Customizable Medical Bill Invoice Template for Accurate Billing

Efficient and accurate invoicing is essential for healthcare providers to ensure timely payments and maintain smooth financial operations. Proper documentation and clear breakdowns of charges can significantly reduce errors and disputes, making the entire process more manageable for both the service provider and the patient. With a structured approach, you can save time, reduce administrative work, and improve cash flow.

Using a standardized method for creating detailed financial statements allows healthcare professionals to focus on patient care rather than worrying about billing complications. By incorporating essential components such as service dates, procedures, and payment terms, you can ensure clarity and transparency in every transaction.

Whether you’re running a private practice or managing a clinic, implementing an efficient billing system can help you maintain a professional image and establish trust with your patients. A well-organized approach makes it easier to track payments, manage accounts, and quickly identify any discrepancies.

Essential Features of a Medical Bill Invoice

To ensure a smooth and effective billing process, it is crucial to include certain key elements in your financial statements. These features help make transactions clear and transparent, both for the healthcare provider and the patient. An organized structure not only reduces errors but also simplifies the tracking and processing of payments.

Clear Identification of Services Rendered

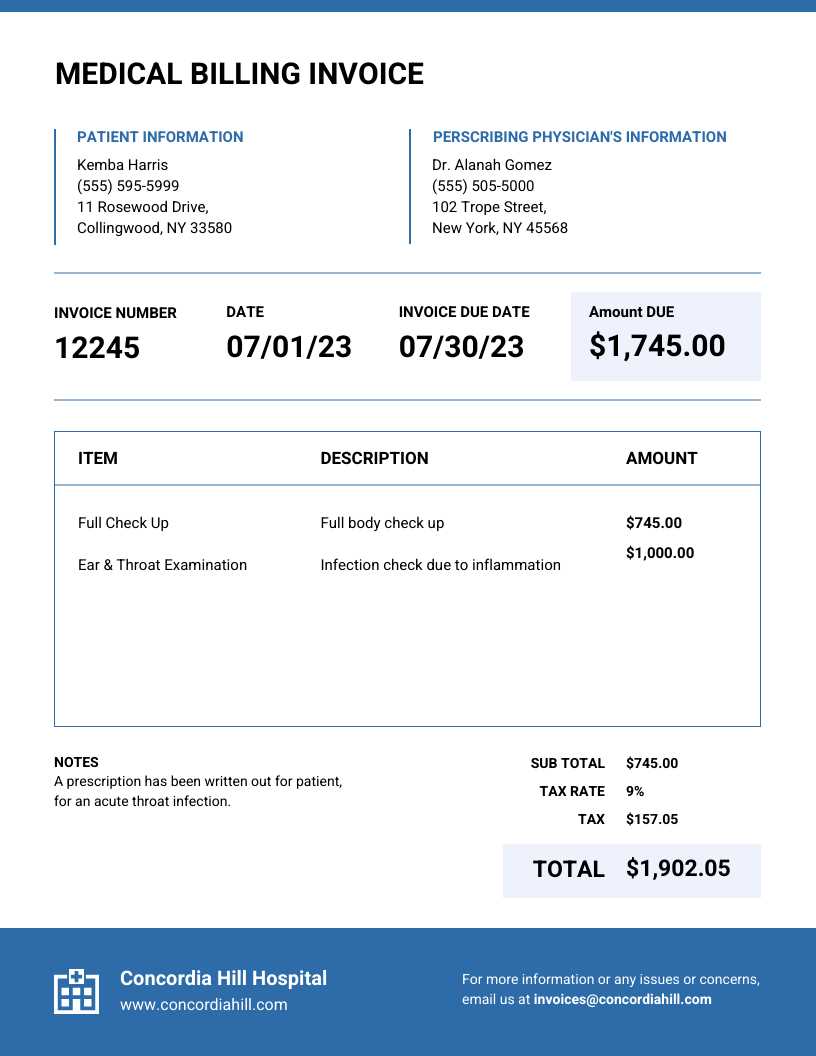

One of the most important aspects is a detailed breakdown of the services provided. Each procedure or consultation should be listed separately with clear descriptions, including the date it was performed. This level of detail ensures both parties understand the charges and prevents misunderstandings regarding the costs.

Accurate Payment Terms and Due Dates

Payment terms should be explicitly outlined, including due dates, acceptable payment methods, and any applicable late fees or discounts for early payments. This sets clear expectations and helps patients manage their payments accordingly. Providing this information upfront minimizes the risk of delayed or missed payments.

Including all necessary details such as contact information, references, and unique identifiers for both parties also contributes to a more organized and professional approach, improving communication and ensuring a smoother financial interaction.

Why You Need a Medical Invoice Template

Creating detailed financial records for healthcare services is essential for maintaining organization and ensuring timely payments. A structured approach can save significant time, reduce the risk of errors, and enhance professionalism in dealing with patients and insurance providers. Having a predefined format streamlines the entire process, making it easier to track transactions and minimize discrepancies.

Consistency is one of the primary reasons why utilizing a standardized format is important. With a consistent structure, you can quickly generate accurate statements that include all necessary details, such as service descriptions, charges, and payment terms. This eliminates the need to start from scratch with every new transaction.

Additionally, a well-structured document can improve communication between healthcare providers and patients. By making the billing process transparent, patients are more likely to understand the charges and feel confident in their financial obligations, ultimately leading to faster payments and reduced administrative workload.

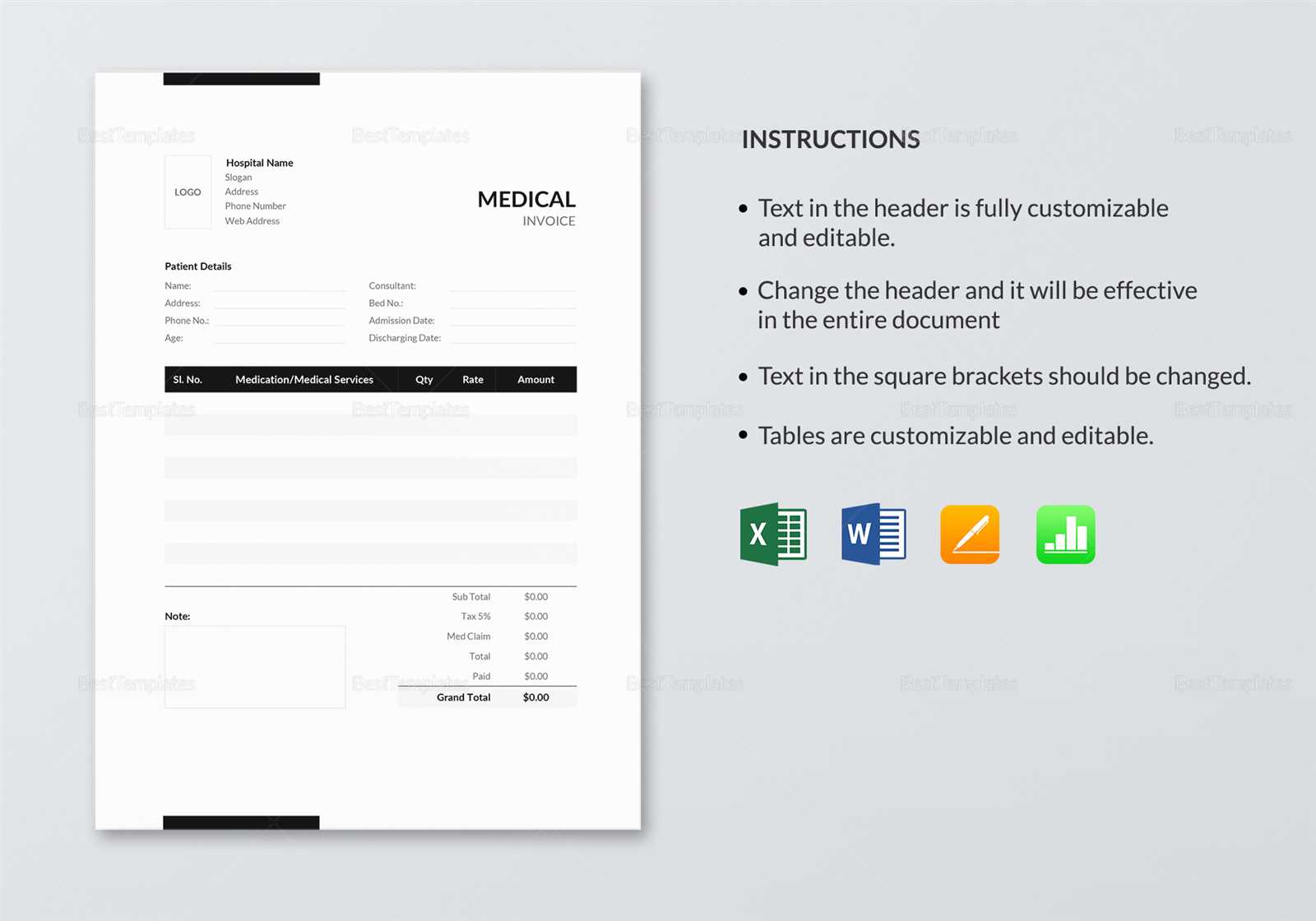

How to Customize Your Invoice Template

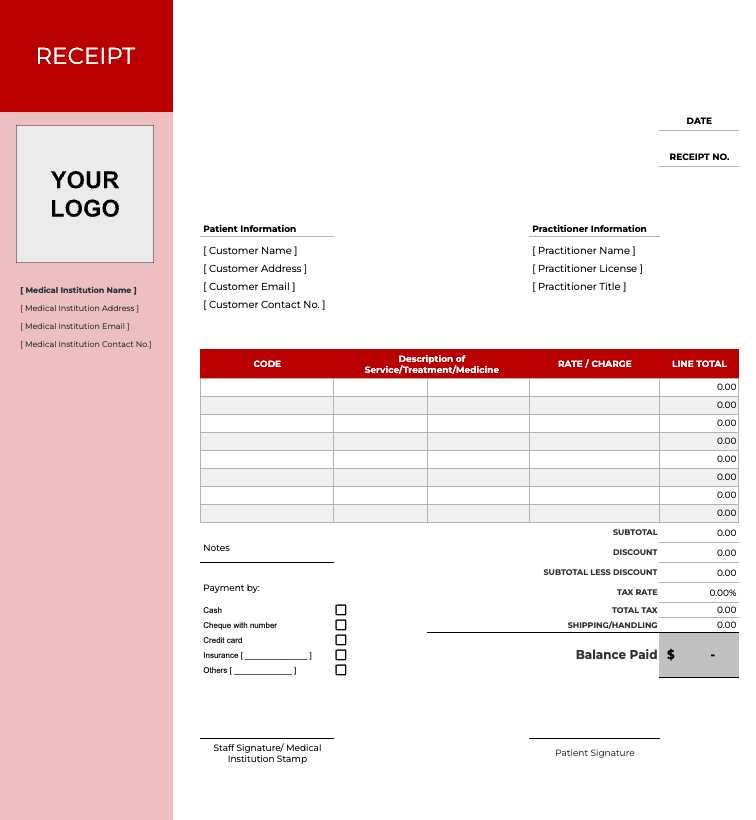

Tailoring your billing format to meet the specific needs of your practice can significantly improve efficiency and accuracy. Customization allows you to incorporate essential elements that reflect your business identity while ensuring that all necessary details are included. By adjusting the layout, design, and structure, you can create a document that is both professional and easy to use for both you and your patients.

Adjusting the Layout and Design

One of the first steps in personalizing your financial document is choosing a layout that fits your style and brand. You can include your logo, adjust font styles, and select appropriate colors that align with your practice’s identity. A well-organized layout not only makes the statement more visually appealing but also enhances its readability, helping recipients to quickly understand the information.

Including Specific Payment Information

Adding custom fields for payment terms, discount offers, or additional instructions ensures that each statement meets your unique requirements. For example, you can include specific details about insurance billing, payment plans, or any other relevant terms that are unique to your practice. This customization improves clarity and helps prevent misunderstandings about payment expectations.

Customizing your document for your practice ensures a more efficient billing cycle. It helps maintain professionalism while streamlining communication with patients and insurance companies.

Key Elements of a Medical Bill

For an efficient and accurate financial statement, certain details are essential to ensure both parties have a clear understanding of the charges and payment expectations. A well-organized document provides transparency, reduces confusion, and facilitates smoother transactions between healthcare providers and patients.

Service Description and Date

Each service provided should be clearly described with corresponding dates. This helps patients easily identify what they are being charged for and when the services were rendered. Whether it’s a consultation, procedure, or treatment, each item should be listed with enough detail to avoid ambiguity.

Payment Terms and Amounts Due

Payment terms are another crucial component. Clear communication about the amount due, payment deadlines, and accepted methods ensures that the patient understands their financial responsibility. Including any discounts, insurance coverage, or payment plans helps to clarify the total amount owed and reduces the likelihood of misunderstandings.

By including these key elements, healthcare providers can enhance the transparency and professionalism of their billing process, leading to smoother interactions and faster payments.

Benefits of Using a Pre-Made Template

Utilizing a pre-designed format for financial statements offers numerous advantages, making the billing process faster, more efficient, and error-free. Pre-made formats are especially useful for healthcare providers who need a reliable and consistent way to manage financial records without starting from scratch each time.

Time and Effort Savings

By using an established structure, you eliminate the need to manually create documents from the ground up. This not only saves valuable time but also allows you to focus on other critical aspects of your practice. Some of the key time-saving benefits include:

- Ready-made structure that reduces document creation time.

- Predefined fields that make data entry faster.

- Quick customization for specific needs, such as service types or patient details.

Enhanced Accuracy and Consistency

Pre-made formats are designed with common industry standards in mind, ensuring that all necessary details are included in the right order. This helps maintain consistency across all your records and reduces the chances of missing critical information. Benefits include:

- Standardized structure that ensures all necessary elements are present.

- Reduced risk of human error due to predefined fields.

- Consistency in presentation, improving professionalism.

Using a ready-made structure can significantly streamline the billing process, improve efficiency, and minimize errors, all while maintaining a professional appearance for your practice.

How to Ensure Accurate Billing

To maintain smooth financial operations, it is essential to ensure that every statement is accurate and free from errors. Accurate billing not only helps avoid disputes but also improves cash flow and builds trust with patients. There are several key steps you can take to prevent mistakes and ensure that all charges are correctly documented and processed.

Double-Check Service Descriptions and Amounts

One of the most critical factors in accurate billing is ensuring that each service and charge is correctly listed. Make sure that the descriptions are clear, the quantities match what was provided, and the corresponding fees are accurate. A simple mistake in these areas can lead to confusion or delayed payments.

Keep Track of Payments and Adjustments

Regularly monitor payments and any adjustments to ensure that outstanding amounts are promptly addressed. Below is a sample table that shows how to track the status of each charge and payment:

| Service Description | Charge | Payment Received | Amount Due | Status |

|---|---|---|---|---|

| Consultation | $150 | $150 | $0 | Paid |

| Procedure | $400 | $200 | $200 | Partial Payment |

| Follow-up Visit | $100 | $0 | $100 | Unpaid |

Regularly updating this type of record helps you stay on top of what

Common Mistakes in Medical Billing

Accurate financial records are crucial for smooth operations, but mistakes can easily happen when managing charges and payments. Whether it’s miscommunication with patients or errors in data entry, these mistakes can lead to delayed payments, financial discrepancies, and strained relationships. Identifying and addressing common errors can significantly improve the billing process and ensure a smoother transaction flow.

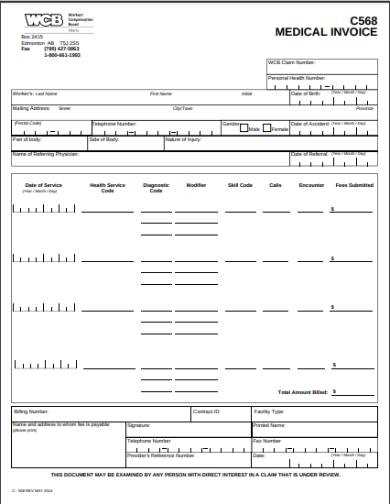

Incorrect Service Codes or Descriptions

One of the most common errors is entering incorrect service codes or descriptions. If the procedure or treatment is not accurately described or assigned the wrong code, it can lead to confusion or incorrect charges. Double-checking the service codes and ensuring they are in line with what was actually provided can help avoid this issue. Always verify with up-to-date coding guides to ensure accuracy.

Failure to Update Insurance Information

Outdated or incorrect insurance information can result in claim rejections or delayed payments. Ensure that patient insurance details are always current and accurately entered into the system. This includes checking the policy number, coverage limits, and any changes to the insurance provider. Regular updates can prevent costly mistakes and ensure timely reimbursement.

Missing or Incomplete Payment Terms

Another frequent mistake is failing to clearly outline the payment terms. Not including details like the due date, payment methods, or late fees can confuse patients about their financial obligations. Clearly specifying all payment terms upfront helps avoid confusion and ensures that patients know exactly what is expected from them.

Not Verifying Charges Before Submission

It’s easy to overlook small errors in charge amounts, especially when dealing with a large volume of transactions. Always verify each charge before submission to ensure accuracy. Simple arithmetic mistakes or overlooked charges can add up quickly, leading to discrepancies that could delay payment processing.

By being aware of these common mistakes and implementing proper checks and balances, healthcare providers can improve the accuracy of their financial records and ensure a more efficient billing cycle.

How Templates Save Time and Effort

Using a pre-designed structure for creating financial documents can dramatically reduce the time and effort required for each transaction. Instead of starting from scratch with every new record, a consistent and predefined format allows you to quickly input the necessary details and focus on more important tasks. The process becomes faster, more efficient, and less prone to errors.

Time Efficiency

One of the main benefits of using a pre-established format is the time saved by not having to design a document every time you need to record a transaction. This efficiency comes from:

- Quick entry of essential information: Fields for names, dates, charges, and payments are already in place.

- Instant accessibility: You don’t need to manually set up a new document every time; simply open the saved format and enter the required details.

- Reduced setup time: Formatting, such as fonts, headers, and alignments, is already taken care of.

Effortless Consistency

Maintaining consistency across multiple documents is key to ensuring professional communication and avoiding mistakes. Using a pre-designed format eliminates the possibility of forgetting key elements or making inconsistent design choices. The advantages include:

- Standardization: Every record follows the same structure, making it easy to compare and track payments.

- Fewer errors: By filling in a predefined format, the chance of missing important details is significantly reduced.

- Easy customization: Modifying a predefined structure to fit specific needs is much quicker than creating a new document each time.

With a ready-made format, the process becomes not only faster but also more reliable, reducing the workload and ensuring that all necessary information is accurately recorded each time.

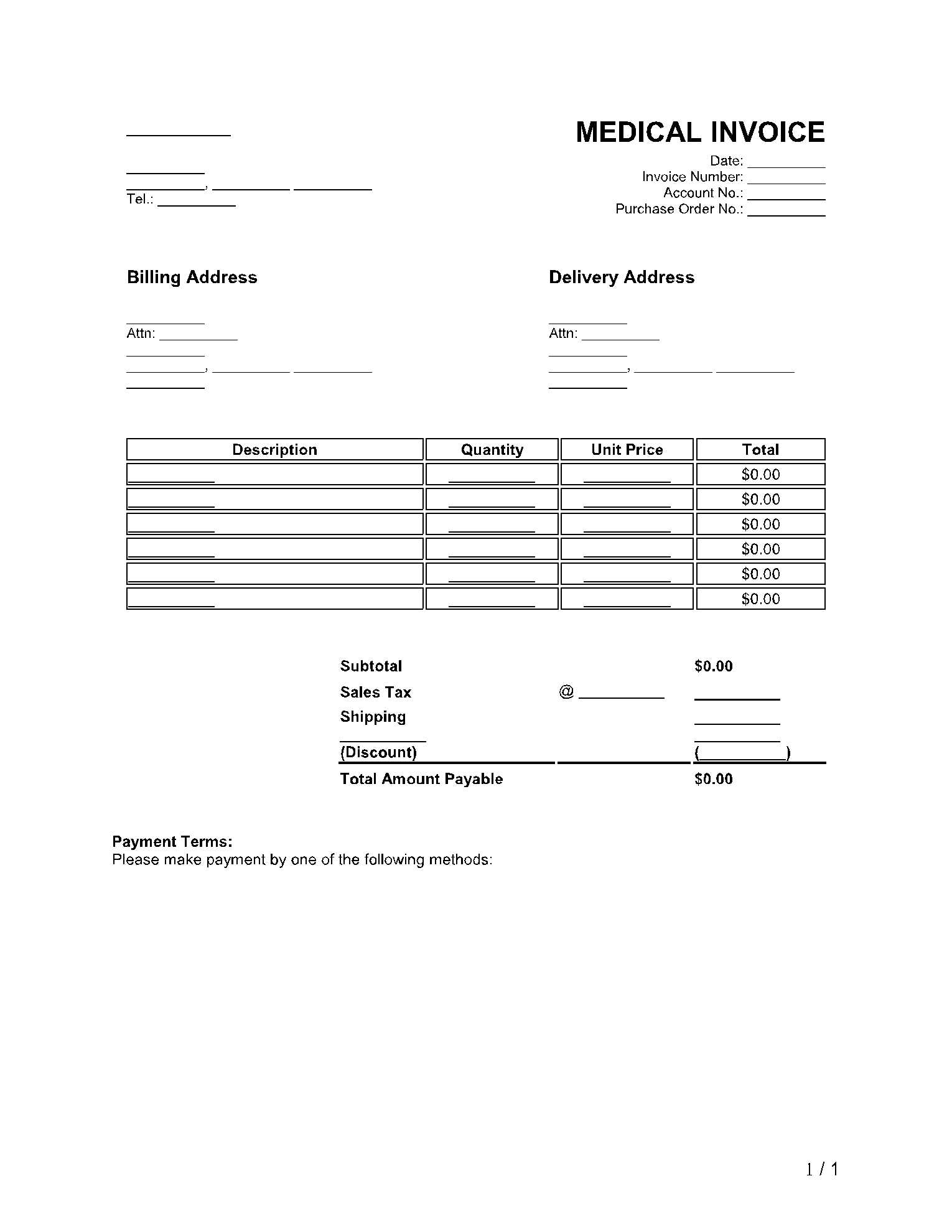

Steps to Create a Medical Invoice

Creating a clear and accurate financial document is crucial for ensuring timely payments and maintaining a professional relationship with patients. By following a simple, step-by-step process, you can ensure that all necessary information is included and properly formatted. This reduces the chance of errors and speeds up the billing cycle.

Step 1: Include Basic Contact Information

The first thing to include is the contact information of both the service provider and the patient. This ensures that both parties know who the statement is from and who it’s for. The basic details to include are:

- Provider’s Name and Address: Include your practice name, address, and phone number.

- Patient’s Information: Include the patient’s full name, address, and contact details.

- Unique Reference Number: Assign a unique number to each statement for easy tracking.

Step 2: List Services Provided

Next, list all services or treatments that were provided. For each service, include the following details:

- Description: A clear explanation of each service or procedure performed.

- Date: The date when the service was rendered.

- Cost: The price associated with each service or treatment.

Be specific and thorough to avoid confusion and to ensure both parties have a clear understanding of what was provided.

Step 3: Specify Payment Terms

It’s important to outline the payment expectations clearly. This includes:

- Due Date: Specify when payment is due.

- Accepted Payment Methods: List which forms of payment are acceptable (e.g., credit card, bank transfer, check).

- Late Fees: If applicable, mention any penalties for late payments.

Step 4: Review and Send

Before sending the document, double-check all the details for accuracy. Make sure all services are correc

Choosing the Right Medical Invoice Format

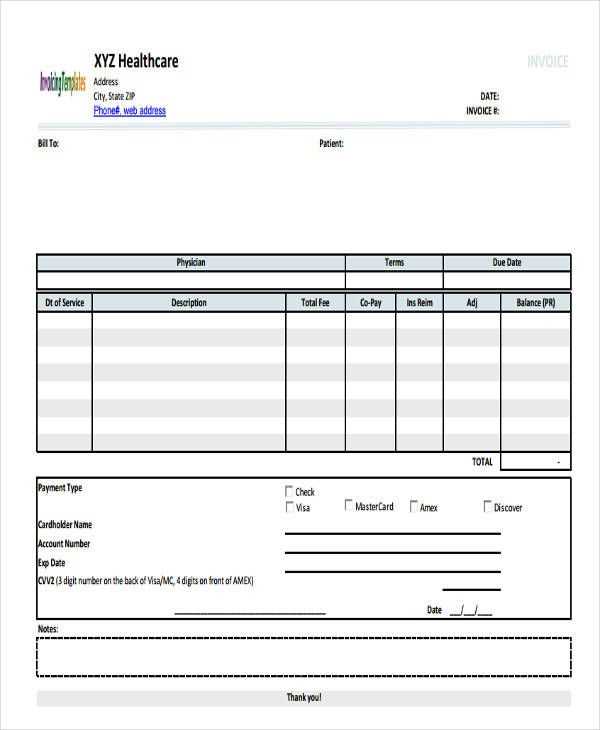

Selecting the correct format for your financial documents is crucial for ensuring clear communication and efficient processing. The right structure not only enhances the professionalism of your practice but also ensures that the necessary details are easily accessible and understood by both the service provider and the patient. There are several factors to consider when deciding on the best format for your records.

Factors to Consider When Choosing a Format

Different practices may require different structures based on their specific needs. Here are some key factors to keep in mind:

- Clarity and Simplicity: The format should be straightforward and easy to read, with clear headings, sections, and a logical flow of information.

- Customization: Consider a format that allows you to easily add or remove fields based on the services provided or specific requirements.

- Consistency: Choose a format that maintains a consistent structure across all records, making it easier to compare and track payments over time.

- Compliance: Ensure that the format meets any legal or regulatory requirements specific to your industry.

Types of Formats to Consider

When choosing the right format, there are a few common types to consider:

- Spreadsheet-based Formats: Using Excel or Google Sheets allows for easy customization, automatic calculations, and tracking. This format is ideal for practices with varying services or large numbers of transactions.

- Pre-designed Digital Formats: There are many online platforms offering ready-to-use, customizable designs that are both professional and easy to navigate.

- Printed Formats: For those who prefer physical copies, a printed format should be clean, well-organized, and straightforward to fill out by hand or in a word processor.

Choosing the right format ensures that all necessary details are captured accurately, helping you streamline your billing process while maintaining a professional image.

How to Handle Patient Billing Disputes

Billing disputes are a common challenge faced by healthcare providers, and addressing them promptly and professionally is essential to maintaining trust with patients. Clear communication, proper documentation, and a structured process for resolving discrepancies can help ensure that misunderstandings are minimized and that payments are processed smoothly. Below are key steps to follow when handling disputes related to financial records.

1. Review the Dispute Thoroughly

The first step in resolving any disagreement is to carefully review the details of the dispute. Examine the financial records and compare them with the patient’s claims. Look for any errors in the charges, omissions, or miscommunications that may have led to the issue. Having a clear understanding of the situation will allow you to address it effectively and accurately.

2. Communicate Clearly and Promptly

Once you have reviewed the issue, reach out to the patient to clarify any misunderstandings. It’s important to communicate in a calm, professional, and empathetic manner. Be transparent about the charges, explain the details, and provide supporting documentation if necessary. Clear communication can help build trust and resolve the dispute faster.

3. Negotiate and Offer Solutions

In some cases, the patient may feel that the charges are too high, or they may have concerns about certain fees. Offering solutions, such as a payment plan, a partial discount, or a review of specific charges, can help resolve the dispute amicably. Try to find a mutually agreeable solution that satisfies both parties.

4. Document All Communications

Throughout the dispute resolution process, it is important to keep detailed records of all communications, decisions, and agreements made. This documentation will be valuable if the situation escalates or if further clarification is needed later. Proper documentation also helps protect your practice in case of legal or regulatory inquiries.

5. Ensure Future Clarity

After resolving the issue, take the necessary steps to prevent similar disputes in the future. This may include updating your billing practices, improving communication with patients about charges, or offering more detailed statements. Proactive measures can help reduce the likelihood of misunderstandings and strengthen patient relationships.

By following these steps, healthcare providers can manage disputes effectively, ensuring that patients feel heard and respected while maintaining the integrity of the financial process.

How to Add Payment Terms to Invoices

Including clear and detailed payment terms in financial documents is essential to ensure both parties understand the expectations regarding payment. Well-defined terms help prevent misunderstandings, reduce late payments, and set clear guidelines for how and when the payment should be made. Below are the key steps for adding payment terms to your financial records.

1. Define the Due Date

The due date specifies when the payment is expected to be received. Including this information is essential to prevent delays. You can set a specific date or provide a time frame such as “30 days from the date of the document” or “Due upon receipt.” Be clear about when the payment should be made to avoid confusion.

2. Specify Accepted Payment Methods

Be sure to list the payment methods you accept. Whether it’s credit cards, checks, bank transfers, or online payment platforms, including this information will make it easier for your clients to settle their accounts. Providing multiple options can help facilitate quicker payments.

3. Outline Late Fees or Penalties

Including a statement about late fees or penalties can encourage timely payments. For example, you can add a clause like, “A late fee of 1.5% per month will be applied to overdue balances.” Be sure to clearly define how long a payment can be overdue before fees are applied, and specify the exact amount or percentage that will be charged for late payments.

4. Offer Payment Plans (if applicable)

For clients who may need more time to pay, consider offering flexible payment plans. Specify the terms of these plans, such as the total number of installments, due dates, and amounts per installment. Clear guidelines on payment arrangements can make it easier for patients to manage their financial obligations while keeping your practice’s cash flow intact.

5. Provide Clear Instructions for Payment Submission

Make

Tips for Organizing Medical Billing Records

Effective organization of financial records is essential for streamlining operations and ensuring that payments are processed promptly. A well-organized system not only makes it easier to track outstanding payments and reconcile accounts but also helps avoid errors and reduces stress when managing large volumes of data. Below are some useful tips for keeping your billing records organized and efficient.

1. Implement a Digital Record-Keeping System

Switching from paper-based records to a digital system can greatly enhance efficiency and reduce the risk of misplaced or lost documents. Use specialized software or cloud-based systems that allow you to store, categorize, and search for records easily. Digital records also allow you to back up your data, ensuring that nothing is lost in case of hardware failure.

2. Categorize Records by Type and Date

Organizing records by type of service and date can help you locate the information you need more quickly. Create categories such as “procedures,” “consultations,” and “payments received,” and sort records by the date of service or transaction. This way, you can easily retrieve a specific document based on the service or time frame it relates to.

3. Keep Track of Payment Status

It’s important to stay on top of payment statuses to ensure timely follow-ups and avoid overdue accounts. Maintain a system where you can track which transactions have been paid, which are pending, and which may require further attention. Using color coding or status labels such as “Paid,” “Pending,” and “Overdue” can make it easy to quickly assess the state of each record.

4. Regularly Reconcile and Update Records

Set aside time to reconcile your financial records regularly. Compare your internal records with bank statements or payment processors to ensure accuracy. This step helps catch discrepancies early on and prevents them from accumulating. Updating your records regularly also makes it easier to manage day-to-day operations and ensures everything is up to date when it’s time for financial reviews.

By adopting these practices, you can create a more organized and efficient workflow for managing financial records, leading to better cash flow and less time spent on administrative tasks.

Why Consistency in Invoicing Matters

Maintaining consistency in financial documentation is crucial for ensuring clear communication, reducing errors, and improving overall efficiency. When records follow a consistent format, both the service provider and the client have a clear understanding of the terms, charges, and expectations. Consistency helps build trust, fosters professionalism, and streamlines the payment process.

1. Enhances Professionalism

A consistent approach in creating financial records reflects professionalism. Clients appreciate clear, well-organized documents that follow the same structure every time. This helps in creating a strong, reliable brand image and reassures clients that they are dealing with a well-managed practice.

2. Reduces Mistakes

When all records follow the same layout and structure, the chances of overlooking critical details or making mistakes are significantly reduced. Standardized fields and sections help ensure that all necessary information is included and presented clearly. This eliminates confusion and prevents errors that could lead to payment delays or disputes.

3. Improves Efficiency

Consistency in record-keeping saves time and effort. When you follow a standard format, there’s no need to spend extra time deciding how to organize each document or what information to include. This leads to faster processing of transactions and fewer delays in payments.

4. Easier to Track Payments

Standardizing your financial records makes it easier to track outstanding payments and reconcile accounts. With consistent formats, it’s simpler to identify whether a payment has been made, what services were rendered, and if there are any discrepancies in amounts charged.

5. Simplifies Audits and Reporting

Consistent documentation is especially important during audits or financial reviews. Standardized records make it easy to analyze patterns, track income, and monitor the overall financial health of the practice. This consistency ensures that you can quickly provide the necessary details if needed for tax reporting or audits.

| Benefit | Impact |

|---|---|

| Professional Image | Increases trust and credibility with clients. |

| Reduced Errors | Prevents costly mistakes and misunderstandings. |

| Efficiency | Speeds up the payment process and reduces admin time. |

| Payment Tracking | Easier to monitor outstanding payments and reconcile accounts. |

Finan

Legal Considerations for Medical InvoicesWhen managing financial records related to healthcare services, it’s crucial to be aware of the legal guidelines and requirements that govern billing practices. Ensuring that your documentation is legally compliant helps prevent disputes, protects your practice, and guarantees that you meet both local and federal regulations. Below are important legal considerations to keep in mind when preparing financial records for your services. 1. Compliance with Health Insurance Portability and Accountability Act (HIPAA)

One of the most important legal considerations is maintaining patient confidentiality. The Health Insurance Portability and Accountability Act (HIPAA) requires that all patient information, including billing details, be protected. When creating financial documents, make sure that sensitive patient data is handled securely and that any shared information complies with HIPAA guidelines. This includes secure storage, transmission, and disposal of personal health and financial data. 2. Accurate and Transparent DocumentationAccuracy is not just a best practice; it’s a legal requirement. Incorrect or misleading information on financial records can lead to fraud allegations, lawsuits, and fines. Ensure that every detail, from service dates to charges, is correct and transparent. Be clear about the services provided and the corresponding costs to avoid confusion or potential claims of overcharging or misrepresentation. 3. Clear Payment Terms and Patient RightsClearly outline payment expectations in your financial records, including due dates, late fees, and accepted payment methods. It’s also important to inform patients of their rights regarding payments, disputes, and any legal protections available to them. Offering clear and understandable terms not only improves transparency but can also help resolve any potential disputes before they escalate. 4. Proper Handling of Insurance Claims and PaymentsIf your practice works with insurance companies, be sure to follow the legal requirements related to insurance billing. This includes submitting claims within the appropriate time frame, adhering to insurer guidelines, and ensuring that all necessary patient information is included. Incorrect or late insurance claims can result in delayed payments or even legal issues. By being diligent about these legal considerations, you ensure that your financial records not only comply with regulations but also foster trust with patients and insurers alike. How to Track Payments EfficientlyTracking payments is a crucial aspect of managing a practice’s finances. By maintaining an organized system for recording and monitoring payments, you can ensure that all transactions are accounted for, minimize errors, and streamline the reconciliation process. Below are strategies for tracking payments effectively and efficiently. 1. Use Accounting SoftwareOne of the most efficient ways to track payments is by using specialized accounting or financial management software. These tools allow you to automatically record payments, generate reports, and track outstanding balances. Many platforms also integrate with your bank or payment processors, making it easier to reconcile your accounts and ensure accuracy. 2. Maintain a Payment LogIf you’re not using software, maintaining a manual payment log is essential. Create a spreadsheet or a simple ledger where you can record each transaction, including the amount paid, the date of payment, the method used, and the patient or client details. This log will serve as a quick reference and help you track overdue payments effectively. 3. Categorize Payments by StatusTo keep your records organized, categorize payments based on their status–paid, pending, or overdue. Using a color-coded system or status labels in your records can make it easy to visually track the progress of each payment. This approach allows you to quickly identify which payments require follow-up and which are successfully processed. 4. Set Reminders for Follow-UpsIncorporating reminder systems helps prevent missed follow-ups on overdue payments. Set automated alerts in your software or manual reminders on your calendar to notify you when a payment is due or when a client has missed a deadline. Timely follow-ups can significantly reduce the chances of outstanding payments lingering for too long. 5. Regularly Reconcile Your Records

Performing regular reconciliations between your payment records and bank statements ensures that all payments are accounted for and that there are no discrepancies. This step should be done weekly or monthly, depending on the volume of transactions. Consistent reconciliation helps identify any errors or missed payments early on and ensures your financial records are accurate. By implementing these strategies, you can manage payments more efficiently, reduce the risk of errors, and improve the overall financial health of your practice. |