and discounts. This minimizes the risk of human error and speeds up the billing process.

Additional Tips for Maintaining Precision

- Standardize Billing Codes: Using standardized codes for services or treatments reduces ambiguity and ensures consistency across all billing documents. This is especially important for larger practices with multiple employees.

- Maintain Clear Payment Terms: Ensure that the payment due dates, methods, and any late fees are clearly stated in the billing document. Clear terms help avoid misunderstandings and make payment collection smoother.

- Review and Reconcile Regularly: Regularly audit your billing records to ensure everything aligns with the services provided and payments received. This helps catch errors before they turn into bigger issues.

By following these practices and maintaining a diligent approach, you can ensure that your billing process is both accurate and efficient. A transparent and error-free system not only helps with timely payments but also fosters trust with your clients and minimizes disputes.

Common Mistakes in Billing Documents

Errors in billing can cause delays in payments, confusion for patients, and administrative headaches. Identifying and correcting these mistakes early on is crucial for maintaining a smooth financial operation. Whether it’s small errors or larger inconsistencies, these issues can affect the overall accuracy and professionalism of your billing process.

Some of the most frequent mistakes in billing documents are easy to overlook but can lead to significant problems down the line. Here are the most common errors that occur during the billing process:

- Incorrect Patient Information: Mistakes in the patient’s name, address, or insurance details are common but can cause confusion or delays in processing payments. Always double-check the accuracy of this information before generating any document.

- Missing or Incorrect Dates: Dates of service should be clearly listed. Omitting this information or entering the wrong date can lead to misunderstandings, especially when dealing with insurance claims or payments.

- Unclear Descriptions of Services: Ambiguities in the description of the services provided can confuse patients or insurance providers. Be specific and detailed when outlining the treatments or services rendered to avoid potential disputes.

- Incorrect Pricing: Pricing errors, such as applying the wrong rates or forgetting to include discounts or additional charges, are common. Make sure all pricing is accurate and up-to-date to prevent discrepancies and ensure that the patient is billed correctly.

- Lack of Payment Terms: Failing to clearly state payment terms, such as due dates or accepted methods, can create confusion about when and how payment should be made. Clear terms ensure that both parties are on the same page and payments are received on time.

- Failure to Account for Insurance Adjustments: If a patient has insurance, not properly accounting for the insurance adjustment can lead to incorrect balances or overcharging. Always ensure that insurance deductions are correctly applied to the final amount due.

By being mindful of these common mistakes and implementing a thorough review process, you can significantly reduce the risk of errors in your billing system. Ensuring accuracy at every step will help build trust with your clients and improve the efficiency of your payment collection process.

Legal Requirements for Billing Documents

When it comes to generating financial statements, especially within healthcare settings, it’s important to ensure that all documents comply with legal standards and regulations. These requirements help protect both the provider and the patient by establishing transparency, accuracy, and fairness in the billing process. Understanding and adhering to legal obligations ensures that the document is valid and prevents disputes or potential legal issues.

Key Legal Considerations

There are several critical elements to include in every billing statement to ensure it meets legal standards. These requirements vary slightly depending on your location and the nature of your services, but some common elements are universally necessary:

- Patient Identification: It is mandatory to include the patient’s full name, address, and any other relevant identifying information. This ensures that the billing document correctly identifies the person being charged.

- Service Details: A clear, itemized list of services provided, including the date, description, and associated costs, must be included. This transparency is essential to prevent disputes and facilitate accurate insurance claims.

- Insurance Information: If applicable, the document must also reflect the patient’s insurance details, including the insurer’s name and the portion of the cost covered. This helps ensure that the insurance company processes the payment correctly.

- Payment Terms and Methods: Clearly stated terms regarding due dates, accepted payment methods, and any applicable fees or interest charges are legally required. This ensures both parties are aware of when and how payment is expected.

Compliance with Local and National Regulations

In addition to the common elements listed above, healthcare providers must be familiar with specific laws governing billing practices in their country or region. These laws could include consumer protection regulations, taxation requirements, and patient rights. Non-compliance could result in penalties, disputes, or even legal action, so it’s essential to stay updated on local regulations and industry standards.

By following these legal requirements, you not only create professional and compliant billing documents but also help maintain a trustworthy relationship with your clients and insurance providers. Consistent adherence to legal standards is crucial for smooth and transparent financial operations in any practice.

How to Add Payment Terms to Billing Documents

Including clear and concise payment terms in your financial statements is essential to ensure that both the service provider and the recipient are on the same page regarding the expectations for payment. Properly outlining these terms helps prevent confusion and ensures timely payments. Whether you’re offering a payment plan, a discount for early settlement, or specifying late fees, these details should be straightforward and easy to understand.

Here’s a step-by-step guide on how to add payment terms to your billing documents:

| Step | Action |

|---|---|

| 1 | Specify the Due Date: Clearly state when payment is due. This is usually a fixed date or a certain number of days after the service is rendered. A common timeframe is “30 days from the date of service.” |

| 2 | Define Accepted Payment Methods: List the ways in which you accept payment, such as credit cards, bank transfers, checks, or online payment platforms. |

| 3 | Late Payment Penalties: If you charge late fees, be sure to specify the amount or percentage that will be added to overdue payments. For example, “A late fee of 1.5% per month will be applied to overdue balances.” |

| 4 | Discounts for Early Payments: If applicable, provide details of any early payment discounts. For instance, “A 5% discount will be applied if the balance is paid within 10 days of the invoice date.” |

| 5 | Consequences of Non-payment: Outline any actions that will be taken if payment is not received within the specified period, such as suspension of services or referral to a collections agency. |

By following these steps, you can ensure that your payment terms are clear, professional, and legally sound, leading to smoother transactions and better cash flow management.

Tips for Streamlining the Billing Process

Efficiently managing financial documentation is key to ensuring smooth operations and timely payments. Streamlining the billing process not only saves time but also reduces errors, improving cash flow and client satisfaction. By adopting the right strategies and tools, you can make the entire process faster and more accurate.

Here are some valuable tips to help you streamline your billing procedure:

- Automate Where Possible: Use software tools that allow automatic generation and delivery of documents. This eliminates the need for manual entries and minimizes the chances of mistakes.

- Standardize Your Documents: Create a consistent format for all your financial records. Having a clear, uniform structure for all statements makes them easier to fill out, review, and understand.

- Use Clear and Concise Language: Avoid using complicated terms or jargon. A straightforward approach helps both clients and your team quickly understand payment requirements and avoid confusion.

- Set Up Recurring Billing: If you offer ongoing services, set up automatic recurring billing. This reduces the time spent on creating and sending documents each cycle.

- Provide Multiple Payment Methods: Offer various payment options, including online payment systems, credit cards, and bank transfers. The more accessible payment options you provide, the quicker clients can settle their balances.

- Implement Clear Payment Terms: Ensure payment terms are easy to read and understand. Clearly state due dates, late fees, and accepted payment methods to prevent misunderstandings.

By following these tips, you can significantly improve the efficiency of your billing system, reduce administrative burdens, and keep your financial operations running smoothly.

Integrating Documents with Billing Software

Connecting your financial documents with billing systems can drastically improve the efficiency of your operations. By integrating these documents into automated software, you can streamline the creation, tracking, and management of all your transactions. This integration reduces manual input, minimizes errors, and ensures consistency across all records.

Here are some key benefits and steps to consider when integrating your documents with billing software:

Benefits of Integration

- Time-saving: Automating the generation and distribution of financial documents saves time, allowing you to focus on other important tasks.

- Improved Accuracy: Reduces the risk of human error by automatically populating fields with accurate data from your system.

- Consistency: Ensures all documents follow the same structure and format, providing a professional and organized appearance.

- Faster Payments: With integrated payment options, clients can quickly settle their bills, improving your cash flow.

- Easy Tracking: Integrated software helps you keep track of payments, due dates, and outstanding balances in one place.

Steps to Integrate Documents with Software

- Choose Compatible Software: Select a billing system that supports integration with your existing document formats and processes.

- Upload Document Templates: Ensure your pre-designed financial documents are compatible and upload them into the software for easy customization.

- Automate Data Entry: Set up the software to pull client and transaction details automatically, reducing manual input and improving accuracy.

- Enable Payment Gateways: Integrate payment gateways that allow clients to pay directly through the generated documents, speeding up the payment process.

- Test and Adjust: Before fully implementing the integration, run tests to make sure all components work correctly and make any necessary adjustments.

By integrating your documents with billing software, you can create a seamless workflow, enhance efficiency, and provide a better experience for both your business and your clients.

How Free Templates Save Time and Money

Using pre-designed documents can significantly reduce the time and financial resources spent on creating customized records from scratch. These ready-made solutions offer a straightforward approach to managing business processes efficiently while ensuring professional results. Instead of dedicating hours to drafting new forms, you can focus on more strategic tasks that contribute to the growth of your business.

Here’s how ready-to-use formats can help you save both time and money:

Time Savings

- Quick Setup: Pre-designed documents can be downloaded and used immediately, eliminating the need for lengthy creation and formatting.

- Standardized Structure: With consistent and structured layouts, there’s no need to rethink the design or layout each time you need to send a new record.

- Easy Customization: Most free solutions allow for simple adjustments to personalize the documents with your business details, reducing the time spent on each task.

- Automatic Calculations: Some pre-built documents come with fields for automatic calculations, saving you from manually inputting totals and reducing the risk of errors.

Cost Savings

- Zero Software Expenses: Many of these tools are available for free, which means no need to invest in expensive billing software or graphic design services.

- No Design Costs: By using ready-made documents, you avoid the costs of hiring a designer to create custom forms from scratch.

- Reduced Administrative Overhead: Simplifying your record-keeping process reduces administrative burdens, allowing you to cut back on staff time or outsourcing services.

- Minimized Errors: Pre-formatted solutions reduce the chances of making costly mistakes, which can lead to delays, additional work, or financial losses.

By utilizing pre-built forms, you not only save valuable time but also reduce expenses, allowing you to allocate your resources toward more important areas of your business. The combination of ease and efficiency makes these solutions a practical choice for many organizations.

Understanding Medical Invoice Terminology

When handling payment records, it is crucial to understand the key terms used in these documents to ensure accuracy and clarity. These terms outline the transaction details and help both service providers and clients keep track of payments and outstanding balances. By familiarizing yourself with common terminology, you can navigate the process with confidence and avoid confusion.

Here are some important terms you should know when working with billing records:

- Charges: The amount billed for services rendered or products provided. It typically includes a breakdown of each item or service provided.

- Billing Period: The time frame during which the services or goods were provided. This period is important for establishing when payment is due.

- Due Date: The date by which the payment should be completed. It is important for both parties to understand when the funds are expected.

- Balance Due: The remaining amount owed after any previous payments have been applied. This figure is critical for tracking the payment status.

- Account Number: A unique identifier assigned to the client or transaction, used to track and manage the payment records efficiently.

- Payment Terms: The specific conditions under which payment is to be made. This could include installment plans, early payment discounts, or penalties for late payments.

Understanding these terms helps in creating clear, accurate, and effective financial documents. It also ensures that both parties involved in the transaction are aligned on expectations, which can minimize confusion and avoid disputes. Whether you’re a service provider or a client, knowing these key terms will make the billing process more transparent and manageable.