Medical Invoice Template Excel for Simple and Efficient Billing

Efficient management of billing and payment tracking is a crucial aspect of any healthcare practice. With the increasing volume of patients and services, keeping accurate records can become a challenge. Utilizing a well-structured digital document can simplify this process, allowing for faster, more reliable management of financial details.

By implementing a customizable system that can automatically calculate totals, apply payment terms, and track outstanding balances, professionals can reduce the risk of errors and improve the overall workflow. The ability to easily adjust and personalize the document to fit specific needs ensures flexibility, while maintaining a consistent format for all transactions.

In this guide, we will explore how to effectively create and manage such a system using a widely accessible tool. Whether you’re a healthcare provider or administrative staff member, this approach can significantly enhance your billing operations and ensure timely payments with less manual intervention.

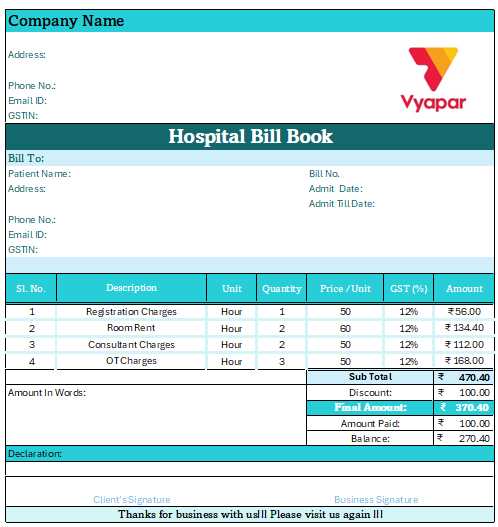

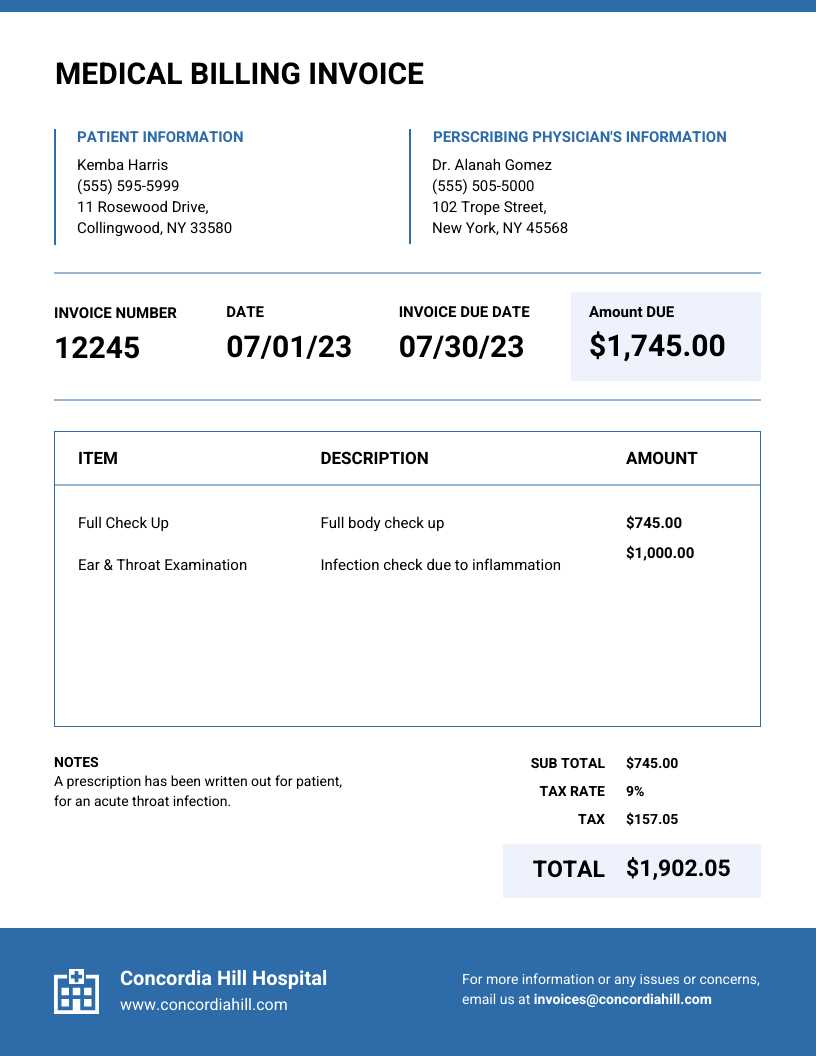

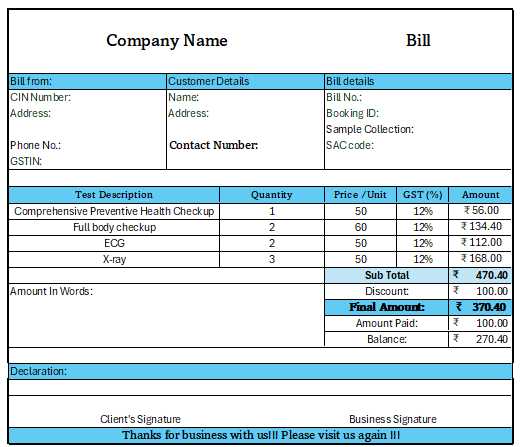

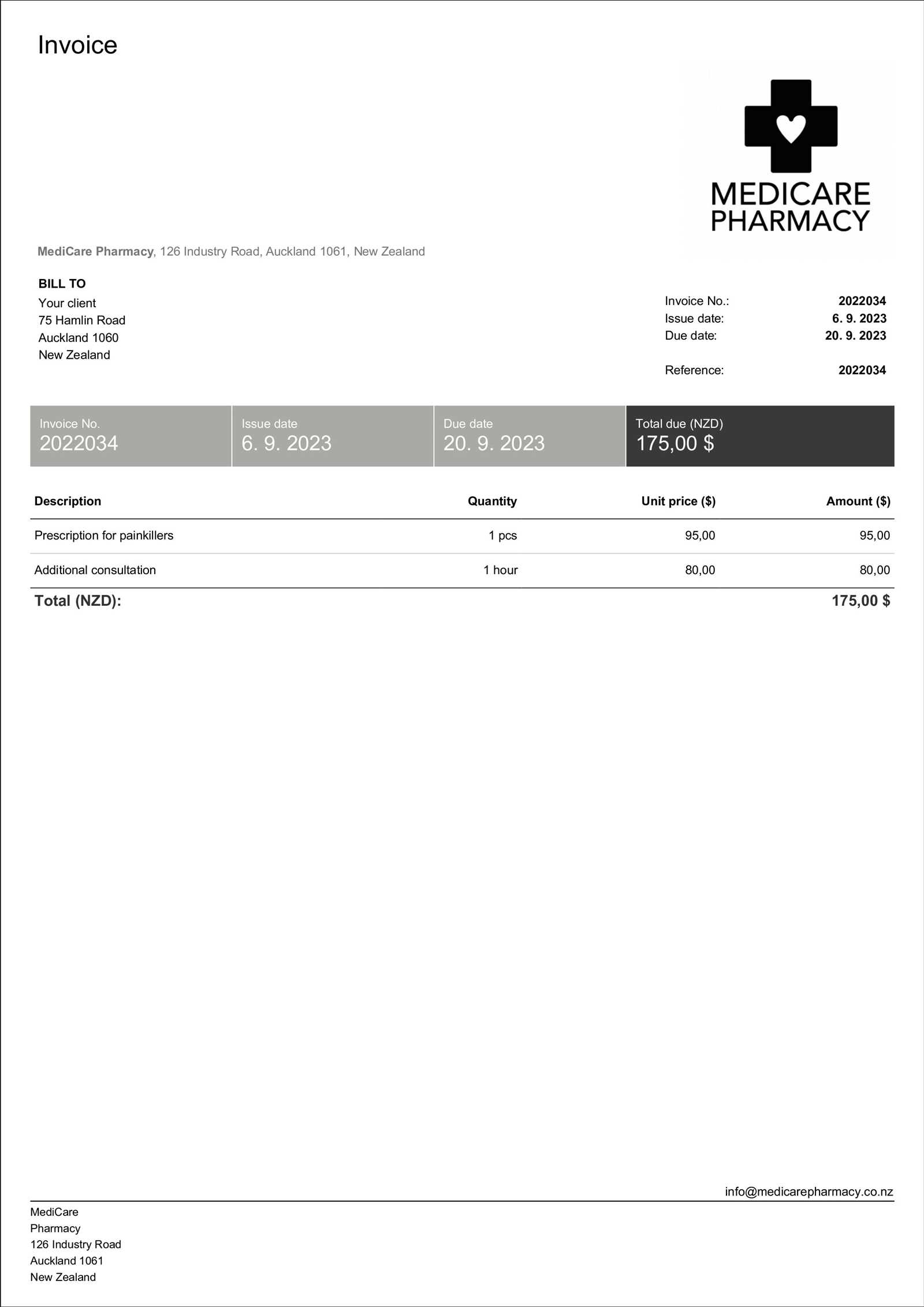

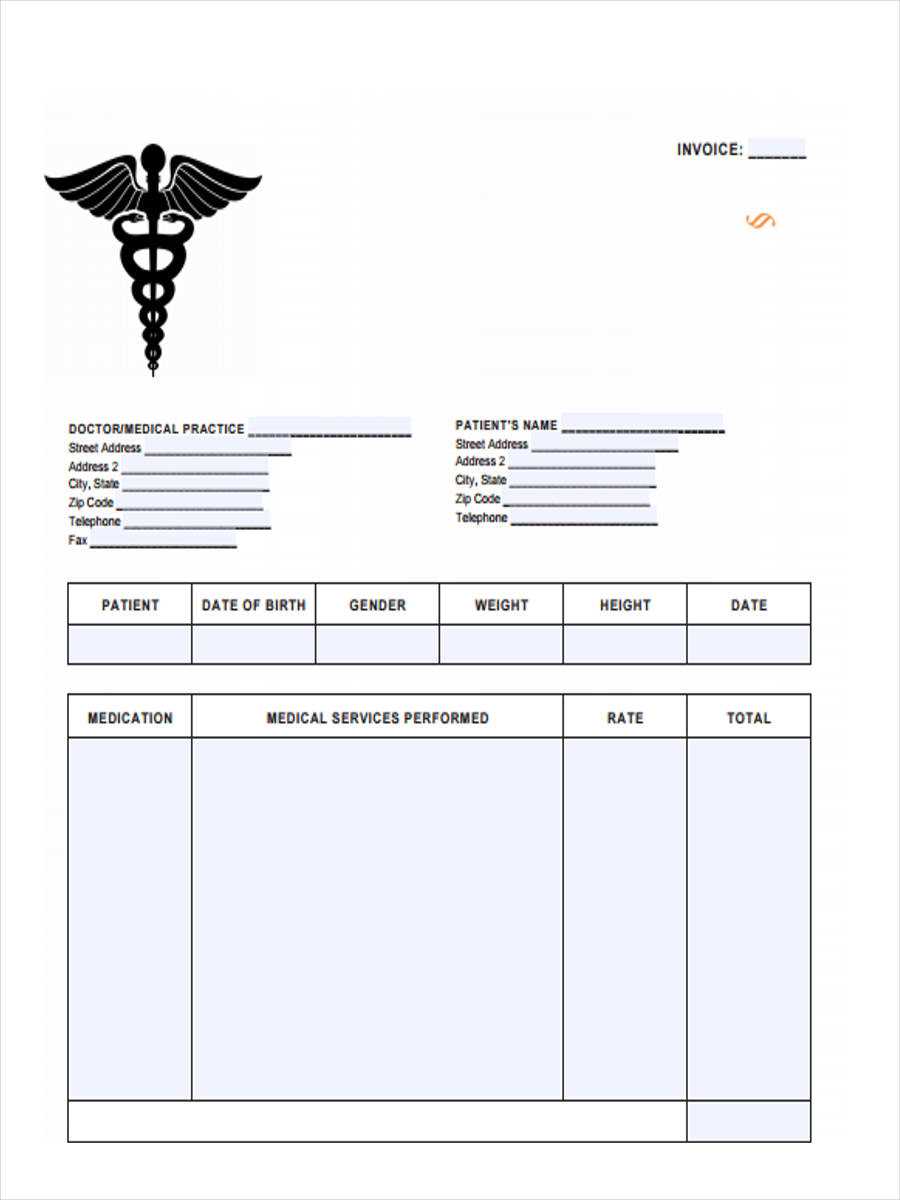

Essential Features of Billing Documents

Effective billing documentation goes beyond just listing charges. It plays a vital role in ensuring transparency, maintaining accurate records, and facilitating timely payments. To achieve these objectives, certain elements are crucial in crafting a comprehensive, professional financial statement for healthcare services. These key features contribute to clarity and help prevent confusion between service providers and clients.

Clear Identification and Contact Information

One of the most fundamental aspects of any billing document is the inclusion of both the service provider’s and the recipient’s details. This ensures that both parties are easily identifiable, preventing any errors related to payment or correspondence. Information such as names, addresses, and contact numbers should be prominently displayed, making it simple for both parties to reach out if needed.

Accurate Breakdown of Services and Charges

Providing a detailed list of services rendered, along with their respective charges, is essential for ensuring that the recipient understands exactly what they are being billed for. Itemizing each procedure or consultation and corresponding costs offers clarity and helps avoid misunderstandings. Additionally, including codes for specific services can be beneficial for insurance purposes or when submitting claims for reimbursement.

Including payment terms, due dates, and accepted methods of payment is equally important. These terms should be clearly stated to avoid confusion and encourage prompt settlement. An effective billing document should also include a

Why Use Spreadsheets for Billing

When it comes to managing billing processes, flexibility and ease of use are key factors that contribute to an efficient system. A simple, widely available tool can help streamline the creation of financial documents and track payments with minimal effort. Spreadsheets provide an accessible and customizable solution that allows users to design their billing structure according to specific needs while keeping everything organized in one place.

Customization and Flexibility

One of the main advantages of using a spreadsheet for financial documents is the ability to tailor it to individual requirements. Users can easily add or remove sections, adjust columns, and format the layout to suit the particular needs of their practice. Whether you’re dealing with various services, multiple payment methods, or specific terms and conditions, this adaptability allows for a streamlined, efficient workflow.

Automatic Calculations and Error Reduction

Spreadsheets offer powerful calculation functions that can significantly reduce manual work and the risk of errors. By setting up automatic summations, tax calculations, and discount applications, the chances of human mistakes are minimized. This ensures that totals are accurate and consistent, making it easier to maintain financial integrity and prevent discrepancies when billing clients.

Customizing Your Billing Document Structure

Creating a billing document that reflects your specific needs is essential for maintaining an organized financial system. By customizing the layout and contents, you can ensure that all necessary details are included and that the document is easy to understand for both you and your clients. Personalization not only improves the clarity of the statement but also helps ensure that all essential information is captured correctly.

Here are some key elements you can adjust to fit your practice or business:

- Header Information: Include your business or practice name, logo, contact details, and any other branding elements you want to feature prominently at the top.

- Service Descriptions: Clearly list each service provided with sufficient detail, including any applicable codes or special notes. This ensures transparency and avoids confusion.

- Payment Terms: Customize payment methods, due dates, and any late fees. This section helps set clear expectations for your clients.

- Tax and Discount Calculation: Set up formulas to automatically apply any taxes or discounts based on the services selected, ensuring accurate totals.

- Footer Information: You can add additional instructions, disclaimers, or thank-you notes at the bottom of the document to further personalize your communications.

By tailoring these features to meet the specific needs of your business or practice, you ensure that each financial document is functional, professional, and relevant to your clients.

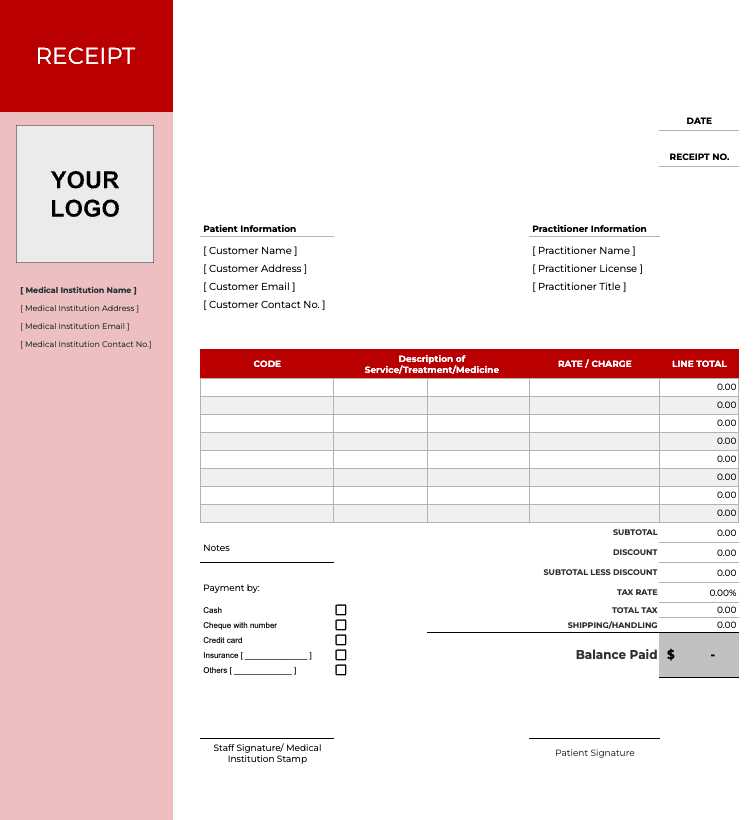

How to Add Patient Details

Accurate and complete patient information is essential for maintaining proper records and ensuring effective communication. When creating a financial document for services rendered, it’s important to include relevant details about the individual receiving the service. This not only helps in identifying the person but also facilitates future reference, billing, and follow-up procedures.

Key Information to Include

To ensure clarity and prevent any confusion, include the following details:

- Full Name: This should be clearly stated at the top of the document, allowing for easy identification of the client.

- Address: A complete address helps ensure that the client receives any necessary communications or physical copies of the statement.

- Contact Information: Include phone numbers and email addresses to enable prompt communication if needed.

- Unique Identifier: If applicable, include any reference numbers, patient ID, or account numbers for quick access to client history.

Where to Position Patient Details

Typically, the patient’s information should be placed at the top of the document, preferably in the header section. This ensures that it’s easy to find and immediately visible when reviewing the document. You can customize the layout to fit your design, but consistency is key for professional presentation and ease of use.

Understanding Billing Codes

Billing codes play a vital role in standardizing and streamlining the process of charging for services rendered. These codes are essential for categorizing procedures, treatments, and medical supplies, ensuring that both the service provider and the client have a clear understanding of what is being billed. They also help facilitate reimbursement from insurance companies and government programs.

Types of Billing Codes

There are several types of codes used to describe different aspects of the billing process. The most common include:

- CPT Codes (Current Procedural Terminology): These codes are used to describe specific medical procedures or services provided.

- ICD Codes (International Classification of Diseases): These codes describe the diagnosis or condition being treated.

- HCPCS Codes (Healthcare Common Procedure Coding System): These codes cover supplies, medications, and other healthcare services that aren’t covered by CPT codes.

Why Accurate Coding Matters

Accurate use of these codes ensures that the billing process is precise and compliant with regulations. Incorrect coding can lead to delays in payment, disputes, or even audits. Additionally, having a reliable system in place to assign the correct codes helps to ensure timely and appropriate reimbursement, reducing the administrative burden on both providers and clients.

Including Itemized Services in Billing Documents

When creating a billing statement, providing a detailed breakdown of services ensures transparency and clarity for both the service provider and the client. An itemized list allows the recipient to easily understand what they are being charged for, which can prevent misunderstandings and disputes. It also provides a clear record for future reference and supports the accuracy of payments and reimbursements.

Why Itemizing Services is Important

Itemizing services allows for a clear and organized representation of all the treatments, consultations, or supplies provided. Each service can be listed with its associated cost, helping the client see the exact charges and making it easier to cross-check with the provider’s records. This practice is particularly beneficial when working with insurance companies or third-party payers, as it offers detailed information that can be submitted for claims.

How to Structure an Itemized List

When listing services, ensure each entry contains the following details:

- Description of Service: A brief but clear explanation of the service provided.

- Quantity: The number of times the service was rendered, if applicable.

- Unit Cost: The price per individual service or item.

- Total Amount: The cost for each service, calculated by multiplying the quantity and unit cost.

Organizing services in this manner helps the recipient quickly understand the charges and reduces the likelihood of errors or confusion. A well-structured itemized list is a key element in creating professional and effective financial documentation.

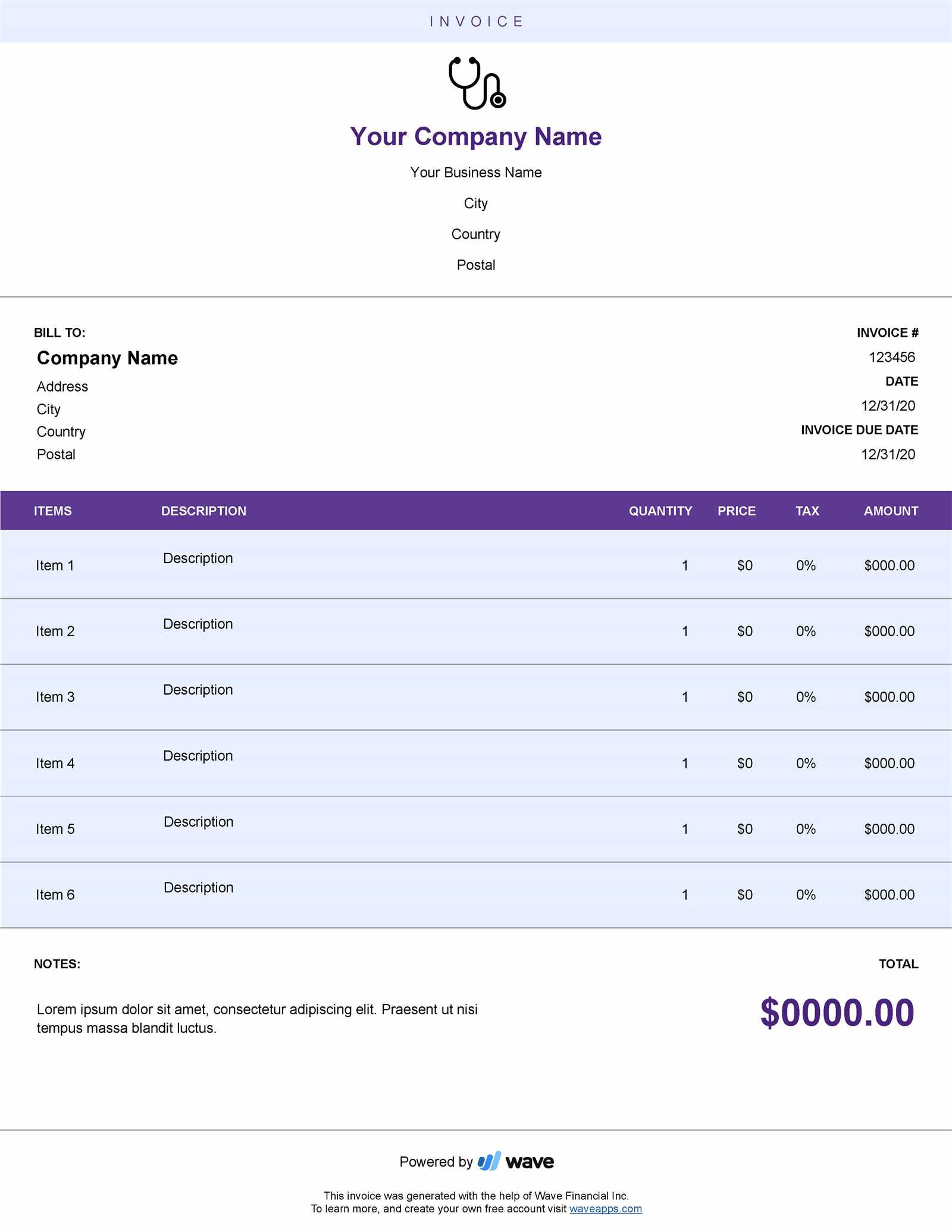

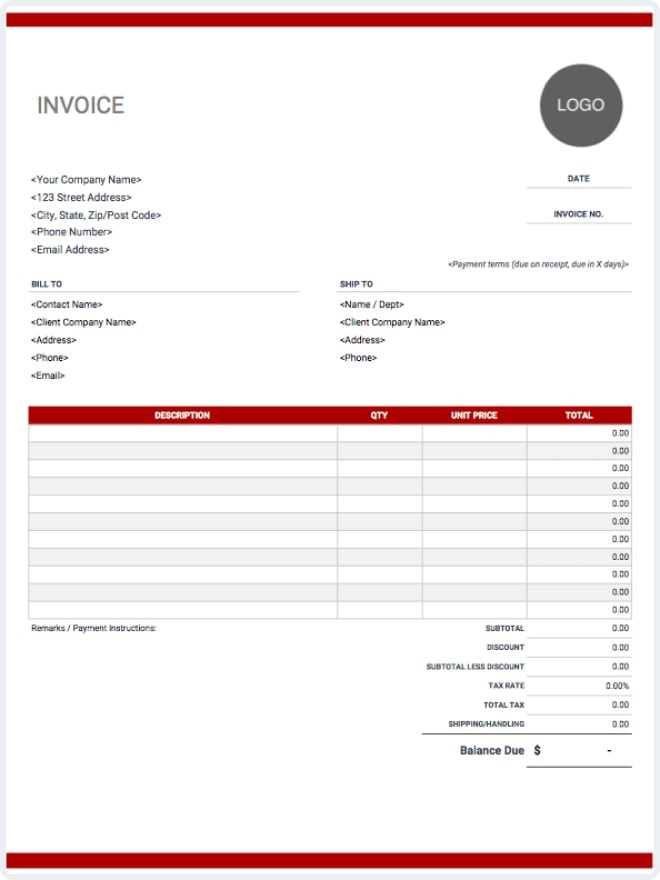

Formatting Your Billing Document Structure

Proper formatting is essential when creating a financial document to ensure that all relevant details are presented clearly and professionally. A well-organized document improves readability, reduces errors, and ensures that clients can easily interpret the charges. When formatting, it’s important to strike a balance between design and functionality, making sure the document looks polished while retaining all necessary information.

Key Formatting Elements

When organizing your financial document, consider the following elements to enhance clarity and presentation:

- Header Section: The header should include the name of your practice or business, contact information, and the document’s title. Ensure it stands out by using larger fonts or bold text for easy identification.

- Service Details: List all services in a clear, organized table. Use bold or colored text for headings like “Service Description,” “Unit Cost,” and “Total Amount” to differentiate them from the entries below.

- Totals and Payment Information: Place the total amount due in a prominent section at the bottom of the document. Make sure payment terms and due dates are clearly visible.

Design Tips for Clarity

To make the document both functional and visually appealing, follow these design tips:

- Consistent Fonts: Use readable fonts such as Arial or Calibri for easy navigation. Stick to one or two font styles for uniformity.

- Color Coding: Consider using light colors to highlight headings or totals. Avoid overly bright or distracting hues that could reduce readability.

- Spacing and Margins: Adequate spacing between sections makes the document look clean and allows for easy scanning of information. Use consistent margins for a professional appearance.

By following these formatting principles, you can ensure your financial document not only looks professional but also functions effectively for both you and your clients.

Adding Payment Terms for Clarity

Clearly defined payment terms are essential for avoiding misunderstandings and ensuring a smooth financial transaction. By outlining when and how payments are due, you provide both yourself and your clients with a clear understanding of expectations. This helps to reduce confusion and ensures timely payments, making the entire process more efficient and professional.

Including specific details such as the payment due date, acceptable methods of payment, and any late fees or penalties for overdue payments sets clear guidelines. These terms should be prominently displayed to ensure they are easily seen and understood. Whether it’s a fixed due date or a range of payment options, these details should be simple and direct, leaving no room for ambiguity.

In addition, including information about installment plans or discounts for early payments can further incentivize timely settlement, improving cash flow and building trust with clients. By setting these expectations upfront, both parties are aligned and potential disputes or delays can be avoided.

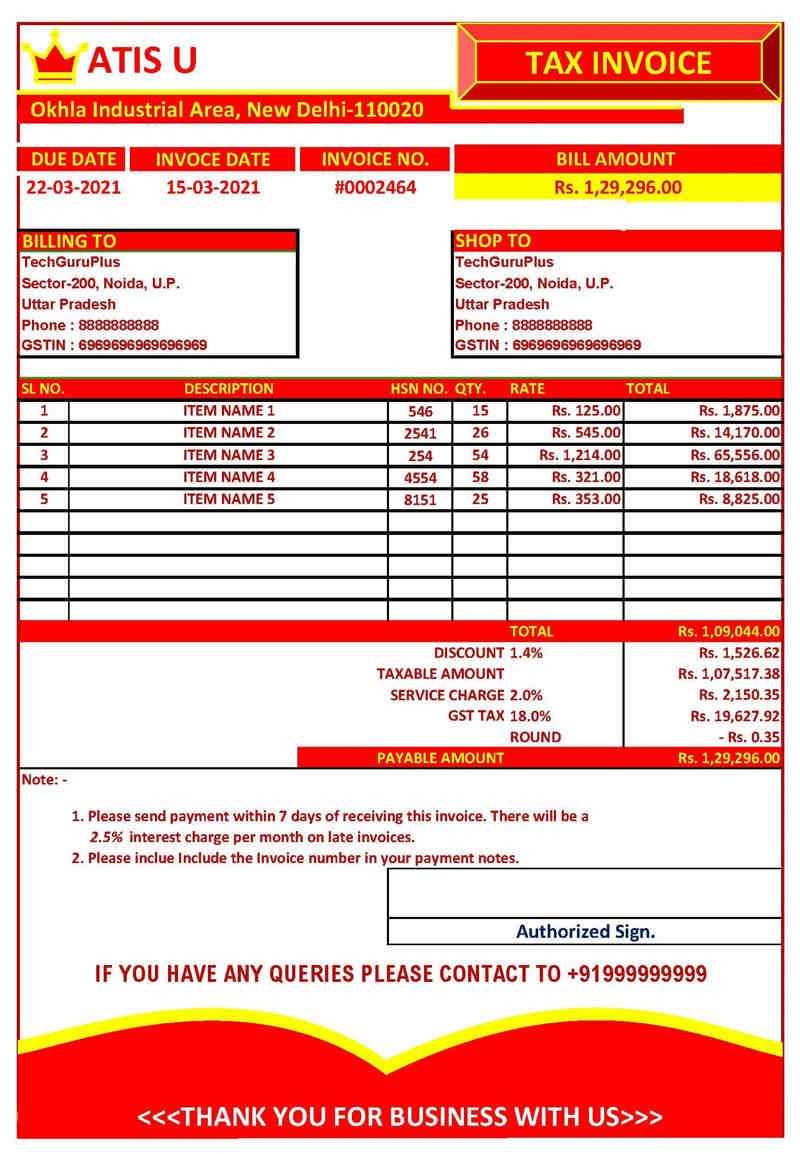

Calculating Totals Automatically in Spreadsheet Software

Automating the calculation of totals is an effective way to minimize errors and save time when creating financial documents. By using built-in functions and formulas, you can quickly sum up charges, taxes, and discounts without the need for manual calculations. This not only increases efficiency but also ensures accuracy throughout the entire document.

To calculate totals automatically, most spreadsheet programs offer simple functions like SUM that can be applied to ranges of numbers. For example, you can set up your sheet so that as you input individual costs or quantities, the total amount due is calculated instantly. This real-time calculation ensures that the final amounts are always up to date, even when other values are adjusted.

In addition, more advanced features such as conditional formatting or custom formulas allow you to account for variables like discounts, taxes, or late fees. By integrating these functions, your document becomes more dynamic, automatically adjusting totals based on the data entered. This capability enhances both the accuracy and speed of your financial processes, making your workflow smoother and more professional.

Integrating Taxes into Billing Documents

Incorporating taxes into your financial documents is an essential aspect of ensuring compliance and transparency. When preparing a document for payment, including applicable taxes helps both you and the recipient clearly understand the total amount due. Properly integrating tax rates and calculating them automatically ensures that the final charges reflect the correct amounts required by law.

Steps for Including Taxes

Here are the key steps to integrate taxes into your billing process:

- Determine the Applicable Tax Rate: This varies by location and type of service. Be sure to check local tax laws to ensure the correct rate is used.

- Set Up Tax Fields: Include a section in your document specifically for tax calculations, separating it from other charges for clarity.

- Apply Tax Calculations: Use formulas to automatically calculate the tax based on the subtotal amount. This ensures accuracy and reduces manual errors.

Tax Calculation Example

For example, if the subtotal for services provided is $500 and the applicable tax rate is 5%, the tax would be calculated as follows:

- Tax Amount: $500 x 0.05 = $25

- Total Amount Due: $500 + $25 = $525

By adding taxes in this way, you ensure that the total amount due is accurate and complies with local tax regulations. This helps both parties understand the financial requirements and prevents any confusion when making payments.

Tracking Payments and Outstanding Balances

Effectively managing payments and monitoring outstanding balances is crucial for maintaining smooth cash flow and ensuring timely settlements. By keeping track of amounts paid and any remaining balances, you can quickly identify which accounts are current and which need attention. This process helps prevent missed payments and allows for proactive communication with clients when necessary.

To track payments and outstanding amounts, it’s essential to have a clear and organized system in place. This includes recording each payment as it’s received and noting the outstanding balance for each client. Automating this process in a financial record can save time, reduce errors, and ensure all payments are accounted for accurately.

By setting up fields specifically for payment tracking, you can easily update and monitor the progress of payments, ensuring that clients are reminded of their responsibilities and that no outstanding balance goes unnoticed.

Maintaining Accurate Records in Spreadsheet Software

Accurate record-keeping is essential for tracking financial transactions, ensuring that all data is correct and up-to-date. By keeping detailed records, you not only maintain transparency but also create a reliable system for reviewing and auditing financial information. Using a digital platform provides flexibility and efficiency in managing these records.

One key to maintaining accuracy is ensuring that all entries are properly categorized and entered in real-time. This helps avoid discrepancies and allows for immediate identification of errors. Furthermore, using built-in functions such as data validation and conditional formatting can reduce the risk of human error and streamline the record-keeping process.

Another important aspect is regularly backing up your data and organizing it in a way that makes it easy to retrieve. Consistently updating records and reviewing them periodically will help ensure that all financial information remains accurate and accessible when needed. The ability to generate reports and summaries also adds a layer of efficiency, offering quick insights into the overall financial status.

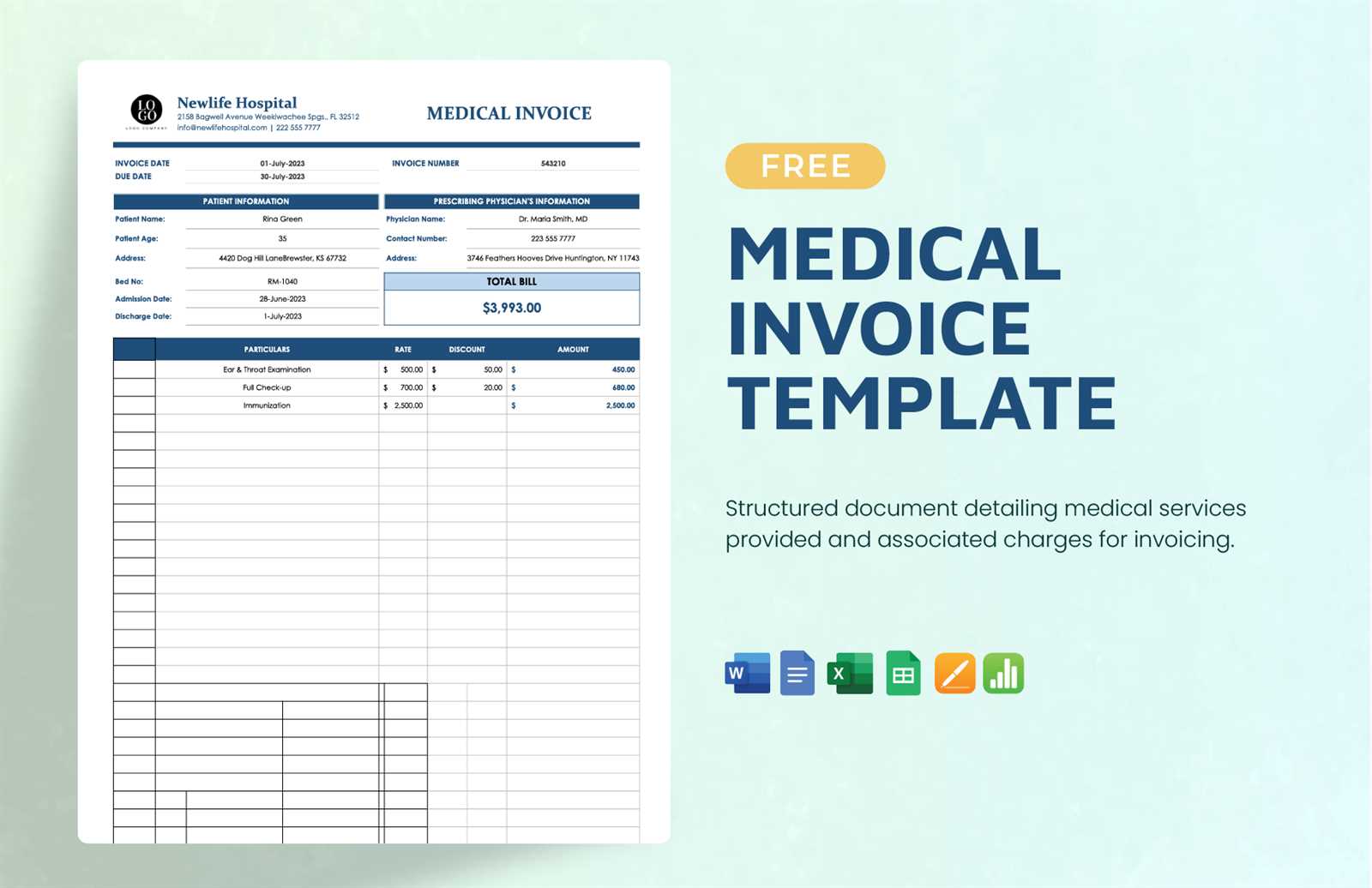

Using Templates for Streamlined Billing

Utilizing pre-designed structures for financial documentation can greatly enhance efficiency and accuracy in the billing process. These ready-to-use forms allow for quick data entry, ensuring that all necessary information is included without the need for starting from scratch each time. This streamlining not only saves time but also minimizes the risk of missing important details.

Benefits of Using Pre-Designed Forms

One of the main advantages of using structured forms is the consistency they provide. With fixed fields for all the required information, such as services rendered, amounts, and payment terms, these forms make it easy to maintain uniformity across all financial records. This consistency also simplifies the process of reviewing or auditing the records, as all documents follow the same format.

Customizing for Specific Needs

While pre-designed structures save time, they can also be customized to meet the unique needs of your business. You can adjust the layout, add or remove fields, and include branding elements to create a professional and tailored document. Customizing these forms ensures they suit your specific requirements while maintaining the benefits of automation and ease of use.

Ensuring Compliance with Legal Standards

Adhering to legal regulations is essential in all financial dealings, especially when it comes to billing and payments. Complying with local and national laws ensures that transactions are conducted transparently and ethically, protecting both the service provider and the client. It’s important to be aware of the specific requirements, such as tax rates, required disclosures, and payment terms, to avoid legal complications.

To ensure compliance, it is crucial to integrate the necessary elements into your financial records. These may include accurate tax calculations, proper identification of both parties, and the inclusion of all legally required information. Below is an example of key components that should be included to stay compliant:

| Element | Description |

|---|---|

| Tax Identification Number | Required for both the service provider and the client in some jurisdictions to track tax obligations. |

| Payment Terms | Clearly state the payment due date, late fees, and other relevant conditions to comply with contractual obligations. |

| Service Description | Provide a clear description of the services rendered to ensure there is no ambiguity or confusion about the charges. |

| Applicable Taxes | Ensure all taxes are correctly calculated and displayed based on current tax rates, including any regional or state-specific variations. |

By ensuring these elements are correctly implemented, you can maintain compliance with all necessary legal standards and avoid potential fines or disputes. Regularly reviewing the requirements will help keep your records accurate and up-to-date with any changes in legislation.

Common Mistakes to Avoid in Billing Statements

When creating financial statements, it’s essential to ensure accuracy and clarity. Even minor errors can lead to misunderstandings, delayed payments, or legal issues. By being aware of common mistakes, you can ensure that your records are both professional and legally compliant. Below are some frequent errors to avoid when preparing financial documents.

| Error | Consequences | Prevention Tips |

|---|---|---|

| Missing Contact Information | Delays in payment and difficulty in contacting clients. | Ensure both the sender’s and recipient’s details are clear and correct. |

| Incorrect Tax Calculations | Legal issues, incorrect payments, and audits. | Double-check tax rates and use automated calculation tools. |

| Lack of Payment Terms | Confusion about due dates and potential disputes over fees. | Clearly state payment due dates and any late fees upfront. |

| Unclear Descriptions of Services | Misunderstandings about charges leading to disputes. | Provide specific and detailed descriptions of all services rendered. |

| Forgetting to Include Late Fees | Unpaid amounts and delays in future payments. | Always include applicable late fees if payments are overdue. |

By taking the time to avoid these common mistakes, you can ensure that all financial documents are precise, professional, and clear. This not only helps with the smooth flow of business but also fosters trust with clients and ensures timely payment processing.

How to Save Time with Pre-built Documents

Using pre-designed documents can significantly reduce the time spent on administrative tasks. With the right setup, repetitive processes such as generating financial statements, tracking transactions, and managing customer details can be completed with ease. By streamlining these tasks, you can focus on other important aspects of your work, making the overall process more efficient and less prone to error.

One of the main advantages of pre-built structures is their ability to automate common calculations. With formulas already in place, you don’t have to manually compute totals, taxes, or discounts each time. This eliminates the risk of human error and speeds up the overall process. Additionally, many of these documents come with ready-made fields for client information, services rendered, and payment terms, making it easy to fill in and update as needed.

Another time-saving feature is the ability to quickly adapt documents for different purposes. Whether it’s for different clients or varying service types, a pre-set structure allows you to make adjustments without starting from scratch. By saving your customized versions, you can reuse them for future projects, keeping your workflow fast and organized.

Improving Invoice Accuracy and Efficiency

Ensuring precision and reducing time spent on generating financial documents is crucial for both small businesses and large organizations. Streamlining the process while minimizing human errors can lead to a more efficient workflow and improved customer satisfaction. By implementing the right tools and techniques, it’s possible to enhance both the accuracy and speed of financial recordkeeping tasks.

Key Strategies for Accuracy

- Automate Calculations: Use built-in formulas to automatically calculate totals, taxes, and discounts. This minimizes the risk of errors during manual entry.

- Standardized Fields: Create consistent sections for client information, services, and payment terms. This reduces confusion and ensures all required details are included.

- Double-Check Data Entry: Use data validation tools to prevent incorrect information from being inputted, such as incorrect dates or incorrect service descriptions.

Efficiency-Boosting Tips

- Pre-set Layouts: Design reusable layouts for commonly used financial documents. Save time by reusing templates that already contain the necessary fields and formulas.

- Integration with Other Systems: Link your documents with other software or databases, such as customer management systems or accounting tools, to avoid duplicate data entry.

- Use Bulk Generation Features: For multiple transactions or similar documents, batch creation tools allow you to generate several financial records in a fraction of the time.

By incorporating these practices, businesses can not only improve the accuracy of their financial records but also streamline their workflow to maximize productivity and reduce administrative overhead.

Managing Multiple Patient Invoices

Handling multiple financial records for various clients can be a challenging task, especially when accuracy and timeliness are paramount. To manage a large volume of records effectively, it’s essential to implement strategies that allow for efficient tracking, updating, and storage. With the right tools and organization methods, processing and maintaining these records becomes less time-consuming and more reliable.

Organizing and Tracking Client Records

- Use Separate Sheets: Divide records by client or service type. Keeping separate sections for each ensures easy access and reduces the risk of mixing up details.

- Client ID Numbers: Assign a unique identifier for each client. This helps avoid confusion and makes searching for a specific record faster and more precise.

- Track Payment Status: Clearly mark whether a payment is pending, completed, or overdue. Color-coding or adding a payment status column can help streamline the process.

Efficient Data Entry and Retrieval

- Pre-populate Common Fields: Use reusable forms or databases to auto-fill standard client information like names, addresses, and contact details to speed up data entry.

- Batch Processing: For routine updates, use bulk-edit features to modify multiple records simultaneously, saving time and reducing the chances of mistakes.

- Centralized Storage: Store all documents in a centralized location, preferably in digital format, for easy access and quick retrieval. This also simplifies record-keeping and backup processes.

By implementing these strategies, managing a high volume of client financial records becomes more organized, allowing businesses to stay on top of their tasks and maintain a high level of professionalism.